Enter your ZIP Code!

Get a quote today., jetblue travel insurance: plans, costs, reputation, & services, whether you’re leaving for vacation or a business trip, jetblue travel insurance offers valuable protection. prices vary by trip, but typical jetblue travel insurance costs between 10 and 20% of your trip’s budget. travel insurance can protect you against trip interruptions and emergencies..

What You Should Know

- While once only a budget airline, JetBlue now offers vacation packages, hotel bookings, and travel insurance

- JetBlue travel insurance protects against trip cancellations and unexpected emergencies

- Prices vary, but you should expect to pay between 10 and 20% of your trip’s budget on travel insurance

JetBlue travel insurance is sold and administered by Allianz Global Assistance.

Plans are underwritten by one of three insurance companies: Jefferson Insurance Company, Nationwide Mutual Insurance Company, or BCS Insurance Company.

The underwriter is chosen based on the policyholder’s state of residence as well as the policy details.

JetBlue was founded in 1998 in New York City.

What Is JetBlue Travel Insurance?

The company is primarily a budget airline that has expanded to offer hotel bookings, vacation packages, and travel insurance .

The airline flies to more than 100 destinations across North America, South America, and Central America and is known as one of the first airlines to offer regular flights into Cuba after the embargo was lifted against the country.

JetBlue offers its customers a frequent-flyer program called TrueBlue, which is a point-based system that entitles its regular customers to travel rewards including free flights and low-cost travel insurance.

Allianz Global Assistance is a subsidiary of Alliance SE and is known to be one of the largest travel insurance providers in the U.S.

JetBlue Travel Insurance Overview

The company is partnered with thousands of travel companies, including JetBlue, and offers travel insurance and concierge services to customers of airlines, hotels, and travel agents throughout the country.

Although JetBlue is partnered with Allianz, customer’s purchasing their insurance policy through JetBlue don’t have access to the full range of plan options that Allianz is known for.

Instead, the company has created a few simple insurance plans with coverage that is best suited to the average JetBlue customer.

Policyholders have access to all of Allianz’s customer services, though, including its online and mobile account management tools, 24/7 customer service, and concierge services.

In the JetBlue travel insurance review that follows, the coverage, pricing, and customer service offered by this company are discussed in detail to give consumers a fair and unbiased evaluation of what JetBlue has to offer in terms of trip protection when compared to other major players in the industry.

JetBlue Travel Protection

JetBlue’s travel insurance options are limited; however, the coverage included in the company’s vacation insurance plans is fairly comprehensive.

Customers purchasing a vacation package can opt for the company’s Vacation Package Protection plan, while those who’ve planned their travel can opt for the slightly higher priced but more comprehensive Global Travel Protection plan.

The trip insurance plans offered by JetBlue include:

- Comprehensive

- Trip cancellation/interruption

JetBlue Vacation Packages Protection

The ideal plan for those embarking on an all-inclusive vacation or cruise, JetBlue’s Vacation Package Protection protects policyholders form trip cancellation or interruption and offers extensive coverage for unforeseen events such as medical emergencies or lost/stolen baggage.

Global Travel Protection Plan

For customers who’ve booked their travel, this plan provides coverage for a wide range of circumstances including trip cancellation and interruption, trip delays, medical and dental emergencies, and lost or stolen baggage.

TrueBlue Domestic Travel Protection

Exclusive to customers who’ve purchased travel using JetBlue’s customer loyalty points program, this plan provides limited medical and trip cancellation coverage for those traveling within the U.S.

TrueBlue International Travel Protection

This plan is similar to the TrueBlue Domestic plan, providing exclusive coverage to those who’ve used the JetBlue loyalty program to purchase tickets.

However, this plan also includes increased coverage for those traveling outside of the country.

JetBlue travel insurance customers should keep in mind that pre-existing conditions aren’t typically eligible for medical coverage.

Please check over policy documents to see if any applicable waivers may apply to your situation.

JetBlue Travel Insurance Cost

When purchasing trip insurance, it’s best to plan on spending 10 to 20% of the total trip cost on a policy.

Of course, this range is based on the average vacation and may vary depending on many factors that include the traveler’s age and how many family members are being insured, the destination, and the date, length, and method of travel.

To obtain an accurate rate, you should contact JetBlue directly or use the company’s online quote calculator.

Those traveling as a family can benefit from purchasing an insurance policy together, as children aged 17 years or younger receive free insurance when traveling with an insured parent or grandparent.

JetBlue also offers low rate insurance plans to those who purchase airline tickets using the company’s points program.

In some cases, travelers may have to change or cancel their plans after purchasing a travel insurance policy.

When this happens, JetBlue will provide the customer with a full refund on their insurance policy provided they request to cancel within ten days of purchase and have not filed any claims on the policy.

Is JetBlue Travel Insurance Good?

JetBlue travel insurance is sold and administered by Allianz Global Assistance; therefore, all claims are processed by Allianz instead of by JetBlue.

Because of this, it’s best to look into and consider the customer reviews and complaints that have been filed against Allianz Global Assistance.

Allianz has been assigned an A+ rating from the BBB, which indicates its commitment to providing comprehensive and reliable insurance that includes transparent and straightforward policies and an efficient claims process.

Although the company has received 396 complaints in the past three years, it’s important to keep in mind that, although this seems like a lot, it’s average for a company of its size.

All complaints that have been filed have been dealt with appropriately by Allianz and closed by the BBB.

A substantial portion of these complaints pertain to denied claims.

Customer Assistance Services

JetBlue is one of the industry leaders when it comes to customer assistance.

Policyholders have access to Allianz’s 24-hour customer hotline, which is available to answer questions, make policy changes, file claims, and request emergency services.

Providing customers with 24-hour policy services is crucial in the travel industry, as most often when service is required urgently, customers are traveling and are located in another time zone.

In addition to the company’s 24-hour hotline, JetBlue policyholders can log on to Allianz’s secure online portal or mobile app to manage their policy details, file claims, and check the status of claims that have already been filed.

JetBlue policyholders also have access to the Allianz concierge service, which assists customers with a variety of travel-related services including recommendations and bookings for hotels, restaurants, ticket reservations, tee times and other entertainment.

JetBlue Travel Insurance Financial Stability

When considering travel insurance it’s important to research several options, and that includes looking into the financial stability of insurance providers .

If insurance is purchased from a company with an inadequate credit rating and a history of poor financial management, it stands to reason that the company may be unable to pay out claims as promised in its policies.

To conduct research on the credit ratings and financial stability of insurance providers, consumers can obtain information from independent rating agencies such as Moody’s, A.M. Best, and Standard and Poor’s.

Because Allianz administers JetBlue’s travel insurance plans, the best way to obtain information about the company’s ability to fulfill its policies is by researching Allianz’s credit ratings and financial profile.

Allianz has been assigned an A+ financial strength rating by A.M. Best, which is the best rating on the company’s scale.

This rating indicates that the company’s financial outlook is positive and that it’s fully operating within its means.

Additionally, BCS Insurance Company, Nationwide Mutual Insurance Company, and Jefferson Insurance Company, all of which underwrite policies for Allianz, have been assigned A+ ratings by A.M. Best.

Additional Providers

There are several other travel insurance providers that deserve consideration as well which you can see in our Best Travel Insurance Companies article.

These companies didn’t make our list of top providers but we have created some more detailed reviews that you can view below:

- Allianz Travel Insurance Review

- Aon Travel Insurance Review

- Carnival Travel Insurance Review

- Chubb Travel Insurance Review

- CSA Travel Insurance Review

- Expedia Travel Insurance Review

- Hotwire Travel Insurance Review

- IMG Travel Insurance Review

- InsureMyTrip Travel Insurance Review

- JetBlue Travel Insurance Review

- John Hancock Travel Insurance Review

- Medjet Medical Transport Insurance Review

- Orbitz Travel Insurance Review

- Patriot Travel Insurance Review

- Priceline Travel Insurance Review

- Progressive Travel Insurance Review

- Red Sky Travel Insurance Review

- Ripcord Travel Insurance Review

- Travel Insured International

- Travelex Travel Insurance Review

- USAA Travel Insurance Review

- USI Affinity Travel Insurance Review

- World Nomads Travel Insurance Review

Free Insurance Comparison

Enter your ZIP code below to view companies that have cheap insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

- Weather

Search location by ZIP code

What to know when buying 'travel protection' from jetblue.

- Copy Link Copy {copyShortcut} to copy Link copied!

GET LOCAL BREAKING NEWS ALERTS

The latest breaking updates, delivered straight to your email inbox.

JetBlue sells what it calls travel protection on its website when you buy a ticket, for an added cost.

Some Massachusetts travelers left stranded by the airline in the last week are finding that coverage doesn't protect them from much.

JetBlue likely won't cover your hotel or meals if they cancel your flight and leave you stranded, even if it's totally their fault. The best they've been offering folks is a JetBlue credit, but that doesn't pay your credit card bill.

Before you pay for a ticket, JetBlue asks if you want to add "Travel Protection."

What you're buying is a travel insurance plan from the insurance company Allianz. However, what it offers may not have the benefits you need if you get stuck somewhere.

Trip delay coverage caps out at a maximum of $300 per person, no matter how many days you are stuck. That provides money that would help pay for a hotel and meals.

One man stuck in Florida for three extra days told WCVB's Ben Simmoneau the cost was over a thousand dollars. He received just $200 from the travel protection.

Another customer who purchased the travel protection told Simmoneau she was exposed to COVID-19 in March two days before flying and was denied coverage because the plan she bought through JetBlue excluded epidemics, even though it had coverage for a quarantine.

"It doesn't cover any COVID, the one that I bought. Epidemics period are excluded," Marianne Jestings said.

JetBlue would not comment on the issues, referring questions to Allianz, who said, "most travelers find the coverage is sufficient."

The bottom line for consumers is to make sure to read the fine print closely.

If you don't like what you see, you can usually cancel travel insurance for no penalty within a certain window.

There are plenty of independent travel insurance comparison websites like Squaremouth or Insure My Trip that offers policies.

If you're flying in the future, consider a policy with robust Trip Delay coverage, which is the coverage you'll need to kick in if you get stuck somewhere.

The Enlightened Mindset

Exploring the World of Knowledge and Understanding

Welcome to the world's first fully AI generated website!

JetBlue Travel Protection: A Comprehensive Review of Benefits, Risks, and Cost

By Happy Sharer

I. Introduction

Are you considering purchasing JetBlue Travel Protection for your upcoming trip? If so, you’ve come to the right place. In this article, you’ll get a comprehensive review of JetBlue Travel Protection, including an overview of its benefits, risks, and cost, as well as a step-by-step guide to buying it. By the end of this article, you’ll have all the information you need to decide whether JetBlue Travel Protection is right for you.

II. A Comprehensive Review of JetBlue Travel Protection

In order to make an informed decision about JetBlue Travel Protection, it’s important to understand what it is and what it covers. Here’s a comprehensive review of JetBlue Travel Protection.

A. Overview of JetBlue Travel Protection

JetBlue Travel Protection is an optional insurance plan offered by JetBlue that provides coverage in case of unexpected events such as flight delays, lost baggage, medical emergencies, and more. It’s designed to give you peace of mind while traveling, and it can be purchased at the time of booking or up to 24 hours before your departure date.

B. Benefits of JetBlue Travel Protection

JetBlue Travel Protection offers several benefits, including:

- Trip cancellation/interruption coverage: In the event of a covered travel interruption, JetBlue Travel Protection will reimburse you for any unused tickets and refund your taxes and fees.

- Flight delay coverage: If your flight is delayed or canceled due to weather or other conditions, JetBlue Travel Protection will cover reasonable expenses such as meals, lodging, and transportation.

- Lost baggage coverage: If your baggage is lost or damaged during transit, JetBlue Travel Protection will reimburse you for the cost of replacing the items.

- Medical emergency coverage: If you become ill or injured while traveling, JetBlue Travel Protection will cover your medical expenses and provide assistance with arranging medical care.

C. Risks of JetBlue Travel Protection

Although JetBlue Travel Protection offers many benefits, there are some risks associated with it. The main risk is that you may not receive full reimbursement for your losses due to exclusions in the policy. Additionally, if you don’t read the fine print, you may not be aware of certain limitations or restrictions.

III. How to Make the Most Out of JetBlue Travel Protection

If you’re planning to purchase JetBlue Travel Protection, there are a few things you should do to make sure you get the most out of it.

A. Understand Your Coverage Options

Before purchasing JetBlue Travel Protection, make sure you understand what types of coverage it offers and which ones are best suited to your needs. This will help you determine which plan is right for you.

B. Read the Fine Print

Once you’ve chosen a plan, it’s important to read the fine print carefully. Pay attention to any exclusions or limitations, as this could affect your ability to file a claim. Knowing what’s covered (and what’s not) will help you make an informed decision.

C. Compare Plans

Finally, it’s a good idea to compare different plans to find one that meets your needs and budget. Different plans offer varying levels of coverage, so make sure to shop around to find one that’s right for you.

IV. What You Need to Know Before Purchasing JetBlue Travel Protection

Now that you know what JetBlue Travel Protection is and how to make the most out of it, here are a few more things you need to know before purchasing it.

A. Types of Coverage

JetBlue Travel Protection offers three types of coverage: cancellation/interruption, flight delay, and lost baggage. Each type of coverage has different levels of protection, so make sure to read the policy carefully to determine which one is best for you.

B. Cost of Coverage

The cost of JetBlue Travel Protection varies depending on the type and amount of coverage you choose. Generally, the higher the coverage, the higher the cost. Be sure to factor in the cost when deciding which plan is right for you.

C. Restrictions

It’s important to note that there are certain restrictions and limitations when it comes to JetBlue Travel Protection. For instance, the coverage may not apply if you cancel your trip due to personal circumstances, such as a change in job or illness. Make sure to read the policy carefully to understand any restrictions that may apply.

V. Pros and Cons of JetBlue Travel Protection

When deciding whether to purchase JetBlue Travel Protection, it’s important to consider both the pros and cons. Here’s a look at the advantages and disadvantages.

- Provides peace of mind during travel

- Reimburses costs for cancelled trips, flight delays, and lost baggage

- Offers medical emergency coverage

- Flexible coverage options

- May not provide full reimbursement for losses

- Restrictions and exclusions may apply

- Cost of coverage can be expensive

- Difficult to understand the policy language

VI. Is JetBlue Travel Protection Worth the Cost?

When deciding whether JetBlue Travel Protection is worth the cost, it’s important to consider your individual needs. Here are a few things to keep in mind when weighing your options.

A. Consider Your Needs

Think about the type of trip you’re taking and the potential risks associated with it. If you’re going on a long international trip, for example, you may want to purchase more coverage than if you’re taking a short domestic trip. Additionally, if you’re prone to last-minute changes, you may want to opt for a more comprehensive plan.

B. Weigh Your Options

Compare JetBlue Travel Protection to other insurance providers and see which one offers the best value for money. Also consider the cost of the policy compared to the cost of replacing lost items or paying for medical bills out of pocket. This will help you determine whether JetBlue Travel Protection is worth the cost.

C. Decide What’s Best for You

Ultimately, the decision to purchase JetBlue Travel Protection comes down to you and what you feel comfortable with. Think about the risks associated with your trip and decide if the extra coverage is worth it. Remember, the goal is to give yourself peace of mind during your travels.

VII. A Step-by-Step Guide to Buying JetBlue Travel Protection

If you’ve decided to purchase JetBlue Travel Protection, here’s a step-by-step guide to help you get started.

A. Research Different Plans

Start by researching different plans to determine which one is right for you. Consider your trip type, duration, and destination, as well as the type and amount of coverage you need. This will help you find the plan that best meets your needs.

B. Choose a Plan

Once you’ve found a plan that works for you, it’s time to purchase it. You can purchase JetBlue Travel Protection at the time of booking or up to 24 hours before your departure date.

C. Follow the Steps for Enrollment

After you’ve purchased the plan, you’ll need to follow the steps for enrollment. This includes filling out an application form, providing proof of insurance, and signing any required documents. Once you’ve completed these steps, you’ll be enrolled in JetBlue Travel Protection.

VIII. Conclusion

JetBlue Travel Protection is an optional insurance plan that can provide peace of mind during travel. It offers coverage in case of unexpected events such as flight delays, lost baggage, and medical emergencies. However, it’s important to understand the risks associated with it, as well as the cost and restrictions. Ultimately, only you can decide if JetBlue Travel Protection is right for you.

(Note: Is this article not meeting your expectations? Do you have knowledge or insights to share? Unlock new opportunities and expand your reach by joining our authors team. Click Registration to join us and share your expertise with our readers.)

Hi, I'm Happy Sharer and I love sharing interesting and useful knowledge with others. I have a passion for learning and enjoy explaining complex concepts in a simple way.

Related Post

Exploring japan: a comprehensive guide for your memorable journey, your ultimate guide to packing for a perfect trip to hawaii, the ultimate packing checklist: essentials for a week-long work trip, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Expert Guide: Removing Gel Nail Polish at Home Safely

Trading crypto in bull and bear markets: a comprehensive examination of the differences, making croatia travel arrangements, make their day extra special: celebrate with a customized cake.

InsurancePrompt

Provide knowledgeable information about Insurance

- Search for:

Travel Insurance JetBlue 2023: Coverage, Benefits, and More

Introduction

Travel Insurance JetBlue: Your Peace of Mind. Allianz Travel Protection offers award-winning coverage for unexpected travel issues. Find out more!

Travel Insurance JetBlue is essential for travelers as it protects against unexpected events that can disrupt travel plans. JetBlue , a popular airline, offers travel insurance to its customers through a partnership with Allianz Global Assistance .

In this article, we will explore the coverage options, benefits, costs, and reputation of JetBlue travel insurance to help readers decide whether to purchase it for their next trip.

Key Takeaways

JetBlue Vacations Partnership : Customers can opt for travel insurance coverage when booking flight and hotel packages through JetBlue Vacations.

Allianz Global Assistance Partnership: J etBlue has partnered with Allianz Global Assistance to offer travel insurance and assistance services.

Insurance Underwriters: JetBlue travel insurance plans are underwritten by Jefferson Insurance Company, Nationwide Mutual Insurance Company, or BCS Insurance Company. The specific underwriter is determined based on the policyholder’s state of residence and policy details.

Coverage Offered: JetBlue travel insurance covers medical expenses, medical evacuation, and situations where work interferes with travel plans.

Evaluating Worth: Determining the value of travel insurance depends on factors such as trip refundability, destination, and the extent of coverage provided.

JetBlue Plus Card Benefits: JetBlue Plus Cardholders can enjoy trip cancellation benefits of up to $10,000 per year, covering expenses like passenger transportation and hotel reservations.

Table of Contents

What is travel insurance jebblue.

JetBlue travel insurance is offered and administered by Allianz Global Assistance. The plans are underwritten by Jefferson Insurance Company, Nationwide Mutual Insurance Company, or BCS Insurance Company, depending on the policyholder’s residence and policy details.

Customers who purchase flight and hotel packages through JetBlue Vacations can avail themselves of JetBlue travel insurance.

The coverage options provided by JetBlue travel insurance include trip cancellation, trip interruption, emergency medical and dental, emergency medical transportation, baggage delay, and baggage loss or damage.

The insurance cost varies based on the chosen coverage options and trip duration. JetBlue offers different plan types , including Basic, Essential, and Deluxe, with the Deluxe plan offering the highest level of coverage at a higher cost.

JetBlue travel insurance offers protection in various situations, such as trip cancellations or interruptions due to illness, injury, death, natural disasters, and other unforeseen events.

For instance, if a traveler falls ill before the trip and cannot travel, JetBlue travel insurance can reimburse the trip cost. Similarly, if baggage is lost or delayed, the insurance can cover the expenses for replacing essential items.

Before purchasing JetBlue travel insurance, customers should carefully review the coverage options, costs, and limitations.

While the insurance has received mixed reviews, it generally offers comparable coverage to other major airlines. Customers should compare coverage options and costs from different travel insurance providers to make an informed decision.

The Benefits of JetBlue Insurance for Travelers

JetBlue travel insurance offers several benefits to customers, including:

Protection Against Unexpected Travel Problems:

JetBlue travel insurance safeguards customers from unforeseen travel issues such as trip cancellations, interruptions, or delays caused by illness, injury, death of the traveler or a family member, natural disasters, and other unexpected events. It also provides coverage for lost or damaged baggage.

Customer Service Benefits:

JetBlue travel insurance provides customer service advantages, including round-the-clock travel assistance and concierge services. Customers can contact Allianz Global Assistance anytime for assistance with travel-related matters such as flight rebooking or finding medical care during their journey.

Financial Strength:

The financial stability of Allianz Global Assistance supports JetBlue travel insurance. As a leading travel insurance provider, Allianz Global Assistance has earned a strong reputation for delivering quality coverage and exceptional customer service.

Peace of Mind:

JetBlue travel insurance guarantees customers peace of mind by protecting them against unexpected travel problems. Travelers can confidently embark on their journeys, knowing they have coverage in case of emergencies or unforeseen events.

In summary, JetBlue travel insurance offers valuable protection to travelers, shielding them from disruptions that can arise during their trips. Before purchasing JetBlue travel insurance, customers must carefully review the coverage options, costs, and limitations.

While the insurance has received mixed reviews, it generally provides coverage similar to other major airlines. Comparing coverage options and costs from various travel insurance providers can help customers decide.

How can JetBlue Insurance for travelers protect customers from unexpected travel problems?

JetBlue provides travel insurance through Allianz Travel Protection . This insurance plan protects customers against unexpected travel problems, including trip delays, cancellations, and medical emergencies. However, it is important to note that the coverage provided by JetBlue’s travel protection plan may not encompass all expenses or situations.

For instance, hotel or meal expenses may not be covered if a flight is canceled, leaving passengers stranded. Therefore, it is crucial for customers to thoroughly review the policy’s terms and conditions and understand what is and isn’t covered before making a purchase.

In addition, customers who have made a significant financial investment in their trip may want to consider obtaining a more comprehensive travel insurance policy. Such a policy would cover all nonrefundable trip expenses, not just the flight cost.

This ensures higher coverage and peace of mind for those who have invested heavily in travel arrangements.

The customer service benefits of JetBlue insurance

JetBlue’s travel insurance plan , provided by Allianz Travel Protection, comes with customer service benefits . These benefits encompass coverage for various circumstances, including trip cancellation, interruption, and medical emergencies.

Customers can choose between Vacation Package Protection and Global Travel Protection plans. While the Global Travel Protection plan is slightly more expensive, it offers more extensive coverage.

However, it is important to note that the coverage provided by JetBlue’s travel protection plan may not include all expenses or situations. For instance, hotel or meal expenses may not be covered if a flight is canceled, leaving passengers stranded.

Therefore, it is essential for customers to carefully review the policy details and understand the coverage limitations before making a purchase decision.

The financial strength of JetBlue

JetBlue’s travel insurance is marketed and administered by Allianz Global Assistance. The insurance plans are underwritten by three insurance companies: Jefferson Insurance Company, Nationwide Mutual Insurance Company, and BCS Insurance Company . The specific underwriter is determined based on the policyholder’s state of residence and policy details.

JetBlue takes pride in its longstanding partnership with Allianz Global Assistance, a recognized travel insurance and assistance industry leader. This partnership has spanned over a decade, highlighting Allianz’s esteemed position as the gold standard in the field.

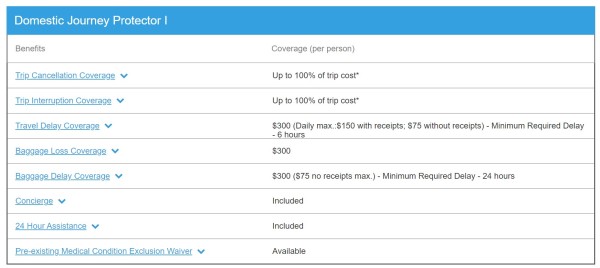

The policy provided by Allianz for JetBlue is known as the Domestic Trip Protector I . JetBlue’s travel insurance options have received A+ and A ratings, respectively, from A.M. Best’s 13 Financial Strength Ratings, demonstrating their strong financial stability.

When considering travel insurance, it is essential to research the company’s financial stability. This factor ensures the insurer can fulfill its obligations and provide the necessary coverage in unforeseen circumstances.

How to Purchase JetBlue Insurance Plans

Purchasing JetBlue travel insurance can be done by following these steps:

Visit JetBlue’s website and navigate the “Customer Assurance” drop-down menu. Select “Travel Insurance” from the options provided.

Choose between the two plans available: Vacation Package Protection and Global Travel Protection .

As requested, provide the necessary information, including trip and personal information.

Before purchasing, carefully review the coverage and costs of the selected plan. It is crucial to understand what is clearly and isn’t covered.

Complete the purchase by making the required payment for the chosen plan.

It is important to remember that the coverage offered by JetBlue’s travel protection plan may not include all expenses or situations. Therefore, it is vital for customers to thoroughly read the policy’s terms and conditions, ensuring a clear comprehension of the coverage limitations before making a purchase.

Additionally, customers who have made a substantial financial investment in their trip may want to consider purchasing a more comprehensive travel insurance policy that covers all nonrefundable trip expenses beyond just the flight cost.

The process of adding travel insurance to a JetBlue flight or vacation package

Adding travel insurance to a JetBlue flight or vacation package can be done by following these steps:

- When booking a JetBlue Vacations flight + hotel package, during the booking process, select the option labeled “Travel Protection” to add travel insurance to your package.

- Choose between the two plans provided: Vacation Package Protection and Global Travel Protection.

- Enter the required information, including trip details and personal information, as prompted.

- Reviewing the coverage and costs associated with the selected plan before finalizing the purchase is essential. Take the time to understand the specifics of what the plan covers.

- Complete the purchase by making the necessary payment for the chosen travel insurance plan.

By following these steps, customers can easily add travel insurance to their JetBlue flight or vacation package, providing additional protection for their travel arrangements.

Regenerate response

Tips for customers when purchasing travel insurance from JetBlue

Here are some helpful tips for customers when purchasing travel insurance from JetBlue:

1. Understand the coverage options: JetBlue offers two plans, Vacation Package Protection and Global Travel Protection, each providing different levels of coverage. It is crucial for customers to thoroughly review the details and understand what is and isn’t covered before making a purchase.

2. Consider the costs: When purchasing trip insurance, it is advisable to allocate approximately 4 to 8 percent of the total trip cost for a policy. Customers can contact JetBlue directly or utilize the company’s online quote calculator to obtain an accurate rate.

3. Research customer reviews and reputation: To gain an impartial assessment of JetBlue’s trip protection offerings compared to other major players in the industry, customers should research JetBlue’s travel insurance reputation and customer reviews. This step helps in evaluating the benefits and drawbacks before making a decision.

4. Check the financial strength: Customers should prioritize researching the financial stability of the travel insurance company. This ensures the insurer can fulfill obligations and provide necessary coverage in unforeseen circumstances.

5. Understand the limitations: It is important to know that the coverage offered by JetBlue’s travel protection plan may only include some expenses or situations. For example, hotel or meal expenses may not be covered if a flight is canceled, leaving passengers stranded. Reading the policy’s fine print and understanding the coverage limitations is vital.

6. Consider adding travel insurance to a JetBlue vacation package: Customers can include travel insurance in their JetBlue vacation package by selecting the “Travel Protection” option during the booking process. This can provide additional coverage for the entire trip, extending beyond the flight.

By following these tips, customers can make more informed decisions when purchasing travel insurance from JetBlue, ensuring adequate coverage and peace of mind throughout their journey.

JetBlue Trip Insurance Reviews

JetBlue provides travel insurance through Allianz Travel Protection, offering various coverage options and benefits. Here’s a summary of information and reviews regarding JetBlue’s travel insurance:

Coverage Options : JetBlue’s travel insurance options may be limited, but the coverage provided in their vacation insurance plans is fairly comprehensive . Customers can choose between the Vacation Package Protection plan for those purchasing a vacation package and the slightly higher-priced but more extensive Global Travel Protection plan for travelers with pre-planned trips. Both plans offer comprehensive coverage.

Costs : JetBlue’s travel insurance depends on the selected plan and trip details. Customers can obtain an **accurate rate** by contacting JetBlue directly or utilizing the company’s online quote calculator.

Customer Reviews & Reputation: Conducting research on JetBlue’s travel insurance reputation and reading customer reviews is essential for obtaining an unbiased evaluation of their trip protection offerings compared to other industry leaders. Some customers have reported issues, including being stranded by the airline.

Customer Service Benefits : JetBlue’s travel insurance plan provides customer service benefits , including coverage for various circumstances such as trip cancellation, interruption, and medical emergencies.

Financial Strength: JetBlue’s travel insurance is sold and administered by Allianz Global Assistance, with the plans underwritten by Jefferson Insurance Company, Nationwide Mutual Insurance Company, or BCS Insurance Company. JetBlue’s travel insurance options have received A+ and A ratings based on A.M. Best’s Financial Strength Ratings.

In conclusion, it is crucial for customers to carefully review the policy’s fine print and understand the coverage details before making a purchase decision.

Types of JetBlue Trip Insurance Plans

JetBlue provides two travel insurance plans through Allianz Global Assistance: Vacation Package Protection and Global Travel Protection.

The coverage included in JetBlue’s vacation insurance plans is comprehensive, offering various benefits. Customers purchasing a vacation package can choose the Vacation Package Protection plan. At the same time, those with pre-planned travel can opt for the slightly higher-priced but more comprehensive Global Travel Protection plan.

The trip insurance plans offered by JetBlue include the following:

Comprehensive coverage

Trip cancellation and interruption coverage

Medical emergency coverage

Baggage coverage

24-hour hotline assistance

It is important to note that while JetBlue’s travel protection plan provides extensive coverage, it may not cover all expenses or situations. For example, hotel or meal expenses may not be covered if a flight is canceled, leaving passengers stranded. Customers should carefully review the fine print and understand the plan’s coverage limitations before purchasing.

Moreover, customers who have made a significant financial investment in their trip may want to consider purchasing a more comprehensive travel insurance policy that covers all nonrefundable trip expenses beyond just the flight cost. This ensures additional protection and peace of mind throughout their travel journey.

Examples of situations where each type of plan would be beneficial

Here are some scenarios where each type of JetBlue travel insurance plan would be beneficial:

Vacation Package Protection:

- A family is planning an all-inclusive vacation or cruise seeking protection against trip cancellation or interruption and comprehensive coverage for unforeseen events like medical emergencies or lost/stolen baggage.

Global Travel Protection:

- A traveler who has independently planned their travel (not a JetBlue vacation package) desires slightly higher-priced but more comprehensive coverage than the Vacation Package Protection plan.

Comprehensive Travel Insurance:

- A traveler seeking the most extensive coverage for their trip, including trip cancellation, trip interruption, lost baggage, emergency medical coverage, emergency evacuation, and other related benefits.

Seven Corners Trip Protection:

- A traveler needs a customizable travel insurance plan that covers the trip’s cost, medical expenses, and belongings, with the option for cancel-for-any-reason coverage.

These various travel insurance options cater to different travel needs and preferences, ensuring that customers can find the appropriate level of coverage based on their specific requirements.

JetBlue Insurance Coverage Details

JetBlue provides travel insurance through Allianz Travel Protection, offering various coverage options and benefits. Here are the key details:

Trip Delay Coverage: JetBlue’s travel insurance includes trip delay coverage with a maximum reimbursement of $300 per person, regardless of the duration of the delay.

Coverage Options: JetBlue offers Vacation Package Protection and Global Travel Protection plans. These plans differ in their levels of coverage. It is important for customers to thoroughly review the policy details and understand what is covered before making a purchase.

Policy Details: JetBlue’s travel insurance policy, the Domestic Trip Protector I, provides a full refund for trip cancellation and interruption. However, customers should be aware that not all expenses or situations may be covered by this policy.

Benefits: JetBlue’s travel insurance plan offers valuable customer service benefits, including coverage for various circumstances such as trip cancellation, interruption, and medical emergencies.

The coverage limits and exclusions

Here are the coverage limits and exclusions for JetBlue travel insurance:

Coverage Limits:

Trip delay coverage has a maximum limit of $300 per person , regardless of the delay duration.

The Vacation Package Protection plan covers trip cancellation or interruption and comprehensive protection for unforeseen events like medical emergencies or lost/stolen baggage.

Though slightly more expensive, the Global Travel Protection plan offers more extensive coverage than the Vacation Package Protection plan.

The TrueBlue Domestic plan offers exclusive coverage to customers using JetBlue’s services.

Exclusions:

JetBlue’s travel protection plan may not cover all expenses or situations.

Hotel or meal expenses may not be covered if JetBlue cancels a flight and leaves passengers stranded, even if the responsibility lies entirely with the airline.

It is important to note that the coverage provided by JetBlue’s travel protection plan may only cover some nonrefundable trip expenses beyond just the flight cost.

Customers are advised to thoroughly review the policy’s fine print and understand what is and isn’t covered before purchasing.

Additional coverage options may be available.

JetBlue customers can explore additional coverage options through the JetBlue Plus card or third-party travel insurance providers.

For instance, the JetBlue Plus card provides travel insurance with maximum coverage of $10,000 per year for expenses such as passenger transportation and hotel reservations.

Customers also have the opportunity to purchase travel insurance from other third-party providers that may offer more comprehensive coverage compared to JetBlue’s plans.

Customers are advised to conduct thorough research and compare different travel insurance options to find the coverage that suits their needs and budget.

It is crucial for customers to carefully review the policy’s details and understand the extent of coverage before making a purchase.

JetBlue Plus Card Travel Insurance

JetBlue offers travel insurance through Allianz Global Assistance, and customers who hold the JetBlue Plus card can also benefit from travel insurance as a card perk . Here are the key details about JetBlue Plus card travel insurance:

Travel accident insurance protects cardholders in case of death or dismemberment during the trip or transit.

Trip cancellation and interruption insurance: Cardholders are covered for non-refundable expenses if their trip is canceled or interrupted due to covered reasons, such as illness or severe weather.

Baggage delay insurance: This coverage reimburses cardholders for expenses incurred due to baggage delays, such as purchasing essential clothing and toiletries.

Lost luggage reimbursement: Cardholders are covered for lost or stolen luggage.

It’s important to recognize that JetBlue Plus card travel insurance coverage and terms can vary depending on the specific card and the agreement between the cardholder and the issuer. Customers should carefully review the policy details and understand the coverage limitations before purchasing.

Is JetBlue Plus Card travel insurance worth it?

Whether JetBlue Plus Card travel insurance is worthwhile depends on individual travel preferences and needs. Consider the following factors:

The JetBlue Plus Card provides travel accident insurance, trip cancellation and interruption insurance, baggage delay insurance, and lost luggage reimbursement.

Cardholders can enjoy a free first checked bag , saving up to $70 per round-trip flight.

The JetBlue Plus Card offers a higher rate of return with 6X points on JetBlue purchases compared to other premium travel rewards cards.

JetBlue Plus Card travel insurance may not cover all expenses or situations .

An annual fee of $99 for the JetBlue Plus Card may not be worthwhile for infrequent JetBlue flyers.

Other travel credit cards and third-party travel insurance providers may offer more comprehensive coverage or better value for the cost.

In summary, frequent JetBlue flyers seeking rewards points may find the JetBlue Plus Card travel insurance to be a valuable perk.

However, those who fly JetBlue infrequently or desire more extensive coverage may want to explore alternative travel credit cards or third-party insurance providers. It is crucial to carefully review the policy details and understand the coverage limitations before purchasing.

How much does JetBlue Travel Insurance cost?

- The cost of JetBlue travel insurance varies depending on the specific plan and the cost of the trip.

- Business Insider reports that JetBlue charges $70 for travel insurance for each JetBlue flight.

- According to AARDY.com, JetBlue travel insurance costs 6.75% of ticket and service fees.

- JetBlue Vacations offers travel insurance that reimburses the unused, non-refundable portion of the trip and covers increased transportation costs for returning home early or continuing the trip due to a covered reason.

- The cost of JetBlue travel insurance may not be worth it for all customers, and some may want to consider other travel insurance options that offer more comprehensive coverage or better value for the cost.

- Customers should carefully read the fine print and understand what is and is not covered by the plan before purchasing it.

- JetBlue travel insurance may be a good option for customers who want comprehensive coverage for their JetBlue flights, but other travel insurance options may offer more value for the cost.

Can I cancel or modify my JetBlue insurance policy?

- According to AARDY.com , JetBlue’s travel insurance policy offers a 100% refund for trip cancellation and trip interruption. However, it does not provide coverage for medical expenses or medical evacuation.

- The JetBlue Card includes trip cancellation insurance, which covers up to $1,500 per insured person in the event of certain unforeseen covered events that cause the customer to cancel.

- JetBlue offers travel protection on its website as an optional add-on when customers purchase tickets. This travel insurance plan is provided by the insurance company Allianz.

- Customers unsatisfied with their JetBlue travel insurance policy have 15 days (or longer, depending on their state of residence) to request a refund, as long as they have not commenced their trip.

- JetBlue Vacations provides travel insurance that reimburses the unused, non-refundable portion of the trip and covers increased transportation costs for returning home early or continuing the trip due to a covered reason.

How to File a Claim with JetBlue Travel Coverage

To initiate a claim with travel insurance JetBlue , customers should follow these steps:

Collect necessary documentation: Customers should gather all relevant documents, including receipts, medical bills, and other proof of expenses related to the claim.

Contact Allianz Global Assistance: Customers can file a claim online by visiting the Allianz Travel Protection website and selecting the “File a Claim” button. Alternatively, they can file a claim by calling the phone number provided in their policy documents.

Policy information: Customers must provide their policy number and other pertinent details concerning their coverage when filing a claim.

Submit supporting documentation: Customers must furnish supporting documentation to substantiate their claims. This may include receipts, medical bills, and other evidence of expenses related to the claim.

Await response: Upon submitting the claim, customers should allow for a response from Allianz Global Assistance. The response time may vary depending on factors such as the complexity of the claim and the volume of claims being processed.

What documentation is required to file a claim?

JetBlue’s Twitter account states that customers needing to file a travel insurance claim must submit “documentation.” The specific documentation necessary may vary depending on the nature of the claim.

However, customers need to gather all relevant documentation, including receipts, medical bills, and other evidence of expenses associated with the claim.

Allianz Global Assistance, the entity responsible for administering JetBlue’s travel insurance, has tried simplifying the claim form for easier completion. They have also provided a claim process.

Customers can refer to the Allianz Travel Insurance website to obtain a general list of the documentation needed for a claim.

Before purchasing the travel insurance plan, it is essential to thoroughly read the terms and conditions and gain a clear understanding of what is covered and what is not.

JetBlue vs. Other Airlines Travel Insurance

There are several alternatives to JetBlue travel insurance that customers can consider:

Third-party travel insurance providers: Customers can purchase travel insurance from third-party providers offering more comprehensive coverage than JetBlue’s plans. These providers may offer more flexibility regarding plan customization and cover a wider range of expenses and situations.

Travel credit cards: Certain travel credit cards, such as the Chase Sapphire Reserve , provide complimentary travel insurance as a benefit when customers use the card to book their flights. This can be a cost-effective way to obtain travel insurance coverage.

Other airlines: Many major airlines offer travel insurance as an optional add-on to flight purchases. Customers can compare the cost and coverage of travel insurance plans offered by different airlines to find the plan that aligns best with their specific needs and budget.

When comparing travel insurance JetBlue to travel insurance offered by other major airlines, there are some key points to consider:

Similarities:

Many major airlines, including JetBlue, provide the option to purchase travel insurance when booking a flight.

The coverage offered by travel insurance plans can vary depending on the airline and the specific plan chosen.

Typical coverage includes protection for trip cancellation, trip interruption, medical emergencies, and lost or stolen baggage.

Differences:

The cost and coverage of travel insurance plans may differ between airlines and the specific plans available.

JetBlue, for example, includes travel insurance as an additional expense during the checkout process, while other airlines, like Southwest, may direct customers to third-party services for insurance.

JetBlue’s travel insurance policy, the Domestic Trip Protector I, offers a 100% refund for trip cancellation and interruption, but it may not cover all expenses or situations.

Some airlines offer more comprehensive travel insurance plans than JetBlue, while others offer less extensive coverage.

Unbiased Evaluation:

JetBlue’s travel insurance plan aligns with those offered by other major airlines, covering common scenarios such as trip cancellation, trip interruption, medical emergencies, and lost or stolen baggage.

However, it’s important to consider that the cost and coverage of travel insurance plans can vary depending on the airline and the specific plan chosen.

JetBlue’s policy, administered by Allianz, is the Domestic Trip Protector I, offering a 100% refund for trip cancellation and interruption . Still, it’s crucial to review the policy details to understand the scope of coverage.

Customers should carefully read the policy’s terms and conditions to know precisely what is covered before purchasing.

In conclusion, customers are advised to conduct thorough research and compare different travel insurance options to find the best plan for their needs and budget.

How to Contact JetBlue?

Here are the ways to get in touch with JetBlue travel insurance:

Online: Customers can visit the JetBlue travel insurance website to access information about coverage and file a claim conveniently online.

Phone: Customers can contact Allianz Global Assistance using the phone number provided in their policy documents. This allows them to file a claim or seek clarification on their coverage by speaking directly to a representative.

JetBlue customer service: Customers can contact JetBlue’s customer service for travel-related inquiries, including questions about travel insurance coverage.

It is crucial to emphasize that customers should carefully review the policy details, including the fine print, to understand the coverage and exclusions before making a purchase decision.

Additionally, customers who have made significant financial investments in their trips may consider purchasing a more comprehensive travel insurance policy that covers all nonrefundable trip expenses beyond just the flight cost.

Phone numbers for JetBlue Trip Insurance:

Here are the contact numbers for JetBlue travel insurance:

Allianz Travel Protection : Customers can reach Allianz Travel Protection at the phone number in their policy documents to file a claim or inquire about their coverage. The phone number for Allianz Travel Protection is (866) 884-3556.

JetBlue customer service: Customers can contact JetBlue’s customer service for support regarding their travel plans, including any inquiries about travel insurance coverage. The phone number for JetBlue customer service is 1-800-JETBLUE (538-2583).

What is travel insurance?

Travel insurance is a type of coverage that can protect you financially while traveling, whether domestically or internationally. Typically, travel insurance can cover you if you need to cancel your trip due to unforeseen circumstances, such as illness, injury, or natural disasters. It can also help cover the costs of medical emergencies and other unexpected expenses that may arise during your trip.

Does JetBlue offer travel insurance?

Yes, JetBlue offers travel insurance through its partner, Allianz. The travel insurance product is called “JetBlue Travel Protection,” and it is available to all passengers who purchase a JetBlue ticket.

What does JetBlue insurance for Travelers cover?

JetBlue’s travel insurance covers a range of events, including trip cancellation, interruption, emergency medical expenses, baggage loss, and more. It also includes coverage for certain travel-related issues related to Covid-19. For specific details about what is covered, please visit JetBlue’s website.

How much does JetBlue Trip insurance cost?

The cost of JetBlue travel insurance varies based on several factors, including your age, the length of your trip, and the level of coverage that you choose. Typically, JetBlue’s travel insurance costs between $79 and $169 per person, depending on the specifics of your trip.

Can I purchase my travel insurance from JetBlue after I’ve booked my flight?

Yes, JetBlue travel insurance can be purchased after you’ve booked your flight. However, it’s important to note that coverage may not go into effect until a certain number of days after you purchase the policy, so it’s best to purchase the insurance as soon as possible after booking your flight.

What should I keep in mind when choosing JetBlue’s travel Coverage?

When choosing JetBlue’s travel insurance, you should consider factors such as the length of your trip, any pre-existing medical conditions, and the level of coverage you need. You should also be aware of the specific terms and conditions of the policy, as well as any exclusions or limitations that may apply.

What services are included with JetBlue’s travel Plans?

In addition to coverage for events such as trip cancellation, emergency medical expenses, and baggage loss, JetBlue’s travel insurance also includes various assistance services. These services include 24/7 emergency travel assistance, medical consultation and referral, and translation services.

Can I cancel JetBlue’s travel insurance if I change my mind?

The ability to cancel JetBlue’s travel insurance policy will depend on the specific terms and conditions of the policy. It’s important to carefully review the policy before purchasing it to understand the cancellation policy. If you decide to cancel your policy, do so as soon as possible to avoid any fees or penalties.

Will JetBlue’s travel Plans cover last-minute cancellations?

JetBlue’s travel insurance may cover last-minute cancellations, depending on the specific circumstances. For example, if you need to cancel your trip due to a medical emergency or a covered event, your travel insurance may reimburse you for some or all of your non-refundable expenses. However, it’s important to carefully review the policy for any exclusions or limitations that may apply.

Is JetBlue trip insurance available for international travel?

Yes, JetBlue’s travel insurance is available for domestic and international travel. However, the specifics of the coverage may vary depending on where you’re traveling, so it’s important to carefully review the policy before purchasing it.

JetBlue offers travel insurance to its customers through Allianz Global Assistance, providing coverage for trip cancellation, interruption, medical emergencies, and lost or stolen baggage. JetBlue Plus cardholders can also benefit from travel insurance as a perk when using the card to book flights.

The JetBlue Plus Card includes travel accident insurance, trip cancellation and interruption insurance, baggage delay insurance, and lost luggage reimbursement.

The value of JetBlue travel insurance depends on each individual’s travel needs and preferences. It is essential for customers to carefully review the policy details and understand the coverage limitations before making a purchase.

Travel insurance JetBlue is a favorable choice for those seeking comprehensive coverage for JetBlue flights. To learn more about travel insurance JetBlue , readers can visit the JetBlue and Allianz Travel Insurance websites.

- Aardy. “JetBlue Travel Insurance Review.” https://www.aardy.com/blog/jetblue-travel-insurance/

- JetBlue Vacations. “Travel insurance.” https://www.jetbluevacations.com/why-jetblue-vacations/travel-insurance

- JetBlue. “Allianz Travel Protection.” https://www.jetblue.com/customer-assurance/travel-insurance

- Insurance Blog by Chris. “JetBlue Travel Insurance: Plans, Costs, Reputation, & Services.” https://www.insuranceblogbychris.com/travel-insurance/jetblue-travel-insurance-company-review/

- WalletHub. “How the JetBlue Plus Card Trip Cancellation Benefit Works.” https://wallethub.com/answers/cc/jetblue-plus-card-trip-cancellation-2140807056/

- La Trobe University Library. “Referencing – Artificial Intelligence (AI) – Expert help guides.” https://latrobe.libguides.com/artificial-intelligence/referencing

- Allianz Global Assistance. “Travel Insurance Plans.” https://www.allianztravelinsurance.com/travel-insurance/plans

- Jefferson Insurance Company. “Travel Insurance.” https://www.jeffersoninsurance.com/travel-insurance/

- Nationwide Mutual Insurance Company. “Travel Insurance.” https://www.nationwide.com/personal/insurance/travel/

- BCS Insurance Company. “Travel Insurance.” https://www.bcsins.com/travel-insurance/

- Recent Posts

- Pet Insurance for Older Dogs: 2024 Full Guide & Top Providers - March 17, 2024

- Small Business Equipment Breakdown Insurance: Full Coverage - November 6, 2023

- DBS Travel Insurance Singapore: Secure Your Trip with Chubb - August 10, 2023

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Do you want to install app?

Add a shortcut to your home screen: Share button at the bottom of the browser. Scroll left (if needed) to find the Add to Home Screen button.

Customer Assurance

Get to know us.

- Our Company

- Partner Airlines

- Travel Agents

- Sponsorships

- Web Accessibility

- Contract of Carriage

- Canada Accessibility Plan

- Tarmac Delay Plan

- Customer Service Plan

- Human Trafficking

- Optional Services and Fees

JetBlue In Action

- JetBlue for Good

- Sustainability

- Diversity, Equity & Inclusion

Stay Connected

- Download the JetBlue mobile app

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Sweepstakes

- Airlines + Airports

JetBlue: What to Know Before You Fly

Here's everything you need to know before you book your flight, plus passenger reviews.

:max_bytes(150000):strip_icc():format(webp)/Eric-Rosen-511f25215f8a4755ba7f3dabb031fcc2.jpg)

JetBlue disrupted the airline industry when it took to the skies in 2000 with the egalitarian model of only economy seats. Since then, it has grown into the sixth-largest airline in North America, carrying around 40 million passengers a year to over 100 cities on more than 1,000 daily flights.

Although JetBlue's routes are mostly in North America, the carrier now operates transatlantic flights from New York City (and some from Boston) to destinations like London, Paris, and Amsterdam, complete with swanky, next-generation Mint business-class suites aboard. So if you haven't flown the airline in a while, now might just be the time to take another look at the most recent JetBlue reviews and services.

Fare Classes

JetBlue sells tickets in five main fare classes , ranging from bare-bones basic economy all the way up to full-service business class.

Frugal fliers can find significant savings by booking JetBlue's first fare tier: Blue Basic. However, unless you've booked a transatlantic flight, carry-on bags are not allowed at this level apart from one small personal item like a purse or laptop bag. While you'll save money on the ticket itself, expect to pay extra for:

- Checked bags

- Changes and cancellations

- Advance seat selection

You will also board last and only earn a single TrueBlue point per dollar (as opposed to three with all other fares).

You might not miss the frills, though, according to Tripadvisor user Elddis74 , who said, "When I looked into this airline it was classed as a budget airline. I have to say from my opinion, I would not class this airline as budget. It is one of the best flights I have had and the return flight was the same."

JetBlue's term for regular economy tickets, Blue lets fliers bring a carry-on bag and personal item aboard for free, enjoy waived change and cancellation fees (excluding same-day switches) on tickets, choose some seats in advance for free, and board in the general group. You still have to pay extra for checked bags, though, except for one suitcase on transatlantic flights.

This category, when available, has the same advantages and restrictions as Blue, but the fare includes one checked bag regardless of the destination.

Want a few more perks? Consider booking a Blue Extra ticket. In addition to the Blue benefits, you can stand by or switch to another flight on the same day without paying a fee, choose from even more seats in advance, and board early. Except on transatlantic flights, you'll still have to pay for checked bags. At select airports, Blue Extra customers might also be able to take advantage of the airline's priority check-in and security service — also available for customers who purchase an Even More Space seat.

The airline offers its flagship Mint business class seats and service on transatlantic flights and some cross-country, Latin America, and Caribbean routes. If you purchase one of these tickets, count on the perks listed above, plus a first shot at boarding and two checked bags for free. On select flights, you'll also have the option to upgrade to lie-flat seats, but these come at a premium price.

As you can imagine, Mint fares are much more expensive than economy ones, but the upcharge is worth it, according to Tripadvisor commenter @644jeremyb , who wrote, "They make a huge effort to look after their passengers, from pre-boarding, providing flat beds which are very comfortable. The meal service is different too and they present a number of choices, all delivering smaller portions, but far more tasty and imaginative than the major airlines."

Even More Space

While it isn't a fare class in and of itself, you can purchase an upgrade to this experience, which includes more legroom in coach and expedited check-in, security, and boarding. Although you get a little more legroom, seats aren't all that more comfortable, according to TripAdvisor user @GoldnAdvice , who summed up the experience in this way: "Unfortunately, JetBlue has not improved its seats therefore I had a very uncomfortable seat."

Change and Cancellation Policies

Like many other airlines, JetBlue relaxed its change and cancellation policies during the COVID-19 pandemic. There are still no change and cancellation fees for most fares, except Blue Basic. For routes in the U.S., Mexico, the Caribbean, and Central America, Blue Basic fliers will be charged a $100 change or cancellation fee, and $200 on other routes. If you have second thoughts after booking a flight (at least seven days in advance), you can cancel for a full refund within 24 hours of purchase.

Those with Blue, Blue Plus, Blue Extra, or Mint tickets will not be charged to change or cancel their flights but will have to pay any applicable fare difference. Instead of a refund, though, you will typically receive a credit toward a future trip, which might be harder to use than it sounds, according to Tripadvisor contributor @patriciaU3085IG . "I was unable to make a trip I had scheduled for July so I canceled it in late February. I had booked it in early February. Instead of giving me my money back on my JetBlue card they gave me a Travel Bank Credit that has to be used by February 2024 or they keep my money."

If you want to stand by or switch to another flight on the same day, you will be charged $75 unless you have Mosaic elite status or you purchased a Blue Extra fare, though there will be no fare difference to pay.

Baggage Policies and Fees

If you're just carrying on, you can bring your bag for free with fares in Blue class and up. If you booked one of those Blue Basic fares, though, don't try to get on the plane with anything larger than the permitted personal item, as outlined in JetBlue's baggage guidelines . If you do, expect to pay $65 each for your first two bags and $180 for a third checked at the gate.

Of course, sometimes you need to bring along more than a small carry-on suitcase. Within the U.S., Latin America, and the Caribbean, Blue Basic, Blue, and Blue Extra passengers will be charged $35 for a first checked bag and $45 for a second. Purchase a Blue Plus fare and you get the first checked bag free but pay $45 for the second. Mint passengers get two checked bags of up to 70 pounds each for free.

The airline's Mosaic elite customers and those with the JetBlue Plus credit card get a carry-on and checked bag free with all fares. So do transatlantic travelers (except Blue Basic fliers unless they purchase an upgrade to an Even More Space seat).

While these fees are pretty standard nowadays, they still caught Tripadvisor user @elliem893 off guard. "They charged me $150 additional to the $35 because my luggage was 10 lbs overweight (60 lbs instead of 50lbs) and when I questioned why so much since they only charge [an] extra $45 for a second [bag], he was very disrespectful, saying that I shouldn't be questioning JetBlue's policy."

Boarding Order

JetBlue operates a grouped boarding order. Here's how the process plays out.

- Pre-boarding for customers with disabilities

- Mosaic and Mint (business class) customers

- Even More Space customers (Group A)

- Active military and those flying with small children

If that sounds well organized, beware that things don't always go according to plan. Tripadvisor user @56denise wrote that there "was a lack of clarity and organization during the check-in and boarding process. There were too many categories of passengers during the boarding procedures. It became confusing as to what class, type, and place in line we were supposed to be."

Seats and Legroom

Given its relatively limited route map (compared to the major legacy carriers like American Airlines and Delta), JetBlue only flies nine different types of jets . It might seem like even fewer from the passenger experience perspective, though, since some of them are essentially the same aircraft but with different configurations. In general, you'll be flying an Airbus A220, A320, or A321, or an Embraer E190.

JetBlue is known for having some of the roomiest coach seats around. According to data collected by SeatGuru , your seat will be between 17.8 and 18.4 inches wide, with 32 to 39 inches of pitch. On Airbus A320s and A321s, seats are laid out in a 3 – 3 pattern, while on Embraers, they're 2 – 2, and on Airbus A220s, they're 2 – 3.

According to Tripadvisor user @emmamQ5613MO , "The flight was the most comfortable flight I had been on, the seats had the most legroom I have ever experienced in economy."

Located at the front of the economy cabin, Even More Space seats cost extra, but get you up to seven extra inches of legroom for around 35 to 41 inches of pitch, depending on the plane.

JetBlue recently introduced Mint Suite and Studio seats on its newest planes but still flies the older version on most of the jets that feature this business-class installation.

The original Mint seats are laid out in alternating rows of 2 – 2 and 1 – 1, where the individual seats have sliding doors for privacy. Each is around 20.5 inches wide with 58 inches of pitch and reclines to an 80-inch lie-flat bed.

JetBlue installed all-new Mint Suites and Mint Studios aboard some of its next-generation Airbus A321neos and A321LRs, which fly on transatlantic and transcontinental routes.

Each Studio is a fully enclosed seat (with sliding doors) that is angled inward toward the aisle and reclines to a lie-flat bed. There are just two of these spacious quarters aboard the planes that have them, comprising the first row of the cabin. These palatial fixtures even have an extra seating area if you want a guest to visit you during your flight. Both Mint Studios and Suites are laid out in a 1 – 1 pattern, so there won't be any neighbors to clamber over on your way to the lavatory.

Tripadvisor commenter @ vickypO2191WD claims, "The Mint class was excellent, lots of room and very comfortable. The flight just whizzed by outbound and return."

Food and Beverage

Passengers in coach can enjoy a selection of free packaged snacks like Popchips and pretzels as well as complimentary drinks including sodas, juices, water, and Dunkin' coffees and teas. On a recent flight from Philadelphia to Orlando, Tripadvisor commenter @sacagawea89 wrote "No delays, the flight was so comfortable and the provided snacks and food were delicious."

Alcoholic beverages are available for purchase, as are the airline's themed EatUp Boxes (on flights longer than two hours), including a Mediterranean-inspired one with hummus, olives, and crackers and another with cheese, crackers, and dried cherries. On some longer flights, you can also buy a larger cheese plate, sandwiches, or a salad. Reviews of the paid offerings are mixed, but @thebay_to_newengland wrote on Tripadvisor, "Got hungry on the way back home so purchased a turkey sandwich for $12. Price was high, but the quality was pretty good."

If you're flying Mint, you can expect a much higher-end meal and drinks service with a selection of small plates to choose from, courtesy of Delicious Hospitality Group . The offerings vary by route and schedule.

Cocktails might include the signature Mint Condition, with Bombay Sapphire gin or Tito's vodka, ginger, lime, cucumber, and mint, and wine options are curated by the folks at NYC wine shop/bar Parcelle. Recent dishes have included lasagna, farro with snap peas, radish, and pistachios, roasted shrimp, and Tuscan fried chicken. Consult the current Mint menus before your flight to plot your courses.

Tripadvisor user @travis219m wrote about his Mint experience, "The food service was great with many menu choices. You could pick three main entrees! I chose the chicken curry, beef filet, and truffle ravioli. All three were delicious!"

Amenities and Entertainment

Although it might not have the global reach of some of its competitors, JetBlue leaves them in the dust when it comes to in-flight connectivity and comfort. First and foremost, the airline is a pioneer in in-flight Wi-Fi. JetBlue offers high-speed service for free "at every seat, on every plane," though you'll get the best service on its new and refurbished A320s and A321s.

JetBlue also offers seatback entertainment screens at every seat. Though they're just under seven inches wide on the Embraers, they're more like 10 inches on the A320s and A321s, and even larger in Mint (up to 22 inches in that Mint Suite). Passengers can watch live television channels through DirecTV or a selection of TV shows and movies, listen to music, play games, and more.

According to Tripadvisor reviewer @hmajck , "The entertainment at each seat was amazing to keep all my kids occupied. All planes have Wi-Fi in the air so they can even play on iPads, phones, etc."

Most of the planes, excluding the A320 Classic and Embraer 190, should feature USB ports at each seat and power plugs at every seat, or two for every three. But be sure to check the specific arrangement on your aircraft when booking.

Coach passengers can't expect much in the way of pillows or blankets these days but if you're flying Mint, you'll be treated to Tuft & Needle bedding, Master & Dynamic noise-isolating headphones, and amenity kits curated by wellness brand Wanderfuel.

JetBlue Credit Cards

JetBlue fields three co-branded credit cards . If you fly the airline a lot, it could be worth carrying one of them to earn even more points on your travels, and to enjoy special perks and discounts.

The JetBlue Card is currently offering 10,000 bonus points after making $1,000 in purchases in the first 90 days. Cardholders earn an extra three points per dollar on JetBlue purchases, and two points per dollar at eligible restaurants and grocery stores, as well as getting a 50 percent discount on in-flight cocktail and food purchases. There's no annual fee.

Opt for the JetBlue Plus Card instead, and you could earn up to 60,000 points after paying the $99 annual fee and spending $1,000 in the first 90 days. The card earns six points per dollar on JetBlue purchases and two points per dollar at eligible restaurants and grocery stores. Cardholders get their first checked bag free (for up to three travelers on the same reservation), 50 percent off in-flight cocktails and food purchases, and a 5,000-point anniversary bonus each year, among other benefits. A business card with similar perks is also available.

Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

JetBlue Travel Insurance - 2024 Review

Jetblue travel insurance review.

- Available at Check-Out

- Insufficient Travel Insurance Cover

- No Medical or Medical Evacuation Benefits

Sharing is caring!

We are huge fans of JetBlue. It seems to have done an excellent job in building an airline that offers low-cost travel in modern aircraft. We think that its Mint Business Class Seats are innovative. Unfortunately, JetBlue Travel Insurance is not.

JetBlue’s Flight Insurance is provided through Allianz Travel Insurance upon checkout. The travel insurance that JetBlue sells its customers is designed not to compete against JetBlue’s own Refundable seats. We’ll look at the insurance shortly.

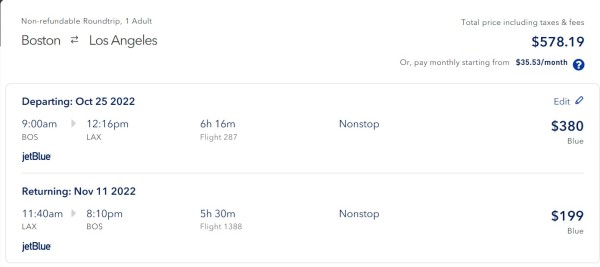

Our Sample Trip – Boston to Los Angeles

For our sample trip, we chose to fly from Boston to Los Angeles for one 63-year-old traveler. Flight choices were between Jet Blue and American Airlines depending on flight schedules. We opted for Jet Blue flights for both departure and return and also opted for the upgraded seats on the ‘Blue’ tier.

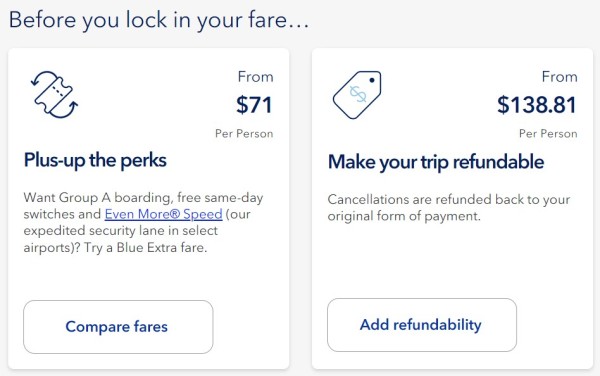

We were provided with several upgrades prior to checkout. We can move to Group A boarding (for an additional $71) or even make the ticket refundable (for an additional $138.81) if we choose:

The issue here is that many people – we estimate around 25% - buy Refundable seats. They need the flexibility because their plans might change. However, there is a way around this extra charge, called the Airline Ticket Hack , and we will cover it a little later in this article. So, for now we’ll decline both the refundable ticket upgrade and the bump to Group A boarding.

JetBlue Travel Insurance Group

Once we select our flights, we are offered travel insurance for an extra $37.58, and they highlight the fact that we have non-refundable tickets.

While the price seems reasonable, what do we actually get for this cost? Let’s look at the benefits the insurance offers:

Allianz Domestic Trip Protector I

The policy provided by Allianz for JetBlue is the Domestic Trip Protector I. This policy provides a 100% refund for trip cancellation and Trip Interruption but provides NO medical coverage nor medical evacuation coverage. Pricing is 6.75% of the total ticket cost and service fees.