Sign In to Avion Rewards

Sign in with:

If you have a personal credit card or deposit account, you need to enrol in RBC Online Banking to enjoy Avion Rewards. It’s easy and secure.

Sign in now to start shopping and saving

RBC client ? Sign in with: Eligible RBC clients enjoy bigger and better benefits from Avion Rewards. Check out the list of eligible products – if you have any of these, you’re in. Close

Don’t have Online Banking credentials?

Not an RBC client? Sign in with:

Tutorial: How to use the $100 travel credit on the RBC Avion Visa Infinite Card

Former HSBC World Elite Mastercard holder: $100 travel credit with RBC

Since the end of March 2024, HSBC World Elite ® Mastercard ® holders have had their card replaced by an RBC Avion Visa Infinite Card . Certain benefits have been maintained, such as :

- A travel credit of up to $200 for any hotel stay or car rental of $200 CAD or more, booked with Avion Rewards , until April 5, 2025 ;

- No conversion fees for foreign currency transactions.

For this famous travel credit, you have to use it between April 4, 2024 and April 5, 2025 and it is distributed as follows:

- $ 100 travel credit from HSBC / RBC transition ;

- Any unused portion of your previous $100 HSBC credit.

So you have a travel credit opportunity of up to $200 for 2024-2025. If you don’t use it after April 6, 2025, it’s lost and there’s no way to get it back.

Here’s how to activate this offer and how it works.

How to book with Avion Rewards and your $100 travel credit

This travel credit applies only to former HSBC World Elite MD Mastercard ® holders who have had a product transfer to the RBC Avion Visa Infinite Card following the transition from HSBC to RBC.

Log in to the Avion Rewards website. You will need to log in to your profile with your RBC Online Banking credentials.

Directly on the Homepage, you’ll find Avion Travel Credit , under Shop offers .

Click on Load offer .

That’s all ! You’ll automatically see that the travel credit is activated, highlighted in yellow.

Still can’t see the Travel Credit offer?

Check both on the Avion Rewards website and in the Avion Rewards mobile app (on the App Store or Google Play ).

If you still don’t see the Travel Credit option, call Customer Service at 1 800 769-2511 .

Then all you have to do is use your Avion Rewards travel credit. Here are the conditions:

- Valid only for hotel reservations and car rentals

- Payment must be $200 or more, including taxes and fees, charged to the RBC Avion Visa Infinite Card that holds the travel credit.

In the Avion Rewards Travel section, select your destination and date.

Then choose the hotel you want.

When you confirm your reservation, you can also use your RBC Avion points to deduct part of the cost of your hotel stay!

The redemption rate for RBC Avion points via Avion Rewards is higher than usual: 1.5% (100 points = $1.50) instead of 1.0% (100 points = $1).

In fact, this is the special exchange rate only for former HSBC World Elite ® Mastercard ® cardholders, who have had their card replaced by an RBC Avion Visa Infinite Card .

In this example, 4,002 points X 1.5 = $60.03 off the cost of the room.

After booking, you will see on your statement :

- A deduction of 4,002 RBC Avion points;

- A hotel purchase of $246.38 ;

- An accumulation of 308 RBC Avion points for making this reservation.

The payment on the RBC Avion Visa Infinite Card is over $200, so this will be enough to trigger the travel credit of up to $200.

Attention! If you cancel the hotel, Avion Rewards may charge you a cancellation fee in addition to the applicable taxes, according to the schedule in effect on its site. The fees are $10 per car rental and $10 per hotel reservation.

Bottom Line

This travel credit is available until April 2025 and is only available until April 5, 2025. It will not be renewed.

Don’t lose it, and take advantage of the opportunity to spoil yourself on your travels!

All posts by Caroline Tremblay

Suggested Reading

Avion Rewards

About this app

Data safety.

App support

More by royal bank of canada.

Similar apps

- Book Travel

- Credit Cards

Best ways to earn:

Best ways to redeem:.

RBC Avion points are an incredibly useful, transferrable reward currency for Canadians.

Its diverse suite of transfer partners and ease of earning make it a great program to include as part of your points-earning endeavours.

Before we go further, it’s important to distinguish between the different tiers of RBC Avion Rewards. There are subtypes of Avion points: Avion Select, Avion Premium, and Avion Elite.

Avion Elite is the highest Avion Rewards tier, and has the most redemption flexibility. Both Avion Elite and Avion Premium points are earned through RBC credit cards, and can be transferred from one account to the other, if you hold a credit card that earns Avion Elite points.

Comparatively, Avion Select points are a recent addition to the RBC Avion program, and these aren’t nearly as valuable as the other two tiers.

Avion Select points are earned through applicable shopping activity, and can’t be combined with Avion Elite or Avion Premium points.

In this guide, we’ll be focusing on Avion Elite points, while exploring the possibilities of earning Avion Premium points for the sole purpose of converting the Premium points into Elite points.

Earning RBC Avion Points

The main way to earn RBC Avion points is through RBC credit cards. You can rack up Avion points through credit card welcome bonuses and through everyday spending.

Credit cards will earn either Avion Elite points or Avion Premium points.

The credit cards that earn Avion Elite points include all from the RBC Avion lineup.

Meanwhile, the cards that earn Avion Premium points are from the RBC ION lineup.

As long as you have at least one of the RBC Avion cards from the first list, you’ll be able to freely transfer Avion Premium points earned from the ION cards in the second list to your Avion Elite rewards account.

Transferring Avion points from Premium points to Elite points will give you a lot more redemption options.

Credit Card Welcome Bonuses

The best way to earn RBC Avion points is through welcome bonuses.

Welcome bonuses fluctuate depending on the current promotion. However, you can usually expect an RBC Avion card to come with a welcome bonus of 15,000–35,000 Avion points, with the bonus sometimes getting as high as 55,000 Avion points if you’re able to meet the associated spending requirements.

Despite having similar welcome bonuses, the Avion cards do all have slight differences in the benefits they offer, their earning rates, and their annual fees.

The RBC® Avion Visa Platinum†, RBC® Avion Visa Infinite†, and RBC® Avion Visa Business all have an annual fee of $120 (all figures in CAD).

Meanwhile, the RBC® Avion Visa Infinite† Business has an annual fee of $175, and lastly, the RBC® Avion Visa Infinite Privilege† card has the highest annual fee at $399.

With the higher annual fees, you can usually expect to also see additional benefits, such as higher earning rates and access to airport lounges.

By comparison, the RBC ION cards seriously lag behind in terms of welcome bonuses offered, often ranging from 3,500–7,000 Avion Premium points.

However, the ION cards do have minimal annual fees, with the RBC® ION Visa having no annual fee, and the RBC® ION+ Visa charging a fee of only $4 per month.

Credit Card Spending

In addition to earning the welcome bonus, you’re also able to earn Avion points on your day-to-day purchases.

The RBC Avion-branded credit cards come with the following earning rates on daily spending:

RBC® Avion Visa Infinite†

- 1.25 Avion points per dollar spent on all travel purchases (flights, hotels, car rentals, etc.)

- 1 Avion point per dollar spent on all other qualifying purchases

RBC® Avion Visa Platinum†

- 1 Avion point per dollar spent on all qualifying purchases

RBC® Avion Visa Infinite Privilege†

- 1.25 Avion points per dollar spent on all qualifying purchases

RBC® Avion Visa Business

RBC® Avion Visa Infinite† Business

The RBC ION cards, earning Avion Premium points instead of Avion Elite points, have better earning rates than the cards above, despite fetching little to no annual fees.

Although the ION cards earn less valuable Avion Premium points, you can easily transfer the Avion Premium points earned through ION cards to Avion Elite points at a rate of 1:1, if you hold one of the Avion cards listed above.

The two cards through which you can earn Avion Premium points have the following earning rates:

RBC® ION Visa

- 1.5 Avion points per dollar spent on qualifying grocery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming, and digital subscriptions

RBC® ION+ Visa

- 3 Avion points per dollar spent on qualifying grocery, dining, food delivery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming, and digital subscriptions

- 1 Avion point per dollar spent spent on all other qualifying purchases

Avion Rewards

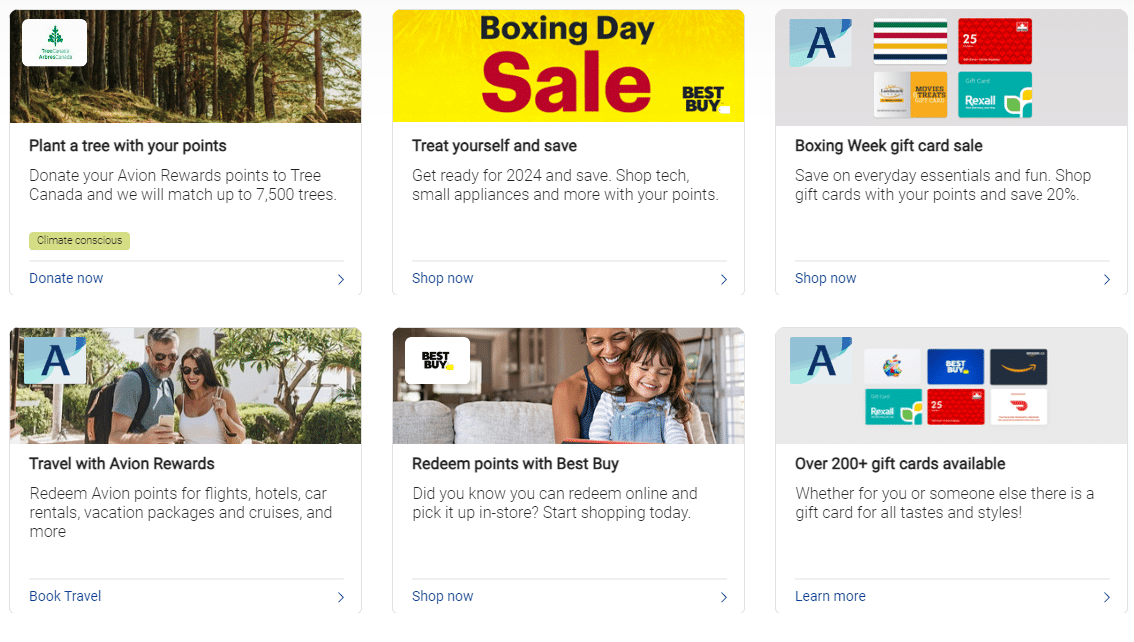

A relatively recent addition to the RBC Avion program is Avion Rewards, which is open for RBC clients and non-clients alike.

Since all points transactions are made under its platform, those with an Avion or ION card product have automatically been registered to Avion Rewards, while those with other RBC products may use their existing RBC credentials to enroll.

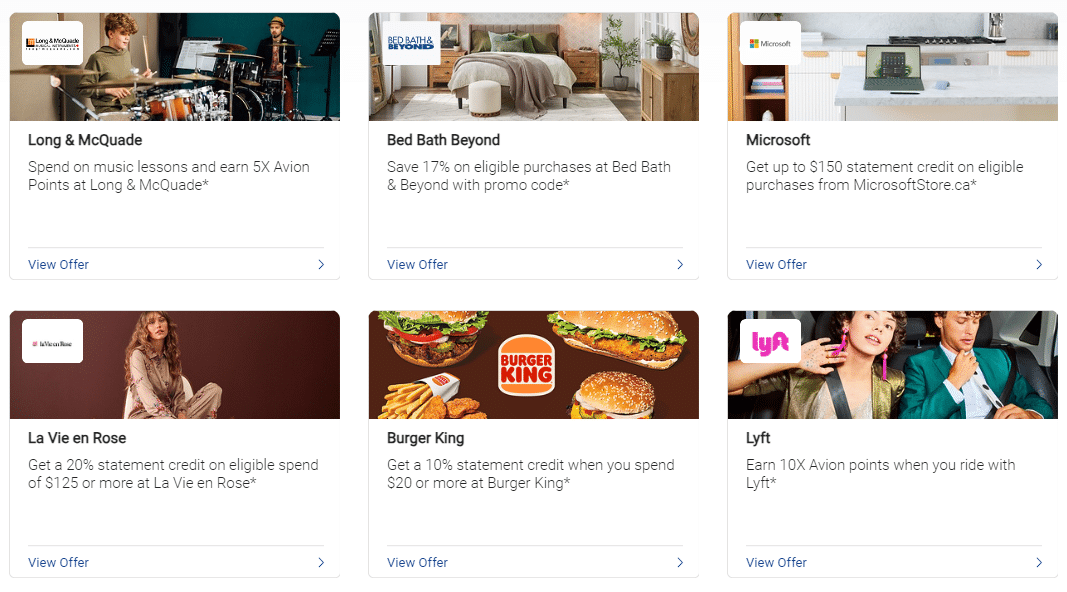

Under Avion Rewards, you may benefit from two types of offers: “save & earn” offers, and “shop now” offers.

The former lets you earn Avion points, discounts, and cash back when you use your eligible RBC card at participating online and in-store establishments. Meanwhile, the latter lets you earn cash back on online purchases, akin to the Aeroplan eStore and Rakuten.

Examples of save & earn Avion points offers are as follows:

- Earn 1,000 Avion points when you spend $300 or more at participating Marriott Bonvoy hotels in Canada

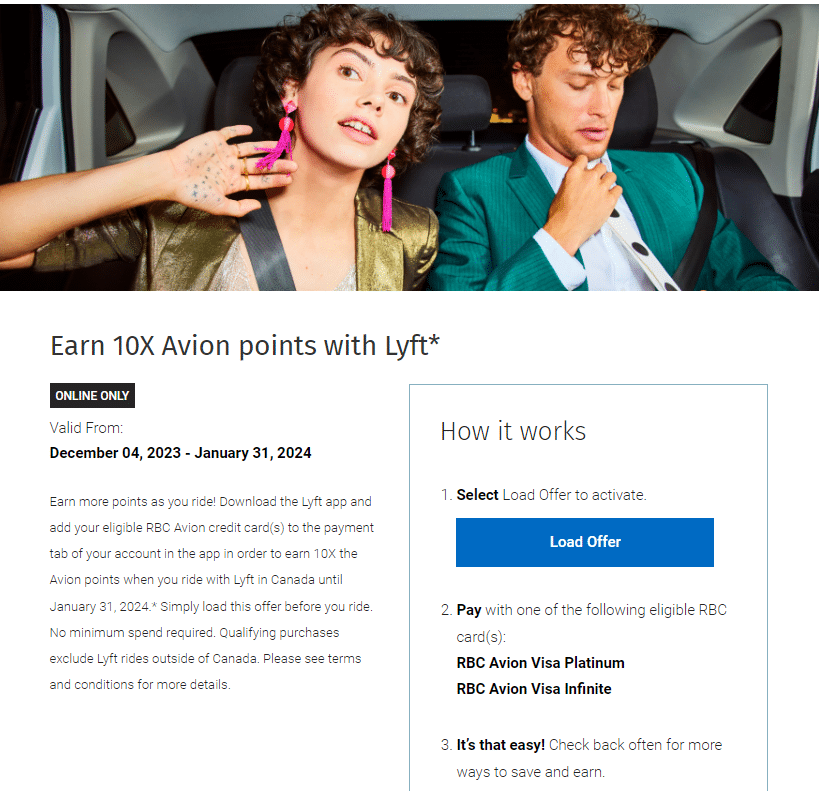

- Earn 10x Avion points on Lyft rides

- Earn 2x Avion points on eligible Apple purchases

For save & earn offers, you must opt into each offer by logging into your Avion Rewards account.

Redeeming RBC Avion Points

The best feature of the RBC Avion program is the flexible nature of Avion points.

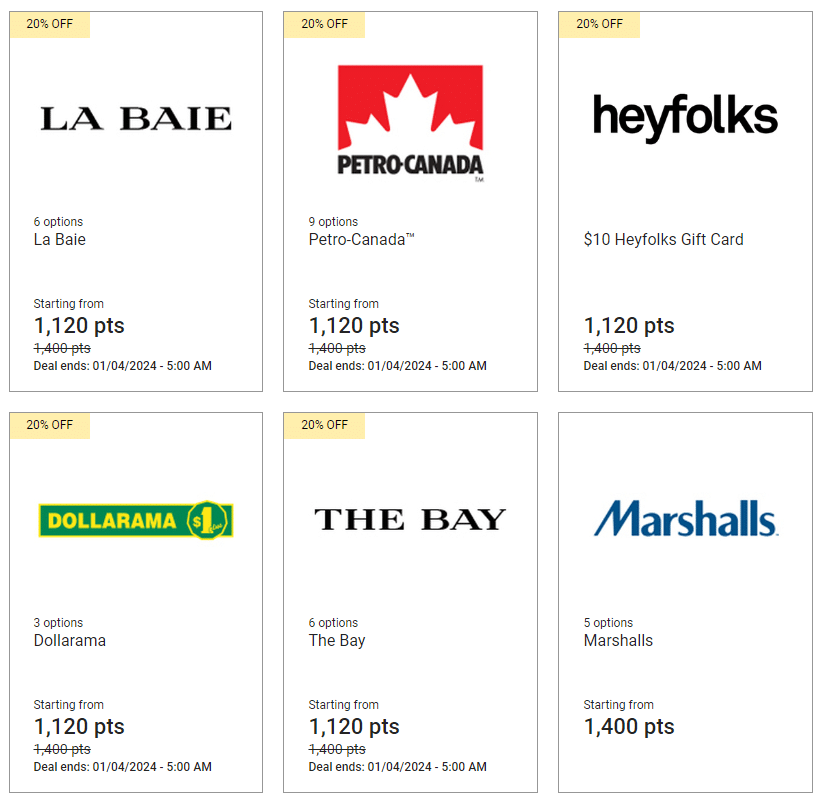

Avion Elite points can be transferred to airline loyalty programs, redeemed through RBC’s Air Travel Redemption Schedule , or cashed out through gift cards or statement credits.

Comparatively, Avion Premium points aren’t quite as valuable on their own.

Avion Premium points can only be transferred to WestJet Rewards , or they can be cashed out for statement credits and gift cards. Notably, Avion Premium points cannot be transferred to any other airline loyalty program and can’t be used to book travel through RBC’s Air Travel Redemption Schedule.

Given this, the best use of RBC Avion Premium points is simply to transfer them to RBC Avion Elite points, which you can easily do as long as you have a Avion credit card.

Even if you don’t currently have an Avion credit card, it’s still best to save your Avion Premium points, and make plans to get an Avion credit card in the future.

For this reason, we’ll look exclusively at the redemption options for RBC Avion Elite points.

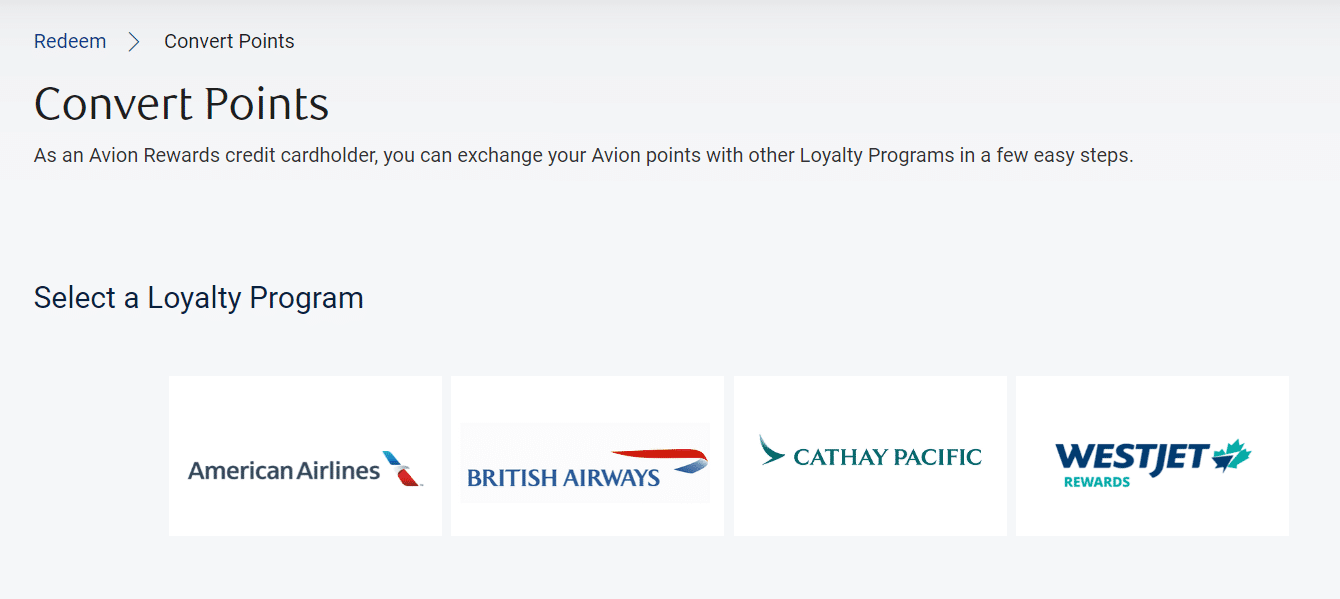

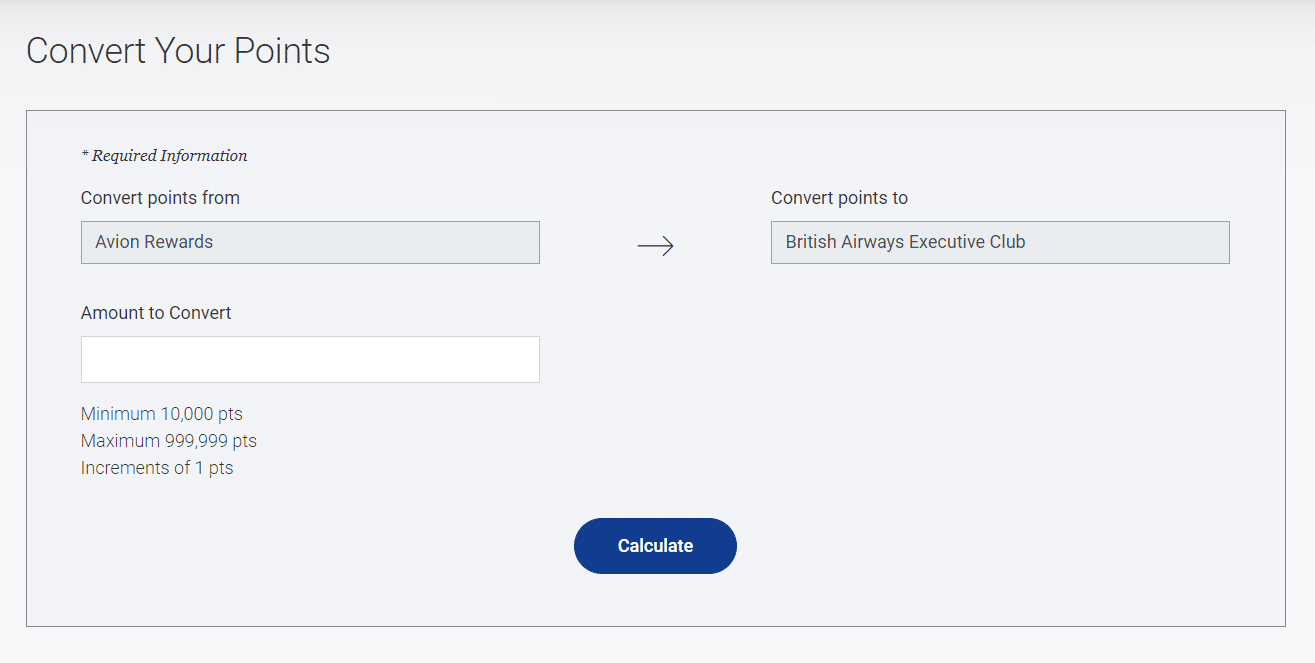

Transferring to Partner Programs

You can transfer your RBC Avion Elite points at a 1:1 ratio to British Airways Executive Club (Avios) and Cathay Pacific Asia Miles, and to WestJet Rewards at a rate of 1 Avion point = $0.01 in WestJet Dollars (WSD).

You can also transfer Avion Elite points to American Airlines AAdvantage at a rate of 10 Avion points = 7 AAdvantage miles.

British Airways Executive Club is great for short-haul journeys, as well as long-haul trips in economy class.

One amazing sweet spot is transferring British Airways Avios to Qatar Airways Avios at a 1:1 ratio. From there, you can book Qatar Airways QSuites one-way from North America to Doha for only 70,000 Qatar Airways Avios.

It’s also worth noting that RBC regularly offers transfer bonus promotions from Avion to British Airways Executive Club. Historically, the most common promotional offer is a 30% bonus on point transfers.

Lastly, keep in mind that there are a few restrictions on the ability to transfer points to these partners. In particular, for British Airways Avios, American AAdvantage, and Cathay Pacific Asia Miles, you need to transfer a minimum of 10,000 Avion points at a time. However, there is no such restriction for transfers to WestJet Rewards.

RBC Air Travel Redemption Schedule

If you’re not interested in transferring your Avion points to an airline loyalty program, you can still get great value by redeeming points through the RBC Air Travel Redemption Schedule.

While you won’t be able to get outsized value for your points, you’ll still get more value through this avenue than if you redeemed Avion points for a statement credit or for gift cards.

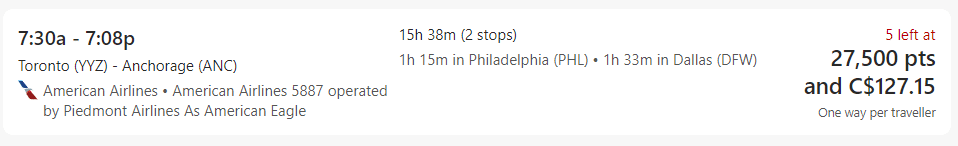

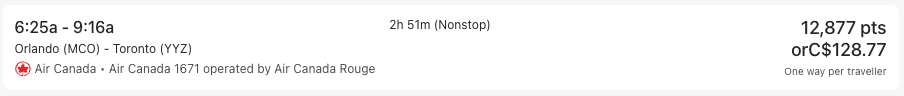

Through the Air Travel Redemption Schedule, you’ll be able to redeem Avion Elite points at a fixed rate for the base fare of any flight booked through the Avion Rewards portal, powered by Expedia.

Each redemption option allows you to use the specified number of points towards a listed maximum base fare.

It’s important to note that you’ll be responsible to pay for any base fare amount that’s over the maximum base fare listed in each category, as well as for the taxes and additional fees.

If you wish to redeem Avion points for the additional costs, you can choose to do so, albeit at the lower redemption rate of 1 cent per Avion point.

When using RBC’s Air Travel Redemption Schedule to book a flight, you’ll get a value of up to 2.3 cents per Avion point, depending on the origin and destination of your trip and the cost of the base fare.

The maximum value of 2.3 cents per Avion point can be found in the “Quick Getaway” category when you redeem 15,000 Avion points for the maximum return-trip base fare of $350.

In all the other categories, the maximum value you’ll be able to extract is 2 cents per Avion point, when booking a round-trip for the maximum base fare amount.

As an example, if you were to redeem 100,000 Avion points for a round-trip flight from Toronto to Lima with a base fare cost of $1,700, you would receive a value of 1.7 cents per point.

Notably, with the Air Travel Redemption Schedule, the number of Avion points required for a redemption in each category doesn’t fluctuate with the cost of the base fare.

Using the above example of the round-trip flight between Toronto and Lima, even if the base fare was only $900, you would still need to redeem 100,000 Avion Elite points.

Based on this, to extract maximum value from your Avion points when using the Air Travel Redemption Schedule, you’ll want to aim to redeem for base fares that are as close to the category’s maximum base fare as possible.

For this reason, the fixed-rate redemption chart can be particularly valuable for bookings during busy times of year, such as holiday seasons, when travel costs are elevated.

This is because the fixed-rate nature of the Air Travel Redemption Chart allows you to book these more expensive dates of travel for the same number of points as a cheaper date of travel (assuming the base fare remains below the maximum threshold for the category).

Travel Credit

Another option for redeeming your Avion Elite points is for fixed-rate travel statement credits through the Avion Rewards platfo.

By booking through this avenue, most cardholders will receive a fixed rate of 1 cent per point, and if you hold the RBC® Avion Visa Infinite Privilege† or the RBC® Avion Visa Infinite† Business , you’ll have access to a fixed rate of 2 cents per point if you’re booking a business class or First Class flight.

When compared to the Air Travel Redemption Schedule , this may seem like a similar or even slightly worse valuation; however, it can actually prove to be better in certain scenarios.

As we mentioned above, when redeeming Avion points through the Air Travel Redemption Schedule, you are required to redeem the set number of points regardless of the cost of the base fare, as long as it’s under the maximum amount.

Looking at the “Explore North America” category from the Air Travel Redemption Schedule, this means that even if the base fare ends up being less than the $750 maximum listed, you’ll still have to pay the full 35,000 Avion points.

Taking a deeper dive, based on the redemption rate of 1 Avion point = 1 cent, the 35,000 Avion points required for this booking is equal to $350.

This means that if you’re looking at redemptions using the Air Travel Redemption Schedule and you find a base fare within this category for less than $350, you’ll be better off booking the flight on your own and then redeeming your Avion points for a travel credit.

Other ways to Redeem Avion Points

Beyond what’s already been mentioned, RBC provides a number of additional options for redeeming Avion points through the Avion Rewards platform. However, these options are not particularly valuable.

For example, you can use points to send e-transfers, pay bills, add to your existing investments, make a mortgage payment, or even pay off your credit card.

For most of these financial redemption options, you’ll get a value of 0.83 cents per point, and if you want to pay your credit card directly, the value is only 0.58 cents per point.

You can access better value than this by redeeming Avion points for gift cards, with some options offering value as high as 1 cent per point (and occasionally higher during promotions), but the best value can still found by transferring Avion Elite points to partner airline loyalty programs.

One additional option is to redeem Avion points for merchandise, but similarly to the other non-travel redemption options, this doesn’t offer nearly as much value for your Avion points.

RBC Avion is an important rewards program that can help unlock some amazing sweet spots through transfers to partnered airline loyalty programs, such as British Airways Executive Club and Cathay Pacific Asia Miles.

Thanks to its unique set of transfer partners, the relative ease of accumulating points via RBC’s Avion- and ION-branded credit cards, and the frequency of transfer promotions, Avion points are extremely useful to collect as a way to supplement the other major Canadian points programs.

Warning: Lorem ipsum dolor sit amet, consectetur adipiscing elit. Etiam interdum ligula bibendum interdum fringilla. Quisque non arcu vel arcu bibendum convallis id congue mauris. Nam a eros a eros luctus tristique .

- Find a Branch

- Call 1-866-756-1105

Customer Service

Let us help you find the answers you're looking for....

Month Day at Time

Find More Ideas Workshops Near You

Local events coming soon.

Or Choose a Topic:

- Bank Accounts

- Credit Cards

- Investments

Top Questions

- What type of accounts do you offer?

- How do I reset my Online Banking password?

- How do I register for Online Banking?

- I'm having trouble signing in to RBC Mobile, what can I do?

Helpful Links

- Find the right account

- Personal Account Interest Rates

- Learn more about RBC Personal Banking accounts

- How to dispute a credit card transaction

- What do I do if my credit card was lost or stolen?

- How do I change my credit limit?

- Why is my card being declined?

- Do you offer any Cash Back credit cards?

- Apply for a Credit Card

- Replace Damaged Card (Goto URL?)

- Let Us Help You Choose the Right Credit Card

- Compare Credit Cards

- Managing Your Credit

- Learn More About RBC ® Credit Cards

- What is a Line of Credit?

- If I buy a vehicle from a dealer, can I finance it with an RBC Royal Bank car loan?

- Where can I find information on student loans?

- Where can I find information on Loans?

- Loan Calculators

- Compare All Lines of Credit & Loans

- Line of Credit & Loan Payment Calculator

- Manage Your RBC Line of Credit or Loan

- Pay Down Debt and Improve Cash Flow

- Learn More About RBC ® Lines of Credit & Loans

- What Mortgages to you offer?

- How do I Skip a Mortgage Payment?

- What is the RBC Homeline Plan?

- When can I expect to receive my mortgage annual statement?

- Mortgage Payment Calculator

- Mortgage Rates

- Mortgage Specialist Locator

- How Much Home Can I Afford?

- Rent or Buy Calculator

- Which Type of Mortgage is Right for Me?

- Credit Selector Tool

- Credit Selector Tool Mortgage Payoff Calculator

- Learn More About RBC ® Mortgages

- How do I withdraw funds from my TFSA?

- How do I purchase an Investment?

- What are your current rates?

- What is Direct Investing?

- Learn about what Investments are right for you

- Try the TFSA Calculator

- Maximize your RRSP savings

- Select and compare GICs

- Investment tools and calculators

- Learn more about RBC ® Investments

- How do I sign up for the pay employees and vendors service?

- How much does it cost to send a wire payment through Online Banking for Business?

- What is your ABA Routing number?

- How do I send an Interac e-Transfer Online?

- RBC Express Login

- Business Account Selector

- Business Solution Selector

- Cash Flow Tool

- Business Loan Calculator

- Standard Online Banking

- Premium Online Banking

- Your Digital Business Advisor

What Others Are Asking About

- How do I reset my online banking password?

- How do I set up or change my Personal Verification Questions?

- How do I set up or change my Online Banking username?

- How do I get the login screen to remember my card number?

- How do I log onto Online Banking?

- How do I open an account?

- How do I open a TFSA online?

- How do I transfer money between my accounts?

- How do I transfer money to another person?

- How do I transfer money between banks?

- How do I send an Interac e-Transfer?

- Do you offer Mobile Cheque Deposit?

- What banking features can I access through RBC Mobile?

- I’m having trouble signing into the RBC Mobile app, what can I do?

- How do I change my RBC Mobile password?

We’re Here to Help

Find a branch, atm, mortgage specialist or financial planner.

Over 800 branches open longer. Award-winning convenience. Expert Advice.

RBC Online Banking Secure Email

International toll-free service, global toll-free numbers:.

These Global Toll-Free numbers are accessible from 21 countries outside of North America. The “+” sign stands for the international access code, which varies depending on the country you’re calling from.

Telephone Banking +800-0-769-2511

Online/Mobile Banking Technical Support +800-0-769-2555

Credit Cards +800-0-769-2512

Please note that if you dial from a cell phone, air time charges by your local provider may apply.

Collect Call Phone Numbers:

If you are calling from outside North America and are not in one of the participating countries, please call us collect at:

Telephone Banking 506-864-2275

Online/Mobile Banking Technical Support 506-864-1555

Credit Cards 416-974-7780

Please contact your Telephone Directory system or an International Operator to obtain the International Access Code or other unique dialing codes that may apply in your country.

Participating countries or regions and corresponding International Access Codes:

† Please note for Finland, Japan, and South Korea the International Access Code depends on the telephone service provider.

Mailing Addresses

Attention: Please be advised that the head office locations listed below are currently closed. We ask that you send physical mail to an open branch location , or book an appointment for an advisor to call you for more options.

How to redeem Avion Rewards points for financial rewards

When logged into RBC Rewards, if you look under the Shop & Redeem menu, you’ll see there’s an option to use your points for RBC financial rewards. Assuming you have financial products with RBC, you can use your points for the following:

- Add to your existing investments

- Mortgage payments

- Repayment to your line of credit.

It takes 12,000 RBC points to get $100 in financial products which gives you a value of .83 cents per point. At first glance that may seem like a lot, but think about the long term. With mortgage and line of credit payments, you’re basically paying off your loan earlier which you immediately save on the interest. If you’re adding to your investments, you can take advantage of compound interest which could make your redemption very valuable in the long run.

If you use your points for a financial reward that’s put towards your RRSP , you could also get a tax break. Putting in your TFSA would allow you to invest with tax free gains. It’s a win-win situation, but you won’t see the reward for many many years.

Redeeming Avion Rewards points for merchandise, statement credits, and charitable donations

The final three redemption options for your RBC Rewards points are merchandise, statement credits, and charitable donations. Although the RBC Rewards merchandise catalogue is quite large and there are some quality products available, the number of additional points required for the value is not worth it at all. I would advise avoiding using your points for merchandise. That said, there are occasionally discounts on merchandise redemptions, so sometimes the transactions aren’t a terrible deal.

Using your points for a statement credit is an even lower value. It takes 17,200 points to get $100 off your statement. That means your points would be worth .58 cents per point. Unless you’re facing financial difficulties, you’re better off redeeming your points for anything else.

RBC Avion points transfer partners

I love programs that let you convert points to other loyalty programs since it adds flexibility and value. Avion Rewards has one of the most extensive and valuable lists of conversion partners when it comes to Canada’s bank travel reward programs. American Express Membership Rewards is better, in my opinion, but RBC Rewards isn’t far behind.

Here is the list of programs you can convert Avion points to, but note that except WestJet Rewards, only Avion cardholders can transfer their points to the following partners:

- WestJet Rewards : 1,000 RBC points = $10 WestJet dollars

- Hudson’s Bay Rewards : 1,000 RBC points = 2,000 HBC Rewards points (worth $10 at Hudson’s Bay)

If you are an Avion cardholder you can also benefit from these conversion options:

- American Airlines : 10,000 RBC points = 7,000 AAdvantage miles

- Cathay Pacific Asia Miles : 10,000 RBC Points = 10,000 Asia Miles

- British Airways : 10,000 RBC points = 10,000 Avios miles

It’s hard to put an exact value on airline miles since there are so many variables, but generally speaking, their value is around a minimum of 1.5¢ per mile for economy tickets. Often you can get double the value if you’re booking in business class. That said, WestJet Rewards uses a dollar system, so they have a fixed value.

It’s a good idea to log into RBC Rewards often since they have many redemption promotions throughout the year, which boost your points’ value. In addition, RBC Rewards had a few transfer bonuses (10% to 30% bonus points) for Westjet, Asia Miles, British Airways Avios Miles, and American Airlines AAdvantage Miles. That meant you got extra value when transferring your points to a partner.

Of particular interest is how you can transfer your points to WestJet dollars. Nothing stops you from holding an RBC Avion card and the RBC WestJet World Elite Mastercard. Both cards come with good sign up bonuses so you could quickly rack up those WestJet dollars. For example, the RBC Avion card typically has a welcome bonus of 15,000 points which can be transferred to WestJet for $150 WestJet dollars. The WestJet RBC World Elite Mastercard’s standard bonus is $250 and a companion voucher. When you combine the two, you’ll have $400 in WestJet dollars without having to spend much. No purchase is required to get the bonus with the Avion card, and you only need one purchase with the WestJet Card.

Do RBC Rewards points expire?

There’s a lot of conflicting information out there about when RBC Rewards points expire. I have confirmed that RBC Avion points don’t expire as long as you have an active eligible RBC Royal Bank credit card. If you cancel your card, you have 90 days to redeem them before losing them. The first-in, first-out rule you may have read about online is an old outdated article. RBC really needs to delete that page. If you’re unsure when your points expire, you could always call customer service to confirm.

How RBC Avion compares to others

RBC Avion Rewards is easily one of the best travel loyalty programs of Canada’s big five banks. There are many reasons why I rank RBC Rewards so high, including:

- No blackout dates

- No minimum number of points to redeem

- A fixed points flight program

- Many transfer partners to convert points to

- Many promotions for redemptions

- Value of points

In my opinion, RBC Rewards is only second to American Express Membership Rewards . American Express holds the first place because RBC Rewards lacks an option to book travel on your own (you can only book through their portal) and because RBC Rewards credit cards don’t really have any increased earn rates which limit how fast you can earn points. You can also read my reviews of CIBC Rewards , BMO Rewards , TD Rewards and Scene+ to see how RBC Rewards compares.

How to earn RBC Avion Rewards

To earn RBC Rewards, you must have a credit card account that earns you RBC Rewards. As you can imagine, the easiest ways to earn points are via credit card sign up bonuses and everyday purchases you make on your RBC Rewards credit card. Currently, there are six personal credit cards and two business credit cards that will earn you RBC Rewards points. To make things a bit complicated, RBC Rewards has two tiers of RBC Rewards points: regular and Avion RBC Rewards points. Points from an Avion account have more redemption options, and these options are the most valuable ones. With this in mind, the RBC Visa Infinite Avion card is arguably the best card to earn Avion points and is one of the best RBC credit cards .

RBC Avion Visa Infinite Card

- $120 annual fee

- 35,000 Avion points on approval

- 20,000 Bonus points when you spend $5,000 in the first 6 months

- Earn 1.25 Avion points for every $1 spent on travel purchases

- Earn 1 Avion point per $1 on all other purchases

- Comprehensive travel insurance

- Mobile device insurance up to $1,500

The sign up bonus for new cardholders is typically 15,000 points which isn’t much compared to some of the best travel credit cards in Canada . That said, the RBC Visa Infinite Avion Card often has promotions where the welcome bonus is 25,000 – 35,000 points, and the annual fee for the first year is waived. Whenever a promo like that comes around, it’s worth signing up for the card.

The earn rate of 1.25 points per $1 spent on travel is decent, while the 1 RBC Reward point earned per dollar spent on all other purchases, including bill payments, is pretty common. Here’s something that many people don’t realize. You don’t need to make any purchases to get the bonus. The terms and conditions say you get it after the first statement.

Another little-known trick is that you can switch from the RBC WestJet World Elite Mastercard to the RBC Visa Infinite Avion Card and vice versa. This is useful if you’re not able to maximize your points and want to try something new. That said, be sure to use up your points before you make any changes.

The RBC Visa Infinite Avion Card also provides good travel insurance when travelling outside Canada. Not only do you get travel medical, but you’ll also be covered for trip cancellation/interruption, delayed and lost baggage, hotel/motel burglary and more. Obviously, some exclusions apply, so read the certificate of insurance for complete terms.

Link to your Petro-Points card

RBC has a deal in place with Petro-Canada where you can save 3 cents per litre at Petr-Canada, 20% extra Petro-Points, and 20% extra RBC Rewards points.

To be eligible, you just need to add your Petro-Points number to your RBC online banking account. You would link your Petro-Points card to all of your eligible RBC debit or credit cards.

Final thoughts

Avion Rewards is one of the best bank travel rewards programs . The RBC Visa Infinite Avion card may not give you the best signup bonus or have the highest earn rate, but there’s no denying that once you have the points, they’re easy to use. There are no blackout dates and no minimum points required to make a redemption, so you’ll never run into any issues using your points. If you’re a fan of RBC, check out my RBC InvestEase review and find out how you can reduce your investment management fees.

About Barry Choi

Barry Choi is a Toronto-based personal finance and travel expert who frequently makes media appearances. His blog Money We Have is one of Canada’s most trusted sources when it comes to money and travel. You can find him on Twitter: @barrychoi

97 Comments

Can you explain more on the comprehensive cancellation insurance for traveling? For flight

What I mean is you get travel medical, trip accident, trip cancellation, lost luggage, etc. You cAN READ THE FULL DETAILS HERE.

https://www.rbcroyalbank.com/credit-cards/travel/rbc-visa-infinite-avion/rbc-visa-infinite-avion-certificate-of-insurance.pdf

Barry choi, What about outright flight cancellation by company with no booking possibility ? this happened to me 5 years ago and Avion card could not do anything!

When saying trip cancellation … talking from whom??

What do you mean by company with no booking possibility? With fight cancellation, it only applies to reasons that are outlined in your insurance policy.

When should I pay for a flight as opposed to redeeming points. I want to go to Vancouver – Honolulu -L.A. – Vancouver. Points 45000 plus $266 Cash $960 Plse advise and thx,Lawrence

45,000 Rewards points would be worth $450 + $266 for taxes = $716. Since the value of your redemption via the fixed travel program is $960, you come out ahead using the fixed program.

How much is 28906 rbcrewards point please

10,000 points = $100 so you have $289 at the base value. Your points are worth more if you use the RBC Rewards Air Travel Redemption Schedule

Hi. I have 10500 pts and I purchased my ticket for $2000 whose base fair is $1400. What’s the best way to go with the schedule?

You need 15,000 points to make a claim within or to an adjacent Province/Territory/U.S. State. That fare has a maximum base price of $350 so you can’t use the fixed redemption schedule.

you could just 10,000 points to redeem $100.

Sorry Barry. I have 105000 points. I missed a zero. Can you please update your response?

If you’ve already paid for your ticket, you can’t use the air redemption schedule. Assuming you didn’t 100K points gets you a flight from any major gateway in Canada/U.S. to destinations in Asia, Australia, New Zealand, South Pacific, Middle East, Africa, South America

Hi Barry, thanks for the article and for all the Q&A work as well !!

I’m looking at making the switch to Amex. I have 160k reward points I’ve saved up over the years. Looking to cash out or use these points up somehow with the best value. Appears as tho 10,000 points for $100 value is about the best offer from RBC rewards? Also, do you know if these points expire if I got rid of my RBC Avion card?

Yup, 10K points for $100 is indeed the best value. You lose all your points if you cancel your card. Your best bet would be to transfer your points to WestJet Dollars or hotels.com giftcards as they have good value.

I product switched to the RBC British Airways Visa almost 4 months ago. My account has remained in good standing however, I haven’t received the welcome bonus of 15k points yet. I have called RBC multiple times and each time I have been told that BA awards the points but when I speak to BA, they say that RBC needs to award the points. Do you have any idea who should be awarding the points? Thanks in advance for any help you can provide.

In theory, it should be BA that actually issues the points but RBC would have to authorize it.

I would advise escalating the case with RBC first to see if that resolves anything.

If I wish to use my Avion Rewards points to pay off my credit card bill, is it straight 100 points/per every $1?

No, it takes 172 points to claim $1 in statement credit so you’re devaluing your points quite a bit if you were to go that route.

Is this card best to earn miles to book a points first class flight from Vancouver to Tokyo?

I just noticed RBC is offering 50% more points if converted to Avios, does the same offer ever happen with AA points?

The 50% bonus is quite rare. I’ve never seen it with AA.

Is it worth it to convert your Avion points to BA Avios given the 50% bonus on until Dec 15th? I live in Vancouver and typically fly to Hawaii in Winter and Europe in summer. Your insight is much appreciated.

If you plan on using those BA points, then yes, it’s a great deal. That said, I’m not sure which airlines you can use BA Avios points to get you from Vancouver to Hawaii.

Hi, is it worth buying the air Canada gift cards at a 10% discount? Are they easy to use and are there any hidden charges / rules to these we should know about?

Buying the gift cards gives you a guaranteed discount of 10%, but you might get better value if you used your points on the fixed travel program. It’s honestly a personal choice but I imagine you wouldn’t have any issues with using the gift cards. As far as I know there are no additional charges or rules, but read the fine print before you commit.

Do my RBC rewards expire at any point

Not as long as you have a credit card account that earns you RBC Rewards active with them that’s in good standing.

RBC Reward points expire after 3 years on a First In, First out basis.

That is incorrect. If you refer to handbook, the first page states that RBC points don’t expire.

https://www.rbcroyalbank.com/credit-cards/travel/rbc-visa-platinum-avion/rbc-visa-platinum-avion-benefits-guide.pdf

The reference to points expiring after 3 years is old and should have been removed from the website.

my mistake, you are correct. I believe my knowledge was outdated.

I just logged into my RBC Rewards and I see that I have a – 69K point balance. How is it possible to end up with a negative reward points balance?? I have never even used my rewards and forgot that it was even available. Any help would be appreciated.

You’d have to check with RBC about that

Do you think it is worth keeping the RBC Infinite Avion card beyond the first year? Is it worth the $120 per annum annual fee considering that I am also paying fees for amex gold card and BMO cash back card?

Thanks for your insight

Hi Viviene,

I personally wouldn’t keep three credit cards with annual fees. Of the three cards you mentioned, I’d probably drop the BMO cash back card but that’s because I prefer travel points. Who do you bank with? Do they waive the fee for any cards?

I bank with BMO but it’s a joint account and the waiver goes towards my partner’s BMO MC world elite card. I figure the cashback we get each year more than pays for the annual fee.

What does RBC Avion offer that justifies its fee? It seems as if it would take a long time to build up any significant number of points.

Well it’s really for you to decide based on your spending. E.g. if you moved all the spending from your cash back card to the RBC card, you could more in points for flights than what the annual fee would cost you. I think the RBC Rewards fixed flight travel chart offers good value especially if you’re looking at short haul flights. However, that may be redundant since you have the Amex Gold which also has a fixed points program.

How would you compared the two fixed points program? I tend to focus on transferring my Amex points to Avios and haven’t really looked at the Amex fixed points program. I also feel that the Amex Gold has more to offer than the RBC card in terms of travel insurance and flexibility on how to use points. But I may be wrong….

Both programs have their sweet spots. Amex is arguably better since you have more transfer partners. The Amex Gold has a slightly higher earn rate on travel. but RBC Rewards has occasional promos where if you transfer your points to BA, you get 25 or 50% more points.

I do agree that the Gold Amex is a better overall card.

Is there anyway I can browse through options for say a vacation package, that would be qualified for if I had 150000 points? For example my 150000 points would allow me to go to Cayo Largo Cuba, or Puerto Plata Dominican Republic or Cozumel Mexico…you get the idea.

It doesn’t give you an option to search for results based on X points. All really allows you to do is search by price from low to high after you’ve selected a country.

I have always been a fan of the RBC Avion program until today when I tried to change a departing flight and was told that all the flights I chose were “not available” although there were clearly seats for sale on both the airline website AND Expedia. RBC only offered a few very poor flight options. I thought “any flight” meant “any flight”. I have never encountered this before. We ended up buying new flights from the airline after spending over 30 minutes on hold, suffering through a painfully frustrating conversation with an agent and draining the battery on my phone.

I’m going to bail on Avion after learning that they recognize an Air Canada fuel surcharge of 570$ per ticket to europe in a time of extended, sustained low fuel prices. It was going to cost me 1100$= in fees when flights can be purchased outright for just over 1600$.

Value lost due to poor decisions at Avion….. adios!

That’s Air Canada’s fault, not Avion.

How long does it take to convert RBC points into Asia Miles? Is it instantaneous or do you have to wait 6-8weeks?

It usually takes 4-5 days for the transfer to Asia Miles

I have around 200k in avion points. I am trying to figure out the best option for using them as we are moving to Europe for a year. I looked into the flights but almost 1/2 goes to the taxes, etc. I was wondering if it was best to use them while we are there for short trips. So, what would be the best value? (ie rental car, hotels, ?), anything else?

Points for flights to Europe are typically of low value due to the fees. Using them within Europe is also not a good value since you wouldn’t be able to use the fixed travel program. You could use the RBC travel portal when you’re abroad and book points at 10,000 points = $100 in travel.

Alternatively, you could convert your points to WestJet dollars at a 1:1 ratio. On occasion, there are promos where you can convert to hotels.com giftcards which can be a good value.

Hi Barry, we have ~250,000 RBC Avion points and I’m trying to maximize getting to FCO (Rome) this summer from YYZ (Toronto.) We also have 90,000 in Aeroplan.

Traveling with a 15 month old so really wanted to optimize for lie-down seats. But they are pricey. ($8000 for two seats on AC’s direct flights.)

Can you suggest a way to optimize our points to make it work?

Flying from Toronto to Europe is one of the worst redemptions regardless of the program due to high airport taxes. With Aeroplan, you need 110K points for a return business flight so that won’t really work.

For RBC, I don’t think you can use your points for business so that doesn’t really help.

The best value I can think of right now and this is honestly not the greatest solution is to consider transferring your points to WJD. If you have the WestJet World Elite Mastercard, you can use the companion voucher for premium economy. I just booked two flights from YYZ to LGW for $2400. Of course, you would still need to get a flight to Rome and you’d only be redeeming your points at a 1% value.

IMO, you’re better off paying cash for this route and saving your points for later.

Help. We have 175000 Avion points. Looking to use them from YVR to LHR. If I use the points for 3 fares return it looks like another $700 each on top !!!! With Aur Canada. Flights in September are approximately $700 each return. Can you give any advice. I have not checked if BA charges the same.

Flights to Europe are a terrible value due to the high taxes. You’re better off saving your points for a different redemption.

Is it possible to use Avion points to pay for an upgrade on an already booked flight? Is it worth it? Looking at this for a flight from Houston to Auckland on Air New Zealand.

You’d have to call and ask. You definitely can’t do upgrades via the RBC Travel portal.

Is there a time limit to redeem accumulated points? And I wld like to purchase a gift card for electronics?

Your points don’t expire as long as you have an active RBC credit card that’s in good standing.

I am a bit lost with car rental points… if my rental was $800.00 how many points would I need

That falls under travel so it would cost you 80,000 points.

Barry, Can RBC Avion Visa Infinite cardholders redeem for a Premium Economy class seat instead of Economy class? Thanks!

RBC Rewards is a full service travel agency so you can book premium economy, but it’ll cost you more points. It’s unlikely you’d be able to book premium under the Air Travel Redemption Schedule since the price would exceed the maximum base price.

Barry, RBC Avion Visa Infinite redemption schedule From Canada to Hong Kong: 100,000 points. Maximum ticket price: $2,000.

Normally the Air Canada Premium Economy ticket from Canada to Hong Kong costs close to (less than) $2,000. It’s not worth to redeem Economy class, which is about $1,000 or less. That’s why I would like to know whether I can redeem Premium Economy class or not.

As long as the base ticket price is below $2,000, you should be able to redeem a premium economy flight using your RBC Rewards points.

Hi Barry, I’m totally torn between Scotia Passport and RBC AVion? Which one do you really prefer if we plan on going US visits and Asian Countries as well?

Both cards a bit different. The Scotiabank card is a good all-in-one card since it has no forex fees, but the RBC Avion has a fixed points travel chart which can be of good value. Since you’re based in Canada, Air Canada/Aeroplan cards are good for US travel thanks to the new Buddy Pass. WestJet companion vouchers can also be handy.

Barry, early thanks for answering my question. I am contemplating on utilizing approx. 111,000 Avion points for Best Western gift cards. I presume the gift cards are in Canadian funds? Travel contemplated is in the U.S. once the ban is lifted. How is the difference in currency handled by U.S. based Best Westerns?

The gift cards are only worth it if you’re getting an equal value to your RBC Avion points. E.g. 1,000 points = $10. Yes, the cards would come in CAD. If you use them outside of Canada, you would be subject to the exchange rate at the hotel which will definitely have a markup.

Avion $350 air fare fee for interprovincial travel is useless to many Canadians outside the Upper / Lower Canada belt. Many interprovincial one way tickets are $350 or more. I’ve amassed nearly a million dollars over the years on my Avion card, and travel with my family of 6, using the points. I always have to wait for airlines to post sale prices before I can use the points, because their reward amount is set too low. Its not a cheap card either. I’ve never complained, but its been the same price system for over 10 years. Hello! Inflation!

Paying the taxes on flights is also a bummer. I’ve often just bought sale priced flights with cash, because the Avion rewards taxes where close to half the flight cash amount. Didn’t see the point in wasting them.

How do I book a business class seat? We’d like to go back to Europe next year and want to fly business class. I have over 300,000 points with Avion.

Two years ago we booked two business class seats after transferring points to British Airlines, What a nightmare!

I swore that I’d move to another point card to get better service, connections, etc.

Please help.

RBC has a travel rewards portal where you’d book your flights and then redeem your points.

Aeroplan is a lot easier these days, it’s worth considering switching to a card that earns you Aeroplan points.

We have 215000 points with RBC and travel to Mexico, US and are thinking of going from Edmonton to Amsterdam and returning to Edmonton from Rome. What are the best way to use our points. Is transferring points to Westjet a better deal than buying Westjet gift cards .

To maximize your value, you should use the RBC Air Trave Redemption schedule – https://www.rbcrewards.com/#!/travel/redemptionSchedule

It’ll cost 65,000 points to get to Europe with a max ticket value of $1,300. That works out to 2 cents a point which is double the normal value.

Ad for WJD, it’s a better value to transfer your points directly instead of buying gift cards

Any luck with product switching lately and receiving the welcome bonus of 15,000 points for Avion Infinite?

Darn. Seems to still work for WJ MC. Perhaps makes sense to PS to a no AF card and then cycle back.

I recently “purchased” airline tickets using Avion points. Unfortunately I mistakenly selected the Flexible Points Pricing and as a result ended up using roughly twice as many points as would have been needed under the Fixed Points Pricing. The difference is somewhere around 35,000 points. I requested that Avion reverse this mistake but was advised that it was their policy to not allow such a change. I requested to talk to a manager, but they basically advised that this wasn’t going to happen (they told me it would take 6 weeks). Any advice.

Unfortunately, it’s unlikely they’ll reverse the charges. This happens with all points programs.

Hi Barry… I have over 1 Mil points… and on flight can I upgrade to Exec or 1st Class with my points ?? I don’t see it anywhere when i am looking at the booking … Any ideas. Thanks Mike

In the RBC Avion travel portal, you should be able to choose premium economy or business class seats for your flights.

What are the pros & cons of flex points vs flexible points booking w Avion? How do I know which we should use?

All rbc rewards and avion rewards points can be used on any travel purchase made through the RBC travel portal.

I have been reading your awesome feedback from Avion customers! I recently tried to receive information from the RBC Rewards program call centre and it was horrific – unprofessional and unknowledgeable agents, transferring me first to Expedia and then to Air Canada. They wore me down. I then went online and read reviews on the performance of the program – from what I saw, every customer who had to make a change on their travel booking experienced exactly the frustration I did.. Has this program gone down hill in recent years on their customer service assistance?

The program itself is fine, but I imagine every travel operator is experiencing customer service issues. I guess the real problem is knowing who to call. If you book travel through the Avion travel portal, technically speaking, you will go through them to make changes even if you booked an Air Canada flight.

Hi Barry, I’m unsure whether to use my avion infinite Visa card to pay a Europe bike tour purchase as the surcharge is 4 percent or pay with an e-transfer. The foreign currency rate I’m billed at was 1.49. I look forward to your response. Also, if I pay with an e-transfer will I have any travel protection? Thanks in advance! Barbara

Hey Barbara,

A 4% surcharge is quite a bit. That said, an e-transfer may come with fees too. I personally would just choose what’s cheaper. That said, if you don’t pay with your credit card, you don’t get any protection if you need to cancel your tour for a qualifying reason.

Hi Barry, Thank you for your responses. I really appreciate it! Barbara

Regarding financial rewards, more specifically applying a credit to an existing RBC mortgage: is the cash value going to be considered a lump sum payment or something else? I ask this because the options to pay down a mortgage faster are limited to double-up payments upon each scheduled payment, and one lump sum payment (aka prepayment) of up to 10% of the initial principal per year. I already used my yearly lump sum and I’m concerned that I wouldn’t be allowed to redeem my Avion points towards my mortgage or I may be allowed to do so, but I could be issued a penalty for not following the rules. I couldn’t find anything online about what the value of the points redeemed is considered to be.

Hey Stephanie,

If I had to guess, it would count as a prepayment. You’d have to call them to find out for sure.

Too old to travel. So thinking of using my Avion points to buy RBC merchandise. How can I see what is available if I don’t do any banking transactions on a computer?

You need to go to the RBC Avion website to see what items are available for redemption – https://www.avionrewards.com/index.html

On the web site that I see, the first thing that they want is your Visa number. And that is exactly why we don’t do money matters on line.

Avion Rewards is a credit card rewards program. Using your credit card number is how you log in.

Hello I redeemed 130,000 points for a flights to Barcelona from Toronto and had to cancel. What is the value of these points so that I can make a travel insurance claim

That’s a value of $1,300.

Hi Barry, Thought you might be interested in my experience being transitioned from HSBC World Elite MC to RBC Avion Visa. Since I don’t have anything that spells out the fees, conversion rate, etc. I called the RBC conversion team. They are waiving the $120 annual fee for the first year and that’s it. Although the HSBC card did not charge the 2.5% foreign conversion fee, the RBC card does. The extra points which HSBC gave for travel expenses are likewise not available with the RBC card. It seems to me that if I wanted this card I would be better off applying for it and getting the bonus. Very disappointing.

You should have received paperwork about the details of your new card. HSBC World Elite MC holders being switched the Avion Visa Infinite will still get no FX fees on their card.

You’re correct about losing the travel credit after the first year.

The Avion card is a clear downgrade, I mention a few other options in this article – https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-hsbc-clients-may-not-love-their-new-rbc-credit-cards-but-rbcs-avion/

Thanks Barry. I don’t subscribe to the Globe but I assume you suggested the Scotiabank Passport Visa as an alternative. I don’t want to take up your time with all this but I applied for the Scotia card and it developed into a real mess. I’m still trying to find out what happened, currently waiting to hear back from their Escalated Customer Concern team.

I suggested a few.

The Amex Cobalt for high earn rate, Rogers Mastercard for Costco (if you use Rogers), and Platinum for high end travel benefits. If you want no FX, the Scotiabank card is indeed good, but I like the EQ Bank card cuz it has no fees.

I’ll def check into the EQ card, thanks again.

Leave a Comment Cancel Reply

Get a FREE copy of Travel Hacking for Lazy People

Subscribe now to get your FREE eBook and learn how to travel in luxury for less

COMMENTS

Book through Avion Rewards Travel or contact the Avion Rewards Travel Call Centre at 1-877-636-2870 (additional service fees apply). To book a new flight using an airline travel credit If you have an airline credit due to a flight cancellation that you'd like to use, contact the Avion Rewards Travel Call Centre at 1-877-636-2870.

For RBC Royal Bank credit card customer service, please send us an e-mail or call 1-800-769-2512. If you are a commercial cardholder, ... Contact Avion Rewards Travel at 1-877-636-2870 to find out more. I want to redeem my points for a trip with Via Rail but do not see it listed. How do I redeem? Please contact Avion Rewards Travel at 1-877-636 ...

When you book your travel through Avion Rewards, you may redeem Avion points at the rate of 100 points per CAD $1.00 to pay for any taxes and service fees (including sales, GST, departure and transportation taxes and fees, airport improvement fees, or other taxes), excess baggage charges, immigration fees, governmental fees and levies, customs charges and passenger facilities charges, health ...

Explore travel. Pay with points. Use your points 2 to shop Apple, Best Buy, gift cards, home decor, sports gear and more. ... Avion Rewards ShopPlus is available for desktop and mobile iOS users - and it's free! ... Customer Service; Avion Rewards Apps.

Cash back, Points and Savings - Get it all with Avion Rewards. Avion Rewards, Canada's largest bank-owned loyalty program, brings you more ways to shop, earn, save, and redeem every day. With 3 membership levels: Avion Select, Avion Premium and Avion Elite, it's easy to get rewarded, no matter how you shop or where you bank.

Avion Elite members can travel more for less. ... Explore travel. Do it all with points in the Avion Rewards app. The Avion Rewards app lets you access your account quickly and easily. Use your points for gift cards, merchandise, travel and more. Shop, earn, save and redeem - all in the app. ... Customer Service; Avion Rewards Apps.

Travel & Commuting Electric Car Financing ... The Avion Rewards app lets you access your account quickly and easily. Use your points for bill payments, credit card payments, Interac e-transfers and more. Shop, earn, save and redeem - all in the app. ... Customer Service. Apply Online; Branch & ATM Locator; Voluntary Codes & Public Commitments ...

Avion Rewards travel. Redeem your points for flights, hotels, car rentals, and more. ... For complete terms and conditions that apply to the Avion Rewards Program, please visit www.avionrewards.com or call 1-800-769-2512. ... Customer Service; Avion Rewards Apps.

Get 35,000 Welcome Points on approval and 20,000 bonus points when you spend $5,000 in your first 6 months 1. Apply by April 30, 2024. Earn 1 Avion point for every dollar you spend 2. Choose any airline, any flight, any time. There are no blackout dates or advance booking restrictions, even during peak periods.

RBC Avion Rewards points can be used to travel anywhere in the world with a round-trip ticket. A one-way trip requires half as many Avion points. Here is the airfare table for a round-trip flight: ... At that time, call Avion Rewards Customer Service at 1-800-769-2512.

Occasionally, the Avion Rewards site may experience technical difficulties or your flight may not appear in the search results. During that time, call Avion Rewards Customer Service at 1-800-769-2512. Get an authorization number to book the flight you want; Book your own flight directly on the desired airline's website;

Sign in with: RBC Online Banking. Business credit card. Commercial credit card. Email and Password.

Customer Service 1-800-769-2512. Points Value CAD . ¢1.50 What is the value of your points? Points. Calculate Value CAD $750 Reward ... One of the highlights of the Avion Rewards Travel program is the ability to convert Avion Rewards points to other partner programs such as American Express or Marriott Bonvoy.

Get the Avion Rewards App. The Avion Rewards app is the easiest way to manage your activity and the best way to ensure you don't leave points and savings behind. Explore and load offers, redeem points, shop the web, get cash back deals and more. Download the app.

Check both on the Avion Rewards website and in the Avion Rewards mobile app (on the App Store or Google Play). If you still don't see the Travel Credit option, call Customer Service at 1 800 769-2511 .

Avion Rewards members who are eligible to redeem for travel have the flexibility to book any flight on any airline at any time. MANAGE YOUR POINTS Combine your points across your Avion Rewards accounts and use them where you need them most. Get the flexibility you need when you convert your Avion points to another loyalty program. PAY BILLS

High: $0.0233 for the Air Travel Redemption Schedule. Low: $0.0058 for statement credits. Ways to redeem Avion Rewards points: * Air Travel Redemption Schedule - 2.33 cents per point (CPP) * Transfer to Avion partner airlines - 1.75 CPP. * Travel booked with RBC Rewards - 1 CPP. * Transfer to WestJet Rewards - 1 CPP.

There are subtypes of Avion points: Avion Select, Avion Premium, and Avion Elite. Avion Elite is the highest Avion Rewards tier, and has the most redemption flexibility. Both Avion Elite and Avion Premium points are earned through RBC credit cards, and can be transferred from one account to the other, if you hold a credit card that earns Avion ...

Earn Avion Rewards points on debit and credit purchases. Redeem them for flights, hotels, tech, financial rewards, and much more. ... Explore travel. Pay with points. Use your points 2 to shop Apple, Best Buy, gift cards, home decor, sports gear and more. Browse now. Do more with points.

Description Phone Number; Everyday Banking; Banking Accounts Client Cards Lines of Credit and Loans Mortgages: 1-800-769-2511 Teletypewriter (TTY) Services for those who are deaf or hard of hearing: 1-800-661-1275: Credit Cards

RBC Avion Visa Infinite. The Visa Infinite card costs $120 a year, the welcome bonus is up to 35,000 points, and you generally earn 1 reward point per dollar, rising to 1.25x on eligible travel purchases. Even though it's at the lower end of the scale in terms of Avion credit cards, it comes with plenty of insurance coverage, including mobile ...

Earn Avion Rewards points on debit and credit purchases. Redeem them for flights, hotels, tech, financial rewards, and much more. ... I was able to find what I was looking for in the travel section! ... Customer Service; Avion Rewards Apps. Royal Bank of Canada Website, ...

How to redeem RBC Avion points for travel. With RBC Rewards, you must book through their travel portal or via the phone, but RBC will charge you $30 for that privilege. ... If you're unsure when your points expire, you could always call customer service to confirm. How RBC Avion compares to others. ... RBC Rewards is a full service travel ...