Enter the first 6 and last 4 digits of the number found on the front of your card.

Please Wait...

Can't remember your password?

- Click ' Forgot Password '

- Confirm your account details

- An email with a link to reset your password will be sent to you

Please check your email

Need an account? Activate your card

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386837) arranges for the issue of the Australia Post Travel Platinum Mastercard® (“Travel Mastercard") in conjunction with the issuer, EML Payment Solutions Limited ('EML') ABN 30 131 436 532 , AFSL 404131 . Australian Postal Corporation (ABN 28 864 970 579, AR No. 338646), the card distributor, acts as an Authorised Representative of Australia Post Services Pty Ltd (ABN 67 002 599 340, AFSL 457551). You should consider the Travel Mastercard Product Disclosure Statement and Financial Services Guide before deciding to acquire the product. The Target Market Determination for this product can be found here auspost.com.au/travelcard . Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

^Pay no foreign transaction fees on purchases when travelling, when you load your Australia Post Travel Platinum Mastercard with USD or EUR currencies supported by the product, and transact in that same currency.

Before you make a decision to acquire the card, please check auspost.com.au for the latest currencies supported. Lock in your rates means the exchange rate is locked in for the initial load only. The exchange rates for subsequent reloads will be set at the prevailing exchange rate at the time of the transaction. Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386837) arranges for the issue of the Australia Post Travel Platinum Mastercard in conjunction with the issuer, EML Payment Solutions Limited ('EML') ABN 30 131 436 532 , AFSL 404131. Australian Postal Corporation (ABN 28 864 970 579, AR No. 338646), the card distributor, acts as an Authorised Representative of Australia Post Services Pty Ltd (ABN 67 002 599 340, AFSL 457551). You should consider the Australia Post Travel Platinum Mastercard Product Disclosure Statement and Financial Services Guide before deciding to acquire the product. These can be found together with the Target Market Determination for this product at auspost.com.au . Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Terms, conditions and fees apply. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386837) arranges for the issue of the Australia Post Travel Platinum Mastercard in conjunction with the issuer, EML Payment Solutions Limited ('EML') ABN 30 131 436 532 , AFSL 404131. Australian Postal Corporation (ABN 28 864 970 579, AR No. 338646), the card distributor, acts as an Authorised Representative of Australia Post Services Pty Ltd (ABN 67 002 599 340, AFSL 457551). You should consider the Australia Post Travel Platinum Mastercard Product Disclosure Statement and Financial Services Guide before deciding to acquire the product. The Target Market Determination for this product can be found here.

Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. Terms, conditions and fees apply. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Post Office Travel 4+

Travel money card & insurance, post office limited.

- #91 in Travel

- 4.5 • 7.6K Ratings

Screenshots

Description.

Buy, add, and manage your Travel Money Cards, travel insurance, holiday extras and more all in one place. Take the new-look Post Office travel app on your adventures today. Combining all the travel features our loyal app users love, this refreshed version’s now cleaner and simpler to use. So, it’s even easier to relax on your travels. Do all this on the move Manage your Post Office Travel Money Cards · Buy and activate new cards in the app · Add existing Travel Money Cards · Top up with any of 22 currencies, including US dollars and euros · Swap funds between different currencies · Check your PIN, balance, spending, and daily exchange rates · Freeze your card for security or to limit your spending · Add your cards to your Apple Wallet Buy and check your travel insurance · Get a quote and buy cover – plus any add-ons to tailor it to your trip · Link the app to your existing Post Office Travel Insurance policy · View and download your policy documents Get those holiday extras sorted · Book parking at 60 UK domestic airports · Find great deals on airport hotels · Check into lounges at 100+ airports · Fast track your security checks at 11 UK airports · Book airport transfers to your holiday accommodation · Hire a car with leading brands in over 60,000 locations What to do now Download the Post Office travel app today. Order or link your existing Travel Money Card and Travel Insurance policy. Or order a Travel Money Card at your nearest Post Office branch.

Version iOS App version 461.2

Bug fixes and performance improvements, all to make your experience the best that it can be. Recent updates include fixes to Apple Wallet, sign up and login journeys.

Ratings and Reviews

7.6K Ratings

Post office travel application

Now, the post office application has been very useful, as one can top up money whilst travelling as well as check ones balance on the travel money card. In conclusion, lastly, I found the travel money card particularly useful on 16th November 2019, evening time as one can search for useful tips and questions that one maybe concerned about before travelling, during and after travel, and for me, I found this application extremely useful, as there was information I needed to know before my travel, such as the currency of the country I am travelling to, and where to obtain the currency of the country I am travelling to shortly. Moreover, I thank the developers for making this useful, and appropriate travel application as I believe it is a safe as well as secure method of travelling with money, to the country of ones choice instead of carrying loads of cash around in different currencies, and risking theft issues or lost issues. Also, I found the help and advice section on the website useful, as I had forgotten my PIN number as I never used my travel money card for a while, and I was able to call up a number from the travel money website, and follow the on phone instructions to retrieve my PIN number once again. Next, thank you developers for making this travel application once again. Many thanks Hannah Boyce

Developer Response ,

Thanks very much for the fantastic feedback, glad you like the app and the product.

Dreadful new App not working for 3 days now

Rang customer services 3 days ago now as newly downloaded App top up button gives an error that it can’t fetch the rates right now so have to go on main website to do that. Then when you use the card it doesn’t update the balance. It retrieve the pin either. The card was then unsupported in an ATM when I tried doing a balance enquiry. Different information from service staff who told me I needed to load another £50 minimum on card and buy something using chip and pin to use card for for first time. However that’s £3 commission just to load on £50 of your own money ! I don’t even need sterling on the card as the whole point is for using it abroad to TRAVEL!! So I had already bought Euros. The lady in the post office said I can’t use the card at all for online purchases however I managed to pay for my holiday eventually over the phone in euros once they had removed the security 3 times! A smarter assistant also said I don’t need to add sterling to buy something in U.K. - the euros will auto convert- which they did. Still stuck with a non working app and took 3 hours to finally get the card loaded and working to pay for holiday. Agh. Why so complicated

Thank you for your feedback. This will be shared with our development teams who are committed to improving the app experience for all.

Thank You Post Office

Local main clearing bank closed its branch. Called into the post office for some euro as the rate was in line and it was convenient accessible and handy and I was in a hurry. The staff were friendly, practical, product knowledgeable and the advice, service and overall helpfulness was first rate. I’m currently overseas and have used my card without problem; I have topped up using the app, again with no apparent problem. I don’t have the worry of carrying a lot of cash or suffering retailer ripoff rate charges. So overall a great service. Thank you Post Office, Boroughbridge, North Yorkshire. PS. I’m an older less tech savvy person so I would recommend this travel aide to all ages.

Thanks very much for your review. Hope you had an amazing break

App Privacy

The developer, Post Office Limited , indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy .

Data Used to Track You

The following data may be used to track you across apps and websites owned by other companies:

Data Linked to You

The following data may be collected and linked to your identity:

- Contact Info

- Identifiers

Data Not Linked to You

The following data may be collected but it is not linked to your identity:

- Diagnostics

Privacy practices may vary based on, for example, the features you use or your age. Learn More

Information

- App Support

- Privacy Policy

Get all of your passes, tickets, cards, and more in one place.

More by this developer.

Post Office EasyID

You Might Also Like

Jet2 - Holidays and Flights

loveholidays: hotels & flights

On the Beach Holiday App

National Trust - Days Out App

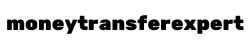

Post Office Travel Card Review

Travelling is one of the most exciting and liberating experiences out there. Whether you’re jetting off to a far-off destination or just exploring your own country, having the right travel card can make the whole experience easier and more enjoyable.

Are you planning a trip? If so, you may be wondering if the Post Office Travel Money Card is a good option for you. In this article, we’ll take a close look at the Post Office Travel Money Card, how it works, and what you need to know before using it.

By the end of this guide, you’ll have all the information you need to make an informed decision about whether or not the Post Office Travel Money Card is right for your next trip.

Table of Contents

Benefits of Having a Travel Card

First and foremost, travel cards are an excellent way to earn miles and points. This can be incredibly valuable if you are a frequent traveller or want to visit somewhere far off where you’ll have to pay high airfare. Plus, you can use these miles and points to book travel, hotels, flights, vacation packages, and more.

Another major advantage of travel cards is their versatility. As you travel, you’ll have the ability to withdraw cash from ATMs using your card, pay for purchases using your card, and even get roadside assistance on select cards. You’ll also have access to excellent trip cancellation and travel insurance.

Plus, travel cards are typically easier to qualify for than other types of credit cards. This is because many companies view travel cards as a “safe” type of credit. However, having a travel card can also help to improve your credit score.

Post Office Travel Cards: What Are They?

The Post Office Travel card is a Mastercard prepaid card, which can be loaded with a choice of 23 currencies. ATMs are available in more than 200 countries where you can spend and withdraw money.

You can load your account with any currency before travelling and then use it abroad without having to convert your currency.

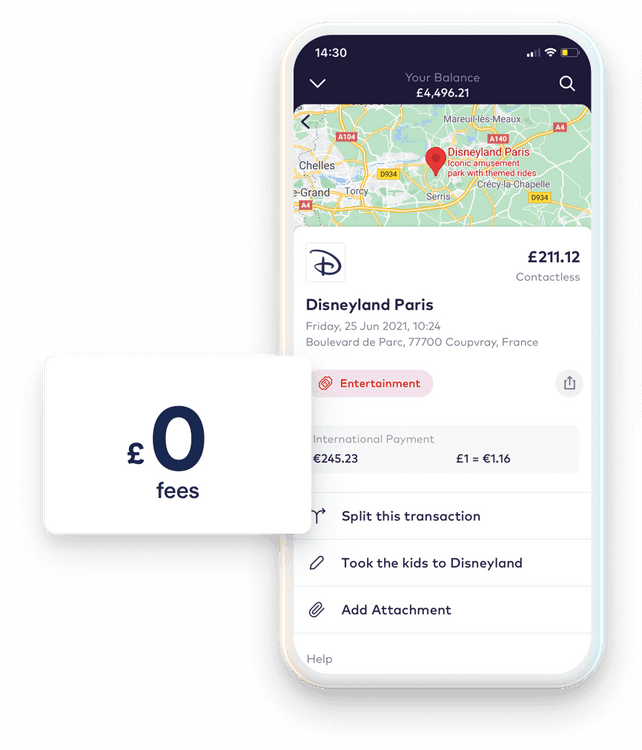

Post Office Travel offers a contactless card that can be accessed through its app.

Post Office Travel Cards Benefits and Features

Here’s a quick look at the Post Office Travel card’s main features and benefits:

- Payments for low-value items can be made quickly and conveniently using contactless technology

- Compatible with Apple Pay and Google Pay

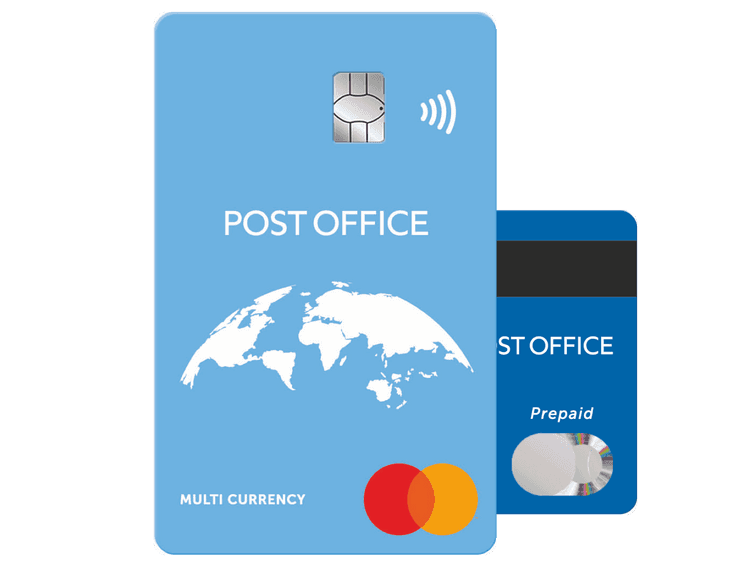

- With the Travel app, you can manage your card, top it up, transfer currencies, as well as freeze it.

- You can choose from 23 different currencies and top it up whenever you need it

- Accepted everywhere Mastercard is accepted

- Call centre assistance is available 24/7

- Whenever there is currency left over, it can be transferred into another currency by using the wallet-to-wallet feature

- If you use a local currency supported by your card to spend abroad, there are no fees

Post Office Travel Card Costs

Travel money cards from the Post Office cost nothing to order and no fees apply when you pay for purchases using the currency you hold. Provided your available balance is in a currency accepted by the card, you can shop, dine, and drink without any charges.

When using your card in a country that doesn’t support the currency of your card, you will have to pay a 3% foreign transaction fee. Using your card in Brazil, for example, will result in a 3% foreign transaction fee since the Brazilian Real isn’t a supported currency.

Despite the card’s currency support, you’ll still have to pay ATM withdrawal fees. Each currency has a different ATM fee.

An example would be:

- Euro – 2 Euros

- Canadian Dollar – 3 Canadian Dollars

- US Dollar – 2.5 United States Dollars

- Swiss Franc – 2.5 Switzerland Francs

- Australian Dollar – 3 Australian Dollars

- Pound Sterling – 1.5 Pounds Sterling plus 1.5% commission

Regarding fees, one final note. There is a three-year validity period on all Post Office Travel cards. After your card expires, you will be charged a maintenance fee of £2 per month.

Exchange Rates

Exchange rates fluctuate based on the demand for currencies at the Post Office. Thus, you’ll receive a particular amount of travel money depending on the current exchange rate.

For travel money cards, you can get exchange rates at Post Office branches and on the website. Be sure to remember that rates may differ whether you are purchasing online, by phone, or in person.

In addition to the margin, the exchange rate at the Post Office will probably include a markup. When you search for the rate on Google or currency websites, you’ll most likely get an accurate one. Consequently, a margin will reduce the amount you receive when exchanging EUR, USD, or another currency.

A Post Office Travel Money company profits by offering its customers a better rate than the base rate. U.K. pounds are converted into U.S. dollars at a rate of 1.23 dollars per pound, for example.

If you exchange £400 through Post Office Travel Money, you can get 1.18 USD per pound. In this case, there is a difference of £16 or 4%. Exchange rates are better when you exchange large sums of money .

Exchange Rates for In-Branch Travel Money

According to the Post Office, in-branch exchange rates are determined by many factors, including branch location, competitor pricing, convenience, etc. The company will always strive to offer the best possible rate within these parameters. Online orders/distribution is the cheapest method for many retailers, as they can use centralised packing costs. Because of this, online exchange rates are always better than branch rates.

Comparing Post Office Travel Money Rates to Other Providers

There are several new services that it’s worth comparing directly to Post Office Travel Money.

Online-Only Banks

There have been several purely mobile banks launched in recent years both in the UK and across Europe. With services like Monzo, N26, Revolut, Monese, or Bunq, consumers can access a wide range of banking options.

Each of these modern financial institutions provides services such as money transfer agencies and international travel cards, and it makes sense to compare them with Post Office Travel Money.

For example, Monzo facilitates international money transfers through the popular exchange company Wise. For example, when sending a thousand pounds to a Swedish account using Monzo/Wise, the recipient receives 12,103 Swedish crowns versus 11,546 with Western Union, a difference of around 5%.

Other Currency Providers

It may also be possible to transfer money at a better rate in some countries. Using Xendpay, you could send 500 pounds to Saudi Arabia, and the beneficiary would receive 2,289 Saudi Riyals instead of 2,158 Saudi Riyals with Post Office Travel Money.

Supported Currencies

Prepaid travel cards from Post Office can be loaded with any of the following 23 currencies:

- CAD – Canadian dollar

- JPY – Japanese yen

- USD – US dollar

- AUD – Australian dollar

- CHF – Swiss franc

- AED – UAE dirham

- CNY – Chinese yuan

- DKK – Danish kroner

- PLN – Polish zloty

- CZK – Czech koruna

- ZAR – South African rand

- GBP – Pound sterling

- TRY – Turkish lira

- HKD – Hong Kong dollar

- THB – Thai baht

- HRK – Croatian kuna

- SGD – Singapore dollar

- HUF – Hungarian forint

- SEK – Swedish kronor

- SAR – Saudi riyal

- NOK – Norwegian krone

- NZD – New Zealand dollar

Sending Money With the UK Post Office

Many Post Office branches and their website offer Post Office Travel Money. They offer convenient and quick foreign exchange services. They are useful for local currency exchanges because they are so widely available. Post Office services like international money transfers and travel cards offer additional options for sending and spending overseas.

How to Get and Use a Post Office Travel Card?

Post Office travel cards are only available to UK residents over 18 years old.

Ordering Your Card

To order a Post Office Travel card, you can do one of three things:

- You can order through the Post Office Travel app

- Visit the Post Office website to apply online

- Get your card at your local Post Office. It will be necessary to bring photo identification, like a passport or driver’s licence

Your card should be available immediately if you apply at a branch. Your card will be delivered within two to three days after you apply online or via the app.

Card Activation

It’s necessary to activate your travel card before you can use it. You’ll find detailed instructions in your welcome letter.

Using Your Card

ATMs and online sites that accept MasterCard accept Post Office travel cards, too. If you are buying something in person, you’ll need your PIN to verify your purchase and possibly your signature if the Chip and PIN system is not widely available in the country.

In some countries, contactless payments are also allowed for small amounts, although the rules and limitations vary.

According to its terms and conditions, you should not use your Post Office card in certain situations.

Some of them include:

- Tolls on the road

- Petrol pumps with self-service

- Deposits for car rentals or hotels

- Airline or cruise ship transactions

Adding Money to Your Card

With the Post Office Travel app, you can add money to your card easily. Additionally, you can add money at a local branch or on the Post Office website.

Buying Back Currencies

Having unused currency on your card gives you a few options. You may be able to withdraw cash at your local Post Office branch or ATM, but there may be a fee.

Wallet-to-wallet transfers are also available in the app. You can transfer unused balances from one currency to another. In preparation for your next trip to Europe, you can convert unused USD into EUR.

Each currency listed above can be topped up for between fifty pounds and five thousand pounds on your card. Your card can hold up to ten thousand pounds, as well as carry out transactions of up to thirty thousand pounds annually.

Different currencies have different limitations on cash withdrawals. For example, in a single transaction, you may withdraw up to 450 euros or 500 dollars.

App Overview

On Google Play and the App Store, you can download the Post Office Travel app for free. With the app, you can activate and order your card, check your balance, add money to it, and more.

In addition to transferring leftover currency between wallets, it’s possible to convert it to another currency you prefer by using the new wallet-to-wallet feature.

Furthermore, you can book airport parking, purchase travel insurance through the app, and use other features.

Contacting the Post Office

If you need assistance, you may reach the contact centre by dialling 0344 335 0109 in the United Kingdom or 0044 20 7937 0280 from abroad. Customer service is available each day of the week at any time of the day.

In addition, you can reach Customer Services at the Post Office in the following ways:

- Postal mail at PO Box 3232, Cumbernauld, G67 1YU, Post Office Travel Card

- Send an email to [email protected]

Post Office Travel Card: FAQs

Here are some common travel card problems you might encounter.

When I lose or damage a card, what do I do?

Post Office currency cards are easy to replace if lost or damaged. Your card will be blocked, and another one will be sent to you. App users can also freeze their cards.

How should I deal with a declined or blocked card?

The first thing you need to do is ensure that you have enough money in your account via the app. If you don’t have enough money in your account to purchase your item, call the customer care centre.

If I forget my PIN, what should I do?

Call the customer service centre if you cannot remember your travel money card PIN. If you need a new one, they can issue it for you.

My card is about to expire. What should I do?

A new card should automatically be sent to you. You can call the contact centre if it hasn’t arrived after the expiration date, and they’ll issue you another.

Post Office Prepaid Travel Card Summary

Travel cards from the Post Office are handy if you want to keep your money safe while you’re away from home. The convenience of not carrying cash around with you and not having to change money during your trip will make your trip much more enjoyable.

Because it’s a contactless card, you can pay in local currencies quickly and easily. This helps you budget because you can only spend what’s on it.

If you travel frequently or take multi-destination holidays, the card is convenient since you can store 23 currencies on it. A card that supports a variety of currencies might be more useful if you love exploring far-flung areas.

The exchange rate is a drawback to take into account. Post Office rates may be competitive (compared to airport exchange rates, for example), but they will likely include a margin or markup. ATMs also charge fees when you use your card.

Comparing other travel money cards could help you find a better deal, so make sure to shop around.

by Matt Woodley

Using the Post Office Travel Money Card: Pros and Cons

Table of Contents

What is the post office travel money card, pros of the post office travel money card, cons of the post office travel money card, user experiences and reviews, how to get and use the card, best practices for cardholders, alternatives to the post office travel money card.

T he Post Office Travel Money Card is a convenient and secure way for UK residents to manage their finances while traveling abroad. This prepaid card allows travelers to load funds in multiple currencies, offering a practical alternative to carrying cash or using credit cards overseas. It’s particularly popular among those who seek a controlled and budget-friendly travel spending method.

The Post Office Travel Money Card is a prepaid, multi-currency card that can be loaded with up to 23 different currencies. It functions similarly to a debit card but is specifically designed for international travel. The card can be used to make purchases at millions of locations worldwide where MasterCard is accepted and to withdraw money from ATMs.

- Convenience and Ease of Use : The card is straightforward to obtain and use. Travelers can easily load funds onto the card online or at a Post Office branch.

- Security Features : The card is not linked to a bank account, reducing the risk of fraud. Additionally, if lost or stolen, it can be easily replaced.

- Wide Acceptance : Being a MasterCard product, it’s accepted at a vast number of outlets and ATMs worldwide.

- Currency Exchange Rates : Users benefit from competitive exchange rates compared to traditional currency exchange services.

- Budget Control : The prepaid nature allows travelers to manage their spending effectively, avoiding the risk of debt.

- Fees and Charges : Although the card offers free purchases, there are fees for certain transactions, such as ATM withdrawals and inactivity.

- Limitations in Usage : Some countries and establishments may not accept the card, limiting its utility in certain situations.

- Reloading Issues : Adding more funds to the card can be less straightforward, especially in remote areas or during non-business hours.

- Customer Service Concerns : Some users have reported issues with customer service, particularly in resolving card-related problems quickly.

- Comparison with Other Travel Money Options : While the card has many benefits, it may not always be the best option compared to other travel money products, like credit cards with no foreign transaction fees.

Feedback from users generally highlights the convenience and security of the card. However, some have noted the fees and reloading issues as drawbacks. It’s essential to consider both the positive and negative aspects to make an informed decision.

Obtaining the card is a simple process, either online or at a Post Office branch. Users need to load the card with the desired amount and can start using it immediately. For reloading, options include online transfers or visiting a Post Office.

To maximize the benefits of the card:

- Keep track of spending and remaining balance.

- Be aware of the fees for different transactions.

- Have an alternative payment method as a backup.

Other options include other brands of travel money cards, credit cards with no foreign transaction fees, and traditional cash exchange. Each has its pros and cons, depending on individual travel needs and spending habits.

The Post Office Travel Money Card is a valuable tool for travelers seeking a secure and convenient way to manage their funds abroad. While it has several advantages, potential users should also be aware of its limitations and fees.

Q: How does the Post Office Travel Money Card work? A: It’s a prepaid card that you load with currency before traveling. You can use it for purchases and ATM withdrawals anywhere MasterCard is accepted.

Q: Are there any fees associated with the card? A: Yes, there are fees for certain transactions like ATM withdrawals, and there may be inactivity fees if the card is not used for a prolonged period.

Q: How do I load money onto the card? A: You can load money online or at any Post Office branch. The process is simple and can be done in multiple currencies.

Q: What should I do if my card is lost or stolen? A: Contact the Post Office immediately to report the lost or stolen card. They will arrange for a replacement and transfer the balance from the old card.

Q: Can I use the card in any country? A: The card is accepted in most countries worldwide. However, it’s always best to check the specific country’s acceptance before traveling.

Q: How does the card compare to using a regular debit or credit card abroad? A: Unlike regular cards, the Travel Money Card is prepaid, which helps in budget management. However, some regular cards might offer better exchange rates or lower fees, so it’s worth comparing options.

Q: Is the Post Office Travel Money Card a good option for all travelers? A: It depends on individual needs. The card is excellent for those who want a secure, budget-friendly way to carry money abroad. However, for those who travel frequently or to less common destinations, other options might be more suitable.

Related Posts

Expert Tips for Managing Hays Travel Money Effectively

Navigating TUI Travel Money for Better Holiday Finance

John Lewis Travel Money: Convenience and Value Combined

Marks & Spencer Travel Money : Maximizing Value with M&S Travel Money on Your Trips

Leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

create unique & memorable travel experiences with VOLodge

About volodge.

1325 Derry Rd E Suite 3, 2nd Floor, Mississauga, ON L5S 0A2, Canada

Sign up for the exclusive offers and best deals from us

© 2023 | VOLodge.com | All Rights Reserved

- Argentina

- Australia

- Deutschland

- Magyarország

- New Zealand

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Post Office Travel Card review

The Post Office Travel Card is a prepaid travel card you can load in cash or online, to switch to the currency you need for spending and withdrawals. It’s not linked to your regular bank account, and can be managed from your smartphone, for secure spending across 23 currencies.

Before you order a Post Office Travel Card check out this full review - we’ll look at what the card can do , how to order your card and how much it’ll cost .

And to help you compare we’ll also touch on Post Office Travel Card alternatives like Wise and Starling, which may offer cheaper and more flexible options for taking travel money abroad.

TL;DR - it's a solid prepaid card

- The card supports most major currencies for holidays, including Euros (Europe), Lira (Turkey) and UAE Dirhams (Dubai)

- Several top-up methods , with the option of doing so online or in-store

- Only convert what you want to spend; good for holiday budgeting

However, there are some downsides.

- There are better exchange rates available with other travel cards

- You'll get a worse exchange rate (a.k.a "buy-back rates") when converting leftover foreign currency to pounds

Find out more about the card on the Post Office website or click the button below to purchase a card. Order a card

Not sure yet? Continue reading to decide whether this is the right prepaid card for you.

What's in this guide?

What is the post office travel money card, how does it work.

- Fees & limits

How do I get a Post Office Travel Money Card?

What happens when the card expires, what are the alternatives.

The Post Office Travel Money Card is a prepaid card you can top up in cash or from your bank account, in any of 23 supported currencies.

Once you have funds on your card you can use it as you would a regular debit card, for contactless and mobile payments, and cash withdrawals. There’s no fee to spend currencies you hold on your card, although other transaction fees do apply depending on how you use the account.

Use your Post Office card to buy travel money before you head off on holiday, or top up as you go online.

As pictured, you can also manage, view and freeze your card in the Post Office app for security.

- Top up your card in cash at a Post Office or online by purchasing one of 23 different currencies

- If you choose to top up in GBP and convert later, you’ll be charged an administration fee of 1.5%, from a minimum of 3 GBP up to a maximum of 50 GBP

- Exchange rates are shown in the Post Office app, and may include a markup on the market exchange rate - but rates often improve if you top up more

- It’s free to spend currencies you hold. You can also spend unsupported currencies, but a foreign transaction fee of 3% will apply

It’s worth noting that the Post Office exchange rates are shown in the Post Office app before you convert your funds. They may include a markup, which is an extra fee added into the rate applied to switch to the currency you need.

Another thing worth noting is that the exchange rate gets better for higher top up amounts - meaning you’ll pay a smaller markup the more you add to your card.

Using a markup is pretty common but does make it tricky to see what you’re really paying for your foreign currency transactions.

Spending limits and card fees

Before you order a Post Office Travel Card it’s good to know a bit about the fees and limits that apply to card usage.

When you transact with your Post Office Travel Money Card, there are also fees to pay.

While these do vary slightly by currency, they’re roughly similar.

It’s easy to get your Post Office Travel Card online or in person by calling into a Post Office near you. Here’s what you’ll need to do.

- Head to the Post Office website

- Select "Order Your Card >"

- Top up in your preferred currency - there’s a minimum top up of 50 GBP, through to a maximum of 5,000 GBP

- Input personal details following the prompts

- Delivery of your card will take 2-3 days by post

- Head to your local Post Office branch

- Show a valid form of ID (driving licence, passport or EEA ID card)

- Apply in branch and load your card

The expiry date for your card will be printed on the back of the card - usually it’s valid for 3 years from the point you order it.

Once your card has expired you’ll pay a monthly inactivity fee of £2 per month if you don’t redeem your balance within 12 months of the card expiring. This fee continues until there’s no remaining balance, at which point your account will be closed.

If you’re not sure whether the Post Office Card is right for you, check out a few alternatives to see which gives you the best balance of cost and convenience.

The Wise card allows you to hold and exchange 50+ currencies, and spend in 170+ countries. It's a fully-fledged debit card, meaning it works at home just as well as it does abroad.

There’s no markup on the exchange rate, and they are super transparent about the fees (usually around 0.4% for foreign spending) they'll charge you.

Starling card

The Starling debit card is a good option for international spending as there are no foreign transaction fees and no ATM fees .

You can sign up entirely online for an account with no monthly fees which you can manage from your phone, with instant notifications and a whole range of banking features. Get a Starling Card

Frequently Asked Questions

Post Office is a trusted institution and will keep customer funds safe according to all applicable legal requirements.

When it comes to travel money, the Post Office works in partnership with First Rate Exchange Services, which is a registered business and holds a Money Services Business License in the UK.

You can hold up to 23 different currencies:

- Australian dollars

- Canadian dollars

- New Zealand dollars

- Croatian kuna

- Turkish lira

- South African rand

- Swiss francs

- Polish zloty

- Pounds sterling

- Chinese yuan

- Czech koruna

- Danish kroner

- Hong Kong dollars

- Hungarian forint

- Japanese yen

- Norwegian krone

- Saudi riyal

- Singapore dollar

- Swedish kronor

- About Antique Wolrd

- Antique News

- Cards & Envelopes

The Post Office Travel Money Card Review: Key Features, Rates and Fees

If you’re heading overseas, a travel card could be a handy solution for covering your spending. They tend to be cheaper to use than your ordinary bank debit card, and can even offer better exchange rates compared to buying currency.

- Easter eCards

- A Must-Read Guide to Greeting Card Paper for Your Printer

- Trading Card Packaging

- How to Make a 3D Christmas Card Pop Up DIY

- Pop It Valentines Printable (4 FREE Versions!)

There are lots of travel cards out there, but here we’re going to focus on the Post Office Travel card. We’ll run through what it is and how it works, along with fees, exchange rates, supported currencies and how to apply for one.

You are watching: The Post Office Travel Money Card Review: Key Features, Rates and Fees

And while you’re comparing spending options ahead of your trip, make sure to check out the Wise card. This international card can be used in 175 countries worldwide, automatically converting your pounds to the local currency at the mid-market rate. There’s only a small fee to pay for the conversion¹, or it’s free if you already have the currency in your Wise account.

But for now, let’s focus on the Post Office travel card.

¹ Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

What is the Post Office travel card?

The Post Office Travel card is a prepaid Mastercard that you can load up with up to 23 currencies. You can use it for spending and ATM withdrawals in over 200 countries, in 36 million locations².

Simply top up with your chosen currency before you travel, then spend overseas without needing to convert currency.

The card is contactless and can be managed using the Post Office Travel app.

Key features and benefits

Here’s your quick at-a-glance guide to the main features and benefits of the Post Office Travel card ²:

- Contactless for making fast and convenient low-value transactions

- Available with Google Pay and Apple Pay

- Manage, top up, transfer between currencies and freeze your card using the Travel app

- Reload whenever you need to, with up to 23 currencies available

- Can be used wherever Mastercard is accepted

- 24/7 call centre help is available if you need it

- Wallet-to-wallet feature – where you can transfer any leftover currency to a new currency of your choice

- No charges when you spend abroad using an available balance of a local currency supported by the card (although there are some fees to know about – we’ll look at those next).

Post Office travel card fees and charges

Post Office travel cards are free to order and there are no charges for paying retailers in the currencies held on your travel money card. So, you can spend in shops, bars and restaurants without any charge – as long as you’re paying with an available balance of a currency supported by the card².

If you do use your card in a country with a local currency that isn’t supported by the card, you’ll be charged a cross-border fee of 3%². For example, if you go to Brazil and use your card at a local restaurant, you’ll be charged the cross-border fee of 3% as Brazilian real isn’t supported by the card.

You’ll also be charged for withdrawing cash from any ATM, even in currencies supported by the card. These ATM fees vary depending on the currency used. For example ²:

- Euro – 2 EUR

- US Dollar – 2.5 USD

- Australian Dollar – 3 AUD

- Pound Sterling – 1.5 GBP + commission of 1.5%

- Swiss Franc – 2.5 CHF

- Canadian Dollar – 3 CAD.

One last thing to note on the subject of fees. All Post Office Travel cards are valid for up to 3 years. Exactly 12 months after your card expires, you’ll start to be charged a monthly maintenance fee of £2².

Here is also a list of the European countries that charge the highest ATM fees.

Exchange rates

The Post Office offers exchange rates that move up and down according to the demand for currencies. So, the exact amount of travel money you’ll receive on your travel card will depend on the rate at the time of your purchase.

You can check the Post Office exchange rates on its website, travel money card app and branches. Keep in mind though that rates may vary whether you’re buying online, via phone or in-store.

The Post Office exchange rate is also likely to include a margin or mark-up on the mid-market rate. This is the rate you’ll find on Google or currency sites like XE.com, and is generally considered to be a fair rate. A margin added on top of this makes the rate worse for you, so you’ll get less EUR, USD or whatever other currency you’re exchanging.

Read more : ‘Hallmark Postcard from a Family Member’ Virus

Wise only ever uses the mid-market exchange rate, with no mark-ups or margins. This means that your pounds go further, wherever you’re travelling to.

Currencies supported

You can load your Post Office prepaid travel card with funds in any of these 23 currencies²:

- EUR – Euro

- USD – US dollar

- AUD – Australian dollar

- AED – UAE dirham

- CAD – Canadian dollar

- CHF – Swiss franc

- CNY – Chinese yuan

- CZK – Czech koruna

- DKK – Danish kroner

- GBP – Pound sterling

- HKD – Hong Kong dollar

- HRK – Croatian kuna

- HUF – Hungarian forint

- JPY – Japanese yen

- NOK – Norwegian krone

- NZD – New Zealand dollar

- PLN – Polish zloty

- SAR – Saudi riyal

- SEK – Swedish kronor

- SGD – Singapore dollar

- THB – Thai baht

- TRY – Turkish lira

- ZAR – South African rand

You can top up your card with between £50 and £5,000 in any of the currencies listed above. The maximum you can hold is £10,000, plus you can load and spend up to £30,000 on your card each year².

Cash withdrawal limits vary from currency to currency. For example, you can withdraw a maximum of €450 euros or $500 US dollars² in a single transaction.

App overview

The Post Office Travel app is free to download from the Google Play and Apple App stores. You can use it to order and activate your card, monitor your balance and top up with currencies. Using the new wallet-to-wallet feature, you can also transfer leftover currency to other currencies of your choice in just a few taps.

You can also buy Post Office travel insurance, book airport parking and access other features through the app.

How good is the Post Office prepaid travel card?

The Post Office travel card is handy to have if you’re travelling and want to keep your money safe. You won’t need to carry cash around with you, or have to take time out of your trip to change currency.

Paying in local currencies is quick and easy, especially as it’s a contactless card. Plus, you can only spend what’s on it, so this can help you to budget.

As you can store 23 currencies on it, the card is convenient if you travel regularly or are taking multi-destination holidays. If you love visiting far-flung places, however, you might need a card that supports more currencies.

One drawback to consider is the exchange rate. While rates may be competitive (compared to changing money at the airport, for example), the Post Office is likely to include a margin or mark-up on the mid-market rate. There are also charges for using your card at an ATM.

So, it’s important to shop around and compare other travel money cards, as some could offer you a better deal.

Take the Wise card, for example. With this contactless international card, you can spend in 175 countries and manage over 50 currencies in your Wise account. There are no ATM fees¹ for withdrawing up to £200 a month (2 or less withdrawals) and you’ll get the mid-market exchange rate on every transaction. Note, that Wise will not charge you for these withdrawals, but some additional charges may occur from independent ATM networks.

The Wise card will automatically convert your money to the local currency at the mid-market rate when you spend, for just a small conversion fee¹.

How to get and use a Post Office travel card

You can only get a travel card from the Post Office if you’re aged over 18 and a resident of the UK.

Ordering your card

There are three ways to order a Post Office Travel card:

- Download the Post Office Travel app and place an order there.

- Apply online at the Post Office website.

- Pop into a local Post Office branch to apply for a card. You’ll need to take a form of photo ID with you, such as a passport or UK driving licence.

If you’re applying in a branch, you should be able to pick up your card there and then. For applications made online or in the app, you’ll need to wait 2-3 days for your card to be delivered.

Card activation

You’ll need to activate your travel card before you can use it.

Read more :

You’ll be given instructions on how to do this in the welcome letter delivered along with your new card.

Using your card

You can use your Post Office travel card anywhere that accepts MasterCard, online and at ATMs³.

If you’re buying something in person, you’ll need to enter your PIN. If you’re in a country where Chip & PIN isn’t as widely available (such as the USA), you may be asked to sign to verify your purchase instead.

You can also make contactless payments for small amounts, although different countries have different rules and limits for this.

The Post Office’s terms and conditions list a handful of situations in which you shouldn’t use your card. These include the following³:

- Self-service petrol pumps

- Car hire or hotel check-in deposits

- Transactions on planes or cruise ships.

How to top up your card

The easiest way to top up your Post Office Travel card is using the app. If you prefer, you can also top up at the Post Office website or in a local branch³.

Buying back currencies

If you have unused currency on your card, there are a couple of options available. You may be able to withdraw it at a local Post Office branch or ATM, although fees may apply³.

Alternatively, you can use the new wallet-to-wallet feature in the app³. This lets you transfer unused balance in one currency over to another. For example, you can transfer unused USD to EUR, ready for your next trip to Europe.

How to contact the Post Office about your card

You can call the contact centre on 0344 335 0109 when you’re in the UK or +44 (0) 20 7937 0280 when you’re overseas³. Lines are open 24 hours a day, seven days a week.

You can also contact the Post Office Travel Card Customer Services department via the following methods³:

- By post at Post Office Travel card, PO Box 3232, Cumbernauld, G67 1YU

- By email at [email protected].

Post Office Travel Card: troubleshooting tips

Here’s how to deal with some common problems you might have with your travel card.

How do I report a lost or damaged card?

If you lose your Post Office currency card or discover that it’s damaged, just phone the contact centre. They’ll block it and send you another. You can also freeze your card using the app.

What should I do if my card is declined or blocked?

Firstly, check your account via the app to make sure you have enough money in it. If you have enough to pay for your item or have less than you should have in your account, call the contact centre.

What if I’ve forgotten my PIN?

If you can’t remember your travel money card PIN, phone the contact centre. They can issue you with a new one.

What happens when my card expires?

You should receive a new card automatically³. If it hasn’t arrived after the expiry date, call the contact centre and they’ll issue you with one.

And that’s pretty much it – everything you need to know about the Post Office Travel card. It’s handy if you don’t want to carry cash around or exchange currency while on holiday. And you can use it in multiple countries, as it supports 23 currencies. The app is another great feature, letting you top up and manage your money on the move.

But just remember to compare exchange rates and fees (especially for those all-important ATM withdrawals) before choosing a travel card for your trip – as you could be getting a better deal elsewhere.

Sources used:

- Wise – terms and conditions & pricing

- Post Office – Travel Money Card

- Post Office Travel card – Terms and Conditions

Source: https://antiquewolrd.com Categories: Cards & Envelopes

Join Lenon Blur

I am a JOIN LENON BLUR - world-leading expert, and I am the admin of Antiqueworld with many years of experience researching antiques and postal publications. I hope to provide the audience with the most accurate and informative information.

Suggested companies

Post office.

Post Office Travel Money Card Reviews

Visit this website

Company activity See all

Write a review

Reviews 4.0.

Most relevant

No fees and easy to use

The Travel Money Card was so easy to use and having the physical card as well as the app meant my husband and I could pay for things from the same account when needed. There are no transaction fees as there are with most bank cards used overseas so would definitely recommend and use next time we go abroad.

Date of experience : March 02, 2024

Used first in 2023 and then raised my…

Used first in 2023 and then raised my concerns (cost of withdrawals and inadequate daily withdrawal limits) but apparently both outside of Post Office control - fair enough. Getting ready for 2024 travel, first found a newer App was required but it's not compatible with my not ancient tablet. Secondly getting verification after loading the new App on my mobile failed as no emails were received (yes I checked in Spam folder etc.) Finally only resolved by linking to an alternative email address. If I wasn't concerned about possibly running out of money abroad I'd have given up on this card by now and dread further problems if I do need to add credit whilst abroad and hope that it shows immediately and emergency withdrawal is possible.

Date of experience : April 09, 2024

Post Office money card account. Problem logging in.

Having activated my new account, my attempts to log in, using my smartphone, are persistently met by your pop-up message "Something went wrong. We're experiencing a systems error. Please try again later." Even your helpline phone receptionist couldn't resolve it (though she was very patient. We tried numerous attempts to uninstall & re-install the app). It still doesn't work. I cannot log in to my account.

Date of experience : April 05, 2024

Very to use and safe to use easy to…

Very to use and safe to use easy to convert money to the currency where your going to visit, you dont have the headache of finding a money exchange shop etc even if you lose your card u can block it etc i would defo recomend to use when going abroad

Date of experience : March 01, 2024

so far, so good

I am an older person and view apps and phone banking as necessary evils and with great distrust. However it is almost impossible to live without them and some products do help make life easier. This is the premise behind the PO Travel card which allows you to carry foreign currency in the equivalent of a use-abroad deposit account card. While it wasn't entirely pain-free to set up it was bearable with minimal faff, and it worked 100% the small handful of times I tried it in shops abroad. Assuming the remainder of the currency I put in that card does not vanish before I next go abroad I will continue to use it. I'm unsure of the exact advantage it gives over my UK bank account card and using that abroad, perhaps not getting fleeced by fluctuating exchange rates. I was told it is more efficient than just buying a wad of Euros at the Post Office.

Date of experience : April 01, 2024

Mixed experience once abroad

Mixed experience once abroad. In France there was no problem using the card for any transaction. In Netherlands however it was declined in 50% of transactions in tourist cafes, pubs and restaurants. Mastercard needed for back up.

Date of experience : April 06, 2024

Reply from Post Office Travel Money Card

Hi, I am sorry to hear that you experienced your Travel Money card declining in tourist cafe's, Pubs and restaurants in the Netherlands. Can you please call us on 0344 335 0109 and we will be happy to have a further look into this for you.

Straightforward to set up.

Straightforward to set up the Travel Card: user-friendly interface, easy to understand and easy to use when completed.

Travel Money cards - Easy to set-up and use

The Travel Money cards are very easy to set-up and use. It means that you do not have to use your own debit or credit cards when travelling, making it safer for you to pay for things abroad. The website was easy to use and the cards arrived very quickly.

Date of experience : March 27, 2024

Poor. Will be pursuing refund. Contactless not working in Singapore

Trying to use in Singapore for my son on MRT. The contactless doesn't work. Checked at the MRT customer services. If I try to login to the app, it says I can't because I might be using a VPN. I'm not. I'm just on Singtel 4G. What's the point in blocking the app from a foreign country?? So I cannot take a look or get support on the app. All in all, a poor experience and will pursue a full refund when I'm back.

Used my card for the first time in…

Used my card for the first time in Portugal and found it extremely easy and hassle free, it will be my method of payment when abroad from now on.

Date of experience : March 14, 2024

app won't send verification email

Not even worth a one star! App wants me to verify by sending an email but the email is never sent! Previous app worked perfectly

Excellent Service

The lady who dealt with my enquiry was very patient and informative all the way through and nothing was too much trouble for her.

Date of experience : March 30, 2024

This card is great

This card is great, no hidden charges when using abroad and easy to set up and use.

Date of experience : March 06, 2024

Lessons in travelling

I've found the Post Office travel money card very useful and easy to use on two European trips in the past four months. For a number of reasons my current trip, to Australia, has not been so smooth. I found it impossible to top up on either the app or the website, which proved to be my bank's fault - it declined the transaction, despite having allowed it in the past. The TMC app and website fell short by not explaining at all why things were not working out. And I fell short by switching off my UK phone SIM card to avoid international call rates, which meant that I couldn't receive messages from my bank which would have explained why I couldn't top up. So, faults with me, my bank and (really least of all) the TMC, all now resolved.

Date of experience : March 21, 2024

I wouldn't go on holiday without it!

I've had my Post Office Travel Money Card for years and carry all my holiday spending money on it. Its so easy to use and I've always been able to access cash if I've needed it, from an ATM. The App makes everything easy to manage and I can transfer from my bank whenever I need to because who sticks to budget when they're on holiday?! 😅

Date of experience : March 05, 2024

Thank you so much for your great review and feedback, it really helps us. It's really good to hear that you have been using your Travel Money card for so long with us, so thanks again and we hope that you continue to enjoy it for many more years!

Great customer service for Travel Money

Went in to my village Post Office to ask how many Euros I would get for £400, I was asked if I would be using any credit or bank cards whilst on holiday and I said yes, the very pleasant counter person gave me details about the Post Office Travel Money Card and explained the safety benefits of the card rather than taking all cash or using bank/credit cards, they also told me about their Travel APP which I can use to see transactions or top up the card with more currency in the future, I was also told that if I buy over £700 I would get a much better exchange rate. I decided to take the Travel Money Card, I got an exchange rate of just over 1.12 for £700 of Euros on the card rather than a rate of 1.05 had I taken just £400 in Euro notes. Thank you for the great advice and service.

Date of experience : March 04, 2024

Thank you so much for your great review, it really helps us and we hope that you get to enjoy using your Travel Money Card again soon!

Excellent service

spoke to a real person, within a few minutes of calling . Was very helpful and sorted the problem quickly.

Date of experience : March 25, 2024

TMC the best

Great travel money card and app to use on your phone and you benefit with the best exchange rates. You can have multiply currencies and switch between them. The card can be top up online, in branch or via your bank if linked even when on holiday.

Thanks so much for your great review, we're really pleased that you enjoy your Travel Money Card

Quick and easy way of preparing for…

Quick and easy way of preparing for holiday spending.

Date of experience : April 02, 2024

Very easy to use app

Very easy to use app. Modern look, information readily available. Great features eg balance check, spend, freeze/unfreeze card. Excellent app.

Thanks for the great review and feedback, it's really useful to us!

Beginner’s guide to travel rewards: How to travel with credit card points and miles

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

When you read articles about travel rewards, you’re often regaled with tales of how the writer traveled in first class to Asia in a private suite drinking champagne for $5.60. You’re right to read that with skepticism. While using travel rewards, airline miles, and hotel points can allow you to travel well outside of your weight class, it’s well worth it to dig into the details before opening up a wallet-full of credit cards. Here’s how to enjoy the fruits of travel rewards responsibly.

Types of travel credit cards and how they work

Travel rewards credit cards—as opposed to cash-back credit cards or credit cards that don’t earn rewards at all—can generally be divided into the following three categories:

- Cards that earn flexible points.

- Cards that earn airline miles.

- Cards that earn hotel points.

We’ll delve deeper into the specifics of each type of card in the sections below.

Flexible travel credit cards

A credit card that earns flexible travel rewards is not tied to one specific airline or hotel chain. Instead, the points can be transferred to the loyalty programs of the airlines and hotel chains that your card offers as partners. Then, you redeem your points for flights or stays booked directly with the airline or hotel chain.

The Chase Sapphire Preferred ® Card is an example of a popular travel card that earns flexible points. This card comes with more than a dozen transfer partners and points transfer at a 1:1 rate (meaning each point you transfer from your credit card to a partner program nets you one airline mile or hotel point on the other end). Partners include United Airlines, World of Hyatt , and more.

Issuers of flexible travel cards may also provide a portal you can book travel through. For example, cardholders with the Chase Sapphire Preferred have the option of booking flights, hotel stays and more through Chase Travel℠, in which case each Chase Ultimate Rewards point (the rewards currency the card earns) is worth 1.25 cents.

If this is what you’re looking for, a card from our list of best travel credit cards might be a fit for your needs.

Chase Sapphire Preferred ® Card

Intro bonus.

Rewards Rates

- 5x 5x points on travel purchased through Chase Travel℠ (excluding hotel purchases that qualify for the $50 Annual Chase Travel Hotel Credit)

- 3x 3x points on dining at restaurants, including takeout and eligible delivery services

- 2x 2x points on travel purchases not booked through Chase

- 1x 1x points on other purchases

- 5x 5x points on Lyft rides through March 31, 2025 (that's 3x points in addition to the 2x points you already earn on travel)

- Valuable welcome bonus

- Extensive list of transfer partners

- Extra value on travel redemptions

- No premium travel perks

- Has an annual fee

- Additional perks: $50 annual hotel credit, trip cancelation/interruption insurance, auto rental collision damage waiver, complimentary Doordash and Instacart+ membership along with quarterly Instacart+ credits

- Foreign transaction fee: None

Airline-specific credit cards

An airline credit card is tied to a specific airline’s loyalty program, and earns miles you can use to book or upgrade flights with that airline and its partner airlines. For example, consider the United SM Explorer Card . The miles you earn with this card are deposited into your MileagePlus loyalty account, and you can redeem them to book flights on United Airlines or with United’s partners in the Star Alliance.

Cards of this type may offer airline-specific perks—such as free checked bags, priority boarding, an annual companion certificate, and more. If you fly a particular airline regularly, you could potentially save hundreds of dollars per year through the right card’s benefits.

If you think this is what you need, check out our list of best cards for earning airline miles .

Or if you already have an airline in mind that you’re loyal to, and just need help selecting a card for that specific airline, one of the following guides is likely to have what you’re looking for:

- Best American Airlines credit cards

- Best Delta Air Lines credit cards

- Best Southwest Airlines credit cards

- Best United Airlines credit cards

United SM Explorer Card

- 2x 2x miles on dining (including eligible delivery services), hotel stays, and United® purchases (including tickets, inflight food, beverages and Wi-Fi, Economy Plus® and more)

- 1x 1x miles on all other purchases

- Free first checked bag benefit.

- Expanded award availability on United Saver flights.

- No foreign transaction fee.

- $0 introductory annual fee for the first year (then $95) annual fee

- Subject to Chase 5/24 rule.

- United perks: 25% back on in-flight purchases checked bag benefit, expanded Saver award ticket availability

- Travel perks: TSA/Global Entry credit, trip cancellation and interruption protection

Hotel-specific credit cards

Hotel credit cards are tied to a specific hotel chain, such as Marriott, Hilton, Hyatt, etc. When you spend with these cards, they earn points that deposit into their respective loyalty program.

Often, when picking a hotel card, the perks matter just as much or even more than the rewards. For example, the right card might provide you elite status, a free night certificate, and statement credits you can use for certain expenses at eligible properties within the chain’s portfolio.

The Marriott Bonvoy Boundless® Credit Card illustrates these sorts of perks well. Cardholders get automatic Marriott Bonvoy Silver Elite status just for holding the card, as well as a Free Night Award every account anniversary good for properties worth up to 35,000 points per night.

If you’re looking for a card to help you earn almost-free hotel stays, check out our recommendations for best hotel credit cards . Alternatively, if there’s a hotel chain that is already your favorite home away from home, these specific lists may have what you’re seeking:

- Best Hilton credit cards

- Best Hyatt credit cards

- Best IHG credit cards

- Best Marriott credit cards

Marriott Bonvoy Boundless® Credit Card

- 6x 6X points per dollar at Marriott Bonvoy hotels

- 3x 3X points per dollar on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining

- 2x 2X points per dollar on other purchases

- All information about the Marriott Bonvoy Boundless® Credit Card has been collected independently by Fortune Recommends™.

- Generous free night welcome bonus

- Robust bonus category

- Ability to earn a free night via card spending

- Free night welcome bonus is less flexible than a points welcome bonus

- Marriott points aren’t as valuable as other points currencies

- Charges an annual fee

- Additional perks: Trip cancelation/interruption insurance, auto rental collision damage waiver, purchase protection, ability to spend to higher status

Are there travel credit cards with no annual fee?

Yes, there are travel cards with no annual fee on the market—some of them pretty dang good, especially considering the price tag is $0 per year to hold them. For example, the Bilt Mastercard and the Wells Fargo Autograph℠ Card are two no-annual-fee cards that let you earn points you can transfer to airline and hotel partner programs.

That said, it’s true many of the most popular travel cards on the scene do charge annual fees, often in exchange for more premium benefits. A card that grants airport lounge access will generally run you hundreds of dollars, such as the Capital One Venture X Rewards Credit Card and its $395 annual fee. The Platinum Card® from American Express is perhaps the most famous luxury travel card, charging $695 per year but offering extensive lounge access and numerous statement credits.

Mid-range travel cards provide a happy medium for those seeking more perks than you can get with a no-annual-fee card but not ready to shell out for a premium travel card. Some may even waive the annual fee in the first year. Examples of strong mid-tier travel cards include the American Express® Green Card —priced at $150 per year—and the United Explorer, charging a $0 introductory annual fee for the first year (then $95).

To view rates and fees of the The Platinum Card® from American Express, see this page .

All information about the American Express® Green Card has been collected independently by Fortune Recommends™

Wells Fargo Autograph℠ Card

Intro bonus.

- 3X 3X points on restaurants, travel, gas stations, transit, popular streaming services and phone plans

- 1X 1X points on other purchases

- No annual fee

- 20,000 bonus points when you spend $1,000 in purchases in the first 3 months (that's a $200 cash redemption value)

- Points transfer to partners

- Car rental insurance is secondary

- No travel insurance

- Transfer partners are limited

- Additional perks: Cell Phone Protection: Provides up to $600 in cell phone protection when you pay your monthly cell bill with your Wells Fargo Autograph card. Coverage is subject to a $25 deductible and limited to two claims every 12-month period.

- Foreign transaction fee: N/A

Top perks of travel credit cards

While benefits vary dramatically from card to card, there are a few types of benefits you’re likely to encounter and that you may want to look for when choosing a new card to apply for.

- Travel-related statement credits. Take for example the aforementioned Capital One Venture X and Chase Sapphire Preferred. The former offers a $300 annual credit for bookings through Capital One Travel while the latter offers a $50 annual credit for hotel stays booked via Chase Travel. These credits alone go a long way toward offsetting each card’s annual fee ($395 for the Venture X, $95 for the Sapphire Preferred).

- Travel insurance. The Sapphire Preferred is a great example here as well. Cardholders can travel with a little extra peace of mind knowing that if they pay with this card, they’ve got trip cancellation and interruption insurance up to $10,000 per person and $20,000 per trip, trip delay reimbursement up to $500 per ticket, baggage delay insurance up to $100 a day for up to five days, and primary rental car insurance .

- Elite status. Maybe you really like the sound of certain perks that come with having elite status in your favorite hotel chain’s or airline’s loyalty program. For example, travelers with Hilton Gold status get a daily food and beverage credit or continental breakfast (varies by brand and region). In that case, maybe you’d want to open the Hilton Honors American Express Surpass® Card , which includes Gold status among its benefits.

- Airport lounge access. While cards with airline lounge access as a perk tend to charge expensive annual fees, you can still end up better off than paying for a lounge membership by itself. For example, if you really want to get into United Club lounges, you might find it a better value to pay $525 for the United Club℠ Infinite Card rather than the $650 a general MileagePlus member would pay for United Club membership.

- A free night or a companion pass. With some cards, a free night certificate or a companion ticket can cover the cost of the annual fee in one fell swoop. Let’s look at the Delta SkyMiles® Platinum American Express Card (different from the Amex Platinum mentioned earlier) as an example. The annual fee is $350 but you get a Companion Certificate each year good for a domestic, Caribbean or Central American round-trip flight. If you travel with a friend regularly, this could save you hundreds of dollars. But do note that you’re responsible for covering government-imposed taxes and fees.

To view rates and fees of the Hilton Honors American Express Surpass® Card , see this page

To view rates and fees of the Delta SkyMiles® Platinum American Express Card, see this page

How to choose the right travel card for you

Asking a few questions can help you determine if a card is a fit:

- Does the rewards currency suit your needs? If you want flights, collect airline miles. If you want hotel stays, collect hotel points. And if you want both, collect transferable points. Just make sure you’re earning rewards you can actually use. For example, don’t open a Hyatt credit card if there aren’t any Hyatts where you want to vacation or a Southwest Airlines card if you want to fly to Asia.

- If there’s a welcome bonus, can you hit the spending target? Most travel credit cards offer a welcome bonus of some kind, typically one where you earn bonus points or miles for spending a certain amount on purchases in a specified time period. For example, the Wells Fargo Autograph Journey℠ Visa® Card —the big sibling of the Autograph card mentioned elsewhere—offers 60,000 bonus points if you spend $4,000 in the first three months. If you open a new travel card with a welcome bonus spend requirement that’s unrealistic for your financial situation, you’re leaving rewards on the table.

- Will you actually use the card’s benefits? This is particularly crucial to consider with statement credits. For example, the American Express® Gold Card ’s dining statement credit of up to $120 per year may sound great, but not if you don’t have any of the eligible merchants (Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar, and select Shake Shack locations) in your area or you never dine with these merchants.

- Does the card’s rewards program fit your lifestyle? This should be fairly obvious, but in most cases, you’ll want to make sure the card you’re applying for offers rewards in a category that makes up a substantial portion of your budget. So, while someone who frequently eats out at restaurants will probably love the Bilt Mastercard’s elevated rewards on dining, someone who always cooks at home won’t benefit as much.

- If there’s an annual fee, does it seem reasonable to you? This isn’t to say you shouldn’t pay an annual fee, or even that you shouldn’t pay for a card with an expensive annual fee. But if you do pay for a mid-tier or premium travel card, you should receive more than the cost of the annual fee through rewards and perks. Someone who uses the Capital One Venture X’s annual $300 travel credit has already almost recouped the Capital One Venture X Rewards Credit Card annual fee, but someone who prefers to book directly with airlines and hotels and refuses to book via a portal might never use that credit. Every so often, do the math for your own needs and see if you’re getting value out of the cards you’re carrying.

To view rates and fees of the American Express® Gold Card , see this page

Glossary of travel card-related terms

Here are a few terms you’ll find useful as you get into traveling with points and miles:

- Award travel. This refers to using points and miles to book hotel stays and flights.

- Transferable points. Consider this the same as the flexible rewards we explained above. You earn points that your credit card issuer allows you to transfer to various airline and hotel partners, rather than being tied to one airline or hotel chain.

- Welcome bonus. You may also hear this called a welcome offer or a sign-up bonus. Welcome bonuses reward new cardholders after opening an account, typically by offering bonus points or miles for spending a certain amount in a specified time frame.

- Foreign transaction fee. This is a fee, typically around 3%, that some credit cards charge for using your card abroad. Most travel cards charge no foreign transaction fee, though there are exceptions. We recommend making sure you’re taking a card with no foreign transaction fee if you’re planning a trip outside the United States.

- Award chart. If an airline or hotel chain offers a chart showing the number of points you need to redeem for various types of flights or stays, you’re looking at an award chart. Fixed award charts used to be more common in the past, with many programs nowadays using dynamic pricing. More on that in the next entry.

- Dynamic pricing. Essentially, dynamic pricing means the number of points or miles you’ll need to redeem for a flight or stay varies based on factors such as seasonality and demand. There isn’t a set cost for the award ticket or room that you wish to book, in this case—it can and likely will fluctuate.

- Chase 5/24 rule. This is an unwritten rule that affects applications for Chase-issued credit cards (including co-branded airline and hotel cards). Basically, it means that if you’ve opened five or more personal credit cards from any issuer in the past 24 months, you’ll get denied if you apply for any Chase credit cards. For this reason, you may hear travelers who collect points and miles talking about their Chase 5/24 status.

How to maximize your travel rewards

Maximize your rewards-earning potential.

We mentioned this before, but pick a credit card that rewards categories you normally spend in. If you dine out at restaurants frequently, you may find a card such as the Bilt Mastercard or Chase Sapphire Preferred allows you to satisfy both your inner foodie and your inner travel rewards lover. But if you tend to spend more at supermarket, consider the American Express Gold Card.

Meanwhile, someone who makes a lot of hard-to-categorize purchases might prefer a card that earns rewards at a flat rate on every purchase, like the Capital One Venture Rewards Credit Card or Venture X.

It may even be worth carrying multiple credit cards that compliment each other. For example, one might carry the Chase Sapphire Preferred, Chase Freedom Flex℠ , and Chase Freedom Unlimited ® . With this setup, you’d use the Sapphire Preferred for purchases like travel and dining, use the Freedom Flex for its rotating categories, and the Freedom Unlimited for your more random purchases.

Capital One Venture Rewards Credit Card

Reward Rates

- 5x Earn 5x miles on hotels and rental cars booked through Capital One Travel

- 2x Earn 2x miles on every purchase

- Flexible travel rewards

- No foreign transaction fee

- Maximizing Capital One Miles requires a learning curve

- Cash redemption value is limited

- The Venture offers travel accident insurance, rental car coverage, extended warranty protection, exclusive access to events through Capital One Dining and Capital One Entertainment

Redeem your rewards wisely

At the risk of stating the obvious, redeem airline miles for flights and hotel points for hotel stays. If your card offers redemption choices such as shopping for merchandise with your rewards, beware that you’ll probably get a subpar value.

Similarly, with a card that earns flexible points, transfer them to airline or hotel partners or use them to book travel in your issuer’s portal.

As a rule of thumb, strive to get a value of 1 cent or more per point or mile redeemed with most airline programs. Hotel program values are more variable so it helps to do a bit of research before booking. To calculate that value, divide the cash price of the purchase by the points required, then multiply by 100. For example, a redemption with a cash price of $500 and an award cost of 26,000 points means you’re getting a value of roughly 1.9 cents per point. (To get even more nitty gritty, subtract the cost of any taxes and fees from the cash price before you do the calculation.)

If you’re someone who values luxury, know that you can often get the highest cents-per-points value when springing for high-end properties or business class and first class flights. But of course, it’s not just the math that matters, but the utility.