You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

American Express Travel Help Center

How can we help, get in-the-know before you go. the travel help center has resources and information to help you plan a trip, learn about your travel benefits, manage an existing booking, and more. , popular topics.

Get up-to-date info on trending travel topics.

Manage My Trips

View your itinerary or cancel your trip online.

Why Amex Travel?

Explore the benefits of booking with American Express Travel.

How to use Pay with Points

Use Membership Rewards ® points toward all or part of your qualified booking. Terms apply.

Travel Packing Essentials

Whether you’re planning a weekend getaway, or a month-long escape near or far, don't leave home without the essentials.

eTicket Flight Credits

If you have eTicket Flight Credits available with Amex Travel, learn about your redemption options and expiration and ticket details. Terms apply.

Platinum Card® Travel Benefits

Explore all the travel benefits you get when you're with Amex.

International Airline Program

Get savings on the best seats in the house and accelerate rewards every time you takeoff. Explore lower fares on international First, Business, and Premium Economy seats with the International Airline Program through American Express Travel. Terms apply.

Fine Hotels + Resorts ®

Every stay at Fine Hotels + Resorts ® is packed with perks when you book with American Express Travel. Explore your benefits and find a hotel now. Terms apply.

Global Lounge Collection

Platinum Card Members can enjoy access to more than 1,400 airport lounges across 140 countries and counting. Terms apply.

Find a lounge

Insider Fares

Go further with fewer Membership Rewards ® points. With Insider Fares, it takes less points to get around the globe. Access these flight deals at AmexTravel.com if there are enough points for the entire fare. Terms apply.

The Hotel Collection

For a stylish escape in locations near and far, book The Hotel Collection with American Express Travel. Enjoy signature perks on stays of two or more nights. Terms apply.

Explore a new path. Earn every step of the way. Get to your next vacation faster with 5X Membership Rewards ® points on flights* and prepaid hotels booked on AmexTravel.com . Terms apply.

*Per dollar spent on up to $500,000 per calendar year on flights booked directly with airlines or AmexTravel.com.”

$200 Airline Fee Credit

Receive up to $200 per calendar year in statement credits when you charge incidental travel fees on one selected qualifying airline to your eligible Card account. Terms apply

$200 Hotel Credit

Get up to $200 back in statement credits each year for prepaid Fine Hotels + Resorts bookings or The Hotel Collection bookings of two nights or more through American Express Travel when you pay with your eligible Platinum Card. Terms apply.

Other Travel Benefits

Learn about additional Platinum Card ® benefits across each step of the journey.

Fee Credit for Global Entry or TSA, PreCheck ® , $200 Uber Cash, $189 CLEAR ® , Platinum Card Concierge, Premium Global Assist ® Hotline and

more! Terms apply.

Planning My Trip

From destination inspiration to travel insurance, get the most up-to-date trip planning information all in one place.

Explore Destination Experiences

Tour the tastes of San Sebastian. Watch elephants roam the Serengeti. Explore more of the world with the help of American Express Travel. Through personalized service and trusted partnerships, we help you experience destinations in an unforgettable way.

Recommended Flights

From now until October 1, 2024, Platinum Card ® and Business Platinum Card ® Members can access lower fares on select routes, for travel through October 1, 2024 when you book at AmexTravel.com. Terms apply.

Get Inspired

Plan your next vacation with the help of American Express Travel. View insider travel guides, sun to slope destinations, and one-of-a-kind properties from Fine Hotels + Resorts ® and The Hotel Collection.

Insurance, Protections, Trip Cancel Guard TM , and more.

You can enjoy a variety of benefits with American Express Cards ® , including embedded Card Benefits. American Express also offers optional trip protections available for purchase, including Trip Cancel Guard , for bookings made through AmexTravel.com. Terms apply.

Fine Hotels + Resorts ® Special Offers

Enjoy special offers including complimentary nights and property credits at select Fine Hotels + Resorts ® properties when you book through American Express Travel. Travel dates and terms apply.

Take control of your travel with easy links and tips to help redeem eTicket Flight Credits, view your itinerary, cancel bookings, and more. Simply log in to “ My Trips ”.

View Itinerary

View the details of your trip, invoice, and itinerary.

Flight Booking Hotel Booking Car rental Vacation Packages Cruise Booking

Redeem eTicket Flight Credits

If you have eTicket Flight Credits available with Amex Travel, learn about your redemption options and expiration and ticket details.

Change my Booking

Understand how to make a change to your trip.

Change your Flight Booking Change your Hotel Booking Change your Car rental Change your Vacation Packages Change your Cruise Booking

Amex Travel Terms & Conditions

Membership Rewards ® Fine Hotels + Resorts ® The Hotel Collection

Cancel my Booking

Understand how to cancel an existing booking.

Cancel your Flight Booking Cancel your Hotel Booking Cancel your Car rental Cancel your Vacation Packages Cancel your Cruise Booking

Frequently Asked Questions

Chat with us.

Please log in using your User ID and Password.

Trending Articles

View your itinerary, cancel a booking, or manage a trip yourself by logging in to “ My Trips ”.

Learn how to use Membership Rewards ® points for your next booking.

Eligible Platinum Card Members can get up to $200 back in statement credits each year for prepaid Fine Hotels + Resorts ® bookings or The Hotel Collection bookings of two nights or more through American Express Travel when you pay with your eligible Platinum Card.

How-to Videos

Learn how to use Membership Rewards ® Pay with points for all or part of your flight, prepaid hotel, prepaid car rental, vacation packages (flight and prepaid hotel), or prepaid cruise booking through AmexTravel.com

How to Manage My Trip

Learn how to view your itinerary or cancel an existing booking, understand seat and baggage options, and more within My Trips.

How to Redeem an eTicket Flight Credit Online

If you have an eTicket Flight Credit from a flight originally purchased through AmexTravel.com, learn how to redeem it online.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Guide to the AmEx Travel Portal

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Who can use the American Express Travel portal?

Benefits of booking travel on amex travel, how to book travel in the portal, is travel insurance included when booking through amex travel, downsides of booking via amex travel, final thoughts on the amex travel portal.

The American Express Travel portal is similar to many other online booking sites in that it allows you to purchase flights, hotels and other travel reservations. The main difference is that only those who hold an American Express card can use it.

Certain cards come with additional perks for booking in the portal. For instance, some AmEx cards allow travelers to earn extra points for bookings, receive a 35% points rebate, pay for a portion of the reservation with points, get room upgrades and more. Terms apply.

Here's a look at what the AmEx Travel portal offers and how to use it to maximize your benefits.

American Express Travel flights, hotels and other reservations are available for American Express cardholders. Depending on which American Express card you have, you may earn additional points on your reservation or unlock additional features. Terms apply.

For example, The Platinum Card® from American Express cardholders earn 5x points on flights booked directly with an airline or through AmEx Travel and 5x points on prepaid hotels booked through AmEx Travel. They also have access to the Fine Hotels & Resorts collection through the travel portal. Additionally, American Express® Gold Card and The Platinum Card® from American Express cardholders can book room reservations with The Hotel Collection . Terms apply.

Here are eight reasons why booking with AmEx travel could be a good idea.

1. Earn up to 5x points

When you book flight through the AmEx Travel portal, your credit card may earn additional points for the purchase. In addition, prepaid hotel reservations through the AmEx travel portal also earn extra points. These are a few of the cards that offer a bonus when making reservations through AmEx travel:

on American Express' website

• 5 points per $1 on flights booked directly with airlines or with American Express Travel, on up to $500,000 spent per year.

• 5 points per $1 on prepaid hotels booked with American Express Travel.

• 1 point per $1 on other eligible purchases.

Terms apply.

• 4 points per $1 at restaurant plus takeout and delivery in the U.S.

• 4 points per $1 at U.S. supermarkets (on up to $25,000 in purchases per year).

• 3 points per $1 on flights booked directly with airlines or with American Express Travel.

• 3 points per $1 on eligible travel purchases.

• 3 points per $1 on restaurants worldwide.

• 1 point per $1 on other purchases.

• 2 points per $1 on the first $50,000 in purchases each calendar year.

• 1 point per $1 on purchases above $50,000 in a calendar year.

» Learn more: AmEx Membership Rewards: How to earn and use them

2. Pay for reservations using Pay with Points

With American Express Travel, flights, hotels and more can be paid for with points instead of cash. Members can even choose to pay a portion of the trip with points and the rest with cash. Once your reservations have been booked, the full amount of your trip will be charged to your American Express credit card, and then a credit will be posted for the points redeemed within 48 hours.

You must redeem at least 5,000 points in order to use Pay with Points. Points are redeemed at a value of 1 cent per point when booking flights or making Fine Hotels & Resorts reservations. Other eligible travel receives only 0.7 cents per point. NerdWallet values Membership Rewards points at 2.8 cents per point if you take advantage of transferring to and booking through travel partners, so the redemption rates in the travel portal are significantly below our ideal value.

If you need to cancel your reservation, you'll receive a statement credit on your card for the cash equivalent. Members who would rather have the unused Membership Rewards points returned to their accounts must contact American Express customer service at 800-297-3276. Terms apply.

3. Upgrade flights with points

Eligible flights booked with cash can be upgraded using your American Express Membership Rewards points. You'll receive 1 cent per point credit towards the cost when upgrading a flight with points (which is again below our AmEx point valuation ).

To upgrade your flight with points, select your airline and provide your reservation details in the AmEx travel portal. You will be notified if your flight is eligible or not. If your flight is eligible, you can submit an offer to the airline for the upgrade. The airline will accept or reject your bid between one and five days of your flight's departure and you'll receive a decision via email.

If your upgrade offer is accepted, the points will be deducted from your account. Your statement will show a charge and a credit for the corresponding points.

» Learn more: You can now use AmEx points to bid on flight upgrades

4. Discounted international flights through AmEx IAP

Platinum cardholders have access to discounted flights through International Airline Program (IAP) , which allows members to book first, business and premium economy at a discount on select airlines and routes. Plus, you'll receive 5x Membership Rewards points on the booking when using your The Platinum Card® from American Express or The Business Platinum Card® from American Express to pay for the flight. Terms apply.

There are 25 airlines that participate in this program. You can book refundable and nonrefundable tickets for up to eight passengers through the IAP. Tickets can be paid with your card, points or a combination of the two. You will have to pay a $39 nonrefundable ticketing fee, however the discount received on these tickets should outweigh the fee.

5. Cancel For Any Reason insurance

CFAR is shorthand for an insurance policy that allows you to cancel your trip for any reason whatsoever and receive a refund. In May 2022, AmEx launched its own version of CFAR coverage for airfare booked through the travel portal using an AmEx card.

This feature, called Trip Cancel Guard, will get you up to a 75% reimbursement on nonrefundable airfare costs, provided you cancel at least two calendar days out from your departure. You'll need to purchase Trip Cancel Guard coverage at the point of booking and if you cancel, whether through the airline directly or through AmEx Travel, you can request reimbursement online or over the phone.

» Learn more: The guide to Cancel For Any Reason (CFAR) travel insurance

6. 35% points rebate with The Business Platinum Card® from American Express

When The Business Platinum Card® from American Express cardholder book flights using points through the AmEx travel portal, they can receive up to 35% of their points back . The benefit is available on first or business class flights on any airline and all economy flights with their chosen airline. This benefit provides up to 500,000 points back per calendar year.

However, as with all AmEx credits , it's not as straightforward as you may hope. You will have to designate the airline for the 35% rebate and the airline must be the same as the one chosen for the $200 airline incidental credit .

» Learn more: The best travel credit cards right now

7. Fine Hotels & Resorts

The Loews Portofino Bay Hotel at Universal Orlando. (Photo by Sally French)

Fine Hotels & Resorts (FHR) is a collection of resorts and benefits available only to Platinum Card members. There are over 2,000 properties worldwide that participate in this program. When making reservations with Fine Hotels & Resorts for one night or more, you'll receive the following benefits:

$200 statement credit provided once per year.

Noon check-in (when available).

Room upgrade upon arrival (when available).

Daily breakfast for two.

Guaranteed 4 pm late checkout.

Complimentary in-room WiFi.

Unique property benefit valued at least $100.

These benefits rival those that many travelers receive when booking directly with hotels to obtain elite status perks. Some locations also offer a last-night free benefit, depending upon when you make your reservation. And some of the best hotels to book using FHR credits offer especially-unique amenities.

For example, many theme park fans consider Loews Portofino Bay Hotel as the best FHR hotel in Orlando . That's because — on top of all the above benefits — guests receive complimentary Universal Express Unlimited ride access, which allows you to skip the lines inside the Universal theme parks .

8. The Hotel Collection

The Loews Sapphire Falls at Universal Orlando falls under The Hotel Collection. (Photo by Sally French)

AmEx Gold and Platinum cardholders receive elite status-level perks at more than 600 hotels worldwide. When you stay for two nights or more, you'll receive a $100 resort credit and an upgrade upon arrival (when available). In addition, you can use your AmEx Membership Rewards credit card to book and pay for your reservation entirely or partially with your points.

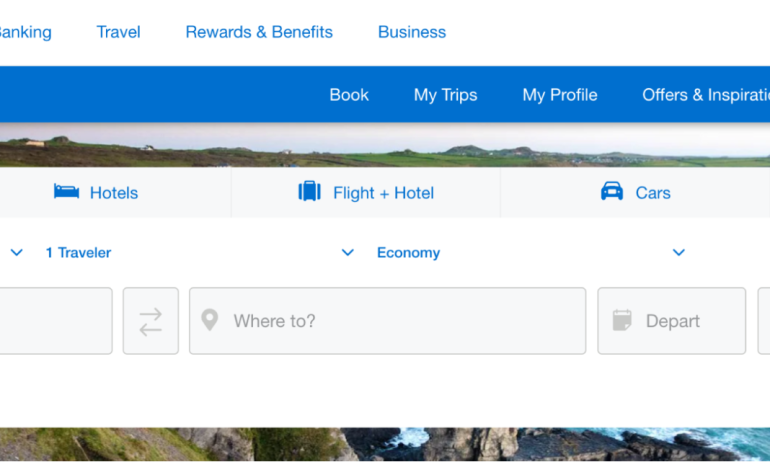

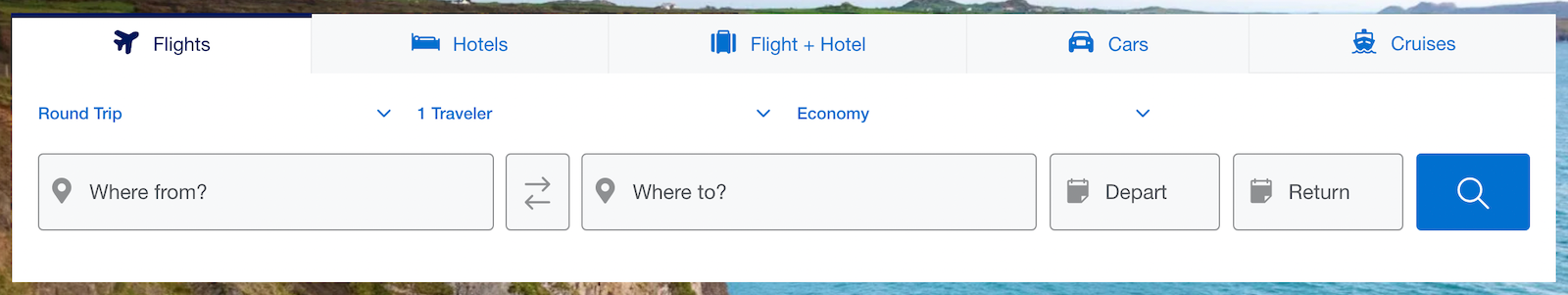

While you can book travel over the phone with an agent, it is often quicker and more convenient to make your reservations through the AmEx Travel portal.

Here's how to book travel in the American Express travel portal:

Go to americanexpress.com/en-us/travel/ .

Log in with your username and password.

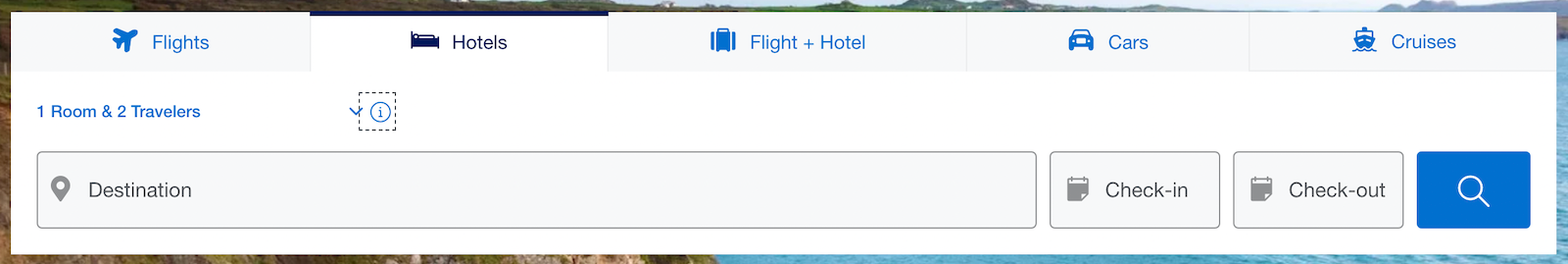

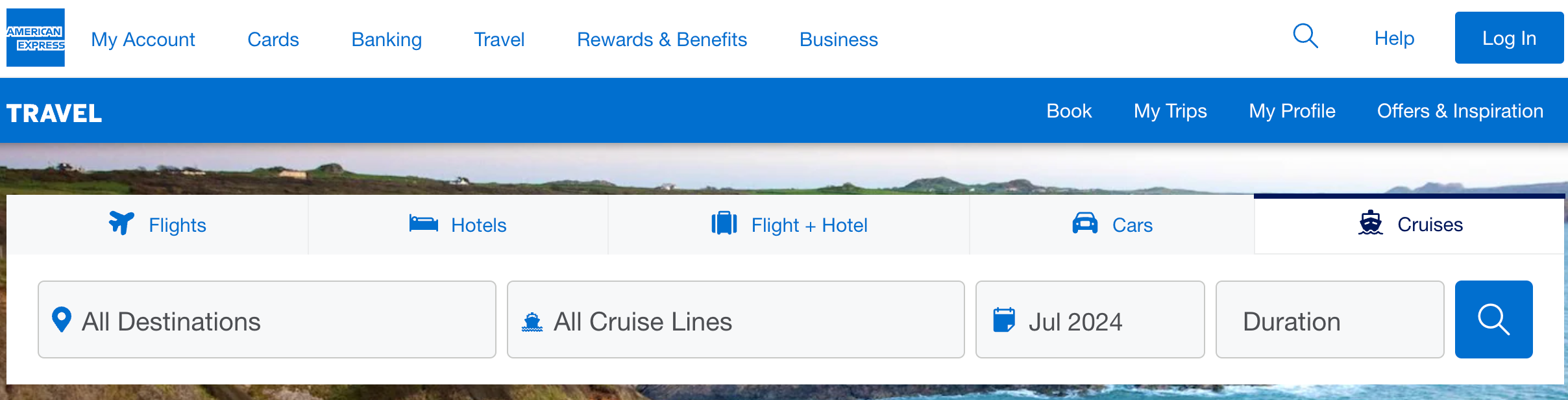

Select flights, hotels, flight + hotel, cars, or cruises.

Enter your travel dates, cities and other relevant information.

Choose options based on your trip.

Pay with your American Express credit card, points, or a combination.

Since you need an American Express card to make reservations through AmEx travel, you may already hold a card that offers complimentary travel insurance . If you don’t get travel insurance perks through your AmEx card, you can purchase Trip Cancel Guard through when making your booking.

Trip Cancel Guard works similarly to CFAR in that it allows you to cancel your trip for any reason whatsoever and get up to a 75% reimbursement of your travel costs as long as the cancellation is made two full days before your trip.

What is the AmEx Travel cancellation policy?

When you book travel through the American Express travel portal, you may be eligible to cancel your reservation within 24 hours and get a full refund. However, the cancellation policy is determined by the airline.

As such, AmEx instructs travelers to refer to the cancellation policy on the itinerary or reach out to customer service with any questions. Terms apply.

There are many appealing reasons why travelers want to book reservations with the AmEx travel portal. However, there are some downsides as well. These are some of the most common reasons why you shouldn't:

Low value for your points. Redeeming points through the AmEx travel portal yields a value of 1 cent per point or less. That's at least a 50% reduction compared to our value of Membership Rewards points.

Complicated customer service. Resolving flight or hotel reservation issues becomes more complicated when you book through a third party such as AmEx travel. The airline or hotel blames the booking agency and may not immediately resolve the problem in some instances. However, providers have no scapegoat when you book direct.

No hotel elite status benefits or loyalty credits. Most hotels require you to book directly to receive elite status benefits, stay credits or earn points. For travelers looking to take advantage of their elite status or earn status for the next year, booking AmEx travel hotel reservations is not a good idea.

Despite the above policy, hotels booked through Fine Hotels & Resorts allow you to earn elite night credit and earn loyalty perks associated with your elite status level on any hotel reservations — regardless if you book in the portal or not.

The AmEx travel portal offers numerous benefits for all American Express cardholders. If you have a Membership Rewards credit card, you can pay for all or part of eligible travel reservations using your points.

And any portion that you pay with your Membership Rewards card can earn up to 5x points. AmEx Travel also offers two hotel collections that provide additional perks similar to elite status benefits.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Everything you need to know about Amex Travel

The American Express Travel portal allows you to redeem Membership Rewards points directly for travel reservations and activities rather than transfer your rewards to airline or hotel partners like Delta Air Lines SkyMiles and Marriott Bonvoy .

You also can book discounted premium tickets, use benefits like a 35% points rebate on certain bookings and even book premium hotels with additional perks through Amex Travel.

Let's explore this booking portal to uncover all its benefits and potential disadvantages.

What is the American Express Travel portal?

Amex Travel is the booking portal for most American Express cards . You can book flights, hotels, rental cars and cruises through the site, and you can pay with points, cash or a combination of the two.

How to book flights on the Amex Travel portal

To find flights on American Express Travel, visit this webpage . The flight booking process on the Amex Travel portal is similar to other popular sites like Kayak and Orbitz. You'll find a search box where you can enter your departure and destination cities.

If you're flexible with your departure airport, you can choose an entire city, such as New York, which has multiple airports. Additionally, you can customize your booking by selecting your preferred class and the number of travelers, and choosing between one-way and round-trip flights.

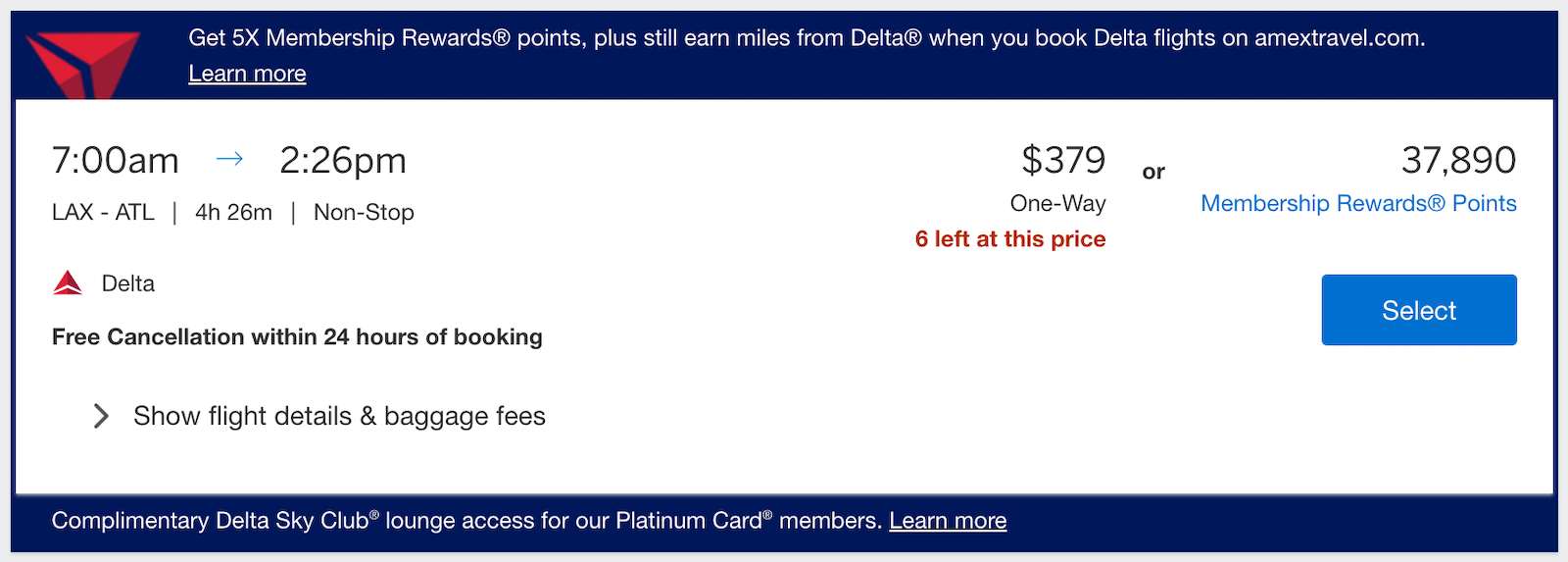

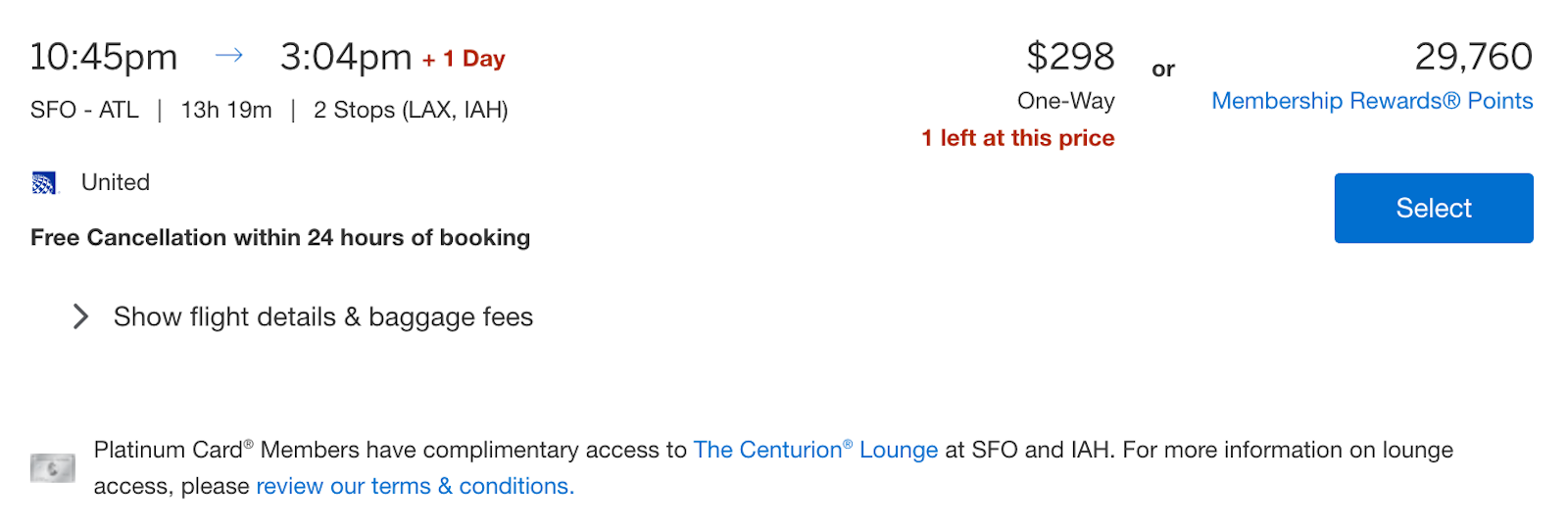

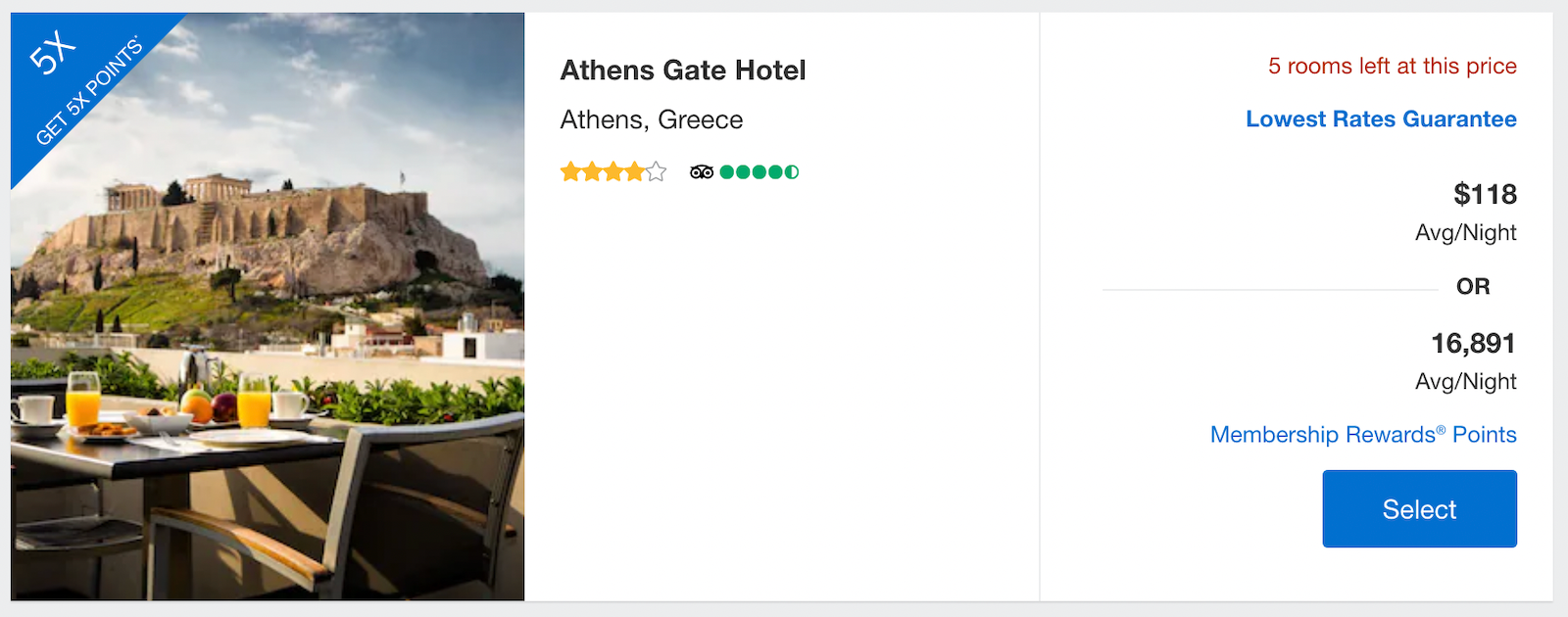

You'll see the price listed in dollars and the number of Amex Membership Rewards points during the booking process.

You can also use the options on the left-hand side to filter flights by number of stops, departure and arrival times, flight duration and airline.

Delta Air Lines is a featured airline in the Amex Travel portal. Sometimes, Delta flights appear at the top of your results, listed as "recommended," but this doesn't mean those flights are always the cheapest.

Additionally, if you have The Platinum Card® from American Express or The Business Platinum Card® from American Express and are flying from an airport with a Centurion Lounge , you'll see an indicator that a lounge is available.

Points vs. cash

When paying for your flights on Amex Travel, several American Express cards offer elevated earning rates:

You can also pay with Amex Membership Rewards points to cover the cost of your flight.

You'll see the number of points required next to the cash price of a flight. You can expect a value of 1 cent per point when using Pay with Points . However, TPG values Membership Rewards points at 2 cents apiece when you maximize Amex's transfer partners.

Related: How to redeem American Express Membership Rewards for maximum value

It's important to compare the number of points required for bookings on Amex Travel with the points you'd need to transfer to an airline program . If you can't book a flight through transfer partners and prefer to use your points, Amex Travel remains an option.

There's an additional benefit for Amex Business Platinum cardmembers: You can get 35% of your points back when paying with points on Amex Travel. This applies to first- and business-class flights on any airline plus tickets in any class on your preferred airline (the same one used for your airline incidental credits ; enrollment is required in advance). This 35% points rebate can provide a value of 1.54 cents per point, which may influence your decision to pay with cash or points.

Similarly, the Business Centurion® Card from American Express offers a 50% Pay with Points rebate on eligible flights. Note that Centurion cards are available by invitation only.

The information for the Business Centurion Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

More details about flights through Amex Travel

During the payment process, you can use points, your credit card or a combination of both. The minimum number of points you can use is 5,000, and each point is valued at 1 cent.

You can upgrade your flights using cash or points in the Amex Travel portal. This generally gives you a return of 1 cent each, and you can book using your Amex card, points or a combination of both.

During your flight search, you might come across "Insider Fares" that offer a discounted price. But to benefit from the discount, you must redeem points to cover the full fare amount.

Amex Platinum and Amex Business Platinum cardmembers have another benefit: discounted premium tickets through Amex Travel's International Airline Program . This program offers discounts on first-class, business-class and premium economy tickets from over 20 participating airlines.

To book a premium ticket using the IAP, go to the Amex Travel portal and pay with cash or points, including the Business Platinum card's 35% airline rebate. Keep in mind that not all flights are eligible and there are restrictions:

- The cardmember must travel on the itinerary.

- A maximum of eight tickets can be booked per itinerary; travel must begin and end in the U.S. or Canadian international airports.

- Tickets are nonrefundable unless stated otherwise.

- Name changes for passengers are not allowed.

Finally, note that flights booked through Amex Travel are typically treated as normal paid tickets, meaning you're eligible to earn points or miles with participating airline loyalty programs.

Related: Why I love the Amex Business Platinum's Pay with Points perk

How to book hotels on the Amex Travel portal

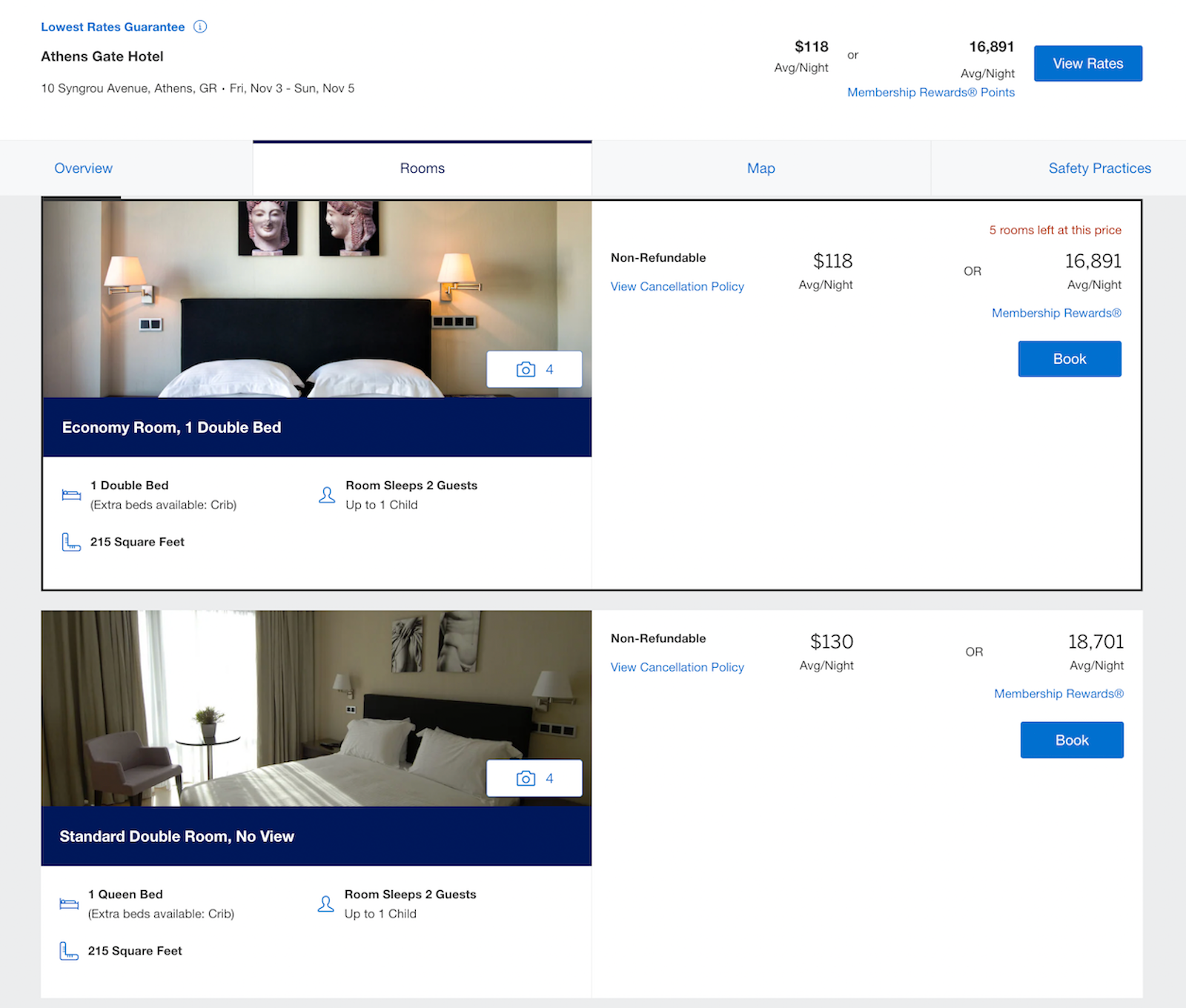

You can book hotels through American Express Travel with a Gold, Platinum or Centurion card. As with other travel portals, you can input your destination, dates, number of rooms and number of guests (with separate input fields for adults and children).

Platinum and Business Platinum cardmembers earn 5 points per dollar on prepaid hotel reservations.

After selecting your hotel, you'll choose your preferred room and pay with points or cash. If you pay with points, you'll only get a value of 0.7 cents per point (compared to 1 cent when you book flights).

Note that these are considered third-party bookings, so you likely won't earn hotel points or elite credits for your stay . While there are reports of people receiving stay credits with Marriott Bonvoy or Hilton Honors on rooms booked through Amex Travel, the hotel is not guaranteed to recognize your elite status in these programs or provide status-qualifying stay credits.

Related: 9 things to consider when choosing to book via a portal vs. booking directly

Amex Fine Hotels + Resorts

Platinum and Centurion cardholders also have access to the Fine Hotels + Resorts program through Amex Travel. This can add some great benefits to your hotel stays — and may not cost much more than booking directly with the hotel.

Here are the perks you'll receive with every FHR booking, regardless of the length of your stay:

- Room upgrade upon arrival (when available): Some room types may be excluded, but you could receive an upgrade to preferred rooms with better views or a better location in the hotel.

- Daily breakfast for two people: The provided breakfast must be, at a minimum, a continental breakfast.

- Guaranteed 4 p.m. late checkout

- Noon check-in when available

- Complimentary Wi-Fi

- Unique property amenity: The amenity varies by hotel but should be valued at $100 or more and usually consists of a property credit, dining credit, spa credit, private airport transfer or similar amenity.

You'll need to book these stays through Amex Travel, but note that FHR is considered a separate program from Amex Travel.

In addition, if you have the personal Amex Platinum , you can also get up to $200 in statement credits every year for prepaid reservations through Fine Hotels + Resorts or The Hotel Collection — which we'll discuss next. Enrollment is required.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

The Hotel Collection

A lesser-known American Express benefit is The Hotel Collection , which allows you to book in cash or with points. Those with Amex Gold, Platinum and Centurion cards have access to this program, which offers the following benefits:

- A room upgrade at check-in (if available)

- $100 on-property credit for qualifying dining, spa and resort activities

Note that The Hotel Collection bookings require a minimum stay of two nights, though they too are eligible for the $200 hotel credit on the Amex Platinum.

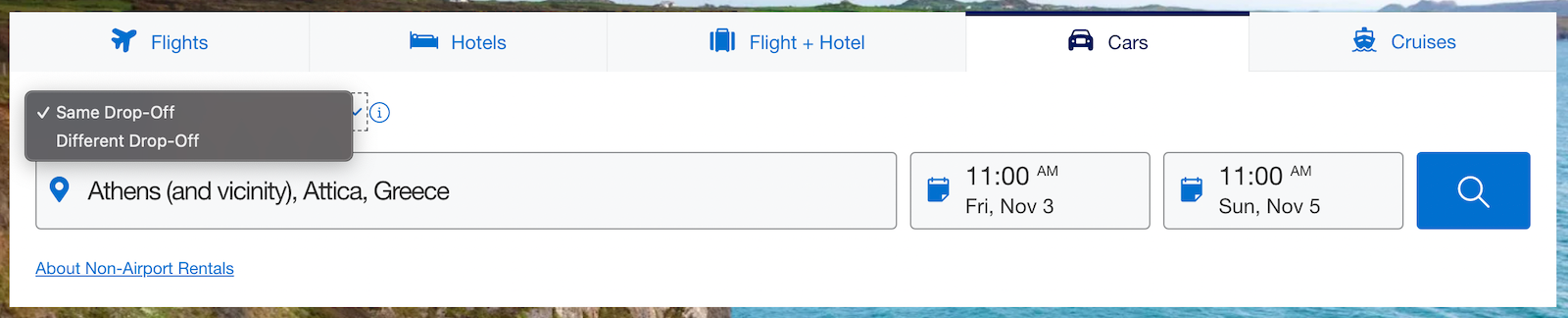

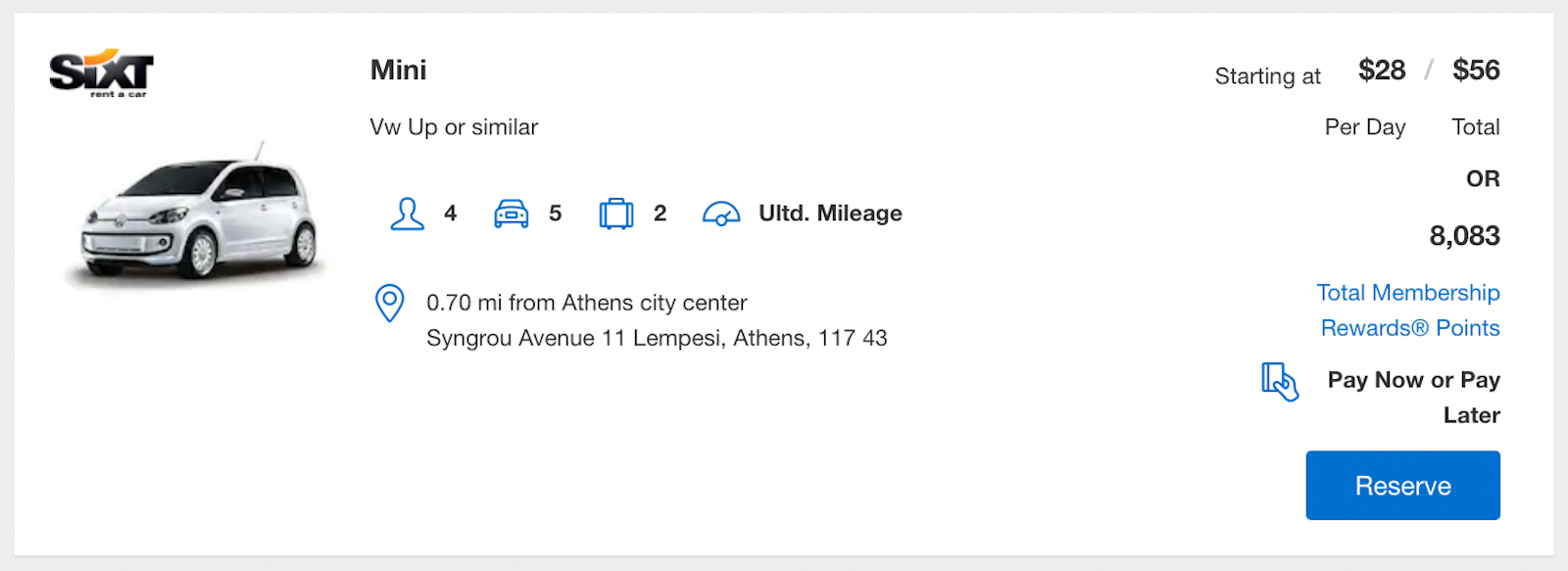

How to book rental cars and cruises on the Amex Travel portal

Reserving a car in the Amex portal is relatively simple. You'll input your pickup and drop-off times and location.

You'll see rental car prices listed in cash and points. When using Pay with Points , your points are worth 0.7 cents — just over a third of TPG's valuation of Amex Membership Rewards points.

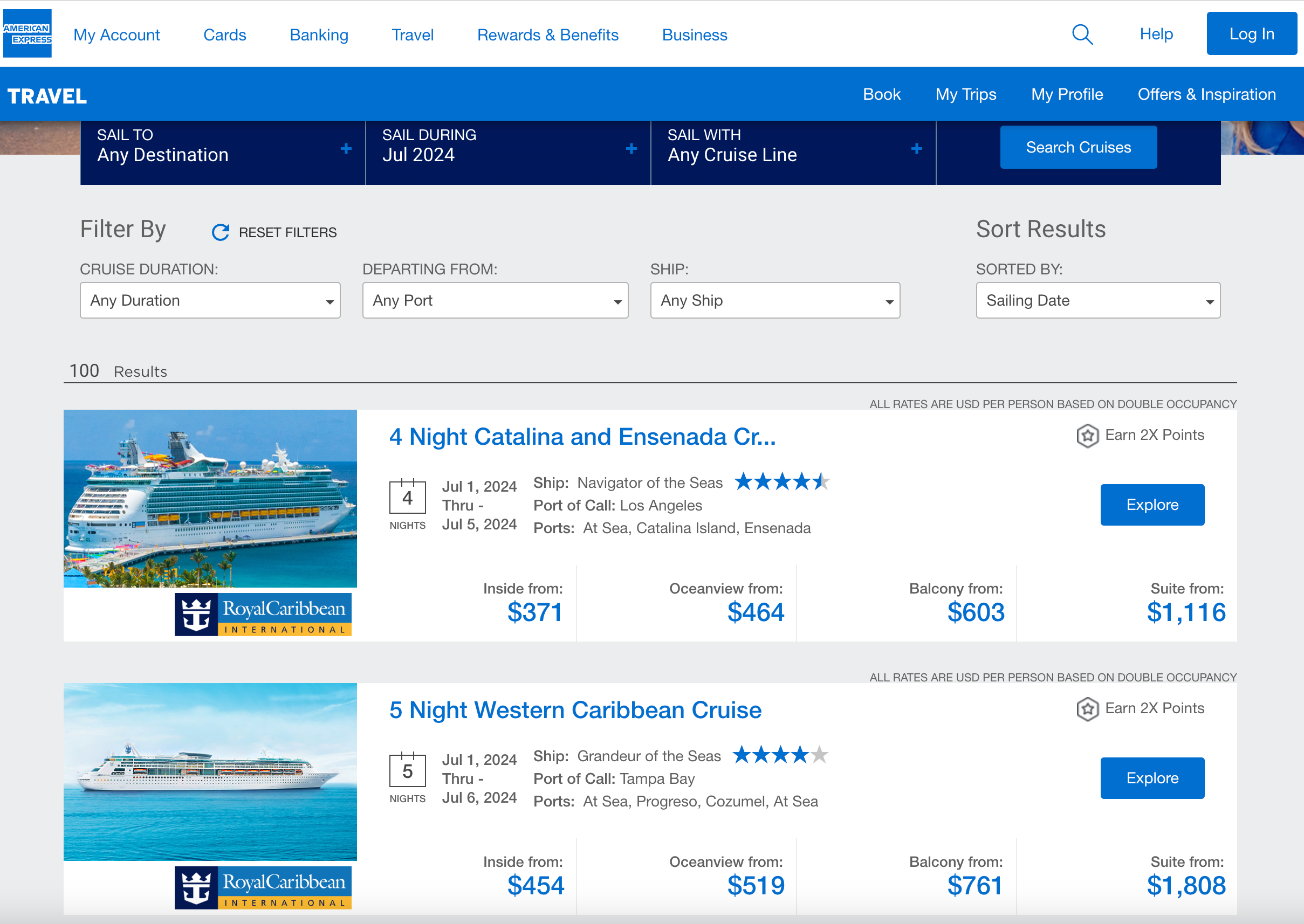

Although the format differs, you can also search for cruises on Amex Travel.

Rather than typing specific dates and numbers of passengers, you'll see four drop-down menus. These allow you to choose a destination (by region), filter by cruise lines and choose a month for travel — though not specific dates — on this first page. You can also select your desired cruise duration.

From here, you can filter by cruise duration, departure port and ship. You can sort your results by sailing date, value, price or ship rating.

On the final payment page, you can use your card or redeem points, ranging from 1 point to enough to cover the entire cost. Using points for a cruise will result in a low valuation of 0.7 cents per point, but it can be a money-saving option if you prefer not to spend cash.

There's another benefit available if you're a Platinum or Centurion cardholder (including personal and business versions of these cards): the Cruise Privileges Program .

This is available on cruises of five nights or more with select cruise lines, and it offers the following perks:

- $100-$500 in onboard ship credit (note that this cannot be used for casino or gratuity charges)

- Additional onboard amenities vary by line, such as spa vouchers, a bottle of Champagne, shore excursion credits or a private ship tour

Note that the Platinum cardmember must be one of the travelers on the cruise to enjoy these benefits.

Related: How to book a cruise using points and miles

Further things to consider about Amex Travel

When booking through the Amex Travel portal, there are a few factors to consider.

First, using Amex Membership Rewards points on Amex Travel may not provide the best value compared to transferring points to airline or hotel loyalty programs. The Pay with Points feature typically values points at 0.7 to 1 cent per point, which is far lower than our 2-cent valuation .

Additionally, the prices on Amex Travel may not always be the most competitive, so we recommend checking other platforms like Google Flights before booking your travel. Also, booking directly with hotels is advised for those seeking to utilize elite status benefits.

When you need to change your upcoming trips booked through Amex Travel, it can get complicated. You may encounter change and cancellation fees, often around $75, and making a change requires a phone call. Flight credit vouchers from cancellations can only be used for rebooking through Amex Travel via phone.

On the positive side, Amex Travel allows a 24-hour cancellation window for most reservations, and booking flights through the site generally still qualifies for earning miles and status with airline loyalty programs.

Related: Redeeming American Express Membership Rewards for maximum value

Bottom line

American Express Travel offers an array of booking options, including the ability to earn bonus Membership Rewards points on select purchases. Although you can use your points to book hotels, flights, rental cars and cruises through Amex Travel, you can get more from your points when you transfer them to Amex's airline and hotel partners .

However, there are exceptions, such as when there is no award availability for last-minute travel. In addition, Amex Travel offers perks like discounted premium flights, added benefits with Amex Fine Hotels + Resorts and a user-friendly interface. And with a simple redemption scheme that doesn't involve complicated loyalty programs and transfer partners, many Amex cardholders prefer it when planning their trips.

Additional reporting by Ryan Patterson and Kyle Olsen.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Book a Flight

Where are you going, when are you going.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit Cards

The complete guide to the Amex Travel portal

Carissa Rawson

Allie Johnson

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 7:39 a.m. UTC Feb. 28, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

onurdongel, Getty Images

The American Express Travel portal offers valuable benefits to American Express cardholders, including special prices. Depending on which card you hold, you may also be able to pay for travel with Membership Rewards® points and get access to perks such as discounted airfare and specialty benefits at luxury hotels. Let’s take a look at how the Amex Travel portal works, whether the benefits are worthwhile and who can access Amex Travel’s website.

- American Express Travel offers hotels, vacation rentals, flights, rental cars and cruises.

- Luxury hotel benefits and discounted airfare are two benefits of booking through Amex’s travel portal.

- American Express cardholders can access Amex Travel.

How to book travel through the Amex Travel portal

Booking travel through the Amex Travel portal requires you to have an online account associated with an Amex card. While you can complete a search on the Amex Travel website without logging in, you will need to do so in order to make a booking.

After you choose whether to book a flight, hotel, vacation rental, vacation package, rental car or cruise, you’ll need to enter your travel details.

For example, if you want to book a flight through Amex Travel, you’ll need to put in your departure airport and destination as well as your dates of travel. The site will then bring up a list of matching results.

You can filter based on when the flights take off as well as how many stops you’re willing to tolerate, among other options.

The Amex Travel site offers a wide variety of hotel stays and flights, but you’ll always want to double check elsewhere before booking since it doesn’t always feature every option.

Once you’ve selected a booking, you’ll be taken through the checkout process. This includes providing your personal information and can also include seat requests and adding in loyalty program numbers.

To pay for your booking, you can use your American Express Membership Rewards, if you have a card that earns them, or your American Express card or a combination of both.

After you’ve booked, you’ll receive a confirmation email containing your reservation information. You can also find your bookings under the My Trips section of Amex Travel.

Who can use the portal?

Any American Express cardholder can use the Amex Travel portal to book travel. But those whose cards don’t earn Amex Membership Rewards points will need to pay with their Amex card.

However, many American Express cards earn Membership Rewards points that can be redeemed for travel through the Amex Travel portal. These cards include (terms apply):

The Platinum Card® from American Express

- American Express® Gold Card

- American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Amex EveryDay® Credit Card * The information for the Amex EveryDay® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- American Express® Business Gold Card * The information for the American Express® Business Gold Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

All information about American Express® Green Card, Amex EveryDay® Credit Card, The Business Platinum Card® from American Express and American Express® Business Gold Card has been collected independently by Blueprint.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

Welcome bonus

Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on the Card in your first 6 months of Card Membership.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s take

- Over $1,500 in travel and entertainment credits can offset the annual fee.

- Comprehensive lounge access benefit.

- Generous travel and purchase protections.

- High annual fee and spending requirements.

- Amex’s once-per-lifetime rule limits welcome bonus eligibility.

- Annual statement credits have limited use.

Card details

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR® Plus Credit: CLEAR® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck® application fee for a 5-year plan only (through a TSA PreCheck® official enrollment provider), when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That’s up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Is the portal worth using?

The Amex Travel portal can be worth using in certain cases, though it won’t always make sense. For example, some flights aren’t bookable via Amex Travel, so if what you need isn’t available you’ll want to look elsewhere.

That being said, those with certain cards are entitled to exclusive benefits that can lower prices or allow them to redeem points for travel. There are also perks for booking luxury hotels within the portal. In these cases, Amex Travel is definitely worth investigating.

How to maximize your Amex Travel benefits through the portal

International airline program.

Available to those who hold a high-end American Express card, including The Platinum Card from American Express, The Business Platinum Card from American Express and the American Express Centurion Black Card * The information for the American Express Centurion Black Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , the International Airline Program (IAP) can save you money on certain international flights booked via the Amex Travel portal.

All information about American Express Centurion Black Card has been collected independently by Blueprint.

This benefit is only available on tickets booked in premium economy, business or first class, but the savings can be significant.

For example, we looked at a round-trip flight in premium economy from San Francisco (SFO) to Tokyo (NRT). Booking with Japan Airlines (JAL) directly resulted in a cost of $4,431.40, while the Amex Travel portal and the IAP charged just $3,797.40 for a savings of over $600.

Fine Hotels + Resorts ® and The Hotel Collection

American Express also offers the Fine Hotels and Resorts and The Hotel Collection to eligible cardholders.

Fine Hotels and Resorts allows guests to book luxury hotels with special benefits. These include room upgrades, complimentary breakfast, an experience credit, late check-out, early check-in and more.

The Hotel Collection offers similar but less exorbitant benefits. It’s directed toward more midscale properties and includes an experience credit as well as a room upgrade.

35% rebate on redeemed points

Those who hold The Business Platinum Card from American Express are able to get a 35% rebate on points redeemed for eligible flights booked through the Amex Travel portal (up to 1,000,000 points per calendar year).

Eligible flights include all fare classes on an airline that you select each year. It also includes first and business class tickets on any airline.

Quick guide to Amex Membership Rewards

American Express Membership Rewards are the points you earn with eligible Amex cards. These highly flexible and valuable points can be redeemed in a number of ways, though they tend to be most valuable when transferred to Amex airline partners.

Other ways of redeeming Amex points include:

- Gift cards.

- Travel booked via Amex Travel.

- Online shopping.

- Statement credits.

While these are nice options to have, you’ll generally get much less value from your Membership Rewards points by redeeming them in these ways. Finally, although you can redeem your points in the Amex Travel portal, this isn’t necessarily a good idea if you aim to reap maximum value. Even if you’re taking advantage of the 35% rebate on redeemed points for flights, you’ll only ever receive a value of 1.54 cents per point. This is lower than you’d expect when transferring your Amex points to many airline and hotel partners.

Frequently asked questions (FAQs)

No, travel insurance is not automatically included when booking through the Amex portal. But many of the best credit cards feature complimentary travel insurance when using your card to pay, including those from American Express. Otherwise, you may be able to opt in to travel insurance during the booking process or via a third party provider.

Those with the The Platinum Card from American Express can earn 5 Membership Rewards® points per $1 for flights booked directly with airlines or with American Express Travel on up to $500,000 per calendar year, 5 points per $1 on prepaid hotels booked with American Express Travel and 1 point per $1 on other purchases. The card has an annual fee of $695 ( rates & fees ).

Those with the The Business Platinum Card® from American Express * The information for the The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , meanwhile, earn 5 Membership Rewards® points per $1 on flights and prepaid hotels through American Express Travel, 1.5 points per $1 at U.S. construction material & hardware suppliers, electronic goods retailers and software and cloud system providers, shipping providers, and purchases of $5,000 or more on up to $2 million per calendar year and 1 point per $1 on other eligible purchases. The card has a $695 annual fee.

All information about The Business Platinum Card® from American Express has been collected independently by Blueprint.

The phone number for American Express Travel is: 1-800-297-2977.

The number of Amex points that you’ll need to redeem for a flight will depend on the cash cost of your flight and whether you’re booking through Amex Travel or transferring your Membership Rewards points to an Amex airline partner. Amex Points are worth about one cent when booking flights through the portal, so a flight that costs $500 in cash would require about 50,000 Amex points. You’ll typically get a better deal with transfer partners than booking through the portal.

For rates and fees for The Platinum Card® from American Express please visit this page .

*The information for the American Express Centurion Black Card, American Express® Business Gold Card, American Express® Green Card, Amex EveryDay® Credit Card and The Business Platinum Card® from American Express has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Carissa Rawson is a credit cards and award travel expert with nearly a decade of experience. You can find her work in a variety of publications, including Forbes Advisor, Business Insider, The Points Guy, Investopedia, and more. When she's not writing or editing, you can find her in your nearest airport lounge sipping a coffee before her next flight.

Allie is a journalist with a passion for money tips and advice. She's been writing about personal finance since the Great Recession for online publications such as Bankrate, CreditCards.com, MyWalletJoy and ValuePenguin. She's also written personal finance content for Discover, First Horizon Bank, The Hartford, Travelers and Synovus.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Capital One Venture X vs. Chase Sapphire Preferred

Credit Cards Yury Byalik

Capital One Venture X benefits guide: Packed with premium perks for a lower fee than its peers

Credit Cards Carissa Rawson

Credit card application rules by issuer

Credit Cards Lee Huffman

Why the Chase Ink Business Unlimited is part of my core credit card setup

Credit Cards Eric Rosenberg

U.S. Bank Business Platinum review 2024: It’s got one job – an intro APR for purchases and balance transfers

Credit Cards Julie Sherrier

How to do a balance transfer with Capital One

Credit Cards Harrison Pierce

Amex Gold vs. Chase Sapphire Reserve

Credit Cards Natasha Etzel

How to avoid interest on a credit card

Credit Cards Sarah Brady

New Citi Strata Premier Card layers on the perks, replaces the Citi Premier Card

How do credit card refunds work?

Credit Cards Tamara Aydinyan

I’m an expat, and here’s why I love my Bank of America Travel Rewards card

Credit Cards Kelly Dilworth

Amex purchase protection benefits guide

Credit Cards Ryan Smith

Limited-time 75K offers on Chase Sapphire Preferred and Sapphire Reserve

Credit card statement balance vs current balance: What’s the difference?

Credit Cards Michelle Lambright Black

Check it out: This is what the average household spends on grocery costs per month

Credit Cards Stella Shon

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

Full List of American Express Card Customer Service Numbers [2024]

Christy Rodriguez

Travel & Finance Content Contributor

88 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3213 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1179 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![american express travel support Full List of American Express Card Customer Service Numbers [2024]](https://upgradedpoints.com/wp-content/uploads/2021/01/customer-care-representative.jpeg?auto=webp&disable=upscale&width=1200)

Table of Contents

American express personal card customer service numbers, american express business card customer service numbers, american express corporate cards customer service numbers, american express travel and membership rewards customer service numbers, american express customer service alternate methods of contact, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

If you want to contact American Express Customer Service regarding your personal, business, or corporate card, you’ve come to the right place. Whether you want to make a payment, apply for a new card, dispute a fraudulent charge, or simply have questions about your account, you can use the following customer service phone numbers.

The best number to call may vary depending on the purpose of your call, so we’ve broken out some common areas of concern. We’ve also included some alternate contact methods so you can choose the best way to get in touch with American Express. That said, the general customer service line is always a good place to get started.

If you need to talk to someone regarding one of the Amex credit cards , you’ll want to use the phone numbers in this section.

Customer Service for Personal Cards: 800-528-4800 or contact the number on the back of your card for the following American Express personal cards:

- American Express Cash Magnet ® Card *

- American Express ® Gold Card

- American Express ® Green Card *

- The Amex EveryDay ® Credit Card *

- The Amex EveryDay ® Preferred Credit Card *

- Blue Cash Everyday ® Card from American Express

- Blue Cash Preferred ® Card from American Express

- Delta SkyMiles ® Blue American Express Card

- Delta SkyMiles ® Gold American Express Card

- Delta SkyMiles ® Platinum American Express Card

- Delta SkyMiles ® Reserve American Express Card

- Hilton Honors American Express Aspire Card *

- Hilton Honors American Express Card

- Hilton Honors American Express Surpass ® Card

- Marriott Bonvoy Brilliant ® American Express ® Card

- The Platinum Card ® from American Express

* All information about these cards has been collected independently by Upgraded Points.

Hot Tip: This list includes all cards that American Express currently issues. If you hold a card that is not listed, you are still able to call the phone numbers listed or call the number listed on the back of your card for assistance.

To Report Lost or Stolen Card, Fraud, or Dispute a Charge: 800-528-4800

Make Payments by Phone: 800-472-9297

Apply for a Card: 888-297-1244

Check Application Status: 877-239-3491

Verify Card: Call the number listed on the activation sticker or verify receipt online

If you have an American Express business card , this is the section you’ll want to use.

Customer Service for Business Cards: 800-492-3344

- Amazon Business American Express Card*

- Amazon Business Prime American Express Card *

- The American Express Blue Business Cash™ Card

- American Express ® Business Gold Card

- The Blue Business ® Plus Credit Card from American Express

- Business Green Rewards Card from American Express *

- The Business Platinum Card ® from American Express

- Delta SkyMiles ® Gold Business American Express Card

- Delta SkyMiles ® Platinum Business American Express Card

- Delta SkyMiles ® Reserve Business American Express Card

- The Hilton Honors American Express Business Card

- Lowe’s Business Rewards Card from American Express *

- Marriott Bonvoy Business ® American Express ® Card

- The Plum Card ® from American Express

Hot Tip: If you have a card that is not listed, you can still call the phone numbers listed or refer to the number listed on the back of your card for assistance — this just means that your card may no longer be open to new applicants.

To Report a Lost or Stolen Card, Fraud, or Dispute a Charge: 800-528-4800

Apply for a Card: 800-519-6736

Verify Card: Call the number listed on the activation sticker or verify receipt online

If you hold a corporate card that your employer manages, these are the customer service numbers you’ll want to reference.

General Customer Service for American Express Corporate Cards: 800-528-2122

- American Express ® / Business Extra ® Corporate Card*

- American Express ® Corporate Gold Card*

- American Express ® Corporate Green Card*

- Corporate Platinum Card ® by American Express*

Platinum Customer Service: 800-492-3932

Bottom Line: We’ve included the numbers for cardholders only. If you’re a Program Administrator, you’ll need to call 888-800-8564 for customer service support.

If you’re looking to book or change travel through American Express or have questions about your Membership Rewards account , here are some good numbers to use.

Reservations for Air, Hotel, and Car Rentals:

- Inside the U.S.: 800-297-2977

- Outside the U.S.: 312-980-7807

Reservations for Cruises: 800-297-5627

Membership Rewards Customer Service Number: 800-297-3276

Company Website: americanexpress.com

General Inquiries Mailing Address: American Express P.O. Box 981535 El Paso, TX 79998-1535

Payment Mailing Address: American Express P.O. Box 650448 Dallas, TX 75265-0448

Customer Login: global.americanexpress.com/login

Secure Chat: Log into your American Express account and click the blue Chat box in the bottom right corner. This secure chat function will allow you to speak with an American Express representative.

Twitter: Tweet questions to @AskAmex

Facebook: Send messages via Facebook

In the event you need to contact American Express, you can use this post as a resource. It includes the various ways you can contact American Express, including by phone, chat, and social media. And could come in handy if you need to do things like make a payment, dispute a charge, or even apply for a new card.

The information regarding the Amazon Business American Express Card, American Express ® / Business Extra ® Corporate Card, American Express ® Corporate Gold Card, and American Express ® Corporate Green Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

The information regarding the American Express Cash Magnet ® Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the American Express ® Green Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information for The Amex EveryDay ® Credit Card has been independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the The Amex EveryDay ® Preferred Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Hilton Honors American Express Aspire Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Business Green Rewards Card from American Express was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Corporate Platinum Card ® by American Express was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of the American Express ® Gold Card, click here . For rates and fees of the Blue Cash Everyday ® from American Express, click here . For rates and fees of the Blue Cash Preferred ® Card from American Express, click here . For rates and fees of the Delta SkyMiles ® Blue American Express Card, click here . For rates and fees of the Delta SkyMiles ® Gold American Express Card, click here . For rates and fees of the Delta SkyMiles ® Platinum American Express Card, click here . For rates and fees of Delta SkyMiles ® Reserve American Express Card, click here . For rates and fees of the Hilton Honors American Express Card, click here . For rates and fees for The Hilton Honors American Express Surpass ® Card, click here . For rates and fees of the Marriott Bonvoy Brilliant ® American Express ® card, click here . For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of the Amazon Business Prime American Express Card, click here . For rates and fees of The American Express Blue Business Cash™ Card, click here . For rates and fees of the American Express ® Business Gold Card, click here . For rates and fees of The Blue Business ® Plus Credit Card from American Express, click here . For rates and fees of The Business Platinum Card ® from American Express, click here . For rates and fees of the Delta SkyMiles ® Gold Business American Express Card, click here . For rates and fees of the Delta SkyMiles ® Platinum Business American Express Card, click here . For rates and fees for the Delta SkyMiles ® Reserve Business American Express Card, click here . For rates and fees of The Hilton Honors American Express Business Card, click here . For the rates and fees of the Lowe’s Business Rewards Card from American Express, click here . For rates and fees of the Marriott Bonvoy Business ® American Express ® Card, click here . For rates and fees of The Plum Card ® from American Express, click here .

Frequently Asked Questions

Does amex have live chat.

American Express has a live chat feature that allows you to speak directly with an American Express representative 24/7.

To access this chat, log on to your American Express account and click the blue Chat box in the bottom right corner. American Express suggests doing this from a desktop for the best results.

What is the number for American Express customer service?

American Express has a few customer service lines depending on your card type:

- Personal cards — 800-528-4800

- Business cards — 800-492-3344

- Corporate cards — 800-528-2122

You can also contact the number on the back of your card as well.

How do I dispute a charge on my American Express card?

Once you see a charge on your card that you don’t recognize or see charges for services you believe are incorrect, you’ll want to contact American Express customer service immediately. Whether you have a personal, business, or corporate card, the best number to call is 800-528-4800 .

You can also log on to your account and do the following:

- Visit Account Services

- Select Inquiry and Dispute Center from the side menu

- Click on Open a Billing or Payment Dispute

How do I verify my American Express card?

Once you receive your new American Express card in the mail, you’ll have to confirm that you’ve received it for it to be activated. You can confirm receipt online or by calling the phone number listed on the sticker on the front of your new card.

With either method, you’ll need to provide the card number and 4-digit security code.

Was this page helpful?

About Christy Rodriguez

After having “non-rev” privileges with Southwest Airlines, Christy dove into the world of points and miles so she could continue traveling for free. Her other passion is personal finance, and is a certified CPA.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![american express travel support American Express Green Card — Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2018/03/American-Express-Green-Card.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Forget Chase and American Express -- These Travel Cards Will Surprise You

We've all heard of Chase, Amex and Capital One travel cards, but what about those lesser-known (yet just as rewarding) options?

Jason Steele

Credit card expert and founder of CardCon

As a freelance personal finance writer since 2008, Jason has contributed to over 100 outlets including Forbes, USA Today, Newsweek, Time, U.S. News, Money.com and NerdWallet. As an industry leader, Jason has spoken at dozens of conferences and is the founder and producer of CardCon, an annual conference for credit card media. Jason also consults with individuals and small business owners to create customized plans to help them earn and spend travel rewards. He can be reached via his website; JasonSteele.com and on LinkedIn.

Dashia Milden

Dashia is a staff editor for CNET Money who covers all angles of personal finance, including credit cards and banking. From reviews to news coverage, she aims to help readers make more informed decisions about their money. Dashia was previously a staff writer at NextAdvisor, where she covered credit cards, taxes, banking B2B payments. She has also written about safety, home automation, technology and fintech.

Evan Zimmer

Staff Writer

Evan Zimmer has been writing about finance for years. After graduating with a journalism degree from SUNY Oswego, he wrote credit card content for Credit Card Insider (now Money Tips) before moving to ZDNET Finance to cover credit card, banking and blockchain news. He currently works with CNET Money to bring readers the most accurate and up-to-date financial information. Otherwise, you can find him reading, rock climbing, snowboarding and enjoying the outdoors.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

It’s always amusing to see your favorite travel blogger taking trips of a lifetime. But you may wonder how they afford it. Most use credit card rewards to cut costs. But how? What perks are really saving them money and how much are they having to spend to make the rewards worthwhile?

Even though there are hundreds of different credit cards available from major card issuers, most of the buzz is generated by a few of the most popular products, like the Chase Sapphire Reserve ® or The Platinum Card® from American Express .

But I’ve been traveling using credit card rewards and perks for years, and found a few unsung heroes that are just as rewarding as the big-name cards. If you look beyond those popular choices and consider some lesser-known options, you could get a card that holds more value and better perks.

Wyndham Rewards Earner Card

Solid hotel and dining perks for no annual fee

Wyndham Rewards Earner® Card

Next to hotel brands like Marriott, Hilton and Hyatt, Wyndham isn’t as well known. And even then, most people associate Wyndham with budget brands such as Days Inn, Super 8 and LaQuinta. These hotels are fine for their purpose, but most don’t imagine them as part of their ultimate dream vacation.

However, Wyndham is partnered with Caesars Entertainment, a hotel and casino company with properties that dominate the Las Vegas strip. Wyndham also owns Vacasa, a vacation rental management company that has properties in Hawaii, Colorado and Florida.

To earn stays in these areas, you can get the Wyndham Rewards Earner® Card*. It’s a no-annual-fee credit card that offers a few perks including a cardmember booking discount and automatic Wyndham Rewards Gold status, which offers preferred room selection, late checkout and 10% more points on qualifying hotel stays.

Wyndham Rewards Earner® Business Card* is even better. It offers even higher reward rates, a better welcome offer and top-tier Diamond status with Wyndham and Caesars Entertainment.