- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

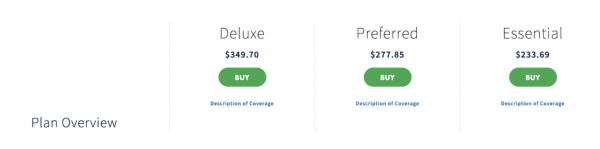

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

AIG Travel Guard Insurance Coverage Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

311 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3202 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1178 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

Why purchase travel insurance, aig travel guard — coverages and policy options, aig travel guard and covid-19, additional information — aig travel guard, how does aig travel guard compare, the value of travel insurance comparison websites, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Purchasing insurance for your home, auto, or your life, can be complicated and time-consuming if you want to compare coverages and premium costs between companies. Fortunately, the process of purchasing travel insurance is quite simple , and you can secure immediate coverage within minutes.

It all starts with determining the coverages that most important to you, securing a quote, then making sure you’re purchasing from an established, highly-rated company. One such established travel insurance company is AIG Travel Guard .

With over 25 years of experience and high ratings from premier insurance financial rating company A.M. Best , AIG Travel Guard was named the best travel insurance company of 2020 by Forbes . Its Travel Guard Deluxe policy was also given a top 5-star rating by Forbes’ insurance analysts.

We’ll certainly discuss AIG Travel Guard’s policy offerings in our article today but we also want to discuss why you’d want to purchase travel insurance , whether travel insurance covers COVID-19, the process for obtaining a quote, and additional resources to help ensure you’re receiving good value.

Plus, if you’re wondering if you need to purchase travel insurance or whether you might have enough coverage elsewhere, you’ll want to read on.

While the primary reasons for purchasing travel insurance are to protect your economic investment and to cover unexpected additional expenses you might incur due to trip disruptions, purchasing travel insurance has another, more intangible, purpose.

Purchasing travel insurance can provide peace of mind prior to and during your trip as you won’t be worried that an unforeseen event will result in an economic loss. Knowing you have evacuation insurance when you’re traveling to a remote area on safari, for example, could be tremendously reassuring, even if you never use the coverage.

Here are some sample situations where travel insurance may provide coverage:

- Your sister is diagnosed with a life-threatening illness and you must cancel your trip

- You broke your ankle and will not be able to go on your skiing trip

- You become ill and cannot travel

- You or your traveling companion is terminated or involuntarily laid off from your job

- You are summoned to jury duty or other legal action such as requiring you to appear as a witness

If your trip is expensive, complicated, or you need medical coverage while traveling, a travel insurance policy is a must.

Bottom Line: In addition to protecting your trip investment and covering unexpected expenses due to trip disruptions, travel insurance can also provide peace of mind before and during your travels.

There’s probably nothing more boring than listing insurance coverages but it’s important to know the types of coverages you can expect when purchasing an AIG Travel Guard policy.

First, AIG Travel Guard offers 3 policy options for U.S. residents (not including NY residents), 3 separate options for NY residents, and 1 policy for Canadian residents.

- Tr avel Guard Essential

- Travel Guard Preferred

- Travel Guard Deluxe

- Travel Guard Essential Expanded — available to NY residents

- Travel Guard Protect Assist — available to NY residents

- Travel Guard Tour, Cruise, & Travel — available to NY residents

- Gold Trip Cancellation Policy — available to Canadian residents

Coverage options and limits will vary by policy, however, you can expect to find the core and optional coverages listed here.

Core Coverages

Here are the types of coverages you’ll find offered on AIG Travel Guard policies and the applicable coverage limits for each type of policy.

There are also additional coverages that may be included at no extra charge, depending on the policy type selected. Terms and conditions apply.

- 1 child under 17 per covered adult is included for no extra charge

- Pre-existing conditions waiver

- Trip exchange coverage

- Single occupancy fee coverage

- Evacuation for a security reason

- Non-flight accidental and dismemberment insurance

- Worldwide travel and medical assistance services

Optional Coverages for an Additional Fee

You may secure any of the following add-on coverages by paying an additional fee.

- Cancel for Any Reason Insurance — covers trip cancellation for any reason

- Rental vehicle damage — coverage for collision damage when renting a vehicle

- Pet bundle coverage — pet care, medical expenses, and adds pet illness to trip cancellation benefit

- Adventure sports coverage — coverage for higher risk adventure activities

- Increased lodging expense bundle — increases the amount covered under travel inconvenience benefit

- Wedding bundle — coverage when a destination wedding is canceled

- Name a family member bundle — select a traveler to be covered as a family member

Hot Tip: For more information and tips on purchasing travel insurance, start here in our article on travel insurance basics .

Travel insurance , in general, is designed to protect you from financial loss due to unforeseen events that may cause you to cancel your trip, or to cover disruptions that could occur during your journey. It is not meant to cover voluntary trip cancellations due to fear of getting ill.

Voluntary cancellations, including those that are related to the fear of getting ill, are not covered on travel insurance policies. However, there is 1 option for obtaining coverage for voluntarily canceling your trip.

Cancel for Any Reason insurance (CFAR) is an optional coverage that can be added to select travel insurance policies allowing you to cancel your trip for any reason you deem necessary and be covered for partial reimbursement.

AIG Travel Guard offers CFAR coverage as an optional add-on to add to its Preferred and Deluxe plans , with these stipulations:

- Must be purchased within 15 days of the initial trip deposit

- The trip must be canceled more than 48 hours prior to departure

- The full cost of the trip must be insured for at the time of purchase

Cancel for Any Reason insurance does not cover the entire cost of the trip. In this case, to add CFAR insurance to the Deluxe and Preferred plans above, the additional premium would be $53.31 for coverage to cover up to 50% of the trip price. Additional options may be available to cover up to 75% of the cost of your trip.

The above prices are for a single trip 1-week in length for a traveler of 40 years of age at a cost of $3,000.

AIG Travel Guard policies, even without the CFAR insurance add-on, offer coverage for trip cancellations due to COVID-19 related illness and also medical coverage should a covered traveler become sick with COVID-19 during their travels. Terms and conditions apply.

Bottom Line: While trip cancellation, trip interruption, and emergency medical may offer some coverage for illness, you must purchase Cancel for Any Reason insurance to have coverage for canceling a trip due to the fear of getting ill. AIG Travel Guard offers this coverage on its Deluxe and Preferred plans.

Point-of-Sale Availability — In addition to offering travel insurance package policies directly to the public, AIG Travel Guard offers travel insurance products via several travel providers including airlines and various travel services. You’ll find the option to purchase Travel Guard protection during the checkout process with companies such as United Airlines or Frontier Airlines when purchasing a flight and when making a travel purchase via Costco Travel .

Call for Additional Quotes — While AIG Travel Guard does sell annual multi-trip policies, you must call to request a quote. Adventure sports coverage, medevac coverage, and rental vehicle damage coverage quotes are also available via phone.

15-Day Free Look Period — If you decide, after you have reviewed your purchased policy, that you do not want it, you may receive a full refund.

Cruise Insurance Option — AIG Travel Guard offers cruise insurance that includes cruise diversion and other applicable coverages.

Filing a claim — to initiate a claim, you can either call AIG Travel Guard at 866-478-8222 or access travelguard.com to begin the process. You will need your policy number handy. Once your claim is submitted, you can check the status at claims.travelguard.com/status .

First, know that when purchasing a policy from AIG Travel Guard, you’re buying from a highly-rated established insurance company. Here’s how the company stacks up in relative comparison with other travel insurance companies.

To Other Travel Insurance Companies

Comparing travel insurance policies can be complicated as coverage limits and prices vary widely. We looked at a 1-week trip to Mexico for a traveler 40 years of age and a total trip cost of $3,000 as criteria for obtaining a quote.

AIG Travel Guard’s Preferred plan, which prices out at around $200, aligns with the John Hancock Bronze policy above. Add in CFAR coverage, however, and the comparison costs are closer to AIG Travel Guard’s $254 premium for its Preferred level plan that also includes CFAR.

This 1 example uses the criteria of a specific trip for an individual traveler of a certain age and may not reflect the same relative premium costs as other comparisons.

Your own individual traveler information, the number of travelers, trip length, destination, state of residence, selected coverages, and the total cost of your trip will ultimately determine the premium cost. Our example is just a narrow snapshot comparison.

Bottom Line: Travel insurance policy coverages and costs vary dramatically. To ensure you’re receiving good value, determine the coverages that are most important to you, compare policy options, and purchase from a reliable company.

To Credit Card Travel Insurance

The travel insurance coverages that come complimentary on your credit cards are no substitute for a comprehensive travel insurance policy. With that being said, the coverage that comes with your credit card could be enough to cover some trips.

Here are some examples of trips where you may not need travel insurance and the coverage you have on your credit card could be sufficient.

- The trip consists of only a round trip domestic flight and hotel stay

- The trip is a road trip by car

- The trip does not include any non-refundable trip expenses

- The trip does not have several travel providers involved

- Your health insurance covers you while traveling and you are not worried about having additional medical coverage during your trip

Also, keep in mind that coverage offered on your credit card is generally secondary versus a primary travel insurance policy. This means you must first file a claim with other applicable insurance, including coverage with the airline or travel provider, for example, before the credit card coverage will kick in.

Bottom Line: If you have a significant investment at stake, several travel providers involved, or want medical coverage during your travels, you should purchase a comprehensive travel insurance policy for your trip and not depend on a credit card with travel insurance .

Travel insurance is widely available and competitive. You won’t have trouble purchasing some level of coverage regardless of your situation. Additionally, there are travel insurance comparison websites that make it easy to find a policy that fits and purchase coverage that is effective immediately.

These travel insurance comparison websites are each easy to use, have qualified people to assist, and all feature policies offered only by highly-rated companies.

Travelinsurance.com

- Instant coverage

- Simple format, easy to secure a quote quickly

- Guarantees the best price for the policy you’re purchasing

Squaremouth

- Features 20 companies with nearly 120 different policy options

- Its customer service team is award-winning

- You can access thousands of customer reviews

InsureMyTrip

- Educational content to assist you in understanding coverages

- Features 21 highly-rated companies

- Licensed agents can answer questions and assist with a claim

Bottom Line: Travel insurance comparison websites provide quick easy access to securing a quote, compare several high-rated travel insurance providers at once, and the benefit of receiving immediate coverage.

While airlines and travel providers have made significant changes to cancellation, refund, and exchange policies, it’s still important to consider purchasing travel insurance if you’re uncomfortable with the possibility of losing your trip investment or incurring unexpected expenses during your journey.

In addition, if you need medical insurance coverage during your trip, you won’t find that coverage on a credit card or with the airlines — you’ll need to purchase it.

The fact that AIG Travel Guard does not exclude COVID-19 related claims under certain coverages and offers a Cancel for Any Reason add-on is significant as not every travel insurance company can make that claim.

Also, if you have children traveling with you, you may find good value with AIG Travel Guard having those under 17 included for no extra charge (1 per premium-paying adult).

The bottom line when purchasing travel insurance from AIG Travel Guard is that if you can secure the coverages you need at a price you’re comfortable with and you’ll know you’re completing that transaction with a highly-rated established company.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

Frequently Asked Questions

Is aig travel guard a good travel insurance company.

AIG Travel Guard is a highly-rated established travel insurance company. It is rated A by the prominent insurance financial rating company A.M. Best and has been in business for over 25 years.

It was also named the best travel insurance company of 2020 by Forbes.

Does AIG Travel Guard cover trip cancellation?

Yes, AIG Travel Guard will cover trip cancellations but only for covered reasons listed in the policy. Examples of situations that may be covered include becoming ill and having to cancel your trip, being called for jury duty or other covered legal obligation, or your home becomes uninhabitable.

Does AIG Travel Guard cover flight cancellations due to COVID?

AIG Travel Guard, like other travel insurance companies, does not cover canceling a flight due to the fear of getting ill. However, if you become ill from COVID-19 and have to cancel your trip, you may have coverage for trip cancellation, trip interruption, or emergency medical if should become ill during your trip.

How do I make a claim with AIG Travel Guard?

You can file a claim with AIG Travel Guard by calling 866-478-8222 Monday through Friday from 7 a.m. to 7 p.m. CST. You can also initiate a claim online at travelguard.com using your policy number and last name.

Once you have submitted a claim, you can check the status of your claim at claims.travelguard.com/status , using your claim number and last name.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

AIG Travel Guard insurance review: What you need to know

Whether you need an annual plan or a policy for a last-minute trip, travel guard can deliver..

Travel Guard is one of CNBC Select 's picks for best travel insurance , thanks to its wide range of customizable policies. But are any of them right for you? Below, we review the provider and its offers and how they compare to the competition to help you choose the right travel insurance for your next trip.

Travel Guard review

Other insurance offered, how it compares, bottom line, travel guard® travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

24/7 assistance available

- A variety of plans are available to help cover different types of trips

- Not all products are available for purchase online

Travel Guard® is a global travel insurance provider specializing in plans for leisure and business travelers. Its online travel insurance packages include five options, from basic and last-minute trip coverage to more comprehensive plans. This allows travelers to pick a plan that best matches their situation.

For example, budget-minded travelers might go for the Essential Plan which offers basic protections, such as trip cancellation, interruption and delay insurance, coverage for lost, damaged and delayed baggage, and medical, evacuation and death coverage.

On the other hand, the Deluxe Plan — the most comprehensive option — adds such extras as missed connection coverage, security evacuation, travel inconvenience benefits and more. It also boosts high limits for essential coverages.

Last-minute travelers can opt for the Pack N' Go Plan which only includes certain post-departure coverages. Or, if you travel often, the Annual Plan can cover your trips throughout the year.

Finally, Travel Guard offers "offline" travel insurance packages, meaning you'll have to call if you're looking for a specialty plan.

Coverage types

Depending on the plan, here are the types of protection Travel Guard can include in your package:

- Trip cancellations

- Trip interruption

- Baggage coverage

- Baggage delay

- Travel medical expenses

- Travel inconvenience benefits (reimbursement for such situations as runway delays, cruise diversion and other unforeseen situations)

- Medical evacuation

- Trip Saver (reimbursement for meals, hotels and transportation if you need to begin your trip sooner due to weather or airline changes)

- Trip exchange (reimbursement in case you have to cancel your trip and book a new one due to covered unforeseen circumstances)

- Security evacuation (due to a riot or civil disorder)

- Flight guard (coverage for accidental death or dismemberment that occurs when traveling by plane)

- Pre-existing medical conditions exclusion waiver

You can also customize your plan with add-ons, such as car rental insurance and "cancel for any reason" coverage .

Travel Guard landed on our list of the best travel insurance companies thanks to its variety of coverage. With plenty of options to choose from, both online and offline, it's easy to build a policy that meets your needs.

Travel Guard also features 24-hour concierge services that you can use to book a new flight in case of an emergency or delay.

The provider's website also offers informational resources — here, you can check travel news, read safety tips and find general travel advice. Additionally, the website lets you modify your plan, file a claim and check its status, or apply for a voucher or refund.

As of writing, Travel Guard doesn't offer any discounts. That's common for travel insurance — you're more likely to find deals when shopping for other types of insurance, such as home and auto insurance .

Travel Guard is a portfolio of travel insurance and travel-related services offered by AIG Travel, a member of American International Group (AIG). AIG also offers life insurance and a variety of business insurance products.

Travel Guard makes it easy to get a travel insurance policy customized to your needs. But before you purchase coverage, it's always a good idea to shop around.

For example, if you're going on a cruise, you might want to look at Nationwide Travel Insurance . The provider advertises cruise-specific insurance with three plan options available. This type of coverage is designed with issues unique to cruises in mind — from ship-based breakdowns to missed pre-pard excursions.

If you're planning a more active trip filled with rock climbing or sky diving, Berkshire Hathaway offers the AdrenalineCare® plan which features coverage for unforeseen costs that result from participating in extreme sports on your trip, as well as reimbursement for sporting equipment delay. Pre-existing conditions are covered under this plan (if you meet qualifying conditions).

Berkshire Hathaway Travel Protection

Berkshire Hathaway Travel Protection has multiple plans to cover vacations from luxury travel to adventure travel. The brand's LuxuryCare offers the highest limits of travel insurance coverage offered by the company. Quotes and policies are available online.

As you can see, offerings vary by provider. It can be helpful to compare multiple companies and the plans they offer to find what works best for you. It's even better if you gather several quotes to ensure you're getting a good price for your policy.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Travel Guard offers plenty of ways to customize your policy, making it a solid choice for travel insurance. You can also access additional options by giving Travel Guard a call. However, make sure to check out other travel insurance companies too — comparison shopping is essential when picking any type of financial product.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of insurance products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- These are the best homeowners insurance companies in Florida Liz Knueven

- First-time homebuyer grants: What you need to know Kelsey Neubauer

- Earn elevated perks during Amex's Platinum Card anniversary celebration Andreina Rodriguez

- Travel Insurance

- Travel Guard Travel Insurance Review

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

Travel Guard Travel Insurance Review 2024

Updated: Feb 28, 2024, 7:42am

Travel Guard travel insurance offers unlimited emergency medical coverage for travellers under age 54, and a still-generous $10 million for those 55 and up. There’s also a number of add-ons for certain plans if you’re a business traveller, taking a golf or ski vacation, or flying to a destination wedding. And if you’re worried about having to cancel, the Cancel For Any Reason upgrade gives peace of mind. But there are downsides. The mail-in claims process is clunky, and the upgrades aren’t available for all plans. Plus Travel Guard travel insurance isn’t currently offered in Quebec. Still, Travel Guard offers comprehensive coverage for a competitive price.

- Unlimited medical coverage under age 54

- Several benefit add-ons

- Pre-existing medical condition exclusion waiver

- CFAR coverage option

- Not available for Quebec residents

- Medical questionnaire required at age 56

- Clunky claims process

- Maximum age is 85

Table of Contents

About travel guard travel insurance, what travel insurance does travel guard offer, travel guard travel insurance plans, summary: plan comparison, travel guard travel insurance cost, comparing travel guard travel insurance with other insurers, optional add-ons for travel guard travel insurance, does travel guard travel insurance offer any discounts, does travel guard offer annual multi-trip plans, travel guard 24/7 travel assistance, does travel guard travel insurance have cancel for any reason (cfar), does travel guard travel insurance have interruption for any reason (ifar), travel guard travel insurance and pre-existing medical conditions, travel guard travel insurance exclusions, travel guard travel insurance eligibility, how to file a claim with travel guard travel insurance.

AIG Travel, Inc., a member of American International Group, Inc., is a worldwide leader in travel insurance and global assistance. Travel Guard is the marketing name for AIG’s portfolio of travel insurance and related services for both leisure and business travellers. Medical and security services are provided through a network of wholly-owned assistance centres located in Asia, Europe and the Americas.

Travel Guard Travel Insurance is underwritten by Toronto-based AIG Insurance Company of Canada.

Travel Guard Travel Insurance is currently not available for Quebec residents.

Here are the key types of travel insurance coverage offered in Travel Guard Travel Insurance plans:

- Emergency medical insurance: If you get ill or are injured on your trip, travel medical insurance can pay for emergency medical expenses, up to the coverage limits in your plan. These expenses can include doctor and hospital bills, medication and lab work, as well as medical evacuations, repatriation and arranging for a bedside companion if you are hospitalized.

- Trip cancellation insurance: If you cancel a trip for a reason listed in your travel policy, such as you or your travelling companion becoming ill, weather conditions cause a massive delay or you lose your job, trip cancellation insurance can reimburse you for prepaid, non-refundable costs.

- Travel interruption or delay insurance: Trip interruption insurance can pay for a last-minute flight home in an emergency and reimburse money that you lose by cutting a trip short due to a covered reason, including non-refundable activities and hotel stays. If your flight is delayed , your insurance can cover the cost of incidentals, such as meals or accommodations, after a specified period of time, such as six, 10 or 12 hours.

- Baggage insurance: Baggage travel insurance can compensate you up to your policy limits if your luggage is lost or stolen. It will reimburse the depreciated value of your suitcases and what you packed. If your bags are delayed, it can reimburse you for the cost of the necessities you’ll have to buy to tide you over. It also extends to your personal belongings, if they are lost, damaged or stolen.

- Travel accident insurance: This coverage offers compensation in the event of accidental death or catastrophic injury from an accident during your trip. Flight Accident Insurance covers injury while you’re on a commercial plane, during a connection or in an airport. Travel Accident Insurance covers death or dismemberment, including the loss of limbs or eyesight, while in transit during your trip.

Travel Guard Travel Insurance offers four plans for travelling outside of Canada.

Platinum All Inclusive Package: This is the most comprehensive plan offered by Travel Guard with unlimited emergency medical insurance for travellers under age 59, and $10 million in coverage for travellers 60 and up. It includes coverage for unforeseen medical emergencies, trip cancellation and interruption, flight and travel accident coverage, and baggage loss, damage and delay insurance.

Eligible emergency medical expenses include:

- Care received from a physician in or out of hospital

- A hospital room

- Rental or purchase of a hospital bed

- Medical appliances including a wheelchair, brace or crutches

- Diagnostic tests

- Prescription medication

- Private duty nursing

- One follow-up visit for your emergency

- Ground ambulance transportation

- Emergency evacuation and repatriation

- Dental treatment due to a blow to the face, up to $1,500

- Dental treatment due to other causes, up to $600

- Paramedical services, such as treatment from a physiotherapist, chiropractor, chiropodist, podiatrist or osteopath, up to $300 per profession

Medical benefits also include coverage to bring someone to your bedside, expenses for meals, hotel accommodations and associated expenses if you are hospitalized and/or if a medical delay prevents you from returning home, repatriation expenses and return of your remains if you die.

The Platinum All Inclusive Package offers two optional add-ons: Cancel For Any Reason (CFAR) and Cruise and Tour Protector coverage.

The Platinum All Inclusive Package is for travellers age 74 and younger.

Gold Emergency Medical Plan: If you’re only worried about medical emergencies while travelling, this benefit offers all of the medical coverage listed above. The Gold Emergency Medical Plan offers unlimited medical coverage for travellers aged 54 and under, and $10 million in coverage for travellers 55 and older.

Silver Deluxe Trip Cancellation & Interruption Package: This coverage option reimburses you for insured non-refundable travel expenses (such as hotels or prepaid excursions) if you have to cancel, interrupt, or delay your trip due to a covered reason. This benefit also includes baggage loss, damage and delay coverage, flight and travel accident coverage, and provides a specific benefit for a missed connection.

The Silver Deluxe Trip Cancellation/Interruption Package includes six optional add-ons: Cruise and Tour Protector, Expanded Benefits Upgrade, Golf Protector Coverage, Ski Protector Coverage, Business Protector Coverage and Collision Damage Waiver Coverage.

Gold Deluxe Trip Cancellation & Interruption Package: This coverage option offers the same benefits as the Silver package but some have higher payouts.

The Gold Deluxe Trip Cancellation/Interruption Package includes one optional add-on: Cruise and Tour Protector. There is also a Change of Mind benefit that reimburses your cancellation penalties up to $400 if you cancel a trip because you changed your mind, provided your trip has been paid in full.

We’ve highlighted the key benefits of Travel Guard Travel Insurance for the four single trip plans to help you identify which coverage is the best fit for you.

The price of a Travel Guard Travel Insurance plan depends on factors such as the cost of your trip, your age, your answers to a medical questionnaire, if required, and the amount of coverage you choose.

Here are some examples of the cost for Travel Guard Travel Insurance single trip plans for healthy travellers based in Ontario:

TravelSafe Travel Insurance Review

Emergency medical: $1 million Cancel For Any Reason: Yes, 75% Baggage insurance (maximum): $2,000

Related: TravelSafe Travel Insurance Review

CAA Travel Insurance

Emergency medical: $5 million Cancel For Any Reason: Yes, 50% to 75% Baggage insurance (maximum): $1,500

Related: CAA Travel Insurance Review

TuGo Travel Insurance

Emergency medical: $10 million Cancel For Any Reason: Yes, 50% Baggage insurance (maximum): $500

Related: TuGo Travel Insurance Review

Travel Guard offers several optional add-ons for its travel insurance.

The following six add-ons are available with the Silver Deluxe Trip Cancellation & Interruption Package :

- Business Protector coverage

- Cruise and Tour Protector

- Expanded Benefits Upgrade

- Golf Protector coverage

- Ski Protector coverage

- Collision Damage Waiver coverage

Business Protector coverage: This upgrade offers the following added benefits if you are travelling for business and need to make a claim under these scenarios:

Cruise and Tour Protector: If your pre-booked cruise is cancelled or if the dates are changed by the cruise company or tour operator, you are eligible for the following benefits:

Expanded Benefits Upgrade: This upgrade offers the following increased benefits and added benefits under these scenarios:

- Wedding coverage: If the primary reason for your trip is to attend a wedding and the wedding is cancelled due to the death or hospitalization of the bride, groom and/or parents of the bride or groom

- Wedding, sporting event or conference arrival delay: If the primary reason for your trip is to attend a wedding, sporting event or conference and your arrival is delayed for a reason beyond your control.

- Entertainment benefit: If you are delayed beyond your scheduled return date, the entertainment benefit pays for a ticketed event, such as a movie, live production or sporting event.

- Same-class ticket benefit: If you travelled on business or first class and you are later eligible for a flight replacement under your trip cancellation. Interruption or delay coverage, this benefit upgrades your economy-class ticket to your same-class ticket.

- Meals & accommodation benefit increase: Your meals and accommodation benefits for trip interruption and trip delay are increased.

- Baggage delay benefit increase: Your baggage delay benefit is increased from $400 to $750.

- Hurricane coverage: Your trip cancellation, interruption and delay coverage will now cover hurricanes.

Golf Protector coverage: This upgrade offers the following added benefits if you are playing golf on your trip and need to make a claim under these scenarios:

Ski Protector coverage: This upgrade offers the following added benefits if you are skiing or snowboarding on your trip and need to make a claim under these scenarios:

Collision Damage Waiver coverage: The benefit offers $50,000 in coverage if you need to make a claim due to physical loss or damage to a rental car during your trip.

If you purchase the Platinum All Inclusive Package , you can purchase the following add-ons:

- Cancel For Any Reason coverage

- Cruise and Tour Protector coverage

If you purchase the Gold Deluxe Trip Cancellation & Interruption Package , you can purchase the following add-on:

There are no add-ons with the Gold Emergency Medical Plan .

Using the example of the couple travelling to Mexico, here is the cost of the optional add-ons when selecting the Silver Deluxe Trip Cancellation & Trip Interruption Package with a base premium of $134:

Yes. You can buy multi-trip annual insurance if you travel more than once a year for multiple individual trips. Travel Guard offers nine, 16, 30 and and 60-day annual plans for emergency medical coverage.

Here’s how the cost compares for a single-trip emergency medical plan and the four multi-trip annual plans:

Worldwide emergency travel assistance is available 24/7 by calling the LiveTravel hotline.

When you have a travel medical emergency, the following support may be available:

- Health care facility location

- Assistance finding a doctor who speaks your preferred language

- Translation assistance

- Prescription refill assistance

- Coordinating medically necessary return travel arrangements

- Emergency medical evacuation

- Medical monitoring

- Medical equipment rental/replacement

Depending on your coverage, worldwide travel assistance services include:

- Lost baggage search and stolen luggage replacement assistance

- Lost passport and travel documents assistance

- ATM locator

- Emergency cash transfer

- Travel information, including visa and passport requirements

- Emergency telephone interpretation services

- Urgent message relay to family, friends or business associates

- Up-to-the-minute travel delay reports

- Assistance with obtaining long-distance calling cards for worldwide telephoning

- Inoculation information

- Embassy or consulate information

- Currency conversion or purchase assistance

- Up-to-the-minute information on local medical advisories, epidemics, required immunizations and available preventive measures

- Up-to-the-minute travel supplier strike information

- Legal referrals/bail bond assistance

- Worldwide public holiday information

- Flight rebooking assistance

- Hotel rebooking assistance

- Rental vehicle booking assistance

- Coordinate emergency return travel arrangements

- Roadside assistance

- Rental vehicle return assistance

- Guaranteed hotel check in

- Missed connection coordination

Personal security assistance includes:

- Arrange emergency and security evacuations

- Coordinate consultants to extract client to safety

- 24/7 access to security and safety advisories, global risk analysis and consultation specialists

- Immediate security intelligence on events occurring throughout the world

- Collaboration with law enforcement

The Gold and Silver Deluxe Trip Cancellation & Interruption Packages also offers the following Concierge Services:

- Assistance with restaurant reservations

- Ground transportation arrangements

- Event ticketing arrangements

- Tee times and course referrals

- Floral services

- Local activity recommendations

You must contact the Assistance Centre before receiving medical treatment or you may have to pay 30% of the eligible medical expenses. If you are unable to call, you must get someone to call on your behalf.

Yes. Travel Guard offers Cancel For Any Reason coverage as an optional add-on with the Platinum All Inclusive Package. If you are prevented from taking your trip for any reason not otherwise covered by the trip plan, Travel Guard will reimburse you for up to 75% of your prepaid, forfeited and non-refundable payments or deposits.

This add-on must be purchased at the same time the base plan is purchased, and within 15 days of the initial trip payment. Any additional payments must also be insured under this coverage within 15 days. To be eligible for coverage, you need to cancel your trip 48 hours or more prior to your departure date.

In general, a pre-existing condition is defined as any sickness, injury or medical condition that existed before the start of your coverage, whether or not diagnosed by a physician, that you showed signs or symptoms of or received medical attention for.

With a Travel Guard travel insurance plan, any pre-existing conditions must be stable and controlled for 90 days before the start of your policy to be eligible for coverage. In additional, Travel Guard will not cover any losses if you:

- Have been required to use, take or been prescribed nitroglycerin in any form more than once during a seven-day period for a heart condition

- Require the use of home oxygen or had to take oral steroids, such as prednisone or prednisolone, for a lung condition

According to Travel Guard, a medical condition is considered stable and controlled when there has been:

- No new treatment, new medical management or newly-prescribed medication

- No change in treatment, change in medical management, or newly prescribed medication

- No new, more frequent or more severe symptom or finding

- No test results showing deterioration

- No investigations or future investigations initiated or recommended for symptoms whether or not your diagnosis has been determined

- No hospitalization or referral to a specialist (made or recommended)

Travel Guard offers a Pre-existing Medical Condition Exclusion Waiver whereby the company will waive any pre-existing medical condition exclusions if:

- The policy is purchased within 15 days of making the initial trip payment

- Any additional payments or deposits are insured within 15 days of purchase

- You (the insured) are medically able to travel when you pay your premium

In addition to pre-existing condition exclusions, there are a number of scenarios not covered by travel insurance and it’s critical to know what not to do before you make a claim. The following are general exclusions to coverages provided by Travel Guard travel insurance:

- Expenses from any sickness or injury present before you bought your policy that you would expect to need medical treatment or hospitalization during your trip

- Expenses incurred once the medical emergency ends

- Non-emergency or prescription medication, including vaccinations, medication for the maintenance of a medical condition, vitamins, physical exams or routine tests

- Organ or bone marrow transplants, or surgery for artificial joints or prosthetic devices or implants

- Expenses for acupuncture or holistic treatment

- Ionizing radiation or radioactive contamination

- Eligible expenses that were not pre-approved

- Any medical condition if if was determined you could return home but you chose not to travel

- Expenses for any services prohibited by your provincial or territorial health insurance plan

- Routine prenatal care, a child born during your trip, childbirth or associated complications, pregnancy or associated complications after 26 weeks or any time after the expected date of delivery

- Your mental or emotional disorders

- Suicide or attempted suicide or intentional self-inflicted injury

- Any alcohol-related sickness, injury or death, or the abuse of medication, drugs, alcohol or other toxic substance

- A trip taken against your physician’s orders not to travel

- Your commission of, or attempt to commit, a crime

- Your participation in rock or mountain climbing, hang-gliding, parachuting, bungee jumping, skydiving, ski jumping, ski flying, heli-skiing, ski acrobatics, ski stunting, freestyle skiing, ski racing, ski bob racing, on-piste and off-piste skiing in areas designated as unsafe

- Your participation as a professional athlete in a sporting event

- Your participation in a motorized race or motorized speed contest

- Operating or learning to operate any aircraft, performing employment duties on any aircraft or ship, performing duties in any regular armed force services

- Travel to any country where there is an active travel advisory not to travel before your departure date

- War, acts of foreign enemies or rebellion

- Expenses relating to travel in, to or through Cuba, Iran, Syria, Sudan, North Korea or the Crimea region

There may be additional exclusions specifically for medical, trip cancellation/interruption/delay and baggage coverage.

To be eligible for Travel Guard Travel Insurance you must:

- Be a Canadian resident

- Have purchased your policy prior to your departure date

- Have purchased your policy less than 18 months prior to your departure date

- Have purchased your policy for the full duration of your trip

- Have purchased your policy for the full value of your non-refundable, prepaid travel arrangements

- Be insured under your provincial or territorial insurance plan (or your emergency medical benefits will max out at $10,000)

- Be less than 75 years old

- Be travelling for less than 183 days if you are less than 60 years old

- Be travelling for less than 60 days if you are between 60 and 75 years old

In addition, the following makes you ineligible for Travel Guard Travel Insurance:

- A licensed physician has diagnosed you with a terminal condition.

- You have undergone a bone marrow transplant or an organ transplant (except for a corneal transplant) that requires the use of anti-rejection/immune suppression drugs.

- You require dialysis of any type for kidney disease.

- If you are under the age of 75 and in the last 12 months you have been prescribed or utilized home oxygen therapy at any time.

You can file a claim by contacting Travel Guard by telephone at the numbers listed on the website depending on the province or territory you are calling from.

The insurer will provide the forms for your claim within 15 days of you initiating the claim. However, if you haven’t received the required forms during that time, you can submit your proof of claim in the form of a written statement outlining the cause or nature of the accident, sickness or disability that caused the claim.

If you are making an emergency medical claim, you must provide original receipts for incurred expenses, including those for subsistence allowance expenses.

For a trip cancellation/trip interruption/trip delay claim, you may be asked to provide:

- Proof of all non-refundable, prepaid deposits or payments

- Completed documentation if a medical condition was the cause of the cancellation

- Complete unused transportation tickets and vouchers

- Original receipts for subsistence allowance expenses

- Original receipts for new tickets

- Reports from police or local authorities documenting the missed connection or travel delay

- Invoices and original receipts from travel service providers

If you are making a baggage insurance and personal effects claim, you may need to provide:

- A letter of coverage or denial from the transportation carrier

- A written report regarding the loss or damage

- Original receipts or sales slips for all lost and stolen items over $149.99 per item claimed and proof that you owned the articles

- Original receipts and sales slips for all items claimed under baggage and personal effects coverage

If you are making a Rental Car Collision Damage Protection Benefit claim, you may be asked to provide:

- Your car rental invoice

- Your rental agreement with the record of the damages that existed when you picked up the car

- The police report and rental car agency report including estimate of repair costs

You must file your claim with us within 30 days of the loss or damage in the case of a claim under Rental Car Protector Coverage.

Travel Guard Travel Insurance FAQs

Does travel guard travel insurance pay for medical costs upfront.

According to the company, benefits for emergency medical expenses, emergency evacuation and repatriation of remains services may be payable directly to the provider of the services, however the provider, “must comply with the statutory provision for direct payment and may not have been paid from any other sources.” The insurer adds it will “make every effort, though we cannot guarantee, to pay providers directly.”

Does Travel Guard Travel Insurance offer coverage extensions?

Yes. Your coverage is automatically extended for up to 72 hours if your return home is delayed due to a transportation issue. If you or your travelling companion are hospitalized, your coverage is extended for the period of hospitalization, plus up to 120 hours after discharge. If you or your travelling companion are too sick to travel on your return date but do not require hospitalization, your coverage is automatically extended for up to 120 hours after your planned return date.

If you want to stay longer on your trip, you can extend your coverage if you apply and pay the premium before your original return date as long as you have not made a claim and there is no reason to make a claim.

Does Travel Guard Travel Insurance require a medical questionnaire?

Yes. Travellers over age 55 are required to complete a medical questionnaire to determine your eligibility and rate category.

Does Travel Guard Travel Insurance have any age restrictions?

Yes. You must be a minimum of 15 days old and no more than 85 years old.

When does my coverage with Travel Guard Travel Insurance begin?

In general, if you purchase cancellation coverage, it begins the day you buy your policy and ends the day you make a claim or leave on your trip. Your medical and interruption coverage, if purchased, begins when you leave home. Your delay coverage begins once an insured risk prevents you from returning home as scheduled.

Does Travel Guard Travel Insurance offer a free look period?

Yes. Travel Guard offers a 10-day Right to Examine period during which you can review your policy and cancel if you’re not satisfied with it.

Can I get a refund with Travel Guard Travel Insurance?

You can request a refund for the all-inclusive plan up to the departure date as long as you have not made a claim against the policy. A refund will also be issued if your travel supplier cancels or changes your trip and all your insured trips costs are refunded without penalty.

With an emergency medical plan, you can request a refund if you have a minimum of four unused days of coverage.

No refund will be issued if you have initiated, reported or made a claim against your policy.

Fiona Campbell is a Staff Writer for Forbes Advisor Canada. She started her career on Bay Street, but followed her love for research, writing and a good story into journalism. She is the former editor of Bankrate Canada, and has over 20 years of experience writing for various publications, including the Globe and Mail, Financial Post Business, Advisor’s Edge, Mydoh.ca and more.

- Goose Travel Insurance Review

- CAA Travel Insurance Review 2023

- TuGo Travel Insurance Review

- Blue Cross Travel Insurance

- Manulife Financial CoverMe Travel Insurance

- World Nomads Travel Insurance Review

- Medipac Travel Insurance Review

- RBC Insurance Travel Insurance

- TD Insurance Travel Insurance Review

- Johnson MEDOC Travel Insurance

- Allianz Global Assistance Travel Insurance

- TD Bank Travel Insurance

- CUMIS Travel Insurance Review

- AMA Travel Insurance

- GMS Travel Insurance Review

- CIBC Travel Insurance Review

- BMO Travel Insurance Review

- Desjardins Travel Insurance Review

- Travelance Travel Insurance

- Scotia Travel Insurance Review

- How To Get Pre-Existing Conditions Covered By Travel Insurance

- Should You Buy Travel Insurance And Is It Worth It?

- Why Travel Medical Insurance Is Essential

Do I Need Travel Insurance When Travelling Within Canada?

- Trip Cancellation Travel Insurance

- How To Get Reimbursement For A Travel Insurance Claim

- Do Canadian Travellers Need Schengen Visa Insurance?

- How Travel Insurance Works For Baggage

- How To Travel To The U.S. From Canada

- Do You Need Annual Multi-Trip Travel Insurance?

- Travel Insurance For Trips To Europe

- What Travel Insurance Does Not Cover

- Top 10 Travel Insurance Tips For 2023

- Travel Insurance For A Mexico Vacation

- How To Read The Fine Print Of Your Travel Insurance Policy

- 5 Top Tips For Handling Flight Cancellations Like A Pro

- What Does Travel Delay Insurance Cover?

- Advantages Of Buying Travel Insurance Early

- Travel Insurance For U.K. Trips

- Travel Insurance For Trips To Italy

More from

$10 etias travel pass for europe visits pushed to 2025, what’s the purpose of an etias travel authorization, bcaa travel insurance review 2024, pacific blue cross travel insurance review 2024, cumis travel insurance review 2024.

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

Best Price Guarantee By Comparing Top Providers In A Single Platform

- Buy online and get instant coverage by email

- 24/7 emergency assistance worldwide

- Over 100,000 verified customers with 5-star reviews and $3.5 billion in protected trip costs

- Includes coverage from theft, trip cancellations, baggage loss and delay, medical expenses for hospital treatments

- Policies from trusted providers including: Travel Insured International, AEGIS, Global Trip Protection, Arch RoamRight and others

- Travel Insurance

- Travel Guard Insurance Review

AIG Travel Guard Travel Insurance Review

The following companies are our partners in Travel Insurance: Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

How is Travel Guard Insurance rated?

Overall rating: 4 / 5 (very good), travel guard insurance plans & coverage, coverage - 4 / 5, emergency medical coverage details, baggage coverage details, travel guard insurance financial strength, financial strength - 3.8 / 5, travel guard insurance price & reputation, price & reputation - 3.8 / 5, travel guard insurance customer assistance services, extra benefits - 4.3 / 5, travel assistance services.

- Lost Passport/Document Assistance

- Up to the Minute Travel Advisories

- Roadside Assistance

Emergency Medical Assistance Services

- Physician Referral

- Emergency Prescription Replacement

Concierge Assistance Services

- Restaurant/Event Referral and Reservation

- Ground Transportation Recommendations

- Weather Advisories

- Wireless Device Assistance

- Plane/Boat Charter Assistance

Our Comments Policy | How to Write an Effective Comment

29 Customer Comments & Reviews

- ← Previous

- Next →

Related to Travel Insurance

Top articles.

- Trip Cancellation Insurance – What is Covered?

- Do I Really Need Travel Insurance?

- Emergency Travel Insurance Coverage

- Common Parasites and Travel-Related Infectious Diseases

Suggested Comparisons

- Travel Guard Insurance vs. Travelex

- Allianz Global Assistance vs. Travel Guard Insurance

- Allianz Global Assistance vs. Berkshire Hathaway

- Allianz Global Assistance vs. Travelex

- Or via Email -

Already a member? Login

AIG Travel Insurance: The Complete Guide

Everything you need to know before you buy AIG Travel insurance plans

:max_bytes(150000):strip_icc():format(webp)/joecortez_headshot-56a97f185f9b58b7d0fbf9ac.jpg)

For decades, AIG Travel , part of American International Group, Inc., has provided travel insurance options for many travelers. Marketed under Travel Guard, the company offers travel insurance solutions and travel-related services, including medical and security services, marketed to both leisure and business travelers around the globe.

If you have purchased a trip insurance plan in the past, it may have been provided by AIG Travel without you even knowing it: the company also creates custom policies for several smaller insurance brokers, airlines and even travel groups. Is AIG Travel the right company for your trip?

About AIG Travel

AIG Travel is a member of American International Group, Inc., a global insurance company that provides everything ranging from property casualty insurance, life insurance, retirement products, and other financial services. Travel Guard is the marketing name that AIG Travel uses to advertise its portfolio of products.

Today, the company is headquartered in Stevens Point, Wisc., and serves travelers in 80 countries and jurisdictions through eight wholly-owned global service centers in key regions, including Houston, Texas; Stevens Point, Wisc.; Kuala Lumpur, Malaysia; Mexico City, Mexico; Sofia, Bulgaria; Okinawa, Japan; Shoreham, England; and Guangzhou, China.

How Is AIG Travel Rated?

AIG Travel policies are underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., another subsidiary of AIG. As of June 2018, the policy writer has an A.M. Best A rating, putting them in the “Excellent” credit category with a stable outlook.

For customer service, AIG Travel is highly rated on three major travel insurance marketplaces online. With more than 400 reviews, AIG Travel has a five-star rating from TravelInsurance.com , with a 98 percent recommendation rate. Customers of InsureMyTrip.com give the company 4.56 stars (out of five). Although Squaremouth.com no longer offers AIG Travel policies anymore, previous customers gave the company 4.46 stars (out of five), with less than one percent negative reviews.

What Travel Insurance Does AIG Travel Offer?