Protect Your Trip »

Is a travel agent worth it the pros and cons.

Travel experts agree there are several advantages to hiring a vacation planner.

The Pros & Cons of Using a Travel Agent

Getty Images

A travel agent can save you money and time.

Need to pivot your trip plans but don't want to deal with the extra time, money and hassle of rebooking flights and accommodations on your own? That's just one area where a knowledgeable travel agent (also commonly known as a travel advisor) can help. Read on to discover the other benefits – as well as the downsides – of using a travel agent, so you can confidently decide whether or not a travel agent is worth it for your next trip.

The Pros of Using a Travel Agent

Travel agents can save you money – and get you other perks.

"In some cases, you'll actually get a better deal by working with a travel agent," says Jackie Steele, travel expert at MagicGuides . "This could be in the form of a cruise onboard credit (free spending money to use on the ship), access to special agency/group rates, or even just learning about a discount you qualify for but weren't aware of." The best agents will even keep an eye on new discounts as they're announced and apply them to your trip even after you've booked, he notes.

Travel agents handle all the details

Hotel room? Booked. Dinner reservations? Made. Tour tickets? Ready to go. A travel agent handles every detail of your vacation itinerary. "The traveler still gets to be involved in the fun part of dreaming up ideas and providing their travel wishes, while we take and perfect them," says Jessica Parker, founder of Trip Whisperer .

Molly McShea, owner and travel advisor at McShea Travel , points out that travel agents can also help with timing logistics. "Travel agents know how many days should be spent in each destination, which tours go together, and how many things you should do in a day," she says, adding that crafting an itinerary can be challenging if it's not something you regularly do. Additionally, travel agents can help you choose the best time to visit your preferred destination(s) based on seasonality and your budget, and sift through travel insurance policies to find the best option for your needs.

Travel agents can provide local expertise

"A travel advisor's industry connections and relationships provide added value to their clients," says Valerie Edman, a luxury travel advisor and agency owner at Cultured Travel LLC. She says when working with a travel agent, travelers gain access to a global network of connections including:

- In-destination specialists who work exclusively with travel advisors and can connect travelers with unique, off-the-beaten-path experiences they wouldn't otherwise know about

- Exclusive experiences not available to the general public

You'll avoid surprise fees

When deciding if a travel agent is worth it for you, remember this: A reputable agent can guarantee you won't encounter any surprise fees on accommodations and activities once your trip is booked.

You'll have someone to troubleshoot unexpected travel issues

A travel advisor is essentially your personal vacation concierge. "Because they've been around for so long, agents really know what to look for," says Christopher Elliott , a consumer advocate and journalist. "Travel agents are among the first to know about flight cancellations and delays , making it easy for them to rebook itineraries right away."

The Cons of Using a Travel Agent

It might not be your cheapest option.

There are some instances when it makes more sense to plan your own trip. "If you're planning a quick flight from New York City to Los Angeles, it's easy enough to book it yourself online directly or through a third-party booking site," says Elliott. "If you're planning a once-in-a-lifetime trip or bucket list honeymoon , that's when you call the experts."

You'll have less flexibility in your itinerary

The upside of working with a travel agent is having someone plan an epic vacation for you based on industry knowledge and local expertise. But this can also be a downside in the event you discover an activity you'd like to do or a restaurant you'd like to try that isn't on your pre-planned itinerary. If you alter your plans, you risk losing money; plus, the time it takes for you and your travel agent to coordinate your change of plans may not be worth the hassle.

You still have to do some research

It's important to find an agent you can trust, which means you still have to do some of the vacation planning. For this part, Parker recommends picking up the phone. "Lots of people avoid or don't pick up the phone as much anymore," she says. "That's where you get the high-touch service, tone of voice, excitement or concerns to manage." She advises to look for the following red flags:

- No fees: " Travel advisors are charging planning fees more now or increasing them, so the client knows more confidently than ever, we work for them, not the suppliers with the best commissions," Parker explains. "There are a lot of things that are non-commissionable and the advisor's time and expertise shouldn't be given away for free, either. That's the best way to show an advisor takes their business seriously."

- Limited options: If you work with someone who is inexperienced or has an incentive to book you with a certain supplier, they may not be prioritizing your best interests. "It's important to check if they are with a larger consortia, accreditations and network, typically listed on their website and signatures," says Parker. "That level of mindshare doesn't come with a lone advisor unless they have many, many years of experience."

- Slow response times: If communication is delayed, that's a sign they may be too busy to plan your trip – but again, this is something you can avoid by having the right conversations early on.

Edman suggestes starting your search with the American Society of Travel Advisors . "ASTA-verified travel advisors are committed to the highest industry standards and have verifiable industry knowledge so consumers can feel confident in working with them," she says.

You might also be interested in:

- Is Travel Insurance Worth It?

- First-Time Cruise Tips

- Carry-on Luggage Sizes by Airline

- What to Pack in Your Carry-on Bag

- The Best Luggage Brands

Tags: Travel , Travel Tips

World's Best Places To Visit

- # 1 South Island, New Zealand

- # 4 Bora Bora

If you make a purchase from our site, we may earn a commission. This does not affect the quality or independence of our editorial content.

You May Also Like

Icon of the seas.

Skye Sherman May 10, 2024

The Best New York City Tours

John Rodwan and Ann Henson May 9, 2024

The Best Cheap Luggage

Erin Vasta and Amanda Norcross May 9, 2024

Top-Rated St. Augustine Ghost Tours

Holly Johnson May 9, 2024

The Best San Francisco Tours

Lyn Mettler May 8, 2024

The Best Water Parks in the U.S.

May 8, 2024

Top Adults-Only Cruises

Gwen Pratesi May 6, 2024

Top-Rated Newport Mansion Tours

Andrea McHugh May 6, 2024

The 9 New York City Boat Tours

Lyn Mettler May 6, 2024

The 13 Best Key West Tours of 2024

Gwen Pratesi May 3, 2024

All you need to know about annual travel insurance policies

As demand for travel soars and everything from weather to staffing issues leads to higher prices and cancellations, it's more important than ever to protect your trip arrangements with travel insurance .

However, it's not always easy figuring out which type of plan to pick. There are standard policies that cover general delays, interruptions and cancellations; "cancel for any reason" plans that account for personal whims in addition to unforeseen circumstances; and lesser-known annual options.

In this article, I'll go over what you need to know about the third type: annual travel insurance coverage.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter .

What is annual travel insurance?

Annual travel insurance plans (also known as multi-trip plans) last for one year and generally cover all trips taken within that period until either the policy expires or the maximum payout amounts are reached. The policy usually kicks in for trips that take you more than a certain distance from home.

For example, my Allianz AllTrips Prime annual plan remains in effect for one year following the purchase date of my policy. I'm covered on all trips during which I'm at least 100 miles from my residence.

This differs from standard travel insurance, which is purchased on a per-trip basis and covers only one specifically insured journey per policy. Standard policies begin when travel for the insured trip begins and end when the insured trip ends, rather than covering multiple travel experiences within a specific period of time.

What does annual travel insurance cover?

Coverage depends on the plan you purchase. There are usually several tiers from which to choose, with the lowest offering the least coverage and the highest offering the most.

Using my policy as an example, I'm covered for up to $3,000 per year in trip interruption expenses, including hotel room coverage at $250 per night, which I used when I was recently isolated for 10 days after testing positive for COVID-19.

My policy also offers a $3,000 annual trip cancellation benefit, $20,000 in emergency medical coverage, $100,000 in emergency transportation (including medevac services), $45,000 in rental car theft and damage protection, $25,000 in travel accident coverage and $1,000 for essentials in the event of baggage loss or damage, along with a handful of other small benefits.

Note that many annual policies do not include things like "cancel for any reason" coverage or trip interruption benefits. If those items are important to you, check with your provider before making a purchase.

How much is an annual travel insurance policy?

Sure, an annual travel insurance policy may sound great, but how much does one cost? I was surprised to find that insuring your trips for a whole year with an annual policy is often not much more expensive than insuring one or two trips individually, depending on the options you select.

A decent annual travel insurance plan will likely set you back a couple hundred dollars. The more coverage you add, the more expensive the plan will become. The cost also changes depending on variables like your age and where you live.

The best thing to do is contact your preferred provider for a quote or check out an aggregator like InsureMyTrip to compare premiums.

Which companies offer annual travel insurance plans?

The Points Guy recommends the following travel insurance providers , all of which sell annual or semi-annual policies:

- Allianz Travel Insurance .

- Seven Corners .

- Travel Guard .

- World Nomads .

When should I purchase annual travel insurance?

There are several reasons why annual travel insurance might be better for you than separate policies for individual trips. If you travel a lot — more than two or three times annually — it could be more cost-effective than purchasing separate policies for each journey.

For me, it makes sense because I travel for a living, often taking a dozen or more trips each year. Also, much of my travel is comped, which makes insurance more difficult to acquire. (If I haven't paid for a cruise, flight or hotel, I can't attach a dollar amount to it and, therefore, often can't insure it. I also wouldn't be able to provide purchase receipts in the event something went wrong and had to file a claim.)

Other factors to consider include your health, how adventurous your travels might be, whether you have coverage as a credit card perk and how much your travel arrangements cost versus how much coverage you can get with an annual plan versus individual policies.

Another consideration right now is COVID-19. For me, the annual plan made sense because most of Allianz's individual plans don't cover issues linked to COVID-19. However, the annual coverage I purchased does.

Other things to know about annual travel insurance policies

Here are a few additional tidbits I learned after filing a trip interruption claim under my annual travel insurance policy. Keep them in mind when deciding if an annual policy is right for you.

- Before committing to the purchase of any travel insurance plan, make sure to inquire about specific components that are important to you. For me, those were COVID-19 coverage, trip interruption benefits and medevac coverage.

- Know that your coverage does not reset each time you travel when you opt for an annual policy. So, if you have a trip that goes awry, you file a claim and you max out the benefit allowed by your plan, you won't have that benefit available to you for the remainder of your policy year.

- Depending on your policy, you might have to return home between travel sessions in order for each trip to be covered. Taking several back-to-back trips could prevent them from qualifying for coverage under your annual insurance plan, so be sure to read the fine print, and plan accordingly.

- If you purchase annual or multi-trip travel insurance, keep your policy card and provider phone number with the other important documents you bring when you travel so they're easily accessible in a pinch.

- If you find yourself in a covered situation for which you'd like to seek reimbursement, keep all receipts and take photos that will help to support your claims when they're submitted.

- Don't assume all your expenses will be reimbursed, even if you think they'll be covered. It doesn't hurt to try, but in my case, my Allianz plan only partially covered the hotel expenses I submitted.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How Does Travel Insurance Work?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

While every traveler hopes for the best when going on a trip, it's possible for unexpected outcomes to ruin some or all of your vacation. Travel insurance helps in those unfortunate situations by covering the necessary expenses to get you back on the right track.

But how does travel insurance work, how do you buy coverage, and is it a good idea for your next trip? Let’s find out.

What is travel insurance?

Travel insurance protects against financial losses and other risks from unexpected events that occur when traveling. Policies cover the expenses and inconveniences incurred from delayed flights, canceled reservations, lost or delayed luggage, injuries and illness.

You can buy policies that cover one reservation, an entire trip or a specific period of time. Policies can provide protection for a single person or a whole family. Prices vary based on your age, protected items, coverage limits and duration of coverage.

You don’t always have to buy a policy out-of-pocket, though. Some travel cards include built-in travel insurance as a perk. Keep in mind, however, that these policies and their coverage limits vary widely, so it pays to be mindful of what’s covered by any given travel card.

» Learn more: How to find the best travel insurance

Types of travel insurance coverage

Now that we know what it is, how does trip insurance work? There are many types of policies and coverage levels available, depending on your budget and what risks you want to cover.

So what is travel insurance for? Typically it will cover some or all of the following situations:

Trip delay. If your flight or other transportation has delays, you’ll receive compensation to cover food, lodging and other related expenses.

Trip interruption/cancellation. When your trip is interrupted or canceled for a covered reason, it provides financial assistance to make other arrangements to continue your trip or go home early.

Baggage delay. Covers the cost of reasonable clothing, toiletries, medication and other necessary items until your bag arrives.

Lost or damaged baggage. Pays to replace lost or damaged items, including both the luggage itself and personal effects that were in the luggage.

Rental car damage. Commonly called an auto collision damage waiver, this covers the cost to repair or replace a damaged or stolen rental car. Some policies also cover the lost income of the rental to the car agency while it’s being repaired.

Injury or sickness. If you get injured or sick during your trip, this benefit pays for necessary medical care. Depending on the coverage you choose, this benefit may be primary or secondary to your existing medical insurance.

Emergency assistance and transportation. Pays to transport you to the nearest facility that offers adequate medical care to treat your illness or injury. In some cases, this may mean transporting you back to your home country.

Keep in mind that many travel insurance policies do not provide protection for COVID-related situations or pre-existing medical conditions.

» Learn more: Trip cancellation insurance explained

How to use your travel insurance

Travel insurance works like most insurance policies. You purchase coverage for a period of time to protect against certain risks. When a covered event occurs, you file a claim with the insurance company to request payment or reimbursement for financial losses.

In most cases, travel insurance covers only prepaid or non-cancelable reservations. If you are able to cancel your reservations for a full refund, you should cancel them directly with that company as soon as possible. Additionally, most travel insurance policies do not cover reservations booked with airline miles or hotel points .

When you submit a claim, you’ll need to provide documentation for your loss. For example, you should document the cause of the issue (e.g., flight delay or cancellation) and provide copies of your receipts to substantiate your claims. Since there are many different types of losses that could occur, your claims process may vary by company and type of loss.

» Learn more: How do travel insurance claims work?

How to get travel insurance coverage

For travelers interested in getting a travel insurance policy, there are three primary ways to obtain coverage — purchase a standalone policy, use travel card benefits, or add on coverage when booking a trip.

Purchase a travel insurance policy

Many companies sell travel insurance as standalone policies that vary in length from a single trip to a full year. Your policy can cover a single person or an entire family. Policies range from those that offer basic coverage to others that are very robust and cover almost every possibility. Coverage options start from around $20 per trip.

For frequent travelers, it may make sense to purchase a full year of coverage instead of buying a policy for each individual trip.

» Learn more: When you don’t need to buy travel insurance

Access via travel card benefits

Many travel cards include protections that cover issues with your flight, bags and other aspects of your trip. These protections are included at no extra charge, and their coverage levels vary from card to card. You may have travel protections from some of the travel cards that are already in your wallet.

Here's a sample of the coverage available from some popular cards:

Terms apply.

» Learn more: The best credit cards for travel insurance benefits

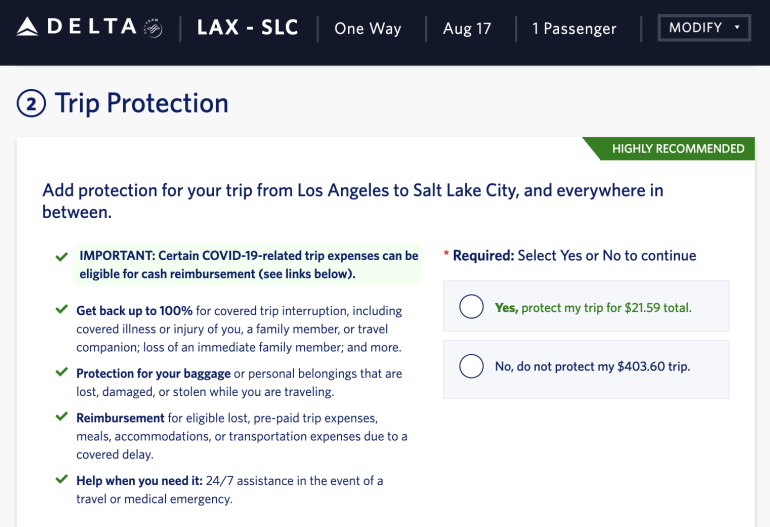

Get add-on protection for your trip

Some companies offer travelers the option of purchasing insurance when booking a trip. However, they are generally limited in nature and usually cover only that specific reservation.

Below is an example of an add-on policy proposed by Delta Air Lines for a flight from Los Angeles to Salt Lake City for a refundable, first-class fare.

In most situations, these add-on policies only make sense for a large financial commitment, such as a cruise or a premium cabin flight. Even then, you should compare how the add-on insurance works versus buying a general policy that could cover your entire trip.

» Learn more: Airline travel insurance vs. independent travel insurance

If you’re interested in buying travel insurance

Now that we've answered "how does travel insurance work," you can see how it can be a smart way to protect your trip in case an unexpected problem occurs. Coverage limits and benefits vary by company and budget, so shop around for the best deal. Review your travel card benefits to ensure that you’re not paying for coverage that you’re already getting for free. And, if you have a claim, document everything and compile your receipts to request reimbursement right away.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Pet Week 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Is travel insurance worth it?

The right policy can protect your belongings, your bank account and your peace of mind..

Terms apply to American Express benefits and offers. Visit americanexpress.com to learn more.

On April 24, 2024, the White House established new rules for airlines , mandating automatic and timely refunds for passengers whose flights had been changed, delayed or canceled. That's a big relief to travelers, but there are still many unexpected situations where travel insurance can be a lifesaver before or during your trip.

"Travel insurance is often an overlooked investment until the unforeseen happens," says Beth Godlin, president of Aon Affinity Travel Practice . "It's designed to give travelers peace of mind and financial protection against travel risks."

A policy doesn't have to be expensive, according to Godlin, to add a layer of protection and security.

Getting travel insurance

How do i get travel insurance, what does travel insurance cover.

- New airline regulations in 2024

How much does travel insurance cost?

- Bottom line

There are many options in the travel insurance marketplace: Aggregator site Squaremouth lets you get price quotes from different carriers and, because it receives a commission from the insurance companies on its site, users aren't charged any additional fees.

Allianz has both single-trip and annual plans, with a Cancel For Any Reason (CFAR) policy that reimburses up to 80% of prepaid, non-refundable expenses. That's more than most similar plans on the market.

In addition to trip cancellation, Allianz's popular OneTrip Prime plan includes travel interruption, emergency medical care and emergency transportation. Children 17 and under are covered for free when traveling with a parent or grandparent.

AIG's Travel Guard® plans are great if you need to customize coverage: The mid-range Travel Guard Preferred plan pays out 100% for trip cancellation and 150% for trip interruption, with up to $50,000 in coverage for medical expenses and up to $500,000 for emergency evacuation. There's even a payout of up to $1,000 if you miss your connection.

Travel Guard® Travel Insurance

The best way to estimate your costs is to request a quote

Policy highlights

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

24/7 assistance available

If you're booking a trip with an aggregator site like Expedia , review the details of any travel policy that's offered. Plans are usually based on the elements of the trip (hotel, flight, rental car, etc.) and can differ every time you book.

Travel insurance generally covers your expenses, your belongings and your well-being. When shopping for a policy, look for these benefits:

Trip cancellation

If your trip is canceled for a covered reason, a policy will often reimburse airline tickets, hotel rooms, rental cars, tours, cruises and other prepaid, non-refundable expenses. Covered situations can include illness or injury, the death of a family member or traveling companion, job loss, military deployment and even unplanned jury duty, according to Allianz's Daniel Durazo.

Cancellations can also be covered if a natural disaster, severe weather or airline strike prevents your carrier from getting you to your destination for at least 24 hours.

CFAR plans provide a lot more flexibility and typically reimburse 50% to 75% of your expenses. But they can bump up the cost by about 40%, said Durazo. Policyholders are also still usually required to cancel no later than 48 hours before their scheduled departure.

Trip delay

Should you experience a hiccup in your plans, your policy can provide some relief: Food, lodging and local transportation are usually covered if a delay is due to severe weather, airline maintenance or civil unrest.

"For a traveler to be eligible, they must be delayed for the minimum amount of time listed on their policy," said Squaremouth spokesperson Megan Moncrief. "Some policies are very lenient and provide benefits for any length delay, while others list a length requirement — usually somewhere between three to 12 hours."

Daily payout limits range from $150 to $250 per traveler, according to Moncrief, while the total policy limit can be anywhere from $500 to $2,000. Save any receipts to submit with your reimbursement claim.

Don't miss: The best credit cards with trip delay insurance

Trip interruption

Should you need to cut your trip short due to illness or injury, or if there's a family emergency back home, your policy may reimburse non-refundable expenses you forfeited.

It may also cover the cost of a one-way economy airline ticket home.

Baggage loss

Airlines are required to compensate passengers for luggage lost in transit, but a travel insurance policy may have a higher benefit limit. It could also cover you if your bags, passport or other possessions are lost, damaged or stolen once you've gotten to your destination., The Platinum plan from AXA Assistance USA has a $3,000 benefit limit for lost luggage, well beyond the $1,700 that airlines are required to provide on international flights. AXA has offices in more than 50 countries, with multilingual operators available 24 hours a day to help reschedule flights, book hotels and make other arrangements.

AXA Assistance USA Travel Insurance

AXA Assistance USA offers several travel insurance policies that include travel interruption, trip cancellation, and the option of cancel for any reason (CFAR) coverage.

Travel insurance doesn't cover every loss: Cash is not reimbursable and many policies won't reimburse for expensive jewelry or heirloom items. Read your policy carefully to see what is included.

Medical expenses and emergency evacuation

If you travel within the U.S., your health insurance should cover any illness or injury you sustain. If you're traveling abroad, though, your plan may provide little or no coverage. The right travel insurance should cover doctors' fees and hospital bills, Durazo said.

The provider can also help coordinate care and ensure you're at a medical facility that's up to U.S. standards.

An emergency medical evacuation can cost anywhere from $15,000 to over $200,000, Durazo added.

New airline regulations in April 2024

The Biden administration announced on April 24, 2024 , that it had finalized new rules requiring airlines to issue cash refunds to passengers if their flights were canceled or significantly changed, their checked luggage was significantly delayed or if purchased services, like Wi-Fi, were not provided.

Refunds must be automatic and made via the same form of payment as the original purchase. Travelers must be reimbursed within seven business days if the refund is going to a credit card. (Other forms of payment can take 20 calendar days to be reimbursed.) The new Department of Transportation regulations also require airlines and ticket agents to disclose upfront any fees for changing or canceling your reservation, seat selection, checked bags or carry-ons. The Biden administration has targeted junk fees across numerous industries, including credit card companies. It said the rule will help consumers avoid unneeded or surprise charges that can quickly add up and obscure the real cost of a seemingly inexpensive ticket.

A travel insurance policy typically costs between 4 and 10% of the overall price of your trip. The cost can vary:

- Plans with higher limits and more optional coverage cost more.

- A plan with a CFAR benefit can cost up to 40% more.

- Older travelers typically pay more because there's more of a likelihood of a claim being filed.

Whichever plan you choose, read the fine print so you understand what you're paying for.

While regulations on airlines are becoming increasingly stringent about reimbursing travelers for delayed or canceled flights, that doesn't do you any good if it wasn't the airline that put a kink in your plans. Travel insurance covers numerous scenarios, from medical emergencies to tropical storms. It could be particularly useful if:

- You've spent a lot on prepaid, non-refundable expenses

- You're traveling internationally where your health insurance won't apply

- You're traveling to a remote area

- Your flight involves multiple connections or destinations

"When deciding if travel insurance is right for you, ask yourself how much you could stand to lose if you had to cancel at the last minute," said Godlin.

If you're not as concerned about risk, your credit card may offer built-in travel protection if you book with that card: Chase Sapphire Preferred® , Southwest Rapid Rewards® Plus Card and the *American Express® Gold Card all come with trip cancellation and interruption coverage, among other benefits.

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

Chase Sapphire Reserve®

Earn 5X total points on flights and 10X total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3X points on other travel and dining & 1 point per $1 spent on all other purchases plus, 10X points on Lyft rides through March 2025

Welcome bonus

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

Regular APR

22.49% - 29.49% variable

Balance transfer fee

5%, minimum $5

Foreign transaction fee

Credit needed.

Terms apply.

Read our Chase Sapphire Reserve® review.

Southwest Rapid Rewards® Plus Credit Card

Earn 2X points on Southwest® purchases, 2X points on local transit and commuting, including rideshare; 2X points on internet, cable and phone services; select streaming. 1X points on all other purchases

Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

21.49% - 28.49% variable

Foreign transaction fees

Excellent/Good

American Express® Gold Card

4X Membership Rewards® points at Restaurants (plus takeout and delivery in the U.S.) and at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X), 3X points on flights booked directly with airlines or on amextravel.com, 1X points on all other purchases

Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

Not applicable

See Pay Over Time APR

See rates and fees , terms apply.

Read our American Express® Gold Card review .

Research your card's travel benefits before making any purchases related to your trip.

Policies vary, but most comprehensive plans cover travel cancellation and interruption, baggage loss, medical care and emergency transportation.

While the price for coverage varies, most policies cost between 4% and 10% of the trip's prepaid, non-refundable expenses.

When should I get travel insurance?

It's best to take out a policy within days of making your reservations.

Does travel insurance cover COVID-19?

If you contract COVID-19 before or on your trip, it may be covered by your policy's trip cancellation/interruption benefit . You'll likely have to confirm your test results with a diagnosis from a healthcare provider.

Bottom line

Travel can be a wonderful experience, but it involves a lot of time, planning and money. Missing a single connection can have a cascade effect that impacts your flight, hotel room, dinner reservations and more. A good travel insurance policy can provide peace of mind so you can focus on your vacation.

Compare and find the best life insurance

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Meet our experts

At CNBC Select, we work with experts with specialized knowledge and authority. For this story, we interviewed Beth Godlin, president of Aon, which provides custom travel insurance for tour operators, cruise lines, travel websites and others. We also spoke with former Squaremouth Megan Moncrief and Allianz communications director Daniel Durazo.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every insurance article is based on rigorous reporting by our team of expert writers and editors . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

For rates and fees for the American Express® Gold Card , click here .

- First-time homebuyer grants: What you need to know Kelsey Neubauer

- Earn elevated perks during Amex's Platinum Card anniversary celebration Andreina Rodriguez

- How to use the Chase Sapphire Preferred hotel credit Jason Stauffer

- Travel Agents

- Agent Login/Dashboard

- Travel Insurance Plans

- Travel Medical Insurance

- Group Travel Insurance

- Agent Plans

- Supplier Plans

- Consumer Notices

- Insurance Plan Documents

- How Does Travel Insurance Work

- When To Buy

- What Our Travel Insurance Can Cover

- Why Choose TravelSafe?

- TravelSafe FAQ

- Travel Tips

- Report a Claim

- View Claim Status

- Documentation

What is Travel Insurance & How Does it Work? 11 Questions Answered

Travel insurance is a valuable way to limit the risks associated with travel, deserving of consideration by every traveler. Despite its many benefits, there remains a great deal of confusion, and even skepticism, surrounding travel insurance .

Perhaps the perceived complexity of travel insurance plans and our reluctance to prepare for worst-case scenarios prevents us from discovering the many benefits of travel insurance. However, equipped with the proper information, you can choose the best plan for your trip and simplify the decision-making process.

From questions regarding pre-existing medical conditions to choosing the right plan, here are answers to 11 common travel insurance questions.

1. WHAT IS TRAVEL INSURANCE EXACTLY ?

Travel insurance is a contract between a travel insurance provider and a traveler who has financial interest in lessening risks associated with travel.

The traveler pays a premium to a travel insurance company in exchange for coverage for things like unexpected medical costs, flight delays, cancellations, evacuations, and emergency assistance. Depending on which plan you choose, coverage will vary.

2. WILL TRAVEL INSURANCE COMPANIES TRY TO CHEAT ME OUT OF WHAT IS OWED TO ME?

No. Travel insurance companies strive to pay every legitimate claim covered by your policy’s terms. Understanding your plan is always helpful because it avoids confusion as to what is covered during your trip or the claims process.

Be sure to take advantage of your plan's review period. Each travel insurance plan comes with an industry-wide review period, which allows you to look over your policy, ask questions, and determine whether the coverage works for you. If you believe the plan you purchased is not to your liking, you are able to cancel the policy in exchange for a full refund during this time.

3. IS IT JUST A FANCY VERSION OF HEALTH INSURANCE?

No, it is not a fancy version of your health insurance plan. In order to receive coverage, a qualified physician must deem treatment medically necessary. Routine doctor’s visits, medical tourism, prescription refills, and standard health assessments are not covered within plan benefits.

An added benefit to travel insurance: it can offer emergency medical and dental treatment during your trip without the strict network limitations of several PPO and HMO plans.

4. I AM ALREADY BEING TREATED FOR AN ILLNESS. WILL I BE COVERED?

Possibly. One company may provide coverage while others will not. Most companies who offer coverage for pre-existing medical conditions have eligibility requirements.

This coverage usually requires purchase at deposit or within 7-21 days from the date you made the first payment on your trip. Additionally, your doctor must have cleared you to travel at the time you purchased your policy.

Expert Tip: Many policies offered by cruise lines, tour operators, and airlines do not cover pre-existing medical conditions.

Are your pre-existing conditions covered?

Take a peek at our coverage & find out. Get a quote today.

5. DO PRE-EXISTING CONDITIONS APPLY TO NON-TRAVELING FAMILY MEMBERS?

It will depend on the company and plan you choose. There are travel insurance companies who only apply pre-existing conditions to policyholders and traveling companions.

In contrast, you have to have pre-existing conditions waived for some plans and others will not cover you for the pre-existing conditions of your non-traveling family members.

6. MY CREDIT CARD SAYS THEY OFFER TRAVEL INSURANCE. ISN’T THAT ALL I NEED?

Not unless you carry an American Express Centurion card, which is exclusively for big spenders, invite only, and has a steep initiation fee of $5,000.

The truth is, even the best credit cards offer limited coverage. Low benefit limits and a long list of exclusions can leave you with a costly bill for things you could have had covered otherwise.

7. HOW DOES TRAVEL INSURANCE WORK? WILL I RECEIVE AN INSURANCE CARD IN THE MAIL?

You will not receive an insurance card in the mail. Instead, travel insurance companies send you a brief description of coverage with your emergency assistance contact information via email (it can be mailed upon request).

Smaller costs are often paid out of pocket, and you file for reimbursement later on. Larger catastrophic costs are handled by the travel insurance and emergency assistance company.

For example, both payment and planning would be handled by the travel insurance and assistance companies for a hospital stay or medical evacuation.

8. WHAT ARE THE DIFFERENT KINDS OF TRAVEL INSURANCE?

There are two main types of travel insurance: medical only and packaged plans, or comprehensive travel insurance. Both have long-term and short-term travel options, and the type of plan you choose will depend on your needs.

Medical only plans offer coverage for the costs of necessary medical care, medical evacuations, and sometimes, repatriation. These plans are often used by expatriates or student travelers living overseas. Return dates are not always set, so the option for renewal works out well for them.

Packaged plans offer coverage for you, your things, and your travel investment. Necessary medical costs are usually covered, along with things like medical evacauations, non-medical evacuations, flight delays, cancellation, and lost or stolen baggage .

9. WHAT IS NOT COVERED BY TRAVEL INSURANCE?

Things the insurance company lists as exclusions. Exclusions are defined within your travel insurance plan and are always predetermined. They exist so you know what is and is not covered up front.

Here is what you would typically see as an exclusion:

- An act of war.

- Riding or driving races, or speed or endurance competitions or events.

- Participating in a professional stunt.

- Being intoxicated or under the influence of any controlled substance, unless as administered by a legally qualified physician.

While policy exclusions vary by plan, travel insurance companies agree on one thing: anything foreseen is not covered. In other words, if you know about it ahead of time, you do not have coverage. You cannot buy coverage for a hurricane that is already named or a terrorist incident that happened yesterday.

10. HOW OFTEN IS TRAVEL INSURANCE USED SUCCESSFULLY?

According to the U.S. Travel Insurance Association , in 2014, 85% of impacted travelers who had travel insurance said they were satisfied with their purchase.

Here are real claims told by travelers:

11. HOW DO I KNOW IF I AM CHOOSING THE RIGHT PLAN FOR MY TRIP?

By asking yourself the right questions. It will help you effectively choose a plan that fits your needs.

Some questions you should ask are:

- How long is my trip?

- How often do I travel?

- How much of my prepaid trip costs am I willing or able to lose?

- Will I be partaking in extreme sports?

- What are the plan features?

- What are the risks associated with my trip?

- What are the costs associated with these risks?

- If faced with travel mishaps, which risks would I need help lessening?

1. " Americans Spending More on Travel Insurance ." Press Release. www.ustia.org . July 14th, 2017.

Subscribe to Our Blog

- Agent Login

- Privacy Policy

- Terms & Conditions

- Return Policy & Guarantee

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

The Comprehensive Guide to Annual Travel Insurance

Who Should Buy Annual Travel Insurance?

Older travelers: Here’s a secret many travelers don’t realize: Annual travel insurance is an especially good deal for people 65 and up. That’s because, unlike single-trip insurance plans, the cost of multi-trip plans is not affected by the traveler’s age. A 71-year-old traveler will pay the same as a 41-year-old traveler.

> Read more: What Factors Affect the Cost of Travel Insurance?

Business travelers: Your friends think your on-the-go life is glamorous. You know the truth: business travel is a grind. The AllTrips Executive plan helps you bounce back when things go wrong by reimbursing your expenses for covered travel delays, misplaced luggage, and even lost or damaged business equipment.

Spontaneous travelers: People with flexible schedules can score savings on last-minute cruises and hotel stays. But travel deals like these often have strict cancellation policies, making travel insurance all the more important. A multi-trip plan automatically protects your trip as soon as you book it.

Road trippers: Because road trips tend to have few pre-paid expenses, people don’t bother to insure them. But travel delays, trip interruptions and medical emergencies can still wreck your plans — what then? An annual travel insurance plan protects you from those unexpected speed bumps.

Budget travelers: If you’re careful with your travel spending, then an AllTrips plan is a must. The expense is minimal, especially if you’re planning several trips. And travel insurance can protect you from unexpected expenses when you’re dealing with a medical emergency, lost bag, travel delay or other mishap.

Parents and grandparents: Did you know you can give an AllTrips plan as a gift ? If your child or grandchild is an avid traveler, an annual insurance plan will accompany them everywhere they go, helping them when things don’t go as planned. You’ll enjoy more peace of mind, too.

Which Benefits Are Included in Annual Travel Insurance?

Every AllTrips plan includes the following benefits:

- Emergency medical benefits , to reimburse you for covered medical expenses in case of a covered illness or injury

- Emergency transportation benefits , in case you require a medically necessary evacuation for a covered illness or injury

- Baggage loss/damage benefits , in case your bags are stolen, or damaged or misplaced by your travel carrier

- Baggage delay benefits to reimburse you for necessary, eligible purchases when your bags are delayed

- Travel delay benefits to reimburse you for eligible meals, accommodations and other covered expenses during a covered delay

- Rental car damage and theft coverage . (Rental car coverage, when purchased as part of an annual plan, is not available for residents of all states.)

- Travel accident benefits, which can pay you for covered losses due to death, loss of limb(s) or sight as a result of a covered travel accident

- Access to 24-Hour Hotline Assistance , so you can get expert help dealing with travel emergencies

- Concierge assistance to help with travel planning and arranging special experiences

Some AllTrips plans also include:

- Trip cancellation benefits , to reimburse your prepaid, non-refundable expenses if you have to cancel your trip due to a covered reason.

- Trip interruption benefits , to reimburse you for the unused, non-refundable portion of your trip and for the increased transportation costs it takes for you to return home due to a covered reason.

- Business equipment coverage, to reimburse the repair, replacement and/or rental of business equipment that has been lost, stolen, damaged or delayed by your common carrier.

- Change fee coverage , to reimburse fees if you change the dates on your airline ticket for a covered reason.

- Loyalty program redeposit fee coverage, which reimburses fees charged for re-depositing loyalty program awards (such as frequent flyer miles) back into your account following a covered trip cancellation or interruption.

What’s the Best Annual Travel Insurance Plan?

Allianz Global Assistance offers four annual travel insurance plans. All of them include our award-winning 24-Hour Assistance services , which can help you find solutions to tough travel problems.

AllTrips Basic is the most economical multi-trip plan offered by Allianz Global Assistance. It includes post-departure benefits to protect you in case of baggage loss/damage/theft, travel delays, covered medical emergencies and more. It does not protect your travel investment with trip cancellation/trip interruption benefits.

AllTrips Prime includes all the benefits (with the same maximum limits) as AllTrips Basic, with the addition of trip cancellation and trip interruption benefits. There’s a limit of $3,000 for trip cancellation and trip interruption per person, per year .

AllTrips Executive can protect business, pleasure and blended trips, with multiple tiers of coverage for trip cancellation and interruption up to $10,000. If your business equipment is lost, stolen, damaged or delayed by an airline or other carriers, this plan can reimburse reasonable costs for equipment rental, replacement and/or repair.

AllTrips Premier can protect your entire household while you’re traveling. It offers four tiers of trip cancellation/trip interruption benefits, up to $15,000 per household, per trip, per year.

> Read more: Which Annual Travel Insurance Plan is Right for You?

Tips for Buying Annual Travel Insurance

An alltrips plan protects trips within a 365-day span (not a calendar year)..

It’s wise to look ahead at your travel plans to make sure your trips will be protected. Your AllTrips plan takes effect at 12:01 a.m. on the day after we receive both your order and full premium payment (or on a future date you choose at the time of purchase). It ends at 11:59 p.m. local time on your coverage end date, unless you are on a trip. If you are on a trip, your coverage will end on the day you arrive at your point of origin or primary residence, or seven days after the coverage end date, whichever is earlier.

Trip cancellation and interruption benefit limits are per person, per year.

This is key! Each benefit in your AllTrips plan has a maximum dollar limit, depending on which plan you choose. For example, AllTrips Prime has a maximum limit of $20,000 in emergency medical benefits per insured person, per trip . So, if you incur $20,000 in emergency medical costs from a car accident while in Romania, and then another $20,000 in emergency medical costs from a hippopotamus attack on a trip to Botswana (bad luck!), both claims could be covered.

Trip cancellation/interruption is different: The maximum limit applies per person, per year . AllTrips Prime’s maximum trip cancellation benefit is $3,000. So, if you file a claim for $2,000 after canceling your Jamaican vacation, you only have $1,000 left to cover any other trip cancellations for the duration of your plan. Keep your total trip costs in mind when you’re choosing a plan.

AllTrips plans can cover losses resulting from pre-existing conditions.

We define a pre-existing medical condition as injury, illness, or medical condition that, within the 120 days prior to and including the policy purchase date:

- Caused a person to seek medical examination, diagnosis, care, or treatment by a doctor;

- Presented symptoms; or

- Required a person to take medication prescribed by a doctor (unless the condition or symptoms are controlled by that prescription, and the prescription has not changed).

With an AllTrips plan, you can be covered for losses due to a pre-existing medical condition if you were a U.S. resident when the policy was purchased and:

a. The trip was purchased during the coverage period; or

b. Your policy was purchased within 14 days of the date of the first trip payment or deposit.

Please read your plan documents for details.

Some trips may not be eligible for travel protection.

While there’s no limit on how many trips you take, most of our AllTrips plans have a 45-day limit on trip length. If you’re planning a longer journey, consider AllTrips Premier , a multi-trip plan that can protect trips up to 90 days, or OneTrip Emergency Medical , a low-cost single-trip plan that can protect trips up to 180 days in length. Also, travel insurance plans do not cover travel with the intent to receive health care or medical treatment of any kind, moving, or commuting to and from work.

Look at your options for protecting the whole family.

If your family is taking multiple trips together in the next 12 months, AllTrips Premier may be your best choice, because it can cover your entire household. But if you’re planning only one big family vacation, then you might opt for the single-trip OneTrip Prime or OneTrip Premier plan . Both cover kids 17 and under for free when they’re traveling with a parent or grandparent (not available on policies issued to Pennsylvania residents).

Read your plan documents before you travel.

Travel insurance can do a lot, but it can’t cover every possible situation. Take some time to read your annual plan documents so you understand which situations, events, and losses can be covered, and which aren’t.

> Read more: Travel Insurance 101: How Travel Insurance Works

The free Allyz ® TravelSmart app is the easiest way to access your benefits when you’re traveling.

Allyz TravelSmart , available for iOS and Android, helps you contact Assistance, file a claim, get travel alerts and flight updates, find pre-screened medical facilities and more.

Related Articles

- The Comprehensive Guide to Travel Insurance Benefits

- Why an Annual Travel Insurance Plan is a Smart Move for Domestic Trips

- Why I Finally Bought Annual Travel Insurance (And Why You Should Too)

Get a Quote

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Share this Page

- {{errorMsgSendSocialEmail}}

Your browser does not support iframes.

Popular Travel Insurance Plans

- Annual Travel Insurance

- Cruise Insurance

- Domestic Travel Insurance

- International Travel Insurance

- Rental Car Insurance

View all of our travel insurance products

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Personal Finance

What is travel insurance.

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created independently from TIME’s editorial staff. Learn more about it.

Travel insurance can cover financial losses due to unforeseen setbacks both before you depart and during a trip. These include trip cancellation, travel delays and interruption, medical emergencies, medical evacuations, and loss of luggage. In general, travel insurance policies are good for U.S. and international travel and usually cost between 4% to 8% of the total trip price.

Travelex Travel Insurance

Policy cancellation, how does travel insurance work.

Travel insurance works in the same manner as other kinds of insurance policies, such as plans to protect a home, car, or other valuable assets like jewelry. Travel insurance plans protect certain prepaid, nonrefundable, trip-related costs that could be at risk in the case of an unexpected issue. Among them: a delayed flight that causes you to miss a cruise, an injury that causes your trip to be cut short, or an airline losing your luggage.

Should you get travel insurance?

The decision to purchase a travel insurance plan is closely connected to the traveler’s risk tolerance, the value of their trip, and the potential for certain circumstances to arise that could cause disruptions to their travel plans, says Rhonda Sloan , head of marketing and travel industry relations at AIG Travel.

“For example, a cruise that cost $15,000 would be an investment that many would consider worth protecting, particularly if there could be issues that put prepaid, nonrefundable trip costs at risk,” says Sloan. “For more expensive trips or those that take a traveler farther from home, a travel insurance plan might be on their radar, as the chances of lost luggage, canceled or delayed flights, injuries related to trip activities, or other travel mishaps are greater.”

Travel insurance types

Most travel insurance plans include some coverage for trip cancellation, trip interruption, trip delay, medical expenses, emergency medical evacuation, and lost luggage. AIG Travel, for example, offers three levels of its basic travel insurance plans for standalone trips— Deluxe, Preferred and Essential — that provide varying levels of coverage limits. Also, travel insurers offer optional travel insurance plan upgrades, known as “bundles,” that augment your policy with customized travel insurance plan packages tailored to your specific travel needs.

One of the most popular reasons people buy travel insurance is for trip cancellation coverage, which is a pre-departure benefit. Emergencies can happen before a scheduled trip, and your travel insurance policy will provide a list of acceptable reasons that are covered by your plan. It’s important to thoroughly read your travel insurance documents.

If the reason you’re canceling is covered under your policy, you can file a claim to receive 100% of the prepaid, nonrefundable trip deposits you would lose because you aren’t going on your trip. Typical reasons that will be covered by your trip cancellation benefits include: death, illness, or injury to you, a travel companion, or a close family member; a serious family emergency; severe weather; a sudden job loss; unplanned jury duty; your travel supplier going out of business; a national transportation strike; and a national emergency.

Not all reasons will be covered by a basic travel insurance policy. For example, fear of travel or having a fight with your travel companion before a trip are not reimbursable reasons to cancel.

If you want the highest level of flexibility regarding your travel plans, consider adding “ cancel for any reason ” coverage to your basic travel insurance plan. This add-on will boost your travel policy price by about 50%, but it will allow you the latitude to cancel for any reason, so long as you do so no later than 48 hours before your scheduled departure. If you meet all the criteria, you can expect to recover between 50% to 75% of your nonrefundable, prepaid trip outlays.

How do you choose the best insurance policy?

There is no one-size-fits-all when it comes to travel insurance. It’s up to the individual to review each policy type and determine if the benefits included fit their personal needs and concerns, says Daniel Durazo , director of external communications at Allianz Partners U.S. “How much insurance you need comes down to how much you’re willing to risk losing in the event of an unexpected cancellation or emergency situation,” he adds.”

It’s also advisable to research policy options and your destination. “Do your homework,” says Sloan. She explains that it is important for travelers to have a good understanding of their destination and the mishaps that might be common there: severe weather, petty crime, etc. “Travelers should also carefully review the details of any insurance plan they are considering to learn about coverage amounts, potential coverage exclusions, and optional policy upgrades,” says Sloan.

Aim to get an understanding of plan and coverage options, as well as the likelihood for certain mishaps at a planned destination, so you’re in a better position to choose a travel insurance plan that’s best suited for your trip.

What is covered by a standard travel insurance policy?

Most standard travel insurance policies are going to include some coverage for trip cancellation, trip interruption, trip delay, travel medical expenses, emergency medical evacuation, and benefits for lost or stolen baggage and some personal effects.

What is not covered by travel insurance?

Policy exclusions will vary by carrier and plan, so be sure to read your plan documents to understand all the exclusions and limitations.

Sloan says that travel insurance plans generally do not cover losses caused by—or resulting from—such situations as acts of war, epidemics or pandemics, travel restrictions imposed by government authorities, foreseeable events, or fear of travel.

The following items are also generally not covered by travel insurance.

- Pre-existing conditions. Although travel insurance is an excellent safeguard against many types of medical emergencies abroad—from accidents to evacuations—most policies have built-in exclusions for pre-existing conditions, says Stan Sandberg , cofounder of TravelInsurance.com. “If you’ve been seriously ill in the past or need ongoing treatment, consider looking for a plan that offers a pre-existing condition waiver ,” he says.

- Luggage in limbo. Coverage for lost luggage is common, but it usually doesn’t kick in until your bags have been missing for a set number of hours. Check your policy for waiting times, says Sandberg. “In case of a delay, it’s a good idea to carry a least a day’s worth of medication, toiletries, and clothing in your carry-on.”

- When trip cancellation rules don’t apply. As mentioned, not all reasons to receive benefits under your starter travel insurance plan will apply. “Generally, coverage extends to situations that are out of your control, including death in the family, natural disasters, unexpected work obligations, new illnesses, and injuries. In other words, you won’t be able to get your money back if you simply change your mind,” says Sandberg.

- Pregnancy and childbirth. Standard pregnancy-care expenses incurred while away won't be covered by a travel insurance plan, even if you hold a pre-existing condition waiver. Prenatal services such as routine care, ultrasounds, and medical expenses for labor and uncomplicated childbirth won’t be covered by travel insurance. The best course of planning is to speak with your medical provider to decide if travel is advisable during pregnancy. Some emergency pregnancy-related expenses may be covered by travel insurance. Also, you may be able to get special coverage for pregnancy as an add-on.

How much does travel insurance cost?

As noted above, travel insurance policies for U.S. and international travel usually cost between 4% to 8% of the total trip price.

What affects travel insurance costs?

As an example, AIG Travel’s Deluxe, Preferred, and Essential travel insurance plans are priced based on:

- Traveler’s age.

- Trip duration.

- State of residence.

How can you get travel insurance?

You can purchase travel insurance through:

- Carrier. You can buy directly from a travel insurance carrier online and answer prompts to get a quote and make a purchase. You can also call the company’s toll-free number and speak with a representative. In addition, travel advisors also offer travel insurance plans.

- Credit card. Some credit cards have travel insurance benefits, but this coverage will vary, so it’s best to check with your specific credit card issuer. There are often exclusions and limitations, so request an overview of the scope of the policy. Another important factor is that you must pay for your entire trip on the card on which you plan to file a claim.

How can you get the most out of travel insurance?

- Purchase your travel insurance plan as soon as you book your trip and take advantage of all the pre-departure benefits, such as trip-cancellation coverage.

- Look into a waiver of the exclusion for pre-existing medical conditions.

- Take advantage of all the perks included. For example, there should be travel-assistance services if you experience a travel disruption, such as a delayed flight or lost luggage. Most carriers have a 24/7 hotline that provides free help, including concierge services, translation services, and medical referrals.

What are the key travel insurance trends for 2023?

According to a report released in 2022 by Allianz the top trends are :

- Elevated levels of demand for travel insurance.

- How increased economic and geopolitical volatility are affecting travel insurance.

- Higher customer expectations regarding travel insurance and the claims process.

TIME Stamp: Travel insurance provides a valuable safety net

The nominal cost of a policy, which spans from 4% to 8 % of your trip costs, can save you thousands of dollars if you need to cancel your trip due to a covered reason in your policy, experience travel delays or interruptions, become ill or injured while away, or have your baggage or personal belongings lost or stolen while traveling.

There are also upgrades that can be purchased, such as “cancel for any reason” coverage and sports and medical bundle upgrades to starter insurance plans. Ultimately, travel insurance provides peace of mind and can protect your trip investment, health, and belongings.

Virtually all travel insurance carriers have an 800 number where representatives can answer questions. Their websites also provide very thorough descriptions of travel insurance plans to select.

Frequently asked questions (FAQs)

What are the top travel destinations for 2023 .

Based on TravelInsurance.com customer data , popular destinations for 2023 include Italy, Mexico, the United Kingdom, Jamaica, Canada, France, Ireland, Germany, the Bahamas, and Greece.

Does travel insurance get more expensive closer to the trip?

Generally, the price won’t get higher as your trip approaches. For instance, Sloan says that AIG Travel’s Deluxe, Preferred, and Essential travel insurance plans do not change in price when purchased closer to the departure date. “However, purchasing early relative to the initial deposit date has its advantages, such as a waiver of the pre-existing medical conditions exclusion,” she says.

Do I need car rental insurance when I travel outside of the United States?

Personal auto insurance policies in the U.S. may not provide coverage if you’re renting a car abroad. “Some countries require certain minimum coverage amounts or types of coverage for a vehicle rental insurance policy, so be sure to check the specifics of the country you’ll be driving in,” says Sloan.

The information presented here is created independently from the TIME editorial staff. To learn more, see our About page.

Agent Information

← Return to Blog

The Best Annual Travel Insurance and Subscriptions for Frequent Travelers

Becky Hart | Jan 30, 2024

Share Twitter share

We all love travel hacks that save us money and time. Luckily, there are three important types of services or “memberships” you can take advantage of to make travel more economical and convenient: annual plans, loyalty programs, and subscription services.

But are each of these really that different? How do travel subscriptions work compared to annual plans? Are any of them worth the money? To answer these questions, and to make sure you’re getting the most out of your travel dollars, Seven Corners created the ultimate guide to these travel plans and programs.

What Is an Annual Travel Plan?

How does an annual travel plan work? You make a single purchase and then use that service or product for the year without additional charges. There’s no monthly fee like you’ll see below for subscription services.

One of the most common examples of a yearly plan in the travel industry is annual travel insurance. You’ll see annual plans in other industries, too, though. For example, some spas allow you to purchase a year’s worth of services upfront so you can enjoy a regular massage or facial without reaching for your wallet each time.

Examples of annual plans

Seven Corners offers two annual plans — a travel medical plan and a trip protection plan — that are perfect for frequent travelers who make several trips throughout the year or who are looking for long-term travel insurance.

Seven Corners Travel Medical Annual Multi-Trip provides you with medical coverage when you take multiple international trips over the course of a year. Perhaps you travel often to see expat family members or visit your company headquarters in another country. This plan could be a great option to help protect your health and cover medical expenses if you get sick or hurt during any of your trips.

Alternatively, Seven Corners Trip Protection Annual Multi-Trip helps protect the money you invest in your travels as well as your health. The purchase of a single plan covers each of your trips during the course of the year. It offers benefits such as trip cancellation and trip interruption so that you can be reimbursed for trip expenses if you have to cancel or interrupt your trip for a covered reason. You’ll also find coverage for personal belongings and medical expenses — including pre-existing conditions — in our Trip Protection Annual Multi-Trip plan.

Our annual trip protection coverage can cover you during both domestic trips within the U.S. and internationally. This is a great choice if you travel to see family frequently, take frequent business trips, or simply see no reason to save your vacation time. (We don’t blame you; you deserve your PTO.)

You’ll find annual travel plans outside of insurance, too. U.S. travelers will likely recognize AAA as an annual service. The once-yearly charge gets you roadside assistance, travel and vacation planning services, as well as discounts on hotels, theme parks, car rentals, and more. If you’ve ever run out of gas or needed a jumpstart on your car, you know how helpful AAA’s annual plans can be.

If you’re traveling in London, you can purchase an annual Travelcard . A Travelcard gives you unlimited travel on buses, the Tube, London Overground, and more, and can be purchased for a single day, weekly, monthly, and of course, annually. The benefit of buying a one-year Travelcard is its lower cost. According to their website, compared to 7 Day Travelcards, the annual option reduces the price of a ride by 23%.

As you can see, while you might be less familiar with annual travel insurance, there are plenty of year-long plans available for adventurers.

Are annual plans worth it?