An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Understanding business travel deductions

More in news.

- Topics in the News

- News Releases

- Multimedia Center

- Tax Relief in Disaster Situations

- Inflation Reduction Act

- Taxpayer First Act

- Tax Scams/Consumer Alerts

- The Tax Gap

- Fact Sheets

- IRS Tax Tips

- e-News Subscriptions

- IRS Guidance

- Media Contacts

- IRS Statements and Announcements

IRS Tax Tip 2023-15, February 7, 2023

Whether someone travels for work once a year or once a month, figuring out travel expense tax write-offs might seem confusing. The IRS has information to help all business travelers properly claim these valuable deductions.

Here are some tax details all business travelers should know

Business travel deductions are available when employees must travel away from their tax home or main place of work for business reasons. A taxpayer is traveling away from home if they are away for longer than an ordinary day's work and they need to sleep to meet the demands of their work while away.

Travel expenses must be ordinary and necessary. They can't be lavish, extravagant or for personal purposes.

Employers can deduct travel expenses paid or incurred during a temporary work assignment if the assignment length does not exceed one year.

Travel expenses for conventions are deductible if attendance benefits the business. There are special rules for conventions held outside North America .

Deductible travel expenses include:

- Travel by airplane, train, bus or car between your home and your business destination.

- Fares for taxis or other types of transportation between an airport or train station and a hotel, or from a hotel to a work location.

- Shipping of baggage and sample or display material between regular and temporary work locations.

- Using a personally owned car for business.

- Lodging and meals .

- Dry cleaning and laundry.

- Business calls and communication.

- Tips paid for services related to any of these expenses.

- Other similar ordinary and necessary expenses related to the business travel.

Self-employed individuals or farmers with travel deductions

- Those who are self-employed can deduct travel expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) .

- Farmers can use Schedule F (Form 1040), Profit or Loss From Farming .

Travel deductions for the National Guard or military reserves

National Guard or military reserve servicemembers can claim a deduction for unreimbursed travel expenses paid during the performance of their duty .

Recordkeeping

Well-organized records make it easier to prepare a tax return. Keep records such as receipts, canceled checks and other documents that support a deduction.

Subscribe to IRS Tax Tips

Hiring Remote Employees: Travel Reimbursement, Home Offices, and More

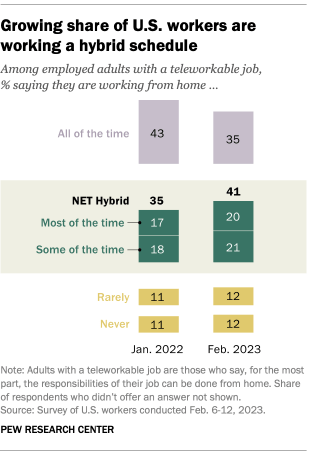

Many businesses have transformed since the COVID-19 pandemic. Organizations experiencing human resource constraints are getting more creative when it comes to retaining and recruiting employees—including a growing remote workforce. But hiring remote employees can create uncertainties for companies to navigate.

Remote Working Tax Implications

Explore these frequently asked questions related to remote working tax implications.

- What’s the definition of tax home?

- What are considerations for determining payroll reporting?

- What’s the impact of remote employees on nexus?

- Can internal revenue code (IRC) Section 139 still be used?

- What are business considerations when hiring remote employees?

- What are the options for providing home office equipment?

- How can a company reimburse home office expenses?

- How is commuting defined and applied to travel reimbursements?

- Can employees working from home write off their office spaces?

- How is the convenience of employer rule used to determine travel reimbursement?

Generally, an employee’s tax home is the regular place of business or post of duty, regardless of where they live. It includes the entire city or general area of a business or work location.

The IRS hasn’t published updated guidance following the COVID-19 pandemic. Thus, taxpayers should follow previous rules and guidance and apply them to their specific facts and circumstances.

It’s important for businesses to understand the definitions of both home and office in relation to flexible workforces for employees who can be:

- 100% remote

- Working in the field

The remote workforce ushered in by the COVID-19 pandemic seems here to stay, resulting in the need to meet new payroll reporting requirements.

If a company has remote employees in a state where it hadn’t already registered, there will be certain thresholds being met that could call for registration in states where those employees are located.

If certain thresholds are met, such as the number of days worked in-state or amount of compensation, then the company needs to register for payroll reporting with those states. Note that the company may be required to complete other registrations with the state aside from just income tax withholding.

Employers will want to remind their employees of their individual tax reporting obligations. Given that employer withholding taxes are based on employee residence, employees need to understand the individual filing requirement in their own states as opposed to where the company is located—unless there’s reason to file in the state where the company is located.

An example reason for filing in the company’s state would be if the employee visits the office location in the other state and meets the states specific thresholds for personal income tax filing requirements, among other possible personal reasons for activity in that state.

When a company has a remote employee with out-of-state payroll, that typically creates nexus in that state for the company, unless a specific exception is met. When nexus is established, also known as physical presence, a company can create additional filing requirements for themselves, in addition to having to withhold income taxes on the employee’s wages.

A company is typically recognized as doing business in a state when any remote employee located there works for the company. This employee could establish nexus, possibly creating new income, franchise, and sales and use tax obligations.

IRC Section 139 deals with disaster relief payments from the employer that are generally tax free to the recipient. The COVID-19 pandemic was declared a disaster by the federal government and the covered period for expenses to qualify started March 13, 2020.

Section 139 disaster relief payments need to be reasonable, necessary, and the result of the declared disaster. Wages aren’t considered a Section 139 payment. IRC Section 139 can still be used related to the COVID-19 pandemic if the expenses meet the definition of a qualified payment under IRC Section 139.

If an organization is interested in providing disaster relief payments and other support to employees under Section 139 for other payment related to disaster relief (COVID-19 or otherwise), the organization could implement a policy for these types of payments.

When hiring remote employees, there are several business considerations that should be thought, both internally and externally. Below is a list of items to be considered.

- Well documented working arrangements, such as through employment agreements

- Additional administrative tasks of having remote employees

- Payroll requirements and registrations with the states, such as state tax withholding and unemployment taxes

- State nexus establishment and adding new footprints in new states

Internal Revenue Code (IRC) Section 162 permits employers to reimburse employees for legitimate job-related expenses deemed ordinary and necessary, such as a computer, monitors, printer, or internet service.

An employer has many options on how to structure home office reimbursement expenses, such as a stipend or reimbursement policy. What’s important is that it be made under an accountable plan , meaning, a set of procedures that ensures that employees don't get reimbursed for personal expenses.

An employer can reimburse employees for certain home office expenses through an accountable plan. As discussed above, the main factor for reimbursement is the IRC Section 162 standard of an ordinary and necessary business expense.

According to the IRS, ordinary and necessary expenses related to the COVID-19 pandemic can include a range of expenses related to remote work, health care, and childcare, such as:

- Home office items, such as monitors, printers, phone, and office supplies

- Cost to install new or expanded internet service

- Cost of increased utilities

Would Reimbursement be Taxable or Nontaxable?

The accountable plan allows employees to receive tax-free money for expenses while the employer deducts the expense. An employer should be ready to substantiate the business connection and cost of the expense.

Transportation expenses between an employee’s home and the main place of work are considered commuting expenses.

Daily transportation expenses employees incur while traveling from home to one or more regular places of business are generally nondeductible commuting expenses, with some exceptions.

One can deduct daily transportation expenses incurred going between the residence and a temporary workstation outside the metropolitan area where they live.

Daily transportation expenses can be deducted if an employee has one or more regular work locations away from the residence or the residence is the principal place of business, and they incur expenses going between the residence and another work location in the same trade or business.

Travel expenses are the ordinary and necessary expenses for traveling away from the home for the job. Generally, a tax home refers to the entire city or general area of a main place of business or work, regardless of where a family home is.

The Tax Cuts and Jobs Act (TCJA) of 2017 eliminated the miscellaneous deduction for home office expenses for tax years 2018–2025, making employees not eligible to claim the home office expense deduction.

Convenience of employer generally means that daily transportation expenses incurred by an employee between the primary residence and employer’s office are personal expenses.

These personal expenses aren’t eligible for either a deduction by an employer under section 162(a)(2) or tax-free reimbursement to an employee—unless they’re excluded as qualified transportation fringe benefits. This rule is subject to exceptions, however.

For example, if an employee’s residence is the principal place of business, within the meaning of IRC Section 280A, then the transportation costs between the home office and employer’s office may be deductible by the employer and eligible for tax-free reimbursement to the employee.

We’re Here to Help

For guidance on the tax implications of a remote workforce, contact your Moss Adams professional. You can also visit our Tax Services page for additional resources.

Assurance, tax, and consulting offered through Moss Adams LLP. ISO/IEC 27001 services offered through Cadence Assurance LLC, a Moss Adams company. Wealth management offered through Moss Adams Wealth Advisors LLC. Services from India provided by Moss Adams (India) LLP.

Related Topics

Contact us with questions.

Still need to file? – An expert can help or do taxes for you with 100% accuracy. Get started

- Tax Deductions and Credits

Your Top Tax Questions About Working Remotely, Answered

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to print (Opens in new window)

- Written by TurboTaxLisa

- Published Feb 26, 2024

Let’s take taxes off your mind

We’re ready to help you get your taxes done right,

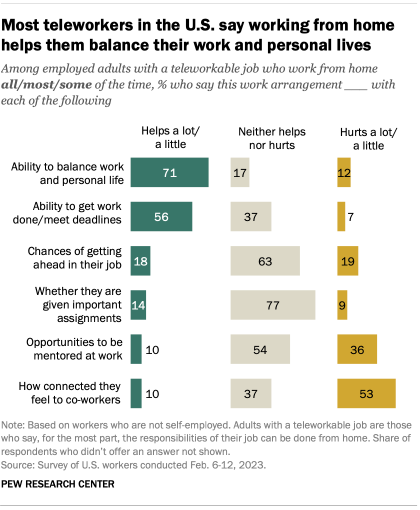

No matter your career, recent years have changed all of our working routines in one way or another. Whether it means wearing a mask to work every day, staying home and working from your kitchen table, or working hybrid – work life definitely feels and looks different than it used to – especially before 2020.

If you’re one of the many who have been working from home, you may be wondering, “Can I deduct my work from home expenses?”

Answers To Tax Questions About Remote Work

TurboTax has you covered and is here to answer the most common remote-working questions we’re seeing, including what type of remote work qualifies for tax deductions and what work-related items you may be able to deduct.

If I’m an employee and my job is fully remote and I have working from home, can I deduct my work-from-home expenses?

Although there has been an increase in employees working at home since coronavirus, under tax reform, employees can no longer take federal tax deductions for unreimbursed employee expenses like work-from-home expenses.

In general, only self-employed individuals can take deductions for expenses related to working from home. *Reservists, performing artists, and fee based government officials may be able to deduct certain unreimbursed business expenses.

If I can’t deduct work-from-home expenses as an employee, is there anything I can do to offset some of my out of pocket expenses related to work?

Although you can’t take federal tax deductions for work-from-home expenses, if you are an employee, some states have enacted their own laws requiring employers to reimburse employees for necessary business expenses or allowing them to deduct unreimbursed employee expenses on their state tax returns.

You can check with your individual state departments of revenue. TurboTax is also up to date with individual state laws, so you don’t need to know if your state allows unreimbursed employee deductions.

If my employer has an accountable plan, can I be reimbursed for business expenses?

Yes, an accountable plan is a plan set up by employers to reimburse employees for business-related expenses. As long as the plan follows IRS regulations, employees can be reimbursed for necessary business expenses.

I’m self-employed, what work-from-home expenses can I take?

Self-employed business owners can deduct up to $1,160,000 (for tax year 2023) for qualified business equipment like computers, printers, and office furniture. The amount you can deduct is still limited to the amount of income from business activity. You can also deduct supplies that you buy like paper, printer ink, or supplies for your customers, and you can take the home office deduction .

What is the home office deduction and how does it work?

The home office deduction may be one of the biggest work-from-home expenses a self-employed person can take since you can take a deduction that is a portion of your home mortgage interest or rent, property taxes, homeowners insurance, utilities, and depreciation based on the square footage of space used directly and exclusively for your business.

There is also a simplified method that is up to $1,500 (up to 300 square feet x $5 per square foot) that gives you a flat deduction without taking into account individual home expenses. The simplified method allows for less record keeping, however the original home office deduction can give you a bigger deduction.

For instance, if your home office takes up the maximum 300 square feet of your home, the maximum you can deduct is $1,500 under the simplified home office deduction, but if you use up to 300 square feet of your 2,000 square foot home and your home expenses are $40,000 your deduction will be $6,000 (300/2000 sq ft x 40,000).

If I’m self-employed but don’t have an office in my home and instead work from my kitchen table, can I take the home office deduction?

No, you must have a dedicated space where you conduct your business. You can’t claim the home office deduction for conducting business in the same space your family eats and your kids do their homework. Your home office must be: your principal place of business; a place where you meet patients, clients, or customers in the normal course of business; a separate structure not attached to the dwelling and used in connection with the business.

What if I’m a teacher and have been required to work from home? Can I deduct work from home expenses?

You may have been working from home toward the end of last school year and part of this school year. If you’re a teacher, keep in mind that although you can’t deduct work-from-home expenses like the home office deduction, you can take the Teachers Educator Deduction worth up to $250 for supplies you buy directly related to teaching. If you and your spouse are both teachers, that can be up to a $500 tax deduction.

No matter what moves you made last year, TurboTax will make them count on your taxes. Whether you want to do your taxes yourself or have a TurboTax expert file for you, we’ll make sure you get every dollar you deserve and your biggest possible refund – guaranteed.

Previous Post

Can I Take a Tax Deduction for a Bad Investment?

What is a Refundable Tax Credit?

Written by Lisa Greene-Lewis

Lisa has over 20 years of experience in tax preparation. Her success is attributed to being able to interpret tax laws and help clients better understand them. She has held positions as a public auditor, controller, and operations manager. Lisa has appeared on the Steve Harvey Show, the Ellen Show, and major news broadcast to break down tax laws and help taxpayers understand what tax laws mean to them. For Lisa, getting timely and accurate information out to taxpayers to help them keep more of their money is paramount. More from Lisa Greene-Lewis

Leave a Reply Cancel reply

Browse related articles.

Unknown Tax Deductions for Bloggers

7 Crazy Things People Have Deducted

You Can Deduct That? 6 Surprising Tax Deduction Tips fo…

5 Tax Deductions and Credits for Working Moms

Is a Dog Your Tax Refund’s Best Friend?

Top Job Seeker Tax Deductions

8 Tax Breaks and Tips for the Working Mom

- Tax Planning

Tax Tips for Retirees

Tax Considerations for Cancer Patients

TurboTax AnswerXchange Question of the Month: Standard…

- How work from home tax deductions work

- Who is eligible for work from home deductions?

- How to claim work from home deductions

- How to calculate work from home tax deductions

WFH tax deductions explained: who qualifies and how to claim them

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate tax products to write unbiased product reviews.

- Work from home tax deductions allow self-employed people to reduce their taxable income.

- W2 employees generally can not take work from home deductions.

- Freelancers and gig workers generally qualify as having business income and are thus eligible for work from home deductions.

- See Personal Finance Insider's picks for the best tax software .

Work from home (WFH) tax deductions are business expenses that you can subtracted from revenue to lower your tax bill. But these deductions almost exclusively apply to those who own their own businesses or have some sort of self-employment income, such as freelancers and gig workers. Regular W2 employees generally can't take these deductions, even if you switched from working in an office to working from home.

Perhaps the most prominent WFH tax deduction is the home office deduction, which allows you to reduce your taxable income based on the expense of maintaining a home office. But there can also be other deductions that apply to running a business out of your home or being an independent worker who incurs some relevant business expenses, ranging from computer equipment to retirement contributions.

How work from home tax deductions work

WFH tax deductions work by allowing those with self-employment income to offset some of their business income with relevant expenses, which are considered to be "ordinary and necessary" for their work.

According to the IRS , "an ordinary expense is one that is common and accepted in your industry. A necessary expense is one that is helpful and appropriate for your trade or business. An expense does not have to be indispensable to be considered necessary."

For example, if a freelancer takes in $50,000 in a given year based on what they bill clients, but then they also have $10,000 in expenses like advertising, home office supplies, and the business use of a car, then they would only be taxed on $40,000 (aside from any other types of income, deductions or credits).

For simplicity's sake, suppose this person paid taxes at a 20% rate (actual amounts would likely differ). Instead of paying 20% of $50,000, which would be $10,000, the freelancer would pay 20% of $40,000, which equals $8,000. So, those $10,000 in WFH expenses reduce the total tax bill by $2,000 in this scenario.

Who is eligible for work from home deductions?

Because of the Tax Cuts and Jobs Act (TCJA), which came into effect during the 2018 tax year, employees are generally not eligible to take WFH deductions, even if they have significant expenses that their employers won't reimburse.

There are a few exceptions, such as for " eligible educators ," who can deduct as much as $250 in unreimbursed expenses. Otherwise, you must own your own businesses or have some sort of self-employment income such as from freelance work in order to qualify for WFH tax deductions.

"Miscellaneous itemized deductions prior to 2018 used to be claimed on Schedule A, but since the Tax Cuts and Jobs Act, those deductions really went away. So for W2 employees, it's really difficult to be able to take any kind of [work-related] deduction at all," explains Mark Witte, CPA and managing director at UHY Advisors . Previously, employees could deduct itemized expenses that totaled more than 2% of their adjusted gross income. However, the TCJA is only set to run through 2025 , so it's possible that old rules will come back into play. Some states did not follow the TCJA and still allow for taxpayers to itemize their deductions, including unreimbursed employee expenses, subject to limitations.

"Potentially, once that expires, W2 employees could take deductions again. I haven't seen anything on the horizon to speed up that deadline," adds Witte.

- Tell TurboTax about your life and it will guide you step by step. Jumpstart your taxes with last year’s info.

$69 federal fee, plus $64 per state

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good for those with a complex tax situation that may need help navigating deductions and forms

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers step-by-step guidance

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Ability to upgrade for instant access to an expert

- con icon Two crossed lines that form an 'X'. No brick-and-mortar locations to meet with a tax pro

- Snap a photo of your W-2 or 1099-NEC and TurboTax will put your info in the right places.

- CompleteCheck™ scans your return so you can be confident it’s 100% accurate.

- You won’t pay for TurboTax until it’s time to file and you’re fully satisfied.

- TurboTax is committed to getting you your maximum refund, guaranteed.

How to claim work from home deductions

Claiming WFH deductions doesn't have to be complicated, especially if you use tax software or have a tax professional's help. Even if you were to file taxes manually, those with self-employment income who file Schedule C can fill in line items for different categories of expenses, such as advertising and business insurance. Use Form 8829 to calculate the allowable expenses for business use of your home.

The main thing to remember is whether an expense is ordinary and necessary for your business. Building a gym within your home office because you want to work out during the day probably wouldn't be something you could claim as it's not an ordinary and necessary expense for, say, a real estate agent or IT consultant. But buying a printer for your home office to use for work could be something that's justifiable.

Taxpayers should keep records "of any kind of potential expenses that are deemed reasonable and necessary for them to operate their business and generate their revenue," says Witte. "If they deal with a financial professional or a tax preparer, they can certainly bounce ideas off of them. They could keep a simple Excel spreadsheet, listing down all the money they spend that they think relates to the business, and then with the CPA they can hash out what qualifies, or if something has some personal use to it, then maybe they can take a piece of that expense."

How to calculate work from home tax deductions

Calculating WFH deductions can differ a bit depending on what expenses you want to deduct. One of the more prominent ones, the home office deduction, allows renters and homeowners who regularly and exclusively use part of their home as their principal place of business to reduce their taxable income based on this expense. If you used that portion of your home during just part of the year, you can only deduct expenses incurred during that time.

To calculate the home office deduction, you can use one of the following options:

- Simplified option : Since tax year 2013, under the simplified option for calculating the home office deduction, you can deduct $5 per square foot used for your business, up to 300 square feet. For example, a 200-square-foot home office could potentially equal a $1,000 deduction. Other expenses related to your home, such as mortgage interest, could then be claimed in full under Schedule A, which is used for itemized deductions.

Using the regular method can also have further tax consequences down the line if you own your home and later sell it or dispose of the property. If you sell or dispose of the property at a profit, you will have to recapture the depreciation previously allowed or allowable for the portion of the home used in a qualified business, and may pay up to 25% rate in capital gains.

Other types of expenses, such as home office supplies, can be more straightforward, especially if they're exclusively for business. In these cases, you can often fully deduct the cost of the item. For example, if you spend $100 to make business cards for yourself, you can generally deduct that $100 in full.

Regardless of the method used, you may not take a home office deduction in excess of the gross income from business use of the home minus business expenses. Excess amounts may be carried forward under the regular method, and are not allowed to be carried forward under the simplified method.

- Main content

Home Office Tax Deduction: Work-from-Home Write-Offs for 2023

Can you claim the home office tax deduction this year?

- Newsletter sign up Newsletter

Like millions of people in the U.S., you may be fortunate to work from home. ( Data show that the number of people working from home nearly tripled over the past few years). That may make you wonder whether you can claim a home office tax deduction on your federal income tax return. After all, you likely have some unreimbursed expenses. For example, you might pay for printer paper, ink, and other office supplies. Plus, your electric and utility bills are likely higher since you're home during the day.

But the reality is not every taxpayer can claim the home office deduction. Here's what you should know about the home office tax deduction before you file your 2023 tax return.

Home office tax deduction: Who qualifies?

Some people who work from home can deduct their business-related expenses, and there is also something called the "home office tax deduction" that lets you write off expenses for the business use of your home. However, whether you can claim those tax breaks depends on your employment status.

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Employees miss out. If you're a regular employee working from home, you can't deduct any of your related expenses on your tax return.

In the past, you could claim an itemized deduction for unreimbursed business expenses, including expenses for the business use of part of your home if they exceeded 2% of your adjusted gross income. However, that deduction was temporarily suspended. It's scheduled to go back into effect in 2026.

Home office tax deduction for self-employed people

Self-employed people can generally deduct office expenses on Schedule C (Form 1040) whether or not they work from home. This write-off covers office supplies, postage, computers, printers, and all the other ordinary and necessary things you need to run a home office.

The home office tax deduction is an often overlooked tax break for the self-employed that covers expenses for the business use of your home, including mortgage interest, rent, insurance, utilities, repairs, and depreciation.

It doesn't matter what type of home you have (e.g., single family, townhouse, apartment, condo, mobile home, or boat.) You can also claim the home office tax deduction if you worked in an outbuilding on your property, such as an unattached garage, studio, barn, or greenhouse.

Note: You cannot claim the home office tax deduction for any part of your home or property used exclusively as a hotel, motel, inn, or the like.

Claiming the home office tax deduction might lower your tax bill , but to qualify, you must use part of your home "regularly and exclusively" as your principal place of business. If you only work from home for part of the year, you can only claim the deduction for the period that you can satisfy the "regularly and exclusively" requirements.

"Regular use" means you use a specific area of your home (e.g., a room or other separately identifiable space) for business regularly. Incidental or occasional use of the space for business doesn't count.

"Exclusive use" means you use a specific area of your home only for your trade or business. The space doesn't have to be marked off by a permanent partition. You can't claim the home office deduction if you use the space for business and personal purposes. However, the exclusive use requirement might not apply if you use part of your home:

- For the storage of inventory or product samples; or

- As a daycare facility.

The space must also be used:

- As your principal place of business for your trade or business;

- To meet or deal with your patients, clients, or customers in the normal course of your trade or business; or

- In connection with your trade or business if it's a separate structure that's not attached to your home.

(See IRS Publication 587 for more information about these and other requirements for the home office deduction.)

How to calculate the home office deduction

If you qualify, there are two ways to calculate the home office deduction.

- Under the actual expense" method , you essentially multiply the expenses of operating your home by the percentage of your home devoted to business use. If you work from home for part of the year, only include expenses incurred during that time.

- Under the simplified method , you deduct $5 for every square foot of space in your home used for a qualified business purpose. Again, you can only claim the deduction for the time you work from home.

For example, if you have a 300-square-foot home office (the maximum size allowed for this method), and you work from home for three months (25% of the year), your deduction is $375 ((300 x $5) x 0.25).

Tax Tip: If you use the simplified method, you can't depreciate the part of your home used for business. However, to the extent you qualify, you can still claim itemized deductions for mortgage interest, real property taxes, and casualty losses for your home without allocating them between personal and business use.

The deduction is claimed on Line 30 of Schedule C (Form 1040) . If you use your home for more than one business, file a separate Schedule C for each business. Don't combine your deductions for each business on a single Schedule C.

If you use the actual expense method to calculate the tax break, also complete Form 8829 and file it with the rest of your tax return. If you use more than one home for business, you can file a Form 8829 for each home or use the simplified method for one home and Form 8829 for others. Combine all amounts calculated using the simplified method and amounts calculated using Form 8829, and then enter the total on Line 30 of the Schedule C you file for the business.

Employees with a side business

If you're an employee at a "regular" job, but you also have your own side hustle, you can claim deductions for business expenses and the home office deduction for your own business — if you meet all the requirements. Being an employee doesn't mean you can't also claim the deductions you're entitled to as a self-employed person.

Related Content

- Educator Expenses Tax Deduction

- 7 Overlooked Tax Deductions and Credits for the Self-Employed

- 2023-2024 Federal Tax Brackets and Income Tax Rates

To continue reading this article please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

Rocky Mengle was a Senior Tax Editor for Kiplinger from October 2018 to January 2023 with more than 20 years of experience covering federal and state tax developments. Before coming to Kiplinger, Rocky worked for Wolters Kluwer Tax & Accounting, and Kleinrock Publishing, where he provided breaking news and guidance for CPAs, tax attorneys, and other tax professionals. He has also been quoted as an expert by USA Today , Forbes , U.S. News & World Report , Reuters , Accounting Today , and other media outlets. Rocky holds a law degree from the University of Connecticut and a B.A. in History from Salisbury University.

- Katelyn Washington Tax Writer

What is DeFi, and how can it help financial services?

By Zain Jaffer Published 25 April 24

Here’s how to use your home equity in combination with an annuity contract to produce late-in-life income.

By Jerry Golden, Investment Adviser Representative Published 25 April 24

Tax Cuts Georgians now have a tax package containing income tax cuts, childcare relief, and potential property tax caps.

By Kelley R. Taylor Last updated 23 April 24

EV Credits Claiming federal electric vehicle tax credits at the point of sale is a new and popular option in 2024.

By Kelley R. Taylor Last updated 20 April 24

Fraud A new report sheds light on how older adult scam victims end up with big tax bills and lost retirement savings.

By Kelley R. Taylor Last updated 18 April 24

Tax Filing Tax Day means some people need to mail their federal income tax returns.

By Kelley R. Taylor Published 15 April 24

Tax Schemes The IRS says high-income filers are targets for several illegal tax schemes.

By Katelyn Washington Last updated 14 April 24

Tax Filing There are plenty of reasons not to mail your tax return this year, but here’s what you should know if you are.

By Katelyn Washington Last updated 15 April 24

Tax Breaks Lowering your taxable income is the key to paying less to the IRS. Several federal tax credits and deductions can help.

By Kelley R. Taylor Last updated 9 April 24

Scams Tax season is a time to look out for email and text message scams.

By Kelley R. Taylor Last updated 3 April 24

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise with us

Kiplinger is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future US, Inc. Full 7th Floor, 130 West 42nd Street, New York, NY 10036.

Everything You Need to Know About the Business Travel Tax Deduction

.jpeg)

Justin is an IRS Enrolled Agent, allowing him to represent taxpayers before the IRS. He loves helping freelancers and small business owners save on taxes. He is also an attorney and works part-time with the Keeper Tax team.

You don’t have to fly first class and stay at a fancy hotel to claim travel expense tax deductions. Conferences, worksite visits, and even a change of scenery can (sometimes) qualify as business travel.

What counts as business travel?

The IRS does have a few simple guidelines for determining what counts as business travel. Your trip has to be:

- Mostly business

- An “ordinary and necessary” expense

- Someplace far away from your “tax home”

What counts as "mostly business"?

The IRS will measure your time away in days. If you spend more days doing business activities than not, your trip is considered "mostly business". Your travel days are counted as work days.

Special rules for traveling abroad

If you are traveling abroad for business purposes, you trip counts as " entirely for business " as long as you spend less than 25% of your time on personal activities (like vacationing). Your travel days count as work days.

So say you you head off to Zurich for nine days. You've got a seven-day run of conference talks, client meetings, and the travel it takes to get you there. You then tack on two days skiing on the nearby slopes.

Good news: Your trip still counts as "entirely for business." That's because two out of nine days is less than 25%.

What is an “ordinary and necessary” expense?

“Ordinary and necessary” means that the trip:

- Makes sense given your industry, and

- Was taken for the purpose of carrying out business activities

If you have a choice between two conferences — one in your hometown, and one in London — the British one wouldn’t be an ordinary and necessary expense.

What is your tax home?

A taxpayer can deduct travel expenses anytime you are traveling away from home but depending on where you work the IRS definition of “home” can get complicated.

Your tax home is often — but not always — where you live with your family (what the IRS calls your "family home"). When it comes to defining it, there are two factors to consider:

- What's your main place of business, and

- How large is your tax home

What's your main place of business?

If your main place of business is somewhere other than your family home, your tax home will be the former — where you work, not where your family lives.

For example, say you:

- Live with your family in Chicago, but

- Work in Milwaukee during the week (where you stay in hotels and eat in restaurants)

Then your tax home is Milwaukee. That's your main place of business, even if you travel back to your family home every weekend.

How large is your tax home?

In most cases, your tax home is the entire city or general area where your main place of business is located.

The “entire city” is easy to define but “general area” gets a bit tricker. For example, if you live in a rural area, then your general area may span several counties during a regular work week.

Rules for business travel

Want to check if your trip is tax-deductible? Make sure it follows these rules set by the IRS.

1. Your trip should take you away from your home base

A good rule of thumb is 100 miles. That’s about a two hour drive, or any kind of plane ride. To be able to claim all the possible travel deductions, your trip should require you to sleep somewhere that isn’t your home.

2. You should be working regular hours

In general, that means eight hours a day of work-related activity.

It’s fine to take personal time in the evenings, and you can still take weekends off. But you can’t take a half-hour call from Disneyland and call it a business trip.

Here's an example. Let’s say you’re a real estate agent living in Chicago. You travel to an industry conference in Las Vegas. You go to the conference during the day, go out in the evenings, and then stay the weekend. That’s a business trip!

3. The trip should last less than a year

Once you’ve been somewhere for over a year, you’re essentially living there. However, traveling for six months at a time is fine!

For example, say you’re a freelancer on Upwork, living in Seattle. You go down to stay with your sister in San Diego for the winter to expand your client network, and you work regular hours while you’re there. That counts as business travel.

What about digital nomads?

With the rise of remote-first workplaces, many freelancers choose to take their work with them as they travel the globe. There are a couple of requirements these expats have to meet if they want to write off travel costs.

Requirement #1: A tax home

Digital nomads have to be able to claim a particular foreign city as a tax home if they want to write off any travel expenses. You don't have to be there all the time — but it should be your professional home base when you're abroad.

For example, say you've rent a room or a studio apartment in Prague for the year. You regularly call clients and finish projects from there. You still travel a lot, for both work and play. But Prague is your tax home, so you can write off travel expenses.

Requirement #2: Some work-related reason for traveling

As long as you've got a tax home and some work-related reason for traveling, these excursion count as business trips. Plausible reasons include meeting with local clients, or attending a local conference and then extending your stay.

However, if you’re a freelance software developer working from Thailand because you like the weather, that unfortunately doesn't count as business travel.

The travel expenses you can write off

As a rule of thumb, all travel-related expenses on a business trip are tax-deductible. You can also claim meals while traveling, but be careful with entertainment expenses (like going out for drinks!).

Here are some common travel-related write-offs you can take.

🛫 All transportation

Any transportation costs are a travel tax deduction. This includes traveling by airplane, train, bus, or car. Baggage fees are deductible, and so are Uber rides to and from the airport.

Just remember: if a client is comping your airfare, or if you booked your ticket with frequent flier miles, then it isn't deductible since your cost was $0.

If you rent a car to go on a business trip, that rental is tax-deductible. If you drive your own vehicle, you can either take actual costs or use the standard mileage deduction. There's more info on that in our guide to deducting car expenses .

Hotels, motels, Airbnb stays, sublets on Craigslist, even reimbursing a friend for crashing on their couch: all of these are tax-deductible lodging expenses.

🥡 Meals while traveling

If your trip has you staying overnight — or even crashing somewhere for a few hours before you can head back — you can write off food expenses. Grabbing a burger alone or a coffee at your airport terminal counts! Even groceries and takeout are tax-deductible.

One important thing to keep in mind: You can usually deduct 50% of your meal costs. For 2021 and 2022, meals you get at restaurants are 100% tax-deductible. Go to the grocery store, though, and you’re limited to the usual 50%.

{upsell_block}

🌐 Wi-Fi and communications

Wi-Fi — on a plane or at your hotel — is completely deductible when you’re traveling for work. This also goes for other communication expenses, like hotspots and international calls.

If you need to ship things as part of your trip — think conference booth materials or extra clothes — those expenses are also tax-deductible.

👔 Dry cleaning

Need to look your best on the trip? You can write off related expenses, like laundry charges.

{write_off_block}

Travel expenses you can't deduct

Some travel costs may seem like no-brainers, but they're not actually tax-deductible. Here are a couple of common ones to watch our for.

The cost of bringing your child or spouse

If you bring your child or spouse on a business trip, your travel expense deductions get a little trickier. In general, the cost of bring other people on a business trip is considered personal expense — which means it's not deductible.

You can only deduct travel expenses if your child or spouse:

- Is an employee,

- Has a bona fide business purpose for traveling with you, and

- Would otherwise be allowed to deduct the travel expense on their own

Some hotel bill charges

Staying in a hotel may be required for travel purposes. That's why the room charge and taxes are deductible.

Some additional charges, though, won't qualify. Here are some examples of fees that aren't tax-deductible:

- Gym or fitness center fees

- Movie rental fees

- Game rental fees

{email_capture}

Where to claim travel expenses when filing your taxes

If you are self-employed, you will claim all your income tax deduction on the Schedule C. This is part of the Form 1040 that self-employed people complete ever year.

What happens if your business deductions are disallowed?

If the IRS challenges your business deduction and they are disallowed, there are potential penalties. This can happen if:

- The deduction was not legitimate and shouldn't have been claimed in the first place, or

- The deduction was legitimate, but you don't have the documentation to support it

When does the penalty come into play?

The 20% penalty is not automatic. It only applies if it allowed you to pay substantially less taxes than you normally would. In most cases, the IRS considers “substantially less” to mean you paid at least 10% less.

In practice, you would only reach this 10% threshold if the IRS disqualified a significant number of your travel deductions.

How much is the penalty?

The penalty is normally 20% of the difference between what you should have paid and what you actually paid. You also have to make up the original difference.

In total, this means you will be paying 120% of your original tax obligation: your original obligation, plus 20% penalty.

.jpeg)

Justin W. Jones, EA, JD

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email [email protected] with your questions.

Voted best tax app for freelancers

More Articles to Read

Free Tax Tools

1099 Tax Calculator

- Quarterly Tax Calculator

How Much Should I Set Aside for 1099 Taxes?

Keeper users have found write-offs worth

- Affiliate program

- Partnership program

- Tax bill calculator

- Tax rate calculator

- Tax deduction finder

- Quarterly tax calculator

- Ask an accountant

- Terms of Service

- Privacy Policy

- Affiliate Program

- Partnership Program

- Tax Bill Calculator

- Tax Rate Calculator

- Tax Deduction Finder

- Ask an Accountant

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

Managing business travel expenses

Working from home expenses & allowance.

?)

Here at Travelperk, our workplace management team was quick to respond to the new demands of WFH. They were able to quickly recognize what we could and could not supply and set up expense processes for the cost of purchasing or transporting essentials.

What are working from home expenses?

- A reliable internet connection—either an unlimited business broadband service or a cellular backup based on a mobile router, like a Mifi dongle

- A laptop or computer,—as well as additional hardware such as a laptop riser, an external keyboard and mouse, and a second (or third) monitor

- Specialist software—you’ll need the right tools to carry out your job, in addition to communicating and collaborating with your team

- Appropriate furniture - get your desk set-up feeling comfortable with an ergonomic chair

What work from home expenses can you (or your employees) claim?

Hmrc and working from home expenses, what working from home expenses do you not have to cover, how can employees calculate working from home expenses, how can businesses track and collect working from home expenses.

At TravelPerk, we use Expensify to allow our employees to make expense claims. Working from home meant paper receipts were not an option, so it was good that we were already digital-first.

What home office equipment should you provide?

What is the nature of the work, call-heavy jobs, large files and downloads, when is it easier to provide a home office stipend and avoid expenses.

Here at TravelPerk, we made the decision to provide staff with a general working from home stipend. We felt this was more time-efficient than asking people to make individual expense claims for recurring things like additional data usage or stationary. Only expenses that exceed the stipend are processed by our Finance team.

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Travelperk Sustainability Policy

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Thoughts from TravelPerk

- Careers Hiring

- User Reviews

- Integrations

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

How to Deduct Travel Expenses (with Examples)

Reviewed by

November 3, 2022

This article is Tax Professional approved

Good news: most of the regular costs of business travel are tax deductible.

Even better news: as long as the trip is primarily for business, you can tack on a few vacation days and still deduct the trip from your taxes (in good conscience).

I am the text that will be copied.

Even though we advise against exploiting this deduction, we do want you to understand how to leverage the process to save on your taxes, and get some R&R while you’re at it.

Follow the steps in this guide to exactly what qualifies as a travel expense, and how to not cross the line.

The travel needs to qualify as a “business trip”

Unfortunately, you can’t just jump on the next plane to the Bahamas and write the trip off as one giant business expense. To write off travel expenses, the IRS requires that the primary purpose of the trip needs to be for business purposes.

Here’s how to make sure your travel qualifies as a business trip.

1. You need to leave your tax home

Your tax home is the locale where your business is based. Traveling for work isn’t technically a “business trip” until you leave your tax home for longer than a normal work day, with the intention of doing business in another location.

2. Your trip must consist “mostly” of business

The IRS measures your time away in days. For a getaway to qualify as a business trip, you need to spend the majority of your trip doing business.

For example, say you go away for a week (seven days). You spend five days meeting with clients, and a couple of days lounging on the beach. That qualifies as business trip.

But if you spend three days meeting with clients, and four days on the beach? That’s a vacation. Luckily, the days that you travel to and from your location are counted as work days.

3. The trip needs to be an “ordinary and necessary” expense

“Ordinary and necessary ” is a term used by the IRS to designate expenses that are “ordinary” for a business, given the industry it’s in, and “necessary” for the sake of carrying out business activities.

If there are two virtually identical conferences taking place—one in Honolulu, the other in your hometown—you can’t write off an all-expense-paid trip to Hawaii.

Likewise, if you need to rent a car to get around, you’ll have trouble writing off the cost of a Range Rover if a Toyota Camry will get you there just as fast.

What qualifies as “ordinary and necessary” can seem like a gray area at times, and you may be tempted to fudge it. Our advice: err on the side of caution. if the IRS chooses to investigate and discovers you’ve claimed an expense that wasn’t necessary for conducting business, you could face serious penalties .

4. You need to plan the trip in advance

You can’t show up at Universal Studios , hand out business cards to everyone you meet in line for the roller coaster, call it “networking,” and deduct the cost of the trip from your taxes. A business trip needs to be planned in advance.

Before your trip, plan where you’ll be each day, when, and outline who you’ll spend it with. Document your plans in writing before you leave. If possible, email a copy to someone so it gets a timestamp. This helps prove that there was professional intent behind your trip.

The rules are different when you travel outside the United States

Business travel rules are slightly relaxed when you travel abroad.

If you travel outside the USA for more than a week (seven consecutive days, not counting the day you depart the United States):

You must spend at least 75% of your time outside of the country conducting business for the entire getaway to qualify as a business trip.

If you travel outside the USA for more than a week, but spend less than 75% of your time doing business, you can still deduct travel costs proportional to how much time you do spend working during the trip.

For example, say you go on an eight-day international trip. If you spend at least six days conducting business, you can deduct the entire cost of the trip as a business expense—because 6 is equivalent to 75% of your time away, which, remember, is the minimum you must spend on business in order for the entire trip to qualify as a deductible business expense.

But if you only spend four days out of the eight-day trip conducting business—or just 50% of your time away—you would only be able to deduct 50% of the cost of your travel expenses, because the trip no longer qualifies as entirely for business.

List of travel expenses

Here are some examples of business travel deductions you can claim:

- Plane, train, and bus tickets between your home and your business destination

- Baggage fees

- Laundry and dry cleaning during your trip

- Rental car costs

- Hotel and Airbnb costs

- 50% of eligible business meals

- 50% of meals while traveling to and from your destination

On a business trip, you can deduct 100% of the cost of travel to your destination, whether that’s a plane, train, or bus ticket. If you rent a car to get there, and to get around, that cost is deductible, too.

The cost of your lodging is tax deductible. You can also potentially deduct the cost of lodging on the days when you’re not conducting business, but it depends on how you schedule your trip. The trick is to wedge “vacation days” in between work days.

Here’s a sample itinerary to explain how this works:

Thursday: Fly to Durham, NC. Friday: Meet with clients. Saturday: Intermediate line dancing lessons. Sunday: Advanced line dancing lessons. Monday: Meet with clients. Tuesday: Fly home.

Thursday and Tuesday are travel days (remember: travel days on business trips count as work days). And Friday and Monday, you’ll be conducting business.

It wouldn’t make sense to fly home for the weekend (your non-work days), only to fly back into Durham for your business meetings on Monday morning.

So, since you’re technically staying in Durham on Saturday and Sunday, between the days when you’ll be conducting business, the total cost of your lodging on the trip is tax deductible, even if you aren’t actually doing any work on the weekend.

It’s not your fault that your client meetings are happening in Durham—the unofficial line dancing capital of America .

Meals and entertainment during your stay

Even on a business trip, you can only deduct a portion of the meal and entertainment expenses that specifically facilitate business. So, if you’re in Louisiana closing a deal over some alligator nuggets, you can write off 50% of the bill.

Just make sure you make a note on the receipt, or in your expense-tracking app , about the nature of the meeting you conducted—who you met with, when, and what you discussed.

On the other hand, if you’re sampling the local cuisine and there’s no clear business justification for doing so, you’ll have to pay for the meal out of your own pocket.

Meals and entertainment while you travel

While you are traveling to the destination where you’re doing business, the meals you eat along the way can be deducted by 50% as business expenses.

This could be your chance to sample local delicacies and write them off on your tax return. Just make sure your tastes aren’t too extravagant. Just like any deductible business expense, the meals must remain “ordinary and necessary” for conducting business.

How Bench can help

Surprised at the kinds of expenses that are tax-deductible? Travel expenses are just one of many unexpected deductible costs that can reduce your tax bill. But with messy or incomplete financials, you can miss these tax saving expenses and end up with a bigger bill than necessary.

Enter Bench, America’s largest bookkeeping service. With a Bench subscription, your team of bookkeepers imports every transaction from your bank, credit cards, and merchant processors, accurately categorizing each and reviewing for hidden tax deductions. We provide you with complete and up-to-date bookkeeping, guaranteeing that you won’t miss a single opportunity to save.

Want to talk taxes with a professional? With a premium subscription, you get access to unlimited, on-demand consultations with our tax professionals. They can help you identify deductions, find unexpected opportunities for savings, and ensure you’re paying the smallest possible tax bill. Learn more .

Bringing friends & family on a business trip

Don’t feel like spending the vacation portion of your business trip all alone? While you can’t directly deduct the expense of bringing friends and family on business trips, some costs can be offset indirectly.

Driving to your destination

Have three or four empty seats in your car? Feel free to fill them. As long as you’re traveling for business, and renting a vehicle is a “necessary and ordinary” expense, you can still deduct your business mileage or car rental costs even when others join you for the ride.

One exception: If you incur extra mileage or “unnecessary” rental costs because you bring your family along for the ride, the expense is no longer deductible because it isn’t “necessary or ordinary.”

For example, let’s say you had to rent an extra large van to bring your children on a business trip. If you wouldn’t have needed to rent the same vehicle to travel alone, the expense of the extra large van no longer qualifies as a business deduction.

Renting a place to stay

Similar to the driving expense, you can only deduct lodging equivalent to what you would use if you were travelling alone.

However, there is some flexibility. If you pay for lodging to accommodate you and your family, you can deduct the portion of lodging costs that is equivalent to what you would pay only for yourself .

For example, let’s say a hotel room for one person costs $100, but a hotel room that can accommodate your family costs $150. You can rent the $150 option and deduct $100 of the cost as a business expense—because $100 is how much you’d be paying if you were staying there alone.

This deduction has the potential to save you a lot of money on accommodation for your family. Just make sure you hold on to receipts and records that state the prices of different rooms, in case you need to justify the expense to the IRS

Heads up. When it comes to AirBnB, the lines get blurry. It’s easy to compare the cost of a hotel room with one bed to a hotel room with two beds. But when you’re comparing significantly different lodgings, with different owners—a pool house versus a condo, for example—it becomes hard to justify deductions. Sticking to “traditional” lodging like hotels and motels may help you avoid scrutiny during an audit. And when in doubt: ask your tax advisor.

So your trip is technically a vacation? You can still claim any business-related expenses

The moment your getaway crosses the line from “business trip” to “vacation” (e.g. you spend more days toasting your buns than closing deals) you can no longer deduct business travel expenses.

Generally, a “vacation” is:

- A trip where you don’t spend the majority of your days doing business

- A business trip you can’t back up with correct documentation

However, you can still deduct regular business-related expenses if you happen to conduct business while you’re on vacay.

For example, say you visit Portland for fun, and one of your clients also lives in that city. You have a lunch meeting with your client while you’re in town. Because the lunch is business related, you can write off 50% of the cost of the meal, the same way you would any other business meal and entertainment expense . Just make sure you keep the receipt.

Meanwhile, the other “vacation” related expenses that made it possible to meet with this client in person—plane tickets to Portland, vehicle rental so you could drive around the city—cannot be deducted; the trip is still a vacation.

If your business travel is with your own vehicle

There are two ways to deduct business travel expenses when you’re using your own vehicle.

- Actual expenses method

- Standard mileage rate method

Actual expenses is where you total up the actual cost associated with using your vehicle (gas, insurance, new tires, parking fees, parking tickets while visiting a client etc.) and multiply it by the percentage of time you used it for business. If it was 50% for business during the tax year, you’d multiply your total car costs by 50%, and that’d be the amount you deduct.

Standard mileage is where you keep track of the business miles you drove during the tax year, and then you claim the standard mileage rate .

The cost of breaking the rules

Don’t bother trying to claim a business trip unless you have the paperwork to back it up. Use an app like Expensify to track business expenditure (especially when you travel for work) and master the art of small business recordkeeping .

If you claim eligible write offs and maintain proper documentation, you should have all of the records you need to justify your deductions during a tax audit.

Speaking of which, if your business is flagged to be audited, the IRS will make it a goal to notify you by mail as soon as possible after your filing. Usually, this is within two years of the date for which you’ve filed. However, the IRS reserves the right to go as far back as six years.

Tax penalties for disallowed business expense deductions

If you’re caught claiming a deduction you don’t qualify for, which helped you pay substantially less income tax than you should have, you’ll be penalized. In this case, “substantially less” means the equivalent of a difference of 10% of what you should have paid, or $5,000—whichever amount is higher.

The penalty is typically 20% of the difference between what you should have paid and what you actually paid in income tax. This is on top of making up the difference.

Ultimately, you’re paying back 120% of what you cheated off the IRS.

If you’re slightly confused at this point, don’t stress. Here’s an example to show you how this works:

Suppose you would normally pay $30,000 income tax. But because of a deduction you claimed, you only pay $29,000 income tax.

If the IRS determines that the deduction you claimed is illegitimate, you’ll have to pay the IRS $1200. That’s $1000 to make up the difference, and $200 for the penalty.

Form 8275 can help you avoid tax penalties

If you think a tax deduction may be challenged by the IRS, there’s a way you can file it while avoiding any chance of being penalized.

File Form 8275 along with your tax return. This form gives you the chance to highlight and explain the deduction in detail.

In the event you’re audited and the deduction you’ve listed on Form 8275 turns out to be illegitimate, you’ll still have to pay the difference to make up for what you should have paid in income tax—but you’ll be saved the 20% penalty.

Unfortunately, filing Form 8275 doesn’t reduce your chances of being audited.

Where to claim travel expenses

If you’re self-employed, you’ll claim travel expenses on Schedule C , which is part of Form 1040.

When it comes to taking advantage of the tax write-offs we’ve discussed in this article—or any tax write-offs, for that matter—the support of a professional bookkeeping team and a trusted CPA is essential.

Accurate financial statements will help you understand cash flow and track deductible expenses. And beyond filing your taxes, a CPA can spot deductions you may have overlooked, and represent you during a tax audit.

Learn more about how to find, hire, and work with an accountant . And when you’re ready to outsource your bookkeeping, try Bench .

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

clock This article was published more than 1 year ago

When remote workers live far away, who pays for their office visits?

Employers need to consider what’s legal, cost-effective and fair when approving expenses for office travel for remote workers.

Reader: I recently became the boss of a small business. During the coronavirus pandemic, some of our remote-working employees decided to move out of town without asking for or receiving employer approval. Who is responsible for their expenses when they come back to town for a meeting or conference — the employer or the employee?

The remote workers who have moved out of town seem to think the employer should pay for their transportation, hotels and meals when they come back to town for work. Besides being an added expense for a small business, it also seems unfair to local employees, since we don’t cover their commuting costs when they come to the office. Any thoughts on this?

The remote work revolution already is reshaping America

Karla: As the dust settles from the Great Resignation / Great Resettlement / Great Whatever-we’re-calling-it-now, remote work has enabled more workers than ever to move out of their offices — and in some cases, far away from them. Some seek more affordable and spacious housing, or to be closer to family or live in an area that suits their overall well-being.

But employees who abruptly and unilaterally change the terms of their working conditions, under the theory that it’s easier to ask forgiveness than permission, have to understand that they’re still at risk of hearing “No.” With a worker-favorable job market and employers desperate to retain talent, many workers have decided they’re willing to take that risk.

This employee-driven exodus has forced many employers to rethink their business model and how they manage their dispersed workforces. Some, including Meta/Facebook, Novartis, Dropbox and Slack, are embracing a remote-first , “work from anywhere” model for many or all employees. Others, including Apple, Amazon, Microsoft and Tesla, are choosing to limit or prohibit remote work. Between those extremes are employers like you, looking for a hybrid solution that’s legal, cost-effective and fair to both out-of-town and local workers.

First, there’s the question of what’s legal. As you note, regular commuting costs between home and work are not usually covered by employers, and that commute time is not generally considered work time. But when a worker’s home becomes their primary workplace, it can change how the law views travel between that primary workplace and other employer-owned sites.

Federal law doesn’t require employers to reimburse employees for any expense unless it reduces their pay below minimum wage. But California and other states do require reimbursement for some work-related expenses including travel. So you should start by determining whether you are legally required to cover the cost of transporting employees to your office, or have the option to refuse to do so.

Then there’s the question of cost. Covering travel costs would be an added expense. Allowing remote workers’ homes to become their primary workplaces, especially if they’ve moved to another state or country, can also mean additional tax exposure and other new expenses. But refusing to allow these changes can also cost you if those workers quit and you need to replace them.

If you decide paying for travel is the better investment, you can control those costs with a clear, consistent expense policy; limiting the frequency of required office visits; and revising your compensation structure to account for variable cost of living in different geographical areas, including pay cuts or leveling off future raises and bonuses for workers in lower-cost areas. You may even be able to lessen the financial blow if the new expenses you’re paying are tax-deductible. In any case, you should be talking to tax, legal and benefits experts to determine the most cost-effective options.

Finally, there’s the question of what’s fair. As you say, it doesn’t quite sit right that employees who made a unilateral decision to move out of commuting range should travel, sleep and eat on the company’s dime when local employees bear those costs themselves. And don’t kid yourself that the local employees won’t notice or care about that disparity.

Lawsuit alleges Booz Allen employee lost job over remote work for migraines

But as with any personal lifestyle choice that can result in workplace friction — workers with kids vs. those without, early birds vs. night owls — there are ways to balance the plates. If you’re not already doing so, you can offer local employees transit and parking perks; provide group meals at the office; and, of course, allow local workers the same kind of flexibility and autonomy over their work hours that their out-of-town colleagues enjoy. And you should design a policy laying out how your company will handle remote-work and relocation requests in the future.

There’s no guaranteed solution to make everyone happy, but if you are deliberate, consistent and transparent in your response to these changes, your company can come out stronger for it.

Reader query: Is your employer requiring employees to live within commuting distance of an office? Let me know at [email protected] .

If you work primarily from home, your trips to the office could be tax deductible

Court sides with beauty company employee who had to drive from her home office in Pickering to head office in Oakville

You can save this article by registering for free here . Or sign-in if you have an account.

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Article content

While some of us continue to work from home during COVID-19, others don’t have that flexibility and commute daily to and from the office. While in the past, many may have taken public transit to get to work, since the pandemic hit, the fear of taking mass transit has caused some daily commuters to begin driving to work, raising the question as to whether any of these commuting expenses may be tax deductible.

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O'Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world's leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

Sign In or Create an Account

Generally speaking, the Canada Revenue Agency considers the cost of driving back and forth between home and work as a personal expense. But, what if your main place of employment is actually your home office and you only occasionally visit your employer’s place of business, but don’t have a regular work spot there? That was the issue in a tax case decided last month.

If you work primarily from home, your trips to the office could be tax deductible Back to video

The general rule.

Before getting into the details of the case, let’s review the general rule surrounding the deductibility of automobile expenses by employees. If you’re an employee who uses your car for work, you may be able to deduct some of your automobile expenses on your tax return, assuming you meet certain conditions. First, you must normally be required to work away from your employer’s place of business or in different places. Second, under your contract of employment, you must be required to pay your own automobile expenses and this must be certified by your employer on a signed copy of the Canada Revenue Agency’s Form T2200, Declaration of Conditions of Employment. Finally, to claim vehicle expenses, you must not be the recipient of a “non-taxable” allowance for motor vehicle expenses.

Get the latest headlines, breaking news and columns.

- There was an error, please provide a valid email address.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

A welcome email is on its way. If you don't see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again