- How it works

- Try it out for free

- Expenses from Your Profession

Claim Travel Expenses on Your Tax Return

Travel expenses for professional-related commutes can be claimed as income-related expenses (Werbungskosten) on your tax return and help increase your chances of a tax refund. These expenses can include business trips, trips home in the case of double household management, or simply your daily commute to work – To learn more about deducting these on your tax return, keep reading this article!

Which travel expenses can be claimed?

Travel expenses incurred for professional reasons can be claimed on your tax return by entering the appropriate lump sums or flat rate and in some cases, these costs are fully deductible. These can be divided into 3 categories:

- Expenses for the commute from your residence to your primary workplace

- Travel costs from your secondary to primary residence in the case of double household management

- Travel costs for external activities & business trips

Traditional employees can deduct all of these costs as income-related expenses while freelancers/self-employed persons can claim their travel expenses as business expenses (Betriebsausgaben).

1. Your work commute

Primary profession: commuter allowance.

You can claim a commuter allowance (Entfernungs-/Pendlerpauschale) for the commutes between your residence and your primary profession . Primary profession refers to your main and permanent job. Freelancers can claim the commuter allowance for commutes to their first business location while students/trainees can claim it for commutes to their place of education.

The commuter allowance amounts to 30 cents per kilometer for the first 20 kilometers of one-way travel to or from your workplace, regardless of means of transportation or actual incurred expenses. That means this can be claimed whether you walk, ride a bike, drive a car, ride passenger, or take public transportation – just keep in mind that you can only claim one-way per working day. The tax office will only accept deductions for the shortest possible route (regardless of means of transport) and long detours would have to be justified, for example, if it’s more convenient and is a faster route (due to the shorter route having heavy traffic etc.).

Note: As of January 2021, the commuter allowance was increased to 35 cents from the 21st kilometer of one-way travel for long-distance commuters and from 2022 to 2026 it is increased again to 38 cents from the 21st kilometer of one-way travel.

Commuter allowance: Maximum limit

Generally, the tax office accepts a flat rate of 230 trips per year for a 5-day work week, and 280 trips for a 6-day work week. Commuter expenses can not be deducted for days spent home sick, on vacation, or working from home – days spent working from home can instead be claimed using the home office lump sum . A maximum of 4,500 euros per year can be deducted, unless you meet one of the following two exceptions :

- If you commute to work in your own personal or business vehicle and exceed 4,500 euros per year with the commuter allowance, the excess amount may be deducted.

- If you commute to work with public transportation and the costs exceed 4,500 euros per year, you can enter and claim the actual expenses on your tax return (not as a part of the commuter allowance).

If you meet either of these exceptions, hang on to your receipts as proof must be submitted upon the tax office’s request.

Commuter costs for multiple workplaces or professions

There can only be one primary workplace per profession, if you work at several locations they are considered external activity (Auswärtstätigkeit). Expenses for commuting to external activities can be reimbursed if you travel by public transport and the kilometer allowance (Kilometerpauschale) can be used if you travel by car. This applies to both the outward and return journey and amounts to 30 cents per kilometer.

If you have several professions , the commuter allowance can only be used for your primary profession if you travel between there and home on the same day. If you travel from workplace to workplace, the distances can be added, but then the commuter allowance can only be used for half of the total distance .

Mobility premium for long-distance commuters

As of 2021, long-distance commuters with a daily commute of 21 kilometers or more can apply for the new mobility premium (Mobilitätsprämie). In order to apply, your taxable income must not exceed the basic tax-free allowance (Grundfreibetrag) of 9,744 euros (as of 2021). The bonus is based on the 2021 commuter allowance increase and will remain valid until 2026. If eligible, you can apply for this premium directly on your tax return and receive it directly to your bank account. The premium grants a bonus of 14% to the already increased commuter allowance from the 21st kilometer of one-way travel to work and the assessment basis for the premium varies upon the difference between your annual taxable income and the basic tax-free allowance.

2. Commutes to your main residence with two households

Many employees manage two households for professional purposes and shorter commutes to the office, leading to common trips between their primary and secondary residences. One trip per week (or a total of 46 per calendar year) back to your primary residence can be deducted using the commuter allowance regardless of means of transportation. The same rules apply: either the outward or return journey can be deducted. The allowance can be deducted even if no costs were incurred from the trip, such as if you were given a ride.

In order to be eligible to deduct costs for double household management , your “life core” must take place at your primary residence, where you regularly stay and contribute at least 10% of the costs. It is not a prerequisite to have a spouse, partner, or child(ren) living at your primary residence.

The commuter allowance increase to 35 cents (2021) / 38 cents (2022) from the 21st kilometer also applies to trips home to your primary residence to see your family. Note: The maximum of 4,500 euros per year doesn’t apply to family trips home.

If you travel with public transportation and the costs exceed the benefits from the commuter allowance, you can instead deduct those costs individually on your tax return. If you fly home, you can only claim the price of the plane ticket.

Note: Weekly trips to your primary residence cannot be deducted if made with a company car. No tax must be paid on the first trip home with a company car as a non-cash benefit (geldwerter Vorteil), but it must be taxed from the second trip onwards.

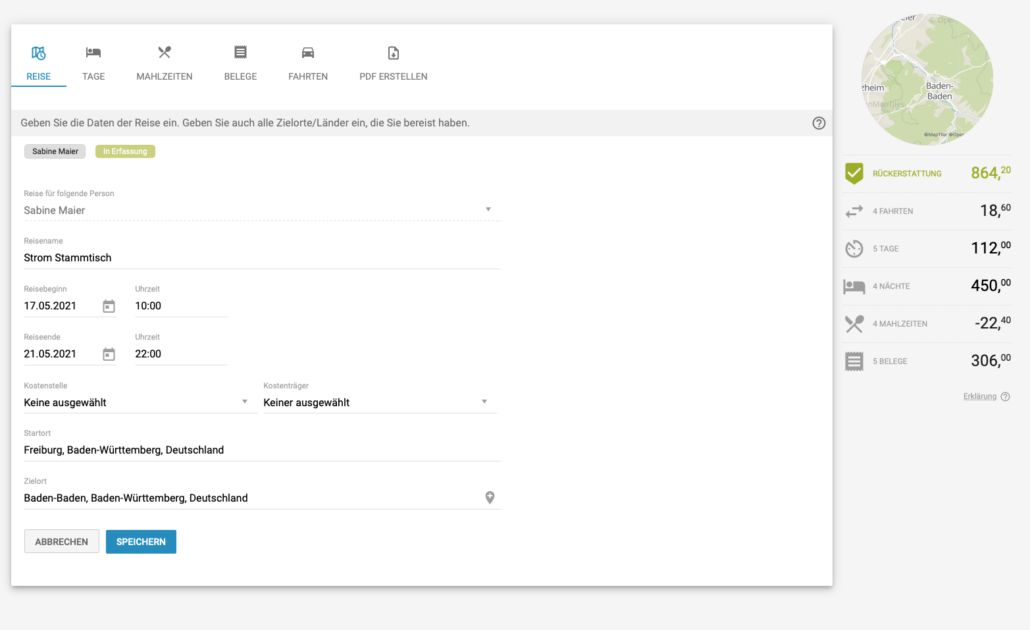

3. Costs for business trips

Employers often pay for business trip expenses out of their own pocket – whether it be field service, further education, or visits to a trade fair. If the costs aren’t covered by your employer, it’s definitely worthwhile to claim them on your tax return. Means of transport are irrelevant unless you’ve traveled in a company car , which is not tax-deductible.

Expenses for travel by public transport, ship, or airplane are all reimbursed based on the lowest class available. Train journeys exceeding two hours in the next higher class can be reimbursed.

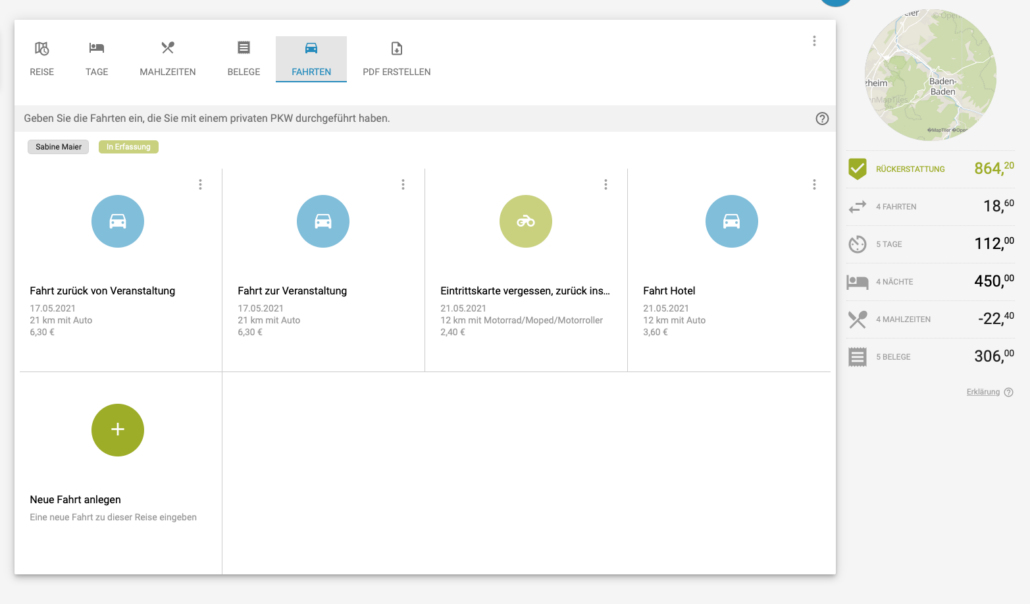

If you traveled by car, you can either determine the actual incurred costs and claim them or use the kilometer allowance (Kilometerpauschale). Unlike the commuter allowance, the kilometer allowance can be applied to both the outward and return journey .

Per kilometer traveled, the kilometer allowance amounts to:

- 30 cents for trips by car

- 20 cents for trips by motorcycle, scooter, moped, or e-bike

Tip: If your business trip away from home and your workplace exceeds 8 hours, you can claim a flat rate of 14 euros for room and board as well as meals (Verpflegungsmehraufwand). If the trip exceeds 24 hours, you can claim a flat rate of 28 euros.

Please note: The portion of travel expenses covered by your employer can no longer be included in your tax return. You can alternatively declare the costs in full if you also claim the employer subsidies for your travel costs.

Is it worth it for you to file a tax return?

Related articles.

- Tax Forms for your 2021 Tax Return

- What exactly is double household maintenance?

- How to Deduct Bahncard from Tax with Travel Expenses

Travel Allowance (Fahrkostenzuschuss) and Taxation in Germany explained

Main points.

- The travel allowance is a salary supplement that you grant your team for the journey to work - regardless of which means of transport they choose. It is paid at a rate of 0.30 euros per kilometer (0.35 euros per kilometer from the 21st kilometer onwards) for the one-way journey between home and work, and only for the days on which your employees are at work.

- For whom. The travel allowance is available to all full-time employees, part-time employees, trainees, and mini-jobbers on a 520 euro basis.

- A complement to your employer branding strategy. The travel allowance is a mobility benefit and is suitable as a retention tool, especially for employees who live further away.

- Accounting & taxation. The allowance is a salary supplement and is paid out with the monthly salary. Travel allowances are taxed at a flat rate of 15% wage tax.

- What to look out for. The allowance can only be paid to employees who regularly commute to work and in many cases, there is an annual cap of 4,500 euros (the same cap as for income-related expenses). In addition: If you grant your employees a travel allowance, they can no longer claim these costs as income-related expenses in their tax return.

What is the travel allowance?

Here is our explanation and definition:

- The travel allowance is a monthly payment with your salary that you grant to your employees to compensate them for the costs of traveling to work. The travel allowance applies to all means of transport used for commuting to the office.

- Your team member is free to choose how they get to work, whether by bus, train, bicycle, or car. Important is that only the days on which your employees actually commute to work are taken into account. The allowance covers 0.30 Euro paid per kilometer, if your team member travels beyond 21 kilometers the compensation is 0.35 Euro per kilometer.

- All employees who regularly come to the office to work can receive a travel allowance, i.e. full-time and part-time employees as well as trainees and mini-jobbers. For full-time employees in your team who usually commute to work every day, the allowance can be applied for 15 days per month without further proof, according to the law.

- As a salary bonus, the travel allowance is paid out with the salary and taxed at a flat rate of only 15% wage tax. If your team works in the home office every day, you cannot pay your team a travel allowance.

- If your team comes to the office e.g. for two days a week, you can also grant the allowance to your team for these two days only.

Create the work place of tomorrow with NAVIT. We are happy to support you with designing the best mobility solution for your company. Get in touch with us!

For whom is the travel allowance worthwhile?

As with other mobility benefits, the travel allowance generally increases motivation and satisfaction at work and is thus an important employee retention tool.

For employees who live far from their workplace, the travel allowance is particularly valuable. As a general rule, travel allowances are worthwhile for distances greater than 17 kilometers.

Many employees benefit from flat-rate wage taxation of 15%. As a monthly supplement to their salary, the travel allowance offers your employees the convenience of not having to wait until the end of the year or until their tax return to receive reimbursements.

This is how travel allowances are taxed and accounted for: If your employees are entitled to a monthly travel allowance, they can receive 0.30 euros per distance kilometer (0.35 euros from the 21st kilometer), which is the otherwise deductible distance allowance. As an employer, you are responsible for paying the 15% flat-rate wage tax.

The travel allowance does not require social security contributions. To calculate the amount of the allowance, you use the shortest or most convenient route between your employee's place of residence and your company's office location.

If you decide to pay your employees a higher amount than € 0.30 per distance kilometer or to grant them an allowance for days on which they worked in their home office, this additional benefit is subject to the individual tax rate of your employees.

If you decide to offer your employees an additional mobility budget, this can be granted as a benefit in kind up to 50 euros per month tax-free (or taxed at a flat rate) on top of the salary.

What about if your employees only use public transport?

In this case, it makes more sense to offer a public transport-specific allowance, e.g. a job ticket. Since 2019, the job ticket can also be subsidized above the upper limit of the tax-free benefit in kind of 50 euros.

In this way, the tax-free benefit in the kind of 50 euros can be used for other mobility benefits, such as a flexible mobility budget.

With the job ticket, you as an employer provide your employees with free or discounted monthly tickets for public transport, which can be used not only for commuting to work but also for private journeys.

With regard to the tax return, it is important to note: If your employees receive a travel allowance, they cannot claim income-related expenses for travel to work in their tax return.

A travel allowance is therefore only attractive for your employees if the distance between home and work is at least 17 kilometers.

Our mobility experts at NAVIT would love to share their knowledge with you about the new mobility product. Feel free to get in touch with us!

What is the difference between the travel allowance and the commuter allowance?

The travel allowance is not the same as the commuter allowance.

While the travel allowance is a voluntary offer from you as an employer, the commuter allowance is a state offer to your employees and offers them the possibility to deduct their travel costs from their taxes.

What both offers have in common is the amount of 0.30 euros per kilometre (or 0.35 euros from the 21st kilometer).

Travel allowance and other mobility benefits

The travel allowance is a mobility benefit and thus an effective instrument for employee retention as an additional benefit to the salary.

You can offer the allowance to your employees either as a single mobility benefit or together with others, such as a flexible mobility budget.

If you grant your employees a higher amount than the already mentioned 0.30 euros per kilometer or offer them a credit in the form of a mobility budget for the use of public transport or sharing offers (e.g. car sharing, bike sharing, e-scooter sharing), your employees pay the individual additional wage tax.

In contrast to a mobility budget or a job ticket, the travel allowance is transferred directly to your employee's bank account as a monthly salary supplement. This means that your employees have this amount at their free disposal.

Information and content disclaimer

NAVIT hereby states that the information provided about benefits on our website is only for informational purposes only and does not represent any tax or legal advice. The content is not intended to replace any individual, binding tax and legal advice that addresses your specific tax or legal situation. We, therefore, declare that information provided is without guarantee of correctness and completeness.

We continue to provide updated information and research insights. We as a provider of this information cannot assume any liability for the accuracy, completeness, and timeliness of the information provided. In particular, the information is of a general nature and does not constitute tax or legal advice in individual cases. For questions about taxes and legal topics, please consult a certified tax advisor or lawyer.

Sign up for our newsletter to receive the latest insights about our mobility solution products like the 49 eurojob ticket.

More mobility topics

What is micro-mobility and which vehicles are included? The contribution of micromobility to the mobility transition.

Why companies need to rethink corporate mobility and how the transition to a mobility policy can succeed.

How does a virtual credit card work and what advantages does it have as a mobility budget card?

Employers have various options for supporting their employees' mobility. What is the difference between a mobility budget, mobility allowance and mobility bonus?

How does non-cash remuneration affect salary and how are non-cash benefit done in payroll?

The implementation of a mobility budget works best with a mobility platform

The amount of a mobility budget depends on these factors.

What is meant with shared mobility? What sharing services are out there? How does it work?

How to choose the right benefit for your team. Five popular employee benefits and their providers compared.

The most important terms and definitions: Everything you need to know about employee benefits for your company.

The most important terms and trends from the world of New Work.

When and for whom are they best suited? An overview of the individual concepts.

Lease a bike or e-bike for employees: What is important to know? Key criteria for a provider comparison.

New Mobility: Trend terms and definitions. Everything you need to know about the latest mobility and transport topics.

E-Bike leasing for employers: Is it worth it? The benefits of E-Bike leasing for companies and employees.

How is the mobility budget implemented in other European countries? A comparison.

Why are employee benefits relevant for companies and why do mobility benefits become popular?

When it comes to business trips, a mobility budget can have advantages over a classic travel expense management.

Job ticket, company bike and company car at a glance - Which allowances can employees use at the same time?

Tax-free fuel voucher & fuel card: advantages, use & non-cash benefit in Germany for employers

The future of bicycle mobility. Bike leasing, bike subscription and bike sharing in Germany quickly explained.

Comparison: Car subscription, leasing or long-term rental as an alternative to a company car in German

how can you make the complex topic of taxation understandable to your finance department? In this article we show you how to make the right choice.

We provide tax optimisation tips that employers and employees should consider when applying mobility budget in Germany

Corporate benefits: 4 ideas for modern employee benefits 2024 in Germany

We explain how employers can provide their employees with a company bike tax-free through a bike lease program in Germany

What mobility budget providers are there on the market? A comparison of mobility budget platforms vs. expense and benefits platforms

Mobility budget: salary increase or salary conversion?

More companies are committed to effective climate protection. This also applies to mobility. We explain how this works in Germany

In depth comparison between Deutschlandticket, jobticket and mobilitybudget.

Find out who can benefit most from this ticket and for whom a job ticket is worthwhile in this article.

Read all pros and cons of the new ticket and how the 49 Euro Deutschland ticket affects the Job ticket in Germany

What are the pros and cons of a car subscription? Is it a viable alternative to traditional leasing and fleet management?

CO2 reporting, CSRD corporate social responsibility for companies from 2023 in Germany. Here are the new CSRD rules & requirements

How can the mobility budget for employees be implemented in your company? What are the current solutions? What do you have to pay attention to with the individual mobility budget providers? We will explain the various mobility solutions to you.

We show you the advantages of a mobility budget as an employee benefit that can help make a difference in your mobility management.

This article is to inform you about the fuel & charge card and what the advantages of a hybrid card are.

Here you find all the info about travel allowances (Fahrkostenzuschuss) and taxation in Germany.

In this article we will tell you about the job ticket. What is it? What do you have to consider in terms of tax law? How does it relate to the mobility budget?

This article is all about bike leasing as a supplement to the mobility budget. How does bike leasing work? What are the benefits of company bikes? What's the deal with salary conversion?

How can the mobility budget be integrated into corporate mobility management? Or can it even replace it? We'll clarify that in this article.

Read all information about mobility budget and ticket reimbursement usage. How do you reimburse your ticket? Which tax implications apply.

Mobility Budget Taxes, Taxation and Non-cash remuneration. We will give you a brief overview of how the individual means of transportation are taxed.

The mobility budget explained. What is a mobility budget? Which advantages does it have? How does it work? We give you all the answers.

GermanPedia

Tax Deductions in Germany [Save Tax in 2024]

Last Updated:

You can get back thousands of euros in tax returns in Germany. Know the allowances and tax deductions in Germany.

Key takeaways

- The income-related expenses are the most significant expenses that employees can use to recoup overpaid taxes.

- Since 2022, long-distance commuters will benefit from the increased commuting allowance of 38 cents from the 21st kilometer traveled.

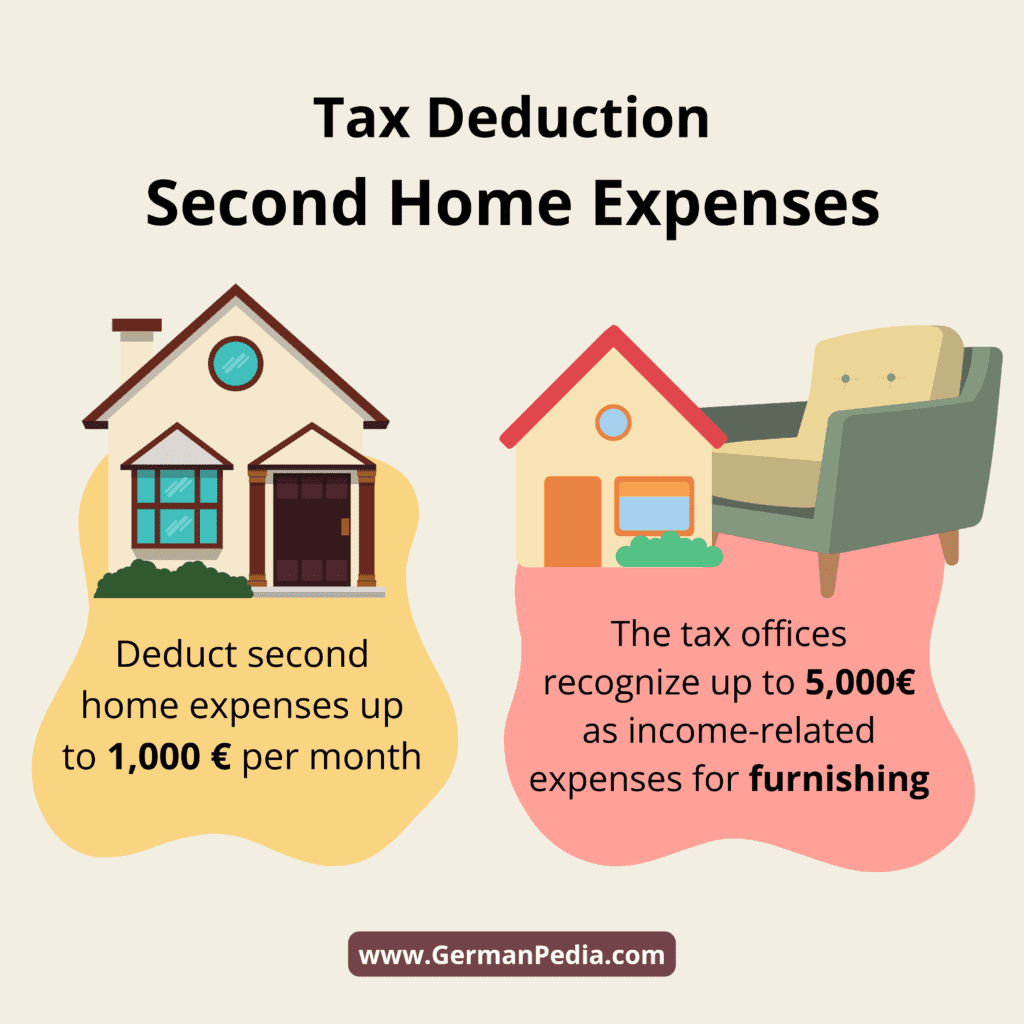

- For the second home at the place of employment , you can deduct up to 1,000 € per month for rent, ancillary costs, and double home tax.

- You must file the income tax return by 2 September 2024.

This is how you do it for your tax deductions .

- There are a lot of ways available to save tax. These are often separated into personal and professional categories.

- Remember to separate your company and personal finances by having a separate business account.

- Keep the receipts of your expenses handy. You will need them to get the most out of your tax return.

- Ensure you pay the taxes on time. The tax office may charge penalties and interest if you miss the tax payment deadline, i.e., 2 Sept 2024.

Many online services help you file and save income tax in Germany. We recommend SteuerGo *, Wundertax *, and Smartsteuer *.

Table of contents

While filing an income tax return, you must consider

- working from home,

- buying work equipment,

- fewer trips to work,

- short-time work,

- child bonuses,

- flat-rate energy price,

- and many other aspects.

You may pay up to 45% tax in Germany based on your income . But the good news is you can get a significant amount back when you file a tax return .

In this guide, you will find out what you need to pay particular attention to about income tax in Germany.

Gross Income vs. Taxable Income

Let’s first understand the difference between your income and taxable income. Your income is the money you earned in a particular year. It’s the gross amount you made.

We also refer to it as “Gross Income.”

On the other hand, “taxable income” is the “gross income” minus your “expenses” to earn that “gross income.”

Cheatsheet to Save Taxes – Free Download

- Download the cheatsheet summarizing all the expenses you can deduct from the taxes.

- Maximize your tax savings by claiming expenses you don’t need proof of.

- Moved due to work, bought a new chair, repaired your rental apartment, etc. Claim all these expenses to save tax.

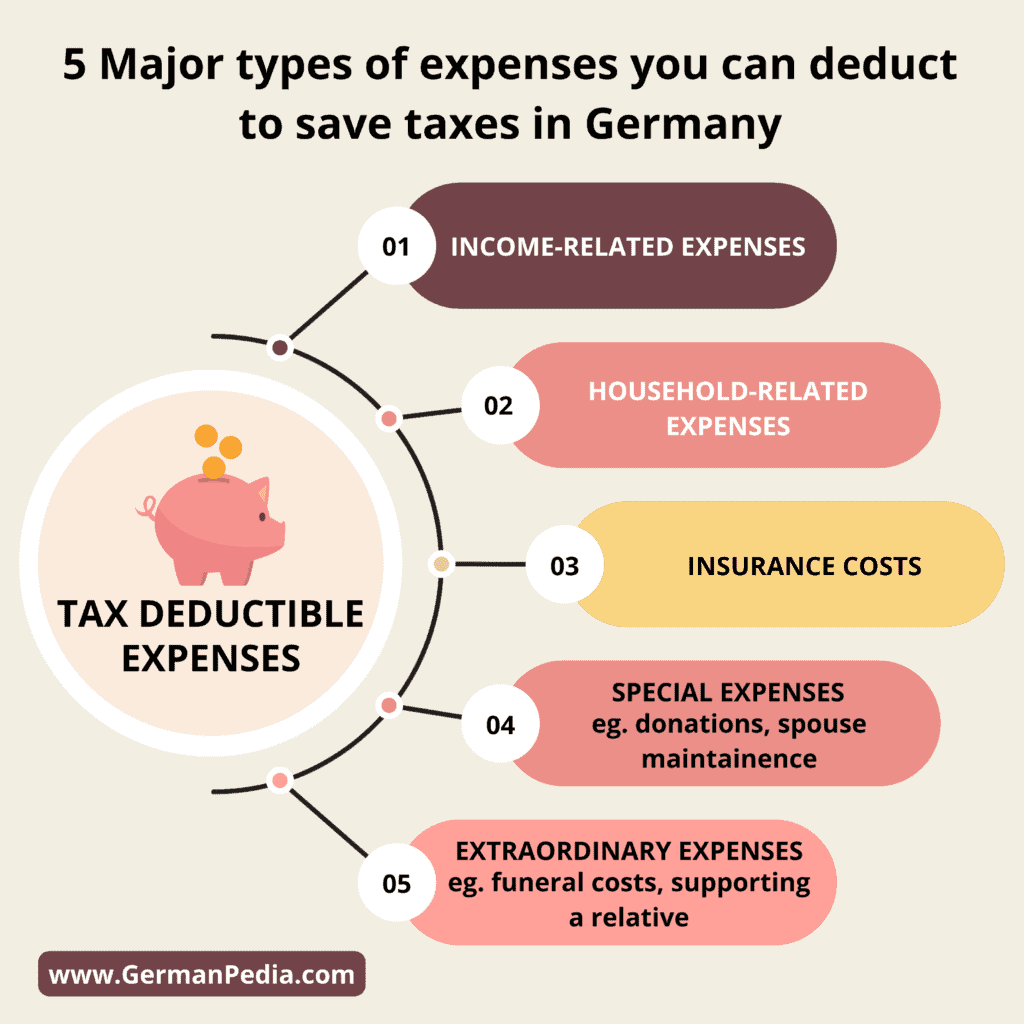

What can be your possible tax deductions in Germany?

Income-related expenses are the most significant expenses employees can claim to recoup overpaid taxes.

The tax office deducts a flat rate of 1,200 € from employees’ income. Hence, reducing your taxable income further.

Moreover, if your professional expenses exceed the default lump sum (1200 €), you can use them to reduce your tax liability.

Thus, collecting professional expense receipts from the beginning of the year is advisable.

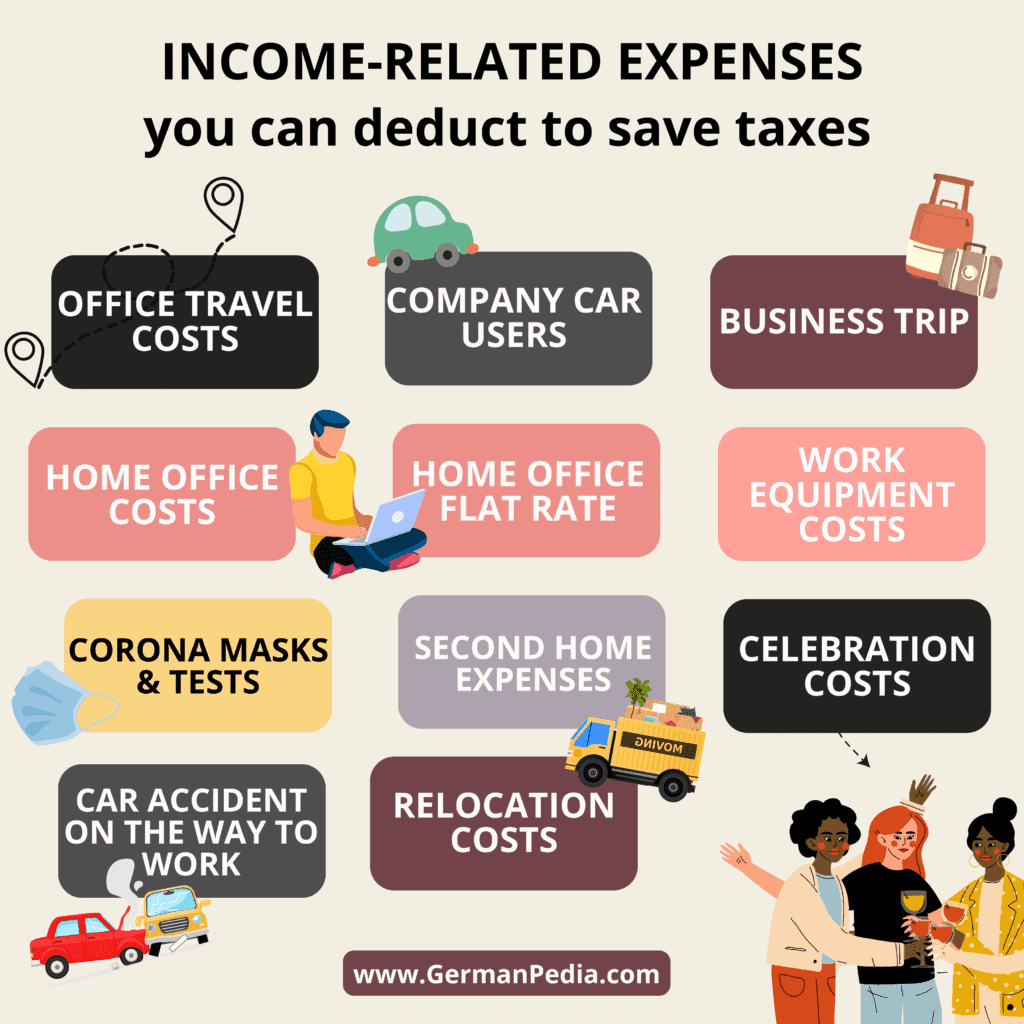

Income-related expenses

Costs of travel to the office

If you are an employee who commutes to work daily, you may be eligible to deduct travel costs from your income.

The tax office calculates travel costs based on the distance flat rate of 30 cents per kilometer .

For example, if you drive 18 kilometers to work 230 days a year, your travel costs would be €1,242 (80 * 0.3 * 230 = 1242 €).

The German tax office accepts

- 220 to 230 days for the distance allowance (Entfernungspauschale in German) with a five-day working week

- and 50 days more for a six-day working week .

You can find a state-specific working day calculator on this website (German).

Long-distance commuters enjoy increased travel allowance, i.e., 38 cents starting from 21 kilometers .

How do you claim costs?

When completing Appendix N, you must state the actual number of days you went to work.

Keeping a calendar of when you traveled to the office is the best way to keep track of your travel expenses.

If the tax office requests further information, you can submit your travel entries and an employer’s certificate.

Good to know

You can deduct the commuter’s flat rate for the working days you travel to the office. It’s independent of how long you stay in the office.

For example, you went to the office to attend a meeting and worked from home for the rest of the day. You can also deduct the commuter’s flat rate for this day.

The distance allowance applies regardless of the means of transport you choose. You can travel on foot, by cycle, train, or bus.

If you use public transport, you can either claim the distance allowance up to a maximum of 4,500 € or the actual travel costs if they are higher.

But you must be able to provide proof to claim for higher travel costs.

Company Car users

You can reduce your tax burden via individual assessment (Einzelbewertung in German) if

- you have a company car that you can use for private purposes

- and drove the company car to work less frequently in 2023.

You can use one of the two methods to determine the tax benefits.

- The logbook (Fahrtenbuch in German)

- Or the flat 1 percent rule.

Under the method logbook, you must maintain the logs of your journies throughout the year. Later, you can submit the journey logs to the tax office as proof of your travel expenses.

You and your employer must decide which method to use at the beginning of the year.

The reason is the tax office does not accept the logbook if you create it at the end of the year. This is because the tax office believes the logbook is mostly manipulated in such cases.

Only employees have the option of an individual assessment.

Self-employed or tradespeople (BFH, judgment of June 12, 2018, Az. VIII R 14/15 ) cannot benefit from an individual assessment.

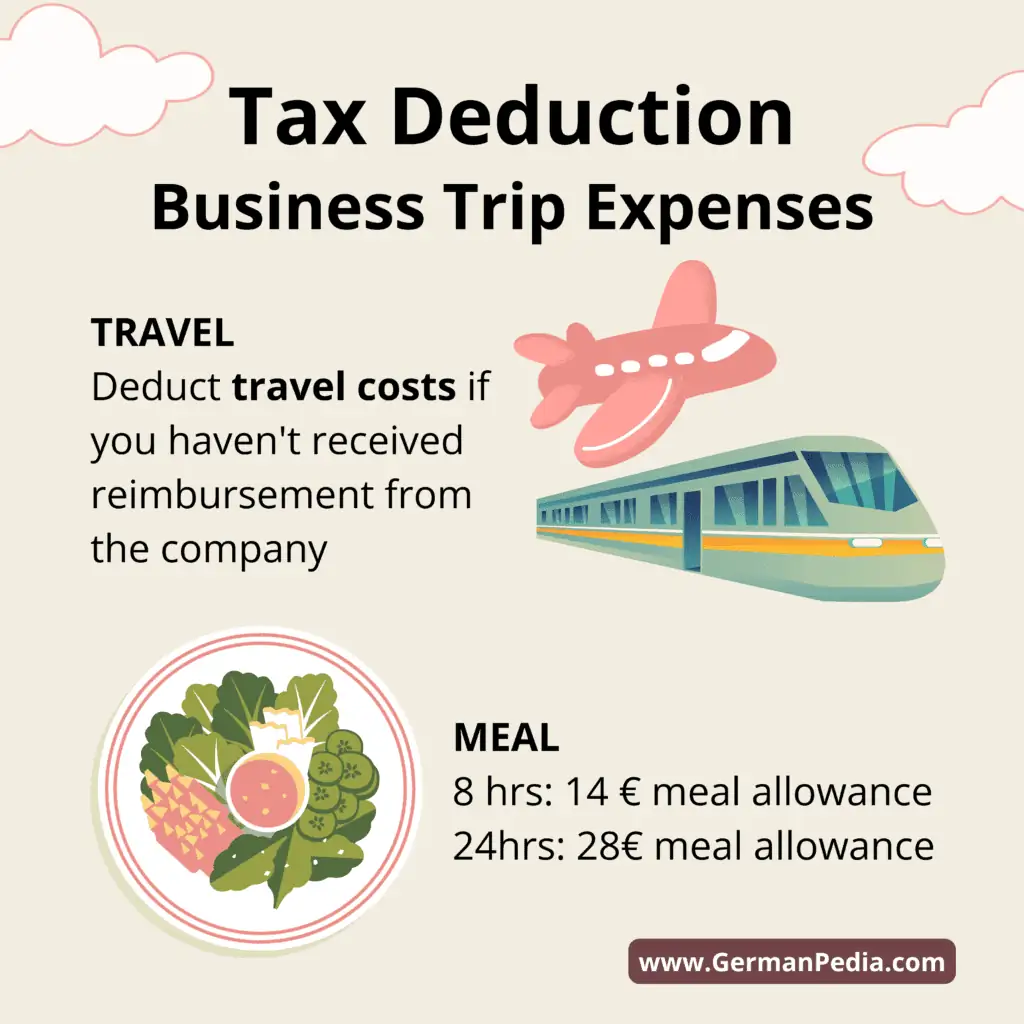

Business trip expenses

You can deduct the travel cost of business trips from your income if you haven’t received reimbursement from your company.

You would get 14 € as additional meal expenses if you were on the road for more than eight hours on a business trip.

The meal allowance increases to 28 € if your business trip lasts more than 24 hours.

The meal allowance increases further if you travel abroad. The increase depends on the country you travel to.

You can find a list of country-specific allowances in the Federal Ministry of Finance letter dated December 3, 2020.

There is also a flat rate for professional drivers who spend the night in their driver’s cabins. They can deduct 8 € per day as a meal allowance.

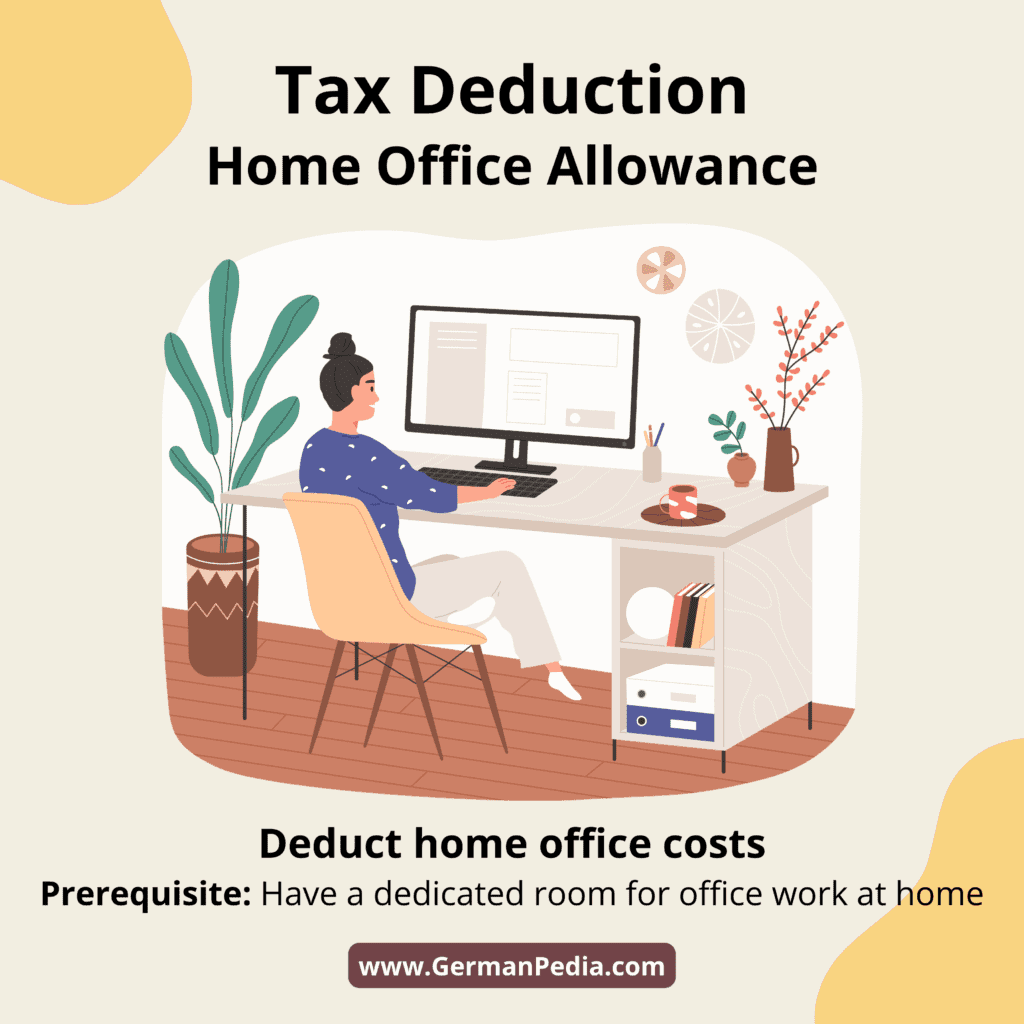

Home office cost

You can deduct all your home office costs from your taxable income. The only requirement is to have a dedicated room you use for office work at home.

The tax office has strict rules to determine whether you have a dedicated home office space. You may even have to provide proof to back it.

Suppose your employer does not provide a working space. In such a situation, the tax office limited the deductible to 1,250 € (for the 2022 tax year) and 1,260 (for the 2023 ta x year).

You don’t need proof to deduct the home office flat rate from taxes. Read our guide on home office tax deductions to learn more.

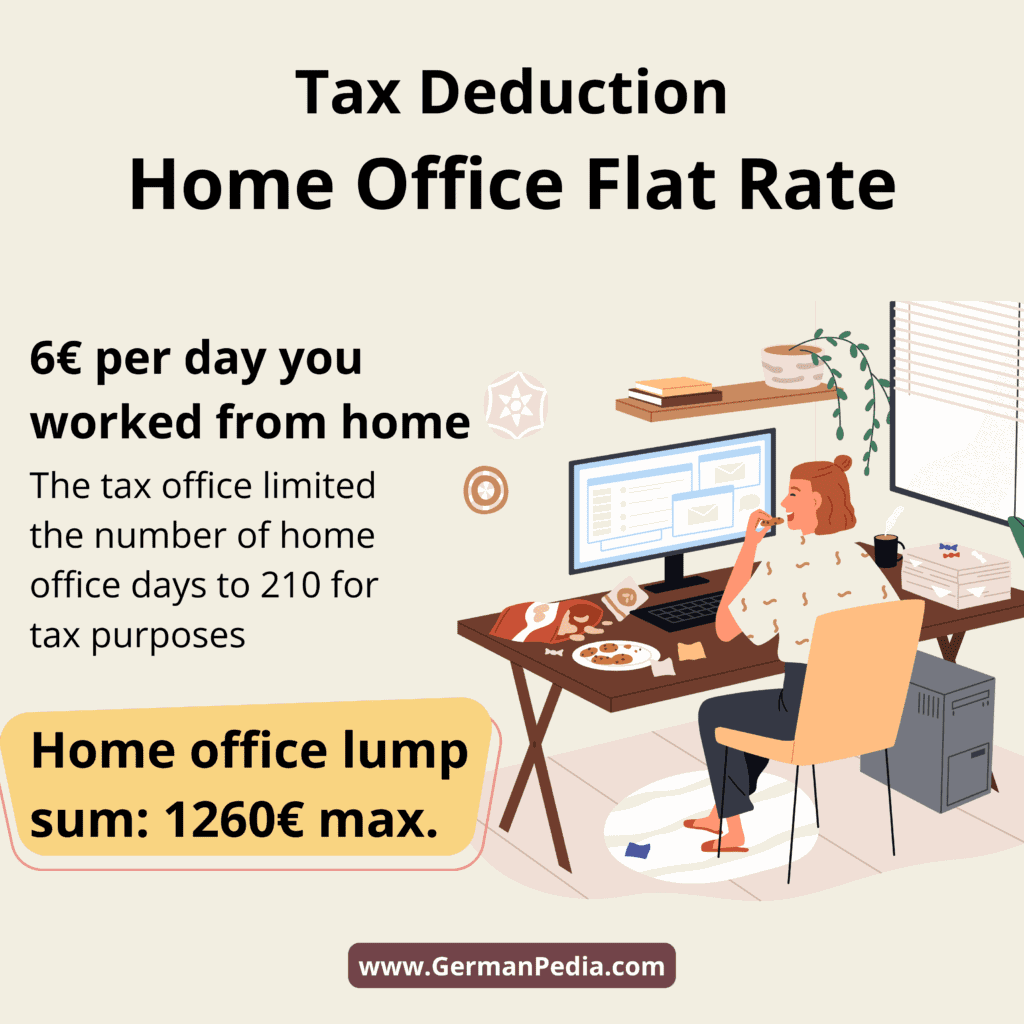

Home office flat rate (Homeoffice-Pauschale in German)

You can deduct up to 600 € (for the tax year 2022) from your taxable income as a home office flat rate. The tax office increased it to 1,260 € for the tax year 2023.

The home office flat rate benefits people who do not meet the strict requirements of a dedicated room for office work at home.

You can set 5 € (for the 2022 tax year) and 6 € (for the 2023 tax year) for each working day you work exclusively from home. The tax office limited the number of home office days to 120 (for the 2022 tax year) and 210 (for the 2023 tax year) for tax purposes.

Thus, the home office lump sum is limited to 600€ (for the 2022 tax year) and 1,260€ (for the 2023 tax year).

The tax office considers the home office flat rate to be income-related expenses. Hence, they offset the “home office flat rate” against the “employee flat rate” of 1,230 €.

Thus, you will enjoy the additional tax benefits from the home office flat rate if your income-related expenses exceed the employee flat rate of 1,230 €.

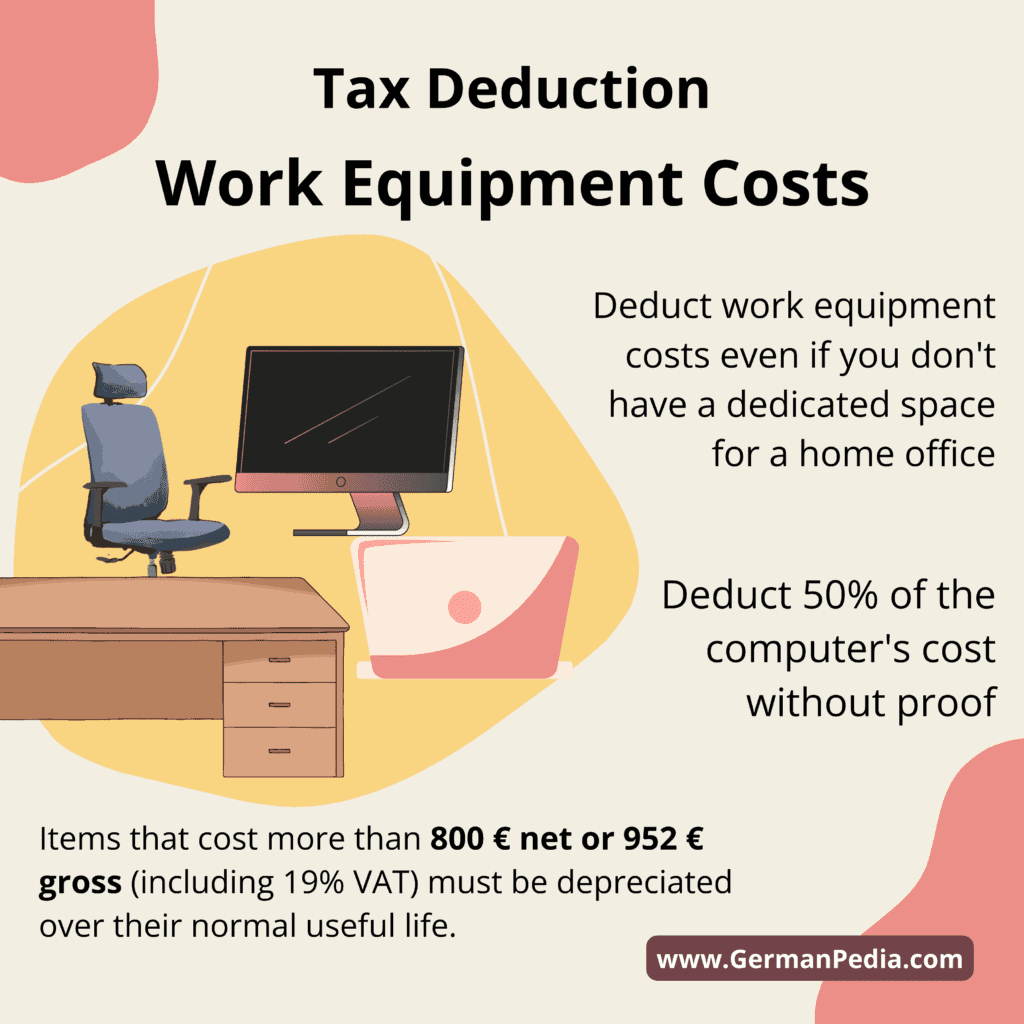

Costs related to work equipment (Arbeitsmittel in German)

You can deduct the costs of the work equipment (e.g., office chair, printer, computer, etc.) you bought from your income tax.

Moreover, you can deduct the work equipment costs even if you don’t have a dedicated space for a home office.

You can deduct the complete costs of the items you used at least 90% professionally.

Without proof, the tax office allows you to deduct 50% of the computer’s cost from your taxable income.

But you can deduct 100% of your computer’s cost if you use it at least 90% for office work. But, of course, in this situation, the tax office may ask for proof.

NOTE : Items that cost more than 800 € net or 952 € gross ( including 19% VAT ) must be depreciated over their normal useful life. It is called Geringwertigen Wirtschaftsguts (GWG) in German.

Corona masks

You can deduct the costs of the Corona masks you wore at work.

But as we also use masks privately, it isn’t easy to differentiate between private and work use. Thus, the tax office may refuse you a tax deduction.

Nevertheless, you should include the cost of Corona masks in your income-related expenses. Primarily if you work a lot from the office and use public transport to get there.

Corona tests

You can deduct the costs of the Corona tests from your taxable income if you fulfill the following conditions.

- Your employer requested the test

- You paid for the test yourself

- And you didn’t get a reimbursement from your employer

While filing the tax return, you can put the Corona tests’ costs under income-related expenses.

Other income-related expenses (Weitere Werbungskosten in German)

You can enter other expenses related to your work in Appendix N from line 47.

They may be

- application costs

- travel expenses for business trips not reimbursed by the employer

- cost of books that you professionally need

- double housekeeping

File and Save Income Tax in Germany

- Follow the steps and fill in your data to see how much tax you can save.

- It is a cheaper way to file income tax than hiring a tax advisor.

- Get tax-saving tips to maximize your tax return in the current and the following years.

Second home expenses at the place of employment ( Zweitwohnung in German)

You can deduct the second home expenses up to 1,000 € per month from your taxable income.

The expenses could be

- Rental costs

- Ancillary costs

- House tax on the second home

On top of the above expenses, you can also deduct the costs of furniture, lamps, curtains, etc.

The tax offices recognize up to 5,000€ as income-related expenses for furnishing and equipping the second home.

Moreover, you don’t have to provide proof of furnishing expenses up to 5000€ (Federal Ministry of Finance letter dated November 25, 2020, text number 108).

You can also deduct work equipment, telephone, and internet costs. Of course, if your employer doesn’t reimburse the expenses.

Celebration costs ( Feierkosten in German)

You can deduct the cost of celebration with your colleagues in your company from the taxable income.

You can even claim entertainment expenses (Bewirtungskosten) under certain conditions.

The tax office recognizes account management fees of up to 16 € without proof.

Car accident on the way to work

If you have a car accident on the way to work, you can deduct all the non-reimbursed costs from your tax return.

These can be

- car repair costs you bear yourself,

- damage to clothing and objects,

- medical expenses,

- travel expenses to doctors and workshops,

- legal, court, and expert costs,

- expenses for rental cars as well as salvage and towing costs.

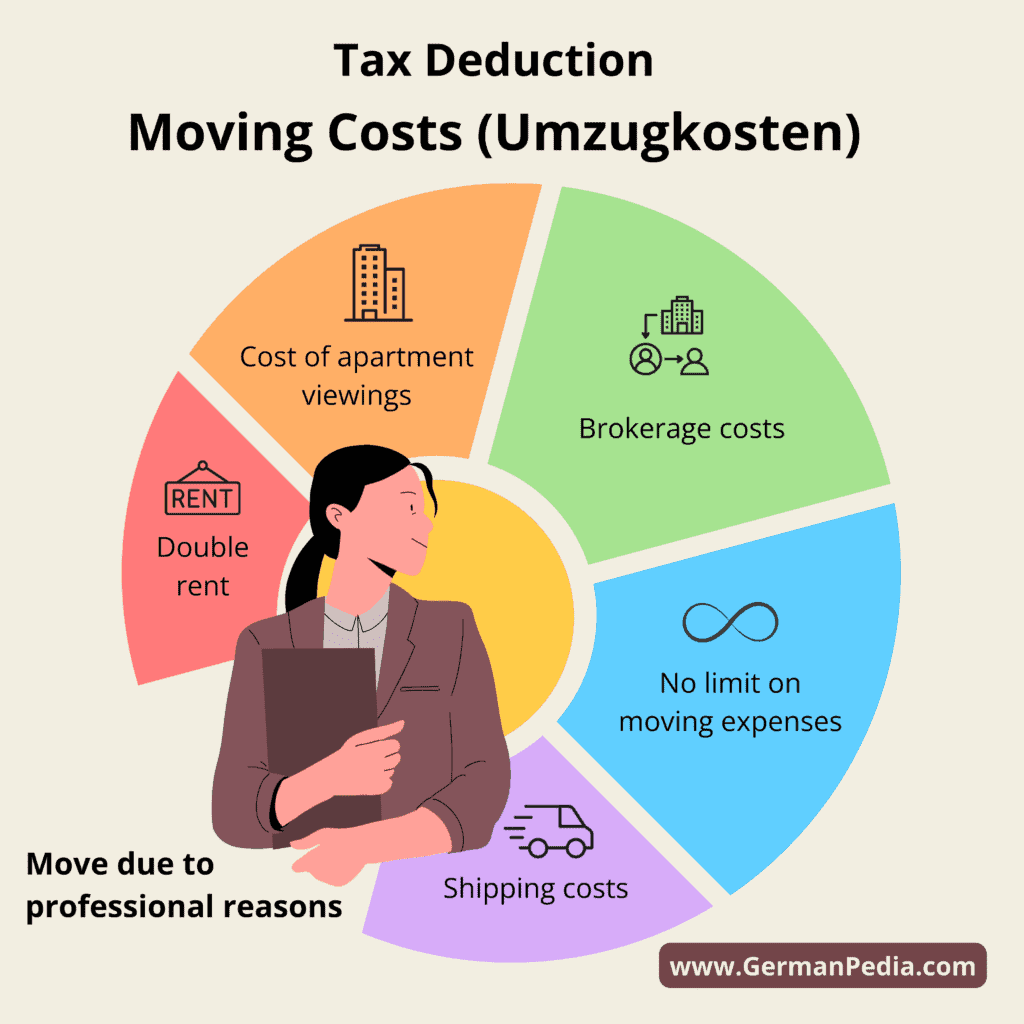

Moving costs (Umzugkosten in German)

Professional reasons

Moved to a new city or changed residence within the same city?

You can claim the moving costs as income-related expenses for tax purposes. But the move should be for professional reasons .

For example,

- move to work as a young professional,

- changed jobs

- were transferred by the employer or

- your daily commute to work has been shortened by at least one hour due to the move.

You can submit the following travel costs for tax deductions.

- Cost of apartment viewings,

- brokerage costs,

- shipping costs,

- double rent, etc.

The tax office puts no limit on moving expenses. You can deduct all the costs during tax declaration as long as you have the proof.

You can apply for a flat-rate relocation fee in your tax return if you don’t have proof of expenses.

The tax office revises the relocation flat rate every year. Thus, the date you moved determines which relocation lump sum applies to you.

Moreover, you can apply for a tuition fee lump sum in your tax return if your child needs private tuition because of moving to another federal state.

Private reasons

You can deduct 20% of the labor and travel costs if you move for personal reasons.

In this case, the relocation expenses come under the “household-related service” (haushaltsnahe Dienstleistung in German) category.

If you must move for health reasons, you can submit the expenses as an “extraordinary burden” (außergewöhnliche Belastung in German).

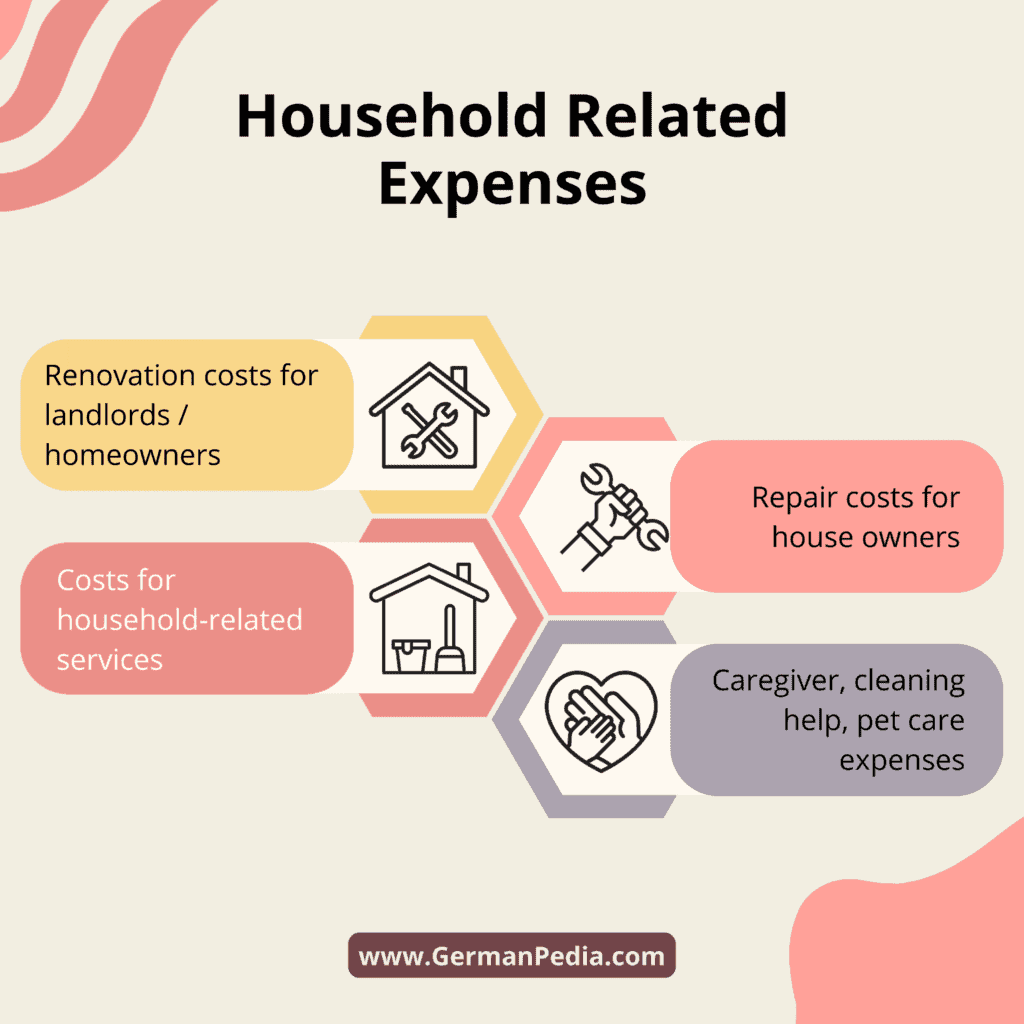

Household related expenses

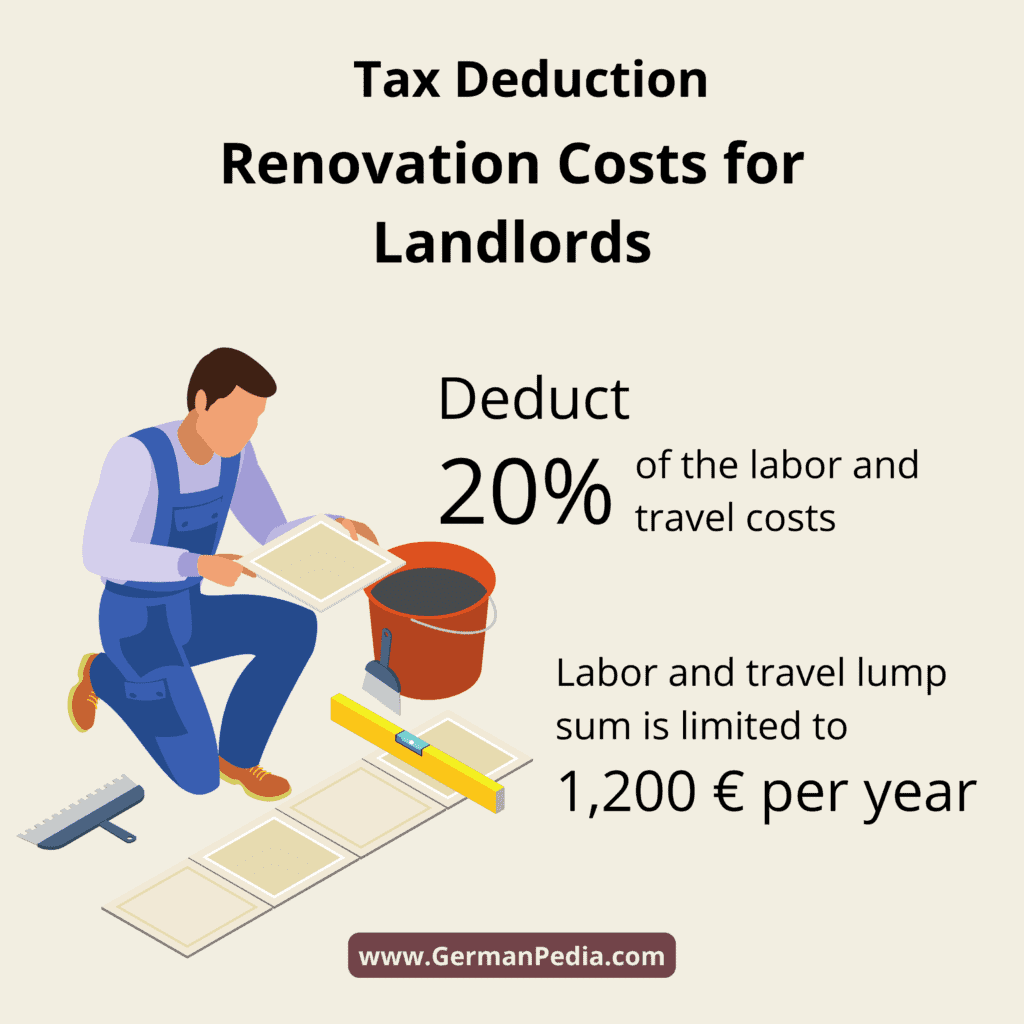

Renovation costs for landlords/homeowners

When filing a tax return, you can deduct an apartment’s renovation, repair, and assembly costs from your income.

- You can enter labor expenses (Handwerkerarbeiten in German) in your tax return.

- You get back 20% of the labor and travel costs as a tax rebate. The tax office limited the labor and travel lump sum to 1,200 € per year. Thus, you can state labor and travel invoices up to 6,000 € (20% of 6k = 1200 €).

- The craftsman’s equipment costs are also tax deductible but not material expenses.

NOTE : You must have invoices for all the costs incurred . And you pay the invoice via bank transfer instead of cash .

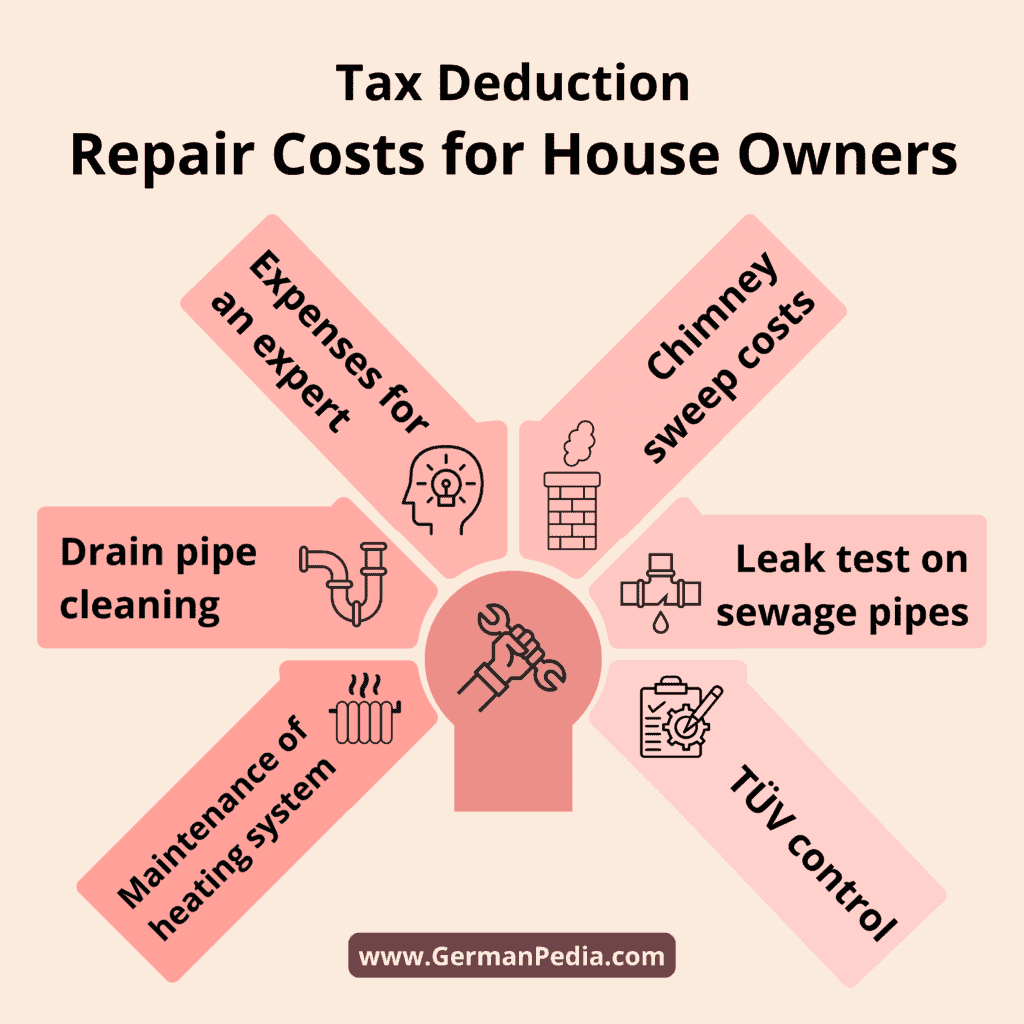

Other tax-deductible repair costs for house owners

According to a letter from the Federal Ministry of Finance (Bundesfinanzministeriums (BMF) in German) dated November 9, 2016, tax officials must also recognize the following items:

- Drain pipe cleaning

- Certain expenses for an expert, for example, for measurements on a stove, a gas boiler, or oil heating

- Leak test on sewage pipes

- Legionella test

- Complete chimney sweep costs

- TÜV control at the elevator

- Checking a lightning protection system

- Maintenance of the heating system

On page 25, the BMF letter lists which costs are eligible for a tax deduction. The letter also mentions which expenses fall into the category of craftsmen’s or household-related services.

Tenants may also deduct costs for household-related services

Tenants can enter all the labor costs for house repair or household-related services in their tax returns.

Usually, landlords transfer some of the house repair costs to the tenants. The landlords put such expenses in the utility bill. And you can enter these expenses in your tax return.

The household-related expenses could be

- expenses for the building’s caretaker (Hausmeister Service in German),

- stairway cleaning,

- the gardener,

- the chimney sweep,

- maintenance work or winter service, etc.

For the 2023 tax return, you can use the 2022 “service charge statement” (Nebenkostenabrechnung in German) that you received in 2023.

Caregiver, cleaning help, pet care expenses

You can deduct the following costs during your tax return.

- Caregiver expenses

- Cleaning help costs

- Costs related to the care of your cat or other pet

- According to current case law, the costs for a dog walk service can also be included

You must have the invoices for the costs incurred.

You can get back 20% of the total costs incurred. But the tax office put a limit of 20,000 € on such expenses. Thus, you can get a maximum of 4,000 € (20% of 20k) in a tax refund.

On top of it, you can get a tax refund of up to 510 € if you employ the household help as a mini-jobber.

Thus, you can get up to 4510 € (4000 € + 510 €) via the tax return.

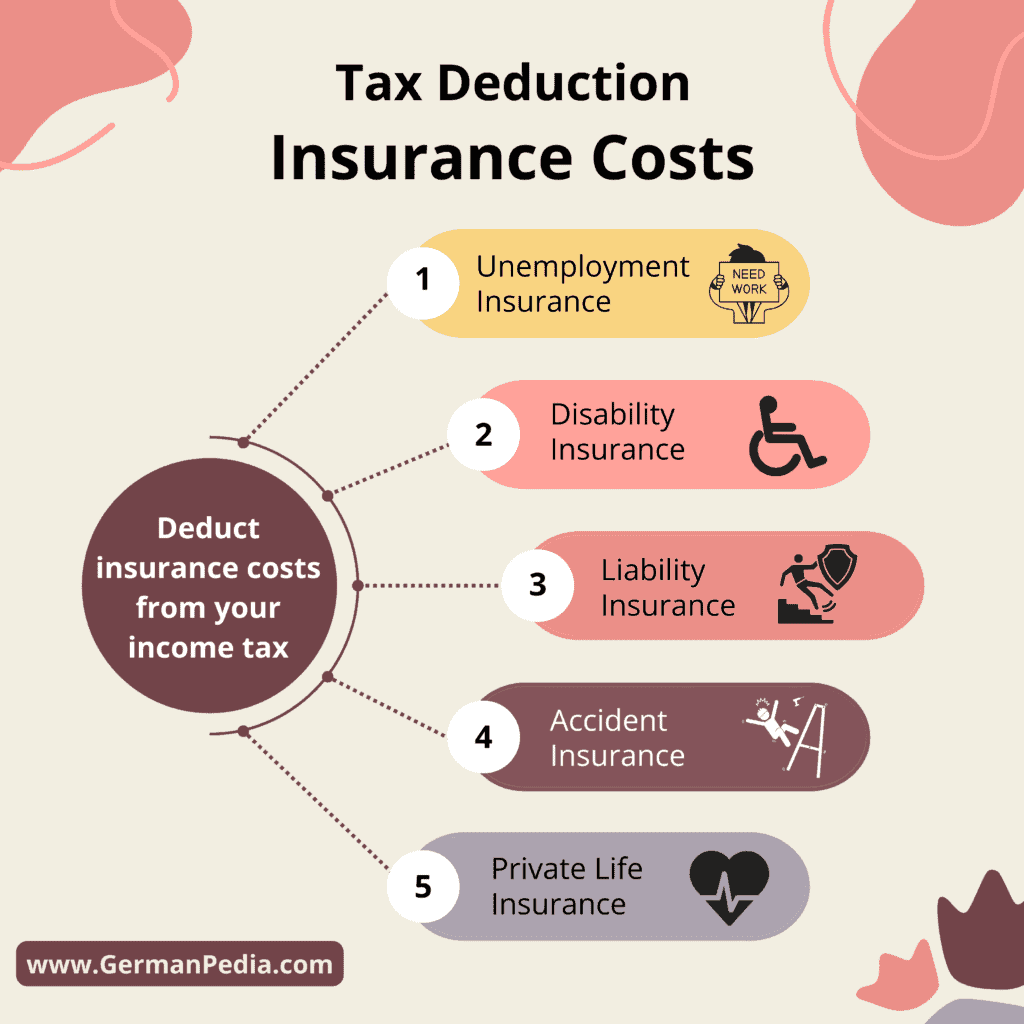

Insurance costs

Deduct social security contributions, insurance, and pension schemes.

You deduct the following insurance contributions during tax declaration.

- pension insurance (Rentenversicherung in German)

- health insurance (Krankenversicherung in German),

- long-term care insurance (Pflegeversicherung in German),

- unemployment insurance (Arbeitslosenversicherung in German)

You can fully deduct the contributions to the statutory health insurance (without optional supplementary benefits).

Similarly, you can deduct contributions to private health insurance . However, the tax office accepts contributions to basic coverage only.

If you paid for your child’s health and nursing care insurance, you can deduct it from your income tax.

Other tax-deductible insurances

The following insurances are also tax deductible if you took them before 2005.

- unemployment insurance (Arbeitslosenversicherung in German),

- disability insurance (Berufsunfähigkeitsversicherung in German),

- liability insurance (Haftpflichtversicherung in German),

- accident insurance (Unfallversicherung in German),

- and classic private life insurance (Privat Lebensversicherung in German).

If you took any insurance because of your job or business, you could deduct the contributions as income-related or operating expenses (for the self-employed).

For example, professional liability or accident insurance if you travel frequently for your company.

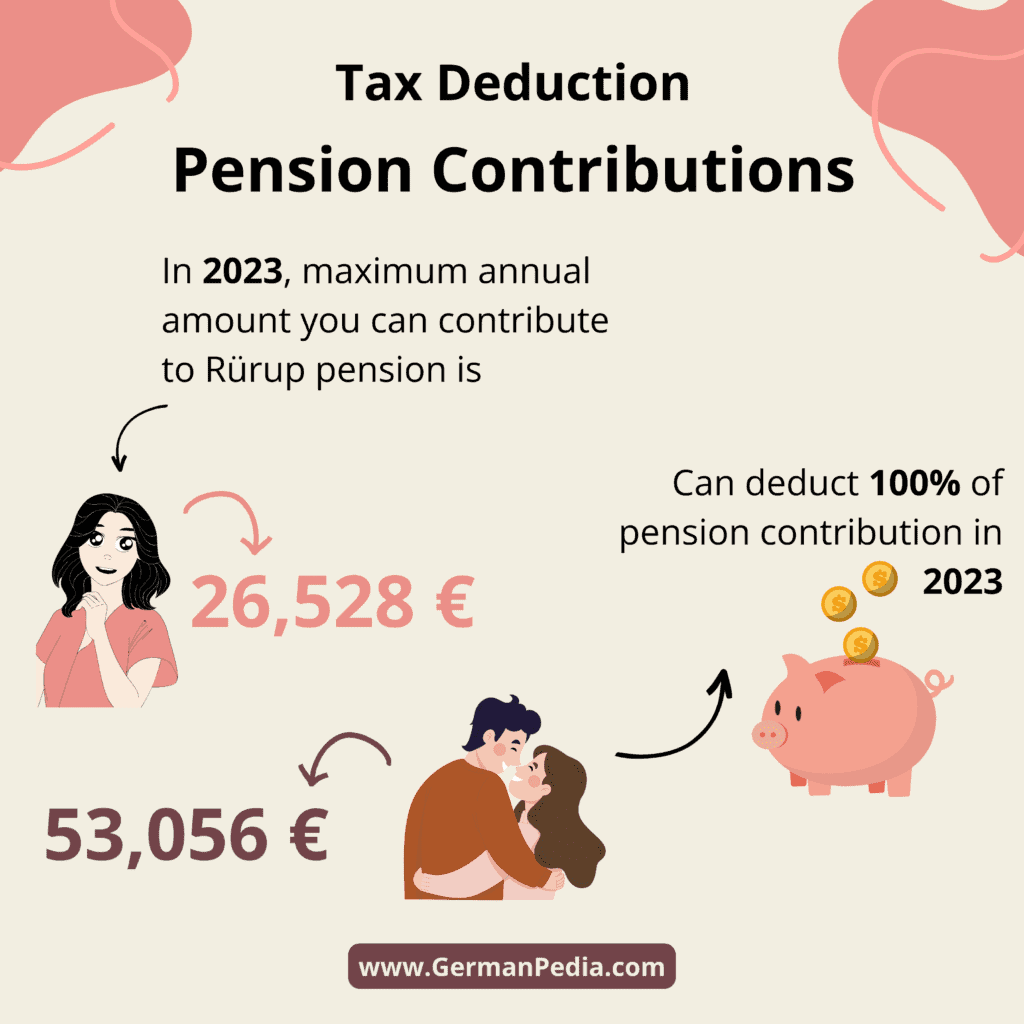

Deduct contributions to pension plans ( Altersvorsorgeaufwendungen in German)

You can also deduct the contributions to professional pension schemes or Rürup contracts.

In 2023, you can deduct 100% of your paid contributions while filing tax returns.

In 2023, the maximum annual amount you can contribute to your Rürup pension is

- 26,528 € for a single person, and

- 53,056 € for a married couple filing jointly.

And you can deduct all of it from your income tax return.

NOTE : The tax office deducts the tax-free employer’s contribution from the pension contributions while calculating the tax returns.

Riester savers

Do you have a Riester contract ? If yes, you can enjoy both; the Riester allowances and the tax benefits.

For those who don’t know what Riester is – it’s one of the many pension plans you can opt for in Germany.

The German government gives allowances to the people to support the Riester plan. These allowances are deducted before you make a Riester contribution.

For example, your annual contribution is 2100 €. You are eligible for a basic allowance, i.e., 175 €. Thus, your annual contribution amount reduces to 2100 – 175 = 1925 €.

On top of it, the tax office allows you to deduct the Riester contributions from your tax returns.

Annual allowances from the German government

You will get the following annual allowances from the German government.

- Basic allowance of 175 € per annum

- If you have kids, you get an allowance of 300 € (kids born after 2008) or 185 € (kids born before 2008) per kid per annum .

Minimum contribution amount

To be eligible for the allowances by the government, your annual Riester contribution should be at least 4% of your gross annual income.

For example, you earned 70,000 € gross last year. Then you must pay 4% of 70k, i.e., 2,800 € into your Riester account in the new year.

The insurance company automatically deducts the state allowances you are eligible for from your contribution. Hence, you only pay the remaining amount yourself.

Tax deductions

You can deduct the Riester contributions you made while filing your tax return.

The tax office limited the Riester contribution amount you can deduct during the tax return to 2100 €.

Thus, if your Riester contribution was 2800 €, you can deduct 2,100 € only.

On top of it, the tax office subtracts the allowances from your Riester contribution amount while calculating the taxes.

So, if you received only the basic allowance of 175 €, the tax office would deduct it from 2100 € for tax calculation purposes.

In other words, you save tax on the amount you actually contributed.

Different scenarios based on your situation

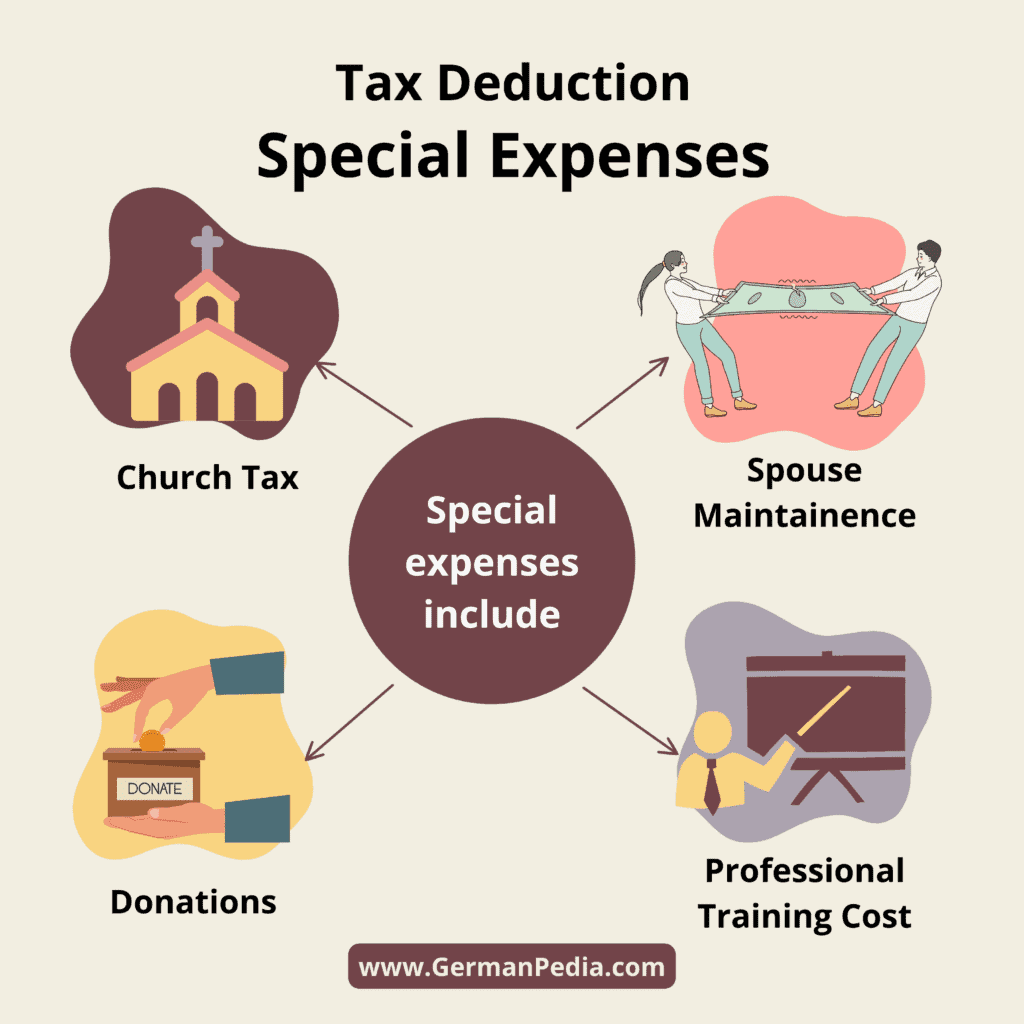

Special expenses

The tax office considers special expenses up to 36 € (72 € for married couples or registered life partners who file tax returns jointly).

The special expenses include

- Professional training expenses

- Maintenance payments to the ex-partner (“Unterhaltszahlungen an den Ex-Partner” in German).

Save tax as a student

While filing the tax return, you can deduct your tuition fee as a special expense. The prerequisite is that you start studying immediately after high school.

However, the tax office limited the amount you can deduct to 6,000 € per year.

You can also deduct the costs of further studies (e.g., master’s degree) as anticipated income-related expenses.

You also have the option to carry forward the study costs to later years. Hence enjoying the tax benefits in the future.

Deduct maintenance payments

You can deduct the maintenance payments you paid to your ex-partner. The tax office allows you to deduct up to 13,805 € as a special expense .

You can also claim the health and nursing care insurance costs (at least the basic protection) you paid for your ex to save taxes.

You enter the payment amount in the attachment, “special expenses” (Anlage Sonderausgaben in German), and in attachment U in section A.

In section B of attachment U, you need the payee’s (your ex’s) signature and tax identification number . This procedure is called Realsplitting in German.

If your ex refuses to sign section B of attachment U, the alternative is the deduction as an extraordinary burden.

But unfortunately, the maximum amount you can deduct in this situation is 10,908 €.

Deduct donations as special expenses .

You can deduct donations to a non-profit organization from your income to save taxes.

The tax authorities limited the tax-deductible donation amount to 20% of your total income. In addition, you must provide a donation receipt issued by the recipient to enjoy the tax benefits.

The tax authorities honor the donation to the following entities.

- Non-profit organizations

- Legal entities under public law, such as a university.

Every donation receipt pays off because special expenses reduce the taxable income as soon as they exceed the flat rate of 36 € (72 euros for jointly assessed persons).

A bank statement is usually sufficient proof of donations and membership fees of up to 300 €.

You can also use a bank statement as proof of more than 300 € donations. But, the payment must go to a special account (Sonderkonto in German), and you must pay it within a fixed period.

Donations to political parties

You can deduct half of the donations to political parties from your tax liability .

The tax office limited the amount to 825 € per year for individuals and 1,650 € for partners filing tax returns jointly.

Childcare expenses

You can deduct 2/3 of the childcare expenses per year per child as special expenses. However, the tax office limited the amount you can deduct to €4,000 per child.

The child must be part of the taxpayer’s household and below the age of 14.

Parents of children with disabilities

Parents of children with disabilities can deduct childcare expenses even if the child is older than 14.

The prerequisite is that the child cannot support themselves because of a disability that occurred before the age of 25.

Extraordinary expenses

Deduct medical expenses from your taxes ..

Depending on your income, marital status, and the number of children, you can deduct the medical expenses as extraordinary burdens (außergewöhnliche Belastungen in German).

The tax authorities consider medical expenses only if they exceed a reasonable amount.

The most common high medical expenses include glasses, dentures, physical therapy, and acupuncture .

You can also deduct

- the hospital and medical expenses,

- expenses for drugs prescribed by a doctor,

- the prescription fee,

- and travel expenses to doctors, hospitals, and pharmacies.

Thus, keep the receipts of your medical expenses to save taxes.

Besides that, you should also consider taking supplementary health insurance. The most important one is supplementary dental insurance to cover expensive dental treatments.

Funeral expenses

If a loved one dies and you pay for the funeral expenses, those expenses can be deductible. However, the costs must exceed the inheritance.

Cost of supporting a relative in need

You can deduct up to 10,908 € (in 2023) to support the people in need.

For example, supporting

- a destitute child for whom there is no child benefit (anymore),

- a relative, or your parents in need of care.

You can also claim contributions to basic health insurance and statutory long-term care insurance of the supported person if you paid them.

The tax office considers the recipients’ income, especially if the income is more than 624€.

German tax authorities consider a person in need if their net assets do not exceed 15,500 €. A self-used property is not considered an asset.

You enter the support expenses in the Extraordinary Expenses attachment (Anlage Außergewöhnliche Belastungen in German).

Cost of civil proceedings

Since 2013, you can no longer deduct the costs of civil proceedings. This includes divorces.

One exception is if you have to conduct a legal dispute to safeguard your economic livelihood.

In this situation, you can deduct all the legal and court expenses you spent to secure your vital income.

You can learn more about legal and court expenses in our guide on legal insurance in Germany .

Volunteering while being financially compensated

For volunteer work, you can accept

- Trainer flat rate (Übungsleiterpauschale in German) – up to 3000 € per year tax-free for volunteering as a trainer.

- Volunteering allowance (Ehrenamtsfreibetrag in German) – up to 840 € a year tax-free for volunteering in a non-profit organization.

You must enter the income from a part-time job or volunteering in Appendix N or Appendix S.

You can save taxes by using both flat rates. But not for the same activity.

Thus, you can enjoy tax benefits from both; the “trainer flat rate” and “volunteering allowance” if you hold multiple posts, remunerated separately.

For example, if you work as a trainer for a sports club and also look after the club’s treasury.

NOTE : Appendix N applies if an association employs you. However, you must submit Annex S if you are self-employed.

Loss from an investment

There are special rules for compensating for losses from an investment.

Here are a few points to consider

- If your expenses exceed your income in a year, you can carry the loss back to the previous year or forward to the following years.

- If you sell an investment at a loss, you can never offset this against other income , such as wages, pensions, or rentals.

- If you sell shares at a loss , this can only be offset against a profit from share transactions .

- If you sell investments (apart from stocks and futures) at a loss, you can offset this against other investment income – including a profit from the sale of stocks.

You can learn more about capital gain taxes in Germany here .

References:

- https://www.brutto-netto.de/wissen/steuern/altersvorsorgeaufwendungen/

- https://www.finanztip.de/steuererklaerung/

Categories:

The information provided in this post is based on our own experience and in-depth research. The content of this post might be inaccurate. It should not be considered financial, tax, legal, or any kind of advice.

We are not certified brokers or consultants. Always do your own research and contact certified professionals before making any decision.

We finance our extensive work via affiliate links. Thus, some or all of the links in the post might be affiliate links.

We get money if you click on such a link or conclude a contract with the provider without costing you a cent extra.

All links marked with the “*” are affiliate links.

Other useful guides

Is your child ready for school in germany, requirements to enter gymnasium in germany, private vs public schools in germany, motor vehicle tax in germany [2024 english guide], car theft coverage by car insurance in germany, is voluntary tax return worth it in germany [2024 guide], home insurance in germany | insure household contents, drone liability insurance in germany [2024 english guide], best dog liability insurance in germany [2024 english guide], employer refuses to pay wages: employees right in germany.

Subscribe to get free welcome kit

The welcome kit contains

- Links to important guides at one place

- Tips to save money every year

- Tips to earn money in Germany

- Know your rights as a tenant

- Cheatsheet on saving taxes

- NETHERLANDS

- SWITZERLAND

Expat Info Articles

7 tax allowances and deductions you should know about in Germany

German tax law allows for numerous lump sums, tax allowances and deductions that you can use to decrease your taxable income and generate huge tax savings. Many of them don’t even require proof or receipts – and sometimes you can deduct the full amount even if your expenses aren’t that high! Natascha Manthe from wundertax walks you through the seven most important tax rules all expats in Germany should know about.

Want to save money on your tax bill? Make sure to take advantage of these allowances and deductions on your annual tax return!

1. Income-related expenses lump sum

The German tax office grants a 1.000-euro (in 2021) income-related expenses lump sum ( Werbungskostenpauschale ) that you can deduct for any costs incurred through your work. From the 2022 tax year onwards, this lump sum will be increased to 1.200 euros per year.

It’s automatically deducted from your taxable income, so you don’t need to provide any proof or receipts - even if your actual expenses don’t add up to this amount. If you exceed the lump sum with travel expenses, work equipment, further education, home office expenses, and so on, the costs can be deducted individually - and you will need to provide proof.

It’s worth noting that, if you didn’t work the entire year, you’ll only receive the full lump sum for income-related expenses if you file a tax return!

2. Basic tax-free allowance

The basic tax-free allowance ( Grundfreibetrag ) ensures that you only pay income tax on your annual income above a certain threshold. In 2021 the basic tax-free allowance is 9.744 euros and will be increased to 10.347 euros in 2022.

The same rule applies here: if you haven’t worked the entire year, you can reclaim taxes by submitting your tax return.

3. Commuter allowance

If you commute to work, you can claim 30 cents per full kilometre of your commute with the commuter allowance ( Entfernungspauschale ). From 2021 onwards, long-distance commuters will also receive 35 cents per kilometre from the 21st kilometre of one-way travel and this will increase again to 38 cents from 2022 onwards. Please note that the allowance can only be claimed one way, so either for your outward or return trip.

The commuter allowance can be claimed regardless of which form of transportation you use. Whether you commute by public transport, bike, in a carpool, or even on foot, you can claim the 30 cents per kilometre!

4. Home office lump sum

Are you one of the 25 percent of all professionals who worked from home in 2021? If so, you can benefit from the home office lump sum ( Home-Office-Pauschale ): a lump sum of 5 euros per day worked from home that can be claimed on your tax return - up to 120 days per year!

If you worked from home for (at least) 120 days, you already have 600 euros in income-related expenses in your pocket. You can easily exceed the income-related expenses lump sum, for example, by claiming the commuter allowance for the days you worked from the office.

The home office lump sum can also be used by freelancers and self-employed people. In this case, the lump sum is deducted as a business expense.

5. Save taxes with volunteer work

As of January 1, 2021, anyone who takes part in volunteer work or volunteers as an exercise leader in Germany can save more money on their tax return. The volunteering allowance ( Ehrenamtspauschale ) has been increased to 840 euros, and the lump sum for exercise leaders ( Übungsleiterpauschale ) has been increased to 3.000 euros per year.

These lump sums can be claimed for your part-time volunteering commitment without you having to pay tax or social security contributions on them.

6. Lump sums for additional moving expenses

You can also claim expenses incurred from moving for professional reasons on your tax return, as income-related expenses. There is, however, a distinction made between “general moving costs” ( allgemeine Umzugskosten ) and “additional moving costs” ( sonstige Umzugskosten ).

General moving costs such as moving company expenses, forwarding agencies, and doubled rent payments can be deducted in full if you provide proof.

Additional moving expenses can be deducted as a lump sum without providing any proof, even if the expenses were low. From April 1, 2022, the moving allowance is 886 euros for the eligible person and 590 euros for each additional household member.

Additional moving expenses include, but are not limited to, expenses incurred from:

- Newspaper advertisements

- New telephone connections

- Vehicle re-registrations

- Trips to various authorities

- A portion of the costs of renovation / cosmetic repairs at your old residence

- Tips / meals for movers

- Curtains, curtain rods, and blinds

- Light installations in your new residence

- Dismantling / installing household appliances

- Registering your child(ren) at a different school

7. Special expenses

Certain costs incurred in your private life can also be categorised as special expenses ( Sonderausgaben ) and claimed on your tax return. The tax office automatically grants a 36-euro lump sum for special expenses (or 72 euros for married couples filing a joint tax return), but this lump sum can easily be exceeded with other kinds of expenses, for instance:

- Retirement provisions : Contributions to statutory and private retirement insurance funds, occupational pension provisions, Riester and Rürup pension plans

- Insurance : Contributions to health insurance, long-term care insurance, additional insurance such as accident, liability or employment, and occupational disability insurance

- General special expenses : Alimony, childcare expenses, church tax, donations, educational fees, initial vocational training costs

Not only do lump sums, allowances and flat rates simplify your tax return by allowing you to deduct expenses without having to provide any proof or receipts, but they also allow you to claim back tonnes of taxes as well! And with wundertax’s user-friendly interface , claiming deductions couldn’t be simpler. Get started today to secure an average tax refund of 1.072 euros.

Natascha Manthe

Natascha works as a Content Manager at wundertax. She loves to dive into tax topics and put them into easy-to-understand form. The other half of her heart belongs to acting:...

JOIN THE CONVERSATION (1)

Leave a comment

LisaMarkinson2 15:32 | 10 April 2023

Thanks for sharing this article on tax allowances and deductions for expats in Germany. As someone who is new to the country, navigating the tax system can be overwhelming, so it's great to have resources like this to help me better understand what I'm entitled to. However, my issue is that I wouldn't like to track all of this myself. I recently came across Richmond Blackwood (https://www.richmondblackwood.com/en) who offer personal expense management and tax optimization services for high-earners like myself. Have you spoken to them by any chance? I'm intrigued and plan to reach out to them soon to see if they can help me make the most of my finances in Germany.

Tax return Germany | 49 deductible expenses

- share

What is Steuererklärung – income tax return Germany?

Steuererklärung – Germany tax return is a declaration by which those who are employed or have their own company (Gewerbe) in Germany present to the tax office (Finanzamt) their income and costs in real figures.

You can complete the Steuererklärung – your tax return in Germany either as a paper form or electronically.

After submitting your tax return in Germany, the tax office (Finanzamt) determines how much tax you have to pay as a taxpayer.

Furthermore, the Finanzamt will determine whether you still owe money to the tax authorities or whether you should get money back, depending on your expenses and type of income.

SteuerGo * has launched the online application for completing the Steuererklärung – Tax return in Germany in ENGLISH !

The link below will take you to the tax return calculator Germany, which can be filled out directly in English:

ONLINE HELP in ENGLISH for filling in the tax return in Germany Steuererklärung*

Who has to fill in the Steuererklärung – tax return Germany?

You will have to file tax return in Germany if in the year for which you are filing your tax return you have received:

- unemployment benefit (Arbeitslosengeld)

- sick leave paid by the health insurance fund (Krankengeld)

- short-time working allowance (Kurzarbeit)

- parental allowance (Elterngeld)

- financial aid from the employment office (Jobcenter)

You must also complete the tax return and submit it to the Finanzamt if:

- in that year you received salaries from several employers

- as spouses you have chosen income tax combination III/V or the factor has been entered for tax class IV

- if your spouse does not work in Germany, you will need to present the EU/EWR European Income Tax Form to the tax office (Finanzamt)

- whether tax exemptions are specified on the annual payroll tax slip (Lohnsteuerkarte)

- you remarried in the year of your partner’s death

- you remarried after getting divorced in the same year

- you have earned additional income or income subject to progressive taxation exceeding EUR 410

- if you have a certain degree of disability, if you receive a disability pension or sickness pension

- if you are a legal person, i.e. if you have your own company (Gewerbe), regardless of whether you work as an employee or not

- if your local tax office (Finanzamt) requires you to file a German tax return – Steuererklärung – even if you do not fall into any of the above categories

In addition to the above examples some other possibilities exist.

Why should you fill in the Steuererklärung – Germany tax return, even if you don’t fit into the above categories?

Even if you don’t have to file a Steuererklaerung – tax return in Germany, it’s worth doing.

Especially when you have deductible expenses (see below) you can almost always expect to get some of your tax back.

And sometimes the amounts can be very interesting.

What income is taxed in Germany?

According to steuern.de there are several types of income that are taxable and must be declared. This is income earned from:

- employment or self-employment

- in a company or commercial enterprise

- capital assets (interest, dividends, price gains on sale of shares and others)

- rent and lease, obtained in Germany. Income earned in this way, at least in an European Union country, is not taxed in Germany.

- state pensions or pensions provided by the companies you work for

- agriculture and forestry (obtained in Germany). The incomes obtained in this way in Romania are not taxed in Germany.

- special pensions, subsistence payments, parliamentary allowances and miscellaneous income from private sales transactions

Can income from inheritances or gifts be taxed?

Although this type of income does not fall under German tax law, it is subject to taxation (by a special law).

Is income from gambling (e.g. lottery winnings) taxed in Germany?

Income from gambling in Germany is not taxed.

So good luck with the money you win on the lottery!

Tax return Germany deadline

From 2018, the tax return Germany deadline depends if you seek the advice of a tax adviser in Germany or not:

Persons who are obliged to file a tax return and who do NOT seek the advice of a tax consultant/accountant (Steuerberater):

Steuererklärung – tax return in Germany must be filed by the end of July of the following year (e.g. 31.07.2021 for 2020 tax return)

Those who are obliged to file a tax return and who seek the advice of a tax consultant/accountant (Steuerberater):

Steuererklärung – the German tax return must be filed by the end of February in another year (e.g. 28.02.2022 for the 2020 tax return)

Does Corona pandemic has any impact on the tax return Germany dealine?

Yes, due to the Corona pandemic the deadline to file the tax return in Germany for the year 2020 has been exceptionally extend with 3 months.

Thus, the tax return dealine Germany for 2020 is 31st of October 2021 (without tax adviser) and 31st of May 2022 with tax adviser.

What expenses can be deducted from tax in Germany?

Here you can find the types of expenses that can be deducted from your tax with the Steuererklärung – Germany tax return.

What exactly does this mean?

You will get some money back if you declare them as expenses.

Typical tax-deductible expenses in Germany for a household

- Handwerkerrechnungen über Reparaturen oder Modernisierungen – labour (e.g. bathroom renovation, heating maintenance, chimney sweeping, gardening)

- Costs for household help, e.g. for cleaning, ironing or cooking (Hilfen im Haushalt)

- Expenditure on care for the older persons (Aufwendungen für die Pflege alter Menschen)

- Childcare costs (Kosten für die Betreuung von Kindern)

- Funeral expenses (Beerdigungskosten)

- Medical expenses for you and your family members (Krankheitskosten auch für Familienangehörige

- Maintenance payments to relatives in Germany or abroad (e.g. spouses, children, parents, grandparents, divorcees) Unterhaltsleistungen an Verwandte im In- oder Ausland (z. B. geschiedene Ehegatten, Kinder, Eltern, Großeltern)

- expenses due to disability (Aufwendungen aufgrund von Invalidität)

- Income tax return Germany consultancy costs (Steuerberatungskosten)

- Donations (Spenden)

- Riester / “Rürup” pensions

- Certain types of insurance (Zahlungen an Versicherungen)

- Expenses for substitute or supplementary schools (Schulgeldzahlungen an Ersatz- bzw. Ergänzungsschulen)

Tax-deductible expenses in Germany for those who are employed

(in German: Werbungskosten bei Einkünften aus nichtselbstständiger Arbeit)

- Moving costs (Umzugskosten)

- Costs you have when applying for a job: photos, CV writing, translations, certificates, files, travel to interviews (Bewerbungskosten)

- Expenses related to the space/room where you work (Arbeitszimmer)

- Expenditure on clothing for work purposes (Arbeits- und Berufskleidung)

- Language courses and vocational training courses (Ausbildung / Weiterbildung)

- Work equipment, used for professional purposes – electronic equipment, furniture, bags (Arbeitsmittel)

- Costs resulting from accidents to and from work (Unfallkosten)

- Travel expenses and travel abroad (Auslandsreisen und Reisekosten)

- Expenses related to participation in professional conferences (Fachtagungen)

- Membership fees to trade associations, e.g. trade union membership fees (Beiträge zum Berufsverband)

- Purchase of professional books or journals (Fachbücher/Fachzeitschriften)

- Meal expenses taken for business purposes (Bewirtungskosten)

- Charges for telephone calls for work purposes (Telefonkosten)

- Double budget household (doppelte Haushaltsführung)

- Travel expenses on the way to work (Fahrtkosten)

- Bank account maintenance fee (Kontoführungsgebühr)

- Expenditure on the purchase of a computer, laptop (Computer)

Tax-deductible expenses in Germany for those who rent, lease or lease back in Germany

(in German: Werbungskosten bei Einkünften aus Vermietung und Verpachtung)

- Depreciation of fixed assets (Abschreibungen)

- Rental search ads (Annoncen im Zusammenhang mit der Mietersuche)

- Membership fees for landlords’ clubs (Beiträge zum Hausbesitzerverein)

- Tax on leased land (Erbbauzins)

- Costs of registration or amendment of the land register (Erschließungs-/Anschlusskosten)

- Financing costs of real estate purchases (Finanzierungskosten)

- Property tax (Grundsteuer)

- Heating costs of rental properties (Heizkosten)

- Costs of landscaping (Gartenanlagen)

- Cable TV/Internet connections (Kabelanschluss)

- Rental agreement forms (Mietvertragsformulare)

- Purchase of furniture (Möbel)

- Fees for lawyers and litigation costs in connection with disputes with the tenant and service providers (Rechtsanwalts- und Prozesskosten)

- Repairs (Reparaturen)

- Installation of satellite antennas (SAT-Schüssel)

- Administrative costs, such as written correspondence and telephone calls to the tenant (Verwaltungskosten)

- Rainwater (costs for drainage) (Wasser – Kosten für Entwässerung)

- Other expenditure on rental of immovable property (Vermietung/Immobilien)

What documents are required for the Steuererklärung – Germany tax return?

Information about you and your family (allgemeine angaben).

Here you need ID cards and passports, tax number, etc.

Income for the year for which you make the tax return (Einkommensnachweise)

Here you will find documents such as the annual payroll tax slip

(Lohnsteuerbescheinigung) or evidence of compensation payments, etc.

Deductible expenses for employment income (Werbungskosten aus nichtselbständiger Arbeit)

Among the evidence you need here are receipts for various deductible expenses such as the purchase of equipment or proof of distance travelled to work and number of days worked, etc.

Evidence of deductible expenses for income from renting, leasing, leasing (Werbungskosten aus der Vermietung von Wohnraum)

For example, here you have to prepare documents proving the amount of interest, whether you have taken out a bank loan to buy a property, maintenance costs, and so on.

Deductible child care and education expenses (Kinder)

For this category of expenses you need to prepare evidence of childcare costs, school fees, health insurance and childcare contributions for privately insured children, etc.

Evidence of special deductible expenses (Sonderausgaben)

In this case you need proof of special expenses such as insurance, donations, training costs, etc.

Extraordinary expenses (Außergewöhnliche Belastungen)

It is best to have proof of expenses related to health, treatment, burial, etc. ready, if applicable.

Other documents (Weitere Unterlagen)

Among the documents you may need here are invoices for various services from the carpenter, electrician, plumber, or home maintenance services.

How to file tax return in Germany?

There are three options for completing your tax return in Germany – Steuererklärung:

1. Fill out the Steuererklärung with a tax return calculator Germany, in English

For completing your Germany tax return online I recommend:

SteuerGo.de*

SteuerGo is an online application from Germany, in English . With the help of this tax return calculator Germany you can quickly fill in the Steuererklärung from your PC, tablet or mobile phone.

According to the SteuerGo website, SteuerGo users recover, on average, more than €1,000 per year from the German state.

Important: the SteuerGo platform is recognised by the Finanzamt and is (also) in English.

2. Ask for help from a financial advisor – Steuerberater in Germany

A Steuerberater in Germany is the financial advisor who helps you complete your tax return in Germany (Steuererklärung).

The cheapest way is to contact an association of financial advisers who can help you to complete your tax return in Germany.

Such associations are called Lohnsteuerhilfeverein.

3. You complete your tax return in Germany ALONE, without any help

To do this, you need to be very familiar with: the German language, the specialist terms used in the tax return and what expenses are deductible.

For this you can use the German tax authorities’ online application ELSTER (elektronische Steuererklärung – electronic tax return).

The advantage is that it doesn’t cost you any money, and the disadvantage is that you can make a lot of mistakes if you’re not good at it.

Short recap

What is steuererklärung – tax return in germany.

It is a declaration in which those who are employed in Germany or have their own company present their income and costs for the previous year to the tax authorities (Finanzamt).

Where can you get the form to fill in the Steuererklärung – German tax return?

If you use the SteuerGo * online application you will automatically have access to the form.

You can alternatively find the form on www.elster.de

Who has to fill in the Steuererklärung – the German tax return?

Although only certain categories of people are required to file a tax return, depending on their income type, I recommend that you do so every year.

This way you can get good money back from the Finanzamt.

Income from employment and self-employment, rents, stock market earnings and so on.

By when must the Steuererklärung – tax return – be filed in Germany?

Usually by 31 July of the following year.

You can find some of the types of expenditure above. To these are added many more each year.

In addition to personal identification documents, prepare all proofs of payment, invoices, contracts you have made for tax-deductible services.

How can you fill in the Steuererklärung – tax return in Germany?

- With the help of a tax return Germany calculator in English SteuerGo *

- With the help of an association of financial advisors – Lohnsteuerhilfeverein

- By using ELSTER from the German tax authorities

Important notice:

The information on germansuperfast.com and in this article is gathered with great care, from the most reliable sources and after long research. However, the information may be incomplete, incorrect or may not accurately reflect your case. Therefore, if you need a specialist opinion, please contact a financial advisor in Germany (Steuerberater).

Links marked with * are affiliate links. If you use these links to purchase the services of our partners, we will receive a small commission from which we pay the administration costs of this site. But for you, it won’t cost you anything extra.

Average Salary in Germany | Region, Gender, Education

List of Audio Books to Learn German for Beginners

© 2024 GermanSuperfast

Products and features may vary by region.

Your guide to tax deductions in Germany for 2023

Filing your tax return in Deutschland? Find out which expenses are tax deductible. Plus, learn about a practical tool designed to make your 2023 tax return a breeze.

10 min read

From after-lunch power naps to meetings in sweatpants and a 30-second commute from your bed to your desk — working from home has some advantages. And now, thanks to some recent changes in the tax code, employees who work from home can benefit from brand new tax deductions on their 2023 tax return! Read on to learn about the updates, whether you need to submit your return in 2024, what you can claim for 2023, and more. We’ll also show you some practical tools that will help you with your return.

Why should I file a tax return in Germany?

Let’s be honest — filing your taxes can be a pain. Like many of us, you’ve probably put “file my tax return” on the back burner, or even thought about skipping it altogether.

However, employees can deduct a variety of expenses from their taxes, and by doing so, could qualify for a hefty tax refund. According to the Federal Statistical Office , in 2019, over 88% of all unlimited income taxpayers (those with a permanent residence in Germany) who filed a tax return received a refund. And the amount is nothing to sneeze at — the average refund that year was up to €1,095! This means that filing a voluntary tax return could definitely be worth your while.

Plus, thanks to brand new tax deductions for your 2023 return, your refund could be even higher this year. There’s never been a better reason to roll up your sleeves and start adding up your expenses.

Budgeting made easy

When is the deadline for submitting my 2023 tax return?

Want to submit your tax return voluntarily, but worried about meeting the deadline? Don’t stress — you now have until December 31, 2027.

However, there is a catch. If you received more than €410 of so-called “wage replacement benefits” ( Lohnersatzleistungen ) as an employee in 2023, such as unemployment benefits, sick leave benefits, or parental leave, filing an income tax return isn’t optional — you’re obligated to do it. In this case, you’ll need to file your income taxes by September 2, 2024 if you’re doing it yourself. If you use an accountant to file for you, the deadline can be extended until June 2, 2025.

What expenses can I deduct from my taxes?

From your commute to paper clips and even account maintenance fees for your bank account — here’s a handy list of deductions you may be able to claim:

- Work-related deductions: You’ll be able to declare any work-related expenses on your tax return, as long as you weren’t reimbursed by your employer. These include work equipment such as office supplies and work-related books or literature, expenses related to job applications such as postage and photocopies, as well as training courses, language classes, travel expenses, or professional relocation costs. You can also deduct bank account maintenance fees from your taxes — a lump sum of €16 per year can be claimed, regardless which month you opened your account .

- Commuting expenses: Work-related deductions also include the cost of commuting to work. You can deduct 30 cents per kilometer for every working day — but only for the one-way distance. From the 21st kilometer, it’s 38 cents. Didn’t drive to work? No problem! The means of transport makes no difference, so you can deduct commuting expenses even if you cycled or walked to work.

- Internet and telephone: If your job requires you to use your private internet, telephone, or smartphone, you can deduct these costs at a flat rate of 20% per month as work-related expenses — up to a maximum of €20 per month.

- Home office costs: Work-related expenses also include expenses for your home office. Starting in 2023, however, your home office needs to be the center of your entire professional activity — as long as that’s the case, all costs you incurred are deductible without any restrictions. Alternatively, you can make use of the annual lump sum ( Jahrespauschale) of €1,260.

- Insurance costs: When filing your tax return, you can declare both your and your employer’s share of social security contributions — this includes your health insurance, long-term care insurance, unemployment insurance, and pension insurance. In addition, you can also declare a proportion of your private liability insurance, if you have one.