- Home ›

- Travel Money ›

Compare euro travel money rates

Get the best euro exchange rate by comparing travel money deals from the UK's top foreign exchange providers

Best euro exchange rate

Over 340 million people use the euro every day according to the European Central Bank, making it the second most-traded currency in the world after US dollars. Twenty out of 27 EU Member States have adopted the euro as their official currency, and euros are used officially and unofficially in many non-EU countries and territories throughout Europe such as Monaco, San Marino, and Vatican City.

If you're travelling to Europe, it's important to shop around and compare currency suppliers to maximise your chances of getting a good deal. We can help you to find the best euro exchange rate by comparing a wide range of UK travel money suppliers who have euros in stock and ready to order online now. Our comparisons automatically factor in all costs and commission, so all you need to do is tell us how much you want to spend and we'll show you the top suppliers who fit the bill.

Compare before you buy

Some of the best travel money deals are only available when you buy online. By using a comparison site, you're more likely to see the full range of deals on offer and get the best rate.

Order online

Always place your order online, even if you plan to collect your currency in person. Most supermarkets and high street currency suppliers offer better exchange rates if you order online beforehand.

Combine orders

If you're travelling with others, consider placing one large currency order instead of buying individually. Many currency suppliers offer enhanced rates that improve as you order more.

The best euro exchange rate right now is 1.1477 from Travel FX . This is based on a comparison of 17 currency suppliers and assumes you were buying £750 worth of euros for home delivery.

The best euro exchange rates are usually offered by online travel money companies who have lower operating costs than traditional 'bricks and mortar' stores, and can therefore offer better currency deals than their high street counterparts.

For supermarkets and companies who sell travel money online and on the high street, it's generally cheaper to place your order online and collect it from the store rather than turning up out of the blue and ordering over the counter. Many stores set their 'walk-in' exchange rates lower than their online rates because they can. By ordering online you're guaranteed to get the online rate and you can collect your order from the store as usual.

Euro rate trend

Over the past 30 days, the Euro rate is up 0.36% from 1.1477 on 17 Apr to 1.1518 today. This means one pound will buy more Euros today than it would have a month ago. Right now, £750 is worth approximately €863.85 which is €3.07 more than you'd have got on 17 Apr.

These are the average Euro rates taken from our panel of UK travel money providers at the end of each day. You can explore this further on our British pound to Euro currency chart .

Timing is key if you want to maximise your euros, but the best time to buy will depend on the current market conditions and your personal travel plans.

If you have a fixed travel date, you should start to monitor the euro rates as soon as possible in the period leading up to your departure so that you've got time to buy when the rate is looking favourable. For example, if the euro rate has been steadily increasing over several weeks or months, it could be a good time to buy while the rate is high.

Some people prefer to buy half of their euros as soon as they've booked their holiday, and the remaining half just before they depart. This can be a good way of maximising your holiday money if the exchange rate continues to rise after you've bought, but will also help to minimise your losses if the rate drops.

You could also consider signing up to our newsletter and we'll email the latest rates to you each month.

If you need your euros sooner and don't have time to wait for the rates to improve, you can still save money by comparing rates from a range of different providers before you buy. Online travel money suppliers usually have better euro rates than high street exchanges, but supermarkets are a good compromise if you want to collect your currency in person and still get a decent rate. Just remember to buy or reserve your euros first before you collect them from the store so you benefit from the supplier's better online rate.

Euro banknotes and coins

Euros are governed and issued by the European Central Bank which is based in Frankfurt, but the actual production of euro banknotes and coins is handled by various national banks throughout the Eurozone. Spain and Greece are responsible for printing €5 and €10 banknotes, Germany prints €100 notes, and the other EU member states are responsible for printing €20 and €50 notes.

One euro (€) can be subdivided into 100 cents (c). There are seven denominations of euro banknotes in circulation: €5, €10, €20, €50 and €100 which are frequently used, plus €200 and €500 notes which are no longer printed but are still in circulation and remain legal tender. The designs printed on each banknote are intended to be symbolic of the European Union's identity and unity, as well as highlighting the diversity and richness of different European cultures. The front of each banknote features architectural styles from different periods in Europe's history, including Classical, Gothic, Renaissance and modern, while the reverse side features bridges that represent communication and cooperation between the different countries within the European Union.

Euro coins are available in eight denominations: 1c, 2c, 5c, 10c, 20c, 50c, €1 and €2. Each EU member state is responsible for minting its own coins, and can choose their own design for the 'tails' side. For example, German coins feature the 'Bundesadler' or Federal Eagle which has been the German coat of arms since 1950, while French coins depict Marianne; an important symbol of French national identity. Next time you've got a handful of euro coins, take a look at the tails side and see if you can guess which EU country they came from!

There's no evidence to suggest that you'll get a better deal if you buy your euros in Europe. While there may be better exchange rates available in some locations, your options for shopping around may be limited once you arrive, and there's no guarantee the exchange rates will be any better than they are in the UK.

Exchange rates aside, here are some other reasons to avoid buying your euros in Europe:

- You may have to pay commission or other hidden fees to a currency exchange that you wouldn't have paid in the UK

- Your bank may charge you a foreign transaction fee if you use it to buy euros when you're abroad

- It can be harder to spot scammers and fraudulent currency exchanges in Europe

Lastly, it can be handy to have some cash on you when you arrive at your destination so you can pay for any immediate expenses like food, transport and tips. You don't want to be searching for the nearest currency exchange when you've just landed and you're desperate for a cup of tea - or a cocktail!

Twenty out of 27 EU member states have adoped the euro as their official currency. These are: Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain.

The following European countries and territories who are not part of the EU also use the euro as their official currency: Andorra, Kosovo, Monaco, Montenegro, San Marino and Vatican City, French Guiana and Martinique, the Azores, Canary Islands, and Madeira.

Tips for saving money while visiting Europe

The most budget-friendly destinations in Europe are generally those located in the east such as Latvia, Lithuania and Estonia. In contrast: Luxembourg, Ireland and France usually top the list as some of the most expensive holiday destinations. Regardless of where you're planning to visit, you can save money during your trip by following some simple tips:

- Research your accommodation: Hotels can be expensive, so one way of saving money is to look for more budget-friendly accommodation such as hostels, holiday rentals, or even campsites. AirBnB can be an affordable option too, especially if you rent a room instead of an entire apartment; and you'll get to experience what it's like to live like a local. Salud!

- Use public transport: Make the most of any metro systems, buses, or trams to get around instead of relying on private taxis or rental cars. Many European countries also offer national and regional travel passes for public transport which can work out significantly cheaper than buying individual tickets.

- Eat like a local: Opt for local restaurants or street food vendors that offer authentic cuisine at lower prices. Avoid dining at expensive tourist restaurants, and try cooking your own meals if your accommodation has a kitchen. Not only is this a great way to save money, but it can also be a fun cultural experience to shop around in European supermarkets and cook with local ingredients.

- Plan your itinerary: Look out for free attractions such as museums, parks, churches and historical sites, and plan your itinerary around these. Many cities in Europe also offer free walking tours which can be a great way to get an overview of a new location while learning about its culture and history.

- Find discount vouchers: Many tourist attractions and activities offer discount vouchers and codes that can save you money on entry fees and other perks. Look for vouchers online; sign up to newsletters and follow the social media accounts of places you're planning to visit.

- Take cash: Using cash will help you to stick to a budget more easily than paying by card, and you'll also avoid foreign transaction fees. If you do take a card with you, look out for ATMs that are affiliated with your UK bank to avoid ATM fees, and if you're asked whether you want to pay in pounds or euros - always choose euros. If you pay in pounds the merchant can set their own exchange rate which won't be in your favour.

Choosing the right payment method

Sending money to a company you might not have heard of before can be unsettling. We routinely check all the companies that feature in our comparisons to make sure they meet our strict listing criteria, but it's still worth knowing how your money is protected in the unlikely event a company goes bust and you don't receive your order.

Bank transfer

Your money is not protected if you pay by bank transfer. If the company goes bust and you've paid by bank transfer, it's unlikely you'll get your money back. For this reason, we recommend you pay by debit or credit card wherever possible because they offer more financial protection.

Debit cards are the most popular payment method and they offer some financial protection. If you pay by debit card and the company goes bust, you can instruct your bank to make a chargeback request to recover your money from the company's bank. This isn't a legal right, and a refund isn't guaranteed, but if you make a chargeback request your bank is obliged to try and recover your money.

Credit card

Credit cards offer full financial protection, and your money is protected by law under Section 75 of the Consumer Credit Act. Section 75 states that your card issuer must refund you in full if you don't receive your order. Be aware that many credit cards charge a cash advance fee (typically around 3%) for buying currency, so you may have to weigh up the benefits of full financial protection with the extra cost of using a credit card.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

- Turkish Lira

- Australian Dollars

- Canadian Dollars

- Polish Zloty

- VIEW ALL CURRENCIES

- canadian dollars

- ALL BUY BACKS

- US Dollar Card

- Multi-currency Card

Travel Money Comparison

Get the best exchange rates when you buy or sell foreign currency online

- buy Currency

- sell Currency

What Currency do you want to buy?

How much do you want to spend, what currency do you want to sell, how much do you want to sell, buy currency, sell currency, why use a travel money comparison site.

Have you ever started researching the best rates between different travel money providers?

We know it can be overwhelming: the different suppliers, their different offers and of course, the ever-changing currency exchange rates. It's a lot of information to process and compile!

Our comparison site takes the stress out of researching and does it all for you. FInd the travel money supplier that will get you the best rate today.

- ✓ Compare Travel Cash is a non-biased travel money comparison site.

- ✓ To ensure our independence, we always use transparent, objective and verifiable criteria in our comparisons.

- ✓ Our mission is to show you the best rates so you can save when buying your travel money.

- ✓ We constantly update our exchange rates as they change for each money exchange supplier, and whilst we try to do this in almost real-time, there will be times when our data is slightly out of date (in normal circumstances, not more than 5 minute). Our travel money comparison site is designed to save you money by showing you the latest rates.

- ✓ We check out all the companies we list, ensuring they are reputable suppliers and pass our standards before we list them.

- ✓ We value your privacy. We do not sell your data - you don't even need to give us your information to use our site. Even if you choose to, it is safe with us, we will never pass it on to third parties.

- ✓ You won't get cheaper rates if you go directly to the supplier, at times, we may have discounts and incentives that you would not get by going direct!

- ✓ We do sometimes make money - but we don't make it from you. We will never add fees or commissions to the travel money rates on the site.

Frequently asked questions

It's a great idea to buy your currency online to ensure you get the best exchange rate. You can often get much better deals online compared to what you can find on the high street or the airport. In fact ccording to recent surveys, 9 out of 10 tourists find that exchanging money at airports is the most expensive option.

The best thing about buying your travel money online through a comparison site is seeing all currency prices in one place, so whether you are buying euros , buying dollars or other currencies you get the best rate for your travel money and more importantly save time!

The quickest way to get the best currency exchange rate is by using our comparison tool . We compare the latest information from all the best travel money providers in the market to show you the best currency exchange rates.

Keep an eye out for the following when searching for the best currency exchange deals so you can choose the best option for buying your holiday money:

- High exchange rate - The higher the exchange rate number, the more holiday money you will get to the pound

- Delivery Charges - different currency providers charge different amounts for delivering your holiday money to your door

- Special offer - We will let you know if the providers are offering travel money deals

Commission is the fee that travel money providers charge for the service to exchange your money into foreign currency . The charge is usually included in the exchange rate they advertise. You will see that many foreign exchange companies advertise 0% commission, they are still charging you by including the charge in the rates.

All the travel money prices we quote include any fees and commissions, including delivery!

The simple answer is yes! Usually, the minimum order amount for foreign currency is £100, and the maximum is usually £7,500, although some providers allow you to exchange more.

Travel money is normally sent via special delivery service with Royal Mail. Travel cash orders worth more than £2,500 will be sent via a courier or multiple Royal Mail packages. This is for insurance reasons, making sure your travel money is safe.

This depends on the currency provider. Some providers offer next-day delivery, sending your travel money using Royal Mail's Special Delivery Guaranteed by 1pm service. There will be an extra cost for this and you can see how much when you compare the holiday money prices.

Don't forget, many foreign currency providers also allow you to pre-order currency and you can collect it in store, this means you can avoid delivery charges.

Most do, any holiday money that you have leftover after your trip abroad can be sold using a buy-back service that will convert it back to pounds. Our comparison tool will show you the providers offering the best buy-back rates .

Every few of minutes we compare the exchange rates and latest currency deals from the best travel money providers in the UK. You can see instantly who is offering the best deals and choose a service that suits your needs best.

Also, if you've come home from a trip abroad and have leftover currency, we compare many foreign currency buy back companies, showing the best rates to convert your foreign currency back into pounds.

Hundreds of customers order travel money through our site daily and have a great experience. However, as with ordering anything online, the process is never completely risk-free and you should always take care when transfering money to any company.

We undertake comprehensive checks on all of our providers and monitor them to make sure they meet our high standards and continue to do so. Having said that, no company is guaranteed not to come into trouble and we cannot guarantee the solvency of any of the providers listed on our website. We always recommend that you conduct your own due diligence before placing an order with any company.

There are many destinations where taking some local currency is extremely useful to make sure you are covered in places where credit cards are not accepted. Many of the smaller retailers globally will not allow credit cards, so cash is the only option.

Read our blog post on taking cash on holiday .

The best time to buy any travel money is when the pound is performing strongly relative to the currency you are buying, this means it will have a higher exchange rate, so will give you more currency for your money. The amount you receive is calculated by multiplying the exchange rate by the amount of pounds you want to spend, so the higher the exchange rate, the more foreign currency you get.

Exchange rates are constantly changing but we show you the historical exchange rate performance for each of the currencies so you can have more of an idea of whether now is a good time to buy your travel money.

Exchange rates tend to be very similar wherever you are in the world to those offered in the UK, however waiting until you are away means you may be stuck with poor exchange rates, fewer options of places to offer competitive rates or even worse, you may have to pay big additional fees and commissions. By buying your travel money in the UK there are no hidden fees, charges or nasty surprises, you know exactly how much you are getting.

Once you have found the best rate, place an order on the currency suppliers’ site, and pay for your currency.Each currency supplier has different payment options, including bank transfer, debit card, with some suppliers offering payment by Apple pay and Android pay. Once your order has been confirmed your order will be prepared and your currency sent to you by registered delivery, some suppliers even offer next-day delivery.

LATEST CURRENCY NEWS

The 8 Best Travel Money Belts of 2024: Secure Your Valuables on the Go

The best travel money belts of 2024 excel in comfort, style and security. These belts are not just fashionable, they are also equipped with the latest technology like RFID-blocking to protect your personal information from theft. Particularly noteworthy is a model that offers sizes adaptable to multiple waist measurements. After all, securing your cash and

The Perfect Carry-on Case for Airline Travel: Top Recommendations and Tips

The perfect carry-on case for airline travel fits within the usual size limits of 22 x 14 x 9 inches. This ensures it complies with most airlines’ overhead bin space restrictions. Despite this uniformity, some international airlines may have varying rules, so cross-checking with your specific airline before purchasing a case is a smart move.

What currency is used in Dublin, Ireland? A clear answer for travellers

Dublin, the capital city of Ireland, is a popular tourist destination known for its rich history, vibrant culture, and stunning architecture. As a result, many people who plan to visit Dublin may wonder what currency is used in the city. The official currency of Ireland is the Euro, which is used throughout the country, including

Join newsletter

- Best Euro Rate

- Best US Dollars Rate

- Best Turkish Lira Rate

- Best Australian Dollars Rate

- Best Thai Baht Rate

- Best UAE Dirham Rate

- Best Canadian Dollars Rate

- Best Polish Zloty Rate

- Best Croatian Kuna Rate

- Buy Travel Money

- Sell US Dollars

- Sell Turkish Lira

- Sell Australian Dollars

- Sell Thai Baht

- Sell UAE dirham

- Sell Canadian Dollars

- Sell Polish Zloty

- Currency buy backs

- Currency Online Group

- Sterling FX

- Covent Garden FX

- The Currency Club

- Tesco Money

- Sainburys Bank

- Virgin Money

- Natwest Travel

- Post Office

- Thomas Cook

- Marks and Spencer

- No1 Currency

- Rapid Travel Money

- Best Supermarket Euros

- Privacy Policy

@2024 Comparison Technology Ltd, 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ | Company Registration Number 12065287

CompareTravelCash.co.uk is a travel money comparison service that's designed to help you save money – whilst we do our best to ensure the site is 100% up-to-date, we cannot guarantee this. We advise you to carry out your own due diligence before buying or selling travel money.

- Store finder

- Too Good To Go

- Food Stores

- Shaping the future of British produce

- Our producers

- Join us today

- Member Perks

- Annual Members' Meeting 2024

- 2023 Annual Members' Meeting

- 2022 Annual Members' Meeting

- 2021 Annual Members' Meeting

- 2020 Annual Members' Meeting

- 2019 Annual Members' Meeting

- Frequently Asked Questions

- Using your account as a savings account

- Digital Membership

- Request a new membership card

- Add a Missed Receipt

- Get a share account statement

- Change my address

- Change my name

- Change your donation preferences

- Keep my account open

- Register for postal voting

- Close my account

- Membership for groups

- Explanation of Withdrawable Share Capital in a Consumer Retail Co-op Society

- Terms and Conditions

- Code of Practice

- Swipe to Win £500

- Funeral arrangements

- Burial or cremation

- Green funerals

- How much does a funeral cost?

- Multicultural, religious and non religious services

- Funeral costs & pricing

- Wimpole Road Service Chapel

- Traditional funeral

- Attended funeral

- Direct burial

- Direct cremation

- Coffins & caskets

- Funeral flowers, wreaths & tributes

- Funeral cars & hearses

- Headstones & gravestones

- Masonry Brochure Request

- Order of service

- Our Tribute Service

- Without Ceremony

- The Bespoke Plan

- Why should I buy a plan?

- Frequently asked questions

- Funeral plan terms and conditions

- Funeral branches

- What to do when someone dies

- Beach Escapes

- City Breaks

- Cruise & Touring Holidays

- Long Haul Holidays

- Travel branches

- In-branch hosting

- Small donations

- Local giving

- About the Community Cares Fund

- Previous grant winners

- Supported Community Groups

- Unit adj. Co-op Funeral, The Street, Acle

- 1-21 Long Wyre Street, Colchester

- Unit 7 Great Eastern Square, Felixstowe IP11 7DY

- Unit 3 Rosehill Centre, Hines Road, (off Felixstowe) Rd, Ipswich IP3 9BG

- Former Ford Car Dealership, Framlingham IP13 9EE

- Unit A, 2 - 8 Weavers Court, Halstead

- Car Park, Burrell Road, Ipswich

- Derby Road/Hines Road, Ipswich Suffolk

- Unit 3, Heyford Road, Fifers Lane, Norwich

- Bridge House, Wherstead Park

- Office Space, Wherstead Park, Wherstead

- Stable Block, Wherstead Park, Wherstead

- 75 High Street, Wickham Market IP13 ORA

- Cauldwell Hall Road

- New Street, Woodbridge

- Wimpole Road, Colchester

- Ramsey Road, Dovercourt

- Rosehill Retail Centre

- 24 Cromer Road, Nowich

- Woodbridge Thoroughfare

- Flat 2, 1-3 Chapel Road, Tiptree

- 14/16 and 14a and 16a Torquay Road, Chelmsford, Essex CM1 6NF

- 48/72 St Stephens Street, Norwich NR1 3SH

- New Street, Woodbridge, Suffolk IP12 1DX

- Cauldwell Hall Road, Ipswich, Suffolk IP4 4QE

- Share a property lead with us

- Choose your stone

- HL Perfitt Branches

- Request a Kitchen brochure

- Post Office branches

- Annual Report 2024

- Annual Report and Accounts

- Co-op Loan Fund

- Board of Directors

- Our Chief Executive and Leadership team

- Apprenticeships

- Day in the life of.....

- Flexible working

- Colchester Nursery receives £5,000 donation from East of England Co-op’s Community Cares Fund

- Charities and community groups across East of England set for funding boost from East of England Co-

- East of England Co-op and Osprey Charging Network partner to support critical public charging infra

- East of England Co-op donates £50,000 to local foodbanks and makes it easy for its customers to don

- East of England Co-op proudly sponsors inclusive rugby club in Colchester

- East of England Co-op scores first with new shopping app

- Leiston travel branch re-opens in response to holiday demand increase

- East of England Co-op Funeral Services expands into Thetford

- New East of England Co-op Travel branch coming to Woodbridge as retailer continues investment in the

- Second Cambridgeshire East of England Co-op opens its doors to customers at Cambridge North Station

- The East of England Co-op is coming to Chelmsford this winter

- First Cambridgeshire East of England Co-op opens its doors to customers in Waterbeach

- Five modern flats completed as part of development above Brightlingsea Co-op

- Duo of Silver Carbon Charter awards

- Funeral Services colleagues raise money for cancer charity

- Funeral Services colleagues collect clothing and blankets for those in need across the world

- Gold award for Acle supermarket

- Thousands of period products donated through new East of England Co-op partnership

- Trees gifted to members as part of The Queen's Green Canopy

- East of England Co-op donates £100,000 from Christmas marketing budget to keeping people warm and fe

- East of England Co-op Funeral Services colleagues lend a hand at Norwich child bereavement charity

- East of England Co-op to hold third virtual remembrance event

- 82% of public in East of England back raising value of Healthy Start vouchers

- Annual Report and Financial Statements 2021

- Annual results reveal profit growth of £7.6m

- Appeal launched for food bank donations to support families over summer holidays

- Beer lovers invited to join local virtual beer tasting with Adnams and the East of England Co-op

- Bird’s eye view of local retailer’s Big Hoot owl

- Brightlingsea supermarket benefits from zero carbon electricity

- Community Cares Fund hands out a record £100K to good causes

- Drive to support foodbanks through ethical Christmas gifting

- East of England Co-op ‘adopts’ tortoise in support of local charity

- East of England Co-op adds Equal Brewkery to its Sourced Locally range

- East of England Co-op and Archant to host Big Hoot sticker swap events

- East of England Co-op announce a £1.8m dividend for members

- East of England Co-op brings festive cheer to people spending Christmas alone

- East of England Co-op coming to East Harling

- East of England Co-op customers raise over £33,000 for Ukraine

- East of England Co-op donates £1,000 to Emmaus after van was vandalised

- East of England Co-op donates £1,000 to north-east Essex hospice

- East of England Co-op donates £1,000 to support local women and girls

- East of England Co-op elects new President

- East of England Co-op grows ink cartridge recycling partnership to fundraise for local schools

- East of England Co-op joins national Christmas campaign to support the NHS

- East of England Co-op joins the Big Hoot Ipswich 2022

- East of England Co-op launches campaign to clean up local towns, villages, and coastal areas

- East of England Co-op launches gift card to support local foodbanks this Christmas

- East of England Co-op launches live show to get us talking about end of life

- East of England Co-op launches Sourced Locally Awards to celebrate producers and colleagues going th

- East of England Co-op offers £100k to local community groups

- East of England Co-op raise over £50k for Ukraine

- East of England Co-op raises over £5.5k to support the NHS

- East of England Co-op Sourced Locally Awards winners crowned

- East of England Co-op to continue topping up the Government’s Healthy Start vouchers

- East of England Co-op to host cost-of-living advice session

- Essex school wins competition to further green ambitions

- Former Co-op distribution centre back in action

- Joint Chief Executive awarded OBE

- Local community heroes set to be recognised this Christmas

- Mental health charity provides training to East of England Co-op colleagues

- More than 1,200 trees planted in Fairfields Farm Big Tree Plant

- New East of England Co-op food store in East Harling officially opens

- New East of England Co-op Supermarket opens in Chesterwell

- New record set as local produce sales top £1m during East of England Co-op’s Sourced Locally Fortnig

- New, modern family home development complete near Ipswich

- Our pledge to be carbon neutral by 2030

- Over £100,000 in grants from the East of England Co-op’s Community Cares Fund awarded to 30 organisa

- Over £200,000 in grants available to organisations in East Anglia through East of England Co-op’s Co

- Over £44,500 donated to foodbanks and 17,500 people supported at local warm hubs: the East of Englan

- Over £85,000 available to organisations across East Anglia as next round of funding from East of Eng

- A statement of solidarity from retail societies during Co-op Fortnight

- Budding young chocolatier’s winning idea hits shelves

- East of England Co-op steps up 'food justice' support after shoppers donate 5 tonnes of foodbank ess

- East of England Co-op’s community fund backs food waste reduction project

- Co-op donates £22,500 more to foodbanks hit by soaring demand during coronavirus pandemic

- Doing Suffolk Proud: Suffolk Sweet Tomatoes and Scarlett & Mustard team up!

- £75,000 donation in response to COVID-19

- Annual Report and Financial Statements 2020

- Barista Bar is back!

- Housing development complete despite lockdown

- Independent retailer welcomes U-turn on deregulation of Sunday trading hours

- Local charity appeals for smartphone donations to get service users online

- New 6,000 sqft Co-op planned for Chesterwell

- New community fund helps keep vital local transport service on the road

- New programmes set to support young unpaid carers

- Our community cares for young people impacted by Domestic Abuse

- Regional Funeral Director appoints new management team

- Retailer wraps-up summer of litter picks at seaside town

- Retailer’s community fund provides essential hygiene packs to local youth foundation

- Romano Lounge set to open as part of Long Wyre Street development

- Sales of locally sourced food soars as shoppers savor home cooking

- East of England Co-op shares plans to open three new branches across its family of businesses

- Sourced Locally supplier receives top award for commitment to sustainable business practice

- Suffolk Libraries expands Lifeline service

- Two thirds of people in food poverty not accessing foodbanks - local retailer launches campaign to t

- Woodbridge colleagues lend a hand at local foodbank

- Your Co-op Live – Mental Health Matters

- Yum Yum Tree Fudge Awarded Silver Carbon Charter

- Fairfields Charity Crisps

- Australia Bushfire Appeal - thank you

- Co-op Community Cares Fund launched today

- ‘Golden Ticket’ win for Kyson Primary pupil

- Felixstowe Volunteer Coast Patrol Rescue Service receives ‘first real home’

- Local retailer sees 17% growth in food profits despite challenging market

- Apprenticeship Programme recognised with national award

- Baker rises to the occasion to be named Suffolk Champion

- Burnham-on-Crouch celebrates a new look store after short closure

- Charity car wash to support Kernos Centre

- Colchester crowds cheer Battle of the Bangers!

- Colchester Funeral Bike Tour 2018

- Colleagues and customers celebrate Dedham High Street store reopening

- Community thanked as refurbished supermarket reopens its doors

- County Champions tickle the taste buds of voters

- Cult classic raising funds for local Lifeboat Service

- David and Goliath battle sees little brewery beat giant

- Dedication service supports Help for Heroes

- Dedication Service supports Macmillan Coffee Morning

- East of England Co-op ‘Best Before’ scheme shortlisted for national award

- East of England Co-op to sell products past ‘Best Before’ to reduce food waste

- ‘The Women Shaping the Future of British Produce’: group portrait by renowned photographer Jenny Lew

- Chapel dedicated in special community service

- Community invited to hear more about new store

- Co-operation results in much needed new housing

- Attleborough Funeral Service's Chapel of Rest Dedication

- Caister Funeral Branch Supports Lifeboat Station to Raise Funds

- Chapel of Rest Dedication for Ely Funeral Services

- County Winners announced for Producer of the Year 2017

- Cromer Funeral Service's Chapel of Rest Dedication

- East of England Co-op answers call for help from Waveney Food bank

- East of England Co-op becomes driving force for greener lifestyle

- East of England Co-op extends security services to East Anglian businesses

- East of England Co-op finalists in international training awards

- East of England Co-op Funeral Services awarded Outstanding Dementia Care Innovation Award

- East of England Co-op Funeral Services is announced as finalists in the National Dementia Care Award

- East of England Co-op gives £70k to local organisations in bid to tackle loneliness

- East of England Co-op helps local schools learn about Fairtrade

- East of England Co-op hosts first ever International Women’s Day event as part of 150th birthday cel

- East of England Co-op house herd of Elmers

- East of England Co-op kick off summer holidays with a family fun day in Hadleigh for Macmillan Cance

- East of England Co-op lend their support to life savers in Felixstowe

- East of England Co-op mark national day with renewed focus on making it easier for people to use the

- East of England Co-op on the hunt for teams for charity 'Walking Football Tournament'

- East of England Co-op opens its doors to Tendring Technology College to mark Fairtrade Fortnight

- East of England Co-op raises a glass to Sourced Locally Fortnight

- East of England Co-op raises over £4,800 for Alzheimer’s Society

- East of England Co-op supports GoodGym team with GoGoHares clean-up for Co-operatives Fortnight

- East of England Co-op to celebrate Norfolk Day with GoGoHares swap shop

- East of England Co-op to host GoGoHares ‘swap shop’

- East of England Co-op to take on former O'Flynns Budgens store in Acle

- East of England Co-op Travel official ITFC travel partner

- East of England Co-op wins second national award for waste reduction campaign

- East of England Co-op wins prestigious national award for ground-breaking food waste scheme

- Easter egg hunt is great success

- énergie Fitness opening at Rosehill Centre

- Families invited to day of fun in aid of local Air Ambulance

- Family fun day for Haverhill community

- Family of businesses extended at Stanway store

- Felixstowe in Flower causes buzz in local community

- Felixstowe resident wins star ’eco car’ prize in East of England Co-op 150th anniversary celebration

- Film Feast Suffolk line up is unveiled by renowned British film director

- Donate your divi

- Food fans challenged with creating new sausage flavour

- Fundraising Quiz Night in aid of The Royal British Legion

- Funeral Teams take part in 'Flip it for EACH' pancake race

- Haverhill Funeral Services Chapel of Rest Dedication

- Healthy growth in sales and profit for East of England Co-op

- Heat is on for students in cookery invention contest

- Hellesdon Funeral Service's Chapel of Rest Dedication

- Help fill Santa's Suitcase this Christmas

- Learning and Development Team named Team of the Year at TJ Awards

- Local businesses join forces to combat church lead theft

- Local charities benefit from a share of £15,500 donation

- Local communities mark Remembrance Day

- Local community advocates open new supermarket for town

- Local Co-op continues support for refugees

- Local Funeral Arrangers scaling new heights for charity

- Local MP Dr Thérèse Coffey backs East of England Co-op waste reduction scheme

- Local retailer sees over 30% growth in trading profit despite tough economic climate

- Local school to perform at community event

- M&Co comes to East of England Co-op Halstead store

- Masquerade ball raises over £2,000 for Newmarket charity

- Mayor of Ipswich opens new Multi-Faith Centre for Ipswich and the region

- Members set to share £2.1million in dividend

- Members set to share £3 million East of England Co-op Dividend

- Meredith Greengrass spread Easter joy to patients

- Most successful year to date for Santa’s Suitcase campaign

- 90 Cub Scouts now Dementia Friends

- East of England Co-op announced as 'Pigsty Partner'

- East of England Co-op fighting food poverty this Christmas

- East of England Co-op Funeral Services Chapel of Rest Dedication

- East of England Co-op Abbots Road Supermarket to close

- East of England Co-op Funeral Services Invests in State-of-the-Art Funeral Cars

- East of England Co-op honoured by HRH The Princess Royal

- Dementia Friends training recognised at national awards

- East of England Co-op named 'Organisation of the Year' at Alzheimer's Society's Awards

- East of England Co-op signs all 47 funeral branches to Fair Funerals Pledge

- East of England Co-op supporting Emmaus Ipswich

- East of England Co-op wins esteemed Hermes Grand Prix Award

- Fairfields Farm named Producer of the Year 2016

- Hamford Primary go bananas for Fairtrade Fortnight

- Healthy trading performance despite challenging conditions

- Help fill Santa’s Suitcase this Christmas

- International ballet star goes back to his roots as a Co-op Junior

- It's bigger and better for local brass band

- Local business flying high after successful tea card revival

- Local construction company awarded contract

- Local food fortnight generates over £900,000 for the regional economy

- Local Volunteer Services benefit from £14,000 donation

- Members set to share £3million Dividend

- Minnie Moll takes on Ambassador role for HRH The Prince of Wales

- Mountain Warehouse coming to Woodbridge Thoroughfare

- Musical partnership with Co-op and award-winning local tech startup

- New Acle store now open

- New bereavement support service for Felixstowe

- New East of England Co-op Funeral Service Branch for Ely

- New East of England Co-op Funeral Service for Acle

- New East of England Co-op Funeral Service for Downham Market

- New East of England Co-op Funeral Service for Frinton On Sea

- New family homes now available in Ipswich

- New Funeral Service Branch for Clacton-On-Sea

- New Harleston supermarket opening this week

- New homes available at the heart of Woodbridge

- New homes developing in Dovercourt

- New homes set for New Street, Woodbridge

- New housing development underway in East Ipswich

- NHS latest tenants to join Wherstead Park

- Norfolk brewers offer taste test to win votes

- Our response to COVID-19

- Over £1,000 raised for local Lifeboat Station

- Over 1000 people join Easter Egg Hunt to support Norfolk’s bereaved children

- Overwhelming response of support for local charity

- Pigs (and kids!) Go Wild at Family Fun Day

- Pigs, poems, paintings and peppers!

- Planning submitted for Newland Street, Witham

- Plans submitted to give former department store new lease of life

- Plans to take on former Budgens Store

- Pop to the Bramford Cock

- Producers crowned County Winners

- Providing housing for the homeless in Ipswich

- Pupil creates winning design to help combat anti-social behaviour

- Quiz night raises over £1,000 for local RNLI Station

- Remembering together this Christmas

- New East of England Co-op Funeral Service for Cromer

- New Woodbridge store opens tomorrow

- Local community invited to hear plans for new store

- New Woodbridge Store now open

- Rosehill Travel branch to relocate to Ravenswood

- Sale of Woodbridge store to East of England Co-op successful

- Sales soar to £1m during retailer’s Sourced Locally Fortnight initiative

- Secure Response Services supporting St Mary's Church

- Sharing the community love at Valentines

- Shopworkers entitled to Freedom from Fear

- Songs for supper in celebration of Sourced Locally Fortnight

- Sourced Locally Fortnight generates nearly £1million for regional economy

- Stowmarket community encouraged to Meet and Mingle

- Suffolk businesses given advice on tackling anti-social behaviour

- Suffolk kids create new chocolate bar

- Suffolk resident's 'egged-on' to support local causes this Easter

- Sweet success for Essex jam producer

- Sweet Success for Great Tilkey Honey

- Taking action to tackle anti-social behaviour

- 'The Big Conversation' about all the little things

- The East of England Co-op thank Dedham community for support with makeover for Duchy Barn

- The Pig Reveal...

- Time Garden Cycle Tour

- Tiptree travel branch named one of the best-rated agents in UK and Ireland for second year running

- Tiptree Travel shortlisted for TTG Awards

- Transformed local pub opens doors to public

- United Against Dementia

- Unique afternoon tea secures votes for Essex producers

- Vote opens for food fans to choose new sausage flavour

- Why a visit to the optician isn’t just about your vision

- Widow Twankey pops to the Co-op this Christmas

- Wivenhoe Tempest FC show-off new kit

- Woodbridge community come together at dedication service

- Woodbridge community coming together at dedication service

- Woodbridge feels the love for Suffolk food producers

- Work on restaurant and retail destination underway

- Work starts on £4million retail development in East Ipswich

- Working together to tackle anti-social behaviour

- Let Your Creative Side Shine with Rock Paper Scissors

- Sailing Barge May: The Bread & Roses Barge bringing vulnerable women together

- Future Female Society: Combatting Isolation, Raising Aspiration

- Norwich Men's Shed: Connect, Converse, Create

- Colchester Kings RFC: Try with Pride

- Too Good To Go Top Tips #5

- Too Good To Go Top Tips #4

- Too Good To Go Top Tips #3

- Too Good To Go Top Tips #2

- Too Good To Go Top Tips #1

- She just needed someone to believe in her: Zoe's Story

- Her life has been changed around: Beryl’s Story

- We’ve been able to reach these young people quicker: Zara’s Story

- How the rising cost-of-living is affecting people with disabilities in Waveney

- Cost of school uniforms impacting young carers in Great Yarmouth

- Understanding how to make healthy choices has never been more important

- Sizzling deals this summer

- 3 for 2 on Picnic

- Emmaus Suffolk: Supporting vulnerable people in Ipswich

- Firstsite: Helping Families in Need in Colchester

- Supporting You this Summer: Stress, Sleep & Current Affairs

- NR5 Community Hub: Reconnecting Communities in Norwich

- How to be the perfect guest this Easter

- Be the perfect Easter guest and make the ultimate traybake cake!

- How to be the perfect host this Easter

- 3 great ways to entertain the kids this Easter

- Age Well East: Reuniting Communities

- Nelson’s Journey: Bringing back smiles for bereaved children in Norfolk

- The Amazing Things You've Done

- The Mix: Empowering Young People in Suffolk

- Celebrate Pancake Day 2021 with an indulgent sweet topping

- Celebrate Pancake Day 2021 with an irresistible savoury topping

- A Smaller Christmas

- Get help to buy fruit, veg and milk with Healthy Start vouchers

- Have you got eyes on the pies?

- Have yourself a delicious, waste-free Christmas: top tips from one of our local potato suppliers

- Have yourself a delicious, waste-free Christmas: top tips from one of our Norfolk sprout suppliers

- How to make a scaled-down Christmas special?

- Keeping our communities litter-free

- Rock around the Christmas tree

- Competition Terms and Conditions

- Thank you for your donation

Travel Money

In this section.

Make the most of everything your chosen destination has to offer, with our great rates on foreign currency.

Why choose Co-op Travel Money?

With 0% commission on over 80 different currencies, we have some of the best rates – so whether you need US Dollars, Euros or even some Thai Baht, you no longer need to scour the High Street for travel money at great rates.

Cash Passports

If you'd rather not carry all your holiday money in cash, come and talk to us about a Cash Passport.

Similar to a debit card, you simply load up your card with cash before you travel and then it can be used to withdraw money or to make purchases whilst you are away – without any fees. As well as having the added security of not going over budget, you can also cash in anything left over on your return or keep it for your next holiday, as the cards are valid for two years.

Cash Passports are available in seven currencies: GBP, Euro, US Dollar, Canadian Dollar, Australian Dollar, South African Rand and New Zealand Dollar.

Money Transfers

Compare our best travel money deals

Get maximum value for your travel money, currency calculator.

Join our personal finance newsletter for top deals and insight

You can unsubscribe at any time - privacy notice .

Today’s best exchange rates

How do you get the best holiday money exchange rate, high exchange rates, delivery charges, special offers, pros and cons, five golden rules of travel money, 1. know how much cash you'll need.

Carrying around a large amount of cash isn't the safest thing to do. At the same time, not having enough cash can cause a lot headaches too. It's a good idea to take a little more than you think you'll need.

But it's also good sense to have a backup prepaid , debit or travel credit card that you can rely on - assuming you're going to a destination that widely accepts card transactions.

2. Shop around

Not all currency exchange companies are created equal. Some may have good exchange rates, but higher fees. Others may have higher rates, but no fees. You have to make sure which one offers the best value to you.

This is why it’s worth comparing the deals on offer from several companies before ordering your travel money. Factor in the fees and the exchange rate and see where you end up better off. Often the amount of money you're exchanging can be a deciding factor.

3. Don't buy your travel money at the airport

Airport holiday money providers have notoriously high prices because they offer a last-chance solution for those who are just about to board a plane. By planning ahead you can save a small fortune.

4. Don't carry too many large notes

Notes of large denominations can be tricky, as small shops and taxi cabs, which are more likely to require cash, might not have enough change to accept a large note.

Some retailers are also often wary of accepting large notes. Smaller notes and change can also be handy when it comes to tipping or buying small everyday items.

5. Don't use your credit card to buy travel money

Avoid buying foreign currency with a credit card as credit card providers treat the transaction as a 'cash advance' . Not only will you be charged daily interest, you're also likely to be hit with a fee.

Budgeting for your holiday

How much travel money you need to take depends on your plans . You'll need to budget for your holiday to make sure you don't run out of money before the end.

Deciding how much money to take depends on were you're going, whether debit or credit card usage is prevalent, and if you want to have some local currency on hand for emergencies.

Having some cash is extremely important , as there's always a possibility your cards could get declined or blocked for some reason, and it may take some time to resolve the issue.

Also, some countries still rely predominantly on cash transactions , so you should factor that into how much cash you decide to take.

What are the top alternatives to buying travel money?

Travel credit cards.

Travel credit cards - i.e. the ones with no foreign transaction fees - offer two key advantages over travel money:

Great exchange rates - when you spend on a travel credit card you get the Mastercard or Visa exchange rate, which is about the best you can find as a regular consumer

Purchase protection – for purchases costing between £100 and £30,000 you're covered by Section 75 of the consumer credit act , meaning if something goes wrong you can make a claim with your card provider should the vendor fail to pay up

However, not everywhere accepts travel credit cards and using them at a cash machine abroad can come with hefty fees. It can also be easier to overspend on a credit card, leaving you with debts on which interest is charged.

Travel money cards

Currency cards and travel bank accounts let you spend overseas without being charged a foreign transaction fee. Their key strengths are:

Great exchange rates - you card provider will pass on the Mastercard or Visa rate to you without adding extra charges

No charges for ATM use overseas - if you need extra cash on holiday, you can withdraw it without being charged by your provider. Watch out for local ATM fees though, as these might still apply

The downsides include that there can be limits on how much you can withdraw abroad using a travel money card, and that they're not accepted quite as widely as cash. Some travel current accounts also come with fees.

Prepaid travel cards

Prepaid travel cards can be loaded with currency and used abroad without paying foreign exchange fees. You can load a prepaid card with a specific foreign currency or a variety of different currencies, depending on your travel plans. The key advantages are:

Low or no fees to use abroad – prepaid travel card providers charge far less than traditional banks for overseas usage

Safer than carrying cash - you can cancel or freeze the card if it's lost or stolen, protecting your balance

However, you’ll need to watch out for general usage fees, which often apply when you load the card with cash and may also be charged monthly.

Can you get commission-free travel currency?

Yes and no. It depends on how you define it. Commission refers to the service fee that a currency exchange broker charges for exchanging your money.

Many companies advertise 0% commission to exchange money online or on the high street, but, instead of charging commission, they offer a less competitive exchange rate. This is why you need to compare the whole deal rather than just opting for a zero-fee travel money deal.

Are there restrictions on getting currency delivered?

When you buy your currency online, it's normally sent via Royal Mail's Special Delivery service. This means you have to sign for the package. Cash orders that exceed £2,500 will be sent in batches because that's the maximum value that can be insured for each delivery.

Can you get next-day delivery for currency?

Some travel money providers do offer next-day delivery. These brokers send out currency using Royal Mail's Special Delivery Guaranteed by 1pm service.

Our comparison shows which operators offer this option and how much they charge for it. With some companies, you also have the option to pre-order your travel money for collection in person from a local branch, meaning you don't have to pay for delivery.

Will anyone buy my currency back?

If you've got leftover travel money from a trip abroad, you can use a buy-back service to convert it back into pounds.

The buy-back rate tells you how much sterling you'll get back.

Remember to factor in the rate and delivery costs, and compare exchange rates. You can check out the best euro-to-pound exchange rate by looking at our comparison table.

About our comparison

Who do we include in this comparison.

We include every company that gives you the option of buying euros online. Discover how our website works .

How do we make money from our comparison?

We have commercial agreements with some of the companies in this comparison. We get paid commission if we help you take out one of their products or services. Find out more here .

You do not pay any extra and the deal you get is not affected.

Learn more about travel money

About the author

Didn't find what you were looking for?

Below you can find a list of currencies to exchange

Other products that you might need for your trip

We’ve been featured in

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

Chelmsford Star Co-op main site

Braintree travel branch:

01376 551444

Chelmsford travel branch:

01245 490290

Braintree Travel Branch: 01376 551444

Chelmsford travel branch: 01245 490290, foreign currency, do you need foreign currency, and need it quick, pop into one of our in-branch bureau de change kiosks for some of the best rates around. you can even save time by requesting your travel money in advance..

We keep Euros and US Dollars in stock, and can get any other currency for the next day*.

To save you time, why not get the process started early by filling out the request form below. Don’t worry, it won’t commit you to buy, we’ll be in touch to discuss our rates first. That way you can be confident you’re getting the best deal for you, and we can have your currency ready for you on your next visit.

*Orders placed before 1pm Monday – Thursday can be ordered for the next day (card or cash payment only).

Highly competitive exchange rates

0% commission

No minimum purchase

Next day collection available*

We’ll buy back left over cash when you return

Don’t pay high rates at the airport!

Don’t pay exorbitant conversion fees at overseas ATMs!

Your Name* Your Email* Telephone*

What is your local branch* Chelmsford Travel Branch Braintree Travel Branch

Currency requested AUD Australian Dollar CAD Canadian Dollar CHF Swiss Franc CZK Czech Koruna DKK Danish Krone EUR Euro JPY Japanese Yen MXN Mexican Peso NOK Norwegian Krone NZD New Zealand Dollar PLN Polish Zloty SEK Sweden Krona SGD Singapore Dollar THB Thai Baht TRY Turkish Lira USD US Dollar ZAR South African Rand Other - please specify

Please specify your currency

Amount required in £GBP £

When do you want to collect

I understand I will need to bring ID (passport or driving licence for transactions of £600 or more.

I understand amounts over £2000 may require more time to process, and additional ID to collect, which I will be advised on.

*Orders placed before 1pm Monday – Thursday can be ordered for next day. Card or Cash payment only.

Book with confidence

- Money Transfer

- Rate Alerts

Xe Currency Converter

Check live foreign currency exchange rates

Xe Live Exchange Rates

The world's most popular currency tools, xe international money transfer.

Send money online fast, secure and easy. Live tracking and notifications + flexible delivery and payment options.

Xe Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

Xe Rate Alerts

Need to know when a currency hits a specific rate? The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

Xe Currency Data API

Powering commercial grade rates at 300+ companies worldwide

Xe Currency Tools

Recommended by 65,000+ verified customers.

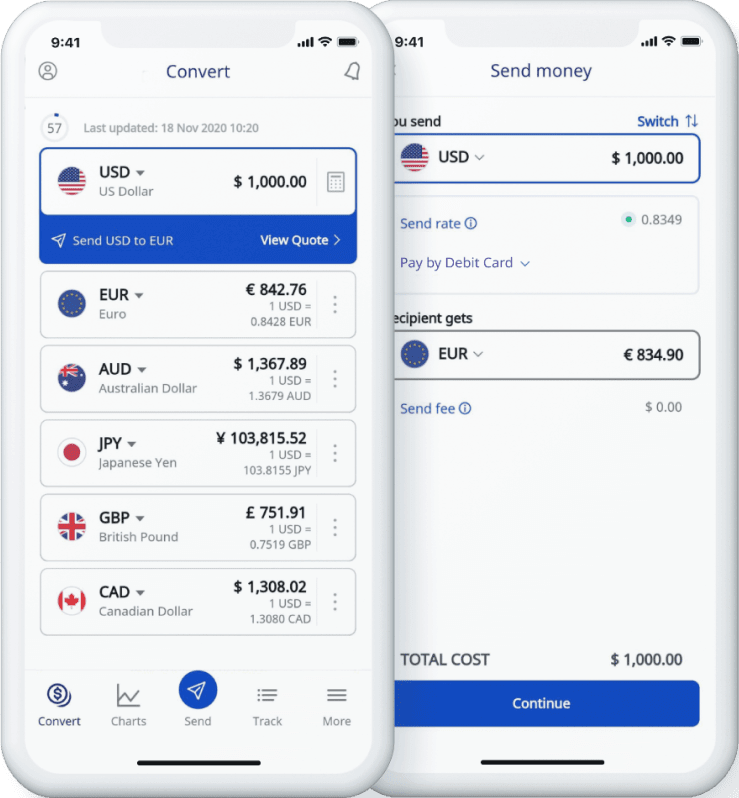

Download the Xe App

Check live rates, send money securely, set rate alerts, receive notifications and more.

Over 70 million downloads worldwide

Daily market updates straight to your inbox

Currency profiles, the original currency exchange rates calculator.

Since 1995, the Xe Currency Converter has provided free mid-market exchange rates for millions of users. Our latest currency calculator is a direct descendent of the fast and reliable original "Universal Currency Calculator" and of course it's still free! Learn more about Xe , our latest money transfer services, and how we became known as the world's currency data authority.

YOUR MONEY YOUR WAY

Travel money, hays travel foreign exchange, 4 great ways to buy your holiday money, click & collect.

Great rates & currency expertise come as standard with our Click & collect service & with no minimum spend, your holiday money is just a few clicks away.

This brings the total quotes to £000.00

£000.00 for currency

£000.00 for Buy Back Guarantee

Guarantee Peace of mind when buying your currency from Hays Travel

Save money on your unused currency with our Buyback Guarantee^

Return your unused currency for the same rate as you purchased it.

Available on all currencies sold in cash.

Available on multiple currency transactions

Available Instore & online

Terms & Conditions

Exchange Rates

Always great value and no minimum spend*

- Euro 1.1427

- US Dollar 1.2426

- Australian Dollar 1.8312

- Bulgarian Lev 2.143

- Canadian Dollar 1.6665

- Czech Koruna 26.7821

- Danish Krone 8.2786

- Hungarian Forint 424.2414

- Icelandic Krona 160.7936

- Indonesia Rupiah 18422.9206

- Mexican Peso 19.493

- New Zealand Dollar 1.9913

- Norwegian Krone 12.9005

- Polish Zloty 4.6319

- South African Rand 22.2077

- Sweden Krona 12.8937

- Swiss Franc 1.104

- Turkish Lira 37.2899

- Thai Baht 42.5752

- United Arab Emirates Dirham 4.3365

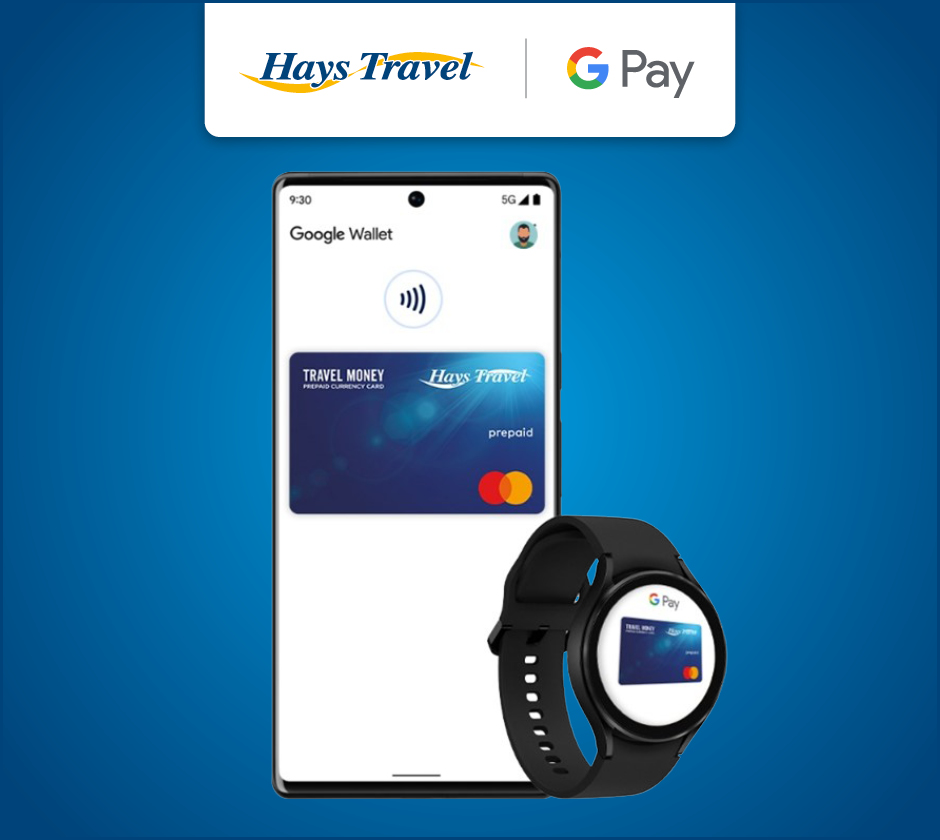

Travel Money Card

- Use anywhere Mastercard® prepaid is accepted worldwide.

- Carry less cash.

- Top up in 15 currencies including Euro, US Dollar, Australian Dollars and UAE Dirhams.

- Phone support available worldwide 24/7.

- Manage on the go via Hays Travel Currency Card App.

Connect to your google pay wallet

You can now link your Hays Travel Mastercard with Google Pay for swift and secure transactions wherever you go. Say goodbye to carrying physical cards and hello to effortless payments with just a tap of your phone. Simplify your travel experience today!

BUY YOUR HAYS TRAVEL MASTERCARD

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

It is free to use in millions of locations worldwide where Mastercard Prepaid is accepted: including restaurants, bars, and shops when you spend in a currency loaded on the card.

This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals wherever you see the Mastercard Acceptance Mark, and also 24/7 phone support.

Take your money card with you on every holiday, simply top up and go!

- BUY IN BRANCH

WHY CHOOSE HAYS TRAVEL?

For your next departure, buy your holiday money from Hays Travel. Always commission free currency with competitive online and high street exchange rates.

- Wide selection of currencies available

- Hundreds of nationwide Hays Travel branches offering on-demand Foreign Exchange; buy from branch to receive high quality customer service from the travel experts or order online for convenient home delivery

- 0% commission when we buy and sell foreign currency

Home Delivery

Ordering currency from the comfort of you own home has never been easier, with our great rates & over 60 currencies to choose from as well as next day delivery why not chose your currency to be delivered to your doorstep?

Holiday Money to your door

Order before 3pm for next working day home delivery via Royal Mail Special Delivery. *Customer must be home to sign for delivery. Over 60 currencies to select from. Free delivery on all orders £500 and over Convenient Saturday delivery available for no extra charge Minimum order value of £200 up to a maximum of £2500 Peace of mind, your local Hays Travel branch will buy back any leftover currency purchased through Hays Home Delivery commission free

Call Into a Branch

With over 400 branches to choose from arranging your holiday money has never been more convenient – Why not call into branch today where one of our experienced & Friendly Foreign Exchange Consultants will be on hand with our great rates, expert advice & fantastic service.

Bank on our branches for your Holiday Money

Over 400 branches Nationwide - Use our branch locator to find your nearest Hays Travel branch.

A wide selection of currencies & Hays Travel Money Cards available Instantly in-store

Competitive high street rates and always commission free

Exotic Currency Ordering service – Over 70 currencies available to order

Buyback Guarantee – Save money on your leftover Currency.

All major currencies Bought Back Commission Free

Experienced & Friendly Staff instore

- FIND YOUR NEAREST BRANCH

- What is a co‑operative?

- Our history

- Board of Directors

- Financial reports

- Our purpose

- Join our Board of Directors

- Board of Directors Elections 2024

- Community Champions

- Our environment

- Green Spaces

- Health and wellbeing

- Mental Health support

- Wellbeing walks

- Community Cuppa

- Helping the community

- Charitable support policy

- Community contacts

- Tackling Hunger

- Sign up to become a member

- Make the most of your membership

- Member benefits

- Family benefits

- Free fruit for under 13s

- Dividend card app

- Members' Meetings

- Competitions

- Votes & polls

- Cook with Co‑op

- Members' share accounts

- Replacement dividend card

- Membership T&Cs

- Dividend bonus

- Post offices

- Store finder

raised so far this campaign

A problem has occurred

We're sorry but a problem has occurred. The developers have been notified and will investigate as soon as possible.

Ready to go?

You’ve researched your resort, browsed different accommodations and booked your perfect break. 😎

Now, it’s time to start sorting out those holiday extras to make sure your trip runs super smoothly. No matter your destination, we're here to help you get everything ready for your getaway. 💺

We offer a range of services in each of our 13 travel branches – just pop into your nearest branch and our expert colleagues can help you book, pack and go!

Destination information

Travel documents.

Check the date your passport expires. When travelling to the EU the UK government recommends that you have at least six months left on your passport. Remember, renewing your passport can often take up to 10 weeks.

The validity is now counted from the issue date, not the expiry date. This is because if you renew your passport early, they would have added the extra months onto your new passport, however, these extra months no longer count.

For example: A passport issued on the 12th March 2014 and expires on the 12th December 2024, your passport is now only valid until the 12th March 2024. This is 10 years from the issue date.

How much time you need on your passport depends on the country you’re visiting. Check Foreign Office travel advice for the country you want to travel to – read the entry requirements section.

You can renew your passport online or by using the Post Office’s check and send service. If you need help, visit your local post office they'll be able to help you with passport applications and renewals.

Find more guidance about passports on the ABTA website.

You may wish to renew your passport sooner rather than later to make sure you have it in time for your holiday.

UK Global Health Insurance Card (GHIC)

If you're travelling in Europe, do you have a UK Global Health Insurance Card (GHIC)?

The UK has reached a new agreement on healthcare when visiting the EU. The new Global Health Insurance Card (GHIC) card has replaced the old European Health Insurance Card (EHIC).

More information about the GHIC can be found on the government website. You can apply for your free GHIC on the NHS website. You can also find information and how to apply by typing GHIC into your search engine. Please be aware of unofficial websites, they may charge if you apply through them. A GHIC is free of charge.

Driving Licences and permits

You need to take your driving licence with you to drive abroad. Check yours will be valid while you're away. You can get help renewing your driving licence at your local post office . In some countries, you may need an international driving permit ( IDP ). If you are travelling in or between different countries you may need more than one permit to comply with the law.

If you are taking your own vehicle check with your insurer what is covered under your policy when abroad. Find more information about driving abroad on the government website.

Travel Insurance

Travel vaccines and antimalarials, airport hotels and parking, executive lounges, travel money, attractions and experiences, don't forget.

Make sure your luggage complies with your airline's rules.

Don’t forget, there are still rules around what you can and can’t carry in your hand luggage e.g. any liquids you’re taking must be in containers of 100ml or less and placed inside a 20cm x 20cm plastic bag.

When going through security, these liquids and large electrical items like laptops and tablets will need to be taken out and placed in the security tray alongside your hand luggage, and you’ll need to remove certain items of clothing, like coats, belts and boots. Check what rules apply to the airport you’ll be travelling through and read more about the restrictions.

Electronics and communication

Don't forget to pack your chargers and adaptors, we recommend packing them in your hand luggage, just in case. Check with your mobile service provider about international roaming plans or consider purchasing a local SIM card for data and calls. When in doubt, turn off data roaming in your device settings. You don't want to return home to a huge phone bil

Lincolnshire Co-op runs 47 pharmacies that offer free advice on vaccinations, anti-malarial medication and the first aid supplies you need for your trip. We recommend you take a first aid kit with you.

Don't forget to pack any prescription medications you require, along with copies of your prescriptions.

Still unsure?

Find your nearest travel branch.

Use our store finder to search for your local Lincolnshire Co-op outlets.

News and blogs

Celebrating our 2024 Colleague Award win

Coffee shop coming to Waterside as part

Planning paw-mission granted for statue

our use of cookies.

We use necessary cookies to make our site work. These cookies ensure our core functionality works, such as signing into your membership account and keeping our website secure.

We also use analytics cookies to help us make improvements to our website experience by evaluating how visitors use the site. You can manage these cookies by clicking the below button.

More information on this can be found on our cookies page and privacy policy .

Manage my cookies

Necessary cookies.

We use necessary cookies to enable core functionality on our website such as security, network management and for our membership area to work. You may choose to disable these by changing your browser settings, but this may affect how the website functions.

To help us continue to improve our website, we’d like to use Google Analytics cookies which will provide us with information on how you use the site. These cookies collect general behaviour information and doesn’t directly identify anyone. More information on how these cookies work can be found on our cookies page.

14 Best Travel Credit Cards of May 2024

Best travel cards main takeaways.

- Money has evaluated hundreds of credit cards, comparing their fees, benefits, welcome offers, travel insurance policies and more.

- The top credit cards for travel offer high rewards on travel purchases, which can be redeemed for airfare, hotel nights, cash back, statement credits or more.

- Our picks feature the best travel cards for every budget and include no-annual-fee, low-annual-fee, premium and business cards.

Why Trust Us?

Our editorial team has spent well over a thousand hours analyzing, evaluating and comparing the top credit card offers in the market. We carefully vet each card’s fine print in order to understand their features, limitations and potential benefits for consumers. We review cards independently, ensuring our content is accurate and guided by editorial integrity. Read our full methodology to learn more.

- 46 travel credit cards evaluated

- 10+ data points used, including ongoing fees, reward programs and welcome offers

- 100+ sources reviewed

Money.com has partnered with CardRatings.com for our coverage of credit card products. Money and CardRatings may receive a commission from card issuers. This site does not include all card companies or all available card offers. O ur top picks are listed strictly in alphabetical order.

Our Top Picks for Best Travel Credit Cards

Best no-annual-fee travel credit cards.

- Bank of America® Travel Rewards Credit Card – Best no-annual-fee travel card for flat rate rewards

- Bilt Mastercard® – Best no-annual-fee travel card for paying rent

- Capital One VentureOne Rewards Credit Card – Best no-annual-fee card for travel partners

- Chase Freedom Unlimited® – Best no-annual-fee travel card for domestic travel

- Discover it® Miles – Best no-annual-fee travel card for simple rewards

- Wells Fargo Autograph℠ Card – Best no-annual-fee travel card for everyday spending

Best low-fee-annual-fee travel credit cards

- Capital One Venture Rewards Credit Card – Best travel card for flat-rate rewards

- Chase Sapphire Preferred® Card – Best travel card for flexible rewards

Best premium travel credit cards

- American Express® Gold Card – Best travel card for dining

- Capital One Venture X Rewards Credit Card – Best low-cost premium travel card

- Chase Sapphire Reserve® – Best premium travel credit card

- The Platinum Card® from American Express – Best travel card for lounge access

Best business travel credit cards

- The Business Platinum Card® from American Express – Best business travel card

Best airline travel credit cards

- United℠ Explorer Card: Best airline credit card

Best Travel Credit Cards Reviews

Our top picks are listed in alphabetical order.

Best No-Annual-Fee Travel Credit Cards

- No annual fee

- No foreign transaction fees

- Earns 1.5x points on all purchases

- No bonus category for travel

- Few benefits compared to other cards

- Limited redemption options

Why we chose it: The Bank of America® Travel Rewards Credit Card is an easy-to-use card best suited for travel reward beginners or those who are already Bank of America customers.

Some cardholders can earn up to 75% more points if they are Bank of America Preferred Rewards members — that’s up to 2.62 points for every dollar spent.

However, the card doesn’t offer hotel and airline point transfer partners, travel insurance or extended warranty and purchase protection. Additionally, you can only redeem your points as statement credit to cover travel and dining purchases.

All information about Bank of America® Travel Rewards Credit Card has been collected independently by Money.com

- No annual or foreign currency conversion fee (Click herehttps://www.wellsfargo.com/credit-cards/bilt/terms/">here; for rates and fees)

- Use it to pay your rent and earn rewards without incurring any processing fees

- You can earn double points on all purchase categories (except rent payments) on the first of every month (up to 10,000 points)

- Earn 2x points on travel (when booked directly through an airline, hotels, car rental agencies and cruise lines)

- No welcome bonus or introductory APR period

- Points redeemed for statement credits are worth 0.55 cents each

- You must make at least five transactions in a statement period to earn points

- Rent payments can only be made to one rental property per month

Why we chose it: The Bilt Mastercard® lets you earn travel rewards on rent payments without incurring any processing fees — unlike most credit cards that typically charge around 2.5% to 2.9% per rent payment.

You can use the card to pay rent without worrying about surcharges. Once you get approved for the card, all you have to do is set up an account through the Bilt app or website and use your assigned routing and account number to pay rent through your usual payment portal. You can also use your card even if your landlord only accepts checks, and Bilt will send a check on your behalf.

Additionally, Bilt doubles the card’s rewards rates on the first of every month, which means you can earn 6x points on dining, 4x points on travel and 2x points on other purchases (up to 10,000 points per month). However, this bonus doesn’t apply to rent rewards.

On the downside, the Bilt Mastercard® doesn’t offer a welcome bonus, and points redeemed for statement credits are only worth 0.55 cents each.

- Can transfer your miles to 16 travel partners

- Earns 5x miles per dollar on hotels and rental cars booked through Capital One Travel

- Doesn't earn bonus points on airfare

- No domestic travel partners

Why we chose it: The Capital One VentureOne Rewards Credit Card is a great option if you’re looking for a no-annual fee travel credit card with a simple rewards structure.

You can use your miles to book travel through the Capital One Travel portal or as a statement credit to cover travel purchases made from airlines, hotels, rail lines, car rental agencies and more.

You can also transfer your points to one of Capital One’s 16 travel partners, which include international airlines such as Avianca and British Airways. This option is notable since travel credit cards with no annual fee don’t typically offer the option to transfer your reward to airline and hotel partners.

However, the card’s list of bonus categories is limited compared to some other no-annual-fee credit cards, and Capital One doesn’t offer bonus points on airfare booked through Capital One Travel.

- Includes trip cancellation/interruption and car rental insurance

- Features a high flat cash back rate combined and popular bonus categories

- 3% foreign transaction fee

Why we chose it: The Chase Freedom Unlimited® is the best credit card for traveling domestically. It offers a 1.5% flat cash back rate on most purchases plus it has several appealing bonus categories, including travel and dining.