A Comprehensive Guide to Opening a UK Bank Account (Even For Non-Residents Online)

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

.jpg?auto=compress,format&rect=0,0,1629,1629&w=120&h=120)

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

With its high standard of living and easy-going way of life, the UK is one of the world's most popular countries for living and working.

Whether you've just arrived in the country or are planning to move there soon (or whether you're there for university, work, or anything else), one of the things you'll need to get in order is a local bank account. This comprehensive guide delves into the nitty-gritty of how to open a bank account in the UK for non-residents in particular . If you're already a UK resident, no problem; you'll find that much of our information still applies to you too.

Fortunately, depending on your needs, the process should be doable, and you'll likely be able to open a bank account online in the UK without much hassle. (And, if you've heard the horror stories about opening a bank account in the UK, don't worry too much!)

Are you in a rush? Here are our recommendations if you're...

- from the EEA with no UK residence: Revolut gives you a UK account number, sort code, SWIFT code, and a debit card to spend in over 30 currencies, including pounds.

- not from the EEA with no UK residence: A Wise Account gives you multi-currency bank details in nine countries, including in the UK.

- in possession of a UK residence: Starling Bank offers a fully-fledged online current account that costs next to nothing every month.

Because it's needed to open most bank accounts, proof of address is usually where newcomers and non-residents in the UK hit a brick wall. It's also challenging if you've landed in the UK to live with relatives, where you won't have any bills or rental contracts in your name.

Can I Open a UK Bank Account as a Non-Resident?

All told, there are three main paths to open a bank account online in the UK, and not all of them are suitable for all types of non-residents. As a result, the best UK bank account will depend heavily on your needs and preferences. These paths are as follows:

- High-street banks: This path requires proof of UK residence and is only open to non-residents who make significant investments or who will soon be relocating to the UK. It's best for those who want extensive banking services and don't mind the fees.

- Online banks: Although the application is significantly more straightforward than at high-street banks, this path still requires proof of UK residence. It's best for those who want low-cost, digital banking services and don't mind slightly less banking coverage.

- Multi-currency accounts: This path provides a UK bank account without proof of address and is ideal for those wanting to open a UK bank account online from abroad.

Without further ado, let's explore each of these paths in detail below:

- 01. Path 1: Use a high-street bank (UK residents only) scroll down

- 02. Path 2: Use an online bank (UK residents only) scroll down

- 03. Path 3: Use a multi-currency account (no UK residence required) scroll down

- 04. How to get proof of address in the UK scroll down

- 05. How to transfer your money to the UK scroll down

- 06. Recapping how to open a UK bank account for non-residents online scroll down

- 07. FAQ about non-resident banking in the UK scroll down

Key Facts About Banking in the UK

Path 1: high-street uk banks.

The biggest high-street banks in the UK are HSBC, Lloyds, Barclays, NatWest, and Standard Chartered¹. Other big names include RBS, Nationwide, Santander, and Metro Bank. By "high-street", we mean traditional big banks with physical branches across the country (versus online banks, which don't have any branches).

High-street banks will generally only accept your application if you can provide proof of UK residence in your name. The only exceptions are for wealthy foreign investments (which we won't discuss in this article) and for opening an account before moving to the UK. In the latter case, some banks such as Barclays and Lloyds allow account opening from abroad within three months of moving to the UK. Still, they also require a higher barrier to entry, i.e. upwards of £50,000 in gross annual income or £25,000 saved or invested with the bank².

All deposits in UK high-street accounts are protected up to £85,000 in the case of bankruptcy by the Financial Services Compensation Scheme (FSCS)³, making them safe from a customer perspective.

Types of Bank Accounts in the UK

There are numerous types of accounts in the UK, but here are the two that most people mean when they talk about a "bank account":

- Current account: Called a 'checking account' in the US, this is what most people are looking for basic everyday use, such as paying bills and receiving a salary. They generally come with a debit card and overdraft facilities. Chequebooks are no longer automatically issued to new customers, but you can opt for one if you wish.

- Savings account: These accounts traditionally yield a higher interest rate and are meant for what their name implies — saving money. Some savings accounts require you to not touch the funds for a set number of months or years. However, some current accounts also pay interest on balances up to a set amount.

- Basic account: Major high-street banks in the UK are mandated by law to provide basic bank accounts to legal residents and citizens. Basic accounts are fee-free and offer only the most standard deposit and withdrawal operations, including failed payments to prevent overdrafts.

- Joint account: Joint accounts are legally shared between family members. They are generally used for married couples to combine their finances together, or for parents to manage expenses with their children.

- Student account: Banks usually offer accounts with added features and low fees for university students. The fees raise to their standard levels once you graduate or reach a certain age limit.

- Digital mobile account: With both high-street banks and UK online banks, you should be able to access your account balances by desktop or mobile app. User experience and service quality certainly varies from bank to bank, with UK online banks specialising in digital-only accounts.

- International non-resident account: International accounts are ideal for non-UK residents who want access to current accounts and everyday services in the UK. In addition to the resources found in this guide below, learn more with our guide about the 8 best international bank accounts for expats .

- Offshore account: UK banks with an international presence (such as HSBC or Barclays), and banks in your home country with a presence in the UK (like Santander or Citibank), may offer offshore accounts. These accounts have high minimum balance requirements and monthly fees, but they usually come with an account manager and balances held in multiple currencies . Offshore accounts are often used for real estate management, investment management, trusts, or holding deposits.

Documents Needed To Open a UK Bank Account

To open a UK bank account, you generally need the following:

- Proof of identity: Passports, driving licences, and national identity cards are accepted. In general, if you're a foreign national, your best bet is to use your passport — EU ID cards are usually accepted, but if you're from Australia, your home driving licence may not be.

- Proof of UK address: Generally, a recent utility bill, rental contract, or council tax bill will suffice. Mobile phone bills are generally not accepted.

There are no banks that don't need ID to open an account. Banks are required by law to collect this information for Know Your Customer (KYC) and anti-money laundering (AML) reasons⁴.

Which UK High-Street Banks Offer Accounts For Non-Residents?

Below, you'll find the account offerings among major high-street UK banks that we found the most useful for newcomers to the UK. As we saw above, there are also premium accounts and specialised accounts for students and youth too, but we selected the basic current accounts for the sake of illustration:

HSBC is the UK's largest bank by market value and total assets.

- Account: HSBC Bank Account

- Monthly fee: £0

- Int'l transfer cost: 1.5% - 8% (depending on the currency)

- Int'l card payment cost: 2.75% with limits

- Proof of UK residence required: Yes

National Westminster Bank, known colloquially as 'NatWest', is a large British bank that's based in Edinburgh, Scotland.

- Account: Select account

- Int'l transfer cost: 5% - 10% (depending on the currency)

- Int'l card payment cost: 2.75%

3. Barclays

Barclays is a UK banking giant offering retail, business, and investment banking worldwide.

- Account: Barclays Bank Account

- Int'l transfer cost: 4% - 10% (depending on the currency)

- Int'l card payment cost: 2.99%

Famous for its black horse logo, Lloyds is a popular banking choice among UK residents, with millions of customers nationwide.

- Account: Classic Account

- Int'l transfer cost: 3.5% - 8% (depending on the currency)

Opening an Account Before You Move to the UK

If you plan to relocate to the UK soon, you can sometimes still open a British bank account without proof of residence.

At Barclays, for example, you can open a UK bank account online from your home country within 90 days of relocating there. You'll then be required to complete the application process at a Barclays bank branch after you arrive in the country. You'll be eligible to open the following two types of accounts this way: (1) the £0-per-month Barclays Bank Account mentioned earlier, or (2) the Premier Current Account , which has a high barrier to entry (£75,000 gross annual income or £100,000 saved or invested with Barclays) and comes with a lucrative rewards program.

Similarly, Lloyds offers customers the International Current Account in GBP before they move in from abroad. To open an account from your home country, you can apply online, though you must have a £50,000 gross annual income or £25,000 saved or invested with Lloyds (which is a lower barrier to entry than Barclays).

Learn more with our guide about the 8 best international bank accounts for expats .

Hire a Third Party to Sort Out the Paperwork

If you want a high-street bank account but merely thinking about all the options makes you lose your marbles, we recommend visiting Sable International , which has relationships with several traditional banks, including Lloyds, Barclays, HSBC, and Metro Bank.

Sable facilitates an introduction to the banks, enabling you to open a UK bank account without the usual proof of residency documents, such as a utility bill. It offers several options:

- Bank account: If you want to open a UK bank account, you can get one without proof of address. You have to provide a valid passport, proof of permission to live and work in the UK, a residential address to receive post (this can be a friend or relative you're staying with, you don't need a utility bill), and be able to attend an appointment in London with one of their banking affiliates.

- Relocation: If you'd like a UK bank account plus various bells and whistles, this option assists with setting up a UK bank account and obtaining a National Insurance (NI) number and offers one free international money transfer, a pay-as-you-go UK SIM card, and a guidebook covering life in the UK.

- Tier 5 Visa: If you want all of the above (including a bank account) and help to apply for a Tier 5 Youth Mobility Scheme visa, then this option allows people between the ages of 18 and 30 to live and work in the UK for up to two years. However, it's only available to citizens of certain countries (including Australia, New Zealand, and Canada).

Path 2: Online Banks

UK online banks (sometimes called "challenger banks" or "neobanks") can be either registered banks or non-bank fintechs. They're characterised by not operating out of branches, with all banking services handled online instead. These banks generally offer a more limited range of services than the high-street banks we explored above, but at a fraction of the price and over a user-friendly web or mobile app interface.

If you want to open a UK bank account without proof of UK address, then the only online banks that may accept your application will be Monese and Revolut (although these will still require proof of residency in the EU/EEA or another country). On the other hand, Monzo and Starling Bank will require proof of address in the UK. Note that even if you don't submit proof of address, you might still need to supply a UK address to deliver your debit card.

Take a look at the UK's top three challenger banks according to our rankings, though we've summarised these rankings below too:

Starling Bank: Best UK Online Bank

Starling Bank is a fully-authorised bank in the UK that's well known for its fee-free current account .

- Trust & Credibility 9.3

- Service & Quality 8.5

- Fees & Exchange Rates 10

- Customer Satisfaction 9.3

Because this account is entirely free and gives you access to an impressively complete range of financial services (including the Starling bank card , overdraft facilities, loans, joint accounts, youth cards, pensions, a euro account, interest rates, etc.), we think Starling offers the best free bank account in the UK — one we think makes an excellent replacement for a bank account at a high-street bank.

- Account name: Personal Account

- Int'l transfer cost: 0.5% - 3% (depending on the currency)

- Int'l card payment cost: 0%

- Proof of UK residence required: Yes

- More info: See our full Starling Bank review .

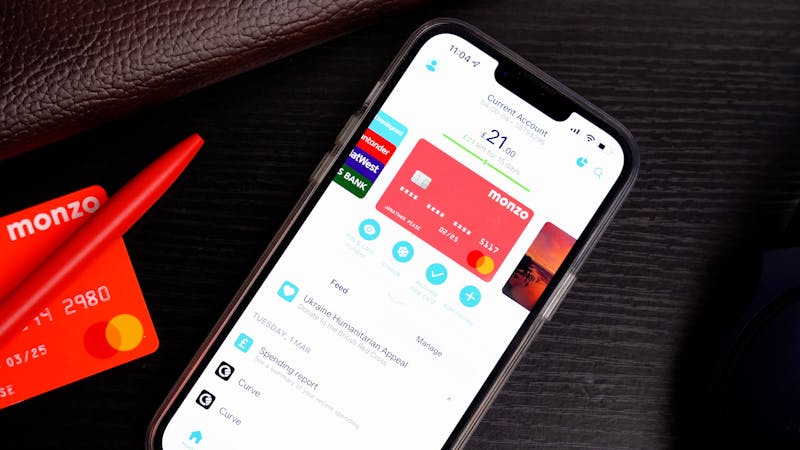

Monzo: Best Bank for Savers

Monzo is a regulated UK bank and probably the country's most famous mobile-only bank account.

- Trust & Credibility 8.3

- Service & Quality 8.4

- Fees & Exchange Rates 9.8

An excellent choice if you're looking to avoid fees, Monzo (like Starling) charges no fees for day-to-day card use in the UK and abroad. Moreover, because it offers one of the most advanced and comprehensive savings systems we've seen from any challenger bank (allowing lots of flexibility over your time horizon and savings goals), we think Monzo is especially well-suited for managing and growing wealth , regardless of your individual goals.

- Account name: Monzo

- Monthly fees:

- Int'l transfer cost: 0.2% - 2.5%

- More info: See our full Monzo review .

Suits Me: Best For New Arrivals

Suits Me is a reliable banking alternative for new arrivals in the UK.

- Trust & Credibility 7.3

- Service & Quality 7.0

- Fees & Exchange Rates 6.1

- Customer Satisfaction 8.6

It offers an easy and fast account opening process without requiring credit checks or proof of address. Additionally, Suits Me gives you a prepaid debit Mastercard, online banking services, and the ability to receive payments from employers and other sources (e.g. Faster Payments, BACS, and CHAPS, although not international SWIFT transfers).

- Account names: Essential, Premium, Premium Plus

- Int'l transfer cost: Not available

- Int'l card payment cost: £1.00 + 2%

- Proof of UK residence required: No

- More info: Go to the website .

Path 3: Multi-Currency Accounts

Online multi-currency accounts aren't full banks in the UK but rather fintech companies (known formally as Electronic Money Institutions or EMIs) that often compete to offer the cheapest ways to transfer money globally. However, in addition to money transfers and currency exchange, multi-currency wallets normally come complete with a debit card, multi-currency account balances, and even foreign bank details.

Below, we go over three of the most prominent multi-currency fintechs: Revolut, Wise, and Monese.

Revolut: Best UK Account for EEA Residents

Probably the UK's most famous fintech, there's a good chance you've heard of Revolut .

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

Using its innovative personal finance platform, you'll not only have access to a broad range of financial services unique among free online accounts, but you'll also be able to take advantage of these services at a comparatively low price. However, because it's not yet a bank in the UK, we think Revolut is best used as a powerful spending tool next to a main bank account, as opposed to in place of it (even if that bank account is in your home country).

Sadly, although Revolut is also available in the US, Australia, Singapore, Switzerland, and Japan, its British pound account details are only available to EU/EEA and UK customers who get both an EU IBAN account (in Lithuania) and a British current account number, sort code, and SWIFT code.

- Account names: Standard, Plus, Premium, Metal

- Monthly fee:

- Int'l transfer cost: 0.5% - 1.5%

- Proof of UK residence required: Not necessarily

- More info: See our full Revolut review or visit the website .

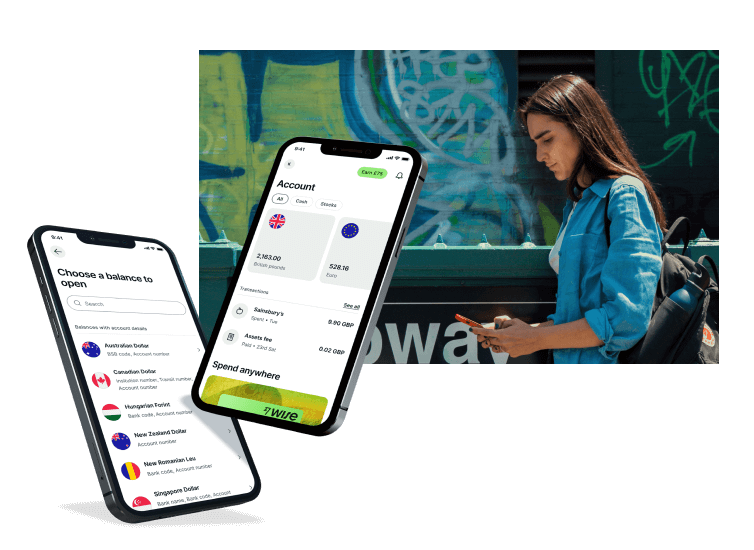

Wise: Best UK Account for Non-EEA Residents

The Wise Account is the best way to open a UK bank account from abroad (especially if you're not from the EU/EEA and don't have access to Revolut).

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

Wise will work for you no matter whether you want to hold money in pounds, spend money on holidays abroad, shop online, or receive earnings from the UK. Fortunately, after opening your account online, you'll only be required to verify your identity; you won't need to show proof of residence in the UK to sign up and obtain the VISA debit card (although you will need to show proof of residence in the EU/EEA, US, Singapore, Japan, Australia, or New Zealand).

Here's what Wise has to say about opening an account without proof of residence in the UK⁵:

"You can then choose to either supply proof of address from a standard list of documents, or to send in a selfie, in which you're holding your proof of ID. This can be a great alternative if you're still waiting to move to the UK or haven't yet got bills and other paperwork registered in your name."

Wise's Top Features

Your Wise Pound account will be held by Barclays Bank and come with the following details unique to you:

- A sort code;

- An account number;

- A British IBAN (starting with "GB").

This means you'll be able to spend and be paid just like a local in the UK and convert your GBP balance into your home currency without the exorbitant bank fees. Here's an overview of the other features you'll get:

- Local bank details, not just in the UK, but also in the US, EU, Australia, New Zealand, Singapore, Romania, Canada, and Hungary.

- Hold, exchange, and top-up up to 56 currencies.

- A multi-currency VISA debit card that's handy for paying in foreign currencies without hidden fees.

- Access to Wise 's powerful international money transfer service right from your account balance.

An Example of How Wise is Useful

To get a sense of how helpful Wise can be for expats and non-residents in the UK, let's say that you've just moved from Paris to London and need an active online account to receive and spend pound sterling. With a Wise, you'll be able to...

- send euros from your bank to your Wise euro account,

- convert all or part of your euro balance into sterling at a low fee of around €6.94 to add £1,000,

- pay with your Wise debit card, make or receive SEPA and SWIFT payments, and set up direct debits .

You'll also have UK bank details to share with an employer. Note that this account does not offer overdraft facilities, and you also won't earn interest on any in-credit balances.

Monese: Another Option for EEA Residents

Monese is a mobile-only challenger bank that offers fully-fledged checking accounts to more than two million customers in the UK and across much of Europe.

- Trust & Credibility 7.6

- Service & Quality 9.0

- Fees & Exchange Rates 6.6

- Customer Satisfaction 8.7

Because Monese doesn't require you to prove your residence to meet the minimum creditworthiness standards to open an account in the UK, we think Monese is especially well-suited for new arrivals to the UK from the EEA. Although we don't find Monese quite as feature-rich as Revolut, we do think it has an advantage over Wise if you plan to split your life between the UK and a country in Europe.

Although you only get a Euro IBAN (starting with 'BE') if you're an EU/EEA resident, you will be able to use this to receive British pounds too. It's currently illegal to discriminate based on the origin of an IBAN in the UK and EU.

Here's an overview of Monese's offering:

- Account name: Starter, Classic, Premium

- Int'l transfer cost: 0.5% - 1.5%

- Int'l card payment cost: 0% (0.4% - 0.8% for cash withdrawals)

- Proof of UK residence required: Not necessarily

- More info: See our full Monese review .

How To Get Proof of Address in the UK

Regardless of which bank account you choose, if you're planning to move to the UK for a more extended period, getting your proof of address in order will be a necessary step in the long run.

Following modern anti-money laundering (AML) regulations, banks and other financial institutions are required to ask for appropriate evidence of identity whenever certain financial transactions occur. Checking that identity and proof of address match minimizes the chance that the account is opened under a false identity⁶.

What Document Count as Proof of Identity?

Banks and other financial institutions will require proof of identity in the form of a valid, government-issued passport, original birth certificate, EU/EEA member state ID card, current UK or EU/EEA driving licence, registration card for self-employed individuals, Resident Permit issued by the Home office to EEA nationals, National Identity card, or a Firearms certificate.

Provisional driving licenses and biometric residence permit (BRP) cards are often not accepted as proof of ID by UK banks.

What Document Count as Proof of Address?

In addition to a proof of identity, you'll also be required to provide one (even two) original documents to prove that you live where you claim to live (i.e. your residential address) in the UK. The following documents are practically always accepted:

- Utility bills, such as for electricity, gas, satellite, TV, or landline that are at most three months old. (Note that a mobile phone bill will not be accepted).

- A local authority council tax bill for the current council tax year.

- A valid UK driving licence.

- Bank or building society statement or passbook less than three months old (bank statements won't be accepted if they're from Monzo).

- Mortgage statement (issued for the last full year).

- Solicitors letter within the last three months confirming the property purchase (or the land registry confirmation of address).

- A council or housing association rent card or tenancy agreement for the current year.

- HMRC self-assessment letters or tax demand dated within the current financial year.

- Electoral Register entry.

- NHS medical card or letter of confirmation from GP's practise of registration for surgery.

Credit card statements or provisional driving licenses will not be accepted as proof of address. According to the Financial Conduct Authority (FCA) , if you're unable to provide the documents listed above, you can request to see if the bank will accept any of the following documents:

- A letter from a care home manager or warden of sheltered accommodation or a refuge.

- A letter from the warden of a homeless shelter.

- A letter from a probation officer or a hostel manager.

- A letter from a prison governor.

- If you are a traveller, a letter from the local authority that verifies your address.

- If you are an international student, a passport or European Economic Area National Identity Card and letter of acceptance or introduction from a body on the Department for Education list.

- If you're an asylum seeker, an application registration card.

What If My Application to Open a UK Bank Account is Refused?

There are 9 major high-street banks in the UK that are required to offer basic bank accounts to legal residents and citizens in the UK. These banks are: Barclays UK, the Co-operative Bank, HSBC UK, Lloyds Banking Group (including Halifax and Bank of Scotland brands), Nationwide Building Society, NatWest Group (including Royal Bank of Scotland and Ulster Bank brands), Santander UK, TSB, and Virgin Money.

However, banks in the UK can still refuse to open bank accounts if you fail to provide proper documentation, such as a proof of ID or proof of UK address. Know Your Customer (KYC) laws require banks to obtain identity information about their customers to help prevent money laundering and terrorist financing.

Banks are not required to give their reasons for refusing an account. However, you can issue a complaint to the Financial Ombudsman Service if you think you have faced discrimination. Typically, it takes 8 to 12 weeks to address such disputes. In the event that you are dissatisfied with the Ombudsman's final decision, you may consider pursuing legal action, though you will generally be responsible for covering your own legal expenses.

How To Send Money to a UK Bank Account

Once you've opened a bank account in the UK, you'll need to consider how to move your funds across , a process that can be exceptionally costly if you're depositing money from a currency other than pounds. To deposit money into your new pound sterling account from your home currency before you move, you'll need to go to your online banking and choose between one of two options:

- Sending a wire transfer through your bank directly;

- Sending a bank transfer via a money transfer specialist.

We don't recommend using your bank to transfer money internationally, as the fees can be exorbitant, and the waiting times can be lengthy. This is mainly because banks wire funds over the SWIFT network , which adds many timely and expensive steps to the money transfer process.

Instead, if the amount you'd like to send to the UK is in the order of several hundred or thousand Pounds or equivalent, then we recommend you use a money transfer specialist service ( Wise is one among many.) To compare which services are cheapest for your transfer amount and your home country to the UK, run a search on Monito's real-time comparison engine here .

On the other hand, if you're moving large amounts of money from your home currency to your new bank account in the UK (i.e. anything upwards of £30,000 or equivalent), services such as Wise may not be your cheapest bet. Instead, we recommend exploring your options among the foreign exchange brokers that support transfers from your country to the UK. These services specialise in negotiating favourable exchange rates on your behalf. They are the most cost-effective option for transferring large sums of money (such as life savings or liquid investments) across borders.

To find out which service will offer you the best deal in real-time, run a search on our comparison engine below:

Find the best deal when sending money to the United Kingdom:

Recap: what are the best online bank accounts in the uk.

To conclude, let's recap the main recommendations we explored in this non-resident banking guide:

- Revolut : Best GBP non-resident account for EU/EEA residents.

- Wise : Best GBP non-resident account for non-EU/EEA residents.

- Starling Bank : Best low-cost online bank for UK residents.

- Monzo : Best online savings account for UK residents.

- HSBC : Best traditional banking experience for UK residents.

- Monito : Best way to compare money transfers to the UK.

See our guide on the best online-only banks in the UK for more.

FAQ About Opening a Bank Account Online in the UK For Non-Residents

Few solutions offer a bank account in the UK when you don't have proof of address in the UK. With Monzo or Monese, you can open a UK bank account with just a few clicks, although you'll need to show proof of residence. Generally, we consider the Wise Account the best UK bank account for non-residents. See all the details about opening a bank account in the UK without proof of address in our in-depth guide.

Expats moving to the UK might find it difficult to open a traditional bank account. To open a bank account, you need proof of address, which might be hard to get if you are a non-resident. The good news is that companies like Monzo or Monese offer a UK bank account without proof of address. You can have a UK bank account with just a few clicks. You will find more info about UK bank accounts for non-residents in our blog post .

Yes, it is possible to have a Euro bank account in the UK, and some UK banks offer bank accounts in Euros. However, the fees for such accounts are quite high. For low-fee (or even free) solutions, take a look at our guide to the best Euro bank accounts in the UK .

To open a bank account in the UK, you'll generally need two things:

- Proof of your identity: E.g. Passport, drivers license, or national identity card. In general, if you are a foreign national, your best bet is to use your passport.

- Proof of the address in the UK: E.g. a recent utility bill, rental contract, council tax bill. Mobile phone bills are generally not accepted. If you don't have proof of address, then we recommend opening a Wise Account to take care of your finances until you sort one out.

UK banks ask customers to prove who they are and where they live in the UK before they open a bank account. Proof of address ensures that a bank account is not opened under a false identity. Each bank accepts different documents, but in general, you will be asked to show two official documents, for example:

- Utility bills

- Local authority council tax bill for the current council tax year

- Current UK driving license

- Bank, Building Society or Credit Union statement

- Mortgage statement

- A council or housing association rent card or tenancy agreement for the current year

- Solicitors letter within the last three months confirming the property purchase (or the land registry confirmation of address)

- HMRC self-assessment letters

- Electoral Register entry

- NHS Medical card

Foreigners can open a traditional bank account in the UK as long as they have proof of the address, which sometimes it's hard to get. The good news is that there are companies like Monzo or Monese which offer UK bank accounts even without proof of the address. All the information about opening a bank account in the UK you will find in our blog post .

A non-resident cannot open a bank account in the UK in a strict sense, as proof of address is always required by British banks for new customers. However, to open an account ahead of a move to the UK, you can opt to open a British pound foreign currency account at your local bank in your home country, or, you can open a savvy only multi-currency account in pounds (and dozens of other currencies) via Wise that gives you a full set of official UK banking details, including an IBAN, account number, and sort code.

- Current account: Called a 'checking account' in the US, this is what most people are looking for basic everyday use, such as paying bills and receiving a salary. They generally come with a debit card and overdraft. Chequebooks are no longer automatically issued to new customers, but you may be able to opt for one if you wish.

- Savings account: These accounts have traditionally yielded a higher interest rate and are meant for what their name implies — saving money. However, a number of current accounts also pay interest on balances up to a set amount.

There are also basic accounts (which are generally on offer for people with a poor credit history), as well as premium current accounts (which cost a monthly fee and come loaded with features), as well as current accounts aimed at youth and students.

Yes, in some cases, it's possible to open a Spanish bank account from the UK, although you'll need to prove a legitimate interest in Spain and obtain a certificate of non-residency (and the associated NIE number) in order to do so. Take a look at our guide to opening a non-resident bank account in Spain to learn more.

If you don't yet have a UK ID and are planning to move to the country, you can opt to open a British pound foreign currency account at your local bank in your home country, or, alternatively, you can open a savvy only multi-currency account in pounds (and dozens of other currencies) via Wise that gives you a full set of official UK banking details, including an IBAN, account number, and sort code.

Yes, it's possible to open a bank account online at most UK banks, although many high-street banks will require you to come in for an appointment too. To get an overview of which banks are completely online in the UK, take a look at Monito's guide to the best UK challenger banks .

- Statista: Largest banks in the United Kingdom (UK)

- Lloyds Bank: International Current Account

- FSCS: What we cover

- GOV.UK: Your responsibilities under money laundering supervision

- Wise: How to get a proof of address in the UK

- GOV.UK: Proof of identity checklist

Compare Top Online Banks in the UK

Filter your results.

- Languages open English (8) Polish (5) German (4) French (4) Italian (4) See all

- Country availability 1 open United Kingdom (8) Italy (14) Germany (13) Poland (11) United States (11) See all

- Services open Multi-currency account (3) Travel card (3) Full bank account (2) All-in-one finance app (2)

- Monthly fee open Very low (6) Low (1) Moderate (1)

- Card delivery time open Fast (5) Mid (3)

- Best for open Spending while abroad (4) Easy registration (2) Everyday banking (2) Spending online (1) Saving money (1)

- Bank details open Euro IBAN (5) UK account no. & sort code (5) Romanian account no. (2) Australian account & BSB no. (1) Canadian account, transit, institution no. (1) See all

- Supported currencies open Pound sterling (8) Euro (6) US dollar (5) Australian dollar (4) Canadian dollar (4) See all

- Overdraft open No (5) Yes (3)

- Annual interest rate open Very low (6) High (1) Low (1)

- Supports cash deposits open Yes (5) No (3)

- International transfers open Yes (8)

- Overall Monito Score

- Trust & Credibility

- Service & Quality

- Fees & Exchange Rates

- Customer Satisfaction

- Service & Quality 7.8

- United Kingdom

- Full bank account

- Everyday banking

- UK account no. & sort code

- Pound sterling

- Overdraft Yes

- Supports cash deposits Yes

- International transfers Yes

- Saving money

- Czech Republic

- Liechtenstein

- Netherlands

- Switzerland

- United States

- New Zealand

- Multi-currency account

- Spending while abroad

- Hungarian account no.

- US account & routing no.

- Australian account & BSB no.

- New Zealand account no.

- Canadian account

- institution no.

- Romanian account no.

- Singaporean account no. & bank code

- Turkish IBAN

- Australian dollar

- Bulgarian lev

- Canadian dollar

- Swiss franc

- Czech koruna

- Danish krone

- Croatian kuna

- Japanese yen

- Malaysian ringgit

- Norwegian krone

- New Zealand dollar

- Polish zloty

- Romanian leu

- Swedish krona

- Singapore dollar

- Turkish lira

- United Arab Emirates dirham

- Chilean peso

- Moroccan dirham

- Pakistani rupee

- Tanzanian shilling

- Uruguayan peso

- Argentine peso

- Botswana pula

- Chinese yuan

- Egyptian pound

- Ghanaian cedi

- Indian rupee

- Kenyan shilling

- Mexican peso

- Ukrainian hryvnia

- Vietnamese Dong

- Costa Rican colon

- Israeli new shekel

- South Korean won

- Ugandan shilling

- Bangladeshi taka

- Sri Lankan rupee

- Nigerian naira

- Philippine peso

- Russian ruble

- Overdraft No

- Supports cash deposits No

- All-in-one finance app

- Spending online

- Hong Kong dollar

- Qatari riyal

- Saudi riyal

- Trust & Credibility 8.6

- Service & Quality 8.6

- Fees & Exchange Rates 7.3

- Customer Satisfaction 9.9

- Travel card

- Easy registration

- Fees & Exchange Rates 7.8

- Customer Satisfaction 6.2

- Service & Quality 5.4

- Fees & Exchange Rates 6.0

- Customer Satisfaction 7.9

- No account details (balance only)

Non-Resident Bank Accounts in the UK vs Other Countries

Many countries allow non-residents to open a bank account within their legal jurisdictions, but exactly what kind of requirements non-residents face can differ drastically from country to country and even bank to bank. See the list below to get a better idea of this:

Last updated: 18/2/2022

Other Banking Guides in the UK

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

- United States

- United Kingdom

Opening a bank account in the UK as a foreigner or non-resident

Yes. foreigners moving to the uk to live, work or study can usually open a bank account..

In this guide

Compare bank and e-money accounts for non-UK residents

How do i open a bank account in the uk, opening a bank account via a high street bank, opening a bank account with a digital bank, opening a multi-currency account.

- What if I don't have proof of address?

Which kinds of accounts are available to foreigners and expats arriving in the UK?

What are the benefits to opening a bank account in the uk, what should foreigners and expats look for in a bank account, bottom line, frequently asked questions.

Current accounts with

Current accounts

We compare the following banking apps

It’s a relatively simple process to open a bank account in the UK if you’re migrating, studying or working here. If you’re on a tourist or visitor visa you may be able to open a bank account with one of the e-money digital banking providers. If you live in another country and don’t intend to move to the UK, you can speak to a local bank that has international ties with a UK bank. We have separate guides on opening a bank account as an international student , opening a bank account without a standard type of ID and opening a bank account without proof of address if you don’t have permanent residence here.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

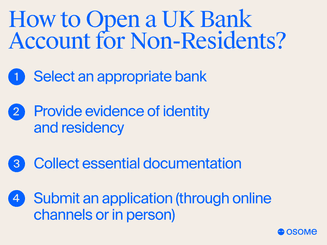

You can open an account online before arriving in the UK, on the phone or in person at the branch once you arrive. If you decide to open an account in a branch, remember to bring valid forms of ID with you. This includes your passport or driving licence, and maybe an overseas credit card or student ID, a Visa and a letter proving where you are living in the UK. If you don’t have ID, you won’t be able to open an account however the range of documents that banks can accept is wider than you might think. We have created a list on this guide . A lot of banks, especially the high street banks, require proof of address to prove you are living in the country. This can take the form of a recent utility bill or other documents.

What are the requirements to open a bank account in the UK?

Opening an account with a high street bank will give you access to face-to-face banking in-branch, but you’ll usually be asked to provide proof of UK residency.

However, some banks, such as HSBC, Lloyds and Barclays, have international arms, enabling you to open certain accounts as a non-UK resident. The downside is that you often need to have several thousand pounds saved or invested with the bank, and you might need to meet minimum income requirements too.

You can usually open – or at least, start to open – these accounts online in selected countries across the globe. With the Barclays Bank Account and Premier Account, for example, you can start your application online before arriving in the UK and you then have 90 days to complete your application in a UK branch.

If you open an account with a UK bank, your money will be protected up to £85,000 by the Financial Services Compensation Scheme (FSCS).

Perhaps one of the easiest ways to open a bank account as a non-UK resident is with a digital bank. You’ll need to be happy completing your application and managing your account online or via an app. But if you are, providers such as Revolut, Monese, Monzo, Suits Me and Starling don’t require proof of a UK address. You may, however, still need proof of residency in the EU/EEA or another country and you’ll usually need a UK address so you can receive your payments card.

Opening an account with one of these online providers is quick and easy – you can often have your account up and running the same day. Many will include spending and budgeting features on their app, but to access a greater range of perks, you’ll usually need to select a plan with a monthly fee.

Just be aware that not all of these providers have FSCS protection. Revolut, Monese and Suits Me are e-money institutions, which means your money is protected by a process known as safeguarding. But it won’t be covered by the FSCS.

It’s also possible to open a multi-currency account with a number of e-money institutions, such as Wise, Revolut and Monese. The major advantage of this is that you can hold multiple currencies in your account and should you need to transfer funds globally, you won’t be charged extortionate fees for doing so. What’s more, Wise, Revolut and Monese don’t require proof of UK residency to open an account – which you can do quickly and easily online.

Again, though, you’ll need to be happy banking online or via an app and you won’t get FSCS protection on your money. What’s more, the best features are usually included on the accounts that charge a monthly fee.

What if I don’t have proof of address?

You could open an account with a challenger bank – these are digital banks without branches and you open the account online. This usually takes a few minutes and requires a UK address and a proof of identity (passport or driving licence), but usually no proof of address .

Monzo , Monese , Starling Bank and Revolut will all help you set up a UK account without requiring proof of residency. Exactly what you’ll need will vary but in some cases, it will only be an email address, phone number and an ID document such as your passport. Note that you will still need a UK address so that your card can be sent to the right place.

The type of account depends on your personal situation, your reasons for being in the UK and how much you’re willing to pay for additional services and add-ons. Students pay limited or no management fees, since their accounts are quite basic. Professional people may require more elaborate account types, like those that allow for joint accounts and access to loan and investment facilities. Here are a few of the account types available to foreigners.

Basic current accounts

This option is an everyday account from which to pay bills, send and receive money, and manage your daily expenses. Compare basic bank accounts here .

Savings account

A savings account pays you interest on the money in the your account: the more you have in this account, the more interest you earn.

Since these funds aren’t intended for everyday use, account holders are usually penalised with loss of interest when withdrawing from this account. Also keep in mind that most savings accounts can’t be opened from overseas, as they require you to have at least a UK residential address.

While there are lots of online money transfer services available for foreigners to send and receive money internationally, there are some advantages to having a local account.

- Immediate access to your money. If you transfer money to your UK bank account before you leave, you’ll be able to withdraw from the account as soon as you land in the UK. You’ll be asked to present positive identification when collecting your bank card.

- Lower fees when using domestic services. Moving or withdrawing money between international and UK accounts incurs high fees, whereas you’d pay low transaction fees when using a local account. These kinds of fees are usually waived for students.

- Professional advantage. If you open an account before leaving for the UK, you can provide a future employer with your banking details straight away, saving yourself time on administration.

The type of bank account you choose will depend on how you like to manage your money and what you’ll be using the account for. Here’s a few of the main things to consider when choosing an account:

- Low fees. Make sure the account charges low or no account fees.

- Branch access. If you’ll be making in-branch transactions (such as depositing foreign cash or cheques), make sure you go for a bank with lots of branches in your local area. Some banks, such as First Direct, Staring and Monzo, are online only, with no branches.

- International transfers . It’s likely that you’ll need to send money back home from time to time, so check what the fees are for transferring money internationally, as well as the exchange rates.

- Hold multiple currencies. Some bank accounts let you hold several foreign currencies in the one account. This could be really handy if you’re going back home regularly and need the local currency there.

Opening a bank account in the UK if you’re an expat is usually a simple process, especially if you’re moving, studying or working here. People in the UK on a tourist visa can open an account by visiting a local branch and providing their passport.

It can be a little trickier to open a UK bank account if you don’t intend to live in the UK. You’ll usually need to speak to a local bank that has international ties with a UK bank.

The type of account you’ll be able to open will depend on your personal situation, your reasons for being in the UK and how much you’re willing to pay for additional services and add-ons. For example, students applying for student accounts won’t usually pay any account management fees, since their accounts are quite basic.

As a major financial centre, the UK’s banking system is broadly open to foreigners looking to open accounts here.

Can I open a bank account without ID?

While it might be possible to open an online bank account without proof of address, you will always need to provide proof of ID. Banks must verify your identity before they can agree to opening an account for you.

Are challenger banks safe?

If you're thinking of opening an account with an online challenger bank, it's worth checking whether they have a full UK banking licence, or whether they are an electronic money institution.

If your chosen provider has a UK banking licence, your money will be protected up to £85,000 by the FSCS. If it's an e-money institution, it must still be regulated by the Financial Conduct Authority (FCA) and protect your money through a process known as safeguarding. This essentially means the provider must separate customer funds from its operational capital.

Do UK banks have foreign-language services?

Most major UK banks have staff who can speak a range of languages. This makes it a lot easier to open a bank account and avoid miscommunications. These banks include, among others: HSBC, Santander, Barclays and Starling.

- FSCS cover policy

- Finder UK banking statistics

We show offers we can track - that's not every product on the market...yet. Unless we've said otherwise, products are in no particular order. The terms "best", "top", "cheap" (and variations of these) aren't ratings, though we always explain what's great about a product when we highlight it. This is subject to our terms of use . When you make major financial decisions, consider getting independent financial advice. Always consider your own circumstances when you compare products so you get what's right for you.

Shirley Liu

Shirley Liu is Finder's global program manager. She was previously the publisher for banking and investments and has also written comparisons for energy, money transfers, Uber Eats and many other topics. Shirley has a Master of Commerce and a Bachelor of Media, Journalism and Communications from the University of New South Wales. She is passionate about helping people find the best deal for their needs.

More guides on Finder

How to get £175 from switching to first direct. Plus, how to get up to £136.50 in savings interest through first direct’s Regular Saver.

You can score yourself £200 for switching accounts through the Current Account Switch Service.

See what you need to do to get £200 just for switching accounts.

Find out how you can pocket £175 for switching current accounts and how much interest you could earn on top.

How to get £200 from switching to NatWest. Plus, how to get an extra £36 in rewards and nearly £60 extra in interest.

We look at switching bonuses, what they are, how they work and which banks offer the best ones. If you’re fed up with your current bank, you could switch accounts and get a nice little cash bonus as an extra perk.

Find out more about the Nationwide FlexAccount current account and how it works.

Compare different types of virtual debit cards and how to use each.

While it’s impossible to open a bank account without proving your identity, banks accept a range of documents as ID; so even if you don’t have a passport or a driving licence, you should be able to get one. Here’s how to go about it.

Is the digital-only bank the right option for you? Read our review to get the low-down on all of Starling’s features and benefits. We cover everything from Starling’s overdraft service to whether the card can be used abroad.

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

International Money Made Simple

Open a Bank Account in the UK

About Author: Hi, I’m Quinn Askeland. In 2014, I started Transumo after experiencing expensive, slow, and frustrating international money transfers and payments through banks. Once I discovered how to manage my own international currencies much better, I became driven to help others improve their transfers and payments. Fortunately, today, there are many excellent options. See My Full Bio .

Many years ago I struggled to open my own bank account in the UK. While it remains a solid task, in addition to traditional high street banks, you can also consider the convenience of opening a digital account with services like Wise or Revolut and others which can save time, money and frustration.

It can be frustrating opening a UK bank account – usually documents are needed to prove your residency in the UK.

Fortunately:

There are some banks who can make it easier and great online alternatives that can be opened without the need for documents which prove your address. We will show you the minimum requirements for many of traditional “high street” banks.

But there are pros and cons to both options.

First we will explain the difference between traditional high street bank accounts and digital (or neo) banking alternatives. Then we will discuss the documentation needed for the different options and finally the pros and cons of each option.

Let’s dive in.

Disclosure: This post contains affiliate links and savings on transfers if you use some of the links! For more information, see my disclosures here .

Traditional Vs Online Banking (Requirements)

Traditional banks have a wide range of bank accounts and offer lots of other services like loans, mortgages, insurance and wealth management services. Also UK banks have deposit protection through the (FSCA) Financial Services Compensation Scheme which means that even if the bank goes bust, your money is safe up to £85,000.

However these banks are subject to more regulation and as a result they also generally require proof of identity and proof of a UK address to open them. However there are some banks that offer slightly easier ways (we will show you in a moment).

This can be a problem if you are not yet in the UK or have just arrived.

Fortunately you can open a bank-like account without proof of a UK address.

These online accounts from companies like Wise, Revolut, Monzo, Starling, Monese and others have limitations but tend to be very user friendly with great apps , multi-currency accounts and international prepaid debit cards .

Most importantly they enable you to to get paid by your employer in British pounds, pay bills and pay others.

Skip down to 4 Best Online Banking of Alternatives Below .

3 Best High Street Bank Accounts (+ How to Open Them)

There are a few expat-friendly banks in the UK including HSBC, Barclays, and Lloyds Banking Group.

These banks offer both free and paid bank accounts and let you manage your account offline (at a branch) and online (website and mobile app). They also offer deposit protection up to £85,000 GBP.

Every bank has a different sign up process, and a handful of banks also let users open an account from overseas before moving to the UK – more on that in a moment.

1.3 How to get address proof in the UK as a non-resident/expat

UK banks accept the following alternatives as address proof for expats and non-residents:

- Salaried individuals: A letter from the employer confirming an applicant’s address

- International Student: Passport and a letter from the educational institution confirming the applicants acceptance and current address

- Frequent traveler/digital nomad: A letter from a local authority verifying the current address

- Asylum seekers: Application registration card

The preference may vary from bank to bank and it’s best to ask what you can submit to make the account opening process go smoothly.

1.4 UK bank options

1.4.1 hsbc overseas account (for existing customers).

Account type: Overseas Account

Who is it for? Existing HSBC One, Jade or Premier customer in 30 countries

Monthly fee: £0

International transfers? Yes

Proof of UK residence required? No (but must show probable cause to move to the UK)

If you are not an existing HSBC customer you may find that only Council tax bills are accepted for proof of address.

1.4.2 HSBC for international Students

Account type: UK Current Account for International Students

Who is it for? Students living in the live in the UK, Channel Islands or Isle of Man

Proof of UK residence required? Yes

1.4.3 Barclays International Bank Account

Account type: Global Bank Account (Savings and Current)

Who is it for? Non-residents living in 70 eligible countries

Monthly fee: NA – but must maintain £100,000 balance

Proof of UK residence required? No (but proof of residence in eligible country overseas required)

1.4.4 Barclays Current Account

Account type: Regular and Premier Current Account

Who is it for? Anyone with a UK biometric residence permit

Monthly fee: £4 monthly fee

1.4.5 Lloyd’s Classic or Basic Account

Account type: Current Account

1.5 International Alternatives

Although a bit of a long shot, over 250 foreign banks operate in the UK and it may be possible to set up a UK bank account if you have a corresponding account in your home country.

Some of these banks include:

- CitiBank (the US)

- Triodos (the Netherlands)

- Axis Bank (India)

- Emirates NBD Bank (Middle East)

1.6 How to Choose the Best Bank Account

With so many options, it can be hard to zero in on the best UK bank account for you as an expat. To make things easier, consider the following.

Ease of signup and covers basic needs: If your goal is simply to get established in the UK (get paid and pay others) an online bank-like alternative may be the best way to get started. After you are more established opening a high street bank will be easier and you can benefit by having both.

Specific products and services: Ask yourself how you plan to use the bank account – do you plan to use it only for receiving your salary or expenses? Do you need savings or investment options? Do you want to manage multiple currencies? What kind of debit or credit card do you need?

Costs: Most UK bank accounts are free, but some premium accounts may have monthly or annual fees. If the perks offset the features, sometimes having a paid account can be worthwhile.

User friendliness: Ultimately, the experience you have with the bank will help you can get out of your account. Dig deeper into customer service, flexibility of usage across mediums (offline and online), 24×7 banking, etc.

4 Best Digital Accounts (+ How to Open Them)

New age digital services (also known as challenger banks or neo banks) operate fully online and offer many helpful features that make managing your money easier.

Opening an account with them is a smooth and fast process and some do not even need a UK proof of address (you will need to provide a valid ID and proof of address from your home country though.

Most of them have free accounts , but the paid options do come with some cool features, expand the capacity of the account (ATM withdrawal limits, deposit limits, etc.), and help to save money in the long run.

Here are our tried and tested recommendations:

1. Wise – Best Multi-Currency Account (for frequent travellers and digital nomads)

Wise is not a bank but they offer many banking-like features with their multi-currency account (and they’re a regulated financial institution in the UK by the FCA ). If you’re a frequent traveler, expat or digital nomad, Wise can work really well.

For example, regardless of where you open your Wise account you can get paid like a local through unique UK account details. The Wise debit card (review) is also a winner, enabling you to then spend in British Pounds wherever Visa is accepted (everywhere). Once signed up their App pulls everything together.

The best thing about them is their radical transparency and low fees. Check out Wise Multi Currency Account here .

With Wise, you can hold, manage, and convert between 50+ currencies, use their debit card to withdraw money in the UK (and anywhere in the world), and even get a spending account in GBP which can make you instantly fee like a local.

Account Fees: Free to open and hold an account (other fees applicable)

Interest on savings: No

International transfers: Yes – at very affordable rates in 70+ currencies

Learn more about the Wise Multi-currency Account (review) here.

2. Revolut – Overall best online UK account for new Arrivals (no UK address proof to sign up)

Revolut (founded in 2015) has a EU banking license and offers fully digital checking and savings accounts. But Revolut is not a bank in the UK – yet anyway.

Users love their all-in-one money management features and the fact that they don’t need a UK ID address proof to sign up makes them a go-to option for new expats. (However you do need a mobile phone, which can be tricky in itself)

Click here to see the options and pricing available in your country (opens a new tab so you can keep reading).

Note: Revolut and other online banks are great as current accounts because they make day-to-day money management easier. We recommend opening a high street bank account for your savings for higher interest rates and deposit guarantee.

3. Monzo – Best Online Current Account in the UK

Monzo has a UK banking license and offers deposit protection up to £85,000 GBP.

This means you you’ll need a UK mobile phone and a valid ID. They accept:

- Driving licence (your provisional is fine)

- National ID card

- Biometric residency permit

They will also need a residential address in the UK where they can send your card .

They specialize in digital current accounts with fee-free overdrafts up to £1,000 GBP and loans up to £15,000 GBP.

The account also comes with a debit card, lets you set up direct deposits for bills, and integrates with both Apple Pay and Google Pay

Account Fees: Monzo Free Monzo Plus (£5/month) Monzo Premium (£15/month)

Learn more about what you get with each tier in our Monzo review

Interest on savings: Yes (AER/Gross fixed)

International transfers: Yes – via Wise

4. Starling – Most cost effective online bank in the UK

Starling is a regulated online bank in the UK that offers fee-free current accounts with overdraft features.

The account also comes with a debit card, dedicated savings spaces, and the ability to set up direct debits.

Starling also has the option to get an EUR account as an add on so you can move money between the two accounts easily.

You will need a UK address proof to open an account , but the application process is completely online.

Interest on savings: Yes – on balances up to £85,000

International transfers: Yes – to 35+ countries

Note: Revolut and other online banks are great as current accounts because they are often easier to open and make day-to-day money management better. But opening a high street bank account eventually for higher interest rates on savings, deposit guarantee and other financial services like credit cards, loans may be a very good idea.

Types of bank accounts (and why you might want them).

Here are the most common types of bank accounts in the UK.

Current Account (also called a Checking Account in the US): This is the most common type of bank account used for receiving wages and managing everyday expenses like grocery shopping, paying bills, etc. These accounts come with debit cards as well as overdraft facilities. Some banks also offer low-cost current accounts for expat students.

Savings Account: These accounts are for exactly what the name suggests – building your savings and they come with a variety of investment options and interest rates. Every bank has their own terms and conditions about how they help their users grow their money. For example, you may need to have a certain amount or keep the money in the account for a predefined period before it can start accruing interest.

Offshore accounts: These savings bank accounts are a great option for expats who have a high net worth. They also come with multi-currency options – usually EUR, GBP, and USD. You can open and operate an offshore UK account whether you live in the UK or overseas. However, these accounts have a high barrier to entry – you need to maintain a balance of £50,000 GBP – £100,000 GBP to get the account.

Other Types of Bank Accounts in the UK

Basic accounts: These are bank accounts for individuals with low credit score and usually come with limitations like no overdraft or low ATM withdrawal limits.

Joint accounts: You can also open a bank account jointly with a family member or a partner.

Apart from high street banks, there are financial institutions in the UK called building societies who provide banking services like savings accounts and mortgages.

While building societies can sometimes get you a better deal – lower mortgage rates or higher savings rates – they’re not as secure as they used to be and often have a limited choice of accounts (no current accounts).

Documents Needed for Traditional Banks

As licensed financial institutions, banks in the UK (and everywhere!) need current ID and address proof to make sure the accounts can’t be used for illegal purposes like money laundering.

UK Banks usually accept the following as address proof:

- Utility bills (gas, water, electricity, etc.) – no older than 3-4 months

- Council tax bill

- Valid UK driving license

- Tenancy agreement

- Credit card or bank statement (no older than 2-3 months)

Some things to keep in mind:

- All documents for proof of address need to show your full name and current address

- They must be recent

- Council or tax bill can’t have validity of more than 12 months

- Submit separate documents if a bank asks for both ID proof and address proof

We get that most of these can be difficult to get your hands on if you just moved or are planning to move to the UK.

The good news is that there are digital alternatives .

Bottom Line

There are a few good ways to open a UK bank account from overseas or as a new arrival.

We think, if you are a non-resident the easiest way to open an account is through an online bank-like service (not a real bank). For our money, Wise is the best option if you are still overseas because of their ability to get paid like a local (in the UK) before you even arrive. Revolut on the other hand requires to local phone number, but has great app based service and card which can be super handy for travellers.

Ultimately you will likely want to open a real bank account eventually and real banks like HSBC, Barclays and Lloyds have relatively user friendly sign up options (above) which can save you a lot of time and hassle.

Happy Money!

It can take anywhere between a couple days to a week to open a bank account with a high street bank in the UK.

For online banks, the sign up process is often instant and you can start setting up your account. However the verification process can take up to a week.

Yes – you can get a EUR account when you open an offshore account with a high street bank. Monzo offers a more affordable alternative with their add-on EUR accounts.

If you’re only traveling to the UK, we recommend checking out Wise. They let you set up local spending accounts in 10 currencies (including GBP) so you can handle your money like a local.

Yes, online banks like Revolut and Monzo make it easy to open a bank account for your business. Wise also has a business option for their multi-currency account.

These accounts let you receive money from businesses in the UK and abroad with low fees, pay vendors and suppliers overseas, connect with accounting software, etc.

You can also open a business account with any of the high street banks if your business is local.

All banks (high street and online) will need your address proof, company registration details, and other documentation to open the account.

If you’re planning to send small amounts below $7000 USD/£4000 GBP/€4500 EU/$9500 CAD/AU, we recommend Wise for their affordable and transparent rates.

If you’re sending large amounts above $7000 USD/£4000 GBP/€4500 EU/$9500 CAD/AU like your savings or proceeds from a property sale, etc. we recommend OFX (review) , TorFx (review) , or Currencies Direct (review) for their fee structure for large amounts and personalized phone support.

How Do I Open a UK Bank Account from Overseas?

The majority of UK banks require that have proof of a UK address. Fortunately some high street UK banks are making it a bit easier but regulations in the UK can still make it a challenge. In practice though, digital bank-like services can do many things real banks do and at least one offers a way to get paid and pay others and they don’t require proof of a UK address.

What are the Main Differences between Real Banks and Online Accounts?

Digital bank-like accounts are generally very user friendly and have great Apps which make it easy to be paid and pay others. Real banks on the other hand tend to have additional fees but they also pay interest and have more services like credit cards, loans and a deposit guarantee.

Similar Posts

Paypal international transfers.

Like many others, I first started using PayPal for money transfers a long time ago (2008). Since then I have used them (and many others) extensively to transfer money, get paid and be paid … and the truth is I still use them occasionally even though I know their fees are usually much higher than…

7 Best Cash App Alternatives and What They Do Better

Cash App is a great payment app if you’re based in the US or the UK and want to send and receive payments to anyone. It’s even got some cool extra features (Like buying Bitcoin and investing in stocks). But here’s the deal… Cash App has some key limitations. For example, it does not have…

Wise Fees Calculator

Summary: Let’s get started. 1. Wise Fees Calculator Overview According to the World Bank, “the single most important factor leading to high remittance prices is a lack of transparency in the market.” Since being founded in 2011, Wise has always tried to aim for transparency and is the only money transfer service in the industry…

How to Open an Australian Bank Account Online (Non-Residents and New Arrivals)

Are you a non-resident or new arrival to Australia? The challenge is you can’t do anything in Australia without a Bank Account. The good news is it is relatively easy to open an account online – some even while you are overseas. But they are all quite different. The key is to match you personal…

OFX Exchange Rate

When you’re sending money internationally, getting a good deal on the exchange rate is the best way to save money – especially large transfers. OFX claims to offer “bank-beating” exchange rates for large transfers. We uncover the OFX exchange rate and other fees that can be charged by OFX and their competitors. And how OFX…

Wise Exchange Rate

In our testing against Reuters the Wise exchange rate we found it is extremely close to if not the exact mid-market or interbank rate. Wise calls it the “Real” exchange rate. But Wise is not a charity. So how do they make money and most importantly can Wise save you money? And who might be…

Thank you for breaking it down without the banking jargon, much appreciated!

You’re very welcome! Please let me know if you have any questions.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

How To Open A UK Bank Account For Non-Residents

Uk bank account for non-residents: why do you need one, do you have to open a bank account as a non-resident in the uk.

- Building societies

- Credit unions

- National Savings and Investment accounts (formerly Post Office Savings accounts)

Why is it more difficult to open a bank account in the UK as a new resident?

What can you do to prepare for opening a bank account in the uk as a non-resident.

- check with your home bank if your debit or credit cards can be used abroad

- make sure that you know the exact costs of transaction fees and currency exchange fees

- double check if your home bank is able to help open a bank account in the UK for you if it has a correspondent banking relationship with a UK bank

Why is it worth opening a bank account in the UK as a non-resident?

- If you’re planning to work in the UK, your future employer will be transferring your salary into a UK bank account.

- It will be easier to rent a property if you can cover the costs from a UK account.

- You’ll be charged currency conversion fees each time you use your debit card or withdraw cash in the UK. Currency exchange rates fluctuate, making it harder to keep to a budget.

- You will need a local bank account for your bills, such as mobile phone contracts, gym membership and energy bills.

- Last but not least, if you get locked out of your home bank account because you’ve forgotten your PIN code, it will be challenging to deal with it internationally as opposed to a local branch.

Banking in the UK if you’re a non-resident: traditional vs online banks

Types of uk bank accounts.

- Current account – Usually referred to as a ‘checking account’ in the US. This is your day-to-day account, the one your main salary is paid into. Current accounts offer debit cards and, depending on your circumstances, will permit you to go overdrawn up to a set limit. Some of these accounts charge a fee, for which you get benefits in return, like cashback on your spending and/or interest on your balance when you’re in credit or roadside car insurance.

- Basic banking accounts – these are a type of current account, mainly aimed at people with a low income or with a poor credit rating. As the name suggests, they only offer the basics. You won’t get an overdraft, for example.

- Savings accounts – these come in different types, including regular savings accounts where current account customers get a preferential rate, and ISAs, where interest earned is protected from tax.

Which documents will you need to open a UK bank account as a non-resident?

- Proof of your identity : it can be a passport, driving licence, or national identity card. In general, if you are a foreigner, you most likely will use your passport.

- If you are an international student , you will need to show a valid study visa, a Student ID or a letter of acceptance from your university, and sometimes a bank statement from your home bank.

- Proof of address: This is generally a recent utility bill, rental contract, council tax bill. Mobile phone bills are generally not accepted.

How do you open a UK bank account without proof of address?

How do you get proof of residence in the uk as an expat.

- Utility bills

- Local authority council tax bill for the current council tax year

- Current UK driving license

- Bank, Building Society or Credit Union statement

- Mortgage statement

- Council or housing association rent card or tenancy agreement for the current year

- Solicitors letter within the last three month confirming the property purchase (or the land registry confirmation of address)

- HMRC self-assessment letters

- Electoral Register entry

- NHS Medical card

How do you choose a UK bank account as a non-resident?

- Flexibility – as an expat, if you’re looking for ease of access and 24/7 banking, digital and mobile accounts are well worth considering.

- International scope – if you want an account that will be well-linked to accounts and services overseas, you’ll need to check international and multi-currency account options as well as services such as international money transfers.

- Potential costs – some banks may charge you for withdrawing money. You also might want to check the commission you pay for exchanging currency.

- Range of products and services – this can range from account-related services such as credit and borrowing options to other financial services including UK mortgages, insurance in the UK, and investments.

- Incentives – many banks will try to attract customers by offering incentives such as cash deposits or interest-free periods, so shop around to see what’s available

What is the easiest UK bank account to open for non-residents?

- HSBC Expat Premier account – sterling, USD and euro multi-currency accounts and exclusive foreign exchange rates. But you need a salary of £100,000 or £50,000 in an HSBC bank account.

- Lloyds International account – a choice of sterling, USD or euro and free international money transfers. You’ll need an annual income of £50,000.

- NatWest International Select account – pay in a minimum salary of £40,000 and manage your money on the mobile app.