Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

Amex Business Platinum Card vs. Amex Corporate Platinum Card [Detailed Comparison]

Christine Krzyszton

Senior Finance Contributor

308 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Jessica Merritt

Editor & Content Contributor

86 Published Articles 492 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Senior Editor & Content Contributor

96 Published Articles 681 Edited Articles

Countries Visited: 41 U.S. States Visited: 28

![american express corporate travel card Amex Business Platinum Card vs. Amex Corporate Platinum Card [Detailed Comparison]](https://upgradedpoints.com/wp-content/uploads/2022/04/Amex-Business-Platinum-vs-Amex-Corporate-Platinum-Upgraded-Points-LLC.jpg?auto=webp&disable=upscale&width=1200)

Amex Business Platinum Card vs. Amex Corporate Platinum Card — Overview

Business credit cards vs. corporate credit cards, application guidelines, the value of a welcome offer, earning potential, amex business platinum card, amex corporate platinum card, additional travel benefits and protections — amex business platinum card, annual fees and authorized users, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Upgraded Points: Expertise You Can Trust

Our seasoned and experienced team brings years of expertise in the credit card and travel sectors. Committed to integrity, we offer data-driven guides to help you find the card(s) that best fit your requirements. See details on our intensive editorial policies and card rating methodologies .

- Content by Leading Industry Experts

- Routine Updates and Fact-Checks

- First-Hand Credit Card Experience

- Shared Across 200+ Top Outlets

The U.P. Rating System

- 1028+ Expert Credit Card Guides

As your business grows, you may need to think seriously about a business credit card that can help you manage your business expenses. You may also want to secure a card that ensures you’ll earn rewards on those expenses and has redemption options that can add value to your bottom line .

If your business involves travel, having a card that provides premium travel benefits and protections might also be a priority.

Additionally, if you’re considering a corporate card for your business operation, you’ll want to keep reading. We’re comparing The Business Platinum Card ® from American Express to the Corporate Platinum Card ® by American Express* .

While both cards offer plenty of value for a business owner, they’re considerably different .

Join us as we look at the guidelines for applying, how each of these cards earns rewards, the redemption options you’ll have, and an overview of any benefits and protections that might add value to your business.

All information about the Corporate Platinum Card ® by American Express has been collected independently by Upgraded Points.

Before we dive into all the key details of the Amex Business Platinum card and the Amex Corporate Platinum card, let’s look at a high-level overview comparing our featured cards side-by-side.

*All information about the Corporate Platinum Card ® by American Express has been collected independently by Upgraded Points.

There are stark differences between a business credit card and a corporate credit card. We’ll talk about American Express-issued cards next, but first, let’s look at the general differences between these 2 types of cards:

- Liability for Debt — Typically, a business credit card requires the primary cardholder to be personally responsibility for any charges made on the card. With a corporate card, the business entity is normally responsible.

- Eligibility — Any business, large or small, can apply for a business credit card, while corporate cards may accept only incorporated businesses. Additionally, minimum annual revenue requirements and even a minimum number of employees may be required for eligibility.

- Card Features — Both business and corporate cards allow you to manage employee spending with tracking and spending-limit capabilities. Both types of cards also typically offer rewards earning and redemption options.

- Application Process — You can apply online for a business card, but applying for a corporate card may require a consultation with a representative to work through the application process and discuss available employee card options.

A corporate card may be the better choice if your business has an extraordinary amount of transactions, if spending limits need to be higher, or if you have 100 employees or more. Corporate cards may also feature a more enhanced card management system than a business card.

Bottom Line: Business credit cardholders are typically responsible for charges on the card, while the business is responsible for charges on a corporate card. Any business can normally qualify for a business card, but a corporate card may require the business to be incorporated and have specific revenue or employee levels. Both types of cards offer management tools and can offer rewards on purchases.

Now let’s talk specifically about American Express-issued business and corporate cards.

It’s recommended that you have good to excellent credit to qualify for the Amex Business Platinum card — generally a score of 700 or better . It is possible to be approved with a slightly lower credit score as other factors of your credit history are considered. When applying for the Amex Corporate Platinum card, your business credit score and history will determine your acceptance.

Anyone with the appropriate credit history and a business, even a small business, can apply for the Amex Business Platinum card. The Amex Corporate Platinum card requires a business to meet the following criteria:

- Revenue of over $4 million each year

- Business address other than a home address

- 12 months or more in business

- Not a sole proprietor

One major difference between the Amex Business Platinum card and the Amex Corporate Platinum card is that your personal credit can be used to guarantee the debt on the Amex Business Platinum card, while the business would guarantee the debt on the Amex Corporate Platinum card.

Additionally, both cards require that the balance be paid off in full each statement period .

Hot Tip: Select American Express Corporate cardmembers may qualify for an annual statement credit offer, up to $150, for select personal American Express cards.

When you apply and are subsequently approved for the Amex Business Platinum card, you’ll have the opportunity to earn a welcome bonus after meeting minimum spending requirements during the period immediately following your card approval.

This card is ideal for business travelers who enjoy luxury travel and are looking for a card loaded with benefits!

The Business Platinum Card ® from American Express is a premium travel rewards card tailored toward business owners who are frequent travelers with a high number of annual expenses.

When you factor in the large number of perks that the card offers like the best airport lounge access at over 1,400 lounges , along with tons of annual credits, it’s easy to see why this card can is a top option for frequent traveling business owners.

Hot Tip: Check to see if you’re eligible for a huge welcome bonus offer of up to 170,000 points with the Amex Business Platinum. The current public offer is 150,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

- 5x Membership Rewards points per $1 on flights and prepaid hotels at Amex Travel

- Access to over 1,400 worldwide airport lounges as part of the American Express Global Lounge Collection

- High annual fee of $695 ( rates & fees )

- Airline fee credit does not cover airfare, only incidentals like checked bags

- Welcome Offer: Earn 150,000 Membership Rewards ® points after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership.

- 5X Membership Rewards ® points on flights and prepaid hotels on AmexTravel.com, and 1X points for each dollar you spend on eligible purchases.

- Earn 1.5X points (that’s an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year.

- Unlock over $1,000 in statement credits on select purchases, including tech, recruiting and wireless in the first year of membership with the Business Platinum Card ® . Enrollment required. See how you can unlock over $1,000 annually in credits on select purchases with the Business Platinum Card ® , here.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to the Card.

- $189 CLEAR ® Plus Credit: Use your card and get up to $189 in statement credits per calendar year on your CLEAR ® Plus Membership (subject to auto-renewal) when you use the Business Platinum Card ® .

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market as of 03/2023.

- $695 Annual Fee.

- Terms Apply.

- APR: 19.49% - 28.49% Variable

- Foreign Transaction Fees: None

- Credit Card Reviews

- Best Business Credit Cards

- Credit Cards

- Best Sign Up Bonuses

American Express Membership Rewards

Hot Tip: Check to see if you’re eligible for a huge welcome bonus offer of up to 170,000 points with the Amex Business Platinum. The current public offer is 150,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

We value Membership Rewards points at approximately 2.2 cents each , which means a 100,000-point welcome offer would be worth up to $2,200 .

Welcome bonuses and spending requirements change so be sure to check the most current offer before applying.

Note that the Amex Corporate Platinum card does not feature a welcome offer.

It’s a smart decision to earn rewards on purchases you’re making anyway , especially when you have a lot of business expenses.

Here’s how you’ll earn rewards on all of the purchases you make with either the Amex Business Platinum card or the Amex Corporate Platinum card:

Bottom Line: The Amex Business Platinum card has the edge with a more robust earning structure than the Amex Corporate Platinum card.

Redemption Options

The primary cardholder on the Amex Business Platinum card and company-designated program administrators on the Amex Corporate Platinum card have several redemption options for Membership Rewards earned on the corresponding cards .

- Flights — Redeem points at 1 cent each for flights via AmexTravel.com

- Transfer to Amex Transfer Partners — Transfer points to airline and hotel partners to purchase award flights or free hotel nights.

- Flight Upgrades — Use points to bid for flight upgrades .

- Pay With Points Rebate — Redeem points via AmexTravel.com for business or first class flights on any airline or any class flights on your preselected airline and receive a 35% rebate in points (up to 1 million points back per calendar year).

- Additional Redemption Options — Redeem points for statement credits, to shop at Amazon and select retailers, for gift cards, or prepaid hotels via AmexTravel.com.

- Certificates and Gift Cards — Purchase gift certificates or retail gift cards with Membership Rewards points earned on the card.

- American Express Gift Cards — Membership Rewards points may be used to purchase American Express gift cards online.

- Use Pay With Points — Use points to book select travel via AmexTravel.com or for purchases at Ticketmaster.

- Shop With Points — Link your Amex Corporate Platinum card to your Amazon account and use points for your purchases. You can also redeem points to shop with select retailers such as Best Buy, but shopping with points is generally a poor value.

- Statement Credit — Membership Rewards points are worth 0.5 cents each towards a statement credit. For example, you can redeem 20,000 points for a statement credit of $100.

For the Amex Business Platinum card, the primary cardholder has redemption privileges. For the Amex Corporate Platinum card, the company will designate administrators who are granted redemption privileges in the Corporate Membership Rewards Program. A company may also choose to allow individual cardholders to accumulate Membership Rewards and have redemption privileges.

Bottom Line: The Amex Business Platinum card offers more flexibility and additional options at redemption time than the Amex Corporate Platinum card.

Travel Benefits and Protections

Travel benefits can save you money while protections can provide peace of mind knowing you’re covered should something go wrong during your travels.

Here are some of the key travel benefits and protections you can expect to receive on both the Amex Business Platinum card and the Amex Corporate Platinum card:

- Centurion Lounges

- Delta Sky Club (when flying Delta on the same day)

- Escape Lounges – The Centurion Studio Partner

- International Centurion Lounges

- Select Lufthansa Lounges (when flying on a Lufthansa Group flight the same day)

- Plaza Premium Lounges

- Priority Pass Select (upon enrollment)

- Select Virgin Clubhouse Lounges

- $189 CLEAR Plus Credit — Pay for CLEAR Plus expedited airport security membership with your card and receive up to $189 in statement credits.

- Up to $200 Airline Fee Credit — Log into your online card account and select your preferred airline. Use your card to make your purchase and receive a statement credit.

- Global Entry or TSA PreCheck Credit — Pay the application or renewal fee with your card and receive reimbursement for up to $100 Global Entry or up to $85 TSA PreCheck for application fees.

- Hilton Honors Gold Status — Sign in to your Amex card account online and register for this complimentary elite status benefit.

- Marriott Bonvoy Gold Elite Status — Receive complimentary Marriott Bonvoy Gold Elite status as long as you have the card. Registration is required.

- Fine Hotels & Resorts Benefits — Amex Business Platinum card benefits include room upgrades when available, daily breakfast for 2, noon check-in when available, 4 p.m. checkout, complimentary Wi-Fi, and an onsite amenity or experience (minimum value of $100). The Amex Corporate Platinum card offers the same benefits, however, the onsite amenity or experience value is based on prior year bookings.

- International Airline Program — Receive discounts of up to 20% on international fares with select airlines when using AmexTravel.com’s International Airline Program.

- Premium Global Assist Hotline — Enjoy 24/7 assistance with emergency transportation arrangements, medical referrals, translation services, and more. Cardholders are responsible for the actual services received.

- Roadside Assistance — Receive up to 4 service calls each calendar year, including tire changing, lockout service, jump-starting, limited towing, and fuel delivery.

In addition to the list of shopping benefits and protections you’ll find on both cards, the Amex Business Platinum offers these additional features:

- No Foreign Transaction Fees — Unlike the Amex Corporate Platinum card which charges 2.5%, the Amex Business Platinum card does not charge foreign transaction fees ( rates & fees ).

- Points Rebate via AmexTravel.com — Business and first class flights purchased using Pay With Points on any airline via AmexTravel.com will receive a rebate of 35% of the points used. Any flights purchased with points via AmexTravel.com on your preselected airline using points will also receive the rebate.

- The Hotel Collection Benefits — Use your card to book a stay for a minimum of 2 nights and receive an upgraded room, when available, and a $100 experience credit to use onsite for dining, spa, and resort activities.

- Car Rental Program Benefits — Receive elite-style benefits such as discounted pricing, a grace period for returning your rental car, car upgrades, and more with Avis, Hertz, and National.

Bottom Line: While the Amex Corporate Platinum card comes with several travel benefits and protections, the Amex Business Platinum card offers additional benefits and protections such as no foreign transaction fees, a points rebate when booking flights via AmexTravel.com, and hotel and car rental benefits.

Shopping Benefits and Protections

Shopping benefits can save you money while protections can save the day if an eligible item you purchase with your card becomes damaged.

Here are the shopping benefits and protections you can expect on both the Amex Business Platinum card and the Amex Corporate Platinum card:

- Cell Phone Protection — Pay for your monthly eligible cell phone service with your card and receive coverage for theft or damage, up to $800 per claim. There is a limit of 2 claims per eligible card account each 12-month period and there is a $50 deductible applied to each claim.

The Amex Business Platinum card offers these additional shopping benefits/protections:

- Dell Statement Credit — Receive up to $400 in annual statement credits for qualifying purchases at Dell Technologies, a limit of $200 from January through June, and another $200 from July through December.

- Wireless Services Statement Credit — Pay for your monthly wireless phone service with your card and receive up to $10 per month, $120 each year, as a statement credit.

- Adobe Statement Credit — Receive up to $150 each year in statement credits for qualifying Adobe purchases.

- Indeed Statement Credit — Purchases made directly with Indeed can qualify for up to $90 in statement credits each quarter, for a total of $360 in credits each calendar year.

Bottom Line: The Amex Corporate Platinum card does not list any shopping benefits or protections in its benefit descriptions other than cell phone protection.

The Amex Business Platinum card charges an annual fee of $695 while the Amex Corporate Platinum card charges $550 .

Adding employee cards is a key component to managing the expenses your business makes. Both cards provide card management tools and make it easy to add employee authorized users.

Adding an additional user to the Amex Business Platinum card will cost $350 each year for every additional cardmember. You can add Amex Gold card members for $45 each annually and there is no charge to add Amex Gold card members . You can add up to 99 additional card users .

Each Amex Corporate Green card issued to an employee has an annual fee of $75 .

Hot Tip: Authorized users on the Amex Business Platinum card receive full unlimited access to the Amex Global Lounge Collection plus a Global Entry or TSA PreCheck fee reimbursement.

If your business has grown to the point where you’re considering a corporate card, you may want to first consider a premium business card . You’ll need to weigh the personal liability issue of a business credit card versus a corporate card, determine which has a better rewards program for your spending mix, and whether the management tools meet the expense activity of your business.

The Amex Business Platinum card may be a better choice over the Amex Corporate Platinum card depending on your business structure.

Finally, let’s clarify that not all of the benefits for both cards have been included in this article, only key ones. Benefit and protection descriptions have also been abbreviated, so you’ll want to access each card’s Guide to Benefits for full descriptions and the terms/conditions. Additionally, for the Amex Corporate Platinum card, some features, benefits, and fees are not publicly accessible but are disclosed and applied during the application process.

The information regarding the American Express ® Corporate Green Card was independently collected Upgraded Points and not provided nor reviewed by the issuer.

For the Global Assistant Hotline benefit of The Business Platinum Card ® from American Express and The American Express Corporate Platinum Card ® , cardmembers can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, we may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Visit americanexpress.com/benefitsguide for more details. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

For the Cell Phone Protection benefit of The Business Platinum Card ® from American Express and The American Express Corporate Platinum Card ® , coverage for a stolen or damaged eligible cellular wireless telephone is subject to the terms, conditions, exclusions and limits of liability of this benefit. The maximum liability is $800, per claim, per Eligible Card Account. Each claim is subject to a $50 deductible. Coverage is limited to two (2) claims per Eligible Card Account per 12 month period. Eligibility and benefit level varies by Card. Terms, Conditions and Limitations Apply. Visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

The information regarding the Corporate Platinum Card ® by American Express was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Business Platinum Card ® from American Express, click here . For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Which is better, the amex business platinum card or the amex corporate platinum card.

Either card could be a potential fit for a business. However, the Amex Corporate Platinum card is only available to businesses that have over $4 million in annual revenue.

Any business, regardless of size or entity, can apply for the Amex Business Platinum card.

The better card for your business will be the one your business qualifies for that matches your spending mix, has redemption options and benefits your business can use, and has card management tools adequate for your business’ size.

Can I use the Amex Business Platinum card for personal purchases?

It is possible to charge personal expenses on the card, but not advisable. A key purpose of securing a business credit card is to separate business and personal expenses.

Additionally, the card’s terms and conditions state that the card is for business purposes. Charging personal items could violate this agreement.

And finally, there are regulations that cover business credit cards that do not provide the same level of protection you receive when making purchases on a personal consumer credit card.

Does the Amex Business Platinum card have a Saks Fifth Avenue credit?

No. Only The Platinum Card® from American Express offers the Saks Fifth Avenue statement credit.

Can I apply for an Amex Corporate Platinum card?

You can apply if your business has been operational for more than 12 months, has more than $4 million in revenue each year, has an address other than your residential address, and you’re not a sole proprietor.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![american express corporate travel card The Amex Business Platinum Card – Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2021/06/American-Express-Business-Platinum.jpeg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

American Express Business Platinum Review: Worth the Fee for Heavy Travelers

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If you travel often for business, the generous rewards and perks on this card could make the big fee seem like a bargain. Don't travel much? This isn't your card.

on American Express' website

Quick Facts

- Welcome Offer: Earn 150,000 Membership Rewards® points after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership.

- 5X Membership Rewards® points on flights and prepaid hotels on AmexTravel.com, and 1X points for each dollar you spend on eligible purchases.

- Earn 1.5X points (that’s an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more everywhere else, on up to $2 million of these purchases per calendar year.

- Unlock over $1,000 in statement credits on select purchases, including tech, recruiting and wireless in the first year of membership with the Business Platinum Card®. Enrollment required. See how you can unlock over $1,000 annually in credits on select purchases with the Business Platinum Card®, here.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to the Card.

- $189 CLEAR® Plus Credit: Use your card and get up to $189 in statement credits per calendar year on your CLEAR® Plus Membership (subject to auto-renewal) when you use the Business Platinum Card®.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market as of 03/2023.

- $695 Annual Fee.

- Terms Apply.

Pros & Cons

Lounge membership

Transfer partners

Bonus categories

Automatic elite status

Premium travel protections

High annual fee

Complicated rewards

Requires good/excellent credit

Compare to Other Cards

Full review.

If you travel often for your business, The Business Platinum Card® from American Express is a stellar choice for making trips easier and more rewarding.

Used right, the card can make up for its steep $695 annual fee while providing generous rewards for travel spending and a suite of perks that road warriors will appreciate. It’s an ideal business credit card for those who spend — and expect — a lot.

Key features of The Business Platinum Card® from American Express

Card type: Small business .

Annual fee: $695 .

Welcome offer: Earn 150,000 Membership Rewards® points after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership. Terms Apply.

5 Membership Rewards points per dollar spent on flights and prepaid hotels booked through amextravel.com.

1.5 points per dollar on certain business categories (such as electronics and software) and eligible purchases of $5,000 or more for up to $2 million spent per calendar year.

1 point per dollar on all eligible purchases.

Terms apply.

Membership Rewards points are worth about 0.5 cents to 1 cent each depending on how you redeem them. Travel and gift card redemptions are generally the most valuable. Points are also transferable and can be worth even more if redeemed strategically after being transferred to other loyalty programs.

Aer Lingus (1:1 ratio).

AeroMexico (1:1.6 ratio).

Air Canada. (1:1 ratio).

Air France/KLM (1:1 ratio).

ANA (1:1 ratio).

Avianca (1:1 ratio).

British Airways (1:1 ratio).

Cathay Pacific (1:1 ratio)

Delta Air Lines (1:1 ratio).

Emirates (1:1 ratio).

Etihad Airways (1:1 ratio).

Hawaiian Airlines (1:1 ratio).

Iberia Plus (1:1 ratio).

JetBlue Airways (2.5:2 ratio).

Qantas (1:1 ratio).

Qatar Airways (1:1 ratio).

Singapore Airlines (1:1 ratio).

Virgin Atlantic Airways (1:1 ratio).

Choice Hotels (1:1 ratio).

Hilton Hotels & Resorts (1:2 ratio).

Marriott Hotels & Resorts (1:1 ratio).

For details on transfer ratios, see AmEx's website .

Interest rate: Purchases made with The Business Platinum Card® from American Express are classified as either "Pay Over Time" or "Pay In Full":

Pay Over Time: This is an optional feature that allows you to carry a balance from one month to the next, just like purchases on a regular credit card. If you have this option activated, purchases of $100 or more are automatically classified as Pay Over Time. The ongoing APR is 19.49%-28.49% Variable APR . Although The Business Platinum Card® from American Express does not have a preset spending limit, it does impose a limit on your Pay Over Time balance; any purchases above that limit become Pay In Full. Terms apply.

Pay In Full: These purchases must be paid off completely each month, so they do not incur interest. All purchases of less than $100 are Pay In Full, as are any purchases over your Pay Over Time balance limit. If you choose not to use Pay Over Time, then all purchases are Pay In Full. Terms apply.

Foreign transaction fees: None.

Airline fee credit. Up to $200 a year in credit for incidental fees on one airline, such as checked bag fees or in-flight refreshments or entertainment, but not airfare or seat upgrades. Each year, you select an airline to use this credit with.

Airline redemption bonus. When you redeem points for eligible flights through American Express Travel, get back 35% of those points. Eligible flights include all fare classes on your selected qualifying airline or first- or business-class fares on any airline.

Trusted traveler program application fee credit. When applying for the Global Entry or TSA Precheck programs, you'll receive a credit of $100 or $85, respectively, for the application fee when it's charged to the card. Cardholders are eligible every 4.5 years for Precheck or every four years for Global Entry.

Global Lounge Collection. Get access to more than 1,400 airport lounges worldwide, including the issuer's own Centurion Lounges, Delta Sky Clubs (when flying Delta) and Priority Pass lounges, among others.

Hotel status. Automatically qualify for Gold status in the Marriott Bonvoy and Hilton Honors programs, and reap upgrades elsewhere.

Purchasing perks. Purchase protection covers purchases against loss, theft or damage within 90 days. Return protection also lasts 90 days. Extended warranty protection adds up to one extra year to a manufacturer's warranty. Eligibility to earn points in the Neiman Marcus loyalty program, called InCircle.

$400 Dell statement credit: $200 in the first half the year and another $200 in the second half.

Travel protections. Trip cancellation and interruption insurance, trip delay insurance and baggage insurance.

Minor travel benefits: Potential perks for car rentals (Hertz, Avis, National), cruises, vacation packages and private-jet bookings.

Business tools: American Express Business App, Connect to QuickBooks, employee cards and ability to set employee spending limits .

Experience perks: Preferred seating, ticket presale opportunities, VIP experiences and access to exclusive restaurant reservations and customized experiences.

Why you'd want The Business Platinum Card® from American Express

Rich benefits.

The value of some business travel credit cards lies in the points earned for using it. But the value of The Business Platinum Card® from American Express is tightly tied to its benefits — almost like it’s a membership card that unlocks a wide range of perks to make your traveling life easier.

Some benefits mitigate direct costs, like up to $200 a year in statement credit for incidental fees on an airline you choose, as well as a fee credit for TSA Precheck or Global Entry . And many business owners can find something they need from Dell. The card provides up to $400 in statement credit — $200 in the first half of the year and another $200 in the second half — for purchases directly from Dell.

Other perks are harder to put a dollar figure on, but are clearly valuable — from automatic hotel elite status to travel protections to concierge service.

Lounge access

A welcome perk for road warriors, airport lounges can be a refuge from the loud, teeming gate areas and come with free refreshments. The Business Platinum Card® from American Express offers access to several types, including the highly respected American Express Centurion Lounges and the more ubiquitous Delta Sky Clubs when flying Delta. In addition, you get access to International American Express Lounges, Priority Pass lounges, and lounges in the Plaza Premium, Airspace and Escapes networks, when enrolled in each.

All told, that’s access to more than 1,400 lounges across 140 countries. AmEx claims that collection is the largest to be offered by a card, making The Business Platinum Card® from American Express tough to beat when it comes to business credit cards with airport lounge access .

Transferable points

Besides redeeming points for travel through American Express, you can also transfer them to some airline and loyalty programs , many on a 1-to-1 basis. This might provide more value per point. Airline and hotel partners include Delta, JetBlue, British Airways, Air France/KLM, Hilton, Choice and Marriott.

Other redemption options include merchandise, gift cards, Amazon.com purchases and more. But we recommend redeeming points toward travel to get the best value.

» MORE: AmEx Membership Rewards points: How to earn and use them

Potential for big bonus

A new-cardholder bonus offers an impressive haul of points — but earning the full bonus requires spending big bucks soon after receiving the card. Full details: Earn 150,000 Membership Rewards® points after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership. Terms Apply.

The Business Platinum Card® from American Express isn't designed for the low-spending entrepreneur. If you won't spend enough to earn the bonus but still want a travel-friendly business credit card, try a different option, such as the Bank of America® Business Advantage Travel Rewards World Mastercard® credit card . Here's what you can get by signing up for this card: Earn 30,000 online bonus points after you make at least $3,000 in net purchases in the first 90 days of your account opening which can be redeemed for a $300 statement credit towards travel or dining purchases.

» MORE: American Express credit cards mobile app review

Why you might want a different card

Narrow bonus spending rewards.

Rewards are rich for travel spending via AmEx — and poor for everything else.

The good. Membership Rewards points are worth an average of 1 cent apiece , so the 5 points per dollar on flights and prepaid hotel stays booked through amextravel.com is equivalent to a 5% rewards rate, which is exceptional. Spend $11,900 a year on travel to break even on the annual fee, before factoring in card perks. What’s more, get 35% of your points back when redeeming them for flights with your selected airline through amextravel.com, meaning you could squeeze out an effective rate of 6.75% on travel spending.

The bad. If you won’t book a lot of travel through AmEx, this card loses its allure quickly. It’s simply a poor choice for racking up rewards for other types of spending, which earns just 1 point per dollar spent or 1.5 points on certain business categories or if the purchase is more than $5,000.

For non-AmEx travel, you'd be better off with a cash-back business card like the Capital One Spark Cash Plus . This card offers an unlimited 2% cash back on every purchase, and it comes with a good welcome bonus — but it's a charge card, so you can't carry a balance.

Dining rewards, in particular, are a weak spot for The Business Platinum Card® from American Express . Restaurant spending, which typically accompanies travel, earns just 1 point per dollar.

If you make full use of the perks offered by The Business Platinum Card® from American Express , the $695 annual fee is worth it.

Notably, fully using the annual $200 airline fee credit mitigates the fee substantially. And it helps that the annual fee is a deductible business expense .

Use the calculator below to get an idea of whether the card's rewards and most popular credits and benefits make up for your annual fee.

But if like many people you're dead-set against paying that much, consider the Ink Business Preferred® Credit Card . It earns 3 points per dollar on the first $150,000 spent on travel and select business categories each year, and 1 point per dollar on everything else. Points are worth 1.25 cents apiece when redeemed for travel through the Chase Ultimate Rewards® portal. It has a jumbo welcome bonus and a much lower annual fee.

If you still want some luxury in a business travel card, consider the less pricey Capital One Venture X Business . With an annual fee of $395 , it still has an annual travel credit and complimentary access to more than 1,300 airport lounges, plus the following rewards: Earn unlimited 10X miles on hotels and rental cars and 5X miles on flights booked through Capital One Travel, where you'll get the best prices on thousands of options. Earn unlimited 2X miles on every purchase, everywhere—with no limits or category restrictions. (See rates and fees .)

To extract the most value from a high-end travel card, you need patience to learn the card’s perks, figure out bonus rewards and wrestle with redemption processes. If that sounds like too much hassle, consider the Capital One Spark Miles for Business .

The Capital One Spark Miles for Business earns 5 miles per dollar on hotels and car rentals booked through Capital One Travel and 2 miles per dollar on all other purchases. Miles can be redeemed at a value of 1 cent apiece for any travel purchase, without the blackout dates and other restrictions of branded hotel and airline cards. The card offers a great sign-up bonus, too. (See rates and fees .) Learn more and apply .

Is The Business Platinum Card® from American Express right for you?

Light-traveling small-business folks who fly coach and pinch pennies will struggle to get their money's worth from this high-end card. After all, it is a luxury travel card. But that’s exactly why hard-core road warriors are likely to extract enough value from the card to make its hefty fee seem like a bargain.

To view rates and fees of The Business Platinum Card® from American Express , see this page . To view rates and fees of the American Express® Business Gold Card , see this page .

Find the best credit card

- The best credit cards of 2024

- Best travel credit cards

- Best rewards credit cards

- Best cash back credit cards

Methodology

You’ll need at least good credit to qualify for The Business Platinum Card® from American Express .

Generally speaking, “ good credit ” is defined as a score of at least 690. But a credit score alone isn’t enough to qualify for any credit card. Issuers take into account your income, existing debts and other information.

The annual fee is $695 .

Cardholders earn 5 Membership Rewards points per dollar spent on flights and prepaid hotels booked through amextravel.com; 1.5 points per dollar on certain business categories and eligible purchases of $5,000 or more (an extra half-point per dollar); and 1 point per dollar on all other eligible purchases. Terms apply.

The card comes with a broad array of benefits. Among the most valuable are access to more than 1,400 airport lounges worldwide, a $200 annual airline fee credit, an application fee credit for Global Entry ($100) or TSA Precheck ($85) programs; and elite status in the Marriott Bonvoy and Hilton Honors hotel loyalty programs.

The Amex Business Platinum is aimed at frequent travelers who want to go in style; Gold is a better choice for rewards on daily spending. See NerdWallet’s comparison .

Getting a business card might not be as hard as you think. You don’t need a formal business structure, like an LLC, partnership or corporation. Sole proprietorships count, too, including those who earn extra income freelancing, contracting or side hustling. Your personal credit factors into whether you will be approved.

The Business Platinum Card® from American Express offers access to several types of lounges, including American Express Centurion Lounges and the more ubiquitous Delta Sky Clubs when flying Delta. In addition, you get access to International American Express Lounges, Priority Pass lounges , and lounges in the Plaza Premium, Airspace and Escapes networks, when enrolled in those programs. All told, that’s access to well over 1,400 lounges worldwide. Terms apply.

It works like any other credit card for making business purchases, but to fully use its myriad of benefits and to optimize Membership Rewards points? Yes, there is a learning curve.

This card was originally introduced as a charge card, meaning your full balance was due every month. However, cardholders are now able to carry a balance on certain purchases using the American Express "Pay Over TIme" feature.

You’ll need at least good credit to qualify for

The Business Platinum Card® from American Express

Generally speaking, “

good credit

” is defined as a score of at least 690. But a credit score alone isn’t enough to qualify for any credit card. Issuers take into account your income, existing debts and other information.

The annual fee is

The card comes with a broad array of benefits. Among the most valuable are access to more than 1,400 airport lounges worldwide, a $200 annual airline fee credit, an application fee credit for Global Entry ($100) or TSA Precheck ($85) programs; and elite status in the

Marriott Bonvoy

Hilton Honors

hotel loyalty programs.

The Amex Business Platinum is aimed at frequent travelers who want to go in style; Gold is a better choice for rewards on daily spending. See

NerdWallet’s comparison

Getting a business card

might not be as hard as you think. You don’t need a formal business structure, like an LLC, partnership or corporation. Sole proprietorships count, too, including those who earn extra income freelancing, contracting or side hustling. Your personal credit factors into whether you will be approved.

offers access to several types of lounges, including

American Express Centurion Lounges

and the more ubiquitous

Delta Sky Clubs

when flying Delta. In addition, you get access to International American Express Lounges,

Priority Pass lounges

, and lounges in the Plaza Premium, Airspace and Escapes networks, when enrolled in those programs. All told, that’s access to well over 1,400 lounges worldwide. Terms apply.

This card was originally introduced as a charge card, meaning your full balance was due every month. However, cardholders are now able to carry a balance on certain purchases using the American Express

"Pay Over TIme"

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Pet Week 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

Here are the best corporate credit cards of 2024, these cards offer rewards and additional features designed to help corporations manage the financials..

Corporate credit cards are similar to business credit cards but have a few key differences. Small business cards are typically designed for smaller businesses or sole proprietorships and usually require a personal guarantee and personal credit check . However, corporate cards typically don't require a personal guarantee and instead often have other requirements such as revenue minimums or are only available to U.S. registered business entities (LLCs, corporations, etc.).

Corporate cards are designed to help business managers seamlessly manage spending for a large number of employees and some offer rewards as well. Below, CNBC Select details the best corporate cards with a range of benefits. (See our methodology for information on how we chose the best corporate credit cards).

Best corporate credit cards

- Best for travel spending: Brex Card

- Best for cash back: Ramp Visa® Corporate Card

- Best for travel perks: The American Express Corporate Platinum Card ®

- Best for mid-sized corporations: U.S. Bank Commercial Rewards Card

Best for travel spending

Earn rewards and cash back on everything you spend, like 7x on rideshare, 2x on recurring software, and access exclusive events and over $400K in software discounts.

Welcome bonus

10,000 points when you spend $3,000 on your Brex card within three months of your Brex business account being opened.

- No annual fee

Brex does not charge interest

Regular APR

Balance transfer fee, foreign transaction fee.

No foreign transaction fees, free ACH and wires worldwide, global acceptance on the Mastercard network

Credit needed

No personal guarantee or credit check. Only companies organized and registered in the United States may apply for a Brex account. See Platform Agreement for business criteria.

- No foreign transaction fee

- You'll have to pay off the balance daily or monthly

* Offer available to new Brex Card customers only.

Brex Mastercard® issued by Emigrant Bank, Member FDIC. Brex Cash provided by Brex Treasury LLC, member FINRA and SIPC. Brex Treasury is not a bank; Brex Cash is not a bank account. Testimonials may not represent experiences of all clients. Terms apply, visit brex.com. Information about the Brex Card has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

Who's this for? Brex is a fintech company that offers financial services to corporations, including the Brex Card , which offers an exceptional return for many different bonus spending categories.

Standout benefits : The Brex Card is available to Brex business account members (a cash management account). Eligible businesses can earn generous rewards in useful bonus categories like rideshare , Brex travel, restaurants, eligible Apple purchases through the Brex rewards portal, recurring software and additional categories depending on your primary industry. The Brex Card is a charge card that must be paid off monthly or daily. If you opt for daily payments, your company may earn additional rewards in certain categories.

[ Jump to more details ]

Best for cash back

Ramp visa corporate card.

Earn an unlimited 1.5% cash back on all purchases

Receive $250 after you apply and are approved with no minimum spending requirement.

No personal guarantee or credit check.

- Strong cash-back rate

- Need at least $75,000 in a U.S. business bank account to qualify

Who's this for? The Ramp Visa® Corporate Card is worth considering if your company wants to earn straightforward, yet valuable cash-back rewards.

Standout benefits : The Ramp Visa Corporate Card can boost your company's bottom line with an uncapped 1.5% cash back on all purchases. This card has no annual fee and a long list of partner deals which can save you even more money. Ramp members enjoy discounts with UPS, OpenAI, Stripe, Amazon Web Services, QuickBooks , Indeed and more. You can even transfer Ramp rewards to various airline and hotel loyalty programs.

Best for travel perks

The american express corporate platinum card®.

Earn 1X Membership Rewards® points on all purchases; 5% Uber Cash on Uber rides and U.S. Uber Eats orders

Good/Excellent

Terms apply.

- Amazing airport lounge access benefits

- Annual statement credit when you have a personal Amex Platinum Card

- Hotel and rental car perks

- Low reward earning rate

- Corporate Membership Rewards program doesn't allow point transfers

Information about the The American Express Corporate Platinum Card® has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

Who's this for? The American Express Corporate Platinum Card ® offers some of the same valuable benefits as other versions of The Platinum Card® from American Express but with some key differences.

Standout benefits : Corporate employees on the go will appreciate this card's travel benefits, and the crown jewel of what this card offers is its airport lounge access . Cardholders can access over 1,400 airport lounges through the American Express Global Lounge Collection, including Amex Centurion lounges , Delta Sky Clubs , Priority Pass lounges (enrollment required), Plaza Premium lounges, Escape lounges and Lufthansa lounges.

Best for mid-sized corporations

U.s. bank commercial rewards card.

Companies can choose rebates or rewards as follows: Qualify for 1% cash back after spending $150,000 per quarter or earn 5X points on car rentals, 4X points on lodging, 3X points on airlines and 1X points on all other purchases

Revenue requirements

$10 to $150 million annually

- Flexibility in what type of rewards you earn

- No annual fees or interest

- Quarterly spending requirement to qualify for rebates

Who's this for? The U.S. Bank Commercial Rewards Card provides mid-sized corporations flexibility in how they earn rewards.

Standout benefits: With a U.S. Bank Commercial Rewards Card account, companies can choose what type of rewards they earn. If your company opts for earning a rebate, it will earn a 1% cash rebate after hitting $150,000 in quarterly spending. With the rewards option, the company earns 5X points on car rentals, 4X points on lodging, 3X points on airlines and 1X points on all other purchases.

More on our best corporate credit cards

The Brex Card has extremely generous spending categories, which are even more valuable than they appear because you can transfer Brex points to partner travel programs.

Brex Exclusive rewards (monthly payments):

- 7X points on rideshare

- 4X points on Brex travel rewards

- 3X points at restaurants

- 3X points on eligible Apple purchases through the Brex rewards portal

- 2X points on recurring software

- 1X points on all other purchases

By opting for daily payments (instead of monthly) you can earn an additional 1X points in select categories. Life sciences companies don't earn bonus rewards on software, rideshare or restaurant purchases. Instead, they earn additional points on lab supplies and life sciences conference tickets.

Brex also has a custom rewards program that's available to companies with 50 or more Brex users who also will meet minimum spending requirements. You'll have to speak with Brex to see if your company qualifies.

Learn more about all reward multipliers and options here .

Earn 30,000 points after spending $3,500, or 50,000 points after spending $9,000 in the first 30 days.

$0 (paid plans available)

Notable perks

The Brex Card is a World Elite Mastercard® and includes Mastercard ID Theft Protection ( activation required ), MasterRental Insurance (rental car damage and theft coverage) and Mastercard Luxury Hotel Program (free daily breakfast for two guests, room upgrades when available, etc.).

The card also unlocks discounts for a long list of software services and business products such as TurboTax , Microsoft 365, QuickBooks® and Salesforce Essentials. Brex account holders also receive 5% back on Microsoft advertising purchases on up to $10,000 in annual spending per card.

You can use Brex rewards for a long list of redemptions including, gift cards, travel, cryptocurrency, cash back and more. One of the best ways to use Brex points is to transfer points to one of its partner airline loyalty programs, including:

- Air France/KLM (Flying Blue)

- Singapore Airlines KrisFlyer

- Emirates Skywards

- Avianca LifeMiles

- Aeromexico Club Premier

- Qantas Frequent Flyer

- Cathay Pacific Asia Miles

You are allowed to transfer points to any cardholder associated with the Brex account.

[ Return to card summary ]

Ramp Visa® Corporate Card

Ramp is a financial technology company that issues the Ramp Visa® Corporate Card and provides expense management and other services to U.S.-based corporations.

- 1.5% cash back on all purchases

Earn a $250 bonus after account approval.

$0 (paid subscriptions available)

Ramp is a fintech company that offers businesses a variety of tools to manage and automate their finances, including bill payments, expense reimbursement and corporate cards. To qualify for Ramp your company will need at least $75,000 in a U.S. business bank account , be a business registered in the U.S. and the majority of your operations and spending should be in the U.S.

The Ramp card's Visa Signature Business benefits include:

- Rental car collision insurance (primary coverage)

- Purchase security

- Extended warranty protection

- Travel and emergency assistance services

Ramp users have access to a massive amount of deals and discounts on business-related products, services and software. Some of these deals include (at the time of writing):

- QuickBooks discounts

- Up to $5,000 in Amazon Web Services credits

- Up to $2,500 in OpenAI credits

- UPS discounts

- 50% off Amazon Business Prime

- And many more

In addition to straight cash back or gift cards, you can transfer Ramp rewards to airline and hotel partners at a 1.5:1 ratio, including:

- AeroMexico Rewards

- Air France/KLM Flying Blue

- British Airways Executive Club

- Etihad Guest

- Marriott Bonvoy

- Qatar Airways Privilege Club

- TAP Air Portugal Miles&Go

- Wyndham Rewards

While Ramp's transfer ratio isn't great, having the option to convert your cash back to hotel and airline points can help you increase the value of your rewards. For example, you can often book one-way Star Alliance business-class awards from the U.S. to Europe through Avianca for 63,000 miles (94,500 Ramp points).

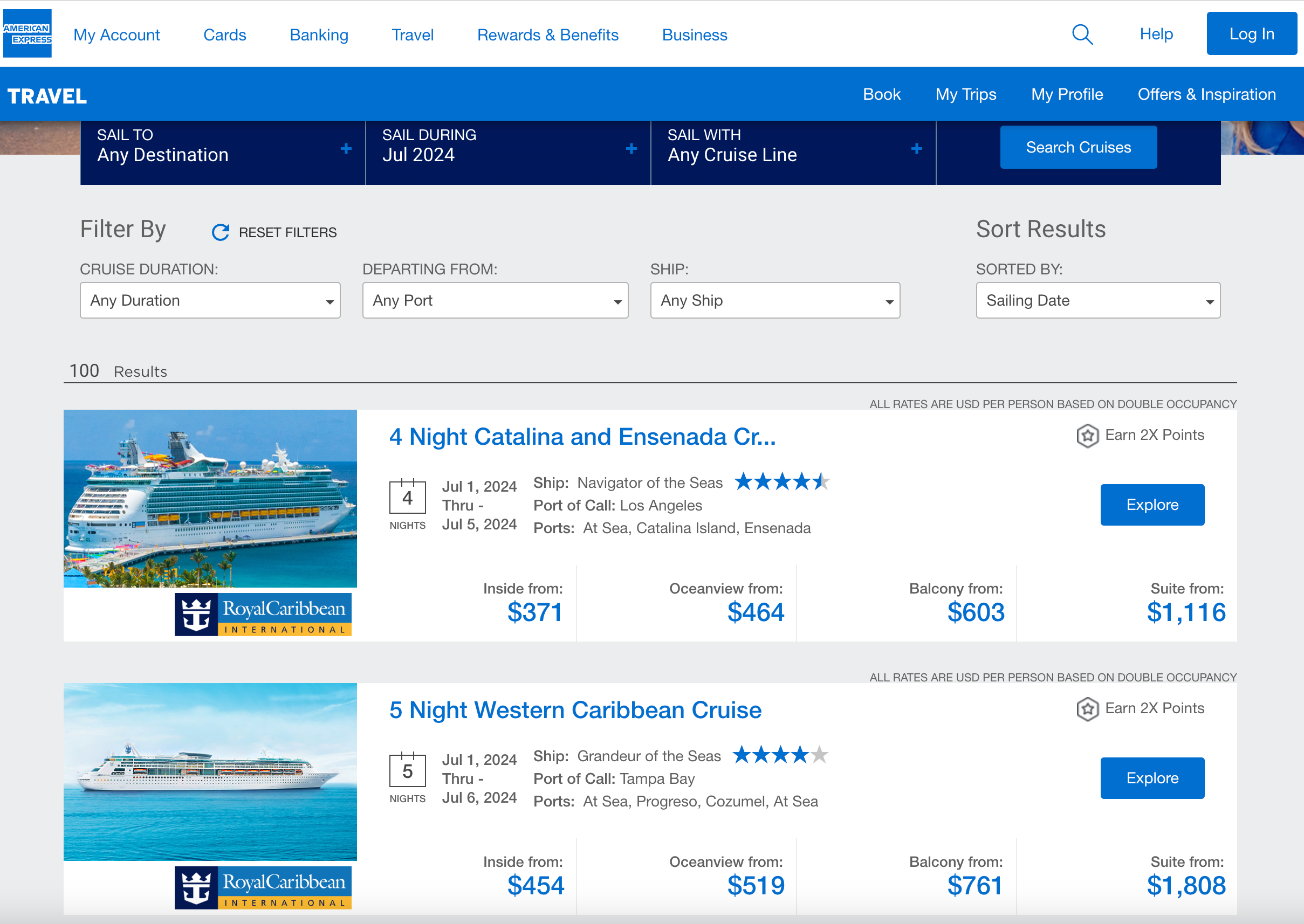

The American Express Corporate Platinum Card ® provides cardholders with a robust list of travel perks such as lounge access and elite-status benefits.

- 1X points on all purchases

- 5% Uber Cash on Uber rides and Uber Eats orders (enrollment required)

$550 (see rates and fees)

Employees with a personal Amex card , in addition to an Amex corporate card, can qualify for a Personal Card Annual Credit . To be eligible for the credit you must have the same type of personal and corporate card (i.e. Gold, Platinum, etc.). Cardholders with both a personal and corporate Platinum card receive an annual statement credit of $150.

Other perks include:

- Up to $189 in CLEAR Plus credit

- Up to $200 in airline fee credit per calendar year (airline selection required)

- Cell phone protection

- Global Entry or TSA PreCheck application fee credit

- Hilton Honors Gold status (enrollment required)

- Marriott Bonvoy Gold status (enrollment required)

- Roadside assistance

- Trip delay insurance

- Trip cancellation and interruption insurance

- Baggage insurance

- Global Assist Hotline

- The American Express Global Lounge Collection (enrollment required)

- Fine Hotels and Resorts program

- Rental car status perks

Corporate Amex Platinum cards can be linked to either an individual or a corporate rewards program, each card can be enrolled in one program at a time. With the corporate rewards program, designated account administrators can manage and redeem rewards. American Express' corporate rewards program allows redemptions for gift cards , statement credits, travel and merchandise. As an employee, you may be able to link your corporate card to an existing individual Membership Rewards account and redeem the rewards as you like. However, not all Amex corporate cards are eligible for enrollment in an individual rewards account , so you'll need to contact your program administrator to find out your options.

The U.S. Bank Commercial Rewards Card is available to corporations with an annual revenue between $10 million and $150 million.

A company can choose how it earns rewards:

- 1% rebate after spending at least $150,000 in quarterly spending

- 5X points on car rentals

- 4X points on lodging

- 3X points on airlines

With a U.S. Bank Commercial Card account, your company will have access to more than just the ability to earn rewards. This card also has several tools and features designed to simplify expense management and corporate travel. It offers integration with popular accounting software, including QuickBooks online, NetSuite, Xero and more. When employees book through the travel platform it automatically tracks the receipts. You can also set card limits or merchant category restrictions to align with company policies.

How do corporate cards differ from small business cards?

The key differences between corporate and small business cards are how you qualify and what type of business the card is designed for. Small business cards usually require a personal guarantee and personal credit check, whereas corporate cards do not. Corporate cards typically require the business to have a specific legal structure, minimum revenue or cash holdings or a certain minimum number of employees.

Is it hard to get a corporate credit card?

Corporate credit cards aren't necessarily hard to get, but your business typically needs to be larger than a small business with just a couple of employees. To qualify for a corporate card, you could need 15+ employees, a minimum of six figures in annual expenses or a large sum of money in the bank.

Does a corporate credit card hurt your credit score?

If your employer issues you a corporate credit card it won't have an impact on your personal credit score. Corporate card activity isn't tied to your personal credit report.

Bottom line

Corporate credit cards are designed for larger businesses and often offer additional services beyond just credit card rewards. If your company is at the point where managing small business credit cards is becoming tedious, the features offered by the best corporate credit cards may be able to save you time and money.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every credit card article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit card products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. See our methodology for more information on how we choose the best corporate credit cards.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Our methodology

To determine which credit cards are best for corporations, CNBC Select analyzed corporate cards based on a range of features. We compared rewards (e.g., cash back, points and miles), annual fees, welcome bonuses, introductory and standard APR and balance transfer fees and foreign transaction fees. We also considered additional perks, protections and other features available to corporations.

We also considered CNBC Select audience data when available, such as general demographics and engagement with our content and tools.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- Here are the best commercial auto insurance companies Liz Knueven

- Kasasa bank accounts: Get up to 6% APY with this high-yield checking account Elizabeth Gravier

- Pets Best pet insurance review and price Liz Knueven

Built for your ambitions

Corporate cards.

- American Express ® Corporate Cards

- American Express ® Corporate Meeting Card

Employee spending

- Business Travel Account

- Virtual Payments

Partner Solutions

- SAP ® Concur ®

Vendor Payments

- Buyer Inititiated Payments

- American Express ® Early Pay

- American Express ® Corporate Purchasing Card

NMLS ID # 913828

GET MORE OUT OF YOUR SPENDING. CONTACT US TODAY!

All fields are mandatory.

By providing your email address and phone number, you agree that American Express may contact you with information about our products and services. For information about how we protect your privacy, please read our Privacy Statement.

Everything you need to know about Amex Travel

The American Express Travel portal allows you to redeem Membership Rewards points directly for travel reservations and activities rather than transfer your rewards to airline or hotel partners like Delta Air Lines SkyMiles and Marriott Bonvoy .

You also can book discounted premium tickets, use benefits like a 35% points rebate on certain bookings and even book premium hotels with additional perks through Amex Travel.

Let's explore this booking portal to uncover all its benefits and potential disadvantages.

What is the American Express Travel portal?

Amex Travel is the booking portal for most American Express cards . You can book flights, hotels, rental cars and cruises through the site, and you can pay with points, cash or a combination of the two.

How to book flights on the Amex Travel portal

To find flights on American Express Travel, visit this webpage . The flight booking process on the Amex Travel portal is similar to other popular sites like Kayak and Orbitz. You'll find a search box where you can enter your departure and destination cities.

If you're flexible with your departure airport, you can choose an entire city, such as New York, which has multiple airports. Additionally, you can customize your booking by selecting your preferred class and the number of travelers, and choosing between one-way and round-trip flights.

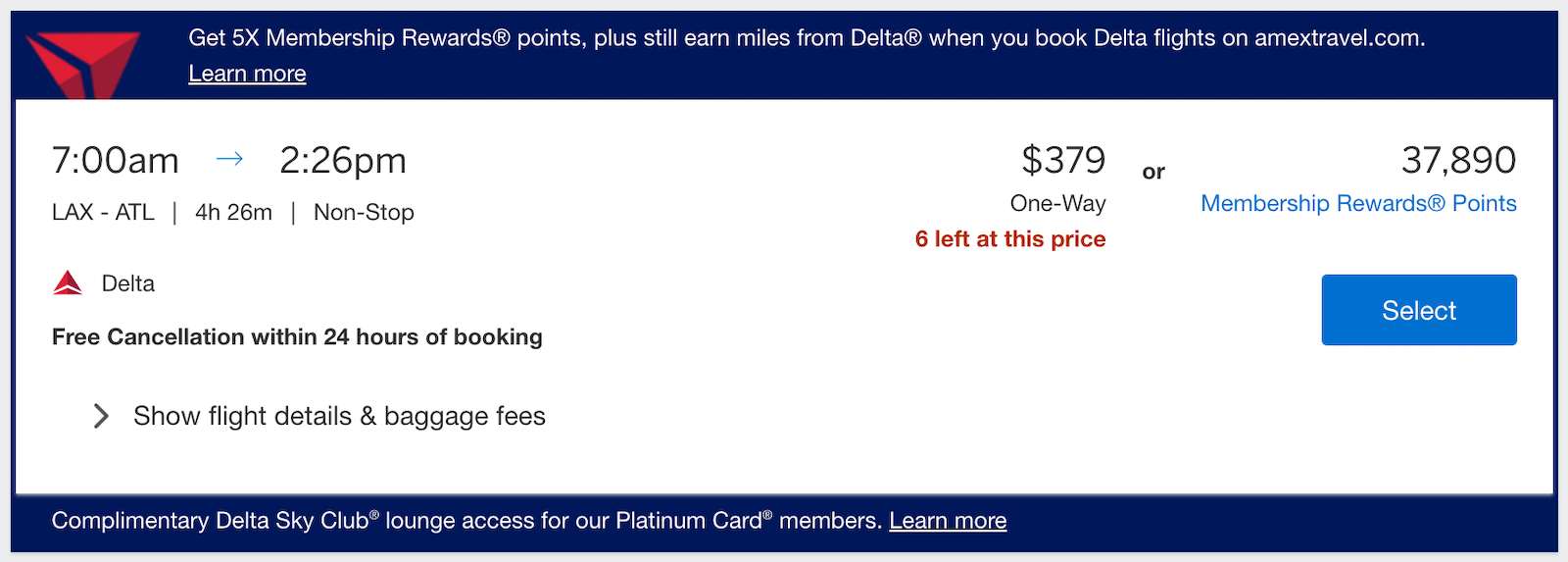

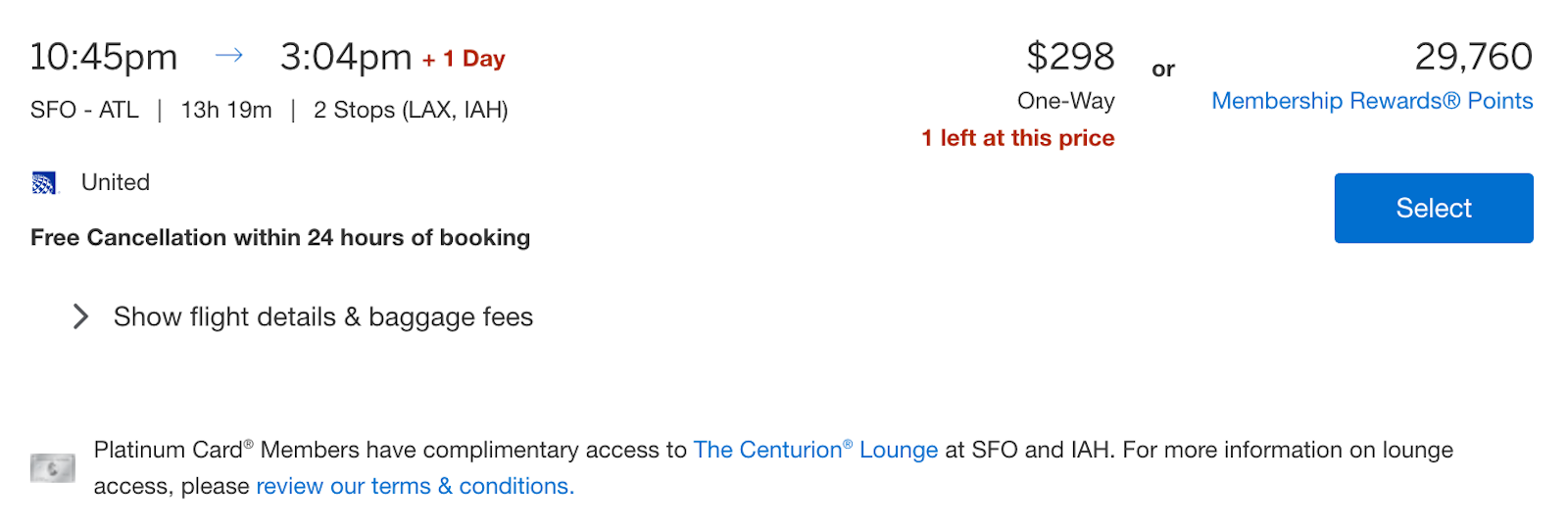

You'll see the price listed in dollars and the number of Amex Membership Rewards points during the booking process.

You can also use the options on the left-hand side to filter flights by number of stops, departure and arrival times, flight duration and airline.

Delta Air Lines is a featured airline in the Amex Travel portal. Sometimes, Delta flights appear at the top of your results, listed as "recommended," but this doesn't mean those flights are always the cheapest.

Additionally, if you have The Platinum Card® from American Express or The Business Platinum Card® from American Express and are flying from an airport with a Centurion Lounge , you'll see an indicator that a lounge is available.

Points vs. cash

When paying for your flights on Amex Travel, several American Express cards offer elevated earning rates:

You can also pay with Amex Membership Rewards points to cover the cost of your flight.

You'll see the number of points required next to the cash price of a flight. You can expect a value of 1 cent per point when using Pay with Points . However, TPG values Membership Rewards points at 2 cents apiece when you maximize Amex's transfer partners.

Related: How to redeem American Express Membership Rewards for maximum value

It's important to compare the number of points required for bookings on Amex Travel with the points you'd need to transfer to an airline program . If you can't book a flight through transfer partners and prefer to use your points, Amex Travel remains an option.

There's an additional benefit for Amex Business Platinum cardmembers: You can get 35% of your points back when paying with points on Amex Travel. This applies to first- and business-class flights on any airline plus tickets in any class on your preferred airline (the same one used for your airline incidental credits ; enrollment is required in advance). This 35% points rebate can provide a value of 1.54 cents per point, which may influence your decision to pay with cash or points.

Similarly, the Business Centurion® Card from American Express offers a 50% Pay with Points rebate on eligible flights. Note that Centurion cards are available by invitation only.

The information for the Business Centurion Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

More details about flights through Amex Travel

During the payment process, you can use points, your credit card or a combination of both. The minimum number of points you can use is 5,000, and each point is valued at 1 cent.

You can upgrade your flights using cash or points in the Amex Travel portal. This generally gives you a return of 1 cent each, and you can book using your Amex card, points or a combination of both.

During your flight search, you might come across "Insider Fares" that offer a discounted price. But to benefit from the discount, you must redeem points to cover the full fare amount.

Amex Platinum and Amex Business Platinum cardmembers have another benefit: discounted premium tickets through Amex Travel's International Airline Program . This program offers discounts on first-class, business-class and premium economy tickets from over 20 participating airlines.

To book a premium ticket using the IAP, go to the Amex Travel portal and pay with cash or points, including the Business Platinum card's 35% airline rebate. Keep in mind that not all flights are eligible and there are restrictions:

- The cardmember must travel on the itinerary.

- A maximum of eight tickets can be booked per itinerary; travel must begin and end in the U.S. or Canadian international airports.

- Tickets are nonrefundable unless stated otherwise.

- Name changes for passengers are not allowed.

Finally, note that flights booked through Amex Travel are typically treated as normal paid tickets, meaning you're eligible to earn points or miles with participating airline loyalty programs.

Related: Why I love the Amex Business Platinum's Pay with Points perk

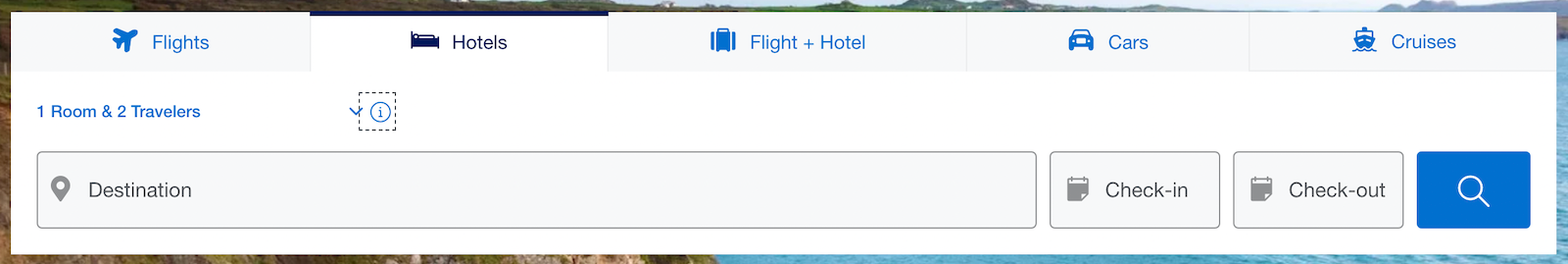

How to book hotels on the Amex Travel portal

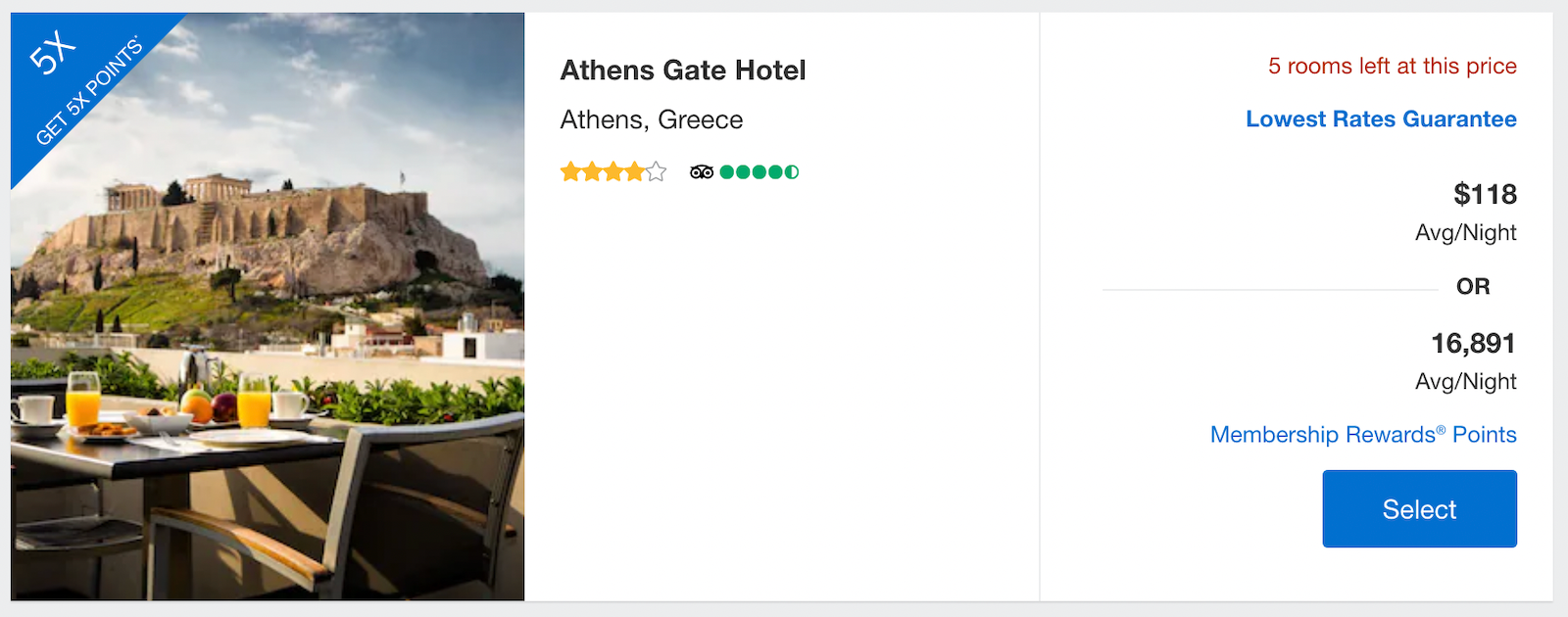

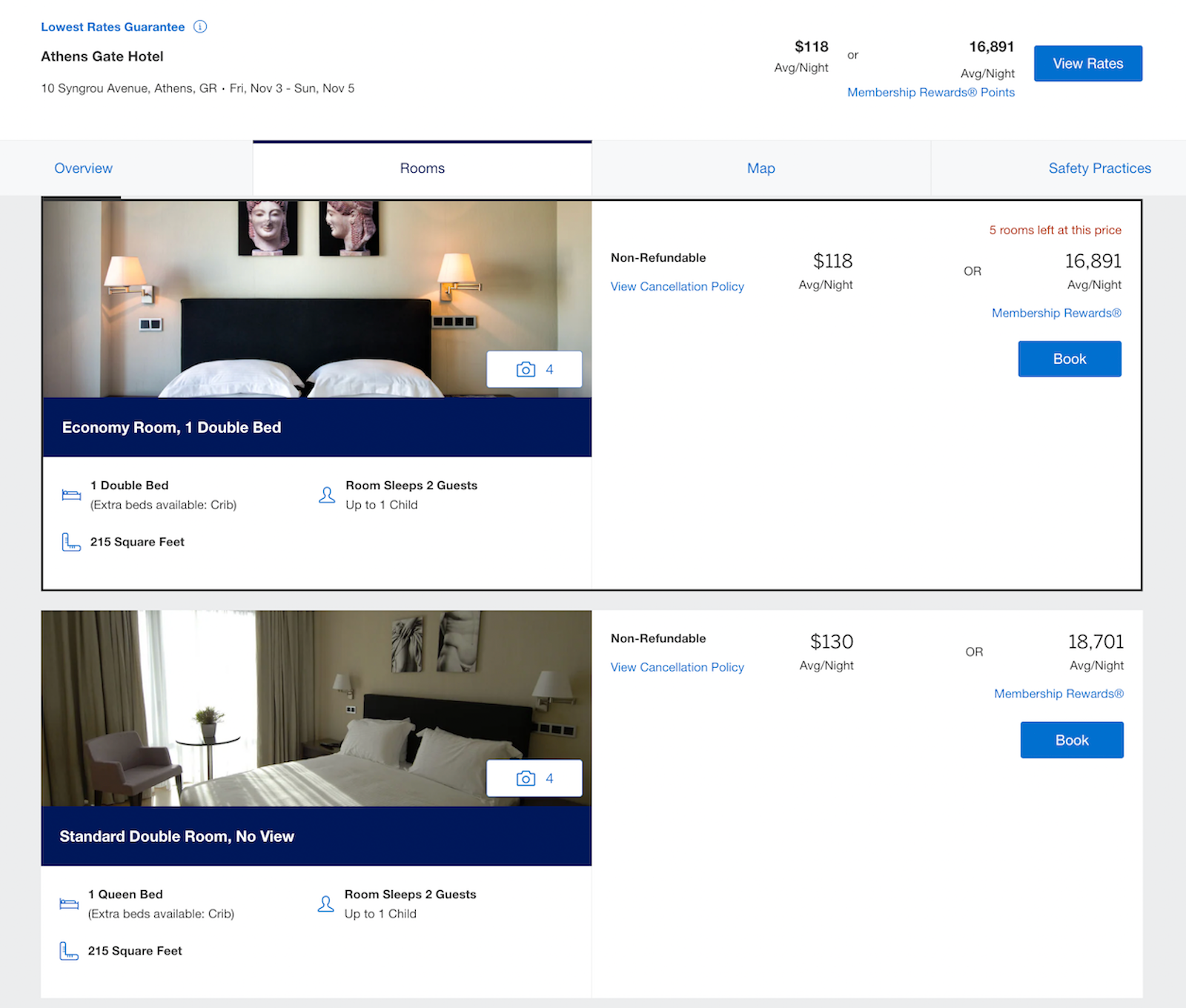

You can book hotels through American Express Travel with a Gold, Platinum or Centurion card. As with other travel portals, you can input your destination, dates, number of rooms and number of guests (with separate input fields for adults and children).

Platinum and Business Platinum cardmembers earn 5 points per dollar on prepaid hotel reservations.

After selecting your hotel, you'll choose your preferred room and pay with points or cash. If you pay with points, you'll only get a value of 0.7 cents per point (compared to 1 cent when you book flights).

Note that these are considered third-party bookings, so you likely won't earn hotel points or elite credits for your stay . While there are reports of people receiving stay credits with Marriott Bonvoy or Hilton Honors on rooms booked through Amex Travel, the hotel is not guaranteed to recognize your elite status in these programs or provide status-qualifying stay credits.

Related: 9 things to consider when choosing to book via a portal vs. booking directly

Amex Fine Hotels + Resorts

Platinum and Centurion cardholders also have access to the Fine Hotels + Resorts program through Amex Travel. This can add some great benefits to your hotel stays — and may not cost much more than booking directly with the hotel.

Here are the perks you'll receive with every FHR booking, regardless of the length of your stay:

- Room upgrade upon arrival (when available): Some room types may be excluded, but you could receive an upgrade to preferred rooms with better views or a better location in the hotel.

- Daily breakfast for two people: The provided breakfast must be, at a minimum, a continental breakfast.

- Guaranteed 4 p.m. late checkout

- Noon check-in when available

- Complimentary Wi-Fi

- Unique property amenity: The amenity varies by hotel but should be valued at $100 or more and usually consists of a property credit, dining credit, spa credit, private airport transfer or similar amenity.

You'll need to book these stays through Amex Travel, but note that FHR is considered a separate program from Amex Travel.

In addition, if you have the personal Amex Platinum , you can also get up to $200 in statement credits every year for prepaid reservations through Fine Hotels + Resorts or The Hotel Collection — which we'll discuss next. Enrollment is required.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

The Hotel Collection

A lesser-known American Express benefit is The Hotel Collection , which allows you to book in cash or with points. Those with Amex Gold, Platinum and Centurion cards have access to this program, which offers the following benefits:

- A room upgrade at check-in (if available)

- $100 on-property credit for qualifying dining, spa and resort activities

Note that The Hotel Collection bookings require a minimum stay of two nights, though they too are eligible for the $200 hotel credit on the Amex Platinum.

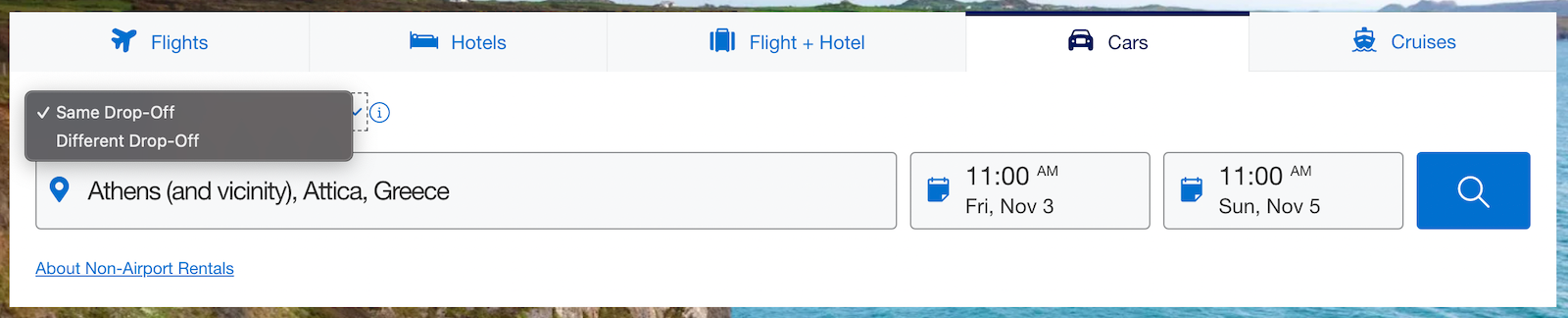

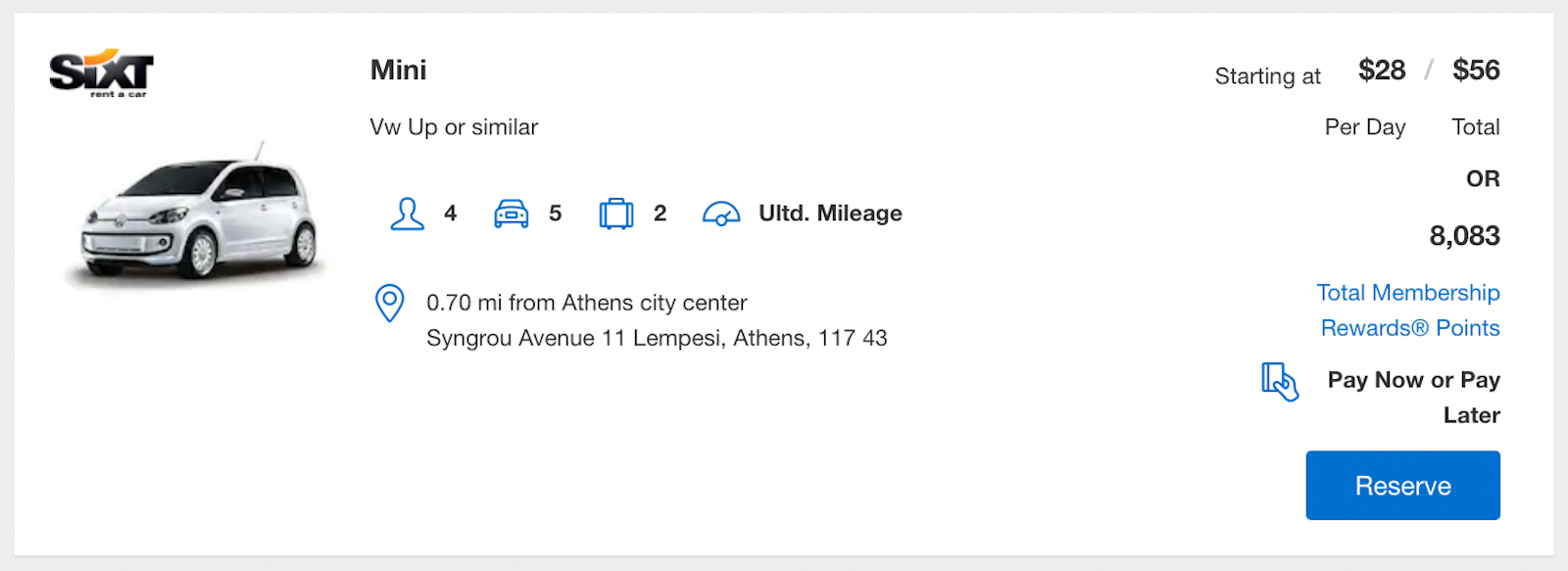

How to book rental cars and cruises on the Amex Travel portal

Reserving a car in the Amex portal is relatively simple. You'll input your pickup and drop-off times and location.

You'll see rental car prices listed in cash and points. When using Pay with Points , your points are worth 0.7 cents — just over a third of TPG's valuation of Amex Membership Rewards points.

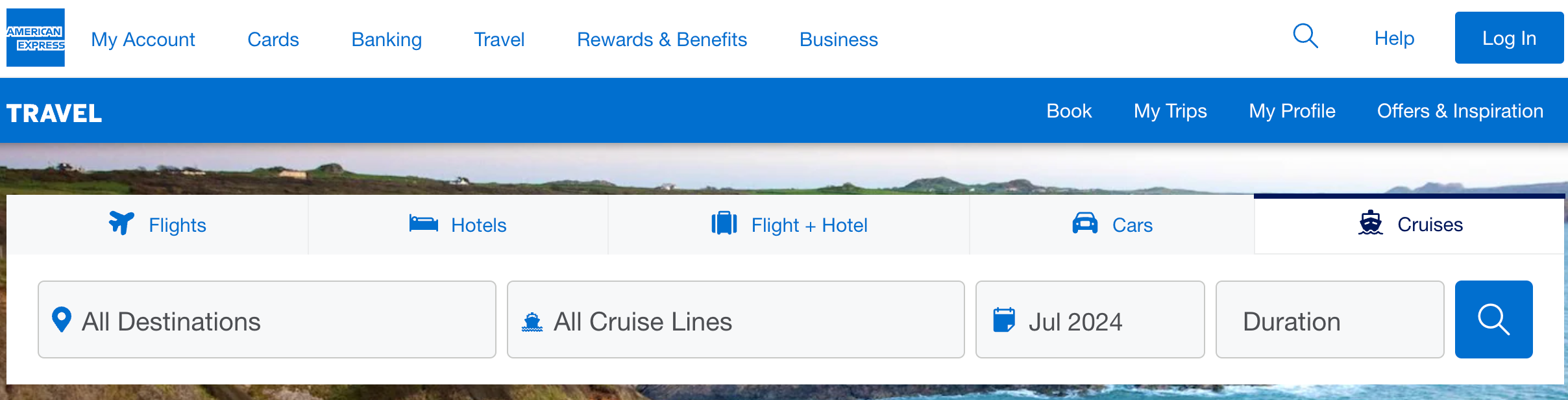

Although the format differs, you can also search for cruises on Amex Travel.

Rather than typing specific dates and numbers of passengers, you'll see four drop-down menus. These allow you to choose a destination (by region), filter by cruise lines and choose a month for travel — though not specific dates — on this first page. You can also select your desired cruise duration.

From here, you can filter by cruise duration, departure port and ship. You can sort your results by sailing date, value, price or ship rating.

On the final payment page, you can use your card or redeem points, ranging from 1 point to enough to cover the entire cost. Using points for a cruise will result in a low valuation of 0.7 cents per point, but it can be a money-saving option if you prefer not to spend cash.

There's another benefit available if you're a Platinum or Centurion cardholder (including personal and business versions of these cards): the Cruise Privileges Program .

This is available on cruises of five nights or more with select cruise lines, and it offers the following perks:

- $100-$500 in onboard ship credit (note that this cannot be used for casino or gratuity charges)

- Additional onboard amenities vary by line, such as spa vouchers, a bottle of Champagne, shore excursion credits or a private ship tour