Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Market Research

- Artificial Intelligence

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- Customer Journey Mapping

- Consumer Decision Journey

See how XM for Customer Frontlines works

The consumer decision journey.

14 min read Understanding the consumer decision journey – and working with what you learn – can help your marketing efforts, customer support teams, and product rollouts thrive. Here’s everything you need to know…

Author: Adam Bunker

Subject Matter Expert: Dave Pabley

What is the consumer decision journey?

The ‘consumer decision journey’ is the name given to a framework that deconstructs and explores the myriad factors that go into customer purchases. In other words: it’s the way we make sense of the consumer decision-making process.

Did you know that 70% of buyers fully define their own purchasing needs before they engage with sales people? If not, you might need to rethink what your customer decision journeys look like, and how you work to manage them.

Every time a customer buys something from a brand, it’s the result of a complicated set of processes and influences that – often – they’ve experienced in a nonlinear fashion. The consumer decision journey is a means to map and understand that path, with a view to try and meet potential future customers at every touchpoint along the way.

Understanding how and why new and previous customers make purchases is the holy grail of every marketing department in the world. And if you can actually influence those factors with your CX and marketing strategy? Even better. Doing that means unpicking the complicated rationale and stop-start nature of today’s buying journeys.

Understanding the consumer decision journey is really about asking a few key questions:

- How can you meet your customers at important touchpoints?

- How can you maximize each interaction?

- What goes into each purchase decision?

If you have answers to those questions, you’ll go a long way toward ensuring you have the right processes, resources, and technology in place to help your business grow its customer base. You’ll know how and when to upsell, how to convert prospects, and what influences each and every purchase.

That’s a complicated task, but digging into customer analysis can really pay off – in some pretty meaningful ways.

Free course: Elevate your customer journey management today

‘Customer managed’ journey versus a ‘managed customer’ journey

Today’s customer is increasingly empowered in their decision-making, since they have access to much more choice, information, and branded content across a range of channels.

As such, it’s important that brands understand their role in the decision-making process. In most instances, things can’t be controlled in a streamlined way on the brand side – it’s the customer in control. That means organizations need to be adaptable, responsive, and able to meet the customer where they are, rather than the other way round.

While you might map out a perfect, best-case journey for your customer personas – a managed customer journey – things may not pan out that way. This gives rise to the idea of the ‘customer managed’ journey instead – one where your customers call the shots in terms of how they make their decisions, and you cater as best you can to their preferences.

Why is the consumer decision journey important?

Customer interactions and the journeys they create are more complicated, nonlinear, and omnichannel than ever. But that presents an opportunity: the brands that can leverage the tools at their disposal to unpick that complicated knot stand a great chance at winning over more customers than their competitors.

Today’s customers aren’t easily influenced or led down a specific path. Whereas in decades gone by you might easily nurture a customer down the sales funnel with a compelling TV ad and then an in-store salesperson, things are different now. In fact, even if you manage to get customers into your physical store, some 71% of them will still be using their phones to look up reviews or even to make their purchases.

95% of consumers read online reviews before making purchases, which can take the wind out of any marketing efforts’ sails if there’s no real strategy in place to maximize other customer journey touchpoints. In fact, chances are that by the time a customer speaks to a representative, they’re already most of the way along the buying process.

That means meeting your customers where they are – like online influencer accounts, for example, which 55% of 18-24-year-olds rely on.

Whatever the case, it’s important to understand the factors that influence buying decisions because that lets you personalize and tailor those experiences as best you can to capture more interest.

Beyond this though, getting to grips with the consumer decision journey means understanding that the journey doesn’t end with a purchase – that’s just part of a cyclical experience.

So let’s explore how that works…

Understanding how consumers make decisions

In the traditional purchasing funnel, customers move along the stages from awareness to purchasing and customer loyalty linearly, beginning with a widely cast net of possible brands, and ending with just one. But that model’s now outdated.

Today, customers move from touchpoint to touchpoint in a way that makes it impossible to put importance on any one part of the funnel over any other. Instead, the decision journey is cyclical – and capturing attention needs to be handled as part of a two-way conversation at every stage.

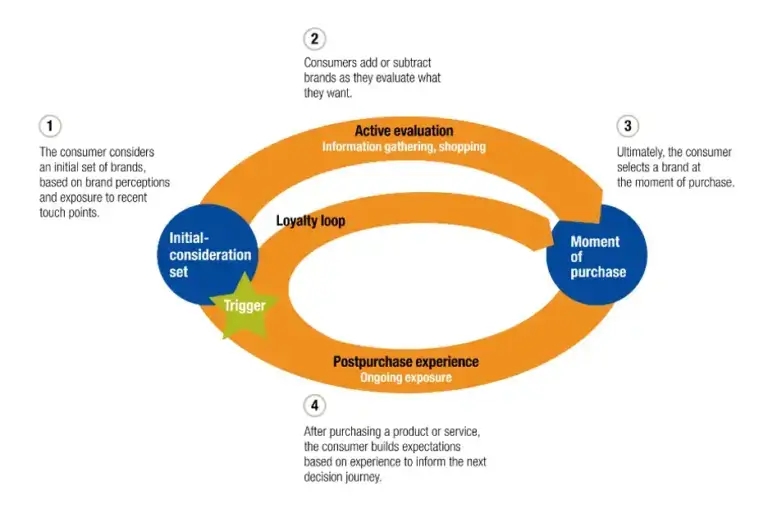

McKinsey’s research , involving some 20,000 consumers, has resulted in a new framework for the decision journey that it describes as having four interlinked phases:

“The decision-making process is a more circular journey, with four primary phases representing potential battlegrounds where marketers can win or lose: initial consideration; active evaluation, or the process of researching potential purchases; closure, when consumers buy brands; and postpurchase, when consumers experience them.”

Image credit: McKinsey.com

In fact, the journey here is more of a spiral than a circle; it’s in that fourth, post-purchase stage where the decision journey becomes a ‘loyalty loop’ that can repeat itself forever. McKinsey puts forward the following roadmap for those latter stages:

- Purchasing: After initial consideration, the customer makes a purchase

- Experiencing: The customer forms opinions on the product or service

- Advocating: The customer spreads the word

- Bonding: The customer becomes a loyal customer who makes repeat purchases

Tools and processes for enhancing customer journeys

Understanding the modern customer journey and adapting to it are two very different things. Customers expect more than ever before from their brands in terms of personalization , relevance, and the ability to meet them where they are, on the channels they care about.

That means that customer experience and marketing teams need to employ processes that can make every touchpoint work harder. Usually, that means using a mix of surveys , customer experience analytics software , and behavioral data to finetune every channel and provide more powerful, personal and adaptable experiences.

Let’s take a look at some of the methods, tools and processes you can use to do exactly that, across three key areas:

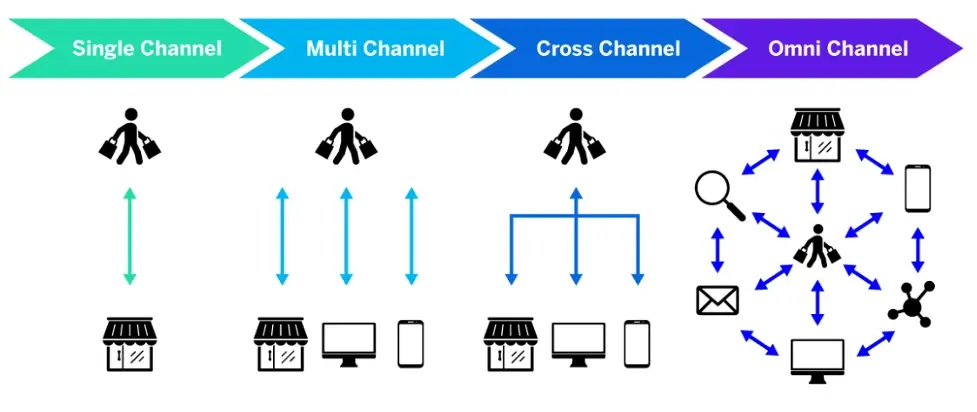

1. Omnichannel engagement

Your customers are moving between channels and platforms in search of the information they need to make informed purchasing decisions. You need to be where they are.

Customer touchpoint analysis

Take stock of every touchpoint in which customers can interact with your brand. That’s everything from your website to your customer service portal, as well as TV ads, social media channels and third-party review sites.

Your first step here is to lean into digital analytics to understand your share of voice, your conversion rate on call-to-action links, and anywhere you’re underrepresenting yourself. This stage is an audit, in effect – are you meeting people where they already are?

Omnichannel customer engagement

Once you understand every touch point, you need to think about how you can tie them together. Customers may jump from one touchpoint to the next in any order, so you need to be able to offer them a consistent experience that’s channel-agnostic.

That’s as important in marketing as it is in customer service – both rely on being able to track customer movements and proactively engage with people.

Customer journey optimization

Journey optimization starts with customer journey mapping exercises, in which you use customer data and your own insight to map out potential routes your customers take toward purchase. How can those journeys be tightened and streamlined? Hypothesize around this, make changes, and then test to see whether things improved.

2. Behavioral analysis

How well do you understand what makes your customers tick? With the right software, you’ll be able to glean invaluable insights from the actions your customers do and don’t take.

Consumer behavior analysis

Understanding customer behavior allows you to adapt things to suit them – and identify where pain points and areas of friction lie. You’ll achieve this by using customer experience analytics suites capable of understanding behavioral heuristics.

These tools can identify patterns, show you how different audience segments act, and how purchasing decisions act as part of a wider whole.

Behavioral targeting strategies

Imagine if you knew that a specific customer always shops for a certain kind of product at certain times of the year, that they’re much more likely to make a purchase if there’s a discount with their name on it, or if bundling two items together will make them much more appealing than the sum of their parts.

These are examples of behavioral targeting strategies that require a rock-solid understanding of each and every customer – and customer segment. Tools like Experience ID can help you gather that understanding, and tailor your efforts accordingly.

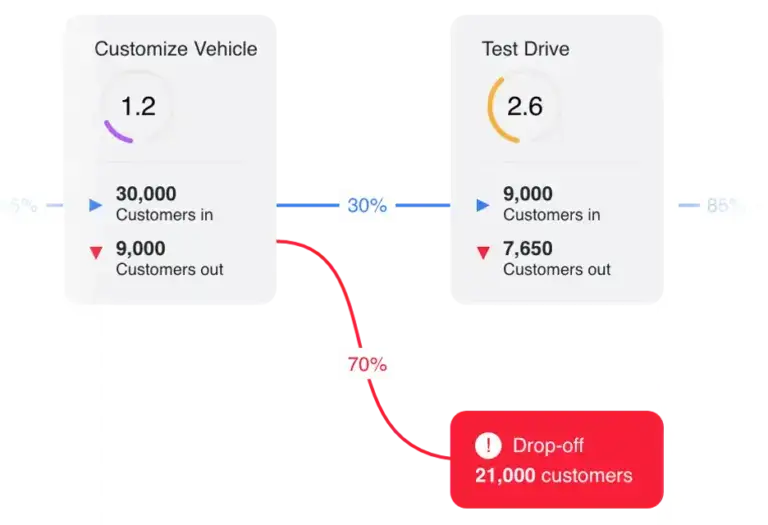

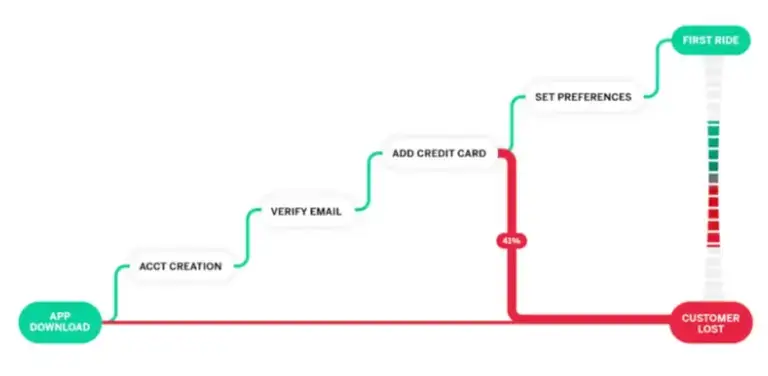

Refining the purchase decision process

It’s important to understand areas of your customer experience that are letting things down – and negatively impacting the customer buying process. If you can track customers as they move through your owned digital properties, you’ll have a clear idea of where people are dropping off, and why shopping carts are being left abandoned.

With that information, you can make proactive changes to the user experience in order to refine that initial consideration stage and better influence consumer purchasing behavior.

Learn more about customer behavior analysis

3. Postpurchase excellence

Once a customer has made a purchase, they’ll move into that inner ‘loyalty loop’ track of the consumer decision journey. This is your chance to wow them with postpurchase excellence – and generate real loyalty .

Customer experience analytics

Customer experience analytics is the process of collecting and analyzing customer data so that you can better understand customer needs, viewpoints, and experiences. This will help you to increase customer engagement and customer loyalty at every part of their journey – not just after making a purchase.

If you can understand the experience as it stands for existing customers, you’ll be able to direct your internal teams to take action on issues that are affecting satisfaction and loyalty.

Curating the customer engagement journey

Customer service is a huge part of postpurchase (repeat) purchase decisions. If a customer has had a positive customer support experience, they’re much more likely to buy from you again. So it’s important that this side of the customer experience is being monitored and managed.

Contact center management tools with AI and natural language processing can help here, by scanning and understanding every interaction every customer has with your business and proactively suggesting where things can be improved. That could be through trends that a bunch of different customers all mention, or by spotting opportunities for support agent coaching.

Customer lifecycle management

To keep customers coming back, you need to be able to keep a good eye on their behavior and ensure that if they have feedback, you’re able to close the loop by making the changes they want to see.

That’s alongside continually delighting them with proactive, personalized offers and communications. Keeping customers for the long haul means fostering a human-centric approach that uses software, surveys and analytics to help you show just how much you value their business.

Delivering customer-driven journeys

The consumer decision journey represents a complex, ever-evolving landscape that demands a really nuanced and adaptive approach from businesses. In an era where digital platforms dominate and consumer behaviors shift rapidly, understanding journeys from a scientific perspective is not just beneficial – it’s imperative for sustained success.

By embracing journey insights, businesses can position themselves at critical touchpoints, offering personalized solutions that resonate with consumers’ needs and preferences at the right moments. Integrating advanced analytics, omnichannel strategies and customer-centric thinking is what’ll help you exceed the expectations of today’s savvy consumers.

In other words? As you navigate this dynamic terrain, the key to unlocking customer loyalty and driving business growth lies in the ability to continuously adapt, innovate, and deliver exceptional experiences at every stage of the consumer decision journey.

Ready to transform your understanding of the consumer decision journey? With Qualtrics® Customer Journey Optimizer , you can take your customers where they want to go—in the fastest and most profitable way.

Elevate your customer journey management today

Related resources

Customer Journey

Customer Journey Orchestration 12 min read

Customer journey management 14 min read, customer journey stages 12 min read, buyer's journey 16 min read, customer journey analytics 13 min read, create journey map 24 min read, b2b customer journey 13 min read, request demo.

Ready to learn more about Qualtrics?

Trending News

Related Practices & Jurisdictions

- Communications, Media & Internet

- Law Office Management

- Litigation / Trial Practice

- Financial Institutions & Banking

- All Federal

The internet has transformed many aspects of life over the last three decades . Individuals in the United States and across the globe now use computers or mobile devices to communicate with friends, family, and strangers; look for information; purchase products; and perform a host of other everyday activities. In 1990, for example, less than 1 percent of the U.S. population was online. By 2015, this percentage had increased to 75 percent and by 2019 the overwhelming majority, nearly 90 percent, of American adults used the internet. Americans also increased the time they spent online, from a weekly average of 9.4 hours in 2000 to 23.6 hours in 2016. In 2018, more than three-fourths (77 percent) of Americans were online on a daily basis.

The Purchase Funnel

Unsurprisingly, the internet has fundamentally altered the consumer decision-making process. This shift has led many marketing professionals to rethink the foundational framework that has been widely used to conceptualize consumer purchasing behavior for many decades. Specifically, since the early 1900s, marketing experts have used the “purchase funnel” to describe the stages that consumers pass through to buy products and services.

Generally, the stages of the purchase funnel are as follows:

Problem recognition : Consumers identify a need and seek a product to fill that need.

Information search : Using various sources of information, consumers research products that might satisfy their need.

Evaluation of alternatives : Consumers evaluate brands they are considering and decide on the brand they intend to purchase.

Purchase decision : Consumers may adjust their intentions based on a host of situational factors; ultimately, they execute a purchase.

Postpurchase : Consumers’ satisfaction with the product affects whether they will buy it again in the future. 1

Traditionally, this process has been described as a funnel because consumers were assumed to proceed down a linear path that started with many brands and products that might fulfill their need (at the broad top of the funnel). As they move closer to purchase, consumers sequentially decrease the number of products they might buy until, ultimately, they make a final decision (at the narrow bottom of the funnel). 2

While this kind of thinking can have merit, the growth of the internet in everyday life has dramatically changed the way consumers make purchasing decisions. 3 For example, before the internet became ubiquitous, most consumers did not have access to hundreds of product reviews or search engines to price shop, and had only a handful of local retail establishments for many goods.

The Decision Journey

To account for this increasing complexity, marketing scholars and practitioners have reimagined the purchase funnel. Now, many marketing professionals use the framework of a “decision journey” to describe consumers’ decision-making processes.4 Consumers on a decision journey are not assumed to sequentially eliminate brands and products that may satisfy their needs; instead, consumers go through cycles in which some products that they initially considered may be eliminated, but other products may be added to the consideration set even if consumers did not consider these products initially:5

Given the shift in consumer purchasing behavior, marketing practitioners have had to adjust their traditional thinking and adapt to the new options that consumers have for shopping. One of the most critical aspects of this is acknowledging who controls the marketing message.

Previously, marketers were in charge of the process, exerting more control over both the message itself and how it was received by consumers. Today, consumers have more control regarding the messages they hear and the means to receive them. For example, today’s consumers have the ability to receive information and insights from other consumers, and they may rely heavily on online reviews and other electronic word-of-month (sometimes called “eWOM”).

Furthermore, the emergence of search engines has resulted in dramatic differences in how consumers actively search for information and make purchase decisions. These new ways of obtaining information limit the effectiveness of “one size fits all” marketing messages. Consumers now play the lead role because they have the ability to “pull” information, reducing the marketer’s ability to “push” information.

The development of the decision journey framework has also contributed to the understanding that the journey for a given consumer for the same good can vary from situation to situation. And, of course, the journey for one consumer who purchases a product can be very different from the journey taken by another consumer who purchases the exact same product.

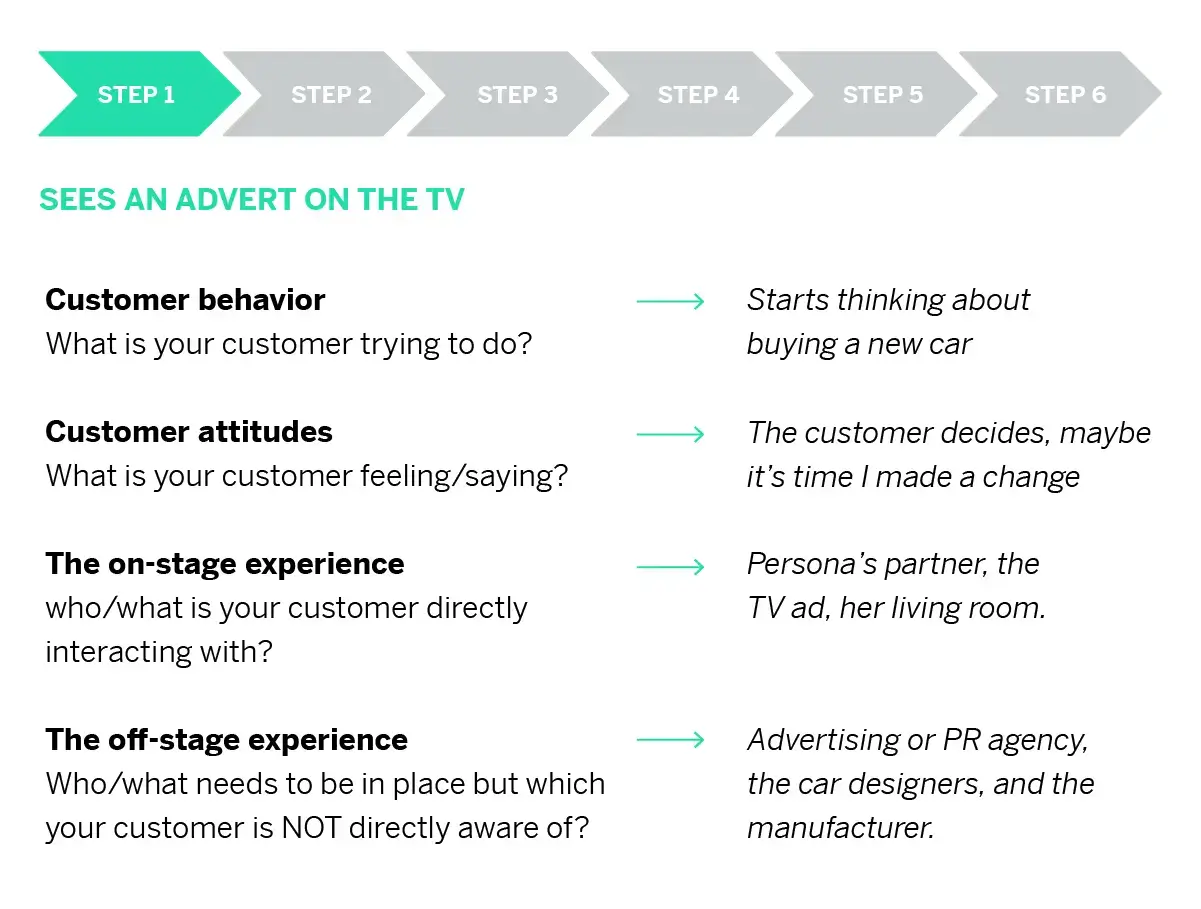

An Example of the Decision Journey for an Automobile

An example can illustrate the complexities of decision-making under the decision journey framework as compared to the purchase funnel framework. Imagine Chris, a consumer in today’s market searching for a vehicle. On the journey towards an automobile purchase, Chris initially considers a set of vehicles comprising those she has previously owned and had positive experiences with. However, instead of restricting her consideration set to known options, Chris begins to research other vehicles. For example, Chris may email dealers who display their inventories online for more information, or she may read one of many third-party review websites. Chris may also search social media sites and glean information from both her own friends and family and strangers whose experiences she finds instructive.

Through this research process, the number of options in Chris’s consideration set may increase, decrease, or stay the same. When it comes time to select a specific vehicle, Chris may go with a dealer she previously identified online, or visit one or many in person. After these interactions, which may also increase or decrease the number of vehicles being considered, Chris may conduct further real-time research on her smartphone to compare features and prices. She might also navigate to websites that advertise rates for car loans instead of being limited to the dealership’s finance department—some of these websites may point her to yet more vehicles. After completing her purchase, Chris may continue to conduct research on her vehicle by visiting general or model-specific enthusiast websites. Thus, the winding journey that led Chris to her ultimate purchase was affected by many complex factors and, in fact, continued after the actual purchase.

Implications for Litigation

The consumer decision journey framework has many important implications for litigation. For example, it is important to consider the various types of information sources that consumers are exposed to and whether and to what extent this information affects an individual’s purchase decision. Furthermore, one can analyze the relative importance of manufacturer advertising or specific advertising claims as compared to content generated by consumers themselves. Finally, experts should carefully examine the appropriateness of analytical methods that may not allow for the richness of the products and brands that consumers may consider at various stages of the consumer decision journey.

1 P. Kotler and K. Keller, Marketing Management, 14th ed. (Prentice Hall, 2012), 172–180. 2 Kotler and Keller (2012), 172–180; D. Court et al., “The Consumer Decision Journey,” McKinsey & Company, June 1, 2009, https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/the-consumer-decision-journey (“McKinsey Consumer Journey”). 3 “The Evolution of Consumer Behavior in the Digital Age,” Medium, November 16, 2017, https://medium.com/analytics-for-humans/the-evolution-of-consumer-behavior-in-the-digital-age-917a93c15888 ; McKinsey Consumer Journey. 4 McKinsey Consumer Journey; R. Divol, D. Edelman, and H. Sarrazin, “Demystifying Social Media,” McKinsey Quarterly, April 1 2012, https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/demystifying-social-media . 5 Chart reproduced from McKinsey Consumer Journey, Exhibit 2.

Current Legal Analysis

More from cornerstone research, upcoming legal education events.

Sign Up for e-NewsBulletins

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- Springer Nature - PMC COVID-19 Collection

Avoiding digital marketing analytics myopia: revisiting the customer decision journey as a strategic marketing framework

Matthew d. vollrath.

1 Department of Economics and Business, Ohio Wesleyan University, 61 S. Sandusky St, Delaware, OH 43015 USA

Salvador G. Villegas

2 School of Business, Northern State University, Aberdeen, USA

The use of analytics data in digital marketing has had a profound impact on the way marketers create consumer relationships and how firms make decisions. However, the marketing analytics literature offers little guidance on how digital marketing analytics tools should be selected and leveraged in service to the firm’s overall strategy. Foundational marketing theory and research concerning the origin of consumer value and the primary importance of the consumer decision journey to strategy formation offer a pathway to evaluating digital marketing tools and analysis in a strategic and theoretically sound manner. This paper builds on seminal marketing thought to propose a conceptual framework that places use of digital marketing analytics tools and channels in the context of a firm’s marketing plan. The framework has diverse applications across many industries and platforms and can help markers avoid falling victim to digital marketing analytics myopia, even as evolving technologies and broader societal forces like the response to Covid-19 accelerate the digitalization of marketing.

Introduction

How customers experience a brand is increasingly taking place online. It is estimated that e-commerce accounted for over 14% of global retail sales in 2019 and that it will account for 22% of global retail sales by 2023 (eMarketer 2019 ). COVID-19 may accelerate this growth, with 48% of consumers reporting in May 2020 that the virus had caused them to purchase products online that they would have usually purchased in stores (Numerator Intelligence 2020 ). Digital retail sales are quickly becoming a necessary sales channel for consumers and may no longer be seen as merely an alternative to traditional brick and mortar shopping. At the same time, marketers reported allocating 50.1% of their budgets to digital marketing channels in 2019 and are forecasting to spend 60.5% of their marketing budgets on digital initiatives by 2023 (eMarketer 2020 ). In this digitally driven environment marketing analytics are essential and manifold (Saura et al. 2017 ). There is an abundance of marketing literature exploring practical aspects of marketing analytics ranging from basic definitions (Iacobucci et al. 2019 ), to specific applications (Mikalef et al. 2018 ), and adoption within a firm (Branda et al. 2018) but relatively little has been written about analytics integration with marketing theory (Iacobucci et al. 2019 ). It has been observed in this journal that “metrics and data are empty shells without proper theories and interpretations behind them (Krishen and Petrescu 2017 , p. 117).” What is missing from the marketing analytics literature is a conceptual yet functional framework that is grounded in seminal marketing thought, connecting the selection and use of marketing analytics to an organization's comprehensive marketing strategy. This paper will briefly review how marketing literature has generally approached the topic of marketing analytics and consider how marketing research combined with theory suggests directions for a conceptual and strategic digital marketing analytics framework. This paper then proposes such a framework and argues that even as emerging technologies, new marketing channels, and the realities of COVID-19 accelerate the digitalization of marketing activities, a customer journey focused approach to marketing can offer clarity about what data is strategically valuable across diverse industries and circumstances.

Literature review

A need for strategic integration.

The concept of marketing analytics, defined by Iacobucci et al. ( 2019 ) as “the study of data and modeling tools used to address marketing resource and customer-related business decisions” (p. 155), has been present in the literature and industry since around the beginning of the twentieth century. It was not until the advent of the internet, and with it, technologies such as CRMs and search engines, that marketing analytics emerged as the field we know today (Wedel and Kannan 2016 ). Since that time, interest in marketing analytics has grown rapidly (Petrescu and Krishen 2017 ) as researchers explored the application of diverse marketing analytics techniques across diverse industries. This growth was largely driven by the exponential growth of available data, and marketers’ efforts to answer the basic question of what to do with it all? (Krishen and Petrescu 2017 ). Grappling with that question has produced research that focused on the how and what of marketing analytics, offering definitions, techniques, applications, and assessments of marketing analytics’ impact (Wedel and Kannan 2016 ). What was and remains neglected in the literature, is a guiding consensus about which of the myriad techniques are most valuable (Saura et al. 2017 ), and how digital marketing analytics can be effectively integrated into an organization’s overall marketing strategy (Kingsnorth 2019 ; Iacobucci et al. 2019 ). Indeed, while the use of data tools has been welcomed in the business world as a possible solution to most problems, their implementation is often deemed a failure, and their results are seen as disappointing (Tabesh et al. 2019 ). From a marketing perspective, key reasons for these failures are reliance on confusing and disparate planning frameworks (McTigue 2019 ), and focusing on tools, specific marketing metrics or financial returns instead of the consumer’s needs (Dimitriadis et al. 2018 ; Kaushik 2015 ; Grigsby 2015 ). In other words, these failures are strategic failures.

Marketing strategy and consumer needs

The broader marketing literature has long grappled with reconciling disconnections between marketing strategy and tactics, and more importantly, disconnections between marketing strategy and the consumer. Theodore Levitt’s ( 2016 ) seminal 1960 article, Marketing Myopia , diagnosed marketers’ primary strategic problem as operating from a perspective that prioritized the firm's products and goals over consumers’ needs:

The usual result of this narrow preoccupation with so-called concrete matters is that instead of growing…the product fails to adapt to the constantly changing patterns of consumer needs and tastes…The industry has its eyes so firmly on its own specific product that it does not see how it is being made obsolete. (p. 45).

By themselves and without customer focus, marketing analytics can lead to the very same trap that Levitt ( 2016 ) described. Wells Fargo’s use of analytics offers a prime example of this problem. In the years leading up to an ethics crisis that would cost the bank billions in fines and inflict enduring reputational damage (Eisen 2020 ), Wells Fargo was known for its highly advanced use of analytics throughout its operations. However, these analytics tools were not employed to understand and create value from the consumer’s perspective, but rather to create value from the firm's perspective . Wells Fargo leadership set a customer relationship goal of eight accounts per customer, leveraged analytics tools toward that goal, and two million fake/unauthorized customer accounts were the end result (Ali et al. 2018 ). When the focus of analytics is boosting profit from existing products and services, firms are effectively deciding that what consumers need does not matter. Consumers must buy more of what is being sold, regardless of their unique needs and circumstances.

The marketing analytics myopia displayed by Wells Fargo is not unique and manifests itself wherever a marketer or firm leader is stubbornly committed to any singular metric or dashboard. Kaushik ( 2015 ) described how digital marketing campaigns are destined to fail when marketers fixate on a key performance indicator (KPI) such as click thru rate (CTR), measuring campaigns against it regardless of customer segment or location in their buying journey. An antidote to these problems is a focus on creating customer value conceptualized through a consumer decision journey (Edelman 2010 ; Rust et al. 2010 ).

Consumer decision journeys

The idea that consumers experience the buying process as a journey can be traced as far back as 1898, when salesman and advertising pioneer Elmo St. Lewis proposed the now famous Awareness, Interest, Desire, Action (AIDA) framework (Strong 1925 ). St. Lewis’ central insight was that consumers need to receive different messages about a product at different times, moving along a linear path with specific steps of awareness, interest, and desire which culminate into action. The AIDA model is foundational to the field of marketing and advertising, in part because its conceptualization of marketing/advertising specific activities facilitates measurement as consumers move from one stage of their cognitive and affective journey to the next (Wijaya 2012 ). This concept translates neatly into a funnel metaphor in which many possible consumers are narrowed to fewer with interest, still fewer with desire, and ultimately fewer still who become customers. Digital marketers are typically adept at building effective and measurable strategies around this linear conception of the consumer decision journey (Kingsnorth 2019 ).

The modern consumer decision journey

Over the last decade, many marketing researchers and practitioners have shifted away from the traditional AIDA model of thinking, toward a model that emphasizes the importance of consumer relationships (McTigue 2019 ). This shift seeks to account for the fact that people do not just buy brands as isolated transactions, but buy them based on a personal perception of value formed by the totality of their experiences with the brand. This concept postulates that when a consumer becomes a customer, the relationship they form with the brand becomes part of the total value that the brand offers (Edelman 2010 ). This aspect of consumer behavior is neglected in both linear AIDA and funnel models, but included in a circular model of the consumer decision journey first proposed by McKinsey consultants (Court et al. 2009 ).

The McKinsey model sees the consumer decision journey as a four-part directional process in which the consumer: (1) begins with a list of brands they intend to consider, (2) adds or subtracts brands to the list as they evaluate what they want, (3) makes a purchase, and (4) builds expectations based on their experience with the product or service to inform future behavior (Court et al. 2009 ). When consumers are satisfied with the total value that a firm has provided throughout these four stages, they are likely to skip steps one and two of their buying journey the next time a buying need arises and go directly to step three—making a purchase.

Subsequent research has suggested a multitude of slight variations to the stages and terminology of this model (e.g. Wolny and Charoensuksai 2014 ; Young 2014 ; Kaushik 2015 ; Kotler et al. 2016 ; Katz 2017 ; Kingsnorth 2019 ), but at a high-level, these stages are accepted as the modern conception of the consumer decision journey (McTigue 2019 ). One variation on the model that stands out for its simplicity was proposed by Avinash Kaushik, Marketing Evangelist for Google. Kaushik ( 2013 , 2015 ) conceptualized the four stages of the journey as See (awareness), Think (evaluation), Do (purchase), and Care (managing the post-purchase experience), and created the framework that is used internally at Google (Eriksson 2015 ). The simplicity of this model lends itself to quick understanding and easy translation to diverse business situations, an essential attribute for any model's use and adoption (McTigue 2019 ). The one-word verb descriptions of each stage orient the marketer to a consumer-centric perspective, and correspond to stages 1 through 4 of the McKinsey model. It is also a useful model to adopt in the context of a discussion of digital marketing analytics because as it was specifically developed for digital marketing (Kaushik 2013 ).

Whatever the specific model, the modern consumer decision journey implies that marketing strategies, tactics, and measurements should be aligned with the needs and behaviors of consumers at each of the decision journey stages (Kingsnorth 2019 ; Malthouse et al. 2019 ). This pushes the consumer decision journey beyond abstraction and into the world of practical application—the world of digital marketing analytics.

Psychological stages vs. brand encounters

It is important to note the difference between the consumer decision journey as a framework for understanding the psychological stages that consumers go through when making a purchase (Court et al. 2009 ), in contrast to a consumer journey as a map of brand encounters that consumers experience as they consider and ultimately complete a purchase (Vakulenko et al. 2019 ). The latter represents actual experiences or destinations that a consumer navigates in the process of making a purchase, while the former represents a state of mind that a consumer may hold across multiple stages of their decision journey. For example, a customer in the post-purchase stage of the consumer decision journey may travel a journey map that includes a visit to the product support website followed by viewing product tutorials on the company’s YouTube page. Both of these journey map destinations are encompassed by the fourth stage of the customer decision journey in which customers build expectations that will inform their future behavior. This distinction is significant because the journey map invariably represents occasions when a consumer is seeking to fulfill a functional need (e.g., how can I fix the problem I’m experiencing with this product?), while the decision journey represents the changing psychological needs that a consumer is seeking to fulfill through their interactions with the company (e.g., do I believe the company I purchased from cares about me and its brand is aligned with my conception of value?). Meeting functional needs may satisfy a customer, but it will not be enough to create customer loyalty. Consumer behavior research is clear that brand loyalty requires addressing emotional needs as well as functional expectations (Johansson and Carlson 2015 ).

Segmentation

An implication of the consumer decision journey (See-Think-Do-Care), is that segmentation based on consumer behavior should be the starting point for effective marketing. Describing and reacting to consumer behavior is at the heart of marketing analytics, but attention to consumer behavior will lead marketers in diverse directions depending on the behavior in focus. Absent a framework for strategic segmentation, analytics may lead marketers astray, or at least produce suboptimal results. The consumer decision journey pushes marketers to embrace several basic strategic concepts.

Layers of segmentation

Consumers are diverse and behave differently based on their different needs (Peter and Olson 2010 ) and where they are in the consumer decision journey (Edelman and Singer 2015 ). Salient segments for an athletic apparel company, for example, might include consumers who use the product when they run, and those who use the product when they play basketball. Some consumers in the runners segment have never bought from the firm before, and others are repeat customers. One layer of segmentation then is the consumer’s location within the consumer decision journey, and another layer is how the consumer will ultimately use the product, that is, the problem the product solves (Christensen et al. 2005 ). Both layers of segmentation are defined by consumer behavior, and both layers have implications for which marketing message and platform should be employed for the target consumer (Young 2014 ; Hughes et al. 2019 ; Kingsnorth 2019 ). Ignoring this segment or the stage will result in marketing that does not fit the consumer.

One potential digital marketing analytics segmentation pitfall is an uneven use of analytics at different stages of the consumer decision journey. It is easy to measure and react to metrics such as CTR, as a natural application of digital marketing analytics is to use that data to maximize the efficiency of a specific campaign. However, maximizing a campaign on a single metric may not be consistent with the broader goals of the firm. The classic example is the parable of the AI program tasked with ensuring an office never ran out of paperclips. It did so by gaining control of the systems and organizations throughout the world, while leveraging the planet's resources to produce and protect paperclips (Sterne 2017 ). In the context of marketing, a strategy can become subject to ineffective tactics when it is matched with an inappropriate stage of the consumer decision journey. CTR will be nearly nonexistent at the See stage, and making marketing choices according to this metric will ignore the needs of that segment (Kaushik 2013 ). Maximizing based solely on CTR could produce impressive results at the Do stage, and also post-purchase cognitive dissonance that undermines the goals of the Care stage (Johansson and Carlson 2015 ).

The central assumption of the consumer decision journey framework is the goal of creating and maintaining customers who are loyal brand advocates (Edelman 2010 ; Rust et al. 2010 ). This is different from achieving a financial benchmark or hitting specific KPIs. Marketers may choose financial benchmarks and specific KPIs to help guide efforts at each stage of the consumer decision journey, but these should be subject to the overarching goals of loyalty and advocacy. This is a consumer-centric perspective: consumers will begin and continue their relationship with the firm because it consistently creates value for them (Levitt 1960 ; Sheth et al. 2000 ). Digital marketing analytics should help the firm create value for consumers by (1) producing insights about what fundamental problem consumers are trying to solve with the product, which is the source of its value according to Levitt ( 2016 ), and (2) connecting consumers to what they want (Hollebeek and Macky 2019 ).

Mapping consumer journeys

A starting point for both of these value-based objectives is mapping the consumer journey. All consumers move through the consumer decision journey (See, Think, Do, Care), but may experience a variety of sequences of brand encounters. Mapping seeks to describe how consumers generally, and as salient segments (sometimes referred to as personas in the context of consumer journey mapping), typically navigate this process and why (Lemon and Verhoef 2016 ). Marketers can gain insight into these questions through methods that could include personal shopping diaries (Wolny and Charoensuksai 2014 ), personal interviews (Micheaux and Bosio 2019 ), customer surveys (De Keyser et al. 2015 ), combining third party socioeconomic and demographic data with customer purchase histories (Faulds et al. 2018 ), analyzing Google search data (Rennie et al. 2020 ), leveraging website analytics (Google Marketing Platform 2018 ), and creating blueprints of internal workflows (Birtel et al. 2016 ). Whatever the method, the goal is the same: to create a map connecting relevant marketing channels and consumer experiences to each stage of the consumer decision journey. It is critical for marketers to recognize that no single method of researching consumer decision journeys is likely to yield a complete picture of consumers' journey maps. Website analytics can show how consumers arrived at and moved through a firm's website, but offers little insight into the See stage of their journey. Blueprints of internal workflows can help a firm understand how consumers interact with its various departments, but this will be focused on the Do and Care stages of the journey. Qualitative research may address each stage of the journey, but findings and conclusions are inherently limited by the size of the study. Complete consumer decision journey mapping will likely require the use of multiple research methods.

Application

Consumer journey mapping is valuable to the extent that it is viewed as a tool for understanding a consumer's need at each stage of their decision journey. When marketers lose sight of the journey map as a means for understanding consumer needs, the points of the map become just another misleading analytics metric. The firm's goal is not, for example, to ensure that e-commerce delivery times meet a certain threshold or trend in a certain direction. The goal is to ensure that the customer’s needs in the Care stage of their journey are met. This is bigger than any single metric, and maintaining this level of strategic focus throughout an organization requires a strategic framework for the selection and analysis of marketing analytics.

To this end, we propose the conceptual framework shown in Table Table1: 1 : Using the Consumer Decision Journey for Strategic Selection of Digital Marketing Analytics Tools. The framework is built around Kaushik's ( 2015 ) simple See, Think, Do, Care conception of the consumer decision journey, which itself is rooted in the McKinsey model (Court et al. 2009 ). To use the framework, a marketer will consider the consumer decision journey of a specific segment, moving left to right across the table, selecting an appropriate tool for each column and stage (row). The first column of the framework lists the See, Think, Do, Care psychological stages of the consumer's decision journey, and the last (fourth) column of the table lists their corresponding measurable consumer behavior outcomes (as described in the McKinsey model), which will be practically defined differently by each firm. In between, column two focuses the marketer on Levitt's ( 2016 ) and Christensen et al.'s ( 2005 ) admonition to design offerings around the consumer's conception of value (solving their problem). This column acknowledges that understanding what constitutes value for a consumer must begin with market research (Dimitriadis et al. 2018 ) and that digital marketing analytics are inherently limited by the data they include (Kingsnorth 2019 ). Market research beyond what an organization's existing digital analytics tools can readily provide may be required, whether through traditional market research methods or a specially designed analytics project (Grigsby 2015 ; Van Bommel et al. 2014 ). Column three focuses attention on selecting specific and contextually appropriate digital marketing channels and analytics tools, a key task of digital marketing (Young 2014 ; Kingsnorth 2019 ). It must be informed by the segment and stage-specific value understanding developed in the prior column.

Creating consumer value: using the consumer decision journey for strategic selection of digital marketing analytics tools

The goal of this framework is to ground the digital marketer’s selection of channels and their corresponding digital marketing analytics in service to consumer’s needs, and in so doing, integrate these decisions with an organization's marketing strategy. The framework is intended to be used for analyzing the decision journey of each segment that an organization has targeted. It is not intended to prescribe specific digital marketing analytics techniques or tools, but rather to ensure the techniques and tools that are selected are strategically sound and not a quick path to digital marketing analytics myopia.

To better illustrate the value of the proposed framework we will apply it to the hypothetical example of an athletic apparel company with a target segment of basketball players. Digital marketers may find it helpful to translate the guidance of each row of the framework into a concise, template like statement:

- Our SEE stage goal is to increase our SHARE OF VOICE (Measure of Awareness) among BASKETBALL PLAYERS (Segment) by using INSTAGRAM INFLUENCERS (Channels) to position our brand as SOURCE OF CONFIDENCE ON AND OFF THE COURT (Value).

- Our THINK stage goal is to increase BRAND SEARCHES (Measure of Intent) among BASKETBALL PLAYERS (Segment) by using DISPLAY (Channels) to position our brand as HIGH QUALITY AND AFFORDABLE (Value).

- Our DO stage goal is to increase CART CONVERSION RATE (Measure of Purchase) among BASKETBALL PLAYERS (Segment) by using A CHATBOT (Channels) to OVERCOME DOUBTS ABOUT SIZES (Value).

- Our CARE stage goal is to increase REPEAT PURCHASE RATE (Measure of Loyalty) among BASKETBALL PLAYERS (Segment) by using BRAND APP (Channels) to position our brand as A VEHICLE FOR SELF-EXPRESSION (Value).

It is important to note that the value for each segment may slightly change from stage to stage. This is because consumers’ needs change slightly from stage to stage (Court et al. 2009 ). A consumer in the Think stage may need specific information, while a consumer in the Do stage may need specific reassurance. A consumer in the See stage may need to be introduced to the emotional benefits your brand provides, but a consumer in the Think stage may already be persuaded of these benefits and they are weighing your other product attributes against those of a competing brand that provides the same emotional benefits (Peter and Olson 2010 ). Digital marketers will not know exactly what a consumers’ stage needs are until they do the research to find out. Digital channel and analytics choices must always follow an understanding of a segment’s conception of value in each decision journey stage.

It is also important to note that although the hypothetical example only lists one channel choice for each stage, in practice there will be many channels employed. Each selected channel should have associated analytics, and none of those metrics alone will be able to determine if digital marketing efforts are successful or not. Limiting channel analytics until the meaning and effects of each are well understood would be wise. Evaluating channel analytics should be viewed as an equation:

If a digital marketer has put in the work to ensure a proper understanding of consumer value, then disappointing stage outcome results should be addressed by reconsidering and/or optimizing the digital marketing channels. However, if the digital marketer did not start by understanding value, value is where stage outcome problem resolutions must begin; to focus on channel effectiveness without first addressing value is to fall victim to digital marketing myopia.

Finally, just as this framework does not seek to prescribe specific digital analytics tools for understanding value or evaluating channel effectiveness, it is not prescribing specific methods for measuring stage outcomes. These should be selected based on an individual organization’s expert knowledge of their segments, industry, and overall marketing strategy.

Limitations and future research

The strategic framework proposed in this paper is limited in several ways. First, it is merely conceptual and has not been tested by practitioners or researchers. It also assumes that an organization has already invested significant effort in developing a marketing strategy. It assumes that an organization has identified clear target segments, has tailored its offerings to the needs of those segments and has communicated this information across departmental silos. Perhaps most importantly, we have not attempted to address the appropriate timeframes and stage segmentation procedures for implementing the framework. How often should digital marketers go through the process recommended by the framework, and when they select that timeframe, is it necessary to measure stage outcomes in a way that isolates consumers according to their stage during the time considered? In order to bridge the gap between theory and practice, the testing and application of this construct are essential by future researchers to gain a greater understanding of the consumer decision journey in the world of digital marketing analytics.

As marketing evolves toward an increasingly digital future, the field of marketing analytics will be challenged to make sense of more data from more diverse sources. However, technology and relevant marketing channels may change, the consumer decision journey is a strategic marketing framework that can guide digital marketing analytics practitioners and academics toward contributions that create real value for consumers and firms. Mapping the consumer decision journey helps marketers understand what consumers want and how to connect them to it. The process can illuminate consumer needs and expectations, informing content creation (Malthouse et al. 2016 ), UX design, and marketing channel choices. This framework provides strategic guidance to avoid marketing reactions that are misaligned with organizational and consumer expectations. As marketers gain deeper insight into these specifics of consumer decision journeys, they should beware of the temptation to unleash ever more analysis and KPIs; the proliferation of these is not a strategy, but a quick path to digital marketing analytics myopia. Instead, savvy marketers will leverage analytics at each stage of the consumer decision journey to meet consumers' needs and align digital and firm-level marketing strategy.

Biographies

is an Assistant Professor of Business Administration at Ohio Wesleyan University where he teaches courses in marketing and brand strategy. Prior to becoming a professor, Matt spent over a decade working in marketing and communications roles in corporate, non-profit, and government settings. His research interests include the evolving role of data in marketing and the relationship between consumers and brand values.

is an Assistant Professor of Management at Northern State University in Aberdeen, SD. He holds a Doctor of Business Administration (DBA) degree in Management from George Fox University and has nearly two decades of successful industry experience in the banking & finance sectors. Dr. Villegas’ research interests include business ethics, multigenerational workforce management, and networking/reciprocity. He is very active in his local community and has served on the board of directors for several non-profit organizations.

Compliance with ethical standards

The authors declare that they have no conflict of interest.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

- Ali A, Mancha R, Pachamanova D. Correcting analytics maturity myopia. Business Horizons. 2018; 61 (2):211–219. doi: 10.1016/j.bushor.2017.11.003. [ CrossRef ] [ Google Scholar ]

- Birtel, C., Pajtas, J., and Green, M. 2016. Unleashing the power of an analytics organization: Why a large financial institution used ethnography to transform analytics. EPIC. https://www.epicpeople.org/unleashing-the-power-of-an-analytics-organization-why-a-large-financial-institution-used-ethnography-to-transform-analytics/ .

- Christensen CM, Cook S, Hall T. Marketing malpractice: The cause and the cure. Harvard Business Review. 2005; 83 (12):74–83. [ PubMed ] [ Google Scholar ]

- Court, D., Elzinga, D., Mulder, S., and Vetvik, O. 2009. The consumer decision journey. McKinsey Quarterly . https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/the-consumer-decision-journey .

- De Keyser A, Schepers J, Konuş U. Multichannel customer segmentation: Does the after-sales channel matter? A replication and extension. International Journal of Research in Marketing. 2015; 32 (4):453–456. doi: 10.1016/j.ijresmar.2015.09.005. [ CrossRef ] [ Google Scholar ]

- Dimitriadis N, Dimitriadis NJ, Ney J. Advanced marketing management: Principles. Skills and Tools: Kogan Page Publishers; 2018. [ Google Scholar ]

- Edelman DC. Branding in the digital age: you’re spending your money in the wrong places. Harvard Business Review. 2010; 88 (12):16–23. [ Google Scholar ]

- Edelman DC, Singer M. Competing on customer journeys. Harvard Business Review. 2015; 93 (November):88–100. [ Google Scholar ]

- Eisen, B. 2020. Wells Fargo reaches settlement with government over fake-accounts scandal. The Wall Street Journal. https://www.wsj.com/articles/wells-fargo-nears-settlement-with-government-over-fake-account-scandal-11582299041 .

- eMarketer. 2019. Global ecommerce 2019. https://www.emarketer.com/content/global-ecommerce-2019 .

- eMarketer. 2020. Global digital ad spending 2019. https://www.emarketer.com/content/global-digital-ad-spending-2019 .

- Eriksson, J. 2015. KPIs: An essential framework. Google. https://www.thinkwithgoogle.com/intl/en-145/perspectives/global-articles/kpis-essential-framework/ .

- Faulds DJ, Mangold WG, Raju PS, Valsalan S. The mobile shopping revolution: Redefining the consumer decision process. Business Horizons. 2018; 61 (2):323–338. doi: 10.1016/j.bushor.2017.11.012. [ CrossRef ] [ Google Scholar ]

- Google Marketing Platform. 2018. Understand today’s customer journey with Google Analytics . https://services.google.com/fh/files/misc/analytics_customer_journey_feature_brief.pdf .

- Grigsby M. Marketing analytics: A practical guide to real marketing science. London: Kogan Page Publishers; 2015. [ Google Scholar ]

- Hollebeek LD, Macky K. Digital content marketing's role in fostering consumer engagement, trust, and value: Framework, fundamental propositions, and implications. Journal of Interactive Marketing. 2019; 45 :27–41. doi: 10.1016/j.intmar.2018.07.003. [ CrossRef ] [ Google Scholar ]

- Hughes C, Swaminathan V, Brooks G. Driving brand engagement through online social influencers: An empirical investigation of sponsored blogging campaigns. Journal of Marketing. 2019; 83 (5):78–96. doi: 10.1177/0022242919854374. [ CrossRef ] [ Google Scholar ]

- Iacobucci D, Petrescu M, Krishen A, Bendixen M. The state of marketing analytics in research and practice. Journal of Marketing Analytics. 2019; 7 (3):152–181. doi: 10.1057/s41270-019-00059-2. [ CrossRef ] [ Google Scholar ]

- Johansson J, Carlson K. Contemporary brand management. Thousand Oaks: Sage Publications; 2015. [ Google Scholar ]

- Katz H. The media handbook: A complete guide to advertising media selection, planning, research, and buying. Abington: Routledge; 2017. [ Google Scholar ]

- Kaushik, A. 2013. See-think-do: A content, marketing, measurement business framework. Occam’s Razor. https://www.kaushik.net/avinash/see-think-do-content-marketing-measurement-business-framework/ .

- Kaushik, A. 2015. See, think, do, care winning combo: Content +marketing +measurement!. Occam’s Razor. https://www.kaushik.net/avinash/see-think-do-care-win-content-marketing-measurement/ .

- Kingsnorth S. Digital marketing strategy: An integrated approach to online marketing. London: Kogan Page Publishers; 2019. [ Google Scholar ]

- Kotler P, Kartajaya H, Setiawan I. Marketing 4.0: Moving from traditional to digital. New York: Wiley; 2016. [ Google Scholar ]

- Krishen AS, Petrescu M. The world of analytics: Interdisciplinary, inclusive, insightful, and influential. Journal of Marketing Analytics. 2017 doi: 10.1057/s41270-017-0016-4. [ CrossRef ] [ Google Scholar ]

- Lemon KN, Verhoef PC. Understanding customer experience throughout the customer journey. Journal of Marketing. 2016; 80 (6):69–96. doi: 10.1509/jm.15.0420. [ CrossRef ] [ Google Scholar ]

- Levitt, T. 1960. Marketing myopia. Harvard Business Review. [ PubMed ]

- Levitt, T. 2016. Marketing myopia. Harvard Business Review: Measuring Market Insights , p. 11–19.

- Malthouse EC, Calder BJ, Kim SJ, Vandenbosch M. Evidence that user-generated content that produces engagement increases purchase behaviours. Journal of Marketing Management. 2016; 32 (5–6):427–444. doi: 10.1080/0267257X.2016.1148066. [ CrossRef ] [ Google Scholar ]

- Malthouse EC, Wang WL, Calder BJ, Collinger T. Process control for monitoring customer engagement. Journal of Marketing Analytics. 2019; 7 (2):54–63. doi: 10.1057/s41270-019-00055-6. [ CrossRef ] [ Google Scholar ]

- McTigue K. Leveraging touchpoints in today’s branding environment. In: Taybout A, Calkins T, editors. Kellogg on branding in a hyper-connected World. New York: Wiley; 2019. pp. 110–128. [ Google Scholar ]

- Micheaux AL, Bosio B. Customer journey mapping as a new way to teach data-driven marketing as a service. Journal of Marketing Education. 2019; 41 :127–140. doi: 10.1177/0273475318812551. [ CrossRef ] [ Google Scholar ]

- Mikalef P, Pappas IO, Krogstie J, Giannakos M. Big data analytics capabilities: A systematic literature review and research agenda. Information Systems and e-Business Management. 2018; 16 (3):547–578. doi: 10.1007/s10257-017-0362-y. [ CrossRef ] [ Google Scholar ]

- Numerator Intelligence, N. 2020. The impact of Coronavirus (COVID-19) on consumer behavior . https://www.numerator.com/resources/blog/update-impact-coronavirus-covid-19-consumer-Behavior-us-10 .

- Peter JP, Olson JC. Consumer behavior & marketing strategy. New York: McGraw-Hill Irwin; 2010. [ Google Scholar ]

- Petrescu M, Krishen AS. Marketing analytics: from practice to academia. Journal of Marketing Analytics. 2017; 5 (2):45–46. doi: 10.1057/s41270-017-0019-1. [ CrossRef ] [ Google Scholar ]

- Rennie A, Protheroe J, Charron C, and Breatnach G. 2020. Decoding decision: Making sense of the messy middle. Think with Google . (July).

- Rust RT, Moorman C, Bhalla G. RethinkingMarketing. Harvard Business Review. 2010; 88 (1):94–101. [ Google Scholar ]

- Saura JR, Palos-Sánchez P, Cerdá Suárez LM. Understanding the digital marketing environment with KPIs and web analytics. Future Internet. 2017; 9 (4):76. doi: 10.3390/fi9040076. [ CrossRef ] [ Google Scholar ]

- Sheth JN, Sisodia RS, Sharma A. The antecedents and consequences of customer-centric marketing. Journal of the Academy of Marketing Science. 2000; 28 (1):55–66. doi: 10.1177/0092070300281006. [ CrossRef ] [ Google Scholar ]

- Sterne J. Artificial intelligence for marketing: practical applications. New York: Wiley; 2017. [ Google Scholar ]

- Strong E. The psychology of selling. New York: McGraw-Hill; 1925. [ Google Scholar ]

- Tabesh P, Mousavidin E, Hasani S. Implementing big data strategies: A managerial perspective. Business Horizons. 2019; 62 (3):347–358. doi: 10.1016/j.bushor.2019.02.001. [ CrossRef ] [ Google Scholar ]

- Vakulenko Y, Shams P, Hellström D, Hjort K. Service innovation in e-commerce last mile delivery: Mapping the e-customer journey. Journal of Business Research. 2019; 101 :461–468. doi: 10.1016/j.jbusres.2019.01.016. [ CrossRef ] [ Google Scholar ]

- Van Bommel E, Edelman D, Ungerman K. June) McKinsey Quarterly: Digitizing the consumer decision journey; 2014. [ Google Scholar ]

- Wedel M, Kannan PK. Marketing analytics for data-rich environments. Journal of Marketing. 2016; 80 (6):97–121. doi: 10.1509/jm.15.0413. [ CrossRef ] [ Google Scholar ]

- Wijaya BS. The development of hierarchy of effects model in advertising. International Research Journal of Business Studies. 2012; 5 :73–85. doi: 10.21632/irjbs.5.1.73-85. [ CrossRef ] [ Google Scholar ]

- Wolny J, Charoensuksai N. Mapping customer journeys in multichannel decision-making. Journal of Direct, Data and Digital Marketing Practice. 2014; 15 :317–326. doi: 10.1057/dddmp.2014.24. [ CrossRef ] [ Google Scholar ]

- Young A. Brand media strategy (2e) London: Palgrave Macmillan; 2014. [ Google Scholar ]

Spotler Activate gives wings to your ambitions. Here’s why you also want to start with our products.

Build the optimal ecosystem for your business with Spotler Activate’s innovative products.

Learn all about CDPs, personalisation and customer journeys with our inspiring content.

As a part of Spotler Group, Spotler Activate delivers and develops software for data collection, automation and personalisation.

Login mobile

Mckinsey’s customer journey model: origin, evolution, and how to use it.

In 2009, the renowned marketing consultancy McKinsey introduced an innovative customer journey model. While the customer journey was often described as linear until that point, McKinsey’s experts presented a model of a cyclical nature. In the subsequent years, the e-commerce world changed, and McKinsey’s widely-used model evolved accordingly. This blog provides insights into the origin and development of the model. Additionally, it guides you on how to use it to map the customer journey of your visitors and customers.

The traditional customer journey: a linear funnel

Twenty years ago, the relationship between marketers and customers was largely one-way traffic. From the initial encounter with a brand or product to the purchase, it was the marketer who transmitted, and the consumer who received. The consumer progressed through the phases chronologically, with minimal distractions and side paths. In each phase, marketers endeavoured to influence consumers and smoothly guide them towards the end of the funnel. Did this succeed? According to the theory, the customer would remain loyal to the brand or product. However, with the rise of digital media and the shift from offline to online purchases, the model proved to be increasingly inaccurate.

The introduction of the McKinsey customer journey model

In response to digitization and the growing influence of online media, McKinsey developed a new customer journey model. With this model, McKinsey aimed to provide marketers with a framework that better aligned with modern consumer behaviour.

The model introduced by McKinsey in 2009 consists of four phases:

- Consideration

- Post-purchase experience

After the purchase, the entire cycle starts anew: the customer encounters various options, considers them, makes a decision, and evaluates the experience.

Three key differences: consideration, touchpoints and loyalty

In addition to the cyclical element, three significant differences exist between the traditional customer journey model and the customer decision journey as described by McKinsey:

1. Brand Consideration

The traditional funnel model suggests that the consideration phase proceeds in a highly structured manner. Consumers gradually narrow down their initial set of options as they consider them, reaching the point of purchasing one of the options. For the modern consumer, McKinsey’s model sees this phase as a dynamic and interactive process, where consumers sometimes take a step back and reassess their considerations.

2. Number and Type of Touchpoints

Not only has the number of options (brands, products, services) exponentially increased, but also the way we come into contact with them has changed significantly. The traditional model posits that marketers largely determine when and how consumers come into contact with their brand. In the digital world, power lies with the consumer, resulting in a much less linear and orderly progression through the first and second phases.

In contrast to traditional customer journey models, McKinsey’s model suggests that successfully navigating the journey does not guarantee loyalty. Additionally, it distinguishes between active and passive loyal customers. Passive loyal customers are open to changing brands if approached by competitors. For these customers, it is crucial to invest in the customer relationship even after the purchase. Active loyal customers not only stick with your brand but actively promote it. This group should be prioritised by investing in new touchpoints in the post-purchase phase.

“Actually, the decision-making process is a more circular journey, with four primary phases representing potential battlegrounds where marketers can win or lose.” – McKinsey, 2009

The newest version of the McKinsey Model

In 2016, McKinsey’s customer journey model received a new update. With the rise of new technologies, such as Customer Data Platforms (CDPs), McKinsey’s experts observed another shift in power. They found that CDPs help organisations personalise and influence the customer journey, thereby regaining some control.

Organisations offering personalised experiences reduce the average time consumers spend on consideration and evaluation. Some customers will skip these phases entirely and directly enter the loyalty loop. Based on these developments, McKinsey adjusted the model once again.

Classic journey

In the classic journey, consumers engage in an extended consideration and evaluation phase before either entering into the loyalty loop or proceeding into a new round of consideration and evaluation that may lead to the subsequent purchase of a different brand.

New journey

The new journey compresses the consider step and shortens or entirely eliminates the evaluate step, delivering customers directly into the loyalty loop and locking them within it.

How to use the McKinsey customer journey model with a CDP

The McKinsey customer journey model is a practical framework for mapping touchpoints in each phase. However, to optimally leverage this insight, you need a Customer Data Platform.

A CDP like Spotler Activate collects and unifies data from all your sources, creating 360-degree customer profiles. These profiles reveal who your customers are, the phase they are in, and their preferences. You can then intelligently respond with personalised content, such as recommendations, landing pages, or offers. Additionally, the CDP helps you thoroughly analyse the results of your marketing activities and continuously optimise the customer journey.

Schedule an online demo

Curious about how Spotler Activate can help you build the optimal customer journey? We’d be happy to show you in a demo!

Related blogs

Improve your shopping funnel with data-driven marketing software.

Spotler Activate is a solution that centralizes data from different sources and uses it to...

Prepare yourself with Spotler Activate for a cookieless future

Spotler Activate lets you manage your own data without using third-party cookies.

CEO priorities: Where to focus as the year unfolds

Over the past several years, CEOs have faced mounting uncertainty—and 2024 is proving no exception. On this episode of The McKinsey Podcast , Homayoun Hatami , McKinsey’s managing partner for client capabilities, and Liz Hilton Segel , McKinsey’s chief client officer, speak with global editorial director Lucia Rahilly about what matters most , amid serial crisis and disruption, and where leaders should focus their energies to enable their organizations to thrive.

In our second segment, there’s something new to stress about: microstress. Discover how little things add up with Rob Cross, author of the book The Microstress Effect: How Little Things Pile Up and Create Big Problems—And What to Do about It , in an excerpt from our Author Talks series.

The McKinsey Podcast is cohosted by editorial director Roberta Fusaro and global editorial director Lucia Rahilly.

This transcript has been edited for clarity and length.

What’s new in 2024

Lucia Rahilly: The three of us spoke a little more than a year ago on McKinsey Live about what was top of mind for CEOs at that juncture. In 2023, the operating environment seemed beleagueringly tough. In 2024, not a whole lot simpler—not exactly a year of reprieve for leaders. Homayoun, what has changed the most for CEOs over the past year?

Homayoun Hatami: Obviously, all of the CEOs we have talked to are grateful for the opportunities and the lives they have. Yet it’s fair to say, as you said, that it has become a much more difficult time to lead. We are dealing with an endless series of crises. There are two major conflicts. There is suffering in many parts of the world. There are upcoming elections in many countries. There are concerns about the global economy, with performances varying across different pockets, and there is hesitation and hope around technology.

I find the CEOs in this context to be humble. They know it’s important to lead with empathy and humanity. You ask what’s new? I think one of the biggest issues impacting business today is geopolitics. Economically, there is more and more fragmentation. There are competing interests among the US, Europe, China when it comes to technology platforms, and we can keep going on. But it’s fair to say that geopolitics has moved away from being the remit of the chief risk officers and government affairs to take the center stage on the agenda of CEOs and the boards.

Perhaps the story of the last year or the story of the decade, and maybe we’re still not done with it, is technology, notably gen AI [generative AI]. We saw just a year ago the launch of very powerful gen AI tools. Today, we are seeing a shift from pilots to enterprise-wide rollouts of an explosion of use cases across every industry as companies try to figure out how to make the most out of gen AI while managing the risk. These disruptions mean that CEOs will have to lead in a new way.

Want to subscribe to The McKinsey Podcast ?

The juggernaut that is gen ai.

Lucia Rahilly: Many organizations, as you alluded to, are launching their own proprietary gen AI tools to manage some of the risks. Liz, how should CEOs be thinking about gen AI and about how to make the most of its potential?

Liz Hilton Segel: Lucia, to put it in context, the McKinsey Global Institute estimates that generative AI could be worth more than $4 trillion in value. So it’s something that everyone is talking about constantly.

In our annual survey, we asked folks, “To what degree is generative AI in use in your organization today?” A third of them said it was already in at least one business function. And that’s in contrast with about half who say AI is in use in one function in some form. So it is absolutely already in use and also very much something that people are investing in going forward.

And I think people are wondering, “Where will I get the greatest value out of it, and what changes will be necessary? Is this just about technology and new analytics? Or is this about more fundamental change in our entire organization?” And our view is that it is about more fundamental change in the entire organization.

To give you one example, last fall we worked with the bank ING. ING has over 30 million customers around the world. They’re in about 40 countries. We simply started in one country. We started in the Netherlands, and we looked at how they could get a customer-facing chatbot working. In less than two months, they had it up and running. They had about a 20 percent increase in customers seeing a lower wait time and getting better answers to their questions. And then they were able to take the step toward rolling it out all over the world.

Lucia Rahilly: Our research has shown, historically at least, that most digital transformations, including some AI-driven transformations , fail to deliver the expected impact. Why is this? And what can leaders do to realize that impact and drive performance?

Homayoun Hatami: Despite all the investments, we estimate that companies on average have captured less than a third of the full potential they should expect from their digital transformations . And we’re seeing the distance between the leaders and the laggards getting bigger. Some leaders are pulling ahead because they are building hard-to-copy capabilities. They know it’s not just about tech. It’s also a lot about change management. They know it’s not just about what some CEOs called a snackable AI feature. It’s about transformative AI that will build superpowers for their people and for their company.

The compounding effect of gen AI and digital happens when CEOs rewire their organization . And to do that, we see them do six things. First, they adopt a digital road map that is business led, not feature led. They ensure they have the right talent. They adopt an operating model that can scale from the get-go; this is not just about the pilot—you have to have the end-state rollouts and the scaling in mind. They make technology easier for people to use; this is about making the lives of employees, colleagues, and customers easier. They put experience at the heart of change. And they use data—they embed data everywhere and they focus their leadership and their investments on adoption and enterprise scaling.

The compounding effect of gen AI and digital happens when CEOs rewire their organization. Homayoun Hatami

Here at McKinsey, we are using gen AI to give our people superpowers. A year ago, we launched Lilli, our own private gen AI solution. We have made it integral to the way we work. We are training our colleagues on it, and we are changing our colleagues’ behavior. From day one, we ran it with the idea of full-scale adoption.

Rising risks on the world stage

Lucia Rahilly: Let’s pivot. Geopolitical tensions have been escalating, and that introduces significant risk for companies, especially those that are operating internationally. And 2024 is a major election year, not just in the US, where Liz and I are. But globally, folks in more than 70 countries are heading to the polls over the next 12 months. Liz, how should CEOs be planning to navigate this intensifying geopolitical uncertainty?