Tee Precision

Golf Industry Statistics: Key Insights and Trends

The golf industry is a significant contributor to the global economy, generating billions of dollars in revenue each year. With golfers of all ages and skill levels, the sport has a broad appeal that continues to grow. The National Golf Foundation’s (NGF) 2022 report showed that over one-third of the U.S. population over the age of 5 played golf , followed golf on television or online, read about the game, or listened to a golf-related podcast. This was up 12% year-over-year, indicating a surge in popularity for the sport.

Table of Contents

Overview of the golf industry, global golf market size, golf course statistics, golf equipment market, consumer demographics, golf tourism statistics, impact of technology on golf industry, environmental impact of golf, golf industry trends for the future.

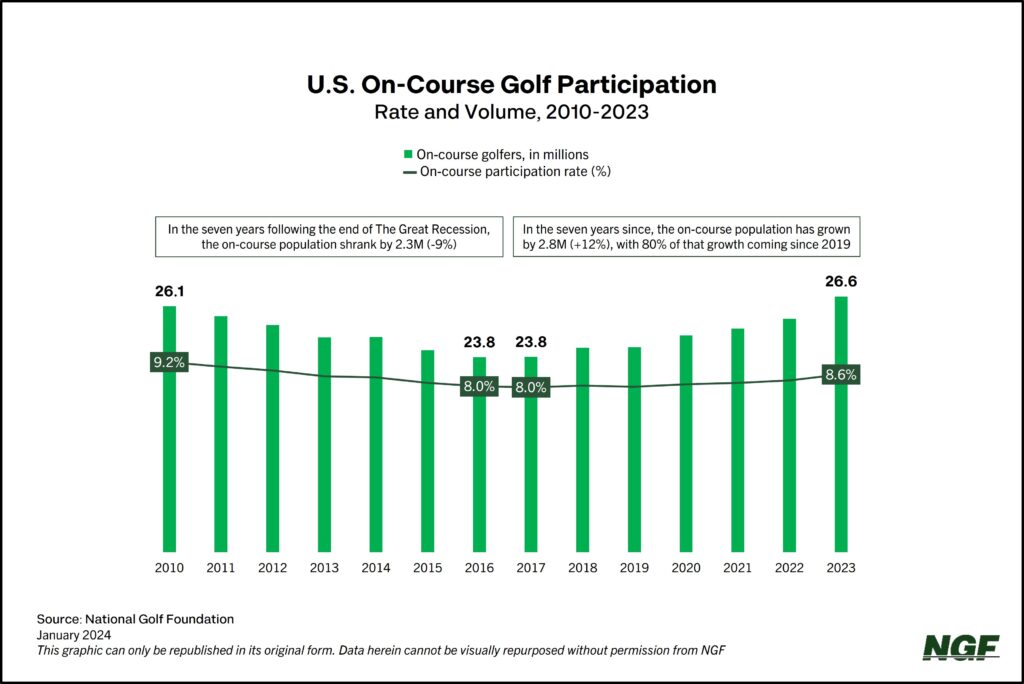

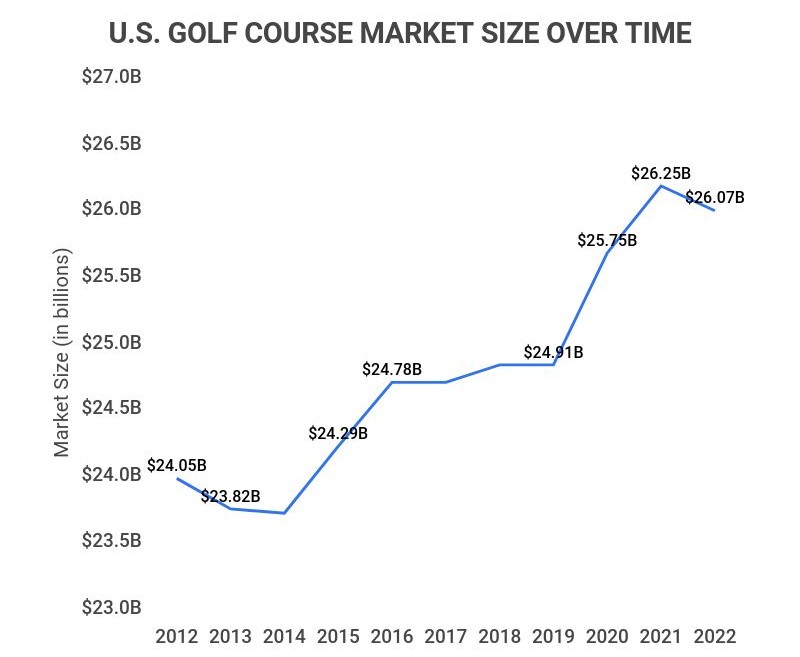

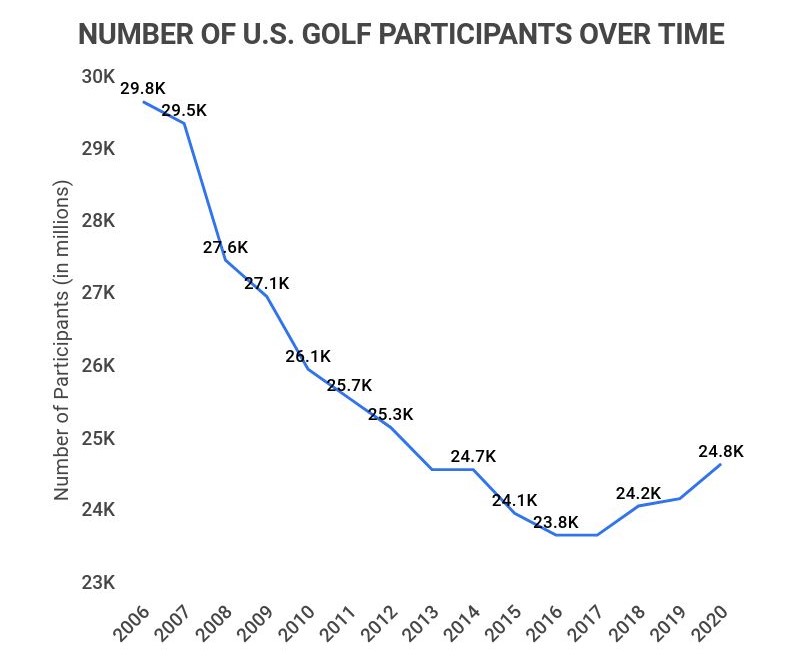

The golf industry statistics reveal that the sport has grown significantly since 2011, with the industry’s value reaching $68.8 billion and increasing by 22%. In California alone, the golf industry is worth $13.1 billion, employing 128,000 people with $4.1 billion in wages. The U.S. golf course/country club industry has a market size of $27.2 billion. In 2020, the NGF reported that there were 24.8 million golfers in the U.S., an increase of 500,000 and 2% over 2019. This is the largest net increase in 17 years, indicating that the sport’s popularity is on the rise.

The golf industry statistics point to a bright future for the sport, with more people than ever before taking an interest in golf. As the industry continues to grow, more jobs will be created, and more revenue will be generated, making it an essential part of the global economy.

The golf industry is a multi-billion dollar industry that has been growing steadily over the past few years. According to the National Golf Foundation, the industry has had nine straight years with more than 2 million beginners, with the past three topping 3 million. Prior to the pandemic-boosted totals of recent years, the previous recorded-high of 2.4 million was set in 2000, when Tiger Woods was at the height of his popularity.

The golf industry encompasses a wide range of businesses, including golf courses, country clubs , golf equipment manufacturers, and golf apparel companies. The industry is highly competitive, with companies constantly striving to offer new and innovative products and services to attract customers.

One of the key factors driving growth in the golf industry is the increasing popularity of the sport around the world. Golf is now played in over 200 countries, with an estimated 60 million people playing the sport worldwide. In the United States alone, there are over 15,000 golf courses and more than 24 million golfers.

Despite the challenges posed by the COVID-19 pandemic, the golf industry has remained resilient. Many golf courses and country clubs have implemented new safety protocols to ensure the safety of their customers and employees, and golf equipment manufacturers have continued to release new products and innovations. As a result, the golf industry is expected to continue to grow in the coming years.

The global golf market size is valued at USD 84 billion as of 2023. The market is majorly driven by the growing popularity and adoption of golf as an active sport. In 2019, the global golf equipment market was valued at USD 6.5 billion and is expected to reach USD 9.7 billion by 2025, growing at a CAGR of 5.7% during the forecast period.

According to a report by Statista, the golf course and country club market size in the U.S. is expected to reach USD 29.5 billion by 2023. The report also suggests that the number of golfers in the U.S. is declining, with only 23.8 million people playing golf in 2021, compared to 25.7 million in 2011. However, the market for golf equipment and apparel is still growing, with the revenue of selected golf equipment/apparel companies worldwide expected to reach USD 13.4 billion by 2021.

The Asia-Pacific region is expected to witness significant growth in the golf market due to the increasing popularity of golf among the middle class in countries like China, Japan, and South Korea. In 2019, the Asia-Pacific golf market was valued at USD 12.8 billion and is expected to reach USD 16.4 billion by 2025, growing at a CAGR of 4.1% during the forecast period.

Europe is another significant market for golf, with countries like the UK, Germany, and France having a large number of golf courses and clubs. In 2019, the European golf market was valued at USD 18.5 billion and is expected to reach USD 20.4 billion by 2025, growing at a CAGR of 1.9% during the forecast period.

Overall, the global golf market is expected to continue growing in the coming years, driven by the increasing popularity of golf as a sport and the growing demand for golf equipment and apparel.

The golf course industry in the United States has experienced a decline in recent years. According to Statista , the market size of the golf course and country club industry in the country was valued at approximately $22.1 billion in 2020. This is a decrease from the previous year’s market size of $23.2 billion.

The number of golf courses in the United States has also been on a decline. In 2020, there were approximately 14,794 golf courses in the country, a decrease from the previous year’s 15,014. This is a continuation of a trend that has been ongoing for several years, with the number of golf courses declining steadily since its peak of 16,052 in 2005.

The decline in the number of golf courses is due to several factors, including a decrease in interest in golf among younger generations, the high cost of maintaining golf courses, and the availability of alternative leisure activities.

Despite the decline in the number of golf courses, the industry still employs a significant number of people. According to Zippia , the golf industry in California alone employs 128,000 people with $4.1 billion in wages. Nationally, the industry employs approximately 2 million people.

Overall, while the golf course industry has experienced a decline in recent years, it still remains a significant employer and contributor to the economy.

The global golf equipment market has been growing steadily in recent years. According to a report by Grand View Research , the market was valued at USD 7.48 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. Another report by Mordor Intelligence estimates that the market size was USD 11.10 billion in 2023 and is expected to reach USD 13.65 billion by 2028, growing at a CAGR of 4.21% during the forecast period (2023-2028).

The golf equipment market consists of various products that are used to play golf, including clubs, balls, bags, shoes, and apparel. The equipment is used by both professional and amateur golfers. The market is highly competitive, with many established players and new entrants vying for market share. Some of the leading players in the market include Callaway Golf, TaylorMade Golf, Acushnet Holdings, and Amer Sports.

One of the reasons for the growth of the golf equipment market is the increasing popularity of golf as a sport. According to a report by Statista , the number of golfers in the United States increased from 23.8 million in 2011 to 24.2 million in 2020. The report also states that the revenue of Callaway Golf, one of the leading manufacturers of golf equipment, exceeded three billion U.S. dollars in 2021.

Another factor driving the growth of the golf equipment market is the increasing demand for technologically advanced equipment. Golf equipment manufacturers are constantly innovating to develop equipment that can help golfers improve their game. For example, some golf clubs now feature sensors that can provide data on a golfer’s swing, allowing them to make adjustments to improve their performance.

Overall, the golf equipment market is expected to continue growing in the coming years due to the increasing popularity of golf and the demand for advanced equipment.

The golf industry is seeing a shift in the demographics of its consumers. According to the National Golf Foundation, more than one-third (33%) of today’s junior golfers are girls, compared to just 15% in 2000. Additionally, more than one-quarter (26%) of juniors are non-Caucasian, while just 6% were minority participants just over 20 years ago.

Around 77% of golfers are men, while a little over 22% are women, according to Zippia. However, this gender gap is slowly closing as more women are taking up the sport. The number of women playing golf has increased by 14% since 2011, while the number of men has decreased by 9%.

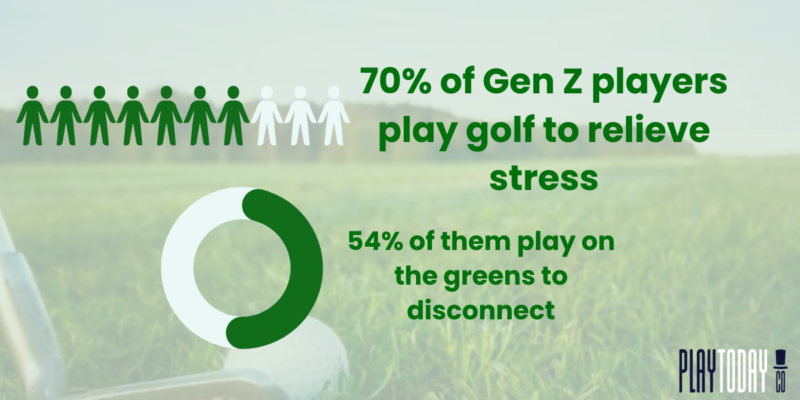

Golf is also becoming more popular among younger generations. Six million people aged 18-34 play golf, as reported by Zippia. This age group is also more likely to play golf for fun , rather than for competition.

In terms of income, golf remains a sport that is primarily played by higher-income individuals. The average annual income of a golfer is $100,000, according to Statista. However, golf is becoming more accessible to lower-income individuals through the rise of affordable public golf courses and driving ranges.

Overall, the golf industry is seeing a shift in its consumer demographics, with more women, minorities, and younger generations taking up the sport. While golf may still be primarily played by higher-income individuals, it is becoming more accessible to a wider range of people.

Golf tourism is a growing industry that involves traveling to play golf in different parts of the world. According to Grand View Research , the global golf tourism market was valued at USD 21.74 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 7.6% from 2022 to 2030. The report also states that golf sport has emerged as a professional, amateur, and leisure activity in recent years.

The National Golf Foundation reports that golf tourism accounts for a significant portion of the golf industry’s revenue. In 2020, golf tourism generated $18.2 billion in revenue, which is approximately 22% of the total golf industry revenue. The report also states that golf tourism has been growing steadily over the past few years, with more golfers traveling to play golf in different parts of the world.

The Future Market Insights report states that the global market for golf tourism was valued at US$ 21.75 Billion in 2021, with a CAGR of 6.1% during the period of 2018 to 2022. The report also highlights that the rising purchasing power of people and the increase in the number of professional tournaments have contributed to the growth of the golf tourism industry.

According to Zippia , the golf industry in California alone is worth $13.1 billion. California’s golf industry employs 128,000 people with $4.1 billion in wages. The report also states that the U.S. golf course/country club industry has a market size of $27.2 billion.

In summary, golf tourism is a growing industry that accounts for a significant portion of the golf industry’s revenue. The industry is expected to continue growing in the coming years, driven by factors such as rising purchasing power and an increase in the number of professional tournaments.

Advancements in technology have significantly impacted the golf industry in recent years. From equipment to course management, technology has revolutionized the way golf is played and experienced by players and fans alike.

One area where technology has had a significant impact is in golf club design. With the use of computer-aided design (CAD), manufacturers can design clubs that are more precise and consistent than ever before. This has led to clubs that are easier to hit and more forgiving, making golf more accessible to players of all skill levels.

Another area where technology has made a significant impact is in golf course management. With the use of GPS and other tracking technologies, course designers can create more accurate and detailed course maps, allowing players to better plan their shots and navigate the course. Additionally, these technologies can be used to track player progress and provide real-time feedback on performance, allowing players to make adjustments on the fly.

Technology has also had a significant impact on the fan experience. With the rise of social media and streaming services, fans can now follow their favorite players and tournaments from anywhere in the world. Additionally, technologies such as virtual reality and augmented reality are being used to create immersive fan experiences, allowing fans to feel like they are right in the middle of the action.

Overall, technology has had a profound impact on the golf industry, making the game more accessible, precise, and engaging for players and fans alike. As technology continues to advance, it will be interesting to see how it continues to shape the future of the sport.

Golf courses can have a significant environmental impact, but proper management practices can help mitigate negative effects. Here are some key environmental impacts associated with golf:

Golf courses require significant amounts of water to keep the turf green and healthy. According to the Golf Course Superintendents Association of America (GCSAA), the average 18-hole golf course in the United States uses about 312,000 gallons of water per day. However, many courses have implemented water conservation measures, such as using drought-tolerant grasses, installing efficient irrigation systems, and using recycled water.

Pesticides and Fertilizers

To maintain the quality of the turf, golf courses often use pesticides and fertilizers. However, these chemicals can have negative impacts on the environment, including contaminating water sources and harming wildlife. The GCSAA has developed best management practices for pesticide and fertilizer use to help reduce the environmental impact. These practices include using integrated pest management strategies, applying chemicals only when necessary, and using slow-release fertilizers.

Golf courses require a significant amount of land, which can lead to habitat loss and fragmentation. However, golf courses can also provide habitat for wildlife if properly managed. The Audubon Cooperative Sanctuary Program for Golf Courses encourages courses to implement practices that promote biodiversity, such as planting native vegetation, creating wetlands, and leaving natural areas undeveloped.

Golf courses require energy for irrigation, clubhouse operations, and maintenance equipment. However, many courses have implemented energy-efficient practices, such as using solar panels, LED lighting, and hybrid maintenance equipment. The USGA has developed a program called the Environmental Leaders in Golf Awards to recognize golf courses that demonstrate environmental stewardship and sustainability.

Overall, golf courses can have both positive and negative environmental impacts. By implementing best management practices and promoting sustainability, golf courses can help minimize their negative impacts and contribute to environmental conservation efforts.

Golf Industry Growth Rate

The golf industry has been experiencing a steady growth rate in recent years. According to the National Golf Foundation, in 2022, more than one-third of the U.S. population over the age of 5 played golf (on-course or off-course), followed golf on television or online, read about the game, or listened to a golf-related podcast. This was up 12% year-over-year. In 2020, there were 24.8 million golfers in the United States, which is 500,000 more people than there were playing golf in 2019.

The growth rate is expected to continue in the future, with the golf industry projected to be worth billions of dollars. The revenue of Callaway, one of the major golf equipment manufacturers, reached $1.8 billion in 2020, and is expected to continue growing in the coming years.

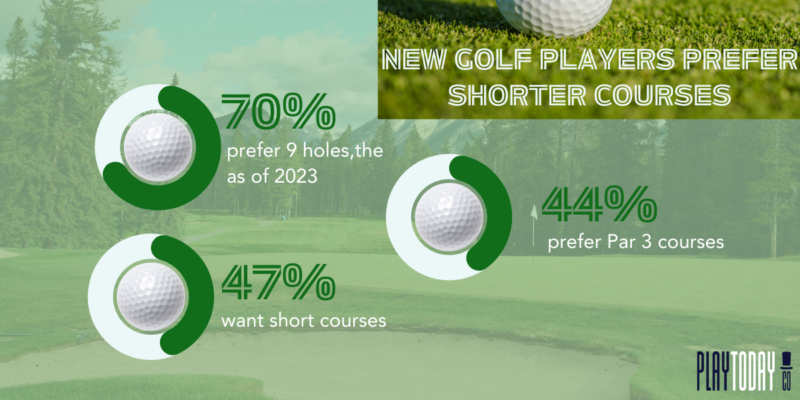

However, the golf industry is not without its challenges. As 2023 advances, the golfing industry will grapple with some ongoing problems, such as declining participation rates, aging membership bases, and the need to attract younger players.

To address these challenges, golf courses and clubs will need to implement innovative strategies to attract new players, such as offering flexible membership options, creating social events, and investing in technology to enhance the golfing experience.

In conclusion, the golf industry is poised for growth in the future, but it will require adaptation and innovation to overcome its challenges and continue to attract new players.

- Recent Posts

- Should Tee Boxes Be Level? - January 23, 2024

- 3 Hybrid Distance - November 15, 2023

- Innovations in Golf Mobility: An In-depth Review of Top Golf Scooters - October 12, 2023

- Global Locations -

Headquarters

Future Market Insights, Inc.

Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, United States

616 Corporate Way, Suite 2-9018, Valley Cottage, NY 10989, United States

Future Market Insights

1602-6 Jumeirah Bay X2 Tower, Plot No: JLT-PH2-X2A, Jumeirah Lakes Towers, Dubai, United Arab Emirates

3rd Floor, 207 Regent Street, W1B 3HH London United Kingdom

Asia Pacific

IndiaLand Global Tech Park, Unit UG-1, Behind Grand HighStreet, Phase 1, Hinjawadi, MH, Pune – 411057, India

Consumer Product

- Food & Beverage

- Chemicals and Materials

- Travel & Tourism

- Process Automation

- Industrial Automation

- Services & Utilities

- Testing Equipment

- Thought Leadership

- Upcoming Reports

- Published Reports

- Contact FMI

Golf Tourism Market

Golf Tourism Market Forecast by Travel Agent and Online Direct Booking for 2024 to 2034

Key Players in the Golf Tourism Industry Boost Efforts to Make Golfing More Accessible to Diverse Demographics, Including Beginners and Individuals with Disabilities

- Report Preview

- Request Methodology

Golf Tourism Market Outlook for 2024 to 2034

The golf tourism market size is estimated to be valued at US$ 23,145.8 million in 2024. Golf tourism contributes significantly to the economies of destinations hosting golf courses and resorts. Local governments and tourism boards often invest in developing and promoting golf tourism to attract tourists who spend on accommodation, dining, and leisure activities.

The demand for golf tourism is predicted to mark a steady rise with a CAGR of 4.9% through 2034. The industry is projected to surpass a valuation of US$ 37,344.5 million by 2034. Companies invest in developing world-class golf courses and resorts with top-notch facilities and services to attract discerning travelers. This includes designing courses by renowned architects, maintaining course quality, and offering personalized experiences tailored to golfers' preferences.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Demand Analysis of the Golf Tourism

- Golf resorts and clubs attract demand from corporate groups seeking venues for retreats, conferences, and team-building activities. Companies utilize golfing experiences as networking opportunities and team-building exercises, driving demand for golf tourism among business travelers.

- Golf courses with rich heritage and historical significance draw enthusiasts interested in experiencing the sport's traditional roots.

- Increasing awareness of environmental conservation and sustainability practices influences travelers' choices in golf tourism. Companies promoting eco-friendly initiatives, such as water conservation, habitat preservation, and renewable energy usage, appeal to environmentally conscious golfers seeking responsible tourism options.

Key Trends Influencing the Golf Tourism Market

- Wellness Integration

Golf resorts and destinations are incorporating wellness offerings such as spa treatments, yoga classes, and healthy dining options to cater to travelers seeking holistic wellness experiences alongside their golfing activities, aligning with the growing demand for wellness tourism .

- Heritage and Historical Tours

Golf tourism destinations with rich heritage and historical significance are offering guided tours and experiences that highlight the historical significance of golf in the region. These tours may include visits to historic courses, museums, and landmarks, providing golf enthusiasts with insights into the sport's evolution and cultural impact.

- Adventure Golf Experiences

Some golf tourism destinations are incorporating adventure elements into the golfing experience, such as safari-style golf tours, where players navigate courses amidst natural landscapes and wildlife habitats. Adventure golf experiences offer a unique blend of golfing excitement and outdoor exploration, appealing to adventurous travelers seeking memorable experiences.

- Ecotourism and Conservation Initiatives

Golf tourism destinations are embracing ecotourism principles and conservation initiatives to preserve natural habitats and promote biodiversity within golf course ecosystems. These destinations may offer guided nature walks, birdwatching tours, and environmental education programs that emphasize the importance of environmental stewardship and sustainability in golf tourism.

- Culinary and Gastronomic Experiences

Golf tourism destinations are enhancing their culinary offerings by partnering with renowned chefs, local farms, and wineries to create gastronomic experiences that complement the golfing experience, including farm-to-table dining, wine tastings, and culinary events showcasing regional cuisine.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

Comparative View of the Adjacent Golf Tourism Market

This section provides a comparative view of the golf tourism industry, the golf outfit market , and the Europe golf tourism market . The table below compares each adjacent market from 2024 to 2034, including CAGR, opportunities, and key trends.

Golf Tourism Market:

Golf Outfit Market:

Europe golf tourism:

Category-wise Insights

This section provides detailed insights into specific segments in the golf tourism industry.

Domestic Nationality to Secure a Share of 58% in 2024

Domestic tourism continues to be the primary driver of the golf tourism industry, holding a substantial market share of 58% in 2024. This sustained dominance can be attributed to several key factors:

- Domestic travel often provides greater ease of access and convenience compared to international trips. This makes it an attractive option for golfers seeking a leisure break without the complexities of navigating foreign destinations.

- Domestic travel can be more cost-effective than international trips, particularly when considering transportation, accommodation, and potential language barriers. This cost advantage can attract a broader range of golfers.

- The increasing popularity of golf in developing countries is leading to a growing pool of domestic golfers, further contributing to the overall market share of domestic tourism within the golf tourism industry.

Online Direct Booking Method to Record High Sales in 2024

The analysis suggests a significant shift towards online direct bookings, with this method capturing a dominant 42.0% share in 2024. This trend can be attributed to several key drivers:

- Online platforms offer a user-friendly and flexible booking experience, allowing golfers to compare various options, research destinations, and make reservations at their own pace.

- Online platforms provide access to a wider range of golf packages and resorts, enabling golfers to make informed decisions based on transparent pricing, detailed information, and comprehensive reviews.

- Online platforms often offer competitive promotions and discounts, making golf vacations more accessible to a wider range of travelers, attracting both budget-conscious and premium golfers.

- Consumers are increasingly comfortable booking travel experiences online, favoring the ease, control, and efficiency that online platforms offer. This shift in consumer behavior is driving the growth of online direct bookings in the golf tourism industry.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Country-wise Insights

The section analyzes the golf tourism market across key countries, including the United States, Australia, China, Japan, and Germany. The analysis delves into the specific factors driving the demand for golf tourism in these countries.

Golf Tourism Industry in the United States

The United States golf tourism industry is expected to maintain a steady growth trajectory with a CAGR of 3.2% through 2034. This consistent growth can be attributed to several factors:

- The United States boasts a well-established golfing infrastructure, featuring a vast network of renowned courses, diverse landscapes, and renowned hospitality options, catering to a wide range of golfing preferences.

- The United States benefits from a robust domestic golfing community, contributing significantly to the overall demand for golf tourism experiences.

- Targeted marketing efforts and promotional campaigns play a crucial role in attracting international golfers to explore the diverse golfing experiences offered within the United States.

- Well-developed transportation infrastructure and strong international connections make the United States easily accessible to golfers from various countries.

- The emergence of unique course designs and specialized golfing experiences, catering to specific interests and skill levels, further attracts a broader range of golfers to the United States.

Golf Tourism Industry in Australia

The golf tourism industry in Australia is projected to rise at a CAGR of 6.5% through 2034.

- The rising affluence and increasing interest in golf within Asian countries, particularly China, is creating a significant demand for Australian golf tourism experiences.

- The Australian government actively supports the development of the golf tourism industry through various initiatives, promoting the country as a premier golf destination.

- Integrating golf into MICE (Meetings, Incentives, Conferences, and Exhibitions) packages caters to a broader audience, attracting business travelers seeking leisure activities alongside professional events.

- The growing emphasis on eco-friendly practices and sustainable course management aligns with the evolving preferences of environmentally conscious golfers, creating a competitive advantage for Australian courses.

Golf Tourism Industry in China

China’s golf tourism industry is likely to witness expansion at a CAGR of 7.3% through 2034. This potential stems from several key drivers:

- China boasts a rapidly expanding domestic golfing population, fueling the demand for domestic and international golf tourism experiences.

- Rising disposable incomes among Chinese citizens create greater opportunities for leisure travel, including golf tourism.

- The Chinese government is actively investing in developing the golf tourism industry, recognizing its potential to contribute to economic growth and tourism revenue.

- Golf is gaining popularity among China's millennial generation, fostering a new demographic of potential golf tourists.

- Investment in luxurious golf resorts and high-quality courses caters to the growing demand for premium golf tourism experiences within China.

Golf Tourism Industry in Japan

Japan's golf tourism industry is projected to rise at a steady CAGR of 5.0% through 2034. This continued growth can be attributed to:

- Japanese courses are known for incorporating innovative technology and design elements, offering a unique and technologically advanced golfing experience.

- Renowned Japanese hospitality ensures exceptional service standards that enhance the overall golf tourism experience.

- Japan's proximity to major Asian economic hubs like South Korea and China facilitates easy access for potential golf tourists from these regions.

- Courses and resorts are increasingly offering unique experiences beyond traditional golf, such as cultural immersion programs and culinary experiences, catering to a broader range of interests.

Golf Tourism Industry in Germany

Germany's golf tourism market is expected to rise at a robust CAGR of 7.4% through 2034.

- Many German courses have undergone significant modernization and upgrades, offering improved facilities and amenities to attract new golfers and international visitors.

- German golf courses are increasingly embracing sustainable practices, such as water conservation and eco-friendly maintenance, appealing to environmentally conscious golfers.

- Germany's central European location and well-developed transportation infrastructure make it easily accessible to golfers from neighboring countries.

- Combining a golf vacation with exploring Germany's rich cultural heritage and historical sites creates a multi-faceted travel experience, attracting a wider audience.

- Many German golf resorts offer comprehensive wellness and spa facilities, catering to golfers seeking a holistic and rejuvenating experience.

Competition Outlook of the Golf Tourism Industry

The golf tourism industry, fueled by global passion for sport, presents an exciting yet competitive landscape. Established destinations like the United States, Europe, and Asia Pacific remain dominant players, attracting golfers with well-developed infrastructure, iconic courses, and diverse experiences. However, emerging markets like China, Vietnam, and the Middle East are rapidly gaining traction, offering unique golfing experiences, upscale resorts, and cost-competitive packages, challenging the established order.

Recognizing the evolving preferences of golfers, the industry is shifting its focus beyond just the course. Sustainable practices, eco-friendly course management, and integration with wellness offerings are gaining traction, catering to a more environmentally conscious and health-focused clientele. Additionally, destinations are increasingly emphasizing cultural immersion and unique experiences alongside the golfing experience, creating a multi-faceted vacation package.

Recent Developments in the Golf Tourism Industry

- Golfasian launched operations in Vietnam, offering unique golfing experiences and cultural immersion tours.

- Premier Golf Tours introduced the “Luxury Golf Getaway” package, featuring exclusive access to private courses, Michelin-starred dining, and personalized concierge services.

- The Haversham and Baker Company upgraded their online booking platform with user-friendly features like virtual course tours and AI-powered recommendations for personalized trip planning.

Key Companies in the Market

- Golf Asian Co. Ltd

- Premier Golf Tours

- The Haversham and Baker Company

- Celtic Golf

- Golf Breaks Limited

- Golf Tours International

- Travelosports

Key Coverage in the Golf Tourism Industry Report

- USA Golf and Golf Tourism Market Outlook

- Golf Travel Market Key Trends

- Golf Travel Trends 2024

- Europe Golf Tourism Industry

- Companies in the Golf Tourism Industry

Key Segments

By booking method:.

- Travel Agent

- Online Direct

By Demographic:

By nationality:.

- International

By Group Type:

- Youth Groups

- Single Tourist

- North America

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the market potential for golf tourism.

The golf tourism market is projected to expand at a CAGR of 4.9% between 2024 and 2034.

Which Booking Method Segment Dominates the Golf Tourism Market?

The online direct booking method dominates the industry.

Who are the Top Three Golf Tourism Companies?

Some of the leading golf tourism companies are Golf Asian Co. Ltd, Premier Golf Tours, and The Haversham and Baker Company.

What is the Golf Tourism Market Growth Outlook for 2034?

The golf tourism market is anticipated to surpass US$ 37,344.5 million by 2034.

What is Driving the Demand for Golf Tourism?

The desire for unique leisure experiences combined with the appeal of destination golf courses is driving the demand for golf tourism.

Table of Content

List of tables, list of charts.

Recommendations

Golf Training Aids Market

Published : December 2023

Travel and Tourism

Europe Golf Tourism Market

Published : June 2023

Explore Travel and Tourism Insights

Talk To Analyst

Your personal details are safe with us. Privacy Policy*

- Talk To Analyst -

This report can be customized as per your unique requirement

- Get Free Brochure -

Request a free brochure packed with everything you need to know.

- Customize Now -

I need Country Specific Scope ( -30% )

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

- Info Centers

- 2024 Golf Business Pulse Report

An Immersion Into Current and Future Trends Impacting Golf Facility Operations

NGCOA has released the 2024 Golf Business Pulse Report , sponsored by Pepsi . The Golf Business Pulse Report, initiated in 2022, was once again developed and produced in partnership with Sports and Leisure Research Group . This insightful publication examines emerging trends and critical issues for the year ahead, a macro perspective on the state of golf course operations , and a deeper analysis into three key operating areas: Operations, Agronomy and Marketing.

This year’s report incorporates perspectives drawn from in-depth interviews conducted with NGCOA members and a comprehensive and empirical survey of 242 facility owners and operators on emerging trends and critical issues for the year ahead. Readers will notice year over year trending analysis, revealing significant shifts and developments.

The results show attitudes and perceptions on significant challenges, opportunities and issues , and determine the extent of their impact on golf facility performance optimization. This report explores technology, labor issues, inflation, automation, gamification, smart ranges and more — we take off the gloves to finely peel back the layers of not only which trends golf course owners and operators are embracing, but heavy challenges they’re facing.

Get the Full Report Today

Ngcoa members $0, non-members $199.

The Golf Business Pulse Report was produced in partnership with Sports and Leisure Research Group. For any questions related to the report, contact Taylor Wall, Senior Director of Education, at [email protected] . .

NGCOA provides research, data, tools, education and more to support our members in their golf businesses; most NGCOA publications are available to members at no additional cost. Join NGCOA today at NGCOA.org/join or contact Rachel Carter, Senior Director of Membership, at [email protected] .

Other Research topics

- 2024 Compensation & Benefits Report

- Beware of Barter Report

- Industry Data & Reports

- Resource Library

🎙 Golf Business Podcast Episodes

- Manage My Account

- Terms & Conditions

- Hospitality

- Real Estate

- Diversity & Inclusion

- Golf Business Conference 2024

- All Communities

- Peer Resource Panel

- View All Discussions

- Golf Business Magazine

- Golf Business Podcasts

- Golf Business LIVE

- Golf Business WEEKLY

- [email protected]

- +1 909 414 1393

- Report Details

- Table Of Content

- Request Free Sample

Global Golf Tourism Market by Type (Leisure Tourism, Tournament Tourism, Business Tourism, Golf Touris), By Application (Domestic, International) And By Region (North America, Latin America, Europe, Asia Pacific and Middle East & Africa), Forecast From 2022 To 2030

- Table of Content

- Free Sample

The global golf tourism market is expected to grow at a CAGR of 4.5% during the forecast period, from 2021 to 2030. The growth in this market is attributed to the increasing number of golf courses and resorts being developed across the world, which will lead to an increase in demand for golf tourism services. The leisure tourism segment accounted for the largest share of this market in 2018, followed by tournament tourism and business tourism segments. North America was the leading region for this market in 2018, followed by Europe and Asia Pacific.

- Golf tourism is a growing industry in the United States.

- The number of golf courses in the US has increased by more than 50% since 1990, and there are now more than 15,000 courses nationwide.

- Golf tourism is a $6 billion industry in the US, with an estimated $4 billion coming from international visitors.

- The average golfer spends about $1,500 per year on golf-related expenses.

- Golf tourism is one of the few industries that has seen consistent growth during this economic downturn.

Industry Growth Insights published a new data on “Golf Tourism Market”. The research report is titled “ Golf Tourism Market research by Types (Leisure Tourism, Tournament Tourism, Business Tourism, Golf Touris), By Applications (Domestic, International), By Players/Companies Your Golf Travel, Golfbreaks, Golf Plaisir, EasyGolf Worldwide Australia, Golfasian, Classic Golf Tours, Premier Golf, Carr Golf, PerryGolf, Haversham & Baker, Emirates Holidays, Caribbean Golf & Tours, Golf Holidays Direct, SouthAmerica.travel, Ascot Golf Tours, Golf Touris ”.

Scope Of The Report

Global golf tourism market report segments:.

The global Golf Tourism market is segmented on the basis of:

Leisure Tourism, Tournament Tourism, Business Tourism, Golf Touris

The product segment provides information about the market share of each product and the respective CAGR during the forecast period. It lays out information about the product pricing parameters, trends, and profits that provides in-depth insights of the market. Furthermore, it discusses latest product developments & innovation in the market.

Applications

Domestic, International

The application segment fragments various applications of the product and provides information on the market share and growth rate of each application segment. It discusses the potential future applications of the products and driving and restraining factors of each application segment.

Some of the companies that are profiled in this report are:

- Your Golf Travel

- Golf Plaisir

- EasyGolf Worldwide Australia

- Classic Golf Tours

- Premier Golf

- Haversham & Baker

- Emirates Holidays

- Caribbean Golf & Tours

- Golf Holidays Direct

- SouthAmerica.travel

- Ascot Golf Tours

Golf Touris

Highlights of the golf tourism market report:.

- The market structure and projections for the coming years.

- Drivers, restraints, opportunities, and current trends of market.

- Historical data and forecast.

- Estimations for the forecast period 2030.

- Developments and trends in the market.

Leisure Tourism

Tournament tourism, business tourism.

- By Application:

International

- Market scenario by region, sub-region, and country.

- Market share of the market players, company profiles, product specifications, SWOT analysis, and competitive landscape.

- Analysis regarding upstream raw materials, downstream demand, and current market dynamics.

- Government Policies, Macro & Micro economic factors are also included in the report.

We have studied the Golf Tourism Market in 360 degrees via. both primary & secondary research methodologies. This helped us in building an understanding of the current market dynamics, supply-demand gap, pricing trends, product preferences, consumer patterns & so on. The findings were further validated through primary research with industry experts & opinion leaders across countries. The data is further compiled & validated through various market estimation & data validation methodologies. Further, we also have our in-house data forecasting model to predict market growth up to 2030.

Regional Analysis

- North America

- Asia Pacific

- Middle East & Africa

- Latin America

Note: A country of choice can be added in the report at no extra cost. If more than one country needs to be added, the research quote will vary accordingly.

The geographical analysis part of the report provides information about the product sales in terms of volume and revenue in regions. It lays out potential opportunities for the new entrants, emerging players, and major players in the region. The regional analysis is done after considering the socio-economic factors and government regulations of the countries in the regions.

How you may use our products:

- Correctly Positioning New Products

- Market Entry Strategies

- Business Expansion Strategies

- Consumer Insights

- Understanding Competition Scenario

- Product & Brand Management

- Channel & Customer Management

- Identifying Appropriate Advertising Appeals

8 Reasons to Buy This Report

- Includes a Chapter on the Impact of COVID-19 Pandemic On the Market

- Report Prepared After Conducting Interviews with Industry Experts & Top Designates of the Companies in the Market

- Implemented Robust Methodology to Prepare the Report

- Includes Graphs, Statistics, Flowcharts, and Infographics to Save Time

- Industry Growth Insights Provides 24/5 Assistance Regarding the Doubts in the Report

- Provides Information About the Top-winning Strategies Implemented by Industry Players.

- In-depth Insights On the Market Drivers, Restraints, Opportunities, and Threats

- Customization of the Report Available

Frequently Asked Questions?

Golf tourism is the travel industry that focuses on golf courses and resorts. Golf tourism can be broken down into three main categories: golfing, lodging, and dining. Golfers visit golf courses to play the game while tourists stay in hotels or resorts to enjoy all of the amenities that these facilities have to offer. Restaurants are often located near or within a golf course so visitors can enjoy a meal after playing their round.

Some of the major companies in the golf tourism market are Your Golf Travel, Golfbreaks, Golf Plaisir, EasyGolf Worldwide Australia, Golfasian, Classic Golf Tours, Premier Golf, Carr Golf, PerryGolf, Haversham & Baker, Emirates Holidays, Caribbean Golf & Tours, Golf Holidays Direct, SouthAmerica.travel, Ascot Golf Tours, Golf Touris.

The golf tourism market is expected to grow at a compound annual growth rate of 4.5%.

Report Payment

Request for sample, ask for discount, enquiry before buying, related reports.

Global Biogas Systems Market by Type (Wet Digestion, Dry Digestion, ), By Application (In...

Global Bio Agriculture Market by Type (Biopesticides, Biofertilizers, Others, Bio Agricul...

Global Credit Insurance Market by Type (Domestic Trade, Export Trade, Credit Insuranc), B...

Global Slicing Software Market by Type (Cloud-based, On-premise, ), By Application (Comme...

Global Customer Care BPO Market by Type (Onshore Outsourcing, Offshore Outsourcing, Custo...

Global Military Avionics Market by Type (Displays, Weapons Systems, Navigation Systems, S...

Our trusted clients.

Industry Growth Insights is Product of YOAAP Media Services LLP. | COPYRIGHT © 2024 IGI | All Rights Reserved.

Get call back from us

Thank you for subscribing to our newsletter. You Should receive a confirmation email soon.

- Sports & Recreation ›

- Professional Sports

Golf - statistics & facts

How many people play golf, what is liv golf, key insights.

Detailed statistics

Golf course and country club market size in the U.S. 2013-2023

Revenue of selected golf equipment/apparel companies worldwide 2012-2023

Golfers with the highest career earnings on the PGA Tour 2023

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Sports Participation

Participants in golf in the U.S. from 2007 to 2022

Individual Sports

Average number of U.S. TV viewers major golf tournaments 2021

Sporting Goods

Related topics

- Golf in Europe

- Golf in the United Kingdom (UK)

- Golf in South Korea

Sports industry

- Sports sponsorship

- Sports Brands

- Sporting goods industry in the U.S.

Recommended statistics

Participation.

- Premium Statistic Participants in golf in the U.S. from 2007 to 2022

- Premium Statistic Golf participation in U.S. high schools 2010-2022, by gender

- Basic Statistic Golf participation in England 2016-2022

- Premium Statistic Monthly participation at golf courses in Japan 2023

Number of people participating in golf in the United States from 2007 to 2022 (in millions)

Golf participation in U.S. high schools 2010-2022, by gender

Number of participants in high school golf in the United States from 2010/2011 to 2021/2022, by gender

Golf participation in England 2016-2022

Number of people participating in golf in England from 2016 to 2022

Monthly participation at golf courses in Japan 2023

Monthly number of golf course users in Japan in 2023 (in millions)

Golf clubs & courses

- Premium Statistic Golf course and country club market size in the U.S. 2013-2023

- Premium Statistic Golf courses & country clubs number of businesses in the U.S. 2012-2022

- Premium Statistic Golf driving ranges & family fun centers number of businesses in the U.S. 2012-2022

- Premium Statistic Golf driving ranges & family fun centers industry market size in Canada 2011-2022

- Premium Statistic Monthly revenue of golf courses in Japan 2019-2023

Market size of the golf course and country club industry in the United States from 2013 to 2023 (in billion U.S. dollars)

Golf courses & country clubs number of businesses in the U.S. 2012-2022

Number of golf courses & country clubs in the United States from 2012 to 2022

Golf driving ranges & family fun centers number of businesses in the U.S. 2012-2022

Number of businesses in the golf driving ranges & family fun centers industry in the United States from 2012 to 2022

Golf driving ranges & family fun centers industry market size in Canada 2011-2022

Market size of the golf driving ranges & family fun centers industry in Canada from 2011 to 2022 (in billion U.S. dollars)

Monthly revenue of golf courses in Japan 2019-2023

Monthly sales of golf courses in Japan from 2019 to 2023 (in billion Japanese yen)

Golf equipment

- Premium Statistic Revenue of selected golf equipment/apparel companies worldwide 2012-2023

- Premium Statistic U.S. wholesale sales of golf equipment 2007-2022

- Basic Statistic Revenue of Topgolf Callaway Brands Corp. worldwide 2017-2023, by product category

- Basic Statistic Revenue of Acushnet Holdings Corp. 2014-2023, by segment

- Basic Statistic Number of golf equipment and supplies stores in Canada by region 2023

- Premium Statistic Golf clubs: UK manufacturers' sales value 2008-2022

Selected golf equipment/apparel companies ranked by revenue from 2012 to 2023 (in million U.S. dollars)

U.S. wholesale sales of golf equipment 2007-2022

Wholesale sales of golf equipment in the U.S. from 2007 to 2022 (in million U.S. dollars)

Revenue of Topgolf Callaway Brands Corp. worldwide 2017-2023, by product category

Topgolf Callaway Brands Corp.'s net sales worldwide from 2017 to 2023, by product category (in million U.S. dollars)

Revenue of Acushnet Holdings Corp. 2014-2023, by segment

Acushnet Holdings Corp. revenue by segment worldwide from 2014 to 2023 (in million U.S. dollars)

Number of golf equipment and supplies stores in Canada by region 2023

Number of golf equipment and supplies stores in Canada as of June 2023, by region

Golf clubs: UK manufacturers' sales value 2008-2022

Manufacturer sales of golf clubs and golf equipment in the United Kingdom (UK) from 2008 to 2022 (in 1,000 GBP)

- Premium Statistic Golfers with the highest career earnings on the PGA Tour 2023

- Basic Statistic Highest money earners on the PGA tour 2022

- Basic Statistic Sentry Tournament of Champions: Golfers with the most PGA Championship points 2022

- Premium Statistic Golfers with the highest career earnings on the LPGA Tour 2023

- Premium Statistic Female golfers with the highest driving accuracy on the LPGA tour 2021

- Premium Statistic TV ratings for final round of The Masters in U.S. 1997-2022

- Premium Statistic TV viewers for final round of The Players Championship in the U.S. 2021

Golfers with the highest PGA Tour earnings as of 2023 (in million U.S. dollars)

Highest money earners on the PGA tour 2022

Professional golfers with the most money earned on the PGA tour in the 2022 season (in million U.S. dollars)

Sentry Tournament of Champions: Golfers with the most PGA Championship points 2022

Professional golfers with the most PGA Championship points in the Sentry Tournament of Champions as of August 2022 (in millions)

Golfers with the highest career earnings on the LPGA Tour 2023

Golfers with the highest LPGA Tour earnings as of 2023 (in million U.S. dollars)

Female golfers with the highest driving accuracy on the LPGA tour 2021

Female professional golfers with the highest driving accuracy on the LPGA tour in 2021

TV ratings for final round of The Masters in U.S. 1997-2022

TV ratings for final round of The Masters Golf Tournament on CBS in the United States from 1997 to 2022

TV viewers for final round of The Players Championship in the U.S. 2021

Number of TV viewers of the final round of The Players Championship golf tournament in the United States from 2002 to 2021 (in millions)

- Basic Statistic LIV Golf: total prize pool 2022-2023

- Premium Statistic Golfers with the highest on-course earnings at LIV Golf 2022

- Premium Statistic Public opinion on LIV Golf in the U.S. 2022

- Basic Statistic Approval of LIV Golf among GolfLink users worldwide 2022

- Premium Statistic Public awareness of LIV Golf being funded by Saudi Arabia in the U.S. 2022

- Basic Statistic Share of adults in the U.S. that believe LIV Golf seems like sportswashing 2022

LIV Golf: total prize pool 2022-2023

Total prize fund for LIV Golf events in 2022 and 2023 (in million U.S. dollars)

Golfers with the highest on-course earnings at LIV Golf 2022

Golfers with the highest individual winnings at LIV Golf 2022 (in million U.S. dollars)

Public opinion on LIV Golf in the U.S. 2022

Favorability of LIV Golf in the United States as of June 2022

Approval of LIV Golf among GolfLink users worldwide 2022

LIV Golf approval rating among GolfLink users worldwide in 2022

Public awareness of LIV Golf being funded by Saudi Arabia in the U.S. 2022

Level of awareness of LIV Golf being funded by Saudi Arabia's Public Investment Fund in the United States as of June 2022

Share of adults in the U.S. that believe LIV Golf seems like sportswashing 2022

Share of adults in the United States that believe LIV Golf looks like sportswashing in 2022

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Welcome2Golf

- Sneak Peek >>

Golf’s State-of-Industry in 3 Minutes

Perhaps the most pressing question facing the golf industry over the past several years is whether the “pandemic dividend” would last.

There were further encouraging signs in 2023, with increases in participation and play, a healthier balance between the number of golfers and courses, and an evolution of a traditional game that’s positively affecting golf demand… and golf’s brand.

An estimated 26.6 million Americans played golf on a course in 2023, a net increase of approximately one million golfers. It’s the biggest single-year jump in on-course participants since 2001, the year Tiger Woods held all four major titles simultaneously – aka “The Tiger Slam” — which helped spur recreational golf engagement levels to new heights.

In the “Covid era,” the game has experienced momentum not seen since that “Tiger Boom,” with record or near-record levels of play and high-water marks for beginners and interest among non-golfers. The number of rounds of golf played in 2023 will check in just shy of the all-time high (in 2021) when the December data is released at the end of this month.

It’s not just a post-pandemic carryover either. The popularity and increasing availability of off-course forms of golf are introducing more people to the game in different ways, helping not only increase interest in golf but driving record on-course trials and creating a consumer base that’s more diverse than ever. Total participation – counting both green-grass and off-course play (like that at Topgolf or in indoor simulators) – climbed to 45 million in 2023, a 9% year-over-year gain and a jump of over 50% in the past decade.

When looking at the nearly 14,000 golf facilities nationwide, rounds per course over the past few years are at their highest levels since the early 1990’s, an indication of the better balance between supply and demand.

Golf course closures in 2023 dipped to their lowest levels since prior to the Great Recession. And there were more new course openings last year than any time since 2010.

NGF’s full state-of-industry – the annual member-only Graffis Report – will include comprehensive information on participation, engagement, supply and much more upon its release next week ahead of the PGA Merchandise Show. A detailed one-page “leaderboard” on the industry’s key metrics is being shared today with our Executive Members.

While many of golf’s traditional KPIs are resoundingly positive, this doesn’t mean all golf businesses are thriving.

The above is primarily related to golf facilities and course operators. Many businesses in and around the golf industry are feeling the pinch of cautious consumerism. We will not only expound more on the above topics – most notably participation segments, supply trends and rounds – in Fortnight over the coming weeks and months, we’ll also be delving into golfer sentiment and behaviors.

So, stay tuned, and be sure to get your copy of the latest Graffis Report, which is named after our NGF founders.

If you’re not yet a member, what are you waiting for? With everything that’s happening in an evolving industry, 2024 is the year to join hundreds of other businesses, facilities, organizations, and individuals in the NGF member community.

National Golf Foundation

Get the latest bi-weekly golf business perspective.

" * " indicates required fields

Get the latest Bi-Weekly Golf Business Viewpoints.

How can we help?

Ngf membership associate.

Learn From NGF Members

Whether you’re the head planner of your upcoming buddies golf trip or simply along for the ride, we’ve gathered a few easy ways to keep everyone in your group happy.

As humans, we see our primary care physician on a regular basis to proactively evaluate our vital signs. Likewise, a superintendent should perform frequent diagnostic testing on their golf course.

We’ve long known that higher launch and lower spin is a powerful combination for generating consistently long and straight tee shots. A key factor in optimizing launch conditions, one often overlooked, is ...

This content is available to VIP and Executive Members only.

Member Access:

Member Upgrade Choices:

Not a Member?

Privacy Overview

The graffis report is available to ngf members..

Member Login

Membership Options

Spotlight NGF+ articles are member only articles.

To view the full article:, this content is accessible by vip and executive members only., to access the state-by-state golf reviews interactive map:.

Member Login:

Membership Upgrade:

Member Upgrade

The Vault content is reserved for VIP and Executive Members only

To access the vault:.

- Hotels, Resorts & Cruise Lines

Golf Tourism Market by End-user, Type and Geography - Forecast and Analysis 2023-2027

- Published: Oct 2023

- SKU: IRTNTR45526

Enjoy complimentary customisation on priority with our Enterprise License!

Golf Tourism Market Forecast 2023-2027

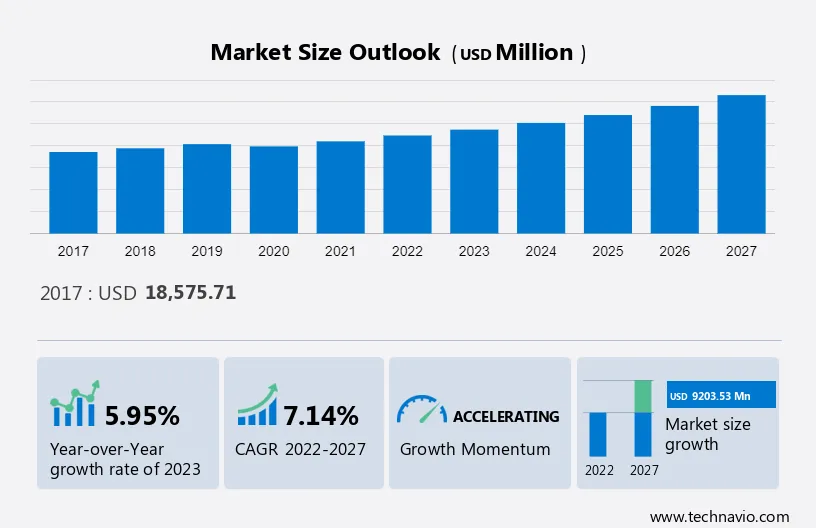

The golf tourism market size is estimated to grow at a CAGR of 7.14% between 2022 and 2027. The market size is forecast to increase by USD 9.20 Billion . Government backing for golf tourism fuels market growth, notably in regions like North America where tourism is burgeoning. Governments worldwide are bolstering the sector's expansion, establishing comprehensive frameworks to meet escalating demand. Concurrently, the surge in outdoor recreational activities contributes to market dynamics. Increased engagement in pursuits like hiking, wildlife safaris, camping, and fishing reflects a global trend driven by consumers seeking respite from hectic lifestyles. This inclination towards health consciousness and stress relief motivates individuals to explore diverse recreational options, propelling the market growth.

What will be the Size of the Market During the Forecast Period?

To learn more about this report , View Report Sample

Key Market Segmentation

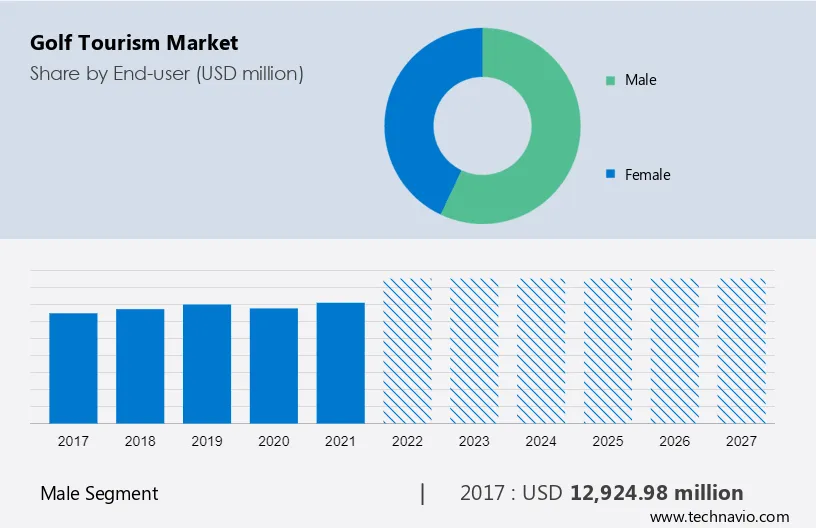

The male segment is estimated to witness significant growth during the forecast period. There is an increasing focus by key companies on tourists especially those who are predominantly middle-aged males and who play golf as a secondary activity while on vacation or a business trip or those who prefer to participate in this tourism as spectators. There is a significant increase over the years and is expected to grow further due to its expansion to many destinations.

Get a glance at the market contribution of various segments View the PDF Sample

The male segment was the largest segment and was valued at USD 12.92 Billion in 2017. Some of the key reasons why golf can be included as a leisure activity include watching sports events, nostalgia for sports tourism, and active participation in sports as a part of vacation activities. Additionally, there is a growing popularity for golf as a game across the world due to factors such as improved living standards, increased interest among men, and better sports facilities, which in turn is expected to significantly contribute to this segment. Furthermore, several governments across the globe are promoting golfing destinations to domestic and international tourists, which will essentially attract the male segment. Hence, such factors are expected to fuel the growth of this segment which, in turn, will drive the market growth during the forecast period.

Which are the Key Regions for the Market?

For more insights on the market share of various regions Download PDF Sample now!

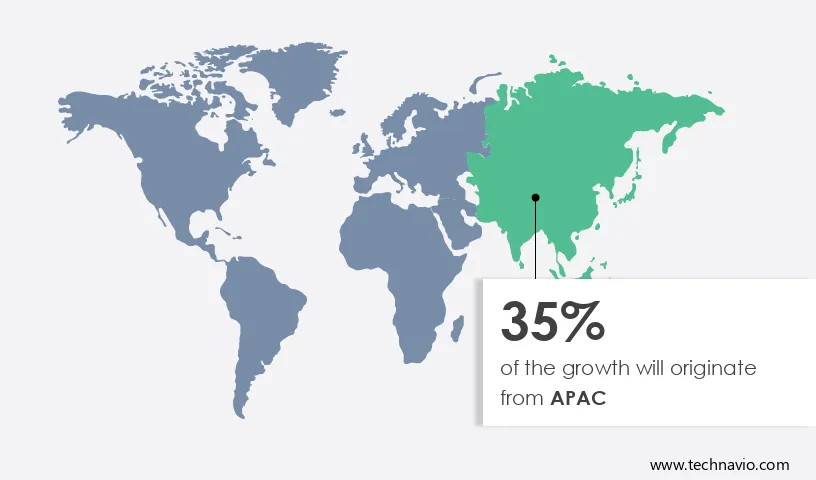

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Another region offering significant growth opportunities to vendors is North America . Some of the key countries that are significantly contributing to the market growth in North America include the US and Canada. Additionally, there is a high potential for growth of the market in South America due to the presence of well-developed economies, favorable weather conditions, availability of a variety of terrains, and extensive media exposure to the sport.

Furthermore, the game has a stable participation rate, and there has been an increase in the number of players over the last 4-5 years. Additionally, there is an increasing preference for visiting courses for tourism, especially in North America and Mexico, which is known for professional events such as PGA tours. Hence, such factors are expected to drive the market growth and forecasting in the region during the forecast period.

Market Dynamics and Customer Landscape

The market report outlines robust drivers propelling the industry forward, including the allure of Destination Resorts and tailored Travel Packages. Rising demand for Luxury Accommodations and diverse Tourist Attractions amplifies growth. However, challenges such as fluctuating Tourism Trends and evolving travelers preferences require adaptability. Ensuring seamless integration of Resort Amenities and captivating Vacation Experiences remains pivotal. Travel Agencies play a vital role in curating enticing Travel Itineraries, catering to the evolving landscape of Vacation Destinations, and enriching Destination Activities. The convergence of leisure and luxury defines the future of Golf Tourism.

Key Market Driver

A significant driving force behind market growth is the burgeoning government backing for golf-tourism , amidst a surge in global tourism appeal, notably in North America. Various governmental bodies worldwide are actively bolstering their countries' tourism sectors . For instance, authorities are meticulously crafting comprehensive frameworks to cater to escalating interest, thereby fostering luxury accommodations, tourist attractions, and resort amenities. These concerted efforts not only bolster the tourism industry but also entice both international and domestic travelers.

Moreover, factors such as the proliferation of golf courses, upscale resort facilities, and diverse leisure activities are fueling market expansion, alongside burgeoning traveler preferences and evolving tourism trends.

Significant Market Trends

A key factor shaping the market growth is the rise in popularity of outdoor recreational activities. There is an increasing participation of people across the world in several outdoor recreational activities such as hiking, wildlife safari, camping, fishing, and others. One of the main factors that significantly fuelling the participation of these outdoor recreational activities is the hectic lifestyle schedules, which are encouraging consumers to become more health-conscious and scout for different ways to de-stress.

Furthermore, the increase in disposable income is allowing customers to experience more outdoor activities. Thus, factors such as the growing participation in outdoor recreational activities, the growing interest of consumers in exploring the beauty of nature, and growing health awareness are expected to positively impact the market growth. Hence, such factors are driving the market growth during the forecast period.

Major Market Challenge

The elite nature of golf as a sport is one of the key challenges hindering market growth . One of the main participants of the sport is the affluent sections of society, as it is considered a game for the elite. The key reason for this is the high cost of the equipment. As a result, many consumers in developing and developed regions are reluctant to invest in equipment as well as opt for tourism .

Additionally, this sport is not popular in some developing countries. Thus, courses are available only in resorts. These courses in resorts are very expensive and are not affordable for the majority of the population. Additionally, renting a golf-cart can add to these expenses. Hence, the elite nature of the sport negatively impacts the market. Hence, such a factor hinders the market growth during the forecast period.

Market Analyst Overview

The market presents travelers with enticing travel packages and unforgettable vacations, focusing on golf-centric experiences. As a pivotal component of the tourism industry, it caters to enthusiasts craving distinctive holiday escapades and premium attractions. Various management services oversee promotion and marketing strategies, ensuring destinations are adeptly showcased to global golf enthusiasts. From opulent accommodation choices to meticulously crafted travel itineraries, every aspect is curated to deliver an unforgettable golfing getaway. Continuous market growth analysis and research propel innovation and progress within the industry, furnishing stakeholders with valuable insights. Market forecasting empowers businesses to anticipate trends and tailor their offerings to meet the evolving preferences of travelers seeking exceptional golfing experiences. With an emphasis on luxury accommodations, resort amenities, and leisure activities, the market fosters an environment ripe for unparalleled holiday adventures and destination management services.

Market Customer Landscape

The market research report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Market Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Ananta Group Pvt. Ltd: The company offers packages that are designed by various tour operators in such a way that the enthusiasts are comfortably able to make the best out of their trips.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- Ascot Tours

- Carr Golf and Corporate Travel Ltd.

- Duffers GolfTravel

- Fairway GolfTours

- GARMANY GOLF and TRAVEL LLC

- Golf and Tours Pty Ltd

- Golf Tourism Australia

- Golf Tours International Ltd

- Golf Tours Worldwide

- Grasshopper GolfTour

- Indian Holiday Pvt. Ltd.

- Liberty Travel and Tours M Sdn Bhd

- Palatinate Group Ltd.

- Perry Travel Inc.

- Pioneer Golf Inc.

- Scottish Golf Holidays Inc.

- Travel Impresarios

- The Golf Travel Group.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

- Segment Overview

The market report forecasts market growth by revenue at global, regional & country levels and provides an analysis of the latest trends and growth opportunities from 2017 to 2027.

- International

- Rest of Europe

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

View PDF Sample

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market between 2023 and 2027

- Precise estimation of the market size and its contribution to the market in focus on the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across North America, APAC, Europe, South America, and the Middle East and Africa

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research and growth report to meet your requirements.

Get in touch

1 Executive Summary

- Exhibit 01: Executive Summary – Chart on Market Overview

- Exhibit 02: Executive Summary – Data Table on Market Overview

- Exhibit 03: Executive Summary – Chart on Global Market Characteristics

- Exhibit 04: Executive Summary – Chart on Market by Geography

- Exhibit 05: Executive Summary – Chart on Market Segmentation by End-user

- Exhibit 06: Executive Summary – Chart on Market Segmentation by Type

- Exhibit 07: Executive Summary – Chart on Incremental Growth

- Exhibit 08: Executive Summary – Data Table on Incremental Growth

- Exhibit 09: Executive Summary – Chart on Vendor Market Positioning

2 Market Landscape

- Exhibit 10: Parent market

- Exhibit 11: Market Characteristics

3 Market Sizing

- Exhibit 12: Offerings of vendors included in the market definition

- Exhibit 13: Market segments

- 3.3 Market size 2022

- Exhibit 14: Chart on Global - Market size and forecast 2022-2027 ($ million)

- Exhibit 15: Data Table on Global - Market size and forecast 2022-2027 ($ million)

- Exhibit 16: Chart on Global Market: Year-over-year growth 2022-2027 (%)

- Exhibit 17: Data Table on Global Market: Year-over-year growth 2022-2027 (%)

4 Historic Market Size

- Exhibit 18: Historic Market Size – Data Table on global golf tourism market 2017 - 2021 ($ million)

- Exhibit 19: Historic Market Size – End-user Segment 2017 - 2021 ($ million)

- Exhibit 20: Historic Market Size – Type Segment 2017 - 2021 ($ million)

- Exhibit 21: Historic Market Size – Geography Segment 2017 - 2021 ($ million)

- Exhibit 22: Historic Market Size – Country Segment 2017 - 2021 ($ million)

5 Five Forces Analysis

- Exhibit 23: Five forces analysis - Comparison between 2022 and 2027

- Exhibit 24: Chart on Bargaining power of buyers – Impact of key factors 2022 and 2027

- Exhibit 25: Bargaining power of suppliers – Impact of key factors in 2022 and 2027

- Exhibit 26: Threat of new entrants – Impact of key factors in 2022 and 2027

- Exhibit 27: Threat of substitutes – Impact of key factors in 2022 and 2027

- Exhibit 28: Threat of rivalry – Impact of key factors in 2022 and 2027

- Exhibit 29: Chart on Market condition - Five forces 2022 and 2027

6 Market Segmentation by End-user

- Exhibit 30: Chart on End-user - Market share 2022-2027 (%)

- Exhibit 31: Data Table on End-user - Market share 2022-2027 (%)

- Exhibit 32: Chart on Comparison by End-user

- Exhibit 33: Data Table on Comparison by End-user

- Exhibit 34: Chart on Male - Market size and forecast 2022-2027 ($ million)

- Exhibit 35: Data Table on Male - Market size and forecast 2022-2027 ($ million)

- Exhibit 36: Chart on Male - Year-over-year growth 2022-2027 (%)

- Exhibit 37: Data Table on Male - Year-over-year growth 2022-2027 (%)

- Exhibit 38: Chart on Female - Market size and forecast 2022-2027 ($ million)

- Exhibit 39: Data Table on Female - Market size and forecast 2022-2027 ($ million)

- Exhibit 40: Chart on Female - Year-over-year growth 2022-2027 (%)

- Exhibit 41: Data Table on Female - Year-over-year growth 2022-2027 (%)

- Exhibit 42: Market opportunity by End-user ($ million)

- Exhibit 43: Data Table on Market opportunity by End-user ($ million)

7 Market Segmentation by Type

- Exhibit 44: Chart on Type - Market share 2022-2027 (%)

- Exhibit 45: Data Table on Type - Market share 2022-2027 (%)

- Exhibit 46: Chart on Comparison by Type

- Exhibit 47: Data Table on Comparison by Type

- Exhibit 48: Chart on Domestic - Market size and forecast 2022-2027 ($ million)

- Exhibit 49: Data Table on Domestic - Market size and forecast 2022-2027 ($ million)

- Exhibit 50: Chart on Domestic - Year-over-year growth 2022-2027 (%)

- Exhibit 51: Data Table on Domestic - Year-over-year growth 2022-2027 (%)

- Exhibit 52: Chart on International - Market size and forecast 2022-2027 ($ million)

- Exhibit 53: Data Table on International - Market size and forecast 2022-2027 ($ million)

- Exhibit 54: Chart on International - Year-over-year growth 2022-2027 (%)

- Exhibit 55: Data Table on International - Year-over-year growth 2022-2027 (%)

- Exhibit 56: Market opportunity by Type ($ million)

- Exhibit 57: Data Table on Market opportunity by Type ($ million)

8 Customer Landscape

- Exhibit 58: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

9 Geographic Landscape

- Exhibit 59: Chart on Market share by geography 2022-2027 (%)

- Exhibit 60: Data Table on Market share by geography 2022-2027 (%)

- Exhibit 61: Chart on Geographic comparison

- Exhibit 62: Data Table on Geographic comparison

- Exhibit 63: Chart on North America - Market size and forecast 2022-2027 ($ million)

- Exhibit 64: Data Table on North America - Market size and forecast 2022-2027 ($ million)

- Exhibit 65: Chart on North America - Year-over-year growth 2022-2027 (%)

- Exhibit 66: Data Table on North America - Year-over-year growth 2022-2027 (%)

- Exhibit 67: Chart on APAC - Market size and forecast 2022-2027 ($ million)

- Exhibit 68: Data Table on APAC - Market size and forecast 2022-2027 ($ million)

- Exhibit 69: Chart on APAC - Year-over-year growth 2022-2027 (%)

- Exhibit 70: Data Table on APAC - Year-over-year growth 2022-2027 (%)

- Exhibit 71: Chart on Europe - Market size and forecast 2022-2027 ($ million)

- Exhibit 72: Data Table on Europe - Market size and forecast 2022-2027 ($ million)

- Exhibit 73: Chart on Europe - Year-over-year growth 2022-2027 (%)

- Exhibit 74: Data Table on Europe - Year-over-year growth 2022-2027 (%)

- Exhibit 75: Chart on South America - Market size and forecast 2022-2027 ($ million)

- Exhibit 76: Data Table on South America - Market size and forecast 2022-2027 ($ million)

- Exhibit 77: Chart on South America - Year-over-year growth 2022-2027 (%)

- Exhibit 78: Data Table on South America - Year-over-year growth 2022-2027 (%)

- Exhibit 79: Chart on Middle East and Africa - Market size and forecast 2022-2027 ($ million)

- Exhibit 80: Data Table on Middle East and Africa - Market size and forecast 2022-2027 ($ million)

- Exhibit 81: Chart on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- Exhibit 82: Data Table on Middle East and Africa - Year-over-year growth 2022-2027 (%)

- Exhibit 83: Chart on US - Market size and forecast 2022-2027 ($ million)

- Exhibit 84: Data Table on US - Market size and forecast 2022-2027 ($ million)

- Exhibit 85: Chart on US - Year-over-year growth 2022-2027 (%)

- Exhibit 86: Data Table on US - Year-over-year growth 2022-2027 (%)

- Exhibit 87: Chart on Japan - Market size and forecast 2022-2027 ($ million)

- Exhibit 88: Data Table on Japan - Market size and forecast 2022-2027 ($ million)

- Exhibit 89: Chart on Japan - Year-over-year growth 2022-2027 (%)

- Exhibit 90: Data Table on Japan - Year-over-year growth 2022-2027 (%)

- Exhibit 91: Chart on UK - Market size and forecast 2022-2027 ($ million)

- Exhibit 92: Data Table on UK - Market size and forecast 2022-2027 ($ million)

- Exhibit 93: Chart on UK - Year-over-year growth 2022-2027 (%)

- Exhibit 94: Data Table on UK - Year-over-year growth 2022-2027 (%)

- Exhibit 95: Chart on Canada - Market size and forecast 2022-2027 ($ million)

- Exhibit 96: Data Table on Canada - Market size and forecast 2022-2027 ($ million)

- Exhibit 97: Chart on Canada - Year-over-year growth 2022-2027 (%)

- Exhibit 98: Data Table on Canada - Year-over-year growth 2022-2027 (%)

- Exhibit 99: Chart on Australia - Market size and forecast 2022-2027 ($ million)

- Exhibit 100: Data Table on Australia - Market size and forecast 2022-2027 ($ million)

- Exhibit 101: Chart on Australia - Year-over-year growth 2022-2027 (%)

- Exhibit 102: Data Table on Australia - Year-over-year growth 2022-2027 (%)

- Exhibit 103: Market opportunity by geography ($ million)

- Exhibit 104: Data Tables on Market opportunity by geography ($ million)

10 Drivers, Challenges, and Trends

- 10.1 Market drivers

- 10.2 Market challenges

- Exhibit 105: Impact of drivers and challenges in 2022 and 2027

- 10.4 Market trends

11 Vendor Landscape

- 11.1 Overview

- Exhibit 106: Overview on Criticality of inputs and Factors of differentiation

- Exhibit 107: Overview on factors of disruption

- Exhibit 108: Impact of key risks on business

12 Vendor Analysis

- Exhibit 109: Vendors covered

- Exhibit 110: Matrix on vendor position and classification

- Exhibit 111: Ananta Group Pvt. Ltd. - Overview

- Exhibit 112: Ananta Group Pvt. Ltd. - Product / Service

- Exhibit 113: Ananta Group Pvt. Ltd. - Key offerings

- Exhibit 114: Ascot Tours - Overview

- Exhibit 115: Ascot Tours - Product / Service

- Exhibit 116: Ascot Tours - Key offerings

- Exhibit 117: Carr Golf and Corporate Travel Ltd. - Overview

- Exhibit 118: Carr Golf and Corporate Travel Ltd. - Product / Service

- Exhibit 119: Carr Golf and Corporate Travel Ltd. - Key offerings

- Exhibit 120: GARMANY GOLF and TRAVEL LLC - Overview

- Exhibit 121: GARMANY GOLF and TRAVEL LLC - Product / Service

- Exhibit 122: GARMANY GOLF and TRAVEL LLC - Key offerings

- Exhibit 123: Golf and Tours Pty Ltd - Overview

- Exhibit 124: Golf and Tours Pty Ltd - Product / Service

- Exhibit 125: Golf and Tours Pty Ltd - Key offerings