Our website doesn't support your browser so please upgrade .

Travel Insurance

Alternatively please call 800 4560 .

- Instant quote & Instant cover

- Simple enrollment process

- High value cover for low premiums

- Extensive Cover options

- Global presence and worldwide arrangements

- Multilingual healthcare professionals

- 24/7 365 days a year travel assistance

Are you eligible?

You can apply for travel insurance if you are:

- a UAE resident

- a GCC resident traveling from their country of residence

Things you should know

- travel smart is one of the best travel insurance products in the market, to cover you for any medical and travel inconvenience, ensuring a worry-free holiday

- travel schengen is the compulsory minimum cover required for obtaining a visa to any Schengen country

- Travel insurance policy Terms and Conditions (PDF) Travel insurance policy Terms and Conditions (PDF) Download link

Find out more

Get started by requesting a quote online

Product terms and conditions and exclusions apply. Please read the full policy wording for further information.

General insurance products are provided by GIG Insurance (Gulf) B.S.C. (c). HSBC Bank Middle East Limited in the UAE is only a referrer of GIG's general insurance products and is not responsible for claims, processing or otherwise.

Related products

Life insurance

Life insurance could well be one of the most important financial products you purchase.

Home insurance

With GIG Home Insurance, protect your home contents, personal belongings and more.

Car insurance

Give your car the care it deserves with GIG Motor Insurance today.

Personal accident insurance

Make sure your loved ones are taken care of.

Connect with us

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy

Travel Insurance

Why choose travel insurance.

ICICI Lombard General Insurance company limited introduces the "Smart Traveller" travel insurance policy to deal with any of the contingencies while travelling abroad.

Travelling away from home for business or leisure without travel insurance can be quite worrisome. Medical treatment for illness, cancellation of trips, loss of important documents or financial emergency are among the few risks that may turn your dream holiday into an overseas nightmare.

In order to suit the different segments of overseas travel insurance needs, we have tailored three exclusive product variants for online purchase for individuals and families.

Plan UIN Number:

- IRDA/NL-HLT/BAXAGI/P-T/V.I/222/13-14

Ways to open:

Online, Branch

Features & Benefits

Product feature.

Single trip policy:

- This is a Single trip policy pre underwritten by the insurance provider

- This policy covers individuals with a minimum age of 3 months and maximum age of 85 years

- Minimum number of days per trip should be 2 days and is extendable up to a maximum of 356 days

Schengen policy:

- This is a Single trip policy applicable for individuals having valid Schengen visa and are travelling to Schengen countries/regions

- Minimum no. of days per trip shall be 2 days and is extendable up to a maximum of 356 days

Annual Multi Trip policy:

- This policy covers two or more trips to different destinations overseas during the Policy period

- This policy covers persons individuals with a minimum age of 3 months and maximum 70 years

- Minimum number of days per trip shall be 2 days and per trip the duration should not exceed more than 30 days, 45 days, and 60 days as per the plan chosen

Key Inclusions

Smart Traveller (Individual / Family Travel) insurance includes:

- Medical expenses for in-patient and out-patient treatment, medical aid for injuries, pathological tests, daily allowance, etc.

- Personal Accident, Accidental Death & Permanent Total Disablement incurred during the trip

- Reimbursement of actual expenses incurred towards loss of passport, travelers cheques, traveling tickets/documents

- Compensation for loss or delay of checked-in baggage

- Reimbursement of expenses towards trip delay and cancellation

- Damage to contents at home of the insured in India, caused by Fire, Allied perils, burglary while the insured is on an overseas trip

We strongly recommend you to note the complete list of Inclusions by clicking on the Apply Today.

Key Exclusions

Smart Traveller (Individual / Family Travel) insurance excludes:

1. Any pre-existing condition, cosmetic surgery, pregnancy, etc. unless medical assistance provided to save the insured’s life.

2. Losses arising from any delay, detention, confiscation by the customs officials or public authorities

3. Loss of valuables, money, tickets, passes or any other item will not be payable

4. Trip Cancellation and / or Interruption due to strike, plan change of the travelers, cancellation by an airline, or tour operator, etc.

5. Non Allopathic treatment e.g. - Ayurvedic, Yogic, Homeopathic, Unani treatment(s)

We strongly recommend you to note the complete list of Exclusions by clicking on the Apply Today.

Key Things You Should Know

The Policy provides cover against emergency medical expenses for an individual and/or families while overseas along with covering travel related contingencies like loss of important documents, trip cancellation/delay, emergency accommodation, Personal liability and financial emergency assistance, among others.

This policy also covers the Total loss of checked – in baggage of the insured for the corresponding flight of the licensed carrier. Other valuables can also be covered if declared specifically and agreed by the Insurance provider.

This insurance policy can be offered only for overseas travel.

Family Floater option is available under this policy and can be extended to the traveller’s family including spouse and to a maximum of 2 dependent children upto the age of 23 years.

In case of family floater option, the individual premium for the spouse would be a maximum of 75% of the premium for the senior most member insured under the policy. Premium for each dependent child would be a maximum of 50% of the premium for the senior most member. However the overall Sum Insured for the entire family as mentioned in the plan can be used by any or all the members of the family.

Purchase of insurance product is purely voluntary and is not linked to availment of any other facility from the bank.

This policy also covers the Total loss of checked – in baggage of the insured during the course of flight of the licensed carrier. Other valuables can also be covered if declared specifically and agreed by the Insurance provider.

Kindly refer to the “Key Exclusions” section to understand the terms not covered under this policy.

Policy wordings

- Smart Traveller Insurance Policy Wordings (PDF, 12.4 MB) Smart Traveller Insurance Policy Wordings (PDF, 12.4 MB) Download

Product brochure

- Smart Traveller Insurance Policy Brochure (PDF, 152 KB) Smart Traveller Insurance Policy Brochure (PDF, 152 KB) Download

Apply for Smart Travellers Insurance policy

Want to talk.

Contact us today to have your questions answered

You might be interested in

Smart health Insurance

This comprehensive Health Insurance policy is flexible and affordable, available in 4 different plan options to suit your needs

Smart Super Health

Cover for hospitalization expenses incurred in India for treatment of Illness, disease or injury

Motor Insurance

Motor Insurance offers a comprehensive protection to your car and its passengers keeping you protected on the road

Important Information

Terms & conditions.

Insurance is the subject matter of solicitation.

The Insurance products are offered and underwritten by ICICI Lombard General Insurance Company Ltd., ICICI Lombard House, 414, Veer Savarkar Marg, Prabhadevi, Mumbai – 400025, India.

The Hongkong and Shanghai Banking Corporation Limited, India (HSBC) (IRDAI Regn. no. CA0016) whose India corporate office is at 52/60, M. G. Road, Fort, Mumbai – 400001, India, does not underwrite the risk or act as an insurer.

The contract of insurance is between the insurer and the insured and not between the bank and the insured. The Hongkong and Shanghai Banking Corporation Limited, India does not underwrite the risk or act as an insurer. HSBC will receive 15% commission on the premium amount from ICICI Lombard General Insurance Company for this transaction. For more details on risk factors, terms and condition please read the Customer Information Sheet carefully before concluding a sale.

Website: www.icicilombard.com Call : 18001032292 SMS : Claim or Service or Renew or Call Back to 5667700 Email : [email protected]

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS. IRDA clarifies to public that:

IRDA or its officials do not involve in activities like sale of any kind of insurance or financial products nor invest premiums. IRDA does not announce any bonus. Public receiving such phone calls are requested to lodge a police complaint along with details of the phone call and number.

Connect with us

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AXA Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is AXA?

Axa travel insurance plans, which axa travel insurance plan is best for me, can you buy axa travel insurance online, is axa legit, what isn't covered by axa travel insurance, is axa travel insurance worth it.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss , trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

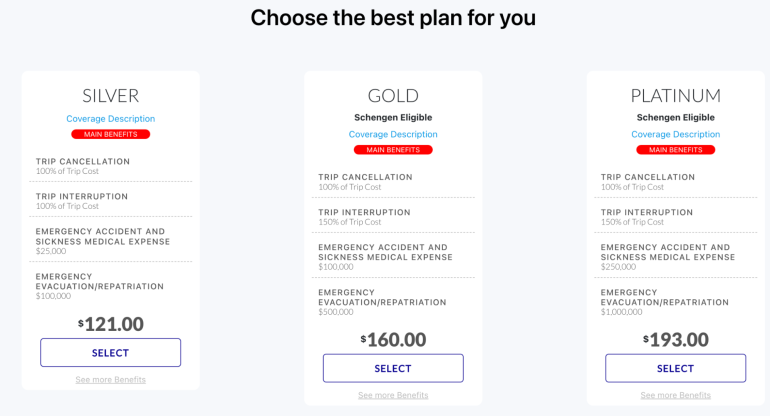

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions , a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

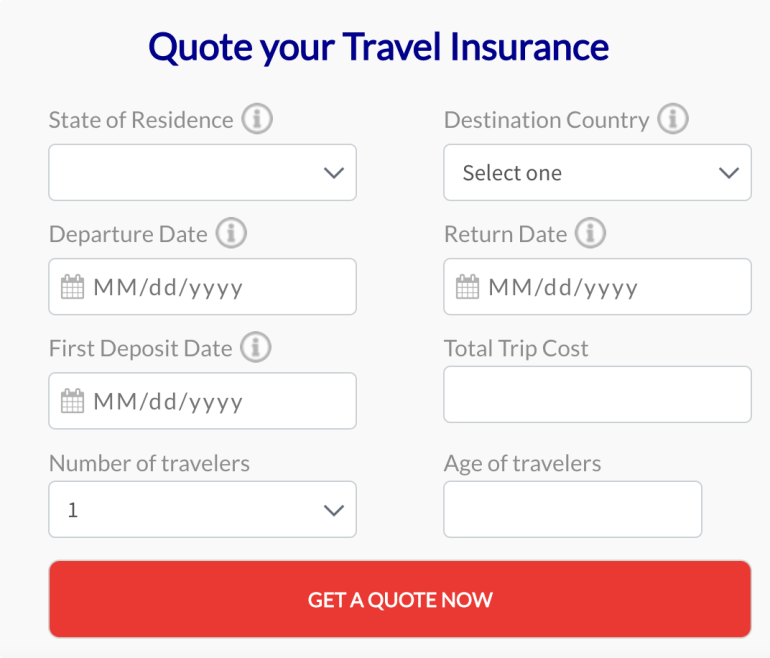

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

AXA handles more than 14 million cases each year, and every plan includes access to their 24/7 assistance hotline. The company is well established and has three plans for travelers to choose from.

AXA travel insurance covers several benefits including but not limited to 100% trip cancellation and trip interruption, medical emergencies, emergency evacuations, baggage delay or lost baggage, and accidental death and dismemberment. The Platinum plan also lets you add Cancel For Any Reason coverage.

AXA's least expensive plan, Silver, and its mid-range Gold policy do not have the option to add-on Cancel For Any Reason coverage. For travelers who opt to purchase the Platinum insurance plan, you can add Cancel For Any Reason coverage a la carte within 14 days of paying the initial trip deposit.

In the event that you need to make a claim, you can upload supporting documents online. If the claim is accepted, you will receive reimbursement within 30 days.

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Compare Travel Insurance Plans

What travel insurance plan is right for you and your trip, axa already looks after millions of people around the world.

With our travel insurance we can take great care of you too

Our AXA Commitment

Need help choosing a plan.

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

Android 裝置的全新安全措施

來自非手機官方應用商店的應用程式或含惡意軟件,請小心提防。由2024年2月26日起,Android版本的HSBC HK App將推出全新安全措施,以保護您免受惡意軟件侵害。 了解更多 。

我們透過使用Cookie以評估您在我們網站的使用情況,為您提供最佳的網站體驗。如果你繼續瀏覽本網站,即表示您接受我們使用Cookie來收集數據。 了解更多

每次當您計劃出門旅遊時,「旅遊萬全保」都會為您和您的家人及親友提供保障,直至您們盡興而返。「旅遊萬全保」讓您每個旅程都輕鬆無憂,其全面的承保範圍包括意外受傷、醫療及住院費用、個人責任、行李及現金遺失、航機延誤及財物被竊等。

有關 新型冠狀病毒 下「旅遊萬全保」的保障查詢,請查閱 常見問題 。

提供周全保障,包括個人意外賠償額高達港幣200萬元,以及醫療費用賠償額高達港幣500萬元

保障由惡劣天氣、罷工、恐怖活動或自然災難引起的指定損失

所有受保人士,包括兒童均可享本計劃的全部保障

您的手提電話提供高達港幣6,000元保障

於2024年3月18日至2024年5月17日期間(包括首尾兩天)申請:

- 「多程旅遊萬全保」可享首年保費七折及港幣100元之惠康超市現金禮券

- 單次「旅遊萬全保」可享保費八五折

比較「滙豐旅遊萬全保」計劃

查看 更多保障詳情 。此外,您亦可以投保全年適用的「多程旅遊萬全保」,獲享額外優惠:

- 只需一個保費,保障全年無限次旅程,每程最長可達100日

- 為您提供24小時的網上保單服務,無論任何時候,只需登入個人網上理財,即可隨時查閱保單,並申請保單服務。

- 若您經常到中國內地旅遊或公幹,您可在全年多程旅遊保障計劃附加「中國醫療卡」,以享指定醫院入院按金擔保保障

本計劃承保範圍一般包括:

我們將為您支付在旅途中必須的醫療費用及返回香港特別行政區後三個月內的跟進醫療費用,賠償額最高達港幣500萬元。如您的子女必須因您留院而返回香港,我們亦會為您支付因此而引起的額外交通和住宿費用。

運動及活動 [@sportsactivitiestravelsurance]

我們承保各種運動和活動,例如沙漠四驅車、滑沙、森林探索、出海觀鯨、溫泉、騎馬、吊車、攀爬冰川、觀看賽車、水上運動、滑雪、溜冰、踏單車及遊樂場內的各種機動遊戲等。

「旅遊萬全保」亦為某些高風險活動提供保障,包括乘坐熱氣球、綁繩跳崖、滑翔風箏、跳降落傘、溜索、激流划艇、快艇、水上電單車、攀山、滑水、花式滑水、無繩滑水、海上皮划艇、深水潛水(潛水深度不超過四十米)、登山及攀石等。

行李遺失或損毁賠償額最高可達港幣20,000元。如隨行的行李送遞延誤或誤送而令受保人抵達海外目的地6小時或以上仍未能取得行李,並因此須緊急購買基本衣物或必需品,可獲最高港幣2,000 元賠償。

旅程延誤及遺失重要文件

假如您的預定交通工具延誤超過6小時,可獲現金津賠最高港幣2,500元。或者,在標準計劃下,您可選擇購買另一張旅票以追上原訂的行程, 賠償金額最高可達港幣4,000元。 如果遺失重要文件(如護照),補領費用的賠償金額最高可達港幣5,000元。

- 「中國醫療卡」 (PDF)

您只需在入院登記處出示中國醫療卡及身份證明文件,便可於國內指定醫院接受治療而毋須預先繳付住院按金。每張卡的年費僅為港幣300元。

如受保人在香港特別行政區境外的地方不幸身故,並在旅程期間有任何以受保人持有的信用卡所簽賬的未付結餘,我們將代其繳付,最高港幣5,000元。

了解更多有關信用卡保障的詳情 (PDF)

有關詳情請參閱保單 (PDF)

本計劃承保範圍一般不包括:

- 暴亂、內亂、戰爭、入侵、內戰及一切相關危險事項

- 自殺、蓄意受傷、違法行為、神智失常、服用藥物、酗酒、性病或愛滋病

- 任何投保前已存在的病症

- 分娩、懷孕、流產、以接受診治為目的而旅遊

- 職業運動或同類賽事或有酬金的競賽或其他活動,包括獎金,捐贈,贊助或任何形式的報酬

- 深水潛水(潛水深度超過四十米)

- 航空活動,但以購票客身份乘搭認可航空公司或包機公司經營的飛機則不在此限

- 體力工作(如涉及使用機械和/或電子設備或需要處理爆炸性或有害物質等)

- 在旅程結束後31天內未能以書面通知安盛保險香港有限公司的索償事故

有關不受保項目的完整列表,請參 保單(PDF) 。

您須符合以下資格,才可投保「旅遊萬全保」:

- 必須為滙豐信用卡或滙豐戶口持有人

- 必須為香港特別行政區居民,並在香港境內申請旅遊萬全保

- 受保旅程出發和返回地點必須是香港特別行政區

- 必須持有香港身分證進行網上投保

- 注意以下兒童的年齡涵蓋:

- 如小童未滿18歲,必須在投保期間提供小童家長或合法監護人[@legalguardiantravelsurance]的資料

- 如小童未滿12歲,必須由成人陪同旅遊

- 若您想為你的配偶/伴侶[@partnerdefinition]、子女、親屬和朋友投保於相同的保單,您必須提供他們的資料

- 「旅遊萬全保」聲明、條款及細則 「旅遊萬全保」聲明、條款及細則 互動視窗連結

- 服務費用 服務費用 互動視窗連結

- 表格及文件下載 表格及文件下載 互動視窗連結

- 重要資料 重要資料 互動視窗連結

- 「旅遊萬全保」產品冊子 (PDF) 「旅遊萬全保」產品冊子 (PDF) 下載連結

- 「旅遊萬全保」保單文件 (PDF) 「旅遊萬全保」保單文件 (PDF) 下載連結

- 常見問題 常見問題 互動視窗連結

- 尋找分行 尋找分行 互動視窗連結

滙豐客戶可網上投保「旅遊萬全保」

您可親臨我們的分行了解更多

非香港身分證持有人可否投保旅遊萬全保?

只要您的行程由香港出發,並以香港為回程終點,非香港身分證持有人可以致電 (852) 2867 8678 或親臨任何一間香港的滙豐分行投保旅遊萬全保。如您希望透過網上投保,您需要持有香港身份證方可進行申請。

旅遊萬全保可以為小童提供保障嗎?

可以,旅遊萬全保可以為18歲以下的小童提供保障,而投保人必須在申請過程中提供父母或法定監護人的資料。

我能否為我的朋友或他們的子女購買旅遊萬全保?

可以,但在您開始投保申請之前,您需要確保您獲得受保人的全名、香港身份證號碼及出生日期資料。

如果我需要在緊急情況下尋求協助,應該怎麼辦?

您可隨時致電緊急支援熱線 (852) 2528 9333 尋求緊急醫療及撤離支援、旅遊資料、行李支援、醫療服務轉介、法律專業人員轉介及緊急票務安排。熱線支援英文、廣東話及普通話三種語言。

如果我身處外地,仍可以延長受保期嗎?

可以,您可在辦公時間內致電 (852) 2867 8678 或隨時登入滙豐個人網上理財管理您的保單及提出服務要求。請注意您可以在保單到期日前延長您的保單受保期限。

如果在受保期間,我需要在海外住院,卻不會說當地語言,應該怎麼辦?

如果您在海外生病或受傷,並需要翻譯員的協助,您可以致電緊急支援熱線尋求服務轉介,我們會為您支付每日高達港幣500元的服務費用,而每次旅程最多可獲港幣5,000元補助。

如果我準備乘搭的航班出現延誤,導致我未能按時登上接駁航班,應該怎麼辦?

如果您因為航班延誤,而延誤時間超過六小時,導致您需要乘搭另一班航班,我們會為您支付單程機票的全部或部分額外費用。亞洲標準計劃的受保人可獲得高達港幣2,000元的賠償額,而環球標準計劃的受保人則可獲得高達港幣4,000元的賠償額。

旅遊萬全保會為體育運動或活動提供保障嗎?

會,例如是野外探索、出海觀鯨、水上運動及滑雪等,甚至是更高風險活動,包括熱氣球、滑翔風箏及跳降落傘等,只要你不是職業運動員或從該項運動收取酬金,旅遊萬全保均可提供保障。

航空活動則為不受保項目,但購票乘搭由認可航空公司經營的持牌飛機則不在此限;另外,水深超過40米的水肺潛水亦不會受到保障。

有關旅遊萬全保的受保範圍,請參閱 完整清單 (PDF) 。

如我計劃前往的目的地獲發外遊警示,我可獲得哪些額外保障?

如外遊警示在您旅遊前或在旅程中發出,您可獲得以下的額外保障。

- 您可以取消您旅遊萬全保的單次旅程保單,並獲得全額保費及徵費退款

- 如果您的旅程因紅色外遊警示而取消,您可以獲賠償高達50%無法取回的預付訂金或相關款項。標準計劃受保人最多可索賠港幣50,000元,而基本計劃受保人則最多可索賠港幣25,000元

- 如果您的旅程因黑色外遊警示而取消,您可以獲賠償高達100%無法取回的預付訂金或相關款項。標準計劃受保人最多可索賠港幣50,000元,而基本計劃受保人則最多可索賠港幣25,000元

- 如果您的航班外遊警示而遭到無可避免的延誤,受保期可免費自動延長10天。

- 如果您的旅程因紅色外遊警示而取消,您可以獲賠償高達50%任何未使用且無法取回的預付款項及額外的旅遊相關費用。標準計劃受保人最多可索賠港幣50,000元,而基本計劃受保人則最多可索賠港幣25,000元

- 如果您的旅程因黑色外遊警示而取消,您可以獲賠償高達100%任何未使用且無法取回的預付款項及額外的旅遊相關費用。標準計劃受保人最多可索賠港幣50,000元,而基本計劃受保人則最多可索賠港幣25,000元

- 如果因黑色外遊警示,導致交通中斷並影響預定行程,您可額外獲得港幣1,000元的補助

我可以就在旅遊期間所支付的醫療費用提出索償嗎?

可以,只要接受治療的狀況不是投保前已存在的病症,在海外的醫療費用支出可受到旅遊萬全保保障。

您也可能對以下內容感興趣

我們的家居財物保險「家居超卓萬全保」可按您的需要度身訂造,讓您自由自在享受生活,不必為珍貴財物勞心。

保障您本人和家屬的綜合保險,以免遭遇人身意外時帶來財政緊張。

助您應付突如其來的醫療支出及危疾。

一般保險計劃只適用於滙豐客戶。

上述資料僅為摘要,有關詳盡條款及細則,以及不受保項目細則,概以保單內文為準。

以上保單由 安盛保險有限公司(「AXA安盛」) 承保,AXA安盛已獲香港保險業監管局授權並受其監管。AXA安盛將負責按保單條款為您提供保險保障以及處理索償申請。香港上海滙豐銀行有限公司乃根據保險業條例(香港法例第41章)註冊為AXA安盛於香港特別行政區分銷一般保險產品之授權保險代理商。一般保險計劃乃AXA安盛之產品而非滙豐之產品。

有關與滙豐於銷售過程或處理有關交易的金錢糾紛,滙豐將與您把個案提交至金融糾紛調解計劃;此外,有關涉及閣下保單條款及細則的任何糾紛,將直接由AXA安盛與您共同解決。

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 27 March 2024, new safety measure in the Android version of the HSBC Singapore app will be launched to protect you from malware. Read more on malware scams .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Privacy Policy .

HSBC Travel Companion

Get ready to travel with hsbc.

- Protect yourself and enjoy travel insurance promotions

- Explore HSBC credit card promotion for hotels and flights bookings

- Earn cashback with one multicurrency account

Enjoy complimentary travel insurance promotion on selected HSBC credit cards

* Travel insurance coverage is underwritten by MSIG Insurance (Singapore) Pte. Ltd. HSBC Bank (Singapore) Limited is not the underwriter nor the distributor for this insurance plan. It is not an obligation of, deposit in or guaranteed by HSBC Bank (Singapore) Limited (Company Registration No. 201420624K).

1 HSBC Visa Infinite Credit Card Travel Insurance: Read the policy in detail .

2 HSBC Premier Mastercard Credit Card: Read the policy in detail

3 HSBC Advance Credit Card: Read the policy in detail

4 HSBC Revolution Credit Card: Read the policy in detail

5 HSBC TravelOne Credit Card: Read the policy in detail

Looking for a more comprehensive travel insurance plan? Check out our latest promotions for TravelSure .

Don't have an HSBC credit card?

Explore our exclusive promotions for hotel and flight bookings with your hsbc credit card.

From dining out to jetting off, find just what you're looking for. Get the latest travel deals and offers now!

Royal Caribbean

- Get 5% off on bookings & redeem a complimentary luggage Get 5% off on bookings & redeem a complimentary luggage click here to view more details This link will open in a new window

Expires 31 Dec 2024

- 8% off hotel bookings 8% off hotel bookings click here to view more details This link will open in a new window

Apply for one today and get a Samsonite luggage worth SGD670, or SGD150 cashback. T&Cs apply .

- extra 7% off hotel bookings extra 7% off hotel bookings extra 7% off hotel bookings This link will open in a new window

- 8% off worldwide hotel bookings 8% off worldwide hotel bookings click here to view more details about hotel bookings This link will open in a new window

Travel with your taste buds through global and sustainable dishes with One Planet Plate

Eating sustainably while on a holiday can be quite daunting, but it doesn’t mean that we have to stop paying attention to our environmental footprint while on the road.

One Planet Plate presented by HSBC aims to address the inherent problems in our food system, and has pulled together chefs from across the world to showcase dishes that celebrate local ingredients, produce zero waste and are low carbon footprint.

This opens up more opportunities for you to discover new sustainable restaurants and find out what delicious sustainable food actually looks, smells and tastes like in in Singapore and globally.

We've also partnered up with amazing restaurants so that you can explore a myriad of international cuisines right at your doorstep. View a range of exclusive credit card offers so you can shop and dine sustainably whilst in Singapore.

Travel and earn cashback with our multicurrency Everyday Global Account

Sign up now and receive preferential foreign exchange (FX) rates with our Everyday Global Account. Terms and conditions apply .

Sign up for an account with us and enjoy the following benefits

- $0 fee in 10 currencies for your retail purchases and cash withdrawals

- Free cash withdrawals at all HSBC ATMs worldwide

- Send money internationally faster with HSBC Global Money Transfers with no fees

Open an account today

New to hsbc.

You can apply faster with Myinfo via Singpass.

Already using online banking?

Unlock rewards easily with 1% cashback and enjoy up to sgd300 bonus cash rewards with everyday+, 1% cashback.

on all eligible spends on your HSBC Credit Cards, HSBC Everyday Global Debit Card and GIRO bill payments .

1% p.a. Bonus Interest

on your incremental SGD average daily balances.

Receive a total of up to

in Cashback and Bonus Interest each month through HSBC Everyday+ Rewards Programme.

Plus, earn One-time Bonus Cash Reward

when you're new to the HSBC Everyday+ Rewards Programme.

Caps apply. For definition of the capitalized terms used here and further details on the HSBC Everyday+ Programme and applicable exclusions, please refer to the full terms and conditions here .

To qualify for HSBC Everyday+, simply:

Credit your salary or set up a regular deposit of at least SGD2,000/5,000 into your HSBC Everyday Global Account

Make 5 Eligible Transactions with your Everyday Global Debit Cards or any HSBC Credit Card

Deposit scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to SGD75,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Protect yourself and enjoy travel insurance promotions

Explore hsbc credit card promotion for hotels and flights bookings , earn cashback with one multicurrency account .

Unlock instant travel rewards and elevated travel experiences with HSBC TravelOne

- Redeem travel rewards instantly with a wide range of airline and hotel partners.

- Earn up to 2.4 miles (6× Reward points) for your spending.

- Suite of travel privileges including 4 complimentary airport lounge visits, travel insurance coverage of up to USD100,000, and more

- Get 20,000 miles (in the form of 50,000 Reward points) for new HSBC TravelOne credit cardholders.

Terms and conditions apply.

Connect with us

Our website doesn't support your browser so please upgrade .

Make a travel insurance claim

About hsbc travel insurance claims.

HSBC Travel Insurance is provided by Aviva Insurance Limited. Aviva manages the claims process from start to finish so that your claims are handled as quickly and efficiently as possible.

When to make an HSBC Travel Insurance claim

If your trip has been cancelled, your first step should be to contact your travel and/or accommodation provider for a refund.

If you paid any part with your debit or credit card or PayPal, you may also contact the payment provider for a refund. If you paid with an HSBC debit or credit card, here’s how you can raise a dispute .

Claiming a refund from either your travel operator or your card provider may lead to a better outcome for yourself than claiming via your travel insurance, as you may be able to claim the full amount you paid without having to pay an excess. You could also potentially recover losses for all the party members on the booking, some of whom may not have taken insurance. You can find further useful information on this topic on the MoneyHelper website. If you’ve been unable to get a refund from your travel and/or accommodation provider or your payment provider, please contact Aviva to make a claim.

Coronavirus advice

For the latest coronavirus travel guidance, see what’s covered under HSBC Travel Insurance .

How to make a claim

If you don't need urgent medical attention, you can make a claim online.

All medical emergency lines are open 24 hours a day, 365 days a year:

All travel claim lines are open 8am to 6pm Monday to Friday and 8am to 6pm on Saturdays, closed Sundays.

For HSBC Premier

Medical emergency line: +44 (0)1603 605 135

For travel claims: +44 (0)1603 605 122

For HSBC Private Banking and Premier (retained Jade benefits)

Medical emergency line: +44 (0)1603 605 102

For travel claims: +44 (0)1603 605 122

For HSBC Select and Cover

Medical emergency line: +44 (0)1603 208 95

For travel claims: +44 (0)345 302 8387

For HSBC Insurance Aspects

Medical emergency line: +44 (0)1603 605 142

For travel claims: +44 (0)1603 604 910

For HSBC Gold MasterCard and HSBC Platinum MasterCard

Medical emergency line: +44 (0)1243 621 064

What you’ll need to make a claim

You’ll need to provide Aviva with:

- confirmation of the original booking and which parts of it are non-refundable

- evidence you’ve tried to get your money back from your travel and/or accommodation provider, plus your credit or debit card provider if you paid by card - for example, copies of emails you’ve sent and/or their replies

- details of any self-isolation advice you’ve been given by either your GP or from NHS 111

For all claims, normal policy excess, terms and conditions, exclusions and claims assessment apply.

How long will it take to process my claim?

As soon as you’ve notified Aviva of your claim, they will send you a claims pack detailing the information they need from you. To ensure your claim is handled as swiftly as possible, please follow the instructions in this pack.

After receiving your details, Aviva will assess your claim and make a payment to you within 28 days if your claim’s been successful.

If you’re having financial difficulties, please visit our financial support page for ways we can help.

Policy documents

HSBC Premier Account & Private Banking Worldwide Travel Insurance

- HSBC Travel Insurance Policy Wording: HSBC Private Banking, HSBC Premier (retained Jade benefits) and HSBC Premier Accounts (PDF, 528KB) HSBC Travel Insurance Policy Wording: HSBC Private Banking, HSBC Premier (retained Jade benefits) and HSBC Premier Accounts (PDF, 528KB) Download

- HSBC Premier Travel Insurance Product Information Document (PDF, 153KB) HSBC Premier Travel Insurance Product Information Document (PDF, 153KB) Download

- HSBC Private Banking Travel Insurance Product Information Document (PDF, 114KB) HSBC Private Banking Travel Insurance Product Information Document (PDF, 114KB) Download

- Premier (retained Jade benefits) Travel Insurance Product Information Document (PDF, 257KB) Premier (retained Jade benefits) Travel Insurance Product Information Document (PDF, 257KB) Download

Select and Cover

- Select and Cover Terms and Conditions (PDF, 427KB) Select and Cover Terms and Conditions (PDF, 427KB) Download

- HSBC Summary of Cover Limits (PDF, 105KB) HSBC Summary of Cover Limits (PDF, 105KB) Download

Insurance Aspects Worldwide travel insurance

- Your Travel Policy Document (PDF, 519KB) Your Travel Policy Document (PDF, 519KB) Download

- Insurance Product Information Document for customers aged under 70 (PDF, 296KB) Insurance Product Information Document for customers aged under 70 (PDF, 296KB) Download

Customer support

IMAGES

COMMENTS

Enjoy the freedom to travel the world with TravelSurance - Hong Kong travel insurance from HSBC. Fully comprehensive cover for you, your family and friends. ... claims where not notified in writing to AXA General Insurance Hong Kong Limited within 31 days after end of the trip; For a full list of exclusions, refer to the policy provisions ...

COVID-19 coverage. COVID-19 coverage is automatically included for Single and Annual plans. Get up to SGD250,000 medical expense coverage when you travel overseas. Please refer to the COVID-19 section for more information.

Relax with HSBC Premier Worldwide Travel Insurance. Enjoy worldwide travel insurance for you and your loved ones. Cover is provided by Aviva Insurance Limited. You must complete an application to be covered. Please read the Premier Worldwide Travel Insurance Product Information Document (PDF, 152KB) for a summary of terms, conditions ...

GIG Travel Insurance covers you for those unexpected incidents while travelling, leaving you free to relax and enjoy your vacation. This insurance covers the cost of medical emergencies, trip cancellation and lost luggage and provides many other benefits which leave you free to relax and enjoy your vacation. Alternatively please call .

HSBC will receive 15% commission on the premium amount from ICICI Lombard General Insurance Company for this transaction. For more details on risk factors, terms and condition please read the Customer Information Sheet carefully before concluding a sale. Website: www.icicilombard.com. Call : 18001032292.

Platinum. Platinum is AXA's highest tier level. This plan includes: Trip delay: $300 per day, with a $1,250 maximum. Trip cancellation: 100% of the trip cost. Trip interruption: 150% of the trip ...

Compare AXA Travel Insurance Plans which includes benefits like trip cancellation, interruption, emergency medical expense, emergency evacuation and baggage delay to help give you peace of mind before and during your trip. Optional benefits are also available to enhance our travel insurance plans and offer additional protection for your trip.

Entering the peak season for travelling, AXA collaborates with HSBC to launch the upgraded "TravelSurance", offering four different protection plans, including Asia Basic, Asia Standard, Worldwide Basic and Worldwide Standard, to give customers a hassle-free vacation with comprehensive travel protection. Mr. Martin Rueegg, Managing Director ...

Welcome to your HSBC Travel Insurance Travel Checklist 2 AV383239_CTRTG9185_0220.indd 2 16/01/20 4:24 PM. 3 To help you understand what you are covered for at a glance - we've highlighted some Frequently Asked Questions below. If you have a question and cannot find

How do I contact AXA? For enquiries and claims information, please contact AXA Customer Service Hotline at 1800 880 4888 (Within Singapore) or +65 6880 4888 (Outside of Singapore) or email ... (AXA's paid travel insurance plan)? The HSBC Visa Infinite complimentary travel insurance plan is a tailored plan for HSBC Visa Infinite HSBC cardholders.

axa安盛將負責按保單條款為您提供保險保障以及處理索償申請。香港上海滙豐銀行有限公司乃根據保險業條例(香港法例第41章)註冊為axa安盛於香港特別行政區分銷一般保險產品之授權保險代理商。一般保險計劃乃axa安盛之產品而非滙豐之產品。

HSBC Premier MasterCard vOct2019 TRAVEL INSURANCE FOR HSBC PREMIER MASTERCARD HOLDERS POLICY WORDINGS This insurance is arranged by HSBC Bank (Singapore) Ltd for the benefit of the Cardholder or/and his/her Family as herein defined. The Policy, P2155284, is issued and underwritten by AXA Insurance Pte Ltd. In consideration of the payment of the

Redeem travel rewards instantly with a wide range of airline and hotel partners. Earn up to 2.4 miles (6× Reward points) for your spending. Suite of travel privileges including 4 complimentary airport lounge visits, travel insurance coverage of up to USD100,000, and more. Get 20,000 miles (in the form of 50,000 Reward points) for new HSBC ...

If you're looking for worldwide travel insurance, we offer it alongside a minimum of 2 other types of cover in our multi-cover policy, Select and Cover. ... For existing HSBC Advance customers with an HSBC Insurance Aspects policy. Find out more Find out more about Insurance Aspects .

the Travel insurance helplines section for assistance. Explaining HSBC's service Your travel insurance policy is underwritten by Aviva Insurance Limited. As an insurance intermediary HSBC UK Bank plc deals exclusively with Aviva for the purposes of your policy. Aviva will deal with the administration of your insurance (including claims).

With the increasing popularity of overseas study, AXA Hong Kong ("AXA") and HSBC launch a new insurance plan "Overseas StudySurance" to provide extensive care for students getting education abroad. With annual premium as low as HKD4,000, students can enjoy the comprehensive protection away from home with the following premium features:

All travel claim lines are open 8am to 6pm Monday to Friday and 8am to 6pm on Saturdays, closed Sundays. For HSBC Premier. Medical emergency line: +44 (0)1603 605 135. For travel claims: +44 (0)1603 605 122. For HSBC Private Banking and Premier (retained Jade benefits) Medical emergency line: +44 (0)1603 605 102.

HSBC and AXA Hong Kong today jointly announced the launch of an online packaged general insurance platform for business customers in Hong Kong. Through this platform, customers from a wide range of local companies are able to apply for commercial packaged insurance with instant quotes, covering startups, office assets and retailer protection.

HSBC completes acquisition of AXA Singapore. 11 Feb 2022. *** Accelerating HSBC's ambition to be Asia's leading insurance and wealth provider ***. Further to the announcement on 16 August 2021, HSBC Insurance (Asia Pacific) Holdings Limited, an indirect wholly-owned subsidiary of HSBC Holdings plc (HSBC), has completed the acquisition of ...