- Tour de France

- Giro d'Italia

- La Vuelta ciclista a España

- World Championships

- Amstel Gold Race

- Milano-Sanremo

- Tirreno-Adriatico

- Liège-Bastogne-Liège

- Il Lombardia

- La Flèche Wallonne

- Paris - Nice

- Paris-Roubaix

- Volta Ciclista a Catalunya

- Critérium du Dauphiné

- Tour des Flandres

- Gent-Wevelgem in Flanders Fields

- Clásica Ciclista San Sebastián

- INEOS Grenadiers

- Groupama - FDJ

- EF Education-EasyPost

- Decathlon AG2R La Mondiale Team

- BORA - hansgrohe

- Bahrain - Victorious

- Astana Qazaqstan Team

- Intermarché - Wanty

- Lidl - Trek

- Movistar Team

- Soudal - Quick Step

- Team dsm-firmenich PostNL

- Team Jayco AlUla

- Team Visma | Lease a Bike

- UAE Team Emirates

- Arkéa - B&B Hotels

- Alpecin-Deceuninck

- Grand tours

- Countdown to 3 billion pageviews

- Favorite500

- Profile Score

- Stage winners

- All stage profiles

- Race palmares

- Complementary results

- Finish photo

- Contribute info

- Contribute results

- Contribute site(s)

- Results - Results

- Info - Info

- Live - Live

- Game - Game

- Stats - Stats

- More - More

- »

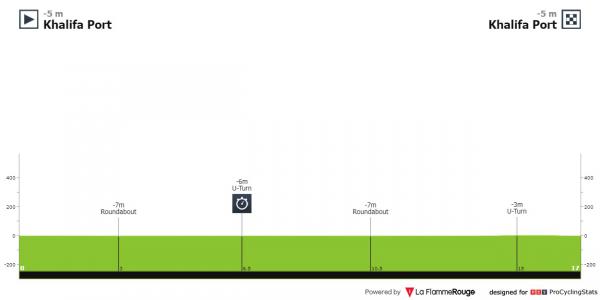

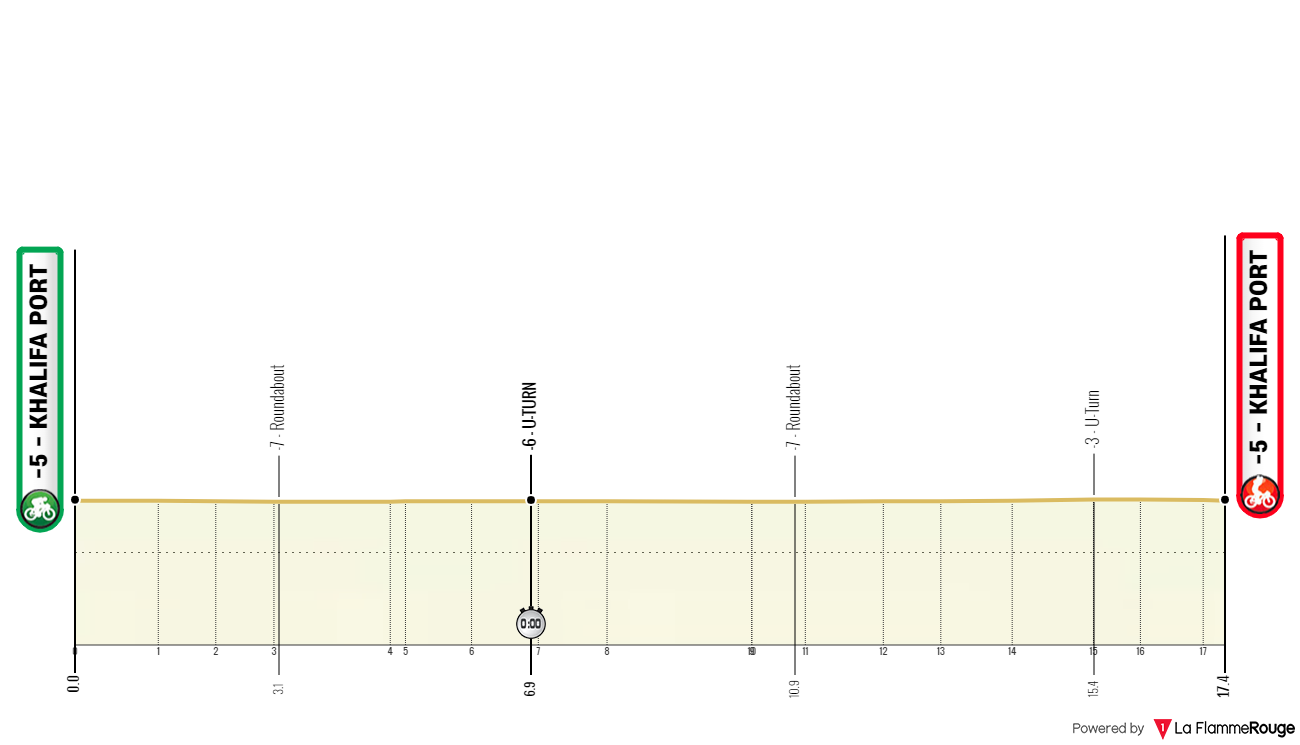

- Stage 2 (TTT)

Youth day classification

Team day classification, race information.

- Date: 21 February 2023

- Start time: 13:35 (10:35 CET)

- Avg. speed winner: 56.77 km/h

- Race category: ME - Men Elite

- Distance: 17.3 km

- Points scale: 2.WT.TTT

- UCI scale: UCI.WR.C3.Stage

- Parcours type:

- ProfileScore: 0

- Vert. meters: 5

- Departure: Khalifa Port

- Arrival: Khalifa Port

- Race ranking: 35

- Startlist quality score: 530

- Avg. temperature: 23 °C

Race profile

Grand Tours

- Vuelta a España

Major Tours

- Volta a Catalunya

- Tour de Romandie

- Tour de Suisse

- Itzulia Basque Country

- Milano-SanRemo

- Ronde van Vlaanderen

Championships

- European championships

Top classics

- Omloop Het Nieuwsblad

- Strade Bianche

- Gent-Wevelgem

- Dwars door vlaanderen

- Eschborn-Frankfurt

- San Sebastian

- Bretagne Classic

- GP Montréal

Popular riders

- Tadej Pogačar

- Wout van Aert

- Remco Evenepoel

- Jonas Vingegaard

- Mathieu van der Poel

- Mads Pedersen

- Primoz Roglic

- Demi Vollering

- Lotte Kopecky

- Katarzyna Niewiadoma

- PCS ranking

- UCI World Ranking

- Points per age

- Latest injuries

- Youngest riders

- Grand tour statistics

- Monument classics

- Latest transfers

- Favorite 500

- Points scales

- Profile scores

- Reset password

- Cookie consent

About ProCyclingStats

- Cookie policy

- Contributions

- Pageload 0.0658s

- Subscribers

- EDITORS PICK // TOP TWO CYCLING LIGHTS FOR 2023

- TOP TWO CYCLING LIGHTS FOR 2023

- TECH TUESDAY: DEALINGS WITH SHIMANO DI2

- ALL ABOUT WIND TRAINERS AND INDOOR CYCLING

- WHAT YOUR PRESTA VALVE CAPS ARE ACTUALLY FOR

- BIKE TEST: ALLIED ECHO

- ALL ABOUT AIR & HOW-TO FIGHT FLAT TIRES

- PINARELLO F SERIES – WHAT TO KNOW ABOUT THE ALL-NEW RACE BIKES

- CANNONDALE UNVEILS SLEEK 2023 ROAD LINE-UP

- THROWBACK THURSDAY, 2015: ALEX DOWSETT BREAKS THE HOUR RECORD

2023 UAE TOUR STAGE 2 RESULTS

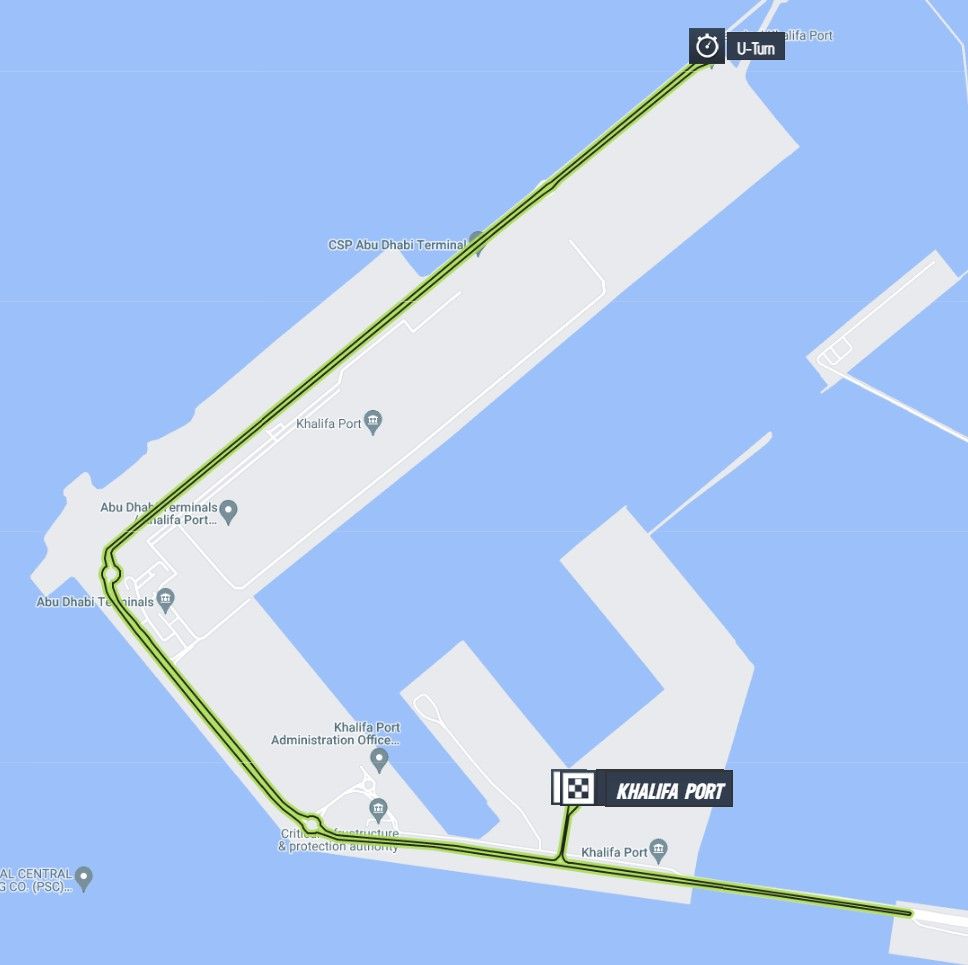

World champion Remco Evenepoel had another good day at the UAE Tour Tuesday as his Soudal-Quick-Step team won a 10.7 mile team time-trial round the port of Khalifa. The collective win puts the Belgian rider level top of the overall standings with Ineos Grenadiers’ Luke Plapp after two of the seven stages.cBoth riders were part of a masterful breakaway in a blustery cross wind on Monday when a clutch of riders made it home 51 seconds ahead of Team UAE leader Adam Yates.

With teams setting off round the sunny, deserted port at two-minute intervals, finish times were taken once five of them had crossed the line. Evenepoel’s outfit eventually abandoned the sprinter Tim Merlier who won Monday’s opening stage, so he let slip the overall leader’s red jersey to Plapp.

“We wanted to stay all together until we came out of the headwind and then some guys used all their energy to do one last pull. To win it by one second is pretty crazy. It’s my first ever TTT victory and to do it in this race with back-to-back victories is pretty special,” Evenepoel said after the race.

English rider Yates is no time-trial specialist either and his UAE Team lost another 15 seconds here on his first major outing since joining the home side, who are riding without their iconic double Tour de France winning superstar rider Tadej Pogacar. Lurking behind the lead pair are two Bahrain Victorious riders, Nikias Arndt and Pello Bilbao.

Wednesday’s stage will shake up the leaderboard even further as it leaves the pretty seaside district of Umbrella Beach to head out across the desert. The riders then have a 12 mile climb above five percent incline as they climb up the Jebel Jais mountain.

UAE TOUR OVERALL STANDINGS

RBA/AFP Photos: Sprint Cycling

Get real time updates directly on you device, subscribe now.

2023 UAE TOUR STAGE 1 RESULTS

HOOKLESS WHEELS 101 — WHAT TO KNOW

2023 UAE TOUR STAGE 7 RESULTS

2023 UAE TOUR STAGE 6 RESULTS

2023 UAE TOUR STAGE 5 RESULTS

Comments are closed.

We and our {{count}} partners use cookies and other tracking technologies to improve your experience on our website. We may store and/or access information on a device and process personal data, such as your IP address and browsing data, for personalised advertising and content, advertising and content measurement, audience research and services development. Additionally, we may utilize precise geolocation data and identification through device scanning.

Please note that your consent will be valid across all our subdomains. You can change or withdraw your consent at any time by clicking the “Consent Preferences” button at the bottom of your screen. We respect your choices and are committed to providing you with a transparent and secure browsing experience.

Privacy Overview

- Most purposes explained in this notice rely on the storage or accessing of information from your device when you use an app or visit a website. For example, a vendor or publisher might need to store a cookie on your device during your first visit on a website, to be able to recognise your device during your next visits (by accessing this cookie each time).

- A car manufacturer wants to promote its electric vehicles to environmentally conscious users living in the city after office hours. The advertising is presented on a page with related content (such as an article on climate change actions) after 6:30 p.m. to users whose non-precise location suggests that they are in an urban zone.

- A large producer of watercolour paints wants to carry out an online advertising campaign for its latest watercolour range, diversifying its audience to reach as many amateur and professional artists as possible and avoiding showing the ad next to mismatched content (for instance, articles about how to paint your house). The number of times that the ad has been presented to you is detected and limited, to avoid presenting it too often.

- If you read several articles about the best bike accessories to buy, this information could be used to create a profile about your interest in bike accessories. Such a profile may be used or improved later on, on the same or a different website or app to present you with advertising for a particular bike accessory brand. If you also look at a configurator for a vehicle on a luxury car manufacturer website, this information could be combined with your interest in bikes to refine your profile and make an assumption that you are interested in luxury cycling gear.

- An apparel company wishes to promote its new line of high-end baby clothes. It gets in touch with an agency that has a network of clients with high income customers (such as high-end supermarkets) and asks the agency to create profiles of young parents or couples who can be assumed to be wealthy and to have a new child, so that these can later be used to present advertising within partner apps based on those profiles.

- An online retailer wants to advertise a limited sale on running shoes. It wants to target advertising to users who previously looked at running shoes on its mobile app. Tracking technologies might be used to recognise that you have previously used the mobile app to consult running shoes, in order to present you with the corresponding advertisement on the app.

- A profile created for personalised advertising in relation to a person having searched for bike accessories on a website can be used to present the relevant advertisement for bike accessories on a mobile app of another organisation.

- You read several articles on how to build a treehouse on a social media platform. This information might be added to a profile to mark your interest in content related to outdoors as well as do-it-yourself guides (with the objective of allowing the personalisation of content, so that for example you are presented with more blog posts and articles on treehouses and wood cabins in the future).

- You have viewed three videos on space exploration across different TV apps. An unrelated news platform with which you have had no contact builds a profile based on that viewing behaviour, marking space exploration as a topic of possible interest for other videos.

- You read articles on vegetarian food on a social media platform and then use the cooking app of an unrelated company. The profile built about you on the social media platform will be used to present you vegetarian recipes on the welcome screen of the cooking app.

- You have viewed three videos about rowing across different websites. An unrelated video sharing platform will recommend five other videos on rowing that may be of interest to you when you use your TV app, based on a profile built about you when you visited those different websites to watch online videos.

- You have clicked on an advertisement about a “black Friday” discount by an online shop on the website of a publisher and purchased a product. Your click will be linked to this purchase. Your interaction and that of other users will be measured to know how many clicks on the ad led to a purchase.

- You are one of very few to have clicked on an advertisement about an “international appreciation day” discount by an online gift shop within the app of a publisher. The publisher wants to have reports to understand how often a specific ad placement within the app, and notably the “international appreciation day” ad, has been viewed or clicked by you and other users, in order to help the publisher and its partners (such as agencies) optimise ad placements.

- You have read a blog post about hiking on a mobile app of a publisher and followed a link to a recommended and related post. Your interactions will be recorded as showing that the initial hiking post was useful to you and that it was successful in interesting you in the related post. This will be measured to know whether to produce more posts on hiking in the future and where to place them on the home screen of the mobile app.

- You were presented a video on fashion trends, but you and several other users stopped watching after 30 seconds. This information is then used to evaluate the right length of future videos on fashion trends.

- The owner of an online bookstore wants commercial reporting showing the proportion of visitors who consulted and left its site without buying, or consulted and bought the last celebrity autobiography of the month, as well as the average age and the male/female distribution of each category. Data relating to your navigation on its site and to your personal characteristics is then used and combined with other such data to produce these statistics.

- An advertiser wants to better understand the type of audience interacting with its adverts. It calls upon a research institute to compare the characteristics of users who interacted with the ad with typical attributes of users of similar platforms, across different devices. This comparison reveals to the advertiser that its ad audience is mainly accessing the adverts through mobile devices and is likely in the 45-60 age range.

- A technology platform working with a social media provider notices a growth in mobile app users, and sees based on their profiles that many of them are connecting through mobile connections. It uses a new technology to deliver ads that are formatted for mobile devices and that are low-bandwidth, to improve their performance.

- An advertiser is looking for a way to display ads on a new type of consumer device. It collects information regarding the way users interact with this new kind of device to determine whether it can build a new mechanism for displaying advertising on this type of device.

- A travel magazine has published an article on its website about the new online courses proposed by a language school, to improve travelling experiences abroad. The school’s blog posts are inserted directly at the bottom of the page, and selected on the basis of your non-precise location (for instance, blog posts explaining the course curriculum for different languages than the language of the country you are situated in).

- A sports news mobile app has started a new section of articles covering the most recent football games. Each article includes videos hosted by a separate streaming platform showcasing the highlights of each match. If you fast-forward a video, this information may be used to select a shorter video to play next.

- An advertising intermediary delivers ads from various advertisers to its network of partnering websites. It notices a large increase in clicks on ads relating to one advertiser, and uses data regarding the source of the clicks to determine that 80% of the clicks come from bots rather than humans.

- Clicking on a link in an article might normally send you to another page or part of the article. To achieve this, 1°) your browser sends a request to a server linked to the website, 2°) the server answers back (“here is the article you asked for”), using technical information automatically included in the request sent by your device, to properly display the information / images that are part of the article you asked for. Technically, such exchange of information is necessary to deliver the content that appears on your screen.

- Store and/or access information on a device

- Use limited data to select advertising

- Create profiles for personalised advertising

- Use profiles to select personalised advertising

- Measure advertising performance

- Measure content performance

- Understand audiences through statistics or combinations of data from different sources

- Develop and improve services

- Ensure security, prevent and detect fraud, and fix errors

- Deliver and present advertising and content

- Match and combine data from other data sources

- Link different devices

- Identify devices based on information transmitted automatically

- IP addresses

- Device identifiers

- Probabilistic identifiers

- Browsing and interaction data

- Non-precise location data

- Users’ profiles

- Privacy choices

- Tracking method : Cookies

- Maximum duration of cookies : 90 days

- Cookie lifetime is being refreshed

- Actively scan device characteristics for identification

- Device characteristics

- Tracking method : Cookies and others.

- Maximum duration of cookies : 365 days

- Use precise geolocation data

- Authentication-derived identifiers

- Precise location data

- Maximum duration of cookies : 30 days

- Cookie lifetime is not being refreshed

- Measure advertising performance ( Data Retention Period : 90 days )

- Maximum duration of cookies : 395 days

- User-provided data

- Maximum duration of cookies : 396 days

- Maximum duration of cookies : 394 days

- Create profiles to personalise content

- Maximum duration of cookies : 17 days

- Use profiles to select personalised content

- Use limited data to select content

- Maximum duration of cookies : 540 days

- Maximum duration of cookies : 3628 days

- Maximum duration of cookies : 180 days

- Maximum duration of cookies : 183 days

- Maximum duration of cookies : 397 days

- Maximum duration of cookies : 182 days

- Use profiles to select personalised advertising ( Data Retention Period : 180 days )

- Maximum duration of cookies : 390 days

- Maximum duration of cookies : 3650 days

- Maximum duration of cookies : 45 days

- Create profiles for personalised advertising ( Data Retention Period : 365 days )

- Use profiles to select personalised advertising ( Data Retention Period : 365 days )

- Measure advertising performance ( Data Retention Period : 365 days )

- Maximum duration of cookies : 730 days

- Maximum duration of cookies : 720 days

- Maximum duration of cookies : 21 days

- Maximum duration of cookies : 2555 days

- Maximum duration of cookies : 400 days

- Maximum duration of cookies : 273 days

- Maximum duration of cookies : 60 days

- Maximum duration of cookies : 393 days

- Create profiles for personalised advertising ( Data Retention Period : 90 days )

- Use profiles to select personalised advertising ( Data Retention Period : 90 days )

- Use profiles to select personalised advertising ( Data Retention Period : 390 days )

- Maximum duration of cookies : 2190 days

- Maximum duration of cookies : 364 days

- Use profiles to select personalised advertising ( Data Retention Period : 4320 days )

- Understand audiences through statistics or combinations of data from different sources ( Data Retention Period : 90 days )

- Develop and improve services ( Data Retention Period : 90 days )

- Maximum duration of cookies : 366 days

- Maximum duration of cookies : 120 days

- Maximum duration of cookies : 403 days

- Use profiles to select personalised advertising ( Data Retention Period : 0 days )

- Maximum duration of cookies : 729 days

- Maximum duration of cookies : 62 days

- Maximum duration of cookies : 1825 days

- Maximum duration of cookies : 25 days

- Maximum duration of cookies : 0 days

- Maximum duration of cookies : 1 days

- Maximum duration of cookies : 50 days

- Maximum duration of cookies : 14 days

- Maximum duration of cookies : 913 days

- Create profiles for personalised advertising ( Data Retention Period : 395 days )

- Use profiles to select personalised advertising ( Data Retention Period : 395 days )

- Create profiles to personalise content ( Data Retention Period : 395 days )

- Use profiles to select personalised content ( Data Retention Period : 395 days )

- Measure advertising performance ( Data Retention Period : 395 days )

- Measure content performance ( Data Retention Period : 1125 days )

- Understand audiences through statistics or combinations of data from different sources ( Data Retention Period : 1125 days )

- Develop and improve services ( Data Retention Period : 1125 days )

- Maximum duration of cookies : 18 days

- Maximum duration of cookies : 93 days

- Maximum duration of cookies : 386 days

- Maximum duration of cookies : 89 days

- Maximum duration of cookies : 1095 days

- Maximum duration of cookies : 500 days

- Maximum duration of cookies : 91 days

- Maximum duration of cookies : 912 days

- Maximum duration of cookies : 370 days

- Maximum duration of cookies : 9 days

- Create profiles for personalised advertising ( Data Retention Period : 10 days )

- Maximum duration of cookies : 360 days

- Maximum duration of cookies : 15 days

- Maximum duration of cookies : 31 days

- Maximum duration of cookies : 1157 days

- Maximum duration of cookies : 30000 days

- Maximum duration of cookies : 7 days

- Maximum duration of cookies : 730000 days

- Maximum duration of cookies : 300 days

- Maximum duration of cookies : 28 days

- Use profiles to select personalised advertising ( Data Retention Period : 7 days )

- Measure advertising performance ( Data Retention Period : 7 days )

- Create profiles for personalised advertising ( Data Retention Period : 0 days )

- Create profiles to personalise content ( Data Retention Period : 0 days )

- Use profiles to select personalised content ( Data Retention Period : 0 days )

- Measure advertising performance ( Data Retention Period : 0 days )

- Measure content performance ( Data Retention Period : 730 days )

- Understand audiences through statistics or combinations of data from different sources ( Data Retention Period : 730 days )

- Develop and improve services ( Data Retention Period : 730 days )

- Maximum duration of cookies : 2485 days

- Maximum duration of cookies : 2 days

- Maximum duration of cookies : 4 days

- Maximum duration of cookies : 146 days

- Maximum duration of cookies : 13 days

- Maximum duration of cookies : 356 days

- Create profiles for personalised advertising ( Data Retention Period : 180 days )

- Create profiles to personalise content ( Data Retention Period : 90 days )

- Develop and improve services ( Data Retention Period : 120 days )

- Maximum duration of cookies : 358 days

- Maximum duration of cookies : 57 days

- Create profiles to personalise content ( Data Retention Period : 91 days )

- Use profiles to select personalised content ( Data Retention Period : 91 days )

- Measure advertising performance ( Data Retention Period : 91 days )

- Understand audiences through statistics or combinations of data from different sources ( Data Retention Period : 91 days )

- Develop and improve services ( Data Retention Period : 4320 days )

- Maximum duration of cookies : 3652 days

- Maximum duration of cookies : 56 days

- Maximum duration of cookies : 3000 days

PREVIEW | UAE Tour 2023 stage 2 - Team time-trial to create further damage in GC fight

Preview . After a brutal first day at the UAE Tour where crosswinds dealt a lot of chaos, Tim Merlier took the victory. Now on stage 2 there will be a team time-trial where the GC contenders and their teams will have an important challenge.

Stage two will see the riders race a team time-trial. In 17.2 kilometers at Khalifa Port, teams will face each other in a day where the overall classification will take relative importance. The race will fully be within the port's roads, going back and forth in the area. There will then be plenty of changes of direction, but with no technical or tight sections, as well as any gradients, it will be a day where the most organized teams will without a doubt benefit from.

Start Times - UAE Tour 2023 stage 2 team time-trial

UAE Tour: Tim Merlier wins photo-finish stage 1 as Evenepoel and Bilbao profit greatly from crosswind action

The Weather

Moderately strong and consistent wind from the east. It won't make a meaningful difference since there are so many changes in direction. It will likely make for some more tension however between teammates.

The Favourites

Technique matters a lot in team time-trials, as does having powerhouse riders - not necessarily specialists against the clock. This can through some surprises, however the field here is not particularly strong when it comes to time-trialists. In 17 kilometers as much as 1 minute can be created between a strong and a more modest lineup, but most of the big teams should be within 30 seconds.

Soudal - Quick-Step - With Evenepoel leading there's no doubt that there will be pressure to perform. The team lacks another specialist but the likes of Josef Cerny and Mauro Schmid will be valuable, and the team features several leadout men and Tim Merlier who can perform for short periods of time.

INEOS Grenadiers - This is a team that's relatively well prepared for the effort. Luke Plapp, Ben Tulett and Joshua Tarling will be very important engines for the effort. Several of the riders are track experts and with no exception all riders can roll quite well. Plapp will benefit from this day greatly for the GC.

UAE Team Emirates - Mixed results in the TT's, but UAE seem to have good engines for the effort. McNulty and Bjerg will be strong. The question will be on what kind of day all Yates, Vine and Soler are - all can both put in a great performance or an underwhelming. It's perhaps the lineup that has focused the most on the GC and that is visible here.

The likes of Bahrain - Victorious , BORA - hansgrohe , EF Education-EasyPost and Team DSM also have some strong riders who will be able to boost the team's result, but the victory should be hard to reach.

Race Center - UAE Tour 2023

Prediction UAE Tour 2023 stage 2:

*** INEOS Grenadiers, UAE Team Emirates ** Soudal - Quick-Step * Bahrain - Victorious, BORA - hansgrohe, EF Education-EasyPost, Team DSM

Pick : INEOS Grenadiers

Prize Money UAE Tour 2023 with €300.000 available

Read more about:, place comments.

You are currently seeing only the comments you are notified about, if you want to see all comments from this post, click the button below.

Confirmation

Are you sure you want to report this comment?

UNDER_ARTICLE

Thu 11 Apr 2024

Fri 12 Apr 2024

- Spring Classics

UAE Tour - Stage 2

- Share on Facebook

- Share on Twitter

- Dates 10 Feb

- Race Length 133 kms

- Start Al Dhafra Castle

- Finish Al Mirfa

- Race Category Elite Women

BePink-Gold

Canyon//sram racing, ceratizit-wnt pro cycling, fenix-deceuninck, human powered health, israel-premier tech roland, laboral kutxa-fundacion euskadi, liv racing teqfind, movistar team, st michel-mavic-auber 93, team coop-hitec products, team dsm-firmenich, team jayco-alula, team sd worx, top girls fassa bortolo, uae team adq, uno-x pro cycling team, zaaf cycling team.

Provided by FirstCycling

Major Races

Subscribe to the gcn newsletter.

Get the latest, most entertaining and best informed news, reviews, challenges, insights, analysis, competitions and offers - straight to your inbox

UAE Tour 2023 stages

- UAE Tour past winners

- UAE Tour 2023 route

Latest on Cyclingnews

Stites and Ehrlich on form to repeat Redlands Bicycle Classic GC wins - Analysing the contenders

Tim Merlier to ride second Giro d'Italia in 2024, Soudal-QuickStep boss confirms

‘A brush with death’ – Steff Cras revisits mass crash at Itzulia Basque Country

Electric bike conversion kits 2024: Add a motor to your bike

Giro d'Abruzzo: Enrico Zanoncello wins photo finish sprint on stage 1

Recovery time unclear for Jonas Vingegaard after successful collarbone surgery

Itzulia crash changes everything for Vingegaard and Evenepoel - Philippa York analysis

Sport's strangest hall of fame: Inside the Roubaix shower block

Breaking the ‘vicious cycle’ – The how and why of Australia’s new ProVelo Super League

UAE Tour 2023

- Related races

This is the general page of the UAE Tour 2023 , here you can see a summary of the race (the winners of one of each rankings, the leaders, jerseys or who won the points classification, when it starts, who is the leader, where to follow live, etc...), schedules and cities where race pass through (including when the mountain and time trial stages), where to watch it and also with the dropouts and withdrawals , and of course the positions and results in the general standing of your favorite cyclists (Remember to check the teams they run on). Everything so that you do not miss any of the best cycling live races of the season.

Stage 1 - Flat

Al Mirfa (Stage 1 - UAE Tour 2023)"> Al Dhafra Castle -> Al Mirfa

20-02-2023 Start : 12:55:00 - End : 16:26:00

© Images by theuaetour.com / RCS

Stage 2 - Team Time Trial

Khalifa Port (Stage 2 - UAE Tour 2023)"> Khalifa Port -> Khalifa Port

21-02-2023 Start : 14:00:00 - End : 15:30:00

Stage 3 - Mountain

Jebel Jais (Stage 3 - UAE Tour 2023)"> Al Fujairah -> Jebel Jais

22-02-2023 Start : 11:40:00 - End : 16:30:00

Stage 4 - Flat

Dubai Harbour (Stage 4 - UAE Tour 2023)"> Al Shindagha -> Dubai Harbour

23-02-2023 Start : 12:20:00 - End : 16:28:00

Stage 5 - Flat

Umm al Quwain (Stage 5 - UAE Tour 2023)"> Al Marjan Island -> Umm al Quwain

24-02-2023 Start : 12:25:00 - End : 16:27:00

Stage 6 - Flat

Abu Dhabi Breakwater (Stage 6 - UAE Tour 2023)"> Warner Bros. World Abu Dhabi -> Abu Dhabi Breakwater

25-02-2023 Start : 12:30:00 - End : 16:27:00

Stage 7 - Mountain

Jebel Hafeet (Stage 7 - UAE Tour 2023)"> Hazza Bin Zayed Stadium -> Jebel Hafeet

26-02-2023 Start : 12:45:00 - End : 16:29:00

Frequent questions about UAE Tour 2023

When it began to dispute this race.

The first time was in the year 2015 and this edition is number 5

How many kilometers are covered? And stages?

1028 km are covered in a total of 7 stage/s

What day begins? How long does it last?

It starts on 20-02-2023 in Al Dhafra Castle and ends on 26-02-2023 in Jebel Hafeet

How many teams and cyclists participate?

A total of 140 cyclists and 20 teams . Click on this link to see more

What UCI category does this race have?

UCI World Tour (Various stages) 2.UWT

What company or organizer manages it?

UAE Tour stage 2 individual time trial start times

T he second day of racing at the 2024 UAE Tour makes a return to Al Hudayriyat Island for the individual time trial, last contested there three years ago. The stage 2 individual time trial takes place on Al Hudayriyat Island on a very fast 12.1km course. There is only one intermediate time check for the route, at kilometre 5.7.

The first rider down the ramp at 11:00 CET (14:00 local time) will be Elia Viviani (Ineos Grenadiers), with 138 more riders to follow. The final rider will be stage 1 winner Tim Merlier (Soudal-QuickStep), wearing the leader’s jersey, taking the course at 13:18 CET (16:18 local time).

A favourite in the race against the clock is Brandon McNulty (UAE Team Emirates), who was fourth in the discipline at last year’s World Championships. The reigning US national champion already has a GC win at Volta Valenciana, and he’ll get to showcase his stars-and-stripes jersey for the first time this year at the UAE Tour.

His last ITT competition in a stage race was last September when he finished second at Tour Luxembourg. He is among the early starters, the 11th rider to take the course.

Adam Yates (UAE Team Emirates) and Olav Kooij (Visma-Lease a Bike), like McNulty are both just 10 seconds off the race lead set by Monday’s winner Merlier, and could use the short course as a marker to stamp impressions for the GC. Yates, who finished third overall last year in the UAE, performed well on the 22.4km ITT at the 2023 Tour de France, riding to seventh. Kooij has tried to improve his individual performances, and was third in a 6.6km prologue at ZLM Tour last year.

While flat and using wide roads, it is not without technical points to keep riders alert, especially a pair of u-turns situated between a sweeping clockwise spiral. The first u-turn comes at kilometre 7.5, which leads to a swooping 1.7-mile, “S”-shaped portion of the course. At the end of the spiral is the second u-turn, which leaves a swooping and slightly uphill section of 2.9km to the line for the clock to stop.

Hudayriyat Island hosted the individual time trial in 2021, but on a different course. That year, Ineos’s Filippo Ganna won the 13km route by 14 seconds over Stefan Bissegger (EF Education).

Last year Soudal-QuickStep won the team time trial on stage 2 at Khalifa Port, with Remco Evenepoel riding along with Merlier, who had also won the opening stage.

- About Amazon (English)

- About Amazon (日本語)

- About Amazon (Français)

- About Amazon (Deutsch)

- Newsroom (Deutsch)

- About Amazon (Italiano)

- About Amazon (Polski)

- About Amazon (Español)

- Press Center (English)

- About Amazon (Português)

CEO Andy Jassy’s 2023 Letter to Shareholders

- Facebook Share

- Twitter Share

- LinkedIn Share

- Email Share

- Copy Link copied

Dear Shareholders:

Last year at this time, I shared my enthusiasm and optimism for Amazon’s future. Today, I have even more. The reasons are many, but start with the progress we’ve made in our financial results and customer experiences, and extend to our continued innovation and the remarkable opportunities in front of us.

In 2023, Amazon’s total revenue grew 12% year-over-year (“YoY”) from $514B to $575B. By segment, North America revenue increased 12% YoY from $316B to $353B, International revenue grew 11% YoY from $118B to $131B, and AWS revenue increased 13% YoY from $80B to $91B.

Further, Amazon’s operating income and Free Cash Flow (“FCF”) dramatically improved. Operating income in 2023 improved 201% YoY from $12.2B (an operating margin of 2.4%) to $36.9B (an operating margin of 6.4%). Trailing Twelve Month FCF adjusted for equipment finance leases improved from -$12.8B in 2022 to $35.5B (up $48.3B).

While we’ve made meaningful progress on our financial measures, what we’re most pleased about is the continued customer experience improvements across our businesses.

In our Stores business, customers have enthusiastically responded to our relentless focus on selection, price, and convenience. We continue to have the broadest retail selection , with hundreds of millions of products available, tens of millions added last year alone, and several premium brands starting to list on Amazon (e.g. Coach, Victoria’s Secret, Pit Viper, Martha Stewart, Clinique, Lancôme, and Urban Decay).

Being sharp on price is always important , but particularly in an uncertain economy, where customers are careful about how much they’re spending. As a result, in Q4 2023, we kicked off the holiday season with Prime Big Deal Days, an exclusive event for Prime members to provide an early start on holiday shopping. This was followed by our extended Black Friday and Cyber Monday holiday shopping event, open to all customers, that became our largest revenue event ever. For all of 2023, customers saved nearly $24B across millions of deals and coupons, almost 70% more than the prior year.

We also continue to improve delivery speeds, breaking multiple company records . In 2023, Amazon delivered at the fastest speeds ever to Prime members, with more than 7 billion items arriving same or next day, including more than 4 billion in the U.S. and more than 2 billion in Europe. In the U.S., this result is the combination of two things. One is the benefit of regionalization, where we re-architected the network to store items closer to customers. The other is the expansion of same-day facilities, where in 2023, we increased the number of items delivered same day or overnight by nearly 70% YoY. As we get items to customers this fast, customers choose Amazon to fulfill their shopping needs more frequently, and we can see the results in various areas including how fast our everyday essentials business is growing (over 20% YoY in Q4 2023).

Our regionalization efforts have also trimmed transportation distances, helping lower our cost to serve . In 2023, for the first time since 2018, we reduced our cost to serve on a per unit basis globally. In the U.S. alone, cost to serve was down by more than $0.45 per unit YoY. Decreasing cost to serve allows us both to invest in speed improvements and afford adding more selection at lower Average Selling Prices (“ASPs”). More selection at lower prices puts us in consideration for more purchases.

As we look toward 2024 (and beyond), we’re not done lowering our cost to serve . We’ve challenged every closely held belief in our fulfillment network, and reevaluated every part of it, and found several areas where we believe we can lower costs even further while also delivering faster for customers. Our inbound fulfillment architecture and resulting inventory placement are areas of focus in 2024, and we have optimism there’s more upside for us.

Internationally , we like the trajectory of our established countries, and see meaningful progress in our emerging geographies (e.g. India, Brazil, Australia, Mexico, Middle East, Africa, etc.) as they continue to expand selection and features, and move toward profitability (in Q4 2023, Mexico became our latest international Stores locale to turn profitable). We have high conviction that these new geographies will continue to grow and be profitable in the long run.

Alongside our Stores business, Amazon’s Advertising progress remains strong , growing 24% YoY from $38B in 2022 to $47B in 2023, primarily driven by our sponsored ads. We’ve added Sponsored TV to this offering, a self-service solution for brands to create campaigns that can appear on up to 30+ streaming TV services, including Amazon Freevee and Twitch, and have no minimum spend. Recently, we’ve expanded our streaming TV advertising by introducing ads into Prime Video shows and movies, where brands can reach over 200 million monthly viewers in our most popular entertainment offerings, across hit movies and shows, award-winning Amazon MGM Originals, and live sports like Thursday Night Football . Streaming TV advertising is growing quickly and off to a strong start.

Shifting to AWS , we started 2023 seeing substantial cost optimization, with most companies trying to save money in an uncertain economy. Much of this optimization was catalyzed by AWS helping customers use the cloud more efficiently and leverage more powerful, price-performant AWS capabilities like Graviton chips (our generalized CPU chips that provide ~40% better price-performance than other leading x86 processors), S3 Intelligent Tiering (a storage class that uses AI to detect objects accessed less frequently and store them in less expensive storage layers), and Savings Plans (which give customers lower prices in exchange for longer commitments). This work diminished short-term revenue, but was best for customers, much appreciated, and should bode well for customers and AWS longer-term. By the end of 2023, we saw cost optimization attenuating, new deals accelerating, customers renewing at larger commitments over longer time periods, and migrations growing again.

The past year was also a significant delivery year for AWS. We announced our next generation of generalized CPU chips (Graviton4), which provides up to 30% better compute performance and 75% more memory bandwidth than its already-leading predecessor (Graviton3). We also announced AWS Trainium2 chips, which will deliver up to four times faster machine learning training for generative AI applications and three times more memory capacity than Trainium1. We continued expanding our AWS infrastructure footprint, now offering 105 Availability Zones within 33 geographic Regions globally, with six new Regions coming (Malaysia, Mexico, New Zealand, the Kingdom of Saudi Arabia, Thailand, and a second German region in Berlin). In Generative AI (“GenAI”), we added dozens of features to Amazon SageMaker to make it easier for developers to build new Foundation Models (“FMs”). We invented and delivered a new service (Amazon Bedrock) that lets companies leverage existing FMs to build GenAI applications. And, we launched the most capable coding assistant around in Amazon Q. Customers are excited about these capabilities, and we’re seeing significant traction in our GenAI offerings. (More on how we’re approaching GenAI and why we believe we’ll be successful later in the letter.)

We’re also making progress on many of our newer business investments that have the potential to be important to customers and Amazon long-term. Touching on two of them:

We have increasing conviction that Prime Video can be a large and profitable business on its own. This confidence is buoyed by the continued development of compelling, exclusive content (e.g. Thursday Night Football, Lord of the Rings, Reacher, The Boys, Citadel , Road House , etc.), Prime Video customers’ engagement with this content, growth in our marketplace programs (through our third-party Channels program, as well as the broad selection of shows and movies customers rent or buy), and the addition of advertising in Prime Video.

In October, we hit a major milestone in our journey to commercialize Project Kuiper when we launched two end-to-end prototype satellites into space, and successfully validated all key systems and sub-systems—rare in an initial launch like this. Kuiper is our low Earth orbit satellite initiative that aims to provide broadband connectivity to the 400-500 million households who don’t have it today (as well as governments and enterprises seeking better connectivity and performance in more remote areas), and is a very large revenue opportunity for Amazon. We’re on track to launch our first production satellites in 2024. We’ve still got a long way to go, but are encouraged by our progress.

Overall, 2023 was a strong year, and I’m grateful to our collective teams who delivered on behalf of customers. These results represent a lot of invention, collaboration, discipline, execution, and reimagination across Amazon. Yet, I think every one of us at Amazon believes that we have a long way to go, in every one of our businesses, before we exhaust how we can make customers’ lives better and easier, and there is considerable upside in each of the businesses in which we’re investing.

In my annual letter over the last three years, I’ve tried to give shareholders more insight into how we’re thinking about the company, the businesses we’re pursuing, our future opportunities, and what makes us tick. We operate in a diverse number of market segments, but what ties Amazon together is our joint mission to make customers’ lives better and easier every day. This is true across every customer segment we serve (consumers, sellers, brands, developers, enterprises, and creators). At our best, we’re not just customer obsessed, but also inventive, thinking several years out, learning like crazy, scrappy, delivering quickly, and operating like the world’s biggest start-up.

We spend enormous energy thinking about how to empower builders, inside and outside of our company. We characterize builders as people who like to invent. They like to dissect a customer experience, assess what’s wrong with it, and reinvent it. Builders tend not to be satisfied until the customer experience is perfect. This doesn’t hinder them from delivering improvements along the way, but it drives them to keep tinkering and iterating continually. While unafraid to invent from scratch, they have no hesitation about using high-quality, scalable, cost-effective components from others. What matters to builders is having the right tools to keep rapidly improving customer experiences.

The best way we know how to do this is by building primitive services . Think of them as discrete, foundational building blocks that builders can weave together in whatever combination they desire. Here’s how we described primitives in our 2003 AWS Vision document:

“Primitives are the raw parts or the most foundational-level building blocks for software developers. They’re indivisible (if they can be functionally split into two they must) and they do one thing really well. They’re meant to be used together rather than as solutions in and of themselves. And, we’ll build them for maximum developer flexibility. We won’t put a bunch of constraints on primitives to guard against developers hurting themselves. Rather, we’ll optimize for developer freedom and innovation.”

Of course, this concept of primitives can be applied to more than software development, but they’re especially relevant in technology. And, over the last 20 years, primitives have been at the heart of how we’ve innovated quickly.

One of the many advantages to thinking in primitives is speed . Let me give you two counter examples that illustrate this point. First, we built a successful owned-inventory retail business in the early years at Amazon where we bought all our products from publishers, manufacturers, and distributors, stored them in our warehouses, and shipped them ourselves. Over time, we realized we could add broader selection and lower prices by allowing third-party sellers to list their offerings next to our own on our highly trafficked search and product detail pages. We’d built several core retail services (e.g. payments, search, ordering, browse, item management) that made trying different marketplace concepts simpler than if we didn’t have those components. A good set of primitives? Not really.

It turns out that these core components were too jumbled together and not partitioned right. We learned this the hard way when we partnered with companies like Target in our Merchant.com business in the early 2000s. The concept was that target.com would use Amazon’s ecommerce components as the backbone of its website, and then customize however they wished. To enable this arrangement, we had to deliver those components as separable capabilities through application programming interfaces (“APIs”). This decoupling was far more difficult than anticipated because we’d built so many dependencies between these services as Amazon grew so quickly the first few years.

This coupling was further highlighted by a heavyweight mechanism we used to operate called “NPI.” Any new initiative requiring work from multiple internal teams had to be reviewed by this NPI cabal where each team would communicate how many people-weeks their work would take. This bottleneck constrained what we accomplished, frustrated the heck out of us, and inspired us to eradicate it by refactoring these ecommerce components into true primitive services with well-documented, stable APIs that enabled our builders to use each other’s services without any coordination tax.

In the middle of the Target and NPI challenges, we were contemplating building a new set of infrastructure technology services that would allow both Amazon to move more quickly and external developers to build anything they imagined. This set of services became known as AWS, and the above experiences convinced us that we should build a set of primitive services that could be composed together how anybody saw fit. At that time, most technology offerings were very feature-rich, and tried to solve multiple jobs simultaneously. As a result, they often didn’t do any one job that well.

Our AWS primitive services were designed from the start to be different. They offered important, highly flexible, but focused functionality. For instance, our first major primitive was Amazon Simple Storage Service (“S3”) in March 2006 that aimed to provide highly secure object storage, at very high durability and availability, at Internet scale, and very low cost. In other words, be stellar at object storage. When we launched S3, developers were excited, and a bit mystified. It was a very useful primitive service, but they wondered, why just object storage? When we launched Amazon Elastic Compute Cloud (“EC2”) in August 2006 and Amazon SimpleDB in 2007, people realized we were building a set of primitive infrastructure services that would allow them to build anything they could imagine, much faster, more cost-effectively, and without having to manage or lay out capital upfront for the datacenter or hardware. As AWS unveiled these building blocks over time (we now have over 240 at builders’ disposal—meaningfully more than any other provider), whole companies sprang up quickly on top of AWS (e.g. Airbnb, Dropbox, Instagram, Pinterest, Stripe, etc.), industries reinvented themselves on AWS (e.g. streaming with Netflix, Disney+, Hulu, Max, Fox, Paramount), and even critical government agencies switched to AWS (e.g. CIA, along with several other U.S. Intelligence agencies). But, one of the lesser-recognized beneficiaries was Amazon’s own consumer businesses, which innovated at dramatic speed across retail, advertising, devices (e.g. Alexa and Fire TV), Prime Video and Music, Amazon Go, Drones, and many other endeavors by leveraging the speed with which AWS let them build. Primitives, done well, rapidly accelerate builders’ ability to innovate .

So, how do you build the right set of primitives?

Pursuing primitives is not a guarantee of success. There are many you could build, and even more ways to combine them. But, a good compass is to pick real customer problems you’re trying to solve .

Our logistics primitives are an instructive example. In Amazon’s early years, we built core capabilities around warehousing items, and then picking, packing, and shipping them quickly and reliably to customers. As we added third-party sellers to our marketplace, they frequently requested being able to use these same logistics capabilities. Because we’d built this initial set of logistics primitives, we were able to introduce Fulfillment by Amazon (“FBA”) in 2006, allowing sellers to use Amazon’s Fulfillment Network to store items, and then have us pick, pack, and ship them to customers, with the bonus of these products being available for fast, Prime delivery. This service has saved sellers substantial time and money (typically about 70% less expensive than doing themselves), and remains one of our most popular services. As more merchants began to operate their own direct-to-consumer (“DTC”) websites, many yearned to still use our fulfillment capabilities, while also accessing our payments and identity primitives to drive higher order conversion on their own websites (as Prime members have already shared this payment and identity information with Amazon). A couple years ago, we launched Buy with Prime to address this customer need. Prime members can check out quickly on DTC websites like they do on Amazon, and receive fast Prime shipping speeds on Buy with Prime items—increasing order conversion for merchants by ~25% vs. their default experience.

As our Stores business has grown substantially, and our supply chain become more complex, we’ve had to develop a slew of capabilities in order to offer customers unmatched selection, at low prices, and with very fast delivery times. We’ve become adept at getting products from other countries to the U.S., clearing customs, and then shipping to storage facilities. Because we don’t have enough space in our shipping fulfillment centers to store all the inventory needed to maintain our desired in-stock levels, we’ve built a set of lower-cost, upstream warehouses solely optimized for storage (without sophisticated end-user, pick, pack, and ship functions). Having these two pools of inventory has prompted us to build algorithms predicting when we’ll run out of inventory in our shipping fulfillment centers and automatically replenishing from these upstream warehouses. And, in the last few years, our scale and available alternatives have forced us to build our own last mile delivery capability (roughly the size of UPS) to affordably serve the number of consumers and sellers wanting to use Amazon.

We’ve solved these customer needs by building additional fulfillment primitives that both serve Amazon consumers better and address external sellers’ increasingly complex ecommerce activities. For instance, for sellers needing help importing products, we offer a Global Mile service that leverages our expertise here. To ship inventory from the border (or anywhere domestically) to our storage facilities, we enable sellers to use either our first-party Amazon Freight service or third-party freight partners via our Partnered Carrier Program. To store more inventory at lower cost to ensure higher in-stock rates and shorter delivery times, we’ve opened our upstream Amazon Warehousing and Distribution facilities to sellers (along with automated replenishment to our shipping fulfillment centers when needed). For those wanting to manage their own shipping, we’ve started allowing customers to use our last mile delivery network to deliver packages to their end-customers in a service called Amazon Shipping. And, for sellers who wish to use our fulfillment network as a central place to store inventory and ship items to customers regardless of where they ordered, we have a Multi-Channel Fulfillment service. These are all primitives that we’ve exposed to sellers.

Building in primitives meaningfully expands your degrees of freedom . You can keep your primitives to yourself and build compelling features and capabilities on top of them to allow your customers and business to reap the benefits of rapid innovation. You can offer primitives to external customers as paid services (as we have with AWS and our more recent logistics offerings). Or, you can compose these primitives into external, paid applications as we have with FBA, Buy with Prime, or Supply Chain by Amazon (a recently released logistics service that integrates several of our logistics primitives). But, you’ve got options. You’re only constrained by the primitives you’ve built and your imagination.

Take the new, same-day fulfillment facilities in our Stores business. They’re located in the largest metro areas around the U.S. (we currently have 58), house our top-moving 100,000 SKUs (but also cover millions of other SKUs that can be injected from nearby fulfillment centers into these same-day facilities), and streamline the time required to go from picking a customer’s order to being ready to ship to as little as 11 minutes. These facilities also constitute our lowest cost to serve in the network. The experience has been so positive for customers that we’re planning to double the number of these facilities.

But, how else might we use this capability if we think of it as a core building block? We have a very large and growing grocery business in organic grocery (with Whole Foods Market) and non-perishable goods (e.g. consumables, canned goods, health and beauty products, etc.). We’ve been working hard on building a mass, physical store offering (Amazon Fresh) that offers a great perishable experience; however, what if we used our same-day facilities to enable customers to easily add milk, eggs, or other perishable items to any Amazon order and get same day? It might change how people think of splitting up their weekly grocery shopping, and make perishable shopping as convenient as non-perishable shopping already is.

Or, take a service that some people have questioned, but that’s making substantial progress and we think of as a very valuable future primitive capability—our delivery drones (called Prime Air). Drones will eventually allow us to deliver packages to customers in less than an hour. It won’t start off being available for all sizes of packages and in all locations, but we believe it’ll be pervasive over time. Think about how the experience of ordering perishable items changes with sub-one-hour delivery?

The same is true for Amazon Pharmacy. Need throat lozenges, Advil, an antibiotic, or some other medication? Same-day facilities already deliver many of these items within hours, and that will only get shorter as we launch Prime Air more expansively. Highly flexible building blocks can be composed across businesses and in new combinations that change what’s possible for customers.

Being intentional about building primitives requires patience . Releasing the first couple primitive services can sometimes feel random to customers (or the public at large) before we’ve unveiled how these building blocks come together. I’ve mentioned AWS and S3 as an example, but our Health offering is another. In the last 10 years, we’ve tried several Health experiments across various teams—but they were not driven by our primitives approach. This changed in 2022 when we applied our primitives thinking to the enormous global healthcare problem and opportunity. We’ve now created several important building blocks to help transform the customer health experience: Acute Care (via Amazon Clinic), Primary Care (via One Medical), and a Pharmacy service to buy whatever medication a patient may need. Because of our growing success, Amazon customers are now asking us to help them with all kinds of wellness and nutrition opportunities—which can be partially unlocked with some of our existing grocery building blocks, including Whole Foods Market or Amazon Fresh.

As a builder, it’s hard to wait for these building blocks to be built versus just combining a bunch of components together to solve a specific problem. The latter can be faster, but almost always slows you down in the future. We’ve seen this temptation in our robotics efforts in our fulfillment network. There are dozens of processes we seek to automate to improve safety, productivity, and cost. Some of the biggest opportunities require invention in domains such as storage automation, manipulation, sortation, mobility of large cages across long distances, and automatic identification of items. Many teams would skip right to the complex solution, baking in “just enough” of these disciplines to make a concerted solution work, but which doesn’t solve much more, can’t easily be evolved as new requirements emerge, and that can’t be reused for other initiatives needing many of the same components. However, when you think in primitives, like our Robotics team does, you prioritize the building blocks, picking important initiatives that can benefit from each of these primitives, but which build the tool chest to compose more freely (and quickly) for future and complex needs. Our Robotics team has built primitives in each of the above domains that will be lynchpins in our next set of automation, which includes multi-floor storage, trailer loading and unloading, large pallet mobility, and more flexible sortation across our outbound processes (including in vehicles). The team is also building a set of foundation AI models to better identify products in complex environments, optimize the movement of our growing robotic fleet, and better manage the bottlenecks in our facilities.

Sometimes, people ask us “what’s your next pillar? You have Marketplace, Prime, and AWS, what’s next?” This, of course, is a thought-provoking question. However, a question people never ask, and might be even more interesting is what’s the next set of primitives you’re building that enables breakthrough customer experiences? If you asked me today, I’d lead with Generative AI (“GenAI”).

Much of the early public attention has focused on GenAI applications , with the remarkable 2022 launch of ChatGPT. But, to our “primitive” way of thinking, there are three distinct layers in the GenAI stack, each of which is gigantic, and each of which we’re deeply investing.

The bottom layer is for developers and companies wanting to build foundation models (“FMs”). The primary primitives are the compute required to train models and generate inferences (or predictions), and the software that makes it easier to build these models. Starting with compute, the key is the chip inside it. To date, virtually all the leading FMs have been trained on Nvidia chips, and we continue to offer the broadest collection of Nvidia instances of any provider. That said, supply has been scarce and cost remains an issue as customers scale their models and applications. Customers have asked us to push the envelope on price-performance for AI chips, just as we have with Graviton for generalized CPU chips. As a result, we’ve built custom AI training chips (named Trainium) and inference chips (named Inferentia). In 2023, we announced second versions of our Trainium and Inferentia chips, which are both meaningfully more price-performant than their first versions and other alternatives. This past fall, leading FM-maker, Anthropic, announced it would use Trainium and Inferentia to build, train, and deploy its future FMs. We already have several customers using our AI chips, including Anthropic, Airbnb, Hugging Face, Qualtrics, Ricoh, and Snap.

Customers building their own FM must tackle several challenges in getting a model into production. Getting data organized and fine-tuned, building scalable and efficient training infrastructure, and then deploying models at scale in a low latency, cost-efficient manner is hard. It’s why we’ve built Amazon SageMaker, a managed, end-to-end service that’s been a game changer for developers in preparing their data for AI, managing experiments, training models faster (e.g. Perplexity AI trains models 40% faster in SageMaker), lowering inference latency (e.g. Workday has reduced inference latency by 80% with SageMaker), and improving developer productivity (e.g. NatWest reduced its time-to-value for AI from 12-18 months to under seven months using SageMaker).

The middle layer is for customers seeking to leverage an existing FM, customize it with their own data, and leverage a leading cloud provider’s security and features to build a GenAI application—all as a managed service. Amazon Bedrock invented this layer and provides customers with the easiest way to build and scale GenAI applications with the broadest selection of first- and third-party FMs, as well as leading ease-of-use capabilities that allow GenAI builders to get higher quality model outputs more quickly. Bedrock is off to a very strong start with tens of thousands of active customers after just a few months. The team continues to iterate rapidly on Bedrock, recently delivering Guardrails (to safeguard what questions applications will answer), Knowledge Bases (to expand models’ knowledge base with Retrieval Augmented Generation—or RAG—and real-time queries), Agents (to complete multi-step tasks), and Fine-Tuning (to keep teaching and refining models), all of which improve customers’ application quality. We also just added new models from Anthropic (their newly-released Claude 3 is the best performing large language model in the world), Meta (with Llama 2), Mistral, Stability AI, Cohere, and our own Amazon Titan family of FMs. What customers have learned at this early stage of GenAI is that there’s meaningful iteration required to build a production GenAI application with the requisite enterprise quality at the cost and latency needed. Customers don’t want only one model. They want access to various models and model sizes for different types of applications. Customers want a service that makes this experimenting and iterating simple, and this is what Bedrock does, which is why customers are so excited about it. Customers using Bedrock already include ADP, Amdocs, Bridgewater Associates, Broadridge, Clariant, Dana-Farber Cancer Institute, Delta Air Lines, Druva, Genesys, Genomics England, GoDaddy, Intuit, KT, Lonely Planet, LexisNexis, Netsmart, Perplexity AI, Pfizer, PGA TOUR, Ricoh, Rocket Companies, and Siemens.

The top layer of this stack is the application layer. We’re building a substantial number of GenAI applications across every Amazon consumer business. These range from Rufus (our new, AI-powered shopping assistant), to an even more intelligent and capable Alexa, to advertising capabilities (making it simple with natural language prompts to generate, customize, and edit high-quality images, advertising copy, and videos), to customer and seller service productivity apps, to dozens of others. We’re also building several apps in AWS, including arguably the most compelling early GenAI use case—a coding companion. We recently launched Amazon Q, an expert on AWS that writes, debugs, tests, and implements code, while also doing transformations (like moving from an old version of Java to a new one), and querying customers’ various data repositories (e.g. Intranets, wikis, Salesforce, Amazon S3, ServiceNow, Slack, Atlassian, etc.) to answer questions, summarize data, carry on coherent conversation, and take action. Q is the most capable work assistant available today and evolving fast.

While we’re building a substantial number of GenAI applications ourselves, the vast majority will ultimately be built by other companies. However, what we’re building in AWS is not just a compelling app or foundation model. These AWS services, at all three layers of the stack, comprise a set of primitives that democratize this next seminal phase of AI, and will empower internal and external builders to transform virtually every customer experience that we know (and invent altogether new ones as well). We’re optimistic that much of this world-changing AI will be built on top of AWS.

(By the way, don’t underestimate the importance of security in GenAI. Customers’ AI models contain some of their most sensitive data. AWS and its partners offer the strongest security capabilities and track record in the world; and as a result, more and more customers want to run their GenAI on AWS.)

Recently, I was asked a provocative question—how does Amazon remain resilient? While simple in its wording, it’s profound because it gets to the heart of our success to date as well as for the future. The answer lies in our discipline around deeply held principles: 1/ hiring builders who are motivated to continually improve and expand what’s possible; 2/ solving real customer challenges, rather than what we think may be interesting technology; 3/ building in primitives so that we can innovate and experiment at the highest rate; 4/ not wasting time trying to fight gravity (spoiler alert: you always lose)—when we discover technology that enables better customer experiences, we embrace it; 5/ accepting and learning from failed experiments—actually becoming more energized to try again, with new knowledge to employ.

Today, we continue to operate in times of unprecedented change that come with unusual opportunities for growth across the areas in which we operate. For instance, while we have a nearly $500B consumer business, about 80% of the worldwide retail market segment still resides in physical stores. Similarly, with a cloud computing business at nearly a $100B revenue run rate, more than 85% of the global IT spend is still on-premises. These businesses will keep shifting online and into the cloud. In Media and Advertising, content will continue to migrate from linear formats to streaming. Globally, hundreds of millions of people who don’t have adequate broadband access will gain that connectivity in the next few years. Last but certainly not least, Generative AI may be the largest technology transformation since the cloud (which itself, is still in the early stages), and perhaps since the Internet. Unlike the mass modernization of on-premises infrastructure to the cloud, where there’s work required to migrate, this GenAI revolution will be built from the start on top of the cloud. The amount of societal and business benefit from the solutions that will be possible will astound us all.

There has never been a time in Amazon’s history where we’ve felt there is so much opportunity to make our customers’ lives better and easier. We’re incredibly excited about what’s possible, focused on inventing the future, and look forward to working together to make it so.

Andy Jassy President and Chief Executive Officer Amazon.com, Inc.

P.S. As we have always done, our original 1997 Shareholder Letter follows. What’s written there is as true today as it was in 1997.

To our shareholders:

Amazon.com passed many milestones in 1997: by year-end, we had served more than 1.5 million customers, yielding 838% revenue growth to $147.8 million, and extended our market leadership despite aggressive competitive entry.

But this is Day 1 for the Internet and, if we execute well, for Amazon.com. Today, online commerce saves customers money and precious time. Tomorrow, through personalization, online commerce will accelerate the very process of discovery. Amazon.com uses the Internet to create real value for its customers and, by doing so, hopes to create an enduring franchise, even in established and large markets.

We have a window of opportunity as larger players marshal the resources to pursue the online opportunity and as customers, new to purchasing online, are receptive to forming new relationships. The competitive landscape has continued to evolve at a fast pace. Many large players have moved online with credible offerings and have devoted substantial energy and resources to building awareness, traffic, and sales. Our goal is to move quickly to solidify and extend our current position while we begin to pursue the online commerce opportunities in other areas. We see substantial opportunity in the large markets we are targeting. This strategy is not without risk: it requires serious investment and crisp execution against established franchise leaders.

It’s All About the Long Term

We believe that a fundamental measure of our success will be the shareholder value we create over the long term . This value will be a direct result of our ability to extend and solidify our current market leadership position. The stronger our market leadership, the more powerful our economic model. Market leadership can translate directly to higher revenue, higher profitability, greater capital velocity, and correspondingly stronger returns on invested capital.

Our decisions have consistently reflected this focus. We first measure ourselves in terms of the metrics most indicative of our market leadership: customer and revenue growth, the degree to which our customers continue to purchase from us on a repeat basis, and the strength of our brand. We have invested and will continue to invest aggressively to expand and leverage our customer base, brand, and infrastructure as we move to establish an enduring franchise.

Because of our emphasis on the long term, we may make decisions and weigh tradeoffs differently than some companies. Accordingly, we want to share with you our fundamental management and decision-making approach so that you, our shareholders, may confirm that it is consistent with your investment philosophy:

- We will continue to focus relentlessly on our customers.

- We will continue to make investment decisions in light of long-term market leadership considerations rather than short-term profitability considerations or short-term Wall Street reactions.

- We will continue to measure our programs and the effectiveness of our investments analytically, to jettison those that do not provide acceptable returns, and to step up our investment in those that work best. We will continue to learn from both our successes and our failures.

- We will make bold rather than timid investment decisions where we see a sufficient probability of gaining market leadership advantages. Some of these investments will pay off, others will not, and we will have learned another valuable lesson in either case.

- When forced to choose between optimizing the appearance of our GAAP accounting and maximizing the present value of future cash flows, we’ll take the cash flows.

- We will share our strategic thought processes with you when we make bold choices (to the extent competitive pressures allow), so that you may evaluate for yourselves whether we are making rational long-term leadership investments.

- We will work hard to spend wisely and maintain our lean culture. We understand the importance of continually reinforcing a cost-conscious culture, particularly in a business incurring net losses.

- We will balance our focus on growth with emphasis on long-term profitability and capital management. At this stage, we choose to prioritize growth because we believe that scale is central to achieving the potential of our business model.

- We will continue to focus on hiring and retaining versatile and talented employees, and continue to weight their compensation to stock options rather than cash. We know our success will be largely affected by our ability to attract and retain a motivated employee base, each of whom must think like, and therefore must actually be, an owner.

We aren’t so bold as to claim that the above is the “right” investment philosophy, but it’s ours, and we would be remiss if we weren’t clear in the approach we have taken and will continue to take.

With this foundation, we would like to turn to a review of our business focus, our progress in 1997, and our outlook for the future.

Obsess Over Customers

From the beginning, our focus has been on offering our customers compelling value. We realized that the Web was, and still is, the World Wide Wait. Therefore, we set out to offer customers something they simply could not get any other way, and began serving them with books. We brought them much more selection than was possible in a physical store (our store would now occupy 6 football fields), and presented it in a useful, easy- to-search, and easy-to-browse format in a store open 365 days a year, 24 hours a day. We maintained a dogged focus on improving the shopping experience, and in 1997 substantially enhanced our store. We now offer customers gift certificates, 1-Click shopping℠, and vastly more reviews, content, browsing options, and recommendation features. We dramatically lowered prices, further increasing customer value. Word of mouth remains the most powerful customer acquisition tool we have, and we are grateful for the trust our customers have placed in us. Repeat purchases and word of mouth have combined to make Amazon.com the market leader in online bookselling.

By many measures, Amazon.com came a long way in 1997:

- Sales grew from $15.7 million in 1996 to $147.8 million – an 838% increase.

- Cumulative customer accounts grew from 180,000 to 1,510,000 – a 738% increase.

- The percentage of orders from repeat customers grew from over 46% in the fourth quarter of 1996 to over 58% in the same period in 1997.

- In terms of audience reach, per Media Metrix, our Web site went from a rank of 90th to within the top 20.

- We established long-term relationships with many important strategic partners, including America Online, Yahoo!, Excite, Netscape, GeoCities, AltaVista, @Home, and Prodigy.

Infrastructure

During 1997, we worked hard to expand our business infrastructure to support these greatly increased traffic, sales, and service levels:

- Amazon.com’s employee base grew from 158 to 614, and we significantly strengthened our management team.

- Distribution center capacity grew from 50,000 to 285,000 square feet, including a 70% expansion of our Seattle facilities and the launch of our second distribution center in Delaware in November.

- Inventories rose to over 200,000 titles at year-end, enabling us to improve availability for our customers.

- Our cash and investment balances at year-end were $125 million, thanks to our initial public offering in May 1997 and our $75 million loan, affording us substantial strategic flexibility.

Our Employees

The past year’s success is the product of a talented, smart, hard-working group, and I take great pride in being a part of this team. Setting the bar high in our approach to hiring has been, and will continue to be, the single most important element of Amazon.com’s success.

It’s not easy to work here (when I interview people I tell them, “You can work long, hard, or smart, but at Amazon.com you can’t choose two out of three”), but we are working to build something important, something that matters to our customers, something that we can all tell our grandchildren about. Such things aren’t meant to be easy. We are incredibly fortunate to have this group of dedicated employees whose sacrifices and passion build Amazon.com.

Goals for 1998

We are still in the early stages of learning how to bring new value to our customers through Internet commerce and merchandising. Our goal remains to continue to solidify and extend our brand and customer base. This requires sustained investment in systems and infrastructure to support outstanding customer convenience, selection, and service while we grow. We are planning to add music to our product offering, and over time we believe that other products may be prudent investments. We also believe there are significant opportunities to better serve our customers overseas, such as reducing delivery times and better tailoring the customer experience. To be certain, a big part of the challenge for us will lie not in finding new ways to expand our business, but in prioritizing our investments.

We now know vastly more about online commerce than when Amazon.com was founded, but we still have so much to learn. Though we are optimistic, we must remain vigilant and maintain a sense of urgency. The challenges and hurdles we will face to make our long-term vision for Amazon.com a reality are several: aggressive, capable, well-funded competition; considerable growth challenges and execution risk; the risks of product and geographic expansion; and the need for large continuing investments to meet an expanding market opportunity. However, as we’ve long said, online bookselling, and online commerce in general, should prove to be a very large market, and it’s likely that a number of companies will see significant benefit. We feel good about what we’ve done, and even more excited about what we want to do.

1997 was indeed an incredible year. We at Amazon.com are grateful to our customers for their business and trust, to each other for our hard work, and to our shareholders for their support and encouragement.

Jeffrey P. Bezos Founder and Chief Executive Officer Amazon.com, Inc.

Amazon and Anthropic deepen their shared commitment to advancing generative AI

Amazon Q4 earnings call: Here’s what CEO Andy Jassy and CFO Brian Olsavsky had to say

An update on Amazon leadership in Operations and AWS Finance

Watch Amazon CEO Andy Jassy’s conversation with CNBC’s Jim Cramer

Amazon and Hyundai launch a broad, strategic partnership—including vehicle sales on Amazon.com in 2024

Andy Jassy and Dave Limp welcome Panos Panay as Amazon's new Devices & Services leader