Wise Travel Debit Card Review: Fees, Exchange Rates, Limits and How to Use It

There are many things you need to keep track of as a digital nomad, such as visas , travel documents, and accommodation , to name a few.

But one of the most important things to work out is your finances. As a digital nomad, you are likely constantly moving between countries and switching currencies, so having a travel debit card is imperative .

The Wise debit card is an easy financial solution for frequent travelers, digital nomads, and expats . So, what is the fuss about this Wise travel card? How does it work? And most importantly, should you hop on the bandwagon and sign up for it?

I have been using the Wise Travel Card for quite some time now and, in this article, I will give you my honest opinion about it.

What is a Wise Travel Debit Card?

If you travel often, you have probably used or at least heard of Wise (formerly Transfer Wise) .

This UK-based tech company was founded in 2011 by Estonian businessmen Kristo Käärmann and Taavet Hinrikus on the principle of providing fast and fair exchange rates for international transfers without any sneaky fees or below-par exchange rates.

I have been personally using their Wise multi-currency account for years now, and it is still the primary way I transfer money abroad. But, I recently started using the Wise travel card , which added an entirely new dimension to my travels.

Can I Use The Wise Card For Traveling Abroad?

The Wise travel card it's not a credit card and functions pretty much like a regular debit card. You simply add funds to the account and insert, swipe, or tap to pay for items.

The main difference? With Wise, you can hold money in more than 40 different currencies and pay like a local for items in more than 160 countries worldwide without having to worry about hefty fees or markups on conversion rates.

Your Wise Travel Card is connected directly to your Wise account, so you can spend funds from your balances.

Who is the Wise Travel Card for?

Obviously, this is a “travel” card, so its primary purpose is for spending abroad while traveling . That said, you could totally use this for your day-to-day expenses. Traditional banks aren’t really designed to cater to frequent travelers or digital nomads , and the Wise Travel Card fills this gap.

For example, my wages are paid from the US, but I live abroad permanently, so I can easily transfer from my US-based bank to Wise and then simply use my Wise card for most of my daily expenses.

You should consider using the Wise Travel Card if one or more of the following applies to you:

- You frequently transfer funds from another country that uses a different currency.

- You travel internationally often and need a card with low currency conversion fees.

- You often shop online with international retailers that sell their products in a foreign currency.

- You own a business and need a card for international expenses.

- Your current bank card has high currency conversion fees and you want to get away from a traditional bank account

- Your current bank card has high fees for using international ATMs.

Wise Card Features for Traveling Abroad

If you have used a travel prepaid card like Revolut , Chime , or Monzo in the past, you can expect similar features from the Wise Travel Card. Let's see which ones are those:

- Low fees on conversions with the mid-market exchange rate

- Hold, spend, and exchange more than 40 different currencies in your Wise account

- Available to citizens and residents of more than 30 countries , including the UK, Canada, EU, USA, and Australia

- Manage, top up, freeze, and view your card balance in the Wise App

- Use at over 2 million ATMs with free monthly withdrawals up to certain limits.

- Create up to 3 digital virtual cards for free

- Auto currency convert feature to automatically convert your funds at your set rate

- Ability to make Contactless payments

- Connect to most popular eWallets like Google Pay, Apple Pay, and more

- Free spending of any currency you hold in your Wise account

- Biodegradable and eco-friendly card design

Pros and Cons of the Wise Debit Card for Travel

When I first started my digital nomad journey, I quickly came to a rude awakening when I found that my bank was charging exorbitant markups on foreign exchange and fees for ATM withdrawals .

If the same is happening to you, you’ll want to get your hands on this gem of a travel card . But before you sign up, let’s go over some of the upsides and downsides of the Wise Travel Card.

Pros and cons:

What to love about the wise debit card.

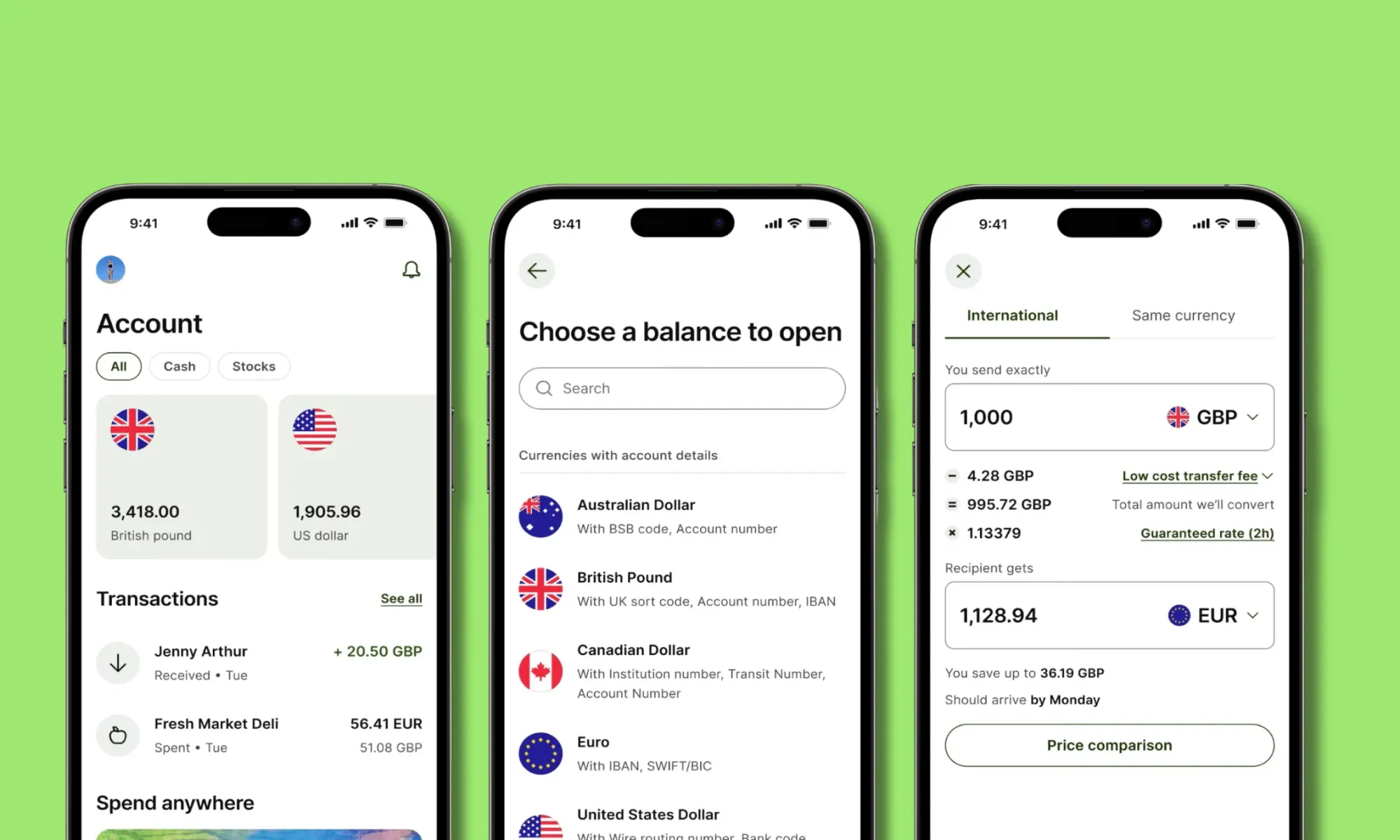

For me, the Wise card's standout features are the app's user-friendliness , the multi-currency account , and the low markup on exchange rates .

Being able to hold more than 40 currencies is a game changer. Transferring funds to different currencies in their app when I travel abroad is super easy. To give you an example, I spend quite a bit of time in Europe, the USA, and New Zealand. And with Wise , I can have separate accounts for USD, EUR, and NZD, which makes my life SO much more manageable when traveling to these countries!

On top of that, while there is a small markup fee on currency exchange, it is extremely minimal compared to other banks I have used .

What Could Be Improved About the Wise Debit Card?

The obvious downsides of the Wise Travel Card lie with ATM withdrawal limits , longer card delivery timeframes , and the lack of a premium option .

I am based in the USA, and my card took more than 2 weeks to arrive. Most digital nomads don’t spend too much time in each place, so this can make it difficult to receive your card initially if you are a frequent traveler .

Also, while card transactions are becoming the norm in many countries, cash is still king in several countries I have traveled to in the past few years. The Wise card is NOT exactly the ideal card for withdrawing cash . You’ll only get two transactions for free , and then you’ll be paying a usage fee as well as a 1.75% to 2% markup . This definitely isn’t a dealbreaker, but I hope Wise will improve this in the future.

What Currencies Can You Use With the Wise Travel Card?

One of the main reasons Wise has kept me on board as a customer all these years is their multi-currency account . This is truly the crown jewel of all of Wise’s features.

You can store 40+ currencies in various wallets in your Wise account , but this doesn’t mean you are limited to spending in those currencies. In fact, you can use the Wise debit card in more than 160+ countries ! If the currency you are spending in doesn’t have a wallet option, the Wise card will simply exchange the money into the payment currency at the time of your purchase .

For example, I was recently in Guatemala, and, unfortunately, I was not able to store Quetzal (the local currency) in my multi-currency account. But when I bought something, my funds were automatically converted from USD to Quetzal at the mid-market rate (plus 0.5%).

There are also 11 currencies for which you get account details to make bank transfers . This means you can transfer funds in the following currency balances directly from your Wise account to another bank account.

This is a feature of Wise that I use often. If I need to transfer funds from my US bank account to one in another country, I almost always use Wise as a “middleman” in order to avoid unexpected transfer fees .

While you won’t be able to make bank transfers in other currencies, you can hold them in your Wise account and spend with your travel card.

How Does the Wise Card Exactly Work?

As you can see, the Wise Travel Card is a wise decision for any traveler (see what I did there?), but how does it exactly work?

As with any new bank account or credit card, there is a bit of a learning curve when first using your Wise travel card . That said, using this card isn’t rocket science, so you’ll be saving money on exchange fees in no time!

How to Use the Wise Travel Card Abroad

The Wise travel card is specifically designed for spending money outside of your home country, so as you would expect, it is pretty easy to use abroad.

All you need to do is order your card , activate it, create a PIN, add money to your account, and you will be all set to use the card in a different country!

The Wise App

There is nothing more annoying than an app that is built for developers and not for the general public. Your banking and financial app should be easy to navigate and access.

I personally find the Wise app to be extremely user-friendly and intuitive . All features are easy to find, and when navigating through the app, I rarely got stuck or failed to find a setting.

I was easily able to change personal settings, connect bank accounts, exchange money, and send transfers from the app.

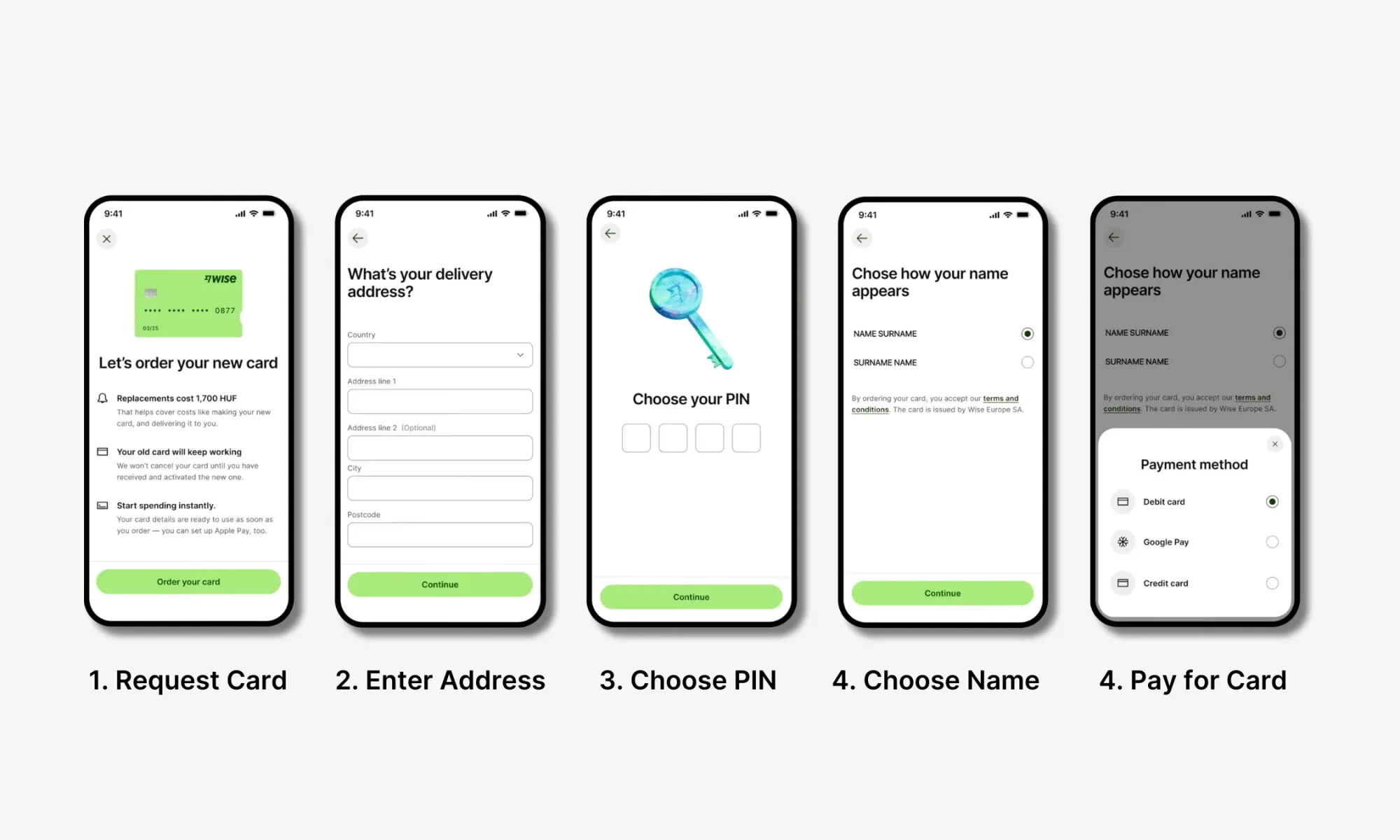

How to Order Your Wise Travel Card

Ordering your Wise Travel Card can take some time (mine took more than 2 weeks to arrive), so I recommend getting on this as soon as possible to ensure you have the card for your next trip!

These are the 3 simple steps you will need to go through:

Step 1: Create a Multi-Currency Account

If you don’t have one already, your first step will be to sign up for a Multi-Currency Account with Wise

Step 2: Start Using Your Virtual Card Immediately

After making an account and verifying your details, you will then be directed to choose a digital/virtual card or a physical card . Digital cards are free and can be added to Google/Apple Pay or used for online payments immediately!

Step 3: Order a Wise Debit Card (Recommended)

If you want instead a physical card, you can do so by clicking on the “Card” tab on the main page and then click on “ Order a Debit Card ”. Physical cards cost a one-off fee of 7 GBP/7 EUR/10 USD , and it will take 7 to 21 business days for the card to arrive, based on your location.

If you'd like to visualise the entire process, watch the instructional video below:

How to Activate Your Wise Card

Once your Wise travel card arrives, it is time to activate it and start spending ! Luckily, for most Wise account holders, you won’t need to take any steps to activate the card, simply make a chip and PIN payment, and the card is ready to go !

Activate Your Wise Card (for US and Japan Customers Only)

As I mentioned above, Wise customers in the USA or Japan must activate the card separately . This isn’t too much of a headache, just don’t forget you need to be in your home country .

Here is a step-by-step breakdown of activating your card if you are a US and Japan customer.

- Log into the Wise app and tap on “ Card ”.

- Then tap on “ Activate Card ”.

- You’ll then be prompted to enter a 6-digit code that you’ll find on your card.

- After entering the code, you’ll create your PIN .

If you'd like to visualise the steps to activate your Wise card for your region, watch the instructional video below:

How to Change the PIN for Your Wise Card

Did you forget your PIN? Don’t worry, it happens to the best of us!

Luckily, if you are a US card holder, you can easily change your PIN in the Wise app :

- Tap on “ Card ” in the Wise app

- Select “ Change PIN ”

- Enter your new PIN 2 times, and you are all set!

If you are a non-US Wise card holder , you cannot change your PIN in the app , unfortunately. Instead, you’ll need to change it using an ATM that supports PIN changes .

My best advice? Choose a PIN you’ll never forget, or keep it written down somewhere secure.

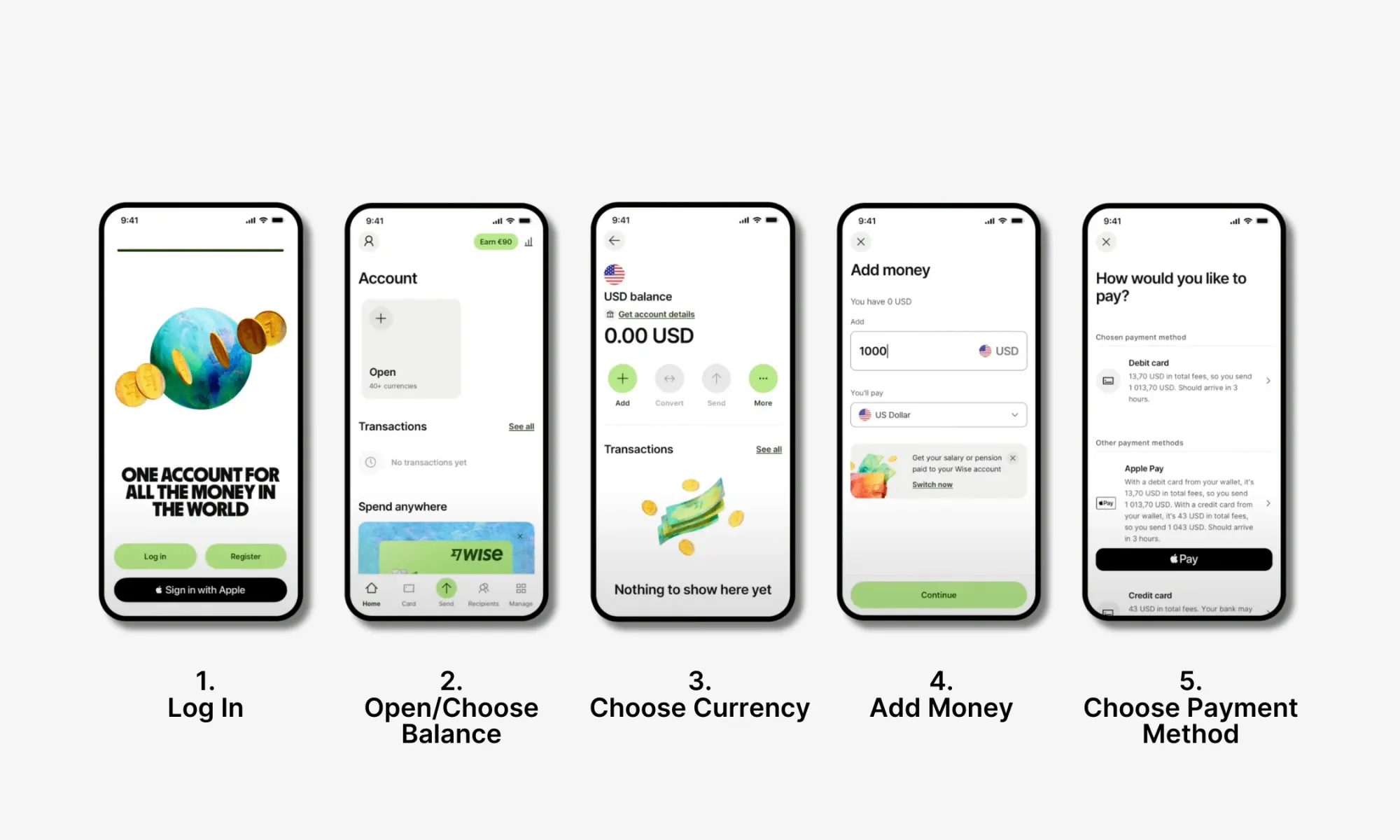

How to Add Money to Your Wise Travel Card

Your Wise travel card is linked to your Wise Multi-Currency account , so you’ll need to top up your Wise account with funds before using the card.

This is a pretty straightforward process:

- Logging into your account

- Choose which currency balance you want to add money to.

- Click “ Add ”.

- Choose which currency you want to use to top up the account.

- Type in the amount of money you want to add.

- Choose your payment method (bank transfer, debit card)

- Confirm the top-up and verify the money arrives in your balance.

Watch the instructional video below to visualise how to top up your Wise balance:

How to Freeze/Unfreeze Your Wise Card

One of the downsides of constant travel is that you put yourself at risk of fraud or losing your card. If you notice potential fraudulent transactions from your Wise card, or you believe your card is lost/stolen, you should freeze your card immediately . This way, you’ll avoid more fraud on your account.

Here are the steps to take to freeze your Wise Travel Card.

- After logging in to your Wise account, tap on “ Card .”

- Then simply click “ Freeze Card ”, or if you want to unfreeze, “ Unfreeze Card .”

- Fill out this transaction dispute form and contact customer support right away. They will be able to help you determine what to do next.

How to Replace a Lost or Stolen Wise Card

If you can confirm that your card has been lost or stolen, you’ll want to cancel the card and then order a new one.

- Log in to your Wise account and click on “ Card .”

- Tap “ Replace Card .”

- You’ll then be prompted to answer why you need a replacement card.

- Wait for the new card to arrive.

How to Use an ATM with Your Wise Travel Card

As mentioned above, ATM withdrawal is not the strongest feature with the Wise card, but you can definitely still use the card to take out cash. Spending with your Wise card is simple since the card can make contactless, chip, and swipe payments and is eligible for Google, Apple, Fitbit, and Garmin Pay. But how do you use an ATM with the Wise card?

Using an ATM with the Wise Travel Card is the same as using any other bank card. Simply insert your card into the machine, enter your PIN, determine how much cash you want to withdraw, and take your cash. Don’t forget to take your card back when you are done (I have made this mistake too many times…).

Wise Card ATM Limits

One of the biggest downsides with the Wise card is that you’ll have limited free ATM withdrawals. For all accounts, you’ll have 2 free ATM withdrawals each month, after which you will be charged an ATM usage fee and a percentage markup on the amount of cash you withdraw.

I use the Wise Travel Card for many of my day-to-day travel expenses, but I use my Charles Schwab Investor Checking account for ATMs. This card not only has a 0% ATM markup, but it also refunds any fees the ATM provider charges. This includes international withdrawals!

Wise Card Delivery Timeframe

Once you order your Wise Travel Card, you can expect it to take between 3 and 21 days to arrive, depending on your location. If you live in Singapore, you’ll get your card SUPER fast. Unfortunately for Americans like me, this isn’t the case.

Wise Travel Card Fees and Exchange Rates

One thing I really love is that using Wise itself is free, and you won’t have to pay an ongoing fee to Wise to use the card. In fact, there isn’t even a Premium account feature, so all users get 100% of the features for free. All this said, there are some charges and exchange rates you should know about before you start using the Wise Travel Card.

Comparison: How Does the Wise Card Holds Up Against Other Travel Cards?

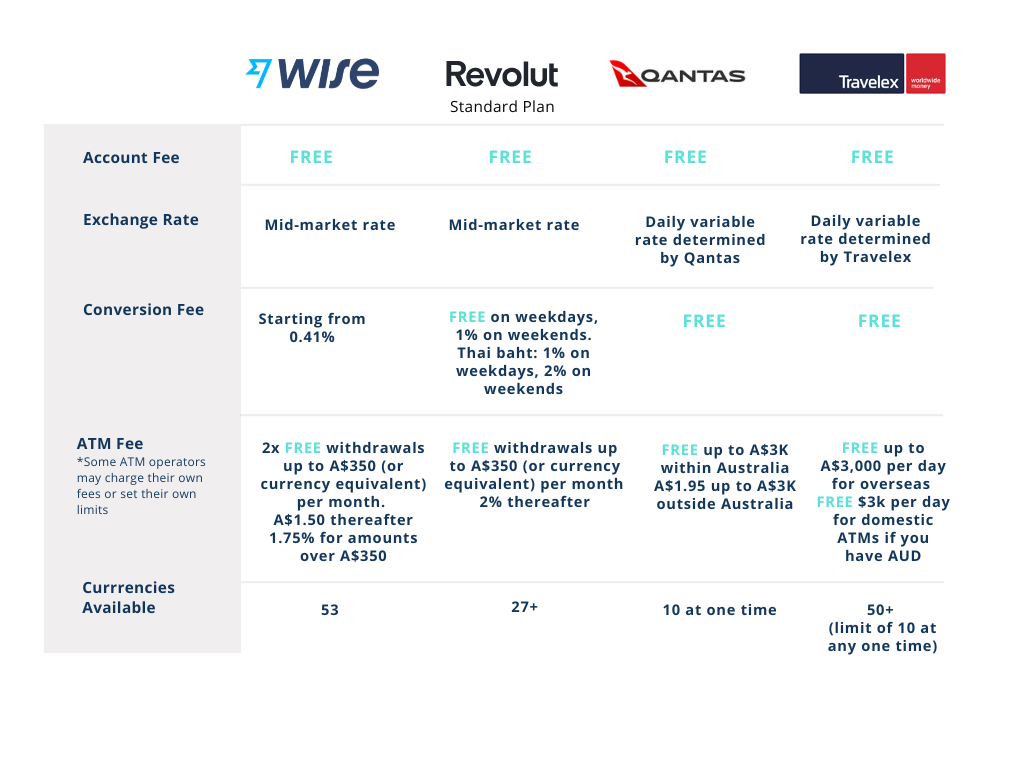

Wise is a leader in the travel account realm, but it still has some major competitors. While all of these different companies vary, they all cater to digital nomads and frequent travelers. The table below will compare some key factors with Wise, Revolut, N26, and Chime.

You may also be interested in:

So, What Travel Card is the Best?

This is a close call and pretty dependent on where you are located. For example, N26 and Chime are awesome choices if you live in the EU or USA (respectively). But, with these options, you can’t hold different currencies like with Revolut and Wise.

For most digital nomads, Wise or Revolut will be the best option. You can hold a huge number of currencies, and they are available to many different nationalities. I have personally used both Wise and Revolut and can say they are both excellent options.

Spending Limits for the Wise Travel Card

The Wise Travel Card has set daily and monthly spending limits for all types of transactions. While these limits won’t be a deal breaker for the vast majority of users, they are still worth noting.

Keep in mind the above limits are for US Wise customers. The amounts will differ slightly for customers based in different regions.

Is It Safe to Use the Wise Travel Card?

Wise is a trusted and safe travel card provider, so you can rest assured that your funds will be protected when using the Wise Travel Card. A licensed and regulated financial institution, your funds are safeguarded in Wise. It is, however, worth noting that since Wise is not considered a bank, it is not FDIC insured. FDIC insures up to $250,000 of bank customer's money, but Wise works a bit differently. Wise safeguards users’ money and is required to ensure all customers have access to all of their funds.

So, is Wise safe to use? Yes, absolutely! We don’t recommend keeping all of your money in Wise, but in general, it is a perfectly secure financial institution.

Additionally, the company uses several security features to protect your data, including HTTPS encryption, a two-step login process, and 24/7 fraud prevention.

What to Do If Your Wise Card Is Lost, Stolen, or Compromised

If you lose your Wise card or suspect it to be stolen or compromised, you’ll need to act quickly to prevent any further fraud. Below, we will go over a step-by-step process for what to do if your card is lost, stolen, or compromised.

- Freeze your card in the Wise app.

- Contact Wise support if you suspect the card to be compromised.

- Cancel the card in the app if you confirm the card is lost or stolen or if fraud charges have been made.

- Order a new card.

- Wait for the new Wise card to arrive.

Bottom Line: Is the Wise Travel Card Worth it?

Time for the 1 million dollar question: Should you get the Wise Travel Card?

If you are a frequent traveler like me and you don’t already have a solid travel card with fair exchange rates, low ATM fees the answer is a resounding yes !

The Wise Travel Card is one of the best cards for digital nomads and expats, as it allows you to seamlessly spend money, withdraw cash, and transfer funds from anywhere around the globe without having to worry about excessive fees. The best part? After paying a one-time card order fee, your Wise account is completely free to use!

Ready To Save Money Abroad with Wise?

If you want more digital nomad guides like these, sign up for our free newsletter and get upcoming articles straight to your inbox!

Sign up for our Newsletter

Receive nomad stories, tips, news, and resources every week!

100% free. No spam. Unsubscribe anytime.

You can also follow us on Instagram and join our Facebook Group if you want to get in touch with other members of our growing digital nomad community!

We'll see you there, Freaking Nomads!

Disclosure: Hey, just a heads up that some of the links in this article are affiliate links. This means that, if you buy through our links, we may earn a small commission that helps us create helpful content for the community. We only recommend products if we think they will add value, so thanks for supporting us!

Heymondo Review: Is It a Good Travel Insurance?

How to beat your post-travel depression: your guide to feeling better, how to create a healthy work-life balance while working remotely.

Wise Travel Card Review: The Multi-Currency Debit Card For Travellers

By: Author Angela Price

Posted on Last updated: March 26, 2024

The Wise Travel Card is a Visa Debit card designed for international travellers and individuals who frequently make multi currency transactions. I was first introduced to the Wise card by another travel blogger who had been using it for a few years and could vouch for its credibility.

At the time, I was looking for a money transfer account that would allow different currencies to be paid into it without incurring the hefty conversion fees my high street bank was charging me. I also wanted an easy-to-use, app-based money card that I could use during my travels to check, top-up and convert balances whenever needed.

The Wise Travel Money Card sounded perfect because it would allow me to have one debit card holding credit balances in USD, EUR, and GBP, all in separate currency wallets. I could then use my Wise Euro credit balance to buy items charged in Euros and likewise for USD. My transactions would be like-for-like, with no hefty currency conversion fees appearing on a statement.

I could also exchange one currency wallet balance for another at any time via the Wise App. The app is easy to use, and with a press of a button, I can auto-convert my USD or EUR balances for GBP, which appear in my online GBP currency wallet immediately. Simple!

Wise also allows me to send, add, or request money at any time and even set up direct debits through the app.

In the time I have been using my Wise Travel Card, I have been very pleased with its functionality and am happy to let other travellers (and non-travellers) know about it. For transparency, please see the Wise Card Fees and Pricing.

This travel guide may contain affiliate links – please read my disclaimer and privacy policy for more information.

Table of Contents

What Is The Benefit Of Using Wise?

- The Wise Debit Visa is linked to a Wise multi-currency account, allowing you to manage money in multiple currencies.

- One of the key features of Wise is its use of the real exchange rate, providing users with rates close to the mid-market rate without additional markups. This can result in cost savings compared to traditional banks.

- The card offers interest on your multi-currency balances, which is great if you don’t intend to withdraw your funds immediately.

- Wise typically offers transparent and competitive fees for international money transactions and currency conversions. Users may benefit from lower fees compared to traditional banks.

- The card supports contactless payments, allowing for quick and convenient transactions at merchants that accept contactless payments.

- The Wise Debit Card is a Visa, which means it’s an international debit card widely accepted globally. Users can use the card for online, in-person, and ATM withdrawals worldwide. It’s all you need in one card.

- Wise provides a mobile app that allows users to manage their multi-currency accounts, monitor transactions, and receive notifications. The Wise app also features such as spending analytics and budgeting tools.

- The card can be used to withdraw cash from ATMs around the world. Wise has partnerships with specific ATMs to offer fee-free or reduced-fee withdrawals up to a specific limit.

- Visa provides standard security features, and Wise offers additional security measures through its app, such as the ability to lock/unlock the card and receive instant transaction notifications.

- Users can activate and manage their Wise Debit Visa through the Wise mobile app.

Wise Card For International Travel

I recently used my Wise travel card while on holiday in Lanzarote, Spain . I paid for entrance fees and food and drink in Euros, which was debited from the Euro currency wallet in my Wise account. The debit card was so easy to use, and I knew I wasn’t going to be charged any additional fees as the transaction was made in EUR rather than being converted from GBP.

I also just purchased a flight online and paid in USD. This came from my Wise USD currency wallet, which was straightforward with no added foreign transaction fees.

How To Get Your Wise Card

I hope this post has helped outline the benefits of getting a Wise Travel Card. The details I have provided are a brief overview, so please visit the official Wise website for more in-depth details before signing up.

You can access a digital card in your app as soon as Wise accepts your application, but if you prefer a physical card like me, you can apply for one below.

The physical Wise card costs a one-off fee of £7. And yes, the card really is the same colour as Kermit the Frog from The Muppet Show!

APPLY FOR YOUR WISE TRAVEL DEBIT CARD

I am not a financial expert, nor did Wise pay me to write this article; however, I am now part of their affiliate scheme, and I will receive a small commission if you sign up through my link. This is at no extra cost to you and helps me keep this travel blog running.

The opinions in this review are based entirely on my own experiences using my Wise Debit Card. Before you sign up for a Wise Card, please be sure to do your own due diligence.

I would like to receive occasional updates and new travel posts.

Notify me of follow-up comments by email.

- United States

- United Kingdom

In this guide

Restrictions

Your reviews, ask a question.

- Wise Travel Money Card Review

This physical and virtual travel money card lets you hold over 40 currencies, with 2 free ATM withdrawals up to $350 a month and a one-time $10 activation fee.

Wise Travel Money Card supported currencies

- Australian dollars (AUD)

- Canadian dollars (CAD)

- Chinese yuan (CNY)

- Emirates dirham (AED)

- Euros (EUR)

- Great Britain pounds (GBP)

- Hong Kong dollars (HKD)

- Japanese yen (JPY)

- New Zealand dollars (NZD)

- Singapore dollars (SGD)

- Thai baht (THB)

- United States dollars (USD)

Complete list of supported currencies

You'll also typically be able to use the Wise Travel Money Card in most countries and regions around the world, with any business that accepts Mastercard/Visa. But places where your card won't work include Cuba, Iran, Iraq and Myanmar.

Features of the Wise Travel Money Card

- Support for over 40 currencies. The Wise Travel Money Card lets you hold and spend in a wide range of currencies, which can make it easier to keep track of your spending and budget.

- Competitive exchange rates. Wise uses the mid-market rate for exchanges so you get the same rate that's typically listed on Google, Bing and other search engines.

- 2 free ATM withdrawals per month. Wise won't charge an ATM when you withdraw up to AUD$350 over 2 or less transactions in a month. After that, you'll be charged fees worth AUD$1.50 and 1.75% of each withdrawal.

- Instant virtual cards. You can get up to 3 virtual cards linked to your Wise account to keep track of different types of spending. You'll also be able to start using your virtual card as soon as you've set up your account by adding it to Apple Pay or Google Pay.

- Plastic card. You'll also get 1 plastic card sent to you, which you can use for in-person payments anywhere Mastercard/Visa are accepted.

- Wise app. The Wise app lets you top up and convert currency in real time, so you know exactly how much you'll have in any of the supported currencies. You can also freeze your card, organise a new one and manage other account features.

How much does the Wise Travel Money Card cost?

- Application fee. A one-time $10 fee applies when you first get this Wise card.

- ATM fees. After the first $350 of withdrawals in a month, a fee of 1.75% applies. You'll also pay a $1.50 fee for each ATM withdrawal after the first 2 you make in a month.

- Load fees. There is no fee to load funds on by bank transfer from Australia. But a fee will be charged for loading funds by debit card, credit card or SWIFT. The exact fee will be shown on your Wise account when you select "Add Money".

- Currency conversion. If you're spending in a currency that's not loaded onto the card, there will be a fee to convert it. The fee starts from 0.43% of the transaction value and varies by currency.

- No currency order. Unlike many prepaid, multi-currency travel cards, Wise does not have a set drawdown order when you're spending in a currency not loaded on your account. Instead, the funds will be taken from the balance that has the lowest currency conversion fee.

- Funding other accounts. If you use your Wise card to fund an e-wallet, cryptocurrency account, betting account or any other account that may be convertible to cash, a 2% fee applies.

How to apply for the Wise Travel Money Card

If you already have a Wise account, you can order a Wise Travel Money Card in a few minutes by logging into your account.

If you're new to Wise and over 18 years of age, you can get this card by following these steps:

- Sign up and add your first balance to the account.

- Request a card through your account and follow the prompts to verify your identity.

- Set up your virtual card/s and activate the plastic card when it arrives in the mail.

You can use the virtual cards instantly. And after you've activated the plastic card, you can use it to spend the funds loaded on your Wise account around the world and online.

- Wise Travel Money Card information PDF

- Wise Travel Money Card TMD

To ask a question simply log in via your email or create an account .

Hi there, looking for more information? Ask us a question.

Error label

You are about to post a question on finder.com.au :

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our 1. Terms Of Service and 6. Finder Group Privacy & Cookies Policy .

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

Amy Bradney-George

Amy Bradney-George was the senior writer for credit cards at Finder, and editorial lead for Finder Green. She has over 16 years of editorial experience and has been featured in publications including ABC News, Money Magazine and The Sydney Morning Herald. See full profile

- Debit cards

- Revolut travel account review

- South Korea

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

Wise Travel Card Review [2024]

In a Nutshell

A market leader for exchange rates and transparency, the Wise card is one of the best prepaid cards for travel and great for making purchases overseas or online in a foreign currency. Fees apply if you go over the ATM limits. Includes a convenient app and virtual card.

Wise Travel Money Card

- Best Excellent exchange rates

- Worst High ATM fees

- The best exchange rates for a travel card

- No annual fees

- Top up on the go in seconds

- Low conversion fees that are clearly labelled

- Ability to preload up to 53 currencies including USD , CAD , SGD , JPY , EUR and more

- Ability to freeze your card via the app should it get lost or stolen

- Track your spending via the app (great if you've got a travel budget)

- Can use digitally with Apple Pay and Google Pay

- One of the most popular travel cards with over 4 million global users

- Customer support can be slow

- No interest on your balance

- Card delivery may be slow (but you can use the digital card straight away)

- If you withdraw over $350 AUD anytime from an ATM, you will be charged an additional 1.75% of the amount

- After the first two free under $350 AUD ATM withdrawals for the month, a $1.50 fee applies per additional withdrawal

The Wise card (formally TransferWise) removes the money headaches we associate with frequent travelling by making it easy to load and spend a huge range of currencies overseas.

Hands down, it is one of the best cards for overseas travel . No other travel card or debit card offers the same low fees and mid-market exchange rates as Wise. However, charges can add up if you need to withdraw large sums of cash from ATMs.

The average Trustpilot review for Wise is 4.3 stars (from 191,128 users on 14 June 2023).

The most common complaints by users are occasional delays to receive the card, along with poor customer support — although these customers are a minority. 84% of reviewers rate Wise 5 stars.

What is the Wise Travel Card?

The Wise card is a prepaid debit card attached to your Wise multi-currency account . Available as a Mastercard or Visa travel card, it allows you to:

- Makes purchases from 175 different countries

- Transfer money to international bank accounts

- Receive money from overseas in your currency using local bank account details with no fees

- Load up multiple currencies and pay like a local while you’re abroad

Note: Wise is the same company as TransferWise, just with a new name (as of 2021). The Wise multi-currency account used to be called the Borderless account. Nothing else has changed — the debit card remains the same.

How it works

The Wise travel card works just like a normal debit card.

You can use it almost anywhere around the world to withdraw money, make contactless purchases in shops and cafes, pay for accommodation, and shop online.

You can load and hold up to 53 currencies in your Wise account.

If you have the local currency for a payment, the card will use it. If you don’t have the right currency, Wise will convert one of your other currencies for you at the best rate.

Natalie lives in New Zealand and travels to Europe. In her Wise account, she adds euros, British pounds, and New Zealand dollars . She uses her Wise debit card throughout the trip.

In the UK, purchases are automatically deducted from her balance of pounds . In Europe, Wise directly debits purchases from her euros balance.

Towards the end of the trip, Natalie wants to buy a handbag for 500€ but she only has 200€ left in her euros balance, alongside £400, and NZ$1,000.

She can still make the purchase. In this case, Wise deducts the final 200€, then finds the best conversion rate into euros from British pounds or New Zealand dollars. It then converts that currency into euros to complete the purchase.

Adding money to your Wise debit card

The Wise app makes it easy to add money to your debit travel card . Just open the app, choose the currency and amount you want to add, and select your payment method (such as a bank transfer or by card).

You can hold and convert money in 53 currencies:

Wise spending limits

For fraud prevention and extra security, spending limits apply to the Wise debit card. These limits depend on where you got your card.

The card has default limits but you can adjust them to your own spending habits in the app or online. a

The table below lists the maximum limits allowed for Australian, New Zealand, and Singapore cardholders (in AUD, NZD, and SGD respectively).

Wise debit card fees

The Wise website declares that their travel card can help you save up to 85% when you spend internationally thanks to a better exchange rate and lower fees compared to banks.

Of course, fees are unavoidable but Wise makes sure to keep them competitively low.

While it’s free to create a multi-currency account with Wise (formerly TransferWise), other charges will be associated with the card, including:

- Card issue and replacement fees

- Currency conversion fees

- ATM withdrawals fees (beyond 2 withdrawals per month)

Currency allowances

Australian customers can hold a large amount of money per currency for free in their Wise balances. The allowance varies depending on the currency but is roughly equivalent to A$23,000 per currency.

If you exceed the maximum allowance per currency for more than 3 days, you’ll be charged an annual fee of 0.4% for Euros and 1.6% for all other currencies. This is charged as a daily fee for every day in the month you hold over the allowance.

For example, if you hold A$24,000 in your account for a month, you will be charged approximately A$1.30 at the end of the month for the excess A$1,000.

Wise card exchange rates

The beauty of the Wise travel card is that it can hold more than 50 currencies so you don’t have to worry about high conversion fees for every purchase.

If you don’t hold the local currency for a purchase, Wise will use whichever currency you have that has the lowest conversion fee.

Here’s where it gets good.

Wise gives you the mid-market exchange rate for any currency conversions — a rate that is typically better than the exchange rates provided by banks or other travel card companies.

If you have the right currency for a payment, you avoid the conversion fee altogether.

Card Provider

Exchange rate.

A$ → GBP (11 am 09 December 2022)

Conversion Fee

Loading A$1000

$4.38 (0.44%)

No fee on weekdays

How it compares

Get your card

You can apply for a Wise card if you live in one of the eligible countries (including Australia and New Zealand). View eligible countries here.

To get your Wise card, it takes just a few simple steps:

Get a Wise multi-currency account for free online or via the Wise (formerly Transferwise) app. You’ll need ID.

Add money to your account

To be eligible for the card, you’ll need to add a minimum of US$20 to the account. This will cover card issuing fees.

Order your card

Apply for your card on the website’s Card tab or the Wise app’s Account tab.

Activate your Wise card

There are different ways to activate your Wise card depending on whether it’s a Visa or Mastercard.

If it’s a Visa card, you can activate it by entering your PIN in the first transaction you make in a physical store or ATM. If it’s a Mastercard, you will need to go online and enter the 6-digit code provided to activate it.

Wise virtual card & app

Wise has fully embraced the digital age with an easy-to-use smartphone app and access to virtual cards — all designed to banish money and currency confusion in an increasingly connected world.

The app (available on Apple and Android) has everything you need to create an account, get your Wise card, and manage it while you’re globe-trotting.

Once you sign up for a Wise multi-currency account and place an order for the physical card, you can have up to 3 Wise virtual cards connected to your account at the same time.

These free digital cards only exist on your phone and are easy to get through the Wise app or website. They’ll have different details to your physical card and are a great backup option.

Wise virtual cards work with Apple Pay, Google Pay, and Samsung Pay and can be used to make payments online, in-store, and overseas.

The best bit? You can start using your virtual cards immediately — no need to wait for your physical card to arrive.

Importantly, the Wise card is not a travel credit card . You must have money in your account to make a purchase. If you don’t have enough funds, the transaction will be declined.

Your Wise card could take anywhere from 3 working days to 3 weeks to arrive, depending on where you live. However, you can set up your digital card on your phone to use immediately.

The Wise card offers 2 withdrawals of up to A$350 each month for free and A$1.50 per withdrawal after that.

If you need to withdraw more than A$350, you will incur a 1.75% fee on the amount withdrawn — plus the A$1.50 withdrawal charge if you’ve already made 2 ATM transactions that month.

The maximum amount you can withdraw in a single transaction is A$1,750. The maximum daily withdrawal is A$2,700 while the monthly maximum is A$7,000 (the default monthly maximum is set at A$5,250 but you can change this in-app).

Contactless is a common form of payment across Australia, Europe, the UK, New Zealand, Japan, Singapore, and Canada.

Wise enables contactless payments with both your physical Wise card and your Wise virtual card (accessible on Google Pay, Apple Pay, Samsung Pay, and more).

There are different payment limits for cardholders in different countries. In Australia, the limit for single contactless payments is A$900. The daily limit is A$1,750 (set at a default of A$900) and the monthly limit is A$7,000.

As an extra security measure, you may be asked to enter your PIN if you’ve made a lot of contactless payments in one day or you’re making a purchase over a certain amount.

You can also pay with a chip and PIN or with the magnetic stripe where possible — different payment limits apply to these payment methods. View payment limits here .

When it comes to your money, safety is paramount. Wise knows this, which is why it has several safety guarantees.

To start, Wise encrypts any information you give them to protect sensitive data and follows strict guidelines for international money transfers.

Safety measures include the ability to freeze and unfreeze your card any time — helpful if you misplace it — and the option to receive instant transaction notifications to track purchases.

The Wise debit card also allows for 3D Secure (3DS) payments, where some transactions require verification through the Wise app, SMS, or a phone call.

As a company, Wise has an Australian Financial Services Licence and is regulated by the Australian Securities and Investment Commission (ASIC). It is also registered overseas with the UK Financial Conduct Authority and the Financial Crimes Enforcement Network (US), among other financial institutions.

It’s worth remembering that the Wise multi-currency account isn’t like a bank account and safeguards your money differently — the company is completely transparent in how it does this .

The Wise card is designed to be used just like a debit card, which means you can use it to withdraw money from any ATM that accepts Visa or Mastercard — with some exceptions.

You can make 2 free monthly withdrawals (up to A$350) each month. After that, there is a withdrawal fee of A$1.50, plus a 1.75% fee on withdrawals over A$350.

Wise cards issued in Singapore or Canada cannot be used for ATM withdrawals in the country of issue. But you can still use them for ATM withdrawals overseas.

For Wise debit cards issued in Japan, you can only withdraw from certain Japanese ATMs (including AEON, Family Mart, Viewcard, and Daily Yamazaki).

If your Wise card is lost or stolen, the first step is to freeze your card temporarily via the Wise website or app.

Freezing the card means it can’t be used for purchases or withdrawals so you can protect your balance. If you find your card, you can unfreeze it online.

If you can’t retrieve your old card, you can order a replacement card through the Wise app or website. There’s a small fee of A$6 for card replacements.

Wise will block and cancel your old card and ship the new one to you. It will take anywhere from 3 working days to 3 weeks for your card to arrive, depending on your location.

While you’re waiting for your replacement card to arrive, you can use a virtual card. Wise allows you to have up to 3 virtual cards at any given time.

Learn more about the best travel money, debit and prepaid cards for travel

Prepaid Travel Card

Best Travel Money Cards

ASIC regulated

Like all reputable money exchanges, we are registered with AUSTRAC and regulated by the Australian Securities and Investment Commission (ASIC).

S Money complies with the relevant laws pertaining to privacy, anti-money laundering and counter-terrorism finance. This means you are required to provide I.D. when you place an order. It also means the order must be paid for by the same person ordering the currency and you must show your identification again when receiving your order.

Please remember to check junk and spam folders for your emailed reply.

Have you joined our free CC Inner Circle?

Delivered once a month to your inbox, you’ll get expert money tricks, rewards point hacks, perks and more!

Click to join the Inner Circle

Regards Pauline + the Creditcard crew

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

We ask for your email so we can respond to you directly. We won’t share your personal data. For more information, see our privacy policy.

Love perks and rewards? Join our free CC Inner Circle for exclusive offers, points boosters & more. Unsubscribe anytime..

- Credit Cards

Wise Travel Money Card

Updated 23 January 2024

Wise cards can be preloaded with local currencies to avoid transaction fees while you travel or spend overseas ✈, or converted into the local currency in real-time using the mid-market rate. You’ll get exceptionally low ATM fees, no monthly fees and instant access when you add it to your digital wallet. T&Cs apply.

Purchase Rate (p.a)

Annual fee (p.a), interest free period (up to).

N/A days on eligible purchases

• The annual fee is charged in the first month. • You only pay the minimum monthly payment of your overall balance each month. • You do not spend or withdraw cash on the card until the balance transfer period ends or is paid in full. • All other fees and charges that may apply are excluded. When there is no interest savings or a negative interest saving after the introductory period, the calculator will display $0."> $ 0

My transfer amount, balance transfer from:, my annual fee, my interest rate, your savings • the annual fee is charged in the first month. • you only pay the minimum monthly payment of your overall balance each month. • you do not spend or withdraw cash on the card until the balance transfer period ends or is paid in full. • all other fees and charges that may apply are excluded. when there is no interest savings or a negative interest saving after the introductory period, the calculator will display $0.">.

- Pros & cons

- Rates & fees

- Eligibility

Pros and cons

- Pay no currency conversion fee when you preload and pay in local currency

- Competitive exchange rates

- No fees when you make up to 2 withdrawals per month of $350 total

- No monthly fees or minimum amounts

- Track spending and manage money using the app

- Syncs with Google Pay, Samsung Pay, Apple Pay, Garmin Pay and Fitbit Pay

- If you withdraw 3+ times or more than $350 in a month, you’ll pay $1.50 per withdrawal

- Withdrawals over $350AUD will be charged 1.75%

- Not all countries accept Wise payments

Creditcard.com.au review

Editor review.

You can use the Wise card as an everyday debit card to buy groceries, pay for an Uber or send flowers to your mum - whether you’re doing it in Australia, online or overseas. Its big drawcards are simplicity and savings.

I’ll explain how the Wise debit card works, including how it's linked to an account that you can transfer money in and out of. It’s a very good alternative to credit cards with no foreign transaction fees if you’re not eligible, don’t want to earn points or don’t need access to credit.

Editor’s Review: What we love about the Wise Travel Money Card

Let’s start by looking at how Wise cards are linked to an account. When you apply for a Wise card, you’ll be directed to set up a Wise multi-currency account first. A Wise account is fully digital, has no monthly fees and allows you to preload money in various currencies, which you can access using the app and your Wise debit card.

For example: if you regularly travel to New Zealand, you could keep NZD in your account and Wise will automatically use it to pay when you tap your card. You wouldn’t be charged any currency conversion fees. If you don’t have any NZD in your Wise account, Wise will automatically convert the money for you at a competitive mid-market rate.

Once your Wise account is set up, you can order a card. It can take a few days for your physical card to arrive (or you can pay $26 to expedite it), but you’ll be able to use your digital card immediately by adding it to your phone or watch.

I’ll break down the features of the Wise card.

Sending money overseas. Wise also works like a regular account, allowing you to send and receive money to other accounts in local currency. The transfer process is the same as a savings account - when you start a transfer in your app, Wise will show you the totals in foreign currency plus any fees (for instance, sending AUD to GBP incurs a flat fee of $0.66 plus 0.45% of the amount that’s converted). You’ll be asked for the recipient's details and you’ll be able to track the transfer via your app. You can also receive money by supplying your account details.

Low or no withdrawal fees. Every month you can make up to 2 withdrawals (totalling $350) without paying a fee. After that, you’ll pay $1.50 per withdrawal, which is still very cheap compared to standard rates fees that can be as much as $5 or a percentage of the amount withdrawn (whichever is highest).

Cutting out the middle man. By preloading your card with the currency you’ll be spending overseas, you’ll avoid the conversion fees. If Wise needs to convert the currency from Australian dollars, it uses the mid-market exchange rate, which is generally a better exchange rate than you’ll get from banks or money transfer agencies. Wise says it can help you save up to 80% on international spending, according to a 2022 study by Alderson Consulting.

Three digital cards. You can set up three digital cards at any one time, each with different details to your physical card. You can cancel and recreate new digital cards anytime, which gives you some extra security.

A properly helpful app. I like that Wise’s app has decent functionality and seems fairly intuitive (it’s been downloaded over 10 million times, so it’s well-tested!). You can cancel or set up new digital cards, freeze and unfreeze your card, make online money transfers, track your spending and even cancel a money transfer that hasn’t been processed yet. The app is available for Apple and Android smartphones.

Transparent fees. I particularly like how transparent Wise is about its fees. It says that it will show you any fees that you’ll pay for making purchases or transferring money and there are no hidden fees. Since fees are a big concern for people travelling or spending online, it’s nice to have a little transparency.

What's not so great

There isn’t too much to pick on, but I should mention that while you can use Wise as your regular spending account and even have your salary paid into it, you’ll miss out on earning interest or offsetting a home loan. Consider whether you want it to be your primary account or one you use specifically for foreign transactions.

While Wise makes spending overseas as cheap as possible, there are still some costs involved. For instance:

Withdrawals: you’ll get 2 withdrawals up to $350AUD each month for free, but after that, fees are charged at $1.50 per withdrawal (still, not bad). If you withdraw over $350, you’ll also pay a 1.75% fee.

Physical card: $10, and $6 to reorder if the card is lost or stolen (digital cards are free)

Sending money overseas: Minimum is 0.42% but it will vary depending on the currency

Receiving USD wire payments: $4.14USD flat fee per payment

Wise does a good job of being available in 175 countries, but not all. You’ll need to check that you can use Wise in the country you’re travelling to or purchasing in. Wise’s website says it currently can’t be used in:

Afghanistan, Belarus, Burundi, Central African Republic, Chad, Congo and The Democratic Republic of the Congo, Cuba, Eritrea, Iran, Iraq, Libya, Myanmar, North Korea, Russia, Somalia, Sudan and South Sudan, Syria, Venezuela, and Yemen

Overall Rating

The Wise Visa card has one of the cheapest exchange rates in the world, plus the ability to spend overseas fee-free if you preload the card in the local currency. It doesn’t cost anything to open or hold an account and gives lots of flexibility in being able to send, spend and receive money globally.

If you’re a frequent traveller or spender abroad, a money transfer card like Wise can help you save money on fees without having to apply for a 0% foreign fee credit card, but you won’t earn interest or rewards points on your spending.

User reviews

Wise travel money card ( based on 1 creditcard.com.au user review ), 28% rating based on 1 review, customer service, 0% of users who have rated this card would recommend it, review the wise travel money card, rewards (not available for this card).

Thanks for submitting you review for the

Your review helps others make a better decision & builds the Creditcard.com.au community

Kind Regards

Personal Finance Expert - Creditcard.com.au

Rates and fees

Interest rates.

Purchase rate N/A

Cash advance rate N/A

Interest free period on purchases up to N/A days

Credit limits

Minimum credit limit $N/A

Maximum credit limit N/A

Fees & repayments

Annual fee $0 p.a.

Additional cardholder fee N/A

Foreign transaction fee N/A

Minimum repayment

Cash advance fee N/A

Late payment fee N/A

Additional features

Complimentary insurance.

International Travel Insurance No

Flight Inconvenience Insurance No

Transit Accident Insurance No

Smartphone Screen Insurance No

Purchase Protection Insurance No

Extended Warranty Insurance No

Rental Vehicle Excess In Australia Insurance No

Key features

Minimum criteria to apply for this card.

You have your personal details ready to complete the online application

Pauline is a personal finance expert at CreditCard.com.au, with 8 years in money, budgeting and property reporting under her belt. Pauline is passionate about seeing Aussies win by making their money – and their credit cards – work smarter, harder and bigger

Recently Asked Questions

Something you need to know about this card? Ask our credit card expert a question.

20 questions (showing the latest 10 Q&As)

Cindy warburton, rod blackwell, zuita jacob, holly r. whyte.

• The annual fee is charged in the first month. • You only pay the minimum monthly payment of your overall balance each month. • You do not spend or withdraw cash on the card until the balance transfer period ends or is paid in full. • All other fees and charges that may apply are excluded. When there is no interest savings or a negative interest saving after the introductory period, the calculator will display $0.'> Filter your savings

Adjust the filters to see how much you could save with a balance transfer to a new credit card

My transfer amount $5000

My interest rate 19.49%, my annual fee $50.

- Recalculate

Make sure you can get approved for the Loading...

- Have your personal details ready to complete the online application

- Proceed to application Proceed to application

- I’m not eligible

Make sure you can get approved for the Westpac Low Rate Credit Card

- If you are not redirected click here to continue

- Copyright 2005-2021 CreditCard.com.au Pty Ltd

- ABN: 76 646 638 146

- ACR: 528318

- AFCA: 80717

Select the reward programs you like

Select the features you like

Adjust the filters to see how much points you could earn over 12 months

My monthly card spend $5000

Rewards program

Benefits i like

- All reward programs

- Airport lounge access

- Balance transfers

- Bonus points offer

- No annual fee

- No foreign transaction fee

- Overseas travel insuarance

- Uncapped points earn

Thank you for taking the time to provide feedback.

Our credit card experts will review your feedback and take action within 1 business day to address or respond to the issue.

Regards Pauline Hatch Personal Finance Expert

By submitting this feedback you agree to our privacy policy.

Thank you for taking the time to let us know that your credit card is not listed on our site.

Our credit card experts will review your listing and ensure that the card is present on the site over the coming weeks.

By submitting this form you agree to our privacy policy.

- Search Search Search …

- Search Search …

How to use Wise for CHEAPER Travel Money & Spending

One of the key considerations for taking a trip is money. Especially if you’re traveling to a location where the currency is different from your home country. Getting hold of cash can be a costly exercise – from fluctuations in exchange rates to poor exchange rates and the dreaded currency commission rates. One of the best ways to pay the least to obtain currency while traveling is to use the Wise debit card for travel. Wise, is a great way to move money between currencies – and using the Wise debit card is one of the cheapest ways to use money while traveling.

THIS POST MAY CONTAIN COMPENSATED AND AFFILIATE LINKS MORE INFORMATION IN OUR DISCLAIMER

#1 TIP FOR CASH & CARDS

Get a Fee Free Card to Use

Get a WISE Card to take to on your travels. Two free ATM withdrawals per month, plus free to use to pay by card with zero foreign transaction fees.

Wise is now Wise

Wise changed its name to Wise in February 2021. However, name changes take a long time, especially in the web world, so the name change from Wise to Wise is a long-term process and the names are used interchangeably – and not just by me!

Using Wise for Lowest Travel Money Costs

There are a couple of elements to Wise and Wise that make it one of the best ways to obtain and spend money abroad.

The Wise Multi-Currency Account.

First, you can create what’s called a Wise“ borderless or multi-currency account ”. All that really means is that you can open bank accounts in multiple countries via Wise and hold different currencies in those accounts. So if I’m traveling to the USA for vacation it would make sense to have some money that I can use in US dollars. The Wise Multi-Currency Account lets me open an account, not just in my native British Pounds, but also in US dollars. (And Euros, and Australian dollars – and a whole lot of other currencies). But, you don’t HAVE to hold money in those currencies until you actually want it there. (Keep it where you’re earning interest if you’re lucky enough to be doing that!).

And the borderless accounts from Wise are Free. There are no account charges with Wise.

Do it now. See how easy it is. Open your Wise multi-currency account now!

These different currency accounts mean that you can move money from your home currency account to the currency in which you’re going to be spending. And the reason you want to use Wise to do this is that it offers some of the best currency exchange rates – WAY better than your bank, or the bureau exchange.

The Wise Currency Exchange Charging Rates

Wise uses the mid-market rate (like all the banks do when they move money between each other) when it is moving your money between currencies. It is completely transparent about this. The way that it makes money is that it charges a small percentage on the commission- and this is ALWAYS displayed and VERY CLEARLY, so you can see exactly how much your currency exchange is costing. Check out Wise currency rates here.

When you move money, say between Euros and US Dollars Wise clearly shows how much it costs, and what their commission is (it’s never hidden like some other providers) and it explains how much you have saved based on average rates for high street banks. You can also run through the process and see what it’s going to cost without committing. Check out the Wise exchange rate here now

The Wise Travel Card

There is a small charge for the Wise debit card – the cost of a Wise debit card depends on where you sign up (for instance in Portugal it’s 8 euros) – check the cost of a Wise debit card here. There’s no minimum balance you have to pay and there are no ongoing charges to pay for the card. The huge benefit of the Wise debit card is that you get TWO FREE ATM withdrawals up to the equivalent of GBP200 a month. After that, there’s a small fee per transaction and a 1.75 percent fee for withdrawals made in a 30-day period.

As of December 2021, Wise debit cards are also available to Canadian residents > Get yours here

There are zero foreign transaction fees with the Wise debit card. Convinced? Get your Wise Debit card here.

You can use the Wise debit card just like any other debit card, in more than 200 countries. Use it to pay for food, in bars, restaurants, shops – there’s no charge – just use it exactly the same as you would any other card, except you’ll be paying in the currency of where you’re traveling, with the money that you’re holding in your multi-currency account, and so getting some of the best exchanges rates around.

So what happens if you don’t have any money left in your Wise currency account? Don’t worry, your card will still work. When you set up your Wise multi-currency account you link it to a bank account in your home country. So if you aren’t holding any money in a particular currency but are spending that currency Wise will automatically do the conversion at the standard exchange rate and charge their regular fees.

You can spend in ANY currency on your Wise debit card and it will be converted using the lowest possible fee.

What are the Wise Fees?

I’m not going to type out what all those fees are, as they make it very clear on their website – you can check them here

Our Guides to Lower ATM Fees When Traveling

If you’re traveling, then our guides to ATMs and ATM fees are here

- Guide to lowest Guatemala ATM fees

- The Ultimate Guide to the lowest Colombia ATM fees

- How to reduce Laos ATM fees

- Understanding Japan ATM fees

- The cheapest Chile ATM fees

Why Use Wise? Reasons for Using Wise

We use Wise for the following reasons

- Because they provide cheap currency exchange rates

- Because it Wise provides us with the ability to hold local accounts in US dollars, GB Pounds, Euros, Australian dollars, Japanese.

- We can receive money for free in GB pounds, US dollars, Australian dollars and Euros – and other currencies – check which currencies you can use Wise with here .

- Because it is all online and you don’t need to go into a branch or find someone to deal with if there is a problem (we haven’t had a problem, but doing it online is seriously important to us). – We ALWAYS login to our VPN before connecting to ANY financial services provider – as we tend to use publicly available wifi networks. Our guide to using VPNs for travel is here.

- They’re transparent about their pricing.

Get the best VPN that we’ve found that works in ANY country we’ve been to including Turkmenistan, China, Myanmar &Cuba. This link gives you a coupon for THREE MONTHS for free as a reader of ASocialNomad

You can’t pop into a branch of Wise, they have a different model to other banks, so their overheads are lower. And those savings are passed onto you and me. Wise is fully regulated – and yes your money is safe – there’s more on regulation and your money at the end of the article.

What is Wise?

Wise is a financial services company with more than 6 million active customers who move more than US$4billion dollars EVERY MONTH, saving on average US$4 million a DAY in bank fees. Wise is an Authorised Electronic Money Institution independently regulated by the Financial Conduct Authority (FCA) in the UK. They are required by law to keep money safe by storing it in low-risk financial institutions. In Europe, they do this with Barclays. In the USA they do this with Wells Fargo.

These accounts are reserved for customer money, this means your money is kept in a separate account from the money they use to run the business.

Wise has more than 1,300 employees in 11 offices and 4 continents. This is a serious operation. Wise is also now a public company, listed on the London Stock Exchange.

How Much Can You Save with Wise?

Wise operates a really simple pricing structure . You get charged what it costs them to send your money plus a small fee. You will always know what that fee is before you send any money. You’ll also always know how long your money is likely to take to transfer between currencies. You can save up to 15 x what your local bank would charge for currency exchanges.

Wise collects data from other financial services providers that are publicly available – to show you how much you can save. They’ll show you this on each transaction you want to make, but you can also take a look for example here where they show how much transfers cost and also how long they take to go through. Some providers take as many as FOUR business days to transfer money, while Wise takes hours, which means you get the benefit of your own money for longer with Wise.

How to Use Wise for Travel

It’s really easy to use Wise for traveling. If you want to use the benefit of a Trnasferwise debit card then you’ll need to set up a Wise account and get hold of the Wise debit card before you leave home. If you don’t want the card, then you can set up a Wise multi-currency account from anywhere. Here’s how to set up Wise for travel .

Set up a Wise Account

The Wise multi-currency account is free to set up and free to maintain. There are no ongoing account costs for Wise accounts. All you need to do to set up a Wise account is to complete your profile , upload ID documents to verify your account for security and then you’re good to start!

Get local bank details with your Wise Account

British Pounds, Euros, Polish Zloty, Australian Dollars, US Dollars, and New Zealand Dollars all come with local bank details. That’s right, you get your own bank account details – IBANs, account numbers – the whole nine yards, just like your regular account.

Download the Wise App

Move money from an app, from your laptop, just as and when you need it. Confirm the rates.

Apply for a Wise card

Simply apply for your Wise debit card here , which gives you

- No foreign transactions fees

- No annual fees

- Low currency conversion rates

- Free ATM withdrawals worldwide – up to the equivalent of GBP200 every 30 days

- Lowest possible fees with auto-convert for any currency

- Manage with the Wise App – get instant notifications, freeze your card, unfreeze it any anytime

How to Use a Wise Card when travelling

Using Wise when traveling is a fabulous to save money.

You can hold balances in your Wise account in different currencies. (like US dollars, British Pounds, Euros, Australian dollars, Japanese Yen.. and so on). But equally, you don’t have to have money in those currencies to spend in those currencies. If you spend in say Japanese Yen but don’t have Yen in your currency account, then Wise will auto-convert to give you the lowest possible rates.

Once you’ve got a Wise account you can apply for a debit card. I don’t know of anyone who’s been turned down. This is a debit card, not a credit card. It is a Mastercard.

Your Wise card lets you take money out of an ATM for FREE – if you hold that currency in your Wise account. It lets you take out up to 200 GBP/250 USD/350 AUD/350 NZD/350 SGD (or your currency’s equivalent) in total per 30 days. After that, a 1.75% withdrawal fee will be charged. After two ATM transactions per 30 days, there’s also a 50p fee. These fees are charged in the currency of your account.

When using your Wise debit card always select to get charged by the ATM in the local currency – NOT your home rate – this means that Wise and not the bank whose ATM you are using will set the exchange rate. ALL ATMs will try and convince you to take their conversion rate – it’s called Dynamic Currency Conversion. You should NOT take their offer. Wise will ALWAYS offer you a better rate. Always.

Using Wise for Currency Transfer Payments

If you need to pay bills in another currency to your home account, then using your Wise account for this is really simple. You can do it ALL online. There’s no waiting period. No hassles and you’ll know exactly how much it is going to cost. And for me, it’s ALWAYS been cheaper than alternatives. Always. Read independent comparisons here.

Simply add your recipient to your recipient’s list – and then transfer the money. You don’t even have to be holding the foreign currency in your Wise account, you can make the exchange on the fly from your connected bank account, the fees are exactly the same as if you move money from say Euros to Dollars, and then pay them as if you just do it all as one transaction.

I love how transparent Wise is about showing me what the cost of the money is, and what their commission charge is for providing the service.

And I really love how quickly it all happens, as well as their humorous comments about how quick the service is compared to other things in the world ( check it out when you do your transfers! )

Using Wise for Holiday Travel Money

We are traveling most of the year, so most of our expenditure is in foreign currency, but even if you’re looking at a one or two-week holiday Wise can save you money. There’s no need to be using the seriously expensive currency exchanges at airports or border crossings. All you need is a Wise account, a Wise debit card, and an ATM.

Pop the card into the ATM, take the cash out and you’re off and running.

Don’t forget you can also use the Wise debit card like a normal debit card, – paying for restaurant meals, trips, tours, car rental, and so on. I don’t know why I keep saying “like a normal debit card”, I really should say, it’s a super-normal debit card – because it doesn’t charge huge fees for spending in a foreign currency!

Using Wise to Receive Foreign Currency Payments

If you get paid in foreign currencies then getting that payment into your home bank account can cost a HUGE amount in fees. Even if the person paying you wants to use, say PayPal, then your fees are high.

Wise lets you open accounts in multiple currencies, so you can give local bank details to the people wanting to pay you, or put them on your invoices. And this is all for free. Check out a multi-currency account here and now. Wise also lets you convert more than 40 currencies! So your billpayers will be paying in their currency, then you can use the low exchange rates that Wise offers to convert to whichever currency you want it in.

Is Your Money Safe with Wise?

In a word. Yes. Here’s how and why.

Wise FCA (Financial Conduct Authority)

Wise is regulated by the Financial Conduct Authority in the UK – they’re required by law to keep money safe. They do this by storing it in low-risk financial institutions – in Europe, it’s Barclays in the UK, in the USA it’s Wells Fargo. All monies are held in a specific customer account, separate from their business operating monies.

Wise FCSC (Financial Services Compensation Scheme)

If Wise were to cease to exist, then your money would be paid back from the accounts referenced above. Wise, is, however, not covered by the Financial Services Compensation Scheme (FSCS) as it is not a bank. Your money is protected by safeguarding.

FAQs on Why Use Wise

Got questions about what is Wise? About how to use Wise to transfer money? Or even what is Wise? Check out our frequently asked questions about Wise money transfers below, or ask us yours in the comments.

What is Wise? What is Wise?

Wise is an Authorised Electronic Money Institution. They are independently regulated by the FCA in the UK.

Wise is a financial services company with more than 6 million active customers who move more than US$ 4 billion dollars EVERY MONTH, saving on average US$4 million a DAY in bank fees. Wise is an Authorised Electronic Money Institution independently regulated by the Financial Conduct Authority (FCA) in the UK. They are required by law to keep money safe by storing it in low-risk financial institutions. In Europe, they do this with Barclays. In the USA they do this with Wells Fargo.

Which countries can get a Wise Account? Can I use Wise in Canada?

As of December 2021 as a resident or citizen of the following countries, you can get a Wise account and Wise debit card: Canada, UK, US, Australia, New Zealand, Singapore, Japan, Switzerland, and EEA. As of December 2021, Canadian residents can get access to Wise cards too. > Get your Wise Account here

What is Transfer Wise borderless?

The Wise borderless account is the old name of the Wise Multi-Currency Account. It’s the same thing. A Wise borderless account is simply a way of holding multiple currencies.

Does Wise work in Cuba?

No. The Wise card will not currently work in Cuba.

How to Use Wise Debit Cards?

You use a Wise card / Wise debit card in the same way that you do any other debit card. Pay in restaurants, pay at tolls, pay in supermarkets. Use it online. There’s no charge for using a Wise debit card to pay for goods and services. As of December 2021 the Wise debit card is also available to Canadian residents > more here

Can You Link Wise to Paypal?

Yes. You can link a Wise account to Paypal easily. Usually, you can link a bank account from your primary Paypal currency online. (So my UK bank account is linked to Paypal online). Then to add a second account in a different currency (say US dollars), you might need to call Paypal. If you are not able to link Wise to Paypal online, then you can phone Paypal and they can add it manually for you. I did this to link my Wise account to Paypal for dollars and they were incredibly helpful and it only took 5 minutes.

Can you use a Credit Card on Wise?

Yes. You can link a credit card to Wise and use it to transfer money to your Wise multi-currency account. You can easily use a credit card on Wise. However, you will be charged a CASH advance fee if you use a credit card attached to Wise. And therefore it is usually cheaper to use a debit card. You should check with your card provider what charges they will make as payments made via Wise using a credit card may be interpreted by your bank as being a cash withdrawal and therefore may incur additional charges.

How do I use Wise?

How you use Wise depends on what type of transactions you want to use it for. You can set up a Wise account for free. You can then add different currency accounts to your wise account for free. There is no charge for this. You do not need to hold money in these currency accounts to have them open.

You link your Wise / Wise account to a “bricks and mortar” bank account or even a credit card. This then means that you can make transfers using Wise as the mechanism. So if you hold your money in Pounds sterling, but want to pay someone in US Dollars, the Wise currency conversion rates tend to be LOTS cheaper than regular bank transfers.