Key Features

- GPS Time Clock Accurate time tracking made easy for workers

- Scheduling Ensure your crew always knows where to be and what to do

- Job Tracking Effortlessly monitor and oversee job progress

- Job Costing Accurately capture exact labor costs for each job

- Reporting Get key insights on how to optimize your workforce

- Labor Compliance Protect your business from costly labor disputes

- Integrations Integrate your key systems & workflows in minutes

- (650) 332-8623

- Help Center Find simple answers to any question about Workyard

- Developer API Connect & build integrations with our easy-to-use API

- About Us How Workyard came to be, our beliefs & who we are

- Blog Explore the latest on productivity, HR & more

Tools + Guides

- Employee Time Tracking Guide

- Free Construction Templates

- Construction Management Guide

- Field Service Management Guide

- Compare: Contractor Software Reviews

- Contact Sales

- Contact sales

Kentucky Labor Laws: A Complete Guide to Wages, Breaks, Overtime, and More (2024)

- 10 min read

- Published : November 6, 2023

Joseph Iyanu

- November 6, 2023

U.S. Labor Laws

- Tennessee Labor Laws

- Florida Labor Laws

- Kentucky Labor Laws

- Texas Labor Laws

- Connecticut Labor Laws

- Minnesota Labor Laws

- Georgia Labor Laws

- Alabama Labor Laws

Ensure Labor Law Compliance With Workyard

In Kentucky, fondly known as the Bluegrass State, the state government provides certain rules and regulations that dictate how a business can and should be run. Understanding these rules and regulations is important for navigating the intricacies of doing business while empowering employers and employees alike.

Kentucky labor laws are panoramic, cutting across the board and controlling several parts of business ranging from hiring ethics or practices to breaks, leaves, and employee pay.

Whether you are an employer looking to stay on the right side of the law while you do business or an employee looking to understand their rights, understanding lawful practices regarding labor and business in Kentucky is a must-have advantage.

This guide, a part of a 50-state series about labor laws, aims to help you achieve that, regardless of the industry you work in as part of the Kentucky workforce.

From details about wages and benefits to essential information about overtime regulations, this guide provides everything you need to know to create or enjoy a productive work environment.

Meals and Breaks in Kentucky

Kentucky employers are legally mandated to provide a meal break of at least 20 minutes to employees who work for at least 7.5 hours. This break must be provided to the employee between the 3rd and 5th hour of the workday as long as there is no mutual agreement stating otherwise. Additionally, this break can last for a reasonable length, such as 30 minutes.

Employers can choose not to compensate their workers for this break if they are fully relieved of their duties. However, all breaks that are less than 20 minutes should be paid.

Another break that is mandated is the rest break. According to Kentucky law, employees within the state must be eligible for a rest period of at least 10 minutes per every 4 hours of work.

Employees can choose to waive their breaks, but this should be written and documented.

Leave and Paid Time Off (PTO) in Kentucky

Kentucky state-specific laws also regulate the types of leaves that employees are mandated to have and those that they are not. These laws also describe in detail if compensation must be offered.

According to Kentucky labor law, employees should not suffer negative consequences upon their return to work after a required leave. This safeguards employee jobs while they get essential time off from work.

The required employee leave types include:

Kentucky employers are legally mandated to provide a meal break of at least 20 minutes to employees who work for at least 7.5 hours . This break must be provided to the employee between the 3rd and 5th hour of the workday as long as there is no mutual agreement stating otherwise. Additionally, this break can last for a reasonable length, such as 30 minutes.

Family and medical leave

This is offered to employees under the Family and Medical Leave Act (FMLA). FMLA states that all employees are eligible for 12 weeks of unpaid, job-protected leave within one year to attend to household medical-related issues.

These issues may include:

- Care of the employee's serious health condition

- Care of an immediate family member with a serious health condition

- Care of the employee's newly-born child

- Placement for adoption/foster care of a child with the employee

- Any difficulty due to the employee's immediate family member is a covered military member on active duty

An employee is only considered eligible for this leave if they have worked for at least a year and 1250 work hours. Additionally, this law only applies to employers with more than 50 employees.

If the employee’s sick family member is a member of the Armed Forces with a severe health condition or injury, the employee is eligible for up to 26 weeks of job-protected leave. However, this sick family member must be the employee’s spouse, parent, child, or next of kin.

Sometimes, an employee might be summoned to perform jury duty. When this happens, the employer must provide permission for the employee to be absent from work without any risk of job loss or being penalized.

Voting Leave

All Kentucky employers must provide at least 4 hours of voting time leave to all employees without penalization of the employees in question. The only exception to this rule is if the employer can prove that the employee didn’t cast their vote during this leave, in which case the employee can be penalized.

Military Leave

Kentucky employers must provide employees a leave of absence to serve in The Armed Forces, The National Guard, or The state militia. This leave is regulated by federal law.

The rule also states that upon the employee’s return, they must be provided with some pay increases and other benefits like they have been present at work the whole period.

Additionally, Kentucky has a law that offers members of the Kentucky National Guard a leave, not only for active duty but all necessary training.

Emergency Response Leave

For every employee who wants to take time off work to respond to or assist in an emergency, employers must provide an emergency response leave. This leave is offered to any employee who performs any of the following roles:

- Volunteer firefighter

- Rescue squad

- Emergency medical technician

- Law enforcement (peace officer)

- Emergency management agency employee

Employers may request proof of emergency role in the form of a letter from the supervisor or an institution where the employee performed the emergency work. However, the volunteering employee must not be penalized.

For an emergency response leave, employees can decide if the leave should be paid or not. Additionally, if an employee suffers an injury while serving at their emergency task, they are eligible for up to 12 months of leave, during which the employer cannot lay them off.

Witness Leave

If an employee is summoned as a witness in any court case, the employer is legally required to provide paid or unpaid leave. Additionally, the employer cannot punish such an employee. However, the employer may request proof that the employee was present as a witness in the court. This proof often comes in the form of a court certificate.

Adoption Leave

If any employee is in the process of adoption, the employee must provide up to 6 weeks of leave, during which the employee can settle custody and perform all necessary activities.

Kentucky Non-Required Leave

Likewise, there are several categories of leave or time off that an employer is not required by law to provide. However, the employer might choose to offer them as employee benefit. If the employer chooses to offer these leaves to employees, it is important to state all details and mutual agreement in the employee contract.

These non-required leave types include:

- Vacation leave

- Holiday leave

- Bereavement leave

Overtime Regulations in Kentucky

In Kentucky, any number of work hours that exceeds 40 hours per week counts as overtime for full-time employees who work 9-5.

When this occurs, employees are entitled to one-and-a-half times their regular wage rate. For minimum-wage employees in Kentucky, this amounts to an hourly wage of $10.875.

Kentucky state law also stipulates that if an employee works for 7 consecutive days, all hours worked on the 7th day will be treated as overtime.

Overtime Exceptions

There are some cases in which certain professionals are exempt from the overtime rule. This includes:

- Individuals working in administration, provided not more than 20% of the time is spent on activities unrelated to the position, e.g. accountants

- Individuals who are executives and who directly manage at least two employees

- Professionals with advanced skill and extensive knowledge e.g. certified teachers

- Sales representatives

Besides these government-approved exemptions, Kentucky state law exempts certain occupations from overtime pay . These occupations include:

- Agriculturists

- U.S. government employees

- People employed in domestic service in a private home

- Babysitters in the employer's home

- Companions of an elderly, sick, or convalescing person

- Newspaper delivery people

- People working in organized non-profit camps, religious, or educational centers (provided they are not open for work more than 7 months in a calendar year)

- Employees in a 24-hour residential care facility for children who are dependant, abused, or neglected

- Employees in non-profit child-caring facilities (licensed by the Cabinet for Health and Family Services)

- Employees in residential care working as family caregivers to an adult with mental health or intellectual disability (certified to provide adult foster care, by the Cabinet for Health and Family Services)

- Employees in retail stores, hotels, motels, restaurants, and service industries as long as the business earns less than $95,000 for the 5 preceding years exclusive of excise taxes or the employees are members of the employer's immediate family.

Wages and Benefits in Kentucky

Like the federal regulation, Kentucky state regulations declare that any number of hours up to 40 hours every week must be compensated to employees at a rate of at least the minimum wage. In Kentucky, the minimum wage is $7.25 per hour, mirroring the federal minimum wage .

Watch the video below for a quick and easy overview of details about wages and benefits in Kentucky:

Wage Type in KY

Regular minimum wage, regular tipped wage, subminimum wage.

Since the Federal wage rate and Kentucky State’s wage rates are the same, the state’s law states that a rise in the federal wage rate is directly proportional to a rise in the state’s wage rate, according to the Fair Labor Standards Act (FLSA).

However, certain professions are exempt from the state-specific minimum wage rule. These professions, specifically those in the hospitality industry who typically receive tips. These employees must regularly and constantly receive gratuities as extra cash to be considered tipped employees, many of which include servers, waiters, and bartenders.

For tipped employees in Kentucky, the minimum wage is $2.13.

However, if the total base pay of $2.13 plus tips does not equal at least $7.25, Kentucky state law mandates that the employer must make up the difference.

Additionally, Kentucky restricts the practice of tip pooling, which involves making tipped employees share their tips with non-tipped employees like chefs and dishwashers. In fact, Kentucky is one of the few states that legally restrict employers from initiating tip pooling.

Subminimum wage is paid to minors, employees with disabilities, apprentices, learners, and student workers. However, it is also set at $7.25 in Kentucky.

Pay Frequency

In Kentucky, employers must establish a payment method that follows at least a semi-monthly schedule. This means employers need to compensate employees no later than 13 days after the end of the pay period.

The employer may choose to pay using:

- Direct deposit

- Payable checks

- Payroll card account

Pay stubs are not mandated by state law, but many employers choose to provide detailed pay information for their employees’ convenience.

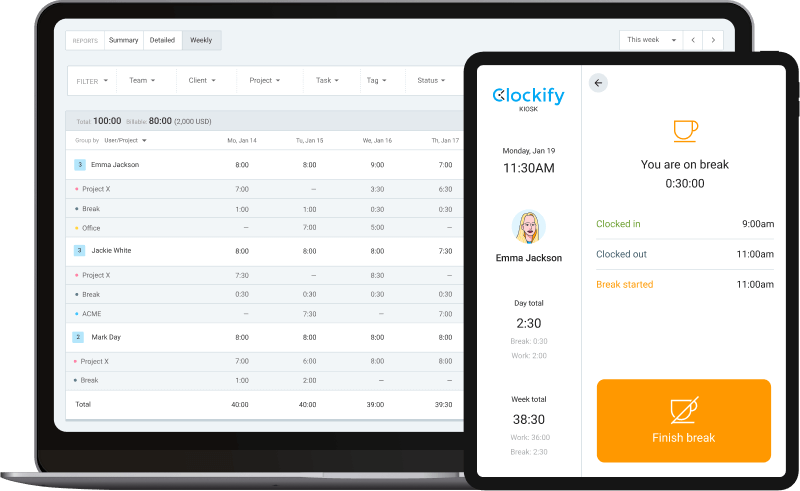

Do you want to keep accurate track of your worker’s payroll and ensure you stay compliant? Try Workyard!

Workyard makes it possible to:

- Keep track of employee work time in the field

- Accurately track employee work location, especially for field services

- Reduce employee overpayments and payroll waste by up to $2,000

- Track all facets of employee payment by integrating Workyard with other accounting software

Keep the most accurate payroll records with Workyard

Wage deductions.

Employers can make deductions from an employee’s wages under certain cases. These cases are usually authorized by local, state, or federal law. Additionally, employers can legally make deductions from wages when they have written consent from a specific employee who wants to cover insurance, hospital, or other important bills by choice of wage deductions.

Final Paycheck

When an employee is let go, employers in Kentucky are required by law to provide a final paycheck to the employee whose employment was terminated . This paycheck must include all the leftover wages and benefits.

The final paycheck must be paid at the next regularly scheduled payday or within 14 days of the separation.

Employee Benefits

Kentucky labor laws do not require employers to provide specific mandatory benefits beyond compliance with federal laws, such as Social Security, workers’ compensation, and unemployment insurance.

However, many employers in Kentucky offer a range of optional benefits to attract and retain talent. These include health insurance, retirement plans, paid time off ( sick leave and vacation ), and more.

However, the rules between required and non-required benefits sometimes overlap.

For example, if you’re a business owner with fewer than 50 workers, you aren’t required to provide health insurance benefits. However, if you employ more than 50 full-time equivalent employees (FTEs) in Kentucky, you must provide health insurance that meets minimum essential coverage (MEC). This will satisfy the Affordable Care Act’s (ACA) employer rule.

Insert content from subsequent informational sections here (delete / replace this placeholder text).

To continue adding text content, duplicate the header above this body content module (right click it) for additional headers, and duplicate this body content module for additional body content.

Prevailing Wages in Kentucky

Kentucky does not have a prevailing wage law. However, employees in Kentucky may be eligible to receive prevailing wages if they work on government-funded projects or perform specific government services. This includes projects like construction, renovation, or repair of public buildings, highways, bridges, and other infrastructure.

The objective of this wage is to maintain fair labor standards and prevent the underpayment of workers involved in these projects.

It is important to note that prevailing wages may differ from the federal minimum wage depending on the employment contract or project being worked on.

It is crucial to remain updated on the law of prevailing wages as the rates are subject to change. To find the most current prevailing wage rates in Kentucky, employers and contractors should refer to the Kentucky Labor Cabinet’s official website, or check federal websites responsible for promulgating prevailing wage rates, like SAM.gov .

These agencies update and publish prevailing wage schedules regularly, which typically include the specific wage rates and fringe benefits applicable to different job classifications and regions within the state.

Hiring Practices in Kentucky

In Kentucky, employers are legally restricted from making hiring decisions based on several factors, such as:

- Gender/gender-related identity

- National Origin

- Genetic information or family medical history

- Physical/mental disability

- Military or veteran status

This is to prevent discrimination during the hiring process.

While discrimination isn’t legal during the hiring process, background checks are. Background checks are controlled by the Federal Fair Credit Reporting Act, which regulates the collection, accuracy, and distribution of information in the Consumer Financial Protection Bureau.

However, only certain positions in Kentucky require background checks:

- School personnel such as new certified hires, student teachers, and coaches

- Public college and university personnel

- Personal services agency personnel

- Long-term care facilities personnel (as long as the facility is owned, managed, or operated by the Department of Behavioral Health, Developmental, and Intellectual Disabilities)

- Childcare center personnel (provided the employee has direct contact with minors)

💡Did You Know?

Employer reporting requirements in kentucky.

Kentucky has various reporting requirements that employers must adhere to, involving reporting to different state agencies.

- Employers in Kentucky are required to report newly hired and rehired employees to the Kentucky New Hire Reporting Center within 20 days of the hire date. This information is crucial for the enforcement of child support orders.

- Employers in Kentucky must report wage and employment information to the Kentucky Office of Unemployment Insurance. This helps determine eligibility for unemployment benefits and the amount of benefits an individual may receive.

Kentucky Recordkeeping Requirements

Recordkeeping requirements in Kentucky fall under the Fair Labour Standards Acts (FLSA) . Under this act, employers are required to:

- Keep payroll records, certificates, agreements, notices, collective bargaining agreements, employment contracts, and sales and purchase records for at least 3 years.

- Keep completed copies of each employee’s I-9 for three years after they are hired. If the employee works longer than three years, the employer is required to keep the form for at least one year after the employee leaves.

- Keep basic employment and earning records like timecards, wage-rate tables, shipping and billing records, and records of additions to or deductions from wages for at least 2 years.

- Keep the records that show why you may pay different wages to employees of different sexes, such as wage rates, job evaluations, seniority and merit systems, and collective bargaining agreements for at least two years

- Keep all employment records for at least one year from the employee’s date of termination according to the Equal Employment Opportunity Commission.

- Keep records of job-related injuries and illnesses for five years. However, some records, such as those covering toxic substance exposure, must be kept for 30 years.

- Keep files of benefit plans and seniority and merit systems while they are in effect and for at least a year after they end.

- Keep summary descriptions and annual reports of benefits plans for six years.

If the Family and Medical Leave Act covers the employing company, the employer must also keep relevant records of all leaves, notices, or policies for at least three years.

Health and Safety Standards in Kentucky

Kentucky, as with all other states, prioritizes the safety of employees at work. As such, the creation and sustenance of a safe working environment are mandated by federal and Kentucky state laws.

The law governing and overseeing employee safety is regulated by the Occupational Safety and Health Act (OSHA) . OSHA highlights every role employers and employees must play in reducing or possibly eliminating the risk of accidents at work.

Additionally, OSHA clearly states that employers are required to continually inspect for flaws and irregularities in the safety conditions and continually improve these irregularities.

In Kentucky, some safety priorities OSHA mandates include:

- Proper employee training and education upon employment

- Employers must conduct educational and advisory activities to ensure safe and healthy working conditions

- Employers must create optimal working conditions to rid the premises of risks that may cause hazards

- Employers should regularly organize safety demonstrations concerning health concerns

To facilitate the adoption of safety and health practices in workplaces , OSHA inspectors, also known as compliance safety and health officers, conduct regular inspections. These inspections may take place for several reasons, some of which include:

- Regularly scheduled inspections

- Taking notes or reporting of imminent danger

- Worker complaints

- Referrals from other agencies

- Targeted inspections that focus on specific high-hazard industries

- Reports of fatalities

The Division of Compliance in Kentucky is responsible for enforcing Occupational Safety and Health Standards in the public and private sectors. If employers and employees wish to report unsafe working conditions in the state, they can contact the division.

Additionally, the Kentucky Occupational Safety and Health Program (KyOSH) is in charge of enforcing OSHA regulations within the state. According to the KyOSH Act, every employer in Kentucky must have a written Safety, Health, and Injury and Illness Prevention Plan (IIPP) in place.

If employers or employees have concerns about their workplace, they can also contact the KyOSH.

Child Labor Laws in Kentucky

Child labor laws in Kentucky are tailored to protect the rights and prevent the exploitation of minors (individuals under 18) in the state. These laws not only keep under-aged individuals safe, but also serve to prioritize education.

- In Kentucky, the minimum age for most employment is 14 years old

- Exceptions allow children as young as 12 to work outside of school hours

- In Kentucky, there is no requirement for a child work permit

- All minors must obtain proof of age documentation and submit it to their employer. This documentation might be in the form of a driver’s license and birth certificate, or any other government-issued document that includes their date of birth.

Child Work Limitation

The rules for hiring minors aged 14 and 15 differ from those for employing minors aged 16 and 17.

Minors aged 14 and 15 can work under the following conditions:

- Up to 3 hours per school day

- Up to 8 hours per weekend or non-school day

- Up to 18 hours per week

- Up to 40 hours per non-school week

- Prohibited from working between 7 p.m. and 7 a.m.

On the other hand, minors aged 16 and 17 can work under the following conditions:

- Up to 6 hours per school day

- Up to 8 hours per non-school day

- Up to 30 hours per week

- If the work shift is scheduled before a school day, minors aged 16 and 17 are prohibited from working between 10:30 p.m. and 6 a.m.

- If the shift happens before a non-school day, minors aged 16 and 17 are prohibited from working between 1 a.m. and 6 a.m.

In all cases, employers must give minor employees a break of at least 30 minutes for every 5 hours of work.

Prohibited Occupations For Minors

Minors in Kentucky are prohibited from working in certain industries and specific occupations.

These include:

- Occupations in or about plants or other establishments manufacturing or storing explosives

- Any and all coal mine occupations

- Any and all logging or sawmill operations

- Handling power-driven hoisting apparatus, including forklifts

- Any and all excavating operations

- Any and all wrecking, demolition, and shipbreaking operations

- Occupations about and in connection with any establishment distilling, compounding, manufacturing, brewing, or bottling alcoholic beverages

- Any and all work on or about a roof

Employee Termination and Resignation in Kentucky

In Kentucky, employment relationships are generally governed by the principles of “at-will” employment, meaning that either employer or employee can terminate the employment relationship at any time, with or without cause, unless there is an employment contract stating otherwise.

It is important to know that in some cases, exceptions to the ‘at-will rule’ may arise in cases involving employment contracts, union agreements, or certain legal protections against wrongful termination

Notice Requirements

There are generally no specific notice requirements for terminating employees in Kentucky. This means employers may lay off employees or terminate employment contracts without providing advance notice, although providing notice or a reason for termination may be advisable in certain situations to avoid potential legal issues.

For employees, while not legally required, providing notice of resignation is a professional courtesy. As with many states, the standard notice period is typically two weeks, although this can vary based on the terms of the employment contract, company policy, or industry standards.

Severance Pay

There are no state-specific laws in Kentucky that require an employer to offer severance pay. Regardless, if severance pay is offered, the employing company must comply with its own established pay policy that is stated in its employment contract.

Employers in Kentucky are legally mandated to provide a final paycheck to any employee whose employment was terminated for any reason. The paycheck must include the employee’s leftover wages and benefits and is due at the next scheduled payday or within 14 days of the employee’s termination.

Right-To-Work

Other than operating under the principle of at-will employment, Kentucky also has state-specific laws that promote a “right-to-work” state, which means that employees are not required to join a union or pay union dues as a condition of employment. Employees have the freedom to choose whether to participate in union activities.

Unemployment Benefits in Kentucky

Employees who are out of a job through no fault of their own may be eligible for unemployment pay and benefits. Eligible Kentucky residents can receive a percentage of their previous pay as unemployment benefits, up to a maximum of $415 per week, for up to 26 weeks . Those eligible must spend time searching for a new job while on unemployment benefits.

Additionally, eligible employees may continue to enjoy previously available health benefits after exiting a job through the Consolidated Omnibus Budget Reconciliation Act (COBRA) .

To be eligible for unemployment benefits, you must:

- Have earned at least a minimum amount in wages before you were unemployed

- Be unemployed through no fault of your own, as defined by Kentucky law

- Be able and available to work, and actively seeking employment

- Have earned at least $750 in one quarter of the base period

- Have earned at least $750 outside of the highest paid quarter of the base period

- Have earned at least 1.5 times your wages in the highest paid quarter of the base period, across the entire base period

- Must have wages at least eight times your weekly benefit amount in the last two quarters

If you are eligible to receive unemployment, your weekly benefit rate in Kentucky will be 1.1923% of your total wages during the base period. You will receive a maximum of $522 each week; the minimum amount is $39.

Application Process for Unemployment in Kentucky

To apply, individuals can file a claim online , in person at a local Kentucky Career Center, or over the phone.

The application process will require them to provide personal and employment information, including details about their previous employers and wages. It’s essential to apply as soon as possible after becoming unemployed, as there may be waiting periods before benefits are distributed.

Penalties for Noncompliance in Kentucky

Failing to comply with Kentucky labor laws can result in various penalties and fines. The specific penalties may vary depending on the nature of the violation:

- Any employer who who refuses employee pay shall be assessed a civil penalty of not less than one hundred dollars ($100) nor more than one thousand dollars ($1,000) and shall also be liable to the affected employee for the amount withheld, plus interest at the rate of ten percent (10%) per annum

- Any violation of Kentucky's child labor laws is punishable by a fine ranging from $100 to $1,000

- Willful violation of OSHA regulations may result in a minimum penalty of \$5,000 and maximum penalty of \$70,000

- If an employer fails to provide records required on employees, KYOSH issues a citation with a gravity-based penalty of $3,500 for each form not made available

- Willful violation of child labor laws can result in a civil money penalty of up to $13,227 per minor employee. If the violation results in serious injury or death of the employee, the maximum civil penalty is $60,115.

- Employers who repeatedly break the child labor laws face a fine of up to $120,230, as well as imprisonment.

Other Essential Information About Labor Laws in Kentucky

- Employees must get reasonable and adequate bathroom breaks.

- If an employee feels an employer doesn’t comply with the regulation on reasonable bathroom breaks, the employee should contact OSHA

- It is illegal for employers to retaliate against an employee for reporting unsafe working conditions.

- Female employees who are breast-feeding require time to express their milk throughout the day

- Kentucky has "right-to-work" laws, which means that unions cannot require employees to join or financially support the union as a condition of employment.

Resources and Further Reading on Kentucky Labor Laws

Here are some resources and contact information for further reading and assistance with Kentucky labor laws:

Kentucky Labor Cabinet

The Kentucky Labor Cabinet is the primary state agency responsible for labor-related matters.

Kentucky Career Center

The Kentucky Career Center provides resources for job seekers and employers, as well as information on unemployment benefits.

Kentucky Department of Workers' Claims

Deals with questions or concerns related to workers’ compensation

Kentucky Occupational Safety and Health (KY OSH)

For workplace safety and health information

Kentucky Legislature

For the most up-to-date Kentucky labor laws and regulations

Final Thoughts on Kentucky Labor Laws

Kentucky safeguards the interest of its employers and employees in the state workforce with several labor laws. These laws are not only tailored to ensure orderliness and fairness in the workforce- they also protect the rights of every employee within the state.

Navigating the complicated web that is Kentucky labor laws is a grueling process for many employers. However, if you want to avoid hefty fines and draining lawsuits, it is important to remain compliant with the laws of Kentucky. To do this, it is important to access the right resources to keep up to date with the constantly changing rules and policies.

For many businesses, the only real solution to compliance challenges is great software. The right business management software tends to come with built-in compliance and recordkeeping rules, regardless of your industry, how many employees you have, what they do, or how widely they’re dispersed across the state (or country).

If you operate a construction or field services company, we humbly suggest trying Workyard for your compliance needs.

Workyard is built around the industry’s most accurate GPS tracking and geofencing technology , which ensures payroll accuracy across your workforce, no matter which job site you send them to or when you need them to work there. Workyard’s timesheet tracking system also comes with built-in federal and state overtime rules, as well as adjustable break rules you can customize at the employee level.

Workyard’s intuitive scheduling dashboard makes it easy to direct your workforce to the jobs you need done, based on their skill sets, their locations, their availability, and (of course) their weekly time worked – so you can avoid unnecessary overtime payments and reduce reimbursible travel expenses.

All of these tools work together to save you money. Minimize payroll waste, ensure regulatory compliance without lifting a finger, accurately assess project costs in real time, and pay your team with ease thanks to seamless payroll processing integrations.

And best of all, you can try it free for 14 days, so you can be sure it’s the right solution for your company. Just click here (or the buttons below) to get started today !

Did you find this post helpful? Please rate it!

Nasdaq “ 6 Statistics to Better Understand the Extent of Discrimination in the Workplace ”, Accessed November 2nd, 2023.

Ministry of Social Affairs and Health “ Occupational Safety and Health Act ” Accessed November 2nd, 2023.

U.S. Department of Labor “ OSHA- Commonly Used Statistics ”, Accessed November 2nd, 2023.

U.S. Department of Labor “ Continuation of Health Coverage (COBRA) ”, Accessed November 2nd, 2023.

Kentucky Career Center “ If You Are Unemployed ”, Accessed November 2nd, 2023.

Kentucky Labor Cabinet “ Labor Cabinet ”, Accessed November 2nd, 2023.

Kentucky Career Center “ Kentucky Career Center ”, Accessed November 2nd, 2023.

Kentucky Department of Workers’ Claims “ Workers’ Claims ”, Accessed November 2nd, 2023.

Kentucky Occupational Safety and Health “ Occupational Safety and Health ”, Accessed November 2nd, 2023.

Kentucky Legislature “ Kentucky Labor Laws ”, Accessed November 2nd, 2023.

U.S. Labor Laws: What They Are & Why They Matter

Labor laws protect employees and prevent employers from risk. Learn what the U.S. labor laws are in this guide designed for every business.

How To Calculate Overtime Pay (2024 Update)

In this article, we'll show you how to calculate overtime pay, which employees are entitled, and tips for saving thousands on overtime costs.

California Labor Laws: Meal & Rest Breaks (2023)

In this guide, you'll learn about California labor laws pertaining to meal and rest breaks, who they apply to, and how to stay compliant.

Workyard provides leading workforce management solutions to construction, service, and property maintenance companies of all sizes.

An official website of the United States government.

Here’s how you know

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- American Rescue Plan

- Coronavirus Resources

- Disability Resources

- Disaster Recovery Assistance

- Domestic Workers

- Equal Employment Opportunity

- Guidance Search

- Health Plans and Benefits

- Registered Apprenticeship

- International Labor Issues

- Labor Relations

- Leave Benefits

- Major Laws of DOL

- Other Benefits

- Retirement Plans, Benefits and Savings

- Spanish-Language Resources

- Termination

- Unemployment Insurance

- Veterans Employment

- Whistleblower Protection

- Workers' Compensation

- Workplace Safety and Health

- Youth & Young Worker Employment

- Breaks and Meal Periods

- Continuation of Health Coverage - COBRA

- FMLA (Family and Medical Leave)

- Full-Time Employment

- Mental Health

- Office of the Secretary (OSEC)

- Administrative Review Board (ARB)

- Benefits Review Board (BRB)

- Bureau of International Labor Affairs (ILAB)

- Bureau of Labor Statistics (BLS)

- Employee Benefits Security Administration (EBSA)

- Employees' Compensation Appeals Board (ECAB)

- Employment and Training Administration (ETA)

- Mine Safety and Health Administration (MSHA)

- Occupational Safety and Health Administration (OSHA)

- Office of Administrative Law Judges (OALJ)

- Office of Congressional & Intergovernmental Affairs (OCIA)

- Office of Disability Employment Policy (ODEP)

- Office of Federal Contract Compliance Programs (OFCCP)

- Office of Inspector General (OIG)

- Office of Labor-Management Standards (OLMS)

- Office of the Assistant Secretary for Administration and Management (OASAM)

- Office of the Assistant Secretary for Policy (OASP)

- Office of the Chief Financial Officer (OCFO)

- Office of the Solicitor (SOL)

- Office of Workers' Compensation Programs (OWCP)

- Ombudsman for the Energy Employees Occupational Illness Compensation Program (EEOMBD)

- Pension Benefit Guaranty Corporation (PBGC)

- Veterans' Employment and Training Service (VETS)

- Wage and Hour Division (WHD)

- Women's Bureau (WB)

- Agencies and Programs

- Meet the Secretary of Labor

- Leadership Team

- Budget, Performance and Planning

- Careers at DOL

- Privacy Program

- Recursos en Español

- News Releases

- Economic Data from the Department of Labor

- Email Newsletter

Travel Time

Time spent traveling during normal work hours is considered compensable work time. Time spent in home-to-work travel by an employee in an employer-provided vehicle, or in activities performed by an employee that are incidental to the use of the vehicle for commuting, generally is not "hours worked" and, therefore, does not have to be paid. This provision applies only if the travel is within the normal commuting area for the employer's business and the use of the vehicle is subject to an agreement between the employer and the employee or the employee's representative.

Webpages on this Topic

Handy Reference Guide to the Fair Labor Standards Act - Answers many questions about the FLSA and gives information about certain occupations that are exempt from the Act.

Coverage Under the Fair Labor Standards Act (FLSA) Fact Sheet - General information about who is covered by the FLSA.

Wage and Hour Division: District Office Locations - Addresses and phone numbers for Department of Labor district Wage and Hour Division offices.

State Labor Offices/State Laws - Links to state departments of labor contacts. Individual states' laws and regulations may vary greatly. Please consult your state department of labor for this information.

Guide to Kentucky employee benefits and HR rules

If you’re a business owner who has just opened shop or employed someone in Kentucky, you and your HR team must familiarize yourself with the state’s employment laws and mandatory employee benefits. Understanding the necessary rules and regulations will help you stay compliant in The Bluegrass State. Learn more about the state’s employment laws with our guide below.

Are you looking for easy-to-manage benefits to help you comply with federal and Kentucky benefits laws? PeopleKeep can help! Schedule a free consultation with a personalized benefits advisor.

Is your organization compliant with Kentucky's employment laws?

If your company is Kentucky-based or you employ Kentucky workers, learning everything you need to know about HR compliance in the state is vital. This guide will provide a basic overview of Kentucky's employment and benefits regulations for small and medium-sized businesses.

Topics covered in this guide include:

What are employment laws in kentucky, what are employees’ rights in kentucky, required and non-required employee benefits in kentucky.

- Health insurance in Kentucky

Wage laws in Kentucky

The federal government sets minimum benefits and HR requirements for employers nationwide. But many states create their own employment laws that are an addition to federal regulations—and Kentucky is no exception.

Before opening or expanding your business in Kentucky, you should familiarize yourself with state employment laws.

In Kentucky, employers must follow several state-specific laws in addition to federal employment laws, such as:

- At-will employment

- Kentucky is an “at-will” employment state, meaning employers and employees can end an employment agreement at any time, with or without cause (provided there is no written contract stating otherwise).

- According to the Kentucky Civil Rights Act, employers can’t terminate an employee based on discrimination or other illegal factors. Employees who believe their employer fired them illegally can file a complaint to the Kentucky Commission on Human Rights.

- Kentucky Civil Rights Act (KCRA)

- The Kentucky Civil Rights Act (KCRA) prohibits discrimination, harassment, and retaliation based on protected characteristics, including race, color, national origin, age, religion, mental or physical disability, sex, and pregnancy-related medical conditions.

- The KCRA applies to all public and private employers with eight or more employees. But for disability and pregnancy discrimination purposes, the Act applies to employers with 15 or more employees.

- Right-to-Work Laws

- As a right-to-work state, Kentucky employers can’t deny or refuse an individual a job based on if they’re a member (or not a member) of any labor union or organization. They also can’t refuse employment based on an individual’s payment (or lack of payment) of labor dues or other related fees.

- Kentucky Pregnant Workers Fairness Act

- Employers must provide reasonable accommodations to employees with medical conditions relating to pregnancy, childbirth, and other health-related situations. Accommodations may include more frequent rest periods, additional time off, creating safe and private spaces for expressing breast milk, and more.

- This Act applies to employers who’ve had at least 15 employees in 20 or more calendar weeks in the current or previous calendar year.

- Kentucky Child Labor Laws

- Child labor laws in Kentucky outline the ages of minors that are eligible to work, their prohibited jobs, the number of hours they can work, the time they can work, regulations regarding lunches and breaks, and other employer requirements.

- Kentucky Equal Pay Law

- This law prohibits wage discrimination between two employees doing similar work based solely on sex. Wage differences are acceptable if determined by seniority or merit.

- Workplace Drug Testing Laws

- As long as they follow specific regulations, employers can drug test current and prospective employees once the employer extends a job offer.

- If an employer implements a drug testing policy, it must include drug and alcohol testing. They aren’t allowed to test based on discriminatory factors like age, race, sex, religion, etc. They can also terminate employees who test positive on random drug tests.

- Organizations certified as drug-free workplaces can receive a discount on their workers' compensation insurance premiums.

- Kentucky Whistleblower Act

- This Act protects employees from retribution for reporting abuses of authority, mismanagement, law violations, public health or safety dangers, and fraud as long as they make the report in good faith.

- Reporting Laws

- Employers must provide the Cabinet for Health and Family Services with a report containing the names, addresses, and Social Security numbers of all new hires and employees returning to work after a furlough or layoff.

- Business owners must submit the report within 20 days of a new hire’s start date, date of hire, or date of an employee’s return to work.

Now that we’ve reviewed a few Kentucky-specific laws, we’ll review the state’s employee rights.

Employees in Kentucky have many rights under state and federal law. Regardless of your organization's size, you must know your employees' rights if you have or plan to hire employees in the state.

Some state rights include:

- Employers must pay the federal minimum wage and overtime pay.

- Meal periods

- Employees must have a meal break, or lunch period, as close to the middle of their shift as possible. The break must be a reasonable period of time, and it can’t be before three hours into their shift or five hours after their shift starts.

- Employers can offer unpaid meal breaks if the employee doesn’t conduct any work during their break.

- Rest periods

- Employees must receive a ten-minute paid rest break for every four hours they work. The rest break is in addition to their meal break.

- Weapons in the Workplace

- Employees may keep concealed weapons, including firearms and ammunition, in their locked personal vehicle while on their employer’s property. They can retrieve their weapon only to defend themselves, others, or company property.

- The law doesn’t apply to company vehicles or employees who move their firearms to another location outside the vehicle for non-defensive purposes.

- Medical examinations

- Employers can’t require potential or current employees to pay for medical examinations or the cost of providing medical records as part of their conditions of employment.

- The Kentucky Safety and Health (OSH) Program

- Alongside the Occupational Safety and Health Administration (OSHA), The Kentucky Safety and Health (OSH) Program enforces standards, training, and services related to workplace safety and health to prevent harmful conditions or practices at places of work.

- The OSH program applies to all employees in the public and private sectors except those working in federal government positions.

- State continuation of health coverage under Kentucky law

- Employees with fully-insured health plans that aren’t eligible for the Consolidated Omnibus Reconciliation Act of 1986 (COBRA) may qualify for group coverage continuation if their employer has fewer than 20 employees.

- Under the state continuation law, employees and their eligible dependents can extend their coverage up to 18 months after no longer being a group member. After 18 months, they must switch to an individual health plan or get coverage through an employer to continue to have health coverage.

All companies must follow federal regulations regarding certain employee benefits. But some benefits required in one state may not be required in others. Let’s look at Kentucky's required and non-required employee benefits in the chart below.

Health insurance coverage in Kentucky

Like in many other states, if you’re a business owner in Kentucky with fewer than 50 workers, you aren’t required to provide health insurance benefits. But if you employ 50 or more full-time equivalent employees (FTEs), you must offer health insurance that meets minimum essential coverage (MEC) to satisfy the Affordable Care Act’s (ACA) employer mandate.

Even if you don’t have to offer health benefits by law, it’s a great way to help your business stay competitive and attract talented employees. But traditional group health insurance can come with high premiums, annual rate hikes, and strict participation requirements that many businesses may be unable to manage.

Let’s look at the numbers. Small group health plan premiums in some Kentucky counties can cost as much as $652 per employee per month . In comparison, the average monthly premium for a 40-year-old with a silver individual health plan can be as low as $479 . This makes covering the cost of individual health plans in Kentucky more affordable for small to medium size businesses.

If you find that individual health insurance premiums are more affordable than group premiums in your county in Kentucky, you can leverage a health reimbursement arrangement (HRA) or a health stipend to cover the cost of individual health plan premiums instead of offering a group health insurance plan.

Health reimbursement arrangement (HRA)

An HRA is a flexible health benefit owned and funded by the employer. It allows you to reimburse your employees, tax-free, for their individual health insurance premiums and eligible out-of-pocket expenses .

With an HRA, your employees choose the individual health insurance plan that suits their medical needs and budget. They can shop for a plan using a private exchange or through Kentucky’s health insurance marketplace, Kynect .

HRAs offer many advantages for employers. They’re more customizable than group health insurance plans, have no annual rate hikes or participation requirements, and can help you control your budget by allowing you to choose your preferred monthly allowance amount.

Some HRAs, like the qualified small employer HRA (QSHERA), are only for employers with fewer than 50 FTEs. But others, such as the individual coverage HRA (ICHRA), are made for employers of all sizes and can even satisfy the federal regulations for applicable large employers (ALEs). This flexibility makes an HRA suitable for all categories of employers.

Learn more about each HRA

For employers with 1-49 employees

A simple, controlled-cost alternative to group health insurance.

For employers of all sizes

A flexible health benefit that can be used alone or alongside group health insurance.

For employers offering group health insurance

A group health supplement to help employees with out-of-pocket expenses.

Health and wellness stipends

With a health stipend, you can offer your employees a fixed amount of money they can use on healthcare items, services, and insurance premiums. A health stipend isn't a formal group health plan, so you have complete control over which expenses are eligible for reimbursement and aren’t subject to many IRS compliance regulations.

You can offer as much stipend allowance as your budget allows, and employees can purchase the medical items that work for them and their families. This makes stipends a more personalized option than group health insurance and flexible enough to accommodate all your employees’ needs.

Stipends are a taxable health benefit, but they’re also customizable. For example, small to medium-sized companies looking for a benefit that covers other expenses, like mental health counseling and gym memberships, can do so with a wellness stipend .

Offering a health and wellness stipend together gives your employees greater coverage for their overall well-being and happiness .

Learn all about employee stipends with our ultimate guide

Wages in Kentucky are subject to various state laws. We've compiled the most important requirements to know below.

Minimum wage laws

The minimum wage in Kentucky is $7.25 an hour, which is also the federal minimum wage. Should the federal minimum wage rate rise in the future, Kentucky will raise its minimum wage to match it.

All employers must meet the minimum wage rate. It’s illegal for employers to pay employees with disabilities, trainees, apprentices, and student learners and workers a lower wage rate the standard minimum wage.

Tipped wages

Employers can pay their tipped employees $2.13 per hour. However, they must ensure the employee’s hourly wage plus tips equals the minimum wage rate of $7.25 per hour. If the combined amount doesn’t reach the minimum wage rate, the employer must make up the difference.

Additionally, employers can’t require their employees to participate in tip pooling or sharing, which distributes a worker’s tips among other employees. An employer may inform employees that tip sharing is an option and explain how it works. After that, employees can choose if they want to participate.

Kentucky defines a workweek as a recurring period of 168 hours or seven consecutive 24-hour periods. Individual employers can decide when their workweek begins and set different workweeks for different employee groups. They aren’t required to align their workweek with the calendar week.

Employers are also free to determine how many hours an individual must work to be a full-time or part-time employee.

Hours worked

According to Kentucky wage and hour laws, employees must pay their employees based on their total hours worked. This includes a variety of instances, such as work performed during an employee’s regular shift, outside their regular shift, or away from the employer’s workplace.

Hours worked include the following situations:

- Waiting time: Depending on the situation, employers must pay for the time employees spend waiting to work. Some examples are a truck driver waiting for their coworker to load their delivery vehicle or a factory worker waiting for vital machinery repairs.

- On-call time: Employers must pay on-call employees if they must stay near the employer’s premises and can’t conduct personal business. On-call employees who leave the premises and have time to themselves are off-duty for compensation purposes, so employers aren’t required to pay them.

- Sleeping time: Employers must count sleeping time as hours worked if the employee is on-call while sleeping. Individuals in these positions may be domestic services workers like nannies or caregivers. Because it’s difficult to separate on- and off-duty hours in these cases, the employer and employee must come to a mutual agreement beforehand to determine how they will calculate sleeping time.

- Travel time: Employers must pay employees that travel as part of their regular job, such as business trips and traveling between job sites or offices during the day. This excludes regular commuting to and from work.

- Meeting, lecture, and training time: Employers must pay for employees' time at meetings, training, and other similar activities. Employers are exempt from paying if the meeting or training takes place outside the employee’s regular shift, attendance is voluntary, the event isn’t role-specific, and the employee can’t work during the event.

Employers aren’t required to pay employees for showing up for their shifts if they perform no work, or the employer dismisses them before their scheduled shift ends.

Regular pay rate

Employers can change an employee’s regular pay rate. But they must inform the employee of the change before they complete any work at the new rate. The change can’t be retroactive or made without notifying the employee.

Overtime pay

Similar to federal overtime rules, Kentucky law requires employers to pay their employees 1.5 times their regular rate when they work in excess of 40 hours in a given workweek and for any hours worked on the seventh day if an employee works seven days in a workweek.

There are no laws prohibiting employers from requiring their employees to work overtime and no limit to the number of hours they can require them to work in a day.

Some employees exempt from overtime laws are those working in sales or retail stores, administrative workers, salaried professional employees with specialized skills, and employees working in restaurants, hotels, or motels.

Prevailing wages

While Kentucky doesn’t have a prevailing wage law, Kentucky employees may be eligible to receive prevailing wages if they work on government-funded projects or perform certain government services. Prevailing wages may differ from the federal minimum wage depending on the employment contract or project.

Pay deductions

Employers are only allowed to make pay deductions in certain situations.

Eligible deductions Kentucky employers may make include from an employee’s paycheck include:

- Deductions required by local, state, or federal law, such as taxes, Social Security, court orders, and wage garnishments

- Deductions detailed in written agreements between the employer and employee, such as health and life insurance premiums, hospital and medical bills, and union dues.

Employers may not withhold or deduct wages from an employee’s paycheck for:

- Personal fines

- Cash shortages in a till, cash box, or register if used by two or more employees

- Losses due to acceptance of a bad check

- Losses due to a defective item

- Lost, stolen, or damaged property

- Default or nonpayment to a customer for goods or services if the loss wasn’t intentional by the employee

Pay frequency

All Kentucky employers must pay their employees at least twice a month and no later than 18 days after the end of each pay period. Any employee who misses their scheduled payment, for whatever reason, must receive their unpaid wages within six days of requesting them.

Payment methods

Under Kentucky law, an employer may pay wages by:

- Payable checks

- Direct deposit

- Employers can require direct deposit payments provided the employee can withdraw their entire paycheck without incurring a fee or penalty from their bank or financial institution.

- Payroll card account

- Employers aren’t allowed to charge the employee for the payroll card’s activation fee. Each pay period, they must allow the employee to make at least one withdrawal of any amount without penalty.

Pay statements and recordkeeping

Employers with ten or more employees must provide each employee with a pay statement at the end of each pay period. It must include an itemized list of all deductions and their general purpose.

Additionally, all employers must keep records showing the wages paid to each employee each pay period, the number of hours they worked each pay period, and other relevant information for authorized individuals upon request.

Once an employee leaves an organization for any reason, employers must pay all their final wages and benefits no later than their next scheduled payday or within 14 days after separation, whichever is later.

Employers aren’t required to provide severance pay unless otherwise stated in the worker’s conditions of employers or contract.

Frequently asked questions

What is the minimum wage in kentucky, what employers are subject to the kentucky civil rights act.

The Act covers all public and private employers with eight or more employees in twenty or more calendar weeks in the current or previous calendar year. For employment discrimination issues due to disability or pregnancy, the employer must have at least 15 or more employees in 20 or more calendar weeks in the current or previous calendar year.

How many hours must Kentucky employees work to be full-time?

Unlike other states, no Kentucky laws outline the number of hours an individual must work to be a full- or part-time employee. Individual employers can determine what is a full-time or part-time position.

There also aren’t any laws prohibiting employers from requiring employees to work overtime.

Do I have to offer health insurance in Kentucky?

No. However, the federal government requires organizations with 50 or more full-time equivalent employees to provide health insurance that meets minimum essential coverage (MEC).

Learn more about the requirements for applicable large employers

Looking to enhance your benefits package?

Speak with a PeopleKeep personalized benefits advisor who can help you answer questions and help you select the right benefits package for your team.

Kentucky Labor Law

1. introduction.

Kentucky, known as the Bluegrass State, has a unique set of state laws governing employment and labor. These laws establish standards that employers must follow and protect the rights of workers across the state. They cover a broad range of topics from wage and hour regulations to workplace safety. Understanding Kentucky state law is crucial for both employers and employees to ensure compliance and to make informed decisions regarding labor practices.

The Commonwealth of Kentucky's labor laws are designed to balance the economic interests of businesses with the protection of the workforce. Kentucky state law is subject to both federal and state legislation. Federal laws provide the baseline for workers' rights across all states, but Kentucky can implement its own laws that offer additional protections. For instance, while federal laws like the Fair Labor Standards Act (FLSA) establish minimum wage and overtime standards, Kentucky state law can supplement these with its own rules and regulations. Such specifics help address the unique economic and social climate of the state.

In this article, we will delve into several key aspects of Kentucky state labor law, exploring minimum wage laws, overtime regulations, leave entitlements, termination policies, unemployment rights, and workplace safety requirements. This comprehensive coverage aims to provide a clear understanding of the labor landscape within Kentucky for everyone involved in the employment process.

2. Minimum Wage Laws

In the Commonwealth of Kentucky, the minimum wage law is enforced by the Kentucky Labor Cabinet. As of the latest information, Kentucky's minimum wage is set to match the federal minimum wage, which is $7.25 per hour. This rate has been in effect since July 24, 2009, when the federal minimum wage last increased. Employers in Kentucky are required to pay their employees at least this hourly rate for all hours worked.

It's important to note that there are exemptions to the minimum wage laws in Kentucky as well. For instance, certain occupations and industries may be exempt from the state minimum wage requirements under both federal and state law. Examples include tipped employees such as waiters and waitresses, who may be paid a lower cash wage if their tips bring them up to the equivalent of the minimum wage. However, if their tips plus the cash wage do not equal the minimum wage, the employer must make up the difference.

Additionally, students, apprentices, and workers with disabilities may also receive wages lower than the minimum under specific circumstances allowed by law. These groups are offered special provisions which are intended to promote employment among individuals who might otherwise face significant barriers to entering the job market.

Kentucky does not currently have a state-specific law that allows for a higher minimum wage than the federal standard; however, local ordinances can affect the minimum wage in certain jurisdictions within the state. For example, cities like Louisville have debated or passed ordinances to increase the minimum wage locally. Employers and employees should stay informed on any municipal wage ordinances that could supersede the state and federal minimum wage laws.

Furthermore, the issue of minimum wage is often discussed politically, and changes to the law could occur. Both employers and employees should keep abreast of current legislative developments to ensure compliance with any changes to the minimum wage laws at the state or local level.

- Federal Minimum Wage: $7.25 per hour.

- Tipped Employee Minimum Cash Wage: Employers can take a tip credit, but employees must still earn the equivalent of the minimum wage when tips are included.

- Special Provisions: May apply for students, apprentices, and workers with disabilities.

- Local Ordinances: May result in higher minimum wage rates in certain cities or counties.

- Legislative Updates: Potential for changes based on political and economic conditions.

3. Overtime Regulations

The state of Kentucky adheres to the federal Fair Labor Standards Act (FLSA) regarding overtime pay, which mandates that employees are entitled to overtime pay for any hours worked beyond 40 in a single workweek. Under these regulations, overtime pay is calculated at a rate of one and a half times an employee's regular rate of pay.

There are exemptions to the overtime provisions under the FLSA, whereby certain employees may be classified as exempt and therefore not entitled to overtime. Typically, this includes executive, administrative, professional, outside sales employees, and some computer-related positions, subject to specific criteria being met related to job duties and salary level.

Kentucky does not have its own state-specific laws for overtime, so the FLSA federal guidelines are what govern overtime compensation within the Commonwealth. Employers in Kentucky must comply with these federal regulations and ensure that eligible employees receive their rightful overtime pay.

Some common issues around overtime that both employers and workers in Kentucky should be aware of include:

- Definition of Workweek: A workweek is defined as a fixed and recurring period of 168 hours, seven consecutive 24-hour periods.

- Comp Time: Private employers are not allowed to offer compensatory time ("comp time") instead of paying overtime. However, state and local governments can offer comp time to their employees under certain conditions.

- Mandatory Overtime: Employers can generally require employees to work overtime, but they must pay the appropriate overtime rate.

- Overtime Calculation: When calculating overtime, it's important to consider all types of remuneration, such as commission and bonuses, as these can affect the regular rate of pay.

It is crucial for both employers and employees in Kentucky to understand these overtime regulations to avoid potential legal disputes and to ensure fair compensation for all labor performed above the typical 40-hour workweek. Any claims of unpaid overtime in Kentucky may be investigated by the Kentucky Labor Cabinet or brought forth as a legal action in court.

4. Vacation Leave

In Kentucky, employers are not required by state law to provide employees with vacation benefits, either paid or unpaid. If an employer chooses to offer vacation leave, it must comply with the terms of its established policy or employment contract. Kentucky's law does not mandate any vacation leave benefits and leaves it to the discretion of the employer.

However, if an employer has a policy that provides vacation leave, the following points should be considered:

- Vacation Accrual: Many employers have policies that allow employees to accrue vacation time over the course of their employment. The rate of accrual and the maximum amount of vacation time that can be accrued is typically outlined in the employer's leave policy.

- Use of Vacation Time: Employers may set specific requirements for how and when vacation time can be used, often requiring advance notice and approval from management.

- Carryover: Policies may include rules about whether employees can carry over unused vacation time to the next year. Employers might place a limit on the amount of vacation time that can be carried over.

- Payment upon Termination: Kentucky employers are not legally required to pay out accrued vacation time upon termination unless the employer has an established policy to do so. Therefore, the terms of the employer’s policy will determine whether an employee is entitled to be paid for unused vacation time when they leave their job.

The important consideration for Kentucky employees is to be aware of the employer's vacation policy and understand how it operates. In instances where an employer does not have a formal vacation leave policy, there is no statutory entitlement for vacation leave.

For employers, consistently applying the vacation policy as written is key to avoiding disputes and potential legal issues. As such, they should communicate the policy clearly to all employees and ensure that it is implemented fairly across the organization.

Please note that while Kentucky state law does not require vacation leave, federal laws such as the Family and Medical Leave Act (FMLA) provide for certain protected leaves, which may apply to Kentucky employees under qualifying circumstances, but this is separate from vacation leave.

5. Sick Leave

Kentucky does not have a statewide law that requires employers to provide paid or unpaid sick leave. Similar to vacation leave, employers are at liberty to establish their own policies regarding sick leave benefits for their employees. If an employer decides to offer sick leave, it must follow the guidelines set forth in its employment policies or contracts.

When an employer chooses to provide sick leave benefits, here are some typical considerations included in such policies:

- Accrual Rates: Employers may determine how much sick leave employees can accrue, often based on the number of hours worked.

- Eligibility: Companies often set criteria dictating eligibility for sick leave, which may include a minimum duration of employment before an employee is entitled to use sick time.

- Usage: Policies may clearly state what qualifies as sick leave, including personal illness, medical appointments, care for ill family members, or other health-related reasons.

- Documentation: To prevent abuse of sick leave, employers might require a doctor’s note or other medical documentation for leave longer than a certain period.

- Carryover: Just as with vacation policies, employers may or may not allow employees to carry over unused sick leave from one year to the next. They may also cap the total amount of sick leave an employee can accumulate.

- Payment Upon Termination: Similarly to vacation leave, unless specifically outlined in the employer’s established policy, there is no legal obligation in Kentucky to pay out accrued sick leave upon an employee’s termination or resignation.

Employees in Kentucky should familiarize themselves with their employer's specific sick leave policy to understand their rights and obligations. It is crucial for employees to understand whether such benefits are offered and how they can be utilized appropriately.

For employers, clear communication and consistent application of sick leave policies are important to avoid misunderstandings and potential disputes with employees. Employers should ensure that policies comply with any applicable collective bargaining agreements or employment contracts.

While the state itself does not mandate sick leave, Kentucky employees are still covered under federal laws such as the Family and Medical Leave Act (FMLA) when they qualify for such leave. These federal protections enable eligible employees to take unpaid leave for specific family and medical reasons, with continued group health insurance coverage.

6. Holiday Leave

Unlike some types of leave, there are no federal or Kentucky state laws that require private sector employers to provide holiday leave, whether paid or unpaid. This decision is left entirely to the discretion of the employer. The same applies to premium pay for working on holidays—Kentucky law does not mandate extra compensation for employees working on national or state holidays.

Nonetheless, many employers in Kentucky do recognize and offer paid holiday leave as a benefit to their employees. Common holidays that may be observed include New Year's Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, and Christmas Day. Some employers may also include additional holidays such as Martin Luther King Jr. Day, Presidents' Day, and Veterans Day, among others, depending on their holiday policy or negotiated collective bargaining agreements.

When an employer decides to offer holiday leave, they usually establish a policy that outlines:

- Eligibility: Criteria that define who is eligible for paid holiday leave, which often depends on factors such as employment status (full-time vs. part-time) or tenure with the company.

- Holiday Schedule: A list of specific holidays that will be recognized and observed by the employer during the year.

- Pay Policies: Details about payment terms for holidays, including whether employees will receive their regular rate of pay, time-and-a-half, or another premium rate.

- Work Requirements: Expectations for employees on holidays, for example, whether certain staff must be available or on-call due to business needs.

While holiday leave is not guaranteed by law, the provision of such benefits can be an integral part of an employee’s total compensation package and can serve as an important factor in attracting and retaining staff.

For Kentucky employees, it is important to review their employer's holiday policy to understand what holidays are covered and any associated benefits or expectations. Employees who are required to work on holidays should also be aware of their compensation rights as stipulated by their employer’s policy or any applicable employment contracts.

Employers should ensure that their holiday policies are clear, fair, and uniformly applied to all eligible employees to prevent potential grievances. Additionally, while it’s not legally mandated, many employers opt to recognize holiday leave as a gesture of goodwill and a means of maintaining positive employee relations.

Public sector employees in Kentucky may have different entitlements regarding holiday leave. State employees are typically provided with paid leave for designated state holidays in accordance with guidelines provided by government authorities. These schedules and policies are often made available to the public and can vary from year to year.

In Kentucky, employers must adhere to regulations concerning breaks and rest periods for employees as outlined in the state's labor laws. Kentucky law requires employers to provide reasonable break periods, typically a lunch or meal period, although the specifics may vary depending on the type of employment and the employee's age.

- Meal Breaks: Employers are required to provide a reasonable period for a meal break, which is not less than thirty (30) minutes. This meal break should be given to employees who are scheduled to work more than five consecutive hours. It's worth noting that these meal breaks do not need to be paid, as long as the employee is completely relieved of all duties. If the employee is required to perform any duties, whether active or inactive, during this period, they must be compensated.

- Rest Breaks: While there are no state laws in Kentucky that mandate rest breaks, or 'coffee breaks,' for adult workers, many employers choose to offer short paid rest periods as a benefit.

- Breaks for Minors: There are more specific provisions for employees under the age of 18. Minors are entitled to at least a thirty (30) minute break after any five consecutive hours of work. This ensures that younger members of the workforce have adequate time to rest and recuperate during their shifts.

Despite the lack of statutory requirements for rest breaks for adults, federal law encourages employers to provide short breaks, usually lasting about 5 to 20 minutes. Under federal law, these short breaks are considered compensable work hours when provided by the employer, and thus must be included in the sum of hours worked during the workweek and considered when determining overtime.

It is important for both employers and employees in Kentucky to understand the requirements and customary practices regarding meal and rest periods. Employers should clearly communicate their policies concerning breaks and ensure that they are implemented in compliance with the law. Likewise, employees should be aware of their rights to certain breaks and how their work schedules accommodate these periods.

Employers found to be non-compliant with break regulations can be subjected to penalties and required to make adjustments to their practices. Employees who feel their rights to meal or rest breaks are being violated may report the issue to the Kentucky Labor Cabinet or seek legal counsel to address the matter.

Both meal and rest breaks are designed to promote the health and well-being of employees, reducing fatigue and stress while boosting overall productivity. While break times may seem minor in the scope of the full workday, they serve an essential role in maintaining a healthy and efficient working environment.

8. Employment Termination Laws

In the Commonwealth of Kentucky, employment relationships are generally considered "at-will". This means that, unless there is an employment contract specifying otherwise, an employer can terminate an employee at any time for any lawful reason, or for no reason at all, and similarly, an employee can leave their job at any time without cause or notice. However, there are still various state and federal laws designed to protect workers from wrongful termination.

The following are some key aspects of employment termination laws in Kentucky:

- Wrongful Termination: While employers have broad rights to terminate employees at will, they cannot do so for illegal reasons. This includes firing an employee based on discrimination (race, color, religion, sex, national origin, disability, age), retaliation (for having filed a complaint or claim against the employer), or other protections under both federal and Kentucky state laws.

- Notice Requirements: Kentucky does not have a state law that requires employers to provide notice of termination or mass layoffs. However, the federal Worker Adjustment and Retraining Notification (WARN) Act requires employers with 100 or more employees to provide at least 60 days' notice of plant closings or mass layoffs under certain conditions.