- Privacy Policy

Travelers Plans How to Travelers Plans in The World

Working holiday travel insurance.

Are you planning an adventure abroad? A working holiday might be just what you need to mix travel and work. But before you pack your bags, it’s important to make sure you have the right travel insurance to protect you during your trip. In this comprehensive guide, we’ll cover everything you need to know about working holiday travel insurance.

What is a Working Holiday?

A working holiday is a type of visa that allows you to travel to another country and work while you’re there. It’s a great way to experience a new culture, learn a new language, and earn some money to help fund your travels. Working holiday visas are available for citizens of certain countries and have specific requirements, such as age limits and proof of funds.

Why Do I Need Travel Insurance for a Working Holiday?

Travel insurance is essential for any trip abroad, but it’s especially important for a working holiday. When you’re working in another country, you’re exposed to a new set of risks and hazards that you might not be familiar with. Working holiday travel insurance can help protect you in case of accidents, illnesses, or other unexpected events that could disrupt your trip or your work.

What Does Working Holiday Travel Insurance Cover?

Working holiday travel insurance typically includes coverage for medical emergencies, trip cancellation or interruption, and personal liability. Depending on the policy, it may also include coverage for lost or stolen luggage, flight delays or cancellations, and emergency evacuation. It’s important to read the policy carefully to understand exactly what is covered and what is not.

How Much Does Working Holiday Travel Insurance Cost?

The cost of working holiday travel insurance depends on a variety of factors, including your age, the length of your trip, and the level of coverage you need. On average, a basic policy might cost around $50-$100 for a month-long trip, while a more comprehensive policy could cost several hundred dollars. It’s important to shop around and compare policies to find the best coverage at the best price.

What Should I Look for in a Working Holiday Travel Insurance Policy?

When you’re shopping for working holiday travel insurance, there are a few things to keep in mind. First, make sure the policy covers the activities you’ll be doing while you’re abroad. If you plan to participate in adventure sports or other activities, make sure the policy includes coverage for those activities. Second, make sure the policy includes coverage for medical emergencies and evacuation. Finally, read the policy carefully to understand any exclusions or limitations.

Where Can I Purchase Working Holiday Travel Insurance?

Working holiday travel insurance is available from a variety of insurance companies and travel agencies. You can also purchase it online from a variety of providers. When you’re shopping for insurance, make sure to compare policies and prices to find the best coverage for your needs.

What Should I Do if I Need to Use My Working Holiday Travel Insurance?

If you need to use your working holiday travel insurance, the first thing you should do is contact your insurance provider as soon as possible. They will be able to guide you through the claims process and help you get the care you need. Depending on the situation, you may need to pay for medical expenses up front and then file a claim for reimbursement later.

Working holiday travel insurance is an essential part of any working holiday abroad. It can help protect you in case of accidents, illnesses, or other unexpected events that could disrupt your trip or your work. When you’re shopping for insurance, make sure to compare policies and prices to find the best coverage for your needs. With the right insurance, you can enjoy your working holiday with peace of mind.

Red White Adventures

Best travel insurance for working holiday visa.

Over the years, we’ve been on Working Holiday Visas in 5 different countries combined: Australia, New Zealand, Denmark, the Czech Republic and Canada! So we know a thing or two about what it’s like being on those visas and what is needed.

One of the most important things you want to make sure you’ve got sorted before you embark on your working holiday visa is to have proper insurance!

Some countries straight up require that you have full insurance for the entire duration of your stay while others are a bit less strict with it.

Either way, we highly suggest you have a travel insurance that covers you (including when you work!) because, at the end of the day, it’s about your personal health and safety as well as your finances in case *knock on wood* something were to happen to you during your time abroad.

In this post, we dive into what we think is the best travel insurance for a working holiday visa – why it’s good, what’s covered, how much it costs, and much more.

Disclosure: This post contains affiliate links which means if you decide to use the links and make a valid purchase, we will receive a small commission at no additional cost to you. Thank you <3

Table of Contents

Why SafetyWing travel insurance for a working holiday

We know looking for insurance can be quite painful (mentally at least) and we’ve personally spent hours and hours researching and reading through different policies.

It really feels like a hassle to find the best-priced, most convenient, and best rated option. But it has to be done!

After travelling for the past 8 years doing working holiday visas in Australia, New Zealand, Canada, the Czech Republic, and Denmark (and now working remotely as digital nomads) we’ve done our fair share of research on travel insurance.

And what we’ve found to be the best insurance is SafetyWing .

SafetyWing is affordable, easy to get, and covers you pretty much anywhere no matter where you’re from or where you’re going!

It can all be done online and the customer service is awesome and responsive which is probably the most important thing when looking for the right company.

As with any insurance, there are a few restrictions and limitations of the insurance but before signing up for SafetyWing (their “nomad insurance”), you can send them a message in the chat to confirm that they cover exactly what you need.

They normally get back to you within a few minutes and you can ask clarifying questions if you have to!

What is the price of SafetyWing travel insurance?

One of the first things you’d probably want to know about your insurance is how much it’s going to cost, right?

Like with most insurances, the price goes up depending on your age but if you’re on a working holiday visa, you’re likely in your 20s or early 30s.

In that case, the starting cost for the insurance is $56.28 for 4 weeks . That is $2.01 a day!

If you want any additional coverage such as for extreme sports and electronic theft, there are also add ons available. But the base price is $56.28 per 4 weeks which comes out to $733.65 a year.

Please note that some countries require for you to have the insurance fully paid for the entire duration of your stay on your working holiday visa.

When Jo did hers in Canada, her insurance had to be paid for a full year and it had to be valid from before she entered the country.

If that is the same case for your visa, all you have to do is toggle on the “I want to pay up front for a trip with an end date” option when you sign up (the insurance can be cancelled and refunded at any time).

Are you eligible for travel insurance?

Let’s just keep this brief because it’s quite simple…

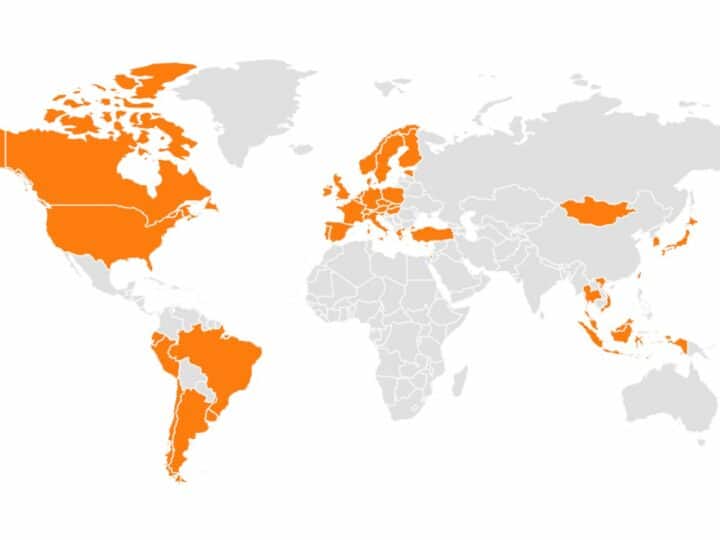

If you’re doing a working holiday visa, you will be eligible for travel insurance. SafetyWing covers every single country you can do a working holiday in so it’s that simple.

“But doesn’t the insurance depend on which country I am from?”

Yes, it does. But the only country SafetyWing doesn’t cover is if you’re from Cuba.

You can double-check your eligibility on their website. Just input the country you’re from and the country you’re going to on a working holiday visa.

Check to see if you’re eligible for SafetyWing travel insurance

Ready to purchase working holiday travel insurance?

So if you’re eligible (which you should be), if the insurance covers the country you’re going to (also should), and if you’re happy with the price, then you’re good to book the travel insurance.

If you already have your flights booked and know which day you’re starting your journey, you can select the date for when you want your insurance to start – and then set it for however long you think you will be gone for.

As we said before, make sure you check your visa requirements. A lot of working holiday visas require that you have insurance for the full duration of your visa.

If you end up going home earlier or want to extend your trip onto another visa or country, you can make adjustments as you go.

SafetyWing’s insurance is super easy to get, easy to cancel, and just way more convenient than dealing with some of these old-school travel insurances. We especially love the option to chat with them whenever we have questions!

Other questions about travel insurance for working holiday

Travel insurance is one of those things that can easily get quite overwhelming because there are so many things you need to keep track of including what is covered and then factoring into that how much it costs.

It’s something you don’t really want to deal with but have to.

We’ve listed out some of the frequent questions below and hopefully, they’ll help give you the answers you need. If not, you can always leave a comment below or DM us on Instagram @redwhiteadventures !

What is covered by the travel insurance?

Probably the most important question to ask is “What is covered by my travel insurance?”

Every insurance is going to be different so it can sometimes be a bit of a jungle to navigate (which is why the live-chat option on SafetyWing’s website is so good). SafetyWings nomad insurance provides coverage for unexpected illness or injuries, including eligible expenses for hospital, doctor or prescription drugs.

It provides this coverage for you while you’re travelling outside of your home country (perfect for a working holiday visa).

In addition, it provides emergency travel-related benefits such as evacuation from local unrest, unplanned overnight stays, and lost checked luggage.

It does not cover routine checkups and preventative care.

Also read: World Nomads vs SafetyWing: Which Nomad Health & Travel Insurances Is Best?

How long is my coverage good for?

You can sign up for automatic travel insurance extensions every 4 weeks until you cancel or for a maximum of 364 days – like a subscription.

If you’re going on a working holiday visa, make sure to check if you need to get a full year’s insurance before entering the country you’re moving to!

You may also like…

- World Nomads vs SafetyWing: Which Nomad Health & Travel Insurances Is Best?

- Bansko Nomad Fest: Celebrating the Digital Nomad Lifestyle

- What Is the Best Bank for Digital Nomads?

- 7 Epic Locations to Live in Spain as a Digital Nomad

- 8 Reasons Why You’ll Want to Be Living in Prague

Recap of finding travel insurance for working holiday

We hope this post helped answer all the questions you may have about finding the right insurance for your working holiday experience!

If you are ready to sign up for SafetyWing or want to learn more, you can click here !

And if you have more questions please comment below or send us a DM on Instagram. We know trying to find travel insurance for your working holiday is challenging, so we’re happy to try to help you out!

That’s why we created this post and why we recommend SafetyWing. It’s a simple process. You know exactly what to expect, the customer service is great, and the price is pretty affordable for what you get.

Travel insurance is one thing we wouldn’t cheap out on because the moment you need it you’ll be grateful you signed up with a good one!

We hope you have the best time on your working holiday visa whether you’re going to Canada, Australia, New Zealand, or wherever!

📍 Save this post for later & share it with a friend

You may also like...

7 Must-Have Apps for Your Trip to Madeira

18 Fun Things to Do in Golden BC in Summer

How to Visit Golden, BC in a Responsible Way

Leave a comment cancel reply.

Where do you live

All persons to be insured must reside at a permanent address within the EEC ( Excluding Switzerland, Russia, Belarus, Montenegro and the Ukraine) to be eligible for cover.

Can I take out this insurance if I am already travelling?

When cover is purchased after an Insured Person has departed their home to commence their journey, there is a fixed period of 48 hours prior to cover commencing. Any illness arising during this initial 48 hour period will be an excluded Pre-existing Medical Condition. In the event of serious injury in connection with an accident, you will be covered from the date you take out cover subject to the accident being independently witnessed and also verified by a Medical Practitioner.

There is no 14 Day Cooling off Period and no premium refund will be made if the insured Person has already travelled.

family family

Definition of a couple

A couple is defined as 2 adults who have been permanently living together at the same address for more than six months, who intend to travel together.

If you do not qualify as a couple, please select individual(s)

Annual Multi-Trip Durations

Annual Multi Trip policies are designed for multiple short holidays leaving from and returning to your home country.

Annual Multi Trip trip limits:

Standard policy - 30 days

Premier policy - 70 days

If you need continuous cover for a year (home visits allowed on policies over 4 months long) select Single Trip or One Way. You can travel around as much as you like, to as many different countries as you like, with a Single Trip or One Way policy.

One Way Trip

Please note a Single Trip policy can cover travels with no return ticket booked, a One Way policy is intended for:

Emigrating to new country where you intend to permanently live

Returning to your home country permanently

All cover ceases upon arrival at final destination

Select the type of policy most suitable for your needs.

Single Trip: A flexible policy with no limits on how many countries you visit or how long you’re away for. Suitable for all types of travel whether it be short term/long stay or backpacking. No return ticket required and unlimited home visits offered on policies over 4 months long.

One Way Trip: Means you are Emigrating to a new country where you intend to live permanently or, returning to your home country permanently. Cover will end upon arrival at your final destination. Please note: There is no cover for emergency return travel expenses if you do not have an original return ticket.

Annual Multi-Trip: This policy covers an unlimited number of trips throughout the 12 month Period of Insurance. Each trip has a maximum stay validity depending on the type of policy chosen. For example, for Standard Policies, the maximum duration of any trip shall not exceed 30 days and for Premier policies, the maximum duration of any trip must not exceed 70 days.

If you are already travelling it is not possible to purchase the annual multi-trip policy.

Geographical Areas

Europe: Europe means the continent of Europe West of the Ural Mountains, and includes the Isle of Man, the Channel Islands, Iceland, Jordan, Madeira, the Canary Islands, the Azores and Mediterranean Islands as well as all countries bordering the Mediterranean. Australia & New Zealand: a) For any period of cover purchased, a 48 hour stop-over anywhere in the World for both outward and return travel will be included. b) If the period of cover purchased is two months or more, a stop-over of 7 days/nights anywhere in the World will be included. Worldwide excluding North America & Mexico: (North America means the USA, Canada & Mexico.) a) For any period of cover purchased, a 48 hour stop-over anywhere in the World for both outward and return travel will be included. b) If the period of cover purchased is two months or more, a stop-over of 7 days/nights anywhere in the World will be included. Worldwide including North America & Mexico: Worldwide means anywhere in the World including the USA, Canada & Mexico.

Automatic Trip Extension If the Insured Person is prevented from completing their travel before the expiration of this Insurance as stated under the Period of Insurance on the Booking Invoice or Validation Certificate (as applicable) for reasons which are beyond their control, including ill health or failure of public transport, this Insurance will remain in force until completion but not exceeding a further 31 days on a day by day basis, without additional premium. In the event of an Insured Person being hijacked, cover shall continue whilst the Insured Person is subject to the control of the person(s) or their associates making the hijack during the Period of Insurance of a period not exceeding twelve months from the date of the hijack. Please ensure you arrange cover for the entire duration of your travel

Where you normally reside

Where do you normally reside? Where do you normally reside? Please use the drop down box to choose your country of residence. Note we can only insure residents of the UK & EEA Countries. Can I take out this Insurance if I’m already abroad? If you are normally a resident of the UK or EEA Countries and your insurance has run out, you may take out cover online with us. This is on the understanding that nothing has occurred at the time of taking out the cover which has led to a claim or may lead to a potential claim. Note you cannot take out our Multi-Trip Insurance if you are already abroad. Do you have minimum residency requirements? No. If you are, for example, a British Passport holder and have right of abode in the UK, we are not concerned as to how many months in the past year you have been in the UK provided at the time of arranging this insurance you have a UK residential address.

Age Restriction Error

We are unable to quote, Please ring our Offices on 0333 0033 161 for further assistance.

Get a Quote

Working While Abroad

Non manual/clerical work such as working in an office , bar/restaurant work or teaching English as a foreign language is covered automatically. If you'll be volunteering , WWOOFing or partaking in any sort of manual labour, like working on a farm or conservation work our activity pack add-on can cover you..

Ski Season / Seasonaire cover

If you’ll be working at a ski resort or travelling just to ski/snowboard for a season, our Winter Sports add-on can cover skiing/snowboarding in your leisure time. Lift operator work and or work of a manual nature is covered with our Activity Pack add-on. Non manual work like working in a chalet or restaurant is covered automatically.

Unlimited Home Visits

If your policy is over 4 months you can put your travels on hold and return home at any time should you feel the need. We are happy to offer completely unrestricted access back home even if you’re just feeling a little homesick! We have no limits, so you can come back for as long or as short as you like!

Extend Cover from Overseas

If at any point you realise you're not quite ready to return home, you can extend your insurance to include the remainder of your trip. Even if you don't have a policy with us.

Cover for 156+ Activities

Whether you'll be scuba diving, jet skiing, bungee jumping, sky diving, trekking above 2,600m or kayaking. Our Activity Packs can cover various levels of adventurous sports.

Get Cover if Already Travelling

You don't need to be in your Home Country to get cover, you can buy a policy from anywhere in the world, as long as you hold residency status in the UK or EU. Just follow the Quote form to get a price and complete your purchase.

Up to £10m Medical Cover

24 hour emergency helpline, cancellation & baggage cover, claim while you're travelling, working holiday travel insurance.

Travelling overseas means you leave the security of the NHS behind in the event of a medical emergency. Enjoy peace of mind on your working holidays abroad with travel insurance from the adventure travel experts. Whether you're headed to Canada on the IEC program to work in a ski resort, or fancy being a lifeguard in Australia, teaching English in your favourite foreign city, coaching sports, or helping to provide essential services in a developing country, we can help you make the most of your adventures overseas.

Big Cat specialises in affordable working holiday travel insurance for Working Travellers, Backpackers, Winter Sportsters, and all-round Adventurers. What’s more, we’ve tailored our policies to cover not just the essentials but also some added benefits too.

Know what activities you might do when travelling abroad

There are so many activities you can do overseas, but some of these may not automatically be covered by travel insurance.

For example, if you’re injured in a motorcycle accident or fall and break a bone while horse riding, you must have these activities covered by your insurance to be able to make a claim. If they’re not covered, you’ll have to personally pay the bill for any medical costs which can be very expensive.

Big Cat automatically covers a huge list of activities including kayaking, snorkelling, hiking and cycling.

If you want to do more adventurous activities like quad biking, trekking below 4,600 metres or walking the Inca Trail, our Activity Pack add-on will make sure that you don’t miss out.

Key Features of our Working Holiday Travel Insurance.

- 24 hour Emergency Medical Assistance

- Emergency Medical and Hospital Expenses up to £10 million.

- Emergency Evacuation and Repatriation Expenses up to £10 million.

- Personal Liability up to £2 million.

- Baggage & Personal Effects up to £2,000.

- Gadgets & valuables cover up to £1000.

- Legal Expenses up to £15,000.

- Personal Money up to £500.

- Tickets up to £1,000.

- Passport and Visa up to £300.

- Winter Sports and Ski Season Cover.

- Money-back 14-day cooling off period if you decide to cancel prior to departure.

Some FAQ's:

Riding a motorbike or scooter up to 125cc is automatically covered with all our policies. Riding a motorbike over 125cc can be covered with our Activity Pack Add-on.

If you are a pillion passenger on a motorcycle tour, such as the Ha Giang Loop, this is covered automatically and does not require any Activity Packs or any relevant licences.

When riding, you must always ensure you:

- Wear an appropriate crash helmet.

- Obey the Local road rules and laws

- Have the relevant licence(s) required to ride a motorcycle in the country or countries you will be riding in. If the country you’re in requires you to obtain a specific in-country licence to legally ride a motorcycle, then to be covered, you must obtain this licence.

- If all that’s required is an International Driving Permit (IDP), and you hold an IDP, then there’s no need to go about getting any more licences.

- Be aware that an IDP will only allow you to ride the same class of vehicle as your home licence allows. So, if you’re not licensed to ride a motorbike at home, you’re not licensed to ride a motorbike abroad under your IDP. It's up to you to make sure you are licensed for the type of motorcycle you hire.

- You should always ensure the bike is fully insured (motor insurance arranged by the company that owns the bike) as there is no Personal Lability cover whilst riding a bike. We cannot cover any participation in competitions or racing or any kind.

If you get sick while travelling or you're seriously injured you are covered for emergency medical treatment including:

- Hospitalisation

- Ambulance costs

- Surgery and follow up treatment

- Visits to the Doctor

- Repatriation

- Prescribed Medicine

- Emergency dental treatment to relieve pain and suffering (limited to £350)

24hrs Medical Emergency Assistance.

Decide Canada’s not for you, and want to return earlier than your full period of insurance?

Other insurers will tell you to wave goodbye to your money, but Big Cat lets you claim a partial premium refund for the unused time you didn’t stay in Canada.

How does the EARLY RETURN REFUND work?

Let’s say you buy a 24-month policy to cover your time in Canada. But after nine months, you decide that Canada’s not for you, and you want to return home. You may have invested a substantial amount for your 24 months Big Cat policy, most of which you’ll now no longer need. Unlike most insurers, Big Cat is happy to offer you a partial refund on the redundant portion of your insurance as a fair’s fair consolation. Please note that travel insurance premiums are not calculated on a pro-rata basis, as such, no refund is calculated in this manner either.

How does Big Cat calculate the amount of EARLY RETURN REFUND?

We take the length of time of the original policy and subtract the actual amount of time you have used, and payout the difference, deducting a £50 Cancellation Charge.

Are there other conditions that apply to my EARLY RETURN REFUND?

- Only applicable to 24 month IEC policies.

- We are not able to offer refunds to cover the first 6 months of the policy.

- No refund can be given on a policy where a claim has been made or is likely to be made prior to the cancellation of your Big Cat policy.

- You must be back in your home country and notify us by email of your wish to cancel the policy within 14 days of your arrival, please also provide us with proof of your return to the UK (flight ticket / e-ticket / boarding pass).

- All refund calculations are based on the base premium paid only. Add-ons are non-refundable.

Can you give an example of how much I could receive back in my EARLY RETURN REFUND?

Say you took out a 24-month budget IEC policy costing £525.24, then you wish to cancel the policy after 9 months. Our 9-month budget IEC policy costs £312.55. So we deduct £312.55 from £525.24 = £212.99

Then we apply the £50 Cancellation Charge, refunding you a total of £162.99.

Temporary return to home country (Single trip policies only) Where cover has been purchased for a total duration of 4 months or more, and you want to return to your home country during the period of insurance for any reason that is not directly or indirectly caused by arising or resulting from, or in connection with a claim under this insurance all cover under this policy will be suspended from the time that you clear customs in your home country and restarts after the baggage check in at the international departure point for the return flights, international train or ferry to the overseas destination. Any illness, disease, injuries, accidents which existed, showed symptoms or were diagnosed in the previous trip(s) during this period of insurance will not be covered in the restarted period of insurance.

To add any of our Activity Packs, just follow the Quote form - to stage 3 - there you will find all of the optional extras.

Means WWOOFing, fruit picking, casual farm work. Other Manual Work can be covered as long as it does not involve the use of plant/trade/industrial/agricultural machinery (other than tractors) or non-domestic power tools.

Please get in touch if you'd like to find out if we can provide cover for any light manual work you will be doing.

WWOOfing is classed as Permitted Manual Work, so with the Activity Pack, you’re covered.

(see above)

Yes, bar work or working in a chalet is automatically covered with all of our policies.

Non-manual/clerical work is covered automatically with a Big Cat policy. So, there’s nothing you need to add to be covered for things like teaching, caring or nursing.

With the Activity Pack, we can also cover work of a more manual nature. This can include things like WWOOFing, partaking in community or wildlife based conservation work, charity based supervised building / renovation projects or other permitted manual work (defined below).

Cover is excluded for any activity that involves the use of industrial machinery (other than tractors) or non-domestic power tools.

Applying for a Working Holiday Visa?

New Zealand

Big Cat Travel Insurance Services, a trading name of Flynow.com Ltd (registration No.FRN 745388) is an Appointed Representative of Campbell Irvine Ltd (registration No.306242) who are authorised and regulated by the Financial Conduct Authority. You may check this on the Financial Services register www.fca.org.uk or by contacting them on (0) 800 111 6768. © 2023 Big Cat Travel Insurance Services. All rights reserved.

A fantastic plugin that allows you to display age restriction message to the visitors while visiting site

List of automatically covered medical conditions that do not need to be declared

Acne, ADHD, Allergic reaction (Anaphylaxis) provided that you have not needed hospital treatment for this in the last 2 years, Allergic rhinitis, Arthritis (the affected person must be able to walk independently at home without using mobility aids), Asthma (the diagnosis must have been made when the affected person was under the age of 50, and the asthma be controlled by no more than 2 inhalers and no other medication), Blindness or partial sightedness, Carpal tunnel syndrome, Cataracts, Chicken pox - if completely resolved, Common cold or flu, Cuts and abrasions that are not self-inflicted and require no further treatment, Cystitis - provided there is no on-going treatment, Deafness, Diabetes (which is controlled by diet or tablets only), Diarrhoea and vomiting - if completely resolved, Eczema, Enlarged prostate - benign only, Essential tremor, Glaucoma, Gout, Haemorrhoids, Hay fever, Ligament or tendon injury - provided you are not currently being treated, Macular degeneration, Menopause, Migraine - provided there are no on-going investigations, Nasal polyps, PMT, RSI, Sinusitis - provided there is no on-going treatment, Skin or wound infections that have completely resolved with no current treatment, Tinnitus, Underactive Thyroid (Hypothyroidism), Urticaria, Varicose veins in the legs.

Important information

If you have a medical condition in addition to any of the automatically covered medical conditions, all conditions will be excluded from cover unless declared to the medical screening helpline.

What is classed as a medical condition?

a Any respiratory condition (relating to the lungs or breathing), heart condition, stroke, Crohn’s disease, epilepsy, allergy, or cancer for which you have ever received treatment (including surgery, tests or investigations by your doctor or a consultant/ specialist or prescribed medication).

b Any psychiatric or psychological condition (including anxiety, stress and depression) for which you have suffered which you have received medical advice or treatment or been prescribed medication for in the last five years.

c Any medical condition for which you have received surgery, in-patient treatment or investigations in a hospital or clinic within the last 12 months, or for which you are prescribed medication.

Any premium for medical screening quoted can be paid directly. This can be done either before or after taking out a policy with us. The policy and medical extension connect automatically, no reference numbers need to be exchanged.

Choosing not to declare a medical condition will not invalidate cover, but any costs incurred in relation to an undeclared condition will not be covered.

If making a declaration all medical conditions must be declared, you can't choose to only declare certain conditions.

Medical conditions can only be declared for up to 12 months at a time. A second declaration will have to be made after 12 months if necessary.

You are about to leave the site, this text will be refined later.

Choosing Travel Insurance for Your Working Holiday

Along with filing taxes , buying travel insurance is likely to be the least exciting part of your working holiday. It is, however, a pretty important part.

Injury and illness can happen wherever you are in the world, but medical care usually isn’t free.

This post will help you choose the best working holiday travel insurance for you, with advice and tips gained from our own experiences living and working in four different countries.

There are affiliate links in the text ahead. If you make a qualifying purchase through one of these links, I may receive a small percentage of the sale at no extra cost to you.

Insurance for work AND play

It sounds obvious but before you buy travel insurance, make sure it covers what you will do on your trip. Most standard travel insurance policies only cover pleasure activities, so make sure having a job and working is OK.

If you’re thinking of doing a ski season, coverage for skiing, snowboarding and all manner of other snow-related activities is, (somewhat unsurprisingly) absolutely essential.

Coverage to visit home

A lot can happen in a year or two; sometime during your working holiday, you may find yourself wanting or needing to return to your home country for a short visit or event like a wedding or funeral.

Returning to your home country automatically cancels most travel insurance policies unless specifically stated otherwise, but a minority allow one or two short trips (typically up to 14 days).

Long policies and extensions

With working holidays available in Canada, New Zealand and Australia for up to two years in length, you will, therefore, need travel insurance lasting up to two years in length too.

The problem is that there are not many insurance companies that offer policies of this length. There are however at least a couple of different options for the most common nationalities for working holidays. Head to the bottom of the article to read about these options.

One-way flight

Flights can usually only be booked 12 months in advance, so if you’ve planned a long trip or prefer being spontaneous, it is very likely you will be flying out on a one-way flight.

Some insurers do not cover people on one-way flights, so be sure to check that this isn’t an issue when purchasing your working holiday travel insurance.

A fair amount of insurers, however, do not cover people on one-way flights.

The importance of adequate coverage

So maybe you’re reading this thinking you’ll just buy any old policy to satisfy a border guard and it won’t matter too much.

The thing is, it does matter because if you actually have to claim on an insurance policy, you want your coverage to be valid.

Without a valid policy, your chances of getting any money from your travel insurance are close to nil.

To process a claim, an insurer will ask for all sorts of evidence to support your request such as flight tickets alongside medical receipts.

If you have done something to invalidate your insurance (arrived on a one-way flight, visited home one too many times), it is likely to be discovered. And then you’ll be out of luck and money.

Working holiday requirements

Valid insurance for the entirety of your planned stay is often a condition of your working holiday visa/work permit.

Border guards do not necessarily ask everyone for proof of it, but you will be sent home if you do not have it. Simple as that.

If you only have six months insurance, you may only be given a visa/work permit for six months.

Secondly, insurance is also important if the worst happens. Or not even the worst case scenario happens, as things go.

With a working holiday visa in hand, you are still a foreigner in your new country and are not necessarily entitled to the same free or low-cost healthcare other residents are.

Even if you do manage to register for local healthcare through employment or otherwise, it may only cover basic rather than emergency care (did you know you have to pay for ambulances in Canada and Australia?!)

Local healthcare will also not allow you (or your remains) to be flown home to your home country due to serious injury or death. Without insurance, your family would have to pay for this. No-one thinks it will ever happen to them until it does.

How to search for the best travel insurance for your working holiday

The first place to start is with the actual travel insurance policy. Yep, the small print!

If there is some legalese you do not understand (or you have a specific question regarding the coverage), reach out to the insurer to be sure.

As a British citizen, I used True Traveller as my working holiday travel insurance provider (before I became a Permanent Resident of Canada) as they ticked all the boxes for me:

- 24 month policies available

- Medical (and personal liability) coverage in the millions of £s

- One-way flights OK

- Lots of special activities covered including winter sports

- Multiple visits home allowed (with no maximum length!)

- A variety of jobs covered

- An excellent online reputation of paying out for claims (check the reviews)

- Policies can be started when ‘already travelling’

- Extensions possible if on short policy

True Traveller also offer policies for EU citizens, including those from Ireland, Germany and the Netherlands.

Not from a country covered by True Traveller? No problem.

More working holiday insurance providers

Australian citizens – Consider Cover More or Fast Cover . With Cover More, 2 x 1 year policies would provide coverage for 24 months. For Fast Cover, an initial 12-month policy can be purchased and then extended for another 12 months on the departure date.

New Zealand citizens – Check out Cover More . 1 x 12 month policy and another 11 month policy would provide coverage for 23 months. Winter sports coverage is available for an additional premium.

Not from any of the countries listed? Best Quote are travel insurance specialists partnered with some of the largest and most reputable insurance providers in Canada.

Through them, it is possible to review, compare and purchase IEC specific insurance policies with up to 2 years of coverage.

The 2 year IEC policies cover basic (non-competitive) ski cover as standard. Some options also include coverage for Covid19 related claims. There are various coverage amounts available (most starting at $100,000), and adjustable excess levels as well.

Adventure in your inbox

Subscribe to our monthly email newsletter and receive a round-up of our latest outdoor adventures plus other exciting beyond the beaten path destinations

We never share your information with third parties and will protect it in accordance with our Privacy Policy

Check out these other posts about working holidays

IEC Working Holiday Canada Extension Guide

IEC Working Holiday Canada: Arrival Checklist

Working Holiday Visa 2024 Canada IEC: Ultimate Application Guide

One half of the Canadian/British couple behind Off Track Travel, Gemma is happiest when hiking on the trail or planning the next big travel adventure. JR and Gemma are currently based in the beautiful Okanagan Valley, British Columbia, Canada

Saturday 4th of January 2020

Canadian here! Looking to buy a travel health insurance for a working holiday visa to Sweden for up to a year. I'm finding it hard to find options =( It also needs to have a cancellation policy in case my visa is rejected, and hopefully has the option for short visits home.

Any leads appreciated. Thanks!

As a Canadian, I personally use World Nomads. Visits home are allowed. Most insurance providers offer a short window for cancellation after the initial purchase. So I'd suggest that you don't purchase the insurance until the last minute, if possible.

Wednesday 3rd of June 2015

Thanks for such useful information. I was wondering whether all insurance companies that offer insurance compatible with IEC is around the same price as True Traveller.

Thursday 4th of June 2015

Hi Harriet,

There are only a few companies out there that offer 2 year travel insurance for British IEC participants. There are a couple that are cheaper than TT.

- Search for:

- Fruit Picking Jobs

- Skilled Labour Jobs

- Au Pair Jobs

- Hospitality Jobs

- Office Jobs

- RSA Certificate Australian Capital Territory

- RSA Certificate Queensland

- RSA Certificate New South Wales

- RSA Certificate Northern Territory

- RSA Certificate South Australia

- RSA Certificate Western Australia

- RSA Certificate Victoria

- RSA Certificate Tasmania

- Join Our Facebook Group

- Australia Guide

- East Coast Australia

- Sydney Gap Year

- Melbourne Gap Year

- Sydney Arrival Package

- Melbourne Arrival Package

- Working Holiday Visa Australia

- Working Holiday Visa New Zealand

- USD 0.00 Cart

Australia , New Zealand , Travel Tips

How to choose the best working holiday travel insurance.

Securing comprehensive health insurance is highly advisable when embarking on a Working Holiday Visa journey to Australia. In accordance with immigration office regulations, it is obligatory to possess health insurance that offers coverage prior to departing for Australia. Regardless of whether you’re on a global expedition with a brief stopover in Australia or intending to stay for an extended period during your Working Holiday, it is crucial to have robust health coverage in place, be it for unforeseen accidents or routine healthcare needs. Here are some pointers to assist you in selecting the most suitable Working Holiday Travel Insurance.

Travel Insurance Criteria

Quality of service.

In addition to the insurance provider’s popularity, the quality of services offered plays a pivotal role in determining the insurance’s overall excellence. Once again, it’s advisable to gather information and seek feedback from fellow backpackers. They can provide valuable insights into whether an insurance company has treated them satisfactorily, how promptly reimbursements were processed, and within what timeframes. If you’re not yet in Australia, you can inquire through online forums, Facebook groups, and similar platforms.

Key factors to consider include:

- Ease of enrollment.

- Flexibility in extending the insurance contract (especially if you plan to stay longer than a year).

- Quality of customer service, including their responsiveness to inquiries.

- Refund schedules (how long do they take to refund your claims?).

These factors will aid you in making an informed choice when selecting your Working Holiday Travel Insurance.

Price of Insurance

Now, let’s delve into the topic we’ve all been eager to discuss: pricing! It’s natural to be enticed by the allure of the cheapest available insurance option, but it’s essential to consider whether it adequately covers your needs. Opting for the lowest-cost option might leave you with insufficient coverage, and you might regret your decision. Conversely, selecting the most expensive insurance doesn’t necessarily guarantee the best coverage. Ultimately, the choice hinges on your individual requirements and budget.

Therefore, it’s advisable to compare the various insurance options before making a decision. In general, we recommend steering clear of both the priciest and the cheapest options. To give you a ballpark figure, most insurance plans fall within the range of 450 to 550 EUR per year. Keep in mind that you can tailor the coverage duration to your specific needs by selecting the number of months required.

Popularity of Insurance

As is often the case with various products, the popularity of a health insurance provider frequently serves as a reliable gauge of its quality. This popularity isn’t solely the result of advertising efforts; it’s often a testament to the trustworthiness and reputation of the provider. When you explore different websites, forums, or blogs, you’ll notice that certain insurance companies are consistently mentioned. It’s true that many sites and blogs may promote their insurance partners (i.e., sponsored content), but when you repeatedly encounter the same names across multiple sources, it’s a promising sign of quality.

For a more candid perspective, it’s advisable to seek advice from fellow travelers. Keep in mind that individual experiences can vary widely, and negative experiences tend to be more vocalized than positive ones. People often express dissatisfaction when things go awry but remain silent when everything goes smoothly.

As you delve into exploring the offerings of various insurance companies, you might have already observed the extensive list of what these insurance policies encompass. To prevent getting overwhelmed by this wealth of information, let’s focus on the primary guarantees you should prioritize:

- Repatriation assistance;

- Support for medical expenses up to a certain threshold;

- Hospitalisation costs up to a certain threshold;

- Reimbursement of an airline ticket in case of early return;

- Public liability;

- Baggage insurance;

- Accident capital;

- Ambulance costs (you often require a seperate insurance for this in Australia);

- Search/rescue costs.

While you’re enjoying your stay, the urge to partake in various activities is almost inevitable. It’s essential to verify in advance whether your insurance includes coverage for these specific activities. If you intend to work, especially in roles deemed “hazardous” like construction, fishing, or farm work, keep in mind that you may need additional insurance. Always ensure that your insurer provides coverage for the activities you plan to engage in.

Countries covered

Some insurers will only cover costs in the country you are doing your WHV in. Make sure to check which other countries your insurance covers as there is a lot to see close to Australia!

Medicare cover

It’s important to consider that if you hail from specific countries with agreements in place with Australia (including the UK, Ireland, The Netherlands, New Zealand, Norway, Slovenia, Malta, Belgium, Finland, and Italy), you may have the opportunity to benefit from Medicare coverage. This means that as long as you maintain your health insurance in your home country, you can apply for Medicare coverage upon arriving in Australia, entailing coverage for certain medical expenses. However, it’s crucial to bear in mind that Medicare does not provide comprehensive coverage. For instance, expenses related to medical transport are not included, and if you plan to work in Australia, you’ll often discover that very little is covered.

Additionally, it’s important to note that Medicare does not extend its coverage to any travel-related issues, such as lost baggage. Furthermore, it does not provide coverage for medical needs outside of Australia during your travels to other countries.

When to take out Travel Insurance?

Before taking any further steps, it’s essential to pose some questions to yourself:

- When do you plan to enroll?

- How long will your stay be?

- Will you remain exclusively within your Working Holiday country?

- What types of activities are on your itinerary?

- What is the procedure for reimbursement?

In most cases, if not all, it’s wisest to enroll before your departure. This way, your insurance will become active as soon as you arrive in the country. You have the flexibility to select the activation date when purchasing the insurance.

The subscription period aligns with the duration of your intended stay in the country, ranging from 1 to 12 months. It’s crucial to ensure that your chosen insurance provider permits extensions if you’re contemplating extending your Working Holiday Visa for an additional year. Additionally, check that the option for online extension is available if needed.

What does the insurance include?

We will now review the different types of coverage offered by insurance providers, valuable information for understanding what to take into account!

Medical fees

For instance, there are expenses associated with hospitalization, medical transport, and maternity-related costs (although not always covered). Certain insurance plans may even provide a daily allowance for extended stays. Additionally, they extend coverage to include physical consultations, medical tests, and examinations.

Furthermore, some insurers offer partial reimbursement for dental and optical expenses.

- Assistance in the event of illness or injury encompasses various aspects. This includes criteria for repatriation of the injured individual, coverage of travel expenses for a relative in case of hospitalization, and vice versa.

- Travel Assistance addresses the diverse expenses you might encounter during your journey. This can involve actions such as providing bail advances, covering legal fees, or offering support during sea or mountain-related incidents.

- Assistance in case of death , while somewhat somber in nature, is nonetheless crucial to consider. For instance, in the unfortunate event of a loved one’s passing, insurance can facilitate a return trip to enable you to be close to your family during this difficult time.

Insurance guarantees

First and foremost, your luggage and personal belongings are a primary concern. In the event of delivery delays, which might require you to purchase clothing or a new toothbrush, your insurance can provide compensation. Additionally, they may offer reimbursement if your belongings are stolen or suffer partial or complete damage during your journey.

Another critical aspect is personal liability coverage. In essence, your insurance will safeguard you when you bear personal responsibility for injuries or property damage, such as in a car accident. It’s imperative to understand the coverage limits, as these amounts can escalate swiftly.

Lastly, during your flight, whether outbound or return, the insurance can provide compensation in cases of flight delays or cancellations.

Exclusions in your contract

This section holds significant importance as it outlines the situations where your insurance coverage will not apply. Hence, it’s of utmost importance to thoroughly review all these terms and conditions. For instance, within this section, you will discover the catalog of uncovered sports, typically including extreme activities like bungee jumping and free fall, among others. Additionally, it provides insight into the medical expenses that are not eligible for reimbursement.

Also read: How To Get Medical Treatment In Australia

Working Holiday Guide

5 thoughts on “ how to choose the best working holiday travel insurance ”.

This website has quickly become my go-to source for [topic]. The content is consistently top-notch, covering diverse angles with clarity and expertise. I’m constantly recommending it to colleagues and friends. Keep inspiring us!

I truly admired the work you’ve put in here. The design is refined, your authored material stylish, however, you seem to have acquired some trepidation about what you intend to present next. Undoubtedly, I’ll revisit more regularly, similar to I have nearly all the time, in the event you sustain this rise.

Simply desire to say your article is as surprising The clearness in your post is simply excellent and i could assume you are an expert on this subject Fine with your permission let me to grab your feed to keep up to date with forthcoming post Thanks a million and please carry on the gratifying work.

I do not even know how I ended up here but I thought this post was great I dont know who you are but definitely youre going to a famous blogger if you arent already Cheers.

I loved as much as you will receive carried out right here The sketch is tasteful your authored subject matter stylish nonetheless you command get got an edginess over that you wish be delivering the following unwell unquestionably come further formerly again as exactly the same nearly very often inside case you shield this hike

Leave a Reply Cancel reply

Your email address will not be published.

Save my name, email, and website in this browser for the next time I comment.

Username or email address *

Password *

Remember me Log in

Lost your password?

Username *

Email address *

Your personal data will be used to support your experience throughout this website, to manage access to your account, and for other purposes described in our privacy policy .

Read about our cover for Covid-19 included on all policies here

All our policies include cover for Covid-19 as standard, to help you decide if this cover is suitable for your needs please view our dedicated Covid Page which explains how your cover applies in a number of circumstances.

While we recommend you read our Covid Page to understand in more detail the cover we include as standard the information below provides you with an overview of the core cover.

- You or a close relative are diagnosed with or have contracted COVID-19

- You are required to self-isolate, subject to a positive test result/confirmation from a GP

- Someone you were due to travel with or stay with on your trip needs to self-isolate.

- You have been denied boarding at your UK departure point because you have COVID-19 symptoms

- If you need to come home early because a close relative has COVID-19

- The Foreign, Commonwealth & Development Office (FCDO) or other regulatory authority in a country in which you are travelling in advise you to evacuate or return home.

- Emergency medical treatment, repatriation and other expenses

- Additional transport and accommodation if you are unable to return home as planned.

Our policies DO NOT require you to be vaccinated against Covid. Please note however that our policies do not offer any cover if you fail to hold the relevant documentation as required by your airline (or other public transport such as a cruise ship or train) or destination country. For example if your destination country requires you to provide either proof of being fully vaccinated or a current negative test certificate and you are denied boarding/entry due to not providing valid documents there is no cover under our policies.

Our policies do not cover the costs of Covid testing or vaccination either prior to, during, or post your trip.

Please note that all cover noted above is subject to terms and conditions.

- get a quote

- policy wording

- sports & activities

- customer zone

- make a claim

- privacy policy

Travel Smart with Outbacker!

Working Holidays and a Return Trip to the UK

Cover up to 230 Sports and Activities

Safe and Secure Online Booking

Instant Online Policy Delivery

24 hours, 365 days Emergency Assistance

instant quote

Step 1 of 4, where are you going.

When are you going?

Who is going, important conditions.

This policy is only valid for permanent UK residents aged 18 to 40 years old at the time of purchase who are registered with a UK GP and for trips departing from the United Kingdom and returning to the United Kingdom. Cover is not provided for a trip already in progress.

Please note: If you travel to a country where the Foreign, Commonwealth and Development Office (FCDO) or other regulatory authority advise against travel there will be no cover under this policy, even if the country would be otherwise covered.

working holiday travel insurance

Key policy benefits, work & travel, activities cover, medical assistance, money & passport.

Outbacker Travel Insurance policies do not cover ANY pre-existing medical conditions.

why outbacker

What others say, quick links, travel options, travel compare.

- Free eBook guide

- Before coming to Australia

- Budget for your Working Holiday

- The Working Holiday Visa

- Which city to arrive

- Packing Guide

- Backpacker Travel Insurance

- Cheap flights to Australia

- What to do on arrival

- Open an bank account

- How to transfer money

- CurrencyFair 5 free transfers

- WISE money transfers

- How to migrate to Australia

- Tourist Visa

- Working Holiday Visa

- Student Visa

- TSS Visa Sponsorship

- Partner Visa

- Travel insurance options

- Australian healthcare system

- Working Holiday Insurance

- Backpacker travel insurance

- Short term travel insurance

- International student insurance

- Travel insurance companies

- Go Walkabout promo code

- Living in Australia

- Accommodation guide

- Phone Plans in Australia

- Driving in Australia

- Cost of living in Australia

- Climate and Seasons

- Claim GST on expenses

- How to claim your tax return

- Claim your Superannuation

- New South Wales

- South Australia

Western Australia

- Northern Territory

- POPULAR SPOTS

- NEW ZEALAND

- ASIA PACIFIC

- Traveling around Australia

- Travel Budget

- Climate and seasons

- Customs in Australia

- Itineraries ideas

- Road Trip Complete Guide

- Budget Road Trip

- Where to camp in Australia

- Choose and buy a vehicle

- Tips for everyday life

- News in Australia

- Festivals & events in Australia

- Just for fun

- Best stopovers from Europe

- When to buy your plane ticket

- Rent a cheap campervan in Australia

- Motorhome rental in Australia

- Car rentals in Australia

- How to rent a vehicle in Australia

- Rent a cheap campervan in NZ

- Motorhome hire in New Zealand

- Best Diving spots in Australia

- Great Barrier Tours – Best tours

- Best spots to surf in Australia

- Working in Australia

- Setting yourself up for work

- Writing a resume in Australia

- Wages in Australia

- Typical Backpacker jobs and salaries

- Certificates & training

- Getting your Tax File Number

- How to get an ABN

- How to claim your superannuation

- Housekeeping work

- Hospitality jobs

- How to find a job in hospitality

- Working in a bar

- RSA Certificate

- Coffee Barista course

- Gambling establishments (RSG / RCG)

- Work in construction

- Work as a Traffic Controller

- White Card certificate

- Become an Au Pair in Australia

- Get your Blue Card

- Fruit picking jobs

- Fruit picking map – contacts

- Fruit picking season – calendar

- How to apply for a second year

- How to calculate your 88 days

- Eligible areas for a second year

- Eligibles jobs for a second year

- Volunteering in Australia

- Work as a freelance

- Best Outback jobs

- Work in a road house

- Working in a cattle station

- Become a Hairdresser in Australia

- Find a professional job

- More job experiences

- Study in Australia

- International Student insurance

- Budget to study

- Diploma equivalency

- How to finance your studies

- Universities in Australia

- ANU: Australia’s number one uni

- Medicine studies in Australia

- Top 10 online courses

- Getting ready for your IELTS Test

- Find a student job

- Orientation Week

- Free study advice

- Internship in Australia

- 10% OFF Go Walkabout

- 5 Free transfer with CurrencyFair

- Promo Code Airbnb

- Cheap Campervan rental

- 5% OFF Travellers Autobarn

- 5% OFF Jucy Rentals

- $25 OFF RSA Courses

- $16 OFF White Card Courses

- $25 OFF RSG / RCG Courses

- Great Barrier Tours - Best tours

- News in Australia Be up to date. Here you will find all the news from Australia that are relevant for backpackers! All news at a glance!

- Festivals & events in Australia

- Wildlife Discover Australia’s wildlife! Find everything you ever wanted to know about Australia’s animals. Kangaroos, wombats, koalas, wallabies, crocodiles, Tasmanian devil, kookaburras, sharks, wales and many more… Understand Australia s animal kingdom and discover some adorable Aussie animals.

- Just for fun Funny articles about random things happening in Australia: Unusual events, illustrations, competitions and much more. Just for fun is entertaining and funny!

- Certificates & training

- Fruit picking map - contacts

- Fruit picking season - calendar

- More info Australia is a popular destination for both Working Holiday Visas and tourists, however, it is also worth considering Australia as a destination for studying. Better yet, foreign students are in great demand, with many nationalities. Many choose to study in Australia to improve their English skills, travel around Australia and to gain an international degree. Many choose to study in Australia.

- ANU: Australia's number one uni

Working Holiday Travel Insurance

Travel insurance is a major consideration when preparing for your departure abroad, no matter where you are travelling to. Some wonder if it is essential to take a policy out, and others wonder what is the best insurance to leave with complete peace of mind. Nobody wants to think about what can go wrong whilst travelling or picture the worst case scenarios such as a car crash, snake bites or surf accidents… But it is easy to forget you could also just get a bad cold and need to see a doctor. So even if it’s not the most entertaining part of preparing your travels, it is important to research travel insurances. This comprehensive article answers all your questions and helps you choose the coverage that best suits your needs for your trip.

Table of Contents

Working Holiday travel insurance: Comparison

There are a few insurances that offer special health insurance policies for travellers on a Working Holiday visa (in Canada, Australia, New Zealand or Argentina, etc). This is why we have drawn up a comparison of Working Holiday travel insurances for Australia & New Zealand that will make it easier for you to choose one that best meets your needs.

There are a plethora of comparison websites with search engines that spit out an overwhelming number of travel insurances. It’s difficult to make a general comparison though, as individual interests and plans differ. We have been working successfully with the partners listed below. If their policies don’t meet your needs, you will surely find a travel insurance provider that offers what you want, when doing your own research. We don’t recommend you to take out a cheap cover. Always compare travel insurance before subscribing.

SafetyWing is a company that specializes in providing travel medical insurance for digital nomads, remote workers, and long-term travelers. Founded with the aim of creating a safety net for the global workforce, SafetyWing offers flexible , comprehensive coverage that can be initiated and adjusted according to the unique needs of individuals who live and work from different parts of the world. Unlike traditional insurance policies that require long-term commitments, SafetyWing operates on a subscription basis. You can choose to start, pause, or stop your coverage as your travel plans change. SafetyWing provides coverage for unexpected medical expenses , including accidents and illnesses, as well as travel-related issues such as trip interruptions, lost checked luggage, and natural disasters.

Go Walkabout (UK citizens only)

Go Walkabout offers a very competitive Travel Insurance to UK citizens traveling with a Working Holiday Visa.

Go Walkabout is a travel insurance company known for offering a wide range of insurance products tailored to meet the diverse needs of travelers. Specializing in policies for backpackers, those taking working holidays, and individuals embarking on once-in-a-lifetime adventures like gap years or extended overseas stays, Go Walkabout is committed to providing comprehensive coverage that ensures peace of mind. Their offerings include cover for medical emergencies , trip cancellations, lost or stolen baggage, and even specific activities that are often excluded by standard policies, such as adventure sports. With a focus on flexibility and customer service, Go Walkabout aims to make the process of purchasing and using travel insurance straightforward and hassle-free, ensuring travelers can focus on enjoying their journey with the assurance that they are well protected.

Go Walkabout Working Holiday policy has been specifically designed to cover a large range of jobs you might be doing whilst away from the UK. It also covers activities: 99 sports, activities, and leisure pursuits (without extra cost) , but you can also have a multitude of other activities covered with the addition of further activity packs.

Prices depend on different factors, such as your age, the length of your trip, visited countries, etc. But you can get a quick quote by clicking on the button below. Make sure to use our promo code ABG10 to get a 10% discount!

True Traveller

True Traveller is a travel insurance company highly regarded by backpackers, adventurers, and long-term travelers for its comprehensive and flexible insurance options . They offer three Policies called True Value, Traveller and Traveller Plus. True Value is designed for travellers under 40 years of age , and is designed for last minute travellers and backpackers . The Traveller policy, is designed for holiday makers and adventurous travellers alike, and Traveller Plus gives enhanced medical and cancellation cover .

What sets True Traveller apart is its ability to provide coverage for a vast selection of adventure activities that many other insurers exclude, making it a popular choice for those engaging in hiking, skiing, scuba diving, and more. Customers can tailor their insurance to suit their specific travel plans, with options for single trips, multi-trip coverage, and extended stays. True Traveller is known for its straightforward claims process and excellent customer support , ensuring that travelers have access to assistance whenever they need it, wherever they are in the world.

World Nomads

World Nomads is a simple and flexible travel insurance for international travel. One of the key features of World Nomads is its flexibility . Policies can be purchased and modified online, even after the trip has begun, making it an ideal choice for long-term travellers and those whose plans are fluid.

World Nomads covers more than 100 countries worldwide except those that have specific Government ‘Do Not Travel’ warnings in place, and any sanctioned countries. So before or after your Working Holiday Adventure in Australia, you can easily have a stop over for a few days or even for a few months in other countries like Indonesia or New Zealand while being covered.

What truly sets World Nomads apart is its deep commitment to the travel community , offering not just insurance, but also a wealth of resources, travel guides, and safety tips to help travellers prepare for their journeys.

Prices depend on different factors like country of residence, age, duration of your travel, and countries you are going to visit. To get a quote, click on the button below.

Note: We receive a fee when you get a quote from the agencies listed above when you use the links provided. We do not represent these agencies. This is not a recommendation to buy travel insurance.

Remember, not all insurances offer the same cover in relation to luggage, emergency care, the practice of extreme sports, or even a possible repatriation or return to the country. Let’s say your teeth have caused a bit of pain lately, so make sure that emergency dental costs are covered. If you plan to go scuba diving, have a look if scuba diving is included. If you’re keen to travel for more than a year, choose a health insurance policy that will cover you for up to 24 or even 36 months. Most importantly, tick off the main criteria that are reimbursement of medical expenses and hospitalization, repatriation, and civil liability.

Read also : How to choose the best Working Holiday Travel Insurance

How to choose the best Working Holiday travel insurance?

There are quite a few health insurance providers, all of which have special features. To make the right decision, you need to thoroughly inform yourself and choose insurance that best suits your needs . This means, don’t skip reading the details.

When should I take out travel insurance?

It is advisable to take out health insurance as soon as you know your departure date. So wait until you have obtained your WHV and bought your plane ticket to subscribe. We advise you to subscribe a little in advance (2 or 3 weeks before departure).

In any case, insurance will not cover illnesses or accidents occurring before the contract takes effect.

If you are already abroad, do not panic! You can also take out insurance to cover you if you’ve already started travelling and already overseas. However, a waiting period may be applied (except in the event of contract renewal), always check with the insurance company prior taking out a policy.

Do I need a travel insurance?

When travelling abroad, you are generally more active and venturesome. Even though in most cases, you are as fit as a fiddle when coming out of the surf or back from a hike, there is always a chance that something goes wrong. Moreover, conditions in foreign countries are different, so the likelihood of falling sick is higher. Here are some of the reasons why you should get covered before leaving:

Healthcare System in Australia

You should think about getting a travel insurance for Australia to cover the services not included in the Medicare insurance, which are important for you and in case something goes wrong. It is also important for the time you are travelling overseas before or after your Work & Travel adventure.

Citizens of the United Kingdom,the Republic of Ireland, New Zealand, Sweden, the Netherlands, Finland, Italy, Belgium, Norway, Slovenia, Malta can benefit from the Australian Health Care System (Medicare) thanks to bilateral agreements with Australia. For others, as Medicare is limited to citizens and permanent residents, travellers or temporary residents are not entitled to claim any benefits from Medicare. You should check if your national insurance plans cover international travel . If not, it is highly recommended to get a travel insurance.

As a member of the United Kingdom , you are eligible for Medicare . However, you aren’t covered at work for example, or when you need repatriation back to the UK if necessary. That’s why you need to consider getting a travel insurance.

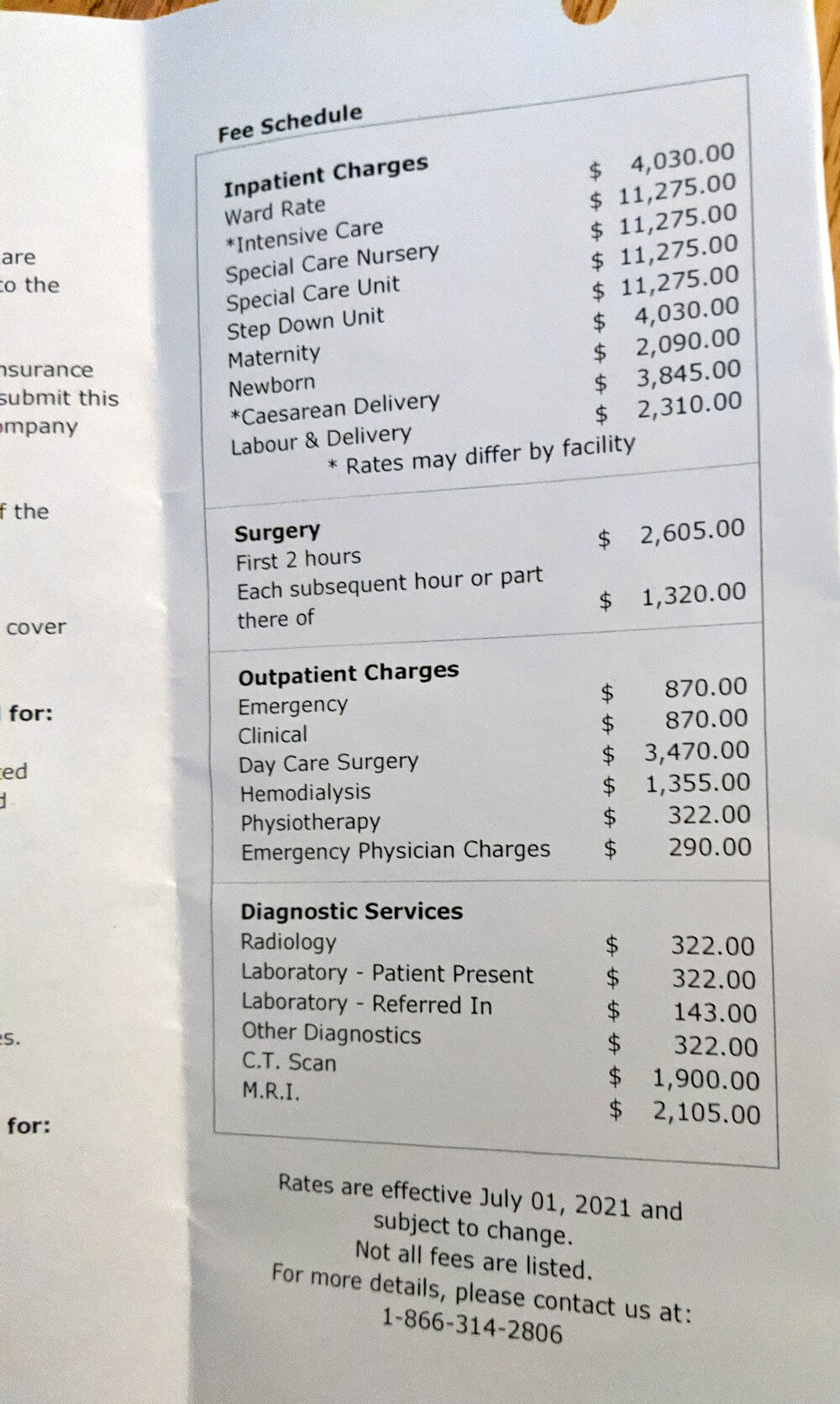

The cost of living is high in Australia. The same goes for medical expenses, hospitalisation, etc. Here some examples of prices:

- Consultation with a general practitioner: from 80 AUD;

- Consultation at a dentist: 200 AUD;

- One day of hospitalisation: from 1500 AUD excluding care.

If you did not get any health insurance that covers you in Australia, these expenses are obviously yours. To make it short, if you don’t want to pay for potential medical expenses in full yourself, take out travel insurance!

Unsuitable Bank Card Insurance

Some travellers leave with a Visa Master or Gold Mastercard, thinking they will be covered no matter what. First of all, note that credit card insurance generally only covers you for a maximum period of three months. Working Holiday Makers usually come to Australia anywhere between six to 24 months (or 36!). Moreover, in general these cards only cover emergencies and repatriations, not traditional care such as consultations with a GP and medication.

Health Risks in Australia

By leaving for a few months, or even for one or two years, to Australia you will be of risk of having accidents . Nevertheless, every year backpackers leave for Australia without insurance trying to save some money, but end up finding themselves in really delicate situations. Australia can be an adventurous country and it is not uncommon to undertake exciting activities such as skydiving, scuba diving, cliff jumping etc. Inherently, the risk of accidents is higher when the danger can be part of the excitement. Even during a road trip, you might run into accidents. In the worst case we must also think about our families. In case of death, the cost of repatriation of the body and funeral expenses can be extremely expensive. Nobody wants to think about these things, but they do happen and it is better to be prepared beforehand.

Aside from the risk of accident you can get sick while traveling in Australia. A simple cold, food poisoning, a toothache…small annoyances of everyday life that can quickly eat up your travel budget if you do not have insurance.

Koalas and kangaroos aren’t the only animals that call Australia home! Pay particular attention to mosquitoes ! Although the risk is low, cases of dengue have been revealed in northern Queensland. Mosquitoes are also vectors of transmission of the Ross River virus or Murray Valley encephalitis (similar to Japanese encephalitis). Again, the risk is very low, but it is never too safe to protect yourself against mosquito bites.

Australia is home to a variety of venomous creatures , including snakes, spiders, jellyfish, and marine animals like the blue-ringed octopus. While encounters with these creatures are relatively rare, it’s important to be cautious, especially in natural habitats, and know what to do in case of a bite or sting.

Australia’s high pollen levels and unique flora can trigger allergies and asthma for some individuals. The country also experiences periodic dust storms and bushfire smoke that can affect air quality. Those with respiratory conditions should carry necessary medication and stay informed about air quality reports.

Precautions and Preparedness

Know the local emergency number in australia: ‘000’.

The most important number is “ 000 “, which includes police, firefighters, and ambulances, who are available 24 hours a day, 7 days a week. This number is common to the whole of Australia.

Royal Flying Doctor Service for remote areas

In remote areas, it may take some time before these help desks can help you. In this case, contact the Royal Flying Doctor Service , a group of doctors and pilots who can fly in to rescue you from the outback. These are the numbers for different states:

SA (Outback Areas): 1800 RFDS SA (1800 733 772)

NT (Central Australia): 1800 1MRACC (1800 167 222)

NT (Top End/Darwin): 000 (St John NT)

HF Radio: (4010kHz, 6890kHz or 8165kHz)

Emergency Poison Advice

Poisons Information Centre provides the latest poisons information to the public, and toxicology advice to health professionals on the management of poisoned and envenomed patients. Telephone advice is available 24/7 on 131126 from anywhere in Australia.

First Aid kit

Carry a basic first aid kit and any personal medications with you.

Am I reimbursed for healthcare costs while I am abroad

Isn't my bank card insurance enough for my trip.

If you have a premium bank card (Visa Premier or Mastercard Gold), you can benefit from cover for up to 90 days. However, most WHV stays last between 6 and 24 months. These cards will not cover standard medical care, but only emergencies and repatriation. Basic cards generally do not offer health cover for travelling abroad.

Am I covered in other countries during my trip?

This will depend on the insurance company you choose. However, in most cases, you are covered worldwide as long as your working holiday visa is valid. So you will be covered in your working holiday host country and also in the rest of the world if you decide to travel during your WHV. Be careful, however, to check the cover that applies outside your whv country (often tourist cover, so you won’t be covered in the event of an accident at work, for example).

How do I renew or extend my travel insurance?

It’s quick and easy! All you have to do is go to your insurer’s website and take out a new policy with new dates. The start date of the new policy must, of course, be the day after the end of your first policy. This will ensure that you don’t run into any problems if an incident or illness occurs between the two policies. If this were the case, there would unfortunately be no coverage.

Updated on 19/02/2024

How to get an ABN?

The Perfect 15-day Itinerary: Brisbane to Cairns Road Trip

Crocodiles in Australia: Exploring Australia’s Species- A Comprehensive Guide

- Terms of Use

- GDPR – Privacy Policy

Working holiday travel insurance

Take cover.

Incoming trip? It’s time to take cover. We require all our BUNAC travellers to have travel insurance before taking part on our programs. Here’s why you need it and how we can help.

Protecting you and your trip

Travel insurance is the superhero of the travel world. Hear us out. Travel insurance protects your travel plans before you go, covers you for lost and stolen items while you’re away, and covers your medical expenses and costs to return home if you’re ill or have an accident. In short, it gives you the power to travel with peace of mind – which in our eyes, is pretty much priceless. And as we happen to think our travellers are also pretty priceless, we want to make sure you’re adequately covered for your trip.

For UK travellers