Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

Oceania Cruises Travel Insurance - 2024 Review

Oceania cruises travel insurance review.

- Strong Insurance Partner

- Limited Cancellation Reasons

- Very Low Medical Coverage

Sharing is caring!

Destination-rich itineraries and some of the finest culinary experience at sea are the hallmark of Oceania Cruises. Oceania Cruises set sail across the entire globe, with cruises which last anywhere from 10 to 46 days, stopping at over 450 ports throughout Africa, Australia, Europe, Asia, the South Pacific, and more. For the more adventurous travelers, Oceania Cruises also offer their grand 180-day Around the World Voyages. With six luxurious ships which carry no more than 1,250 guests, and with a seventh ship set for delivery in 2025, Oceania Cruises are an excellent choice for seasoned cruise travelers and first time cruisers alike.

With high-class service, luxurious cabins and award winning food, one would hope and expect Oceania Cruises trip insurance would protect their passengers with the same level of care that they take with their food, service, and ship.

However, Cruise Insurance 101 has found that Oceania Cruises Travel Insurance coverage is lacking in many areas that we feel are crucial before embarking on a cruise vacation.

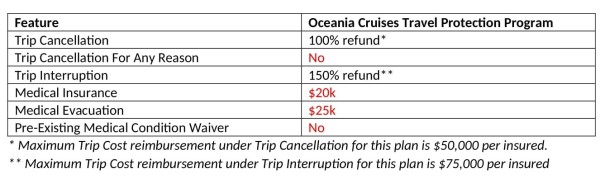

Overview of Oceania Cruises Travel Protection Program

The Oceania Cruises Travel Protection Program is underwritten by Nationwide, who we consider to be a strong insurance partner who underwrite many travel insurance policies across the industry.

Their Travel Protection Program offers many of the benefits and coverages normally expected to be found in a comprehensive travel insurance policy, and indeed contain many of the benefits found in the travel insurance policies offered at Cruise Insurance 101 . Trip Cancellation, Trip Interruption, Medical Insurance, and Medical Evacuation are all included.

However, as is always the case, the devil is in the detail so we need to look at the limits for these common benefits.

If you are traveling outside of the United States, our team at Cruise Insurance 101 advises travelers to carry a minimum coverage of $100,000 in Medical Insurance and $250,000 in Medical Evacuation. We also strongly suggest our travelers secure a policy which contains a Pre-existing Medical Condition Waiver if at all possible. Further, we advise that if traveling further afield to locations such as Asia or Africa or beyond, we recommend a minimum of $500,000 in Medical Evacuation cover.

In our opinion, the Oceania Travel Protection Program does not provide sufficient levels of coverage for international travel. We consider that the coverage level offered for Medical Insurance and Medical Evacuation are far too low for our comfort. Additionally, and an important piece of coverage for many senior travelers, the Oceania Travel Protection Program does not offer coverage for Pre-Existing Medical Conditions.

We’ll discuss these limits and coverages further later in our review.

Cost of Oceania Cruises Travel Protection Program

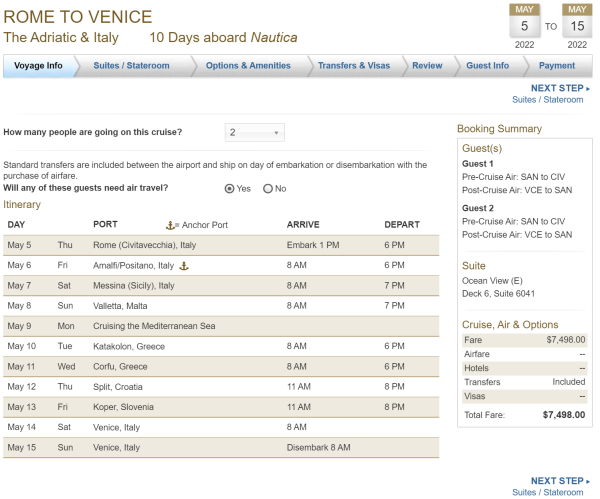

Coverage levels aside, we also need to determine if the Oceania Cruises Travel Protection Program offers good value for money compared to other plans available in the wider travel insurance marketplace. To do this we need to hoist the main sail and set off on a Oceania cruise.

For our example, we chose a 10-day Oceania Cruise that begins in Rome, Italy and ends in Venice, Italy, with stops in Malta, Greece, Croatia, and Slovenia.

The cruise dates that we have chosen are 5/10/22 – 5/15/22, for two travelers. Our travelers are aged 55 and 60 and the cruise is priced at $3,749 per person, giving us a total cost of $7,498.

The Oceania Cruises Travel Protection Program costs $374.90 per traveler, for a total of $749.80, bringing the combined total cost for our travelers of the cruise and Travel Protection Program to $8,247.80.

Travel Insurance Alternatives to Oceania Cruises

Based on our sample couple, ages 55 and 60, we created a comparison quote with the policies offered through Cruise Insurance 101 . The trip cost used for our comparison is the cruise cost for both travelers: $7,498.

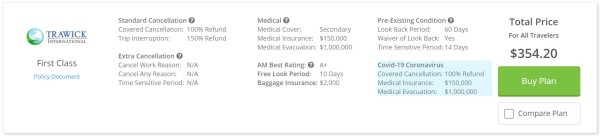

The least expensive plan with adequate coverage on our quote from Cruise Insurance 101 is the Trawick First Class for $354.20.

For a Cancel For Any Reason policy, we selected the Trawick First Class (CFAR 75%), because it is the least expensive travel insurance plan which includes a Cancel For Any Reason (CFAR) benefit.

Now, we’ll take a look at the benefits of each policy in a side-by-side comparison.

From our side by side comparison it is clear that the Oceania Cruises Travel Protection Program offers minimal coverage and low limits of benefits compared to other plans available. What is especially noticeable is the difference in coverage levels for Medical Insurance and Medical Evacuation.

It goes without saying that Travel Medical Insurance is only effective when it can actually mitigate a worst-case scenario that may occur. If a travel plan doesn't have your back if the worst happens, you may bare any costs not covered by your plan. For that reason we recommend travelers who are venturing abroad should carry at least $100,000 in Medical Insurance. Although that may seem high, it’s important to note that international private hospitals can charge between $3,000 to $4,000 per day.

We also recommend that travelers should hold at least $250,000 in Medical Evacuation coverage for international travel. Travelers who are venturing even further from the United States, perhaps to Asia, Africa, or even Australia, would need a minimum of $500,000 in Medical Evacuation coverage. A medical air evacuation with doctors and nurses onboard can cost between $15,000 to $25,000 per flight hour, so it is extremely important to ensure you are properly protected for a worst-case scenario.

In addition to minimal coverage, the benefits offered through the Travel Protection Program are on a per trip basis, as opposed to per person benefits.

It is also very important to remember that the Oceania Travel Protection Program only covers the cost of the cruise fare, up to $50,000. This raises the question of how would a traveler protect other costs that they’ve paid out towards their trip? Put simply they would need to buy a standalone travel insurance plan to cover their airfares, transfers, excursions and car hire.

Not only do the Trawick First Class and Trawick First Class (CFAR 75%) plans offer far more benefits with higher per traveler limits at a lower cost, but they also allow our travelers to protect all of their other pre-paid and non-refundable trip costs that they’ve paid towards their trip, not just the cruise fare.

Cost Comparison

If our travelers purchase the Trawick First Class standard cancellation plan for $354.20 instead of the Oceania Cruises Travel Protection Program, our two travelers would save $395.60, which is a significant savings over the Oceania plan. If our travelers wanted the added piece of mind that comes with a Cancel For Any Reason policy, they could select the Trawick First Class (CFAR 75%) plan for $602.14 and still save $147.66 over the Oceania Cruises Travel Protection Program.

Whilst the Oceania Travel Protection Program does offer some coverage, it’s in our opinion it is simply not enough coverage for the price.

In the following sections, we’ll discuss these coverages in more detail.

Trip Cancellation

Trip Cancellation coverage protects a traveler from losing their pre-paid and non-refundable trip costs if they need to cancel their vacation due to covered reasons that is listed in the policy document.

Oceania Cruises Travel Protection Program has a short list of covered reasons:

- Your Sickness, Accidental Injury or death, that results in medically imposed restrictions as certified by a Physician at the time of Loss preventing Your participation in the Trip. A Physician must advise to cancel the Trip on or before the Scheduled Departure Date.

- Sickness, Accidental Injury or death of a Family Member or Traveling Companion booked to travel with You, that results in medically imposed restrictions as certified by a Physician preventing that person’s participation in the Trip.

- Sickness, Accidental Injury or death of a non-traveling Family Member.

- You or a Traveling Companion being hijacked, Quarantined, required to serve on a jury, subpoenaed, the victim of felonious assault within ten (10) days of departure;

- Having Your principal place of residence made Uninhabitable by fire, flood, volcano, earthquake, hurricane or other natural disaster;

- You or a Traveling Companion being directly involved in a traffic accident substantiated by a police report, while en route to departure

This is just too short of a list of reasons to cancel. Cruise Insurance 101 recommends that cruise insurance policies also include:

- Your or Your Traveling Companion’s primary place of residence or destination being rendered uninhabitable and remaining uninhabitable during Your Scheduled Trip by fire, flood, burglary, or other Natural Disaster.

- Unannounced Strike that causes complete cessation of services for at least 12 consecutive hours of the Common Carrier on which You are scheduled to travel;

- Inclement Weather that causes complete cessation of services for at least 12 consecutive hours of the Common Carrier on which You are scheduled to travel;

- You or Your Traveling Companion or Your Family Member is in the military and called to emergency duty for a national disaster other than war;

- A Terrorist Incident that occurs within 30 days of Your Scheduled Departure Date in a city listed on the itinerary of Your Trip;

- Revocation of Your or Your Traveling Companion’s previously granted military leave or reassignment. Official written revocation/re-assignment by a supervisor or commanding officer of the appropriate branch of service will be required;

- Your family or friends living abroad with whom You are planning to stay are unable to provide accommodations due to life threatening illness, life threatening injury or death of one of them;

- Felonious assault of You or Your Traveling Companion within 10 days of the Scheduled Departure Date;

Many reasons can pop up to cause a traveler to cancel a trip, and although trip insurance can’t cover all the reasons that may come up, it should at least cover those listed above.

Trip Cancellation For Any Reason

In our reviews of other cruise lines travel protection plans, we often find that many of them include coverage for Cancel For Any Reason .

This benefit allows a traveler to cancel their trip for any reason that is not otherwise listed in the policy and still receive a large portion of their pre-paid and non-refundable costs back. Many cruise insurance plans will reimburse up to 75% of the pre-paid and non-refundable trip costs in the form of cruise credits, not cash.

Whilst we are never in favor of a cruise credit as opposed to a cash refund, the Oceania Cruises Travel Protection Program does not include a Cancel For Any Reason benefit of any kind, not even a cruise credit benefit, so the traveler has only a very limited amount of reasons to cancel

Trip Interruption

The Trip Interruption benefit will reimburse you for the unused portion of your trip if you need to interrupt your trip and/or return home early for any of the covered cancellation reasons that are listed in the policy. Trip Interruption coverage can also help with the added expense of getting home before your scheduled return date.

The Oceania Cruises Travel Protection Program states that up to 150% (with a maximum of $75k) of the trip cost listed in the policy, they will pay for:

- a) pre-paid unused, non-refundable land or sea expenses to the Travel Supplier;

- b) the airfare paid less the value of applied credit from an unused travel ticket, to return home, join or rejoin the original Land/Sea Arrangements limited to the cost of one-way economy airfare or similar quality as originally issued ticket by scheduled carrier, from the point of destination to the point of origin shown on the original travel tickets.

- The Company will pay for reasonable additional accommodation and transportation expenses incurred by You (up to $200 a day) if a Traveling Companion must remain Hospitalized or if You must extend the Trip with additional hotel nights due to a Physician certifying You cannot fly home due to an Accident or a Sickness but do not require Hospitalization. In no event shall the amount reimbursed exceed the amount You prepaid for the Trip.

Medical Insurance

The Medical Insurance cover will cover the costs associated with seeking medical treatment for an emergency illness or accidental injury that may occur whilst ony our trip. It is important to remember that most private health insurance plans, including Medicare, do not provide coverage outside of the United States , so Medical Insurance cover is critical for those are traveling internationally.

Oceania Cruises Travel Protection Program only offers cover of $20,000 for Accident Medical Expense and Sickness Medical Expense. At Cruise Insurance 101 , we feel this coverage limit is far too low for adequate medical coverage when traveling overseas.

For international travel, Cruise Insurance 101 recommends a traveler should carry at least $100,000 in medical coverage. While this may seem like a lot, an unexpected traumatic injury or illness overseas can often result in significant medical expenses, as international private hospitals can charge up to $3,000-$4,000 per day. Carrying travel medical insurance of at least $100,000 will ensure our traveler is covered for those unforeseen expenses.

Emergency Medical Evacuation

The Medical Evacuation benefit provides cover for expenses incurred for emergency transportation to a facility that is able to treat your medical emergency, or transport you back home to the United States, if deemed necessary.

The Oceania Cruises Travel Protection Program covers Emergency Medical Evacuation expenses up to $25,000 and covers the following:

- The Company will pay benefits for Covered Expenses incurred, up to the Maximum Benefit shown on the Confirmation of Coverage, if an Accidental Injury or Sickness commencing during the course of the Trip results in Your necessary Emergency Evacuation. An Emergency Evacuation must be ordered by a Physician who certifies that the severity of Your Accidental Injury or Sickness warrants Your Emergency Evacuation.

- Covered Expenses are reasonable and customary expenses for necessary Transportation, related medical services and medical supplies incurred in connection with Your Emergency Evacuation. All Transportation arrangements made for evacuating You must be by the most direct and economical route possible. Expenses for Transportation must be: (a) recommended by the attending Physician; (b) required by the standard regulations of the conveyance transporting You; and (c) authorized in advance by the Company or its authorized representative.

Cruise Insurance 101 recommends travelers who are traveling within 3 to 4 hours of the United States border to carry a minimum $250,000 of Medical Evacuation benefits.

Travelers who are venturing further from home need a minimum of $500,000 for Medical Evacuation coverage – the cost of a long-range private jet staffed with a medical evacuation team.

In our opinion, $25,000 is an extremely low limit to offer for Medical Evacuation cover. This is a critical coverage to have in place, and for that reason, in our opinion the Oceania Cruises Travel Protection Program is not suitable.

Pre-Existing Medical Conditions

According to the Oceania Cruises Travel Protection Program, a Pre-Existing Medical Condition means an illness, disease, or other condition during the sixty (60) day period immediately prior to the Effective Date for which You, a Traveling Companion, or a Family Member booked to travel with You: 1) exhibited symptoms that would have caused one to seek care or treatment; or 2) received or received a recommendation for a test, examination, or medical treatment; or 3) took or received a prescription for drugs or medicine. Item (3) of this definition does not apply to a condition that is treated or controlled solely through the taking of prescription drugs or medicine and remains treated or controlled without any adjustment or change in the required prescription throughout the sixty (60) day period before the Effective Date.

This pre-existing condition means that the Oceania Cruises Travel Protection Program specifically excludes coverage for pre-existing conditions. This means that there will be no Trip Cancellation, Trip Interruption or Medical Insurance coverage if a loss occurs that is caused by a pre-existing condition as defined in the policy.

All comprehensive trip insurance plans exclude pre-existing medical conditions. However, most policies will offer a waiver of this exclusion and will cover pre-existing conditions if the insurance is purchased within a Time Senstive period . This is a defined period of time after the first payment or deposit is placed on the trip.

Usually, this time sensitive benefit is available if the policy is purchased within 14-21 days (depending on the policy) of your initial payment or deposit. At Cruise Insurance 101 we recommend having this coverage, if possible, as it does not cost anything extra and it is included in the policy, as long as you purchase within the Time Sensitive Period.

Cruise Insurance 101 offers many plans that include this Pre-Existing Medical Condition Waiver .

We consider it to be very unfortunate that the Oceania Cruise Travel Protection Program does not include a Pre-existing Condition Medical Waiver, because most comprehensive travel insurance policies will provide a Medical Waiver when a traveler buys their policy promptly and insure all their pre-paid and non-refundable trip costs.

Our Conclusion

The Oceania Cruises Travel Protection Plan is lacking in many areas. Whilst it does have a strong insurance partner, the high cost and low coverage limits are not suitable for most travelers needs.

We spend a lot of money on cruises, and we sometimes book and pay for them months, or even over a year in advance of the departure date. This investment needs to be properly protected.

Cruise Insurance 101 allows you to quickly get a quote based on your travel requirements, and shows a great set of products available from some of the top-rated travel insurance companies in the United States.

If I Go Directly to the Travel Insurance Company, Will I Get a Better Deal?

No, you will not get a better deal by going directly through the travel insurance company. Travel insurance is strictly regulated, and the policy rates are filed with each state. That means no one can sell a plan for more or less than the filed rates.

Cruise Insurance 101 guarantees you will not find a lower price anywhere on any of the plans found on our site.

Have questions? We would love to hear from you. Send us a chat, email , or call at +1(786) 751-2984 .

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Amanda was extremely helpful

Amanda was extremely helpful, very courteous & professional and answered all my questions. I appreciated receiving the emails about the quote and purchase is such a quick and timely manner. Thanks

Miranda was on the spot!

Helpful and knowledgeable customer service

I was not able to narrow down the specifics of my travel insurance needs just utilizing the website; but with the help of a customer service agent I was very satisfied and completed my purchase for my trip.

Travel Insurance

An illness, an accident or an unexpected situation can arise before or during any type of vacation. Such an event might cause you to cut short your cruise or cause your trip to be canceled altogether. Unfortunately, most cruise lines impose penalties for canceling a cruise, up to and including loss of the entire cruise price.

Because a cruise is a significant investment, most cruise lines offer some form of insurance to protect their passengers from financial loss in the event of an emergency. Details and prices vary from cruise line to cruise line, as do coverage limits and exclusions.

If you decide to purchase insurance, you will have two options, to go with the cruise line's plan or to use our independent insurance provider, Generali Global Assistance. Use the summaries below to compare policies and prices.

Generali can provide insurance coverage to all customers, regardless of their country of citizenship, except residents of the province of Quebec, Canada.

For more information or a complete copy of a policy, ask your Vacations To Go cruise counselor.

Independent Insurance Coverage

Generali Global Assistance

Cruise Line Coverage

- Enable Accessibility

- Deutsch Francias 日本語 Portuguese Espanol

- Connect With Us +1-855-623-2642 855-OCEANIA (855-623-2642) Special Offers Request a Brochure Request a Quote

- My Account / Reservation

- Forgot Password

- Create Account

- Find a Cruise

Special Offers

- Specialty Cruises

- Request a Brochure

- Solo Traveler Experience

- Inclusive Air

- Request a Quote

- Cruise Destinations

- Find a Shore Excursion

- Explore Land Programs

- Tours, Land and Hotel Programs

- 2026 Around The World

- 2025 Collection

- 2024 - 2025 Tropics & Exotics Cruises

- 2025 Around The World

- 2024 Collection

- Explore our Ships

- Introducing Allura

- Wellness: Mind, Body and Soul

- The Finest Cuisine at Sea®

- Blog, Videos and Reviews

- Life On Board

- Amenities & Onboard Packages

- Oceania Club Benefits

- Concierge Level Veranda

Travel Protection

Ultimate Value

Included amenities and exclusive offers.

- Where would you like to go? Select Your Destination

- When would you like to go? Select Month & Year

Take advantage of incredible savings of up to 40% plus simply MORE™.

simply MORE™ Included

With our newest offer, simply MORE, you’ll receive more value, greater choice and more convenience than ever before. simply MORE means enjoying more immersive adventures ashore with our FREE Shore Excursions, including more than 8,000 tours available worldwide, ranging from sommelier- and chef-led Food & Wine Trails Tours to highly customizable Executive Collection options. It means toasting to more of life’s special moments on board with our FREE House Select beverage package, which includes a wide selection of vintage Champagnes, wines and beers during lunch and dinner at our onboard restaurants. simply MORE means you have the luxury of relaxing the moment you leave home with FREE Roundtrip Airfare* and FREE Airport Transfers*. Combined with our renowned gourmet specialty dining that is always included as well as FREE Unlimited WiFi, virtually everything you’ve ever wanted is now included.

Oceania Cruises Value Comparison

Oceania cruises culinary comparison.

Oceania Club

As a valued member of our Oceania Club, you enjoy an array of exclusive Oceania Club benefits that we offer in sincere gratitude for your loyalty.

Don’t miss out on these limited-time cruise offers. Featuring a wide array of voyages, these exclusive offers are the best way to take advantage of bonus savings, extra amenities and lower cruise fares. Book early for the best availability and check back often for new deals, all-inclusive cruise vacation packages and more.

Value Without Compromise

Always included for every guest.

Onboard Packages

Designed to help you create your perfect cruise experience, our onboard packages elevate your journey and offer extraordinary value. Sip your favorite cocktail poolside, enjoy the perfect vintage with dinner every evening and stay connected with friends and family back home. With beverage and Internet packages that let you pick and choose, it’s easy to savor your world, your way.

Beverage Packages

The perfect libation for every occasion.

- View Bar Menu

- View Wine & Champagne Menu

Our beverage packages enhance your onboard experience while offering excellent value and the luxury of convenience. Receive a 20% discount on any of our exclusive La Reserve wine pairing dinners on board Marina , Riviera and Vista when you upgrade to our Prestige Select beverage package.

Prestige Select⁺

Upgrade from the House Select beverage package included with our simply MORE offer to enjoy unlimited premium spirits, Champagne, wine and beer wherever and whenever you wish for $30.00 per guest, per day.

House Select⁺

As part of our simply MORE offer, enjoy Champagne, wine and beer with lunch and dinner at our onboard restaurants. Featuring much more than just house pours, the selection includes dozens of premium label wines and Champagnes and beer selections from around the world.

+ All packages are non-refundable. House Select beverage package is included for guests 1 and 2 with the simply MORE offer. View complete simply MORE Terms & Conditions here .

Free Unlimited WiFi

FREE Unlimited WiFi is included in your cruise fare. Stay in touch with friends and family, share your adventures, and keep up to date on business and news.

FREE WIFI ACCESS

Enjoy WiFi access throughout the entirety of the ship, including in all suites, staterooms, public rooms and outdoor decks. One free login is provided per suite or stateroom, which can be used on one device at a time. As of October 1, 2023, two free logins will be provided per suite or stateroom, each of which can be used on one device at a time. Additional logins and upgrade packages are available for purchase on board. For your convenience, Internet-enabled computers are also available in the Oceania@Sea Internet Center aboard each of our ships.

Starlink’s high-speed WiFi is currently available Vista and Riviera, and will be available on every vessel by the end of 2024.

Streaming Upgrade In addition to receiving FREE Unlimited WiFi, you may also upgrade to Wavenet Prime and enjoy streaming. Get access to sites such as Netflix or Audible for $9.99 per day.

Wavenet Unlimited WiFi Purchase an additional login and enjoy general web browsing, post photos to social media and check your personal email for $24.99 per day.

Wavenet Prime Unlimited WiFi with Streaming Purchase an additional login and enjoy the same access as Unlimited WiFi, plus an upgrade to video and audio streaming for $34.98 per day.

Protect Your Travel Investment

We offer Travel Protection Plan coverage and worldwide emergency assistance services for Oceania Cruises' discerning guests, which can help you in the face of the unexpected. For example, if you have an accident overseas that Medicare and other private insurance policies may not cover, our program provides medical expense reimbursement for a covered sickness or accident. Additionally, reimbursement is provided for penalties that may be assessed due to cruise cancellations for covered reasons.

This program covers up to the total trip cost for non-refundable cancellation charges including airfare, cancellation charges, and unused prepaid expenses if you must cancel or interrupt your cruise due to one of the following covered reasons: injury, sickness or death of an insured traveling companion (traveling in the same suite or stateroom) or immediate family member. Unforeseeable circumstances such as jury duty, subpoena, having a home uninhabitable by natural disaster or involvement in a traffic accident on the way to the airport is also covered. Please view the Description of Coverage

How to Enroll in the Program Enrollment is simple and convenient. The plan is an optional addition to your cruise vacation and is available for purchase from the time you make your deposit up to the time you make final payment on your cruise vacation. The plan cost is in addition to any required cruise deposits. If you have already made your cruise deposit, please contact Oceania Cruises to add to your reservation. Payment for this program cannot be accepted after final trip payment or commencement of the penalty period.

To purchase the Oceania Cruises ® Travel Protection Program, all you need to do is pay for the plan cost before making your final cruise payment. The Trip Cancellation provisions take effect upon receipt of payment. All other provisions take effect upon the departure date.

24-Hour Worldwide Assistance Services Wherever you may be in the world, this service provides emergency assistance for a variety of circumstances, including making cash transfers; medical consulting and monitoring; assistance with lost documents; and legal, dental, and medical referrals to physicians or hospitals, to name a few. 24/7 CareFree TM Travel Assistance, Medical assistance, Emergency Services.

Important: This is only a brief description of the plan. This program is only valid if the appropriate plan cost has been paid to Oceania Cruises®. For a summary of the terms, conditions, limitations and exclusions of the plan, please view the Description of Coverage or you may contact Aon Affinity, the Plan Administrator, at 1-800-457-7709. This insurance is provided in excess of all other valid and collectible insurance or indemnity, and shall apply only after such benefits have been paid. Please note: Oceania Cruises can arrange for your purchase of insurance but is not an insurer or broker, and makes such arrangements solely as a convenience to our guests. Guests should consult the terms and conditions of coverage established by the insurance provider, and Oceania Cruises assumes no responsibility whatsoever for the conditions, coverages, or exclusions of any such insurance. This program was designed and is administered by Aon Affinity. Aon Affinity is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc. (TX 13695); (AR 244489); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Services, Inc.; in CA, Aon Affinity Insurance Services, Inc. (CA 0G94493), Aon Direct Insurance Administrators and Berkely Insurance Agency and in NY, AIS Affinity Insurance Agency. Affinity Insurance Services is acting as a Managing General Agent as that term is defined in section 626.015(14) of the Florida Insurance Code. As an MGA we are acting on behalf of our carrier partner. The Travel Protection Plan is underwritten by Nationwide Mutual Insurance Company and Affiliated Companies, Columbus, Ohio; NAIC # 10952 (all states as otherwise noted) under Policy/Certificate Form series TA HC5000. In CA, HI, NE, NH, PA , TN and TX, Policy/Certificate Form series TA HC5100 and TA HC5200. In IL, IN, KS, LA, OH, OR, VT, WA and WY, Policy Form #’s TA HC5100IPS and TA HC5200IPS. Certain coverages are under series TA HC6000 and TA HC7000. Worldwide emergency assistance services are provided by Carefree Travel Assistance. This plan provides cancellation coverage for your trip and other insurance coverages that apply only during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of this policy with your existing life, health, home and automobile policies. If you have any questions about your current coverage, call your insurer, insurance agent or broker.

Luggage Valet Service

Ship luggage directly to your stateroom.

Oceania Cruises is proud to partner with Luggage Forward®, the specialty service offering you the option to have any additional baggage or equipment shipped from your doorstep directly to any Oceania Cruises voyage and then back again. Allow yourself to relax and avoid the inconvenience of carrying, checking and claiming luggage and even going through Customs.

Simply enjoy the journey ahead. Service is available to and from more than 150 ports of call. Follow your bags around the world. Please visit Oceania Cruises’ Luggage Valet service by Luggage Forward ® for specific pricing and service locations.

Arrange Luggage Shipping

Disclaimer: Clicking on the link above will take you to the Luggage Forward website. An independent company, Luggage Forward provides a luggage shipping service for the convenience of Oceania Cruises customers. All shipments are subject to Luggage Forward’s Terms of Service.

- 855-OCEANIA (855-623-2642) or your travel advisor

- Sign Up for Special Offers

- Chat With Us

- Frequently Asked Questions

By clicking "Submit", I agree to the Terms and Conditions

Cruise travel insurance: What it covers and why you need it

What does cruise travel insurance cover? And does it pay to buy cruise travel insurance?

The answer is not always clear-cut, as we'll discuss in this guide. But consider this: It's not always smooth seas when it comes to cruising. Even the best-laid plans for a cruise vacation can sometimes be thrown off course by an unexpected event.

You might need to cancel a cruise in advance due to the sudden onset of an illness, such as COVID-19 or the flu. Or, maybe you fall ill during the cruise and need emergency medical attention. Maybe your flight to your ship gets canceled, and you miss the vessel's departure. Or your ship is late arriving in port at the end of a voyage, and you miss your flight home.

In all of these situations, you might benefit from having cruise travel insurance — keyword "might."

Cruise insurance policies vary widely, and not every policy covers every type of mishap. That's why it always pays to read the fine print in a travel insurance policy before you purchase it to know what you're getting in advance.

It's also why you should read this introduction to everything you need to know about cruise insurance. It has many details, but the next time something unexpected happens on your cruise vacation, you'll be glad to be educated and covered by a comprehensive travel insurance policy.

What does travel insurance cover when you cruise?

The typical cruise insurance policy covers a wide range of circumstances that can go wrong in conjunction with a vacation at sea — both before and during the sailing.

For starters, policies often will reimburse you for the cost of canceling a cruise due to a last-minute crisis. They will also often cover costs related to an interruption of a cruise (maybe your ship breaks down, requiring you to fly home mid-voyage ). These two elements are known as trip-cancellation and trip-interruption insurance, and they are bundled into a typical travel insurance policy.

Some policies will also cover out-of-pocket costs related to a flight delay or cancellation that results in you missing your cruise departure (for instance, the cost of catching up to the ship at its next port). Expenses related to baggage delays and loss are often covered as well.

But perhaps most importantly, many travel insurance policies will cover medical expenses you incur while on a cruise. Some will even cover the cost of evacuating from a foreign destination if you are in the midst of a medical crisis.

Travel insurance giant Allianz Global Assistance reports that 53% of all cruise-related "billing reasons" for claims are because of illness for the insured person, while 14% are for an injury. Another 8% are for the illness of a family member, 4% for the death of a family member and 4% for the illness of a traveling companion, among other reasons.

Those percentages include illness and accidents that happen to cruisers just before a trip, making travel impossible. But, in many cases, such claims result from illness and injuries that occur during voyages.

"People often take risks during vacation that they might not take back home, whether riding a jet ski, zipping around on a motorized scooter in a city they don't know well or hiking unfamiliar terrain," James Page, senior vice president and chief administration officer of AIG Travel, told TPG .

Some policies also cover the financial default of a travel provider. In such cases, if your cruise line goes out of business before you sail, you could get all — or at least some — of your money back.

Cruise travel insurance policies don't cover everything. For instance, standard travel insurers generally will not reimburse you for the cost of a cruise you cancel due to worries about an outbreak of an illness. That's true even if a U.S. government agency such as the U.S. Centers for Disease Control and Prevention issues a recommendation that you don't cruise due to an illness outbreak, as it did during the COVID-19 pandemic .

If you want the ultimate flexibility to cancel for such a reason or any other, you'll want to look into a more expensive cancel for any reason travel insurance upgrade.

Related: Avoiding outbreaks isn't covered by most travel insurance policies

Where to find a cruise travel insurance policy

You can buy a travel insurance policy directly from your cruise line when booking your trip or through your travel agent (if you're using one, which often is a good idea when booking a cruise). You also can go directly to a third-party travel insurance provider or a travel-insurance aggregator site, such as InsureMyTrip or TravelInsurance . Your credit card might even give you some travel protections.

Here's what you need to know about each type of cruise travel insurance.

Third-party insurance companies

Third-party insurance companies that specialize in writing travel insurance include AIG Travel, Allianz Travel Insurance, Travelex Insurance and American Express Travel Insurance.

One reason to use a travel agent or a travel aggregator: They can help you find a policy that offers added coverage specific to cruising.

Related: The Points Guy's guide to the best travel insurance companies

"Many plans now offer benefits that will specifically appeal to cruise travelers, such as missed connection, missed port-of-call and cruise disablement coverage," Stan Sandberg, cofounder of TravelInsurance.com, said.

Missed connection coverage reimburses cruisers for a set dollar amount if they need to rebook travel to catch up with their cruise at the next port. Missed port-of-call coverage pays a benefit if the cruise ship misses a scheduled port of call due to weather, a natural disaster or a mechanical breakdown.

Cruise disablement coverage pays a benefit if the traveler is confined on a ship for more than five hours without power, food, water or restrooms.

As noted, policies vary widely. It's a good idea to compare plans and make sure the one you buy has the elements that are most important to you. One size doesn't fit all.

Credit cards with travel benefits

Some premium credit cards offer valuable travel protections comparable to what you might get from a standard travel insurance plan. For example, the travel insurance provided when you pay for travel with select cards can reimburse you for expenses if your baggage is damaged, you're stranded overnight due to a flight delay or cancellation, or you have to return home to handle a family medical emergency.

The Chase Sapphire Reserve card, for example, offers trip delay reimbursement, trip cancellation and interruption insurance, emergency medical coverage and even medical evacuation coverage , among other benefits. And yes, cruise lines are considered common carriers just like airlines.

If you're planning to rely on a card like the Chase Sapphire Reserve or The Platinum Card® from American Express * (among others) for travel insurance, just be sure to recheck your card's benefits and limits carefully against regular travel insurance. You must pay for at least part — and sometimes all — of the trip with that credit card to take advantage of its protections.

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

Related: The best credit cards for booking cruises

Find out if your credit card protection includes travel accident insurance or covers preexisting medical conditions, and figure out when it will pay you back. Other questions to ask: What are the coverage limits? Will you have to pay for a foreign hospital bill upfront and then seek reimbursement later?

Cruise lines

Cruise lines often ask consumers booking a cruise to buy the line's own protection at the time of purchase. If specifics about the coverage are lacking, always ask the line for details in advance, review coverage perks and limits; then, compare those to one or two independent travel insurance policies or your credit card's insurance benefits.

Related: A beginners guide to picking a cruise line

Cruise line travel insurance policies sometimes have quirks. Many cruise companies will only offer a travel voucher or credit for future use in the event of a covered cancellation, not an outright refund.

Also, financial default may not be a covered event in a cruise line-sold policy, but it's typically covered with plans from third-party travel insurance companies.

Cruise line policies also can be more restrictive.

"Cruise line insurance seems to have become better and has more widespread coverage than in the past, but it typically won't cover air or pre- and post-travel [arrangements] unless those elements are purchased through [the line]," said Debra Kerper, a Cruise Planners travel adviser from Carrollton, Texas, who books travel and sells private insurance. "This is when private insurance coverage becomes so very important."

How much does cruise insurance cost?

Expect to pay anywhere from 4% to 8% of your total prepaid, nonrefundable trip expenses for a travel insurance policy. That's a wide range, we know, but it reflects the wide range of products out there.

You'll also find some basic plans that cost even less than 4% of your trip expenses, while some super-premium plans that cover just about any conceivable issue can cost as much as 12% of your trip expenses.

Related: What's included in your cruise fare?

All reputable insurance companies will offer a "free-look period" during which you can receive a 100% refund on your premium. This allows you to review the policy you've selected and return it for any reason within the period allotted — usually for a small administration fee of less than $10.

Under normal circumstances, you don't need to purchase a so-called "cancel for any reason" add-on to your cruise travel insurance policy unless you really need the flexibility. The upgrades are significantly more expensive.

You can receive a quote and purchase a policy online in minutes with any credit card. Although you may think travel insurance should code as "travel" when paid on a credit card and thus be eligible for bonus points on certain cards, that isn't always the case. Your points earnings will depend on the individual underwriter's merchant code. When in doubt, expect the purchase to fall under the insurance category for earnings.

Should I buy travel insurance for a cruise?

Whether you buy travel insurance is a personal decision that will depend on many factors. Would you be willing to absorb the loss of canceling a cruise on short notice due to an illness or accident? Could you afford an evacuation flight from a far-off port if you suddenly became seriously ill? Only you can answer those sorts of questions.

Here are some things to consider as you make that decision.

You might not be covered by regular medical insurance while cruising

If you're a U.S. citizen traveling internationally (which will be the case for most cruises), you may find that most private medical insurance plans in the U.S. won't cover you.

Additionally, Original Medicare only covers people traveling outside U.S. borders in limited circumstances.

While certain Medicare Supplement Plans do have some foreign emergency medical benefits, not all do. Be sure to talk to your Medical Supplemental Plan provider to see if you're covered, what's covered, what the limits are and how the bill is paid.

Also note that, in some countries (particularly those in Central and South America), travelers may not be discharged from a hospital until their bill is paid in full.

Related: Trip wrecked: 7 ways to prepare for any kind of travel disaster

Plus, if you have a medical incident overseas, you could find yourself stuck in a shared hospital room without air conditioning or a private bathroom. The level of care may not be what you expect.

"For people traveling internationally, it's crucial to know beforehand where to go for any treatment … and how they're going to pay for that treatment," Page said.

Getting evacuated for a medical condition is expensive

Most airlines won't accept seriously ill passengers, those carrying bulky medical equipment or those requiring a full medical team.

Even a low-cost weekend getaway on a cruise to the Bahamas out of Miami can turn costly if you suffer a serious accident or illness requiring medical treatment or an emergency medical evacuation.

Related: Do cruise ships have doctors, nurses, medical centers or hospitals?

Being flown back to the U.S. from a far-flung overseas location in a private, medically equipped aircraft, with a professional medical team on board, can run between $70,000 and $180,000, according to Mike Hallman, president and CEO of Medjet, a medical transport membership company.

"Domestic transports, which we cover as well, can cost upwards of $30,000," Hallman said.

Without proof of medical evacuation coverage, foreign providers will also want that money upfront. Hallman said that regular travel insurance will typically get you to an acceptable overseas hospital and even to a higher-level care facility if "medically necessary." Alternatively, medical evacuation coverage means you can fly home to your own hospital, doctors and family — without claim forms, cost caps on transports or surprise bills.

The tandem approach — buying both travel insurance and a separate medevac transport membership — is a good option, Hallman said.

"We always recommend travel insurance, as it covers trip interruption, which is important, as well as medical coverage for the hospital and treatment costs," he said. "We pick up where they leave off."

You can't predict the weather

Cruising is a great way to explore multiple destinations in one trip. But it's good to remember that unexpected delays, interruptions or cancellations due to weather can happen during cruises, particularly during hurricane seasons in places such as the Caribbean and Asia (where hurricanes are called typhoons).

During a typical hurricane season (June 1 to Nov. 30), Allianz pays about 6,000 claims from customers whose travel plans in the Caribbean, Gulf of Mexico and southeastern U.S. are affected by the storms, according to a spokesperson for Allianz Global Assistance USA.

If you're hoping to insure against a storm-related disaster, it's good to buy travel insurance as early as possible. Once a storm or hurricane is named, it's too late to buy travel insurance to cover it.

Of course, cruise lines will move ships away from a weather threat. When the port lineup is adjusted or the cruise shortened, the company will offer the guest an onboard credit, onboard gift or future cruise credit rather than any refund. It depends on the circumstances of that specific voyage. You won't be able to make a claim on your cruise travel insurance policy just for a minor itinerary change .

Related: Everything you need to know about cruising during hurricane season

Costs can mount quickly when things go wrong

Even if the cruise line does provide a full or partial refund or cruise credit for an itinerary change or some other interruption, travelers could have to swallow the cost of other travel elements not purchased through the line. That could include nonrefundable flights , prepaid resort or hotel nights, nonrefundable tour fees and more.

Travel insurance can cover those, plus help with flight delays or cancellations, baggage loss or theft.

If a winter storm causes you to miss your flight to where the ship is boarding , "travel insurance could help you get to the next port to join the cruise, so you don't miss your entire trip," Page said.

In fact, 13% of "billing reasons" for claims to Allianz are for common carrier delays (such as a flight delay), while weather and natural disaster-related claims account for about 3%.

The government probably won't bail you out

While cruise ships have medical facilities, they're usually not equipped to treat serious illnesses. If you experience a serious medical problem on a vessel, you may have to get off the ship in a foreign port to seek treatment at a hospital. In such a case, if you don't have medical evacuation insurance, you may then find yourself stranded in that port awaiting a medical evacuation.

Don't expect Uncle Sam to step in and help foot the bill.

The U.S. Department of State's Bureau of Consular Affairs clearly states the importance of buying travel insurance.

"The U.S. government does not provide medical insurance for U.S. citizens overseas," the bureau says on the website. "We do not pay medical bills. You should purchase insurance before you travel."

You may need more assistance than you think

If you're injured or become severely ill during a cruise, especially in a foreign country, it may be difficult to access help without the assistance of trained professionals that comes with many insurance plans.

Many travel insurance companies provide around-the-clock assistance with locating overseas clinics and pharmacies, getting to a doctor or hospital, refilling lost or depleted prescriptions, assisting with up-front payments to hospitals, and arranging flight changes so you can get home.

Travel insurance companies also can arrange for an air ambulance, a nurse escort, oxygen and a lie-flat seat on a flight home if your medical condition warrants it.

You want to be careful if you have preexisting conditions

When you cruise, it's important to be fully covered, which means having comprehensive medical coverage that includes any preexisting conditions. Otherwise, if you head into a doctor's office overseas, have any tests completed, or visit an urgent care center or emergency room, you might not be covered.

Here, timing is extremely important. Cruisers seeking coverage of preexisting conditions, as well as cancel for any reason insurance, generally must book within seven to 21 days of the first payment they make for a trip. The timing varies by insurer.

Bottom line

Cruise insurance isn't for every traveler — or even for every sailing. It's not inexpensive. However, it can bring a lot of peace of mind if you're about to head out to sea. Do your homework, compare plans and always assess the risks.

Planning a cruise? Start with these stories:

- The 5 most desirable cabin locations on any cruise ship

- The 8 worst cabin locations on any cruise ship

- A quick guide to the most popular cruise lines

- 21 tips and tricks that will make your cruise go smoothly

- Top ways cruisers waste money

- 12 best cruises for people who never want to grow up

- The ultimate guide to what to pack for a cruise

by Key Traveler

- Destinations

- Special Offers

- Browse Ships

- World Cruise

Testimonials

Just got home from our Oceania cruise on the Nautica- Black Sea. The trip surpassed my expectations...Thank you again for your assistance. Your advice on everything, from air arrangements to shore excursions and even choice of cabins was spot on.

We LOVE Key Traveler! We simply would not consider for a nano-second using anyone other than the Silvermans for all of our travel arrangements. And, we tell anyone who will listen that they should do likewise.

PROTECT YOUR INVESTMENT

Trip Insurance

Trip Insurance is highly recommended to protect our clients for unforeseen incidents such as medical cancelation, trip interruption, travel delay & more.

Key Traveler offers top rated trip insurance plans from the most respected carriers at direct prices .

Click image to receive a quote!

Please call for rates and details on plans listed 1-561-413-5133

- Privacy Policy

- Terms of Use

Copyright © 2024 Key Cruises & Tours. All Rights Reserved.

- 2024 Buyer's Guide

- Travel Insurance for Oceania Cruises

Oceania Cruises Travel Protection Program vs other travel insurance plans. Is their Protection Program Adequate?

A review of oceania's cruise insurance plan.

A quick review of Oceania's current travel protection program shows several areas of weakness that should be considered when reviewing their plan:

Medical Protection: only $10,000 of protection. Granted it's excess over any other insurance that might apply however, many medical plans in the USA either don't provide coverage outside the USA or they restrict coverage because it's out of network. In addition if you're covered by Medicare you should also know that they don't cover you outside the USA. $10,000 of coverage is very limited especially if your current coverage doesn't apply.

Emergency Evacuation: only $25,000 of protection. That level of coverage might be appropriate if you were traveling within the USA but given the destinations that Oceania offers it is going to be very short in the event of a worse case scenario where actual cost can easily exceed $100,000 for a private air ambulance evacuation.

Pre-existing conditions not covered: there is no coverage if a pre-existing medical condition causes a medical expense loss or a trip cancellation or interruption claim. While pre-existing medical condition exclusions are common place, many travel insurance plans offer a "waiver of pre-existing conditions" if you buy the insurance within 10 to 21 days following your first trip payment and you are physically fit to travel on the day you're buying the insurance, and you insure your trip to value.

Better coverage is available. The earlier you shop for alternative coverage the better off you'll be because most travel insurance plans offer time-sensitive benefits that enhance coverage if purchased early.

Start Your Quote for your next Trip here

Click here to find your plan

Case 1: Mr and Mrs Traveler have to cancel their trip due to Mr's pre-existing medical condition. Because the loss is caused by a pre-existing condition their claim is declined and they have lost the total amount that they paid for the cruise.

Case 2: Mr and Mrs Traveler are involved in a serious accident during a shore excursion. Mrs is seriously injured and must be medically evacuated to the nearest medically facility and once stabilized must be then evacuated to another hospital 500 miles away by private air ambulance with a Doctor in attendance. Total cost exceeds $25,000 and doesn't include the cost to be returned to the USA.

Get a Quote now

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Is Cruise Travel Insurance Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is cruise travel insurance?

What does cruise travel insurance cover typically, how much is travel insurance for a cruise, do i need it if i have other travel protections, is cruise travel insurance worth it.

Cruise travel insurance covers the cruise itself, not related travel.

It's usually purchased through the cruise operator, typically before booking.

Check to make sure your credit card doesn't offer similar insurance before buying cruise insurance.

Cruising is one of America's favorite travel experiences. According to a 2021 report from Cruise Lines International Association, an industry trade association, 82% of cruisers will cruise again. As well, 62% of non-cruisers are open to the idea.

And why not? Cruises often give travelers the chance to experience multiple destinations plus enjoy onboard entertainment, activities and dining for a set, all-inclusive price . Cruises simplify budgeting in a year when travel prices have been hard hit by inflation .

But what happens if something goes wrong with your ship, or you can’t make it onboard because of health concerns? Cruise travel insurance might be the answer. It protects your payment and covers you against illness or injury.

Before you pay for a cruise travel insurance policy, here's a look at what it is, how it works and if it's worth it.

Cruise travel insurance is add-on insurance coverage that — just like travel insurance — will reimburse you for delays, interruptions, medical situations or other problems during the cruise.

Depending on which cruise line you're traveling with, you might be able to buy a travel insurance policy when booking your trip (through the cruise line directly) or at a later date (either through the cruise line or separately from a third party).

Protecting travel costs can be a smart money move. A September 2022 survey of 737 past cruisers by InsureMyTrip found that the average trip cost for an insured cruise vacation so far this year is $6,367, an increase of nearly 15% from before the pandemic.

Can you buy travel insurance after booking a cruise? It depends. Some cruise lines require the purchase of a travel insurance policy before the final payment date when charges become nonrefundable. Others require the purchase of coverage a certain number of days before departure. Read the fine print to find out the deadline to purchase and the specifics of its coverage.

Circumstances covered by cruise travel insurance vary by policy and by issuer. Many cruise lines partner with an insurance company to underwrite its policy benefits.

Some common benefits available as part of travel insurance from a cruise line include:

Trip cancellation and interruption . If you cancel your trip or unexpectedly cut it short for an eligible reason, such as severe weather or illness, you'll get back some or all of the upfront costs, depending on the policy.

Cancel For Any Reason . This coverage tends to be more flexible, forgiving and expensive at time of purchase. Policyholders can cancel for any reason not listed in the policy and still receive a portion of their trip cost back, either as cash or as a future cruise credit (assuming they meet other eligibility requirements).

Trip delay . Cruise delay insurance protection protects expenses if your trip is delayed beyond a set number of hours.

Baggage protection . This insures your luggage if it is lost, stolen, damaged or delayed, and gives money to buy necessary items until bags are recovered.

Medical coverage . If you get sick or injured during the trip, the policy covers treatment and related expenses up to a limit.

Emergency evacuation . When emergency evacuation is necessary, the policy covers the transport cost up to a limit.

COVID coverage . If your trip is canceled or interrupted due to COVID, the policy covers the unused prepaid expenses, medical treatment and emergency evacuation, up to policy limits.

When comparing policies, choose a policy that includes all of the benefits, protections and coverage limits that are important to you. While you may be tempted to choose the lowest-priced option, that policy may not have the coverage you need.

We examined cruise insurance prices for a seven-day trip in February 2023 from the U.S. to Mexico. The example traveler was 35 years old, from Georgia, and planned to spend $2,500 on the trip, including airfare.

The average price of each company’s most basic coverage plan was $124. These policies didn't include optional add-ons, such as Cancel for Any Reason coverage or coverage for pre-existing medical conditions .

Separately, we looked at five different cruise insurance add-ons for a similar trip. With this option, the average cost of basic coverage was cheaper than a standalone policy at $111.20. Keep in mind that cruise insurance policies offered by cruise lines typically cover the cruise portion of the trip only, but do include some Cancel For Any Reason coverage.

If you already have a standalone travel insurance policy or a credit card with travel protections, you may wonder if you need to purchase a cruise travel insurance policy.

Credit card travel insurance

Many travel credit cards include travel protections such as trip cancellation, interruption, delayed or lost luggage reimbursement, and emergency evacuation benefits. Before buying a cruise travel policy, compare the coverage benefits and limits to determine if you already have coverage with a credit card.

One benefit that cruise travel insurance policies offer that credit cards don't is the ability to cancel for any reason. Although you may not get back 100% of the cruise price, these policies allow you to cancel for any reason and get a portion of the price back as a credit toward a future trip. If the policy is priced low enough, it may be worth buying the insurance offered through your cruise line for that benefit alone.

Travel insurance policy

Standalone travel insurance policies can be purchased to cover one person or a family for a specific trip or multiple trips within a period of time. These policies are available at a variety of price points to meet a traveler's budget. When comparing policy options, you can balance price versus coverage options.

If you're traveling multiple times within a short period of time, it may be more economical to buy a more comprehensive travel insurance policy instead of separate policies for each trip.

Cruise travel insurance can be worth it to address your concerns about traveling and protect your investments. These policies offer numerous protections that will cover your expenses in case your trip is canceled, interrupted or delayed, or if you get sick during the trip.

Before buying this coverage, compare your options against your credit card benefits. You might also shop for general travel insurance policies to see if you can get a better deal than what’s offered through your cruise line.

If you’re not covered by your credit card, cruise travel insurance can be worth the added cost. It will give you peace of mind before setting sail, when signing up for that adventurous land excursion and when clicking "Book" for an expensive vacation in the COVID travel landscape.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Nationwide Travel Insurance

- AXA Assistance USA

- Seven Corners Travel Insurance

- HTH Worldwide Travel Insurance

- World Nomads Travel Insurance

Cruise Travel Insurance Tips

- Why You Should Trust Us

Best Cruise Insurance Companies of April 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

A cruise vacation can take much of the stress out of planning a vacation. With a pre-set itinerary on the high seas, you don't have to worry about how you're getting to your destination and what you're going to do there. However, an unexpected emergency can take the wind out of your sails and money out of your travel budget. So you'll want to ensure you have the best travel insurance coverage that won't leave you high and dry in an emergency.

Best Cruise Insurance Companies

- Nationwide Travel Insurance : Best Overall

- AXA Assistance USA : Best for Affordability

- Seven Corners Travel Insurance : Best for Seniors

- HTH Worldwide Travel Insurance : Best for Expensive Trips

- World Nomads Travel Insurance : Best for Exotic Locations

Compare the Top Cruise Insurance Offers

- Trip cancellation coverage of up to 100% of trip costs (for cruises) or up to $30,000 (for single-trip plans)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Three cruise-specific plans to choose from

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual travel insurance plans available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong trip cancellation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancel for any reason coverage available

- con icon Two crossed lines that form an 'X'. CFAR insurance not available with every single plan

- con icon Two crossed lines that form an 'X'. Medical coverage is lower than what some competitors offer

Nationwide Travel Insurance offers many of the standard benefits you might see with a travel insurance policy. This can include things like trip cancellation coverage, so you can recover pre-paid costs or trip interruption in the event your vacation is interrupted by an unexpected event. There's also baggage delay coverage and medical coverage.

- Cancel for any reason coverage available

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Diverse coverage options such as CFAR, optional sports equipment coverage, etc.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Available in all 50 states

- con icon Two crossed lines that form an 'X'. Prices are higher than many competitors

- con icon Two crossed lines that form an 'X'. Reviews around claims processing are mixed

- Trip cancellation insurance of up to 100% of the trip cost

- Trip interruption insurance of up to 150% of the trip cost

- Cancel for any reason (CFAR) insurance available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Three plans to choose from

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Reasonable premiums

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. CFAR coverage available with some plans

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High medical emergency and evacuation coverage

- con icon Two crossed lines that form an 'X'. Special coverages for pets, sports equipment, etc not available

- con icon Two crossed lines that form an 'X'. Limited reviews with complaints about claims not being paid

- Trip cancellation of up to $5,000 with the Economy plan and up to $50,000 with the Preferred plan

- Cancel for any reason insurance and missed connection insurance available with the Preferred plan

- Baggage delay insurance starting after 24 or 12 hours depending on the plan

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Coverage for 200+ activities like skiing, surfing, and rock climbing

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Only two plans to choose from, making it simple to find the right option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can purchase coverage even after your trip has started

- con icon Two crossed lines that form an 'X'. If your trip costs more than $10,000, you may want to choose other insurance because trip protection is capped at up to $10,000 (for the Explorer plan)

- con icon Two crossed lines that form an 'X'. Doesn't offer coverage for travelers older than 70

- con icon Two crossed lines that form an 'X'. No Cancel for Any Reason (CFAR) option

- Coverage for 150+ activities and sports

- 2 plans: Standard and Explorer

- Trip protection for up to $10,000

- Emergency medical insurance of up to $100,000

- Emergency evacuation coverage for up to $500,000

- Coverage to protect your items (up to $3,000)

Cruise Insurance Reviews

Best cruise insurance overall: nationwide travel insurance.

Nationwide Travel Insurance is a long-standing and reputable brand within the insurance marketplace that offers cruise insurance plans with solid coverage and reasonable rates.

It has three cruise insurance options: Universal, Choice, and Luxury. The Nationwide Choice plan, for example, offers $100,000 in emergency medical coverage and $500,000 in emergency medical evacuation coverage.

The right plan for you depends on your budget and coverage needs. But each plan offers cruise-specific coverages like ship-based mechanical breakdowns, coverage for missed prepaid excursions if your cruise itinerary changes, and covered service disruptions aboard the cruise ship.

Read our Nationwide Travel Insurance review here.

Best Cruise Insurance for Affordability: AXA Travel Insurance

AXA Assistance USA offers three comprehensive coverage plans: Gold, Silver, and Platinum. Each of these plans offers coverage for issues like missed flights, medical emergencies, lost luggage, and more.

The highest-tier Platinum plan provides $250,000 in medical emergency coverage and $1 million in medical evacuation coverage. The baggage loss coverage is $3,000 per person, and their missed connection coverage is $1,500 per person for cruises and tours.

In addition, travelers can take advantage of AXA's concierge service, which provides an extensive network of international service providers. They'll be able to assist you with things like restaurant reservations and referrals, golf course information, and more. This service could come in handy if you're stopping at a variety of unfamiliar destinations during your cruise.

The coverage limits on AXA's policies are on the higher end compared to other providers. And you can buy coverage for a little as 4% of your trip cost depending on your age, travel destination, and state of residence.

Read our AXA Travel Insurance review here.

Best Cruise Insurance for Seniors: Seven Corners Travel Insurance

Seven Corners Travel Insurance lets cruisers enjoy traveling in their golden years with the knowledge they're covered in the event of an accident or emergency. While other providers do offer coverage to those 80+ years old, Seven Corners is known for its affordable premiums while offering above-average medical expenses and medical evacuation coverage limits — two areas of travel insurance coverage that are even more important as we get older.

Seven Corners also offers the option of a preexisting conditions waiver and CFAR insurance at an additional cost, plus "Trip Interruption for Any Reason" coverage, which you won't find on many policies.

You can choose between the Trip Protection Basic or Trip Protection Choice plans, with the higher-tier Choice plan costing more but providing more coverage.

Read our Seven Corners Travel Insurance review here.

Best Cruise Insurance for Expensive Trips: HTH Worldwide Travel Insurance

HTH Worldwide Travel Insurance offers three levels of trip protection: TripProtector Economy, Classic, and Preferred. The higher the tier, the more coverage you'll get for things like baggage delays, trip delays & cancellations, and medical expenses. But their premiums remain reasonable even at the highest tier of coverage.

Not only does the HTH Worldwide Trip Protector Preferred plan offer higher-than-average medical emergency and evacuation coverage limits ($500,000 and $1 million, respectively), but you'll also get a baggage loss coverage limit of $2,000 per person and coverage for trip interruption of up to 200% of the trip cost. You also have the option to add CFAR coverage for an additional cost.

Read our HTH Worldwide Travel Insurance review here.

Best Cruise Insurance for Exotic Locations: World Nomads Travel Insurance

World Nomads Travel Insurance has been a top choice for comprehensive travel insurance for many years now. And it's a great option when it comes to cruise coverage, too.

Even the most basic Standard Plan comes with $100,000 in medical emergency coverage and $300,000 in emergency evacuation coverage. And you'll get higher coverage limits with their Premium Plan. Plus, unlike many other providers, World Nomads trip cancellation and emergency medical coverage include COVID-19-related issues.

What sets World Nomads apart from many other insurance companies is that its policies cover 200+ adventure sports. This can be important for adventurous cruisers who plan to take part in activities like jet skiing, scuba diving, or parasailing during their cruise.

Read our World Nomads Travel Insurance review here.

Introduction to Cruise Insurance

Cruise insurance may offer unique coverage like missed port of call and medical evacuation coverage. You might not need the flight protections of a regular travel insurance plan if you're catching a cruise at a port near you, but medical and cancel for any reason coverage could be critical.

Understanding the Basics of Cruise Insurance

At its core, cruise insurance is your financial lifeboat, designed to protect you from unforeseen events that could disrupt your sea voyage. Whether it's a sudden illness, adverse weather, or other unexpected occurrences, having the right insurance can make a world of difference.

Why Cruise Insurance is Important