Welcome to all NARPO members

CSIS is proud to offer Worldwide Annual Travel Insurance designed specifically for NARPO Members. NARPO Travel Insurance provides true peace of mind to the frequent traveller.

Worldwide Annual Travel Insurance

Designed specifically for NARPO Members, this annual travel insurance plan offers full worldwide cover for any single trip lasting up to 65 days (45 for Caribbean, USA or Canada). NARPO Travel Insurance provides true peace of mind to the frequent traveller.

To take advantage of this new arrangement, you must be a UK resident and a NARPO member aged between 50 and 74 at the time of joining (thereafter no upper age limit will apply). You must both be medically fit to travel and be able to comply with the Eligibility statement as defined in the policy.

ELIGIBILITY

You must be medically fit to travel at the time of taking out this insurance, booking your trip, paying any further balance or instalments towards the final cost of the trip, up to the date of departure of the trip in order to be eligible for cover under this insurance. This means any and all existing medical conditions you have must be stable and controlled by any treatment you are receiving and/or medication you have been prescribed, and there must be no known likelihood of any medical tests, investigations or major variation of treatment or medication for the condition(s) at the time of taking out this insurance, when booking your trip, when paying any further balance or instalments towards the final cost of the trip up to the date of departure, or whilst travelling. Cover is not suitable if you have been given a terminal prognosis, which is a life expectancy of below one year at the start date of the journey.

You will not be eligible for this policy if any insured member suffers from a chronic breathing condition. A chronic breathing condition is any of the following:

- Severe Allergic Asthma, Asthma with fixed airflow obstruction, Night time (Nocturnal) Asthma

- Obstructive Sleep Apnoea

- Chronic Obstructive Pulmonary Disease (COPD)

- Chronic Bronchitis

- Cystic Fibrosis/Bronchiectasis

- Lung Cancer

- Lung Hernia

- Pleural Effusion

Please check the eligibility tab above to ensure you are eligible for this Travel Insurance Cover before getting a quote.

GET A QUOTE

If you are not eligible for this specific travel insurance cover you can try obtaining a quote with our other insurance provder: Get a Quote Here

Quote and buy online or call us on 01622 766960

Features and benefits.

NARPO members are provided with full worldwide cover for any single trip lasting up to 65 days (45 for Caribbean, USA or Canada). NARPO Travel Insurance provides true peace of mind to the frequent traveller.

- Full Worldwide Cover

- No Medical Screening requirement*

- 24 Hour Emergency Support

- Competitive Prices / Low Policy Excess

*Eligibility: You must be an NARPO Member and an age limit of 74 years applies at the time of joining (once joined no upper age limit applies). Subject to terms and conditions.

NARPO Travel Insurance is a trading name of P J Hayman & Company Limited, authorised and regulated by the Financial Conduct Authority.

The Civil Service Insurance Society (CSIS) administer a number of travel arrangements for P J Hayman, providing insurance to various civil and public service welfare organisations. For over 100 years, the CSIS has maintained a ‘Not for Profit’ status and donates all the remaining annual surplus to charities within the Civil and Public Service.

If we can't offer you the travel insurance cover you want, or your premium is higher than you expected because you have serious medical conditions, you may be able to get help by accessing the Money and Pensions Service (MaPS) Directory online at www.maps.org.uk or by calling them on 0800 138 7777 (Monday - Friday 8am - 6pm).

Offering you even more.

As well as our tailored travel insurance scheme specifically for NARPO Members, CSIS are pleased to also offer you access to a wide range of other products including car insurance, home insurance, Let/2nd Property Insurance and many more . Check out our main website for details...

CSIS INSURANCE WEBSITE

Why choose CSIS?

Our customer service, and treating customers fairly is at the heart of what we do. Rated 'Excellent' for our service on Trustpilot. We are always happy to speak to you on the phone, and our policies include the following as standard:

A reputation you can trust.

Don’t believe us? Just read through some of the many reviews we have from our happy customers.

Call our friendly sales team today on

01622 766960 .

or email us at insurance(at)csis.co.uk

Office Hours:

- 8:30am - 5:30pm Mon-Fri

- 9:00am - 1:00pm Sat

- Privacy Policy

- Cookie Policy

- Terms and Conditions

- Terms of Business

- Complaints Procedure

Civil Service Insurance Society, 1st Floor Gail House, Lower Stone Street, Maidstone, Kent, ME15 6NB Company Reg. No. 34117. CSIS is authorised and regulated by the Financial Conduct Authority, regulation number 304151. All information on this site is intended for permanent residents of the UK and Northern Ireland only. CSIS is a ‘Not for Profit’ organisation.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance for Visiting the U.S.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Travel insurance basics

Best visitors insurance policies, for the lowest price: trawick international, for customizing options: worldtrips, for pre-existing conditions: worldtrips, for highest medical coverage limit: img, other options to consider, the bottom line.

Since health care can be expensive in the U.S., it’s important that visitors have insurance coverage, aka visitors insurance or travel medical insurance, in case something happens that requires medical attention mid-trip.

Whether you have coverage for travel in the U.S. depends on your health care plan in your home country. But if you don't, you'll need to buy a policy from a third-party insurance provider. Several companies sell this kind of visitor insurance, and each company and policy is a bit different. Let’s look at which is best for you.

First, a few basics about visitor insurance. Two kinds are available: travel medical insurance and trip insurance.

Travel medical insurance covers medical expenses that you may incur while traveling internationally, like a visit to the doctor, a trip to the hospital and medical evacuation and repatriation.

Trip insurance usually covers limited medical expenses like emergency care and can compensate you if your trip is delayed, you need to leave the trip early or you have to cancel the trip. It is designed to help you protect the investment you’re making as you prepare to travel.

Standard trip insurance might not cover a visit to the doctor unless it is an emergency.

It’s important to make sure any pre-existing conditions are covered if the visitor has any. Some policies exclude them.

» Learn more: How to find the best travel insurance

With so many kinds of visitors insurance policies, which is the best?

To make comparisons, we got quotes from several companies using Squaremouth , a website to search for different types of travel insurance in one place.

The parameters we set are for a 49-year-old citizen and resident of Spain traveling to the U.S. on May 1-31, 2024.

The quotes don't include cancellation coverage; these examples are for medical coverage only. To get a quote, the hypothetical deposit for the trip was paid on Feb. 15.

Since we’re looking for a policy that will cover medical care for visitors, there are several medical filters to select: emergency medical ($100,000 or more), medical evacuation ($100,000 or more) and coverage for pre-existing medical conditions.

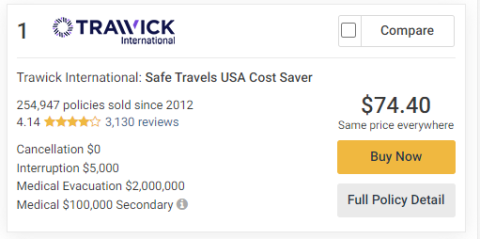

The search came up with nine results ranging in price from $74.40 to $179.18.

The policy with the lowest cost was the Trawick International 's Safe Travels USA Cost Saver at $74.40.

Trawick policies use the FirstHealth PPO network.

The policy as quoted has a $250 deductible and includes $100,000 in emergency medical, $2 million in medical evacuation and $5,000 in interruption coverage. It has limited coverage for pre-existing conditions.

It is possible to change the deductible to as little as $0 or raise it to $5,000.

The same company has another policy, the Trawick International Safe Travels USA Comprehensive policy, that is better at covering pre-existing conditions and costs a little more — $89.59.

The general coverage is the same as the less expensive policy, and the Safe Travels USA Comprehensive option adds coverage for acute onset of a pre-existing condition. it is possible to change the deductible amount to $0 or go up to $5,000.

» Learn more: The best travel credit cards right now

Some policies are sold as is, while others allow some flexibility depending on what is important to you.

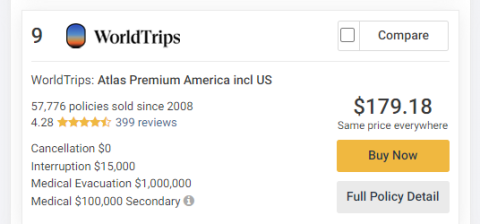

The WorldTrips Atlas Premium America policy for $179.18 allows a lot of customization.

It was also the most expensive of the nine policies Squaremouth suggested.

It’s possible to customize the emergency medical coverage and pre-existing condition coverage and medical deductible. The policy also includes $15,000 in trip interruption coverage, the highest of any of the nine policies available.

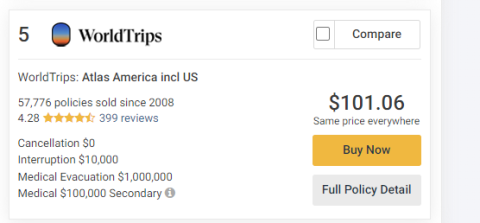

If the traveler has a pre-existing condition, policies from WorldTrips Atlas America are your best bet. The WorldTrips Atlas America policy in our comparison costs $101.06.

The policy as quoted covers $100,000 in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence of a pre-existing condition.

The deductible is also available for customization from $0 to $5,000.

The PPO network for Atlas America Insurance is United Healthcare.

The WorldTrips Atlas Premium America policy mentioned above is also good for pre-existing condition coverage.

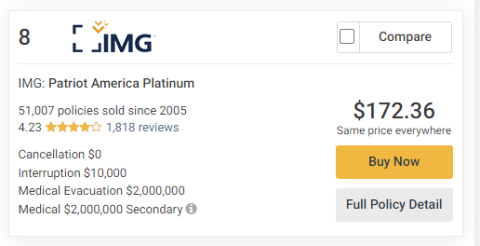

While eight of the nine policies had $100,000 in secondary medical coverage, one had a limit of $2 million.

The IMG Patriot America Platinum policy has a premium of $172.36 along with a high medical evacuation limit of $2 million and interruption coverage of $10,000.

If $2 million in medical coverage is not enough, it’s possible to increase that amount to an $8 million policy limit.

It’s not possible to change the level of coverage for preexisting conditions from the high $1 million limit in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence.

It is possible to change the deductible from $0 all the way up to $25,000.

Our comparison also included policies from two additional companies, Seven Corners and Global Underwriters .

Seven Corners had two policies come up in the results, the Seven Corners Travel Medical Basic for $98.27 and the Seven Corners Travel Medical Choice policy for $136.71. Both of the Seven Corners policies include coverage for hurricane and weather, and the less expensive policy covers acts of terrorism.

Having insurance to cover unexpected medical expenses for anyone visiting the U.S. can be a smart money move.

An illness or accident could cause financial problems for visitors because of potentially having to pay for full health care costs. When planning your travel, be sure to check your current health insurance to find out if it will cover you in the U.S.

For a monthlong stay in the U.S., the lowest-priced visitors insurance policy was around $75 (Trawick International Safe Travels USA Cost Saver) and the highest was about $180 (WorldTrips Atlas Premium America). That’s about $2.42 or $5.81 a day, depending on the policy.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Newsletter Signup

Message from the Branch Secretary;

I have received the following e mail from NARPO HQ in respect of the seemingly everlasting Travel Insurance saga;

Message from Towergate Health & Protection

Travel insurance update – 5th May 2022

In our last update two weeks ago, we explained that the new travel scheme planned for launch on the 20th of April has been postponed and an alternative discounted interim travel insurance offer for NARPO members has been put in place with Able2Travel.

This offers either single trip or multi trip cover and members should use the discount code TGT5 as part of the straightforward online quote process which we recommend you have your medial history and any current medication to hand as details may be required.

In the meantime, work continues with the originally preferred travel insurer to address the aspects of their offer that had not met expectations when launched with other clients. As we previously advised, the previous AXA Health scheme was unique in the market; while we were able to agree an extension to this scheme following their decision to exit the travel insurance market, it has proved impossible to source cover with directly equivalent ‘fit to fly’ acceptance terms.

We now expect to launch the preferred option, Lighthouse, later this month and as with all travel insurance offers, the quotation and application process is on-line. This will offer an increased upper age limit for single trips and an annual multi trip cover option. We appreciate that some members may not have internet access who may then need to speak with our team to help them purchase a policy. This can be a lengthy call for those with complex medical history and while we have increased the team to support, the large number of calls continue to mean members may need to leave a message to be called back.

If you are unable to complete your Able2Travel application online, we are encouraging members then please email our team in the first instance at: [email protected]

If you do not have access to email, then you can call us on 0800 389 7724. As above, our expanded team continue to receive high call volumes while working through a backlog of messages in an orderly fashion and we kindly ask for your patience while we return or answer your call.

The Towergate Health & Protection Team

Towergate Health & Protection is a trading name of Health and Protection Solutions Limited, which is authorised and regulated by the Financial Conduct Authority (FCA). This can be checked on the FCA’s website or by calling them on 0800 111 6768 (freephone). Not all products and services offered are regulated by the FCA. Registered in England and Wales number 4907859.

Registered office: West Park House, 23 Cumberland Place, Southampton, SO15 2BB.

In This Section

- January 2024

- February 2024

- January 2023

- February 2023

- August 2023

- September 2023

- October 2023

- November 2023

- December 2023

- January 2022

- February 2022

- August 2022

- September 2022

- October 2022

- November 2022

- December 2022

- January 2021

- February 2021

- August 2021

- September 2021

- October 2021

- November 2021

- December 2021

- January 2020

- February 2020

- August 2020

- September 2020

- October 2020

- November 2020

- December 2020

- August 2019

- September 2019

- October 2019

- November 2019

- December 2019

Become a NARPO member today. Join the 89,000 former officers who are already benefitting from our expert advice and exclusive deals.

Sign up today for all our latest news direct to your inbox. There’s no fee, but it’s valuable reading.

Private medical insurance

An exclusive healthcare plan for members of the National Association of Retired Police Officers

The NARPO healthcare plan

We’re all likely to get sick or injured at some point, and this can lead to needing to take time out of our schedules for appointments with doctors and specialists.

With private medical insurance you will be able to avoid long waiting lists for treatment. You’ll also have more flexibility with appointment times – allowing you to choose a time that fits around your lifestyle and commitments.

In association with AXA Health, we are delighted to be able to offer NARPO members and their families’ access to an exclusive healthcare plan offering an excellent package of benefits at affordable prices.

The plan is open for application to all NARPO members providing they reside in the UK.

What's included

- Full private in-patient cover

- Full cover for day patient procedures

- Cancer cover

- Up to £1,000 out-patient cover

- Exclusive claims service

- A choice of underwriting options

- Optional worldwide travel cover with no upper age limit

- No claims discount up to 50%

Member update - 14 April 2022

Some members will be aware that, as well as arranging private medical insurance (PMI) for NARPO members, we have for many years also arranged travel insurance with AXA Health.

Following a decision by AXA Health to close the member travel scheme, our team have been experiencing incredibly high call volumes for many weeks now, with members seeking information about travel insurance options. We are aware that, as a result of these high call volumes, some members have found it difficult to contact our team to discuss the renewal of their PMI policy. We apologise for this and are putting in place new call routing options to ensure that members calling to discuss the renewal of their PMI policy can speak with our team.

We would like to thank all members for their continued patience. If members have both a PMI and a travel insurance policy arranged by us, our team are not able to provide any additional information about travel insurance at this time, so we would ask members not to call our team unless they have a PMI policy due for renewal. A separate update regarding the NARPO travel scheme can be found here .

The Towergate Health & Protection Team

Good to know

There is no qualifying period before claiming, however, an excess of £100 per person per year is payable in the event of making a claim.

Applicants will have the option to select from either moratorium or medical history disregarded (MHD*) underwriting.

Moratorium underwriting terms have proven to be particularly good value for members joining the plan. A two year moratorium ensures that new conditions occurring after a member joins the plan are covered immediately. Conditions that occurred over five years before a member joined the plan will also be covered immediately, provided that the condition has completely cleared - no symptoms, medication, advice, and treatment, in the previous five years.

Conditions that have occurred during the five years prior to joining the plan are subject to a two year qualifying period (moratorium). These conditions will become eligible once you have been a member on the policy for 2 consecutive years and you have been completely free of any form of treatment, medical advice, drugs, medicines or special diets relating to that condition, for 1 consecutive year after joining the policy.

Premiums for the MHD* option are usually higher, but applicants selecting MHD* will be covered for pre-existing acute medical conditions.

There is no qualifying period.

*MHD will only be available to members who meet AXA Health's declaration.

The role of Towergate Health & Protection and NARPO

Towergate Health & Protection is an independently authorised broker, who acts on your behalf.

To support their members, NARPO works with Towergate Health & Protection to enable Towergate Health & Protection to market the policy, for which NARPO receives a fee.

Towergate Health & Protection negotiates the overall renewal terms AXA Health offers on this plan, with NARPO agreeing the recommendation. NARPO has no other role within the administration of this arrangement.

For clarity, there is no commercial agreement between AXA Health and NARPO, who do not represent you or negotiate any aspect of your annual travel / healthcare insurance with AXA Health healthcare.

This policy is an individual contract of insurance between you and AXA Health. The subscriptions under this arrangement are set each year by AXA Health to take in to account the claims made by all the members of NARPO and their family members covered under the product.

Useful documents

How to join

For a no obligation quote and review please call 0800 389 7724 (9am - 5pm Monday to Friday) to speak to one of our dedicated plan experts.

We would like to thank all members for their continued patience. If members have both a PMI and a travel insurance policy arranged by us, our team are not able to provide any additional information about travel insurance at this time, so we would ask members not to call our team unless they have a PMI policy due for renewal. A separate update regarding the NARPO travel scheme can be found here .

You are using an outdated browser. Please upgrade your browser to improve your experience.

Necessary cookies enable core functionality such as security, network management, and accessibility. You may disable these by changing your browser settings, but this may affect how the website functions.

We'd like to set Google Analytics cookies to help us to improve our website by collecting and reporting information on how you use it. The cookies collect information in a way that does not directly identify anyone. For more information on how these cookies work, please see our 'Cookies page'.

IMAGES

VIDEO

COMMENTS

Please call 01622 766 960 to find out more. Narpo travel insurance is a trading name of P J Hayman & Company Limited, authorised and regulated by the Financial Conduct Authority. NARPO Travel Insurance is administered by The Civil Service Insurance Society (CSIS). Underwritten by Lloyd's Syndicate 4444 which is managed by Canopius Managing ...

NARPO members are provided with full worldwide cover for any single trip lasting up to 65 days. (45 days Caribbean, USA, or Canada) CSIS may be able to offer an alternative option if you are not eligible for this product. Please call 01622 766 960 to find out more. NARPO travel insurance is a trading name of P J Hayman & Company Limited ...

Important update: With effect from Thursday June 1 2023, travel insurance for NARPO members will transfer from Towergate Health & Protection to a new provider. To find out more about the new product, please click here. If you already have a NARPO Lighthouse travel insurance policy that was purchased between 1 April 2022 and 31 May 2023, and you need to make some changes, please call 0333 005 ...

Designed specifically for NARPO Members, this annual travel insurance plan offers full worldwide cover for any single trip lasting up to 65 days (45 for Caribbean, USA or Canada). NARPO Travel Insurance provides true peace of mind to the frequent traveller. To take advantage of this new arrangement, you must be a UK resident and a NARPO member ...

NARPO Travel Insurance is a tailored insurance policy designed for retired police officers and their families. It offers comprehensive cover for medical expenses, personal accidents, and travel disruptions. ... Up to the cost of the trip: Travel delay, missed departure, and abandonment: Up to £2,000: Luggage and personal effects: Up to £2,000 ...

Travel insurance update - 22 April 2022. In our update last week, we explained that the new travel scheme we had planned to launch on 20th April has been postponed as a result of dissatisfactory feedback about the online application experience from some of our other customers. This had meant many members needing to speak with our team to help ...

NARPO Travel Insurance. Worldwide Annual Travel Insurance providing true peace of mine to the frequent traveller. From June 1st, NARPO Travel Insurance policy will be provided by P J Hayman and Company Limited and underwritten by Lloyd's Syndicate 4444 which is managed by Canopius Managing Agents Limited. NARPO Travel Insurance is sold and ...

The average cost of travel insurance is 5% to 6% of your trip costs, according to Forbes Advisor's analysis of travel insurance rates. For a $5,000 trip, the average travel insurance cost is ...

Message from Towergate Health & Protection. Travel insurance update - 5th May 2022. In our last update two weeks ago, we explained that the new travel scheme planned for launch on the 20th of April has been postponed and an alternative discounted interim travel insurance offer for NARPO members has been put in place with Able2Travel.

The Nerds dove deep into over 50 real world coverage price points to get a clearer sense of typical travel insurance costs in 2024. On average, travelers should expect to pay 6.87% of their total ...

UK travel cover has the same excesses as overseas cover (except those marked with an asterisk), where applicable. ... Winter sports. The benefit marked with a cross (+) is subject to £60 excess unless a UK Global Health Insurance Card (UK GHIC) is used to reduce costs. ... NARPO Benefits Summary_2023.24_0623 Edition 0623.cdr

If you require travel insurance after your AXA Health policy comes to an end, please contact Towergate Health & Protection who will ... How do I take out this new policy? You can obtain a quote and buy a policy online by visiting: https://narpo.lighthousetravelinsurance.co.uk/quote/ or by calling Towergate Health & Protection on 0800 389 7724 ...

Here are our picks for the best travel credit cards of 2024, including those best for: Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card. No annual fee: Bank of ...

NARPO plans. Take advantage of our exclusive discounted health and travel insurance products. Providing you with peace of mind, our private medical insurance plan means you can avoid the lengthy waiting lists and choose instead to manage your health at a time and place that works for you. Whether you are looking to travel the world or just ...

To cancel the insurance, contact the Scheme Administrator, the Civil Service Insurance Society (CSIS) on 01622 766 960. Email: [email protected]; or Write to: CSIS, 1st Floor, Gail House, Lower Stone Street, Maidstone, Kent ME15 6NB. REF: NARPO/IPID/2023.24_0623 Edition: 0623.

For a monthlong stay in the U.S., the lowest-priced visitors insurance policy was around $75 (Trawick International Safe Travels USA Cost Saver) and the highest was about $180 (WorldTrips Atlas ...

Message from Towergate Health & Protection. Travel insurance update - 5th May 2022. In our last update two weeks ago, we explained that the new travel scheme planned for launch on the 20th of April has been postponed and an alternative discounted interim travel insurance offer for NARPO members has been put in place with Able2Travel.

NARPO Travel Insurance Worldwide Annual Travel Insurance providing true peace of mine to the frequent traveller. From June 1st, NARPO Travel Insurance policy will be provided by P J Hayman and Company Limited and underwritten by Lloyd's Syndicate 4444 which is managed by Canopius Managing Agents Limited. NARPO Travel Insurance is sold and ...

How to join. For a no obligation quote and review please call 0800 389 7724 (9am - 5pm Monday to Friday) to speak to one of our dedicated plan experts. Some members will be aware that, as well as arranging private medical insurance (PMI) for NARPO members, we have for many years also arranged travel insurance with AXA Health.