- Search Search Please fill out this field.

- Technical Analysis

- Technical Analysis Basic Education

Rount-Trip Trading Definition, Legitimate & Unethical Examples

Gordon Scott has been an active investor and technical analyst or 20+ years. He is a Chartered Market Technician (CMT).

:max_bytes(150000):strip_icc():format(webp)/gordonscottphoto-5bfc26c446e0fb00265b0ed4.jpg)

What Is Round-Trip Trading?

Round-trip trading, or "round-tripping," usually refers to the unethical practice of purchasing and selling shares of the same security over and over again in an attempt to manipulate observers into believing that the security is in higher demand than it actually is. By creating fake trading volume , round-tripping can also interfere with technical analysis based on volume data.

This sort of churning behavior differs greatly from the legal open and close transactions of day traders or ordinary investors. After all, every investor ultimately completes a round trip when they buy and later sell a security.

Key Takeaways

- Round-trip trading generally refers to an unethical market-manipulation technique involving a series of wash trades.

- Repeatedly buying and selling securities will inflate trading volume and balance sheet figures to game the activity and interest in a stock.

- Round-trip trading has been seen in several high-profile scandals, including the Enron collapse.

Understanding Round-Trip Trading

Round-trip trading is an attempt to create the appearance of a high volume of trades, without the company behind the security experiencing an increase in income or earnings . These types of trades can be carried out in several ways, but most commonly are completed by a single trader selling and purchasing the security on the same trading day, or by two companies buying and selling securities between themselves. This practice is also known as churning or making wash trades .

Round-trip trading can easily be confused with legitimate trading practices, such as the frequent round-trip trades made by pattern day traders. These traders typically execute many transactions on the same day . However, they do have minimum standards they must practice, such as keeping at least $25,000 of account equity before completing these types of transactions, and reporting their net gains or losses on the transactions as income, rather than pretending gains are investments and losses are expenses.

Another instance of acceptable round-trip trades is a swap trade, where institutions will sell securities to another individual or institution while agreeing to repurchase the same amount at the same price in the future. Commercial banks and derivative products practice this type of trading regularly. But the dynamics of this kind of trading do not inflate volume statistics or balance sheet values.

Example of Round-Trip Trading

One of the most famous instances of round-trip trading was the case of the collapse of Enron in 2001. By moving high-value stocks to off-balance-sheet special purpose vehicles (SPVs) in exchange for cash or a promissory note , Enron was able to make it look like it was continuing to earn a profit while hedging assets on its balance sheets.

These transfers were backed by Enron’s stocks, making the illusion a veritable house of cards waiting to collapse. And collapse it did. In addition to other poor and deceptive bookkeeping practices, Enron was able to fool Wall Street and the public into believing that the company was still one of the largest and most profitably secure institutions in the world when, in fact, it was barely treading water.

The Securities and Exchange Commission (SEC) opened an investigation into the activities and several people were prosecuted and imprisoned. The accounting firm that handled Enron’s bookkeeping also went under because of its participation in the deceit. The firm was found guilty of obstruction of justice by shredding paperwork that would implicate members of the board and high-ranking Enron employees.

U.S. Securities and Exchange Commission. “ Margin Rules for Day Trading .” Accessed May 10, 2021.

U.S. Securities and Exchange Commission. " SEC v. Andrew S. Fastow ." Accessed May 10, 2021.

:max_bytes(150000):strip_icc():format(webp)/terms_e_enron.asp-FINAL-e721013a87674a3da429b571a67a1e95.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

Chat

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Mortgage & HELOC

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

Insights & Education

Keeping you at the forefront of modern investing

The latest commentary

Markets and Economy

A Conversation With Chuck Schwab

May 10, 2024 • Liz Ann Sonders • Kathy Jones

Market Snapshot

May 08, 2024

International

The Recession Has Ended

May 06, 2024

The Fed's Message: Patience

May 03, 2024

Government Policy

Global Issues: Risks & Rewards

May 02, 2024

Market updates

Schwab Market Update: Opening

Weekly Trader's Outlook

Today's options market update.

Looking to the Futures

Popular in trading, options expiration checklist.

May 07, 2024

Futures on thinkorswim® web

February 29, 2024

2023 Taxes: 8 Things to Know

December 05, 2023

Form 1099-B Reporting

October 02, 2023

Pattern Day Trading Rule

September 18, 2023

Trading Tools

Intro to thinkorswim® Desktop

August 28, 2023

Planning and retirement

Estate Planning

Protect Assets from a Divorce

May 09, 2024

Financial Planning

Money Stress? You Aren't Alone

The Power of Compounding

Choices for Inheriting an IRA

May 01, 2024

Retirement Budget Planning

April 30, 2024

Declutter Your Portfolio

April 29, 2024

Schwab original podcasts

Behavioral Finance

The Charmer's Playbook

Asset allocation like the pros, onward magazine.

Weighing Insurance Options

How to borrow against assets, how to minimize the risk of an irs audit, india: the next big thing, trading the magnificent seven, estate planning for collectors, explore more topics.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the Options Disclosure Document titled " Characteristics and Risks of Standardized Options " before considering any option transaction. Call Schwab at 1 ‐ 800 ‐ 435 ‐ 4000 for a current copy. Supporting documentation for any claims or statistical information is available upon request.

Investing involves risks, including loss of principal. Hedging and protective strategies generally involve additional costs and do not assure a profit or guarantee against loss. With long options, investors may lose 100% of funds invested. Spread trading must be done in a margin account. Multiple leg options strategies will involve multiple per-contract charges. Covered calls provide downside protection only to the extent of the premium received and limit upside potential to the strike price plus premium received.

Futures and futures options trading involves substantial risk and is not suitable for all investors. Please read the Risk Disclosure Statement for Futures and Options prior to trading futures products. Futures and forex accounts are not protected by the Securities Investor Protection Corporation (SIPC). Futures, futures options, and forex trading services provided by Charles Schwab Futures and Forex LLC. Trading privileges subject to review and approval. Not all clients will qualify.

Charles Schwab Futures and Forex LLC (NFA Member) and Charles Schwab & Co., Inc. (Member FINRA/SIPC) are separate but affiliated companies and subsidiaries of The Charles Schwab Corporation.

What are Round-Trip Transactions?

Complete Explanation of Round Tripping including Purpose, Example, & Risks

Home › Finance › Corporate Finance › What are Round-Trip Transactions?

In the complex world of financial markets and corporate accounting, the term “round-trip transactions” often surfaces amidst discussions of financial ethics, regulatory compliance, and corporate governance.

These transactions, while not inherently illicit, tread a fine line between strategic financial management and the murky waters of manipulative practices.

This comprehensive guide aims to unravel the intricacies of round-trip transactions, shedding light on their purposes, risks, and the legal and ethical considerations they entail.

- Round-Trip Transactions Meaning

Key Takeaways

The purpose of round-trip transactions, how is round tripping used, round tripping example, the risks and implications of round-trip transactions, legal and regulatory framework, ethical considerations of round trip transactions, detecting and preventing round-trip transactions, what exactly defines a round-trip transaction in financial terms, why might a company engage in round-trip transactions, what are the potential risks of engaging in round-trip transactions, how can round-trip transactions be identified or prevented.

Round-trip transactions refer to a series of transactions in which a company sells an asset to another party with the agreement that the asset will be bought back at a later date, usually at a similar or predetermined price.

This cycle creates the appearance of genuine business activity without any substantive change in the company’s financial position or the asset’s ownership. While round-trip transactions span various industries, they are notably prevalent in the energy sector and financial markets, where companies might engage in these deals to inflate revenue figures or to create a facade of heightened market activity.

The distinction between legitimate and manipulative uses of round-trip transactions hinges on intent and disclosure. Legitimate uses are typically transparent and aim to achieve lawful financial or operational objectives, such as hedging against price fluctuations. Conversely, manipulative practices are designed to deceive stakeholders or regulatory bodies about a company’s true financial health or market activity.

Manipulative Impact on Financial Statements : Round-tripping is primarily used to artificially inflate a company’s revenue and trading volume, misleading stakeholders about the company’s true financial performance and market activity.

Legal and Ethical Risks : Engaging in round-trip transactions carries significant legal and ethical risks, including regulatory penalties and reputational damage, as these practices can be considered deceptive and manipulative.

Importance of Transparency and Regulation : The detection and prevention of round-trip transactions highlight the importance of transparent accounting practices and stringent regulatory oversight to ensure the integrity of financial markets and protect investor interests.

Round tripping is often used to artificially inflate a company’s revenue and trading volume, creating the appearance of a higher level of business activity than actually exists.

This practice can be employed to meet financial targets, influence stock prices, or enhance the attractiveness of the company to investors by manipulating financial statements. By artificially inflating revenue, a company can appear more financially robust and liquid than it truly is, potentially influencing stock prices and investor perception.

The allure of round-trip transactions lies in their ability to temporarily enhance a company’s financial standing without necessitating actual business growth or operational improvements. This can make a company more attractive to investors, lenders, and analysts in the short term, albeit at significant risk.

Companies might engage in round-trip transactions in several different ways. Here are the most common round-trip transactions:

Inflating Revenue : A company may engage in round-tripping by selling an asset to another entity and buying it back at a similar price. These transactions can be recorded as legitimate sales and purchases, artificially inflating the company’s revenue and sales volume without any real change in its economic situation, misleading stakeholders about the company’s financial performance.

Boosting Asset Turnover : By repeatedly selling and repurchasing assets in round-trip transactions, a company can give the impression of higher asset turnover than is actually the case. This can make the company appear more efficient in its use of assets, potentially misleading investors about its operational effectiveness.

Manipulating Market Activity: In the case of publicly traded companies, round-trip transactions can be used to create an illusion of heightened trading activity for the company’s shares. This can influence stock prices by suggesting a higher demand for the shares than actually exists, potentially attracting more investors based on misleading information.

An example of round-tripping involves a company, Company A, selling an asset to Company B for $1 million. Shortly thereafter, Company B sells the same asset back to Company A for approximately the same price, say $1.01 million.

This sequence of transactions makes it appear as though Company A has engaged in $1 million worth of sales, thereby inflating its revenue figures, even though there has been no real change in the economic position of either company.

This practice can be used to manipulate financial statements and give an inflated impression of the company’s financial health and trading volume, potentially misleading investors and regulators.

The primary risk associated with round-trip transactions is the potential for legal repercussions and loss of investor trust. Regulatory bodies in many jurisdictions scrutinize such practices closely, and companies found guilty of using round-trip transactions to manipulate financial outcomes can face hefty fines, legal sanctions, and reputational damage.

Notable incidents, such as the Enron scandal, highlight the catastrophic impact that deceptive financial practices can have on stock prices, market stability, and investor confidence.

Moreover, round-trip transactions can distort market perceptions, leading to inefficient capital allocation and undermining the integrity of financial markets. The artificial inflation of activity or liquidity can mislead stakeholders about market demand, price stability, and the true value of assets involved.

The legal status of round-trip transactions varies by jurisdiction, but there is a growing trend towards stricter regulation and oversight. Financial regulatory bodies worldwide have implemented guidelines and reporting requirements to curb the abuse of such transactions.

The role of auditors and financial regulators is pivotal in detecting manipulative practices, necessitating rigorous examination of financial records, transaction trails, and disclosure statements.

Beyond legal implications, round-trip transactions pose significant ethical dilemmas. The fine line between creative accounting and outright fraud is often blurred, challenging companies to maintain integrity and transparency in their financial reporting.

Ethical business practices and robust corporate governance structures are crucial in mitigating the temptation to engage in deceptive financial maneuvers.

Companies must foster a culture of honesty and accountability, ensuring that all stakeholders can rely on the veracity of financial statements and market activities.

For investors and regulators, identifying potential round-trip transactions involves scrutinizing sudden spikes in revenue or trading volume without corresponding changes in market conditions or company operations. Vigilance and due diligence are essential in assessing the authenticity of reported financial health and operational activity.

Companies, on their part, can prevent misuse by adopting transparent accounting practices, regularly auditing financial records, and ensuring that all transactions are conducted at arm’s length and properly disclosed. As the financial landscape evolves, so too must the strategies for maintaining fairness and integrity in corporate reporting and market transactions.

Round-trip transactions, while a legitimate tool in certain contexts, present a complex challenge in the realm of financial ethics and regulation. As companies navigate the pressures of financial performance and market competitiveness, the temptation to engage in such practices underscores the importance of robust regulatory frameworks, corporate governance, and ethical leadership.

The future of round-trip transactions will undoubtedly be shaped by ongoing efforts to balance financial innovation with transparency and integrity, ensuring the stability and trustworthiness of markets and corporate institutions. In this ever-changing environment, the collective responsibility of companies, regulators, and investors to foster transparency and integrity has never been more critical.

Frequently Asked Questions

A round-trip transaction refers to a set of transactions where an asset is sold and subsequently repurchased by the original seller, often at a similar price, to artificially inflate volume or revenue without any real change in asset ownership.

Companies may use round-trip transactions to meet financial targets or create the illusion of increased business activity, thereby enhancing their financial statements or market valuation temporarily.

Round-trip transactions can lead to legal penalties, reputational damage, and a loss of investor trust if used to manipulate financial statements or deceive stakeholders.

Identifying round-trip transactions involves scrutinizing financial records for transactions that inflate company activity without real economic substance, while prevention requires transparent accounting practices and rigorous financial oversight.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

This website uses cookies.

By clicking the "Accept" button or continuing to browse our site, you agree to first-party and session-only cookies being stored on your device to enhance site navigation and analyze site performance and traffic. For more information on our use of cookies, please see our Privacy Policy .

- American Economic Journal: Applied Economics

- APP October 2022

- The Round Trip Effect: Endogenous Transport Costs and International Trade

AEA Journal Article Full-Text Access

- AEA Member Login

- Article Purchase

- OpenAthens Access

Home > Learning Center > Round Trip Time (RTT)

Article's content

Round trip time (rtt), what is round trip time.

Round-trip time (RTT) is the duration, measured in milliseconds, from when a browser sends a request to when it receives a response from a server. It’s a key performance metric for web applications and one of the main factors, along with Time to First Byte (TTFB), when measuring page load time and network latency .

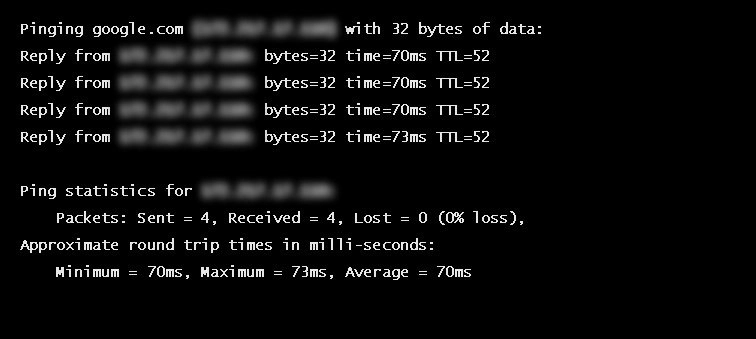

Using a Ping to Measure Round Trip Time

RTT is typically measured using a ping — a command-line tool that bounces a request off a server and calculates the time taken to reach a user device. Actual RTT may be higher than that measured by the ping due to server throttling and network congestion.

Example of a ping to google.com

Factors Influencing RTT

Actual round trip time can be influenced by:

- Distance – The length a signal has to travel correlates with the time taken for a request to reach a server and a response to reach a browser.

- Transmission medium – The medium used to route a signal (e.g., copper wire, fiber optic cables) can impact how quickly a request is received by a server and routed back to a user.

- Number of network hops – Intermediate routers or servers take time to process a signal, increasing RTT. The more hops a signal has to travel through, the higher the RTT.

- Traffic levels – RTT typically increases when a network is congested with high levels of traffic. Conversely, low traffic times can result in decreased RTT.

- Server response time – The time taken for a target server to respond to a request depends on its processing capacity, the number of requests being handled and the nature of the request (i.e., how much server-side work is required). A longer server response time increases RTT.

See how Imperva CDN can help you with website performance.

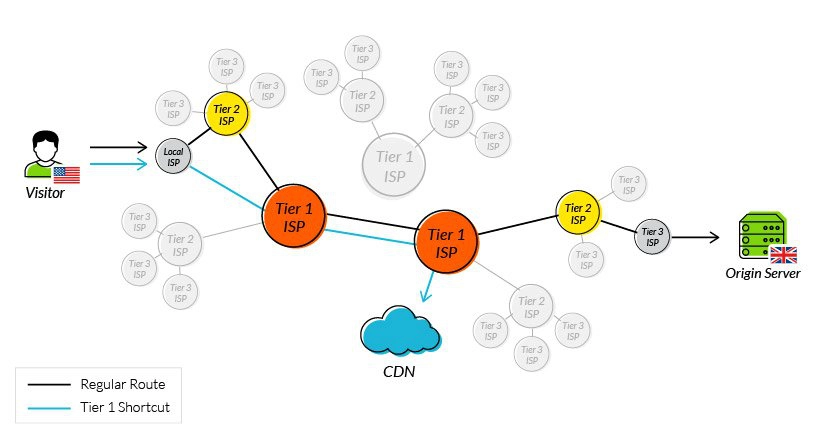

Reducing RTT Using a CDN

A CDN is a network of strategically placed servers, each holding a copy of a website’s content. It’s able to address the factors influencing RTT in the following ways:

- Points of Presence (PoPs) – A CDN maintains a network of geographically dispersed PoPs—data centers, each containing cached copies of site content, which are responsible for communicating with site visitors in their vicinity. They reduce the distance a signal has to travel and the number of network hops needed to reach a server.

- Web caching – A CDN caches HTML, media, and even dynamically generated content on a PoP in a user’s geographical vicinity. In many cases, a user’s request can be addressed by a local PoP and does not need to travel to an origin server, thereby reducing RTT.

- Load distribution – During high traffic times, CDNs route requests through backup servers with lower network congestion, speeding up server response time and reducing RTT.

- Scalability – A CDN service operates in the cloud, enabling high scalability and the ability to process a near limitless number of user requests. This eliminates the possibility of server side bottlenecks.

Using tier 1 access to reduce network hops

One of the original issues CDNs were designed to solve was how to reduce round trip time. By addressing the points outlined above, they have been largely successful, and it’s now reasonable to expect a decrease in your RTT of 50% or more after onboarding a CDN service.

Latest Blogs

Luke Richardson

Dec 27, 2023 6 min read

Erez Hasson

Dec 21, 2023 2 min read

Dec 7, 2023 6 min read

Latest Articles

- Network Management

170.6k Views

166.4k Views

153.5k Views

104.5k Views

100.8k Views

98.8k Views

54.8k Views

2024 Bad Bot Report

Bad bots now represent almost one-third of all internet traffic

The State of API Security in 2024

Learn about the current API threat landscape and the key security insights for 2024

Protect Against Business Logic Abuse

Identify key capabilities to prevent attacks targeting your business logic

The State of Security Within eCommerce in 2022

Learn how automated threats and API attacks on retailers are increasing

Prevoty is now part of the Imperva Runtime Protection

Protection against zero-day attacks

No tuning, highly-accurate out-of-the-box

Effective against OWASP top 10 vulnerabilities

An Imperva security specialist will contact you shortly.

Top 3 US Retailer

- Cambridge Dictionary +Plus

Meaning of round trip in English

Your browser doesn't support HTML5 audio

- break-journey

- circumnavigation

round trip | Intermediate English

Round trip | business english, examples of round trip, translations of round trip.

Get a quick, free translation!

Word of the Day

a unit for measuring the loudness of sound

Varied and diverse (Talking about differences, Part 1)

Learn more with +Plus

- Recent and Recommended {{#preferredDictionaries}} {{name}} {{/preferredDictionaries}}

- Definitions Clear explanations of natural written and spoken English English Learner’s Dictionary Essential British English Essential American English

- Grammar and thesaurus Usage explanations of natural written and spoken English Grammar Thesaurus

- Pronunciation British and American pronunciations with audio English Pronunciation

- English–Chinese (Simplified) Chinese (Simplified)–English

- English–Chinese (Traditional) Chinese (Traditional)–English

- English–Dutch Dutch–English

- English–French French–English

- English–German German–English

- English–Indonesian Indonesian–English

- English–Italian Italian–English

- English–Japanese Japanese–English

- English–Norwegian Norwegian–English

- English–Polish Polish–English

- English–Portuguese Portuguese–English

- English–Spanish Spanish–English

- English–Swedish Swedish–English

- Dictionary +Plus Word Lists

- English Noun

- Business Noun

- Translations

- All translations

To add round trip to a word list please sign up or log in.

Add round trip to one of your lists below, or create a new one.

{{message}}

Something went wrong.

There was a problem sending your report.

IMAGES

VIDEO

COMMENTS

Round-trip trading attempts to inflate transaction volumes through the continuous and frequent purchase and sale of a particular security . The term can also be used to refer to the practice of a ...

This is also called a "round trip." Security position: Day trading applies to virtually all securities—stocks, bonds, ETFs, and even options (calls and puts). Same day: If you do a round trip on the same day, it's a day trade. If you hold your security position beyond the close of the trading day, it's not a day trade.

The round trip efficiency (RTE), also known as AC/AC efficiency, refers to the ratio between the energy supplied to the storage system (measured in MWh) and the energy retrieved from it (also measured in MWh). This efficiency is expressed as a percentage (%). The round trip efficiency is a crucial factor in determining the effectiveness of ...

port costs which incorporates one of its key institutional features, the round trip effect. This paper is the first, to my knowledge, to study both the theoretical and empirical implications of the round trip effect for trade outcomes. Transport costs in the trade literature are typically modeled as exogenous. They are typically approximated ...

There are five stages in this model: 1.Entry decision of the transport firms (carriers). Since carriers commit to servicing a round trip route upon entry, they will enter the market only if their expected joint profits in both directions are non-negative. 2.Export decision of the manufacturing firms (exporters).

round trip effect, as predicted by my theoretical model and Samuelson 1954( ), is a negative correlation in freight rates between the same set of ports. To the best of my knowledge, this is the first paper to provide systematic evidence for this negative correlation. Since trade and freight rates on the same route are nega-

Round tripping is an illegitimate way to boost earnings, by trading shell transactions or assets. It is mostly done on a no-profit basis or mutual agreement. Round tripping benefits the organization by inflating the revenue to demonstrate the organization's expansion, to demoAnstrate that the company is conducting more business than rivals ...

Container ships travel between a fixed set of origins and destinations in round trips, inducing a negative correlation in their freight rates. I study the implications of this round trip effect on international trade and trade policy. I identify this effect and develop an instrument using it to estimate the impact of transport costs on trade.

Round-trip trading, or "round-tripping," is an unethical practice involving the repeated buying and selling of the same security. This manipulative strategy aims to create a false impression of high demand, impacting trading volume and technical analysis. In this comprehensive article, we delve into the nuances of round-trip trading, its ...

VOL. VOL NO. ISSUE THE ROUND TRIP EFFECT A1 A. Online Appendix The Round Trip Effect: Endogenous Transport Costs and International Trade Woan Foong Wong A. Tables and Figures Panel A: Without the Round Trip Effect Q ji T. Quantity from j to i T ji T. Cost (Price) from j to i Q¯S ji = Cji +cjiTji QD ji = D i +diT ji Q ij T. Quantity from i to j ...

DECRG Kuala Lumpur Seminar Series. This paper studies transport costs as market outcomes and highlights the round trip effect, a key feature of the transportation industry that links transport supply between locations. Incorporating transportation into an Armington trade model, I show that this effect mitigates shocks on a country's trade with ...

Fidelity's Excessive Trading Policy. Fidelity has long discouraged excessive trading by mutual fund investors. Excessive trading can be expensive and burdensome for long-term shareholders because it can: Reduce returns to long-term shareholders by increasing fund costs (such as brokerage commissions) Disrupt portfolio management strategies ...

Definition: Round-trip transactions refer to a series of transactions where a company sells an asset and then repurchases the same or similar asset, often at a similar price and within a short time frame. These transactions can artificially inflate a company's revenue and trading volume, creating a misleading impression of its financial activity and health.

The round-trip time (RTT) from the client's network to the AWS Region that the WorkSpaces are in should be less than 100ms. If the RTT is between 100ms and 200ms, the user can access the WorkSpace, but performance is affected. If the RTT is between 200ms and 375ms, the performance is degraded. If the RTT exceeds 375ms, the WorkSpaces client ...

Round tripping occurs when one company sells to another party in order to generate , and later buys back the assets. The intent of doing so is to artificially boost a firm's reported sales. This can be quite useful for a publicly-held business, since investors will see the revenue increase and bid up the price of the firm's shares accordingly.

round-trip: [noun] a trip to a place and back usually over the same route.

The Round Trip Effect: Endogenous Transport Costs and International Trade by Woan Foong Wong. Published in volume 14, issue 4, pages 127-66 of American Economic Journal: Applied Economics, October 2022, Abstract: Container ships travel between a fixed set of origins and destinations in round trips,...

In telecommunications, round-trip delay (RTD) or round-trip time (RTT) is the amount of time it takes for a signal to be sent plus the amount of time it takes for acknowledgement of that signal having been received. This time delay includes propagation times for the paths between the two communication endpoints. In the context of computer networks, the signal is typically a data packet.

Factors Influencing RTT. Actual round trip time can be influenced by: Distance - The length a signal has to travel correlates with the time taken for a request to reach a server and a response to reach a browser.; Transmission medium - The medium used to route a signal (e.g., copper wire, fiber optic cables) can impact how quickly a request is received by a server and routed back to a user.

ROUND TRIP definition: 1. If you make a round trip, you go on a journey and return to where you started from. 2. If you…. Learn more.

What is round-trip time? Round-trip time (RTT) is the duration in milliseconds (ms) it takes for a network request to go from a starting point to a destination and back again to the starting point. RTT is an important metric in determining the health of a connection on a local network or the larger Internet, and is commonly utilized by network ...

ROUND TRIP meaning: 1. If you make a round trip, you go on a journey and return to where you started from. 2. If you…. Learn more.