An official website of the United States government.

Here’s how you know

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- American Rescue Plan

- Coronavirus Resources

- Disability Resources

- Disaster Recovery Assistance

- Equal Employment Opportunity

- Guidance Search

- Health Plans and Benefits

- Registered Apprenticeship

- International Labor Issues

- Labor Relations

- Leave Benefits

- Major Laws of DOL

- Other Benefits

- Retirement Plans, Benefits and Savings

- Spanish-Language Resources

- Termination

- Unemployment Insurance

- Veterans Employment

- Whistleblower Protection

- Workers' Compensation

- Workplace Safety and Health

- Youth & Young Worker Employment

- Breaks and Meal Periods

- Continuation of Health Coverage - COBRA

- FMLA (Family and Medical Leave)

- Full-Time Employment

- Mental Health

- Office of the Secretary (OSEC)

- Administrative Review Board (ARB)

- Benefits Review Board (BRB)

- Bureau of International Labor Affairs (ILAB)

- Bureau of Labor Statistics (BLS)

- Employee Benefits Security Administration (EBSA)

- Employees' Compensation Appeals Board (ECAB)

- Employment and Training Administration (ETA)

- Mine Safety and Health Administration (MSHA)

- Occupational Safety and Health Administration (OSHA)

- Office of Administrative Law Judges (OALJ)

- Office of Congressional & Intergovernmental Affairs (OCIA)

- Office of Disability Employment Policy (ODEP)

- Office of Federal Contract Compliance Programs (OFCCP)

- Office of Inspector General (OIG)

- Office of Labor-Management Standards (OLMS)

- Office of the Assistant Secretary for Administration and Management (OASAM)

- Office of the Assistant Secretary for Policy (OASP)

- Office of the Chief Financial Officer (OCFO)

- Office of the Solicitor (SOL)

- Office of Workers' Compensation Programs (OWCP)

- Ombudsman for the Energy Employees Occupational Illness Compensation Program (EEOMBD)

- Pension Benefit Guaranty Corporation (PBGC)

- Veterans' Employment and Training Service (VETS)

- Wage and Hour Division (WHD)

- Women's Bureau (WB)

- Agencies and Programs

- Meet the Secretary of Labor

- Leadership Team

- Budget, Performance and Planning

- Careers at DOL

- Privacy Program

- Recursos en Español

- News Releases

- Economic Data from the Department of Labor

- Email Newsletter

Travel Time

Time spent traveling during normal work hours is considered compensable work time. Time spent in home-to-work travel by an employee in an employer-provided vehicle, or in activities performed by an employee that are incidental to the use of the vehicle for commuting, generally is not "hours worked" and, therefore, does not have to be paid. This provision applies only if the travel is within the normal commuting area for the employer's business and the use of the vehicle is subject to an agreement between the employer and the employee or the employee's representative.

Webpages on this Topic

Handy Reference Guide to the Fair Labor Standards Act - Answers many questions about the FLSA and gives information about certain occupations that are exempt from the Act.

Coverage Under the Fair Labor Standards Act (FLSA) Fact Sheet - General information about who is covered by the FLSA.

Wage and Hour Division: District Office Locations - Addresses and phone numbers for Department of Labor district Wage and Hour Division offices.

State Labor Offices/State Laws - Links to state departments of labor contacts. Individual states' laws and regulations may vary greatly. Please consult your state department of labor for this information.

An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- A–Z Index

- Operating Status

Resources For

- New / Prospective Employees

- Federal Employees

- HR Professionals

Hours of Work for Travel

Fact sheet: hours of work for travel, description.

In limited circumstances, travel time may be considered hours of work. The rules on travel hours of work depend on whether an employee is covered by or exempt from the Fair Labor Standards Act (FLSA). For FLSA-exempt employees, the crediting of travel time as hours of work is governed under title 5 rules-in particular, 5 U.S.C. 5542(b)(2) and 5544(a)(3) and 5 CFR 550.112(g) and (j). For FLSA-covered employees, travel time is credited if it is qualifying hours of work under either the title 5 rules or under OPM's FLSA regulations-in particular, 5 CFR 551.401(h) and 551.422.

Employee Coverage

Title 5 overtime laws and regulations apply to most FLSA-exempt Federal employees, including General Schedule and prevailing rate employees. Certain employees, such as members of the Senior Executive Service, are not eligible for overtime pay or other premium pay under title 5. (See 5 U.S.C. 5541(2) and 5 CFR 550.101 for coverage rules.)

OPM's FLSA regulations apply to most FLSA-covered Federal employees. (See 5 U.S.C. 5542(b)(2) and 5544(a)(3) and 5 CFR 551.102.) An employee may determine his or her FLSA status by checking block 35 of the most recent Notification of Personnel Action (SF-50) to find out whether his or her position is nonexempt (N) or exempt (E) from the overtime pay provisions of the FLSA. Alternatively, an employee may obtain a determination from his or her servicing personnel office.

Overtime Work

In general, overtime hours are hours of work that are ordered or approved (or are "suffered or permitted" for FLSA-covered employees) and are performed by an employee in excess of 8 hours in a day or 40 hours in a workweek. (See 5 U.S.C. 5542(a), 5544(a), and 6121(6) and (7), and 5 CFR 550.111 and 551.501. Note exceptions.)

Travel That is Hours of Work Under Title 5

Under 5 U.S.C. 5542(b)(2) and 5 CFR 550.112(g), official travel away from an employee's official duty station is hours of work if the travel is-

- within the days and hours of the employee's regularly scheduled administrative workweek, including regularly scheduled overtime hours, or

- involves the performance of work while traveling (such as driving a loaded truck);

- is incident to travel that involves the performance of work while traveling (such as driving an empty truck back to the point of origin);

- is carried out under arduous and unusual conditions (e.g., travel on rough terrain or under extremely severe weather conditions); or

- results from an event that could not be scheduled or controlled administratively by any individual or agency in the executive branch of Government (such as training scheduled solely by a private firm or a job-related court appearance required by a court subpoena).

An agency may not adjust an employee's normal regularly scheduled administrative workweek solely to include travel hours that would not otherwise be considered hours of work.

Travel That is Hours of Work Under the FLSA

For FLSA-covered employees, time spent traveling is hours of work if-

- an employee is required to travel during regular working hours (i.e., during the regularly scheduled administrative workweek);

- an employee is required to work during travel (e.g., by being required to drive a Government vehicle as part of a work assignment);

- an employee is required to travel as a passenger on a 1-day assignment away from the official duty station; or

- an employee is required to travel as a passenger on an overnight assignment away from the official duty station during hours on nonworkdays that correspond to the employee's regular working hours. (See 5 CFR 551.422(a).)

Official Duty Station

"Official duty station" is defined in 5 CFR 550.112(j) and 551.422(d). An agency may prescribe a mileage radius of not greater than 50 miles to determine whether an employee's travel is within or outside the limits of the employee's official duty station for determining entitlement to overtime pay for travel.

Administrative Workweek

An administrative workweek is a period of 7 consecutive calendar days designated in advance by the head of an agency under 5 U.S.C. 6101. The regularly scheduled administrative workweek is the period within the administrative workweek during which the employee is scheduled to work in advance of the administrative workweek. (See definitions in 5 CFR 610.102. See also 5 CFR 550.103 and 551.421.)

Commuting Time

For FLSA-covered employees, normal commuting time from home to work and from work to home is not hours of work. (See 5 CFR 551.422(b).) However, commuting time may be hours of work to the extent that the employee is required to perform substantial work under the control and direction of the employing agency-i.e., productive work of a significant nature that is an integral and indispensable part of the employee's principal activities. The fact that an employee is driving a Government vehicle in commuting to and from work is not a basis for determining that commuting time is hours of work. (See Bobo decision cited in the References section.)

Similarly, for FLSA-exempt employees, normal commuting time from home to work and from work to home is not hours of work. (See 5 CFR 550.112(j)(2).) However, commuting time may be hours of work to the extent that the employee is officially ordered or approved to perform substantial work while commuting.

Normal "home-to-work/work-to-home" commuting includes travel between an employee's home and a temporary duty location within the limits of the employee's official duty station. For an employee assigned to a temporary duty station overnight, normal "home-to-work/work-to-home" commuting also includes travel between the employee's temporary place of lodging and a work site within the limits of the temporary duty station.

If an employee (whether FLSA-covered or exempt) is required to travel directly between home and a temporary duty location outside the limits of the employee's official duty station, the time the employee would have spent in normal commuting must be deducted from any hours of work outside the regularly scheduled administrative workweek (or, for FLSA covered employees, outside corresponding hours on a nonwork day) that may be credited for the travel time. (The travel time is credited as hours of work only as allowed under the applicable rules-e.g., for an FLSA-covered employee, if the travel is part of a 1-day assignment away from the official duty station.)

- 5 U.S.C. 5542(b)(2) (General Schedule employees)

- 5 U.S.C. 5544(a)(3) (Prevailing rate employees)

- 5 CFR 550.112(g) and (j), 610.102, and 610.123

- 5 CFR 551.401(h) and 551.422 (OPM's FLSA regulations)

- Decision by United States Court of Appeals for the Federal Circuit, Jerry Bobo v. United States , 136 F.3rd 1465 (Fed. Cir. 1998) affirming Court of Federal Claims decision of same name, 37 Fed. Cl. 690 (Fed. Cl. 1997).

- Section 4 of the Portal-to-Portal Act of 1947 (61 Stat. 84) as amended in 1996 by section 2102 of Public Law 104-188. (See 29 U.S.C. 254.)

Back to Top

What is TravelTime?

Create a Travel Time Map

Travel time map generator & isochrones, i know i can get from a to b by public transport within my selected time, but it's not showing up.

- Walking to the station platform

- Waiting for the next available departure

- Time spent boarding the train

- Giving enough time to take the A to B journey

- Depart on the station on the other side.

You can't drive that far / you can drive much further than that"

- Open another mapping app of your choice and enter an A to B route

- Select a departure time for tomorrow.

Still not convinced?

About this tool, what is a travel time map, how to create a drive time radius map or other modes.

- Select a start location

- Select a maximum travel time limit

- Select a mode of transport, for example driving

- Voila! There's your driving radius map

Use cases for consumers

- Create a commute time map so you can see where to live based on commute time.

- How far can i travel in a given time: compare transport coverage for different areas.

- Create a drive time radius map: explore how far you can travel on a road trip.

Use cases for businesses

- Travel time mapping up to 4 hours & cross reference other data sets in GIS such as population data

- Site selection analysis: analyse the best location to locate a business by adding thousands of analysis points

- Create a distance matrix or travel time matrix & calculate travel times from thousands of origins to thousands of destinations

- Network analysis / travelling salesman problem: use spatial analytics to solve routing problems

- Commute time map - plot thousands of employee commute times for an office relocation

- Create up to 3 time polygons visualising where's reachable within 2 hours or less. Our API can create large travel time areas, talk to sales.

- Calculate travel times from an origin to various points of interest - in this demo we use points from Foursquare Give A to B routing details

Full access

- Book a demo

- Trial TravelTime API

- Trial QGIS Plugin

- Trial ArcGIS Pro Add-In

- Trial Alteryx Macros

TravelTime Features

- See 'How far can I get' in X minutes

- Create a drive time map or any other transport mode

- Overlap many shapes & highlight overlap area

- Search points of interest within the area

- Get A to B routing details

An Open Access Journal

- Original Paper

- Open access

- Published: 03 August 2022

Value of travel time by road type

- Stefan Flügel 1 ,

- Askill H. Halse ORCID: orcid.org/0000-0002-0892-4158 1 ,

- Knut J. L. Hartveit 1 &

- Aino Ukkonen 2

European Transport Research Review volume 14 , Article number: 35 ( 2022 ) Cite this article

5469 Accesses

2 Citations

2 Altmetric

Metrics details

Travel time is less costly if it is comfortable or can be used productively. One could hence argue that the value of travel time (VTT) of car travellers in economic appraisal should be differentiated by road type, reflecting differences in road quality. We explain the theoretical foundation for such a differentiation, review the relevant literature and show the results of an empirical case study based on actual route choice of highway drivers in Norway. We find little existing literature discussing the link between road type and VTT, but closely related findings suggest that that the impact on VTT could be substantial. Our empirical case study also suggests that the VTT is lower on higher quality road types. Applying this to economic appraisal would imply higher user benefits of road projects that improve road quality.

1 Introduction

The economic benefits of shorter travel time typically account for a large share of the benefit side in cost–benefit analyses (CBAs) of transport investments. A considerable amount of research has therefore been devoted to obtaining accurate estimates of the value of travel time (VTT), both its overall level [ 21 ] and values for various sub-segments, for instance transport mode, trip purpose and contextual factors.

A key insight from microeconomic theory is that travel time is less costly if it is comfortable or can be spent productively [ 6 ]. In private car travel, this may depend both on the infrastructure, traffic conditions and characteristics of the car itself. While a number of studies consider the relationship between congestion and VTT [ 40 ], less attention has been given to the role of infrastructure quality. This is striking, given that obtaining a certain road standard or quality often seems to be a key motivation for public road investments. While part of the economic value of high road standard is related to road safety, we hypothesise an additional positive effect of road standard on the driving comfort level, resulting in a lower VTT.

In this paper, we first explain the theoretical foundations of VTT and how road type may be accounted for within this framework. We also discuss the distinction between driving comfort and traffic safety. We then give a brief review of studies that are relevant for assessing the relationship between VTT and road type and quality. Although there are no existing studies that present values of travel time differentiated by road type, there exists some relevant evidence that can be used to derive such a relationship. Some of these studies suggest that VTT varies substantially by road type, which would have strong implications for CBA if applied.

We also conduct our own empirical investigation based on aggregate data from three road projects in Norway, where travellers can choose between the old and the new road, and where the new road is subject to a road toll. The results from this case study indicate that VTT varies less by road type than suggested by the international literature, but the differences are still economically significant.

Based on the theoretical foundation and the empirical findings, we show how a differentiation of VTT by road type can be implemented in practice, classifying all roads as either one out of five main types. Such a differentiation could have considerable impact on CBA results, increasing the user benefits of road projects that raise the road standard. However, it would also imply a moderate decrease in VTT over time (other things equal) as the overall quality of the road network improves.

Our study makes the following contributions: First, it provides the first systematic review of the existing evidence on the relationship between road type/quality and VTT. Second, it contributes to the broader literature on VTT and contextual factors like transport mode [ 8 ], road congestion [ 40 ], crowding in public transport [ 42 ], and access and waiting time[ 36 , 37 ]. Footnote 1 A closely related topic is the role of infrastructure in cycling route choice [ 9 , 19 ].

Third, our empirical investigation contributes to the growing literature on the use of revealed preference (RP) data for estimating VTT and related parameters, as opposed to stated preference (SP) data. Wardman et al. [ 39 ] find evidence that the VTT is higher in studies based on RP data. This is in line with the RP studies by Wolff [ 43 ], who estimates the VTT based on US data on gasoline prices and speeding behaviour, Footnote 2 and Goldszmidt et al. [ 14 ], who exploit data on waiting times and prices of ridesharing. Following Small et al. [ 31 ], Fezzi et al. [ 7 ] and Tveter et al. [ 33 ], we exploit variation in road tolls to identify the VTT.

Our paper is organized as follows: In Sect. 2 , we explain the theoretical foundation for differentiating VTT by road type. In Sect. 3 , we review the existing empirical literature on this relationship and related topics. In Sect. 4 , we show the results of our own empirical case study. In Sect. 5 , we summarize the findings and discuss how they can be applied in practical CBA. Section 6 concludes.

2 Theoretical foundations

In transport economics, the value of travel time (VTT) refers to the monetary value associated with travel time changes. Its typically positive value suggests a willingness to pay for travel time savings and a willingness to accept higher costs to avoid travel time increases.

Microeconomic time allocation models, going back to Becker [ 2 ] and DeSerpa [ 6 ], suggest that the VTT for a given activity is the sum of the opportunity costs (i.e. the marginal value of what could be gained from alternative activities) and the marginal value of time spent in that activity (in our case driving).

Conceptionally, factors influencing the VTT can therefore be grouped into factors that affect opportunity costs (like income) and factors that affect the direct value of spending time in a certain activity. In our case of driving, factors falling into the latter group include variables that improve driving comfort and facilitate a more productive and enjoyable car trip. To the extent that different road types contribute differently to driving comfort, we can expect the VTT to vary between different types of roads.

In our application, driving comfort should be defined widely and includes (at least).

Increased productivity (more useful use of travel time)

Increased driving pleasure (positive driving experience)

Reduced perceived insecurity (negative driving experience)

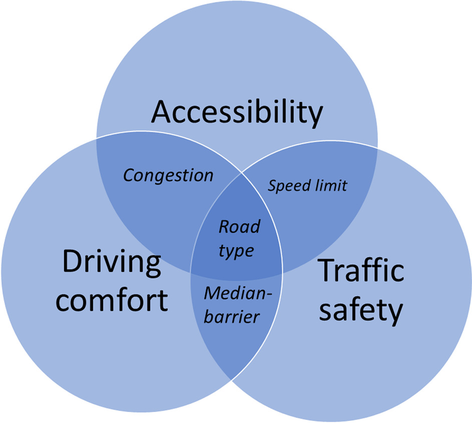

Road types do not only affect driving comfort but also accessibility (driving speed) and traffic safety. This is illustrated in the simplified Venn diagram below (Fig. 1 ).

Illustration of relationship between driving comfort, accessibility and traffic safety with road type as a shared characteristic

Figure 1 includes some variables at the intersection between driving comfort, accessibility and traffic safety. For instance, congestion has a clear effect on accessibility and – as pointed out below – on driving comfort. Footnote 3 Typical road safety measures, such as median barriers, increase traffic safety and reduce the perceived insecurity of the driver and thus also have an effect on driving comfort. While speed limits may indirectly contribute to driving comfort, their main effects are on accessibility and traffic safety.

Differences in VTT by road type that reflect difference in driving comfort should not include accessibility gains from reduced congestion in absolute terms (minutes travel time saved). This is because the VTTs is a marginal measure that applies to the next full minute of (reduced) travel time. That a new motorway reduces travel time does therefore not point to how the VTT of the new motorway is compared to the old road. However, to the extent that different road types lead to different levels of congestion and to the extent that less congestion generates a separate utility gain in the form of more comfortable/less stressful car trips, congestion effects may enter the valuation of road type. For practical applications, one should in this case not apply additional congestion multipliers on the VTT, as this may lead to double counting in demand and/or cost–benefit analysis.

A similar argument applies to traffic safety measures. To avoid double counting, one should ideally separate effects of different road types on traffic safety between traffic safety (i.e. objective accident risk) and perceived traffic insecurity. While the former element is typically captured separately in the (cost–benefit) analysis, Footnote 4 i.e. independent of the value of travel time, the latter element would be included in road type multipliers. As pointed out in Sect. 5.2 , it could be challenging to empirically quantify these two elements.

Mathematically, we can express VTT differences by road type in the form of multipliers on the average VTT, so called VTT multipliers. In our case, we refer to these as “road type multipliers”. Multipliers associated with road types that have an above (below) average comfort level are assigned a value lower (higher) than one, as drivers have a lower (higher) willingness-to-pay to reduce travel time on more (less) comfortable roads.

Departing from microeconomic theory, time allocation models postulate that the effect of driving comfort on utility is time-dependent. Furthermore, the use of simple time multipliers implies that the effect is linear in time, i.e. that the difference in utility from driving on a more comfortable road vs. a less comfortable road increases linearly with travel time. If this is true or not is fundamentally an empirical question. It could be that the more comfortable road also has some characteristics that makes it more attractive, regardless of travel time. For instance, it could be easier to access due to design or traffic signs. In our empirical case study in Sect. 4 , we therefore assume that the route choice of car travellers can partly be explained by a constant term capturing the ‘signage effect’ and partly by a comfort effect that is linear in travel time, i.e. the road type multiplier.

3 Existing literature

In this section, we present the most relevant studies for VTT by road type and quality. Since the literature on this exact topic is quite limited, we also include related literature concerning valuation of other factors affecting the quality of travel.

3.1 Number of lanes and curviness

Hensher and Sullivan [ 18 ] estimate the willingness to pay (WTP) for road curviness and road type utilizing a stated choice experiment done in New Zealand. In the experiment, car and truck drivers undertaking regional and inter-urban trips evaluate alternative trip profiles and choose one of the trip profiles as the most preferred. It includes questions related to the value of driving in free-flow conditions and the value of being slowed down by other traffic, share of driving time with other vehicles tailgating them, the curviness of the road, the number of lanes, vehicle operating costs and road toll costs.

The authors do not find statistically significant differences between the parameters for almost straight, slight and moderate curviness within each alternative. Therefore, they treat them as having a single parameter relative to the worst scenario of curviness (a winding road).

Using the valuations from the experiment and a share of 14% truck drivers and 86% car drivers, Hensher and Sullivan derive WTP values for each combination of road type and curviness, illustrated in Table 1 (Table 6 in Hensher and Sullivan [ 18 ].

Wardman et al. [ 41 ] study the introduction of the UKs first toll motorway, the M6 Toll road (M6T). M6T was designed to alleviate traffic congestion around Birmingham. Initially, the standard toll for cars was £2 and was increased up to £4 later. They model passenger choices utilizing the new tolled road with different toll regimes.

In addition to study the effect of the tolls in terms of time-toll trading, the authors examine other attributes that might influence the traveller’s decision making. This includes estimating time valuations of infrastructure characteristics and road conditions including among others, lane width, number of lanes and road surface (see Sect. 3.2 ).

When it comes to lane width, they find that wide lanes (3.75 m) reduce VTT by 5% compared to standard lanes (3.35 m) and that narrow lanes (3.0 m) increase VTT by 9%. They also find that the number of lanes on motorways plays a role: 4-lane motorways would have a 7% lower VTT compared to standard 3-lane motorways, and 2-lane motorways have a 10% higher VTT.

3.2 Road surface

Road surface is another road quality factor that affects the VTT, as pointed out by Wardman et al. [ 41 ].

BCHF [ 1 ] did a valuation study using SP surveys, where they among other factors focus on the quality of the car ride related to the road surface and safety. They find that the quality of the car ride can imply significant variation in the VTT depending on which conditions the journey is undertaken in, and that these factors will have a significant effect on the VTT. Journeys done on rural roads with rough surface or rutted roads have VTT multipliers of 1,65 and 2,15 respectively. Urban roads with rough surface are estimated to have a slightly lower VTT of 1,59.

Wardman et al. [ 41 ] find that the VTT vary with different road surfaces, where concrete surface adds 12% to the VTT compared to a standard surface and high-level jointed sections of motorway increase the VTT by 9%.

Jamson et al. [ 22 ] study road users’ perceptions about a range of road maintenance issues, with road surface being one of them. They illustrate the additional disutility of moving from perfect conditions to various imperfections with varying duration and frequency in minutes. A road surface that leads to various levels of shaking in the car is valued in the range of 7 to 30 min of travel, depending on the frequency and duration of the vibration or rumbling from the road surface or the noise from the road surface. Similarly, driving on a road surface which gives an unpleasant noise for the driver leads to a valuation of 2 to 18 min of travel.

NZ Transport Agency [ 25 ] has a handbook of monetised benefits and costs, which among other factors includes vehicle operating costs (VOC). In this VOC there is a component which indicates the car user’s willingness to pay to avoid driving on uneven roads. If relevant, these costs are added to the fixed costs.

The NZ Transport Agency uses IRI (International Roughness Index) to measure the unevenness of the road. The higher the IRI is, the more uneven the road is. Using valuations from the manual, we have calculated relative VTTS multipliers illustrated in Table 2 under, where an even road (IRI = 0–2,5) is the baseline. The calculated multipliers span from 1,44 to 2,20.

3.3 Road characteristics and route choice

It is possible that the value of road characteristics could be captured implicitly in some estimates of the VTT based on RP studies using data on route choice. One example is the study by Fezzi et al. [ 7 ], who analyse survey data on route choice collected among visitors at recreation sites in Italy. Here, travellers can choose between routes with and without road tolls. Although the authors include some dummy variables that account for differences between the routes, they do not consider the possibility that the VTT could differ by road type. This could explain the relatively high estimated VTT, which is about 3/4 of the wage rate.

Tveter et al. [ 33 ] estimate the VTT based on a case study of a new motorway in Norway, where travellers can choose between the new road and an alternative route. They exploit that road tolls on the new road were introduced two months after the road was opened. Based on the change in traffic after the toll was introduced and assumptions regarding the distribution of the VTT, they estimate a VTT per traveller of 207 NOK (about 23 USD) for commuting trips and 120 NOK (about 13 USD) for leisure trips. These are relatively high values, which again could reflect that also other road characteristics explain route choice. We will get back to this in our empirical investigation in Sect. 4 .

3.4 Congestion and travel time variability

As pointed out in Sect. 2, the infrastructure could also have an impact on traffic flow. If traffic flow is better, this will imply both shorter and more predictable travel times and a more pleasant driving experience. The former is typically referred to as the value of reliability or the value of travel time variability [ 5 ]. This can be captured in travel demand and cost benefit analysis through travellers’ willingness to pay for a reduction in the uncertainty of travel time, for instance measured by the standard deviation, variance, or certain percentiles of the travel time distribution. Footnote 5 In the meta-analysis by Wardman et al. [ 39 ], one unit reduction in the standard deviation of travel time is found to be equivalent to about a 0.7 unit reduction in travel time. In the recent Norwegian valuation study [ 10 ], this so-called ‘reliability ratio’ is about 0.4 and similar across modes.

The direct discomfort of congestion can be assumed to be proportional with travel time, which means that it can be expressed in terms of VTT multipliers. Wardman and Ibáñez [ 40 ] provide a review of the existing literature on such multipliers and find that most are in the range between 1,3 and 2,0, but some are higher. The definition of congestion varies, and some studies include different levels of congestion.

As most studies are based on SP, one might be worried that congestion multipliers would be biased upwards because respondents pay more attention to these in a survey setting than they do when making actual travel decisions. The study by Wardman and Ibáñez shows no evidence of a difference between SP and RP, but the number of RP studies is limited. An obvious challenge to RP studies of congestion is reverse causality: High demand causes high congestion.

In the recent Norwegian valuation study [ 10 ], the estimated VTT multipliers for commuting and leisure trips are 1,2–1,3 for moderate congestion and 2,3–2,4 for heavy congestion. Interestingly, the multipliers are somewhat lower for car passengers. The results are quite sensitive to whether those with little congestion on their reference trip are included in the sample. This suggests that the valuation is reference-dependent, i.e. that travellers assign a higher value to changes that involve a worsening in congestion compared to what they are used to. For CBA, the valuation of those who are not experienced with congestion might not be the most relevant. Footnote 6

One might be concerned that since congestion and travel time variability is correlated, travellers might also take variability into account when choosing between alternatives with different levels of congestion in SP surveys. Flügel et al. [ 10 ] investigate this through a choice experiment where both congestion and variability are specified. Although the results from this choice experiment are less precise, they indicate that controlling for travel time variability does not reduce the congestion multipliers.

There are also some RP studies of the value of travel time and/or reliability that do not explicitly consider the effect of congestion on the VTT, but use variation in congestion to estimate other unit values. Notable examples are the studies by Brownstone and Small [ 4 ] and Small et al. [ 31 ] of road pricing experiments in California and the study by Bento et al. [ 3 ] of users of a high occupancy toll (HOT) lane in Los Angeles.

4 Empirical case studies

In this section, we present an analytical model to describe the relationship between the VTT and road type based on revealed preference data. In RP, we do not consider explicitly how trip attributes are presented to or perceived by the travellers, but rather how the importance of these attributes is reflected in their real-world choices.

The model is applicable to cases where there are two alternative roads for which market shares are observed over two periods. To identify – at least some of – the underlying behavioural parameters of the model, the monetary costs (e.g. road tolls) for at least one of the two roads need to differ across the two periods. A change in road tolls can be seen as constituting a natural experiment.

Deriving choice probabilities (market shares) from automatic traffic counts, we apply the model to three motorway projects in Norway. In all cases, drivers can choose between a newer motorway offering superior road quality (in terms of numbers of lanes and/or road quality) and a cheaper and slower alternative.

Our analytical model departs from an equation (Eq. 1 ) that describes the probability ( \({P}_{t}^{New}\) ) to choose the new motorway, in two time periods t where t = 1, 2 , as a function of three variables, the generalised costs on the new motorway ( \({GK}_{t}^{New}\) ), the old motorway ( \({GK}_{t}^{Old}\) ) and a scale parameter \(\mu\) .

\({P}_{t}^{New}=\frac{{e}^{\mu {GK}_{t}^{New}}}{{e}^{\mu {GK}_{t}^{New}}+{e}^{\mu {GK}_{t}^{Old}}}\) for t = 1,2

The scale parameter describes the sensitivity of which differences in generalised cost lead to changes in route choice. Its value is a priori unknown. It is expected to be negative, as higher costs typically reduce choice probabilities. The generalized cost functions are further specified as follows:

\({GK}_{t}^{Old}=C*{D}^{Old}+{B}_{Old,t}+{\omega }_{Old}*{T}^{Old}\) for t = 1,2

\({GK}_{t}^{New}= \beta +C*{D}^{New}+{B}_{New,t}+{\omega }_{New}*{T}^{New}\) for t = 1,2

C: cost of driving per kilometre (in NOK/km), assumed to be constant for all roads and periods

\({D}^{Old}\) , \({D}^{Old}\) : distance of the old and new road respectively (in km)

\({\omega }_{Old}\) , \({\omega }_{New}\) : value of time per car on the old and new road respectively (in NOK/hour)

\({T}^{Old}\) , \({T}^{New}\) : travel time of the old and new road, respectively (in hours)

\(\beta\) : a constant term (in NOK)

\({B}_{Old,t}, {B}_{New,t}\) : road toll in the given period (in NOK)

The parameter \(\beta\) represents unobserved factors that make drivers prefer the new motorway. Mathematically, its value is expected to be negative as it enters the cost function of the new motorway. It represents effects of road signage, recommendations in navigation apps or other factors that influence route choice independently of travel costs and comfort-adjusted travel times. We refer to this effect (and the absolute value of the \(\beta\) parameter) as the “signage effect”. The numerical value of the signage effect represents the willingness-to-pay in Norwegian kroners (NOK) for being able to use the new motorway if the alternatives are otherwise equal in terms of cost and ‘effective’ travel time, taking into account differences in the VTT ( \({\omega }_{Old}\) , \({\omega }_{New}\) ).

To connect \({\omega }_{Old}\) and \({\omega }_{New}\) to the official practice of CBA in Norway, we impose that the weighted average of the two needs to match the ‘official’ level of the value of travel time per vehicle (VTT) that would apply to each of our three cases. We use shares of cars on the new motorway in period 2 for weighting:

Combining the Eqs. 1 with t = 1 and t = 2 with Eq. 4 and inserting Eqs. 2 and 3 into 1, we get a system of equations with three equations and four unknowns. To solve this system of equations, we fix \(\beta\) and solve the system with respect to the three unknowns: \(\mu\) , \({\omega }_{New}\) and \({\omega }_{Old}.\) See Appendix for a detailed solution of the system of equations.

Hence, we can derive an expression for \(\mu\) (Eq. 5) that only depends on observable variables ( \({{P}^{New}}_{1}, {{P}^{New}}_{2}\) and \({B}_{2}\) ).

With this, we can calculate the value of time on the old motorway as a function of \(\beta\) (see Appendix for details), as shown in Eq. 6 below.

Similarly, based on Eqs. (5) and ( 4 ), we also get an expression of \({\omega }_{New}\) as a function of \(\beta\) (Appendix).

The three empirical cases are briefly described as follows Footnote 7 :

Case 1: Between the cities of Tvedestrand and Arendal in the South of Norway, a new four-lane motorway was opened in July 2019 going largely parallel to an older two-lane highway (see illustration in Fig. 2 below). The Tvedestrand–Arendal corridor is part of the main motorway connection between the capital of Norway, Oslo, and the city of Kristiansand. Due to technical problems, the road toll on the new motorway was first introduced in September 2019. Footnote 8

Case 2: A new four-lane motorway between the town of Løten and the city of Elverum in Eastern Norway was opened July 2020 with road tolls being introduced shortly after. There were no tolls on the old road, which runs parallel to the new one. Tolls on the new road were reduced from February 2021 as a result of the national budget settlement.

Case 3: As part of the long-distance corridor between Oslo and city of Trondheim, a tunnel (“Øyertunnelen”) and a two-lane motorway with overtaking lanes were opened in December 2012. Tolls were collected on both the new road and the old road from the start. Tariffs for passenger cars were unchanged from 1 July 2016 to January 2021, when tolls on the old road were removed as a result of the national budget settlement.

New motorway (in purple) and old motorway (in red) between Tvedestrand and Arendal (case 1) in the south of Norway

Next, we derive numerical results using the following input data (Table 3 ). Footnote 9 Note that the market shares only include passenger cars, not heavy vehicles.

The average value of travel time is derived based on the official Norwegian values of travel time, assuming a continuous relationship between VTT and travel distance [ 12 ]. We take into account differences in trip purpose, distance, and car occupancy between the three cases, based on transport model simulations. This will indirectly also pick up the effect of other local characteristics like for instance income level, although these are not directly controlled for. We do not expect large differences in the income level of travellers between the three areas considered.

In all three cases, we observe the behavioural change after the new road toll structure was introduced. In case 1, choice probabilities on the new motorways dropped from 85.5 to 71.3% after the road toll was introduced. In case 2, the market share of the new road increased from 70.7 to 82.1% after the road toll was significantly reduced. In case 3, the new road lost some market share (going down from 96.2 to 91.3%) after the road toll on the old road alternative was removed.

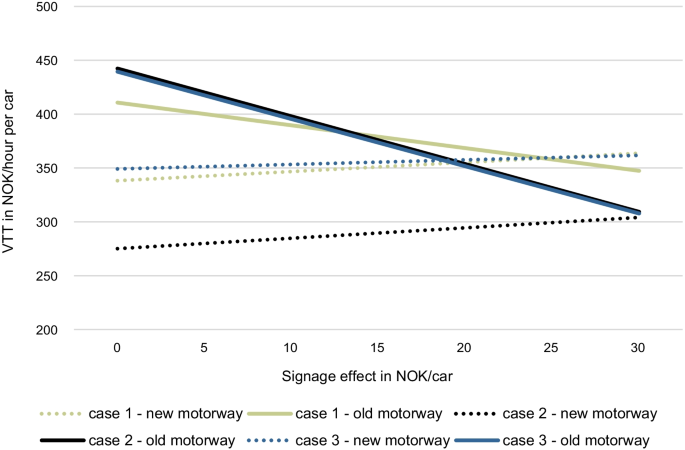

Given this observed behaviour, we can calculate the VTT on the old and the new motorway under different assumption of the signage effect. This is shown in Fig. 3 .

Value of time on old and new road in each case study as a function of the signage effect, given average values of time as indicated in Table 3

Assuming no or a reasonably low signage effect, the VTTs on the new motorway are—as expected—lower than on the old road. This can be attributed to the higher perceived comfort and safety on the new motorway.

When the signage effect exceeds certain values, however, the VTTs on the new motorway would—according to our model and with our data—be higher than on the old motorway. In this case, the signage effect alone would be so high that it would explain the observed route choice and the indicated preference for the new motorway.

Table 4 gives some values for the relative VTT (old/new) for different assumptions of the signage effect. Values greater than 1 indicate higher VTT on the old motorway.

Besides the signage effect, our results are sensitive to other assumptions and input values, such as the average value of the VTT. If the applied VTT values in Table 3 are higher (lower) than the actual VTT in the three cases, we would underestimate (overestimate) the VTT difference by road type. Footnote 10

5 Discussion and application

5.1 summary of findings.

The existing evidence on the relationship between road type and VTT is scarce. One highly relevant international study is the one by Hensher and Sullivan [ 18 ]. Their results in cent/km per vehicle (see Table 1 ) can be translated into VTT multipliers given knowledge of the VTT of one of the road types and an assumption of average speed. As Hensher and Sullivan [ 18 ] only report a generic VTT ($7.68/h Footnote 11 ), we derive a conservative estimate by assuming that this equals the VTT of a straight four-lane motorway with a median. Assuming an average speed of 90 km/h and a base level of straight 4 lanes motorways with median, we calculate VTT multipliers of 2.32 and 2.68 for straight and curvy two-lane motorways, respectively. Footnote 12 These values, derived from SP results, are substantially higher than what we derive in our RP case studies (Sect. 4 ).

Our preferred estimates from our empirical case studies suggest that the VTT is between 1.2 and 1.6 times higher on the old two-lane highway compared to the new four-lane motorway, assuming no signage effect. This is moderate in light of the findings by Hensher and Sullivan [ 18 ], but it still implies a substantial difference in the VTT. It is also in a similar order of magnitude as the multipliers derived by Wardman et al. [ 41 ].

The differences in VTT may very well reflect several characteristics of the new motorway and old highway like the number of lanes, curviness and road surface. This implies that a more modern two-lane highway would have a multiplier closer to one, while other two-lane highways of more moderate standard could have higher multipliers. The results of Hensher and Sullivan [ 18 ] indicate that a curvy two-lane highway would have a 15% higher VTT that a straight or moderately curvy two-lane highway.

The results of Wardman et al. [ 41 ] also suggest that lane width matters for the VTT, which is interesting given that building narrower lanes is a common strategy for reducing construction costs.

5.2 Application in CBA of road projects

Our findings suggest that the difference in VTT between road types can be substantial. Hence, accounting for this in CBA will provide more accurate estimates of the economic benefits of road projects. In this section, we briefly discuss how the results can be incorporated in practical CBA of road projects. For more detail, see Flügel et al. [ 11 ] and [ 16 ].

First, one must choose a classification of road types, taking into account both which characteristics are important for the VTT and data availability. Flügel et al. [ 11 ] propose the following classification for Norway: (1) Urban roads/streets (speed limit up to 50 km/h), (2) Four-lane motorway, (3) Three-lane motorway, (4) Two-lane highway with median strip and (5) Two-lane highway without median strip. The reason for using median strip as a criterion is that this characteristic is easily available in road network data, and is likely to be correlated with other relevant characteristics, like curviness.

Second, if accident costs are already included in the CBA, one should adjust the road type multipliers downwards in order to avoid double-counting. Third, multipliers should be expressed relative to the VTT of a typical trip, which means that some multipliers may be lower and some greater than 1.0. Based a joint consideration of the evidence in the existing literature and from the empirical case studies, Halse et al. [ 16 ] recommend the multipliers in Table 5 . We emphasize that these are practical recommendations based on the evidence available so far, and that more research is needed.

If segmentation by trip purpose is possible, one may consider using multipliers closer to 1.0 for business travel, where a part of the VTT represents the cost to the employer [ 38 ] which might not depend as much on driving comfort. As argued by Halse et al. [ 16 ], the multipliers should not be applied to heavy goods vehicles. It seems unlikely that shippers or carriers are willing to accept a significantly higher cost or shipping time in order for the driver to choose a route with better road quality. Finally, if congestion is high and this is taken into account using congestion multipliers (see Sect. 3.4 ), segmenting by road type in addition might be less relevant.

Applying VTT multipliers by road type in CBA of actual road projects could potentially have a large impact on the estimated net benefits of road projects where a less comfortable road (e.g. type 4) is replaced by a more comfortable one (e.g. type 2), compared to existing practice. The increase in net benefits would depend on several factors, like how much of the benefits is due to time savings, how travellers allocate themselves between different routes etc. On the other hand, the net benefits of a project that shortens travel time on a road that is already of the most comfortable type (type 2) would be lower if applying these multipliers.

5.3 Limitations

While our study is an important step towards more knowledge on a previously unexplored topic, it is important to also note the limitations. First, we only consider private car travel and not other modes of transport. Second, our empirical evidence is based on three case studies, which might not be representative of traveller behaviour more generally. For instance, there could be local differences in income or other socio-economic factors. Third, the analysis is based on aggregate data, which makes parameter identification more challenging and implies that we cannot estimate values for sub-segments of travellers. Forth, combining this evidence with the international evidence from other contexts is not straightforward, and applying the results in CBA requires additional assumptions. Finally, our road type classification based on of four road types might not fully take into account the importance of road quality characteristics that also vary within road type.

5.4 Extensions and further research

In practice, the quantities to which the road type specific VTT are applied in a CBA framework are typically predicted by transport models. Ideally, these transport models should also apply a road type specific VTT in the transport demand and route choice prediction. This is currently not the case in Norway. However, ongoing projects aim to include road specific VTTs in the Norwegian transport modelling framework. If road type has an impact on the VTT, accounting for this should improve the model fit of these models, particularly for route choice.

Based on our findings, we recommend to conduct more research on the relationship between road type and VTT. Preferably, this should be based on more disaggregate data such as GPS-tracking data, which would allow for more robust identification of the VTT and related multipliers [ 13 ]. Furthermore, we recommend to develop methods and tools for including this relationship in practical CBA in a sufficiently precise and at the same time tractable manner. An alternative to discrete road type categories would be to value the road quality elements (number of lanes, curviness, surface etc.) separately. This requires that data on these elements is available.

We have only considered the VTT of car travellers and not other modes of transport. In the case of car passengers we expect the relative importance of road type to be at least as high as for car drivers, since this could determine which activities the passenger can do (e.g. reading) without becoming nauseous. Footnote 13 This could also have relevance for the VTT in future scenarios with autonomous vehicles [ 24 ].

Similar effects would apply to bus passengers, but one should investigate whether this also depends on the vehicle size and type. We expect the infrastructure to matter less for the VTT in railway travel, which is relatively comfortable. However, there could be exceptions for infrastructure of very poor quality. In air travel, the amount of turbulence and noise could have an impact on the VTT, which could be of interest given that climate policy is expected to result in development of new and possibly less noisy aircraft technology [ 44 ].

6 Conclusion

We have documented that the literature on the relationship between the VTT on road type and quality is scarce, with some notable exceptions. The existing evidence suggests that accounting for this relationship could have a large impact on the results of CBA. Our empirical case study suggests a smaller, but still economically significant effect. Accounting for this effect will increase the estimated benefits of projects that replace existing roads with a more comfortable road type. The results could also have implications for how to set toll rates in toll-funded highway projects. If travellers value road quality, tolls on new high-quality roads could be set slightly higher without diverting too much traffic.

However, accounting for the relationship between road quality and VTT will also decrease the benefits of projects that reduce travel time on existing high-quality roads, other things equal. Moreover, average VTT will decrease somewhat over time as roads become more comfortable. While the relationship between communication technology and VTT has received considerable interest, this offers an alternative explanation for why the VTT might increase less over time than predicted based on income growth [ 15 , 21 ].

Our study also highlights the importance of accounting for contextual factors that affect the VTT more generally, both in private car travel and public transport. If such factors are not accounted for, comparisons of VTT estimates based on different approaches could be misleading. This is particularly important given the increasing interest in using RP data to estimate the VTT.

Availability of data and materials

All calculations in this paper are based on data which has previously been documented in published research or which is publicly available via other sources. If requested, the authors will be happy to provide this data to those interested.

Shires and de Jong [ 30 ] and Wardman et al. [ 39 ] provide a review of European studies on the value of travel time across all travel modes.

However, the results of Wolff [ 43 ] also suggest that the VTT in other RP studies is biased upwards.

On the other hand, the effect of congestion on traffic safety is somewhat ambigous [ 29 , 34 ]

While this may be a reasonable practical approach, one may also argue that traffic safety should be captured by the VTT (and that only truly external effects should be treated as separate elements in CBA). This requires that travellers take personal accident risk fully into account and that the risk is proportional to time spent in traffic. This relates to the discussion about constant and time-dependent effects at the end of this section.

If information about individual departure and arrival times is available, it can also be captured through so-called scheduling parameters that capture the cost of late arrival and of early departure or arrival.

In their recommended multipliers, Flügel et al. [ 10 ] exclude those who have no congestion at all on their reference trip.

More details can be found in Halse et al. [ 16 ].

This case was also studied by Tveter et al. [ 33 ], who derived absolute values of travel time from this case and compared it against estimates from stated preference studies. Tveter et al. did not consider effects of different road types on the VTT.

The assumptions behind the data inputs are documented in greater detail in Halse et al. [ 16 ].

This applies as the new motorway is the faster alternative in all our cases.

Calculated as a weighted average of truck driver ($5.08/h) and car driver ($15.6/h). The currency is 2001 New Zealand dollars.

Assuming a lower absolute VTT for straight 4-lane motorways with median equals, these multipliers would get even higher.

Many CBA guidelines do not distinguish between the VTT of car drivers and car passengers. In the current Norwegian guidelines [ 32 ], passengers have a lower VTT, based on the findings by Flügel et al. [ 10 ].

Applies when \({P}_{1}^{New}\ne 0\) and \({P}_{2}^{New}\ne 0\) .

This is true when \({\omega }_{Old}\ne \frac{\beta +C*{D}^{New}+\frac{VOT* {T}^{New}}{{P}_{2}^{New}}- C*{D}^{Old}-{B}_{Old,1}+{B}_{New,1}}{{T}^{Old}+\frac{\left(1-{P}_{2}^{New}\right){T}^{New}}{{P}_{2}^{New}}}\) and \({\omega }_{Old}\ne \frac{\beta +C*{D}^{New}+\frac{VOT* {T}^{New}}{{P}_{2}^{New}}- C*{D}^{Old}-{B}_{Old,2}+{B}_{New,2}}{{T}^{Old}+\frac{\left(1-{P}_{2}^{New}\right){T}^{New}}{{P}_{2}^{New}}}\)

Abbreviations

- Cost–benefit analysis

- Revealed preference

- Stated preference

- Value of travel time

Willingness to pay

BCHF. (2002). Project Evaluation Benefit Parameter Values. Prepared for Transfund New Zealand by Beca Carter Hollings & Ferner Ltd in association with Steer Davies Gleave, Forsyte Research and Brown Copeland & Co.

Becker, G. (1965). A theory of the allocation of time. Economic Journal, 75 , 493–517.

Article Google Scholar

Bento, A., Roth, K., & Waxman, A. R. (2020). Avoiding traffic congestion externalities? The value of urgency. National Bureau of Economic Research Working Paper 26956.

Brownstone, D., & Small, K. A. (2005). Valuing time and reliability: Assessing the evidence from road pricing demonstrations. Transportation Research Part A: Policy and Practice, 39 (4), 279–293.

Google Scholar

Carrion, C., & Levinson, D. (2012). Value of travel time reliability: A review of current evidence. Transportation Research Part A: Policy and Practice, 46 (4), 720–741.

DeSerpa, A. C. (1971). A theory of the economics of time. The Economic Journal, 81 (324), 828–846.

Fezzi, C., Bateman, I. J., & Ferrini, S. (2014). Using revealed preferences to estimate the value of travel time to recreation sites. Journal of Environmental Economics and Management, 67 (1), 58–70.

Flügel, S. (2014). Accounting for user type and mode effects on the value of travel time savings in project appraisal: Opportunities and challenges. Research in Transportation Economics, 47 , 50–60.

Flügel, S., Hulleberg, N., Veisten, K., Sundfør, H. B., & Halse, A. H. (2019). A combined RP-SP model to elicit cyclists' valuation for improved road infrastructure . Paper presented at the ITEA Annual Conference , 2019.

Flügel, S., Halse, A. H., Hulleberg, N., Jordbakke, G. N., Veisten, K., Sundfør, H. B., & Kouwenhoven, M. (2020a). Value of travel time and related factors. Technical report, the Norwegian valuation study 2018–2019 . TØI report 1762/2020

Flügel, S., Halse, A. H., Hartveit, K. J. L., Hulleberg, N., Steinsland, C., & Ukkonen, A. (2020). Valuation of driving comfort for different road types. TØI report 1774/2020.

Flügel, & Madslien. (2020). The value of time as a continuous function of travel distance. TØI report 1778/2020.

Flügel, S., Weber, C., Halse og, A. H., & Ellis, I. O. (2022). Valuation based on Big Data and revealed preference data: An assessment for Norwegian transport appraisal. TØI report 1882/2022

Goldszmidt, A., List, J. A., Metcalfe, R. D., Muir, I., Smith, V. K., & Wang, J. (2020). The value of time in the United States: Estimates from nationwide natural field experiments . National Bureau of Economic Research Working Paper 28208.

Gunn, H. (2001). Spatial and temporal transferability of relationships between travel demand, trip cost and travel time. Transportation Research Part E: Logistics and Transportation Review, 37 (2–3), 163–189.

Halse, A. H., Flügel, S., Hartveit, K. J. L., & Steinsland, C. (2022). Driving comfort level, value of travel time, and route choice of car travelers. TØI report, forthcoming.

Hartmann, A., & Ling, F. Y. Y. (2016). Value creation of road infrastructure networks: A structural equation approach. Journal of traffic and transportation engineering (English edition), 3 (1), 28–36.

Hensher, D. A., & Sullivan, C. (2003). Willingness to pay for road curviness and road type. Transportation Research Part D: Transport and Environment, 8 (2), 139–155.

Hulleberg N., Flügel S., & Ævarsson, G. (2018). Vekter for sykkelinfrastruktur til bruk ved rutevalg i regionale transportmodeller. TØI-rapport 1648/2018.

Ihs, A., Grudemo, S., & Wiklund, M. (2004). Vägytans inverkan på körkomforten: bilisters monetära värdering av komfort. Statens väg-och transportforskningsinstitut., VTI meddelande 957

ITF. (2019), What is the value of saving travel time? ITF Roundtable Reports, No. 176, OECD Publishing, Paris.

Jamson et al. (2011). Asset Management: Capturing Road Users’ Perceptions of the Agency’s Highway Assets and their Management , University of Leeds.

Jiao, X., & Bienvenu, M. (2015). Field measurement and calibration of HDM-4 fuel consumption model on interstate highway in Florida. International Journal of Transportation Science and Technology, 4 (1), 29–45.

Kolarova, V., & Cherchi, E. (2021). Impact of trust and travel experiences on the value of travel time savings for autonomous driving. Transportation Research Part C: Emerging Technologies, 131 , 103354.

NZ Transport Agency. (2021). Monetised benefits and costs manual . Date issued 1 August 2021, Retrieved from https://www.nzta.govt.nz/resources/monetised-benefits-and-costs-manual/

Odoki, J. B., Anyala, M., & Bunting, E. (2013). HDM-4 adaptation for strategic analysis of UK local roads. Proceedings of the Institution of Civil Engineers-Transport, 166 (2), 65–78.

Olsson, C. (2003). Motorists´ evaluation of road maintenance management . Doctoral dissertation, Infrastruktur.

Perrotta, F., Parry, T., Neves, L. C., Buckland, T., Benbow, E., & Mesgarpour, M. (2019). Verification of the HDM-4 fuel consumption model using a Big data approach: A UK case study. Transportation Research Part D: Transport and Environment, 67 , 109–118.

Retallack, A. E., & Ostendorf, B. (2019). Current understanding of the effects of congestion on traffic accidents. International Journal of Environmental Research and Public Health, 16 , 3400.

Shires, J. D., & De Jong, G. C. (2009). An international meta-analysis of values of travel time savings. Evaluation and program planning, 32 (4), 315–325.

Small, K. A., Winston, C., & Yan, J. (2005). Uncovering the distribution of motorists’ preferences for travel time and reliability. Econometrica, 73 (4), 1367–1382.

Article MathSciNet Google Scholar

Statens vegvesen. (2021). Håndbok V712 Konsekvensanalyser.

Tveter, E., Hoff, K. L., Laingen, M., & Bråthen, S. (2019). Nye tidsverdier i samfunnsøkonomiske beregninger: Alternative vurderinger basert på analyser av to vegprosjekter . Møreforskning-rapport nr. 2004

Tang, C. K., & van Ommeren, J. (2021). Accident externality of driving: Evidence from the London Congestion Charge. Journal of Economic Geography . https://doi.org/10.2139/ssrn.3736929

Walton, D., Thomas, J. A., & Cenek, P. D. (2004). Self and others’ willingness to pay for improvements to the paved road surface. Transportation Research Part A: Policy and Practice, 38 (7), 483–494.

Wardman, M. (2001). A review of British evidence on time and service quality valuations. Transportation Research Part E: Logistics and Transportation Review, 37 (2–3), 107–128.

Wardman, M. (2004). Public transport values of time. Transport Policy, 11 (4), 363–377.

Wardman, M., Batley, R., Laird, J., Mackie, P., & Bates, J. (2015). How should business travel time savings be valued? Economics of Transportation, 4 (4), 200–214.

Wardman, M., Chintakayala, V. P. K., & de Jong, G. (2016). Values of travel time in Europe: Review and meta-analysis. Transportation Research Part A, 94 , 93–111.

Wardman, M., & Ibáñez, J. N. (2012). The congestion multiplier: Variations in motorists’ valuations of travel time with traffic conditions. Transportation Research Part A: Policy and Practice, 46 (1), 213–225.

Wardman, M., Ibáñez, J. N., Tapley, N., & Vaughan, B. (2008): M6 toll study: Modelling of passenger choices. Prepared for the Department for Transport.

Wardman, M., & Whelan, G. (2011). Twenty years of rail crowding valuation studies: Evidence and lessons from British experience. Transport Reviews, 31 (3), 379–398.

Wolff, H. (2014). Value of time: Speeding behavior and gasoline prices. Journal of Environmental Economics and Management, 67 (1), 71–88.

Ydersbond, I. M., Buus Kristensen, N., & Thune-Larsen, H. (2020). Nordic sustainable aviation . Nordic Council of Ministers.

Zaabar, I., & Chatti, K. (2010). Calibration of HDM-4 models for estimating the effect of pavement roughness on fuel consumption for US conditions. Transportation Research Record, 2155 (1), 105–116.

Download references

Acknowledgements

We would like to thank Christian Steinsland and Nina Hulleberg at the Institute of Transport Economics for their contributions to the research project that has resulted in this paper. We are grateful for comments from Dag Yngvar Aasland at Nye Veier AS and James Odeck and Oskar Kleven and the Norwegian Public Roads Administration, as well as other representatives from the Norwegian Public Roads Administration and the Railway Directorate. We have also received helpful comments from participants at the International Transportation Economics Association (ITEA) Annual Meeting in 2021.

The research documented in this paper is funded by the government enterprise Nye Veier AS and the Norwegian Public Roads Administration.

Author information

Authors and affiliations.

Institute of Transport Economics (TØI), Gaustadalleen 21, Oslo, Norway

Stefan Flügel, Askill H. Halse & Knut J. L. Hartveit

Oslo Metropolitan University, Pilestredet 52, Oslo, Norway

Aino Ukkonen

You can also search for this author in PubMed Google Scholar

Contributions

Stefan Flügel has been responsible for Sects. 2 and 4 and contributed to all other sections. Askill H. Halse has been responsible for Sects. 1 and 6 and contributed to other sections. Knut L. H. Hartveit has been responsible for Sect. 3 and has contributed to Sect. 5 . Aino Ukkonen has contributed to Sect. 4 . All authors have participated in discussions of the results and their application and have approved the manuscript for publication.

Corresponding author

Correspondence to Askill H. Halse .

Ethics declarations

Competing interests.

The manuscript is based on contract research funded by the government agency Nye Veier AS and the Norwegian Public Roads Administration. The contract between our research institute and the clients ensures independence and scientific integrity, and the clients have not interfered in our conclusions in any way. Hence, we declare that there are no competing interests.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Mathematical specification of model

We have the equation for the probability of choosing the new motorway, as shown in Eq. 1 below.

Equation 1 translates to two equations with values of \(t=1\) and \(t=2\) . In addition, we have the equation for the weighted average of value of time in Eq. 2 .

By replacing the values of \({{GK}_{t}}^{New}\) and \({{GK}_{t}}^{Old}\) in Eq. 1 with

we get a system of three equations, Eq. 1 with t = 1 and t = 2, combined with Eq. 2 . By setting \({B}_{1}=0\) as described in Sect. 4 , and by fixing \(\beta\) , we have a system of equations which is to be solved with respect to the three unknowns \(\mu\) , \({\omega }_{New}\) and \({\omega }_{Old}.\)

Equation 5c in the system can be rewritten into

and inserted into Eqs. 5a and 5b. We get a system with two equations and two unknowns, \({\omega }_{Old}\) and \(\mu\) :

Rewriting and simplifying this system Footnote 14 ( 6 ) of equations gives the following system of Eqs. ( 7 ).

When the system (7) with two unknowns is solved Footnote 15 with respect to \(\mu\) and \({\omega }_{Old}\) , we obtain the solution:

Further, we get an expression for \({\omega }_{New}\) by inserting \({\omega }_{Old}\) in Eq. 5c. This gives the full solution to the system of equations:

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Flügel, S., Halse, A.H., Hartveit, K.J.L. et al. Value of travel time by road type. Eur. Transp. Res. Rev. 14 , 35 (2022). https://doi.org/10.1186/s12544-022-00554-1

Download citation

Received : 28 December 2021

Accepted : 11 July 2022

Published : 03 August 2022

DOI : https://doi.org/10.1186/s12544-022-00554-1

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Road quality

- Driving comfort

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Future Developments

Who should use this publication.

Users of employer-provided vehicles.

Who doesn’t need to use this publication.

Volunteers.

Comments and suggestions.

Getting answers to your tax questions.

Getting tax forms, instructions, and publications.

Ordering tax forms, instructions, and publications.

- Useful Items - You may want to see:

Travel expenses defined.

Members of the Armed Forces.

Main place of business or work.

No main place of business or work.

Factors used to determine tax home.

Tax Home Different From Family Home

Temporary assignment vs. indefinite assignment.

Exception for federal crime investigations or prosecutions.

Determining temporary or indefinite.

Going home on days off.

Probationary work period.

Separating costs.

Travel expenses for another individual.

Business associate.

Bona fide business purpose.

Lavish or extravagant.

50% limit on meals.

Actual Cost

Incidental expenses.

Incidental-expenses-only method.

50% limit may apply.

Who can use the standard meal allowance.

Use of the standard meal allowance for other travel.

Amount of standard meal allowance.

Federal government's fiscal year.

Standard meal allowance for areas outside the continental United States.

Special rate for transportation workers.

Travel for days you depart and return.

Trip Primarily for Business

Trip primarily for personal reasons.

Public transportation.

Private car.

Travel entirely for business.

Travel considered entirely for business.

Exception 1—No substantial control.

Exception 2—Outside United States no more than a week.

Exception 3—Less than 25% of time on personal activities.

Exception 4—Vacation not a major consideration.

Travel allocation rules.

Counting business days.

Transportation day.

Presence required.

Day spent on business.

Certain weekends and holidays.

Nonbusiness activity on the way to or from your business destination.

Nonbusiness activity at, near, or beyond business destination.

Other methods.

Travel Primarily for Personal Reasons

Daily limit on luxury water travel.

Meals and entertainment.

Not separately stated.

Convention agenda.

North American area.

Reasonableness test.

Cruise Ships

Deduction may depend on your type of business.

Exceptions to the Rules

Entertainment events.

Entertainment facilities.

Club dues and membership fees.

Gift or entertainment.

Other rules for meals and entertainment expenses.

Costs to include or exclude.

Application of 50% limit.

When to apply the 50% limit.

Taking turns paying for meals.

1—Expenses treated as compensation.

2—Employee's reimbursed expenses.

3—Self-employed reimbursed expenses.

4—Recreational expenses for employees.

5—Advertising expenses.

6—Sale of meals.

Individuals subject to “hours of service” limits.

Incidental costs.

Exceptions.

- Illustration of transportation expenses.

Temporary work location.

No regular place of work.

Two places of work.

Armed Forces reservists.

Commuting expenses.

Parking fees.

Advertising display on car.

Hauling tools or instruments.

Union members' trips from a union hall.

Office in the home.

Examples of deductible transportation.

Choosing the standard mileage rate.

Standard mileage rate not allowed.

Five or more cars.

Personal property taxes.

Parking fees and tolls.

Sale, trade-in, or other disposition.

Business and personal use.

Employer-provided vehicle.

Interest on car loans.

Taxes paid on your car.

Sales taxes.

Fines and collateral.

Casualty and theft losses.

Depreciation and section 179 deductions.

Car defined.

Qualified nonpersonal use vehicles.

More information.

More than 50% business use requirement.

Limit on the amount of the section 179 deduction.

Limit for sport utility and certain other vehicles.

Limit on total section 179 deduction, special depreciation allowance, and depreciation deduction.

Cost of car.

Basis of car for depreciation.

When to elect.

How to elect.

Revoking an election.

Recapture of section 179 deduction.

Dispositions.

Combined depreciation.

Qualified car.

Election not to claim the special depreciation allowance.

Placed in service.

Car placed in service and disposed of in the same year.

Methods of depreciation.

More-than-50%-use test.

Qualified business use.

Use of your car by another person.

Business use changes.

Use for more than one purpose.

Change from personal to business use.

Unadjusted basis.

Improvements.

Car trade-in.

Effect of trade-in on basis.

Traded car used only for business.

Traded car used partly in business.

Modified Accelerated Cost Recovery System (MACRS).

Recovery period.

Depreciation methods.

MACRS depreciation chart.

Depreciation in future years.

Disposition of car during recovery period.

How to use the 2023 chart.

Trucks and vans.

Car used less than full year.

Reduction for personal use.

Section 179 deduction.

Deductions in years after the recovery period.

Unrecovered basis.

The recovery period.

How to treat unrecovered basis.

- Table 4-1. 2023 MACRS Depreciation Chart (Use To Figure Depreciation for 2023)

Qualified business use 50% or less in year placed in service.

Qualified business use 50% or less in a later year.

Excess depreciation.

Deductible payments.

Fair market value.

Figuring the inclusion amount.

Leased car changed from business to personal use.

Leased car changed from personal to business use.

Reporting inclusion amounts.

Casualty or theft.

Depreciation adjustment when you used the standard mileage rate.

Depreciation deduction for the year of disposition.

Documentary evidence.

Adequate evidence.

Canceled check.

Duplicate information.

Timely kept records.

Proving business purpose.

Confidential information.

Exceptional circumstances.

Destroyed records.

Separating expenses.

Combining items.

Car expenses.

Gift expenses.

Allocating total cost.

If your return is examined.

Reimbursed for expenses.

Examples of Records

Self-employed.

Both self-employed and an employee.

Statutory employees.

Reimbursement for personal expenses.

Income-producing property.

Value reported on Form W-2.

Full value included in your income.

Less than full value included in your income.

No reimbursement.

Reimbursement, allowance, or advance.

Reasonable period of time.

Employee meets accountable plan rules.

Accountable plan rules not met.

Failure to return excess reimbursements.

Reimbursement of nondeductible expenses.

Adequate Accounting

Related to employer.

The federal rate.

Regular federal per diem rate.

The standard meal allowance.

High-low rate.

Prorating the standard meal allowance on partial days of travel.

The standard mileage rate.

Fixed and variable rate (FAVR).

Reporting your expenses with a per diem or car allowance.

Allowance less than or equal to the federal rate.

Allowance more than the federal rate.

Travel advance.

Unproven amounts.

Per diem allowance more than federal rate.

Reporting your expenses under a nonaccountable plan.

Adequate accounting.

How to report.

Contractor adequately accounts.

Contractor doesn’t adequately account.

High-low method.

Regular federal per diem rate method.

Federal per diem rate method.

Information on use of cars.

Standard mileage rate.

Actual expenses.

Car rentals.