Work-related travel expenses – What can you claim

It does not matter if you are an employee, an employer, a sole trader or run a small business; there might occur some situations when you need to travel for business purposes. The costs incurred in such conditions are classified as work-related expenses.

Work-related travel expenses are usually tax deductible. However, the Australian Taxation Office gets thousands of incorrect claims every year for work travel expenses. As a result, they have started keeping a close eye on the expenses that are being claimed to make sure they are valid.

Understanding how to qualify for such deductions and which expenses can be used to help you optimise your travel costs as well as save money on your taxes is a necessity today. So here’s a guide to help you know everything when it comes to business travel expenses.

What are work-related travel expenses?

According to the ATO, while travelling for work, any purchase you make in regard to this travel is usually claimable as a travel expense on the tax return. The travel can be driving your car to the client’s office situated kilometres away (from your office) or visiting a temporary location for work. Along with this, interstate and overseas travel expenses are also deductible.

Work-related travel expenses include ticket costs or fares for any modes of transportation, tolls, parking, etc, along with meal expenses and accommodation. There are some restrictions as well on what you can claim. We will look into that in the later part of this blog.

Here’s what you can claim:

- Accommodation expenses

- Incidental expenses (like laundry)

- Taxi, bus, train and air fares

- Road and bridge tolls

- Car hire charges

- Parking fees

- Meal expenses (only for overnight travel for work)

- Bags used solely for a work trip

Claiming work-related driving costs

When it comes to travel tax deductions, transport costs are extremely popular. Except for the travel from work to home and vice versa, the cost of work-related travel in your personal car or on a means of public transport is claimable.

What can you claim?

You can claim a deduction for the cost of:

- Travelling between two separate workplaces for different jobs

- Travelling from your workplace to meetings or events offsite

- Travelling from one job to a second job if and when required

- Travelling to a different location, if you work at more than one location for your employer

- For those working from home for a specific period of the day and working in the office for the rest of the working hours (but only for the same employer), the cost of travelling to the workplace is claimable.

You can’t claim a deduction for the cost of:

- The everyday travel from your residence to the workplace and back

- If you work from home for one employer but not for the other employer, your cost of travelling to a second job can’t be claimed.

- Any additional task or work you do on your way back home, for instance, picking up your package

Car parking – Is it a travel expense?

Suppose you had an out-of-office company event or meeting. In order to park your car, you had to pay for parking as you used your own car to get there. In this case, you can claim the cost of the trip and the parking costs.

However, you cannot and should not claim parking or car expenses if you have been reimbursed by your employer.

You cannot claim the cost of everyday parking as well if you drive to work and have to pay for parking near the workplace.

What documentation of work-related travel expenses should you keep for your tax return?

You should keep everything that is relevant to your tax returns. Work-related vehicle charges can be claimed by receipts or tax invoices, which serve as documents supporting a specific order.

However, remember, those fade over time. A logbook can be very useful when claiming employment-related trips.

Travel diary – Do you have to keep one?

Anybody who has to stay away from home for more than six nights consecutively should keep a travel diary. But what should be recorded in a travel diary?

In the travel diary, you can keep a record of what you were doing, where you were and the start and end times of the activities you were engaged in.

It is always a good idea to keep a record of your travel expenses, even when keeping a diary isn’t really required. Since there’s a possibility of you forgetting details about all the expenses made in the months, it can cost you a huge amount in your refund at tax time.

What can’t be claimed?

Since we have discussed what work-related travel expenses can be claimed, now take a look at the expenses that can’t be:

Unless your employer has assigned you to carry bulky tools to work (due to lack of an appropriate place to store them at the workplace), you should not claim a tax deduction on your journey from home to work and back home.

Also, claiming the travel expenses for which you have been reimbursed by your employer is also prohibited.

In case you decide to bring your family along for a business trip, you cannot claim accommodation costs or any travel expenses for them.

Ask your tax agent to know more about what can be claimed or cannot be. If you are looking for good tax accountants in Melbourne, Clear Tax Accountants can help you reduce your tax responsibilities and provide the right advice for your tax matters.

Travel allowance

Usually, the travel allowance you receive from your employer is considered taxable income. Thus, it needs to be listed on your income statement. In simpler terms, if you receive a travel allowance, it is going to be included on your tax return as taxable income.

If you spend the money paid to you as travel allowance, claiming a tax deduction against it when the tax time comes is possible. There is a common misconception that the entire allowance can be claimed as a tax deduction even if you haven’t spent all of it. This is not true at all.

Travel records – What to keep

What travel records are worth keeping? There is practically no record that is not worth keeping. You should have all the receipts and records for all the travel expenses related to work, even if you were reimbursed for it.

Record keeping will help you ask your tax agent if you can claim certain work-related travel expenses (in case you are doubtful).

Remember, you can’t claim something if you do not have anything to prove it!

What if you travel for work and then spend an extra few days on holiday at the end of the trip?

When your travel is split between leisure and work, you need to split all your travel expenses between the two as well. You must keep the following two rules in mind in these circumstances:

- The primary purpose of the trip has to be work-related

- You cannot claim any part of the said trip that wasn’t work-related

To understand it better, consider that you had to go on a three-day work-related trip. But you decided to extend your trip by two more days. Since only the first three days were for work, you can claim work-related travel expenses for those days.

You cannot claim the cost for the next two days because you spent the money on your leisure. The accommodation costs incurred in the first three days, the fares of the taxi for travelling to and from (only work-related) and the meal expenses for that time are claimable but not for the remaining two days.

If you want to claim a deduction for any work-related travel expense, you will have to keep a few restrictions in mind. Keeping detailed records of work-related travel expenses will increase your chances of receiving a tax refund.

Disclaimer : The information on this website is for general purposes only and should not be relied upon for making legal or other decisions. The advice provided in this article is general in nature and is not subject to the personal financial situation and needs of any individual. Clear Tax tries to keep the information accurate and up-to-date; however, you should bear in mind with changing circumstances, the accuracy and reliability of the information will not necessarily remain the same. The information is by no means a substitute for financial advice.

TFN (Tax File Number) – How To Get One?

A TFN or Tax File Number is your personal reference number and is needed by the Australian tax and superannuation systems. So basically, anybody working within the country must have a TFN. If you do not have a TFN, filing your tax returns online with the Australian Taxation Office (ATO) is not possible. Although having…

Company – Is It The Right Business Structure For You?

Are you deciding to run your business as a company? People's preference to operate their businesses as companies has gone up in the past couple of decades. However, this business structure is not suitable for every business. You need to fulfil some legal obligations to set up a company. A company has multiple advantages, but…

How Can An Accountant Save You Money?

As a small business, it is essential that you avoid unnecessary expenses to save money. From leasing (instead of buying) the equipment to identifying hidden costs and eliminating them, whatever measure you take to save money in the beginning can help in the long run. A lot of business owners end up handling their finances…

- Tax Deductions

- Work Related Car Expenses

- Travel between home and...

Travel between home and work

As a general principle, a direct journey between home and place of work (and the direct return trip) is considered not to be in the course of doing work, and is therefore not tax deductible.

However there are a number of specific circumstances which cause a journey between home and work to be treated as a work-related cost. This summary is not advice – talk to your accountant before taking action.

Travelling expenses for employees

Tr 2021/1 : income tax: when are deductions allowed for employees’ transport expenses.

This ruling sets out when an employee can deduct the cost of travel by airline, train, taxi, car, bus, boat, or other vehicle.

The ruling explains that ordinary travel between home and a regular place of work is not deductible. Expenses of an employee in travelling between work locations usually are deductible. There are, however exceptions.

This Ruling also applies for FBT purposes and the ‘otherwise deductible’ rule.

Taxation Ruling TR 2021/4 reviews the tax treatment of accommodation and food and drink expenses, and provides 14 examples which distinguish non-deductible living expenses from deductible travelling on work expenses. FBT implications for the ‘otherwise deductible’ rule and travel and LAFHA allowances are also considered.

Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location – ATO compliance approach

Practical Compliance Guideline PCG 2021/3 (which finalises draft PCG 2021/D1 ) provides the ATO’s compliance approach to determining if allowances or benefits provided to an employee are travelling on work, or living at a location.

For FBT purposes an employee is deemed to be travelling on work if they are away for no more than 21 consecutive days, and fewer than 90 days in the same work location in a FBT year.

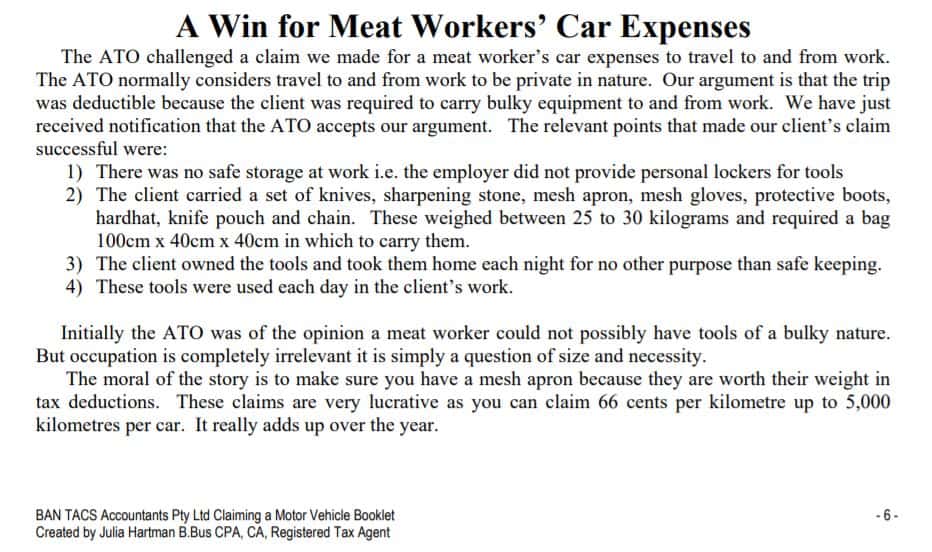

Transport of bulky equipment

Home to work travel is claimable if there is no safe storage at work and therefore of necessity (not just convenience) you transport heavy or bulky equipment (such as a ladder or musical instruments), between home and work.

How heavy does it need to be? In excess of 20kgs is an indication; But review decisions have looked at additional factors such as the type of equipment and its bulk, and whether the equipment itself realistically requires its own transport (with the taxpayer simply hitching a ride), in order to decide whether the trip between home and work takes on a predominantly tax-deductible purpose.

An example of the Tax Office interpreting and enforcing these rules in the case of Curtis Island Bechtel employees can be reviewed here . The correct treatment of meals allowances and claims for internet and telephone expenses are also discussed there.

Examples of bulky equipment used by an inter-city long haulage truck driver are here . They include such items as a portable fridge and sleeping gear, for which (crucially) there is no storage capacity at the employer’s depot.

And here’s another example – see “ A Win for Meat Workers’ Car Expenses ” (page 6)

Abnormal workplace

Broadly, an abnormal or alternative workplace is not where you usually work or are based.

- the trip between your normal and any alternative workplace while still on duty (e.g. client’s premises, another branch or office) is deductible, as is the return trip to either the normal workplace or directly home.

- from your home to an alternative workplace for work purposes and then back to your normal workplace or directly home is all treated as work-related travel

- trips directly between different jobs (i.e. you are off-duty during the trip in between) are claimable, but not the first or last leg to or from home unless some other factors (e.g. “on the way” below) are involved.

Home as the base

- if home is your base of work or employment, work-related travel starts from home

- workers whose work is “itinerant” – meaning “shifting places of work” – can claim the cost of travel between their home and places of work and back. See tax ruling TR 95/34

‘On the way’

Work related tasks on the way to or from work will only be the basis of a claim for the whole trip if the task was significant – involving for example, a break in the journey. Minor or incidental tasks (like dropping off the mail) are not enough, although any “extra” distance travelled to do so may be claimable. See MT 2027 Fringe benefits tax: private use of cars : home to work travel

For more information generally and examples see ATO: Trips you can and can’t claim

Employees’ accommodation and food and drink expenses travel allowances, and living-away-from-home allowances

- ATO guidance on costs of travelling – PWC

- Car expense claims

- Car depreciation

This page was last modified 2023-06-27

19th July, 2021

Work travel expenses: What you can (and can’t) claim

Knowing exactly what deductions apply to travel expenses can save a heap of hassle at tax time.

The Australian Taxation Office (ATO) has released a new ruling that clarifies what expenses employees can deduct for work-related travel.

The new ruling, Income tax: When are deductions allowed for employees’ transport expenses? was released this week, bringing together and clarifying the rules for business advisors and their clients alike.

Key takeaways:

- The ATO’s new ruling sheds light on what travel expenses employees can and cannot claim

- Travel between work locations (neither of which are your home), is typically tax deductible

- Incidental work-related travel, such as a receptionist who makes a stop to pick up office newspapers on their way to work, can’t be claimed on tax

Travel from home to a regular place of work generally isn’t deductible. The ruling states that even if you travel to work by plane, receive a travel allowance or make incidental business-related stops on the way to work, you still cannot claim your travel expenses.

But moving between two separate work locations – like driving from your office to a construction site, or from your business to a meeting at a client’s office – can be claimed.

Tax specialist and accountant, Leo Hollestelle said the ruling is well timed ahead of the busy End of Financial Year period.

“It’s timely that these views are brought together and codified into a single ruling,” said Hollestelle. “Tax advisors will be able to more easily familiarise themselves with the rules and in turn advise their clients on it.”

What are work-related expenses?

Work-related expenses are expenses that you incur in the course of gaining or producing your assessable income.

What work-related travel expenses can I claim?

Transport expenses you incur while travelling between work locations are usually deductible. The travel must occur while gaining or producing your assessable income.

While you can’t usually deduct expenses for travelling between your home and work, you might also be able to deduct the cost of travel from your home to somewhere other than your regular place of work. This might be, for example, to attend a client’s premises or one of your employer’s other offices.

To work out if travel expenses are work-related, things like these are taken into consideration:

- Does the travel fit within your duties of employment?

- Do the travel expenses arise out of your employment and not your personal circumstances?

- Is the travel relevant to the practical demands of carrying out your work duties?

- Has your employer asked you to travel?

- Has the travel occurred during normal work time?

What work-related travel expenses can’t I claim?

Transport expenses that you incur for travel between your home and a regular place of work are not deductible.

If there is a close connection between travel and your private or domestic life, this will usually not be considered deductible. For example, if you travel to your regular place of work from another location in which you undertake private activities, for example a library or a holiday house, the cost of the travel is not deductible.

If you happen to live a significant distance from your regular place of work, your travel expenses are usually considered private and not deductible.

You may also not deduct expenses that are capital, private or domestic in nature. Transport expenses that may be considered capital in nature include, for example, the cost of purchasing a car. Ask your advisor whether such expenses may be recognised under another tax provision.

How much can you claim for work-related expenses?

You can only claim the actual cost of the expenses themselves. These will need to be proven with receipts and/or other written documentation. Your advisor will be able to help you with this.

READ: How to save tax in Australia – 15 tax minimisation strategies

How to calculate work-related travel expenses

You can claim deductions for work-related travel expenses in your tax return , but how you do this depends on the expenses themselves. (See also Claiming overseas-travel expenses , below.)

If your expenses relate to a car you own, lease or hire, you may be able to use the logbook method or the kilometres method .

READ: How long does it take to get a tax return?

Working-away-from-home tax deductions

If your employment requires you to travel away from home overnight, because of your employment (and not because of private circumstances like where you choose to live, for example), the transport expenses incurred in travelling to your alternative work location will usually be considered deductible.

Claiming overseas-travel expenses

If you travel overseas for work, you might be able to deduct expenses relating to flights, accommodation, meals, transport or other minor things (like taxis or using hotel wifi). You’ll need to keep records such as receipts and you may also need to keep a travel diary.

Where’s your regular place of work?

Interestingly, there are several exceptions that – if claimed correctly – can give you an edge come tax time. This is especially true when it comes to defining what a “regular work location” actually is.

For example, imagine you currently work for a business with an office 15-minutes from your home.

But you’re asked to cover a long-service vacancy for six months at another of your business’s offices one hour away. Because this new office becomes your regular place of work for a sustained period of time, travel to and from it cannot be claimed on tax.

But, if your period of work was only for three months, then it could be argued that the second office never became a regular place of work.

Therefore, travel could potentially be claimed on tax.

This is a call to take care in making any assumptions about what you can actually claim. As the ATO ruling states, ‘the full facts and circumstances of the specific working arrangement in place must always be considered in determining the nature and deductibility of the transport expenses incurred’.

And that’s something to keep in mind when it comes to all travel-related tax claims this tax time, as it could be this ruling also indicates an increase in scrutiny for travel-related claims.

“While the ruling is very much in line with the Commissioner’s existing views on travel expenses, the timing is worth noting,” said Hollestelle.

“After a year where many employees have been working from home, it may be the ATO is concerned there will be both workers and employers seeking to make dubious claims in the tax period ahead.”

What else do I need to know?

Find more guidance on transport and travel expenses on the ATO website.

Always seek advice on your individual situation from an accredited business advisor or tax specialist to find out exactly how tax changes and updates might impact your business.

Need an advisor? Find one today with MYOB’s Find an Advisor directory .

You might also like

How long do i have to pay my tax bill a guide for smes, 30th apr, 2024 by kellie byrnes, tax deductions smes should know about at eofy, your key tax dates for end of financial year and beyond, 28th mar, 2024 by myob team, subscribe to be updated on all things myob.

Travelling for work can be expensive, whether it’s visiting clients in your home town or attending a conference overseas, so it’s important to claim everything you are entitled to in your tax return. But be aware that the ATO is paying increasing attention to claims in this area.

The essential thing to consider when claiming any travel expenses in your tax return is that it must be work-related and only take you away from home for a relatively short period of time. Any expenses you have paid and already been reimbursed for by your employer can’t be claimed. Here are some tips on what you can and can’t claim and the records you need to keep for the tax man.

Home to work travel expenses

Employees generally can’t claim for the cost of travel from home to work as this is considered a private expense. It’s worth noting, however, that there are some circumstances where you may be entitled to a deduction.

You can claim the cost of work-related travel if you are travelling directly between two separate workplaces, such as if you have a second job at another location. Travel from your normal workplace to an alternative workplace (such as a client’s premises) and back to your normal workplace or directly home is also claimable.

You can also claim the travel cost of carrying bulky work tools or equipment that can’t be left at your workplace.

Claims for the cost of driving your car between work and home and completing a minor work related task like picking up the mail will not be accepted.

Staying overnight for work

If your work takes you away from home for one or more nights, the rules change slightly. For your travel expenses to be deductible, you need written evidence of all expenses, and if the trip is for six or more consecutive nights, you need to keep a travel diary .

Some employers pay a travel allowance to cover your travel costs rather than asking you to pay for your expenses and reimbursing you later.

Each year the ATO releases a list of ‘reasonable amounts’ for accommodation, meals and incidentals. Reasonable amounts are the maximum you can claim without written evidence of the expense and are not an automatic deduction – you must have actually incurred the expense.

Travelling for work and play

When you travel for work – especially overseas – it’s tempting to add a short holiday to the trip, but you need to be careful about what you claim.

You can only claim travel expenses where there is a direct connection between your employment and the expense. This means if you add a short holiday to a work trip, you can’t claim all your expenses for the entire time you are away from home.

The ATO accepts some elements of business travel will be private, but these must be incidental to the overall purpose of the trip, not its main purpose. For example, if the main reason for your trip is business and you spend a few hours visiting family, all the airfare can still be claimed. Travel costs like car hire or train fares on the days you are working can also be claimed.

If part of your trip is for private enjoyment, your travel expenses must be carefully apportioned between the private and business components. For example, if you stay in a hotel for four days, with three days spent in business-related activities and the final day on private enjoyment, you can only claim three-quarters of your expenses. In this situation you can still claim the full airfare, as the primary purpose of the trip was work-related.

If this situation is reversed, however, your business activities would be considered minor and incidental to the purpose of the trip, making it harder to claim your expenses.

Generally, costs incurred by your spouse or family members who accompany you are not deductible unless they are involved in the business activities in some way.

If you would like to know what travel-related expenses you should be claiming in your annual tax return, give us a call.

On the road: How to treat work-related travel and living away from home costs

6 October 2021

The ATO has released new guidance to help clarify the tax treatment of costs and allowances incurred when an employee travels – or spends time living away from home – for work.

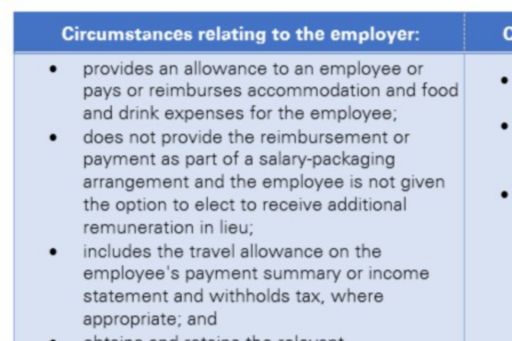

Certain conditions need to be met to ensure an allowance can be considered a travel allowance:

- None of the individual absences from the employee’s usual place of residence exceed 21 days.

- The employee is not present in the same work location for 90 or more days in an FBT year.

- The employee returns to their usual residence once their period away ends.

See the table below for a breakdown of the characteristics of travel allowances versus living away from home allowances.

Where the applicable allowance type remains unclear, certain questions can be asked to discern further, such as:

- Has there been a change in the employee’s regular place of work?

- Is the duration of the employee’s period away from home relatively long?

- Is the nature of the accommodation such that it becomes the employee’s usual place of residence?

- Can the employee be visited by family and friends?

Of course, for a travel expense to be deductible, the employee must be able to demonstrate that it was incurred while travelling for work. Unless exceptions apply, the employee must maintain written evidence of the expenditures and keep travel records for work-related trips that involve an absence of six or more consecutive nights from their usual residence.

The ATO does allow for the not-uncommon scenario where an employee attending a conference, for example, is accompanied by their spouse and stays an extra few days for leisure purposes – although reasonable apportionment is required in these cases.

The ATO also recognises that where employees regularly travel to the same location they may choose to rent or even buy a property there rather than stay in a hotel, motel or AirBnB. The associated costs will be deductible provided they are not disproportionate to what would have been paid had the employee elected to use suitable commercial accommodation instead.

It’s important that allowances paid (or reimbursements made) to cover an employee’s accommodation, food and drink expenses do not form part of a salary packaging arrangement, and must be included in the employee’s payment summary with tax withheld where appropriate. The employer should also obtain and retain documentation establishing that all the circumstances have been met.

Travel allowance versus living away from home allowance

Office Address 38 Sydenham Road Norwood, South Australia 5067

Postal Address PO Box 809, Kent Town DC, SA 5071

Telephone 08 8132 6400

Email [email protected]

© 2024 i2 advisory | Disclaimer | Privacy Policy

- Name * First Last

- Comments This field is for validation purposes and should be left unchanged.

Liability limited by a scheme approved under professional standards legislation.

Claiming travel from home to client

Hi everyone!

I have read the “trips you can and can’t claim” page but would like confirmation on travel deductions!

I have a usual place of work (office) and under a flexible working arrangement, also work from home sometimes. I complete a combination of office based work and a face to face service with multiple clients (clients regular enter and exit the service).

The face to face service is provided in the clients home (cannot be provided in the office). My travel to and from the clients home is during work hours only (I.e during my shift).

My question is, can I claim a deduction for the travel from my home to a clients home for work on the days I work from home? I would usually see multiple clients and then travel home to finish my shift - can this return trip during work hours be claimed as a travel deduction too?

Thank you for your help

- Report as inappropriate

Most helpful reply

Hey @Jbpb1415 ,

Yes, you would be able to claim a deduction for work related travel expenses where you start work at home and then travel to a client's home.

In addition to this you would be able to claim the travel between the other appointments as long as you don't return home between them.

You can find more details on our website.

@JacobATO thanks for you response! I appreciate you taking the time to reply. To clarify, if I claim the trip from my home to a clients home, visit several other clients, then travel back to my home to finish my shift - can I claim all of that travel, including the return travel home whilst still on duty?

Hi @jbqb1415 ,

When we look at the information on our website it talks about being required to start your work at home.

Have a think about contacting tailored technical assistance with your specific circumstances. They'll give you a response in writing.

Related articles

- How much tax should I pay on a second job? Claiming the tax-free threshold

- Working from home deductions

- Tax on gifts and inheritances

- Tax time 2022 – your questions answered

- Tax tips for managing your side hustle

- Tax tips for social media influencers and content creators

- What remote working means for your tax return

- Tax time 2023 – your questions answered

Related keywords

- Income & Deductions Income & Deductions

- Deductions Deductions

Top Liked Authors

Top Contributors

6232 contributions

1089 contributions

804 contributions

527 contributions

Anonymous1283

452 contributions

Travel to a workplace: What’s in, what’s out

A recurrent topic of conversation and enquiry when it comes to possible tax deductions is when taxpayers travel to a work location, and the eligibility or otherwise of certain claims in regard to that travel.

Work-related travel is a hot focus area of the ATO as taxpayers can often get claims wrong.

While trips between home and work are generally considered private travel, you can claim deductions in some circumstances, as well as for some travel between two workplaces.

If your travel was partly private and partly for work, it is the general rule that you can only claim for the part related to your work.

You can claim the cost of travelling:

- directly between two separate workplaces – for example, when you have a second job

- from your normal workplace to an alternative workplace (for example, a client's premises) while still on duty, and back to your normal workplace or directly home

- if your home was a base of employment – that is, you started your work at home and travelled to a workplace to continue your work for the same employer – these rules are tricky so contact us for more information

- if you had shifting places of employment – that is, you regularly worked at more than one site each day before returning home

- from your home to an alternative workplace for work purposes, and then to your normal workplace or directly home

- if you needed to carry bulky tools or equipment that you used for work and couldn't leave them at your workplace – for example, an extension ladder or a piece of your own machinery (note that the ATO is targeting this particular deduction).

But you can't claim the cost of driving your car between work and home just because:

- you do minor work-related tasks – for example, picking up the mail on the way to work or home

- you have to drive between your home and your workplace more than once a day

- you are on call – for example, you are on stand-by duty and your employer contacts you at home to come into work

- there is no public transport near where you work

- you work outside normal business hours – for example, shift work or overtime

- your home was a place where you ran your own business and you travelled directly to a place of work where you worked for somebody else

- you do some work at home.

Flexibility for itinerant work

A notable flexibility for some work travel claims arises where the nature of the employment is deemed to be itinerant.

If you do itinerant work (or have shifting places of work) you can claim the cost for driving between workplaces and your home. Note that you cannot count your home as a workplace unless you carry out itinerant work.

The ATO says that the following factors may indicate that you do itinerant work:

- travel is a fundamental part of your work due to the very nature of your work, not just because it is convenient to you or your employer

- you have a “web” of work places you travel to throughout the day

- you continually travel from one work site to another

- your home is a base of operations – if you start work at home and cannot complete it until you attend at your work site

- you are often uncertain of the location of your work site

- your employer provides an allowance in recognition of your need to travel continually between different work sites and you use this allowance to pay for your travel.

Flexible, up to a point

In case the above factors give some impression of allowing for a very wide degree of flexibility, one recent Administrative Appeals Tribunal (AAT) decision adds to the factors to be considered if making claims for home-to-work travel in the case of itinerant work.

A taxpayer claimed he was entitled to deductions for certain work-related travel expenses for meals and accommodation on the basis that he was employed in itinerant work. On the face of it, he seemed to fit the bill. During the year, the taxpayer undertook a number of employment arrangements and engaged in various roles. Each job was in a different location, each were short-term and seasonal in nature, and were all within the mining industry.

The taxpayer and his wife owned a house, which he asserted was their usual place of residence. However with the exception of one location, he stayed with his wife in a motorhome that they towed to rented caravan sites near each of the locations where he had work. It was found however that they returned home for short periods between each job.

The AAT considered some of the ATO’s factors and concluded that the taxpayer was not an itinerant worker, and could not make his claims. Its reasons included the following:

- travel was not a fundamental part of the taxpayer’s work as it did not arise out of the nature of his employment with each employer. That is, the taxpayer was under no obligation with any employer to work at multiple sites

- the taxpayer worked at only one work place at any given time

- employment duties did not commence at the usual place of residence or at the various caravan parks where he parked his motorhome

- when he finished the work at each workplace, he returned home for up to three weeks before commencing at another workplace

- the taxpayer did not have a “web” of workplaces, and the location of each workplace was known to the taxpayer with a large degree of certainty

- the taxpayer was not required to travel between different workplaces as part of his employment; he would travel between the caravan park where he parked his motorhome and the same workplace for the relevant period of each employment. None of his employers required him to travel from where he was staying to different workplaces

- none of the employers paid him an allowance for travel such that it may indicate that travel was a fundamental part of his employment.

The AAT further remarked as follows:

- the taxpayer’s duties did not involve him travelling from workplace to workplace as is essential for itinerancy

- he made a lifestyle choice to work in regional towns and live in his motorhome

- he was not required to travel to these different locations in the course of his employment. Rather, he chose to travel from his home to undertake work in these locations

- each work place may be regarded as a regular or fixed place of employment, even if there was some uncertainty about the length of time that he would be employed at each location.

The key message

Over the past few years, the ATO has been setting its sights on incorrectly claimed work-related travel expenses (for example, car expenses, flights and accommodation). This focus is expected to continue, and the ATO has warned that it will pay extra attention to people whose work-related deductions are higher than expected.

As can be seen above, your entitlement to a deduction for work-related travel expenses will be subject will depend on your individual circumstances. We can help you work out your eligibility.

Our Management Credentials

Is my home considered a work location for travel expense tax deductions?

3 March 2021

Transport expenses (Taxation ruling TR2021/1 ) incurred by an employee travelling between work locations are generally tax deductible because such travel usually:

Fits in with the duties of employment.

Is done in work time.

Is under the direction and control of the employer.

However, transport expenses incurred for ordinary travel between the employee’s home and the regular workplace (e.g. taking the bus, train, tram or car to and from work) are not deductible because such travel expenses are viewed as private expenses the employee incurs to get to work. In other words, the travel is deemed to be a prerequisite to earning an employee’s assessable income.

If an employee performs work-related tasks at home or work activities while travelling (e.g. reading and responding to work emails while on the train) this does not make these expenses deductible.

With so many employees now working more flexibly, the rules surrounding tax deduction of transport expenses remain the same with home to work travel still not deductible. An employee’s home office is not considered to be a place of business if the employer can still normally accommodate them at their usual offices. Therefore, such expenses would not be deductible as travel between work locations.

Also, if an employee chooses to do work from a location other than their home or regular place of work, for example a holiday resort, the cost of travel to that location is not deductible because such expenses are not incurred in gaining or producing an employee’s assessable income and are private in nature.

To learn more about the deductibility of travel expenses, please speak to your adviser or get in touch with the Findex Tax Advisory team.

Related Articles

)

Smart tax strategies for business owners and investors

)

Tax strategies to help minimise your farm’s tax exposure

)

Tax minimisation strategies for small businesses

KPMG Personalization

- Home ›

- Insights ›

AU – Travel for Work Can Have Tax Implications

Australia – if planning to travel for work, consider tax implications.

This GMS Flash Alert provides an overview of three separate documents released by the Australia Taxation Office in relation to employee travel. One draft ruling was simultaneously withdrawn. The current draft guidance suggests that for some globally-mobile employees, depending on the duration of their assignments, some of the benefits they are provided (e.g., accommodation) may be subject to Fringe Benefits Tax.

ATO Documents

Is there a “bright line” test to establish travelling for work or living away from home.

Hayley Lock

KPMG Australia

Daniel Hodgson

Mardi Heinrich

While personal travel might not be on the cards for all yet, some recent releases from the Australian Taxation Office (ATO) mean that tax costs in Australia need to be front of mind when movement resumes. 1

The ATO recently released three separate documents in relation to employee travel and, simultaneously, withdrew one draft ruling.

These latest releases are a continuation of a process that started in 2017 with the ATO seeking to clarify its position in relation to the tax treatment of employer-provided transport, accommodation, and meals.

WHY THIS MATTERS

An employee’s categorisation as travelling for work, living away from home, or indefinitely relocating, will determine the Australian tax treatment of transport, accommodation, and meal benefits (including allowances).

It is important for employers of internationally-mobile employees travelling into or out of Australia to have a clear view on this categorisation and the resultant impacts to avoid any unnecessary or unexpected tax costs. This is particularly relevant for Fringe Benefits Tax (FBT) in Australia, where the liability rests with the employer and is currently 47 percent on the grossed-up value of the benefit (for example, if accommodation were subject to full FBT, then for every $100 spent on accommodation there would be roughly a corresponding $100 of FBT payable).

From a global-mobility perspective, the ATO had previously provided some guidance whereby international employees on short-term assignments to Australia for up to three months were travelling for work and, as such, not subject to FBT. 2 The current draft guidance suggests that for what are similar circumstances but a longer assignment period (expressed as 90 to 120 days), some of the benefits provided (e.g., accommodation) may be subject to FBT.

Recent Releases

- Final Taxation Ruling, TR 2021/1 Income tax: when are deductions allowed for employees’ transport expenses?

- accommodation and food and drink expenses;

- travel allowances; and

- living-away-from-home allowances.

- Draft Practical Compliance Guideline, PCG 2021/D1 : Determining if allowances or benefits provided to an employee relate to travelling on work or living at a location – ATO compliance approach.

Draft Ruling Withdrawn

- TR 2017/D6 Income tax and fringe benefits tax: when are deductions allowed for employees’ travel expenses?

Given the significant impact the categorisation of an employee’s circumstances can have on the employer’s tax position, whether there exists a “bright line” test that can be used to establish if an employee is travelling for work or living away from home is a valid question and one that is asked often in practice.

The ATO’s prevailing view is that every scenario must be considered on its own merits considering the relevant “facts and circumstances.” However, the ATO has also released some Practical Compliance Guidance (PCG) (currently in draft) specifically providing a “safe harbor” test. 3

PCG 2021/D1 highlights the ATO’s compliance approach when determining if allowances or benefits provided to an employee relate to travelling for work or living at a location. The PCG incorporates a “day count” test, allowing employers a numerical basis for categorisation. It is important to note, this also increases the possibility of automation of this aspect of the FBT process (among other things).

The compliance approach sets a “safe harbour” of an aggregate period of fewer than 90 days in an FBT year for presence at a temporary work location to be treated as travelling for work. Provided that this requirement is met, PCG 2021/D1 allows an employee to have numerous short stints of travel of up to, and including, 21 continuous days.

The following table summarises the requirements for the PCG to apply:

The PCG as a Guideline

It should be noted that the PCG only provides a guideline as to what will be accepted by the ATO as reasonable. If a scenario does not meet the criteria, the PCG does not render the relevant expenses automatically taxable, rather, it will require the employer to collate more evidence to support a “travelling for work” position. In an audit situation, the ATO will want to see evidence of how the employer has come to this conclusion, despite the PCG, and why.

Concluding Thoughts

The introduction of the PCG and the safe harbour it offers will provide a set of rules that can be applied to data and help an organisation assess retrospectively which trips might not require further consideration to classify.

Similarly, the PCG provides an opportunity for employers to plan employee travel within these limits if it wishes to do so and other practical business realities allow it to do so.

Organisations may need support in navigating the relevant legislation, cases, and ATO guidance in considering all relevant facts and circumstances and helping employers classify their travelling employees correctly.

1 For related coverage, see GMS Flash Alert 2020-487 , 9 December 2020.

2 For prior coverage, see GMS Flash Alert 2020-113 , 25 March 2020.

3 Draft Practical Compliance Guideline, PCG 2021/D1 .

PEOPLE SERVICES IN AUSTRALIA

Dan Hodgson

Perth, Western Australia

Partner – People Services

Tel. +61 8 9278 2053

Direct Tel. +61 8 9278 2053

Mobile: +61 416 017 131

Melbourne, Victoria

Partner – Deals, Tax & Legal People Services

Tel. +61 3 9838 4348

Direct Tel. +61 3 9838 4348

Mobile: +61 410 602 993

Ablean Saoud

Sydney, New South Wales

Tel. +61 2 9335 8550

Direct Tel. +61 2 9335 8550

Mobile: +61 421 052 596

Brisbane, Queensland

Tel. +61 7 3434 9176

Direct Tel. +61 7 3434 9176

Mobile: +61 477 764 638

Jackie Shelton

Partner – Deals, Tax & Legal

Tel. +61 2 9335 8511

Direct Tel. +61 2 9335 8511

The information contained in this newsletter was submitted by the KPMG International member firm in Australia.

FLASH ALERT - ALL

TAX FLASH ALERTS

AUSTRALIA FLASH ALERTS

FLASH ALERTS BY COUNTRY

FLASH ALERTS BY TOPIC

FLASH ALERT HOME

To subscribe to GMS Flash Alert, fill out the subscription form .

KPMG Australia acknowledges the Traditional Custodians of the land on which we operate, live and gather as employees, and recognise their continuing connection to land, water and community. We pay respect to Elders past, present and emerging.

©2024 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organisation.

Liability limited by a scheme approved under Professional Standards Legislation.

For more detail about the structure of the KPMG global organisation please visit https://kpmg.com/governance .

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

Connect with us

- Find office locations kpmg.findOfficeLocations

- Email us kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

- Request for proposal

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

Browse articles, set up your interests , or View your library .

You've been a member since

Can You Claim a Deduction for Home to Work Travel?

- October 7, 2013

Did you know that you may be entitled to claim some of the expenses you outlay while travelling between your home and your regular workplace, or even to your alternative workplace?

While claiming such work travel tax deductions are certainly possible, such claims can be a minefield that needs to be navigated very carefully so as to not end up in hot water with the taxman.

So what then is generally allowed as a deductible “travel expense”? Individuals are typically able to claim a tax deduction for work-related travel expenses. As a general rule, travel from your home to your workplace is not allowed as a deduction because it constitutes a “private expense”. There are however specific situations where this rule does not apply.

We shed some light below on what does and doesn’t constitute a travel deduction between home and work and between different workplaces.

What you can claim

You can generally claim the cost of travelling:

- Directly between two separate workplaces; for example, when you have a second job.

- From your normal workplace to an alternative workplace: for example, a client’s premises while still on duty and back to your normal workplace or directly home.

- From your home to an alternative workplace for work purposes and then to your normal workplace or directly home.

- If your home was a base of employment – that is, if you started your work at home and traveled to a workplace to continue your work for the same employer (see comments below).

- If you had shifting places of employment – that is, if you regularly worked at more than one site each day before returning home (see comments below), and –

- If you need to carry bulky tools or equipment that you used for work and can’t leave it at your workplace – like an extension ladder if you’re a trades person or a cello if you’re a musician.

Can you count your home as a workplace?

You cannot count your home as a workplace unless you carry out “itinerant work”; that is, work that requires you to go from place to place. If you do itinerant work or have shifting places of work, you can claim the cost of driving between workplaces and your home.

The following factors may indicate that you do itinerant work:

- Travel is a fundamental part of your work, as the very nature of your work, not just because it is convenient to you or your employer.

- You have a “web” of workplaces you travel to, throughout the day.

- You continually travel from one work site to another.

- Your home is your base of operations – you start work at home and cannot complete it until you attend at your work site.

- You are often uncertain of the location of your work site.

- Your employer provides an allowance in recognition of your need to travel continually between different work sites and you use this allowance to pay for your travel.

Common examples of such workers would include commercial travelers and government inspectors whose homes are the base of their operations from which they travel to one of a number of locations throughout the day over a continuing period.

Typically in these cases, the employee will show up at the employer’s office periodically (like once a week) to complete or file reports, pick up supplies or organised future trips.

Travel from home to the office and back made in these limited circumstances will be treated as business travel, and as a result are tax deductible.

What you can’t claim

You generally can’t claim the cost of travelling between work and home just because:

- You do minor work-related tasks – like picking up the mail on the way to work or home.

- You have to drive between your home and your workplace more than once a day.

- You are on call – for example, you are on standby duty as a locum and your employer contacts you at home to come into work.

- There is no public transport near where you work.

- You work outside normal business hours – for instance, shift work or overtime.

- Your home is a place where you run your own business and you travel directly to a place of work where you work for somebody else, and –

- You do some work at home.

We have provided three examples below adapted from the Tax Office to elucidate what can and cannot be claimed when it comes to home to work travel.

Example 1: Travel between jobs

Bhakti works as a clerk at a large departmental store in a suburban shopping center, but she also has employment at a second job. She drives her car from her primary workplace to her second job as a waiter.

After finishing work as a waiter, she goes directly home.

Yes, Bhakti can claim the car expenses from her normal workplace to her second job. However, she can’t claim the cost of going home from her second job.

Example 2: Travel to an alternative workplace

Jana, a dental assistant in the city, is required to attend meetings at her employer’s other clinic in the suburbs. She drives her car to the suburban clinic. As the meetings finish late, she drives straight home.

Yes, Jana can claim the cost of each journey.

Example 3: Work from home

Benjamin’s employer has an office in the city but is happy for him to work from home three days a week. On these days, Benjamin sometimes has to drive into the office for a meeting before returning home to work.

No, Benjamin cannot claim the expense of driving between his home and work as it is a private expense.

The above are only straightforward examples though. There will be cases where taxpayers find claiming a deduction is less clear.

Consult this office for more information on what home to work travel deductions you may be able, or may not be able, to claim.

Warranty Disclaimer All Client Newsletter Library material is of a general nature only and is not personal financial or investment advice. It does not take into account one individual’s particular objectives and circumstances. No person should act on the basis of this information without first obtaining and following the advice of a suitably qualified professional adviser. To the fullest extent permitted by law, no person involved in producing, distributing or providing the information through this service (including Taxpayers Australia Incorporated, each of its directors, councilors, employees and contractors and the editors or authors of the information) will be liable in any way for any loss or damage suffered by any person through the use of or access to this information.

What you need to know about work-related travel expenses in Australia

I f you are required to travel as part of your job, then you likely incur various costs. Whether making a short trip to attend a meeting or taking an overseas trip for an extended period, you can deduct your travel expenses. However, the laws surrounding travel expenses are complicated, and the Australia Taxation Office (ATO) keeps close tabs on travel expenses . So, it's vital to pay close attention to what you claim to avoid mistakes.

What is work-related travel expenses

Work-related travel expenses are expenses incurred while travelling for work. If you incur any expenses related to work-related travel, such as accommodation or meals, you may be able to claim them as travel expenses on your tax return.

Using your car for work

If your job requires you to use a personal vehicle, you are entitled to deduct the motoring costs you incur while completing your job. This does not generally include the commute you make from your home to your place of work.

Eligibility

However, there are limited circumstances that may allow it. For example,

- An employee travelling between work sites throughout the day can claim their commute.

- If you travel directly from one job to a second job, as long as you do not return home in between.

- If you are travelling to a course or meeting for work, you can deduct expenses.

Methods to calculate work-related travel expenses

There are two options when it comes to vehicle travel for work tax deductions.

- As of April 2023, there is a flat rate of 78 cents per kilometre, and you can claim up to 5,000 km . You will need to keep a log of your travel to determine how far you travel for work purposes.

- Use a logbook if you travel and detail your running expenses, from mileage to fuel, servicing, repairs, insurance, and depreciation. If you use the logbook method, your logbook needs to show your work-related trips for a minimum continuous period of 12 weeks

Alternatively, you can use a r eputable tax software that will provide you with mileage auto-tracking and a simple snap and store for all of the receipts related to your business expenses.

Ensure you maintain your logbook for a minimum of 12 weeks before relying on it for your income tax return. The log should include odometer readings to determine the proportion of time you use it for work purposes. Store all receipts and invoices noting your spending on your vehicle so that you can claim the correct percentage of vehicle expenses.

Travel to and from work is considered a private expenditure unless your employer requires you to transport bulky equipment and vehicles. That being said, the ATO pays close attention to these types of claims and may disallow them.

Other work-related transport expenses in Australia

There are other expenses that can also be claimed for work-related travel if they are for:

- Heavy vehicles and utes if they have a carrying capacity of more than one tonne

- Vans with a carrying capacity of 9 or more passengers

- Fees for hiring or renting a car

- Costs incurred while driving someone else's vehicle for work purposes, such as fuel expenses

- Public transportation fares, including air, bus, train, tram, ferry, taxi, ride-share or ride-sourcing fares

- Expenses associated with work-related transport expenses such as bridge tolls, road tolls, and car parking fees

Other travel expenses

You can claim additional work-related travel expenses for costs you incur that your employer doesn't reimburse. These travel expenses must be work-related rather than your daily commute to and from work.

- Airfare and taxi fares

- Tunnel or bridge tolls

- Car parking

- The cost of public transport

If you are fined for a motoring offence, whether it is for parking, speeding or otherwise, you cannot claim these.

Overnight meals & accommodation

If you are travelling away from home, you can claim accommodation, meals and entertainment. You cannot claim meal expenses if your employer reimburses you or provides you with a full allowance for these expenses. A number of businesses will provide an allowance, expenses included, so the employee doesn't need to cover the costs. You may be taxed for those allowances, in which case a deduction is possible for costs incurred.

The ATO provides a lengthy list of what is viewed as a reasonable spend on accommodation, meals, and incidental expenses. You won't need to produce detailed records with receipts or invoices if you claim below the specified ATO allowance. If you exceed the reasonable amounts as laid out by the ATO, or you don't receive an allowance, then you need to keep detailed records to show your spending wasn't extravagant.

The ATO established a reasonable amount to highlight when detailed records must be kept. Many people would assume that they can claim this maximum amount, but we don't recommend you do this. You must only claim the amount of money you spent.

Even if you claim below the reasonable amount, you should be able to prove the expenses you incurred. A bank or credit card statement is viewed as sufficient evidence should the need arise. It will help support your claim that you were in the particular area at the time you claimed.

As long as your travel includes an overnight stay, you can claim business meals, food and beverages. You can't claim meals when you work from home. You could claim tax travel expenses if you always work from home and need to travel to an office.

What you can’t claim

Travel for personal reasons or between your home and your workplace can’t be claimed Examples include:

- Travel between your home and regular place of work or vice versa

- Travel for personal reasons, like running errands on the way to or from work

- Travel for overtime or out-of-hours work

- Travel from your home (which is also your place of work for one job) to another location where you work for someone else

Read our guide to tax deductions to learn about other tax deductions.

Other situations that allow you to claim travel deductions

You may be able to claim work-related travel expenses tax if you attend a work conference or course. If it is local, you can claim transport or mileage. If it's interstate or overseas, you can claim accommodation, airfares and meals.

In all cases, your best bet is to visit a tax agent to ensure your travel deductions are above board.

This article originally appeared on QuickBooks and was syndicated by MediaFeed.org .

43 incredible facts about Australia you may not believe are true

Advertisement

Supported by

Could Trump Go to Prison? If He Does, the Secret Service Goes, Too

Officials have had preliminary discussions about how to protect the former president in the unlikely event that he is jailed for contempt during the trial.

- Share full article

By William K. Rashbaum

The U.S. Secret Service is in the business of protecting the president, whether he’s inside the Oval Office or visiting a foreign war zone.

But protecting a former president in prison? The prospect is unprecedented. That would be the challenge if Donald J. Trump — whom the agency is required by law to protect around the clock — is convicted at his criminal trial in Manhattan and sentenced to serve time.

Even before the trial’s opening statements, the Secret Service was in some measure planning for the extraordinary possibility of a former president behind bars. Prosecutors had asked the judge in the case to remind Mr. Trump that attacks on witnesses and jurors could land him in jail even before a verdict is rendered.

(The judge, who held a hearing Tuesday morning to determine whether Mr. Trump should be held in contempt for violating a gag order, is far more likely to issue a warning or impose a fine before taking the extreme step of jailing the 77-year-old former president. It was not immediately clear when he would issue his ruling.)

Last week, as a result of the prosecution’s request, officials with federal, state and city agencies had an impromptu meeting about how to handle the situation, according to two people with knowledge of the matter.

That behind-the-scenes conversation — involving officials from the Secret Service and other relevant law enforcement agencies — focused only on how to move and protect Mr. Trump if the judge were to order him briefly jailed for contempt in a courthouse holding cell, the people said.

The far more substantial challenge — how to safely incarcerate a former president if the jury convicts him and the judge sentences him to prison rather than home confinement or probation — has yet to be addressed directly, according to some of a dozen current and former city, state and federal officials interviewed for this article.

That’s at least in part because if Mr. Trump is ultimately convicted, a drawn-out and hard-fought series of appeals, possibly all the way up to the U.S. Supreme Court, is almost a certainty. That would most likely delay any sentence for months if not longer, said several of the people, who noted that a prison sentence was unlikely.

But the daunting challenge remains. And not just for Secret Service and prison officials, who would face the logistical nightmare of safely incarcerating Mr. Trump, who is also the presumptive Republican nominee for President.

“Obviously, it’s uncharted territory,” said Martin F. Horn, who has worked at the highest levels of New York’s and Pennsylvania’s state prison agencies and served as commissioner of New York City’s correction and probation departments. “Certainly no state prison system has had to deal with this before, and no federal prison has had to either.”

Steven Cheung, the communications director for Mr. Trump’s campaign, said the case against the former president was “so spurious and so weak” that other prosecutors had refused to bring it, and called it “an unprecedented partisan witch hunt.”

“That the Democrat fever dream of incarcerating the nominee of the Republican Party has reached this level exposes their Stalinist roots and displays their utter contempt for American democracy,” he said.

Protecting Mr. Trump in a prison environment would involve keeping him separate from other inmates, as well as screening his food and other personal items, officials said. If he were to be imprisoned, a detail of agents would work 24 hours a day, seven days a week, rotating in and out of the facility, several officials said. While firearms are obviously strictly prohibited in prisons, the agents would nonetheless be armed.

Former corrections officials said there were several New York state prisons and city jails that have been closed or partly closed, leaving wings or large sections of their facilities empty and available. One of those buildings could serve to incarcerate the former president and accommodate his Secret Service protective detail

Anthony Guglielmi, the spokesman for the Secret Service in Washington, declined in a statement to discuss specific “protective operations.” But he said that federal law requires Secret Service agents to protect former presidents, adding that they use state-of-the-art technology, intelligence and tactics to do so.

Thomas J. Mailey, a spokesman for New York State’s prison agency, said his department couldn’t speculate about how it would treat someone who has not yet been sentenced, but that it has a system “to assess and provide for individuals’ medical, mental health and security needs.” Frank Dwyer, a spokesman for the New York City jails agency, said only that “the department would find appropriate housing” for the former president.

The trial in Manhattan, one of four criminal cases pending against Mr. Trump and possibly the only one that will go to a jury before the election, centers on accusations he falsified records to cover up a sex scandal involving a porn star. The former president is charged with 34 counts of felony falsifying business records. If convicted, the judge in the case, Juan M. Merchan, could sentence him to punishments ranging from probation to four years in state prison, though for a first-time offender of Mr. Trump’s age, such a term would be extreme.

If Mr. Trump is convicted, but elected president again, he could not pardon himself because the prosecution was brought by New York State.

Under normal circumstances, any sentence of one year or less, colloquially known as “city time,” would generally be served on New York City’s notorious Rikers Island, home to the Department of Correction’s seven jails. (That’s where Mr. Trump’s former chief financial officer, Allen H. Weisselberg, 76, is currently serving his second five-month sentence for crimes related to his work for his former boss.)

Any sentence of more than a year, known as state time, would generally be served in one of the 44 prisons run by New York State’s Department of Corrections and Community Supervision.

The former president could also be sentenced to a term of probation, raising the bizarre possibility of the former commander in chief reporting regularly to a civil servant at the city’s Probation Department.

He would have to follow the probation officer’s instructions and answer questions about his work and personal life until the term of probation ended. He would also be barred from associating with disreputable people, and if he committed any additional crimes, he could be jailed immediately.

Maggie Haberman contributed reporting.

William K. Rashbaum is a Times reporter covering municipal and political corruption, the courts and broader law enforcement topics in New York. More about William K. Rashbaum

Our Coverage of the Trump Hush-Money Trial

News and Analysis

Jurors heard riveting testimony from Keith Davidson , the lawyer who had arranged the hush-money payment between Donald Trump and a porn star, Stormy Daniels. Davidson also described an earlier deal to buy the silence of another woman, Karen McDougal.

The judge overseeing the trial held Trump in contempt and fined him $9,000 , punishing him for repeatedly violating a gag order . The judge threatened jail time if the violations continue.

Todd Blanche upended his career to represent Trump and has been the former president’s favorite lawyer. But Trump has also made him a focus of his episodic wrath .

More on Trump’s Legal Troubles

Key Inquiries: Trump faces several investigations at both the state and the federal levels, into matters related to his business and political careers.

Case Tracker: Keep track of the developments in the criminal cases involving the former president.

What if Trump Is Convicted?: Could he go to prison ? And will any of the proceedings hinder Trump’s presidential campaign? Here is what we know , and what we don’t know .

Trump on Trial Newsletter: Sign up here to get the latest news and analysis on the cases in New York, Florida, Georgia and Washington, D.C.

IMAGES

VIDEO

COMMENTS

Trips while working and between workplaces. You can claim a tax deduction for the cost of transport on trips to: perform your work duties - for example, if you travel from your regular place of work to meet with a client. attend work-related conferences or meetings away from your regular place of work. deliver items or collect supplies.

Where the travel is between home and work. If you are asking about the deductibility of travel expenses where you are travelling between home and work, you should also provide details about: whether you travel directly between home and work or make stops along the way; whether you are required to carry bulky equipment, and if so

Expenses you can claim. Your business can claim a deduction for travel expenses related to your business, whether the travel is taken within a day, overnight, or for many nights. Expenses you can claim include: airfares. train, tram, bus, taxi, or ride-sourcing fares. car hire fees and the costs you incur (such as fuel, tolls and car parking ...

52 cents per work hour. Shortcut method. 1 March 2020 to 30 June 2020. 1 July 2020 to 30 June 2021. 1 July 2021 to 30 June 2022. 80 cents per work hour. For the work from home fixed rates before 2018-19, see PS LA 2001/6 Verification approaches for home office running expenses and electronic device expenses.

If the expense was for both work and private purposes, you can only claim a deduction for the work-related portion. If your total claim for work-related expenses is more than $300, you must have written evidence to prove your claims. Work-related travel expenses include: public transport, air travel and taxi fares. short-term car hire.

A travel allowance expense is a deductible travel expense: you incur when you're travelling away from your home overnight to perform your employment duties. that you receive an allowance to cover. for accommodation, meals (food or drink), or incidentals. You incur a travel allowance expense when you either: actually pay an amount for an expense.

Eligibility to claim travel. You can claim a deduction for travel expenses (accommodation, meals and incidental expenses) if you travel and stay away from your home overnight in the course of performing your employment duties. You can't claim travel expenses if you don't stay away from your home overnight. You are travelling overnight for work ...

Along with this, interstate and overseas travel expenses are also deductible. Work-related travel expenses include ticket costs or fares for any modes of transportation, tolls, parking, etc, along with meal expenses and accommodation. There are some restrictions as well on what you can claim. We will look into that in the later part of this blog.

This ruling sets out when an employee can deduct the cost of travel by airline, train, taxi, car, bus, boat, or other vehicle. The ruling explains that ordinary travel between home and a regular place of work is not deductible. Expenses of an employee in travelling between work locations usually are deductible. There are, however exceptions.

Here's a list of the documents and information we usually need to process a private ruling request or objection about travel between home and work or between workplaces. ato Go to ato.gov.au

In brief. On 17 February 2021, the Australian Taxation Office (ATO) released the following new guidance in relation to whether an employee is "travelling on work" or otherwise, and the income tax and fringe benefits tax (FBT) treatment of associated travel expenses: Draft Taxation Ruling TR 2021/D1: Income tax and fringe benefit tax ...

The ATO's new ruling sheds light on what travel expenses employees can and cannot claim. Travel between work locations (neither of which are your home), is typically tax deductible. Incidental work-related travel, such as a receptionist who makes a stop to pick up office newspapers on their way to work, can't be claimed on tax.

Home to work travel expenses. Employees generally can't claim for the cost of travel from home to work as this is considered a private expense. It's worth noting, however, that there are some circumstances where you may be entitled to a deduction. You can claim the cost of work-related travel if you are travelling directly between two ...

6 October 2021. The ATO has released new guidance to help clarify the tax treatment of costs and allowances incurred when an employee travels - or spends time living away from home - for work. Certain conditions need to be met to ensure an allowance can be considered a travel allowance:

Yes, you would be able to claim a deduction for work related travel expenses where you start work at home and then travel to a client's home. In addition to this you would be able to claim the travel between the other appointments as long as you don't return home between them. You can find more details on our website. Liked by Jbpb1415.

Work-related travel is a hot focus area of the ATO as taxpayers can often get claims wrong. While trips between home and work are generally considered private travel, you can claim deductions in some circumstances, as well as for some travel between two workplaces. If your travel was partly private and partly for work, it is the general rule ...

3 March 2021. Transport expenses (Taxation ruling TR2021/1) incurred by an employee travelling between work locations are generally tax deductible because such travel usually: Fits in with the duties of employment. Is done in work time. Is under the direction and control of the employer. However, transport expenses incurred for ordinary travel ...

The ATO recently released three separate documents in relation to employee travel and, simultaneously, withdrew one draft ruling. These latest releases are a continuation of a process that started in 2017 with the ATO seeking to clarify its position in relation to the tax treatment of employer-provided transport, accommodation, and meals.

Travel from home to the office and back made in these limited circumstances will be treated as business travel, and as a result are tax deductible. What you can't claim. You generally can't claim the cost of travelling between work and home just because: You do minor work-related tasks - like picking up the mail on the way to work or home.

While trips between home and work are generally considered private travel, you can claim deductions in some circumstances, as well as for some travel between two workplaces. If your travel was partly private and partly for work, you can only claim for the part related to your work. What you can claim. You can claim the cost of traveling: If you ...

Highlights from the final and draft rulings, regarding making this assessment, are: The costs of travelling between home and a regular place of work have long been regarded as non-deductible and there is no change to this position. Food and drink costs are usually private, but become deductible where the employee is 'travelling on work ...