Calmer Travel

What to Do With Old Travelers Cheques (Don’t trash them)

Since smartphones and credit cards became ubiquitous, the humble traveler’s cheque (or check, depending on where you’re asking the question) has fallen out of favor. However, not that long ago they played an immensely important role in the lives of travelers across the United States.

Back when there wasn’t an ATM on every corner and cash was king, they minimized the risk globetrotters faced when traveling far from home. Cash could be lost or stolen. While traveler’s cheques could be too, they could also be reported as such and subsequently replaced!

However, now it’s 2021. Credit and debit cards are as common as dental floss and the once novel utility of traveler’s cheques has worn off. So, with that said, what do you do when you find old ones laying around?

Do not throw away your old traveler’s cheques — you may still be able to redeem them for hard currency. They never expire, so if you have ownership and the cheque’s serial number has not already been redeemed, you’ll be able to cash them at participating financial institutions.

Go dig them out of the garbage if you’ve already tossed them out! Then come back here and stick around, as we’re going to explore the state of using traveler’s cheques in the modern era.

One thing — we’re not financial or legal experts. If you doubt your ability to cash the traveler’s cheques you found, consider calling American Express at 1-800-525-7641. If American Express is not your traveler cheque issuer, simply call the company that issued them.

What About for the Deceased?

There’s a chance that if you’ve found old traveler’s cheques, they were a part of a deceased person’s estate. While it’s possible to cash the traveler’s cheques of a dead person, you have to make sure that you have the right to do so — this usually means being the executor of that person’s estate.

This is more complicated than simply proving you’re related to someone — other heirs may have equal or greater rights to the estate.

If you’re not sure if you have the ability to do this, I recommend talking to a probate lawyer or calling the company that issued the cheques.

Where To Cash Travelers Cheques in 2021

While they’re certainly not as in favor as they used to be, there are still many places that someone can redeem their traveler’s cheques for cash. While we won’t go into every location that will cash your traveler’s cheques here, we will give you a rough strategy for getting them redeemed.

via Purchases as Participating Stores

Many stores, including some Walmarts, offer the ability to cash traveler’s cheques in their store. This often takes the form of buying something with the cheque and getting the change back in U.S. currency.

Be warned — some stores will limit traveler’s cheque redemption to a certain amount of money. Consider a situation where a store only allows $20 cash back. If you paid with a $50 traveler’s cheque, you’d need to spend $30 at the store to get your total amount of money back!

Bank Deposits

Nearly all banks will allow customers to deposit their traveler’s cheques into checking or savings accounts. The same usually can’t be said if a person doesn’t have an account at that institution (with some exceptions, listed below).

However, not all banks offer this service. To know for sure, simply call your bank.

Check-cashing stores

Many people don’t know this, but check cashing places will usually cash traveler’s cheques. Like all of their other services, this will cost money. How much they’ll charge depends on the individual store policy. As with the other sections, if you’re in doubt give them a call.

Bank of America

Unlike other banks, the vast majority of Bank of America locations allow you to cash traveler’s cheques. Bank of America will often charge a fee, although some locations offer this service for free.

U.S. Post Offices

According to the USPS , you can use travelers cheques to buy postage services as long as at least 50% of the value goes toward the postage service. This means that if you have a $50 travelers cheque, you would need to buy $25 in postage services to get $25 back in change.

American Express actually offers the ability to redeem your traveler’s cheques online . In order to take advantage of this method, you’ll need the following:

- A government issued ID (social security card, passport, or U.S. driver’s license)

- The traveler’s cheques

- Your bank details

Following their online instructions will allow you to redeem the cheques, depositing the money into your bank account.

Will They Ever Expire?

I touched on this in the introduction, but one of the major benefits of buying traveler’s cheques is that they will never expire . You can keep them for 50 years and they’ll be worth the same amount of issuing currency.

However, there is one major caveat to this.

If the issuing company ever goes out of business, it’s questionable whether or not you would get your money back. This makes intuitive sense — who would give it to you if the company was gone? Luckily, American Express is over 170 years old and is unlikely to go out of business anytime soon.

If they aren’t the company that issued your traveler’s cheques, this may be a concern though.

Can You Still Buy Travelers Cheques?

According to American Express, you can still purchase travelers cheques . However, according to the University of Hawai’i Federal Credit Union, American Express travelers cheques were discontinued as of December 31, 2020. As of this writing, this is the only source I can find about the planned discontinuance.

Travelers Cheques Alternatives

If travelers do go the way of the dodo, there are still other ways to accomplish their purpose. Prepaid travel cards are the 21st century replacement for them. They offer the same advantages while also letting you use them like you would a debit or credit card.

Simply fill them with the amount of currency you want to take with you and use it like a debit card until the funds are exhausted.

Final Thoughts

You should definitely try to hang on to any old travelers cheques you find. If they haven’t already been redeemed, you might have just lucked your way into a small windfall. Even if they have been redeemed, consider holding on to them.

If American Express does discontinue them, you’ll have in your hands a piece of American history!

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

How to Check American Express Travelers Cheques

Travel tips.

Like money, travelers checks need protecting in your purse, wallet or moneybelt. (Photo: Jupiterimages/Photos.com/Getty Images )

Related Articles

- How to Cash a Traveler's Check

- How to Obtain Traveler's Checks Online

- How to Cash American Express Travelers Checks

- Where Do I Get Traveler's Checks?

American Express travelers cheques were at their most useful in the days before widespread ATMs. You could spend traveler's cheques just like cash and receive change back, but, unlike cash, your travelers cheques could be refunded if they were lost or stolen. Now that ATMs are so common all over the world, travelers cheques aren't as commonly accepted – but you can still exchange them for cash in banks and change bureaus, and use them like personal checks at some businesses.

American Express travelers checks don't expire, so you can use them any time. Once you've found a bank or business that accepts traveler's cheques, fill out the check and countersign it just as you would a personal check from another party or a payroll check.

Buying Your Travelers Cheques

You can purchase American Express travelers cheques at many banks and credit unions and at American Express service locations around the world. Note : American Express travelers cheques are available in U.S. dollars, euros and British pounds sterling. In most cases, you'll be charged a commission and/or exchange fee when you buy your cheques. If you hold an American Express card or have a AAA card, you can buy travelers cheques for no commission. (AAA cardholders will need to buy through AAA.)

As soon as you buy your travelers cheques, sign them in the upper left-hand corner. If you've purchased a "cheque for two" that can be used by either of two travelers, you'll both need to make this initial signature.

When you buy your travelers cheques, make sure to record the serial number on each cheque and keep the list in a safe place, separate from your travelers cheques. If your cheques are lost or stolen, you'll need to provide those serial numbers to arrange a refund.

Using Your Travelers Cheques

When it's time to use your travelers cheques, date the cheque in the upper right-hand corner and fill out the "pay to the order of" field, just as you would a personal check. Make sure the cashier watches you countersign the check in the lower left-hand corner. The cashier will verify your signature against the previous signature from the upper left-hand corner. If there's any change left over from the transaction, you'll receive it back in cash.

You can usually cash travelers cheques at banks, currency exchange bureaus (bureaux de change in some countries) and at American Express travel service locations. Some larger hotels and other businesses still accept them, too. That said, not as many businesses accept travelers cheques as they once did, so it's best to confirm in advance whether your cheques will be accepted. Also, ask if the merchant collects any commission fees when you make your purchase.

Tips for Travelers Check Verification

Has somebody offered to pay you with a travelers cheque? Then you should do the same security checks that any merchant would perform. First, have the buyer sign the lower left-hand corner of the cheque while you watch; then verify that the result is a reasonable match for the signature in the upper left corner.

Next, hold the cheque up to the light to see its security features. You're looking for a Centurion watermark in the white area of the cheque and a security thread in the middle. You should be able to see both features from the front and back of the cheque. Also, the color on the Centurion and American Express logo should change as you view the cheque from different angles.

Finally, American Express recommends calling them to authorize the cheque before you complete the transaction. Once you've verified that the cheque is authentic and properly made out to you, deposit it into your bank account.

- Reidsguides.com: Traveler's Checks – Useful Dinosaurs

- American Express: Learn More About Travelers Cheques

- American Express: Frequently Asked Questions

- American Express: Lost or Stolen Cheques

- The American Express service center is open 24 hours a day, seven days a week.

- Before purchasing Traveler's Cheques at a local bank or credit union, ask about fees. Some financial institutions charge customers for this service.

Lisa is the author of the award-winning "Moon Alaska" guidebook, and has penned hundreds of articles about the joys, adventures and occasional miseries of travel for local and national publications including Via, Northwest Travel & Life, Matador, Roots Rated, The Brand USA and more.

More Articles

- Hungary Currency Conversion

- How to Exchange Currency in the US

- How to Cash in Travelers Checks at a Bank

- How Do I Get Foreign Travelers Checks?

- How to Check the Currency Exchange

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Traveler’s Checks When Traveling Abroad — Useful or Outdated?

Christy Rodriguez

Travel & Finance Content Contributor

88 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

34 Published Articles 3151 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

What Are Traveler’s Checks?

Where to buy traveler’s checks, how to use traveler’s checks, what to do if traveler’s checks are stolen, 1. no access to credit or debit card, 2. limited access to atms, 3. access good exchange rates , 4. avoid common credit or debit fees, 5. as an added safety measure, 1. limited availability for use, 2. not all banks offer them, 3. potential for additional fees, 4. bulky paperwork, credit card, prepaid card, do your research, tell your bank you are traveling, don’t keep all of your money in 1 place, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

When traveling abroad, you might wonder how to pay for things once you arrive. Should you bring currency on your trip? Which currency should you bring? Can you get money once you arrive? How much cash should you carry at once?

Many of these questions can be answered by using traveler’s checks. Traveler’s checks might seem like an outdated choice, but they can still be useful in certain situations.

In this article, we’ll explain what traveler’s checks are, how they work, and when they might be worth the hassle. We’ll also explore other more common alternatives and give tips for obtaining foreign currency.

Traveler’s checks are documents that can be used like standard paper checks and cash. Travelers purchase them before they leave home to exchange for cash in the local currency when they arrive at their destination.

These checks are printed in varying denominations, and each check is uniquely numbered so that it can be replaced quickly if lost or stolen.

Banks, hotels, and merchants were once very used to accepting traveler’s checks. These places liked traveler’s checks because of the safeguards that were put in place. Basically, as long as the original signature matched the signature made at the time of the purchase, payment is guaranteed — eliminating any “bounced checks.”

Now, with the increased use of credit and debit cards (especially those with no foreign transaction fees ), prepaid cards, and ATMs on every corner, traveler’s checks have become less popular.

You may find it difficult to find banks or hotels that accept them , and if you do, you might be at the mercy of their business hours to cash them in.

How To Buy and Use Traveler’s Checks

You can still buy and use traveler’s checks in the U.S. and other countries.

You can find traveler’s checks offered by companies like American Express and Visa . You can also go to your local AAA office to purchase them.

The best place to purchase traveler’s checks is from your own bank, but unfortunately, many banks no longer offer traveler’s checks, including Chase, Wells Fargo, and Bank of America.

If you’re not sure if your bank offers traveler’s checks, it’s worth contacting them to confirm. If you are a customer, banks typically waive any fees to obtain them and this can add up because other companies can add on a 1% to 3% fee on top of the base currency amount that you request.

In order to obtain a traveler’s check, you will need to:

- Either go in person to an eligible bank or visit the website of the traveler’s check issuer.

- Select the total amount of currency to purchase.

- Submit payment, including any fees.

Once you have the traveler’s checks, you need to know how to use them. Traveler’s checks work a bit differently than other forms of currency. Here are the steps you’ll need to take:

- Sign the checks immediately. Follow the issuer’s instructions to find out where to sign (and only sign once).

- Leave evidence of your traveler’s check purchase somewhere safe. If checks get lost or stolen, you’ll need to provide proof of purchase along with check numbers to get a refund. Leave those details with a friend or save them online for easy remote access.

- Complete the payee and date fields. Once you have confirmed that the payee or bank will accept traveler’s checks, fill out the payee and date fields.

- Sign the check again. You must complete this portion in-person to ensure that the signature matches the original. You may also need to show some sort of identification as well. This is key to keeping traveler’s checks secure.

- If checks get lost or stolen, contact the issuer immediately. You may be able to get replacement checks locally, and the issuer needs to know which checks to cancel.

Traveler’s checks don’t expire , so if you don’t use them you can either keep them for future use or deposit them into your bank account once you’re home.

If all of your cash is stolen while you’re traveling abroad, you’ll have next to no chance of getting it back.

However, if this happens with your traveler’s checks, you’ll likely get them replaced as long as you’ve complied with your check issuer’s purchase agreement . This is the primary benefit of traveling with traveler’s checks.

Bottom Line: Treat your traveler’s checks like cash. If you lose your checks, you may not get replacements if your check issuer has reason to believe you didn’t safeguard them appropriately.

Here’s what to do if your traveler’s checks are lost or stolen:

- Call the customer service phone number provided by your issuer or find it by accessing their website.

- Provide proof that the check is yours by submitting the check number, proof of purchase, and your identification. It’s important to have easy access to this information for this reason.

- If required by your issuer, provide evidence that you have reported your stolen check to the police.

- Be sure to return any other refund paperwork requested.

If you don’t comply, you could experience delays or even have your claim denied. After you’ve reported your missing check, your provider will void it and issue you a new check.

Some issuers even pledge to get replacement checks out to you within 24 hours !

Best Ways To Use Traveler’s Checks

The following are situations when you might consider using traveler’s checks:

If you don’t have a credit card or a debit card tied to your bank account, a traveler’s check could be a safe alternative to simply carrying lots of cash abroad.

This tip also applies if your particular credit or debit card isn’t accepted abroad. This is more likely to happen if your card is something other than a Visa or Mastercard , as those credit cards claim the widest global network.

In many places, you can easily get cash in the local currency at an ATM once you arrive. This wouldn’t be a problem in Europe, for example, but ATMs are rare in some parts of the world. In addition, ATMs can malfunction, networks can be down, and machines might even run out of cash.

Traveler’s checks allow you to get local currency at participating banks, hotels, and other foreign locations without regard for these potential problems.

Buying traveler’s checks can help you avoid bad exchange rates. If you decide to exchange currency once you arrive, you might not get the best conversion rates by doing this at the airport.

By purchasing traveler’s checks before you leave, you can lock in a set amount at the current exchange rate.

Read our guide for the best places to exchange currency .

If your credit or debit card charges a foreign transaction fee , you can be charged a fee every time you make a purchase with your card in a foreign country. If your card also charges ATM fees, these fees can add up quickly.

To avoid these fees, it might make sense to use traveler’s checks. Although there may be a fee involved when you purchase or cash a traveler’s check, it might still be less than other fees your credit or debit card may charge.

Hot Tip: If your card charges a foreign transaction fee, it will typically be 3% of each purchase you make.

If you’re traveling to a potentially unsafe region, traveler’s checks keep your money secure. Even if you’re in a relatively safe place, anyone who enters your room or has access to your bags could search for your money.

The main benefit of traveler’s checks is that they reduce your risk of theft or loss. Since they can’t be cashed without your signature and often require a photo ID, they are less appealing to thieves or pickpockets. They can also be easily replaced if you provide the issuer with the proper information.

Cons of Using Traveler’s Checks

Here are some reasons that might discourage you from using traveler’s checks:

In much of Europe and Asia, traveler’s checks are no longer widely accepted and cannot be easily cashed — even at the banks that issued them.

This means that cashing in traveler’s checks might require hunting down a bank branch or hotel that accepts them during business hours.

Bottom Line: Those relying solely on traveler’s checks may find that they are unable to cash them in many remote or rural locations.

Certain major banks, such as Bank of America, no longer offer traveler’s checks at all. This might mean ordering traveler’s checks online well in advance of your travel plans or having to find a new bank that offers them.

If a company does offer traveler’s checks, it typically charges fees for both buying and cashing in a traveler’s check. While some banks offer them for free if you are a customer, others charge between 1% to 3% of the total purchase amount.

Check the math for your own situation, but using traveler’s checks could actually cost more than using an ATM or credit card abroad.

Not only are traveler’s checks a hassle to carry, but most companies also require that you keep proof of purchase for the checks to verify the check numbers if they are lost or stolen.

Both of these just add up to keeping track of additional paperwork.

Other Alternatives

Obviously, traveler’s checks aren’t your only option when it comes to obtaining foreign currency. Here are some other options you should consider.

Cash is convenient and relatively easy to exchange. You can bring money from home into a foreign bank or currency exchange location almost anywhere in the world. It can be easily exchanged without the worry of multiple bank fees or ATM fees adding up.

Hot Tip: Be aware: if you exchange your money in tourist areas, you might be hit with a bad exchange rate.

On the downside, carrying paper money is a risk since it can’t be replaced if stolen.

A debit card can be used at an ATM to collect cash. While not all ATM machines (especially in more rural places) accept foreign debit cards, you will find that most do.

Depending on your bank, you might even have to pay both an out-of-network ATM and an international ATM fee for this convenience.

Hot Tip: An out-of-network ATM fee is typically between $2 to $3.50 per transaction in 2021 and a typical international ATM fee can range from $2 to $7 per transaction (plus a 3% conversion fee), depending on your bank and card.

Most restaurants and stores accept foreign debit cards, but carrying a form of backup currency is always wise . Additionally, foreign transaction fees can add up quickly if you are using your debit card frequently.

Like debit cards, credit cards are small and easy to carry. Mastercard, Visa, and more recently, American Express , are widely accepted in other countries, so you can rest easy knowing you will be able to complete your purchases. You can also limit fees by getting a credit card with no foreign transaction fees .

A credit card also comes with fraud protection. You can dispute fraudulent charges and get them removed from your account if reported timely.

Hot Tip: While you can use a credit card for ATM transactions, you will be hit with a cash advance fee . It’s best to avoid doing this, if possible.

If you have difficulty getting approved for a credit card , a prepaid card could be a good alternative. You simply load the card with money from your bank account and use it as a debit card at an ATM or as a credit card at merchants and hotels.

While prepaid cards are locked with a PIN number, they can sometimes be difficult to use at ATM machines. Additionally, fees for foreign currency transactions can be as high as 7% , depending on the card.

Hot Tip: Booking hotels, airfare, or activities online will require either a credit card, debit card, or prepaid card.

Money Tips for Traveling Abroad

Know which types of currency are accepted at your destination and how much of each type (if any) you should bring. Especially be aware of any cash you might need on arrival (to obtain a visa , exchange upon arrival, etc.) in case you can’t immediately locate an ATM or a currency exchange office.

Carry a mix of cash, cards, and maybe even traveler’s checks. Ideally, the cards you bring with you shouldn’t have foreign transaction fees or ATM fees . Having some variety also helps if one of your cards isn’t accepted or your cash is lost or stolen.

Always be sure to let your bank and credit card issuers know where you’re going and when so that your card isn’t declined when you try to make a purchase due to unusual activity.

If you exchange money at your bank, you will likely also get a better exchange rate.

Keep some of your currency or an extra card locked in your hotel room’s safe or in a money belt . In the terrible instance that you lose your purse or wallet, you would still have immediate access to additional money.

We’ve shown that traveler’s checks aren’t necessarily the most convenient way to take currency abroad, but depending on if you have limited access to debit or credit cards or they aren’t accepted where you are traveling, it might be worth it to bring some along.

Overall, if you’ve decided that traveler’s checks can be of use to you, taking some, along with some cash and a debit, credit, or prepaid card, may just be the smartest way to travel.

Frequently Asked Questions

Can you still buy traveler's checks.

While many larger banks are no longer offering traveler’s checks, they are still available at American Express and other smaller banks and credit unions. It is worth asking if your bank offers them and at what cost.

How much does it cost to buy traveler's checks?

While some banks offer them for free if you are a customer, others charge between 1% and 3% of the purchase amount.

What is the purpose of a traveler's check?

A traveler’s check offers a safer option than carrying around money. There are multiple safeguards in place to prevent fraud and if the checks are lost or stolen, they can be easily replaced.

Can you cash old traveler's checks?

Traveler’s checks do not expire. You can cash them in at any time — typically even at banks that don’t offer them for sale. This means you can go to your own bank and redeem your traveler’s checks.

To do this, date them, fill out the “Pay To” field (to your bank), and countersign in the presence of the cashier . Any unused value will be returned to you in cash.

Can I buy traveler's checks online?

American Express is the only large bank that offers traveler’s checks online. Its website offers a step-by-step process to order them.

You should check with your local bank or credit union to see if they might also offer this benefit.

Was this page helpful?

About Christy Rodriguez

After having “non-rev” privileges with Southwest Airlines, Christy dove into the world of points and miles so she could continue traveling for free. Her other passion is personal finance, and is a certified CPA.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![american express travellers cheques expiry IHG One Rewards Traveler Credit Card — Review [2024]](https://upgradedpoints.com/wp-content/uploads/2023/06/IHGOneTravelerCard.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Travellers Cheques FAQ

Travellers cheques frequently asked questions, passport and credit/debit card replacement assistance, quick links, about travelex, useful information, customer support, travelex foreign coin services limited.

If You Have Old Traveler's Checks Lying Around, Here's Why You Should Cash Them ASAP

By Jason Cochran

03/07/2023, 6:15 PM

For a long time, the standard advice about traveler's checks has been conditional: You can still buy them, but be prepared for them to be refused at many places.

Traveler's checks hail from an era before ATMs, credit cards, prepaid debit cards, and digital wallets, when travelers had to bring large sums of money with them to pay for their adventures. The traveler's check enabled people to remain well-funded without the risk of carrying actual cash.

But we no longer need to carry ready funds wherever we go. We have digital payments. And as that global technology has grown, the systems that handle archaic proxy forms of payment such as traveler's checks have vanished.

Many former issuers of traveler's checks, such as Thomas Cook, Bank of America, Chase, and AAA, have either discontinued their traveler's check programs or gone out of business altogether.

Yet there are still some consumers out there who seek out this form of payment out of familiarity.

American Express acts like they're still worthwhile. ("Travelers Cheques mean peace of mind," the Amex website promises .) So does Visa , which issues them through its banking partners.

Don't succumb. You could end up stuck with the checks after you get back home.

Previously, if you still had some traveler's checks in your possession after a trip, you could redeposit them in your bank account. After all, they never expire.

But now big financial institutions have changed the rules.

Last December, Charles Schwab, a major player in consumer investing, announced that it would no longer accept traveler's checks as deposits. (The company also announced it would no longer accept mobile deposits of money orders.) The warning was quietly slipped into a tiny box in the Charles Schwab app.

Financial institutions, like airlines, tend to imitate one another's consumer products. Your bank may follow suit, if it hasn't already.

In Chase's case, sales of traveler's checks were halted in 2015, but Chase still accepts them on deposit for now.

Many banks, though, will simply refer you back to the company that originally underwrote the transaction, so getting your cash might involve detective work and mailing the old checks to Europe to petition for a refund.

Yet a lot of online travel tips still present traveler's checks as an uncommon-but-viable option.

A 2022 post by First Republic Bank sold them as "still a worthy option to consider," and a 2022 post from Capital One warned there may be a fee to deposit unused traveler's checks, but didn't mention that many banks aren't even capable of doing that anymore.

I tested ChatGPT with a question about how to obtain traveler's checks for a vacation. Because the A.I. software is fed by all the bad information online, the chatbot told me traveler's checks "have become less common in recent years," but then nonetheless proceeded to instruct me how and where to buy some.

ChatGPT never warned me that I could potentially have trouble cashing the leftovers after my trip ends.

If you research more carefully, you can find stories of people who run across old traveler's checks but have a hard time locating anyone to redeem them—even at the buyer's own bank or the institution named on the check.

If you can't use traveler's checks easily and you can't easily get your money back afterward, they're not what I'd call a viable option anymore.

One statistic that's frequently cited online states that more than $1 billion in unredeemed traveler's checks are still circulating. Many of those checks are leftovers from long-ago vacations that came in under budget or vestiges of well-meaning grandparents who assumed buying traveler's checks as gifts was as safe as buying a bond.

Although that $1 billion figure may not be accurate, there's still no doubt that heaps of old traveler's checks are out there, forgotten in the backs of closets, sock drawers, and safe deposit boxes. The avenues for getting the value back out of the checks are swiftly closing.

So it's time to call it. Traveler's checks should never be used.

More to the point, if you have any old traveler's checks somewhere, get the value back out of them as soon as possible.

And don't buy any more ever again. Not unless you want to run the risk of locking your hard-earned money into pieces of paper.

When it comes to travel, any company that is still issuing traveler's checks probably shouldn't be. Consider them dead.

- All Regions

- Australia & South Pacific

- Caribbean & Atlantic

- Central & South America

- Middle East & Africa

- North America

- Washington, D.C.

- San Francisco

- New York City

- Los Angeles

- Arts & Culture

- Beach & Water Sports

- Local Experiences

- Food & Drink

- Outdoor & Adventure

- National Parks

- Winter Sports

- Travelers with Disabilities

- Family & Kids

- All Slideshows

- Hotel Deals

- Car Rentals

- Flight Alerts

- Credit Cards & Loyalty Points

- Cruise News

- Entry Requirements & Customs

- Car, Bus, Rail News

- Money & Fees

- Health, Insurance, Security

- Packing & Luggage

- -Arthur Frommer Online

- -Passportable

- Road Trip Guides

- Alaska Made Easy

- Great Vacation Ideas in the U.S.A.

- Best of the Caribbean

- Best of Mexico

- Cruise Inspiration

- Best Places to Go 2024

Travellers Cheques

Everything you need to know about travellers cheques and their alternatives., they’re easy to use, they’re safe, they’re accepted worldwide, they don’t expire, so why aren’t people using travellers cheques as much anymore, travel money card, travel insurance, travelex info, join the conversation, customer support.

MANAGING YOUR MONEY

2022 tax center.

- Share It Share Tweet Post Email Print

Do Travelers Checks Ever Expire?

6 Tips to Save Using the Most Popular Food Delivery Apps

One of the safest ways to travel the world, still, is by using traveler's checks. These financial instruments can be cashed at nearly any bank in the world, and major retailers around the world often accept them -- and return them for cash. In addition, these checks are safe and secure; they come with copies that make it easy to replace them if lost or stolen, and usually the distributor -- in general, either Visa or American Express -- offers round-the-clock customer service. Best of all, these checks never expire.

No Expiration

Traveler's checks never expire. This means that you can use them on a trip abroad, save any remaining checks -- in a safe location, such as a safety deposit box -- and then bring them on any subsequent trips. In addition, if your checks are old and damaged, you can either cash them in for the face value or call the issuer to replace it. Make sure to always keep the check copies for verification.

Eliminating Checks

If you recently returned from a trip and do not expect to take another one for a while, you may want to consider cashing them in and putting the money in an interest-bearing account. While the checks never expire, they also do not help you financially. Traveler's checks will not earn interest or mature past their face value, unlike safety deposit bonds. If you exchange these checks for cash, you have the opportunity to deposit the money into an account that could earn interest.

Traveler's checks don't expire even when the holder of such checks dies. According to the New York Comptroller's Office, traveler's checks become part of the deceased's estate as unclaimed funds. Therefore, it is up to the surviving members of the family -- and those mentioned in the will -- to sort out the unclaimed funds in probate court.

Other Options

One option, particularly attractive if you are a frequent traveler, is to hold onto your checks. Obtaining new traveler's checks incurs new fees and is a hassle, so keeping old checks might be best for the frequent flier. Another option is to donate the old traveler's checks to a charity. The original check holder must sign each traveler's check before it can be cashed by the charity.

- USA Today: What to Do With Unused Travelers Checks?

Based in Eugene, Ore., Duncan Jenkins has been writing finance-related articles since 2008. His specialties include personal finance advice, mortgage/equity loans and credit management. Jenkins obtained his bachelor's degree in English from Clark University.

American Express Travelers Cheques Review: Is it safe? How does it work? What are the rates?

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Traveling or spending money overseas? Discover American Express Travelers Cheques for a safe and secure way to get currency to spend abroad. You'll learn how to save money and how to get the best rate for your next holidays abroad.

American Express Travelers Cheques - All you need to know

American Express (AMEX) Travelers Cheques were first issued more than a hundred years ago, in 1891. Although the traditional travelers cheque has been overtaken by more modern currency exchange options, they’re still used by some as a safe and secure way to spend money overseas. We’ll explore how American Express Travelers Cheques work, what they offer, the fees you’ll need to pay and various other aspects of their services.

*We’re using the same spelling for travelers cheques as AMEX uses on their website, which means no apostrophe and “cheque” instead of “check” — just so you know.

Where to buy AMEX Travelers Cheques

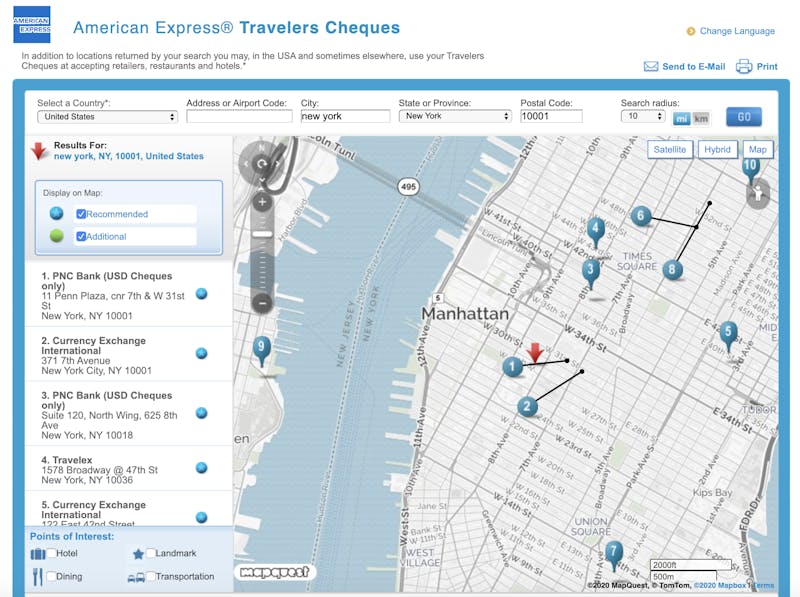

Travelers cheques are available from AMEX service centers, some AAA locations, certain banks and some currency exchange shops. Options to buy travelers cheques outside of major cities like New York, London, Toronto or other big metropolitan areas are limited. Places you may be able to purchase travelers cheques in the US include PNC bank branches and Travelex.

You should contact the location before you visit to check fees, limits, payment methods, restrictions, exchange rates and availability. AMEX recommends you keep your original purchase receipt as proof of purchase.

Where to redeem AMEX Travelers Checks

You can redeem, or “cash” your travelers cheques at thousands of locations around the world. Several currency exchange services, bureaux de change and banks will accept and redeem travelers cheques. Some merchants may even accept travelers cheques directly as payment for goods and services. If you want to make payment, redeem or cash in your travelers cheques, confirm this with the relevant business ahead of time.

When you redeem your travelers cheques, the person you are redeeming them with will need to watch you countersign the cheques, and you may need to present photographic ID and have your original purchase receipt.

In some circumstances, AMEX will allow you to redeem travelers cheques directly with them. They say, “Redemption of your Travelers Cheques directly with American Express may take longer than 30 days, depending on the circumstances of the request. There may be restrictions on the currency and method of redemption and the value of Travelers Cheques that can be directly redeemed.”

Travelers cheques do not expire, so you can either choose to redeem unused ones, or save them for future trips.

Safety and security of AMEX Travelers Cheques

If you’ve purchased travelers cheques, and they’re lost or stolen, AMEX will refund the cheques to you. Travelers cheques are not linked to your bank account either, which means you’re less likely to suffer from identity theft if the cheques are stolen from you.

What Monito Likes About AMEX Travelers Cheques

- A safe and secure way to get currency to spend abroad

- Backed by American Express, a trusted brand and financial services provider

- Refunds available if travelers cheques are lost or stolen

What Monito Dislikes About AMEX Travelers Cheques

- Can be difficult to find locations to buy travelers cheques

- Can be difficult to find locations to redeem or cash in travelers cheques

- Not as widely accepted as they once were

- High commission fees and poor exchange rates can make travelers cheques expensive to use

Alternatives to American Express Travelers Cheques

- Trust & Credibility 10

- Service & Quality 8.7

- Fees & Exchange Rates 10

- Customer Satisfaction 9.4

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

How American Express Travelers Cheques works

1. Buy your travelers cheques from certain banks, currency exchange services and various other locations

2. Travelers cheques are available in a variety of denominations, depending on the currency

3. When you buy the travelers cheques, you will normally need to present your ID and sign the travelers cheques in the top left-hand corner

4. Write down the serial numbers of your travelers cheques as you may need these if they are lost or stolen

5. Once you have purchased your travelers cheques, you can travel to a foreign country and redeem them when you need to

6. Take your travelers cheques to a location that will cash them, sign in the bottom left-hand corner and present your identification

7. The place where you are exchanging your travelers cheques will provide local currency at their prevailing exchange rate

8. You can then spend the local currency as normal

AMEX Travelers Cheques fees & exchange rate

The fees and exchange rates for using travelers cheques can vary widely.

American Express Travelers Cheques fees

AMEX, banks and other issuers may charge a fee when issuing travelers cheques in the first place. This fee is typically between one and three percent of the total value of travelers cheques that you’re buying. AMEX will waive this fee if you’re an American Express cardholder.

Some currency exchange services, banks and other merchants may also charge a commission when you buy or redeem your cheques. You should contact them ahead of time to check what those fees are likely to be.

American Express Travelers Cheques exchange rates

The amount of foreign currency that you receive when redeeming travelers cheques depends on the exchange rates offered by the currency exchange service you’re using. Local bureaux de change and currency exchange services typically have fairly poor exchange rates, so you’ll end up paying more in hidden exchange rate fees.

For example, as we explain in our guide to exchanging currency in London , “this bureau de change is around 2.8 percent more expensive than the base exchange rate for exchanging between dollars and pounds. The base exchange rate was £0.81 for every dollar, but this currency exchange offers £0.79 for each dollar.”

Customer support

If your amex travelers cheques are lost or stolen.

You should safeguard your cheques as you would cash, but if they are lost or stolen, here’s what you need to do:

- Identify the serial numbers of any cheques that have been lost or stolen

- Call American Express as soon as possible to report the missing or stolen cheques and make a claim

- You will need to provide identification and proof of purchase

- AMEX will review your claim, and issue a refund if the claim is valid

When to consider using AMEX Travelers Cheques

Although they’re no longer widely issued or accepted, it does make sense to use travelers cheques in some circumstances:

- If you don’t have a credit or debit card, travelers cheques can be a good alternative

- If you’re concerned about money being lost or stolen, travelers cheques can provide extra security and are not linked to your bank accounts

- If you want to avoid foreign transactions fees (typically up to three percent) when you spend on your credit or debit card overseas, although commission or exchange rate fees on cheques may make this irrelevant

When to think about options besides American Express Travelers Cheques

One of the reasons for the decline of travelers cheques is that you have many more options when it comes to spending money abroad:

- You can use a prepaid travel money card that you top up with currency before you travel and use like a regular debit card

- You can use a credit or debit card that doesn’t charge a foreign transaction fee, like the TransferWise Borderless Account card

- You can compare all your different options for travel money, including fees and exchange rates, with our easy-to-use tool

You might also like these AMEX alternatives

- Australia edition

- International edition

- Europe edition

Epic journey to get refund on old Amex travellers’ cheques

We have €100 in travellers’ cheques from years ago but are unable to exchange them for cash

My husband recently found €100 worth of American Express travellers cheques tucked inside a travel guide. They were bought from our local HSBC branch a number of years ago, and we thought they never expired.

However, when we took them into the branch we were told they no longer issued these cheques and they could not cash them in. They suggested a local travel agent, who could not help either. I tried to contact Amex, but it seems you need to have one of its cards in order to register. Can you advise please? PN, Northallerton, North Yorkshire

You are right that travellers cheques don’t expire, but as you have found, you still need to find somewhere to cash them. The rise of ATMs around the world have made these cheques somewhat redundant, which is presumably why HSBC told you it no longer offers them. Happily the Post Office still does, and if you take them down to your local branch, we are reliably informed that you will get your cash.

We welcome letters but cannot answer individually. Email us at [email protected] or write to Consumer Champions, Money, the Guardian, 90 York Way, London N1 9GU. Please include a daytime phone number

- Consumer affairs

- Consumer champions

- Consumer rights

- Banks and building societies

EasyJet has grounded my claim for flight-delay compensation

Bristan shower pump warranty issue creates a cascade of woe

BT phone and broadband problems left me on hold for three months

Comments (…), most viewed.

Technical Analysis of American Express

The trend for American Express (AXP) is currently higher, indicating a bullish sentiment in the market. However, the stock is currently trading at our first target, which makes it a logical place for the stock to consolidate.

If American Express can break above the 240 level, it would be a positive sign for the stock. In such a scenario, we like the stock with a target of 306, suggesting further potential upside.

Investors should closely monitor the stock's performance and consider the breakout above 240 as a signal to potentially enter or add to their positions, with a target of 306 in mind.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

It appears that JavaScript is either disabled or not supported by your web browser. JavaScript must be enabled to experience the American Express website and to log in to your account.

Welcome to the Help Center

How can i accept travelers cheques.

For information about accepting American Express Travelers Cheques please visit our Travelers Cheque Authorization Centre on how to register, authenticate and authorize Travelers Cheques.

IMAGES

VIDEO

COMMENTS

Call American Express Customer Service 24/7 at 1-800-221-7282. or find additional contact numbers based on your location. American Express stopped issuing Travelers Cheques, so they're no longer available for purchase. Support is available by phone and the American Express website for customers to redeem valid. Travelers Cheques.

To find out locations where you can cash Travelers Cheques and how to redeem your Travelers Cheques directly with American Express please click here

One thing — we're not financial or legal experts. If you doubt your ability to cash the traveler's cheques you found, consider calling American Express at 1-800-525-7641. If American Express is not your traveler cheque issuer, simply call the company that issued them.

The redemption of Travelers Cheques is conducted by American Express Travel Related Services Company, Inc. The redemption application should take less than 15 minutes to complete. Have the following information available as you complete this application: Identity document (Passport, Driver's License or Government Issued ID) The Travelers ...

Travelers Cheques never expire. Unused Travelers Cheques can be used for future trips or redeemed. Redeeming your Travelers Cheques. 1. Redeem your Travelers Cheques with American Express Travel Related Services Company, Inc. You can call American Express customer service on (1800-180-1245) to register a direct redemption claim (1).

Tip. American Express travelers checks don't expire, so you can use them any time. Once you've found a bank or business that accepts traveler's cheques, fill out the check and countersign it just ...

Travelers Cheques never expire. Unused Travelers Cheques can be used for future trips or redeemed. Redeeming your Travelers Cheques. 1. Redeem your Travelers Cheques with American Express Travel Related Services Company, Inc (1) You can redeem your Travelers Cheques online (2). Click the button below to find out more or to register a claim.

Travelers Cheques never expire. Unused Travelers Cheques can be used for future trips or redeemed. Redeeming your Travelers Cheques. 1. Redeem your Travelers Cheques with American Express Travel Related Services Company, Inc (1) You can redeem your Travelers Cheques online (2). Click the button below to find out more or to register a redemption ...

You can find traveler's checks offered by companies like American Express and Visa. You can also go to your local AAA office to purchase them. The best place to purchase traveler's checks is from your own bank, but unfortunately, many banks no longer offer traveler's checks, including Chase, Wells Fargo, and Bank of America.

Our exchange rates for payments made by American Express in currencies other than the Travelers cheque currency are based on interbank rates selected from customary industry sources plus 2.5% margin on the business day the refund payment is processed. We call this conversion rate the 'American Express Travelers Cheque Settlement Rate'.

Redeem your Travelers Cheques online with One App, a simple and safe way to access your funds. Learn more about this service from American Express.

If your Travellers Cheques are lost or stolen, contact an American Express Travellers Cheque Customer Service Centre immediately. They will provide you with step-by-step instructions for reimbursement. Remember to keep a record of all the Travellers Cheques serial numbers in a safe location separate from your Cheques.

Many former issuers of traveler's checks, such as Thomas Cook, Bank of America, Chase, and AAA, have either discontinued their traveler's check programs or gone out of business altogether. Yet there are still some consumers out there who seek out this form of payment out of familiarity. American Express acts like they're still worthwhile.

American Express Travellers Cheques can be replaced almost anywhere in the world - usually within 24 hours. They're accepted worldwide. ... They don't expire. American Express Travellers Cheques don't have an expiration date, so you can save them for your next trip. Just remember to sign your cheques when you get them so you're ...

Traveler's checks never expire. This means that you can use them on a trip abroad, save any remaining checks -- in a safe location, such as a safety deposit box -- and then bring them on any subsequent trips. In addition, if your checks are old and damaged, you can either cash them in for the face value or call the issuer to replace it.

American Express Travelers Cheques - All you need to know. American Express (AMEX) Travelers Cheques were first issued more than a hundred years ago, in 1891. Although the traditional travelers cheque has been overtaken by more modern currency exchange options, they're still used by some as a safe and secure way to spend money overseas.

Epic journey to get refund on old Amex travellers' cheques. We have €100 in travellers' cheques from years ago but are unable to exchange them for cash. Miles Brignall. Thu 25 Sep 2014 02.00 ...

18 October 2021 at 10:30AM. During a recent tidy up at home I discovered that I still have some travellers cheques from the 1990s. I have tried to redeem that at my bank, but they refused. I got the same response from the Post Office and from a travel agent. Where can I get them redeemed ?

American Express is a multinational financial services corporation that provides a wide range of products and services, including credit cards, charge cards, and traveler's cheques. They cater to both individual consumers and businesses, offering various financial solutions and rewards programs.The…

For all information including Frequently Asked Questions about American Express® Travelers Cheques please click here.

For information about accepting American Express Travelers Cheques please visit our Travelers Cheque Authorization Centre on how to register, authenticate and authorize Travelers Cheques.