ColorWhistle

Digital Web Design Agency India

Explore our Market-Fit Services

We ensure to establish websites with the latest trends as we believe that, products whose value satisfies the needs of the market and its potential customers can be efficiently successful.

Quick Links

- About Us – ColorWhistle

- Engagement Models

- Testimonials

- Case Studies

- Agency Services

- Web Development

- Web App Development

- Digital Marketing

- Travel Website Development Services Company

- Real Estate Website Development Services Company

- Education Website Development Services Company

- Healthcare Website Development Services Company

- Hotel and Restaurant Website Development Services

Category: Travel

Date: December 18, 2023

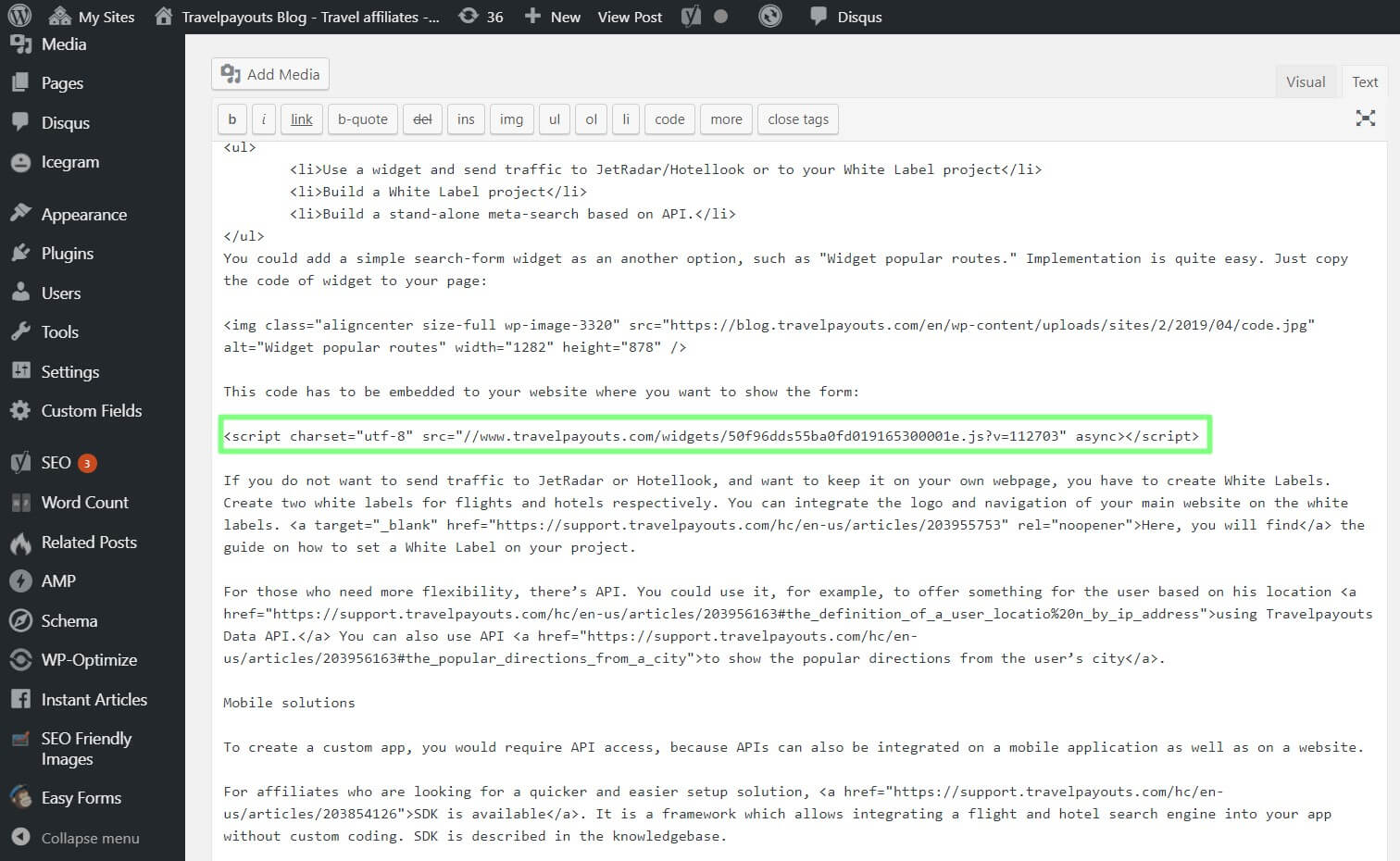

What Are Travel Meta Search Engines and How it Impacts Travel Agencies?

Travel metasearch engines have been around for some time. But, recently, it has become one of the hottest trends in the travel industry as more and more travelers are choosing it as their preferred method for finding and comparing prices.

In this blog, let’s find out how travel metasearch engines can help your hotel gain more online visibility and sell more rooms.

What is a Travel Meta Search Engine?

A travel metasearch engine is a price comparison website that compares hotel rates from different sources across the internet, OTAs (online travel agents) or directly from hotels. It must be noted that these metasearch engines are not a booking channel. They are merely a platform through which booking channels can market themselves.

The business model of travel metasearch engines is similar to most digital advertising platforms. They earn money through CPC (cost per click), CPI (cost per impression), CPA (cost per acquisition) and hybrid ads (a combination of CPC and CPA).

According to Koddi, these are the top 10 metasearch markets in the world.

What are the top 5 travel meta search engines.

Here are some of the most famous travel metasearch engines.

How Are Travel Metasearch Engines Changing the Industry?

Initially, travel engines aggregated rates by gathering them from sites across the internet so that consumers can compare it before making a final decision. Their main partners were OTAs such as Expedia and Priceline. But due to a complicated setup process and campaign management, many hoteliers avoided using the medium.

Things have changed now. Most hotels can easily get listed depending on the booking engine. For example, instant booking features where users remain on the metasearch site to book has produced a hybrid online booking environment.

One of the biggest changes is being driven by the search giant Google. When it comes to traffic growth and CPC, Google Hotel Ads is overtaking other metas. The search giant has integrated rates into Google maps. They are way ahead of the game and their meta is the most preferred choice for travelers. As more and more vendors get listed on Google Hotel Ads, Google will have more power to dictate the booking preference in the years to come. Hoteliers must maximize this channel or else it will cause a decrease in direct bookings.

Now, the online world is slowly shifting to voice-based search. The major meta-search engines are beginning to create their presence on Google Home and Amazon’s Alexa. Hoteliers who are worried about this shift can rest assured that metasearch engines will come to the rescue.

Why Should Hotels Get Listed in Travel Metasearch Engines?

Marketplaces that compare prices which vendors offer help consumers make an informed decision. Every consumer wants to feel like they are doing their due diligence before choosing a price. By listing on metasearch engines, hoteliers can give users the knowledge that they are getting a great deal.

Moreover, listing hotels in metasearch engines is not only about growing revenue. It gives hotels a chance to engage with an entirely new set of customers.

PACE Dimensions’ analyzed 10,000 travel websites and found out that metasearch accounts for over 45% of global unique visitors in travel. This number is greater than the number of unique visitors for OTAs in the US.

Metasearch is a valuable space for hotels because it gives them a greater opportunity to compete with bigger travel agencies and get more direct bookings. Plus, they can spend their marketing budget in an efficient way because the bidding system gives hotels control over how they show up with other competitors. Over time, it will give them more freedom to adjust the marketing strategy and increase ROI.

Within 10 years, the hotel metasearch has progressed into a sector that generates $6 billion in advertising. Metasearch engines such as Google Hotel Ads and Tripadvisor is becoming a one-stop-shop for researching and booking hotels. So, it is the perfect time for hotels to start investing in metasearch.

Interesting Statistics About Travel Meta Search Engines

Mirai, an expert in hotel distribution gathered many important data which depicts the growing importance of travel metasearch engines. Here are some of the major findings.

1. Investment made in ads (Google & Bing) vs metasearch engines.

2. Number of times the investment in metasearch grows than ads.

3. How metasearch engines are dominating the traditional ads?

4. Dominance of Google Hotel Ads over others

5. How Google is the leading company in terms of investment

What Are the Pros and Cons of Travel Meta Search Engines?

Travel metasearch engines have its fair share of advantages and disadvantages. Let’s find out about them.

- Improved online brand visibility and better ROI

- Lists all the hotel rates in one place

- Price transparency

- Provides reviews in one place which helps customers to make better decisions

- Always displays the best rates

- Increased direct channel bookings

- Cost of getting listed on meta appears to be excessive for some hoteliers

- No proper customer service or support to solve disputes

- Amount of choice can be overwhelming to customers

- Managing the marketing department adds extra responsibility

Before you make the decision to list your hotel on metasearch engines, you must take the above points into consideration. Do you have help to manage your campaigns? Does your budget permit the allocation of third-party optimization services? And are you prepared to pay commission fees for direct booking?

If you don’t have a team of marketers, you will not be able to manage the volume of work required to rank high in the metasearch engines. In such situations, you can outsource the work to get instant advertising expertise from professionals who can offer focused attention on a daily basis. If you are looking for such kind of assistance, you can get help from our digital marketing experts at ColorWhistle .

Drive Conversions and Boost your Business with Expert Travel Website Development.

In conclusion, travel metasearch engines is going to be a real game changer.

Travel metasearch engines will help hoteliers to reign control of their distribution pricing. This means that hotels must take serious steps to create a strong presence in meta sites.

But, hoteliers take an off-hands approach. Many are in the mindset that once they are listed, bookings will keep flowing. This is a misconception. Hoteliers must start thinking of meta sites as an online advertising platform.

Since meta sites work with real-time data, dynamic price marketing is gaining momentum. To succeed, advertising budgets must be set on a daily, weekly, and monthly basis. Most meta sites offer real-time bid management and ROAS (Return On Advertisement Spending) tracking. So, you can easily measure how well your marketing dollars are being spent.

Even though travel metasearch engines are changing the hotel marketing game, clients do not get a complete value proposition. For hoteliers, driving traffic is the only part role in this equation. Positive reviews and word of mouth is still essential for building trust.

In addition to spending and managing budget , listen to the needs of customers and promptly address the negative feedback in these mediums. Above all, make sure that your hotel is offering true value and amazing service to your customers.

ColorWhistle’s agility in learning travel tech helps to keep our consumers ahead of the curve. If you need any help in travel website development for your travel agency don’t hesitate to contact us . We are always happy to help.

Which travel metasearch engines are you using to advertise your hotel? Share your experience in the comments section below.

More Resources

- Online Travel Agencies – A Brief Introduction

- How to Build a Travel Aggregator Website?

- Best Travel Website Design Ideas And Inspirations For 2024

In quest of the Perfect Travel Tech Solutions Buddy?

Be unrestricted to click the other trendy writes under this title that suits your needs the best!

- GDS Travel Agency Guide

- GDS OTA Travel Meta Searchengines

- Travel Aggregator Website

- Best Travel Websites Inspiration

- Travel Website Features

- Top WordPress Travel Website Themes

- Vacation Rental Booking Sites vs Traditional Accommodation

Related Posts

How Predictive Maintenance Can Help the Travel Industry

Exploring the World Through AI and VR in the Travel Industry

How AI-based Travel Booking Applications Can be Developed?

About the Author - Anjana

Anjana is a full-time Copywriter at ColorWhistle managing content-related projects. She writes about website technologies, digital marketing, and industries such as travel. Plus, she has an unhealthy addiction towards online marketing, watching crime shows, and chocolates.

View Our Services

Have an idea? Request a quote

Share This Blog

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Ready to get started?

Let’s craft your next digital story

Sure thing, leave us your details and one of our representatives will be happy to call you back!

Eg: John Doe

Eg: United States

Eg: [email protected]

More the details, speeder the process :)

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

OTA vs. Metasearch: A Quick Vocabulary Lesson!

Erin Miller

Content Contributor

188 Published Articles

Countries Visited: 26 U.S. States Visited: 28

Stella Shon

News Managing Editor

87 Published Articles 626 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Online Travel Agency

Metasearch engine, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Let’s delve into a brief lesson on the basic concept of OTAs vs. metasearch engines.

Previously, these terms were fairly straightforward to define, but technology has progressed and there are now many ways in which these services overlap. We’ll do our best to make a decent distinction between them here, but we’ll warn you…it’s not always that simple!

Online Travel Agency : a website that traditionally offers both search and booking capabilities. OTA services usually include flights, hotels, and rental cars, with some also offering vacation rentals, cruises, and events/activities. OTAs often offer bundles to secure greater discounts when booking multiple services together.

An OTA is a sort of “middle-man” between the user and the airline/hotel/etc. While they no longer make commissions on flights, OTAs may take a cut of 15%-20% of your booking fee from the hotel.

Additionally, OTAs also often have toll-free phone numbers for personal assistance with booking/re-booking reservations.

Big players you’ve likely heard of in the OTA industry include Expedia , Hotels.com , Travelocity , Orbitz , Priceline , and Booking.com , among others.

Metasearch Engine : one overarching search engine that aggregates data from various sources (including other third-party search engines, OTAs, hotel websites, etc.) to provide a more comprehensive results page. This tool basically does what you’d do yourself by checking multiple different websites to compare airfares; it just checks more sites much faster… and no offense, but it’s probably smarter!

In the past, metasearch engines only offered the capability to search, directing the user to a third party OTA or individual airline to book and charging a small fee for their services. That’s no longer always the case, as we’re seeing some metasearch engines emerge with the capability to book directly through their websites.

Similar to OTAs, metasearch engine services usually include flights, hotels, and car rentals; some even provide packages to rival OTA’s discounted prices when booking services together.

Big players you’ve likely heard of in the metasearch industry include Google Flights , Kayak , Momondo , and Hipmunk, among others.

Here’s where it gets confusing. Most OTAs now offer price comparison features that essentially stack their results up against other search results, providing a more metasearch-like result. However, this option usually allows users a max of 3-4 comparison sites, whereas metasearch engines compare many more.

In addition, some metasearch engines like Hipmunk now offer assistance with travel planning, booking, canceling, etc., whereas before this was strictly OTA territory.

Things get even more convoluted when an OTA (ex: Expedia) buys a metasearch site like Kayak. Or when a metasearch site like Hipmunk uses an OTA (Travelocity, owned by parent company Expedia ) to power their hotel bookings. Or when a metasearch site like Skyscanner offers various OTAs (Kiwi.com, lastminute.com, etc.) through which to book your flight.

Lastly, we all know OTAs rank their results. How do they do that? Is it fair? Our friends at Duetto Research provide an eye opening report into the ins and outs of OTA search results.

The list goes on, but by now your head may be swimming!

The point is, whether you choose to use multiple OTAs or a certain metasearch engine is really personal preference, and truly depends on how much digging you want to do yourself.

We list both types in our travel resource post on flight searches and go into our thoughts on the best of the best in a separate post.

Additionally, we’ve got an entire article dedicated to the best websites for booking hotels at the cheapest prices.

After all, it is an extensive look into travel resources, and we wouldn’t be Upgraded Points if we didn’t go in-depth!

Frequently Asked Questions

What is the difference between an ota and a metasearch engine.

An Online Travel Agency is a website that traditionally offers both search and booking capabilities. OTA services usually include flights, hotels, and rental cars, with some also offering vacation rentals, cruises, and events/activities.

A Metasearch Engine is one overarching search engine that aggregates data from various sources (including other third-party search engines, OTAs, hotel websites, etc.) to provide a more comprehensive results page.

Was this page helpful?

About Erin Miller

An experienced points hacker, Erin is Alex’s partner-in-crime and contributes to Upgraded Points with in-depth guides and relationship management. Erin’s work has been cited in multiple major publications.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

What is a travel metasearch engine, and how can travel brands benefit from it?

Travel brands are always on the hunt for new ways to attract travelers and direct bookings. They use display ads, search engine ads, native videos, and social media to drive engagement. An ideal marketing strategy would be to use a good mix of all these marketing channels. However, in today’s travel marketing scene, travel metasearch is emerging as a big platform to market. Metasearch advertising generated an economic value worth 6 billion USD in the last decade. As many as 60% of independent hoteliers consider metasearch the most effective marketing channel.

Here in this article, we dissect travel metasearch for you, what it is, how your brand can benefit from it, and conclude by listing major engines.

What is a travel metasearch engine?

For travelers, metasearch is a platform where they can get an aggregated list of available rooms and their respective rates, saving them the trouble of visiting every travel website individually and checking for rates.

Travel businesses see metasearch as a platform to market their brands and bring direct or sales-qualified leads to their website. Therefore, it also works as an acquisition channel. But please note metasearch is not a booking engine. It is a platform that pulls room rate and availability data from multiple sources on the internet. The bidding metasearch engine works on conventional CPC (Cost per click). You or your marketing representative will bid for your brand, and every redirection to your website will have a cost similar to how Google AdWords works.

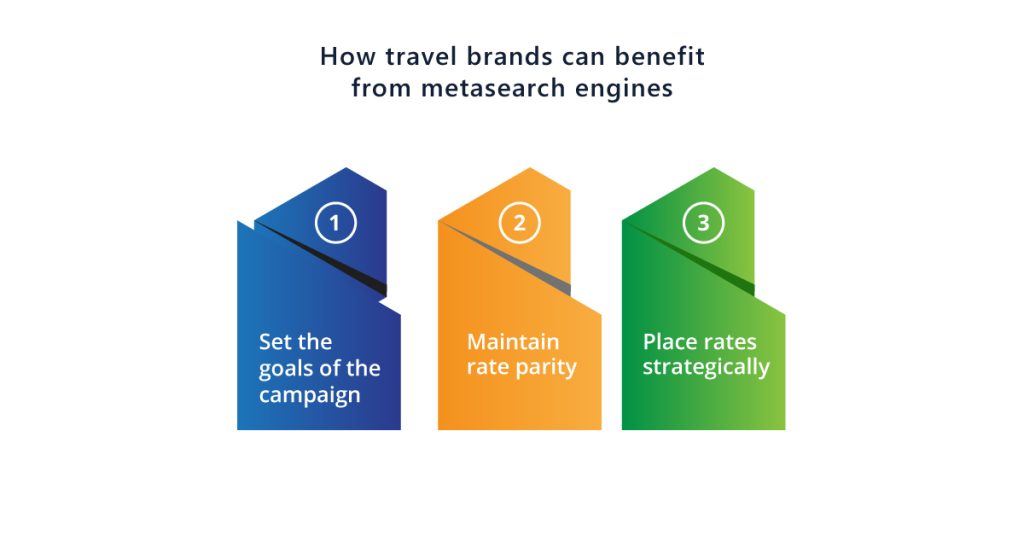

How travel brands can benefit from metasearch engines

Metasearch can help travel brands in many ways. The brand can lift the conversion numbers without doing anything disruptive. Triptease report says “If your metasearch rates are accurate, your conversion rates can increase up to 300%”. It was about the ultimate outcome, but how do you activate it? As someone who’s just starting to use metasearch, what’s the ideal strategy to go ahead with? We are breaking it down for you in a three-tier approach, which will help you effectively get started with travel metasearch.

- Set the goals of the campaign

Implementation of metasearch certainly boosts direct booking numbers, yet to make it a success, you have to set realistic expectations and plan your future budgets accordingly. For instance, if you are 10% direct booking, with metasearch, you can aim around 13-14%, take 5-7x return on ad spend for metasearch. Then, start the campaign. Once your campaign matures, you will have a clearer picture of how to adjust the budget.

- Maintain rate parity

Travel metasearch engines optimize the rate to the user’s location and currency. Therefore, the odds of rate differentiation go higher, and if you are not keeping rate parity, you are giving your competition free winning edges. That’s why you must maintain rate parity across your distribution channels.

- Place rates strategically

Placements of rates can have significant impacts on conversion. Only the advertisement competitive rates on metasearch will not be enough. When potential travelers land on your page, you must ensure that the first rate they see matches your advertised rate. The pricing technique is also famous with the name BAR (Best available rate) – always show BAR first.

What are major travel metasearch engines, and who owns them?

If we talk in terms of crude numbers, there are five major metasearch engines, Google Hotel ads planner, Tripadvisor, Skyscanner, kayak, and Trivago. Let’s look at them objectively one at a time.

- Google Hotels

Google Hotels is arguably the market leader. The metasearch engine leverages google maps and Gmail to offer personalized recommendations to travelers. Google Hotels delivers travelers price tracking and deals directly to their inboxes.

- TripAdvisor

TripAdvisor is also a well-known travel metasearch engine. You should have your TripAdvisor account up and running as soon as your hotel starts accepting bookings. The existence of your hotel brand on Tripadvisor gives you wider reach and acceptability. TripAdvisor Metasearch offers travelers direct booking and allows comparison shopping.

- Skyscanner

Skyscanner is both a metasearch engine and travel agency. The booking tool is quite popular among gen-Z and millennials. Skyscanner offers its users’ destination research and booking travel products like flights, hotels, and cabs.

- Kayak

Kayak is also both an online travel agency (OTA) and a metasearch engine. Kayak is a part Booking.com group, the group wholly owns the platform. Therefore, it’s not easy for other hotels to get ad placement on this metasearch engine. Though, hotels can get into partnerships with airlines and place packaged offerings on Kayak to derive the most value out of the metasearch engine.

- Trivago

Trivago is a proper metasearch engine that fetches room rates and availability from different booking sites and shows it in one place. It has a revenue model like Google Hotels, booking sites have to pay a fee every time a potential customer clicks on a specific offering.

Recommended: What Is Hotel Upsell Software? And How To Choose One?

Ownership of metasearch engines matters a lot. Apart from Google Hotel and Tripadvisor the other three engines, Skyscanner, Trivago, and Kayak, are retailer-owned, so they send the major share of direct traffic to their own website. At the same time, media-owned travel meta-search engines are democratic and run transparent bidding systems.

Metasearch is a powerful medium to get quality direct traffic to your travel website. Ideally, go with media owned metasearch engine and use the implementation strategy we mentioned earlier in this article. You will be all set to benefit from travel metasearch engines.

About Vervotech:

Vervotech is a leading Hotel Mapping and Room Mapping API that leverages the power of AI and ML to quickly and accurately identify each property listing through the verification of multiple parameters. With one of the industry’s best coverage of 98% and an accuracy of 99.999%, Vervotech is quickly becoming the mapping software of choice for all leading global companies operating in the travel and hospitality industry. To learn more about Vervotech and the ways it can enhance your business in the long run contact us: [email protected]

Previous Post Hotel property management system: Key features to look for and benefits

Next post 40+ different hotel content attributes that users check before booking a hotel , related posts.

Six economic theories to handle demand fluctuations in OTA operations

Six leading in-room hotel technology trends in 2024

Comments are closed.

For Sales Enquiry

- For US/Canada: 1 (833) 451-5836

- For Other Countries: +91 9923592502

- [email protected]

- Hotel Mapping

- Room Mapping

- Hotel Curated Content

- Press & Media

- Tech Partner

- Supplier Partner

- Walkthrough Videos

- Documentation

- Case Studies

- Infographics

Privacy Policy

Copyright © 2024 Vervotech Solutions Pvt. Ltd.

- Wall of Love

- Free Sample Data

- Brand Mapping

- Extranet Mapping

- Sync History

- Leadership Team

- Growth Story

- How We Innovate

- Values & Life at Vervotech

- Help Center

- Client Portal

- Provider Portal

- Contact Sales

Vervotech Affiliate Partner Application Form

Which Vervotech product(s) do you want to promote? Please select all that apply. Hotel Mapping Room Mapping Hotel Curated Content

What will you need to be successful partner? (for example: image assets, product training, brand guidelines, etc.)

I accept the

terms & conditions

REFERRAL PARTNER AGREEMENT

THIS REFERRAL FORM EXECUTED BY REFERRAL PARTNER WITH COMPANY AND BETWEEN VERVOTECH SOLUTIONS PRIVATE LIMITED, HAVING ITS REGISTERED OFFICE AT FIRST FLOOR, FLAT NO. 101, E BUILDING, RICH WOODS, PLOT NO. 150, SECTOR 11, PCNTDA, CHIKHALI, PIMPRI CHINCHWAD, PUNE, MAHARASHTRA, 411019, IN, (“THE COMPANY”) AND YOU AS AN INDIVIDUAL REFERRAL PARTNER OR ANY SOLE PROPREITOR, PARTNERSHIP, LIMITED LIABILITY PARTNERSHIP, PRIVATE LIMITED COMPANY OR PUBLIC LIMITED COMPANY OR ANY OTHER BUSINESS ENTITY EXECUTING THE REFERRAL FORM (“THE REFERRAL PARTNER”) IS GOVERNED UNDER THE TERMS OF THIS REFERRAL PARTNER AGREEMENT (“AGREEMENT”). PLEASE READ THIS AGREEMENT CAREFULLY. BY CLICKING “ACCEPTED AND AGREED TO” REFERRAL PARTNER AGREES TO THE AGREEMENT APPLICABLE TO THE REFERRAL FORM.

REFERRAL PARTNER ACKNOWLEDGES THAT IT HAS READ THIS AGREEMENT, UNDERSTANDS IT, AND AGREES TO BE BOUND BY ITS TERMS, AND IF THE REFERRAL PARTNER IS A PERSON WHO IS SIGNING ON ITS BEHALF HAS BEEN AUTHORIZED TO DO SO AND THE COMPANY DOES NOT HAVE ANY LIABILITY TOWARDS VERIFYING THE AUTHORITY OF THE PERSON WHO HAS SIGNED THE AGREEMENT ON BEHALF OF THE REFERRAL PARTNER.

APPOINTMENT REFERRALS

Appointment. Company hereby appoints Referral Partner, and Referral Partner hereby accepts such appointment, as Company’s non-exclusive referral partner for the marketing and promotion of Services and the referral of leads for the sale of Services, as further set forth in this Agreement.

Scope of Authority Referral Partner's sole authority shall be to (a) market and promote Services as set forth in this Agreement, and (b) provide sales leads to Company for Company to contact in its sole discretion. The Parties agree that Company will directly enter into agreements with customers for the provision of Services to such customers.

DUTIES AND RESPONSIBILITIES OF THE REFERRAL PARTNER

Prior to undertaking any solicitation efforts of a prospective customer or client ("Prospect”) relating to the services or products or offerings of the Company as set out at https://vervotech.com/vervotech-affiliate-program ("Services”), Referral Partner shall submit a referral form, in a format shared by the Company ("Referral Form”), for written approval of the Company. The Referral Partner agrees to provide the necessary information, data and materials as may be requested by Company in respect of the Prospect. Referral Partner shall fill out a Referral Form and shall provide Company with the names of the Prospect to which Referral Partner intends to refer to the Services). If the Prospect is a large business entity, Referral Partner shall specify the name of division of such large entity in the customer list.

If a Prospect is approved by Company as a potential customer, Company will confirm such acceptance or rejection of such Prospect in writing via email to Referral Partner (“Referral Date”). Notwithstanding anything to the contrary, the Company will be entitled to accept or reject a Prospect at its own discretion, without providing any justifications or reasons in relation to the same. For the avoidance of doubt, Company reserves the right to decline to enter into a transaction with any prospect for lack of creditworthiness or for any other reason. Prospect which are not approved by Company are considered out of scope of Referral Fee. In the event Company does not notify Referral Partner of acceptance of the Prospect, it shall be deemed to be rejected.

In case Company notifies Referral Partner of its approval of a Prospect, the Referral Partner will provide assistance to the Company in establishing contact between the Prospect and the appropriate contact at Company, without any additional costs.

If the foregoing activities result in the Prospect entering into and executing a formal customer agreement with Company (hereinafter, a “Qualifying Transaction”), Referral Partner shall be entitled to a Referral Fee subject to receipt of amount invoiced to the customer for sale of Services through Qualifying Transaction (hereinafter, a “Qualified Sale”) and subject to the other conditions set forth under this Agreement; provided, however, that such Qualifying Transaction is consummated no later than six (6) months following the Referral Date.

A Prospect may not qualify as such, if, as on the Referral Date: (a) it is an existing customer of Company; (b) it has previously been contacted by Company, Company’ s affiliates or any other agent, reseller, vendor who markets Company’ s products and services; (c) it has previously been introduced or referred to Company as a potential prospect by a third party or (d) it is parent, subsidiary or affiliate of Company.

RESPONSIBILITIES OF THE REFERRAL PARTNER

Limited Authority Referral Partner will make no representations, warranties or guarantees on behalf of Company. Referral Partner has no authority to distribute or resell Services, or to make any commitments, agreements, or to incur any liabilities whatsoever on behalf of Company. Company will not be liable for any acts, omissions to act, contracts, commitments, promises or representations made by Referral Partner hereto. Referral Partner's activities under this Agreement shall be at its own cost and risk. Referral Partner shall not, without prior approval from Company, submit proposals, accept orders, negotiate and conclude contracts, and/or alter, vary or modify in any manner any of the terms and conditions of Company' s offer/ proposal / contract.

Assistance. Referral Partner shall make best efforts in performance of its responsibilities under the Agreement and provide reasonable support to Company.

Quarterly Meetings. Referral Partner agrees to meet, either in person or via teleconference, no less frequently than once every calendar quarter to discuss the status of the relationship contemplated herein and emerging opportunities and as directed by Company from time to time.

Training. Company shall have no obligations to provide the Referral Partner any training regarding the Services. Upon request of Referral Partner and in case the Referral Partner is an organization, Company shall make good faith efforts to provide sales training focused on the marketing and promotion of Services to Referral Partner employees, at REFERRAL PARTNER’s own cost.

Subcontracting. Referral Partner shall not subcontract any of its obligations under this Agreement.

Competing Products and Business Practices. During the term of this Agreement, Referral Partner shall promptly inform Company of Referral Partner promotion, marketing, or distribution of any product or service offering similar functionality to Services. Referral Partner (a) shall conduct its business under this Agreement in a manner that reflects favorably upon Company, Services, and Company's goodwill and reputation, (b) shall not engage in illegal, deceptive, misleading, or unethical trade practices, and (c) shall not, and shall not permit any of its subsidiaries or affiliates, or any of its or their respective directors, officers, managers, employees, independent contractors, representatives, or agents to, promise, authorize, or make any payment, or otherwise contribute any item of value, directly or indirectly, to any third party and in each case, in violation of the applicable anti-bribery or anti-corruption law.

Data Protection and Privacy. In the performance of the services set forth herein Referral Partner may receive or have access to personal data of the Company and its personnel. Referral Partner agrees to comply with the terms set forth in this Agreement, in its collection, receipt, transmission, storage, disposal, use and disclosure of such personal data. Referral Partner agrees to ensure compliance with applicable laws, rules and regulations, including but not limited to laws, rules and regulations related to personal data protection and data privacy. To the extent the Referral Partner will share any personal data with the Company, the Referral Partner shall be responsible for obtaining informed consent from such individuals for the processing of their personal data. The Referral Partner agrees to take all necessary steps to ensure compliance, including but not limited to executing appropriate contractual agreements as may be necessary as per applicable laws.

REPRESENTATIONS AND WARRANTIES

Representations and Warranties. Referral Partner represents and warrants that (a) it has the full corporate right, power and authority to enter into this Agreement and to perform its obligations hereunder, (b) the execution of this Agreement and the performance of its obligations hereunder does not and will not conflict with or result in a breach (including with the passage of time) of any other agreement to which it is a party, and (c) this Agreement has been duly executed and delivered by such Party and constitutes the valid and binding agreement of such Party, enforceable against such Party in accordance with its terms. Referral Partner further represents and warrants that it shall comply with all applicable data privacy laws while performing its obligations under the Agreement, and that it has all rights necessary to provide the Referral Form to Company for Company’s use pursuant to this Agreement. Referral Partner specifically represents and warrants that it has procured from all data subjects whose personal information it is disclosing to Company an explicit consent to disclose their personal information to Company for use in contacting them for marketing and/or other business purposes.

GENERAL DISCLAIMERS- EACH OF COMPANY AND REFERRAL PARTNER ACKNOWLEDGES AND AGREES THAT, IN ENTERING INTO THIS AGREEMENT, EXCEPT AS EXPRESSLY SET FORTH HEREIN, IT HAS NOT RELIED UPON ANY WARRANTIES, EXPRESS OR IMPLIED, AND THAT NEITHER PARTY HAS MADE ANY REPRESENTATIONS, ASSURANCES, OR PROMISES THAT COMPANY WILL RECEIVE ANY NEW REFERRED CUSTOMERS OR NEW BUSINESS OR THAT REFERRAL PARTNER WILL RECEIVE ANY REFERRAL FEES AS A RESULT OF THIS AGREEMENT. COMPANY DISCLAIMS ALL REPRESENTATIONS AND WARRANTIES REGARDING THE SERVICES, WHICH ARE PROVIDED AS-IS, WHETHER EXPRESS, IMPLIED, OR STATUTORY, ORAL OR IN WRITING, ARISING UNDER ANY LAWS, INCLUDING WITH RESPECT TO ERROR-FREE OPERATION, MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, OR NON-INFRINGEMENT.

In consideration of the Services provided by the Referral Partner in accordance with the Agreement, Company will pay to the Referral Partner as per the Referral Fee specified below, which shall be Company’ s sole payment obligation.

Referral Fee: For any invoices issued pursuant to Qualified Sales received by Company from customer during the referral period, Company shall pay Referral Partner a Referral Fee as per the % (mentioned on the referral Page) of the amount actually collected by Company from customer as a one-time Referral Fee.

Company shall make payment of undisputed invoice raised by Referral Partner within Sixty (60) days of the date of Company' invoice to customer for the Qualified Sales.

Company shall not pay or reimburse Referral Partner for any expenses related to this Agreement, unless expressly agreed to by Company in writing, before such expenses were incurred.

Limitation on Referral Fee:

Company will not pay more than one (1) Referral Fee in connection with any given Qualified Sales.

Referral Partner will receive the Referral Fee only as one-time fee.

Referral Partner will not be entitled to receive any Referral Fees for any subsequent services which are beyond the first transaction.

A renewal of a Qualified Sale shall not be considered a new Qualifying Transaction and shall not entitle Referral Partner to any Referral Fee.

Referral Fee shall be paid only when the actual invoicing amount have been collected from Qualified Sales. Referral Partner shall not be entitled to receive payment of Referral Fees for Qualifying Transactions remaining unpaid.

LICENSES AND OWNERSHIP

Company Marks. Subject to the terms and conditions set forth in this Agreement and solely for the purposes hereof, Company grants to Referral Partner a non-transferable, non-exclusive license, without right of sublicense, to use the Company trademarks, service marks, and logos as approved by Company (the “Company Marks”) to perform its obligations set forth in this Agreement. The use of all Company Marks, including placement and sizing, shall be subject to Company’s then-current trademark use guidelines, if any, provided by the Company. If the Company Marks become, or in Company’s opinion are likely to become, the subject of an infringement claim, Company may at its option modify or replace the Company Marks and require Referral Partner to cease use of the allegedly infringing Company Marks. Referral Partner shall promptly provide Company with samples of all materials that use the Company Marks for Company’s quality control purposes. If, in Company’s discretion, the Referral Partner’s use of the Company Marks does not meet Company’s then-current trademark usage policy, Company may, at its option, require Referral Partner to revise such material and re-submit it under this Section prior to display, or release of further materials bearing or containing such Company Marks. Except for the right to use the Company Marks set forth above, nothing contained in this Agreement shall be construed to grant to Referral Partner any right, title or interest in or to the Company Marks, and all right, title, and interest in and to the Company Marks shall be retained by Company. Referral Partner acknowledges that Company asserts its exclusive ownership of the Company Marks and the renown of the Company Marks worldwide. Referral Partner shall not take any action inconsistent with such ownership and further agrees to take all actions that Company reasonably requests to establish and preserve its exclusive rights in and to the Company Marks. Referral Partner shall not adopt, use, or attempt to register any trademarks or trade names that are confusingly similar to the Company Marks or in such a way as to create combination marks with the Company Marks.

Company Materials. Subject to the terms and conditions set forth in this Agreement and solely for the purposes hereof, Company grants to Referral Partner a non-transferable, non-exclusive license, without right of sublicense, to distribute the Company Materials exactly as provided to Referral Partner by Company to perform Referral Partner’s obligations under this Agreement.

Ownership. As between Referral Partner and Company, Company retains all right, title, and interest to (a) the Company Marks, (b) the Services, any of its products, material or pre-existing intellectual property rights (c) the high-level description of the Company Products and the Company Materials, and (d) all Intellectual Property Rights related to any of the foregoing. There are no implied licenses under this Agreement.

No Intellectual Property Rights. Parties agree that no intellectual property rights are conceived or developed under this Agreement. If any intellectual property rights are conceived or developed, the intellectual property rights will vest with Company, unless otherwise agreed by the parties.

CONFIDENTIALITY

In connection with this Agreement, “Confidential Information” means all data and information of a confidential nature of Company disclosed by Company to the Referral Partner under this Agreement, as well as information that Referral Partner knows or reasonably should know that the Company regards as confidential, including business practices, software, technical information, future product/services plans, programming/design techniques or plans, know-how, trade secrets, prospects, customers, end users suppliers, development plans or projects, and services. Confidential Information may be communicated orally, in writing, or in any other recorded or tangible form.

Confidentiality. Referral Partner shall maintain in confidence all Confidential Information disclosed to it by the Company. Referral Partner shall not use for any purpose outside the scope of this Agreement, or disclose to any third party such Confidential Information except as expressly authorized by this Agreement. To the extent that disclosure is authorized by this Agreement, the Referral Partner shall obtain prior agreement from its employees, contractors, agents, and consultants to whom disclosure is to be made to hold in confidence and not make use of such information for any purpose other than those permitted by this Agreement. Referral Partner shall use at least the same standard of care as it uses to protect its own most confidential information (and in no event less than reasonable care) to ensure that such employees, contractors, agents, and consultants do not disclose or make any unauthorized use of such Confidential Information. Referral Partner shall promptly notify the other upon discovery of any unauthorized use or disclosure of the Confidential Information. Notwithstanding any other provision in this Agreement to the contrary, the obligations set forth in this section 7 shall survive any termination or expiration of this Agreement for perpetuity.

Exceptions. The obligations of confidentiality contained in this section 7 shall not apply to the extent that it can be established by the Referral Partner by competent proof that such Confidential Information:

was already known to the Referral Partner, other than under an obligation of confidentiality, at the time of disclosure by the Company;

was generally available to the public or was otherwise part of the public domain at the time of its disclosure to the Referral Partner;

became generally available to the public or otherwise became part of the public domain after its disclosure, other than through any act or omission of the Referral Partner in breach of this Agreement; or

was disclosed to the receiving Party, other than under an obligation of confidentiality, by a third party who had no obligation not to disclose such information to others.

Authorized Disclosure. Notwithstanding any provision to the contrary, the Referral Partner may disclose Confidential Information (a) to the extent required by law or any governmental authority, or (b) on a “need to know” basis under an obligation of confidentiality to its legal counsel or accountants, provided, that such Referral Partner shall to the extent practicable (and except to the extent it would jeopardize the filing or prosecution of letters patent) use commercially reasonable efforts to assist the Company in securing confidential treatment of such information required to be disclosed. Prior to disclosing any Confidential Information under this section 7 Referral Partner shall take reasonable steps to give the Company sufficient notice of the disclosure request for the Company to contest the disclosure request.

Referral Partner shall indemnify, defend, and hold Company harmless from and against any and all liabilities, losses, damages, costs, fees, and expenses (including reasonable attorneys’ fees) resulting from or arising out of any Claims based on allegations that (a) Referral Partner breached any obligations including with limitation Confidential Information, representation or warranty contained herein, or has breached any applicable laws, rules and regulations, or (b) Referral Partner made a representation or warranty regarding Company or the Services that is inconsistent with the written high-level description of Services provided to Referral Partner by Company, or is otherwise unauthorized by Company.

Indemnification Procedure. An indemnifying party hereunder shall be liable for any costs and damages to third parties incurred by the other party which are attributable to any such Claims, provided that such other party (i) notifies the indemnifying party promptly in writing of the claim, (ii) gives the indemnifying party the sole authority to defend, compromise or settle the claim, with prior approval of the Company and (iii) provides all available information, assistance, and authority at the indemnifying party’s reasonable request and at the indemnifying party’s reasonable expense to enable the indemnifying party to defend, compromise, or settle such claim. Any indemnifying party hereunder shall diligently pursue any defense required to be rendered hereunder, shall keep the indemnified party informed of all significant developments in any action defended by the indemnified party, and shall not enter into any settlement affecting the indemnified party’s interests without the prior consent of the indemnified party.

LIMITATION OF LIABILITY

COMPANY SHALL NOT BE LIABLE TO REFERRAL PARTNER OR ANY THIRD PARTY FOR ANY INDIRECT DAMAGES INCLUDING TOWARDS COSTS OF PROCUREMENT OF SUBSTITUTE GOODS, LOST PROFITS OR ANY OTHER SPECIAL, CONSEQUENTIAL, INCIDENTAL OR INDIRECT DAMAGES, HOWEVER CAUSED, AND WHETHER BASED ON CONTRACT, TORT (INCLUDING NEGLIGENCE), PRODUCTS LIABILITY OR ANY OTHER THEORY OF LIABILITY, REGARDLESS OF WHETHER COMPANY HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES. NOTWITHSTANDING ANYTHING TO THE CONTRARY, THE MAXIMUM AGGREGATE LIABILITY OF COMPANY FOR DIRECT DAMAGES FOR ANY REASON SHALL BE LIMITED TO AMOUNTS PAID BY COMPANY IN RESPECT OF THE QUALIFYING SALE . THESE LIMITATIONS WILL APPLY NOTWITHSTANDING THE FAILURE OF THE ESSENTIAL PURPOSE OF ANY REMEDY.

NON-SOLICITATION OF PERSONNEL

The Referral Partner shall not engage or hire as an employee or engage as independent contractor, Company’ s employees or independent contractors during the term of this Agreement and for a period of one (1) year following expiration or termination of this Agreement except as may be mutually agreed in writing.

TERM AND TERMINATION:

Term. The term of this Agreement shall be one (1) year from the Effective Date unless terminated earlier in accordance with the provisions of this Section. This Agreement shall renew automatically for additional one-year terms unless one Party provides the other written notice no later than thirty (30) days prior to the expiration of the then-current term of the Agreement of its intention to allow the Agreement to expire at the end of such term.

Termination for Breach. Either Party may terminate this Agreement for cause resulting from the material breach of this Agreement by the other Party by providing the breaching party written notice of such material breach and the intention to terminate for cause. The Party receiving such notice shall have thirty (30) days to cure such material breach. If at the end of such thirty (30) day period, the breach has not been cured to the reasonable satisfaction of the Party seeking to terminate the Agreement, the Agreement shall terminate.

Termination for Convenience. Either Party may terminate this Agreement for convenience upon ninety (90) days’ written notice.

Effect of Termination; Duties of the Parties Upon Termination. Upon any termination or expiration of this Agreement, Referral Partner shall (a) refrain thereafter from representing itself as a promoter or marketer of Company Products, or as a referral partner of Company, (b) immediately cease all use of any Company Marks, and (c) return to Company the Company materials and Confidential Information and all tangible items in Referral Partner’s possession or under its control containing Confidential Information of Company. Upon any termination or expiration of this Agreement, Company shall return to Referral Partner all tangible items in Company’s possession or under its control containing Referral Partner’s Confidential Information. Upon any termination or expiration of this Agreement, all licenses granted under this Agreement shall terminate.

Survival. Any clauses which by their very nature survive termination of the Agreement, will survive.

MISCELLANEOUS:

Construction. The Parties have participated jointly in the negotiation and drafting of this Agreement. In the event an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as if drafted jointly by the Parties and no presumption or burden of proof shall arise favoring or disfavoring any Party by virtue of the authorship of any of the provisions of this Agreement. As used in this Agreement, the singular shall include the plural and vice versa, and the terms “include” and “including” shall be deemed to be immediately followed by the phrase “without limitation.” The captions and headings in this Agreement are inserted for convenience and reference only and in no way define or limit the scope or content of this Agreement and shall not affect the interpretation of its provisions.

Governing Law and Dispute Resolution: This Agreement will be governed by and construed in accordance with the laws of the India, without reference to its conflict-of-laws principles. The Parties shall resolve any difference or dispute arises out of this Agreement by way of negotiations. If such negotiation process fails, then all disputes arising from or related to this Agreement shall be resolved before exclusive jurisdiction of courts in Pune, India.

NOTICES: All notices including hereunder shall be given in writing by hand delivery, courier service or email at the addresses set forth below:

If to Company

If to REFERRAL PARTNER

Attention: Sanjay Ghare

Email: [email protected]

Address: 3rd Floor, Amar Tech Centre, Sakore Nagar, Viman Nagar, Pune, Maharashtra 411014

Non-Waiver: A party's failure or delay in enforcing any provision of the Agreement will not be deemed a waiver of that party's rights with respect to that provision or any other provision of the Agreement. A party's waiver of any of its rights under the Agreement is not a waiver of any of its other rights with respect to a prior, contemporaneous or future occurrence, whether similar in nature or not.

Captions: The captions in the Agreement are not part of the Agreement, but are for the convenience of the parties. References to Sections are to sections of this Agreement.

Counterparts. Any documents signed in connection with the Agreement may be signed in multiple counterparts, which taken together will constitute one original.

Severability: In the event any term of the Agreement is held unenforceable by a court having jurisdiction, the remaining portion of the Agreement will remain in full force and effect, provided that the Agreement without the unenforceable provision(s) is consistent with the material economic incentives of the parties leading to the Agreement.

Relationship between the Parties. The relationship of Referral Partner and Company is that of independent contractors. Regardless of the use of the word "partner" in the title of this Agreement, neither Party is, nor shall be deemed to be, a partner, joint venturer, agent, or legal representative of the other Party for any purpose. Neither Party shall be entitled to enter into any contracts in the name of or on behalf of the other Party, and neither Party shall be entitled to pledge the credit of the other Party in any way or hold itself out as having authority to do so. No Party shall incur any debts or make any commitments for the other, except to the extent, if at all, explicitly provided herein.

Assignment. Referral Partner shall not assign or transfer this Agreement, in whole or in part, whether by operation of law or otherwise, or delegate any of its obligations hereunder, without the express written consent of Company. Subject to the foregoing, this Agreement shall be binding upon the successors and permitted assigns of the Parties. Any assignment in violation of the foregoing shall constitute a material breach of this Agreement and shall be null and void.

Force Majeure. Neither Party shall be liable for any failure or delay in fulfilling the terms of this Agreement due to fire, strike, war, civil unrest, terrorist action, government regulations, acts of nature or other causes which are unavoidable and beyond the reasonable control of the Party claiming force majeure.

Entire Agreement. The Agreement constitutes and contains the complete, final and exclusive understanding and agreement of the Parties and cancels and supersedes any and all prior negotiations, correspondence, understandings, and agreements, whether oral or written, between the Parties respecting the subject matter thereof. Parties agree that, their engagement with each other is on non-exclusive basis and either Party is free to appoint any third party for performance of their respective obligations.

Electronic Record. This Agreement is an electronic record in the form of an electronic contract formed under Information Technology Act, 2000 and rules made thereunder and the amended provisions pertaining to electronic documents / records in various statutes as amended by the Information Technology Act, 2000. This Agreement does not require any physical, electronic or digital signature. This Agreement constitutes a legally binding document between the Subscriber and the Company.

hfghfghfshdfhd

Referer's Information:

Referral information:, referral details:.

Pravin Mahadik

Chief Financial Officer

Pravin Bandu Mahadik is an ICMAI fellow and accomplished Cost and Management Accountant (CMA) with over a decade of experience in accounts and finance.

As a leader, Pravin has worked across various financial domains, including commercial operations, accounts and finance, auditing, taxation, MIS, transfer pricing, and export management.

He consistently introduces and implements systems to fortify financial control and improve Vervotech’s net organizational efficiency.

Marvel Puri

Chief Revenue Officer

As chief revenue officer (CRO), Marvel is responsible for every process at Vervotech that generates revenue. He has been instrumental in connecting different revenue-related functions, from sales, customer success, pricing, and revenue operations. His focus-driven approach to improving sales performance, and creating great product and pricing strategy, and delivering customer satisfaction has helped Vervotech to acquire 100 clients within a short stint of 2 years.

With the experience of over 15+ years in sales and business development at SaaS-based organizations, Marvel has flourished throughout his career by creating and leading experienced and diverse teams. To Marvel, growth has not only been to hit quotas but is broad and holistic: open new paths to revenue and build the processes to get there.

Ganesh Pawade

Ganesh is a Problem Solver and a Thought Leader. Throughout his 13 yrs professional journey, he helped businesses to identify their platform areas, define solutions and architecture, and make a more technically-informed decision on their current and future business as well as the technology roadmap.

His passion for good code often results in him being engaged in animated discussions with his team of architects and engineers, pushing them to think beyond what is possible. His specialties include Solution Architecture, Full stack specialist, AWS, Azure and Google cloud.

Dharmendra Ladi

Dharmendra Ladi has been instrumental in positioning Vervotech as the “World’s Best Mapping Provider” and is focused on transforming how the industry presents accommodation data to its customers. With his 14+ years of experience in travel and innovative technologies, he is the principal architect behind designing Vervotech’s AI-driven products that are today helping its clients worldwide do business seamlessly.

He leads new product development. Under his leadership, Vervotech has is credited with going from 0 to 100 customers within 2 years of business establishment. Dharmendra is also an inspiring thought leader, and regularly speaks at large scale events, webinars and has been interviewed by multiple media houses.

Sanjay Ghare

CEO & MD

Sanjay brings over 16+ years of entrepreneurial, general management, and senior executive experience with proven expertise in business development, corporate strategy, and product & program management. Sanjay, being an Industry veteran, and an influencer, leads and drives Vervotech’s vision of “Organizing World’s Accommodation Data.” Before he founded Vervotech, he was a VP of Tavisca Solutions, where he took the started SaaS division and grown with customers in more than 15 countries.

With his business acumen, Sanjay is on the trajectory of revolutionizing the accommodation data segment. He’s also a member of the Forbes Technology Council and often puts actionable growth strategies into perspective in his Forbes column.

Anurag Mittal

Chief Marketing Officer

Anurag Mittal is a seasoned technology executive who has led multiple marketing teams at SaaS-based organizations. At Vervotech, Anurag is responsible for marketing and strategy formulation and setting up a growth-oriented marketing & prospecting team. Anurag comes with an experience working with Organizations like Deloitte and ACCELQ, where he led the marketing initiatives for their SaaS product lines and has worn many hats including devising marketing strategies for business growth, managing GTM with alliances and partners, conceptualizing and orchestrating marketing campaigns, end-to-end event management, and demand generation activities to deliver a qualified sales pipeline.

He has been strategic face for the launch of Vervotech’s website and digital presence and have led several winning campaigns that has led to successful brand development and customer acquisition.

Start Free Trial

Get free trial.

Business Email *

Company Name

Schedule a Demo

Error: Contact form not found.

Easy, right?

Within 48 hours, we will email you the entire list of mapped hotels with Vervotech ID

Company Name *

Name of Suppliers (separated by comma) *

Rohit Shukla

Chief Product Officer

As Vervotech’s Chief Product Officer, Rohit is responsible for the product strategy and teams working to advance Vevotech’s position as a leading accommodation data company for OTAs, bed banks, DMCs, and Tour operators.

Rohit has been in the technology space for the last 15+ years, working with companies at different stages of growth within Travel, E-commerce, and FinTech Industries. In his previous roles, he drove product strategies for start-ups and SMEs and was instrumental in building platforms and product lines that generated $900 million in revenues and half a million paid customers. The products included flights, hotels, car rentals, activities & vacation packages.

Archana Garg

Financial Advisor

Archana has more than 15 years of experience in finance and operations management. Archana is proven leader in building and scaling companies as a result of her focus on financial strategy and operational excellence. She is motivated by understanding the customers she serves, and providing value at all levels of a business while building strong relationships with her colleagues.

She is a Chartered Accountant and is responsible for driving the Vervotech’s overall financial strategy, including the growth plans. Her experience navigating high growth companies, developing new business strategies and overall operational mindset delivers meaningful results for growth stage of Vervotech.

Business Email * Company Name *

Get your free EBOOK!

Job openings.

I'd like to Ask a product question Schedule a Demo Talk to sales Invite to RFI/RFP Partner with Vervotech Other

Your information will be used to send you this and other relevant offers by email. We will never sell your information to any third parties. You can, of course, unsubscribe at any time. View our full Privacy Statement .

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My watchlist

- Stock market

- Biden economy

- Personal finance

- Stocks: most active

- Stocks: gainers

- Stocks: losers

- Trending tickers

- World indices

- US Treasury bonds

- Top mutual funds

- Highest open interest

- Highest implied volatility

- Currency converter

- Basic materials

- Communication services

- Consumer cyclical

- Consumer defensive

- Financial services

- Industrials

- Real estate

- Mutual funds

- Credit cards

- Balance transfer cards

- Cash back cards

- Rewards cards

- Travel cards

- Online checking

- High-yield savings

- Money market

- Home equity loan

- Personal loans

- Student loans

- Options pit

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Online travel agencies vs. "meta search" airfare sites

What's the difference between an "online travel agency" (OTA) such as Expedia, Orbitz and Travelocity vs. so-called "meta search" travel site such as TripAdvisor Flights ? For one thing, online travel agencies have toll-free numbers with agents standing by to help you book or re-book a flight; meta search sites such as Kayak don't, because they don't sell airfares; they send you directly to airlines or to online travel agencies to book. Both an online travel agency and a meta search site will let you know if the best deal is on a combination of airlines (say, going out on US Airways and coming back on United).

But neither type of site will show you fares on all airlines (Southwest and Allegiant are excluded) and neither will always have fares that the airlines are keeping for their own websites (airlines sometimes hold back fares and inventory for their own sites in order to entice users to book direct).

But, unlike airline sites which try to keep you on the airline's own network, OTAs and meta search websites do show you the widest range of schedules and fares. Occasionally, an online travel agency such as Expedia or Travelocity will have fares that meta search sites don't. For example, over the summer American Airlines had business class fares to Europe for peak summer travel at prices lower than economy class for the same dates; Travelocity had these deals, Kayak didn't. In general, however, meta search sites do a better job of finding "airline-site-only" fares than do online travel agencies. On the other hand, online agencies offer air plus hotel packages that can sometimes save you serious cash, whereas meta search sites don't.

Bottom line: you need to consult meta search sites, online travel agencies, and airline sites if you really want to find the best deal.

Follow Airfarewatchdog on Twitter @airfarewatchdog to track unadvertised airfare sales that sometimes last only a few hours.

Recommended Stories

Nfl draft: packers fan upset with team's 1st pick, and lions fans hilariously rubbed it in.

Not everyone was thrilled with their team's draft on Thursday night.

NFL to allow players to wear protective Guardian Caps in games beginning with 2024 season

The NFL will allow players to wear protective Guardian Caps during games beginning with the 2024 season. The caps were previously mandated for practices.

Michael Penix Jr. said Kirk Cousins called him after Falcons' surprising draft selection

Atlanta Falcons first-round draft pick Michael Penix Jr. said quarterback Kirk Cousins called him after he was picked No. 8 overall in one of the 2024 NFL Draft's more puzzling selections.

Panthers owner David Tepper stopped by Charlotte bar that criticized his draft strategy

“Please Let The Coach & GM Pick This Year" read a sign out front.

Korey Cunningham, former NFL lineman, found dead in New Jersey home at age 28

Cunningham played 31 games in the NFL with the Cardinals, Patriots and Giants.

NBA playoffs: Tyrese Hailburton game-winner and potential Damian Lillard Achilles injury leaves Bucks in nightmare

Tyrese Haliburton hit a floater with 1.1 seconds left in overtime to give the Indiana Pacers a 121–118 win over the Milwaukee Bucks. The Pacers lead their first-round playoff series two games to one.

Based on the odds, here's what the top 10 picks of the NFL Draft will be

What would a mock draft look like using just betting odds?

Luka makes Clippers look old, Suns are in big trouble & a funeral for Lakers | Good Word with Goodwill

Vincent Goodwill and Tom Haberstroh break down last night’s NBA Playoffs action and preview several games for tonight and tomorrow.

Fantasy Baseball Waiver Wire: Widely available players ready to help your squad

Andy Behrens has a fresh batch of priority pickups for fantasy managers looking to close out the week in strong fashion.

Dave McCarty, player on 2004 Red Sox championship team, dies 1 week after team's reunion

The Red Sox were already mourning the loss of Tim Wakefield from that 2004 team.

UPS and FedEx find it harder to replace gas guzzlers than expected

Shipping companies like UPS and FedEx are facing uncertainty in U.S. supplies of big, boxy electric step vans they need to replace their gas guzzlers.

Jackson Holliday sent back to Triple-A after struggling in first 10 games with Orioles

Holliday batted .059 in 34 at-bats after being called up April 10.

These are the slowest-selling new cars of 2024

iSeeCars cited value and compelling products as drivers for fast-selling car brands' success, and some are doing much better than others.

Arch Manning dominates in the Texas spring game, and Jaden Rashada enters the transfer portal

Dan Wetzel, Ross Dellenger & SI’s Pat Forde react to the huge performance this weekend by Texas QB Arch Manning, Michigan and Notre Dame's spring games, Jaden Rashada entering the transfer portal, and more

Chiefs make Andy Reid NFL's highest-paid coach, sign president Mark Donovan, GM Brett Veach to extensions

Reid's deal reportedly runs through 2029 and makes him the highest-paid coach in the NFL.

These are the cars being discontinued for 2024 and beyond

As automakers shift to EVs, trim the fat on their lineups and cull slow-selling models, these are the vehicles we expect to die off soon.

NBA playoffs: Who's had the most impressive start to the postseason? Most surprising?

Our NBA writers weigh in on the first week of the playoffs and look ahead to what they're watching as the series shift to crucial Game 3s.

Yankees' Nestor Cortés told by MLB his pump-fake pitch is illegal

Cortés' attempt didn't fool Andrés Giménez, who fouled off the pitch.

Donald Trump nabs additional $1.2 billion 'earnout' bonus from DJT stock

Trump is entitled to an additional 36 million shares if the company's share price trades above $17.50 "for twenty out of any thirty trading days" over the next three years.

During 2024 NFL Draft coverage, Nick Saban admits Alabama wanted Toledo CB Quinyon Mitchell to transfer to the Tide

Mitchell went No. 22 to the Philadelphia Eagles.

- TODAY’S TOP FARES

- WEEKEND DEALS

- SEARCH FARES FROM A CITY

- SEARCH FARES TO A CITY

- SEE CHEAPEST MONTH TO FLY

- SEARCH & COMPARE FLIGHT DEALS

- SET UP FARE PRICE ALERTS

- ALL AIRLINE DEALS

- ALASKA DEALS

- AMERICAN AIRLINE DEALS

- DELTA DEALS

- JETBLUE DEALS

- SOUTHWEST DEALS

- UNITED DEALS

- ALASKA AIRLINES

- ALLEGIANT AIR

- AMERICAN AIRLINES

- DELTA AIRLINES

- FRONTIER AIRLINES

- HAWAIIAN AIRLINES

- SOUTHWEST AIRLINES

- SPIRIT AIRLINES

- SUN COUNTRY AIRLINES

- UNITED AIRLINES

- AIRLINE BAGGAGE FEES

- AIRLINE CODES GUIDE

- SEE ALL BLOG POSTS

- RECENT FARE SALES

- TRAVEL TIPS & ADVICE

- TRAVEL GEAR

- SEE MY ALERTS

- MY ALERTS Get Money-Saving Alerts Sign Into Your Account Get Alerts By proceeding, you agree to our Privacy and Cookies Statement and Terms of Use Or Sign In

- SEARCH HOTEL DEALS BY DESTINATION

- SEARCH FAVORITE HOTEL BRANDS

- SET UP ALERTS

Online travel agencies vs. "meta search" airfare sites

See recent posts by George Hobica

What's the difference between an "online travel agency" (OTA) such as Expedia, Orbitz and Travelocity vs. so-called "meta search" travel site such as TripAdvisor Flights ? For one thing, online travel agencies have toll-free numbers with agents standing by to help you book or re-book a flight; meta search sites such as Kayak don't, because they don't sell airfares; they send you directly to airlines or to online travel agencies to book. Both an online travel agency and a meta search site will let you know if the best deal is on a combination of airlines (say, going out on US Airways and coming back on United).

But neither type of site will show you fares on all airlines (Southwest and Allegiant are excluded) and neither will always have fares that the airlines are keeping for their own websites (airlines sometimes hold back fares and inventory for their own sites in order to entice users to book direct).

But, unlike airline sites which try to keep you on the airline's own network, OTAs and meta search websites do show you the widest range of schedules and fares. Occasionally, an online travel agency such as Expedia or Travelocity will have fares that meta search sites don't. For example, over the summer American Airlines had business class fares to Europe for peak summer travel at prices lower than economy class for the same dates; Travelocity had these deals, Kayak didn't. In general, however, meta search sites do a better job of finding "airline-site-only" fares than do online travel agencies. On the other hand, online agencies offer air plus hotel packages that can sometimes save you serious cash, whereas meta search sites don't.

Bottom line: you need to consult meta search sites, online travel agencies, and airline sites if you really want to find the best deal.

Follow Airfarewatchdog on Twitter @airfarewatchdog to track unadvertised airfare sales that sometimes last only a few hours.

More Stories You'll Love

- JetBlue Vacations End of Year Sale

- The 7 Best Waterproof Backpacks for Travel

- The 15 Best Boots for Winter Travel

- 12 Travel Essentials We're Buying on Mega-Sale Now

Trending Stories

The 8 most important travel tips for couples, airline hub guide: which u.s. cities are major hubs and why it matters, 7 best wireless headphones for 2021, the best cyber monday flight deals 2021, the best black friday flight deals 2021, today's top stories.

JetBlue's Big Winter Sale—Ends Tomorrow!

10 Things Not to Wear on a Plane

How Not to Embarrass Yourself in the TSA Line

$99 First-Class Ticket Sale on Breeze Airways

6 Travel Predictions for 2022

- Terms of Use

- Update Preferences

- Privacy and Cookies Statement

- Cookie Policy

- Cookie Consent

- Skift Research

- Airline Weekly

- Skift Meetings

- Daily Lodging Report

Travel Metasearch: What’s Coming Next

Related reports, executive summary.

Metasearch is the hottest thing in travel. Travel metasearch is a lead generation platform that allows consumers to compare rates from multiple online travel agencies and suppliers, usually in a single grid. The sector has attracted several billion dollars in investment in the last couple of years from Priceline, Expedia, Google and Sequoia Capital, to name a few, and metasearch, in the U.S. at least, is the fastest growing channel for travel shopping.

Source: Trivago

Tracing its routes to the very late 1990s and startups such as Sidestep, Qixo and FareChase, travel metasearch features companies displaying pricing and, ever-more-frequently, offering bookings for hotels, flights and car rentals. It has evolved from a channel that online travel agencies and suppliers tested and dabbled in, to a vehicle that large players most often consider an essential part of their digital marketing mix.

Online travel agencies, hotels, airlines, and car rental companies generally view travel metasearch as a relatively efficient way to drive traffic to their own websites, often getting a higher return on investment than they do through Google AdWords because metasearch’s consumer leads are more qualified. Metasearch is also a key battle ground in the online travel agency versus supplier fight for consumer eyeballs and loyalties, and is a tool for hotels to compete against other brands at the property level, for example.

This trends report will examine why travel metasearch is attracting so much attention and investment. It will take an inside look at the economics of travel metasearch for the metasearch companies themselves, and participating online travel agencies and suppliers. This trends report will present interviews with Kayak CEO Steve Hafner and Trivago managing director Malte Siewert about their respective companies’ strategies and practices inside global online travel agencies, and it will provide insights from key executives throughout the sector. This trends report will also detail emerging trends in travel metasearch, including mobile, as well as offer advice on best practices.

Travel Metasearch: A Look Inside

Behind the trend.

Two recent surveys of U.S. leisure travelers pinpointed travel metasearch as the fastest- growing channel for travel shopping.

An MMGY Global/Harrison Group “Portrait of American Travelers” survey, based on interviews with 2,511 active leisure travelers in February 2013, found that 28% of respondents used travel metasearch sites such as Kayak for travel shopping. This figure was up from 18% in 2012. 1 This leap in traveler usage was undoubtedly influenced by online and offline marketing campaigns. For example, Kayak in 2012 spent $75 million on television, billboards and online display media for its Kayak, Swoodoo (Germany) and Checkfelix (Austria) brands. 2 In contrast to the growing preference for travel metasearch, the MMGY survey showed that leisure travelers’ preferences for online travel agencies, offline travel agencies, supplier websites and private sales websites either stayed flat or declined during the same period.

Meanwhile, PhoCusWright’s most recent “U.S. Online Travel Overview” cites a consumer travel survey that found that leisure travelers’ preference for travel metasearch sites such as Kayak or Fly.com for travel shopping rose from 28% in 2010 to 36% in 2012. 3 Leisure travelers were considerably more likely to use online travel agency websites (59%) and search engines such as Google or Yahoo (49%) than travel metasearch for travel shopping in 2012, but these percentages for online travel agencies and general search engines held steady or decreased, respectively, in the prior two years while travel metasearch leapfrogged as a consumer preference, according to the survey. Travel metasearch sites in 2012 also finally caught up to supplier sites (36%) as a resource for travel shopping, the survey found.

Another indicator of the sometimes-hyper growth of travel metasearch is that in the second quarter of 2013, Germany-based Trivago’s initial quarter within the Expedia Inc. fold, Trivago’s revenue grew 80% year over year as it focused on international expansion into the U.S., Canada, Australia and New Zealand, said Expedia CEO Dara Khosrowshahi. 4

And Gareth Williams, CEO of Scotland-based flight-metasearch engine Skyscanner, said the company was on track to see gross bookings for its airline partners jump 66% in 2013 to $6 billion. 5

Why Metasearch?

Rate parity and disparity.

Why are travelers increasingly using travel metasearch sites for comparison shopping if hotel and online travel agency agreements with one another usually call for rate parity? In other words, the room rates on the hotel chains’ own websites are supposed to be the same across all leisure travel channels.

The answer is that there remains a great deal of rate disparity out there, and the travel metasearch sites are capturing and taking advantage of the pricing differences.

Room 77, a metasearch site that focuses on hotels, conducted 19,936 searches and analyzed the base room rates on its own site and the hotel-metasearch desktop offerings of Kayak, Trivago and TripAdvisor from July 26, 2013 to November 15, 2013. It found that there was rate disparity (one or more competitors) 58% of the time. Conversely, the study also found that there was rate parity +/- $1 for all four sites 42% of the time.

Room 77 also analyzed rate parity/disparity on the mobile web for the hotel-metasearch offerings of the four companies, and found that rate disparity was even greater than on the desktop. Of 7,350 mobile web searches conducted August 11, 2013 to November 16, 2013, Room 77 found that rate disparity among one or more of the four competitors existed 65% of the time while rate parity for all four mobile sites was present just 35% of the time.