Compare travel insurance

Ensure you and your family are 100% protected, 5 star policies, compare travel insurance quotes.

Save up to AED 700 on your travel insurance

It's fast, free and simple!

Get a travel insurance quote in less than 5 minutes

How to compare travel insurance quotes, tell us about yourself.

Tell us about yourself, your travel plans and what you need cover for.

We'll show you the cheapest travel insurance quotes and offer the best cover.

Purchase your policy and be immediately covered for your trip.

Why take out travel insurance?

When travelling on business or for leisure, travel insurance can protect you for all the things that could go wrong. If you lose your baggage, become ill or experience cancelled flights or delays travel insurance will ensure you get professional assistance.

What does travel insurance cover?

Baggage : Cover if your luggage or possessions are lost, stolen or damaged.

Cancellation : Support if you trip is cancelled.

Delay : Assistance if you trip is delayed.

Emergency Assistance : Coverage if you need to be brought back because of your injury.

Medical Expenses : Doctor or hospital costs will be covered.

Personal Liability : Protect if you damage anything or anyone.

What does a standard travel insurance include?

Cancellation & Delays

Emergency Assistance

Lost Baggage

Medical Expenses

Personal Liability

What does a standard travel insurance does not include?

Extreme Sports

Natural Disasters

Pre-existing Medical Conditions

Specific Trip Policies

Single trip.

Single trip travel insurance covers you for one trip to specified destinations and a defined period of time.

Annual Multi Trip

If you travel frequently, annual multi trip insurance policies cover you for unlimited trips for a whole year.

Worldwide travel insurance allows you to travel protected anywhere across the world.

Winter Sports

For skiing holidays get protected with our winter sports travel insurance.

Backpackers

If your travelling for a long period of time across multiple countries, get protected with our backpackers travel insurance.

Cover your children under one policy with our family travel insurance policies.

Pre-existing medical conditions

If you have a pre-existing medical condition ensure you can claim just in case your conditions causes you issues when travelling.

Get extra cover for over 65s travel insurance to ensure you're adequately protected when travelling.

Insure your cruise with our cruise travel insurance policies just in case of missed ports, cabin confinement or cruise activities.

How much does travel insurance cost?

Travel insurance is priced on a few different factors, so premiums will vary considerably on your circumstances

Single trip travel insurance

Compare single trip travel insurance quotes online

Annual multi trip travel insurance

Compare annual multi trip travel insurance quotes online

Ski travel insurance

Compare ski travel insurance quotes online

More travel insurance

- Travel insurance guides

- Travel insurance articles

- Travel insurance providers

Our top travel insurance guides / articles

View all travel insurance guides.

Different Travel Policy Types

Travel insurance is designed to protect you and your belongings against life’s unexpected events

Our guide on medical expenses cover

When you are traveling, an unexpected medical emergency is the last thing on your mind

Our guide on holiday cancellation insurance

Holiday cancellation insurance is a form of travel insurance that covers you if something unexpected happens

Our guide to personal liability cover

Personal liability cover is a type of insurance that covers third-party claims

Why is repatriation cover so important?

Repatriation cover is a benefit offered included in some travel insurance packages

Travel insurance over 60s

If you are over the age of 60 and have retired or have family living abroad

Annual multi-trip travel insurance

Annual travel insurance, otherwise known as multi-trip insurance, is a policy that provides cover for individuals who travel more regularly

Why baggage cover is important

Most standard travel insurance policies cover your baggage if it gets lost, stolen, or damaged while you are travelling

A single trip policy covers you for just a single holiday, from the time you leave home until the time you return

Worldwide Travel Insurance

If you are planning an international trip, one thing you should not forget to consider is worldwide travel insurance

Winter sports travel insurance for skiing holidays

Going on an adrenaline-packed skiing holiday is something exciting to look forward to.

Backpacker Travel Insurance

This type of insurance is essential for backpackers to ensure that their plans, possessions, and health is protected

Family travel insurance

This is a policy which typically covers one to two adults, plus at least one child

Why you should always declare your pre-existing medical conditions

There are an array of options out there for you

Cruise Travel Insurance

Why you should take out travel insurance for your upcoming cruise

Are your gadgets covered on your travel insurance policy?

Gadgets such as cameras, mobile phones are laptops are often considered essentials for travelling

Travel insurance and pregnancy

It is generally advised that expecting mothers should not travel after 6 months of pregnancy

Holiday tips

It is important to make sure you have all the essentials sorted out beforehand

Travel insurance for cancer patients

Cancer patients can apply for travel insurance with standard insurance companies

There are generally more risks associated with skiing trips

Emergency Dental Cover

Dental costs can be expensive but if you have travel insurance you are sure to be covered

Medical costs abroad

Medical costs abroad can be crippling and unfortunately accidents do happen

What does flight cancellation actually cover?

Depending on the policy, you could possibly claim in the case of sickness, injury, or death

What happens when you lose your passport whilst travelling?

What do you do if you do not find your passport?

Medical assistance cover whilst travelling

With travel insurance, most standard policies would include medical assistance while you are travelling

Extreme sports activities

If you are planning to go on an adventure holiday, participating in activities that insurers might deem as dangerous

Delayed Baggage

Travel insurance will help you travel with a sense of security – knowing you will be covered if some emergency arises

Trip Cancellation Insurance

Unforeseen emergencies can happen at any time like falling ill so you or your travel partner can’t travel or emergency hospitalisation

Legal fees when travelling

Most standard travel insurance policies offer to pay for your legal bills in case you cause injury to someone else

Terrorism cover when travelling

If your holiday destination is affected by an act of terrorism before you leave for your holiday – it’s possible you are able to cancel your trip

Extra cover for sports activities when travelling

Are you planning an activity-filled holiday for you or your family?

What if you were to get mugged when travelling?

Even the most vigilant and careful travellers can get pickpocketed or mugged.

How to make a travel insurance claim?

Here’s what you need to know to make claiming from your travel insurance policy a little bit easier

Emergency assistance

Travel insurance is made for the unexpected and to save you from huge medical bills while travelling

Flight delay

Most travel insurance policies provide cover as part of your standard policy for flight delays

What would happen if you lost your credit card when travelling?

Credit card fraud is not uncommon at all

Credit Card Fraud

If your credit cards get lost or stolen it could be devastating to your travel plans

Personal accident while on holiday? It’s better to have cover!

If an accident does happen on your trip you will have peace of mind

Visa rejection and travel insurance

What happens if your visa gets denied?

Golf cover and travel insurance

Many golfers travel all over the world to play the different courses in different countries

Car rental excess cover while travelling

A road trip might be your ideal holiday in an unknown destination but are you sure you have the right cover in case of an accident?

Flight overbooking

Always be sure that you check in on time so you would still qualify for compensation in the case of overbooking of a flight

Our Insurance Partners

We’re all about helping you save money

Have you ever bought something only later to find out that you could have gotten the same item cheaper elsewhere? We really hate that feeling.

That’s why at Compare Insurance, we set out to help Dubains like yourself avoid that sinking feeling when it came to buying insurance.

Real, accurate quotes

The premiums for car or health insurance can vary by hundreds or even thousands of dirhams, so it is always wise to shop around for options. The key is to find the lowest rate from dozens of insurance companies in UAE, which is often a time consuming affair.

This is where Compare Insurance would assist in comparing rates from a broad section of insurance companies providing you with impeccable service in the process and also help you save money.

What our members are saying

I was looking for my car insurance online and I stumbled upon you guys, and it has been an unbelievably smooth service all the way from the start till the end. I would definitely recommend you to friends, family and beyond.

According to these lower quotes, I could save AED 2100 by changing insurance companies with the new car I am considering.

Ana, your services were truly delightful. Usually selecting an insurance plan is tedious considering multitude of products in the market, but you made it simple.

Ready to talk?

Our team of professional agents are here to assist you. get in touch today.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

- Complaints & Feedback

Travel insurance that meets your needs

Millions of travelers rely on Travel Guard® travel insurance from AIG UAE, to help them recover from unexpected circumstances that can interrupt their travel plans. Travel Guard® is a comprehensive insurance plan that caters to travelers worldwide.

Platinum Plan

Silver plan.

Our most comprehensive travel insurance plan going above and beyond Schengen visa requirements.

- Up to $500,000 Emergency Medical Expenses

- COVID-19 Medical Expenses up to $250,000

- Baggage Loss or Damage up to $2,500

- Trip Cancellation up to $5,000

- Up to $1,000 in Travel Delay Cover

- Emergency Family Travel up to $2,500

- Secure Wallet up to $1,000 in Credit Card Fraud

- 24h Worldwide Assistance Services

Our most popular travel insurance plan covering Schengen visa requirements.

- Up to $100,000 Emergency Medical Expenses

- COVID-19 Medical Expenses up to $100,000

- Baggage Loss or Damage up to $1,000

- Trip Cancellation up to $2,500

- Up to $500 in Travel Delay Cover

- Secure Wallet up to $500 in Credit Card Fraud

Our basic travel insurance plan covering Schengen Visa requirements.

- Up to $50,000 Emergency Medical Expenses

- COVID-19 Medical Expenses up to $50,000

Why AIG Travel Guard ® ?

Schengen Visa Compliant

All our three travel Insurance plans (Silver, Gold & Platinum) are Schengen Visa Compliant.

Exceptional Price Tag

Whether you are heading near or far, our annual & single trip covers comes at an affordable price letting you get on with your holiday.

Cover Plans To Suit You

AIG offer 3 types of Travel insurance cover plans with optional additions to ensure that we have a policy to match your needs.

Covid-19 Covered

- COVID-19 Medical Expenses up to $250,000 under Platinum plan

- COVID-19 Medical Expenses up to$100,000 under Gold plan

- COVID-19 Medical Expenses up to$50,000 under Silver plan.

- USD 150 per day, per person for up to 14 consecutive days if you test positive for COVID-19 and are unexpectedly placed into mandatory quarantine while overseas.

Enjoy a worry-free holiday with a comprehensive travel insurance from AIG UAE

Pick up a travel policy and explore more with our fantastic cover that provides a range of benefits.

Get Your Travel Insurance in Dubai, Abu Dhabi & The Rest of Emirates Online From AIG UAE

24/7 worldwide support.

Whenever you need us, our 24/7 emergency assistance helpline are here to help as standard.

Get your Travel Insurance online in 4 easy steps

Provide trip information

Enter details about the trip.

Select the preferred plan

Choose the Silver, Gold or Platinum plan.

Fill out personal details

Provide personal information about the traveller.

Review & Pay

Pay online, and the system will successfully issue the policy.

What is AIG Travel Insurance?

AIG Travel Insurance is insurance that is designed to protect your health, belongings and the cost of your trip should anything go wrong while you are abroad or in some cases before you leave.

Travel Guard FAQs

What is travel guard.

Travel Guard is a travel insurance product, underwritten by American Home Assurance Co (Dubai Branch) a subsidiary of American International Group, Inc (AIG). Travel Guard provides coverage in case of unforeseen circumstances that may force you to cancel or shorten your trip or seek emergency medical treatment while traveling. Your travel insurance also offers coverage for the loss or delay of your baggage, in addition to many other benefits described in the policy, which you can review before making your purchase. All coverage is subject to the policy terms and conditions.

How do I buy a Travel Guard policy?

You can buy a Travel Guard policy via www.aig.ae .

Who is eligible to be covered under a Travel Guard policy?

Individuals in the age bracket from 3 months to 74 years and 364 days who are residents or citizens the United Arab Emirates.

Is there a special rate for children?

Yes. There is a 50% reduction on standard rates for a person aged between 3 months and 17 years and 364 days.

Does the Travel Guard policy cover a family traveling together? How is family defined?

Yes. There is a family rate under the Travel Guard policy. Family is defined as insured person, his/her spouse, and unlimited number of their children.

What is the Annual Multi Trip option?

The Annual Multi Trip option covers you for one-year period for unlimited number of trips, but each trip should not exceed 90 days.

Who do I contact for an emergency assistance or if I need to be admitted to a hospital while overseas?

For 24-hour emergency assistance or if you need to be admitted to a hospital, please contact +1 (817) 826 7276 and quote your policy number.

Can I amend my policy?

Yes, the Travel Guard policy can be amended in special cases, but amendment can only be made prior to the departure of the first part of the journey.

Do I have to carry a copy of my certificate of insurance with me while traveling?

No, you don't need to carry a copy of your certificate of insurance with you. All you need is your policy number which can be found on your certificate of insurance.

What do I do if I lose my certificate of insurance?

Please Click here to download your certificate of insurance.

When does my coverage begin?

For Trip Cancellation:

- For a single trip policy, cover starts at the time that you book the trip or pay the premium, whichever is later;

- For an annual multi trip policy cover starts at the time you book a trip, or the effective date shown on the certificate of insurance, whichever is later.

For other benefits, coverage begins when you leave your country of residence. The initial departure point has to be from the United Arab Emirates.

How will my out-patient medical expenses be paid ?

The medical expenses incurred will be reimbursed to you subject to policy T&Cs. Please retain all original medical bills/invoices, medical reports, and laboratory tests (if applicable) and submit them as part of your claim.

Does the Travel Guard policy cover sports and other similar activities?

Travel Guard policy offers an optional coverage for hazardous & winter sports with 100% loading on standard rates.

Can I cancel my trip for any reason and get all my money back under the “Trip Cancellation” Benefit?

The Trip Cancellation Benefit provides coverage for specific reasons as described in your policy terms and conditions and reason for cancellation should be amongst those reasons for the claim to be covered.

Can I buy a Travel Guard policy, if I have a pre-existing medical condition?

Yes. However, Travel Guard policy has an exclusion for pre-existing medical conditions as detailed in the policy wording.

Does “Baggage & Personal Effects” benefit cover theft?

Yes, Travel Guard policy covers theft (and damage due to an attempted theft) as long as incidence occurs while travelling outside of your country of residence and within the period of insurance as stated in your certificate of insurance. Please refer to the Terms & Conditions of the Travel Guard policy to know more on this benefit.

How do I report a claim?

You can submit your claim online by clicking here

Alternatively, you can contact our local office with the below contact details:

How long is the claim processing time?

Claims will be processed within 7 working days after you have submitted all the required documentation.

Can I cancel my Travel Guard policy?

Yes, provided it is before the policy effective date as stated in your certificate of insurance and there is no claim registered under your policy.

Quick & Easy Online Quote

Get your great value Travel Insurance today

Travel Insurance Documents

Table of benefits, policy wordings, verify insurance policy & check coverage, travel insurance claim.

Submit online your claim in few easy steps

Looking for Accident & Health Insurance?

Personal Accident Insurance

Cover for when the unexpected happens

Hospital Cash Insurance

Financial care for every day of hospitalization

Critical Illness Insurance

A helping hand for you and your loved ones

- International Travel Insurance Dubai

- Single Trip

- Schengen product

- Annual Multi-Trip

- Hajj & Umrah

- Inbound to UAE

- Sports Cover

- Policy Document

- Travel Tips

- Glossary of Terms

- Privacy Notice

- Health declaration & health exclusions

Blogs & Newsletters

- BUY ALLIANZ TRAVEL

INTERNATIONAL TRAVEL INSURANCE DUBAI

Discover our travel insurance products and select the cover that best suits your needs., enjoy a stress-free trip wherever your travels may take you with allianz travel insurance. we've got you covered from medical emergencies to lost passports, from flight cancellations to baggage mishaps. start your next adventure with confidence, knowing allianz travel has your back..

- Medical and Dental Emergencies : Immediate assistance and coverage, ensuring you receive essential care without the stress of hefty medical bills.

- Trip Cancellations and Delays : Reimbursements for non-refundable expenses, providing support if your trip faces unexpected interruptions or cancellations.

- Lost or Delayed Baggage : Compensation and assistance if your baggage is delayed for over 6 hours, or if it's damaged or lost during your journey.

- Loss of Travel Documents : Swift assistance to help you navigate the situation if your vital travel documents go missing.

Medical benefits include coverage for accidental death, emergency medical expenses, a daily cash allowance during hospital stays, compensation for lost baggage, and support for trip cancellations. Additionally, missed departures or connection flights are also covered.

Why go with Allianz Travel Insurance ?

Here's why allianz should be your first choice for travel insurance.

Globally recognised expertise

Tailored protection for you

24/7 assistance in case of emergency

Online Quote and Purchase

Why do i need travel insurance .

When do I get travel insurance?

Who should buy travel insurance, allianz travel insurance products, schengen travel insurance .

The perfect travel insurance in the UAE to obtain your Schengen Visa. Buy your Schengen travel Insurance starting from 56 AED* with Allianz Travel and rest assured for your trip, we’ve got you covered.

From 56 AED*

global travel insurance .

Our comprehensive Travel Insurance insures you against the unexpected whilst travelling abroad, whether that be alone or with your family. Buy online today with prices starting from 76 AED* per person.

From 76 AED**

travel insurance uae .

Having some family or friends over ? Our Inbound travel insurance to the UAE is available to protect your loved ones from the unexpected. In a few clicks, you can get this travel insurance right until they enter the country.

From 50 AED***

annual multi-trip .

Our annual multi-trip travel insurance products cover you for all of your trips below 92 days within a year. This is the best cost-effective travel insurance if you are a frequent traveller. Always buy the best with Allianz Travel.

From 664 AED****

sport cover .

At Allianz Travel, we know travelling is about experiences and we want you to be covered when you are taking this extra risk that will make the difference. Our Sport cover accompanies you a step further !

From 169 AED*****

travelsmart app .

* Schengen Travel-price based on a 30 year old travelling up to 5 days within a Schengen Destination with no pre-existing medical conditions.

**Travel Standard -Price based on a 30 year old travelling up to 5 days within Worldwide excluding USA & Canada geographical zone.

***Travel UAE-Inbound - price based on a 30 year old travelling up to 5 days to the United Arab Emirates

**** Standard Annual Multi-trip - price based on an Adult (19-65) purchasing an annual multi-trip insurance.

***** Travel Insurance to UAE - price based on a 30 year old travelling up to 5 days within Worldwide excluding USA & Canada geographical zon and getting a Sport cover

Main covers across our travel insurance products

Emergency medical expenses, loss of travel documents, missed or delayed departure.

If unforeseen circumstances cause you to miss your departure, we will cover the additional expenses for alternative transportation and accommodation. Similarly, if your departure is delayed for more than 6 hours, we offer benefits after the initial 12-hour delay, with further benefits for each subsequent 12-hour delay.

Not every of our products offers this cover, we recommend you to read the terms and conditions for the travel insurance you are about to purchase. Your policy will specify the maximum payable amount, and covered circumstances will be detailed in the Policy Documen t. Additionally, if you decide to cancel your trip after a 24-hour delay, you may be eligible for compensation up to the specified amount in your policy.

Lost Baggage and Personal Belongings Protection

Travel insurance ensures that lost luggage doesn’t derail your trip. It provides compensation for misplaced items and support in replacing essential belongings. Additionally, the insurance covers the loss of personal documents, offering financial assistance and helping you recover lost time spent tracking down your possessions. Our insurance covers temporary loss or theft of your possessions during your departing journey—excluding valuables—if the delay extends beyond six hours from your arrival destination.

As for the previous benefits, not every of our products includes this benefit. You should read the terms and conditions that apply for the travel insurance you are about to purchase.

Personal Liability Coverage

Covid-19 cover.

In these uncertain times, we understand the importance of having COVID-19-related cover. Our travel insurance policies include:

- Emergency Medical and Associated Expenses specifically related to COVID-19.

- If you are infected while travelling and require quarantine, we will cover your accommodation costs during this period.

Travel Insurance Documents

Frequently asked questions, understanding travel insurance, what is travel insurance .

Travel insurance is an insurance you can take on when travelling abroad in order to cover yourself, your family or your belongings in case something goes wrong during your trip. The number of covers and their limits depend on which travel insurance product you choose: usually insurance companies offer different ranges of product (from the most basic to the most comprehensive).

At Allianz Travel, we offer 3 main products:

- A basic product: Also called Schengen product , this travel insurance offers the basic coverages required to apply for a schengen visa. It mostly offers coverage for emergency medical expenses

- The Extra product : this is the mid-range product offering higher limits and more coverages than the Schengen travel insurance above. On top of the medical emergency coverages, it also provides insurance for your belongings and trip cancellation or curtailment.

- The Gold product : this is the most comprehensive product offering higher limits than the 2 other products so you can travel with peace of mind.

What does travel insurance cover?

Travel insurance covers emergency medical expenses in most cases. This means if the traveler gets sick or hurt while travelling, the travel insurance will cover the medical expenses if the claim falls under the Terms and Conditions of the policy.

Aside from the emergency medical expenses, travel insurance can also cover your belongings (delays, loss, thief) as well as expenses if you cut your trip short or if you must cancel your trip.

Every travel insurance product offers different coverages and limits - it is critical for you to carefully read what the product covers before purchasing any travel insurance. We also encourage you to read the Terms and Conditions to make sure the product is aligned with your expectations.

Which travel insurance is the best for UAE and international travellers ?

There is no right answer here. It depends on what YOU need and what the travel insurance offers. One travel insurance product might be the perfect fit for one traveler while not matching someone else's needs.

The best advice we can give you is to read what the travel insurance product covers so you do not get bad surprises at claim stage. At Allianz Travel we try our best to clearly state what each of our product offers. If you have any doubt about one of our products, you can also reach out to us directly and we will be more than happy to answer your question.

Allianz offers tailored packages for both UAE and international travellers, ensuring comprehensive coverage. Our cover options include:

- Single-global trip insurance

- Annual Multi-trip insurance

- Inbound UAE travel insurance

- Schengen travel insurance

What is annual multi-trip travel insurance ?

Annual multi-trip travel insurance covers you for any trips below 90 days you take throughout an entire year. You buy your travel insurance once and then get covered whenever you travel for the next 365 days.

This product is the best fit for frequent travelers since you do not need to buy a new travel insurance every time you travel. Aside from being convenient, it is also much cheaper if you travel a lot for work or for leisure.

As for any other travel insurance products, the terms and conditions apply.

Can I buy travel insurance when I am already abroad ?

You need to buy your travel insurance before you start your trip. Once your trip has started you cannot buy travel insurance. There are no exceptions to this rule.

Please note: this is verified when a customer opens a claim - if you purchased your travel insurance after your trip started, your claims will not be eligible.

What Does Allianz Travel insurance cover ?

Allianz Travel offers different travel insurance products. In order to match your expectations, our real-time quotation engine will ask you a few questions to get you the best travel insurance products based on your trip and profile.

For each quotation, we usually offer 2 to 3 products - you can then choose which level of cover you want. Before buying one of our travel insurance products, we recommend you to carefully check the coverages, their limits as well as our terms and conditions . If you have any questions, please feel free to reach out to us !

What to look for in a travel insurance ?

Most people buy travel insurance to travel with peace of mind knowing they are covered if the unexpected comes up. Before buying travel insurance, you need to know what type of trip you are going to have to make sure the travel insurance product you pick covers you properly.

For example, if you are going skying in the Alps, you will need to get the Winter Sport add-on on top of your travel insurance so you are sure you will be covered in case you get hurt while snowboarding.

As previously mentioned, it is critical you read the terms and conditions before you take on any travel insurance. If you have a doubt about any coverage, then you can call or whatsapp us .

What insurance do I need when travelling ?

Travel insurance is the ideal type of insurance for travelling abroad. Depending on the policy you choose it covers a wide range of things such as medical emergencies, trip cancellations, lost baggage, and more. Choose a plan that aligns with your travel needs.

You can get a free quote online in real-time in a few steps.

Travel Insurance to the UAE

Is it mandatory to have a travel insurance for dubai.

Travel insurance for Dubai is recommended by multiple sources as it will cover you for emergency medical expenses and many other benefits. In a recent news article , the Indian Embassy strongly advises that anyone travelling to the UAE take out travel insurance. It follows the case of someone who was visiting the UAE and faced high bills after an accident.

Financial burden of unforeseen circumstances is covered with a policy such as ours and prevents financial burden at such a difficult time. Money is not something someone should be worried about when someone is ill, injured or in trouble.

Allianz Travel insurance to the UAE also covers quarantine and emergency medical expenses related to COVID-19. Our online travel insurance is easy to buy in a few clicks and will give you peace of mind while exploring Dubai and the rest of the UAE.

Does Dubai visa include travel insurance?

Can i get travel insurance for covid-19 in dubai.

Yes, you can get a travel insurance with COVID-19 cover for your trip to Dubai. You just need to buy your travel insurance to the UAE before you arrive in the country. As any other international travel insurance, an Inbound travel insurance to the UAE needs to be bought before your trip starts otherwise your claims will not be eligible.

Allianz Travel has added specific benefits to its travel insurance for the UAE in order to cover quarantine and emergency medical expenses if you get tested positive to COVID-19 while you are travelling in the UAE.

You can check the Allianz travel insurance to the UAE here . Buying our online travel insurance is easy and fast. In just a few clicks, you can get a quote and buy online your travel insurance with Allianz Travel.

How much does travel insurance cost?

Prices vary depending on the policy type, duration of the trip, where you are travelling to, the age and number of people travelling and whether any options are required.

To find out how much a policy costs:

- Click " Get A Quote "

- Choose the policy type (single trip or annual trip)

- Add any options you require (Winter sports, Hazardous activities, Terrorism cover)

- Enter the dates and destination of the trip you require

- Enter details of the persons requiring cover

- Click 'Submit'

How can I buy travel insurance ?

How do i know that buying my policy online is secure, can i receive a refund for unused days on my travel insurance policy , can i buy travel insurance while on vacation , what if i change my mind about buying the policy, can i buy allianz travel travel insurance if i am not a resident of united arab emirates, does it matter who i book my travel arrangements through, does allianz travel offer an annual multi-trip policy, is there an age limit on the travel insurance policy, when does cover begin and end, what is the maximum trip length, if i return home early do i get a refund of my premium, are there any exclusions to the policy, am i covered for any existing medical conditions.

The policy does not cover claims relating directly or indirectly to any existing medical conditions, if you or anyone to be insured has at the time of taking out this insurance or booking your journey (whichever is the later):

- Been prescribed regular medication

- Received treatment or had a consultation with a doctor or hospital specialist for any medical conditions in the past 6 months

- Been referred to, treated by or are currently under the care of a doctor or a hospital specialist

- Been diagnosed as having a terminal illness

Please click here to read the Health Declaration for more information.

Am I covered for skiing or other adventure activities?

Am i covered for loss of cash, does travel insurance cover for everything .

Travel insurance provides a broad range of coverage to protect you during your trip, but it's important to understand that not every activity or situation is covered.

If you have a doubt - please reach out to us to double check with one of our customer care representatives.

Here’s a more in-depth look at what might not be covered:

- Pre-existing medical conditions : Many travel insurance policies do not cover pre-existing medical conditions unless you purchase a waiver or additional coverage. It’s crucial to disclose any existing conditions and understand your policy’s terms to ensure you have the necessary protection.

- Incidents occurring under the influence : Incidents that occur while you are under the influence of drugs or alcohol are typically not covered by travel insurance. This includes injuries, accidents, or losses that happen during such times

- Travel to high-risk areas : Travelling to areas with travel advisories or known risks may not be covered under standard travel insurance policies. It’s important to check the travel advisories for your destination and understand your policy’s coverage limitations.

- Cancellation for any reason : Standard trip cancellation coverage applies to specific covered reasons. If you want the flexibility to cancel your trip for any reason and still receive reimbursement, you might need to purchase an additional “Cancel For Any Reason” (CFAR) coverage

- Long-term medical care : Travel insurance is designed for short-term emergencies and might not cover long-term medical care or rehabilitation costs.

Do travel insurance policies cover families travelling together?

Do children need travel insurance , what is the minimum age limit for travel insurance, does travel insurance cover me if i lose my passport, does travel insurance reimburse me if i have to cut my trip short because of a family emergency , can i claim from my travel insurance if i get sick before my trip, how do i get my insurance documents, can i purchase a policy if i have already started my journey, if i have any queries, who do i contact, can i still claim even if i don't have receipts for all my personal possessions, who do i contact in the event of a medical emergency, who do i contact to make a claim, how am i ever going to remember all these different contact numbers, more about travel insurance ....

What You Need to Know About Travel Insurance

Help, I Have Missed My Flight, What Do I Do?

Why a Travel Insurance For a U.S Road Trip ?

Making e-Claims

For making your claims journey easier, we have launched a brand new online travel insurance claim portal. Check it out!

Visiting Emerald Isle

All you need to know before visiting Ireland!

A Quick Guide to Visiting Canada

Welcome to Canada!

The Travel Insurance Experts

When you travel with Allianz Travel, you have access to a global network of travel experts...

How can we help?

Authorized Broker | Online Convenience

INSURANCEPOLICY.AE is owned and managed by PLATINUM INSURANCE BROKER LLC licensed by the Central Bank of UAE vide license number 222

- +971 4 3577 997

- Get a Quote

- About Platinum

- Insurance Companies

- Complaints Register

- Home > Get Travel Insurance Quote Online from Insurancepolicy.ae

Relax and enjoy your holiday with the best travel insurance plans. Quick & Easy Online Purchase

Share your details & we will get back to you.

Solve Captcha* 8 + 2 =

Why choose us?

InsurancePolicy.ae is a platform provided by Platinum Insurance Broker LLC, a trusted insurance broker in the UAE offering a comprehensive range of insurance packages for cars, health, travel and general insurance.

What do our Customers say about us

Very responsive and polite employees and their processing for new policies are very fast. Policy servicing is also very efficient.

Linda Grace

Platinum Insurance Brokers has been a great partner to work with. They have always put in efforts to better understand our business and insurance needs. In addition, they are very attentive, not only during the application and renewal process, but more importantly during the claims process.

Narayan Hegde

“I was amazed with the way the customer service team explained the associated benefits and the medical insurance process from quote to claim. They walked me through all the inclusions and exclusions in a very easy to understand language, which enabled me to wisely choose the most appropriate policy. I got a healthcare package for my entire family at a reasonable price....

Ms. Jane Rodrigues

“I was admitted in hospital early this year and was under Intensive Care for almost 10 days. But all through this tumultuous experience, the one thing that I assured of was a stress-free claim process. I was very overwhelmed with their superb service and speedy response at this critical phase of my life. I spread the word and encourage others to avail...

Mr. Navin Sharma

“Platinum Insurance Team has provided a cashless treatment for my ongoing cancer treatment. It was truly a wise decision to have selected a healthcare partner. I went through a hassle-free experience during a lengthy hospitalization period and received support during the most testing times. I strongly recommend their insurance policies to all my near and dear ones.”

Mr. Nitesh Ramchandani

“I recently met with a car accident that led to spinal injury and a massive hospital bill. Thankfully my health insurance covered the entire expenses, and due to lack of worry I recovered much faster. The entire claim process was fast and hassle free. Looking at the current situation, I even got my spouse and kids covered under it.”

Mrs. Stacy Almeida

“I was given complete orientation before purchasing the health insurance policy. Thanks to the proactive team at Platinum Insurance, I have selected the most optimum plan that suits my diabetic medical condition. The entire experience was very satisfying and today I avail the best medical check-ups and treatment at a leading network of world-class hospitals.”

Mr. Amitabh Bhatia

“The insurance I purchased from Platinum Insurance Brokers gave me the confidence to travel again after a major medical treatment. It was quite relaxing to know the insurance agent had an idea of my pre-existing medical condition and the risks involved. The multi-trip travel plan offers coverage against major medical expenses, giving me peace of mind on every trip. Thank you again...

Mr. John Scott

“I recently went on vacation to a famous holiday destination in January 2021. I can firmly say from my experience that I received an excellent, well-affordable policy which enabled me to have a care-free tour with my family, as all my medical ailments and medicines were covered. I would recommend Platinum Insurance Brokers to everyone who wants a stress-free holiday experience.”

Mrs. Jude Mathew

“It was very reassuring to have a corporate travel insurance, that offers me a relaxed mind for my multiple business trip bookings during the year. The premium was reasonable and signing up was easy. Recently my trip got interrupted due to Covid-19 restrictions and I could easily submit the claim process online. The agent was knowledgeable and very responsive to expedite the...

Mr. Freddy Castro

“I appreciate the helpful and professional services provided by the Platinum Insurance Team. They clarified every query I had and provided a clear explanation on the varied insurance options. I feel that I got the travel insurance policy at a fair price, and I will contact them again the next time I am looking for family insurance. Thank you.”

Ms. Rabia Khan

“I rate my experience with five stars because we received a full refund for the portion of our trip that we missed. The customer-service team was courteous in filing our claim and there were no arguments from the insurance company. I would recommend their policies and will use it again for any other trips we book.”

Mr. Edwards Holmes

“I went through an easy process in fetching a competitive quote online for home insurance. I could choose the level of coverage and tailor it towards my requirements. I uploaded my documents and received an email within 24 hours, saying it has been accepted. The application form was easy to complete even for a senior citizen who is not greatly computer literate.”

Mr. Frank Mathias

“I purchased a l liability protection insurance plan from Platinum Insurance Brokers. The medical services were all covered, without no additional cost. The customer representatives were very cordial and assuring during the claim process, and which was settled within a day. Being a company that earned my trust, I opted for other general insurance plans as well. I gladly recommend their services...

Ms. Shilpa Sachdev

“I learned about PIB from a friend when I bought a home. It was relatively so simple and straightforward to obtain the insurance, with no cumbersome paperwork. They offered reasonable quotations immediately and sent reminders in-advance to renew my home insurance. I am extremely delighted and have converted my other properties to their insurance for the convenience and reliability they offer.”

Mr. Khalid Hashim

“For past 12 years, PIB is my only choice in insurance. The service team is very cooperative, professional and clarify your queries on a call. Their rates are also very competitive, and service is quick. I have very strong reasons to never switch to another insurer. “

Mr. Hamad Rashid

“It was really amazing experience to take a term insurance policy during the March 2020 lockdown phase. The service was very prompt and individualized, and they reverted with just the exact coverage I needed. I felt very well taken care of and will return in the future for additional insurance needs.”

Mr. Sachin Kamat

“I wanted to extend my gratitude to Platinum for their tremendous help. Earlier, I had requested quotes from multiple websites and the process seemed daunting—until I finally contacted them. They simplified the insurance purchase process and threw clarity on every policy term. They paid attention to my queries and offered guidance to make the best decision for my critical illness situation.”

Mr. Dhiraj Malhotra

“I have worked with Platinum Insurance since inception, almost 14 years now. I have always felt assured and secure in the knowledge that their whole life insurance plan protects the best interest and the well-being of my family!”

Mr. Patrick Coelho

“I recently experienced my husband passing away suddenly through an accident. Whilst grieving a loss, my claim for insurance had complexities attached to it. Platinum brokers pitched to help me complete the legal and documentation formalities. Their agents were very approachable, professional and the process made me realize their value as an Insurance Broker. I am so glad that their continued care...

Mrs. Sarika D’souza

“I am extremely pleased that my life insurance policy has been put into effect in the fastest and simplest way possible. I would really like to thank the PIB team for their reliable and quick response always. I gladly recommend them to my relatives and friends.”

Mr. Sayed Farooque

“I’ve worked with Platinum Insurance Brokers for over 10 years for all my business and personal insurance needs. Their level of expertise and full-fledged service is what sets them apart. I am glad to recommend them to anyone seeking a reliable insurance advisor.”

“Great service. They do not try to sell something you are not interested in. If you have to file a claim, they are right on it. Thank you for the service.”

Shawn Almeida

“I would highly recommend Platinum Insurance Broker's services for the one who is looking for a quick, reasonable and hassle-free services. The staff is very responsive, and clearly inform list the documents we need to present. I have my medical and vehicle insurances covered with their company and I am happy with their services.”

I was really confused about different plans for my car insurance. I'm glad that insurancepolicy.ae has an amazing team which helps you to find the most suitable plan for your vehicle ..! it was nice connecting with you good job!

Best Services ever🤩, I have received the vehicle insurance from Insurancepolicy.ae within expected time and the staff agent was so helpful and very supportive. She had stayed back in her office even after her office hours to get my insurance done and she kept on following up with my registration for the car.

Risam Rafeek

They are a true gem in the world of insurance. Their unwavering dedication to customer satisfaction, combined with their seamless processes, transparent approach, and competitive pricing, make them the ideal choice for anyone seeking peace of mind through insurance coverage. I wholeheartedly recommend them to anyone in search of top-tier insurance services. Thank you for providing me with the security and confidence...

I highly recommend insurancepolicy.ae for car insurance. The expertise and dedication to his clients make him an asset in the insurance industry. If you're looking for exceptional service and peace of mind with your car insurance, look no further.

Gladson D’Souza

I recently had the pleasure of working with insurancepolicy.ae to secure pet insurance for my beloved furry friend, and I am delighted to share my positive experience with their services.

Mr. Jude Ferns

From the initial consultation to the final policy issuance, the advisor at Insurancepolicy.ae demonstrated a level of professionalism and expertise that truly set them apart in the realm of pet insurance. The agent took the time to understand my pet's unique needs and my concerns, providing personalized recommendations to our specific situation to provide the coverage and support we need. Paws down,...

Mrs. Ribeiro

I highly recommend Insurancepolicy.ae to anyone seeking reliable and comprehensive pet insurance. Their commitment to personalized service, transparent policies, and excellent customer support truly set them apart in the industry. Thanks to the team, I now have peace of mind knowing that my furry companion is well-protected.

Alwyn Matts

When it came to coverage, insurancepolicy.ae broker offered a range of policies tailored to various budgets and preferences. They provided detailed information on coverage limits, deductibles, and reimbursement options, allowing me to customize a plan that suited both my pet's needs and my financial considerations.

The team at insurancepolicy.ae demonstrated a deep understanding of the unique needs and concerns pet owners face. They took the time to listen attentively to my questions and provide comprehensive answers, ensuring I felt confident in my decisions.

- Data Security

- Policy and Payment Disclaimers

- Media Release

Copyright. Platinum Insurance Broker LLC.

Design By: Indiainternets.com

Privacy Overview

- Carrier & Wholesale

- e& group

Accessibility

Accessibility statement.

Etisalat is committed to making this website accessible to the broadest possible audience, regardless of technology or physical capability.

COLOUR : ETISALAT COLOURS

Buy travel insurance for Schengen visa. Get instant insurance policy

Get cashless international travel health insurance online.

Travel Insurance

- Find the travel insurance that works for you Are you always on the go or more of an annual holiday planner? Are you travelling alone or with your family? For us it doesn’t matter as we offer products that best fit your unique needs.

- Get protected where you are Discovering the beauty of Greece? Hiking in Africa? Or maybe welcoming your loved ones in the UAE? Our travel insurance covers you and your loved ones where you choose to go.

- Travel insurance for any situations Why worry while you are travelling? Our travel insurance covers a wide range of situations. From Medical emergency expenses to travel inconvenience or COVID-19 quarantine, we have you covered.

Simple and secure

Purchase a secure insurance policy that suits you best via a very simple process that saves time and effort

Accessible anywhere

View the policy on your email address or log in to view all your purchased policies

Enjoy hassle free insurance

From browsing policies to uploading documents, get your insurance from the comfort of your home

Important to know - Easy Insurance View More View Less The must-know details about this service.

Etisalat is not at any time considered as the insurance service provider or an agent of the Insurance Companies, (the Insurance Providers).

Compare Insurance and Banking Products in the UAE

Compare prices, browse products and buy online.

3700 + Reviews on

Smiles Savers Card

Say goodbye to hefty dental bills

Car Insurance

Pssst...it's cheaper when you compare!

Health Insurance

Doesn't have to be expensive!

Travel Insurance

Travel in peace knowing you're covered!

Home Insurance

We cover your contents too!

Life Insurance

Comfort for your loved ones

Pet Insurance

Protection for our furry friends

Jewellery Insurance

Expensive watches and rings?

Car Warranty

Extend your car warranty

SME insurance

Insure your business

AED 15 million saved every year!

Best prices in the UAE

We can protect your family too!

Best hospitals in the UAE

Have you covered your belongings?

Best insurers in the UAE

Get insurance in 3 simple steps!

Answer a few easy questions online - it takes less than 2 minutes to complete.

Compare & Choose

Compare the benefits & prices from different providers across the region in one place.

Buy & Sit back

Buy online and we'll email the policy to you within a matter of minutes.

Looking for vehicle fleet or group health insurance?

What our customers say, saving tips.

Yallacompare, the leading regional finance site discovers which nationalities claim they are the best drivers

A common misconception we often hear from our customers (and staff members!!) ‘Isn’t it expensive to get life insurance?’ and the answer is NO!

Follow us on Instagram

Stay in touch.

Subscribe to our newsletter and stay updated.

Yallacompare.com is the leading finance comparison site in the Middle East.

+971 45 622 100

8 AM till 6 PM, Sunday to Friday

yallacompare, United Arab Emirates Information found on yallacompare is provided for illustrative purposes only, rates are subject to change based on your personal circumstances. You should always speak to a trained professional before taking out any form of finance. Implications of non-payment: If you fail to keep up with repayments on your finance, your bank may file a report with the UAE credit rating agency which may impact your ability to borrow from UAE banks in the future. YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE, LOAN OR ANY OTHER DEBT SECURED ON IT. Insurance is provided by Yallacompare Insurance Broker LLC (formerly Gulf Resources Insurance Management Services Limited), an Insurance Broker regulated by the UAE Central Bank (registration #20).

All flights suspended by Abu Dhabi and Dubai airports

One of the busiest air transport hubs in the world, Dubai International Airport, made the decision to suspend all passenger flights for at least two weeks yesterday in a bid to halt the spread of the coronavirus in the United Arab Emirates and as flight demand waned. The only flights that will continue to operate out of the airport for the next two weeks will be freight and emergency evacuations, according to a statement from…

Flight suspension in UAE brought forward, Europeans stranded

The General Civil Aviation Authority and the National Emergency Crisis and Disaster Management Authority of the United Arab Emirates have brought forward the directive…

Dubai economy hit by coronavirus shutdowns

The famous malls in Dubai in the United Arab Emirates are being shut down and all passenger flights have been suspended to and from…

Relief needed for UAE hospitality industry

With over 200,000 people affected by the coronavirus in more than 144 countries, the pandemic is showing no signs of abating, and extreme precautions…

Emirates to temporarily halt passenger operations

All passenger operations will be temporarily suspended by Emirates in the United Arab Emirates as the world slows to a halt because of the…

Expo 2020 panel contemplate virus impact

Yesterday, a virtual steering committee meeting was convened by Expo 2020 Dubai featuring representatives from the nations set to take part in the event,…

UAE bans citizens from travelling

The United Arab Emirates is initiating sweeping measures in a bid to stem the spread of coronavirus with a ban on all citizens going…

Flights to 35 destinations suspended by Emirates

Services to 35 destinations have been suspended by Emirates across the airline’s network in an attempt to be in compliance with travel restrictions introduced…

UAE prepares to welcome India at upcoming Expo

The United Arab Emirates and its capital city of Abu Dhabi are making moves to bolster trade and cultural ties as well as tourism…

Sharp rise in cancellation of UAE flight bookings

Airline travel agencies within the United Arab Emirates are experiencing a sharp increase in the cancellation of bookings as restrictions on passenger flights are…

Emirates to operate Saudi Arabia flights

Emirates has been able to secure special permission to operate flights between Dubai and Saudi Arabia. These will take place between 12th and 15th…

Occupancy of UAE hotels hit by coronavirus

The international travel and tourism industry continues to be adversely affected by coronavirus, and a dip in the performance of hotels in the United…

New Abu Dhabi to Vienna route from Etihad Airways

A new daily flight service to Vienna in Austria is being launched by Etihad Airways with the use of a two-class Boeing 787-9 Dreamliner.…

Arabian Travel Market postponed for three months

Arabian Travel Market has been postponed for nearly three months, Reed Travel Exhibitions has announced. The event, which is to be held in the…

UAE increases airport virus checks

Emiratis and expats have been advised to avoid travelling abroad, and airports have stepped up virus checks on newly arrived passengers in the United…

- Medical Insurance

- Car Insurance

- Compare Credit Cards

Type above and press Enter to search. Press Esc to cancel.

Travel Insurance For Dubai: Everything You Need to Know

A re you soon going to fly off to Dubai with your family or friends? If yes, then you must be well-prepared before going on your vacation. Life is uncertain, so anything can happen at any place. Henceforth, you must have a financial backup before travelling approximately 1,538 miles from your hometown. The best way to secure your trip is by buying travel insurance .

For a detailed idea regarding the same, keep reading.

Key Advantages of Travel Insurance for Dubai

You might be wondering why you should buy travel insurance for your next trip to Dubai. Well, travel insurance will not only make you well-prepared for any unforeseen situations on your trip but also help you to enjoy a stress-free vacation by covering your financial emergencies. Check out some of the key benefits of buying travel insurance.

Compensation for Luggage Delays

Just think, you have been waiting for 4 hours and your luggage still hasn't arrived at the airport. Sounds distressing, right? In such situations, you can get compensation as stated in the insurance policy. Additionally, many insurance providers compensate for any pre-booked activity or reservations that you missed due to such reasons.

Trip Cancellation Or Rescheduling Coverage

Life is unpredictable, and sudden emergencies may lead to trip cancellations and rescheduling. In these scenarios, having travel insurance is beneficial as you will get coverage for almost all non-refundable expenses you make. However, the reason for cancellation or rescheduling must be unforeseen or unexpected. As an additional benefit, various insurance companies cover all kinds of cancellations (irrespective of the reason).

Medical & Accidental Coverage

Sudden medical and accidental emergencies can occur anytime and anywhere. Medical expenses in Dubai can cause hefty financial strain. Henceforth, it is an intelligent decision to get international travel insurance for your upcoming Dubai trip. Besides the medical expenses, the insurance policy will cover all kinds of expenses related to emergency evacuation and transport.

Passport Or Cash Loss Coverage

Have you ever wondered what will happen if you lose your passport on your Dubai trip? As a smart tourist, you need to buy travel insurance to get the required help and assistance. In such cases, you can ask for a duplicate passport or emergency certificate from your insurance provider. In addition, they provide emergency cash if you lose your money on your trip.

Things to Consider While Choosing Travel Insurance for UAE

You must remember that buying travel insurance is not enough. You must choose the right insurance plan to safeguard your Dubai trip to the maximum. Go through the below-stated factors that you must consider while purchasing Dubai travel insurance .

- Policy Duration: Go through the duration of the insurance plan and check if it covers your entire trip duration.

- Inclusion & Exclusions: You must be well aware of what coverage you will get. Besides, you must go through the exclusions too.

- Claim Limit: You must look into the maximum amount you can claim (if required). Moreover, you must know all the deductibles on each type of claim.

- Policy Type: Primarily, there are two types of policy that you can choose from, one is a single-trip policy (preferable for one-time travelling) and the other is a multi-trip policy (preferable for frequent travellers).

- Review & Compare: There are various travel insurance providers offering varied types of plans. Thus, you must conduct research, read online customer reviews, compare and then make an informed decision.

How to Buy Travel Insurance for the UAE?

If you are searching for step-by-step guidance on how you can buy travel insurance for Dubai, scroll down.

Step 1: Visit the official website of your preferred travel insurance provider/company.

Step 2: Go through the varied insurance plans and choose as per your preference. Additionally, numerous providers allow their customers to customise the plan.

Step 3: Provide a few trip-related details, like trip duration (starting and ending dates of your Dubai trip).

Step 4: From the given list, you need to choose the coverage as per your needs.

Step 5 : Provide a few necessary details of yourself and other travel companions.

Step 6: Make the online payment and successfully purchase an insurance policy.

Note: Several companies offer both online and offline travel insurance buying options.

Travel Tips to Consider while flying off to Dubai

If you are a first-time visitor to the UAE, then consider the following travel hacks which will make you more confident and ready for your foreign vacation.

- You must pack some light-weighted and coloured clothes as Dubai is quite hot and the temperatures can rise to 48 °C (approximately).

- Do not carry your original passport and visa while sightseeing or shopping. Carry a photocopy of all the necessary travel documents in case of an emergency.

- Remember, public drinking is prohibited in UAE and can cause hefty penalties (if caught).

- Avoid doing PDA (Public Display of Affection) as it is something that the localities frown upon.

- It is advisable for you to have travel insurance while travelling to Dubai.

- You might save some of the local emergency numbers like Coast Guard, ambulance, or police for emergencies.

5 Necessary Documents to Carry for Indians

Here are the 5 necessary documents that you must carry while flying to Dubai from India.

- Valid Passport (more than Six months Validity)

- Passport-Size Photographs

- Travel Insurance

- Foreign Cash (UAE Dirham)

12 Most Popular Tourist Places in Dubai

Dubai is one of the safest and most visited tourist destinations in recent years. You will get to witness spectacular architecture, skylines, and many more beautiful places. To get an idea about which places to visit in Dubai, scroll down.

- Burj Khalifa

- Burj Al Arab

- Palm Jumeirah

- Museum of the Future

- Dubai Frame

- Dubai Aquarium

- Atlantis Aquaventure and Secret Chamber

- Dubai Marina

- Miracle Garden

- Dolphinarium

- Dubai Fountain

To Sum It Up

Now that you know everything about travel insurance for Dubai like benefits, buying procedures, etc., buy insurance before visiting UAE. Having travel insurance is not compulsory for entering the UAE but it is always better to have it for securing your foreign vacation.

Disclaimer : This article is a paid publication and does not have journalistic/editorial involvement of Hindustan Times. Hindustan Times does not endorse/subscribe to the content(s) of the article/advertisement and/or view(s) expressed herein. Hindustan Times shall not in any manner, be responsible and/or liable in any manner whatsoever for all that is stated in the article and/or also with regard to the view(s), opinion(s), announcement(s), declaration(s), affirmation(s) etc., stated/featured in the same.

Read more news like this on HindustanTimes.com

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Faye Travel Insurance Review: Is It Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Travel insurance can be a worthwhile investment, especially if you’re worried about unexpected costs during your trip. There are a ton of different travel insurance companies out there, so finding one that suits your needs can be a struggle. That’s why we’ve done the work for you.

Let’s take a look at travel insurance provider Faye to see what type of plans the company offers, the coverage levels you can expect and whether Faye travel insurance is right for you.

About Faye travel insurance

Faye is the brand name for customizable travel protection plans offered by a company called Zenner Inc. Its website notes that it specializes in quick reimbursements, which can be a big draw for travelers. Policies issued by Faye are underwritten by the United States Fire Insurance Company.

» Learn more: How to pick between travel insurance providers

Faye insurance plans

Unlike many other travel insurance companies , Faye offers only one plan.

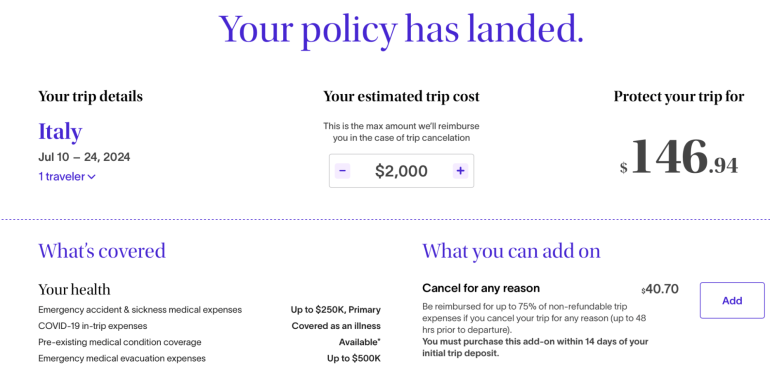

To find out what types of coverage Faye travel insurance plans include, we generated a quote for a 44-year-old woman from Arizona who was traveling to Italy for two weeks. Her total trip cost came in at $2,000.

Here’s what Faye provides:

This plan costs 7.03% of the overall trip cost, which is typical according to NerdWallet's analysis .

The plan is comprehensive and includes coverage you don’t typically see, such as reimbursement for lost credit cards and a payment for being inconvenienced.

Faye also offers a number of customizations; there are different add-ons from which to choose, all of which vary in price. More on your options in the next section.

» Learn more: How travel insurance for domestic vacations works

Plan add-ons

If you'd like to customize your Faye travel insurance plan to meet your needs more specifically, you can add on extra coverage for more money.

» Learn more: How does travel insurance work?

What isn’t covered by Faye

Even if you purchase a very comprehensive travel insurance policy, there are still situations where you’re not covered.

These include:

Bad weather, including hurricanes, if the policy was purchased after the storm was named.

Intentionally self-inflicted injuries or suicide.

Expenses incurred while under the influence of drugs or alcohol.

High-risk sports for which you are paid.

Psychological disorders, unless you’re hospitalized.

War and acts of war.

Illegal acts.

Piloting or learning to pilot or acting as crew of an aircraft.

To find the full list of exclusions for your specific policy, be sure to review your plan’s benefits schedule.

» Learn more: What to know before buying travel insurance

How to choose a Faye plan online

Purchasing a Faye travel insurance plan online is simple. You’ll first want to head to the company’s website to generate a quote.

You’ll need to input information like your age, where you live, where you’re going and how long you’re going to be away. Once you’ve got that all entered in, you’ll be taken to the results page.

Here, you’ll be able to see what plan options you have available, as well as what add-ons there are to pick.

After you’ve selected the coverage you’d like, you’ll need to go through the online checkout process.

» Learn more: Is travel insurance worth it?

Which Faye plan is best for me?

Although Faye has just one base plan available for purchase, it has plenty of different add-ons from which to choose. Faye sorts its bundles and add-ons according to the trip you’re taking, so you may see your bundled offer vary from time to time.

For tentative plans . Choosing to add on a Cancel For Any Reason (CFAR) policy can provide peace of mind if your travel plans aren’t solid. With the ability to get up to 75% of your money back, you’ll just want to make sure you’re canceling at least 48 hours in advance.

For pet owners . Not many travel insurance companies include coverage for your pets , especially not when it comes to vet bills. With a low overall cost, this add-on can make a huge difference if you end up delayed on your return.

For those wanting to customize everything . Faye’s base plan allows customers to create tons of different customizations according to their travel needs. Even though it’s costly, it makes up for it with wholly comprehensive coverage.

Faye’s travel insurance offerings may suit your needs, but before purchasing a plan, take a look in your wallet. Many different travel credit cards offer complimentary travel insurance , which can include benefits such as trip cancellation reimbursement, rental car insurance and more.

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Best travel insurance plans for 2024: a unique and comprehensive list for travelers from international citizens insurance.

Including the Best Plans for Seniors, Global Nomads, Visitors to the USA, Pets, Adventure Sports Addicts and More

BOSTON, MA / ACCESSWIRE / May 2, 2024 / International Citizens Insurance, a leading international insurance broker, has announced the best travel insurance plans for 2024 summer travel. As the cost of airfare and hotels continues to rise along with the increase in flight delays and cruise cancellations, this list could not have come at a better time for travelers looking to protect their travel plans and their finances.

"This summer's travel season promises a high level of demand, increasing costs, and a strong potential for travel disruptions due to political unrest, weather, and other factors," said Joe Cronin, President of International Citizens Insurance. "Our clients want travel insurance they can trust to help them if they suffer a cancellation, a medical emergency, lost luggage, a natural disaster, or have to change plans due to unforeseen events. With this list, they will be able to find the best overall travel insurers as well as the right plans for their individual needs."

International Citizens Insurance judged each company and plan on six key criteria: the user-friendliness of their site, the ease of policy purchase, the number of countries plans are offered in, how extensive the benefits are, the ease of making a claim and the quality of the company's customer service. The most trusted insurers include WorldTrips , who made history as one of the first insurers to offer plans for purchase over the internet; GeoBlue Travel Insurance , which supports seniors with coverage for people up to 84 years old; and Trawick International, which offers coverage for over 500 adventure sports activities.

To help customers find the best insurance for their specific needs, International Citizens Insurance has also identified the best insurance for several use cases, including Cancel for Any Reason (CFAR) insurance, travel medical plans, and insurance with coverage for pets. International Citizens Insurance has also identified the best plans for clients with special needs, including seniors, missionaries and volunteers, U.S. citizens abroad, and digital nomads.

In today's unpredictable world, travel insurance has become the most essential accessory for any international traveler. Travelers want trip cancellation insurance to protect their trip and travel medical insurance plans to protect their health. But with so many companies out there, which ones can you trust?

Learn more about the best travel insurance companies at https://www.internationalinsurance.com/travel-insurance/best-companies.php .

About International Citizens Insurance