7th CPC Leave Travel Concession Rules in Hindi

भारत सरकार LTC rules यानि Leave Travel Concession Rules के अंतर्गत केन्द्रीय कर्मचारियों को होमटाउन और देश में किसी स्थान की यात्रा करने के लिए छुट्टी यात्रा रियायत प्रदान की जाती है।

Leave Travel Concession का प्रयोग करके सरकारी कर्मचारी अपने गृहनगर या देश की किसी जगह की यात्रा कर सकते हैं।

हिन्दी में LTC फुल फॉर्म / LTC Full Form in Hindi – छुट्टी यात्रा रियायत

यह केन्द्रीय कर्मचारियों को मिलने वाली ऐसी यात्रा सुविधा है जिसके तहत किसी कर्मचारी को उसके Hometown या देश के किसी हिस्से में यात्रा करने में हुए व्यय का प्रतिपूर्ति (Reimbursement) किया जाता है।

केंद्र सरकार अपने कर्मचारियों को आर्थिक प्रतिपूर्ति करने के लिए कई तरह के भत्ते प्रदान करती है।

इनमें से कुछ भत्ते ऐसे होते हैं जो कर्मचारियों के वेतन का हिस्सा होते हैं जैसे- Dearness Allowance , Home Rent Allowance , Transport Allowance आदि।

कुछ भत्ते ऐसे होते हैं प्राप्त करने के लिए सरकारी कर्मचारियों को claim प्रस्तुत करना पड़ता है। जैसे- Travelling Allowance , DA(Daily Allowance) आदि।

इन्हीं भत्तों में से एक है Leave Travel Concession, जो वेतन का हिस्सा नहीं होता है और जिसके Reimbursement के लिए सरकारी कर्मचारी को claim करना पड़ता है।

इस लेख में हमनें Leave Travel Concession के विषय में विस्तार से चर्चा की है और इससे संबंधित कुछ महत्वपूर्ण rules के बारे में भी बताया है।

तो आईए जानते हैं आपकी अपनी भाषा हिन्दी में कि Leave Travel Concession क्या होता है यानि Leave Travel Concession meaning in Hindi और उसके बाद जानेंगे LTC Rules के बारे में विस्तृत जानकारी देंगे।

यहाँ हमनें आपकी सुविधा के लिए ltc rules in hindi pdf भी दिया है जिसे आप डाउनलोड भी कर सकते हैं-

Table of Contents

Leave Travel Concession क्या होता है / LTC Meaning in Hindi

इसे हम इस तरह परिभाषित कर सकते हैं कि किसी कर्मचारी द्वारा छुट्टी या अवकाश के दौरान की गई किसी यात्रा के लिए प्रदान की गई सुविधा या रियायत को Leave Travel Concession कहते हैं।

स्पष्ट है कि यह सुविधा प्राप्त करने के लिए सरकारी कर्मचारी को छुट्टी के लिए आवेदन करना पड़ता है। जब competent authority द्वारा उस कर्मचारी की छुट्टियाँ मंजूर हो जाती हैं तो वह यात्रा प्रारंभ कर सकता है।

Leave Travel Concession की सुविधा प्राप्त करने के लिए कर्मचारी को यात्रा के दौरान दो बातों का जरूर ध्यान रखना चाहिए।

पहला यह कि यदि वह कर्मचारी Hometown की यात्रा करता है तो उसे अपने Headquarters से Hometown तक की यात्रा का प्रमाण देना पड़ेगा। इसी तरह यदि वह अपने परिवार के साथ देश के किसी हिस्से की यात्रा करता है तो उसे अपने उस गंतव्य तक की यात्रा का प्रमाण देना पड़ेगा।

यदि उस कर्मचारी का परिवार ही केवल यात्रा पर है तो वह LTC के reimbursement के लिए claim नहीं कर सकता है।

दूसरी महत्वपूर्ण बात यह कि यात्रा के दौरान रेल, सड़क, हवाई मार्ग आदि द्वारा की गई यात्रा पर खर्च के reimbursement के लिए ही LTC का claim किया जा सकता है। अन्य खर्च जैसे होटल, भोजन, दर्शनीय स्थलों की यात्रा, टैक्सी और ऑटो किराए और अन्य तरह के खर्चों के reimbursement के लिए claim नहीं किया जा सकता है।

Leave Travel Concession के प्रकार और Block Year for LTC

केंद्र सरकार की किसी कर्मचारी को दो प्रकार की Leave Travel Concession की सुविधा प्राप्त होती है।

- Hometown LTC और 2. All India LTC

अब आईय जानते हैं दोनों प्रकार के LTC क्या होते हैं और 4 Year Block LTC Rules in Hindi

Hometown LTC:

इसके अंतर्गत किसी सरकारी कर्मचारी को अपने परिवार के साथ घर की यात्रा करने के लिए सुविधा मिलती है।

सभी सरकारी कर्मचारी प्रत्येक चार साल के ब्लॉक में दो बार इसका लाभ उठा सकते हैं और परिवार के साथ अपने hometown की यात्रा कर सकते हैं।

यहाँ Hometown से मतलब है जिसका रिकॉर्ड उक्त कर्मचारी के Service Book में आधिकारिक रूप से दर्ज किया गया हो और उसे सक्षम अधिकारी (competent authority) द्वारा सत्यापित कराया गया हो।

Leave Travel Concession के लिए दावा करते समय कर्मचारी द्वारा दी गई सूचनाओं को किसी वरिष्ठ अधिकारी द्वारा कर्मचारी के Service Book के आधार पर प्रमाणित करना होता है।

All India LTC:

इसके अंतर्गत कोई सरकारी कर्मचारी अपने पूरे परिवार के साथ देश के किसी भी हिस्से में यात्रा कर सकता है और All India LTC की सुविधा का लाभ उठा सकता है।

किसी केंद्र सरकार के कर्मचारी को चार साल में एक बार All India LTC की सुविधा प्रदान की जाती है।

केंद्र सरकार की नौकरियों में भर्ती हुए नए कर्मचारियों को प्रत्येक चार साल के ब्लॉक में तीन साल अपने परिवार के साथ अपने Hometown की यात्रा करने की अनुमति है और चौथे साल भारत में किसी भी स्थान पर जाने के लिए All India LTC की सुविधा मिलती है।

इन नए भर्ती हुए केंद्रीय कर्मचारियों को Hometown LTC और All India LTC की सुविधा पहली बार नौकरी में शामिल होने के बाद लागू चार साल के पहले दो ब्लॉकों के लिए ही उपलब्ध होगी।

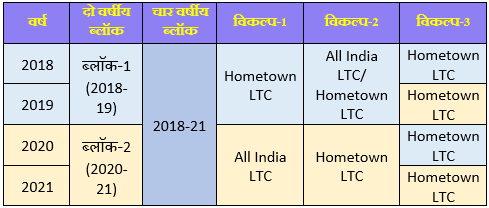

निम्न टेबल से हम समझ सकते हैं कि कैसे कोई कर्मचारी चार वर्षीय ब्लॉक में Hometown LTC और All India LTC ले सकता है। Current Block Year for LTC – 2022 – 2025 (extended up to 2026)

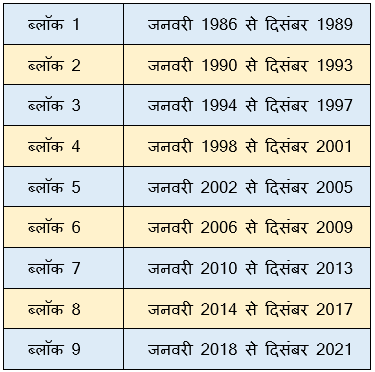

भारत सरकार द्वारा अपने कर्मचारियों के लिए Leave Travel Concession छूट का दावा करने के लिए जो चार साल के ब्लॉक बनाए गए हैं वो निम्न प्रकार से हैं –

Leave Travel Concession की सुविधा प्राप्त करने के लिए शर्तें:

Leave Travel Concession की सुविधा प्राप्त करने केंद्र सरकार के कर्मचारियों द्वारा निम्नलिखित शर्तों को पूरा किया जाना जरूरी होता है-

- छुट्टी के दौरान की गई यात्रा केवल भारत के भीतर ही होनी चाहिए। अर्थात कोई सरकारी कर्मचारी भारत के भीतर यात्रा करने के लिए हीLeave Travel Concession का दावा कर सकता है, भारत के बाहर की यात्रा के लिए नहीं।

- Leave Travel Concession की सुविधा का लाभ उठाने के लिए यह जरूरी है कि संबंधित कर्मचारी की कम से कम एक साल की सेवा बिना किसी Service Break के पूरी हो चुकी हो।

- संबंधित कर्मचारी अपने परिवार के सदस्यों के साथ साथ आश्रितों के लिए भी Leave Travel Concession छूट की सुविधा प्राप्त करने के लिए हकदार है। यहाँ परिवार से मतलब है, पति या पत्नी और बच्चे तथा अन्य आश्रित सदस्य। आश्रित सदस्यों में माता-पिता और भाई-बहन भी हो सकते हैं। आश्रित सदस्य उन्हें ही माना जाएगा जिनकी मासिक आमदनी 9,000 रुपये से ज्यादा नहीं होगी। यहाँ आमदनी से तात्पर्य है माता/पिता को मिलने वाला पेंशन या भाई/बहनों को मिलने वाला स्कॉलरशिप, स्टाइपेंड आदि। कर्मचारी के आश्रितों में उसके अविवाहित दो बच्चे हो सकते हैं या उसके ऊपर पूरी तरह निर्भर गोद लिए हुए बच्चे हो सकते हैं। साथ ही आश्रित भाई-बहनों में अविवाहित नाबालिग भाई या अविवाहित / तलाकशुदा / विधवा बहन हो सकते हैं जो संबंधित कर्मचारी के ऊपर पूरी तरह से निर्भर हों। संबंधित कर्मचारी जिन दो बच्चों के लिए छूट का दावा करना चाहता है उनका जन्म 1 अक्टूबर 1998 को या उसके बाद हुआ हो। इस तिथि के बाद जन्मे दो से अधिक बच्चों के लिए Leave Travel Concession छूट का दावा नहीं किया जा सकता है। 1 अक्टूबर 1998 से पहले पैदा हुए सभी बच्चों के लिए संबंधित कर्मचारी Leave Travel Concession छूट का दावा कर सकता है।

- यदि पति और पत्नी दोनों सरकारी नौकरी करते हैं और दोनों के लिए LTC छूट का दावा करना है तो उनमें से कोई एक ही अपने संबंधित कार्यालय में दावा कर सकता/सकती है। दोनों को अलग-अलग दावा करने की जरूरत नहीं है। साथ ही जो कर्मचारी LTC छूट का दावा करता है, उसे अपने कार्यालय में दावे में यह प्रमाणित करना अनिवार्य होता है कि उसके पति/पत्नी अपने कार्यालय में LTC छूट का दावा नहीं कर रहे हैं।

- LTC छूट का दावा करने के लिए कर्मचारी को अपने गंतव्य (Hometown या देश का कोई हिस्सा) तक की यात्रा का प्रमाण देना पड़ेगा। इसके लिए कर्मचारी द्वारा की गई यात्राओं के लिए टिकट या boarding pass पर्याप्त हैं। परिवार के साथ यात्रा करने पर परिवार के सभी सदस्यों के टिकट या boarding pass होने जरूरी हैं। इससे स्पष्ट है कि यदि कोई कर्मचारी LTC छूट का दावा करता है तो उसे गंतव्य तक यात्रा करना अनिवार्य है। यदि केवल उसके परिवार के सदस्य यात्रा पूरी करते हैं तो भी दावा मान्य नहीं होगा।

Multi-Destinations यानि एक साथ कई गंतव्य यात्रा के लिए Leave Travel Concession का दावा:

यह जरूरी नहीं है कि LTC की छुट्टियों के दौरान कोई सरकारी कर्मचारी केवल तय गंतव्य तक की ही यात्रा करेगा। यदि वह कई शहरों की यात्रा करने के बाद LTC छूट का दावा करता है तो भी वह मान्य होगा।

ऐसी स्थिति में कर्मचारी के तैनाती स्थान से उसके द्वारा यात्रा किए गए सबसे दूर गंतव्य की दूरी के आधार पर उसे LTC छूट प्राप्त होगा।

लेकिन इस बात का भी ध्यान रखा जाएगा कि उस दूरस्थ गंतव्य का कर्मचारी के तैनाती स्थान से सबसे छोटी दूरी (shortest route) कौन सा है। उसी shortest route का किराया उसे LTC छूट के रूप में प्राप्त होगा।

यही शर्तें Hometown LTC के लिए भी लागू होंगी और उस कर्मचारी को उसके तैनाती शहर से Hometown के बीच shortest route का किराया प्रदान किया जाएगा।

क्या होता है जब किसी ब्लॉक वर्ष के लिए LTC का दावा नहीं किया जाता है?

यदि कोई कर्मचारी चार वर्षीय ब्लॉक में मिलने वाले Leave Travel Concession छूट में से एक का दावा नहीं कर पाता है तो यह LTC छूट की सुविधा अगले ब्लॉक वर्ष में carry over यानि कि जुड़ जाती है।

इस तरह किसी ब्लॉक वर्ष में unclaimed LTC को अगले ब्लॉक वर्ष में claim किया जा सकता है। बशर्ते कि उस कर्मचारी को अगले ब्लॉक के पहले कैलेंडर वर्ष में ही यात्रा करनी होगी।

इसके बाद भी यदि unclaimed LTC का अगले ब्लॉक के पहले कैलेंडर वर्ष के भीतर दावा नहीं किया जाता है, तो यह समाप्त हो जाएगा और बाद में दावा करने की अनुमति नहीं दी जाएगी।

उदाहरण के तौर पर यदि कोई कर्मचारी वर्तमान में जारी ब्लॉक वर्ष 2018-21 में एक यात्रा करता है और उसके एवज में Leave Travel Concession छूट का दावा भी कर लेता है।

लेकिन वह किसी कारणवश ब्लॉक वर्ष 2018-21 में दूसरे LTC छूट का दावा नहीं कर पाता है तो ऐसी स्थिति में वह इसका दावा अगले ब्लॉक वर्ष यानि 2022-25 में वर्ष 2022 के भीतर ही कर सकता है। यदि वह 2022 में भी यह दावा नहीं कर पाता है तो यह समाप्त हो जाएगा।

नए भर्ती हुए सरकारी कर्मचारियों के लिए यह सुविधा (carry over of LTC) उपलब्ध नहीं है क्योंकि उन्हें पहले 8 साल तक LTC की सुविधा मिलती है।

All India Leave Travel Concession के तहत यात्रा के स्थान की घोषणा:

जब कोई सरकारी कर्मचारी या उसके परिवार का कोई सदस्य All India LTC पर जाता है, तो उस कर्मचारी को यात्रा किए जाने वाले स्थान की जानकारी अपने Controlling Officer को अग्रिम रूप से देनी पड़ेगी।

यदि उक्त कर्मचारी यात्रा के घोषित स्थान को बदलना चाहता है तो उसे यात्रा शुरू होने से पहले ही अपने Controlling Officer के अनुमोदन से बदल सकता है।

लेकिन कुछ अपवाद की स्थिति में जहाँ Controlling Officer को लगता है कि यात्रा के घोषित स्थान में बदलाव करना उक्त सरकारी कर्मचारी के हाथ में नहीं था, वहाँ यात्रा के बाद भी यात्रा किए जाने वाले स्थान में बदलाव किया जा सकता है।

यह छूट स्थिति के अनुसार प्रशासनिक मंत्रालय/विभाग या Head of Department द्वारा दी जा सकती है।

All India LTC के तहत क्या सरकारी कर्मचारी और उसके परिवार के सदस्य अलग-अलग स्थानों की यात्रा कर सकते हैं?

एक सरकारी कर्मचारी और उसके परिवार का प्रत्येक सदस्य चार वर्षीय ब्लॉक के दौरान All India LTC के तहत देश के विभिन्न स्थानों का दौरा कर सकते हैं।

सरकारी कर्मचारी के परिवार के सदस्यों के लिए यह आवश्यक नहीं होगा कि वे उसी स्थान की यात्रा करें जहाँ की यात्रा उक्त सरकारी कर्मचारी उसी चार वर्षीय ब्लॉक के दौरान पहले कर चुका है।

यात्रा पूरी होने के कितने दिन के अंदर LTC छूट के लिए दावा करना जरूरी है?

यदि सरकारी कर्मचारी ने LTC के तहत तहत यात्रा पर जाने के लिए किसी तरह का Advance लिया है तो उसे यात्रा पूरी करने के दिन से एक महीने के अंदर LTC reimbursement के लिए दावा करना पड़ेगा।

यदि उक्त कर्मचारी ने किसी तरह का Advance नहीं लिया है तो वह LTC reimbursement का दावा यात्रा पूरी करने के दिन से तीन महीने के अंदर कर सकता है।

LTC के तहत हवाई टिकट की बुकिंग

यदि कोई सरकारी कर्मचारी हवाई यात्रा के लिए eligible है तो वह LTC छूट का दावा करने के लिए केवल एयर इंडिया से ही यात्रा कर सकता है। यदि उस मार्ग पर एयर इंडिया की सेवा उपलब्ध नहीं है तो ही वह अन्य प्राइवेट हवाई सेवा का प्रयोग कर सकता है।

लेकिन जो सरकारी कर्मचारी हवाई यात्रा के लिए eligible नहीं हैं वो किसी भी हवाई सेवा का प्रयोग कर सकते हैं। लेकिन उन्हें LTC reimbursement में उनकी eligibility के अनुसार रेल या बस किराया ही प्राप्त होगा।

जहाँ तक हवाई टिकट बुकिंग की बात है तो सभी सरकारी कर्मचारियों को LTC की सुविधा प्राप्त करने के लिए संबंधित एयरलाइन से टिकट बुकिंग करनी पड़ेगी। इसके लिए सरकारी कर्मचारी एयरलाइन के टिकट काउंटर या वेबसाइट का प्रयोग कर सकते हैं।

यदि वे किसी बुकिंग एजेंट से टिकट खरीद रहे हैं तो सरकार द्वारा अधिकृत एजेंट जैसे- M/s Balmer Lawrie & Company, M/s Ashok Travels & Tours और ‘IRCTC द्वारा ही खरीद सकते हैं।

नौकरी बदलने की स्थिति में LTC का दावा करना:

यदि कोई सरकारी कर्मचारी अपनी नौकरी बदलता है तो भी उसे LTC छूट की सुविधा उपलब्ध होगी।

यदि यह परिवर्तन चार साल के ब्लॉक के भीतर होता है और कोई unclaimed LTC है, तो नए सरकारी ऑफिस में इसका दावा किया जा सकता है।

लेकिन, यदि LTC का लाभ पुराने सरकारी ऑफिस से लिया जा चुका है, तो नए सरकारी ऑफिस द्वारा किसी भी नए LTC छूट की अनुमति नहीं दी जाएगी।

LTC Advance Rules

यदि कोई सरकारी कर्मचारी LTC Advance लेता है तो उसे एक निश्चित अवधि के अंदर टिकट बुक करना पड़ता है।

कोई सरकारी कर्मचारी अपने और/या अपने परिवार के सदस्यों के लिए LTC के तहत टिकट बुक करने के लिए यात्रा की प्रस्तावित तिथि से पैंसठ दिन पहले Advance के लिए आवेदन कर सकता है।

लेकिन जिस दिन advance की स्वीकृत राशि उसके अकाउंट में क्रेडिट होती है, उसके दस दिनों के भीतर उक्त सरकारी कर्मचारी को टिकट प्रस्तुत करने पड़ेंगे, चाहे यात्रा शुरू होने की तारीख कुछ भी हो।

LTC के लिए Air Ticket बुक करने के लिए अप्रूव्ड ट्रैवल एजेंट / Govt Approved Travel Agents for LTC

Pay Level 9 और इससे ऊपर के सरकारी कर्मचारी LTC पर Air Travel के लिए योग्य हैं। OFFICE MEMORANDUM dated 29th August, 2022 के अनुसार ये कर्मचारी सरकार द्वारा अप्रूव्ड निम्नलिखित तीन Authorized Travel Agents (ATAs) के माध्यम से ही टिकट बुक कर सकते हैं-

यदि किसी कारणवश (unavoidable circumstances) एलिजबल सरकारी कर्मचारी किसी unauthorized travel agent/website से टिकट बुक कर लेता है तो Head of Department जो की Joint Secretary के पद से नीचे का अधिकारी ना हो, relaxation दे सकता है।

यदि उपरोक्त जानकारी ज्ञानवर्धक लगी हो तो कृपया शेयर करना ना भूलें।

शेयर करें (Sharing is Caring)-

- Click to share on WhatsApp (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to print (Opens in new window)

Related posts

No related posts.

46 thoughts on “7th CPC Leave Travel Concession Rules in Hindi”

Kya koi Sarkari karmchari 4 year block LTC ke dauran apne hometown se any palace of India Yatra kar sakta hai

यदि आपका ऑफिस आपके hometown में है तो जा सकते हैं, लेकिन ऑफिस दूसरे शहर या राज्य में है तो नहीं जा सकते हैं। हाँ, यदि आप अपने ऑफिस से hometown जाते हैं और फिर LTC के लिए, तो कोई दिक्कत नहीं। लेकिन आपको अपने ऑफिस और destination place के shortest route का fare ही reimburse किया जाएगा।

Sir me Srinagar me rahta hoo me 4 year s block ltc me Guwahati se Jammu aana hai hometown se jummu ka fare nahi milega

apka question samajh nahi aaya. please aur explain karen

Sir agar me make my trip ya ease my trip se rail ticket nikalta hu tho muje ltc claim milega kya?

Ha mil jayega

सर क्या 15 दिन पहले हवाई टिकट बुकिंग कराने पर एलटीसी का फ़यदा मिल सकता है।

हाँ जरूर मिलेगा

Sir break up return journey kitne dino ka milta h for Ltc claim…

kya aap is question ko aur explain kar sakte hain

Sir jo naya circular aaya hai august 2022 mei, uske according by air kaha kaha ja sakte hai?

is circular me to distance ki baat hi nahi hai. aap all India LTC to kahi bhi ja sakte hain

Kam se kam kitne dino ka leave lene se Ltc claim milega.?

कितने दिन भी ले सकते हैं, कोई दिक्कत नहीं।

4 year Ltc 2018-21 kis place se milegaa. Duty place ya Home town se

क्या 4 ईयर ltc casual leave(cl) के साथ ले सकते है??

हाँ CL पर कोई भी LTC ले सकते हैं।

All india LTC Claim karne ke liye likhit mai Dena compulsory hai kya agar leave sanction hone ke bad travel karke LTC Claim Kiya ja sakta hai kya

मैं दिल्ली पुलिस में सर्विस करता हूं मेरी पत्नी दूसरे राज्य में नौकरी करती है मैंने 2018 – 21 में 2 Home Town LTC ले ली है किंतु कोई All India LTC नहीं ली तो क्या मेरी पत्नी उसके राज्य में 4 साल में उसी ब्लॉक वर्ष में मिलने वाली LTC ले सकती है

Kya 4 year block 2018-21 me 2018 me hi Bharat me kahi bhi yatra kar sakte h mera 2007 ka SSB me appointment h

Aap 2020-21(extended upto 31.03.2023) ke block year me all India LTC ke liye eligible hain

Kya travelling k doran ashrama express ka rent poora reasonable hai 3 ac ka usi k haqdaar hai hum

yadi aap 3 AC ke liye eligible hain to pura fare reimburse hoga

Kya ltc personal motorcycle se bhi ja sakte hai kya home town pass hone par by road. And iska reimbursment kese hoga

yadi govt transport available nahi hai tabhi personal vehicle se LTC reimburse hoga

Sir mai ltc le rha tha Delhi to Srinagar via flight agar mai vapsi jammu to Delhi flight se kru to kya ltc mil sakti hai ya fir Srinagar se hi vapsi kr sakta hu

aap LTC claim kar sakte hain, lekin claim me jo destination point diya hai usi ke anusar apko reimburse hoga

(1) 4 year All india LTC block 2022-25 apply krne ke liye new employee ko kamse kam kitni service krni hoti h.

I joined my service in 2016. Kya mai 2023 me 4 years block wala all india LTC le sakta hu….ya avi nhi 2025 me lena padega..pkz confirm.

apka 2017 se LTC count hoga aur is hisab se aap 2024 me All India LTC le sakte hain

Sir ager hum home town ltc lekr hum aur family jate hai uske baad hum 10 days me return aa jate hai lakin mera famil 1 mahine ke baad aati hai to kya mera wife ka ticket ka amount milega

Humne ahmedabad se portblair by air travel Kiya tha. Isme direct flight nahi hoti isliye humko pahele culcutta jana pada uske bad vaha se portblair Gaye. Halaki ticket ahmedabad se portblair ki hi thi. Par humko ahmedabad se culcutta ka 2A train ka aur culcutta se portblair ka plain ka kiraya mila he. Kya yahi sahi he sir?

ji ha, jahan railway ki connectivity hai vahan flight ka fare nahi milega

kya LTC me pre-paid taxi aloud hei ya nahi

yadi vahan sarkari transportation nahi hai tab allowed hai

SIR HOME TOWN JANE KE LIYE TRAIN KE SUVIDHA HAI LAKIN HUM AGER FLIGHT KA TICKET LEKR JATE HAI FLIGHT SE AUR RETURN V FLIGHT SE HOTE HAI TO KYA TRAIN Ka jo amount hai 3rd ac ka wo milega ya nahi

ha milega, lekin apko flight ka ticket keval tin authorized travel agents se hi karna hai

33 sal ki service mein kitni bar LTC le sakte hain

Retirement tak le sakte hain, block year ke anusar

june 2019 mein join kiya tha or ab all india ltc lena chahata hun, kya main andaman ke liye eligible hu? agar hun to kis block year ke liye?

Aap 2023 me All India LTC ke liye eligible hain

2023 me kitane din pahale tak air tickets kharidane chahiye.

Ticket kabhi bhi le, lekin travelling December me hi karni padegi

every year Home Town LTC lene ka bad four year block LTC mil jayega

I am eligible four year block-2022-2025 LTC after avail home town LTC during this period

Please elaborate, your question is not clear

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Notify me of new posts by email.

PARAMILITRY HELP

Leave Travel Concession (LTC) Rules in Hindi Full Details

भारत सरकार LTC rules यानि Leave Travel Concession Rules के अंतर्गत केन्द्रीय कर्मचारियों को होमटाउन और देश में किसी स्थान की यात्रा करने के लिए छुट्टी यात्रा रियायत प्रदान की जाती है।

Leave Travel Concession का प्रयोग करके सरकारी कर्मचारी अपने गृहनगर या देश की किसी जगह की यात्रा कर सकते हैं।

हिन्दी में LTC फुल फॉर्म / LTC Full Form in Hindi – छुट्टी यात्रा रियायत

यह केन्द्रीय कर्मचारियों को मिलने वाली ऐसी यात्रा सुविधा है जिसके तहत किसी कर्मचारी को उसके Hometown या देश के किसी हिस्से में यात्रा करने में हुए व्यय का प्रतिपूर्ति (Reimbursement) किया जाता है।

केंद्र सरकार अपने कर्मचारियों को आर्थिक प्रतिपूर्ति करने के लिए कई तरह के भत्ते प्रदान करती है।

इनमें से कुछ भत्ते ऐसे होते हैं जो कर्मचारियों के वेतन का हिस्सा होते हैं जैसे- Dearness Allowance, Home Rent Allowance, Transport Allowance आदि।

कुछ भत्ते ऐसे होते हैं प्राप्त करने के लिए सरकारी कर्मचारियों को claim प्रस्तुत करना पड़ता है। जैसे- Travelling Allowance, DA(Daily Allowance) आदि।

इन्हीं भत्तों में से एक है Leave Travel Concession, जो वेतन का हिस्सा नहीं होता है और जिसके Reimbursement के लिए सरकारी कर्मचारी को claim करना पड़ता है।

इस लेख में हमनें Leave Travel Concession के विषय में विस्तार से चर्चा की है और इससे संबंधित कुछ महत्वपूर्ण rules के बारे में भी बताया है।

तो आईए जानते हैं आपकी अपनी भाषा हिन्दी में कि Leave Travel Concession क्या होता है यानि Leave Travel Concession meaning in Hindi और उसके बाद जानेंगे LTC Rules के बारे में विस्तृत जानकारी देंगे।

Leave Travel Concession क्या होता है / LTC Meaning in Hindi

इसे हम इस तरह परिभाषित कर सकते हैं कि किसी कर्मचारी द्वारा छुट्टी या अवकाश के दौरान की गई किसी यात्रा के लिए प्रदान की गई सुविधा या रियायत को Leave Travel Concession कहते हैं।

स्पष्ट है कि यह सुविधा प्राप्त करने के लिए सरकारी कर्मचारी को छुट्टी के लिए आवेदन करना पड़ता है। जब competent authority द्वारा उस कर्मचारी की छुट्टियाँ मंजूर हो जाती हैं तो वह यात्रा प्रारंभ कर सकता है।

Leave Travel Concession की सुविधा प्राप्त करने के लिए कर्मचारी को यात्रा के दौरान दो बातों का जरूर ध्यान रखना चाहिए।

पहला यह कि यदि वह कर्मचारी Hometown की यात्रा करता है तो उसे अपने Headquarters से Hometown तक की यात्रा का प्रमाण देना पड़ेगा। इसी तरह यदि वह अपने परिवार के साथ देश के किसी हिस्से की यात्रा करता है तो उसे अपने उस गंतव्य तक की यात्रा का प्रमाण देना पड़ेगा।

यदि उस कर्मचारी का परिवार ही केवल यात्रा पर है तो वह LTC के reimbursement के लिए claim नहीं कर सकता है।

दूसरी महत्वपूर्ण बात यह कि यात्रा के दौरान रेल, सड़क, हवाई मार्ग आदि द्वारा की गई यात्रा पर खर्च के reimbursement के लिए ही LTC का claim किया जा सकता है। अन्य खर्च जैसे होटल, भोजन, दर्शनीय स्थलों की यात्रा, टैक्सी और ऑटो किराए और अन्य तरह के खर्चों के reimbursement के लिए claim नहीं किया जा सकता है।

Leave Travel Concession के प्रकार और Block Year for LTC

केंद्र सरकार की किसी कर्मचारी को दो प्रकार की Leave Travel Concession की सुविधा प्राप्त होती है।

- Hometown LTC और 2. All India LTC

अब आईय जानते हैं दोनों प्रकार के LTC क्या होते हैं और 4 Year Block LTC Rules in Hindi

Hometown LTC:

इसके अंतर्गत किसी सरकारी कर्मचारी को अपने परिवार के साथ घर की यात्रा करने के लिए सुविधा मिलती है।

सभी सरकारी कर्मचारी प्रत्येक चार साल के ब्लॉक में दो बार इसका लाभ उठा सकते हैं और परिवार के साथ अपने hometown की यात्रा कर सकते हैं।

यहाँ Hometown से मतलब है जिसका रिकॉर्ड उक्त कर्मचारी के Service Book में आधिकारिक रूप से दर्ज किया गया हो और उसे सक्षम अधिकारी (competent authority) द्वारा सत्यापित कराया गया हो।

Leave Travel Concession के लिए दावा करते समय कर्मचारी द्वारा दी गई सूचनाओं को किसी वरिष्ठ अधिकारी द्वारा कर्मचारी के Service Book के आधार पर प्रमाणित करना होता है।

All India LTC:

इसके अंतर्गत कोई सरकारी कर्मचारी अपने पूरे परिवार के साथ देश के किसी भी हिस्से में यात्रा कर सकता है और All India LTC की सुविधा का लाभ उठा सकता है।

किसी केंद्र सरकार के कर्मचारी को चार साल में एक बार All India LTC की सुविधा प्रदान की जाती है।

केंद्र सरकार की नौकरियों में भर्ती हुए नए कर्मचारियों को प्रत्येक चार साल के ब्लॉक में तीन साल अपने परिवार के साथ अपने Hometown की यात्रा करने की अनुमति है और चौथे साल भारत में किसी भी स्थान पर जाने के लिए All India LTC की सुविधा मिलती है।

इन नए भर्ती हुए केंद्रीय कर्मचारियों को Hometown LTC और All India LTC की सुविधा पहली बार नौकरी में शामिल होने के बाद लागू चार साल के पहले दो ब्लॉकों के लिए ही उपलब्ध होगी।

निम्न टेबल से हम समझ सकते हैं कि कैसे कोई कर्मचारी चार वर्षीय ब्लॉक में Hometown LTC और All India LTC ले सकता है। Current Block Year for LTC – 2018 – 2021 (extended up to 2022)

भारत सरकार द्वारा अपने कर्मचारियों के लिए Leave Travel Concession छूट का दावा करने के लिए जो चार साल के ब्लॉक बनाए गए हैं वो निम्न प्रकार से हैं –

Leave Travel Concession की सुविधा प्राप्त करने के लिए शर्तें:

Leave Travel Concession की सुविधा प्राप्त करने केंद्र सरकार के कर्मचारियों द्वारा निम्नलिखित शर्तों को पूरा किया जाना जरूरी होता है-

छुट्टी के दौरान की गई यात्रा केवल भारत के भीतर ही होनी चाहिए। अर्थात कोई सरकारी कर्मचारी भारत के भीतर यात्रा करने के लिए हीLeave Travel Concession का दावा कर सकता है, भारत के बाहर की यात्रा के लिए नहीं।

- Leave Travel Concession की सुविधा का लाभ उठाने के लिए यह जरूरी है कि संबंधित कर्मचारी की कम से कम एक साल की सेवा बिना किसी Service Break के पूरी हो चुकी हो।

- संबंधित कर्मचारी अपने परिवार के सदस्यों के साथ साथ आश्रितों के लिए भी Leave Travel Concession छूट की सुविधा प्राप्त करने के लिए हकदार है। यहाँ परिवार से मतलब है, पति या पत्नी और बच्चे तथा अन्य आश्रित सदस्य। आश्रित सदस्यों में माता-पिता और भाई-बहन भी हो सकते हैं।

- आश्रित सदस्य उन्हें ही माना जाएगा जिनकी मासिक आमदनी 9,000 रुपये से ज्यादा नहीं होगी। यहाँ आमदनी से तात्पर्य है माता/पिता को मिलने वाला पेंशन या भाई/बहनों को मिलने वाला स्कॉलरशिप, स्टाइपेंड आदि।

- कर्मचारी के आश्रितों में उसके अविवाहित दो बच्चे हो सकते हैं या उसके ऊपर पूरी तरह निर्भर गोद लिए हुए बच्चे हो सकते हैं। साथ ही आश्रित भाई-बहनों में अविवाहित नाबालिग भाई या अविवाहित / तलाकशुदा / विधवा बहन हो सकते हैं जो संबंधित कर्मचारी के ऊपर पूरी तरह से निर्भर हों।

- संबंधित कर्मचारी जिन दो बच्चों के लिए छूट का दावा करना चाहता है उनका जन्म 1 अक्टूबर 1998 को या उसके बाद हुआ हो। इस तिथि के बाद जन्मे दो से अधिक बच्चों के लिए Leave Travel Concession छूट का दावा नहीं किया जा सकता है। 1 अक्टूबर 1998 से पहले पैदा हुए सभी बच्चों के लिए संबंधित कर्मचारी Leave Travel Concession छूट का दावा कर सकता है।

- यदि पति और पत्नी दोनों सरकारी नौकरी करते हैं और दोनों के लिए LTC छूट का दावा करना है तो उनमें से कोई एक ही अपने संबंधित कार्यालय में दावा कर सकता/सकती है। दोनों को अलग-अलग दावा करने की जरूरत नहीं है।

- साथ ही जो कर्मचारी LTC छूट का दावा करता है, उसे अपने कार्यालय में दावे में यह प्रमाणित करना अनिवार्य होता है कि उसके पति/पत्नी अपने कार्यालय में LTC छूट का दावा नहीं कर रहे हैं।

- LTC छूट का दावा करने के लिए कर्मचारी को अपने गंतव्य (Hometown या देश का कोई हिस्सा) तक की यात्रा का प्रमाण देना पड़ेगा। इसके लिए कर्मचारी द्वारा की गई यात्राओं के लिए टिकट या boarding pass पर्याप्त हैं।

- परिवार के साथ यात्रा करने पर परिवार के सभी सदस्यों के टिकट या boarding pass होने जरूरी हैं।

- इससे स्पष्ट है कि यदि कोई कर्मचारी LTC छूट का दावा करता है तो उसे गंतव्य तक यात्रा करना अनिवार्य है। यदि केवल उसके परिवार के सदस्य यात्रा पूरी करते हैं तो भी दावा मान्य नहीं होगा।

Multi-Destinations यानि एक साथ कई गंतव्य यात्रा के लिए Leave Travel Concession का दावा:

यह जरूरी नहीं है कि LTC की छुट्टियों के दौरान कोई सरकारी कर्मचारी केवल तय गंतव्य तक की ही यात्रा करेगा। यदि वह कई शहरों की यात्रा करने के बाद LTC छूट का दावा करता है तो भी वह मान्य होगा।

ऐसी स्थिति में कर्मचारी के तैनाती स्थान से उसके द्वारा यात्रा किए गए सबसे दूर गंतव्य की दूरी के आधार पर उसे LTC छूट प्राप्त होगा।

लेकिन इस बात का भी ध्यान रखा जाएगा कि उस दूरस्थ गंतव्य का कर्मचारी के तैनाती स्थान से सबसे छोटी दूरी (shortest route) कौन सा है। उसी shortest route का किराया उसे LTC छूट के रूप में प्राप्त होगा।

यही शर्तें Hometown LTC के लिए भी लागू होंगी और उस कर्मचारी को उसके तैनाती शहर से Hometown के बीच shortest route का किराया प्रदान किया जाएगा।

क्या होता है जब किसी ब्लॉक वर्ष के लिए LTC का दावा नहीं किया जाता है?

यदि कोई कर्मचारी चार वर्षीय ब्लॉक में मिलने वाले Leave Travel Concession छूट में से एक का दावा नहीं कर पाता है तो यह LTC छूट की सुविधा अगले ब्लॉक वर्ष में carry over यानि कि जुड़ जाती है।

इस तरह किसी ब्लॉक वर्ष में unclaimed LTC को अगले ब्लॉक वर्ष में claim किया जा सकता है। बशर्ते कि उस कर्मचारी को अगले ब्लॉक के पहले कैलेंडर वर्ष में ही यात्रा करनी होगी।

इसके बाद भी यदि unclaimed LTC का अगले ब्लॉक के पहले कैलेंडर वर्ष के भीतर दावा नहीं किया जाता है, तो यह समाप्त हो जाएगा और बाद में दावा करने की अनुमति नहीं दी जाएगी।

उदाहरण के तौर पर यदि कोई कर्मचारी वर्तमान में जारी ब्लॉक वर्ष 2018-21 में एक यात्रा करता है और उसके एवज में Leave Travel Concession छूट का दावा भी कर लेता है।

लेकिन वह किसी कारणवश ब्लॉक वर्ष 2018-21 में दूसरे LTC छूट का दावा नहीं कर पाता है तो ऐसी स्थिति में वह इसका दावा अगले ब्लॉक वर्ष यानि 2022-25 में वर्ष 2022 के भीतर ही कर सकता है। यदि वह 2022 में भी यह दावा नहीं कर पाता है तो यह समाप्त हो जाएगा।

नए भर्ती हुए सरकारी कर्मचारियों के लिए यह सुविधा (carry over of LTC) उपलब्ध नहीं है क्योंकि उन्हें पहले 8 साल तक LTC की सुविधा मिलती है।

All India Leave Travel Concession के तहत यात्रा के स्थान की घोषणा:

जब कोई सरकारी कर्मचारी या उसके परिवार का कोई सदस्य All India LTC पर जाता है, तो उस कर्मचारी को यात्रा किए जाने वाले स्थान की जानकारी अपने Controlling Officer को अग्रिम रूप से देनी पड़ेगी।

यदि उक्त कर्मचारी यात्रा के घोषित स्थान को बदलना चाहता है तो उसे यात्रा शुरू होने से पहले ही अपने Controlling Officer के अनुमोदन से बदल सकता है।

लेकिन कुछ अपवाद की स्थिति में जहाँ Controlling Officer को लगता है कि यात्रा के घोषित स्थान में बदलाव करना उक्त सरकारी कर्मचारी के हाथ में नहीं था, वहाँ यात्रा के बाद भी यात्रा किए जाने वाले स्थान में बदलाव किया जा सकता है।

यह छूट स्थिति के अनुसार प्रशासनिक मंत्रालय/विभाग या Head of Department द्वारा दी जा सकती है।

All India LTC के तहत क्या सरकारी कर्मचारी और उसके परिवार के सदस्य अलग-अलग स्थानों की यात्रा कर सकते हैं?

एक सरकारी कर्मचारी और उसके परिवार का प्रत्येक सदस्य चार वर्षीय ब्लॉक के दौरान All India LTC के तहत देश के विभिन्न स्थानों का दौरा कर सकते हैं।

सरकारी कर्मचारी के परिवार के सदस्यों के लिए यह आवश्यक नहीं होगा कि वे उसी स्थान की यात्रा करें जहाँ की यात्रा उक्त सरकारी कर्मचारी उसी चार वर्षीय ब्लॉक के दौरान पहले कर चुका है।

यात्रा पूरी होने के कितने दिन के अंदर LTC छूट के लिए दावा करना जरूरी है?

यदि सरकारी कर्मचारी ने LTC के तहत तहत यात्रा पर जाने के लिए किसी तरह का Advance लिया है तो उसे यात्रा पूरी करने के दिन से एक महीने के अंदर LTC reimbursement के लिए दावा करना पड़ेगा।

यदि उक्त कर्मचारी ने किसी तरह का Advance नहीं लिया है तो वह LTC reimbursement का दावा यात्रा पूरी करने के दिन से तीन महीने के अंदर कर सकता है।

LTC के तहत हवाई टिकट की बुकिंग

यदि कोई सरकारी कर्मचारी हवाई यात्रा के लिए eligible है तो वह LTC छूट का दावा करने के लिए केवल एयर इंडिया से ही यात्रा कर सकता है। यदि उस मार्ग पर एयर इंडिया की सेवा उपलब्ध नहीं है तो ही वह अन्य प्राइवेट हवाई सेवा का प्रयोग कर सकता है।

लेकिन जो सरकारी कर्मचारी हवाई यात्रा के लिए eligible नहीं हैं वो किसी भी हवाई सेवा का प्रयोग कर सकते हैं। लेकिन उन्हें LTC reimbursement में उनकी eligibility के अनुसार रेल या बस किराया ही प्राप्त होगा।

जहाँ तक हवाई टिकट बुकिंग की बात है तो सभी सरकारी कर्मचारियों को LTC की सुविधा प्राप्त करने के लिए संबंधित एयरलाइन से टिकट बुकिंग करनी पड़ेगी। इसके लिए सरकारी कर्मचारी एयरलाइन के टिकट काउंटर या वेबसाइट का प्रयोग कर सकते हैं।

यदि वे किसी बुकिंग एजेंट से टिकट खरीद रहे हैं तो सरकार द्वारा अधिकृत एजेंट जैसे- M/s Balmer Lawrie & Company, M/s Ashok Travels & Tours और ‘IRCTC द्वारा ही खरीद सकते हैं।

नौकरी बदलने की स्थिति में LTC का दावा करना:

यदि कोई सरकारी कर्मचारी अपनी नौकरी बदलता है तो भी उसे LTC छूट की सुविधा उपलब्ध होगी।

यदि यह परिवर्तन चार साल के ब्लॉक के भीतर होता है और कोई unclaimed LTC है, तो नए सरकारी ऑफिस में इसका दावा किया जा सकता है।

लेकिन, यदि LTC का लाभ पुराने सरकारी ऑफिस से लिया जा चुका है, तो नए सरकारी ऑफिस द्वारा किसी भी नए LTC छूट की अनुमति नहीं दी जाएगी।

LTC Advance Rules

यदि कोई सरकारी कर्मचारी LTC Advance लेता है तो उसे एक निश्चित अवधि के अंदर टिकट बुक करना पड़ता है।

कोई सरकारी कर्मचारी अपने और/या अपने परिवार के सदस्यों के लिए LTC के तहत टिकट बुक करने के लिए यात्रा की प्रस्तावित तिथि से पैंसठ दिन पहले Advance के लिए आवेदन कर सकता है।

लेकिन जिस दिन advance की स्वीकृत राशि उसके अकाउंट में क्रेडिट होती है, उसके दस दिनों के भीतर उक्त सरकारी कर्मचारी को टिकट प्रस्तुत करने पड़ेंगे, चाहे यात्रा शुरू होने की तारीख कुछ भी हो।

LTC के लिए Air Ticket बुक करने के लिए अप्रूव्ड ट्रैवल एजेंट / Govt Approved Travel Agents for LTC

Pay Level 9 और इससे ऊपर के सरकारी कर्मचारी LTC पर Air Travel के लिए योग्य हैं। OFFICE MEMORANDUM dated 29th August, 2022 के अनुसार ये कर्मचारी सरकार द्वारा अप्रूव्ड निम्नलिखित तीन Authorized Travel Agents (ATAs) के माध्यम से ही टिकट बुक कर सकते हैं-

(a) M/s Balmer Lawrie & Company Limited (BLCL),

(b) M/s Ashok Travels & Tours (ATT),

(c) Indian Railways Catering and Tourism Corporation Ltd. (IRCTC).

यदि किसी कारणवश (unavoidable circumstances) एलिजबल सरकारी कर्मचारी किसी unauthorized travel agent/website से टिकट बुक कर लेता है तो Head of Department जो की Joint Secretary के पद से नीचे का अधिकारी ना हो, relaxation दे सकता है।

यदि उपरोक्त जानकारी ज्ञानवर्धक लगी हो तो कृपया शेयर करना ना भूलें।

Visits: 305

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Here Everything is Authentic

LTC rules | छुट्टी यात्रा रियायत (एलटीसी) के नियम

LTC rules | छुट्टी यात्रा रियायत (एलटीसी) के प्रमुख नियम – Leave Travel Concession rules

कार्मिक लोक शिकायत तथा पेंशन मंत्रालय, भारत सरकार के कार्मिक और प्रशिक्षण विभाग के कार्यालय ज्ञापन दिनांक 3 मई, 1988 के अनुसार छुट्टी यात्रा रियायत (एलटीसी) के सम्बन्ध में विस्तृत नियम जारी किये गए है, जो इस प्रकार है:

छुट्टी यात्रा रियायत (एलटीसी) हेतु पात्रता | Eligibility for LTC

स्वनगर में परिवर्तन | change of hometown, यात्रा के स्थान की घोषणा | declaration of place to visit, छुट्टी यात्रा रियायत (एलटीसी) के प्रकार | type of leave travel concession (ltc), छुट्टी यात्रा रियायत की गणना | counting of leave travel concession (ltc), छुट्टी यात्रा रियायत का अग्रनयन | carry over of leave travel concession (ltc), परिवार के सदस्यों की यात्रा का स्थान | place of visit of family members, छुट्टी यात्रा रियायत (एलटीसी) का कपटपूर्ण दावा | fraudulent claim of leave travel concession (ltc), वर्तमान एलटीसी ब्लॉक ईयर | current ltc block year | present ltc block year, अब तक के ब्लॉक वर्षों की सूची नीचे दी गयी है:, frequently asked questions | faqs.

एक सरकारी कर्मचारी केंद्र सरकार के अधीन 1 वर्ष की निरंतर सेवा पूर्ण करने के पश्चात ही छुट्टी यात्रा रियायत (एलटीसी) हेतु पात्र होगा अर्थात् सरकारी कर्मचारी अथवा उसके परिवार को छुट्टी यात्रा रियायत केवल तभी अनुमन्य होगी यदि उन्होंने, यथास्थिति, उनके द्वारा या उनके परिवार के द्वारा रियायत का उपभोग करने के लिए की गई यात्रा की तारीख को केंद्र सरकार के अधीन 1 वर्ष की निरंतर सेवा पूरी कर ली है।

एक बार घोषित और नियंत्रक अधिकारी द्वारा स्वीकृत “स्वनगर” अंतिम माना जाएगा। आपवादिक परिस्थितियों में विभागाध्यक्ष या सरकारी सेवक स्वयं विभागाध्यक्ष है तो प्रशासनिक मंत्रालय, ऐसी घोषणा में कोई परिवर्तन प्राधिकृत कर सकेगी। परंतु यह कि ऐसा कोई परिवर्तन किसी सरकारी सेवक की सेवा के दौरान एक से अधिक बार नहीं किया जाएगा।

जब सरकारी सेवक या ऐसे सरकारी सेवक के परिवार के किसी सदस्य द्वारा भारत में किसी स्थान की यात्रा के लिए छुट्टी यात्रा रियायत (एलटीसी) का उपभोग करने हेतु आवेदन किया जाता है तब सरकारी सेवक यात्रा के इच्छित स्थान की घोषणा नियंत्रक अधिकारी को यात्रा प्रारंभ करने से पहले ही करेगा। यात्रा का घोषित स्थान नियंत्रक अधिकारी के अनुमोदन से यात्रा प्रारंभ करने के पूर्व परिवर्तित किया जा सकेगा, जहाँ यह सिद्ध कर दिया जाता है कि यात्रा प्रारंभ करने से पूर्व परिवर्तित के लिए आवेदन सरकारी सेवक के नियंत्रण से बाहर की परिस्थितियों के कारण नहीं किया जा सका अन्यथा नहीं। यह शिथिलीकरण यथास्थिति, प्रशासनिक मंत्रालय/विभाग या विभागाध्यक्ष द्वारा किया जा सकता है।

(क) स्वनगर (Hometown) के लिए छुट्टी यात्रा रियायत, सरकारी सेवक के मुख्यालय और उसके स्वनगर के बीच दूरी को विचार में लाए बिना दो कैलेंडर वर्षों के किसी ब्लॉक वर्ष में जैसे 1986-87, 1988-89 और उससे आगे के लिए एक बार अनुमन्य के होगी। (ख) भारत में किसी स्थान के लिए छुट्टी यात्रा रियायत, सरकारी सेवक के मुख्यालय से यात्रा के स्थान की दूरी को विचार में लाए बिना चार कैलेंडर वर्षों के किसी ब्लॉक वर्ष में जैसे 1986-89, 1990-93 और उससे आगे के लिए एक बार अनुमन्य के होगी।

परंतु यह कि, किसी ऐसे सरकारी सेवक की दशा में जिसके लिए स्वनगर के लिए छुट्टी यात्रा रियायत अनुमन्य है, भारत में किसी स्थान के लिए उसके द्वारा उपभोग की गई छुट्टी यात्रा रियायत यात्रा के प्रारंभ के समय, उसको स्वनगर के लिए उपलब्ध छुट्टी यात्रा रियायत के बदले और उसके सापेक्ष समायोजित की जाएगी।

(ग) ऐसा कोई सरकारी सेवक, जिसका परिवार उससे दूर उसके स्वनगर में रहता है तो, इस स्कीम के अधीन सभी रियासतों के बदले, जिसके अंतर्गत 4 वर्षों के किसी ब्लॉक के लिए एक बार भारत में किसी स्थान की यात्रा के लिए छुट्टी यात्रा रियायत भी है, जो उसको और उसके परिवार के सदस्यों को अन्यथा अनुमन्य होती, केवल अपने लिए प्रत्येक वर्ष का चयन कर सकेगा।

छुट्टी यात्रा रियायत का उपभोग करने वाला कोई सरकारी सेवक और उसके परिवार के सदस्य, यथास्थिति, 2 वर्षों या 4 वर्षों के किसी ब्लॉक के दौरान विभिन्न अवधियों में यात्रा कर सकेंगे। इस प्रकार उपभोग की गयी रियायत की गणना 2 वर्षों या 4 वर्षों के उस ब्लॉक वर्ष के सापेक्ष की जाएगी जिसके भीतर बाहर जाने की यात्रा प्रारंभ हुई, चाहे वापसी यात्रा उस 2 वर्ष या 4 वर्ष के ब्लॉक की समाप्ति पर की गई हो। यह नियम 10 के निबंधनों के अनुसार अग्रनित (carry over) छुट्टी यात्रा रियायत का उपयोग करने के लिए लागू होगा।

कोई ऐसा सरकारी सेवक जो 2 वर्षों या 4 वर्षों के किसी विशिष्ट ब्लॉक में छुट्टी यात्रा रियायत का उपभोग करने में असमर्थ रहता है, वह उसका उपभोग 2 वर्षों या 4 वर्षों के अगले ब्लॉक के प्रथम वर्ष के भीतर कर सकेगा। यदि कोई सरकारी सेवक स्वनगर के लिए छुट्टी यात्रा रियायत का हकदार है तो, वह भारत में किसी स्थान के लिए छुट्टी यात्रा रियायत को 4 वर्षों के ब्लॉक के लिए केवल तभी अग्रनित (carry over) कर सकेगा यदि उसने 4 वर्षों के ब्लॉक के भीतर 2 वर्षों के दूसरे ब्लॉक की बाबत स्वनगर के लिए छुट्टी यात्रा रियायत को अग्रनित कर दिया है।

भारत में किसी स्थान के लिए छुट्टी यात्रा रियायत के अधीन सरकारी सेवक और उसके परिवार के सदस्यों द्वारा यात्रा किए जाने वाले स्थान के संबंध में भी नियम वर्णित है। कोई सरकारी सेवक और उसके परिवार का प्रत्येक सदस्य 4 वर्षों के ब्लॉक के दौरान अपनी पसंद के स्थानों की यात्रा कर सकेगा। सरकारी सेवक के परिवार के सदस्यों के लिए यह आवश्यक नहीं है कि, वे उसी स्थान की यात्रा करें जिसकी यात्रा स्वयं सरकारी सेवक द्वारा उसी ब्लॉक वर्ष के दौरान पहले किसी समय की गई है।

(i) यदि अनुशासनिक प्राधिकारी द्वारा छुट्टी यात्रा रियायत का कपटपूर्ण दावा करने के आरोप पर किसी सरकारी सेवक के विरुद्ध अनुशासनिक कार्रवाई आरंभ करने का विनिश्चय किया जाता है तो ऐसे सरकारी सेवक की छुट्टी यात्रा रियायत तब तक अनुमन्य नहीं की जाएगी जब तक ऐसी अनुशासनिक कार्यवाही को अंतिम रूप नहीं दे दिया जाता है।

(ii) यदि अनुशासनिक कार्यवाही का परिणाम केंद्रीय सिविल सेवा (वर्गीकरण नियंत्रण और अपील) नियम, 1965 के नियम II में विनिर्दिष्ट शक्तिओं में से कोई भी अधिरोपित करती है, तो सरकारी सेवक को अनुशासनिक कार्यवाही के लंबित रहने के दौरान पहले से ही विधारित सेटों (संवर्गों) के अतिरिक्त छुट्टी यात्रा रियायत के दो आगामी संवर्ग स्वीकृत नहीं किए जाएंगे। कारणों को लेख बंद करके नियंत्रित प्राधिकारी छुट्टी यात्रा रियायत के दो से अधिक सेटों (संवर्गों) को भी अस्वीकृत कर सकता है।

(iii) यदि सरकारी सेवक को छुट्टी यात्रा रियायत के कपटपूर्ण दावे के आरोप से पूर्णतया विमुक्त किया जाता है तो उसे भावी ब्लॉक वर्षों में अतिरिक्त संवर्ग (संवर्गों) के रूप में पहले से विधारित रियायत का उपभोग करने के लिए अनुमन्य किया जाएगा, किंतु ऐसा उसकी अधिवर्षिता की सामान्य तारीख के पूर्व किया जाएगा।

स्पष्टीकरण:- इस नियम के प्रयोजन के लिए नियम 8 के खंड (क) और खंड (ख) में यथा विनिर्दिष्ट स्वनगर के लिए छुट्टी यात्रा रियायत और भारत में किसी स्थान के लिए छुट्टी यात्रा रियायत के 2 संवर्ग गठित करेगी।

वर्तमान में छुट्टी यात्रा रियायत (एलटीसी) का 4 वर्षों का ब्लॉक वर्ष 2022-25 गतिमान है जिसके प्रथम 2 वर्ष के ब्लॉक वर्ष 2022-23 की यात्रा का प्रारंभ/उपभोग वर्ष 2022 एवं 2023 में किया जा सकता है तथा ब्लॉक वर्ष 2022-23 का विस्तारित (grace period or extended period) की यात्रा का प्रारंभ/उपभोग वर्ष 2024 के अंत तक किया जा सकता है। इसी प्रकार शेष 2 वर्ष के ब्लॉक वर्ष 2024-25 की यात्रा का प्रारंभ/उपभोग वर्ष 2024 एवं 2025 में किया जा सकता है तथा ब्लॉक वर्ष 2024-25 का विस्तारित (grace period or extended period) की यात्रा का प्रारंभ/उपभोग वर्ष 2026 के अंत तक किया जा सकता है।

सम्पूर्ण जानकारी के लिए आप नीचे दिए गए लिंक से उक्त नियम की प्रति प्राप्त कर सकते हैं।

Click here to Generate the Link

Ltc full form | full for of ltc.

LTC full form is Leave Travel Concession. LTC को हिन्दी में छुट्टी यात्रा रियायत भी कहा जाता है।

Hometown LTC meaning in hindi

“स्वनगर” अथवा “गृहनगर” से तात्पर्य ऐसा नगर, ग्राम या कोई अन्य स्थान जिसे सरकारी सेवक द्वारा इस रूप में घोषित किया गया है और नियंत्रण अधिकारी द्वारा स्वीकार किया गया है।

All India LTC meaning in hindi

“भारत में किसी भी स्थान” से तात्पर्य भारत के राज्य क्षेत्र के भीतर स्थित कोई स्थान है, चाहे वह मुख्य भूमि पर या समुद्र पार स्थित है।

Share this:

3 thoughts on “ltc rules | छुट्टी यात्रा रियायत (एलटीसी) के नियम”.

Pingback: हिंदी में केंद्र सरकार के कर्मचारियों के लिए एलटीसी नियम | LTC rules for central government employees in hindi » Authentic Informer

sir kya casual leave pe all india ltc jaya ja sakta hai?

Ha ji. Casual leave par All India LTC jaya ja sakta hai.

Leave a Reply Cancel reply

Subscribe free for rules, orders and guidelines.

Voice speed

Text translation, source text, translation results, document translation, drag and drop.

Website translation

Enter a URL

Image translation

Filing taxes, now a pleasure.

AI Summary to Minimize your effort

Leave Travel Allowance (LTA) - Exemption Limit, Rules, How to Claim, Eligibility & Latest Updates

Updated on : Mar 22nd, 2024

The Income-tax Act, 1961 offers salaried individuals several tax exemptions, beyond deductions like LIC premiums and housing loan interest. While deductions reduce your total taxable income, exemptions exclude specific types of income from being taxed altogether. This allows employers to design an employee's Cost to Company (CTC) package in a tax-efficient manner.

One such exemption available to the salaried class under the law and widely used by employers is Leave Travel Allowance (LTA)/Leave Travel Concession (LTC). LTA exemption is also available for LTA received from former employer w.r.t travel after the retirement of service or termination of service. LTA can be claimed for any two years in a block of 4 years . The current block year for claiming LTA is 2022 to 2025.

Note: The tax exemption of leave travel allowance is not available in case you choose the new tax regime .

What is Leave Travel Allowance (LTA)?

Leave Travel Allowance/Leave Travel Concession is a type of allowance given by an employer to their employee for travelling to any place in India: either on leave, after retirement or after the termination of his service. Though it sounds simple, many factors need to be kept in mind before you plan to claim an LTA exemption. Income tax provision has laid down rules for claiming exemption of LTA which are provided below.

Note: The red arrow shows the lower of the two amounts will be exempted. For instance, if you travel by air, the exemption amount will be either your actual travel costs or the cost of an economy class ticket, whichever is lower. The journey should be taken through the shortest route to the destination.

Who Can Claim LTA?

Only individuals can claim LTA for travel costs incurred for themselves and their family (Spouse, children, wholly or mainly dependent siblings, parents)

Conditions for Claiming LTA

Let us understand the conditions/requirements for claiming the exemption:

- Individual must be an employee and should have an LTA component in CTC.

- Actual journey is a must to claim the exemption

- Only domestic travel is considered for exemption, i.e., travel within India. No international travel is covered under LTA/LTC

- The exemption for travel is available for the employee alone or with his family, where ‘family’ includes the employee’s spouse, children and wholly or mainly dependent parents, brothers, and sisters of the employee.

- Further, such an exemption is not available for more than two children of an employee born after 1 October 1998. Children born before 1 October 1998 do not have any restrictions. Further, in cases of multiple births on a second occasion after having one child is also not affected by this restriction.

Amount of LTA/LTC Exemption

The exemption is available only on the actual travel costs i.e., the air, rail or bus fare incurred by the employee. No expenses such as local conveyance, sightseeing, hotel accommodation, food, etc., are eligible for this exemption. The exemption is also limited to LTA provided by the employer.

For example, if LTA granted by the employer is Rs 30,000, and the actual travel cost incurred by the employee is Rs 20,000, then only Rs 20,000 will be available as an exemption and the balance of Rs 10,000 would be included in taxable salary income.

Exemption w.r.t Various Modes of Transport

Can lta exemption be claimed on every vacation.

No, an LTA exemption is available for only two journeys performed in a block of four calendar years .

A block year is different from a financial year and is decided by the Government for LTA exemption purposes. It comprises 4 years each. The very first 4-year block commenced in 1986. The list of block years is 1986-1989, 1990-93, 1994-97, 1998-2001, 2002-05, 2006-09, 2010-13 and so on. The block applicable for the current period is 2022-25. The previous block was the calendar year 2018-21.

Carryover of Unclaimed LTA/LTC

In case an employee has not availed exemption with respect to one or two journeys in any of the block of 4 years, he is allowed to carryover such exemption to the next block provided he avails this benefit, in the first calendar year of the immediately succeeding block.

Consider the below example for a better understanding:

• Where carry over exemption is claimed in the first calendar year of the immediately succeeding block

• Where carry over exemption is not claimed in the first calendar year of the immediately succeeding block

Procedure to Claim LTA

The procedure to claim LTA is generally employer specific. Every employer announces the due date within which LTA can be claimed by the employees and may require employees to submit proof of travel such as tickets, boarding pass, invoice provided by travel agent etc., along with the mandatory declaration. Though it is not mandatory for employers to collect proof of travel, it is always advisable for employees to keep copies for his/her records and also to submit them to the employer based on the LTA policy of the company to tax authorities on demand.

Multi-Destination Journey

Income tax provision provides exemption w.r.t travel cost incurred on leave to any place in India. Conditions pertaining to the mode of transport also refer to the place of ‘origin’ to the place of ‘destination’ and the route which must be the shortest available route.

Hence, if an employee travels to different places in a single vacation, the exemption can only be availed for the travel cost eligible from the place of origin to the farthest place in the vacation by the shortest possible route.

LTA Exemption for Vacation on Holidays

Many organisations that go strictly by the wordings of the income tax provision are allowing employees to claim LTA only if the employee applies for leaves and travel during that time. Such organisations may reject LTA claims for travel on official holidays or weekends.

You Might be Interested in

UAN Login Aadhar PAN Link Last Date to File ITR Section 115BAC of Income Tax Act Income Tax Deductions List How to e verify ITR Annual Information Statement (AIS) Section 80D Home Loan Tax Benefit Budget 2023 Highlights House Rent Allowance (HRA)

Frequently Asked Questions

The amount of LTA/LTC exemption depends on the LTA/LTC component in your compensation package or CTC. You can furnish proof of travel within the block period and claim up to the amount prescribed in your CTC.

The latest block period of four years is from 1 January 2022 until 31 December 2025.

You can claim LTA/LTC exemption only for one trip in one calendar year.

You can claim LTA/LTC benefit for the travel costs of yourself and your family consisting of your spouse, children, dependent parents, brothers, and sisters of the employee.

No, LTC is taxable in case of new tax regime and exempted if chosen to pay tax under old tax regime by fulfilling the required criteria.

Exemption will be available in respect of 2 journeys performed in a block of 4 calendar years.

Yes, you can avail LTC in current block (2022-2025), if you have not availed LTC in previous block. (2018-2021). Where such travel concession or assistance is not availed by the individual during any block of 4 calendar years, one such un-availed LTC will be carried forward to the immediately succeeding block of 4 calendar years and will be eligible for exemption.

Below example gives you clear understanding :

Example : An employee does not avail any LTC for the block 2018-21. He is allowed to carry forward maximum one un-availed LTC to be used in the succeeding block of 2022-25. Accordingly, if he avails LTC in April, 2023, the same will be treated as having availed in respect of the block 2018-2021. Therefore, he will be eligible for exemption in respect of that journey and two more journeys can be further availed in respect of the block of 2022-25.

Illustration : Mr. D went on a holiday on 25.12.2023 to Delhi with his wife and three children (one son – age 5 years; twin daughters – age 3 years). They went by flight (economy class) and the total cost of tickets reimbursed by his employer was 60,000 (45,000 for adults and 15,000 for the three minor children). Compute the amount of LTC exempt if Mr. D chose to pay taxes under old regime.

Solution : Since the son’s age is more than the twin daughters, Mr. D can avail exemption for all his three children. The restriction of two children is not applicable to multiple births after one child. The holiday being in India and the journey being performed by air (economy class), the entire reimbursement met by the employer is fully exempt in the hands of Mr. D, since he chose to pay taxes under the old regime.

In the above illustration, will there be any difference if among his three children the twins were 5 years old and the son 3 years old?

Since the twins’ age is more than the son, Mr. D cannot avail for exemption for all his three children. LTC exemption can be availed in respect of only two children.

Taxable LTC = 15,000 × 1/3 = 5,000.

LTC exempt would be only 55,000 (i.e. 60,000 – 5,000).

About the Author

Ektha Surana

Multitasking between pouring myself coffees and poring over the ever-changing tax laws. Here, I've authored 100+ blogs on income tax and simplified complex income tax topics like the intimidating crypto tax rules, old vs new tax regime debate, changes in debt funds taxation, budget analysis and more. Some combinations I like- tax and content, finance & startups, technology & psychology, fitness & neuroscience. Read more

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

- Real Estate

Form GAR-14C Leave Travel Concession Bill - India (English / Hindi)

- Indian Department of Personnel and Training

- Form GAR-14C Leave Travel Concession Bill - India (English/Hindi)

The Form GAR-14C is a Leave Travel Concession (LTC) bill used in India. It is used by employees to claim reimbursement for their expenses incurred during a leave travel concession. An LTC allows employees to take a vacation with their families and claim the travel expenses as exempt from income tax . The form is available in both English and Hindi languages to accommodate different language preferences . It helps employees in India to avail of the benefits of the LTC scheme and receive the necessary reimbursements.

The Form GAR-14C Leave Travel Concession Bill in India can be filed by the government employees who are eligible for leave travel concession. The form is usually available in both English and Hindi, ensuring that employees can fill it out in their preferred language.

Q: What is GAR-14C Leave Travel Concession Bill?A: The GAR-14C Leave Travel Concession (LTC) Bill is a form that is used in India to claim reimbursements for travel expenses incurred during official leave. It can be filled in either English or Hindi.

Q: Who is eligible to submit the GAR-14C LTC Bill?A: Employees of the Indian government or public sector organizations who are entitled to leave travel concessions can submit the GAR-14C LTC Bill to claim reimbursements for their travel expenses.

Q: In which languages can the GAR-14C LTC Bill be filled?A: The GAR-14C LTC Bill can be filled in either English or Hindi, depending on the preference of the employee.

Q: What is the purpose of filing the GAR-14C LTC Bill?A: The purpose of filing the GAR-14C LTC Bill is to claim reimbursements for travel expenses incurred during official leave. It allows eligible employees to receive financial assistance for their travel costs .

Q: What are the documents required to submit along with the GAR-14C LTC Bill?A: The documents required to be submitted along with the GAR-14C LTC Bill may vary based on the rules and regulations of the specific employer or organization. However, typically, proof of travel expenses like tickets, boarding passes, and accommodation bills are required.

Q: How long does it take to process the reimbursement claim for the GAR-14C LTC Bill?A: The processing time for the reimbursement claim of the GAR-14C LTC Bill can vary depending on the government or organizational procedures. It may take several weeks or even months to receive the reimbursement.

Q: Can I claim reimbursement for travel expenses incurred during personal leave?A: No, the GAR-14C LTC Bill is specifically meant for claiming reimbursements for travel expenses incurred during official leave. Travel expenses incurred during personal leave are not eligible for reimbursement through this form.

Q: Are there any restrictions on the destinations for which I can claim reimbursement using the GAR-14C LTC Bill?A: Yes, there may be restrictions on the destinations for which you can claim reimbursement using the GAR-14C LTC Bill. It is important to refer to the rules and guidelines provided by your employer or organization to determine the eligible destinations for reimbursement.

Q: How much reimbursement can I claim using the GAR-14C LTC Bill?A: The amount of reimbursement that can be claimed using the GAR-14C LTC Bill varies based on the rules and guidelines of the specific employer or organization. It is important to refer to the applicable policies to determine the maximum limit of reimbursement.

Download Form GAR-14C Leave Travel Concession Bill - India (English / Hindi)

Linked topics.

Related Documents

- Form 13 Application for Leave - Kerala, India

- Forme 1 (YG5033) Demande De Concession - Yukon, Canada (French)

- Form 34.2 Victim Impact Statement - British Columbia, Canada (Hindi)

- Form 34.1 Statement on Restitution - British Columbia, Canada (Hindi)

- Form DL-14C Application for Texas Election Identification Certificate - Texas

- Form DL-14CS Solicitud De Certificado De Identificacion Electoral De Texas - Texas

- Form FDACS-10213 Seller of Travel Claim Affidavit - Florida (English/Spanish)

- Form NWT9127 Nwt Medical Travel Program Appeal Request Form - Northwest Territories, Canada (English/French)

- Form ID678 Authorisation for Collection of Identity Card / Travel Document - Hong Kong (English/Chinese)

- Form CPT169 Certificate of Coverage Under the Canada Pension Plan Pursuant to Article 6 Paragraph 2 and Articles 7 and 10 of the Agreement on Social Security Between Canada and the Republic of India - Canada (English/Hindi/French)

- Form AOC-CR-215 Notice of Return of Bill of Indictment - North Carolina (English/Vietnamese)

- Form G-14C Joint Exhibit Tag - California

- Form SR-LD-064 Ontario Enhanced Driver's Licence (Edl) Entitlement to Travel Questionnaire - Ontario, Canada (English/French)

- Form F242-079-242 Application to Reopen Claim Due to Worsening of Condition - Washington (English/Hindi)

- DOH Form 348-013 Certificate of Immunization Status (Cis) - Washington (English/Hindi)

- DOH Form 348-106 Certificate of Exemption - Personal/Religious - Washington (English/Hindi)

- Form LIC119 Affidavit of No Social Security Number - Massachusetts (English/Hindi)

- Form DSS-NEMT-952.1 Payment Authorization Form - Non-emergency Medical Travel (Nemt) - South Dakota (English/Spanish)

- Convert Word to PDF

- Convert Excel to PDF

- Convert PNG to PDF

- Convert GIF to PDF

- Convert TIFF to PDF

- Convert PowerPoint to PDF

- Convert JPG to PDF

- Convert PDF to JPG

- Convert PDF to PNG

- Convert PDF to GIF

- Convert PDF to TIFF

- Compress PDF

- Rearrange PDF Pages

- Make PDF Searchable

- Privacy Policy

- Terms Of Service

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

- Submit Post

- Union Budget 2024

Leave Travel Concession/Allowance (LTC/LTA)

Leave Travel Concession (LTC) is a type of benefit provided to employees by their employers to travel within the country during their leave period. The objective of this benefit is to encourage employees to take a break from work and explore new places while spending quality time with their family. The LTA/LTC scheme was introduced in the year 1986 by the Government of India to help employees working in government or public sector undertakings to travel and enjoy their time off. The scheme has since been extended to employees of private companies as well. Under the scheme, an employee can claim reimbursement for the travel expenses incurred during the leave period. The reimbursement is subject to certain conditions and restrictions, such as the distance of travel, the mode of transport used, the number of family members traveling, etc. The employee is required to submit the travel bills and other supporting documents to the employer to claim the reimbursement.

What is Leave Travel Allowance?

Leave Travel Concession (LTC) is a benefit provided by employers to their employees to travel within the country during their leave period. The objective of this benefit is to encourage employees to take a break from work and explore new places while spending quality time with their family.

Section 10(5) of the Income Tax Act, 1961 with Rule 2B ensures the exemption of tax and also details the conditions subject to tax exemption. Income tax provision has laid down rules for claiming exemption of LTC/LTA which are provided below.

Conditions for Claiming LTC/LTA

Let us understand the conditions/requirements for claiming the exemption.

- Actual journey is a must to claim the exemption

- Only domestic travel is considered for exemption, i.e., travel within India. No international travel is covered under LTC/LTA

- The exemption for travel is available for the employee alone or with his family, where ‘family’ includes the employee’s spouse, children and wholly or mainly dependent parents, brothers, and sisters of the employee.

- Further, such an exemption is not available for more than two children of an employee born after 1 October 1998. Children born before 1 October 1998 do not have any restrictions. Further, in cases of multiple births on a second occasion after having one child is also not affected by this restriction.

Eligible LTC/LTA Exemption

The exemption is available only on the actual travel costs i.e., the air, rail or bus fare incurred by the employee. No expenses such as local conveyance, sightseeing, hotel accommodation, food, etc., are eligible for this exemption. The exemption is also limited to LTC/LTA provided by the employer.

For example, if LTA granted by the employer is Rs 30,000, and the actual eligible travel cost incurred by the employee is Rs 20,000, the exemption is available only to the extent of Rs 20,000, and the balance of Rs 10,000 would be included in taxable salary income.

Exemption w.r.t various modes of transport

Procedure to Claim LTC/LTA

The procedure to claim LTA is generally employer specific. Every employer announces the due date within which LTA can be claimed by the employees and may require employees to submit proof of travel such as tickets, boarding pass, invoice provided by travel agent etc., along with the mandatory declaration. Though it is not mandatory for employers to collect proof of travel, it is always advisable for employees to keep copies for his/her records and also to submit them to the employer based on the LTA policy of the company/to tax authorities on demand.

Frequently Asked Questions

Who is eligible for LTA?

LTA/LTC is usually available to employees of government or public sector undertakings, as well as employees of private companies who have been granted this benefit by their employers.

What exactly does Leave Travel Allowance cover?

Leave Travel Allowance covers only the travel expense incurred during the travel.

Can LTA exemption be claimed for Vacation on Holidays?

Many organisations that go strictly by the wordings of the income tax provision are allowing employees to claim LTA only if the employee applies for leaves and travel during that time. Such organisations may reject LTA claims for travel on official holidays or weekends.

How often can an employee claim LTA?

An employee can claim LTA/LTC twice in a block of four years. The current block of years is from 2022 to 2025.

What is the minimum trip duration under LTA/LTC?

According to Rule 8 of the Central Civil Services (Leave Travel Concession) Rules, 1988, an employee must undertake a journey of a minimum of three days to be eligible for the LTA/LTC benefit. The rule further states that the journey should be undertaken to a place that is different from the place of work and the employee’s residence. This rule applies to employees of the Central Government and is also followed by many State Governments and Public Sector Undertakings.

It is important to note that the LTA/LTC rules may vary for employees of private companies and other organizations. Employers may have their own guidelines and policies regarding the LTA/LTC scheme. Employees should check with their employer to understand the specific rules and conditions applicable to them.

How can an employee claim LTA/LTC?

To claim LTA/LTC, an employee must inform their employer about their proposed travel plans and apply for leave. The employee must then submit the travel bills and other supporting documents to the employer within a stipulated time frame. The employer verifies the documents and reimburses the employee for the eligible expenses.

What happens if an employee does not utilize the LTA/LTC benefit?

If an employee does not utilize the LTA/LTC benefit during the block of years, they can carry it forward to the next block of years. However, the employee must utilize the LTA/LTC benefit within the first year of the next block of years. If the benefit is not utilized within the stipulated time frame, it will lapse.

Can LTA/LTC be availed for international travel?

No, LTA/LTC can only be availed for domestic travel within India.

Can an employee claim LTA/LTC for travel to their hometown?

Yes, an employee can claim LTA/LTC for travel to their hometown, provided that the hometown is located at a distance from the place of work and the employee’s residence.

Can an employee claim LTA/LTC for travel during their probation period?

Generally, employees who are on probation are not eligible for LTA/LTC. However, some employers may have their own policies on this and may allow employees on probation to claim LTA/LTC.

Can an employee claim LTA/LTC for travel by a private car?

Yes, an employee can claim LTA/LTC for travel by a private car, subject to certain conditions. The reimbursement amount is usually limited to the amount that would have been paid if the employee had travelled by public transport.

Can an employee avail of LTA/LTC for travel during the notice period?

An employee can avail of LTA/LTC during the notice period, provided that they have already applied for and obtained leave for the travel period before the notice period begins.

Can an employee claim LTA/LTC for travel to attend a family function?

No, an employee cannot claim LTA/LTC for travel to attend a family function, such as a wedding or a funeral. LTA/LTC can only be availed for travel during the employee’s leave period for the purpose of leisure travel.

Can an employee carry forward unutilized LTA/LTC to the next block of years?

Yes, an employee can carry forward unutilized LTA/LTC to the next block of years, but they must utilize it within the first year of the next block of years.

Can an employee claim LTA/LTC for travel to a foreign country if they travel by land or sea from India?

No, an employee cannot claim LTA/LTC for travel to a foreign country even if they travel by land or sea from India. LTA/LTC is only applicable for travel within India.

Can an employee claim LTA/LTC for travel during a period of leave without pay?

No, an employee cannot claim LTA/LTC for travel during a period of leave without pay. LTA/LTC can only be availed during the employee’s leave period.

Is there a limit on the amount that can be claimed under LTA/LTC?

Yes, there is a limit on the amount that can be claimed under LTA/LTC. The reimbursement amount is usually limited to the actual expenses incurred by the employee, subject to certain conditions and restrictions.

Can an employee claim LTA/LTC for travel expenses incurred for their dependents?

Yes, an employee can claim LTA/LTC for travel expenses incurred for their dependents, such as their spouse, children, and parents. However, there may be restrictions on the number of dependents who can travel.

Can an employee claim LTA/LTC for travel to multiple destinations?

Yes, an employee can claim LTA/LTC for travel to multiple destinations, provided that the total cost of travel does not exceed the eligible amount.

Can an employee claim LTA/LTC for travel to attend a business conference or seminar?

No, an employee cannot claim LTA/LTC for travel to attend a business conference or seminar. LTA/LTC can only be availed for leisure travel during the employee’s leave period.

Can an employee claim LTA/LTC for travel by a rented vehicle?

Yes, an employee can claim LTA/LTC for travel by a rented vehicle, subject to certain conditions. The reimbursement amount is usually limited to the actual rental charges paid by the employee.

Can an employee claim LTA/LTC for travel if they are on medical leave?

No, an employee cannot claim LTA/LTC for travel if they are on medical leave. LTA/LTC can only be availed during the employee’s leave period for leisure travel.

Can an employee claim LTA/LTC for travel during the first year of their employment?

Generally, employees who are in their first year of employment are not eligible for LTA/LTC. However, some employers may have their own policies on this and may allow employees in their first year of employment to claim LTA/LTC.

Can an employee claim LTA/LTC for travel if they have resigned from their job?

An employee can claim LTA/LTC if they have resigned from their job, provided that they have already obtained leave for the travel period before their resignation. The reimbursement amount will be subject to certain conditions and restrictions.

Disclaimer: This document is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party. The views expressed in this write-up are matters based on our understanding of the law and regulations prevailing as at the date of this write-up and our past experience with the tax, regulatory and other authorities as may be applicable. However, there can be no assurance that the tax authorities or regulators will not take a position contrary to our views.

- salary income

- « Previous Article

- Next Article »

Name: Keshaba Palo

Qualification: ca in practice, company: palo & co, location: mumbai, maharashtra, india, member since: 06 feb 2020 | total posts: 2, my published posts, join taxguru’s network for latest updates on income tax, gst, company law, corporate laws and other related subjects..

- Join Our whatsApp Channel

- Join Our Telegram Group

Sir, we are given to understand that the journey should be performed by State run public transport wherever available. But your article says that the journey can be performed by private taxi. Can you please clarify this sir? We find it difficult to convince our employees when our top management says one thing and articles like this say something else.

Can wrongly mentioned BLOCK YEAR be rectified

The time limit to generate e-invoice on IRP for all tax invoices issued is within seven days it is applicable on May 1st. What If my invoice Date is on April 30th I should generate an e-invoice on IRP within 7 days?

Leave a Comment

Your email address will not be published. Required fields are marked *

Post Comment

Notice: It seems you have Javascript disabled in your Browser. In order to submit a comment to this post, please write this code along with your comment: 46263f1fd22d2842b6bcd9b4aec58d3b

Subscribe to Our Daily Newsletter

Latest posts.

Live Course on Section 43B(h) by CA Manoj Lamba

Live Course on How to Reply to GST Notices & SCN & to Fake ITC Notices?

Fourth Head of Income under Income Tax Act, 1961: Capital Gains

Income Tax Implications of Converting Partnership/Proprietorship to Pvt. Ltd

Enhancement of gratuity on account of Dearness Allowance rising by 50%

Direct Listing Of Share Of Indian Companies Overseas Through IFSC GIFT City

Debit Notes and Eligibility of Input Tax Credit of it in GST

Sovereign Gold Bond: A lucrative investment option

Inclusion of Allowances & imposition of upper caps by regulations in Gratuity

No record of service of notice or order: Bombay HC set aside GST Refund rejection order

No section 68 addition for Share Capital Subscription if assessee submits evidence for source of funds

No Section 54 Deduction Without basic Amenities: ITAT Delhi

Popular posts.

Due Date Compliance Calendar March 2024

Corporate Compliance Calendar for February, 2024

Statutory and Tax Compliance Calendar for April 2024

Managing Director and Whole Time Director in a Private Limited Company

GST Implications on Hotels & Restaurant Industry

Empanelment for Concurrent Audit with Union Bank of India

Empanelment -Central Bank of India -Concurrent Audit

Payment to MSMEs in 45/15 Days: Section 43B(h) Explained

Bank of Baroda invites EOI for Concurrent Auditors Appointment

Excel Formulas & Shortcuts: Bank Reconciliation, EMI Calculation, Pivot Tables

Leave Travel Concession Rules: 7th CPC LTC Rules for Govt Employees

Leave Travel Concession Rules : Leave Travel Concession is such a travel facility available to government employees, under which reimbursement of expenses incurred in traveling to their hometown or any part of the country is done by them.

LTC full form – Leave Travel Concession

The central government provides various allowances to its employees for financial compensation and Leave Travel Concession is one of those important allowances. It allows them to travel with their family to their hometown or any other destination within India, at the expense of the government.

Some of these allowances are part of the salary of the employees such as Dearness Allowance, Home Rent Allowance, Transport Allowance etc.

On the other hand, some allowances are reimbursed to the government employees after submitting claims by them. Like- Traveling Allowance , DA (Daily Allowance) etc.

One of these allowances is Leave Travel Concession, which is not a part of salary and for which the government employee has to claim for reimbursement and as per the the Leave Travel Concession Rules (LTC rules) the eligible claimed amount is reimbursed to government employee.

The Leave Travel Concession Rules can be complex and confusing, making it important for government employees to have a clear understanding of them.

In this blog, we are going to explain important Leave Travel Concession Rules for Government Employees, including eligibility, entitlements, and conditions for availing this benefit.

So let’s know what are the Leave Travel Concession Rules for Government Employees ?

Table of Contents

7th Pay Commission Leave Travel Concession Rules for Government Employees?

Before discussing the key aspects of Leave Travel Concession Rules, let’s first define what Leave Travel Concession is.

What is Leave Travel Concession?

We can define it in such a way that the facility or concession provided by government to its employees for any journey performed by them during leave or holiday, is called Leave Travel Concession.

It is clear that in order to avail this facility, the Government servant has to apply for leave. When the leave of that employee is approved by the competent authority then he can start the journey.

To avail the facility of Leave Travel Concession, the employee must keep two things in mind during the journey.

First, if that employee travels to Hometown, then he will have to provide proof of travel from his Headquarters to Hometown. Similarly, if he travels with his family to any part of the country, he will have to provide proof of travel to that destination.

If only the family of the employee performs the journey, then he cannot claim for reimbursement of LTC.

The second important thing is that LTC can be claimed only for reimbursement of expenses incurred on travel by rail, road, air, etc. during the journey. Other expenses like hotel, food, sightseeing, taxi and auto fares and other such expenses cannot be claimed for reimbursement.

Types of Leave Travel Concession

As per LTC rules for central government employees, there are two types of Leave Travel Concession facilities available to an employee.

One is Hometown LTC and second is All India LTC

Home Town LTC Rules

The Home Town LTC rules allow central government employees to travel to their home town ( himself or with his family.

All government employees can avail this twice in every block of four years and can travel with family to their hometown.

Here Hometown means the record of which has been officially entered in the service book of the said employee and got it verified by the competent authority.

While making a claim for Leave Travel Concession, the information given by the employee has to be certified by a superior officer from the Service Book of that employee.

All India LTC Rules

All India LTC Rules allow government employees to travel himself or with his entire family to any part of the country and can avail the facility of All India LTC.

All India LTC facility is provided to a central government employee once in four years block.

New employee recruited in central government jobs is allowed to travel to his hometown himself or with his family for three years in a block of four years and All India LTC for the fourth year.

The facility of Hometown LTC and All India LTC will be available to these newly recruited central government employees only for the first two blocks of four years applicable after joining the job for the first time.

LTC Block Year

The LTC block year that have been made by the Government of India for its employees to claim the Leave Travel Concession. A block year consists of four years. The current block is 2018-19 (extended upto 31.2.2022)

For every four-years block year, a one year grace period is given by government to its employees.

For example, if an employee did not avail LTC for the block year 2018-21 then he will get one year grace period i.e. for 2022.

Conditions for availing Leave Travel Concession

To avail the facility of Leave Travel Concession, it is necessary to fulfill the following conditions by the Central Government employees-

- Travel during leave must be within India only. That is, a Government servant can claim Leave Travel Concession only for travel within India and not for travel outside India.

- To avail the facility of Leave Travel Concession, it is necessary that at least one year of service of the concerned employee has been completed without any service break.