Youi Reviews

In the Insurance Agency category

Visit this website

Company activity See all

Write a review

Reviews 4.5.

14,877 total

Most relevant

Helpful and friendly

The young lady l felt was professional helpful and very pleasant to deal with and did not preform like she was a machine Nothing l asked was a problem and if she didn’t know she went and found out I have at this stage no reservations in changing from another insurer to Youi and would strongly recommend others to try

Date of experience : 11 April 2024

Staff member Flynn 👍👍👍

A staff member by the name of Flynn went above and beyond to help me with getting comprehension car insurance. Even called me back after her normal working hours to get things fast tracked for me. I really appreciated her kindness and efforts to help me get this organised.

Mark Mogale goes above & beyond with his Service

Mark answered the phone with a very positive attitude and provided an absolutely outstanding service. I would highly recommend to any friends or family his service and will continue to use Youi purely from that encounter.

Date of experience : 12 April 2024

Colin is an awesome operator

Colin is an awesome operator. Nothing was a problem for him. He is well trained and could answer my queries. Congratulations Colin on your customer service. Congratulations Youi on the ability to answer a phone call in record time ( 3 rings)

Date of experience : 04 April 2024

Excellent Work

Shaun who answered my call was on point with his customer skills. Shaun was respectful and courteous, listened to my requirements, and provided the best results. Thank you Youi for employing such wonderful staff.

Date of experience : 09 April 2024

I switched to Youi due to better value for money and excellent customer service

I switched to Youi following a 28% markup on my comprehensive car insurance (within a single year) with AAMI. I received this markup despite having been a customer with AAMI for 10+ years, not having made a claim and never accruing demerit points. When I sought a quote from Youi they contacted me within 10 seconds of me making an online enquiry and were able to beat AAMI's price by $1000.00 (and still offer more perks). Yes, the excess is higher, but considering the excellent customer service you receive, I did not hesitate to switch.

Date of experience : 08 April 2024

Youi pricing is very competitive for car insurance.

Youi pricing is very competitive on car insurance. The Roadside Assist is a complimentary bonus even though you hope you never need to use it. The people I spoke with were very informative and listened to my queries.

Was happy with the service I receivedt

Was happy with the service I receivedt. I excepted nothing more and nothing less. The service members i spoke with were very helpful and knowledgeable and extremely helpful with any all queries or questions that I may have had.

Great service from Monae at Youi

Great service from Monae at Youi, she provided me with a policy with more included features than my old provider and saved me over $440.00

The team member Carmela was extremely…

The team member Carmela was extremely helpful and mentioned extras I needed, but forgot to ask about. She guided me through your policy in a way wasceasy to understand. Thanku so much Carmela.

Cody the telephone agent for youi was…

Cody the telephone agent for youi was cordial, cooperative and efficient . She offered to ring me back so I could chase details not at hand. She rang back as pledged.

Awesome customer service

Awesome customer service, everything was explained to me, very helpful operator. The best thing was the amount of savings that I achieved. I will be recommending Youi to my friends.

Very Pleased With Kyle’s Helpful And…

Very Pleased With Kyle’s Helpful And Professional Manner Will Recommend Family And Friends To Go With YOUI!!!!

Don't expect an online quote.

This company won't provide an online quote. Instead they collect quite a lot of personal info. like DOB, email address, mobile phone number, residential address etc., and then rather than send an email quote, some call centre rings you to go through it all over again. I feel like I was cheated so I terminated the call however they have still managed to collect my personal details. I won't deal with companies like that. There should be laws to force companies like this to delete any and all data they hold on any non customer.

First contact with YOUI

First contact with YOUI, and I had Flynn in Brisbane looking after me. She was fantastic! Got me, and my learner son covered for my Honda Jazz! Flynn was a pleasure to deal with, and got the job done beautifully! I am ever so happy to be with YOUI! Just LOVE an Australian Company! Warmest Regards, Nicole Ward

The staff member I had was EXCEPTIONAL

The staff member I had was EXCEPTIONAL. I hope he is told that a big reason I signed up with Youi was the person I spoke with, EXCEPTIONAL customer service skills.

Friendly and informative

Domanic from Auckland was happy and very pleasant to deal with. Clear details were given as well as a series of appropriate questions. Also being able to ring at 8am in the morning before work was a real advantage! Great to talk to somebody who could speak english and who I could understand, rather than other offshore call centres.

Date of experience : 02 April 2024

Great service, but an ongoing problem

I had a really good experience with Jack who was super helpful. I do have a problem however in that they would not insure a property we previously had insured with them. I couldn’t get a definitive reason, which is a shame as I’m sure we have fixed what was previously a problem.

Date of experience : 03 April 2024

A car drove into large glass doors hah…

A car drove into large glass doors hah front the street. I submitted a claim on the day and it took 5 days for a reply and then another 7 days for the assessor to inspect the damage. Heaven knows how long it will take for them to repair to be organised.

Always a pleasure to contact Youii

Always a pleasure to contact Youii, the staff are very helpful and polite.

- Car Finance

- Hire Purchase

- Novated Leasing

- Bad Credit Car Loans

- Car Loan Refinance

- Business Car Loans

- Australian Car Statistics

- Car Loan Repayments Calculator

- Compare Car Loans

- Average Car Loan Interest Rates

- How Much Can I Borrow?

- How to Get a Car Loan?

- Caravan Loans

- Motorbike Loans

- Jet Ski Loans

- Camper Trailer Loans

- Loans for Harley-Davidson

- Boat Loan Calculator

- Caravan Buying Checklist

- How to Choose a Motorbike?

- Top Tips to Choose a Right Boat

- Equipment Finance

- Chattel Mortgage

- Truck Finance

- Aircraft Finance

- Technology Finance

- Agriculture Finance

- Plant & Machinery Finance

- Operating Lease

- Unsecured Personal Loans

- Low-interest Personal Loans

- Debt Consolidation Loans

- Travel Loans

- Wedding Loans

- Bad Credit Loans

- Compare Personal Loans

- Personal Loan Calculator

- Personal Loans Eligibility

- Unsecured Business Loans

- Small Business Loans

- Invoice Financing

- Business Overdrafts

- Cashflow Lending

- Small Business Start-up Loans

- Compare Business Loans

- Business Loan Interest Rates

- First Home Buyers

- Buy Next Home

- Investment Home Loans

- Home Loan Refinance

- Bad Credit Home Loans

- Self Employed

- Construction Home Loans

- Compare Home Loans

- How to Choose a Home Loan?

- Home Loan Repayments Calculator

- Borrowing Power Calculator

- Balance Transfer

- Frequent Flyer

- No Annual Fee

- Master Card vs Visa Card

- Maximise Credit Reward Points

- Perks of Using a Credit Card

- Manage Your Debt with a Balance Transfer Card

- Small Personal Loan

- Quick Cash Loan

- Rental Bond Loan

- Car Repair Loan

- Furniture Loan

- Emergency Loan

- Rent Arrears Loan

- Bank Accounts

- Savings Accounts

- Term Deposits

- Business Bank Accounts

- Debit Cards

- Kids Savings Accounts

- Margin Loans

- Travel Money Cards

- Best International Money Transfers

- Send Money to India

- Send Money to USA

- Send Money to New Zealand

- Send Money to UK

- Send Money to Canada

- Superannuation

- Compare Super Funds

- Cryptocurrency

- Share Trading

- Forex Trading

- CFD Trading

- Comprehensive Car Insurance

- Third Party Fire and Theft Car Insurance

- Third Party Property Damage Car Insurance

- CTP Insurance

- Classic Car Insurance

- Car Insurance for Young Drivers

- Seniors Car Insurance

- How Do I Compare Car Insurance?

- How Much is Car Insurance?

- Types of Car Insurance in Australia

- Market Value Vs Agreed Value

- Car Insurance with Choice of Repairer

- Landlord Insurance

- Building Insurance

- Flood Insurance

- Contents Insurance

- Best Home Insurance

- Cheapest Home Insurance

- Professional Indemnity Insurance

- Public Liability Insurance

- Product Liability Insurance

- Domestic Travel Insurance

- Cruise Travel Insurance

- Single Trip Travel Insurance

- Seniors Travel Insurance

- Best Travel Insurance

- Cheap Travel Insurance

- Travel Insurance for Pre-Existing Conditions

- What Does Travel Insurance Cover?

- Why Do I Need Travel Insurance?

- Travel Insurance COVID-19

- Seniors Funeral Insurance

- Hospital Cover

- Extras Only Cover

- Singles Cover

- Couples Cover

- Family Health Insurance Cover

- Overseas Visitors Health Insurance Cover

- Health Insurance for Seniors

- Cheap Health Insurance

- Income Protection

- Personal Accident Insurance

- Trauma Insurance

- TPD Insurance

- Funeral Insurance

- Seniors Pet Insurance

- Cheap Pet Insurance

- Best Pet Insurance

- Electricity Plans

- Compare Electricity Plans

- Compare Gas Plans

- Solar Electricity Plans

- Green Energy Plans

- ADSL Broadband Plans

- Mobile Broadband

- Home Wireless Broadband Plans

- Internet Providers

- Best Broadband Deals

- Prepaid Plans

- iPhone Plans

- Unlimited Data Plans

- SIM-Only Plans

- Unlimited Data for Mobile Phones

- Travel Insurance for Mobile Phone

- Customer Reviews

Home > Car Insurance > Youi

Youi Car Insurance

Youi is one of Australia’s most popular car insurers, with a range of policies available. Read our review to learn more about their services!

Fact checked

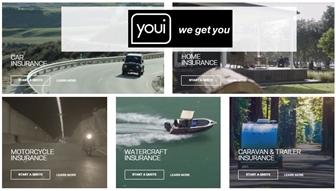

Youi is a specialist insurer headquartered in Queensland. Having been formed relatively recently in 2007, the business is now counted among Australia’s most prominent car insurance companies, as well as offering cover for caravans, trailers, motorcycles, watercraft, home and contents and small businesses.

Learn more about Youi and its car insurance products right here in our review. You can gain a greater understanding of the options available, their coverage and the ways you may be able to customise your policy’s inclusions.

Disclaimer: all coverage offered by Youi is subject to the terms and conditions of your policy. Limits and exclusions apply. Please refer to your Product Disclosure Statement (PDS) or contact Youi if you’re unsure about what is and isn’t covered.

Please note that Savvy does not represent Youi for its car insurance products. All listed policies, inclusions and limits are correct as of June 2023.

What car insurance policies are available through Youi?

Youi offers the following types of car insurance to Australian drivers:

Comprehensive car insurance provides the widest range of coverage options, including damage to your vehicle due to an accident (whether at fault or not). The following features and benefits are included in Youi’s Comprehensive cover policies:

- Loss or damage to your car due to an accident, whether you’re at fault or not, or weather, such as storm and flood

- Fire damage to your car

- Damage to your car caused by theft or attempted theft

- Legal liability for damage to other people’s property caused by your car up to $20 million

- Damage to your car caused by an earthquake

- Reasonable cost of towing and storing your vehicle if it’s deemed unsafe to drive after a covered event

- Reasonable cost of emergency transport or accommodation if you’re more than 100km from home and your vehicle is deemed unsafe to drive (up to $1,000)

- Cost of personal transport from the scene of the incident or to and from your repairer or hire car provider (up to $100)

- Reasonable cost of a rental car following the theft or attempted theft of your vehicle for up to 14 days

- Reasonable cost of a rental car following a not-at-fault accident until your car is repaired or your claim is paid

- Up to $1,000 for the replacement and recoding of stolen keys and locks on your car

- Further car additions such as window tinting, personalised registration plates, towbars and baby seats

- Loss or damage to your personal effects in the car due to accident or theft (up to $750 in total and $150 per item)

- Market value cover for an unbraked trailer damaged in an insured event (up to $1,500)

- Up to $1,500 for counselling sessions required after a claimed incident

- Cover of up to $5,000 per contract period towards funeral expenses for an individual who sustains a fatal injury while driving your car with consent

- Youi Assist – Roadside

- Temporary replacement cover for your new car if you sell your previous one for up to 14 days from the date you sell it (up to a maximum of $100,000 cover for total loss)

Third Party Fire and Theft (TPFT) cover is a step down from Comprehensive but offers more protection than Third Party Property Only. The following may be included in your Youi TPFT cover policy:

- Loss of, or damage to, your vehicle due to fire, theft or attempted theft

- Damage to your vehicle caused by an uninsured motorist who was completely at fault (up to $5,000)

The lowest level of optional car insurance cover, Third Party Property Only (TPPO) cover is designed to offer protection to you against damage you might cause to other people’s property. Youi’s TPPO cover can include the following:

Compulsory Third Party (CTP) insurance, or Green Slip insurance in NSW, is mandatory in all states and territories in Australia. However, while some state governments offer this as part of vehicle registration, others have a list of approved insurers from which you can buy cover. In the case of Youi, you can buy CTP insurance if you’re in NSW or SA. Though the cover specifics vary between states, these policies can include:

- Cover for compensation claims made against you by someone injured or killed in a motor accident you’re liable for, including passengers, pedestrians and other road users

- Liability for injuries caused by a trailer while attached to your vehicle

- Limited cover for injuries sustained by the at-fault driver in a motor accident (NSW)

Are there any optional extras available through Youi?

Yes – Youi offers several optional extras on their Comprehensive and TPFT cover policies. These are:

- Hire car if your vehicle is deemed unsafe to drive after a covered incident, whether at fault or not, for up to 14 days (Comprehensive or TPFT)

- Choice of repairer

- Reduced excess on windscreen, window or sunroof glass claims (automatically included with Comprehensive Plus)

- Cover for business items lost or damaged in an insured event for up to $2,000 per claim (up to $400 per item)

- Up to $1,000 worth of cover for contents lost or damaged in a campervan or motorhome

What are some of the pros and cons of buying car insurance through Youi?

- Extensive coverage and optional extras: Youi offers a wider range of coverage and optional extras on their Comprehensive and TPFT policies than many other insurers while maintaining a competitive price.

- Roadside assistance automatically included: unlike most other leading insurers in Australia, Youi’s roadside assistance is included as standard in Comprehensive policies, rather than for an added cost.

- Counselling costs covered: another point of difference for Youi is their cover for up to $1,500 in counselling costs required after being involved in a claimable event.

- No no-claim bonus: one key area lacking in their coverage, however, is the absence of a no-claim bonus, meaning you won’t be rewarded with a discount for safe driving.

- Roadside assistance only available with Comprehensive cover: although roadside assistance is automatically included in Comprehensive cover policies, it isn’t available under any of Youi’s other policies.

Common questions about Youi car insurance

Yes – Youi offers car insurance products to drivers of all age groups, provided they satisfy the eligibility criteria and terms and conditions of their policy. This means that if you’re a senior driver , you may be able to take out car insurance with Youi.

Yes – car insurance policies taken out through Youi offer coverage for business usage. However, if you’re looking for a policy for a specialist business vehicle, such as commercial car insurance , you may need to look elsewhere.

Through Youi, you can submit your claim online or over the phone, as well as request a call back from a claims advisor.

You can purchase a Youi car insurance policy in any state or territory in Australia aside from the Northern Territory.

More car insurance providers

Bendigo Bank

Budget Direct

Defence Bank

People's Choice

Compare car insurance by state

Helpful guides on car insurance

What Is a Car Insurance Cooling-Off Period?

Changed your mind after taking out a new car insurance policy? Learn about the cooling-off period with Savvy’s useful guide....

How Does Car Insurance Work When You Are at Fault?

Understand car insurance coverage in at-fault accidents in Australia and the claim options that might be available with Savvy's helpful...

Can You Claim Car Insurance on Tax?

Find out when you can claim your car insurance premiums on tax in Australia right here with Savvy’s informative guide....

Car Insurance Jargon Explained

Are you baffled by words and phrases in your car insurance documents and want to know what they mean? Find...

Car Insurance Renewal

Find out about the process of renewing your car insurance and what to consider in Savvy’s handy guide. Are you...

What Does Car Insurance Cover?

Read about what your car insurance does and doesn’t cover right here with Savvy. What your car insurance policy covers...

What Voids Car Insurance?

Learn about the common factors that could void your car insurance with Savvy. Car insurance provides protection and peace of...

Does Car Insurance Cover Engine Failure?

Learn about whether your car insurance covers engine failure and what your other options may be with Savvy today. Engine...

Whose Insurance Pays in a Multi-Car Accident?

Find out more about how to determine who pays for damage in a multi-car accident with Savvy in our helpful...

Non-Owner Car Insurance Australia

Find out how you can be covered as a non-car-owner right here with Savvy. Whether you frequently borrow cars or...

Compare car insurance policies with Compare the Market

Explore car insurance options by make.

Select your car make and find out how much it may cost to insure, read helpful guides and compare quotes.

Disclaimer:

Savvy (ABN 78 660 493 194, ACR 541 339) provides readers with a variety of car insurance policies to compare. Savvy earns a commission from our partnered insurers each time a customer buys a car insurance policy via our website. All purchases are conducted via our partners’ websites. The integrity of our comparison service is unaffected by our partnerships with those businesses and our effort remains to bring further brands that do not already use our comparison service onboard.

Savvy’s comparison service includes selected products from a panel of trusted insurers and does not compare all products in the market. Any advice presented above or on other pages is general in nature and doesn’t consider your personal or business objectives, needs or finances. It’s always important to consider whether advice is suitable for you before purchasing an insurance policy. We always recommend readers to consult the Product Disclosure Statement (PDS) of different policies before purchasing your car insurance.

© Copyright 2024 Quantum Savvy Pty Ltd T/as Savvy. All Rights Reserved.

We'd love to chat, how can we help?

Travel Insurance

Great value travel insurance with australia post.

We have different plans to suit your travel needs.

24/7 Assistance

COVID-19 Benefits

Travel Alerts

International comprehensive insurance

Premium coverage for luggage, cancellations, medical expenses and more.

International basic insurance

Budget overseas holiday cover for unexpected medical costs and personal liability.

Domestic insurance

Protect your car hire, luggage and plans when travelling in Australia.

Annual multi-Trip insurance

Travelling more than once this year? You could save time and money.

Award-winning cover

Australia Post Travel Insurance was awarded MOZO's People's Choice for most recommended, outstanding customer satisfaction, and sign-up experience for 2023.

Why choose Australia Post Travel Insurance?

We deliver great value cover you can depend on and make it easy for you to compare plans and find the international or domestic cover that suits your needs.

COVID-19 benefits for domestic and international plans 1,2

Choose your excess. You can choose your excess on the international travel plans, the higher the excess chosen, the lower your premium will be.

Increased luggage cover. You can increase coverage of valuable individual items with our International Comprehensive and Domestic travel plans.

Increased rental car insurance excess cover. You will have $3,000 standard cover on an International Comprehensive or Domestic plan, with the option to increase.

Skiing, snowboarding, motorcycling and mopeds. We can cover winter sports or riding motorbikes - just ask us for a new international travel insurance quote. Plus, cover for activities like abseiling, jet boating, paragliding, snorkelling, kayaking and bungy jumping is included in our policies.

Travel alerts

Important information regarding Coronavirus (COVID-19) outbreak.

More information

Visit the following pages to learn more:

- Make a claim

- Claims advice on world events

- Policy information

- Existing medical conditions

- Help and emergencies

- Travel Insurance customer reviews

- Find your travel essentials

For help choosing a plan, or assistance with your claim, call us on 1300 728 015 Monday to Friday (8am-7pm EST), Saturday (9am-4pm EST) and Sunday (10am-3pm EST).

For urgent help while you're overseas, call our emergency assistance team - direct and toll free - using the contact numbers provided in our Help and emergencies section.

1 Medical and dental cover will not exceed 12 months from onset.

2 Limits, sub-limits, conditions, exclusions, and fees apply.

Policies may not be available to all travellers. Australian Postal Corporation (ABN 28 864 970 579, AR No 338646) is the distributor of Australia Post Travel Insurance and is an Authorised Representative of Australia Post Services Pty Ltd (ABN 67 002 599 340 AFSL 457551). Travel insurance products are underwritten by Zurich Australian Insurance Limited (ABN 13 000 296 640, AFSL 232507). Consider your financial situation, needs and objectives and read the relevant PDS and TMD before deciding to buy this insurance. For more information on these products, please contact us on 1300 728 015, email [email protected] .

Australia Post acknowledges the Traditional Custodians of the land on which we operate, live and gather as a team. We recognise their continuing connection to land, water and community. We pay respect to Elders past, present and emerging.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

24-Hour Assistance Hotline: How We Can Help

Need to locate a reputable hospital nearby? We can help.

When you need medical care while traveling, finding the right provider isn’t as simple as Googling “doctor near me.” Language barriers, financial requirements, and the varying quality of medical facilities all can make it difficult to decide where to seek help.

Instead of trying to figure it out on your own, call the 24-Hour Assistance Hotline. Our Assistance team can identify the best options for care by researching our worldwide database, searching the Internet and verifying services, consulting with our local agent, and speaking to locals, depending on what the situation requires. If you need to be admitted to a hospital for inpatient treatment, Allianz Global Assistance may be able to guarantee or advance payments for covered medical or dental emergencies.

Example: A policyholder falls asleep in the tropical sun for hours and gets the worst sunburn of his life. As he starts to blister, vomit, and shiver, his alarmed wife insists he see a doctor. But they’re at a resort in a remote part of Costa Rica, without a big city nearby.

Our Assistance expert researches our worldwide database to find the best local medical providers. There’s a qualified physician in the next town over, but the traveling couple doesn’t have a car. After consulting resort staff, the Assistance expert learns that the doctor makes house calls, so she arranges for him to come to the sunburned policyholder’s room.

Need assistance communicating in another language? We can help.

Translation apps and phrasebooks are handy, but they don’t always work for important real-world conversations. When you need to communicate in a foreign language, call the 24-Hour Assistance Hotline. We can provide an interpreter on the phone and even conference in the third party for a seamless conversation.

Example: A solo traveler in Italy sees a surprise charge of 120 euros on her hotel bill. She asks the front desk manager to explain, but he doesn’t speak English. The policyholder calls the Assistance team and asks for an Italian interpreter. Once the interpreter is on the phone, the case manager connects to the front desk so that the guest can ask her question. It turns out that the charge was applied in error, and the hotel manager takes it off her bill.

Lost medication or prescription? We can help.

Within the United States, the assistance department can request that an existing prescription be transferred to a sister pharmacy for pickup, or assist the patient in contacting their doctor for a local refill. Outside the United States, we can assist a customer with obtaining a new prescription by locating a doctor, clinic, or hospital, arranging conference calls with your doctor back home, and locating nearby pharmacies. Even though we will help you coordinate with the pharmacy, the customer is responsible for prescription costs.

Example: A policyholder arrives in Osaka and realizes that he left his heart medication on the kitchen counter at home. He did remember to pack a copy of his prescription — but when he brings it to a nearby pharmacy, he discovers that prescriptions from overseas are not valid in Japan. His medication is crucial, and he’s supposed to take it every day. What can he do?

The traveler calls the 24-Hour Assistance Hotline and explains the situation. Our Assistance expert locates a nearby doctor with extended office hours and English-speaking staff, and makes an appointment. Once the doctor issues a new prescription, the Assistance team member directs the traveler to a local pharmacy that can fill it, and helps interpret from Japanese to English.

Need to obtain services for your pet while traveling? We can help.

As more hotels, resorts and restaurants have adopted dog-friendly policies, traveling with pets has gotten easier. Still, challenges sometimes arise: What if you suddenly need a veterinarian, a groomer, a specialty pet store or boarding facilities? Contact the 24-Hour Assistance Hotline, and our experts will find the best options nearby.

Please be aware that pets, and services for pets, are not covered by your travel insurance plan. While we understand that you love your pet like family, pets are not included in the definition of “family member” for travel insurance purposes. Service animals (as defined by the Americans with Disabilities Act) are considered family members. If you need emergency boarding, vet care or other pet services while traveling, we can help you coordinate these services, but you’ll be responsible for paying the associated costs.

Example: A family plans a spring break road trip to Dollywood with their beloved dog Bowser in tow. They plan to board their dog for the day at the theme park’s on-site kennel, Doggywood. But when they arrive, they learn that the kennel is fully booked. They’ve already purchased their park tickets, but they can’t leave Bowser in the car all day.

They call 24-Hour Assistance for help. The Assistance team rapidly researches local pet boarding locations, requirements and pricing. Once they’ve confirmed the best option, Allianz Global Assistance arranges the booking. Bowser romps at doggie daycare, the family rides roller coasters, and everyone ends the day tired and happy.

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

YOUI INSURANCE

Who are they? Youi is a general insurance company who offer vehicle and home insurance. Youi are a subsidiary of Youi Holdings Pty Ltd and underwrite their own policies. Youi began operating in Australia in March 2008 and was authorised by the Reserve Bank of New Zealand in July 2014. The New Zealand head office of Youi is based in Ellerslie in Auckland.

Scroll down to know more

What do they offer?

Youi offer a variety of policies for vehicles and homes. Their vehicle policies include cars, motorcycles, caravans and trailers and water craft, and range from third party to comprehensive cover. Their home insurance policies include contents only, landlords' insurance, building, and combined building and contents cover. In addition Youi offer roadside assistance.

How are they rated?

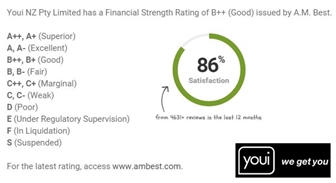

Youi has a financial strength rating of B++ from A M best, which means they are considered good in terms of timeliness and financial obligations. This financial strength rating is somewhat lower than its competitors' and they have received bad press for being expensive car insurers for younger drivers - this was defended by the company in that they 'tailor' their insurance packages and older, more experienced drivers benefit from cheaper policies.

Main New Zealand Insurance Companies:

1cover are a direct travel insurance company. They were discovered...

FMG is an insurance company in New Zealand, has a financial strength rating of A (excellent) from A M best.

IAG NZ DriveRight • Mike Henry Travel Insurance • NAC Insurance • Swann Insurance

IAG NZ is a major insurance provider and offers both direct insurance and intermediated...

Pinnacle are a New Zealand owned and operated online life insurance company.

Southern Cross

Southern Cross Group was established in 1961 and its primary interest is in the health sector.

Sovereign have been offering insurance in New Zealand for the past 25 years.

Suncorp AA Insurance • Asteron life • Vero

Suncorp group are a large finance, banking, and insurance corporation who are based...

Tower are a New Zealand owned and operated insurance company specialising in home...

Unimed has been operating since 1979 and specialises in individual and workplace health insurance.

Youi is a general insurance company who offer vehicle and home insurance.

- Car Insurance

- YOUI Comprehensive Car Insurance Review

The journalists on the editorial team at Forbes Advisor Australia base their research and opinions on objective, independent information-gathering.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia. In comparing various financial products and services, we are unable to compare every provider in the market so our rankings do not constitute a comprehensive review of a particular sector. While we do go to great lengths to ensure our ranking criteria matches the concerns of consumers, we cannot guarantee that every relevant feature of a financial product will be reviewed. We make every effort to provide accurate and up-to-date information. However, Forbes Advisor Australia cannot guarantee the accuracy, completeness or timeliness of this website. Forbes Advisor Australia accepts no responsibility to update any person regarding any inaccuracy, omission or change in information in our stories or any other information made available to a person, nor any obligation to furnish the person with any further information.

Youi Comprehensive Car Insurance Review

Updated: Aug 24, 2023, 1:36pm

Youi Comprehensive Car Insurance is highly regarded by its customers, with an incredible average customer rating of 4.1 stars from 6901 reviews on ProductReview. Unlike many other providers, Youi offers its policyholders free roadside assistance, which is available 24/7, making Youi a top choice for Australians looking to invest in comprehensive car insurance.

Related: Best Comprehensive Car Insurance Providers

- Free roadside assistance included

- High customer ratings

- New-for-old car replacement

- Phone line enquiries only available six days per week

- Choice of repairer is an extra cost

Table of Contents

About youi comprehensive car insurance, what is covered by youi, youi comprehensive car insurance: extras and exclusions, how can i get a discount with youi comprehensive car insurance.

Founded in 2007, Youi is a younger player in the insurance space and offers Australians product liability, home, and of course, car insurance.

Since its founding, Youi has become a popular choice for Australians looking for car insurance thanks to its top-tier offerings and high levels of customer service.

Customers of Youi can choose whether to have their car insured by market value or by agreed value, have roadside assistance automatically included in their policies, and can receive a hire car at no extra cost. It’s choices and benefits like these that have helped Youi stand out with customers, being rated 4.1 stars from 6901 reviews on independent consumer opinion site Product Review.

Youi’s comprehensive car insurance policy is its top insurance offering, covering drivers for accidents, theft, damage to other’s property and more. The comprehensive car insurance policy can be personalised to suit your own needs, with the inclusions and optional extras explained further below.

Break-ins, Accidents and After-Accident Care

With Youi’s comprehensive car insurance policy, accidental damage to your vehicle is covered. This means Youi will cover the costs to replace or repair your car, whether you or someone else is responsible for causing the damage to the car.

In the event that the accidental damage (when you are not at fault) causes your car to be undriveable for a period of time, Youi will also provide a hire car. The maximum number of days and cost limit of the hire car is subject to the individual’s policy.

If an incident occurs more than 100 kilometres from home that causes your car to be undriveable, Youi will provide you with emergency accommodation, transport and repairs up to $1000. Towing and storage of the car is covered to the nearest suitable place after an insured event is also covered.

Theft is also covered with Youi comprehensive car insurance: the contents inside your car are covered up to a maximum of $750, with a cap of $150 per item.

Will Youi Replace My Car if it’s Written Off?

Yes, policyholders of Youi’s comprehensive car insurance policy have a new-for-old car replacement deal in their policy. This means Youi will replace your car for free if it is written off, if you purchased the car as new or demonstrator model, and if it is within the first 24 months from the car’s initial registration.

Can I Choose My Repairer?

Choice of repairer is not an automatic inclusion with Youi’s comprehensive car insurance; however, customers can choose to pay for the feature as an add-on.

Is Free Roadside Assistance Included?

Yes, free roadside assistance is included via Youi Assist. It is available 24/7.

Youi Customer Service (aka How Easy Is it to Make a Claim?)

It is quite straightforward to make a claim with Youi, which can be completed online via the Youi website . You can also track your claims and update them online through the same portal.

If customers would prefer to make a claim over the phone, there is a phone line available six days a week; however, this is the same phone line that is used for enquiries. Rather than waiting in a long queue, Youi offers its customers a call back service so everyone can go about their day without delays.

At Youi, there are certain optional extras: this includes having the choice of your own repairer, and the choice to reduce the excess for your windscreen replacement by increasing your yearly premium.

The exclusions of the policy–being conditions in which claims would be void–are:

- Drivers who are unlicensed or suspended;

- Drivers under the influence, or those who refuse drug or alcohol testing;

- If the driver leaves the scene of an accident without a lawful excuse;

- If the car is being driven in a reckless manner, or any deliberate acts;

- If the incorrect fuel has been used; and

- Other exclusions as listed in the PDS.

Some car insurance providers may have specific bonuses and discounts, such as the ‘no claims bonus’ and a deal called ‘drive less, pay less’.

At Youi, these specific discounts do not exist. However, the concept of each is factored into a policyholder’s premium. This means that the driver’s claims history and the kilometres travelled per year are taken into account when calculating the premium so should reflect the annual amount.

Frequently Asked Questions (FAQs)

Who owns youi car insurance.

Youi was founded in 2007 by OUTsurance Group Limited, which is headquartered in Queensland.

Youi Pty Ltd is an Australian registered company and is a wholly owned subsidiary of Youi Holdings Pty Ltd, which in itself is a subsidiary of OUTsurance International Holdings Pty Limited.

As Youi explains on its website, the ultimate holding company is OUTsurance Group Limited.

How much is Youi comprehensive car insurance?

Like any other car insurance provider, the cost of Youi’s comprehensive car insurance policy will vary between individuals. This is because car insurance is dependent on a number of factors, such as your age, driving history, and any additional extras you choose to opt in or out of.

Youi also take your claims history and the kilometres you travel per year into account when calculating your premium, and the excess you choose will also affect the cost of your premium. Therefore, a general figure for the cost of Youi comprehensive car insurance cannot be provided.

Instead, to get an idea of how much Youi’s comprehensive car insurance would cost you per year, you can use Youi’s online quote calculator found here .

Is Youi car insurance good?

Youi comprehensive car insurance is one of the top rated car insurance providers according to research and analysis by Forbes Advisor. It has been consistently highly rated by its customers, with an average of 4.1 stars from 6901 reviews on ProductReview.

Due to its many perks, benefits and ease of use, Youi car insurance is considered a good choice for Australian drivers.

Sophie Venz is an experienced editor and features reporter, and has previously worked in the small business and start-up reporting space. Previously the Associate Editor of SmartCompany site, Sophie has worked closely with finance experts and columnists around Australia and internationally. Sophie grew up on the Gold Coast and now lives in Melbourne.

- Best Car Insurance Australia

- Best Motorcycle Insurance

Best Car Insurance For Under-25s

- Best CTP Insurance

- Best Caravan Insurance

- What Is Car Insurance?

- What Is Excess In Car Insurance

- Comprehensive Car Insurance Guide

- Third Party Car Insurance Guide

- Guide to Third Party Fire and Theft Car Insurance

- How Much Is Car Insurance?

- Multi Car Insurance

- Applying For Your Learner Licence In Australia

- What Is A Novated Lease?

- RACV Car Insurance Review

- AAMI Car Insurance Review

- NRMA Car Insurance Review

- Budget Direct Car Insurance Review

- Allianz Car Insurance Review

More from

Car insurance offers: how they work, what they mean, ctp insurance in nsw: a guide, how to transfer car ownership in australia, our pick of the best caravan insurance for australians, how to make a car insurance claim in australia.

- Travel Insurance Compare Our Plans Popular Benefits COVID-19 Benefits International Plans Domestic Plans Comprehensive Insurance Annual Multi-Trip Inbound Plan Cruise Ski & Snowboard Motorcycle & Moped Adventure Activities Seniors Medical Conditions

- Emergency Assistance

- Travel Alerts COVID-19 International Travel Tool Cover-More App

- Manage Policy

Travel insurance that’s always by your side

- travel_explore Not sure? See region list.

Last Chance to WIN 1 of 3* travel vouchers

We're giving you a chance to win 1 of 3* $1,000 travel vouchers. To enter, purchase a Cover-More travel insurance policy and use promo code TRAVEL. Get in quick! Entries close 11.59pm AEDT 14 April 2024. Terms and Conditions apply.

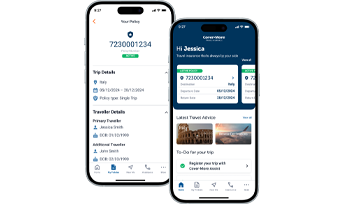

Your policy in your pocket... and more

Register your trip in our app for access to your travel insurance policy details, as well as up-to-date travel advice, real-time safety alerts and 24/7 emergency assistance, all in the palm of your hand.

Travel's back on - and we've got your back

Feel in control by choosing the most suitable plan for you

Feel safe with 24/7 access to Emergency Assistance

Feel joy with 80+ adventure activities included

Feel confident with our 35+ years of travel expertise

Looking for the best travel insurance plan for your holiday?

Whatever your travel budget, style or needs, let's travel the world together - safely.

International Basic

Essential cover designed for Australian travellers on a budget.

Pre-trip cover if you're diagnosed with COVID-19

On-trip cover if you're diagnosed with COVID-19^##

Unlimited~ overseas emergency medical expenses^

Up to $5,000 luggage cover

Existing medical conditions cover available

Optional cancellation cover

Single Trip policies

Annual Multi-Trip policies^

Rental vehicle insurance excess

International Comprehensive

Extensive cover and benefit limits to provide extra financial protection.

Pre-trip cover if you're diagnosed with COVID-19#

On-trip cover if you’re diagnosed with COVID-19 while travelling^##

Up to $15,000 luggage cover*

Optional cancellation cover with Cancellation Extensions

Single Trip or Annual Multi-Trip^^ policies

Rental vehicle comprehensive cover

International Comprehensive +

Everything our Comprehensive Plan includes and more + higher benefit limits.

Pre-trip cover if you’re diagnosed with COVID-19 before travelling#

Up to $25,000 luggage cover*

Business trip benefits

* Item limits apply.

~ Cover will not exceed 12 months from onset of the illness, condition, or injury.

^ For cruise-related expenses, Cruise Cover must be included in the policy. There is no cover for cabin confinement related to COVID-19.

^^ Policy availability subject to age, trip duration and area of travel. Policies may not be available to all travellers.

# Up to $5,000 per policy (or the amount chosen if this is less) applies to International Comprehensive Plan and Comprehensive+ Plan policyholders with Amendment or Cancellation Costs cover included. You must be diagnosed with COVID-19 and certified by a qualified medical practitioner as being not fit to travel for cover to apply.

## Up to $5,000 per policy (or the amount chosen if this is less) applies per policy for policyholders with Amendment or Cancellation Costs cover included. You must be diagnosed with COVID-19 and certified by a qualified medical practitioner as being not fit to travel for cover to apply. A special excess applies.

Searching for COVID-19 cover?

To help you explore the world with confidence, our travel insurance provides cover for COVID-19-related:

Overseas medical costs*~#

Amendment and cancellation costs*^

Additional expenses*#^

*Limits, sub-limits, conditions, and exclusions apply.

~Medical cover will not exceed 12 months from onset.

#Cover for medical costs related to COVID-19 is not available on our Domestic Plans.

^A special excess will apply.

Holiday hasn't gone to plan?

You can submit a Cover-More travel insurance claim online at any time – and from anywhere.

Get emergency support, fast. We're here 24/7.

When adventure awaits... we can help provide cover.

Setting sail for two or more nights? You'll need to let us know and Cruise Cover will be added to your policy.

Snow Sports

Hitting the slopes? Consider protecting your winter getaway with one of our two levels of Snow Sports Cover.

Adventure Activities

Planning on engaging in extreme activities? We've got two additional Adventure Activities Cover options for you.

Motorcycle & Moped

Want to take to the road on two wheels? See if one of our Motorcycle/Moped Riding Cover options is right for your trip.

We're by your side when you need us most

We've been protecting Australian travellers for over 35 years. Read our customers' Cover-More travel insurance reviews to discover how our expert team provides exceptional care during uncertain times.

Mosquito bite in Bali

Shannon was bitten by a mosquito in Bali, which caused Dengue Fever.

"Cover-More were absolutely fantastic. I wasn't responding well to medical treatment, so they flew in a specialist from Singapore to accompany me all the way home. I'm so glad I had Cover-More travel insurance."

Boat crash in Thailand

Natalie was involved in a speedboat crash in Thailand, which resulted in a fractured pelvis and a brain haemorrhage.

"Luckily I had Cover-More insurance. They took care of everything and made sure we had the best medical treatment available."

Accidental fall in Poland

Irene was visiting family in Poland when she had a fall, which resulted in a bad fracture and extensive medical costs.

"Amazing. I can't praise them highly enough. Wonderful, wonderful people... Nobody should travel without insurance."

Protect your trip with us - get a free travel insurance quote now.

How can we help you travel smarter.

Whether you’re a seasoned traveller or a first-timer, we’re here to help you feel empowered to travel further, safely.

Finding cover for Existing Medical Conditions (EMCs)

Have an EMC? We can provide cover for various conditions to help keep you exploring, safely.

7 ways COVID-19 has changed the way we travel

Worried about travel risks during COVID-19? Discover how you can help ensure a safer trip.

What you should know before you hit the slopes

Planning a ski trip at home or abroad? Don't depart without reading our expert advice.

Got a question about travel insurance? We're here to help

What is travel insurance.

Travel insurance is a specific type of insurance that helps cover several costs and disruptions when travelling both domestically and overseas. Levels of cover differ per plan; however, travel insurance typically protects against trip cancellation, delays, lost luggage and personal belongings, overseas medical expenses and repatriation, and personal liability.

Most travel insurance providers offer single or multi-trip policies, which can cover multiple countries within a specific timeframe. Things like the destination, length of trip, optional additional cover for specific activities and pre-existing medical conditions all help determine the cost of a travel insurance policy.

How much does travel insurance cost?

The cost of a travel insurance policy varies from traveller to traveller because various factors affect the amount payable.

At Cover-More, we consider a number of factors when calculating the total amount payable. The following is a guide on these key factors, how they combine and how they may impact the assessment of risk and therefore the premium paid:

- Area: higher risk areas cost more.

- Departure date and trip duration: the longer the period until you depart and the longer your trip duration, the higher the cost may be.

- Age: higher risk age groups cost more.

- Plan: International Comprehensive+, which provides more cover, costs more than International Comprehensive or Domestic.

- Excess: the higher the excess the lower the cost.

- Cruise cover: additional premium applies.

- Cancellation cover: on some policies you can choose your own level of cancellation cover. The more cancellation cover you require, the higher the cost may be.

- Adding cover for Existing Medical Conditions and pregnancy (where available): additional premium may apply if a medical assessment is completed and cover is accepted by us.

- Options to vary cover (where available): additional premium applies.

While a cheaper policy cost upfront may seem appealing, always read the Product Disclosure Statement to ensure your needs are adequately covered should an incident occur.

How does travel insurance work?

Travel insurance protects you when travelling domestically or internationally by providing coverage against unforeseen circumstances that may impact your travel plans. By purchasing travel insurance with cancellation cover prior to departure, your policy can help by providing cover for the costs of trip cancellations should you no longer be able to travel, as well as the costs of overseas medical treatment, lost passports, and personal items while you’re travelling.

The customer usually pays for these costs upfront, before being reimbursed by the travel insurer upon claim approval. To approve a claim, travel insurers require documentation such as medical reports, itemised medical bills or police reports to confirm the incident occurred.

However, at Cover-More, if our customer becomes ill overseas, they can also contact our 24-Hour Emergency Assistance team for support and to seek approval for expensive medical bills to be paid directly by us to the medical care provider/s instead.

Always read the Product Disclosure Statement before purchasing a travel insurance policy to ensure it provides adequate coverage for your circumstances.

What does – and doesn’t – travel insurance cover?

Unfortunately, travel insurance can’t cover absolutely everything. This highlights the importance for travellers to read the Product Disclosure Statement before purchasing to avoid becoming frustrated if claims are unsuccessful. It will contain details on the situations you likely won’t be covered in, including cancellation, pre-existing medical conditions, theft or loss of belongings, adventure sports, COVID-19 scenarios and more.

For full details of the exclusions within our Cover-More travel insurance plans, consult the Product Disclosure Statement .

When is the best time to purchase travel insurance?

The best time to purchase travel insurance is as soon as a trip is booked, as this can increase protection. When purchased ahead of time, a Cover-More customer can cancel their travel insurance policy for a full refund within the 21-day cooling-off period. If the policy is purchased before departing on the trip, claims for rearrangements and cancellations caused by unforeseen circumstances can also be made where cancellation cover is added to the policy.

- United States

- United Kingdom

Youi car insurance vs AAMI

A side by side comparison of youi and aami car insurance including expert analysis of pricing, features, complaints and reviews..

In this guide

Youi vs AAMI car insurance — compare key features

Youi vs aami car insurance prices compared, car insurance policies on offer, customer reviews, youi and aami car insurance complaints information, finder's verdict.

Read our review of other brands

Youi and AAMI car insurance are both solid options if you want a comprehensive car insurance policy. AAMI edges it slightly on a few benefits (its limits are slightly higher) but Youi automatically includes roadside assistance. It's the only car insurer to offer this with its comprehensive policy.

We've compared the comprehensive car insurance policies on offer from Youi car insurance and AAMI car insurance . See further below for other types of car insurance offered by these providers.

As part of our 2024 Finder car insurance awards , we collected over 1,800 comprehensive quotes from 30 car insurance providers, using a range of driver profiles across different states, ages and genders.

On average, AAMI typically offers cheaper car insurance than Youi. However, it's important to keep in mind that price may not be the only factor in your search for the best car insurance .

These quotes are formed based on a fictional driver profile and your own quote will differ based on your personal circumstances. This should be used as a guide only.

About our car insurance methodology

Youi offers 3 levels of car insurance cover:

- Youi Comprehensive

- Youi Third Party Fire & Theft

- Youi Third Party Property Damage

AAMI offers 2 levels of car insurance cover:

- AAMI Comprehensive

- AAMI Third Party Property Damaege

Youi won Finder's Customer Satisfaction awards in 2023 and has a really high score on popular online review sites. AAMI came in third place in the awards. We surveyed over 5,700 people in total.

Youi has always looked after us, really fantastic service always.

Youi user, SA

Great value and friendly staff.

Youi user, VIC

Really good to deal with on phone.

Easy to use app, low premiums, easy to understand policies.

AAMI user, WA

Competitive pricing good service via the phone.

Good value for money and friendly, helpful customer service.

AAMI user, SA

Using data from the Australian Financial Complaints Authority (AFCA), we can see how many motor insurance complaints the underwriters from Youi and AAMI (AAI) have received and resolved.

If you want quality customer service, a solid policy and roadside assistance automatically included, consider Youi. If price is the most important thing for you, or there are certain features you want high limits for, AAMI might be a safer bet. Either way, make sure you look at a handful of insurers, compare their cover and see who is priced best for you.

Gary Ross Hunter Insurance and innovations editor

Gary Ross Hunter

Gary Ross Hunter is an editor at Finder, specialising in insurance. He’s been writing about life, travel, home, car, pet and health insurance for over 6 years and regularly appears as an insurance expert in publications including The Sydney Morning Herald, The Guardian and news.com.au. Gary holds a Kaplan Tier 2 General Advice General Insurance certification which meets the requirements of ASIC Regulatory Guide 146 (RG146).

More guides on Finder

Many Aussies would call someone else for help, even if they're already paying for the service.

What you need to know about getting a multi-policy discount with your car insurance.

Your guide to finding car insurance if you've got a criminal record.

Your guide to CTP car insurance in South Australia.

Your guide to CTP car insurance in Queensland.

Everything you need to know about car insurance claims when your vehicle is damaged in a hit-and-run.

Your guide to cancelling your car insurance policy the right way.

Discover if your car insurance policy will cover you for paint damage with this guide.

Your comprehensive guide to car insurance excess, what it is and when it needs to be paid.

Discover how roadside assistance does so much more than simply helping you out if you have a breakdown with this handy guide.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

2 Responses

Most car insurance companies are owned by the same parent company and when one phones them, they appear to be utilising the same platforms (phone response and questions asked).

How different are they in reality? Do they share data between each other when the person making the inquiry has also made similar inquiries with another one or more of the companies in the ‘group’?

I believe you’re referring to the same underwriters, but with different insurance brands. Is that correct? It’s true that some insurance companies do share the same underwriters.

If you wish to learn more, it’s best you get in touch with an insurance brand and ask them directly about this, including how they handle customer data.

Regards, James

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We're here to help you find what you need. Ask our virtual agent for help any time.

Contact USAA

You can reach any department through our main number. To find information for a specific department, refer to that section.

USAA Banking Routing Number

USAA Main Number

Shortcut Mobile Number

Works with most carriers

USAA Main Mailing Address

Accessibility and Translation Services

To contact USAA regarding accessibility accommodations:

Phone Number

Mailing Address

To learn about our accessibility policy, assistive technologies and more, visit our

For information about Telecommunications Relay Service, visit the

Auto and Property Insurance

24/7 Roadside Assistance Phone Number

Routing Number

Lobby Address

Lobby Hours

Drive Through Hours

Financial Centers

Life, Health and Annuities

Loss of a loved one, mortgage loans and services.

Loans in Process

Hours of Operation

USAA Main Number Update Mortgage Clause

USAA Mortgage Serviced by Nationstar

Shopping and Discounts

Get exclusive deals on car rentals, flowers, travel and more.

Latest offers

Update your browser..

This website doesn't support your browser and may impact your experience.

NAB Mobile Banking app

Contact us – insurance

We've got contact information and resources to help you with insurance for your home, car, travel and more.

Get a quote online

It's quick and easy to find out more about the cost of insurance.

- Home and contents insurance quote

- Car insurance quote

- Landlord insurance quote

- Caravan and trailer insurance quote

Contact us about insurance

Chat to us about getting a quote, making a change to an existing policy or make a claim.

Message us online

NAB Messaging answers your banking questions 24 hours a day. Ask our Virtual Assistant everyday questions or chat to a NAB banker.

For questions about your NAB account, log into NAB Internet Banking or the NAB app to start a conversation with us.

Get answers anytime with NAB Messaging

Make a claim online

If you need to make a claim, it’s easy to do so online.

Make a motor or property insurance claim , opens in new window

Make a travel insurance claim , opens in new window

Monday to Friday, 8:00am to 9:00pm (AEST/AEDT) Saturday and Sunday, 8:00am to 5:00pm (AEST/AEDT)

Within Australia: 13 29 28

Important information

This section contains Important Information relevant to the page you are viewing, but you can't see it because you have JavaScript disabled on your browser. Please enable JavaScript and come back so you can see the complete page. It's important that you read the Important Information in this section before acting on any information on this page.

Apologies but the Important Information section you are trying to view is not displaying properly at the moment. Please refresh the page or try again later.

Retail Asia Publishing Pte Ltd

Blog of Loans, Finance Banking, Insurance

Youi Car Insurance Review Claim? Renewal, Quotes Login Contact (2024)

March 18, 2024 Suze Orman 3 Comments

Youi Car Insurance review is good? Is a Youi car convenient for customers? How to register for youi comprehensive car insurance? How about Quote, Claim, renewal.

Summary of Youi Car Insurance

What is youi car insurance, pros of youi online car insurance, cons of youi car insurance, youi car insurance quotes, youi car insurance policy, step 1: visit the youi website, step 2: get a quote, step 3: provide your information, step 4: complete the registration process, youi car insurance reviews, feedback of youi car insurance, youi car insurance claims, compare to types of youi insurance, youi car insurance contact, is youi car insurance good, how to cancel youi car insurance, what does youi car insurance cover, how much is youi car insurance, who underwrites youi insurance, in conclusion.

Youi Car Insurance is an insurance provider that offers coverage for automobiles. They are renowned for offering tailored coverage depending on the requirements and driving habits of certain drivers. The firm intends to customize insurance policies to meet each customer’s unique needs, which might lead to more pertinent and affordable coverage alternatives.

Here are some advantage based on reviews on Youi car insurance:

- Personalized Policies : Youi is praised for offering customized insurance plans that cater to individual drivers’ needs, potentially leading to more suitable coverage.

- Competitive Pricing : Many customers have found Youi’s car insurance rates to be competitive and affordable compared to other insurance providers.

- User-Friendly Online Platform : The company’s online platform is user-friendly and easy to navigate, making it convenient for customers to manage their policies online.

- Quick and Efficient Claims Process : Positive reviews mention a smooth and efficient claims process, allowing customers to resolve claims quickly.

- Excellent Customer Service : Youi receives favorable feedback for its attentive and responsive customer service team, which assists policyholders throughout their insurance journey.

- Flexible Payment Options : The company offers various payment options, giving customers the flexibility to choose the payment method that suits them best.

- Bundling Options : Customers can bundle multiple insurance products with Youi, which may lead to additional discounts and cost savings.

Please note that individual experiences may vary, and it’s always essential to research thoroughly and read multiple reviews to form a comprehensive understanding of an insurance provider’s offerings and reputation.

Cons of Youi Car Insurance may include:

- Higher premiums : Some customers have reported that Youi’s premiums can be relatively higher compared to other insurance providers.

- Aggressive sales tactics : There have been complaints about aggressive sales tactics, such as persistent phone calls and pushy selling techniques.

- Complex pricing structure : The pricing structure of Youi’s policies can be intricate, leading to confusion for some customers.

- Limited coverage options : Youi may not offer as many coverage options as some larger insurance companies, limiting choices for certain individuals.

To get youi comprehensive car insurance quote, visit their website or contact their customer service for personalized coverage and pricing information. Here is a table for quote:

Here are some Youi car insurance policy:

- Medical coverage for emergency medical expenses and hospitalization.

- Coverage for lost or delayed baggage.

- Emergency assistance services available 24/7.

- Additional options for coverage extensions and upgrades.

- Coverage for personal liability.

- Coverage for travel delays and missed connections.

Guide to register Youi car insurance Step-by-step

Here is a simplified step-by-step guide to register for Youi car insurance :

Go to the official website of Youi Insurance. You can easily find it by searching “Youi car insurance” or access this URL: Youi car insurance website

On the Youi website, you should find a “Get a Quote” or “Get Started” button. Click on it to begin the process of getting a car insurance quote.

You will be asked to provide various details related to your car, such as its make, model, year of manufacture, usage, and your personal information, such as name, contact details, and address. Be prepared to provide accurate and complete information.

Review all the information you provided and the selected coverage options. If you are satisfied with the details, you can proceed to complete the registration process. This may involve setting up an account with Youi or providing payment information for your insurance premium.

From my own experiences, I know that Youi car insurance in Australia is a reliable company that offers full coverage. Some of the best parts of their service are:

- Positive customer experiences with friendly and helpful customer service representatives.

- Some customers appreciate the personalized approach to insurance quotes based on individual circumstances.

- Quick and efficient claims process in certain cases.

- Competitive pricing and flexible coverage options for various needs.

- However, some negative reviews mentioned issues with claims processing delays and premium increases over time.

Youi Car has generally received much feedback from customers related to youi car insurance renewal . Here is some feedback from customers.

- Mr. John, Australia, reviewed over 2 months ago that: “Youi car insurance renewal allows policyholders to extend their coverage for another term. During the renewal process, policyholders can review their policy details, make necessary updates, and adjust coverage options to suit their changing needs. Renewing with Youi ensures continued protection and peace of mind on the road.”

- Ms. Ratna, Sydney, reviewed 11 months ago that: “Youi car insurance renewal is a straightforward process that allows policyholders to extend their coverage and continue benefiting from their services. It’s essential to review and update your policy to ensure it meets your current needs and circumstances.”

Here are some common keywords and themes related to Youi Car Insurance claims:

- Efficient Claims Process : Customers have mentioned a streamlined and efficient process when filing and processing claims with Youi car insurance.

- Personalized Assistance : Youi is known for offering personalized support and guidance throughout the claims process, catering to each customer’s unique situation.

- Friendly Claims Representatives : Positive reviews highlight the helpfulness and friendliness of Youi’s claims representatives, making the process more comfortable for policyholders.

- Timely Settlements : Many customers have praised Youi for providing timely settlements on their claims, helping them get back on track after an accident or incident.

- Smooth Communication : Customers appreciate clear and transparent communication from Youi throughout the claims handling, keeping them informed about the progress of their claim.

- Flexibility in Coverage : Youi’s flexibility in coverage options may allow policyholders to tailor their claims according to their specific needs, enhancing satisfaction with the overall claims experience.

Sources: Refer to Daily Telegraph reporting and research

Here are contact details for Youi Car Insurance:

- Call 1300 555 727 and then ask for 13 9684.

- AEST – Australian Eastern Standard Time.

Sales Services

- Monday to Friday

- 07:00am – 10:30pm

- Claims Lodgement

- 24 hours a day

- 7 days a week

Claims Care

- Monday – Friday

- 7:30 am – 8:00 pm

Client Services

- Monday to Saturday

- 07:00 am – 08:30 pm

It’s recommended to visit the official Youi Car insurance website for the most up-to-date contact details about youi car insurance phone number.

- Top 10 Best Travel insurance in Australia

- Cover More travel insurance

- Cheapest car Insurance Melbourne

- Bingle car insurance

FAQs – Youi car insurance

Here are some FAQs about Youi car insurance to help you have more useful information:

Yes, Youi car insurance is a well-known company that does business in Australia, New Zealand, and South Africa, among other places. They offer different kinds of car insurance, such as full coverage, third-party fire and theft coverage, and third-party property damage coverage. Some Youi car insurance customers have had good experiences.

To cancel Youi car insurance, contact their customer service department through phone or email. Give information about your coverage and why you want to cancel. Review the cancellation terms and any applicable fees. Ensure you have alternative coverage in place before canceling. Follow their instructions for a smooth cancellation process.