How Much Does a Doctor Visit Cost With and Without Insurance?

Without insurance, medical care can get pricy fast. Where you live, what doctor you’re going to, and what tests you need will all figure into your doctor’s visit bill. In this article, we’ll break down those costs and give you some tips for saving money.

What Goes into the Cost of a Doctor’s Visit?

Geography is one of the biggest factors in the price of a doctor’s visit. Most medical facilities pass some of their overhead expenses onto their patients. If you live somewhere with a higher cost of living, like California or New York City, you’ll likely pay more for doctors’ visits. The practice has to pay more for utilities and rent, and those costs show up in your bill. For example, Mayo Clinic’s Patient Estimates tool quotes $846 for a 60-minute office visit in Jacksonville, Florida, but $605 for the same visit in Wisconsin.

Like the cost of living, supplies and equipment will also end up on your tab. Say you need a strep test, blood draw, or Pap smear. The supplies needed for the test plus the cost of the lab fees will all figure into the price.

Bills for the same exams and procedures can also vary depending on what kind of facility you’re going to. Smaller practices and public health centers are often a lot cheaper than university or private hospital systems. This is due in part to their buildings being smaller and their overhead fees being lower.

Price of Out-of-Pocket Doctors’ Visits

The cost of a doctor’s office visit also depends on what kind of doctor and the procedure you need to have done. For example, an in-office general wellness checkup will be cheaper than a specialist procedure. If you have an emergency, an urgent care center will be much more affordable than the emergency room.

Primary Care Physician — Physical Exam

Physicals usually include blood pressure readings, cholesterol measurements, and vaccines. Prostate exams for men and Pap smears and breast exams for women are also often included. Pediatric physicals focus on the growth milestones for your child’s age. Doctors check height, weight, sleep patterns, diet, and the vaccines required by public schools.

The range for a yearly physical can be anywhere from $100 to $250 or more without insurance. A CVS Minutecare Clinic may charge just $59 for a sports physical, but not all organizations will accept this as proof of physical health.

Primary Care Physician — Procedures

On top of the base cost for physical exams, you may have extra charges for any specific tests or procedures you need. According to the Cardiometabolic Health blog, the most common procedures in primary care medicine include bloodwork, electrocardiograms, and vaccines/injections.

Bloodwork is one of the biggest cost wild cards. Certain tests can run you from as little as $10 to as much as $10,000 . Large national labs like Labcorp offer pricing on their website, so you know what to expect going in. For example, Labcorp’s General Health Blood Test , which includes a metabolic panel, complete blood count (CBC), and urinalysis, costs $78.

Electrocardiograms or EKGs check your heart health and can find cardi ac issues. This quick procedure involves monitoring your heartbeat through electrodes placed on your skin. While it’s a painless and accurate way to detect heart conditions, the costs can add up without insurance. Expect to pay as little as $410 or as much as $1700 for this procedure, depending on local prices.

Vaccines are often required before sending your kids to school. The CDC publishes a vaccination price list annually to give you an idea of what to expect. For example, they quote $19-$132 for DTaP, $21 for Hepatitis A, and $13-$65 for Hepatitis B. The COVID-19 vaccine, however, is free of cost, regardless of insurance status.

Urgent Care Visit

If you have an emergency but are stable, urgent care is much cheaper than the emergency room. According to Scripps , most urgent care centers and walk-in clinics can at least treat dehydration, cuts or simple fractures, fever, flu, strep, and UTIs. Note that if you have chest pain, a serious injury, seizures, a stroke, or pregnancy complications, you should go straight to the ER .

For a base exam at an urgent care facility, expect to pay between $100-$150 . That price will go up depending on what else you need. For example, Advanced Urgent Care in Denver quotes $80 for an X-Ray, $50 for an EKG, $135 for stitches, and $5 for a urinalysis. In comparison, expect to pay $1,000-$1,300 for the same procedures in the emergency room.

How to Lower Your Out-of-Pocket Medical Costs

Healthcare expenses may seem overwhelming without insurance. Luckily, there are many resources available to help you cover the costs.

Free & Low-Cost Immunization and Wellness Clinics

For standard vaccines and checkups, look for local free or low-cost clinics. Check out The National Association of Free and Charitable Clinics’ search tool to find a location near you. Your city’s public health department should also offer free or low-cost vaccines and basic medical care services.

Certain large vaccine manufacturers also offer vaccine programs. For example, Merck’s patient assistance program offers 37 vaccines and medicines free to eligible patients. The program includes albuterol inhalers and vaccines for Hepatitis A, Hepatitis B, MMR, and HPV.

Cash Negotiations

Most health systems offer lower rates for patients paying cash. Some even have free programs for low-income families. For example, Heritage UPC in North Carolina has a yearly membership for low-cost preventative care. In Northern California, the Sutter Health medical system offers full coverage for patients earning 400% or less of the Federal Poverty Income Guideline .

As of January 1, 2021, all hospitals in the United States now have to follow the Hospital Price Transparency Rule . That means they have to list procedure prices clearly on their website. You can also call medical billing before your appointment to discuss cash pay options.

Federal Medical Payment Support

If all else fails, there are federal programs to help you cover the cost of medical bills.

Organizations like The United Way and United for Alice offer grants for ALICE (asset-limited, income-constrained, employed) patients. These are people living above the poverty level, making them ineligible for other government programs but below the basic cost-of-living threshold.

Medicaid is available for children, pregnant women, and adults under a certain income threshold. If your income is too high to qualify for Medicaid but you can’t afford private insurance for your children, you may be eligible for the Children’s Health Insurance Program (CHIP) to cover your children’s medical care.

Use Compare.com for the Best Doctors’ Visit Prices

Navigating bills for a doctor’s visit can feel overwhelming, but Compare.com is here to help. With our price comparison tool, you can search all clinic and doctors’ office prices in your area. Compare makes sure you’re prepared for the cost of your checkup long before you schedule your appointment.

Nick Versaw leads Compare.com's editorial department, where he and his team specialize in crafting helpful, easy-to-understand content about car insurance and other related topics. With nearly a decade of experience writing and editing insurance and personal finance articles, his work has helped readers discover substantial savings on necessary expenses, including insurance, transportation, health care, and more.

As an award-winning writer, Nick has seen his work published in countless renowned publications, such as the Washington Post, Los Angeles Times, and U.S. News & World Report. He graduated with Latin honors from Virginia Commonwealth University, where he earned his Bachelor's Degree in Digital Journalism.

Compare Car Insurance Quotes

Get free car insurance quotes, recent articles.

Find Urgent Care today

Find and book appointments for:.

- Urgent Care

- Pediatric Urgent Care

- COVID Testing

- COVID Vaccine

How Much Does a Doctor’s Visit Cost Without Insurance?

According to the Agency for Healthcare Research and Quality, the average cost of a visit to the doctor’s office in 2016 was $265, with expenses ranging from $159 to $419 depending on the specialty.

- At an urgent care center you can expect to pay between $100-200 to see a provider, plus the cost of any treatments or testing you may need.

- Always ask for pricing information before you agree to any testing or treatment. You are entitled to this information.

Going to the doctor for any reason can be expensive. Without insurance, you can expect to pay approximately anywhere from $50–$350 just for a routine medical exam, which doesn’t include additional expenses such as x-rays , blood tests, or other lab work.

The cost of a doctor's visit

According to Solv’s Chief Medical Officer, Dr. Rob Rohatsch, the cost of a doctor’s visit can vary widely depending on factors such as:

- The type of doctor you are seeing

- The reason for your visit

- Where you see the doctor, for example, if you go to an urgent care facility or a doctor’s office

- Whether you are a new or established patient

- Any necessary tests or treatments

- Whether you need lab work

Visits to specialists such as primary care providers, pediatricians, and psychiatrists were lower than the average cost, while the most expensive doctor’s visits were for orthopedists and cardiologists.

Data from the Agency for Healthcare Research and Quality indicates that if you are visiting a doctor and don’t have insurance, you can expect to pay roughly the following amounts. The cost could vary depending on the factors listed above.

- Psychiatry: $159

- Pediatrics: $169

- Primary care: $186

- Dermatology: $268

- OB/GYN: $280

- Ophthalmology: $307

- Cardiology: $335

- All other: $365

- Orthopedics: $419

Additionally, if you are a new patient, there may be an additional charge associated with your new patient exam.

Where to see a doctor without insurance

If you don’t have insurance, the cost of your doctor’s visit can also be affected by where you go to see the doctor. There are many places you can seek medical care, some of which are more affordable than others, notes the Agency for Healthcare Research and Quality:

- Community health clinics often provide free medical care or low-cost care, including preventive care, health screenings, and vaccinations .

- Urgent care centers offer many health services. Many don’t require appointments, although your wait time may be less if you schedule an appointment in advance. You can expect to pay around $100 - $200 to see an urgent care provider, plus the cost of any treatments or testing you may need.

- Many health care facilities now offer telehealth services, which are often more convenient and more affordable. For some conditions, however, you may need to be seen in person for proper diagnosis and treatment.

- If your medical need is not urgent, and you know the type of doctor you need to see, you can schedule an appointment with a primary care physician or a specialist at their office. Be sure to ask about their payment policy in advance. If you don’t have insurance, you may be required to pay the entire bill at the time of service.

- If you have a medical emergency, you can visit the nearest emergency room. Even if you don’t have insurance, you will be able to receive treatment. However, this is typically the most expensive option. If you have a non-emergency medical condition that can wait until you can be seen at one of the other options, you will likely save money.

Paying self-pay prices for doctor’s visits

Even if you have insurance, you may be able to save money by paying cash for certain medical services. While preventive care may be covered at 100% by your insurance company, other tests and treatments may be applied to your deductible. If you have a high deductible and don’t expect to meet it – especially if it’s late in the calendar year – paying cash for your medical care may be a cheaper option.

Most doctor’s offices and health care providers charge a higher price when they bill the insurance company. For example, they may charge the insurance company $70 for a treatment or service, but if the patient is paying cash, they may only charge $60. This is known as the self-pay price . If you pay cash, the claim won’t be submitted to your insurance company, but you could end up saving money.

Always ask for pricing information before you agree to any testing or treatment. You are entitled to this information. As of 2021, hospitals are required to disclose self-pay prices, even when the patient has insurance. If the doctor’s office won’t provide you with this information, be persistent, or seek care somewhere else. If you plan on paying self-care prices, you aren’t limited to the providers in your insurance network. You’ll have a wider range of options to choose from, and you can choose a provider who is willing to provide fair, clear prices.

Let your doctor’s office know that you are paying out of pocket, and ask if they offer a discount for self-pay patients. Many doctor’s offices will offer special rates for patients who are paying cash or who do not have insurance; however, they may not advertise these rates, so it’s always a good idea to ask.

Know what you’ll pay ahead of time with Solv ClearPrice TM

According to Healthcare Finance News, more than half of Americans avoid going to the doctor when they’re sick due to high medical costs or unclear costs. Solv is committed to eliminating surprise medical bills with Solv ClearPrice™ . We partner with thousands of providers across the country who have agreed to display self-pay prices for their services. When you book an appointment on Solv, you will be able to see the self-pay price for many common services.

To schedule an appointment, search our directory for a provider in your area. Begin typing the service you are looking for, and choose from the list of options that appear. If you aren’t sure which type of doctor you need to see, you may want to try an urgent care clinic or a walk-in clinic . In many cases, you can schedule an appointment quickly and conveniently online, and many of our providers have same-day or next-day appointments available.

Frequently asked questions

What factors affect the cost of a doctor's visit, what is the average cost of a visit to the doctor’s office, are there any additional charges for new patients, where can i seek medical care if i don't have insurance, what is the self-pay price, are hospitals required to disclose self-pay prices, can i get a discount if i'm paying out of pocket, what is solv clearprice™.

Michael is an experienced healthcare marketer, husband and father of three. He has worked alongside healthcare leaders at Johns Hopkins, Cleveland Clinic, St. Luke's, Baylor Scott and White, HCA, and many more, and currently leads strategic growth at Solv.

Dr. Rob Rohatsch leverages his vast experience in ambulatory medicine, on-demand healthcare, and consumerism to spearhead strategic initiatives. With expertise in operations, revenue cycle management, and clinical practices, he also contributes his knowledge to the academic world, having served in the US Air Force and earned an MD from Jefferson Medical College. Presently, he is part of the faculty at the University of Tennessee's Haslam School of Business, teaching in the Executive MBA Program, and holds positions on various boards, including chairing The TJ Lobraico Foundation.

Solv has strict sourcing guidelines and relies on peer-reviewed studies, academic research institutions, and medical associations. We avoid using tertiary references.

- Agency for Healthcare Research and Quality: Expenses for Office-Based Physician Visits by Specialty and Insurance Type, 2016 https://meps.ahrq.gov/data_files/publications/st517/stat517.shtml

- Hospital Price Transparency, Centers for Medicare and Medicaid (2022) https://www.cms.gov/hospital-price-transparency

- More than half of Americans have avoided medical care due to cost (2019) https://www.healthcarefinancenews.com/news/more-half-americans-have-avoided-medical-care-due-cost

- telemedicine

- primary care

- healthcare costs

- health insurance

- urgent care

Quality healthcare is just a click away with the Solv App

Book same-day care for you and your family

Find top providers near you

Choose in-person or video visits, manage visits on-the-go, related articles.

How Much Do Annual Physicals Cost Without Insurance?

If you are in need of an annual physical, you may be wondering how much annual physicals cost without insurance....

What is Price Transparency? A consumer’s guide to healthcare costs

No one likes receiving a surprise medical bill, especially when the cost wasn’t clear at the time you needed...

Cost of Blood Test Without Insurance in 2022

When you don’t have health insurance, you’re likely to keep a closer eye on all of your medical costs....

Real-Life Surprise Medical Bills: Six Different Bills for Knee Surgery

As part of Solv’s ClearPriceTM initiative, our team is highlighting real-life stories about how surprise...

How Much Do Stitches Cost Without Insurance?

You fell and got a nasty gash that’s going to require stitches. You can easily get it fixed at an urgent care...

How to Save Money on Healthcare Through Self-Pay

Americans hold a few core beliefs about how health insurance is supposed to work. They know that it’s meant to...

How Much Does Telemedicine Cost Without Insurance?

During the COVID-19 pandemic, when most of the world was quarantined in the confines of their own homes, the use...

Guide to Navigating an Urgent Care Visit Without Insurance

It’s no secret that more and more Americans are taking on health plans with outrageously high deductibles or...

Discounts at the Doctor’s Office?

The healthcare system can be complicated. It often feels overwhelming. Between headlines and legislation,...

Real-Life Surprise Medical Bills: The $6,000 Emergency Room Bill

Related health concerns.

Abdominal Pain

COVID-19 Vaccine

Cataract Surgery

Cold Medicine

Daycare Physical

Pinched Nerve

Sexually Transmitted Diseases

Urinary Tract Infection (UTI)

Urine Culture

This site uses cookies to provide you with a great user experience. By using Solv, you accept our use of cookies.

Policygenius does not allow the submission of personal information by users located within the EU or the UK. If you believe this action is in error, or have any questions, please contact us at [email protected]

No Insurance? How to See a Doctor Without Insurance

Shop around, ask about cash discounts and consider community health centers and free clinics.

This article is based on reporting that features expert sources.

8 Tips for Getting Medical Care Without Insurance

Millions of people in the U.S. live without health insurance, a circumstance that can cause people to weigh the need to see a doctor against the cost. Unfortunately, many people will put off or do without medical care because they can't afford it, a decision that could jeopardize their health.

Getty Images

While the Affordable Care Act has boosted the number of Americans with insurance, millions remain uninsured. In 2018, 27.5 million people – more than 8% of the U.S. population – were uninsured, according to the U.S. Census Bureau. Private health insurance covered 67% of Americans. Those without health coverage face the dilemma: Where can I go for medical care without insurance?

The Coverage Gap

In addition to the people who are uninsured, millions are underinsured, according to a survey by the Commonwealth Fund. Among people with health insurance, 29% were underinsured in 2018, compared to 23% in 2014, according to the fund's Biennial Health Insurance Survey: "People who are 'underinsured' have high health plan deductibles and out-of-pocket medical expenses relative to their income and are more likely to struggle paying medical bills or to skip care because of cost."

The survey found that 41% of underinsured adults reported they delayed needed medical care because of cost. By contrast, 23% of people with adequate insurance coverage said they delayed such treatment. Also, 47% of underinsured adults reported medical bill and debt problems.

Tips for Finding Affordable Medical Care

If you're uninsured or underinsured, here are eight strategies for finding affordable medical care:

- Research your eligibility for insurance.

- Shop around.

- Agree to a price in writing.

- Ask about a cash discount.

- Keep good records.

- Be prepared.

- Consider community health clinics.

- Think about urgent care centers.

1. Research your eligibility for insurance.

Depending on your situation, you might be eligible to buy individual health insurance coverage from the ACA marketplace or in the individual market, or you might qualify for Medicaid, Medicare or the Children's Health Insurance Program for your kids, says Kim Buckey, vice president of client services at DirectPath, a company that provides personalized health benefits education and enrollment services to large employers.

2. Shop around.

Prices for health care appointments and procedures vary dramatically, with differences of up to 2,000%, says Bill Kampine, co-founder and senior vice president, analytics and innovation, for Healthcare Bluebook. The company's client base includes municipal and large self-insured employers. It also offers a free online tool that individuals can use to comparison shop for health care services by region.

3. Agree to a price in writing.

4. Ask about a cash discount.

5. Keep good records.

6. Be prepared.

7. Consider community health centers and free clinics.

There are a number of health care providers that provide services at little or no cost to those who are eligible, says April Temple, an associate professor of health sciences at James Madison University in Harrisonburg, Virginia.

8. Also, think about urgent care centers.

Nationwide, there's been a meteoric rise in the use of urgent care centers in recent years. These facilities provide a higher level of care than what's available at some pharmacy retail clinics, but aren't equipped to provide emergent care for things like heart attacks and strokes. Urgent care centers can treat a wide array of maladies, including upper respiratory infections, bronchitis, diverticulitis; high blood pressure, food poisoning, sprains, minor fractures and lacerations. An urgent care visit typically costs around $150, according to Debt.org.

12 Common Medical Emergencies

The U.S. News Health team delivers accurate information about health, nutrition and fitness, as well as in-depth medical condition guides. All of our stories rely on multiple, independent sources and experts in the field, such as medical doctors and licensed nutritionists. To learn more about how we keep our content accurate and trustworthy, read our editorial guidelines .

Buckey is vice president of client services at DirectPath, a company that provides personalized health benefits education and enrollment services to large employers.

Kampine is co-founder and senior vice president, analytics and innovation, for Healthcare Bluebook. The company’s client base includes municipal and large self-insured employers. It also offers a free online tool that individuals can use to comparison shop for health care services by region.

Temple is an associate professor of health sciences at James Madison University in Harrisonburg, Virginia.

Tags: health insurance , Affordable Care Act , Medicaid , patient advice

Most Popular

Patient Advice

health disclaimer »

Disclaimer and a note about your health ».

Sign Up for Our 3-Day Guide to Medicare

Confused about Medicare? We can help you understand the different Medicare coverage options available to help you choose the best Medicare coverage for you or a loved one.

Sign in to manage your newsletters »

Sign up to receive the latest updates from U.S News & World Report and our trusted partners and sponsors. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy .

You May Also Like

Key medicare enrollment deadlines.

Joanne Kaldy and Vanessa Caceres April 26, 2024

LASIK Eye Surgery

Mariya Greeley and Elaine K. Howley April 26, 2024

What Makes a Good Doctor?

Paul Wynn April 25, 2024

Americans' Primary Care Experiences

Annika Urban April 24, 2024

Does Medicare Cover Cataract Surgery?

Elaine K. Howley April 24, 2024

RSV Vaccines: Who Should Have One?

Stacey Colino April 22, 2024

Your Guide to Hip Replacement Surgery

Lisa Esposito and Elaine K. Howley April 22, 2024

Find a Primary Care Doctor Near You

Payton Sy April 18, 2024

Streamlined Maternity Services Survey

Jennifer Winston, Ph.D. , Xinyan Zhou and Kaylan Ware April 17, 2024

Major Food Allergens

Claire Wolters April 15, 2024

- Type 2 Diabetes

- Heart Disease

- Digestive Health

- Multiple Sclerosis

- COVID-19 Vaccines

- Occupational Therapy

- Healthy Aging

- Health Insurance

- Public Health

- Patient Rights

- Caregivers & Loved Ones

- End of Life Concerns

- Health News

- Thyroid Test Analyzer

- Doctor Discussion Guides

- Hemoglobin A1c Test Analyzer

- Lipid Test Analyzer

- Complete Blood Count (CBC) Analyzer

- What to Buy

- Editorial Process

- Meet Our Medical Expert Board

Will I Have to Pay My Deductible Before I Can Get Medical Care?

- The Old Way

- Why They Bill Upfront

- Handling Upfront Bills

- Can They Deny Care?

Increasing Deductibles

Consider an hsa.

Over the last few years, it's become more common for hospitals and other medical providers to ask people to pay their deductibles before medical services are provided. According to one recent analysis, at least three-quarters of hospital systems in the U.S. ask patients to prepay some or all of their out-of-pocket costs for certain services, including things like MRIs, CT scans, and even births.

This article will help you understand why this is happening, what rights you have, and how to navigate our current healthcare system.

The Way It Used to Be

In the past, it was generally accepted that patients were expected to pay their copays at the time of service, but charges that counted towards the deductible would be billed after the fact.

So, if your health plan had a $20 copay for an office visit, the doctor's office would collect that when you arrived for the appointment.

However, if your plan had a $2,000 deductible and you were going in for surgery, you'd pay nothing at the time of the surgery but would get a bill from the hospital a few weeks later.

First, they would send the claim to your insurer, where the network negotiated rate would be calculated and amounts over that would be written off. Then the insurer would pay their portion, and notify the hospital about your portion of the bill (you would also receive an explanation of benefits with the same information).

At that point, the hospital and medical providers would send you a bill (or multiple bills, depending on the care that was provided) for your deductible and any applicable coinsurance.

Why They're Billing Upfront

Depending on the service you're receiving and how much it costs relative to your deductible, many medical facilities and professionals still use the traditional method of waiting to send you a bill until after your procedure is complete and your insurance company has processed your bill.

It's becoming increasingly common, though, for medical providers to ask for payment of your deductible—partial or in full—before scheduled medical services are provided. This is due to a variety of factors, including increasing medical costs, as well as rising deductibles and total out-of-pocket costs.

Medical providers don't want to be stuck with unpaid bills, and they know after the procedure is completed, people may not pay what they owe. The medical provider can send them to collections or file a lawsuit against the patient. However, obtaining payment upfront is a more effective method of ensuring that the bill gets paid.

Hospitals are also increasingly running credit checks on patients. They can then use the information to determine which patients will be likely to pay their bills after the procedure is completed and the claim is processed by the patient's health plan. Using this information, hospitals may ask for upfront payment from some patients but not others.

If They Ask for Payment Upfront

Ideally, you should discuss the timing of payment with the medical provider's billing office well in advance of your procedure. Finding out 18 hours before your surgery that the hospital wants you to pay your $4,000 deductible immediately is stressful, to say the least, and often simply not possible.

If you're scheduling a medical procedure for which your deductible will apply, inquire about the facility's policies right from the start. Talk with your health plan to see if they have any contract negotiations with this medical facility that require the bill to be sent to the insurer before the patient is charged.

If not, the hospital, clinic, or medical provider may very well want you to pay at least a portion of the deductible ahead of time or when you arrive for the medical procedure ( here's an example of how this works , from the University of Wisconsin Hospital system).

But in general, network contracts between insurers and medical providers will prohibit the medical providers from requiring payment of deductibles before medical services are provided. They can certainly ask for it, and patients have the option to pay some or all of their deductible upfront. But your health plan likely prohibits in-network medical providers from denying care if you can't or don't want to pay your deductible ahead of time.

If in doubt, it's wise to contact your health plan and your state's insurance department to see if they have any advice about contract rules and state regulations that pertain to medical billing practices (note that state insurance regulations don't apply to self-insured group plans , as those are federally regulated under ERISA). The more you know, the better you'll be able to navigate the system.

How Much Will You Actually Owe?

Ask the hospital to provide you with an estimate of what you'll owe, keeping in mind that negotiated medical costs tend to be far lower than retail costs. And double check their estimate with your health plan, to see if they're roughly the same.

The federal government has rolled out some new pricing transparency rules over the last few years, which make it easier for consumers to have access to health care costs in advance (as opposed to having to wait for the explanation of benefits after the procedure is completed). Hospital price transparency rules took effect in 2021 and health plan price transparency rules were fully in place by the start of 2024.

The medical facility might not know in advance exactly what care they're going to have to provide, since this sometimes depends on what they encounter during the procedure. But for the care they know you'll need, make sure you understand the negotiated rate that your health plan has with this medical provider for that specific service.

For example, let's say your deductible is $5,000, you've paid nothing toward it this year, and you're scheduling an MRI.

The average cost of an MRI in the U.S. is about $1,325, although it varies considerably from one facility to another. It's also important to note that what the facility charges is likely to be quite a bit higher than the rate your insurer has negotiated with that facility.

The facility might bill $2,000, but the insurer's negotiated rate might be $1,050. In that case, the amount you would have to pay towards your deductible would be $1,050, not $2,000 .

This isn't an issue if you're having a procedure that's many times more costly than your deductible. If you're about to have a knee replacement, which averages about $34,000, and your deductible is $5,000, you will have to pay the full deductible.

The hospital might ask you to pay all or part of it upfront, or they might bill you after they submit the claim to your insurer, but there's no getting around the fact that you're going to have to pay the full $5,000, and you won't save any money by waiting to pay your bill until after the claim is processed.

Note that coinsurance is different since it's a percentage of the total amount that the health plan has negotiated with the medical provider. Since coinsurance isn't a flat amount, it's particularly important to wait to pay coinsurance charges until the claim has been processed. The exception would be a situation in which you know that you'll meet your health plan's total out-of-pocket limit . In that case, even if you pay it all upfront, it won't be any more expensive than it would have been if you had waited for the claim to be processed.

In the previous example about the MRI, however, the actual amount you'll have to pay isn't certain until your insurer has processed the claim. But again, the health plan price transparency rules ensure that you can find out, in advance, how much your health plan's negotiated rate is for an MRI at the facility you're using.

If the medical provider is asking you to pay a portion of your deductible in advance, and it's unclear how much you'll actually owe, discuss the situation with your insurer before giving any money to the hospital. Make sure that the amount the hospital is asking you to prepay is the rate that your insurer has negotiated with them, as opposed to their retail rate.

Check with your insurer to make sure that their contract allows you to reject the medical provider's prepayment request. You should be able to wait until the claim is sent to your insurance plan and the price adjusted in line with the network contract. At that point, you'll receive an accurate bill from the hospital, which you should pay as soon as possible.

One way or another, you'll want to make sure that you're only paying the amount that your insurer's explanation of benefits will ultimately say that you owe, rather than the amount that the medical provider charges.

Denying Care Based on Ability to Pay

There's sometimes a misconception about hospitals' obligations to provide care regardless of a patient's ability to pay.

Since 1986, the Emergency Medical Treatment and Labor Act ( EMTALA ) has required all Medicare-accepting hospitals (virtually all U.S. hospitals) to provide screening and stabilization services to anyone who arrives in the emergency room—including pregnant people in active labor—regardless of their insurance status or ability to pay for care.

The emergency room is required to:

- Screen you to determine the problem

- Provide stabilization services (e.g., They can't let you bleed to death due to lack of funds.)

They don't have to provide anything beyond that if they're not certain you can pay for it, and EMTALA doesn't extend to any care beyond emergency services.

So a pre-scheduled medical procedure won't be subject to any rules that require hospitals to provide care regardless of the patient's ability to pay.

But if you're covered under Medicare, federal rules do ensure that you can't be denied care due to a failure to prepay your anticipated out-of-pocket costs. The Centers for Medicare and Medicaid Services clarify that: " Except in rare cases where prepayment may be required, any request for payment must be made as a request and without undue pressure. The beneficiary (and the beneficiary’s family) must not be given cause to fear that admission or treatment will be denied for failure to make the advance payment ."

And if you have private coverage, your health plan's contract with the medical provider may prohibit them from requiring that you pay your deductible ahead of time. However, if you haven't paid previous medical bills and still owe money to the facility, they may refuse to continue to treat you.

The ACA limits how high in-network out-of-pocket costs can be , but the limit itself is fairly high. In 2024, health plans can have out-of-pocket costs as high as $9,450 for an individual and $18,900 for a family.

Many health plans have out-of-pocket limits well below those amounts, but deductibles on individual market plans are often multiple thousands of dollars ( cost-sharing reductions lower these deductibles for eligible people, as long as they select a silver plan in the exchange).

Employer-sponsored plans have to abide by the ACA's cap on out-of-pocket costs too, but they tend to have deductibles and out-of-pocket costs that are lower than those in the individual market. In 2023, the average deductible for people with employer-sponsored health insurance was $1,735 for a single person.

Yet the Federal Reserve reported in 2023 that about 37% of U.S. adults would not be able to come up with $400 to cover an unexpected bill, or would have to sell something to cover the cost.

That presents a conundrum when people have an unexpected but necessary medical procedure and a fairly high deductible. It also presents a conundrum for hospitals and medical professionals—tasked on one hand with providing health care to residents, but also needing to generate enough revenue to stay financially viable.

Requiring upfront payment of at least part of the deductible is one way for hospitals to avoid situations in which patients end up unable to pay their bills.

If your employer offers an HSA-qualified high deductible health plan (HDHP), or if you're purchasing your own health insurance in the individual market, consider enrolling in an HDHP. They aren't the right fit for everyone, but if you're covered by an HDHP, you can contribute pre-tax money to an HSA , and it will be there if and when you need it.

In 2024, you can contribute up to $8,300 to an HSA if you have family coverage under an HDHP, and up to $4,150 if you have self-only coverage under an HDHP.

Even if you can only contribute a small amount each month, it will add up over time, and there's no "use it or lose it" provision—the money remains in your account until you need to withdraw it.

You can build up a cushion in an HSA while you have coverage under an HDHP, and withdraw it later to cover future medical expenses, even if you no longer have HDHP coverage at that point.

The takeaway is this: If you have access to an HSA-qualified plan, enrolling and making contributions will make it easier to deal with a potential future situation in which a hospital suddenly asks you to pay a significant chunk of money upfront before you can get medical care. And you'll be able to pay the bill with pre-tax money, which could result in significant savings, depending on how much you owe.

Depending on a patient's health plan, credit history, medical needs, and choice of hospital, the patient may be asked to pay some or all of their deductible upfront, before receiving medical care. Hospitals cannot do this in situations that are covered by EMTALA, but that law only requires an emergency department to assess and stabilize the patient. In other situations, including a pre-scheduled surgery, the hospital or other providers can ask for at least some payment upfront.

But in most cases, a health plan's network contract with the hospital or other medical provider will allow them to request upfront payment of deductibles, but not to require it. So patients need to understand their rights. And if they do prepay deductible and/or coinsurance charges, it's important to ensure that they won't pay more than the network negotiated price for the service they'll receive.

A Word From Verywell

If you're scheduling a medical procedure and are concerned about the cost, the best course of action is to speak up, sooner rather than later. If you think you might have trouble coming up with the amount of your deductible, you may be able to work out a payment plan in advance. If you're asked for an upfront payment and you don't feel comfortable with this, check with your health plan to see if their contract with the hospital prohibits the requirement that deductibles be paid ahead of time.

Wahlberg, David. Wisconsin State Journal. Bill Comes Before Baby, As Hospitals Seek Advance Payments From Patients .

Buck, Isaac D. Hastings Law Journal. Volume 73, Issue 2, Article 2. When Hospitals Sue Patients . February 2022.

Centers for Medicare & Medicaid Services. Hospital Price Transparency . Accessed February 17, 2024.

Centers for Medicare & Medicaid Services. Transparency in Coverage . Accessed February 17, 2024.

Vanvuren, Christina. New Choice Health. What can affect the cost of an MRI?

Claxton, Gary; Rae, Matthew; Levitt, Larry; Cox, Cynthia. Kaiser Family Foundation. Peterson-Kaiser Health System Tracker. How have healthcare prices grown in the U.S. over time?

Centers for Medicare and Medicaid Services. Emergency Medical Treatment & Labor Act (EMTALA) .

Centers for Medicare and Medicaid Services. Medicare Claims Processing Manual Chapter 2 - Admission and Registration Requirements .

HealthCare.gov Glossary. Out-of-Pocket Maximum/Limit .

Kaiser Family Foundation. 2023 Employer Health Benefits Survey .

Board of Governors of the Federal Reserve System. Report on the Economic Well-Being of U.S. Households in 2022 - May 2023 .

Internal Revenue Service. Revenue Procedure 2023-23 .

By Louise Norris Norris is a licensed health insurance agent, book author, and freelance writer. She graduated magna cum laude from Colorado State University.

Ad-free. Influence-free. Powered by consumers.

The payment for your account couldn't be processed or you've canceled your account with us.

We don’t recognize that sign in. Your username maybe be your email address. Passwords are 6-20 characters with at least one number and letter.

We still don’t recognize that sign in. Retrieve your username. Reset your password.

Forgot your username or password ?

Don’t have an account?

- Account Settings

- My Benefits

- My Products

- Donate Donate

Save products you love, products you own and much more!

Other Membership Benefits:

Suggested Searches

- Become a Member

Car Ratings & Reviews

2024 Top Picks

Car Buying & Pricing

Which Car Brands Make the Best Vehicles?

Car Maintenance & Repair

Car Reliability Guide

Key Topics & News

Listen to the Talking Cars Podcast

Home & Garden

Bed & Bath

Top Picks From CR

Best Mattresses

Lawn & Garden

TOP PICKS FROM CR

Best Lawn Mowers and Tractors

Home Improvement

Home Improvement Essential

Best Wood Stains

Home Safety & Security

HOME SAFETY

Best DIY Home Security Systems

REPAIR OR REPLACE?

What to Do With a Broken Appliance

Small Appliances

Best Small Kitchen Appliances

Laundry & Cleaning

Best Washing Machines

Heating, Cooling & Air

Most Reliable Central Air-Conditioning Systems

Electronics

Home Entertainment

FIND YOUR NEW TV

Home Office

Cheapest Printers for Ink Costs

Smartphones & Wearables

BEST SMARTPHONES

Find the Right Phone for You

Digital Security & Privacy

MEMBER BENEFIT

CR Security Planner

Take Action

How Paying Your Doctor in Cash Could Save You Money

Even if you have health insurance, sometimes you are better off not using it, sharing is nice.

We respect your privacy . All email addresses you provide will be used just for sending this story.

A growing number of medical services, from MRIs to blood work to outpatient surgery, could cost you less—sometimes a lot less—if you pay the provider out of your own pocket and leave your insurer out of the picture.

That this is possible seems contrary to what many of us have come to understand about how health insurance is supposed to work. We think using it always saves us money, partly because we assume our insurer negotiates the best rates for health services, and partly because we expect our insurer to pick up the tab for whatever cost remains, or at least much of it.

In many cases, that is still true—but not always, especially for the growing number of people in high-deductible plans who must spend thousands of dollars on health services before insurance even starts to kick in to cover some of the cost.

According to experts Consumer Reports talked to and a review of pricing options offered by dozens of healthcare providers, more doctors, hospital networks, and treatment centers are touting big discounts for patients who pay cash upfront and forgo using their insurance.

Companies like MD Save, with a network of hundreds of hospitals, clinics, labs, and doctors in 25 states, illustrate the shift. It bills itself as an online healthcare marketplace that connects healthcare providers offering big discounts to people willing to prepay their bill online.

That doesn't mean you shouldn't have health insurance. Like homeowner and auto insurance, health insurance protects you from financial shocks that could bankrupt you if you or a family member has a medical crisis that requires major hospitalization or expensive treatments.

But as consumers shoulder more of the cost of their care, they are seeking ways to save money.

And healthcare providers are finding that by charging people who pay cash less than the insurer-negotiated rate for some health services, they can come out ahead financially too, says Bill Kampine, co-founder and senior vice president of analytics at Healthcare Bluebook , which uses insurance claim databases to estimate prices for medical care.

Healthcare providers make up for charging lower prices other ways, Kampine says. Cutting out the insurer as the middleman can significantly reduce the provider's administrative and billing costs. And healthcare providers who get cash upfront don't have to chase down the money later, either from a patient or the insurance company. "It's a much easier transaction in a cash pay environment," Kampine says.

Where You Can Save

Reduced fees for paying cash are more common for diagnostic procedures, such as CAT scans, X-rays, and ultrasounds, but cash payers can also often get a better deal for certain lab work, prescription drugs, out-patient surgeries, and therapeutic services, such as physical therapy, Kampine says.

Some imaging centers even offer off-peak discounts for patients who pay cash and use services after traditional business hours, say, getting an MRI after 7 p.m. "It's like surge pricing by Uber," says Jeanne Pinder, CEO of ClearHealthCosts , a business she founded that researches healthcare prices and allows you to compare costs for specific procedures at different providers around the U.S. The site's PriceCheck tool gets data on insurance-negotiated prices, Medicare rates, and cash prices directly from healthcare providers, as well as from patient crowdsourcing.

The differences in price can be significant, Pinder says. A woman in Louisiana who shared her story with ClearHealthCosts reported paying $766 for an echocardiogram using her insurance. She later learned that the cash price for the same procedure was almost half as much: around $400.

When Cash Payments Can Cost You

Still, even if paying cash is likely to reduce your annual outlay for medical expenses, there are some important drawbacks to consider.

The main one is that the money you spend typically won't count toward your deductible. As a result, those dollars will be "wasted" if you need medical care that requires you to meet your whole deductible anyway, Pinder says.

The money you spend also may not be counted toward your out-of-pocket maximum, which caps the total amount you owe for deductibles, copays, and coinsurance. After you meet your out-of pocket max, your insurer picks up 100 percent of your costs.

The Smart Way to Pay by Cash

Here's how to figure out whether paying directly, rather than using your insurance, is the right move for you.

Weigh the situation. Whether it makes sense to use insurance depends on your specific circumstances. Cash payment generally makes sense only if you're seeking care subject to a deductible which you haven't met yet and don't think you will reach anytime in the same calendar year (deductibles reset annually). Of course, you never know when you'll get sick and need expensive medical care. Make sure you put enough money aside to meet your deductible.

Research price and cost compare. Healthcare prices vary widely, even within the same local area and especially by provider, so it's important to shop around.

First, check your insurance company's website, or call your insurer, to get an estimate of the cost of your test or procedure. Don't forget to consider copays and coinsurance, which requires you to pay a percentage of the cost of a service (typically 20 percent). Then see whether you can do better by paying cash. Healthcare Bluebook and ClearHealthCosts publish both insurance-negotiated prices and cash rates where available. And a growing number of healthcare providers are being transparent and publishing their cash prices online.

Some, like The Surgery Center of Oklahoma , which bills itself as "a free market-loving, price-displaying, state-of-the-art surgical facility," don't take insurance at all. The Surgery Center posts cash prices for dozens of outpatient procedures, such as an Achilles tendon repair ($5,730) and cataract surgery ($4,000). Its prices are all-inclusive, bundling all related fees for the surgery, such as medications or needed specialists. That's still a lot of money, but for a family with a high deductible—say $8,300, the average for families who buy insurance on their own—paying cash could help them save thousands.

Keith Smith, an anesthesiologist and medical director of The Surgery Center, also co-founded an organization called the Free Market Medical Association that lists hundreds of other providers that publish cash prices.

There's also a push for greater price transparency from the Trump Administration. Last month, the Centers for Medicare and Medicaid Services proposed a rule that would require all hospitals to post their standard charges online by Jan. 1, 2019.

Be persistent. Not all healthcare providers make it easy to find out the cash price. That's because if they have a contract with your insurer, undercutting the negotiated price could be a contract violation. So you should ask directly how much your care would cost you with your insurance, and how much if you pay cash, Pinder says. If the healthcare provider balks, keep asking. "You may have to be persistent or go to another provider," she says.

Talk with your insurer. Although most insurers won't count cash payments toward your deductible, it's not a hard-and-fast rule, Kampine says. Ask your insurer what its policy is. Request from your doctor's office what is known as a "superbill," which is an itemized statement of charges and includes information such as diagnosis and procedure codes. Submit that to your insurance company when asking whether your payment can be applied to your deductible.

Use tax advantaged dollars. You can ease the pain of using your own money if you have a flexible spending account or health savings account . Money in FSAs and HSAs, which can be spent on a wide range of healthcare services, is put away pre-tax, so it lowers your taxable income. Most employers offer flexible spending accounts, which you can fund up to $2,650 a year. You have to have a high-deductible health plan to have an HSA, but if you do, you can put away $3,450 a year pre-tax for an individual and $6,850 for families to spend on out-of-pocket medical expenses.

Shop around for drugs, too. As with procedures and tests, you can sometimes save on prescription drugs by paying cash. But your pharmacist may not be able to reveal whether their retail, cash price is lower than your insured price due to "gag clauses" in their contracts with middleman known as pharmacy benefit managers. To work around this, you have to directly ask the pharmacist whether there is a lower price available.

First, look for online discounts at websites such as GoodRx or Blink Health . Then bring them to a pharmacy. Most will honor those coupons, our Consumer Reports secret shoppers have found, and the discounted price could be lower than your insurance copay. Or consider low-cost pharmacies, such as Costco, Sam's Club, or HealthWarehouse.com , all of which often have everyday low prices. Read more about how to shop around for prescription drugs .

Donna Rosato

I write about the financial challenges of paying for college, managing higher-education debt, and the steep cost of healthcare. I want to help people take control of their finances so that they can enjoy the other parts of their life. What I enjoy: running with friends, kayaking with my husband, and playing Legos with my son. Follow me on Twitter (@RosatoDonna).

More From Consumer Reports

Be the first to comment

Yearly "Wellness" visits

If you’ve had Medicare Part B (Medical Insurance) for longer than 12 months, you can get a yearly “Wellness” visit to develop or update your personalized plan to help prevent disease or disability, based on your current health and risk factors. The yearly “Wellness” visit isn’t a physical exam.

Your first yearly “Wellness” visit can’t take place within 12 months of your Part B enrollment or your “Welcome to Medicare” preventive visit. However, you don’t need to have had a “Welcome to Medicare” preventive visit to qualify for a yearly “Wellness” visit.

Your costs in Original Medicare

You pay nothing for this visit if your doctor or other health care provider accepts assignment .

The Part B deductible doesn’t apply.

However, you may have to pay coinsurance , and the Part B deductible may apply if your doctor or other health care provider performs additional tests or services during the same visit that Medicare doesn't cover under this preventive benefit.

If Medicare doesn't cover the additional tests or services (like a routine physical exam), you may have to pay the full amount.

Your doctor or other health care provider will ask you to fill out a questionnaire, called a “Health Risk Assessment,” as part of this visit. Answering these questions can help you and your doctor develop a personalized prevention plan to help you stay healthy and get the most out of your visit. Your visit may include:

- Routine measurements (like height, weight, and blood pressure).

- A review of your medical and family history.

- A review of your current prescriptions.

- Personalized health advice.

- Advance care planning .

Your doctor or other health care provider will also perform a cognitive assessment to look for signs of dementia, including Alzheimer’s disease. Signs of cognitive impairment include trouble remembering, learning new things, concentrating, managing finances, and making decisions about your everyday life. If your doctor or other health care provider thinks you may have cognitive impairment, Medicare covers a separate visit to do a more thorough review of your cognitive function and check for conditions like dementia, depression, anxiety, or delirium and design a care plan.

If you have a current prescription for opioids, your doctor or other health care provider will review your potential risk factors for opioid use disorder, evaluate your severity of pain and current treatment plan, provide information on non-opioid treatment options, and may refer you to a specialist, if appropriate. Your doctor or other health care provider will also review your potential risk factors for substance use disorder, like alcohol and tobacco use , and refer you for treatment, if needed.

Related resources

- Preventive visits

- Social determinants of health risk assessment

Is my test, item, or service covered?

- Home Design Experts

- Senior Living

- Wedding Experts

- Real Estate Agents

- Private Schools

- Mortgage Professionals

- 50 Best Restaurants

- Restaurant Finder

- Be Well Philly

- Find a Dentist

- Find a Doctor

- Life & Style

- Properties & News

- Find a Home & Design Pro

- Find a Real Estate Agent

- Find a Mortgage Professional

- Events in Philly

- Philly Mag Events

- Guides & Advice

- Find a Wedding Expert

- Bubbly Brunch Event

- Best of Philly

- Newsletters

If you're a human and see this, please ignore it. If you're a scraper, please click the link below :-) Note that clicking the link below will block access to this site for 24 hours.

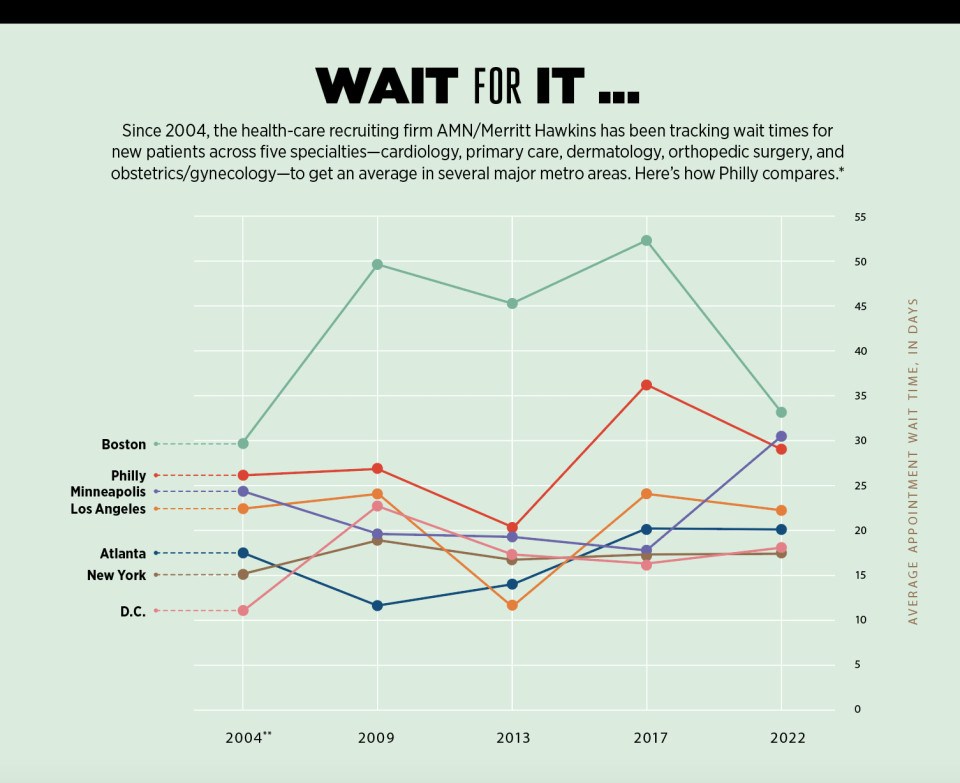

Why Seeing a Doctor Takes So Long — and How to Get Health Care When You Need It

Everyone has experienced it: It can take forever to get an appointment to see your doctor. We dig into the underlying problems and offer hope for a better future.

With the wait for doctor’s appointments taking longer than ever, medical care in Philadelphia has gotten complicated. / Photo-illustration by C.J. Burton

If Philly is one of the greatest medical cities in America, why does it take so long to get a doctor’s appointment here — and does it have to be this way?

Why Is It So Hard to Get a Doctor’s Appointment in Philadelphia?

By now, most of us understand that access to care is one of the many issues that plague America’s beleaguered health-care system. But there’s been a sense, I think — at least among those of us in the habit of absorbing the daily headlines — that the problems have mostly revolved around certain specific, desperate contexts. The medical deserts plaguing rural America, for instance. Niche specialists facing exceptional bursts of demand, like child psychiatrists since COVID. And the increasing number of patients in our country — the poor, the undocumented, those seeking reproductive or gender care — at the mercy of merciless legislative crusades.

What’s becoming more and more apparent, though, is how much more widespread, even mundane, the issue of getting to your doctor — or a doctor — really is, particularly when it comes to primary and preventative care. You know, the kind of care that keeps chronic conditions in check and keeps you out of the more expensive, overcrowded ER and also just generally helps keep you up to snuff and/or alive.

When I say widespread: Anecdotally, everyone I know — and probably you, too — has a story about waiting. A friend of mine who called for a physical with her Jefferson-based primary-care doctor in October couldn’t be seen until February. Another got a quote for a year-and-a-half waitlist to see a Penn Med gynecologist for an annual exam. When she looked instead to private practice, she took the best they could offer: a telehealth visit in two months. Still another friend who had an iffy mammogram at Penn was told she’d need to wait a stomach-churning month before she could even call to make an appointment for a biopsy.

Meantime, a Main Line Health patient I know needed a sick appointment, but her doctor had left the practice and they were booked out three months for “new patients.” When her asthma flares up, she says, her MLH pulmonologist appointments are regularly three to six months out. One of my neighbors waited upwards of four months last year for a run-of-the-mill pediatric allergy appointment at the Children’s Hospital of Philadelphia (CHOP), while another sought an appointment with a CHOP autism specialist and was told there were none, and no waitlist, no cancellations. “Please don’t call back,” the scheduler said. Keep reading …

How to Get a Doctor’s Appointment Sooner

Illustration by James W. Yates

It’s easy to feel helpless when you need to see a doctor but can’t get in for weeks or months (or longer!). But there are steps you can take to potentially speed up the process. Here, tips and strategies for getting a doctor’s appointment sooner. Keep reading …

Where to Get Medical Care in Philly Besides the Doctor’s Office

Can’t wait for the next opening in your doc’s schedule? Don’t have a primary-care doctor? (Eighteen percent of us don’t, according to a 2018 city survey.) Here, a rundown of places you can turn to for medical care when you need it. Keep reading …

What Would You Do To See a Doc?

As much as telemedicine, that Jetsonian marvel, has boosted accessibility for patients in recent years, the quest to deliver more health care more efficiently is never-ending. Plenty of other innovations and adaptations in this brave new world might change how you get your health care. Like, for instance:

Membership Models

Illustrations by James W. Yates

Consider the crazy-expensive concierge-medicine model disrupted. One interesting NYC-based health start-up, Summer Health, is a doctor-led platform offering 24/7 text-based pediatric health advice on everything from belly pain to breastfeeding to fevers for $20 a month — providing on-call support without an appointment or a wait. Meantime, Parkway Pharmacy, located in Fairmount, is in the process of partnering with Big Tree Health to open a neighborhood walk-in primary-care clinic — self-pay only, no insurance — for which $70 a month buys a patient unlimited access to the in-house provider (a physician’s assistant or nurse practitioner) in person or via telehealth, with clinic services and some 185 common prescriptions included in that price along with some preventative medical services, like remote patient monitoring of blood pressure. “What we’re trying to do is be your preventative care,” says owner Dennis Czerw.

Shared Appointments

Group appointments have been around since the 1970s but have gained serious traction in recent decades, in part because they lend themselves well to conditions like asthma, diabetes, sleep apnea, hypertension … even physicals. It works like this: Members of a small group — say, five to 10 patients with a shared condition — meet individually with a clinician for a few minutes to go over personal details, after which everyone gathers for a longer shared time with the doc. Part checkup, part education, part support group, shared appointments aren’t just about efficiency, says Charles Bae, Penn Med neurologist and associate CMIO for connected health strategy, but also comradery and old-fashioned curiosity: “Some people really prefer them!” Cooper University Health Care offers shared appointments for a handful of conditions; other local systems have just dabbled here and there.

AI in the Exam Room

Most everyone these days is looking at ways AI technology can lighten the load for practitioners. One seemingly promising use: ambient listening. In March, the AMA announced that the Permanente Medical Group’s rollout of ambient AI scribes — essentially, dedicated smartphones with microphones — saved physicians an average of an hour of typing time a day by transcribing (but not recording), summarizing and documenting the visit. The point here, Permanente’s director of virtual medicine, tech and innovation has noted, isn’t to find time to squeeze in more patients. Instead, it’s to stem the tide of burned-out physicians and create a little more room for “patient-care experience enhancement.” As with all of AI, though, there are still some kinks to work out: In one instance, when a physician mentioned a patient’s hands, feet and mouth, AI summarized — oops — a diagnosis of hand, foot and mouth disease.

The 2024 Top Doctors List

Our all-new Top Doctors list is here!

Our all-new list: the 3,047 best physicians in the Philadelphia region, as chosen by their peers. Whether you’re looking for a dermatologist, a cardiologist, a pediatrician or a family doctor, consult our list, and sort by name, town, or specialty to find the doctor you need. Read more …

Published as “The Waiting Game” in the May 2024 issue of Philadelphia magazine.

Where to Make Your Own Pottery in and Around Philadelphia

18 Philly-Area CSAs Where You Can Get Farm-Fresh Produce

The Ultimate Guide to Hot Yoga Studios in and Around Philadelphia

Things to Do in Philadelphia This Weekend

20 gorgeous philly-area gardens and arboretums to visit now, in this section.

An official website of the United States government

Here's how you know

The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

What the New Overtime Rule Means for Workers

One of the basic principles of the American workplace is that a hard day’s work deserves a fair day’s pay. Simply put, every worker’s time has value. A cornerstone of that promise is the Fair Labor Standards Act ’s (FLSA) requirement that when most workers work more than 40 hours in a week, they get paid more. The Department of Labor ’s new overtime regulation is restoring and extending this promise for millions more lower-paid salaried workers in the U.S.

Overtime protections have been a critical part of the FLSA since 1938 and were established to protect workers from exploitation and to benefit workers, their families and our communities. Strong overtime protections help build America’s middle class and ensure that workers are not overworked and underpaid.

Some workers are specifically exempt from the FLSA’s minimum wage and overtime protections, including bona fide executive, administrative or professional employees. This exemption, typically referred to as the “EAP” exemption, applies when:

1. An employee is paid a salary,

2. The salary is not less than a minimum salary threshold amount, and

3. The employee primarily performs executive, administrative or professional duties.

While the department increased the minimum salary required for the EAP exemption from overtime pay every 5 to 9 years between 1938 and 1975, long periods between increases to the salary requirement after 1975 have caused an erosion of the real value of the salary threshold, lessening its effectiveness in helping to identify exempt EAP employees.

The department’s new overtime rule was developed based on almost 30 listening sessions across the country and the final rule was issued after reviewing over 33,000 written comments. We heard from a wide variety of members of the public who shared valuable insights to help us develop this Administration’s overtime rule, including from workers who told us: “I would love the opportunity to...be compensated for time worked beyond 40 hours, or alternately be given a raise,” and “I make around $40,000 a year and most week[s] work well over 40 hours (likely in the 45-50 range). This rule change would benefit me greatly and ensure that my time is paid for!” and “Please, I would love to be paid for the extra hours I work!”

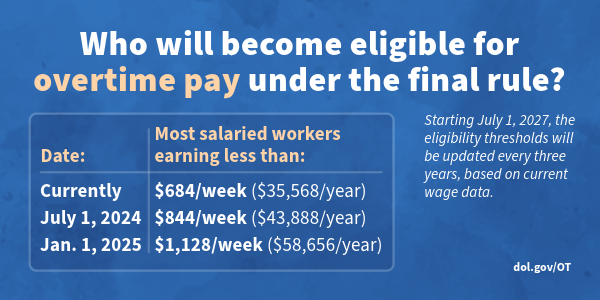

The department’s final rule, which will go into effect on July 1, 2024, will increase the standard salary level that helps define and delimit which salaried workers are entitled to overtime pay protections under the FLSA.

Starting July 1, most salaried workers who earn less than $844 per week will become eligible for overtime pay under the final rule. And on Jan. 1, 2025, most salaried workers who make less than $1,128 per week will become eligible for overtime pay. As these changes occur, job duties will continue to determine overtime exemption status for most salaried employees.

The rule will also increase the total annual compensation requirement for highly compensated employees (who are not entitled to overtime pay under the FLSA if certain requirements are met) from $107,432 per year to $132,964 per year on July 1, 2024, and then set it equal to $151,164 per year on Jan. 1, 2025.

Starting July 1, 2027, these earnings thresholds will be updated every three years so they keep pace with changes in worker salaries, ensuring that employers can adapt more easily because they’ll know when salary updates will happen and how they’ll be calculated.

The final rule will restore and extend the right to overtime pay to many salaried workers, including workers who historically were entitled to overtime pay under the FLSA because of their lower pay or the type of work they performed.

We urge workers and employers to visit our website to learn more about the final rule.

Jessica Looman is the administrator for the U.S. Department of Labor’s Wage and Hour Division. Follow the Wage and Hour Division on Twitter at @WHD_DOL and LinkedIn . Editor's note: This blog was edited to correct a typo (changing "administrator" to "administrative.")

- Wage and Hour Division (WHD)

- Fair Labor Standards Act

- overtime rule

SHARE THIS:

An official website of the United States government

Here’s how you know

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

Take action

- Report an antitrust violation

- File adjudicative documents

- Find banned debt collectors

- View competition guidance

- Competition Matters Blog

New HSR thresholds and filing fees for 2024

View all Competition Matters Blog posts

We work to advance government policies that protect consumers and promote competition.

View Policy

Search or browse the Legal Library

Find legal resources and guidance to understand your business responsibilities and comply with the law.

Browse legal resources

- Find policy statements

- Submit a public comment

Vision and Priorities

Memo from Chair Lina M. Khan to commission staff and commissioners regarding the vision and priorities for the FTC.

Technology Blog

Consumer facing applications: a quote book from the tech summit on ai.

View all Technology Blog posts

Advice and Guidance

Learn more about your rights as a consumer and how to spot and avoid scams. Find the resources you need to understand how consumer protection law impacts your business.

- Report fraud

- Report identity theft

- Register for Do Not Call

- Sign up for consumer alerts

- Get Business Blog updates

- Get your free credit report

- Find refund cases

- Order bulk publications

- Consumer Advice

- Shopping and Donating

- Credit, Loans, and Debt

- Jobs and Making Money

- Unwanted Calls, Emails, and Texts

- Identity Theft and Online Security

- Business Guidance

- Advertising and Marketing

- Credit and Finance

- Privacy and Security

- By Industry

- For Small Businesses

- Browse Business Guidance Resources

- Business Blog

Servicemembers: Your tool for financial readiness

Visit militaryconsumer.gov

Get consumer protection basics, plain and simple

Visit consumer.gov

Learn how the FTC protects free enterprise and consumers

Visit Competition Counts

Looking for competition guidance?

- Competition Guidance

News and Events

Latest news, williams-sonoma will pay record $3.17 million civil penalty for violating ftc made in usa order.

View News and Events

Upcoming Event

Older adults and fraud: what you need to know.

View more Events

Sign up for the latest news

Follow us on social media

--> --> --> --> -->

Playing it Safe: Explore the FTC's Top Video Game Cases

Learn about the FTC's notable video game cases and what our agency is doing to keep the public safe.

Latest Data Visualization

FTC Refunds to Consumers

Explore refund statistics including where refunds were sent and the dollar amounts refunded with this visualization.

About the FTC

Our mission is protecting the public from deceptive or unfair business practices and from unfair methods of competition through law enforcement, advocacy, research, and education.

Learn more about the FTC

Meet the Chair

Lina M. Khan was sworn in as Chair of the Federal Trade Commission on June 15, 2021.

Chair Lina M. Khan

Looking for legal documents or records? Search the Legal Library instead.

- Report Fraud

- Get Consumer Alerts

- Search the Legal Library

- Submit Public Comments

- Cases and Proceedings

- Premerger Notification Program

- Merger Review

- Anticompetitive Practices

- Competition and Consumer Protection Guidance Documents

- Warning Letters

- Consumer Sentinel Network

- Criminal Liaison Unit

- FTC Refund Programs

- Notices of Penalty Offenses

- Advocacy and Research

- Advisory Opinions

- Cooperation Agreements

- Federal Register Notices

- Public Comments

- Policy Statements

- International

- Office of Technology Blog

- Military Consumer

- Consumer.gov

- Bulk Publications

- Data and Visualizations

- Stay Connected

- Commissioners and Staff

- Bureaus and Offices

- Budget and Strategy

- Office of Inspector General

- Careers at the FTC

FTC Announces Rule Banning Noncompetes

- Competition

- Office of Policy Planning

- Bureau of Competition

Today, the Federal Trade Commission issued a final rule to promote competition by banning noncompetes nationwide, protecting the fundamental freedom of workers to change jobs, increasing innovation, and fostering new business formation.

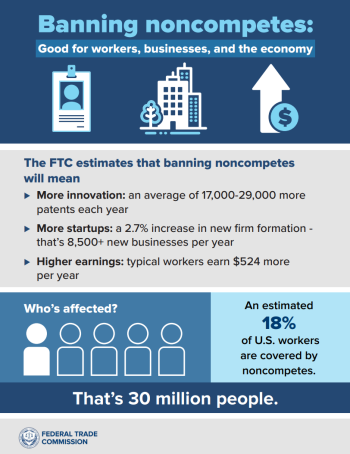

“Noncompete clauses keep wages low, suppress new ideas, and rob the American economy of dynamism, including from the more than 8,500 new startups that would be created a year once noncompetes are banned,” said FTC Chair Lina M. Khan. “The FTC’s final rule to ban noncompetes will ensure Americans have the freedom to pursue a new job, start a new business, or bring a new idea to market.”

The FTC estimates that the final rule banning noncompetes will lead to new business formation growing by 2.7% per year, resulting in more than 8,500 additional new businesses created each year. The final rule is expected to result in higher earnings for workers, with estimated earnings increasing for the average worker by an additional $524 per year, and it is expected to lower health care costs by up to $194 billion over the next decade. In addition, the final rule is expected to help drive innovation, leading to an estimated average increase of 17,000 to 29,000 more patents each year for the next 10 years under the final rule.

Noncompetes are a widespread and often exploitative practice imposing contractual conditions that prevent workers from taking a new job or starting a new business. Noncompetes often force workers to either stay in a job they want to leave or bear other significant harms and costs, such as being forced to switch to a lower-paying field, being forced to relocate, being forced to leave the workforce altogether, or being forced to defend against expensive litigation. An estimated 30 million workers—nearly one in five Americans—are subject to a noncompete.

Under the FTC’s new rule, existing noncompetes for the vast majority of workers will no longer be enforceable after the rule’s effective date. Existing noncompetes for senior executives - who represent less than 0.75% of workers - can remain in force under the FTC’s final rule, but employers are banned from entering into or attempting to enforce any new noncompetes, even if they involve senior executives. Employers will be required to provide notice to workers other than senior executives who are bound by an existing noncompete that they will not be enforcing any noncompetes against them.

In January 2023, the FTC issued a proposed rule which was subject to a 90-day public comment period. The FTC received more than 26,000 comments on the proposed rule, with over 25,000 comments in support of the FTC’s proposed ban on noncompetes. The comments informed the FTC’s final rulemaking process, with the FTC carefully reviewing each comment and making changes to the proposed rule in response to the public’s feedback.

In the final rule, the Commission has determined that it is an unfair method of competition, and therefore a violation of Section 5 of the FTC Act, for employers to enter into noncompetes with workers and to enforce certain noncompetes.

The Commission found that noncompetes tend to negatively affect competitive conditions in labor markets by inhibiting efficient matching between workers and employers. The Commission also found that noncompetes tend to negatively affect competitive conditions in product and service markets, inhibiting new business formation and innovation. There is also evidence that noncompetes lead to increased market concentration and higher prices for consumers.

Alternatives to Noncompetes

The Commission found that employers have several alternatives to noncompetes that still enable firms to protect their investments without having to enforce a noncompete.

Trade secret laws and non-disclosure agreements (NDAs) both provide employers with well-established means to protect proprietary and other sensitive information. Researchers estimate that over 95% of workers with a noncompete already have an NDA.