17 Travel & Tourism VC Investors Who Can Fund Your Startup in 2024

With a recovery in full swing within the travel and tourism industry, it’s time to get back to business to meet people’s wanderlust desires. Now that things are opening up again people are more excited than ever to travel and have experiences.

Julia Simpson, president and CEO of WTTC (The World Travel & Tourism Council) says “Our latest forecast shows the recovery significantly picking up this year as infection rates subside and travelers continue benefiting from the protection offered by the vaccine and boosters. As travel restrictions ease and consumer confidence returns, we expect a welcome release of pent-up travel and tourism demand.”

Businesses have managed to survive through innovative new marketing tactics which encouraged people to travel locally and pivots to accommodate limitations. This is how Airbnb managed to overcome the toughest times of the pandemic. Their marketing strategy encouraged people to get out of the house and explore areas around them.

According to TechCrunch “High-profile funding rounds also appear to be popping up across travel and hospitality’s various sub-sectors, including bookings, activity marketplaces, short-term rental, tourism and hotel platforms. And companies are continuing to pull in funding rounds in the hundreds of millions to billion-dollar range.”

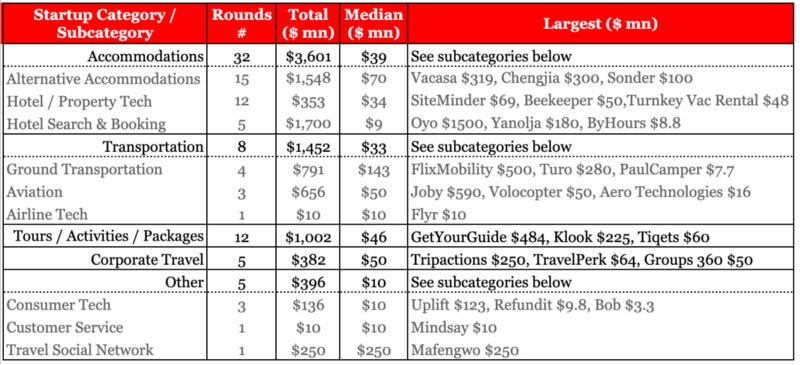

The pandemic gave rise not only to a new way of traveling but also changed the way people want to travel and gave them new opportunities to do so. Investments in alternative accommodation startups and other businesses in this area have been on the rise and seems as though the trend will continue from 2021.

With remote work now being an option to the majority of people, we’re seeing new huge growth opportunities for coworking, coliving, and traveling. Companies like HiveGeist launched last year to offer travelers stylish modern accommodations and offer a place to meet and work with other digital nomads. PhocusWire reports “other significant rounds have gone into vacation home co-ownership startup Pacaso with $125 million and Outdoorsy with $120 million while luxury rental company Kocomo with $56 million, Holidu with $45 million and Getaway with $42 million, also benefited from excitement in the segment.”. Along with large investments going to alternative accommodation, hotel technology companies have also received considerable interest from VC’s.

Skift’s report on Venture Investment Trends in 2022, revealed that “travel startups raised $8.6 billion last year, a figure that’s 90 percent of 2019 levels and a 73 percent increase from 2020.” and we predict this will continue to be on the rise. As well CNN reported , “travel and tourism could generate $8.6 trillion globally this year, according to new research by the World Travel & Tourism Council. That’s just 6.4% below pre-pandemic levels.”

According to the World Travel & Tourism Council :

- U.S. domestic Travel & Tourism spending is forecast to reach more than $1.1 trillion for the year, surpassing pre-pandemic levels by 11.3%

- International traveler spending in the U.S. could see growth of $113 billion, compared to 2020, reaching nearly $155 billion, slightly below (14%) 2019 levels

- Employment in the sector could also surpass pre-pandemic levels, reaching nearly 16.8 million jobs, above pre-pandemic levels by almost 200,000 jobs

Journey Ventures

- Location : Israel

- About : Journey Ventures is a multi-stage VC dedicated to the booming Travel Tech industry. Travel is one of the world’s fastest-growing sectors. Travel startups of the last few years have already disrupted some of the largest sectors in our industry, a momentum we expect to continue. This large market of ever-increasing Travel Tech offerings is ready for smart investments, and Journey Ventures is an expert in the field.

- Thesis: Our goal is to develop a portfolio of Israeli and international companies specializing in the fields of tourism, travel Tech and the hotel industry that have reached an advanced stage of technological development.

- Investment Stages : Pre-seed, Seed, Series A, Series B, Series C

- Roomerang LTD

To learn more about Journey Ventures , check out their Visible Connect Profile.

Related Resource: 9 Active Venture Capital Firms in Israel

MairDuMont Ventures

- Location : Stuttgart, Germany

- About : MAIRDUMONT VENTURES is the venture capital arm of the MAIRDUMONT Group and has been supporting digital travel companies in their future growth since 2015. MAIRDUMONT VENTURES uses its unique sector focus “Travel” to dive deeply into different business models and to evaluate potentials together with our portfolio companies. We have extensive know-how and can leverage the huge network of the MAIRDUMONT Group – with well-known brands such as Marco Polo, DuMont, Baedeker, Kompass or Falk – to offer our portfolio companies not only financial resources, but also strategic and operational support. We invest in fast-growing, early-stage and innovative companies that revolutionize travel. These can be solutions for end customers (B2C) as well as business customers (B2B).

- Paul Camper

To learn more about MairDuMont Ventures , check out their Visible Connect Profile.

Related Resource: 8 Active Venture Capital Firms in Germany

JetBlue Technology Ventures

- Location : San Carlos, California, United States

- About : JetBlue Technology Ventures invests in and partners with early stage technology startups improving the future of travel and hospitality.

- Thesis : We invest in and partner with early stage startups improving travel and hospitality.

- Investment Stages : Seed, Series A, Series B, Growth

To learn more about JetBlue Technology Ventures , check out their Visible Connect Profile.

500 Startups

- Location : Mountain View, California, United States

- About : 500 Startups is a global venture capital firm with a network of startup programs headquartered in Silicon Valley.

- Thesis : Uplifting people and economies through entrepreneurship

- Investment Stages : Seed, Series A

To learn more about 500 Startups , check out their Visible Connect Profile.

- Location : Venice, California, United States

- About : At Fifth Wall we are pioneering an advisory-based approach to venture capital. Full-service, integrated, operationally aligned. We are the first and largest venture capital firm advising corporates on and investing in Built World technology. Our strategic focus, multidisciplinary expertise, and global network provide unique insights and unparalleled access to transformational opportunities.

- Investment Stages : Seed, Series A, Series B

To learn more about Fifth Wall , check out their Visible Connect Profile.

Thayer Ventures

- Location : Valencia, California, United States

- About : Thayer Ventures invests in Travel Technology.

- Thesis : We invest in early-stage travel and transportation technology.

- Snapcommerce

To learn more about Thayer Ventures , check out their Visible Connect Profile.

Structure Capital

- Location : San Francisco, California, United States

- About : Structure Capital help passionate teams build great companies by investing seed-stage capital, time, experience and relationships.

To learn more about Structure Capital , check out their Visible Connect Profile.

Portugal Ventures

- Location : Porto, Lisboa, Portugal

- About : Portugal Ventures is a venture capital firm that invests in seed rounds of Portuguese startups in tech, life sciences, and tourism.

- Thesis : We invest in companies in the seed and early stages operating in the digital, engineering & manufacturing, life sciences and tourism sectors.

- Investment Stages : Pre-Seed, Seed, Series A

- DefinedCrowd

- Sleep & Nature

To learn more about Portugal Ventures , check out their Visible Connect Profile.

aws Gründerfonds

- Location : Vienna, Wien, Austria

- About : Venture Capital for Ideas and Innovations aws Founders Fund invests venture capital during the start-up and early growth phase of Austrian start-ups. We offer support for your future (financial) plans as a long-term investor and partner and believe in the additional value of co-investments.

- CheckYeti.com

To learn more about aws Gründerfonds , check out their Visible Connect Profile.

VentureFriends

- Location : Athens, Attiki, Greece

- About : VC fund based in Athens but investing across Europe, we focus on FinTech, Travel, PropTech, B2C & Marketplaces. We are entrepreneurial investors, with strong experience, network and track record. We have been entrepreneurs, founders, worked at startups or angel investors in early stages and have a founder first & value driven approach

- Thesis : We are entrepreneurial investors who love to support startups and help them become impactful companies with a worldwide presence.

- Investment Stages : Seed, Series A, Series B, Series C, Growth

- Welcome Pickups

To learn more about VentureFriends , check out their Visible Connect Profile.

Travel Impact Lab

- Location : Utrecht, Netherlands

- About : Travel Impact Lab helps start-ups to get started and sets existing travel organizations in motion.

- Investment Stages : Accelerator

To learn more about Travel Impact Lab , check out their Visible Connect Profile.

Gobi Partners

- Location : Shanghai, China

- About : Gobi Partners is an early stage to late stage venture capital firm focusing on IT and digital media investments in China, HK and ASEAN.

- Investment Stages : Seed, Series A, Series B, Series C

To learn more about Gobi Partners , check out their Visible Connect Profile.

Travel Capitalist Ventures

- Location : Irvine, California, United States

- About : Travel focused Venture Capital and Private Equity Investor.

- Thesis : We identify, invest and help travel companies rapidly and sustainably expand.

- Investment Stages : Seed, Series A, Growth

To learn more about Travel Capitalist Ventures , check out their Visible Connect Profile.

Alstin Capital

- Location : Munich, Bayern, Germany

- About : Alstin Capital is an independent venture capital fund based in Munich. We invest in rapidly growing technology companies that have the potential to leverage the significant market potential of the future and become market leaders. We not only invest in convincing technology, but above all in the entrepreneurs behind the technology. We support our entrepreneurs with capital and know-how so that they can grow faster and more successfully. Our investment is based on the conviction that entrepreneurial know-how, many years of transaction experience, international networks and sales excellence are the success factors for sustainable growth. Our team brings a variety of complementary strengths to help make any investment a success.

To learn more about Alstin Capital , check out their Visible Connect Profile.

- Location : Hamburg, Germany

- About : We believe venture capital will make the best returns if you invest in the big future markets. Therefore we are strong believers in Tech (managed by Norbert Beck), Brain Computer Interface (managed by Florian Haupt) and pharma to prevent age related disease and prolong healthy human lifespan managed by Nils Regge with the investment vehicle Apollo.vc.

- DreamCheaper

To learn more about TruVenturo , check out their Visible Connect Profile.

Howzat Partners

- Location : London, England, United Kingdom

- About : We are looking to invest in and build internet businesses that have a “HOWZAT” factor. This may sound a little trite; but we see major changes caused by the internet and the opportunities are genuinely exciting. The right idea; the right business; the right time; should generate the “HOWZAT” feeling. David felt it when he came across Cheapflights and was involved in acquiring the Company in 2000. We are seeking the same feeling again in the investments we make.

To learn more about Howzat Partners , check out their Visible Connect Profile.

Slow Ventures

- About :Slow Ventures invests in companies central to the technology industry and those on the edges of science, society, and culture.

- Thesis : Slow Ventures invests in companies central to the technology industry and those on the edges of science, society, and culture.

To learn more about Slow Ventures , check out their Visible Connect Profile.

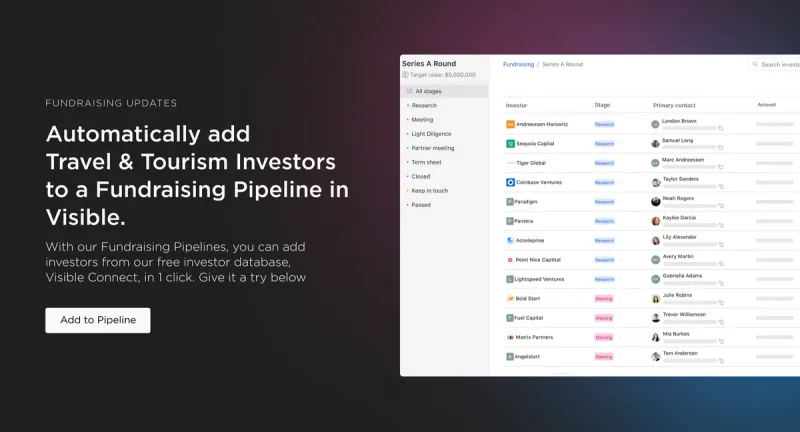

Start Your Next Round with Visible

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our D2C investors here and e-commerce here.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors and How to Cold Email Investors: A Video by Michael Seibel of YC .

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here .

This free Notion document contains the best 100+ resources you need for building a successful startup, divided in 4 categories: Fundraising, People, Product, and Growth.

This free eBook goes over the 10 slides every startup pitch deck has to include, based on what we learned from analyzing 500+ pitch decks, including those from Airbnb, Uber and Spotify.

This free sheet contains 100 accelerators and incubators you can apply to today, along with information about the industries they generally invest in.

This free sheet contains 100 VC firms, with information about the countries, cities, stages, and industries they invest in, as well as their contact details.

This free sheet contains all the information about the top 100 unicorns, including their valuation, HQ's location, founded year, name of founders, funding amount and number of employees.

Top 58 Travel & Hospitality Venture Capital Firms in 2024

Description

Are you a founder building a startup in the Travel & Hospitality industry?

Whether you’re still in the early stages of your entrepreneur journey or you’ve already found product-market fit and are ready to scale your company, I think you’ll find useful this list of venture capital firms investing in your industry.

59 Travel & Hospitality Venture Capital Firms

Everything you need to raise funding for your startup, including 3,500+ investors, 7 tools, 18 templates and 3 learning resources.

Information about the countries, cities, stages, and industries they invest in, as well as their contact details.

List of 250 startup investors in the AI and Machine Learning industries, along with their Twitter, LinkedIn, and email addresses.

List of startup investors in the BioTech, Health, and Medicine industries, along with their Twitter, LinkedIn, and email addresses.

List of startup investors in the FinTech industry, along with their Twitter, LinkedIn, and email addresses.

1) Y Combinator

Y Combinator is a leading accelerator and venture capital providing mentorship and funding to companies across all sectors.

Details of the VC firm:

- Country: USA

- City: Mountain View

- Started in: 2005

- Founders: Jessica Livingston, Lucas Thomaz, Paul Graham, Raffaele Colella, Robert Morris, Trevor Blackwell

- Industries: Enterprise, SaaS, Big Data & Analytics, Productivity, DTC, Cybersecurity, Supply Chain & Logistics, Education, Consumer, Food & Beverage, Gaming, Future of Work, Social, Transportation, Travel & Hospitality, AR & VR, Healthcare, Health & Wellness, Biotech, Fintech, InsurTech, Industrial, Aerospace & Space, Climate & Sustainability, Robotics, Government Technology, Manufacturing, Infrastructure, Legal, Marketing, Agriculture, Automative, Energy

- Stages: Seed, Early Stage, Pre-Seed, Series A

- Minimum check size: $500,000

- Number of investments: 4469

- Number of exits: 444

- 3 remarkable investments: Coinbase, Twitch, Reddit

You can find their website here .

You can send them an email at [email protected] .

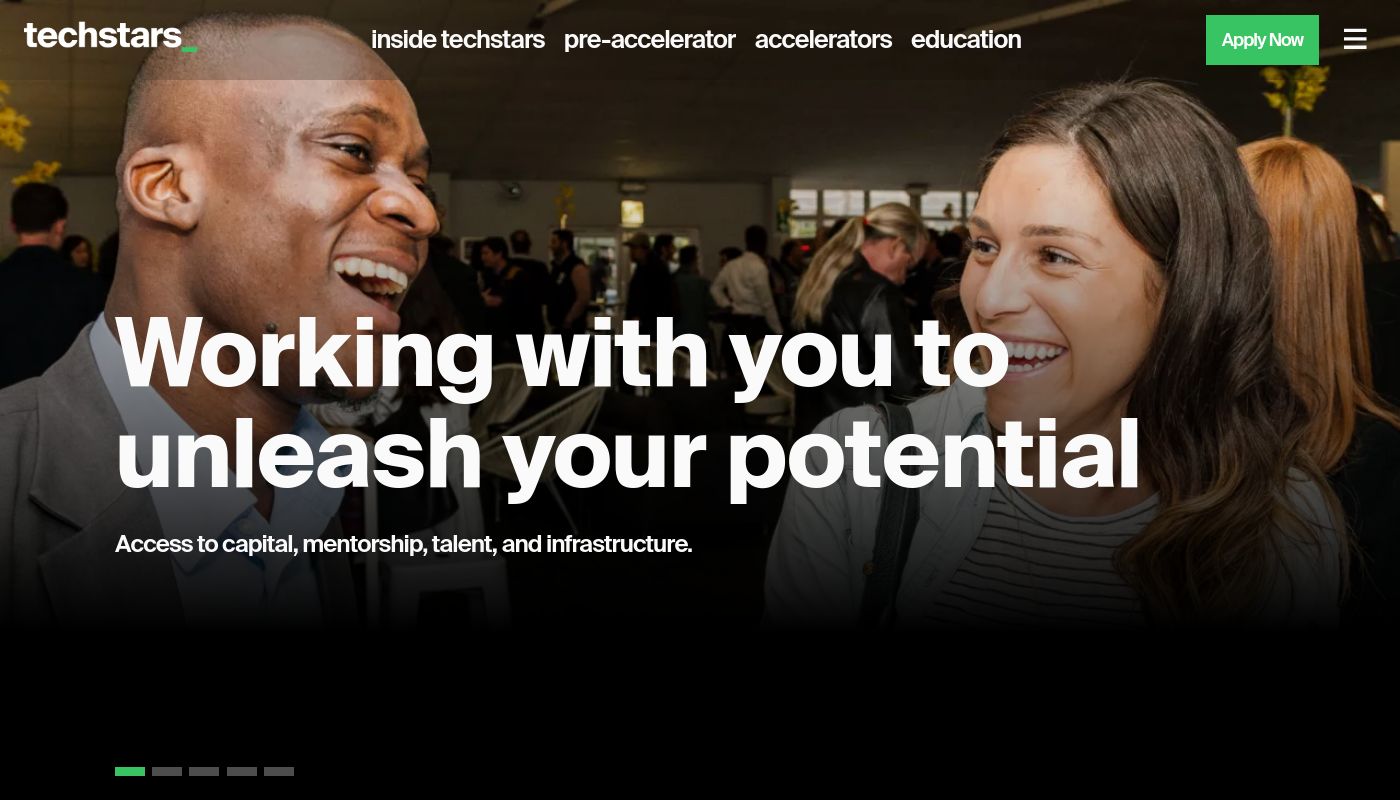

2) Techstars

Techstars is a global accelerator and early-stage investor since 2006.

- Country: Israel, USA, India, China

- City: San Francisco, Mumbai, Hong Kong, Shanghai, Herẕliyya, New York

- Started in: 1989

- Founders: Samuel Isaly

- Industries: Advertising, Aerospace & Space, Agriculture, AI & ML, Biotech, Crypto & Blockchain, Climate & Sustainability, Cloud, Consumer, Cybersecurity, SaaS, Big Data & Analytics, Developer Tools, E-Commerce, Education, Energy, Enterprise, Entertainment, Fintech, Sports, Food & Beverage, Future of Work, Gaming, Government Technology, Hardware, Health & Wellness, Healthcare, Human Resources, Infrastructure, Legal, IoT, Life Sciences, Manufacturing, Marketplace, Media, Mobility, Productivity, Proptech & Real Estate, Robotics, Marketing, Supply Chain & Logistics, Transportation, AR & VR, Travel & Hospitality

- Stages: Pre-Seed, Seed

- Minimum check size: $20,000

- Maximum check size: $100,000

- Number of investments: 4116

- Number of exits: 951

- Funds raised: $108,000,000

- 3 remarkable investments: Rootine, Packworks, Payymnt

You can send them an email at [email protected] .

3) Plug and Play Tech Center

Plug and Play provides an array of services including accelerators, mentorships, and capital to entrepreneurs of all backgrounds.

- Country: USA, Canada, Brazil, United Arab Emirates, Netherlands, Belgium, Spain, Switzerland, Morocco, Germany, Turkey, South Africa, Italy, France, China, Japan, South Korea

- City: Chicago, Cleveland, Detroit, São Paulo, Topeka, Toronto, Abu Dhabi, Amsterdam, Antwerp, Barcelona, Basel, Ben Guerir, Cairo, Geneva, Hamburg, Istanbul, Johannesburg, Madrid, Milan, Munich, Paris, Bangkok, Beijing, Kyōto, Ōsaka, Seoul, San Francisco

- Started in: 2006

- Founders: Ali Safavi, Jackie Hernandez, Saeed Amidi

- Industries: DTC, Enterprise, Fintech, Food & Beverage, Healthcare, InsurTech, IoT, Media, Transportation, Hardware, Proptech & Real Estate, Supply Chain & Logistics, Climate & Sustainability, Travel & Hospitality, Agriculture, Energy

- Stages: Early Stage, Series A, Series B, Series C

- Minimum check size: $50,000

- Maximum check size: $250,000

- Number of investments: 1447

- Number of exits: 140

- Funds raised: $45,500,000

- 3 remarkable investments: Truebill, Honey, Life360

You can send them an email at [email protected] .

4) Matrix Partners

Matrix Partners invest in startups across consumer technology, B2B, enterprise, fintech and many others in the USA, India and China.

- Country: India, USA, China

- City: Bangalore, Delhi, Mumbai, San Francisco, Boston, Palo Alto, Beijing, Shanghai

- Started in: 1977

- Founders: Paul J. Ferri

- Industries: Healthcare, Fintech, Enterprise, SaaS, E-Commerce, Media, Social, Gaming, Travel & Hospitality, Transportation, Education

- Stages: Seed, Series A, Series B

- Minimum check size: $100,000

- Maximum check size: $10,000,000

- Number of investments: 626

- Number of exits: 145

- Funds raised: $2,600,000,000

- 3 remarkable investments: Apple, Zendesk, Hubspot

You can send them an email at [email protected] .

5) Seed Camp

Seedcamp is a European startup fund that seeks investments in early-stage entrepreneurs who are targeting worldwide markets.

- Country: United Kingdom

- City: London

- Started in: 2007

- Founders: Reshma Sohoni, Carlos Espinal

- Industries: SaaS, Robotics, AI & ML, Crypto & Blockchain, Cloud, Infrastructure, Big Data & Analytics, Developer Tools, E-Commerce, Education, Future of Work, Fintech, Productivity, Gaming, Human Resources, InsurTech, IoT, Marketing, Advertising, Marketplace, Media, Creator Economy, Proptech & Real Estate, Cybersecurity, Social, Travel & Hospitality

- Stages: Seed

- Minimum check size: £300,000

- Maximum check size: £500,000

- Number of investments: 612

- Number of exits: 159

- Funds raised: £78,000,000

- 3 remarkable investments: Hopin, Wise, Revolut

You can send them an email at [email protected] .

6) Technology Crossover Ventures

TCV provides investment capital to growth-stage private and public companies in the technology industry.

- Country: USA, United Kingdom

- City: London, New York, San Francisco

- Started in: 1995

- Founders: Jay Hoag, Rick Kimball

- Industries: E-Commerce, Media, Enterprise, Entertainment, Proptech & Real Estate, Travel & Hospitality, Education, Marketing, Legal, Advertising

- Stages: Late Stage, Series A, Series B, Growth

- Minimum check size: $30,000,000

- Maximum check size: $400,000,000

- Number of investments: 393

- Number of exits: 194

- Funds raised: $20,100,000,000

- 3 remarkable investments: Meta, Netflix, Spotify

You can send them an email at [email protected] .

7) BGF (Business Growth Fund)

Business Growth Fund invests in small and mid-sized businesses in UK and Ireland.

- Country: United Kingdom, Ireland

- City: Aberdeen, Belfast, Birmingham, Bristol, Cambridge, Caerdydd, Cork, Dublin, Edinburgh, Leeds, London, Manchester, Milton Keynes, Newcastle, Nottingham, Reading

- Started in: 2011

- Founders: Stephen Welton

- Industries: Deep Tech & Hard Science, AI & ML, E-Commerce, Education, Food & Beverage, Healthcare, Life Sciences, Media, Climate & Sustainability, Travel & Hospitality, Consumer, DTC, Energy, Infrastructure, Construction

- Stages: Early Stage, Debt, Private Equity

- Minimum check size: £1,000,000

- Maximum check size: £8,000,000

- Number of investments: 381

- Number of exits: 70

- Funds raised: £597,300,000

- 3 remarkable investments: Miss Group, LoopMe, Trouva

You can send them an email at [email protected] .

8) Western Technology Investment

WTI is a stage-agnostic venture capital firm, that provides debt and equity capital to technology and life science companies.

- City: Portola Valley

- Started in: 1980

- Founders: Ron Swenson

- Industries: Climate & Sustainability, Consumer, Education, Enterprise, Fintech, Food & Beverage, Hardware, Health & Wellness, Travel & Hospitality, Media, Gaming, Proptech & Real Estate, Social, Transportation, Future of Work, InsurTech, Infrastructure

- Stages: Early Stage, Late Stage, Seed

- Number of investments: 380

- Number of exits: 128

- Funds raised: $375,000,000

- 3 remarkable investments: Meta, Planet, Ansys

You can send them an email at [email protected] .

9) Hiventures

Hiventures is a multistage investment firm located in Hungary.

- Country: Hungary

- City: Budapest

- Started in: 2017

- Founders: Bence Katona

- Industries: Media, Gaming, Big Data & Analytics, Consumer, Education, Fintech, InsurTech, Food & Beverage, Supply Chain & Logistics, Marketplace, Healthcare, Travel & Hospitality, Agriculture, SaaS

- Stages: Pre-Seed, Seed, Series A

- Minimum check size: €50,000

- Maximum check size: €3,000,000

- Number of investments: 280

- Number of exits: 69

- 3 remarkable investments: Briefly, Himoney, Edumarket

You can send them an email at [email protected] .

10) Revolution LLC

Revolution is a venture capital firm that works with entrepreneurs all across the US who are at the forefront of their industries.

- City: Washington, San Francisco

- Founders: Donn Davis, Steve Case, Ted Leonsis, Tige Savage

- Industries: Education, Media, Marketplace, Transportation, Travel & Hospitality, E-Commerce, Health & Wellness, Food & Beverage, Entertainment, Manufacturing, Sports, Fintech, SaaS

- Stages: Late Stage, Early Stage, Seed

- Minimum check size: $1,000,000

- Maximum check size: $12,000,000

- Number of investments: 259

- Number of exits: 55

- 3 remarkable investments: Draftkings, Sweetgreen, Lucid

You can send them an email at [email protected] .

11) Viola Ventures

Viola Ventures is a VC firm investing in early-stage technology companies in Isreal.

- Country: Israel

- City: Herẕliyya

- Started in: 2000

- Founders: Avi Zeevi, Shlomo Dovrat

- Industries: AI & ML, Biotech, Cybersecurity, Enterprise, InsurTech, Proptech & Real Estate, Internet & Mobile, Media, Travel & Hospitality, Climate & Sustainability, DTC, Automative, Agriculture, SaaS

- Stages: Early Stage, Seed, Series A, Series B

- Number of investments: 243

- Number of exits: 50

- Funds raised: $1,300,000,000

- 3 remarkable investments: Sundaysky, Ironsource, Pagaya

You can send them an email at [email protected] .

12) Eurazeo

Eurazeo is an investment firm providing initial to Series C deals to digital services and technologies companies.

- Country: USA, Brazil, United Kingdom, Spain, France, Luxembourg, Germany, Italy, Singapore, China, South Korea

- City: New York, São Paulo, London, Madrid, Paris, Luxembourg, Frankfurt, Milan, Berlin, Singapore, Shanghai, Seoul

- Started in: 2001

- Founders: Michel David-Weill, Virginie Morgon

- Industries: DTC, Cloud, Climate & Sustainability, Consumer, Enterprise, Healthcare, Fintech, Food & Beverage, Internet & Mobile, Industrial, Travel & Hospitality, Life Sciences, Proptech & Real Estate, Advertising, Marketing, SaaS

- Stages: Early Stage, Series C, Seed, Series A, Series B

- Number of investments: 220

- Funds raised: €3,250,000,000

- 3 remarkable investments: Nest New York, Deezer, Gisou

You can send them an email at [email protected] .

13) Heartcore Capital

Heartcore is a consumer technology VC investing in European B2C and B2B2C companies.

- Country: Denmark, Germany, France, USA, Austria, Sweden, Spain, Hungary, Poland, United Arab Emirates

- City: Copenhagen, Berlin, Paris, Lisbon, Stockholm

- Founders: Jimmy Fussing Nielsen, Christian Lindegaard Jepsen,

- Industries: Travel & Hospitality, Education, Entertainment, Food & Beverage, Health & Wellness, Productivity, Consumer, Gaming, InsurTech, Energy

- Stages: Early Stage, Seed, Pre-Seed, Series A

- Minimum check size: €300,000

- Maximum check size: €6,000,000

- Number of investments: 210

- Number of exits: 51

- 3 remarkable investments: Reddit, Insight, Werlabs

You can send them an email at [email protected] .

14) Project A

Project A is a European VC firm providing capital and operational support to startups since 2012.

- Country: Germany

- City: Berlin

- Started in: 2012

- Founders: Rainer Berak, Ben Fischer, Dr. Florian Heinemann, Uwe Horstmann, Thies Sander, Dr. Anton Waitz

- Industries: E-Commerce, Fintech, Cybersecurity, Supply Chain & Logistics, Marketplace, Proptech & Real Estate, Internet & Mobile, InsurTech, SaaS, Climate & Sustainability, DTC, Developer Tools, Health & Wellness, Education, Food & Beverage, Gaming, Media, Transportation, Travel & Hospitality, Manufacturing, Marketing

- Stages: Early Stage, Seed, Series A

- Minimum check size: €1,000,000

- Maximum check size: €10,000,000

- Number of investments: 201

- Number of exits: 36

- Funds raised: €375,000,000

- 3 remarkable investments: Root Global, Knowunity, Re:Cap

You can send them an email at [email protected] .

15) Partech

With offices in Europe, Africa and the US, Partech is the global venture capital for tech investments.

- Country: USA, Germany, France, Senegal

- City: San Francisco, Paris, Berlin, Dakar

- Started in: 1982

- Founders: John Sung Kim, Thomas G. Mckinley, Vincent Worms

- Industries: Food & Beverage, SaaS, E-Commerce, Marketplace, Consumer, Fintech, Health & Wellness, InsurTech, Cybersecurity, Media, Supply Chain & Logistics, Transportation, Developer Tools, Travel & Hospitality, Infrastructure, Energy

- Stages: Seed, Early Stage, Late Stage

- Minimum check size: $200,000

- Maximum check size: $75,000,000

- Number of investments: 200

- Number of exits: 22

- Funds raised: $96,000,000

- 3 remarkable investments: Toss, Alan, Jellysmack

You can send them an email at [email protected] .

16) Backstage Capital

Backstage Capital is a VC firm focusing on diversity and inclusion by funding women, people of color and LGBT founders.

- City: Los Angeles

- Started in: 2015

- Founders: Arlan Hamilton

- Industries: AI & ML, AR & VR, Enterprise, Consumer, Crypto & Blockchain, E-Commerce, Education, Fintech, Food & Beverage, Future of Work, Government Technology, Hardware, Healthcare, IoT, Marketplace, Media, Proptech & Real Estate, SaaS, Social, Travel & Hospitality, Automative, Sports, Human Resources

- Number of exits: 3

- 3 remarkable investments: Sēkr, Mahmee, Civic Eagle

17) Kaszek Ventures

Kaszek is a tech venture capital backing Latin American entrepreneurs.

- Country: Argentina, Mexico, Uruguay, Brazil

- City: Buenos Aires, Mexico City, Montevideo, São Paulo

- Founders: Hernan Kazah, Nicolas Szekasy

- Industries: Biotech, Media, DTC, E-Commerce, Marketplace, Fintech, Healthcare, Travel & Hospitality, InsurTech, Supply Chain & Logistics, Proptech & Real Estate, SaaS, Enterprise, Transportation, Food & Beverage, Advertising

- Stages: Seed, Series A, Series B, Series C

- Maximum check size: $5,000,000

- Number of investments: 195

- Number of exits: 21

- Funds raised: $2,000,000,000

- 3 remarkable investments: Urbvan, Technisys, Pedidosya

You can send them an email at [email protected] .

18) Kalaari Capital

Founded in 2006, Kalaari Capital is an early-stage tech VC firm in India.

- Country: India

- City: Bangalore

- Founders: Vani Kola, Rajesh Raju

- Industries: Climate & Sustainability, Consumer, Creator Economy, Crypto & Blockchain, E-Commerce, Education, Fintech, Food & Beverage, Transportation, Healthcare, Social, Travel & Hospitality, Deep Tech & Hard Science, SaaS, Supply Chain & Logistics, Sports

- Stages: Seed, Series A

- Number of investments: 194

- Number of exits: 45

- Funds raised: $600,000,000

- 3 remarkable investments: Creative Galileo, Phable, Zocket

You can contact them at +91 80-6715-9600.

Strive partners with seed to series B founders across Japan, Southeast Asia and India.

- Country: Japan, Singapore

- City: Tokyo, Singapore

- Founders: Yusuke Amano

- Industries: Transportation, Travel & Hospitality, Marketplace

- Stages: Seed, Early Stage, Series A, Series B

- Number of investments: 177

- Number of exits: 44

- Funds raised: $3,800,000

- 3 remarkable investments: Grab, Galapagos, Qoala

20) Gradient Ventures

Gradient Ventures is an early-stage pre-seed to series A tech-focused venture capital firm based in California.

- City: Santa Clara

- Founders: Anna Patterson

- Industries: AI & ML, Education, Fintech, Supply Chain & Logistics, Travel & Hospitality, Consumer, InsurTech, Healthcare, Life Sciences, Productivity, Enterprise, Crypto & Blockchain, Cybersecurity

- Stages: Seed, Early Stage, Series A, Pre-Seed

- Number of investments: 163

- Number of exits: 23

- Funds raised: $6,300,000

- 3 remarkable investments: Shypyard, Mentum, Norby

90% of startups fail. Learn how to not to with our weekly guides and stories. Join 40,000+ founders.

21) Earlybird Venture Capital

Earlybird is a multistage venture capital investing in European companies.

- City: Berlin, Munich

- Started in: 1997

- Founders: Benjamin Wilkening, Cem Sertoglu, Christian Nagel, Hendrik Brandis, Roland Manger, Rolf Mathies

- Industries: Biotech, Crypto & Blockchain, Cybersecurity, E-Commerce, Education, Enterprise, Productivity, Fintech, Gaming, IoT, Healthcare, Supply Chain & Logistics, AI & ML, Marketplace, Media, Proptech & Real Estate, Travel & Hospitality, DTC, Robotics, Transportation, Legal, SaaS

- Minimum check size: €200,000

- Maximum check size: €15,000,000

- Number of investments: 158

- Number of exits: 42

- Funds raised: €2,000,000,000

- 3 remarkable investments: Aiven, Lexoo, N26

You can send them an email at [email protected] .

22) Chicago Ventures

Launched in 2012, Chicago Ventures is an early-stage capital investing in overlooked founding teams.

- City: Chicago

- Founders: Stuart Larkins

- Industries: Consumer, Education, Enterprise, Entertainment, Gaming, Healthcare, Travel & Hospitality, Supply Chain & Logistics, Media, Proptech & Real Estate, Robotics, Automation, Productivity, Government Technology, InsurTech, Creator Economy, Manufacturing, Legal, Agriculture, Fintech

- Minimum check size: $1,500,000

- Maximum check size: $2,000,000

- Number of investments: 156

- Number of exits: 47

- Funds raised: $1,500,000,000

- 3 remarkable investments: Olive, NOCD, OneRail

You can send them an email at [email protected] .

23) Blume Ventures

Blume Ventures is a seed-stage venture capital firm investing in Indian tech companies.

- City: Mumbai

- Founders: Karthik Reddy, Rob Blum, Sanjay Nath

- Industries: Biotech, E-Commerce, Deep Tech & Hard Science, Education, Fintech, Future of Work, Gaming, Healthcare, Media, Supply Chain & Logistics, Proptech & Real Estate, SaaS, Travel & Hospitality, Climate & Sustainability, Agriculture

- Stages: Early Stage, Pre-Seed, Seed, Series A

- Number of investments: 154

- Number of exits: 24

- Funds raised: $280,000,000

- 3 remarkable investments: Grey Orange, Servify, Cashify

You can send them an email at [email protected] .

24) The Venture City

The Venture City is a female-founded VC firm investing in early-stage startups across America and Europe.

- Country: USA, Spain

- City: Miami, Madrid

- Founders: Laura González-Estéfani

- Industries: Fintech, Advertising, Media, Marketing, SaaS, Mobility, Marketplace, Sports, Travel & Hospitality, Cybersecurity, Health & Wellness, Proptech & Real Estate, E-Commerce, Supply Chain & Logistics, Productivity, Gaming

- Maximum check size: $4,000,000

- Number of investments: 123

- Number of exits: 11

- Funds raised: $125,000,000

- 3 remarkable investments: Bfore.Ai, Delitbee, Sturdy Exchange

You can send them an email at [email protected] .

25) Founders Factory

Founders Factory is an early-stage investor and accelerator program supporting global entrepreneurs.

- Founders: Brent Hoberman, George Northcott, Henry Lane Fox, Jim Meyerle, Julia Brucher

- Industries: Fintech, Education, Travel & Hospitality, AI & ML, Media, DTC, Healthcare, Climate & Sustainability, Crypto & Blockchain

- Maximum check size: £250,000

- Number of investments: 117

- Number of exits: 12

- Funds raised: £13,600,000

- 3 remarkable investments: Solivus, Karmacist, Wiseworks

You can send them an email at [email protected] .

26) Naspers

Naspers is a global corporate venture fund investing in internet businesses across the Americas, Africa, Europe, and Asia.

- Country: South Africa

- City: Cape Town

- Started in: 1915

- Founders: Attorney W. A. Hofmeyr

- Industries: Supply Chain & Logistics, Fintech, Travel & Hospitality, Education, Healthcare, Social, Internet & Mobile

- Stages: Early Stage, Late Stage

- Number of investments: 113

- 3 remarkable investments: Avito, Brainly, BYJU'S

You can send them an email at [email protected] .

27) Playfair Capital

Playfair Capital is a London seed-stage investor since 2013.

- Started in: 2013

- Founders: Chris Smith

- Industries: Advertising, Big Data & Analytics, AI & ML, Automation, E-Commerce, Energy, Fintech, Gaming, Healthcare, IoT, Supply Chain & Logistics, Marketplace, Internet & Mobile, Proptech & Real Estate, SaaS, Social, Travel & Hospitality

- Minimum check size: £100,000

- Number of investments: 111

- Number of exits: 29

- Funds raised: £32,000,000

- 3 remarkable investments: Omnipresent, Orca AI, Ravelin

You can send them an email at [email protected] .

28) LVenture Group

LVenture Group is a corporate venture capital firm providing accelerators and funds for pre-seed and seed-stage startups.

- Country: Italy

- Founders: Luigi Capello

- Industries: Big Data & Analytics, Education, Developer Tools, Entertainment, Travel & Hospitality, IoT, Fintech, Food & Beverage, Healthcare

- Stages: Early Stage

- Maximum check size: €250,000

- Number of investments: 91

- 3 remarkable investments: GenomeUp, Tutored, GoPillar

You can send them an email at [email protected] .

29) Expara Ventures

Expara is a Singaporean venture capital firm investing in SouthEast Asian startups since 2007.

- Country: Thailand, Vietnam

- City: Bangkok, Ho Chi Minh City

- Started in: 2003

- Founders: Douglas Abrams

- Industries: Food & Beverage, IoT, E-Commerce, Healthcare, Travel & Hospitality, Social, Marketplace, Government Technology, Cloud, Proptech & Real Estate, Fintech, AI & ML, Health & Wellness, Gaming, Climate & Sustainability, Education, Hardware, Biotech, API, SaaS, Media, Agriculture, Drones

- Number of investments: 77

- Number of exits: 9

- 3 remarkable investments: Gheorg, Systemstone, Compliy

You can send them an email at [email protected] .

P101 SGR is an Italian Venture capital firm investing in European digital and tech companies since 2013.

- City: Milan

- Founders: Andrea Di Camillo

- Industries: Cybersecurity, E-Commerce, Education, Fintech, Food & Beverage, Healthcare, Supply Chain & Logistics, Internet & Mobile, Transportation, Proptech & Real Estate, Travel & Hospitality, SaaS

- Maximum check size: €5,000,000

- Number of investments: 75

- Number of exits: 20

- Funds raised: €209,200,000

- 3 remarkable investments: Cortilia, Milkman, MusixMatch

You can send them an email at [email protected] .

Lemnos is a pre-seed and seed investor providing capital to hardware startups.

- City: San Francisco

- Founders: Helen Zelman Boniske, Jeremy Conrad

- Industries: Transportation, Travel & Hospitality, AI & ML, Automation, Hardware, Aerospace & Space, Supply Chain & Logistics, Food & Beverage, Robotics, Manufacturing, Energy, Construction, Agriculture

- Stages: Pre-Seed, Seed, Early Stage

- Minimum check size: $250,000

- Maximum check size: $500,000

- Number of investments: 73

- Number of exits: 25

- Funds raised: $71,900,000

- 3 remarkable investments: Quartz, Pico MES, Lumeo

You can send them an email at [email protected] .

32) Geodesic Capital

Founded in Silicon Valley, Geodesic Capital is a growth-stage VC firm backing founders looking to expand into the Asian market.

- Country: USA, Japan

- City: Minato, San Mateo

- Founders: John Roos, Ashvin Bachireddy

- Industries: Big Data & Analytics, AI & ML, Travel & Hospitality, Media, Marketplace, Cybersecurity, InsurTech, SaaS

- Stages: Late Stage, Growth

- Number of investments: 67

- Number of exits: 13

- Funds raised: $335,000,000

- 3 remarkable investments: Snapchat, Uber, Airbnb

You can send them an email at [email protected] .

33) 4Founders Capital

4Founders typically co-invest with angel investors and other VC firms to fund early-stage European tech companies.

- Country: Spain

- City: Barcelona

- Founders: Javier Perez-Tenessa

- Industries: Fintech, SaaS, Travel & Hospitality, Crypto & Blockchain, Gaming, Education, Climate & Sustainability, Entertainment, Marketplace

- Minimum check size: €100,000

- Maximum check size: €4,000,000

- Number of investments: 65

- Funds raised: €62,000,000

- 3 remarkable investments: StockAgile, Improfit, Banktrack

You can send them an email at [email protected] .

Kibo Ventures is a Spanish venture capital firm financing tech startups in Europe.

- Country: Spain, Portugal

- City: Madrid, Lisbon, Barcelona

- Founders: Aquilino Peña, Javier Torremocha, José María Amusátegui

- Industries: Social, API, Fintech, Travel & Hospitality, Transportation, SaaS, Cloud, AI & ML, Big Data & Analytics, E-Commerce, Consumer, Enterprise, Proptech & Real Estate, Marketplace

- Minimum check size: €2,000,000

- Number of investments: 63

- Funds raised: €1,500,000,000

- 3 remarkable investments: Trip4real, Jetlore, Captio

You can send them an email at [email protected] .

35) Bonsai Venture Capital

Bonsai Venture Capital has been investing in early-stage companies since 1999.

- Country: Turkey, Belgium, Spain, Saudi Arabia, Colombia

- City: Riyadh, Brussels, Madrid, Istanbul, Bogotá, Medellín

- Founders: Alfonso De León

- Industries: Gaming, Fintech, Healthcare, Cybersecurity, Travel & Hospitality

- Stages: Early Stage, Growth

- Minimum check size: €250,000

- Maximum check size: €2,500,000

- Number of exits: 38

- Funds raised: €3,500,000

- 3 remarkable investments: Frenetic, Signaturit, Miss Tipsi

36) Chile Global Ventures

ChileGlobal Ventures has been investing in entrepreneurs making an impact in Chile and around the world since 1982.

- Country: Chile

- City: Santiago

- Started in: 2008

- Founders: Felipe Matta Navarro

- Industries: Entertainment, Education, Fintech, Food & Beverage, Supply Chain & Logistics, Proptech & Real Estate, Robotics, Climate & Sustainability, Travel & Hospitality, Agriculture, SaaS, Healthcare

- Maximum check size: $1,500,000

- Number of investments: 60

- Number of exits: 17

- Funds raised: $120,000,000

- 3 remarkable investments: BePretty, Cleevy, Izit

You can send them an email at [email protected] .

37) Reinventure Group Venture Capital Firm

Reinventure partners with Westpac Banking Corporation to fund fintech companies targeting the Asia-Pacific region.

- Country: Australia

- City: Sydney

- Started in: 2014

- Founders: Danny Gilligan, Simon Cant

- Industries: AI & ML, Proptech & Real Estate, Crypto & Blockchain, Education, Gaming, Enterprise, Travel & Hospitality, Social, Cybersecurity, Big Data & Analytics

- Number of investments: 58

- Funds raised: $137,300,000

- 3 remarkable investments: Coinbase, SocietyOne, Hmlet

You can send them an email at [email protected] .

38) Icebreaker

Icebreaker Ventures is an early-stage venture capital firm investing in Estonia, Finland and Sweden.

- Country: Estonia, Finland, Sweden

- City: Helsinki, Tallinn, Stockholm

- Started in: 2016

- Founders: Lasse Lehtinen

- Industries: Cybersecurity, IoT, Travel & Hospitality, Advertising, AI & ML, Big Data & Analytics, Proptech & Real Estate, AR & VR, Automation, Developer Tools, Media, Entertainment, Automative, Energy, Human Resources, Legal, SaaS, Hardware, E-Commerce, Education

- Stages: Pre-Seed, Early Stage

- Minimum check size: €150,000

- Maximum check size: €800,000

- Number of investments: 54

- Funds raised: €126,000,000

- 3 remarkable investments: HoxHunt, Logmore, Flowhaven

You can send them an email at [email protected] .

39) Venture Friends

Venture friends is a seed and series A venture capital firm backing founders in Europe, MENA and Latam.

- Country: Greece

- City: Athens

- Founders: Apostolos Apostolakis, George Dimopoulos

- Industries: Proptech & Real Estate, Fintech, Travel & Hospitality, Marketplace, SaaS, Other

- Number of investments: 50

- 3 remarkable investments: Blueground, Belvo, Plum

You can send them an email at [email protected] .

40) Practica Capital

Practica backs Baltic entrepreneurs primarily in the seed stage.

- Country: Lithuania

- City: Vilnius

- Founders: Silvestras Tamutis

- Industries: Fintech, Supply Chain & Logistics, Travel & Hospitality, Healthcare, Proptech & Real Estate, Robotics, SaaS, InsurTech, Education, E-Commerce, AI & ML, Aerospace & Space, Agriculture, Advertising

- Stages: Seed, Series A, Growth

- Maximum check size: €2,000,000

- Number of investments: 45

- Number of exits: 10

- Funds raised: €46,000,000

- 3 remarkable investments: Eneba, Billo, TransferGo

You can send them an email at [email protected] .

41) Skalata Ventures

Skalata Ventures provides capital, education and network access to Australian founders.

- City: Melbourne

- Started in: 2018

- Founders: Rohan Workman

- Industries: AR & VR, Productivity, Education, Entertainment, Fintech, Health & Wellness, Travel & Hospitality, Supply Chain & Logistics, Marketplace, Proptech & Real Estate, SaaS, Crypto & Blockchain, E-Commerce, Agriculture

- Stages: Early Stage, Seed

- Maximum check size: $200,000

- Number of exits: 0

- Funds raised: $50,000,000

- 3 remarkable investments: Strength by Numbers, Tablogs, ParentalEQ

You can send them an email at [email protected] .

42) Great North Venture

Great North Ventures is an early-stage venture capital investing in tech founders across US and Canada.

- City: St. Cloud

- Founders: Rob Weber, Ryan Weber

- Industries: Enterprise, Consumer, Proptech & Real Estate, Healthcare, Life Sciences, Transportation, Education, E-Commerce, Supply Chain & Logistics, Travel & Hospitality, Fintech

- Stages: Seed, Series A, Early Stage

- Minimum check size: $10,000

- Number of investments: 44

- Number of exits: 8

- Funds raised: $40,000,000

- 3 remarkable investments: Iralogix, Branch, TeamGenius

43) Stride VC

Stride.VC is a London-based VC firm that prefers to invest in British and French startups.

- Founders: Fred Destin

- Industries: SaaS, Marketplace, Enterprise, Travel & Hospitality, Productivity, Media

- Stages: Seed, Pre-Seed

- Minimum check size: £250,000

- Maximum check size: £2,000,000

- Number of exits: 1

- Funds raised: £100,000,000

- 3 remarkable investments: Accountable, Linktree, Kolleno

44) Axivate Capital

Axivate Capital is an investment firm backing Dutch and European founders building companies in the fields of digital media, e-commerce, the Internet and leisure.

- Country: Netherlands

- City: Amsterdam

- Founders: Bas Rasker

- Industries: Media, E-Commerce, Travel & Hospitality, Internet & Mobile

- Stages: Seed, Early Stage

- Number of investments: 41

- 3 remarkable investments: Jmango360, Neurocast, Dealconomy

You can send them an email at [email protected] .

45) Byfounders

Based in Denmark, byFounders is a community-focused early-stage venture capital investing in Nordic entrepreneurs.

- Country: Denmark

- City: Copenhagen

- Founders: Tommy Andersen, Eric Lagier

- Industries: Crypto & Blockchain, Healthcare, Food & Beverage, InsurTech, Gaming, Proptech & Real Estate, IoT, Climate & Sustainability, Fintech, Travel & Hospitality, SaaS, Legal, Marketing

- Minimum check size: €500,000

- Number of investments: 40

- Funds raised: €100,000,000

- 3 remarkable investments: Vibrant, Qvin, Smitten

You can send them an email at [email protected] .

46) Cradle Fund

Cradle provides early-stage funding and programmes to support founders building businesses.

- Country: Malaysia

- City: Kuala Lumpur

- Founders: Norman Matthieu Vanhaecke, Juliana Jan, Ahmad Kashfi, Eliza Elias, Harmender Singh

- Industries: Fintech, IoT, Internet & Mobile, Supply Chain & Logistics, Media, Automation, Cybersecurity, Travel & Hospitality, Future of Work, SaaS

- Minimum check size: RM 100,000

- Maximum check size: RM 1,000,000

- Number of investments: 36

- Number of exits: 2

- 3 remarkable investments: Kumoten, Pandai, Cidekick

You can send them an email at [email protected] .

47) NEXEA Venture Capital

Nexea Angels is a venture capital and startup accelerator backing Southeast Asian entrepreneurs.

- Founders: Ben Lim, Noomi Fessler

- Industries: Travel & Hospitality, Marketplace, E-Commerce, Education, Big Data & Analytics, IoT, Fintech, SaaS

- Minimum check size: RM 50,000

- Number of investments: 35

- 3 remarkable investments: Hauz, Plush Services, Lokein

You can send them an email at [email protected] .

48) Assurance Mezzanine Fund

Assurance Mezzanine is an American investment firm providing funding to late-stage private and public companies in the US.

- City: Orlando

- Founders: Alex Brown, Anthony Yanni, David Ellis, Jeffrey Phillips, Robert Whittel, Seth Ellis

- Industries: Healthcare, E-Commerce, Government Technology, Travel & Hospitality, Construction

- Minimum check size: $3,000,000

- Maximum check size: $20,000,000

- Number of investments: 31

- 3 remarkable investments: Contractor Connect, Visual Connections, Pawz.Com

You can send them an email at [email protected] .

49) Volta Ventures

Volta Ventures is a seed investor for SaaS in the Benelux region.

- Country: Netherlands, Belgium

- City: Amsterdam, Gent

- Founders: Frank Maene, Sander Vonk

- Industries: Deep Tech & Hard Science, Fintech, Devops, Healthcare, Proptech & Real Estate, Gaming, Cybersecurity, Travel & Hospitality, Hardware & Industrials, SaaS

- Number of investments: 30

- 3 remarkable investments: Cashforce, TerminusDB, Sentiance

You can send them an email at [email protected] .

50) Fitz Gate Ventures

Fitz Gate Ventures is a Texas-based venture capital firm investing in early-stage startups.

- City: Houston

- Founders: Jim Cohen, Mark Poag

- Industries: SaaS, E-Commerce, AI & ML, Media, Travel & Hospitality

- Number of investments: 29

- Funds raised: $25,000,000

- 3 remarkable investments: Realworld, Cartful Solutions, Blockapps

You can send them an email at [email protected] .

51) Nation 1 VC

Based in Prague, Nation 1 VC is an accelerator program, pre-seed and seed investor.

- Country: Czechia

- City: Prague

- Started in: 2019

- Founders: Marek Moravec, Martin Bodocky, Petra Koncelikova

- Industries: Healthcare, Travel & Hospitality, SaaS, Hardware, AR & VR, DTC, Enterprise, Supply Chain & Logistics, Cloud

- Maximum check size: €1,500,000

- Number of investments: 22

- Funds raised: €35,000,000

- 3 remarkable investments: Vrgineers, Daytrip, Mindpax,

You can send them an email at [email protected] .

52) Oasis Capital

Oasis capital is an investment firm financing African companies since 2009.

- Country: Ghana

- City: Abidjan, Accra

- Started in: 2009

- Founders: Matthew Boadu Adjei Adjei

- Industries: Education, Travel & Hospitality, Proptech & Real Estate, Food & Beverage, Healthcare

- Number of investments: 19

- 3 remarkable investments: Axis Pensions Group

You can send them an email at [email protected] .

53) Acronym VC

Acronym VC provides late seed and series A to New York founders with at least $1M ARR.

- City: Palm Beach Gardens, New York

- Founders: Joshua B. Siegel, Mat Kaliski

- Industries: SaaS, Travel & Hospitality, DTC, Productivity, Enterprise, Fintech, Proptech & Real Estate, Food & Beverage

- Stages: Series A

- Number of investments: 15

54) Battle Born Venture

Battle Born Venture is a government-backed venture capital fund to invest in Nevadan enterprises.

- City: Las Vegas, Reno

- Founders: Erik Lee

- Industries: Healthcare, Government Technology, Travel & Hospitality, Gaming, Climate & Sustainability, Supply Chain & Logistics, Energy, Manufacturing

- Stages: Early Stage, Pre-Seed, Seed, Late Stage, Growth

- Minimum check size: $40,000

- Number of investments: 14

- Number of exits: 5

- Funds raised: $5,000,000

- 3 remarkable investments: Semi Exact, Circlein, BaseVenture

You can send them an email at [email protected] .

55) ESP Capital

ESP Capital is a sector-agnostic venture capital firm investing in SouthEast Asian startups.

- Country: Vietnam, USA, Singapore

- City: Ho Chi Minh City, Dover, Singapore

- Founders: Nam Nguyen

- Industries: Proptech & Real Estate, Healthcare, Education, DTC, Transportation, Travel & Hospitality, Entertainment

- Funds raised: $1,500,000

- 3 remarkable investments: TaleCity, WeFit, Cooky

You can send them an email at [email protected] .

56) GE Ventures

GE Ventures is a German-focused venture capital firm investing in technology start-ups.

- Country: Liechtenstein, United Arab Emirates

- City: Dubai, Fürstentum

- Started in: 2020

- Founders: Dominik A. Lener, Shailesh Nair

- Industries: E-Commerce, Fintech, Food & Beverage, Crypto & Blockchain, Proptech & Real Estate, Enterprise, DTC, SaaS, Travel & Hospitality

- Stages: Late Stage

- 3 remarkable investments: Klarna, Kraken, Incard

You can send them an email at [email protected] .

57) MGH7 Venture Capital

Founded in 2015, MGH7 Venture Capital is a seed investor for consumer-focused lifestyle businesses such as tourism, fashion, sport, food and design.

- Founders: Francesco Mantegazzini, Andrea Mantegazzini

- Industries: SaaS, Media, Travel & Hospitality, Food & Beverage, Consumer, Entertainment

- Number of investments: 10

- 3 remarkable investments: The Gira, WeShort, Qurami

You can send them an email at [email protected] .

Exor is a corporate venture capital firm investing in early-stage private and public companies.

- City: New York

- Founders: Diego Piacentini

- Industries: AI & ML, Education, Travel & Hospitality, SaaS, Fintech, DTC

- Minimum check size: $150,000

- Number of investments: 9

- 3 remarkable investments: Futura, Nova, Nebuly

59) Tera Capital

Tera Capital is a Singaporean investment firm funding real estate and tech companies since 2003.

- Country: Singapore, China, Peru

- City: Beijing, Shanghai, Singapore, Lima

- Founders: Ted Fang

- Industries: Proptech & Real Estate, Media, Government Technology, E-Commerce, Travel & Hospitality

- Stages: Other

- Number of investments: 1

You can send them an email at [email protected] .

90% of startups fail. Learn how not to with our weekly guides and stories. Join +40,000 other startup founders!

An all-in-one newsletter for startup founders, ruled by one philosophy: there's more to learn from failures than from successes.

100+ resources you need for building a successful startup, divided into 4 categories: Fundraising, People, Product, and Growth.

Stay up to date with our weekly newsletter

16 Best Venture Capital Investors in Travel Tech (in 2024)

The Travel Tech sector in Europe is seeing true innovation. At the heart of this story are investors who recognize the transformative power of the industry and are keen to champion the companies working on problems worth solving.

This list is the result of tracking investment activity across +2,500 venture capital investors in Europe, and only includes funds that have invested in at least 5 Travel Tech startups in the past 12 months. If you're a startup in th space, an investor diversifying into new sectors, or someone keen on tracking the pulse of industry-specific investments, this list is a must-see.

Last update to the database: April 9, 2024. See changelog .

List of 16 top VCs in Travel Tech

Heartcore is a venture capital firm that invests in founders building category-defining consumer internet brands.

Copenhagen (HQ), Berlin, Paris, Stockholm, Lisbon

Seed, Series A, Series B, Series C, Series D, Series E, Series F, Pre Seed

$300k - $6M

Ecommerce, Manufacturing, Proptech & Real Estate and 34 more.

K Fund is a venture capital fund backing founders across Southern Europe and Latin America, from Seed to Series B.

Madrid (HQ)

Seed, Series A, Series B, Series C, Pre Seed

$100k - $10M

Fintech, Mobile, Business Intelligence and 35 more.

Kima Ventures investes $150k in 100 new deals per year.

$0k - $150k

Fintech, Ecommerce, Mobile and 61 more.

Speedinvest is a venture capital fund investing in Pre Seed, seed, and early-stage tech startups.

Vienna (HQ), Berlin, London, Munich, Paris

Seed, Series A, Series B, Series C, Pre Seed, Angel

$700k - $3M

Fintech, Mobile, AI and 57 more.

Notion is an early-stage venture fund that focuses on technology and cloud computing markets.

London (HQ)

Seed, Series A, Series B, Series C, Series D, Pre Seed

Fintech, Data and Analytics, Business Intelligence and 41 more.

Bonsai Partners is a technology venture capital firm investing in both primary and secondary opportunities in tech startups from Europe

Ecommerce, Fintech, Travel Tech and 24 more.

Battery Ventures is a global technology-focused investment firm.

Seed, Series A, Series B, Series D

Travel Tech, Service Industry, Business Intelligence and 4 more.

Coparion provides venture capital to accelerate momentum and growth.

Cologne (HQ), Berlin

Seed, Series A, Series B, Series C, Series D, Series E, Pre Seed

$500k - $8M

Manufacturing, Ecommerce, Health Tech and 36 more.

Y Combinator is a startup accelerator that invests in a wide range of startups twice a year.

Mountain View (HQ)

Seed, Series A, Series B, Series C, Series F, Pre Seed

$500k - $375k

Data and Analytics, Business Intelligence, Fintech and 66 more.

HV Capital is a venture capital firm that supports founders in developing their internet companies.

Munich (HQ), Berlin

$500k - $100M

Fintech, Ecommerce, Mobile and 52 more.

Kinnevik is an entrepreneurial investment group focused on building digital consumer businesses.

Stockholm (HQ)

Series A, Series B, Series C, Series D, Series E

Foodtech, Ecommerce, Mobile and 23 more.

Series A, Series B, Series C, Series D, Pre Seed

Travel Tech, Community & Lifestyle, Ecommerce and 7 more.

DN Capital operates as an early-stage venture capital firm.

Menlo Park (HQ), London, Berlin

Ecommerce, Proptech & Real Estate, Fintech and 40 more.

Bstartup is designed to support entrepreneurs so their projects can be developed with maximum guarantees of success.

Sant Cugat Del Vallès (HQ)

Seed, Series A, Series B, Series C, Pre Seed, Debt Financing

Ecommerce, Travel Tech, Health Tech and 29 more.

Atlantic Labs is an early-stage venture capital investment firm that is based in Berlin, Germany.

Berlin (HQ)

Mobile, Health Tech, Fintech and 53 more.

Seed, Series A, Series B, Pre Seed

Manufacturing, Climate Tech & Green Tech, Hardware and 51 more.

The curated list of the most valuable private companies in the world | Learn More

Travel Demand Is Up, But What About VC Funding To The Sector?

Jan Seale and Cobai Kastan started their travel planning company Out of Office in March 2020—right when the pandemic hit and international borders closed down.

While travel companies, along with businesses in the live events and fitness industries, bore the brunt of the COVID-19 pandemic lockdowns, Out of Office, which helps users source travel recommendations from friends, pushed through. It launched its app in August 2021 and most recently raised a $3.5 million seed round of funding in April.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

“If you fast-forward to today, you’re seeing people are traveling more than ever despite the economic conditions looming,” Seale said.

Seale is correct. For the first time since the COVID-19 pandemic began more than two years ago, travel spending surpassed 2019 levels in April 2022, according to a report released earlier this month by the U.S. Travel Association .

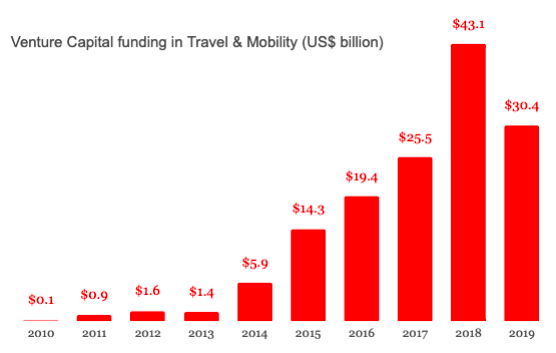

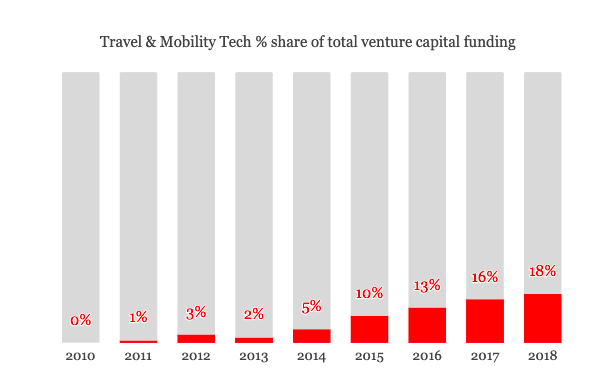

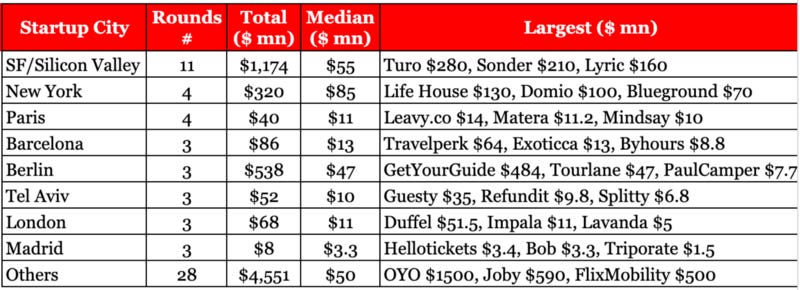

But that doesn’t necessarily mean venture investment in travel companies is keeping up, especially with as investor fears about a recession rise. Funding to VC-backed companies in the travel and tourism industry group is at around $3.2 billion globally so far this year, according to Crunchbase data.

This is slightly behind where it was at the same time last year when investment into the travel sector rebounded to pre-pandemic levels. In 2021, VC-backed travel and tourism companies raised $10.7 billion. That was close to where funding was in 2019, which saw peak funding for the sector of the past five years.

“With so much pent-up demand for travel during the pandemic, the travel sector was really recovering quickly and growing, and yet people are trying to do things a little differently as a result of the pandemic,” said Steve Taub of Jetblue Technology Ventures of investment in 2021.

Jetblue Technology Ventures invests in early-stage companies innovating in the travel and hospitality space.

“It was sort of a reset,” Taub said.

Looking back

Last year laid the foundation for the travel industry’s recovery. The widespread rollout of the COVID-19 vaccines helped restore a sense of normalcy to the world, and travel restrictions eased up.

Simultaneously, VC funding to the sector picked up, and companies in the space made big moves of their own. Airbnb and Vacasa , for example, both went public last year, along with aviation companies Frontier Airlines and Sun Country Airlines.

But volatility in the public markets have caused investors to pause. VC funding as a whole is down, and travel is no exception.

So far in 2022, about a third of the companies in the travel and tourism sector that have raised funding were seed-stage companies. This includes Localeur , Out of Office and Showplace . Several are in the travel planning space, while others are in the hospitality or aviation tech space.

What’s next

It’s too early to say if funding to the travel sector as a whole will pick up. It’s somewhat dependent on the macroeconomic environment. Many VCs are waiting to see what happens in the broader market.

Especially with a recession looming, travel in general is expected to come down following this year’s “supercycle,” according to Hopper CEO Frederic Lalonde . In terms of funding, “I don’t think, travel or not, there’s a founder that can raise on an up round right now,” he said

But according to Samantha Patil, founder of Los Angeles-based travel planning startup Well Traveled, even a recession doesn’t mean that people will stop traveling altogether.

“I think as long as people can remember the point of time in their life that they couldn’t travel, which wasn’t that long ago, they’ll want to travel,” Patil said.

That might mean more local trips rather than a multicountry tour of Europe, she said

Seale of Out of Office, expressed a similar sentiment, pointing to the increased flexibility many people have with work-from-home policies.

“People have had more flexibility than they’ve ever had before, so regardless, people will get out,” Seale said.

Crunchbase Queries Used In This Article:

- Funding to VC-Backed Travel and Tourism Companies

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

You may also like

The Week’s 10 Biggest Funding Rounds: Xaira And Other AI Startups Have Huge Week

After a slowdown in big rounds last week, investors were back at it again dishing out nine-figure rounds. This week’s theme was definitely AI.

The Crunchbase Tech Layoffs Tracker

More than 191,000 workers at U.S.-based tech companies were laid off in mass job cuts in 2023, per a Crunchbase News tally, and the cuts have...

New Funds Target Out-Of-Favor Startup Sectors

Startups in sectors that saw steep funding declines may be getting fresh attention from investors, courtesy of new industry-focused funds that closed...

A Wake-Up Call For Sustainable AI Data Centers

AI’s voracious appetite for power is driving an unprecedented demand for electricity, but is there enough to power the growing number of AI-focused...

How A Product Video Can Increase Your Chances Of Raising Pre-Seed Investment

How To Scale Your Startup Sustainably Rather Than Chase Growth At All Costs

![travel tech vcs Illustration of pandemic pet pampering. [Dom Guzman]](https://news.crunchbase.com/wp-content/uploads/2021/03/Pets-2-300x168.jpg)

Old Dogs Can Inspire New Business Models

5 Interesting Startup Deals You May Have Missed In March: Robot Recyclers, Better Pregnancy And AI For Teeth

67.1k followers.

Find the right companies, identify the right contacts, and connect with decision-makers with an all-in-one prospecting solution.

Explore the world of Travel Tech

Flagship Program

.png)

Travel Startups Finder

Interested in travel startups?

Running a travel startup?

Videos & talks.

How to Work with Your VCs in a Downturn

Corporate Open Innovation - THE opportunity

Vacation Rentals - Business Development During Corona Times

Hubs & Accelerators

Browse investors

- International

Travel Sectors

- Online & Travel Tech

- Accommodation

- Distribution

- Brief & Review

- Destinations

- Business & MICE

- Transport & Mobility

- Corporate News

The most active VCs in travel tech and their investments in one infographic

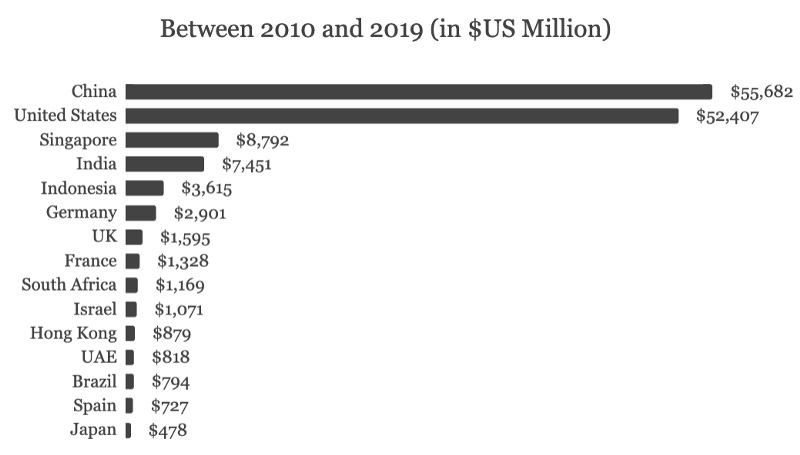

So far this year, travel tech startups have raised over USD 2.5 billion across 198 deals, and an increasing number of those deals are moving outside the United States.

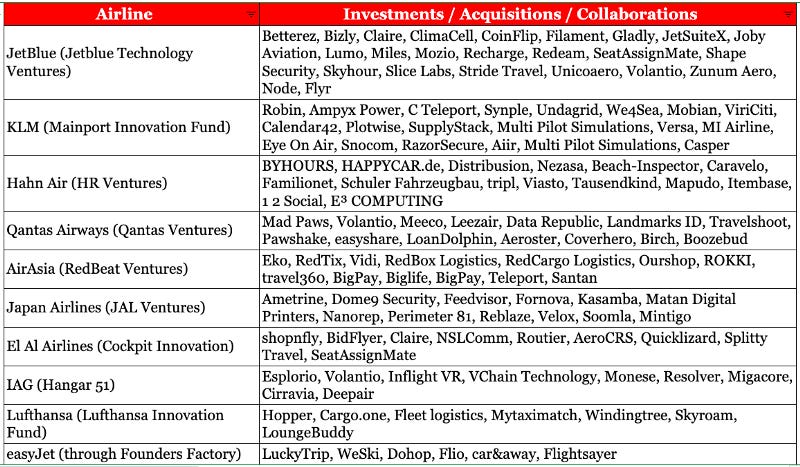

So far this year, travel tech startups have raised over USD 2.5 billion across 198 deals, and an increasing number of those deals are moving overseas. In keeping with this, we’re also seeing that top investors in travel tech are becoming a more cosmopolitan crowd. We used CB Insights data to rank VCs by their unique travel tech investments (i.e., number of portfolio companies) since 2012, and found that among the top 11 VCs in travel tech featured in our infographic, four are located outside the US, including Index Ventures (UK), Caixa Capital Risc (Spain), Blume Ventures (India), and Gobi Partners (China). The rest of the VCs on the list are all based in California. We define travel tech as tech-enabled companies offering products and services focused on tourism, including booking services, search and planning platforms, on-demand travel, and recommendation sites. Car-hailing services are excluded from this analysis. Read original article

Share this article:

Related Coverage

ChinaTravelNews is a wholly owned subsidiary of

©2022 TravelDaily China.

- Advertising & Sponsorships

- +86 20 2882 9757

- [email protected]

- +86 20 2882 9729

- [email protected]

- Hotel/Sharing Accomadation

- Travel Agency/Ticket Agent

- Destination

- Tourism Board

- Transportation

- Comprehensive Tourism & Culture Enterprise

- Digital Marketing

- Tourism Technology

- Tourism Services

- Cancel Subscribe

How duo made travel tech venture investor-ready

- Tour Operators

- Destinations

- Hotels & Resorts

- Agent Feedback

- Deals & Incentives

- On Location

- Industry Experts

- Sphere – HomeBased

- Digital Editions

- Subscribe today!

- Hotels and Resorts

- Types of Travel

- Subscribe Now

Big tech, VCs and start-ups get ready for Virtuoso’s second annual Travel Tech Summit

Post date: Aug 8 2023

Date: Aug 8 2023

By: Travelweek

NEW YORK — Virtuoso will host its second annual Travel Tech Summit during the 35th annual Virtuoso Travel Week this month.

Taking place Aug. 12 at ARIA Resort & Casino, the summit will be led by tech entrepreneur, investor and Virtuoso board member, Gilad Berenstein, with a focus on innovation in the travel industry with insight from including Microsoft, Hopper and Deloitte and more. The summit will also feature a showcase of 20 startup businesses in the travel tech space.

“Integrating the Travel Tech Summit as a recurring session at Virtuoso Travel Week supports our mission to constantly discover the newest technology solutions for our members and partners, allowing for efficiencies so that they can focus on what they do best – serving clients and creating exceptional travel experiences,” says Virtuoso Chairman and CEO, Matthew Upchurch. “Bringing together established and emerging tech companies during a larger event solely focused on furthering luxury travel provides us and our network with the invaluable opportunity to be at the forefront of innovation – something that is imprinted in Virtuoso’s DNA.”

Businesses participating in the Startup Showcase will be divided into four groups based on respective focus areas: Advisor & Agency Tech; Hotel, Cruise, Tour & Transportation Tech; Sustainability Tech; and AI & Emerging Tech.

Here’s a closer look at the participants in the Advisor & Agency Tech showcase …

- HyperGuest – HyperGuest is an end-to-end technology platform that facilitates seamless direct connectivity between hotels and travel companies.

- Tern Travel – Tern is a platform that purports to bring together everything advisors need to run their business with comprehensive technology.

- TravelWits – TravelWits built the first AI-enabled travel search engine to find door-to-door trips fully optimized around various user criteria while integrating the availability and prices of flights, hotels, car rentals and more.

- Tres Technologies – Travel advisors use the Tres software for integrations, automations and workflows aimed to achieve maximum benefits with minimal work.

- TripSuite – TripSuite is a VC-backed startup building the core operating system for travel agencies.

Tags: Lead Story, Virtuoso

Velocys Raises $40 Million for Jet Fuel Tech: Startup Funding Roundup

Justin Dawes , Skift

February 17th, 2024 at 9:00 AM EST

More renewable jet fuel companies are raising money to develop products, but a lot more money is needed to reach the industry's zero-emissions goals by 2050.

Justin Dawes

Travel Startup Funding This Week

Each week we round up travel startups that have recently received or announced funding . Please email Travel Tech Reporter Justin Dawes at [email protected] if you have funding news.

Three travel startups have announced fundraises of nearly $90 million over the last week.

>> Velocys , which develops tech to enable renewable jet fuel production, has raised $40 million from a new group of owners and investors.

The company previously traded on the London Stock Exchange but became a private company last month with funding from Carbon Direct Capital, Lightrock, GenZero, and Kibo Investments.

The England-based company said it makes reactors that clients can use to convert a number of products into jet fuel, known as sustainable aviation fuel. The company says its technology is compatible with a number of feedstocks, including municipal solid waste, woody biomass, carbon dioxide, and green hydrogen

The company last October opened a 52,500-square-foot factory in Ohio. The factory can initially produce 12 reactors per year, which the company said is the typical requirement to operate a renewable fuel facility at commercial scale. There are plans to expand capacity as demand grows.

The funding will go toward product manufacturing, scaling, hiring, and training.

Henrik Wareborn is continuing as the company’s CEO.

Bob W: $43.1 Million

Bob W , a short-term rental company, has raised $43.1 million (€40 million) in a series B funding.

Evli Growth Partnership led the round. Taavet+Sten, the investment arm of online bank Wise’s co-founders, also participated, along with Flashpoint, Supercell co-founder Mikko Kodisoja, and others.

The Denmark-based company operates properties under its own brand, which it typically secures through rental or management agreements. It has its own app for booking and guest management.

The rentals contain furniture and decor by local brands and artists, the company said. Bookings can include features like breakfasts, gym access, and local experiences.

The company said it has now secured over €70 million in funding to date.The company last raised €21 million in 2022.

Bob W has rentals in 10 countries and 17 cities in Europe.

Explurger: $4.5 Million

Explurger , a social media platform meant for travelers, has raised $4.5 million in series A funding.

Affle (India) Limited led the round in exchange for 9.03% ownership in the company, with support from a group of angel investors.

India-based Explurger said the app allows users to share photos and videos, track past travels, and make future plans.

Skift Cheat Sheet

Seed capital is money used to start a business, often led by angel investors and friends or family.

Series A financing is typically drawn from venture capitalists. The round aims to help a startup’s founders make sure that their product is something that customers truly want to buy.

Series B financing is mainly about venture capitalist firms helping a company grow faster. These fundraising rounds can assist in recruiting skilled workers and developing cost-effective marketing.

Series C financing is ordinarily about helping a company expand, such as through acquisitions. In addition to VCs, hedge funds, investment banks, and private equity firms often participate.

Series D, E, and, beyond These mainly mature businesses and the funding round may help a company prepare to go public or be acquired. A variety of types of private investors might participate.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: funding , vcroundup

Photo credit: Three travel startups raised nearly $90 million this week. Pixabay / Pixabay

VCs are obsessed with vector databases. Here are seven AI startups in the space that have raised millions from investors.

- VCs are hungry to back vector database startups and other behind-the-scenes tech that improves AI.

- Vector databases store and structure data that LLMs can then pull from.

- Business Insider has idenfied seven vector database startups that have been early winners.

Vector databases don't get as much love as their flashier counterparts, large language models (LLMs). But the startups building them are still crucial to the current AI revolution, and investors are eager to back the next big thing — to the tune of hundreds of millions of dollars.

Text, images, and videos are all examples of unstructured data. Vector databases capture and store the essence of a particular piece of data that a machine-learning program or LLM can then pull from.

Without a vector database, which can efficiently catalog vast amounts of unstructured data by their actual content, LLMs would have to rely on a human-generated tag or label when parsing through documents and data.

"You literally cannot use OpenAI on its own," explained Tim Tully, a partner at Menlo Ventures . "You have to have a vector database because something has to push context into the query to OpenAI. And where does that context come from? Always a vector database."

As AI startups continue to pique the interest of investors and command sky-high valuations , VCs are hungry to back the "picks and shovels" of AI that operate in the background but are integral to making the tech more powerful and easier for consumers to use.

Vector database startups fit squarely into that remit — and some startups in the space have already raised hundreds of millions of dollars from investors. Early leaders include Pinecone, which Tully has backed, as well as Chroma and Qdrant.

Business Insider has identified seven key players in the vector database arms race. These startups are organized by the amount of VC funding they have received.

Year founded: 2011 HQ: Mountain View, California Total VC funding: $357 million Notable investors: Bain Capital Investors, Tiger Global Management, TCV, SoftBank, Uncorrelated Ventures

Founded more than a decade ago, users can use late-stage startup Redis as a vector database to map otherwise unstructured data. The company most recently raised $110 million in Series G funding in April 2021, valuing the company at $1.89 billion, according to PitchBook.

Year founded: 2019 HQ: San Francisco Total VC funding: $138 million Notable investors: Andreessen Horowitz, Menlo Ventures, ICONIQ Growth