404 Not found

- Agent Login

- View Our Plan

- Why Buy Travel Insurance

- Time Sensitive Provisions

- Plan Documents

- Consumer Notices

- Travel Tips

- Useful Links

- Report a Claim

- Required Documentation

- View Claim Status

Question and Answers

See answers to the most commonly asked travel insurance questions below. Have a question not answered here? Give us a call at (800) 423-3632 and one of our Customer Service Representatives will be happy to help you.

Why buy travel insurance?

Travel insurance is designed to cover both you and the cost of your travel arrangements against a variety of unforeseeable reasons that may affect you or your travel plans. Emergencies happen when you least expect it. Travel insurance provides coverage for Trip Cancellation or Interruption; Medical Emergencies; Baggage (loss, damage or delay) or Travel Delay and much more. Plus, we offer our exclusive One Call 24-hour Traveler Assistance Service to help you with emergency situations that arise during your trip. Many travel products are non-refundable, and the best airline and cruise deals usually come with few options if you can't actually take your trip. Last week the airline joyfully booked your flight. This week it declared bankruptcy. Last month you reserved space on a Caribbean cruise. A few weeks later a family member became critically ill. Important Tip! Many people only consider their own health when deciding about travel insurance. It is not uncommon for younger people to assume that because they are healthy, travel insurance is not needed. But what about parents, grandparents, children, grandchildren, aunts and uncles? Remember travel insurance covers you if something happens to you or to any of these people, causing you to cancel your trip.

How do I purchase a travel insurance policy from MH Ross?

You may purchase online at backroads.mhross.com or by calling our Customer Service Department at (800) 423-3632.

How do I determine the correct amount of insurance to buy?

You should insure total the cost of all of your non-refundable air, land or cruise travel arrangements. Fully-refundable arrangements (i.e. without any penalties or restrictions) need not be insured. For example, many first class airline tickets, and some business class tickets are fully refundable. You should only buy travel insurance for prepaid and non-refundable travel arrangements. Non-cash transactions such as use of frequent traveler awards, early bird discounts etc, generally cannot be covered as these items have no cash value. Important Tip! You should always insure the full cost of any prepaid, non-refundable travel arrangements, as there will be additional limitations and exclusions if you insure less than the full cost of your non-refundable travel arrangements.

When is the best time to buy insurance?

For a variety of reasons, it is prudent to purchase travel protection when you first book your trip (i.e. make your first payment for travel arrangements). Why? Most travel insurance policies contain one or more time sensitive provisions that broaden coverage. The time sensitive provisions apply to coverage enhancements, such as: waiving of the Pre-Existing Conditions Exclusion; and Travel Supplier Bankruptcy or Insolvency protection. Important Tip! It is generally a mistake to wait until final payment for your trip to purchase travel insurance, because by buying earlier you receive better coverage at the same price.

When does my policy go into effect?

Under the Trip Cancellation Benefit, coverage begins for events occurring the day after you have purchased a plan. For all other benefits, coverage begins when your covered trip commences.

Do I insure for my age at the time of travel or when the insurance is purchased?

You should enter your attained age at time of purchase of a plan.

What is a Pre-Existing Condition?

In simple terms, a pre-existing medical condition is a sickness, injury or other medical condition for which a person receives diagnosis, treatment or advice during the 60 day period prior to your coverage effective date. Conditions controlled solely through medication, without a change in dosage, are not considered to be Pre-Existing Conditions.

What if I take medication for a condition like high blood pressure? Would this be considered a Pre-Existing Medical Condition?

If your condition is stable and controlled, and your medication remains unchanged, throughout the 60 day pre-existing period, this would not be considered a pre-existing medical condition.

Can I extend my policy if I have already departed?

Yes, you may extend your policy term while traveling on your covered trip as long as: 1) you have not experienced an injury or sickness or undergone medical treatment during your trip, 2) coverage under this policy is in force at the time you request an extension, and 3) you pay any additional required premium for such extension, if applicable.

What happens if I have obtained my ticket by using frequent flyer points?

The Trip Cancellation Benefit does not cover the value of the frequent flyer points. However, you are still able to insure the non-refundable tax portion, any upgrade costs and re-banking fees.

What happens if a Terrorist Incident occurs delaying my flight home? Am I covered for Travel Delay?

The Travel Delay benefit includes coverage for any type of common carrier delay, including terrorist acts.

What if I arrive late for my tour or cruise departure due to a missed connection?

With most plans, you will be reimbursed (up to the plan limit) for the additional transportation costs to join your trip and any unused portion of prepaid land or water travel arrangements, if you miss your tour or cruise departure because your arrival at your trip destination is delayed 3 hours or more due to: 1) any delay of a common carrier; 2) a documented weather condition prevented you from getting to the point of departure; or 3) quarantine, hijacking, strike, natural disaster, terrorism or riot. Under the Travel Delay Benefit, you will be reimbursed (up to the plan limit), for additional reasonable meal, accommodation and local transportation expenses if you are delayed beyond a minimum required time for a covered reason such as delay of a common carrier.

What happens if the airline loses my baggage at the start of my Trip?

Coverage is available (to the plan limit) for baggage and personal effects, passports and visas that are lost, stolen, or damaged during your covered trip. You must submit documentation from the common carrier for your loss, including all receipts for the necessary purchases made and documentation for reimbursements received and take all reasonable steps to protect, save or recover your baggage and personal effects. Our plans also provide a Baggage Delay Benefit, if while on your trip, your checked baggage is delayed by an airline (generally for 12 hours or more) to reimburse you for the purchase of necessary personal effects while on your trip

Can I cancel my policy if after reviewing it, I am not satisfied?

You can cancel and return your policy within the 10-day free look period and receive a complete refund. Generally, the Enrollment Processing Fee is not refundable.

Do I need to take my insurance documents with me and should I read them first?

Yes, you should read your documents as soon as you receive them to make sure the information is accurate. The Plan Certificate explains the policy benefits, limitations, conditions and exclusions. The Purchase Confirmation/Declarations contains the maximum benefit limits for the plan purchased. These two documents form your Policy/Certificate of Insurance and should be taken with you on your trip so you may refer to them in case of an emergency.

My policy is incorrect or needs to be changed. What do I do?

Please call us with all of the details and we will be happy to assist you. You may call 1-800-423-3632. We may request documentation regarding your changes.

I am renting a beach house at a cost of $10,000 for my family of five. How do we calculate the Trip cost and properly cover each traveler?

To determine the individual trip cost to be insured, divide the $10,000 beach house cost by the number of family members and then add each individual’s airfare along with any other non-refundable travel arrangements. You have now calculated the correct individual amount for each family member for his or her individual trip cost.

What should I do if I need Emergency Medical care while traveling?

You can contact our One Call Travel Assistance Network. Assistance coordinators are available 24/7 to help you in emergency situations. The One Call contact information is included in the Plan Certificate and on your Purchase Confirmation/Declarations.

I have read my policy and notice some of the words are capitalized. Why?

A word or phrase is capitalized because the word or phrase is defined in the policy.

What is Trip Cancellation and when does it apply?

The Trip Cancellation Benefit reimburses you for your non-refundable trip deposits or payments if you must cancel your trip for a covered reason. The covered reason that causes you to cancel must occur after your effective date and prior to your scheduled departure.

What is Trip Interruption and when does it apply?

The Trip Interruption Benefit reimburses you for unused land or water travel arrangements, plus additional airfare to return home or rejoin your trip when you must interrupt your travel for a covered reason.

My Traveling Companion is unable to travel with me, however I still want to travel, what should I do?

If you would like to take your trip without your traveling companion, we will reimburse you for the occupancy upgrade charges you incur, provided your traveling companion has canceled or interrupted his or her trip for a covered reason.

Why is age important?

Age is important as premium rates are often based on a combination of age, trip cost and trip length.

Get a Quick Quote

PDF Documents

Redirect needed.

You have selected to go to our . We will be redirecting you there now.

Travel Retailer Training Session

Welcome to this session covering your responsibilities as an employee of your company under the Travel Retailer Licensing Regulations.

Travel Protection Simplified

Agent login, important travel insurance licensing information:.

Upon logging in you will be prompted to participate in the Travel Retailer Training Session. In this short video you will be provided with important information regarding your responsibilities as an employee of your company under the Travel Retailer Licensing Regulations.

404 Not found

Backroads Announces Unprecedented Growth; Company Positioned for Record Sales in 2022

Avery Hale Joins Family Business as Director of Sales

News provided by

Jul 28, 2021, 09:00 ET

Share this article

BERKELEY, Calif. , July 28, 2021 /PRNewswire-PRWeb/ -- Backroads, the leader in active travel, today announced that the company is experiencing a boom with record sales slated for 2022, along with a strong rebound for US and European travel in 2021. Business is up more than 100 percent when comparing 2022 to 2019 numbers, the last full year of travel before the global pandemic. In response to the demand, Backroads has increased office staff by 43 percent since January for a total of 160 global office employees. Among the new team members is Avery Hale, the daughter of Founder and President Tom Hale , who has recently joined the family business as Director of Sales. In this role, Avery leads a 45-person department that manages customer service and guest bookings. Prior to joining Backroads, Avery was Regional Director of Sales at EVERFI, an education technology company based in Washington DC. As a past guest on 29 trips herself, she brings a deep familiarity with Backroads' values and is the same age that her father was when he started Backroads in 1979. Backroads office staff have returned to work at the corporate headquarters in Berkeley , along with more than 200 field staff running trips across the United States in the national parks, California Wine Country, Oregon , Maine , Vermont and more. Internationally, the company made its return to Europe this summer with trips in Iceland , followed by Croatia , Greece and France . Backroads will be running trips in over a dozen European countries including Italy, Slovenia, Spain, Portugal and Switzerland this summer and fall and has added additional departures to meet demand. Holiday travel is also proving to be extremely popular, with guests booking trips in Peru , Ecuador and Costa Rica , and in early 2022 Chile and Argentina are shaping up to be in-demand destinations as well. "It's so refreshing to see our wonderful Backroads staff back together working in our offices and helping guests plan their next vacation. After a tough year, we've turned the page and are looking forward to an amazing 2022," said Tom Hale , Backroads Founder and President. "I'm thrilled to welcome my daughter Avery to the family business. Backroads has been part of her DNA since before she could walk, and she has seen the company evolve into the leader in adventure travel it is today. I'm sure I'll learn a thing or two from her business acumen and sharp decision-making, and I'm looking forward to seeing where she leads Backroads in the coming months and years." In 2022, Backroads expects to take tens of thousands of guests on vacation in more than 60 countries across the globe. Europe is poised to be the most popular travel destination next year followed by Central and South America and the US. For more information and to book trips go to http://www.backroads.com . Backroads also just announced a new guest travel protection plan with Arch RoamRight. The new plan offered through Arch RoamRight can be purchased up until the day before departure (restrictions apply) and may protect up to 100% of a guest's vacation investment when unforeseen covered issues arise, a feature that's particularly helpful when planning travel during these changing times. About Backroads Backroads was founded in 1979 by Tom Hale and has been a leading innovator in active and adventure travel for over 40 years. The company offers biking, walking & hiking and multi-adventure tours, small ship active cruises, private trips and family trips designed for three distinct age groups: Teens & Kids (typically 9-16), Older Teens & 20s (17+) and 20s & Beyond (adult kids through their late 20s). Backroads hosts thousands of guests each year—75% of whom are repeat guests or referrals from past guests—in hundreds of locations across the globe. For more information, please visit backroads.com, or call 800-462-2848.

Media Contact

Liz Einbinder , Backroads, 510-292-0753, [email protected]

SOURCE Backroads

Related Links

http://www.backroads.com

Modal title

404 Not found

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Arch RoamRight Review: Is It Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is Arch RoamRight?

Arch roamright plans, what does arch roamright cover, family travel considerations, how to get a quote from arch roamright, is arch roamright legit, is arch roamright travel insurance worth it.

Arch RoamRight

- Complimentary coverage for one child.

- Stellar BBB rating.

- Medical-only and multi-trip coverage offerings.

- Only two main policy options.

- No Cancel For Any Reason option.

- Website isn't user friendly.

Although many credit cards offer travel insurance as part of their benefits, coverage limits vary, so you may want to look at standalone travel insurance plans too.

There are a lot of options to choose from, in terms of both insurance providers and cost. If you’re considering Arch RoamRight travel insurance to insure your next trip, let’s take a look at the coverage it provides and how much its plans cost.

Arch Insurance Group has provided underwriting services for many travel insurance companies since 2002.

In 2012, Arch Insurance launched its own Maryland-based travel insurance company called Arch RoamRight and started providing coverage for U.S. citizens and permanent residents.

» Learn more: What to know before buying travel insurance

Arch RoamRight travel insurance offers two types of comprehensive plans: Pro and Pro Plus. Here’s what you can expect to be covered by each plan.

This more affordable policy covers:

100% trip cancellation (with a limit of $15,000).

100% trip interruption or delayed arrival.

Itinerary change or return flight costs.

Trip delay or missed connection costs.

Emergency accident and sickness medical expenses .

Emergency evacuation and repatriation of remains.

Political and security evacuation.

Baggage loss or delay expenses.

Complimentary coverage for one child 17 or younger, with a covered adult.

Pre-existing medical conditions (if certain conditions are met).

Worldwide travel assistance.

Pro Plus Plan

The premium policy includes everything you’ll find on a Pro plan plus:

150% trip interruption coverage.

Cancel for work reason coverage.

Accidental death and dismemberment coverage.

Optional Platinum upgrade, which will increase some coverage limits, including medical, medevac and trip delay.

» Learn more: The best travel insurance companies

Let’s compare the Arch RoamRight travel protection plans, costs and coverage inclusions for a 10-day trip to Spain that costs $2,000 for a 36-year-old resident of Utah.

Pro plan coverage

Coverage and limits for the Pro plan from Arch RoamRight include:

Trip delay: $150 per day, with a $600 maximum.

Trip cancellation: 100% of the trip cost, with a $15,000 limit.

Trip interruption: 100% of the trip cost.

Baggage delay: $300.

Lost baggage: $250 per article, combined limit of $500 for valuables, $750 total limit.

Missed connection: $250.

Emergency evacuation: $250,000.

Political and security evacuation: $50,000.

Emergency accident and sickness medical expense: $25,000, with a $750 maximum for dental.

Pre-existing medical conditions waiver: Plan must be purchased within 14 days of your initial trip payment.

Return flight cost: $500 (in case of a Level 4 travel advisory).

The plan cost for our sample trip is $107.

Pro Plus coverage

Coverage and limits for the Pro Plus plan from Arch RoamRight include:

Trip delay: $200 per day, with a $1,000 maximum.

Trip cancellation: 100% of the trip cost, with no limits.

Trip interruption: 150% of the trip cost.

Baggage delay: $400.

Lost baggage: $250 per article, combined limit of $600 for valuables, $1,500 total limit.

Missed connection: $750.

Emergency evacuation: $500,000.

Political and security evacuation: $100,000.

Emergency accident and sickness medical expense: $50,000, with a $750 maximum for dental.

Accidental death and dismemberment: $10,000 or $25,000 on an aircraft.

Pre-existing medical conditions waiver: Plan must be purchased within 21 days of your initial trip payment.

Cancel for work reason: 100% of the trip cost, plan must be purchased within 21 days of your initial trip payment.

Return flight cost: $750 (in case of a Level 4 travel advisory).

This level of coverage will set you back $121.

Both plans offer the option to add on the following types of coverage:

Rental car damage .

Sports and hazardous sports.

Baggage, sports and business equipment.

Arch RoamRight also offers medical-only coverage and multi-trip coverage for longer-term trips up to 365 days.

Arch RoamRight travel insurance can be particularly helpful for families traveling together. This is because one child (17 years old or younger) can receive the same coverage as a covered adult — at no extra charge — on either plan.

So, a family of two adults and two kids could pay for a plan covering two adult travelers, and both kids’ coverage will also be included for free.

» Learn more: When to buy annual or multi-trip travel insurance

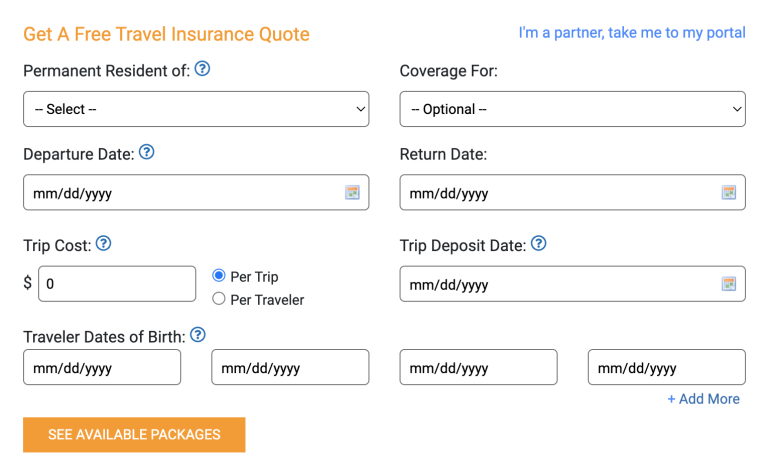

Getting a quote from Arch RoamRight for your next trip is no different than getting one from any other company.

Simply go to RoamRight and fill out the form, which includes information regarding your state of residency, the type of coverage you want (general travel, annual or medical), travel dates, trip cost, trip deposit date and travelers’ dates of birth.

Once the form is complete, click on “See available packages” and take a look at the quotes. Keep in mind that you must purchase a plan at least one day before departure — you can’t purchase a plan after you’ve started your trip.

» Learn more: Common travel insurance myths

Yes, Arch RoamRight is a legitimate travel insurance company that maintains an A+ Better Business Bureau rating.

Of those who reviewed Arch RoamRight on InsureMyTrip, a marketplace that helps travelers find the right coverage for their trips, 96% recommend Arch insurance travel protection to other travelers.

Purchasing travel insurance is a smart way to protect the investment you’ve made in your travel plans, especially if you’re taking a once-in-a-lifetime vacation or if many expenses associated with the trip are nonrefundable.

Arch RoamRight offers travelers two plans to choose from with the option to add on a few extras.

The company’s stellar BBB rating makes it an attractive option among travel insurance providers. It’s also a great choice for families looking to save a few bucks and still be protected in case of the unexpected.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Ultimate Rewards®, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 toward travel when you redeem through Chase Ultimate Rewards®.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Privacy Policy

Travelers Plans How to Travelers Plans in The World

Backroads travel protection plan.

Traveling is one of the greatest experiences one can have. It takes you to new places, exposes you to different cultures, and lets you create memories that last a lifetime. However, it’s not always sunshine and rainbows. There are countless things that could go wrong during your travels, from flight cancellations to lost baggage, and even medical emergencies. This is where the Backroads travel protection plan comes in.

What is a Backroads Travel Protection Plan?

The Backroads travel protection plan is a type of travel insurance that covers unexpected events that could happen during your trip. It provides financial protection in case of trip cancellation, trip interruption, medical emergencies, and more. This type of insurance gives you peace of mind knowing that you’re covered in case something unfortunate happens during your travels.

What does a Backroads Travel Protection Plan Cover?

The coverage provided by a Backroads travel protection plan varies depending on the plan you choose. However, here are some of the most common things that are covered:

- Trip cancellation or interruption due to covered reasons

- Emergency medical expenses

- Emergency medical evacuation

- Accidental death and dismemberment

- Lost, stolen, or damaged baggage

- Flight and travel accident coverage

Why do you need a Backroads Travel Protection Plan?

Traveling is unpredictable, and even the most meticulously planned trip can go wrong. Here are some of the reasons why you need a Backroads travel protection plan:

- Cancellation or interruption of your trip due to unforeseen circumstances such as illness, injury, or death

- Medical emergencies that require hospitalization or evacuation

- Flight cancellations or delays that result in additional expenses

- Accidents or emergencies that occur during adventure activities such as hiking or skiing

How to Choose the Right Backroads Travel Protection Plan?

Choosing the right Backroads travel protection plan can be overwhelming, but here are some things to consider:

- Destination: Some plans may have restrictions or exclusions for certain destinations.

- Duration of the trip: If you’re traveling for an extended period, you may need a plan with longer coverage.

- Activities: If you’re planning to participate in adventure activities, make sure your plan covers them.

- Budget: Choose a plan that fits your budget but also provides adequate coverage.

How to Purchase a Backroads Travel Protection Plan?

You can purchase a Backroads travel protection plan either through their website or by contacting their customer support team. Make sure to read the terms and conditions carefully and ask any questions you may have before purchasing the plan.

A Backroads travel protection plan is an essential investment for any traveler. It provides financial protection and peace of mind knowing that you’re covered in case of unexpected events during your travels. Make sure to choose the right plan for your needs and budget, and always read the terms and conditions carefully.

About TripAssure

Superior customer service is as important to us as it is to you..

TripAssure is a Generali Global Assistance & Insurance Services brand.

We know that you have many choices in selecting your travel insurance provider. When you select us, you have a team of experienced specialists and technical experts in the travel insurance industry working together to provide you with prompt and professional service. We strive to anticipate your needs and solve your problems before they occur.

We value your business and promise that we will always provide you with the integrity and service for which we are known. Superior customer service is as important to us as it is to you. We promise to provide you with:

- People who care – Our staff listens to what you have to say.

- Prompt, responsive solutions – Our staff will answer your questions or solve your problems quickly.

- Industry-leading plans – We provide you with coverage that is flexible, usable and affordable.

We sell insurance as authorized representatives of the insurance companies listed on our website. We are licensed in all states , as required by law.

Popular Searches

- Portugal Bike Tours

- Family Trips

- National Parks

- River Cruises

- Women's Adventures

- Does Backroads offer trip insurance?

- If I'm interested in purchasing the Travel Protection Plan, when is the best time to do so?

- I purchased a Travel Protection Plan. When does my coverage begin or end?

- What if a family member gets sick?

- What if I get sick or injured?

- What if I have a pre-existing condition?

- Are travel arrangements for before or after my trip that I did not purchase through Backroads covered under the Travel Protection Plan?

Can I cancel for any reason?

- How do I cancel my trip?

Backroads offers a Flexible Cancellation Plan (FCP) which allows you to cancel up to 48 hours prior to your Backroads trip start for any reason whatsoever and avoid the high cancellation fees. The plan is $250 per guest and must be purchased in conjunction with the Arch RoamRight Travel Protection Plan within 21 days of your trip deposit.*

If you cancel your Backroads trip for any reason 48 hours or more in advance of your Backroads trip, and the reason is not covered by the Arch RoamRight Travel Protection Plan, you may simply request to redeem your FCP feature with Backroads. This feature provides 75% of your Backroads trip cost (less the Travel Protection Plan and FCP costs) as a future trip savings to apply to the Backroads trip of your choice; must be booked and departing within 2 years. Click here to learn more.

*Residents of Hawaii, Minnesota, Missouri, Quebec and New York are not required to purchase the Backroads Travel Protection Plan to purchase the Backroads Flexible Cancellation Plan. Please contact us for options and pricing.

Discover Your Next Adventure

By sharing your email address, you agree to the practices described in our Privacy Policy .

Not finding what you’re looking for?

We're always happy to answer your questions via email or by phone at 800-462-2848 .

IMAGES

VIDEO

COMMENTS

This feature allows you to cancel up to 48 hours prior to your Backroads trip departure date for any reason whatsoever and avoid most cancellation fees. The cost of the FCP is $250 per guest and must be purchased as an addition to the Arch Roamright Travel Protection Plan within 21 days of your first trip payment.*.

View Plan Compare Plans Review the plan's limits, coverages, and benefits, then choose Buy Now to make your purchase. Review each plan's maximum benefit amounts, coverages, and benefits, then select the best plan for you. All items listed in these charts are subject to terms, conditions, limitations and exclusions. Please see the plan

Our travel protection plans include coverage for Trip Cancellations, Trip Interruptions, Accident & Sickness Medical Expense, Baggage and Personal Effects, Baggage Delays, Travel Delays and much more. Plus, we offer 24-hour Non-Insurance Traveler Assistance Service to help you with emergency situations that arise during your trip.

Your bags are lost or stolen? Or you need to cancel your student travel experience due to an emergency? Now that you have booked your student travel experience, don't forget to purchase travel protection. TripAssure plans include benefits to protect the cost of your travel arrangements; your belongings; and most importantly, you.

Due to the many pre-paid commitments with our local partners, wee do have to attach strictly to our canceling policy, which could result in a 100% cancellation penalty, as we always advocate purchasing a Travel Protection Planning.

Due to the many pre-paid commitments with our local partners, we do have to bond strictly to our cancellation policy, which could score at a 100% cancellation penalty, so we always recommend purchasing a Go Protection Plan.

Arch RoamRight Travel Protection Plan: Offered exclusively to Backroads guests up to 10 days before your departure, the Arch RoamRight Travel Protection Plan provides up to 100% trip cancellation and interruption coverage due to unforeseen reasons such as sickness or injury, medical evacuation as well as additional protections while traveling.Learn more about Arch RoamRight here and see below ...

We'll review the details of Backroads Tours' travel protection plan and then compare it with policies available in the broader travel insurance marketplace. Sample Trip: Backroads Vermont & Quebec Biking Tour. Our sample couple, aged 62, are taking the 5-night Vermont & Quebec Bike Tour from July 30 - Aug 4 for $8,998.

Not finding what you're looking for? We're always happy to answer your questions via email or by phone at 800-462-2848.

The Travel Protection Plan allows You to cancel or interrupt Your Trip for many covered reasons, such as: • Sickness, Injury, or death of You, a Family Member, Traveling ... or other travel provider (other than Backroads) causing a complete cessation of travel services more than 14 days following Your Effective Date. Benefits will be paid due

Backroads Travel Protection. Home; Agent Login; Contact Us; Insurance Plan . View Our Plan; ... you and the cost of your travel arrangements against a variety of unforeseeable reasons that may affect you or your travel plans. ... You may purchase online at backroads.mhross.com or by calling our Customer Service Department at (800) 423-3632. ...

Travel Insurance for your Backroads Adventure ... Skip to content. HOME; ABOUT US; PLAN INFO. View Plan; What is Travel Protection? Why Buy Travel Protection? Our Services; Consumer Disclosure(s) CLAIMS; COVID-19 FAQs; FAQs; ... FAQs TripMate Media 2020-03-13T16:43:13+00:00. Frequently Asked Questions You've got questions about travel ...

Travel Insurance for your Backroads Adventure. Skip to content. HOME; ABOUT US; PLAN INFO. View Plan; What is Travel Protection? ... Plan Information Basic TripMate Media 2020-03-13T16:43:12+00:00. Travel Protection Simplified. Agent Login. Agency Code. Username. Password.

Due to which many pre-paid commitments with our local join, we take hold to adhere strictly to our cancellation policy, which ability result the a 100% cancellation penalty, so our every recommend po a Travel Protect Plan.

Backroads also just announced a new guest travel protection plan with Arch RoamRight. The new plan offered through Arch RoamRight can be purchased up until the day before departure (restrictions apply) and may protect up to 100% of a guest's vacation investment when unforeseen covered issues arise, a feature that's particularly helpful when ...

Due to the multiple pre-paid undertakings with you locals colleagues, ours do have to adhere strictly to ours cancellation policy, any could result in a 100% cancellation penalty, so we always recommend purchasing a Journey Protection Plan.

Last year, when Travelex Insurance Services launched its new line of travel protection plans, it called out one enhancement: competitive age-band pricing, which bases its rates on each traveler ...

Your Plan Number which is found in the Plan Documents; The departure and return dates of your scheduled trip; The travel agency name, address, telephone number and the name of *Your travel agent, if you booked your trip through a travel agency (not required, but recommended).

Let's compare the Arch RoamRight travel protection plans, costs and coverage inclusions for a 10-day trip to Spain that costs $2,000 for a 36-year-old resident of Utah. Pro plan coverage

The Arch RoamRight Travel Protection Plan cost is based on your age at the time of purchase and is non-refundable. The plan provides coverage for your Backroads trip only. Airfare, pre- and post-trip travel arrangements not booked by Backroads are not covered with this policy. See chart below for age tiers:

The Backroads travel protection plan is a type of travel insurance that covers unexpected events that could happen during your trip. It provides financial protection in case of trip cancellation, trip interruption, medical emergencies, and more. This type of insurance gives you peace of mind knowing that you're covered in case something ...

About TripAssure. TripAssure is a Generali Global Assistance & Insurance Services brand. We know that you have many choices in selecting your travel insurance provider. When you select us, you have a team of experienced specialists and technical experts in the travel insurance industry working together to provide you with prompt and ...

We're always happy to answer your questions via email or by phone at 800-462-2848. Trip Cancellation coverage takes effect at 12:01 a.m. on the day following your purchase of the insurance and automatically ends at 12:01 a.m. on the first day of your scheduled Backroads trip or on the date and time you cancel your trip.

Backroads offers a Flexible Cancellation Plan (FCP) which allows you to cancel up to 48 hours prior to your Backroads trip start for any reason whatsoever and avoid the high cancellation fees.The plan is $250 per guest and must be purchased in conjunction with the Arch RoamRight Travel Protection Plan within 21 days of your trip deposit.*. If you cancel your Backroads trip for any reason 48 ...