- Car Finance

- Hire Purchase

- Novated Leasing

- Bad Credit Car Loans

- Car Loan Refinance

- Business Car Loans

- Australian Car Statistics

- Car Loan Repayments Calculator

- Compare Car Loans

- Average Car Loan Interest Rates

- How Much Can I Borrow?

- How to Get a Car Loan?

- Caravan Loans

- Motorbike Loans

- Jet Ski Loans

- Camper Trailer Loans

- Loans for Harley-Davidson

- Boat Loan Calculator

- Caravan Buying Checklist

- How to Choose a Motorbike?

- Top Tips to Choose a Right Boat

- Equipment Finance

- Chattel Mortgage

- Truck Finance

- Aircraft Finance

- Technology Finance

- Agriculture Finance

- Plant & Machinery Finance

- Operating Lease

- Unsecured Personal Loans

- Low-interest Personal Loans

- Debt Consolidation Loans

- Travel Loans

- Wedding Loans

- Bad Credit Loans

- Compare Personal Loans

- Personal Loan Calculator

- Personal Loans Eligibility

- Unsecured Business Loans

- Small Business Loans

- Invoice Financing

- Business Overdrafts

- Cashflow Lending

- Small Business Start-up Loans

- Compare Business Loans

- Business Loan Interest Rates

- First Home Buyers

- Buy Next Home

- Investment Home Loans

- Home Loan Refinance

- Bad Credit Home Loans

- Self Employed

- Construction Home Loans

- Compare Home Loans

- How to Choose a Home Loan?

- Home Loan Repayments Calculator

- Borrowing Power Calculator

- Balance Transfer

- Frequent Flyer

- No Annual Fee

- Master Card vs Visa Card

- Maximise Credit Reward Points

- Perks of Using a Credit Card

- Manage Your Debt with a Balance Transfer Card

- Small Personal Loan

- Quick Cash Loan

- Rental Bond Loan

- Car Repair Loan

- Furniture Loan

- Emergency Loan

- Rent Arrears Loan

- Bank Accounts

- Savings Accounts

- Term Deposits

- Business Bank Accounts

- Debit Cards

- Kids Savings Accounts

- Margin Loans

- Travel Money Cards

- Best International Money Transfers

- Send Money to India

- Send Money to USA

- Send Money to New Zealand

- Send Money to UK

- Send Money to Canada

- Superannuation

- Compare Super Funds

- Cryptocurrency

- Share Trading

- Forex Trading

- CFD Trading

- Comprehensive Car Insurance

- Third Party Fire and Theft Car Insurance

- Third Party Property Damage Car Insurance

- CTP Insurance

- Classic Car Insurance

- Car Insurance for Young Drivers

- Seniors Car Insurance

- How Do I Compare Car Insurance?

- How Much is Car Insurance?

- Types of Car Insurance in Australia

- Market Value Vs Agreed Value

- Car Insurance with Choice of Repairer

- Landlord Insurance

- Building Insurance

- Flood Insurance

- Contents Insurance

- Best Home Insurance

- Cheapest Home Insurance

- Professional Indemnity Insurance

- Public Liability Insurance

- Product Liability Insurance

- Domestic Travel Insurance

- Cruise Travel Insurance

- Single Trip Travel Insurance

- Seniors Travel Insurance

- Best Travel Insurance

- Cheap Travel Insurance

- Seniors Funeral Insurance

- Hospital Cover

- Extras Only Cover

- Singles Cover

- Couples Cover

- Family Health Insurance Cover

- Overseas Visitors Health Insurance Cover

- Health Insurance for Seniors

- Cheap Health Insurance

- Income Protection

- Personal Accident Insurance

- Trauma Insurance

- TPD Insurance

- Funeral Insurance

- Seniors Pet Insurance

- Cheap Pet Insurance

- Best Pet Insurance

- Electricity Plans

- Compare Electricity Plans

- Compare Gas Plans

- Solar Electricity Plans

- Green Energy Plans

- ADSL Broadband Plans

- Mobile Broadband

- Home Wireless Broadband Plans

- Internet Providers

- Best Broadband Deals

- Prepaid Plans

- iPhone Plans

- Unlimited Data Plans

- SIM-Only Plans

- Unlimited Data for Mobile Phones

- Travel Insurance for Mobile Phone

- Customer Reviews

Travel Insurance

Hold tight!

We're currently revamping our travel insurance vertical. In the meantime, you can get a free online travel insurance quote through Fast Cover today!

Disclaimer:

We’ve partnered with Fast Cover, however, we do not act on their behalf. For questions relating to travel insurance policies, contact Fast Cover directly.

If you click on an affiliate link on our website and then make a purchase of the product or service, we may receive monetary compensation.

Fast Cover Travel Insurance provides travel insurance for a variety of trip types. You can get a travel insurance quote at fastcover.com.au or call 1300 409 322.

- Fastcover.com.au

- 1300 409 322

- [email protected]

- Giving Back

- Partner with us

- Privacy Policy

- Terms of Use

- Credit Guide

- How We Handle Complaints

- Scam and Fraud Warning

- Comparison Rate Warning

1300 974 066

Sign up to our newsletter.

Quantum Savvy Pty Ltd (ABN 78 660 493 194) trades as Savvy and operates as an Authorised Credit Representative 541339 of Australian Credit Licence 414426 (AFAS Group Pty Ltd, ABN 12 134 138 686). We are one of Australia’s leading financial comparison sites and have been helping Australians make savvy decisions when it comes to their money for over a decade.

We’re partnered with lenders, insurers and other financial institutions who compensate us for business initiated through our website. We earn a commission each time a customer chooses or buys a product advertised on our site, which you can find out more about here , as well as in our credit guide for asset finance. It’s also crucial to read the terms and conditions, Product Disclosure Statement (PDS) or credit guide of our partners before signing up for your chosen product. However, the compensation we receive doesn’t impact the content written and published on our website, as our writing team exercises full editorial independence.

For more information about us and how we conduct our business, you can read our privacy policy and terms of use .

© Copyright 2024 Quantum Savvy Pty Ltd T/as Savvy. All Rights Reserved.

Thanks for your enquiry!

Our consultant will get in touch with you shortly to discuss your finance options.

We'd love to chat, how can we help?

RACQ Travel Insurance

Important information on terms, conditions and sub-limits.

Are you considering RACQ for your next travel insurance policy? We’ve gone through the fine-print to answer your burning questions about RACQ so you can find the right policy for your needs.

RACQ (Royal Automobile Club of Queensland Limited) is a mutual organisation with approximately 1.75 million members. Founded in 1905, RACQ began as a social club for car and motorcycle owners but has grown to become Queensland’s largest provider of car insurance and the second-largest provider of home insurance. RACQ has a range of products and services, including roadside assistance, travel insurance, banking, and travel agent services. RACQ travel insurance is underwritten by the Tokio Marine & Nichido Fire Insurance Co., Ltd.

RACQ travel insurance policies

RACQ offers three tiers of domestic travel insurance , as well as three tiers of international travel insurance . These tiers range from Saver, to Standard, and up to Premium. RACQ also offers an annual multi-trip travel insurance policy, if you’re looking for cover that will sustain multiple journeys over the course of a year.

- Single Duo Family

Limits shown apply

Covid medical cover

Covid cancellation cover

Overseas emergency hospital expense

Overseas emergency medical assistance

Maximum excess

Cancellation fees

Pay extra for no excess

Luggage and personal effects

Additional accomodation & travel

Emergency companion

Resumption of journey

Hospital cash allowance

Accidental death

Permanent disability

Loss of income

Credit Card fraud and replacement

Travellers cheques

Travel documents

Rental vehicle excess

Alternative travel expenses

Personal liability

Pre existing conditions

Cardiovascular disease

Mental health illness

High cholesterol

High blood pressure

Blood thinning medication

Activities covered

Bungee jumping

Conservation work

Mountain biking

Mountaineering

Rock climbing

Scuba diving

Snow sports

Ocean Cruise

$10,000,000

Assessment required, may cost extra

Annual Multi-Trip (45 days)

Annual multi-trip (30 days), annual multi-trip (60 days).

Any information provided on this page should be considered a summary and general advice only. All information should be verified before purchase via the relevant Product Disclosure Statement (PDS).

Does RACQ travel insurance have COVID-19 coverage?

RACQ does provide some coverage for COVID-19, however, it depends on your policy and level of coverage. Check the PDS for the full story on terms and conditions.

What other optional extras can I add to my RACQ policy?

Cruise cover

If you’re travelling on a cruise ship, then you’ll need to purchase RACQ’s cruise travel insurance on top of your policy, even if your cruise stays within Australian waters. If you do not get this optional extra, then any claims related to any part of your journey on a cruise ship will not be covered. You can pay the premium for cruise cover on any of RACQ’s policies, which will cover you for that policy’s included benefits while on the portion of your journey that takes place on a cruise ship.

Ski and winter sports cover

Snow travel insurance is important if you’re hitting the slopes, and without it, you may not be covered for any claims relating to snow sports. Through RACQ, the ski and winter sports cover is only available if you pay an extra premium on top of either a Premium or Standard policy, or if you have an annual multi-trip plan.

Are pre-existing medical conditions covered under RACQ’s travel insurance?

RACQ automatically includes cover for some pre-existing medical conditions , although you must declare your pre-existing conditions and have them listed on your certificate of insurance in order to be covered. So, make sure you disclose any conditions that you do have at the time of applying.

While you may have to pay an extra premium for your condition, some conditions are covered under your policy’s premium already.

If your pre-existing medical condition is not eligible for automatic cover, you must apply to have a medical assessment. Contact RACQ on 1300 338 821, or complete your medical assessment online, as part of the travel insurance quote process, at http://www.racq.com.au/travelinsurance . They will then be able to tell you if your condition can be covered.

What do I do if there’s an emergency during my trip?

If there’s an emergency, contact RACQ’s 24-hour emergency assistance and claims line on:

+61 2 8055 1696

How do I make a claim with RACQ travel insurance?

To make a claim, head online to RACQ’s website and either register or log in to your account using the email address you used to purchase your policy.

Alternatively, contact RACQ on:

Phone: 1300 338 821

Email: [email protected]

You will need to have supporting documents which are relevant to your claim, like receipts, police reports, or hospital invoices. RACQ will aim to notify you of the success of your claim within 10 working days.

Is it possible to cancel my RACQ travel insurance policy?

You can cancel your policy and receive a full refund within 21 days of purchasing it, provided you have not started your journey, have not made a claim, or intend to make a claim. If you want to cancel after the 21-day cooling-off period, then you may be able to receive a partial refund, at RACQ’s discretion.

To talk to RACQ about cancelling your policy, call them on 1300 338 821.

RACQ customer reviews

Racq travel insurance.

There are no ratings yet for RACQ travel insurance.

Apply for RACQ travel insurance

Compare travel insurance from major brands including:.

Terms, conditions, exclusions, limits and sub-limits may apply to any of the insurance products shown on the Mozo website. These terms, conditions, exclusions, limits and sub-limits could affect the level of benefits and cover available under any of the insurance products shown on the Mozo website. Please refer to the relevant Product Disclosure Statement and the Target Market Determination on the provider's website for further information before making any decisions about an insurance product.

Who we are and how we get paid

Our goal at Mozo is to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. As a marketplace business, we do earn money from advertising.

We do not compare all brands in the market, or all products offered by all brands. At times certain brands or products may not be available or offered to you. If you proceed with a travel insurance policy through Mozo, Mozo may receive a referral fee.

- United States

- United Kingdom

RACQ Travel Insurance

Our verdict: racq offers a variety of travel insurance policies to suit multiple needs and budgets..

In this guide

Summary of RACQ International Premium policy

How does racq travel insurance cover covid-19, what policies does racq offer, here's a breakdown of racq travel insurance features, standard features, optional add-ons, how to make an racq travel insurance claim, here's the bottom line about racq travel insurance, frequently asked questions, request travel insurance quotes and compare policies.

Destinations

- There's no additional premium if you want motorcycle or moped cover on your comprehensive international policy.

- RACQ's premium international policy offers unlimited emergency expenses (within reason).

- While RACQ does cover expenses related to COVID-19, claims have a combined cap of $3,500 (with the exception of medical and funeral).

Compare other options

Table updated September 2023

RACQ offers a broad range of protection against unexpected costs related to COVID-19, including:

- Overseas medical, hospital and emergency costs.

- Funeral expenses, up to $20,000

- Emergency expenses if you're quarantined due to close contact of a COVID-19 case or your travelling companion is diagnosed with COVID-19.

- Cancellation fees and lost deposits due to any COVID-19 related event outside of your control.

- Additional expenses if your trip is disrupted due to any COVID-19 related event outside of your control.

However, there is a combined cap of $3,500 for all expenses, with the exception of medical hospital, emergency and funeral costs.

There are also some scenarios that are not covered by RACQ, including if you ignored medical advice or knowingly put yourself in contact with someone who had COVID-19.

RACQ offers four international policies - Premium, Standard, Saver, and Annual Multi-Trip. It also offers three domestic travel insurance policies - Domestic, Domestic Cancellation and Rental Car Excess Only.

Annual Multi-Trip

Domestic Cancellation

Rental Car Excess Only

The insurer of this product is Tokio Marine & Nichido. It comes with a cooling-off period of 21 days and choice of $250 standard excess for international plans.

These are some of the main insured events that RACQ will cover. These benefits apply across all international policies.

- Overseas medical treatment

- Lost, damaged or stolen property

- Trip cancellation or amendment

- Additional accommodation and transport

- Theft of money

- Luggage and travel delay

- Kidnap and hijack

- Personal liability

- Accidental death

RACQ also offers two add-on options so you can tailor your policy if required.

- Rental vehicle excess cover. If your rental vehicle is damaged, this benefit will cover the cost of the insurance excess. Does not apply to campervans, motorbikes or scooters.

- Ski and Winter Sports Cover. Cover in case you're injured on the slopes, plus additional risks such as equipment hire, piste closure, and avalanche.

- Cruise Cover Extends your insurance policy to cover cruises, medical treatment on board, and marine evacuation.

Unfortunately, travel insurance doesn't cover everything. Generally, RACQ will not pay your claim if it relates to:

- Unlawful, wreckless or unreasonably unsafe behaviour by you.

- Behaviour while you were drunk or under the influence of drugs

- Expenses related to a pre-existing medical condition, if not listed on your policy

- An act of war, invasion or revolution

- You being unfit to travel or travelling against medical advice

- If you travel to an area despite a Department of Foreign Affairs and Trade (DFAT) has issued a 'DO NOT TRAVEL' advisory being in place

- Childbirth or pregnancy complications before the 26th week of gestation or if you have had previous pregnancy complications

- Any errors, mistakes or omissions in booking arrangements, or failure to obtain the relevant visa, passport or travel documents

- You riding a motorcycle without a current Australian motorcycle licence

- An elective medical or dental treatment , cosmetic procedure or body modification (including tattoos or piercing)

- Self-inflicted injury or illness, suicide or attempted suicide

This is not an exhaustive list. Make sure you review the RACQ PDS for a detailed breakdown of what won't be covered, found under its list of general exclusions .

The quickest way to make your claim is through RACQ's 24/7 online portal. Register with the email address you used to buy your policy, and RACQ will email you with instructions.

Alternatively, you can claim on your RACQ travel insurance policy over the phone, by calling 1300 207 371 or +61 2 8055 1696.

RACQ's Premium international policy offers a great range of benefits, including an impressive $10,000 limit for insolvency, $10 million for legal liability, and unlimited emergency expenses.

Members also enjoy additional perks such as discounted pet boarding, car hire, and even movie tickets.

One of the few drawbacks for RACQ policies is the $3,500 cap on COVID-19 related claims (with the exception of medical, emergency and funeral.) While this may be more than enough for some travellers, it may fall short for others.

If you're still not sure about RACQ, you can compare other travel insurance companies here .

What if I change my mind about RACQ travel insurance?

You have 21 days from the date of issue to change your mind, as long as you haven't started your trip and don't want to make a claim. Just let RACQ know and you'll get a full refund.

Is there an age limit for RACQ travel insurance?

Cover is available to travellers over the age of 18.

Can I get a RACQ travel insurance policy as a non-resident?

Yes, temporary residents over the age of 18 can get a RACQ travel insurance policy. You'll just have to hold a current Australian visa (not a tourist, study or working holiday visa) which will remain valid throughout your entire trip. You'll also need a return ticket, have a primary place of residence in Australia, and you must purchase your policy before you leave Australia.

Use a comma or space to separate ages. Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

Nicola Middlemiss

Nicola Middlemiss is a contributing writer at Finder, with a special interest in personal finance and insurance. Formerly a business and finance journalist, Nicola has written thousands of articles helping Australians better understand insurance and grow their personal wealth. She has contributed to a wide range of publications, including Domain, the Educator, Financy, Fundraising and Philanthropy, Insurance Business, MoneyMag, Mortgage Professional, Yahoo Finance, Your Investment Property, and Wealth Professional. Nicola has a Tier 1 General Insurance (General Advice) certification and a Bachelor's degree from the University of Leeds.

More guides on Finder

From accelerated ageing to arguments with loved ones, the cost of living is taking its toll, according to new research by Finder.

Get 10,000 bonus points if you're an eligible first time cardholder who hasn't had a Qantas points earning card in the last 12 months.

The short of it is: this electric car eased my usual range anxiety during the trip, consuming just a quarter of its battery on a journey that typically has seen others dipping into the red by up to 60%.

From bald tyres to worn brake pads, the nation’s roads are crowded with cars that could struggle to pass a roadworthy inspection, according to new research by Finder.

SPONSORED: With the right tools in place, building a global team for your business doesn't have to be a logistics headache.

SPONSORED: Being aware of wider economic considerations can help you make more informed decisions when buying a property.

SPONSORED: From high interest accounts to shopping around, there are all sorts of ways that you can give your savings a boost.

Bitcoin has gone sideways since the halving - is that normal?

SPONSORED: From interest rate to app access, we'll show you the features you could consider in a high-interest saving account.

Will regulators green-light the Optus-TPG deal?

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

RACQ Travel

Turn travel dreams into a reality with RACQ Travel

RACQ Travel has helped Queenslanders plan and book picture perfect holidays for decades. Whether you’re planning a weekend getaway or an international adventure, turn your daydreams into bookings with our team of travel specialists. We’re here to make your travel plans come to life!

Contact us online or call 1300 888 449 .

Browse travel deals and services

- Motorhome hire

- Queensland road trips

- Travel loans

- International driving permit

- Driving overseas

- Taking money overseas

Tools and calculators

Latest holiday deals.

Enjoy RACQ member discounts~~

Want to save even more? Log in to RACQ Member Benefits to browse all discounts and offers.

Become a member with RACQ Lifestyle

For only $26 a year you get all RACQ Member Benefits and discounts.

Need help or would like to know more? RACQ offers many convenient ways for you to get in touch with us.

Things to note

~~Terms and conditions apply to all offers. View the individual offer for full details. Offer is subject to availability and may be withdrawn at any time without notice.

Banking and loan products issued by Members Banking Group Limited ABN 83 087 651 054 AFSL/Australian credit licence 241195 trading as RACQ Bank. Terms, conditions, fees, charges and lending policies apply. This is general advice only and may not be right for you. This information does not take your personal objectives, circumstances or needs into account. Read the disclosure documents for your selected product or service, including the Financial Services Guide and the Terms and Conditions, and consider if appropriate for you before deciding.

Except for RACQ Bank, any RACQ entity referred to on this page is not an authorised deposit-taking institution for the purposes of the Banking Act 1959 (Cth). That entity’s obligations do not represent deposits or other liabilities of RACQ Bank. RACQ Bank does not guarantee or otherwise provide assurance in respect of the obligations of that entity, unless noted otherwise.

Insurance products (excluding Travel Insurance) are issued by RACQ Insurance Limited ABN 50 009 704 152 (RACQ). Conditions, limits and exclusions apply. This is general advice only and may not be right for you. This information does not take your personal objectives, circumstances or needs into account. Read the PDS and any applicable Supplementary PDS before making a purchase decision on this product. You can also access our Target Market Determinations on this website.

RACQ Travel Insurance is issued by Tokio Marine & Nichido Fire Insurance Co., Ltd (Tokio Marine & Nichido) ABN 80 000 438 291, AFSL 246548 and distributed by ++ RACQ Operations Pty Ltd (ABN 80 009 663 414 AR 000234978) and Members Travel Group Pty Ltd (ABN 45 144 538 803 AR 000432492) as an Authorised Representative of Tokio Marine & Nichido. Limits (including sub-limits), conditions and exclusions apply. Please read the Combined Financial Services guide and Product Disclosure Statement (PDS) and any applicable Supplementary PDS before making a decision about this product and read the Target Market Determinations (TMDs) before determining whether this product is suitable for your circumstances. Any advice set out above is general in nature only, and does not take into account your objectives, financial situation or needs.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How Travel Insurance for Domestic Vacations Works

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

You’ve probably heard of travel insurance, which promises to cover you if things go awry during your vacation. This perhaps seems obvious when you’re traveling overseas, but unexpected travel disruptions can happen when you travel domestically, too.

Let’s look at travel insurance for domestic vacations, what it covers and credit cards that’ll cover you during your trip.

Types of travel insurance

There’s more than one kind of travel insurance, including health coverage, trip interruption and rental car insurance. Depending on how you’re traveling, you likely won’t need every type of insurance, but here are the kinds you can generally expect to see:

Trip interruption insurance. This insurance will reimburse you for expenses incurred during a delay or interruption while traveling.

Trip cancellation insurance. This type of insurance will refund your costs if your trip is canceled for a covered reason.

Lost luggage insurance. This insurance will reimburse you for the items you have to repurchase when your bags are lost.

Rental car insurance. This type of insurance protects you while you're using a rental car.

Health insurance. Travel health insurance can differ but may include emergency medical and standard care coverage.

Cancel for Any Reason insurance. As the name suggests, this insurance allows you to cancel for any reason and receive a refund.

Accidental death insurance.

Emergency evacuation insurance.

» Learn more: Common myths about travel insurance and what it covers

Can you buy domestic travel insurance?

So, is it possible to get travel insurance for a domestic U.S. trip? The short answer is: Yes, you can. The longer answer is: Yes, but not all types of coverage may be available to you, and you may need to meet certain requirements to qualify.

For example, the travel insurance offered by the Chase Sapphire Reserve® requires that you be at least 100 miles away from home before its emergency evacuation and transportation benefit kicks in. Your trip must also be at least five days long but no longer than 60 days total.

Meanwhile, some providers of travel health insurance indicate that their coverage doesn’t work within the U.S. Instead, your plan will only work once you’re traveling internationally. This is true for the health plans offered by GeoBlue; those plans are limited to countries outside the U.S. and available only to people who already have a qualifying insurance plan.

» Learn more: How much is travel insurance?

Domestic travel health insurance

It’s possible to get travel insurance within the U.S. whether you’re looking for comprehensive coverage or simply a medical care plan. Companies such as Squaremouth collect quotes from a variety of insurance providers and allow you to compare them.

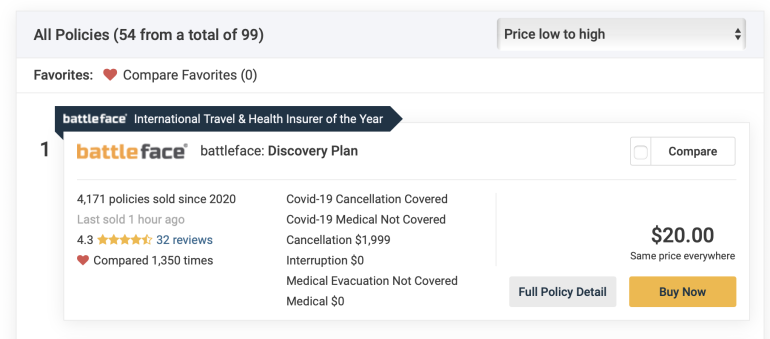

For example, we put in a search for a 32-year-old from California traveling within the U.S. The total trip cost was $1,999 and took place over two weeks during the summer.

Squaremouth returned results from 54 providers, with the lowest charging $20 total.

However, this plan doesn’t include medical insurance. To find policies that offer this coverage, you’ll want to use the filters next to the search results.

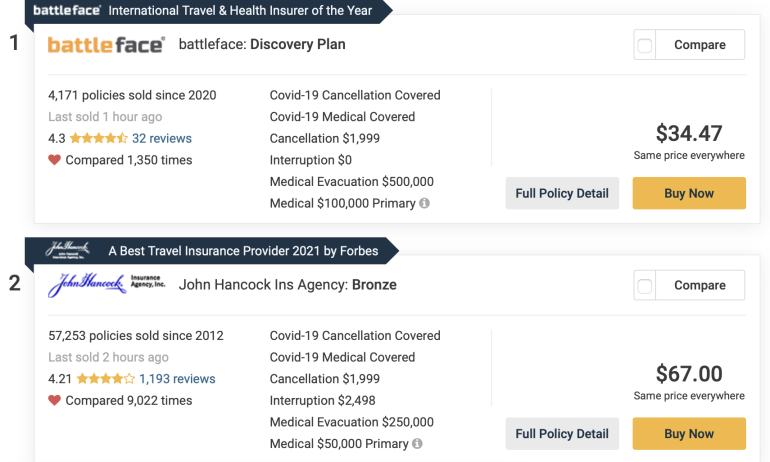

Including filters for domestic travel health insurance limits the total results, but pricing doesn’t change that significantly.

The policies shown will now include primary coverage, coverage for pre-existing conditions, medical evacuation and emergency medical. Even with all those options selected, the cheapest plan comes in at a relatively affordable $34.47.

For those unfamiliar with the terminology, primary insurance acts as the first payer for any claims you have. So if you visit a doctor during your trip, your primary policy will cover costs first. If that plan is exhausted and you also have secondary insurance, the secondary insurance can then pay off the rest.

It’s important to know the difference so you’ll be completely covered during your travels. Note, however, that if you don’t have primary insurance, any secondary insurance becomes primary.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Travel cards with domestic travel insurance

Interested in cheap domestic travel insurance? You won’t find anything cheaper than the complimentary travel insurance offered by many travel cards. We’ve already mentioned that the Chase Sapphire Reserve® has its own travel insurance benefits, but so do many other cards.

Generally, you don’t need to pay anything to be eligible for the travel insurance offered by these types of cards. Instead, you’ll simply need to charge the cost of the trip to your card and the insurance will be automatically activated. This is true whether you’re traveling domestically or internationally.

Here are a few cards that offer complimentary travel insurance:

Chase Sapphire Reserve® .

The Platinum Card® from American Express .

United℠ Explorer Card .

Hilton Honors American Express Aspire Card .

Capital One Venture X Rewards Credit Card .

Terms apply.

» Learn more: The best travel credit cards right now

Travel insurance for domestic vacations recapped

Hopefully we’ve answered the question: “Do I need travel insurance for domestic travel?”

The truth is, whether or not you opt to obtain travel insurance for your trip is going to depend on you. Some travelers have a higher tolerance for risk and are willing to forgo insurance while hoping things go the way they should.

Others may be more interested in being covered for events such as trip delay, emergency medical and rental car insurance.

Whatever you choose, compare quotes from multiple insurance providers to be sure you’re getting a policy that suits your needs. Otherwise, check out the complimentary travel insurance offered by a variety of credit cards to see whether their coverage limits fit your travel budget.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Join CHOICE

Travel insurance

RACQ Premium review

One trip policy..

This is the provider of the insurance product and correlates with the Financial Services Provider (FSP) as registered with the Australian Financial Complaints Authority. You can look up your insurer's provider in the AFCA comparative tables to see how common it is for consumers to bring a travel insurance dispute to AFCA about them.

In years (up to and including the number stated). For policies listed as '100+', there is no age limit.

Maximum age for dependants listed on the policy. In years (up to and including the number stated).

Does the policy list pre-existing medical conditions that are automatically covered.

Does the policy cover pre-existing medical conditions that are not listed as automatic cover on the policy (on application and subject to approval)

The lower the number, the better. It's the time period before booking your trip that a medical condition would be covered if you've had no symptoms, medication or treatment (as long as that condition isn't specifically excluded). If for example, your condition last showed symptoms 18 months ago, but the time period here is 12 months, then you'll be covered subject to the other conditions of the policy.

Are claims covered that arise from pregnancy or pregnancy complications?

Until which stage pregnancy is covered for single births (up to and including).

Are medical costs covered for the mother if childbirth occurs up to the maximum pregancy stage

Limit for medical and emergency evacuation and repatriation expenses for illness or injury.

Expenses for an accompanying person such as a member of the travelling party, a friend or a close relative (not necessarily listed as insured on the certificate of insurance) to travel to the sick policyholder overseas, remain with them in hospital and accompany them home during an emergency repatriation.

Daily hospital cash allowance per person.

Minimum number of hours the insured must be continuously hospitalised before receiving the hospital cash allowance.

Limit for dental as a result of an accident.

Limit for dental as a result of sudden and acute pain.

Limit for overseas funeral costs and the return of mortal remains per deceased person, in the event of the death of the policy holder. There may be a separate limit for 'return of mortal remains' and 'overseas funeral costs', so check the policy terms for more details.

Limit for additional accommodation and travel expenses if the policy holder cannot travel due to injury or sickness.

The limit for additional travel expenses per person if travel is interrupted by an insured event (not including injury or sickness as that is covered separately under 'Additional travel expenses for injury or sickness'). Cover is assessed on individual circumstances.

Whether the policy covers you for additional travel expenses per person if travel is interrupted due to a lost or stolen passport or travel documents. Cover is assessed on individual circumstances.

Whether or not the policy covers you for additional accommodation and travel expenses if you need to curtail travel due to the serious illness or injury of a relative at home. May be subject to assessment of pre-existing conditions for the relative.

Limit for resumption of a journey interrupted due to the serious illness, injury or death of a relative. May be subject to assessment of pre-existing conditions for the relative. Check the policy terms for more details. 'Cancellation cover chosen' means variable cover options are available.

Whether the policy covers you for cancellation or amendment expenses.

Limit for cancellation or amendment expenses. 'Cover chosen' means variable cover options are available.

Limit for cancellation expenses for transportation bought using frequent flyer points.

Limit for travel agent cancellation fees.

Whether the policy covers you for losses arising out of insolvency of a travel services provider (e.g. airline, accomodation provider, bus line, shipping line, railway company, motor vehicle rental agency). Cover is assessed on individual circumstances.

Whether the policy covers you for cancellation expenses due to insolvency of a travel agent. Cover is assessed on individual circumstances.

Whether the policy covers you for cancellation expenses due to unexpected/involuntary retrenchment. Cover is assessed on individual circumstances.

Whether the policy covers you for cancellation expenses due to cancellation of pre-arranged leave from work for members of the Defence Force and Federal, State or Territory Emergency Services. Cover is assessed on individual circumstances.

Whether the policy covers you for cancellation expenses due to cancellation of pre-arranged leave from work for non-emergency services occupations. Cover is assessed on individual circumstances.

Are stolen or damaged personal belongings covered

The overall limit for stolen or damaged personal belongings.

Limit for a single unspecified item.

Limit per item for a video or photo camera. Cover is assessed on individual circumstances.

Limit for a laptop or tablet. Cover is assessed on individual circumstances.

Limit for a smartphone. Cover is assessed on individual circumstances.

Limit for any prescribed medications. Cover is assessed on individual circumstances.

Overall limit for specified items, available for an extra premium. Cover is assessed on individual circumstances.

Cover for belongings locked in a luggage compartment of a car out of sight during the day. Cover is assessed on individual circumstances.

Cover for belongings locked in a luggage compartment of a car out of sight overnight. Cover is assessed on individual circumstances.

Cover for valuables such as laptops, tablets, mobile phones, jewellery or cameras locked in the luggage compartment of a car. Cover is assessed on individual circumstances.

Cover limit per person for lost or stolen cash. Cover is assessed on individual circumstances.

Overall limit for a single person for baggage lost temporarily. Cover is assessed on individual circumstances.

The minimum period of time in hours before which cover applies for temporarily lost baggage. Cover is assessed on individual circumstances.

Limit for additional travel expenses to reach a special event such as a wedding, conference or sporting event on time if the scheduled transport is cancelled or delayed.

Limit for additional travel expenses to reach pre-paid travel arrangements on time if the scheduled transport is cancelled or delayed. Cover is assessed on individual circumstances.

Whether the policy is automatically extended if your journey is extended due to unforeseen circumstances.

Limit for additional meal and accommodation expenses if scheduled transport is delayed.

The minimum number of hours before transport delay is covered. Cover is assessed on individual circumstances.

Limit per person per 24-hour period for this transport delay. Cover is assessed on individual circumstances.

Is the collision damage excess for a hire car covered?

Limit for collision damage excess for a hire car. Cover is assessed on individual circumstances.

Does the policy cover cancellation and additional expenses for claims due to transport incidents like mechanical breakdown and accidents?

Does the policy cover cancellation and additional expenses for claims due to strikes?

Does the policy cover claims due to mental health illness experienced for the first time on the trip, and not classified as an ongoing or existing medical condition?

Does the policy cover claims due to COVID-19?

Does the policy cover claims due to pandemics other than COVID-19?

Does the policy cover claims due to natural disaster?

Does the policy cover claims due to civil unrest?

Does the policy cover claims due to terrorism?

Does the policy cover claims due to war?

Average rating

Compare international travel insurance 2024 | choice.

- Membership & Benefits

- Discounts and special offers

- Competitions

- Become a member

- Have your say

- About your membership

- Change my details

- Pay or renew

- Member News blog

- Online shop

- Log into myRAC

- myRAC Frequently Asked Questions

- 5%* off purchases in-store and online

- Savings on gas for your home

- Save 4 cents per litre off fuel

- Car & Motoring

- Roadside Assistance

- Car insurance

- Caravan loans

- Motoring for businesses

- Motorcycle insurance

- Caravan & trailer insurance

- Car servicing & repairs

- Car Buying Service

- Electric vehicle products and services

- Electric SUVs available in Australia 2023

- WA's cheapest cars to own and run

- Some of the best cars for towing

- Home & Life

- Home insurance

- Boat insurance

- Life insurance

- Health insurance

- Home security

- Investments

- Personal loans

- Pet insurance

- Small business insurance

- Home services

- Pre-purchase building inspection benefits

- Learn to save a life in 30 minutes

- How secure is your home?

- Travel & Touring

- Our holiday parks & resorts

- Find a travel centre

- Travel & cruise deals

- Travel insurance

- Car hire & driving holidays

- WA holidays

- International driver’s permits

Cruise packages

- WA’s best road trips and long distance drives

- Endless things to see and do in Perth and WA

- WA’s top destinations and places worth visiting

Domestic travel insurance

- Cover for cancellation fees and lost deposits

- Members save 15%

Cover for when you're travelling within Australia

Cover your luggage, hire car and the risk of cancellation or disruption when travelling domestically.

There are three types of plans to choose from;

- Comprehensive Domestic

- Domestic Cancellation only

- Rental Vehicle Excess

Comprehensive Domestic Travel Insurance will give you

If you have to cancel your travel as a result of an unforseen event, your policy provides unlimited cover for cancellation.

Our comprehensive international and domestic policies now include limited cover for COVID-19 under the sections of cancellation, travel delay, special events and more. Please refer to the Product Disclosure Statement for more information. Cancellation and lost deposits are based on per adult.

We'll cover disruption to your travel plans including;

- New for old luggage cover up to $7,500

- Luggage delay $500

- Travel delay $1,500

- Personal money $250

When hiring a car on holidays, don't risk any extra costs if your car is stolen or damaged. We'll cover you for up to $5,000.

Don't stress about home if your travel plans are disrupted. We'll cover you for;

- Loss of income $5,200

- Financial default $3,000

Cover for travel agent fees of up to $2,000.

When you're on holiday, have peace of mind knowing that you and your loved ones are covered for;

- Legal liability $10 million

- Accidental death* $25,000

- Accidental disability* $25,000

This option covers a range of recreational winter sports including Snowboarding and Skiing (leisure bigfoot, cat, cross country, glacier, mono, off-piste) ice hockey, ice skating, luging, snowmobiling and tobogganing.

We will cover you for;

- Overseas medical and hospital expenses you pay as a result of injury

- Costs arising from hiring alternative snow equipment hire due to loss, theft or damage

- If you're unable to utilise the full duration of your pre-booked Ski pack (ski passes, ski hire, tuition or lift passes)

- Piste closure if there is not enough snow, bad weather or power failure

- Bad weather and avalanche closure

- Lift pass when there is theft or a loss

See the Product Disclosure Statement for details.

If you'd like to add this option and for pricing information, call 1300 655 179 .

If you have a change of heart and are yet to make a claim, you can cancel your policy within 21 days.

Terms and conditions apply. This advice is general advice only. Please refer to the Product Disclosure Statement before making a decision about this product and read the Target Market Determinations (TMDs) before determining whether this product is suitable for your circumstances. This product is issued by Tokio Marine & Nichido Fire Insurance Co., Ltd (ABN 80 000 438 291 AFSL 246548).

# Medical benefit expenses will not be incurred for more than 12 months from the time of first receiving treatment for the injury or illness. Limits, exclusions and conditions apply.

- Get a quote

Travelling around Australia?

Don't forget these essentials

Rent freedom with SIXT

Enjoy great rates and car rental deals from our partner SIXT Australia

Save on attractions

RAC members save on tours and activities across Australia and NZ.

Maps and guides

Browse our range of local and international destinations.

- Advocating change

- In the community

- Help centre

- Frequently asked questions

- Find a branch

RAC Products & Services

- Pay or Renew

- Holiday Parks and Resorts

- Home Security

- Car servicing & repair

- Home Services

Information & advice

832 Wellington Street, West Perth, Western Australia, 6005

This website is created by The Royal Automobile Club of WA (Inc.). © 2024 The Royal Automobile Club of WA (Inc.).

RAC acknowledges and pays respects to the Traditional Custodians throughout Australia. We recognise the continuing connection to land, waters and community.

- Accessibility

- RAC on Instagram

- RAC on Facebook

- RAC on Twitter

- RAC on LinkedIn

IMAGES

VIDEO

COMMENTS

Our Domestic Plan provides limited cover for COVID-19 cancellation fees, lost deposits, additional expenses, special events and travel delay, up to $3,500 per Adult (combined limit).^. Up to $7,500 per Adult for lost, stolen, or damaged luggage items including smart phones, tablets, and computers.^. Cancellation fees and lost deposits for ...

Like many other travel insurance companies, RACQ offers optional extras for both international and domestic getaways. These include: Skiing and winter sports cover: for an extra cost, you can include this snow and winter sports package on your travel insurance policy to protect you when you're carving up the snow-capped ski fields. The ...

Why travel Insurance is a holiday essential. Travel insurance is available for both international and domestic travel. Anyone who has planned a holiday since COVID-19 restrictions began to ease will understand the importance of flexibility when it comes to travelling in 2022. RACQ Head of Commercial Management and Delivery Quintin Dyer said ...

Tokio Marine & Nichido Fire Insurance Co Ltd (ABN 80 000 438 291 AFSL 246 548) is the issuer of RACQ Travel Insurance. The 'RACQ Travel Insurance - Combined Financial Services Guide and Product Disclosure Statement' (PDS) which includes the policy wording, is available here.Any financial advice provided by RACQ which is set out above is general in nature only, and does not take into account ...

RACQ travel insurance policies. RACQ offers three tiers of domestic travel insurance, as well as three tiers of international travel insurance. These tiers range from Saver, to Standard, and up to Premium. RACQ also offers an annual multi-trip travel insurance policy, if you're looking for cover that will sustain multiple journeys over the ...

How to make an RACQ Travel Insurance claim. The quickest way to make your claim is through RACQ's 24/7 online portal. Register with the email address you used to buy your policy, and RACQ will ...

About RACQ Travel Insurance 7 Contacting us 7 Key benefits 8 The cover 9 The plans We have available 9 Cover for You or Your family 15 Policy options and add-ons 16 ... 12 Domestic Services $1,500 13 Travel Delay $3,000 14 Hijack and Kidnap* $10,000 Ski and Winter Sports Option 15 Ski and Winter Sports Overseas Medical and Hospital

Domestic - No medical expenses are covered in Australia as we are prevented from paying by reason of statutory legislation ... Where it provides financial services in relation to RACQ Travel Insurance (such as financial advice or arranging for the issue of insurance), RACQ Operations Pty Ltd (ABN 80 009 663 414 AR 000234978) and Members Travel ...

RACQ wants You, Your family and loved ones to be safe when You travel. The first priority is to members. RACQ has partnered with Tokio Marine & Nichido to offer You 24 hour emergency assistance and protection when You travel overseas, as well as quality care for Trips taken within Australia. Your contract with Us.

Save 15% on travel insurance. Get 15% off RACQ Domestic and International Travel Insurance. Save 10% on campervan and motorhome hire. Get 10% off the daily hire rate for RVs, campervans and motorhomes. Save 10% at NRMA Parks and Resorts. Get 10% off standard rates at iconic destinations across Australia.

RACQ Travel Insurance c/o TMNFA GPO Box 4616, Sydney NSW 2001 24 Hour Emergency Assistance while overseas Phone +61 2 8055 1696 (reverse charges accepted from the overseas operator) Words with special meanings Within Your travel policy certain words have definite meanings that are capitalised and in italics. It is

Generally, you don't need to pay anything to be eligible for the travel insurance offered by these types of cards. Instead, you'll simply need to charge the cost of the trip to your card and ...

About RACQ Travel Insurance RACQ wants You, Your family and loved ones to travel safely, wherever You go. Our first priority is to our members. We have partnered with a large global insurer to offer You quality care, 24 hour assistance and protection when You travel within Australia and overseas. Contacting us RACQ sales and general enquiries

Medical. Create an account to write a review. We independently review and compare RACQ Premium against 90 other international travel insurance comparison products from 27 brands to help you choose the best.

Comprehensive Domestic Travel Insurance will give you. Cancellation costs. Now with limited COVID-19 Benefits. COVID-19 Cancellation Fees and Lost Deposits. COVID-19 Additional Expenses# and Special Events. COVID-19 Travel Delay#. Compensation for luggage and travel delay. Cover for rental vehicle excess. Peace of mind at home.

Absolute rubbish travel insurance company. We took out RACQ travel insurance from Australia to Greece in august 2022. During one stop for a week, our accomodation had absolutely no electricity upon checking in with no option to refund at the time leaving us no option to find somewhere quickly and book elsewhere.

Our RACT Domestic Travel Insurance policy provides insurance cover from the moment you leave home. With options available including domestic cancellation and rental car excess only, you can choose the most suitable plan for you. As an added bonus all members receive a 10% discount on our travel insurance products.

About RACQ Travel Insurance 7 Contacting us 7 Key benefits 8 The cover 9 The plans We have available 9 Cover for You or Your family 15 Policy options and add-ons 16 ... 12 Domestic Services^ $1,500 13 Travel Delay $3,000 14 Hijack and Kidnap* $10,000 Ski and Winter Sports option 15 Ski and Winter Sports Overseas Medical and Hospital