- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AXA Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is AXA?

Axa travel insurance plans, which axa travel insurance plan is best for me, can you buy axa travel insurance online, is axa legit, what isn't covered by axa travel insurance, is axa travel insurance worth it.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss , trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

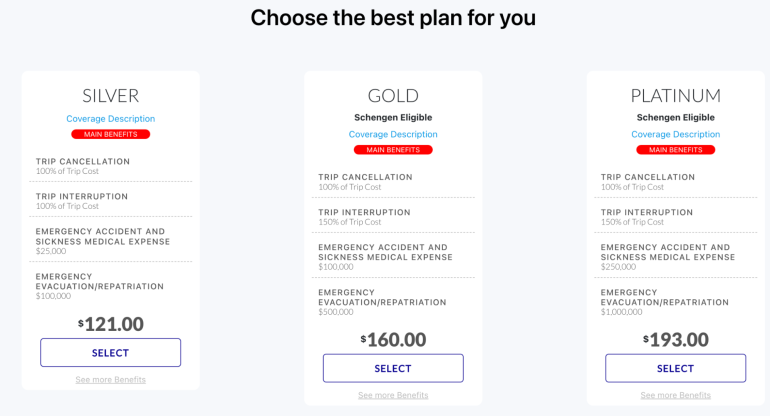

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions , a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

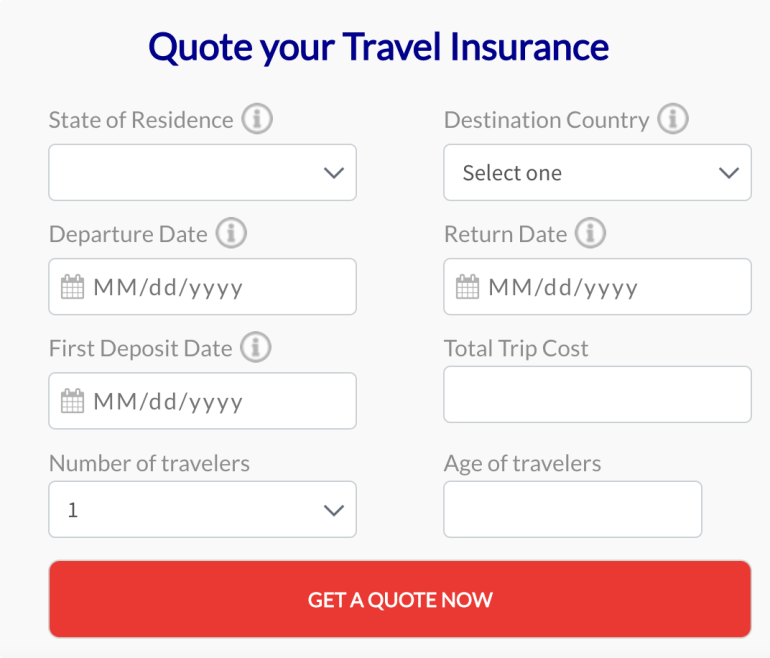

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

AXA handles more than 14 million cases each year, and every plan includes access to their 24/7 assistance hotline. The company is well established and has three plans for travelers to choose from.

AXA travel insurance covers several benefits including but not limited to 100% trip cancellation and trip interruption, medical emergencies, emergency evacuations, baggage delay or lost baggage, and accidental death and dismemberment. The Platinum plan also lets you add Cancel For Any Reason coverage.

AXA's least expensive plan, Silver, and its mid-range Gold policy do not have the option to add-on Cancel For Any Reason coverage. For travelers who opt to purchase the Platinum insurance plan, you can add Cancel For Any Reason coverage a la carte within 14 days of paying the initial trip deposit.

In the event that you need to make a claim, you can upload supporting documents online. If the claim is accepted, you will receive reimbursement within 30 days.

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

AXA Travel Benefits

For your holidays in the USA and abroad

Pre- Departure Travel Benefits

Post- departure travel benefits.

Trip Interruption Rental Car Collision Damage Waiver Missed Connection Lost Golf Days Lost Skier Days

Medical Benefits

Emergency Medical Expenses Emergency Evacuation & Repatriation Non-Emergency Medical Evacuation & Repatriation Accidental Death and Dismemberment Accidental Death and Dismemberment (Air Only)

Baggage Benefits

Luggage Delay Lost or Stolen Luggage

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Expat Travel Insurance: The 5 Best Options for Globetrotters

Travelex Insurance Services »

Allianz Travel Insurance »

World Nomads Travel Insurance »

GeoBlue »

IMG Travel Insurance »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Expat Travel Insurance Options.

Table of Contents

- Rating Details

- Travelex Insurance Services

- Allianz Travel Insurance

Americans living abroad for all or even part of the year have a different set of considerations when it comes to finding a travel insurance plan. For example, expats may not need coverage for the same issues as people taking regular vacations, such as trip cancellations and interruptions, trip delays, and lost or delayed baggage. Instead, expats often primarily need health insurance or medical insurance for travel that works both at home and abroad, as well as coverage for emergency medical evacuation.

That said, not all travel insurance companies cover preexisting conditions within their trip insurance plans for expats. Further, some insurance providers limit coverage in a traveler's home country, especially for those who would normally reside in the United States. That's why, ultimately, U.S. citizens living abroad need to compare health plans that can work when they're away based on their coverage options, limitations and costs. Read on to find out which expat insurance plans U.S. News recommends and what each plan has to offer.

- Travelex Insurance Services: Best Premium Coverage for Expats

- Allianz Travel Insurance: Best for Comprehensive Coverage

- World Nomads Travel Insurance: Best for Adventure Travelers

- GeoBlue: Best for Medical-Only Coverage

- IMG Travel Insurance: Best Travel Health Insurance for Seniors

Best Expat Travel Insurance Options in Detail

Kids-included pricing

Preexisting conditions coverage available

Coverage can be expensive

- Trip cancellation coverage worth up to 100% of the trip cost (maximum of $50,000)

- Trip interruption coverage worth up to 150% of the trip cost (maximum of $75,000)

- Travel delay coverage worth up to $2,000

- Missed connection coverage worth up to $750

- Emergency medical coverage worth up to $50,000 (dental limit of $500)

- Emergency medical evacuation and repatriation coverage worth up to $500,000

- Baggage and personal effects coverage worth up to $1,000

- Baggage delay coverage worth up to $200 (12-hour delay required)

- Sporting equipment delay coverage worth up to $200 (24-hour delay required)

- Accidental death and dismemberment coverage worth up to $25,000

Includes a range of comprehensive travel insurance benefits

Coverage can be purchased on an annual basis

Annual plan coverage lasts for trips of up to 45 days at a time

- Trip cancellation coverage worth up to $3,000

- Trip interruption coverage up to $3,000

- Emergency medical coverage up to $20,000

- Emergency medical transportation insurance up to $100,000

- Baggage loss and damage coverage up to $1,000

- Baggage delay coverage up to $200

- Travel delay coverage up to $600

- Rental car damage and theft coverage up to $45,000

- Travel accident coverage up to $25,000

150-plus adventure sports are covered

Choose the level of protection you need

Preexisting conditions typically not covered

- $10,000 in insurance for trip cancellations

- $100,000 in coverage for emergency medical expenses

- $500,000 in coverage for emergency medical evacuation

- $3,000 in protection for your bags and gear

Get comprehensive travel health insurance that works anywhere in the world

Customize your policy to suit your unique needs

Comes without coverage for trip cancellations, baggage and more

Travel medical coverage can be extended for up to 12 months

Limits can be high based on age and other factors

Deductibles of up to $2,500 can apply

No ongoing coverage for preexisting medical conditions

- Up to $250,000 in protection for emergency medical evacuations

- Prescription drug coverage

- Up to $50,000 in coverage for repatriation of remains

- Up to $50,000 in protection for political evacuations

Why Trust U.S. News Travel

Holly Johnson is an award-winning writer who has been covering personal finance, travel and insurance topics for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, which has led to her having personal experience navigating the claims and reimbursement process. Johnson works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family business.

You might also be interested in:

9 Best Travel Insurance Companies of April 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

9 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

5 Best Travel Insurance Plans for Seniors (Medical & More)

Discover coverage options for peace of mind while traveling.

HelloSafe » Travel Insurance » Expat

Expat Travel Insurance: A Complete Guide (2024)

verified information

Information verified by Adeline Harmant

Our articles are written by experts in their fields (finance, trading, insurance etc.) whose signatures you will see at the beginning and at the end of each article. They are also systematically reviewed and corrected before each publication, and updated regularly.

Medical care can be expensive when living and working in a foreign country, making it crucial for expatriates to consider comprehensive expat travel insurance.

Expatriate travel insurance or expat health insurance serves as a safety net, offering protection against unexpected medical expenses and other challenges that may arise during your time abroad.

So, let's dive into the realm of expat travel insurance, understand its coverage options, and explore the top choices available in Canada. You could use our comparator to compare multiple policies and get free personalized travel insurance quotes so you can pick a policy that truly suits you the best.

Expat Travel Insurance: 5 Key Takeaways

- Expat travel insurance typically includes medical coverage, emergency evacuation, trip protection, and more.

- Types of expat travel insurance include annual multi-trip and single-trip policies.

- Comprehensive policies offer extensive coverage, while basic policies cover a narrower range of expenses.

- Notable expat travel insurance providers include Manulife, Blue Cross, AXA, Cigna Global, and World Nomads.

- The cost of expat travel insurance varies based on factors like the trip duration, age, activities, and coverage level.

What is expat travel insurance?

Expat travel insurance, short for "expatriate travel insurance," is a type of insurance designed to provide coverage and protection for individuals who are living and working in a foreign country , away from their home country or country of origin.

Expatriates are people who have moved to another country for an extended period, often for employment, retirement, or other personal reasons.

The specific coverage and benefits of expat travel insurance can vary significantly depending on the insurance provider and the policy you choose. Expatriate travel insurance can be vital for providing peace of mind and financial protection while living abroad, as healthcare systems and legal regulations can differ greatly from one country to another.

We recommend that you compare multiple travel insurance plans before zeroing in on one. While that may seem daunting, we've made it simple for you. Use our comparator below to compare coverages, policies, and get free personalized travel insurance quotes from the best providers in Canada, and in a few seconds.

comparatorTitles.name

What does expat travel insurance cover?

Expatriate travel insurance offers a range of coverage options, which may include:

- Medical coverage: This is one of the most important aspects of expat travel insurance. It covers medical expenses in case of illness or injury while living abroad. This can include doctor's visits, hospitalization, surgeries, prescription medications, and emergency medical evacuation if necessary.

- Evacuation and repatriation: This coverage ensures that you can be transported to the nearest appropriate medical facility or even repatriated to your home country for treatment if the local healthcare facilities are inadequate or if you require specialized care.

- Emergency assistance: Many policies provide access to 24/7 emergency assistance services, including help with language barriers , locating medical facilities, and coordinating medical care.

- Trip cancellation or interruption : This coverage can reimburse you for non-refundable expenses like airline tickets or accommodations if your trip is canceled or cut short due to covered reasons, such as a medical emergency.

- Personal liability: It can cover legal expenses and compensation for damages in case you are held liable for injuring someone or damaging their property.

- Lost or stolen property: This coverage can reimburse you for lost or stolen belongings , such as luggage, electronics, or important documents.

- Personal accident insurance: This provides coverage in the event of accidental death or disability.

Some policies also offer legal assistance in case you encounter legal issues in your host country, such as visa problems or disputes with landlords or employers.

What does expat travel insurance not cover?

Exclusions in expat travel insurance are specific situations or circumstances under which the insurance policy will not provide coverage. It's crucial to understand these exclusions because they define the limitations of your insurance coverage.

While the specific exclusions can vary from one insurance policy to another, here are some common examples:

- Pre-existing medical conditions

- High-risk activities such as extreme sports, skydiving or mountaineering

- Injuries or damage resulting from war, acts of terrorism, or civil unrest

- Any injuries or damages that result from illegal activities

- Pregnancy and childbirth

- Excessive alcohol or substance abuse

Also, if you fail to follow prescribed medical advice or treatment recommendations, your insurance may not cover related expenses. For example, if a doctor advises you to have a specific medical procedure, and you refuse, the insurance may not cover complications that arise from your refusal.

How much does expat travel insurance cost?

The cost of expat travel insurance from these providers can vary depending on a number of factors, including:

- The length of your stay abroad

- Your age and health

- The activities you plan to do while you are abroad

- The level of coverage you want

- The exclusions and waiting periods

Here is a table of the estimated annual premiums for expat travel insurance from some of the leading providers in Canada:

These are just estimates. The actual cost of your insurance will depend on your individual circumstances and factors like the level of coverage, exclusions, and waiting periods.

We recommend that you get personalized quotes to find the perfect policy and for that look no further. You can simply use our comparator below and get multiple free travel insurance quotes from the best providers and in no time.

Prepare for your trip Compare. Choose. Save.

What are the types of expat travel insurance?

There are a few different types of expat travel insurance available, such as expat annual travel insurance, each with its own set of benefits and drawbacks.

What are the best Canadian expat travel insurance options?

When searching for the best Canadian expat travel insurance options, it's essential to consider your specific needs and circumstances, such as where you're living abroad, your health status, the activities you plan to engage in, and your budget. Here are some reputable Canadian insurance providers and types of policies to consider:

- Manulife travel insurance

- Blue Cross travel insurance

- World Nomads travel insurance

- AXA travel insurance

- Cigna Global insurance

Manulife travel insurance: Medical expenses up to $5 million

Manulife travel insurance offers a variety of plans to suit different needs and budgets. Their plans include coverage for medical expenses, trip cancellation, lost luggage, and emergency medical evacuation. They also offer a variety of add-on benefits, such as coverage for pre-existing conditions and lost passports.

Here are some of the features of Manulife's expat travel insurance plans:

- Medical expenses up to $5 million

- Trip cancellation and interruption up to $5,000

- Coverage for lost luggage up to $1,000

- Emergency medical evacuation up to $1 million

- Coverage for pre-existing conditions with an additional premium

- Protection for lost passports with an additional premium

- Comprehensive coverage

- Variety of plans to choose from

- Competitive prices

- Good customer service

- Some plans may not be as comprehensive as others

- Add-on benefits can be expensive

- There may be waiting periods for certain coverages

Blue Cross travel insurance: Medical expenses up to $10 million

Blue Cross travel insurance also offers expat travel insurance plans for Canadian citizens. Their plans are designed for people who live and work outside of Canada, and they offer a variety of coverage options to suit different needs and budgets.

Here are some of the features of Blue Cross's expat travel insurance plans for Canadian citizens, which include coverage for:

- Medical expenses up to $10 million

- Lost luggage up to $1,000

- Pre-existing conditions with an additional premium

- Lost passports with an additional premium

- Repatriation of remains

- Dental and vision care

- Prescription drugs and mental health services

- Worldwide travel

Here are some of the pros and cons of Blue Cross's expat travel insurance for Canadian citizens:

- A global network of providers

- Coverage for worldwide travel

You can weigh multiple expat travel insurance plans against each other right here using our comparator below. You can also get tailor-made quotes for these plans in seconds.

World Nomads travel insurance: Designed with expats in mind

World Nomads travel insurance , offers travel insurance designed with expats in mind, allowing for flexibility in coverage duration. You can tailor your insurance to your specific needs, whether you require it for an extended period or a shorter trip.

The convenience of World Nomads' online travel insurance is a significant advantage. It's accessible to most nationalities, regardless of their location outside their home country. This means you can purchase coverage while abroad, and you don't need to be physically present in your country of residence to do so.

Here are the pros and cons of World Nomads travel insurance:

- Flexible travel insurance options

- Accessible online even when you've left your home country

- Comprehensive coverage for various activities and events

- Depending on your trip's duration, you may face higher premiums

- There are specific policy conditions to consider

- May not be the ideal choice for expats with highly specialized needs or living in high-risk areas

Good to know

What is expat travel medical insurance?

Expat travel medical insurance, also known as expatriate travel health insurance, is a specialized type of insurance designed to provide medical coverage and protection for individuals who are living and working in a foreign country, away from their home country or country of origin. This type of insurance primarily focuses on covering medical expenses and related healthcare costs that expatriates may incur while residing in a foreign country.

AXA travel insurance: An affordable option

AXA is a large insurance company that offers a variety of travel insurance plans, including plans for expats. Their plans are generally less expensive than some of the other options, but they may not offer as much coverage.

Here’s what AXA travel insurance covers:

- Medical expenses

- Trip cancellation and interruption

- Lost luggage

- Emergency medical evacuation

- Baggage delay

- Personal liability

- Cancellation of connecting flights

- Missed connections

- Accidental death and dismemberment

Pros of AXA travel insurance:

- Generally less expensive than some of the other options

- Offers a variety of plans to choose from, so you can find one that fits your needs and budget

- AXA's website and customer service are easy to use

Cons of AXA travel insurance:

- AXA's travel insurance plans may not be as comprehensive as some of the other options.

- There may be waiting periods for certain coverages, such as pre-existing conditions.

Cigna Global Insurance: International network

Cigna Global is a well-known and respected insurance company that offers a variety of international health insurance plans for expats. Their plans are comprehensive and cover a wide range of expenses, including medical, dental, and vision care, as well as emergency evacuation and repatriation.

Cigna Global covers:

- Prescription drugs

- Mental health services

- Maternity care

Pros of Cigna Global:

- Offers comprehensive coverage for a wide range of expenses

- Has a global network of providers, so you can get care wherever you are in the world

- Provides 24/7 support, so you can get help when you need it

- Has a good reputation for customer service

Cons of Cigna Global:

- One of the more expensive options for international health insurance

- There may be waiting periods for certain coverages, such as pre-existing conditions

Staysure expat travel insurance is for Brits living in France, Spain, or Portugal, covering pre-existing medical conditions. It also covers medical emergencies and repatriation, cancellation, curtailment, baggage claims, personal liability, and more.

Save up to 25% on your travel insurance with our partner soNomad

Get a quote

1-888-550-8302

Sunny has over six years of experience curating engaging content spanning across industries. Specifically in finance, his expertise is insurance reviews and lending and investment topics.

This message is a response to . Cancel

- Guide to Health Insurance Abroad

- Understanding international insurance

Our complete guide to understanding the importance of international health insurance

- My destination

- North America

- Latin America

- Middle East

Apply for an AXA Expat Insurance

- Expat Assurance

- Publié le 22 September 2021

Taking out an AXA expat insurance policy is one of the many solutions available to people who move abroad.

It offers a complete level of coverage that will protect them and their family members during the expatriation.

Know More About AXA International Medical Insurance

Axa: leader in international insurance.

AXA is a French company that ranks among the world’s largest insurance companies.

Its history dates back to 1810. But it didn’t become a major player in the industry until the 1980s. Now, it has more than 107 million customers worldwide.

Today, AXA offers a wide range of international health coverage for expatriates, students, and travellers.

AXA Expat Insurance: A Serious and Reliable Solution

Choosing AXA expat health insurance means entrusting your medical coverage to an expert. This insurer has proven international expertise.

It’s well known for its reliability, and it has an in-depth understanding of the problems encountered by expatriates.

AXA is also able to mobilize the necessary logistics to respond to emergencies at any time. And it has partnerships with local health networks all over the world.

What Does AXA Expat Health Insurance Cover?

When should i get axa international health insurance.

It is possible to subscribe to an AXA expat medical insurance in the following cases:

- As a 1st euro insurance when you don’t have any protection in your country. Or if you have it, but it is not complete enough

- In addition to Social Security if you are affiliated. It will grant you extended coverage and better reimbursements.

A Complete Range of Services

AXA’s expatriate insurance covers you and your dependents worldwide. This includes temporary stays in your home country.

It is possible to choose between a wide range of services to include in your policy.

AXA Expat Medical Insurance Includes Assistance and Repatriation

Repatriation services are almost a must for any expat. With AXA, it will cover you and your family members in case of illness or accident requiring treatment abroad.

Find out what is included:

- Repatriation of the body and return of relatives in the event of death

- Coverage of the travel and stay expenses of relatives in the event of hospitalization in the country of expatriation

- Evacuation in case of a health or political crisis.

Health care

AXA international health insurance covers:

- Routine health expenses

- Dispatch of prescribed medication that is not available in the country of expatriation

- Possibility of coverage of psychological care or alternative medicine (acupuncture, osteopathy, etc.)

Hospitalization

AXA covers expenses related to hospitalization. It also waives the advance payment of costs.

AXA expat insurance provides access to useful services such as:

- Remote consultation with a doctor from your home country by telephone or videoconference

- Delivery of prescriptions in certain countries

- Medical advice is available 24/7.

It is possible to add additional coverage to your insurance, such as:

- Assistance in case of loss or theft of documents or personal effects

- Protection and legal assistance

- Coverage for leisure sports activities, etc.

AXA also offers you a policy that provides daily allowances in the event of temporary incapacity to work or disability.

Is AXA Expat Insurance Right for Me?

Taking out an AXA expatriate insurance policy is the guarantee of very complete coverage.

However, as with any private insurance, a medical questionnaire is mandatory at the time of enrollment.

And it may result in exclusions or restrictions in case of chronic illness or medical history. As well as an increase in the cost.

It is therefore important to compare the AXA international medical insurance offer with other plans available. Either as Social Security supplements or as 1st dollar/euro insurances.

But, with so many offers available, it can be difficult to make a choice.

The easiest and quickest way to decide is by using an online insurance comparator. It will allow you to compare the rates and services of each. As well as the ceilings and deductibles applied by each insurer.

Request a call

We know, you are very busy, and so are we! If you prefer to choose the date and time for us to call each other, just do so using the calendar !

This is also interesting:

What are the best countries to move to?

- Publié le 5 March 2021

- in Expatriation

Travel insurance repatriation costs

- in Expat Insurance

Moving to another country? Discover all the advantages!

Top countries to live in Europe [Guide 2021]

Insurance options, © copyright expat assurance 2024 | all rights reserved.

- Guide de l'assurance à l'étranger

- Ma destination

- L'Amérique du Nord

- L'Amérique latine

- Le Moyen-Orient

Être rappelé·e

On le sait, vous êtres très occupé·e, et nous aussi ! Si vous préférez choisir la date et l’heure pour qu’on s’appelle, il vous suffit de le faire grâce au calendrier ci-dessous !

5000 families

trust Expat Assurance

Passing Thru Travel

Travel Insurance 2024 – 10 Things You Need to Know – Choosing the Right Policy for International Trips

Posted: February 20, 2024 | Last updated: February 20, 2024

Traveling internationally is an exciting adventure, but it also comes with its share of uncertainties. Choosing the right travel insurance is one of the most important steps in planning your trip. Travel insurance can protect you from many unexpected circumstances, from medical emergencies and trip cancellations to lost luggage and flight delays. This guide will explore ten different travel insurance offerings, helping you make an informed decision for your next international journey.

World Nomads

World Nomads is widely acclaimed for its flexibility and comprehensive coverage, catering especially to adventurous travelers. Their policies often include activities that other insurers typically exclude, such as scuba diving, skiing, and hiking. Coverage extends to medical emergencies, trip cancellation, interruption, and baggage loss. They also provide tech gear coverage, a bonus for digital nomads. Their 24/7 emergency assistance is a key feature for those traveling to remote destinations.

Insider’s Tip: Check their activity list to ensure your adventure sport is covered.

Allianz Global Assistance

Allianz Global Assistance offers a variety of plans, allowing travelers to choose a policy that best suits the nature and budget of their trip. Their offerings range from basic emergency medical coverage to more comprehensive plans including trip cancellation, interruption, delay, baggage loss, and emergency medical transportation. Their annual plans are economical for frequent travelers. The 24/7 assistance service is invaluable for dealing with emergencies or unexpected changes in travel plans.

Insider’s Tip: Consider their multi-trip annual plans if you travel frequently.

Travelex Insurance Services

Travelex is renowned for its user-friendly policies, providing essential coverage like trip cancellation, interruption, medical expenses, and evacuation. They have a particular focus on family travel, with children under 17 covered at no extra cost under a parent’s policy. The Travel Select plan stands out for its upgrade options, allowing travelers to add coverage for adventure sports, additional medical coverage, and car rental protection.

Insider’s Tip: Their Travel Select plan is highly customizable with upgrades.

AXA Travel Insurance

AXA Travel Insurance offers a range of plans, including single-trip, multi-trip, and annual plans, each with varying levels of coverage. They cover medical emergencies, trip cancellation, and baggage loss, and offer additional options like “Cancel for Any Reason” coverage. Their plans are known for high coverage limits and the option to add adventure sports coverage, making them a versatile choice for different types of travelers.

Insider’s Tip: Look into their “Cancel for Any Reason” coverage for ultimate flexibility.

IMG (International Medical Group)

IMG specializes in medical travel insurance, ideal for travelers prioritizing health coverage. Their plans range from basic medical coverage to comprehensive policies that include evacuation, trip cancellation, and adventure sports. They also offer unique plans for travelers such as expats and missionaries. The inclusion of pre-existing conditions and their global network of hospitals make them a strong contender in medical travel insurance.

Insider’s Tip: Their global network of hospitals can be particularly useful.

Seven Corners

Seven Corners stands out for its flexibility and range of plan options. They offer medical coverage, trip cancellation, and interruption insurance, with unique features like the ability to choose your medical facility abroad. Their RoundTrip plans are particularly beneficial for trip cancellation, offering reimbursement for trip costs due to unforeseen cancellations.

Insider’s Tip: Their round-trip plans are great for trip cancellation coverage.

Travel Guard by AIG

Travel Guard by AIG offers a comprehensive range of travel insurance plans. Their offerings include medical expenses, evacuation, trip cancellation and interruption, baggage loss, and flight insurance. The Gold Plan is notable for its family-friendly coverage, offering coverage for children at no additional cost, making it an excellent option for family vacations.

Insider’s Tip: Their Gold Plan is ideal for families traveling with children.

HTH Worldwide

HTH Worldwide is known for its high medical coverage limits and extensive network of medical providers worldwide. They cover various medical services, including pre-existing conditions and medical evacuation. Their plans also cater to students and expatriates. The mobile app, which helps find local healthcare providers, is a notable feature for travelers in unfamiliar destinations.

Insider’s Tip: Use their mobile app to find qualified medical care internationally.

Cigna Global

Cigna Global is a leader in international health services, offering extensive medical insurance coverage. Their customizable plans allow travelers to add modules like vision and dental care. Their 24/7 customer support, providing assistance and guidance in medical emergencies, is a critical feature.

Insider’s Tip: They offer 24/7 customer support, which is useful for emergencies.

Generali Global Assistance

Generali Global Assistance provides traditional travel insurance coverage along with specialized services. Their plans cover trip cancellation, medical emergencies, and baggage loss, and offer concierge services. Their premium plans are ideal for sports enthusiasts, offering coverage for sporting equipment and adventure sports activities.

Insider’s Tip: Their premium plans offer coverage for sporting equipment.

The Bottom Line

Choosing the right travel insurance policy is crucial for peace of mind on your international travels. Whether you prioritize medical coverage, trip cancellation insurance, or specific needs like adventure sports coverage, there is a policy to suit your travel style. Always read the fine print, understand the extent of the coverage, and consider any pre-existing conditions you might have. With the right travel insurance, you can embark on your international adventures knowing you’re well-protected against the unexpected.

More Articles Like This…

Barcelona: Discover the Top 10 Beach Clubs

2024 Global City Travel Guide – Your Passport to the World’s Top Destination Cities

Exploring Khao Yai 2024 – A Hidden Gem of Thailand

The post Travel Insurance 2024 – 10 Things You Need to Know – Choosing the Right Policy for International Trips republished on Passing Thru with permission from The Green Voyage .

Featured Image Credit: Shutterstock / Song_about_summer.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.

More for You

Cicada Map Shows States Where Trillions of Bugs Will Emerge

6 Of The Worst Things To Order At Subway, According To Employees

7 CDs You Probably Owned, Threw Out and Now Are Worth Bank

Pilot reveals what happened moments before Boeing 737 Max slid off taxiway

Fact Check: The Truth About Claims That Mark Wahlberg and Mel Gibson Are Launching 'Non-Woke' Film Studio

17 Workplace Norms Millennials Won’t Accept Anymore

What Happens to Your Body When You Eat Blueberries Every Day

Wreckage and clean-up operations at destroyed Baltimore bridge

13 Menu Items McDonald's Employees Refuse To Order

34 movies to watch before they leave Netflix this month

Michael Jordan Senior Flight School Charged Middle-Aged Men $15,000 For Experience Of Lifetime

36-year-old brought in $77,000 in passive income from Etsy in 2023—she spends 5-10 minutes per day on it

The 9 Best Canned Foods You Should Be Eating for Weight Loss, According to Dietitians

‘Inspiration porn’: Paralympian says not all disabled people are heroes

Cruise ship buffet taboos: 10 things you should never do at mealtime

Ukraine Rues Missed F-16 Opportunity

19 American Foods that Are Not Allowed in Other Countries

The best big college town in the US—and see the rest of the top 50, according to data

42 Keto Recipes to Add to Your Weekly Menu

Catastrophic mistake led to US town being abandoned – but 5 people have stayed

5 Best Travel Insurance Options (For Expats and Travelers)

How do I choose good travel insurance? This is a question we get asked all the time. Which provider is best? How can I get coverage as an expat? In this post, you’ll learn about the best travel insurance for travelers and expats traveling abroad.

When we moved to Ecuador we lost eligibility to buy travel insurance from Canada.

The providers we contacted all stipulated that we must be Canadian residents. In researching other providers, this seems to be pretty common. Like all expats, we lost residency in our home country when we settled in our new one.

In this post, we share providers that will insure expats living abroad.

Some insurance providers have an age restriction (there are maximum ages depending on the country of residence). This is an issue for many travelers and expats. So for the past two days, I’ve been researching travel insurance for expats.

Here’s what I discovered.

3 Best Options for Expat Travel Insurance

If you want to save the time of reading the full post, you can check out these top three providers:

- Atlas Travel Insurance

- World Nomads

- SafetyWing Valid for travelers from 15 days old to 69 years old. This insurer is different than the others – you don’t have to pre-purchase the full policy before traveling. Just set up the subscription – renewable in 4-week increments. This is popular with digital nomads who travel to multiple countries.

1. Atlas Travel Insurance

Requirements: you must be at least 14 days old and traveling outside of your home country .

What is your country of residence? If you are a US citizen, your home country is always the United States (regardless of residency issues). For all non-US citizens, your home country is where you principally reside and receive regular mail.

6 Benefits of Insuring with Atlas Travel

- Adventure Sports: Most travel insurance policies exclude adventure and sport activities from coverage. Things like zip-lining and scuba diving aren’t covered with most policies. With Atlas Travel you are covered for a wide variety adventure sports. Find the list of excluded sports here .

- Global Coverage: Receive medical care in a foreign country. This can reduce/eliminate paying out-of-pocket while abroad.

- Emergency Medical Evacuation / Emergency Reunion: For return to your home country in the case of potential loss of life or limb. Emergency Reunion will bring an immediate family member to you – to either stay with you or help you return home.

- Return of Minors: In case of your hospitalization, your children are covered to return back to your home country.

- Common features such as: Accidental death and dismemberment, repatriation of remains, natural disaster, and terrorism coverage.

- Online Account Management: Gone are the days of paper policies. Purchase your policy, manage your account and submit claims online.

Learn more about Atlas Travel insurance

2. World Nomads

Things you should know about world nomads.

- World Nomads travel insurance has been designed by travelers for travelers. If you leave home without travel insurance or your policy runs out, you can buy or extend while on the road.

- Considering travel insurance for your trip? World Nomads offers coverage for more than 150 adventure activities as well as emergency medical, lost luggage, trip cancellation and more.

3. SafetyWing

SafetyWing is different than traditional travel insurance. It is an insurer created by digital nomads – for, you guessed it, other digital nomads.

Once you purchase your policy, you can auto-renew in 4-week increments while you travel .

Of course, you can also purchase for a specific number of days.

There is good coverage for medical and travel – including lost luggage, trip interruption and delay, emergency medical evacuation. Medical coverage includes hospital, ICU, ambulance, emergency dental, and more. See details below.

- Medical Coverage includes hospital, intensive care, ambulance, urgent care (with $50 co-payment), physical therapy and chiropractic care, and emergency dental. Other eligible medical expenses are covered to the overall maximum limit. With SafetyWing, you pay just $250 deductible with a $250,000 maximum limit. Of course, any of these details are subject to change. Please check directly with SafetyWing to confirm their current coverage and limitations.

- Travel Coverage includes trip interruption, trip delay, lost checked luggage, emergency medical evacuation (up to $100,000 lifetime), political evacuation, natural disaster coverage, and more. Please check directly with SafetyWing to confirm their current coverage and limitations.

As with most travel insurance, they exclude high-risk sports, pre-existing disease and injury, and cancer treatment.

Get a quote with SafetyWing

I haven’t traveled with them yet, but I’m planning to give them a try on my next trip. I like the subscription model. And it looks less expensive than other companies I’ve gotten quotes from.

So there you have it. Some travel insurance options. When you are traveling abroad there is an increased risk of a fall or another easy injury. Without insurance, you could be looking at a very large bill.

Please note: This post is not an offer to sell insurance but a listing of the possible options. Please confirm all details with the insurance company before making any purchase or travel decisions. Details and specifics can (and do) change quickly and without notice. If you notice an error in this post, please comment below and I’ll update it.

What insurance provider have you used? What company/policy do you recommend?

Hi, I'm Bryan Haines . And I'm a co-founder of Storyteller.Travel . I'm a traveler and photographer.

I also blog about photography on Storyteller Tech .

Similar Posts

![axa travel insurance for expats How to Choose the Best Camera for Safari [Buyers Guide]](https://storyteller.travel/wp-content/uploads/2018/03/best-camera-for-safari-768x548.jpg)

How to Choose the Best Camera for Safari [Buyers Guide]

Heading on a safari? Congratulations! Here’s how to choose the best camera for safari and trekking adventures. We also include a detailed Buyers Guide that breaks down the 9 primary considerations when deciding on a camera for your upcoming African safari. What else should you bring? Don’t forget anything with our Complete African Safari Packing…

![axa travel insurance for expats Complete African Safari Packing List [Checklist and Guide]](https://storyteller.travel/wp-content/uploads/2018/03/safari-packing-list-768x576.jpg)

Complete African Safari Packing List [Checklist and Guide]

What do you need to pack for your upcoming safari? In this guide, you’ll get the complete African safari packing list – including 4 factors to consider when packing, how to pack minimalist, and just what to include with specific recommendations. We also include things that you shouldn’t bring on your safari. Ultimate African Safari…

7 Best Portable Water Filters & Travel Purifiers: 7 Factors Compared

If you’re traveling to rural areas abroad, you need to decide how you’ll filter your water supply. In this huge guide, you’ll learn how to choose the best portable water filter and purifier for your travels. We include factors to consider, plus common water risks, and answer commonly asked questions about water. How to Choose…

43 Family Camping Games and Activities (For Kids and Adults)

How are you planning on spending your time while camping? In this huge guide, you’ll find 43 camping games and activities. There is something for everyone – from the little kids to families and adults. Keep this guide close and have an amazing camping trip! 43 Camping Games and Activities: Kids, Families, Adults The tent…

How to Make Money While Traveling: Blogging, Web Design, Photography

In this post, you’ll learn how we became location independent. And how to make money while traveling and living abroad. I’ll cover the specific ways we make money while traveling and living abroad, including blogging, web design, and photography. How to Make Money While Traveling Last week, a reader wanted to know how we…

29 Best Books About Ecuador: Travel, Expat, Maps, History

As we planned our move to Ecuador we bought a lot of books. Not just books to learn Spanish or books about becoming expats. Once we decided on Ecuador, we were hungry for information about what was actually there (here). Thinking about Ecuador retirement? Check out the list of the top books about retirement in Ecuador at…

52 Comments

Thanks for the information about travel insurance. Does it cover routine doctor visits and medications that would relate to what would be called a pre existing condition? ie high blood pressure, diabetes for example? Thank you

Thanks for this detailed write up! I just purchased a policy from Atlas Travel using your referral link. All the best, Goats. Oh, and I really like your YouTube videos! 🙂

Help! I am not the dumbest pooch in the pound, but the req for health insurance for tourists of less than 90 days (3 Weeks) has me confused. Some posts say ‘all’, others say after 90 days. I am 74 and some companies won’t insure. Do you know if VA and Med part B are good enough.? If not, which can you recommend. See that some have age cutoff. Thanks. Bob

Hi Bryan, Off the topic a bit, but how do Expats get their social security payments transferred to hem as Ecuadorian Banks are not on the ACH network? As i understand it, and I could be wrong, credit cards are not as generally accepted as in N.America, with there being a preference for cash as a mechanism for purchasing goods.

An easy solution is to have SS transferred to a US bank, then access it via a credit card &ATM. Works for me! JL in Ecuador

For Americans at least, another alternative is squaremouth . They are an online travel insurance brokers selling annual and single trip coverage from a variety of carriers including some listed here and others that are not listed here.

Is there a health coverage amount limit or requirement for temporary/visitors insurance in Ecuador?

I currently have Anthem health insurance. When traveling to Ecuador, do I need additional insurance? Thank you, Tom

Does medicare with medicare supplement qualify?

medicare and supplemental medicare policies cover only within the US.

When a friend wants to visit Ecuador for a week, does he need this health insurance?

It is an entry requirement, so regardless of how long someone will be visiting, they’ll need health insurance to enter the country. Many policies now allow for very short-term trips.

We are in a bind. Arrived on tourist visas BEFORE proof of health insurance was required. Now, to get Visa extensions (which we need before we can apply for residency) we need proof of healthcare. BUT, when we go to sites to get cheap healthcare, they require we are IN our home countries and purchase BEFORE we leave. I’m an American and Brazilian citizen. My boyfriend is Australian. Any ideas? Am sure others got caught in this same situation…

Changing rules create some interesting situations… Have you checked World Nomads ? I just tried the quote app and it looks you can purchase from anywhere. We have traveled with this insurance many times and it is super flexible. I know that you can extend while traveling. Let me know how it works out for you.

Thank you. World Nomads did let us sign up, easily when already in Ecuador 😊

We live here full time, but are US citizens. So with Wnomads do i say Im travelling to Ecuador but am resident of US? or ?

Did you move back to Ecuador??? The last time we talked you had moved back to Nova Scotia for Health Reasons??? If you are back in Ecuador Fantastico Mis Amigos Hasta Luego

Bryan, Do you know if Medicare satisfies Ecuador’s insurance requirement until you get your permanent residency? Will it suffice to get your residency?

Can I ask why you chose World Nomads over Atlas Travel when Atlas seems to cover more things (like extraction, and returning minors home)?

Nothing huge – I just found World Nomads easier to sort out and liked their offering.

If someone already has medical insurance that covers international medical care, but must be paid out of pocket first and then is reimbursed at home in the U.S., is this insurance still necessary? What sort of documentation do you need to show and to whom?

I’m planning on traveling to Ecuador next September, for a month, to see if I’d like to move there. I checked my Medicare Supplement policy, and I have 60 days of covered travel outside the US, with a $250 deductible and then it pays 80% of anything up to $50,000, for any medical need that occurs during that span of time. Do you think that will satisfy Ecuador’s requirement until I actually move there? If and when I do move there, I’ll need to consider the cost of purchasing health insurance from one of the providers and dropping Medicare Part B and the supplement, which I think cost about $250/ month right now. I think it will be close to an even swap. I’ll keep Part A, and if I ever return to the US, I can ad Part B back in. I’d really like to hear from others living there about how they have handled it.

I have used World Nomads for the last year and a half. I always bought the 6 month policy, and it cost $335. Now to renew it is $536 for a 6 month policy. That is a 62% increase. I did use the coverage over a year ago, and I have NO complaints. This rate increase is tough to swallow though.

Hi Bryan I REALLY need to find a Reputable person or company to help facilitate my relocation to Cuenca. Does anyone have someone that they’ve personally dealt with and were 100% (or close to it) happy? PLEASE let me know soon. Thanks a bunch. Alice

I can recommend Isaac May, who is a realtor here but Ive seen him take care of everything, for many of his clients and refer you to the best people if he cannot ie visas. etc . write me here and ill send his email. Lulie

Lulie, I would also like the info for Isaac May. but I don’t see a way to write you here.

Point of Information Allianz is Now available in Canada ….I was in Ecuador in April and Purchased Allianz in Canada.

Thanks Joseph!

Can I ask what health insurance you use while you are in Ecuador? You noted that you use WorldNomads when you left Ecuador, as you would be considered a traveler during those time spans. I just became a permanent Ecuador resident (received VISA) and I consider it my home, but I haven’t gotten my cedula yet. I was informed that my new permanent resident status has voided my travel’s insurance even though I already paid for it through a future date. Do you have any suggestions for coverage until I get my cedula? I don’t think traveler’s insurance would work as I am no longer a traveler.

Thanks for your recommendations. Will definitely look into Atlas, which seems to offer a wide cover, particularly as it covers people of age too.

Okay, batting 0. I followed your new link to the AIBB FRONTIER INSURANCE……..their site is down. 🙁

I see that as well. It looks temporary – sometimes sites will be down for a few hours due to maintenance or another issue. (We’ve had the same problems, once in a while).

Your AAIB/Frontier link is invalid. Perhaps they changed their site? Their main url is now: http://www.frontier-insurance.com/ Unfortunately their “get a quote” link does not work on their site, though the other links do?

Thanks Burt – I’ll check this and update it the first of the week.

Hi Bryan, Sadly, Atlas Insurance won’t allow you to buy their insurance if you live in Canada, Australia or some parts of the USA. Don’t know why this is. I called them to find out if there was any other option but got the robot, then put on hold and eventually i hung up. My next option was World Nomads from your site but the age restriction means i’m out of luck on that one. Back to the drawing board.

The rules can certainly be confusing. I don’t know why they have exclusions for specific areas. Have you tried Travelex ? I’ve heard good things about them, and they insure residents of almost every country. World Nomads recently changes their policy for US residents – now insuring everyone under the age of 70.

Thanks for the reply Bryan. I was able to get a good rate from Presidents Choice…a reputable name here. 🙂

Nice – glad to hear it.

Thanks for the information. Any knowledge on insuring 2 adults & a minor for 6-12 months.

I’ve never bot travelers insurance unless I was forced to by a British Travel Agency (out of the USA by internet). They all seem to require it but were only interested in “extraction” insurance and medical evacuation kinds of stuff. Not insuring the airline ticket, travel agent, etc. My personal philosophy is to insure against disasters, which is relative, I know. But losing the price of 2x airline tickets doesn’t qualify for me. But the Brits wanted travel insurance and 5 or 6 times, I’ve had to get it and here’s where I get it from: Squaremouth is a meta-site that has many, many insurance companies. You start by filling in your rough data – like age, where/when you’re going, etc. They you get a page of side by side comparisons of insurance companies that you’ve likely never heard of before. There is also a ranking of their security of the company and user ratings. I only buy the minimum but you can sign up for any options you like. It’s an easy one-stop shopping site. Works for me.

Thanks for sharing your experience.

Thanks for posting this. We are current WorldNomads customers who formerly used FrontierMedex, and have been extremely satisfied with both providers. I filed extensive claims with Frontier, including a stint in a Bangkok hospital for a double hit of malaria I picked up in India, and they were nothing short of fantastic. Contacted and kept in touch with the hospital, pre-authorized the claim, etc. Couldn’t have been better. We’re new to WorldNomads (less than a year) but so far we’re also impressed with their ease of access and responsiveness to claims and questions (though there have happily been few.) A word of caution to steer clear of the Philippines-based IBERO Filipinas, which is a nightmare of a provider who exploits short-term travelers and often sells through travel agents. They are incompetent, obstructionist and extremely difficult to deal with. I am in a pitched battle with them for a year-old claim they have approved but still not resolving, as they continue to lose documents I send them and bounce me around from department to department. Best to go with one of your winners. Thanks for posting.

Thanks for sharing your experience. So glad to hear about your success with these two providers.

Hi Dena and Bryan, Thanks a lot for bringing up the topic about insurance, it is a very important one indeed. I am French and I am pretty sure rules must be totally different from Canada ones therefore I will get in touch with my insurance provider and ask them for advice. I will post the response on your blog so as other people will be able to get the information. I would have a question on a different topic: does someone know about the translation market in Ecuador? Have a great weekend ! Kindest regards from Daniela

When I decided to stay and officially make Ecuador my place of residence, I shopped around for health insurance. Key was that I was not yet 65 years old. I eventually selected BMI, an Ecuador company affiliated as most with other international companies. When I travel, it pays directly to the medical facility for up to one month and then after I have to pay and claim. There is now a remote possibility that I might move to Europe within the next year and stay their for five years before returning to Ecuador. If I drop the Ecuador BMI insurance when gone, at my age I would not easily get it back. The only answer would be to get insurance in Europe for the time there. In my case I would expect to have a company pay for the European insurance. This, however, raises an important matter for travel and place of resident health insurance – Be aware that where you think you will be one day may not be where you will actually end up. Be very cautious.

Although this post is about travel insurance – which is temporary in nature – you make a good point. Health insurance is often based on country of residence and if that changes then you may not qualify anymore. We’ll be covering health insurance in an upcoming post.

I”m confused by the “home country” and “residence” issues. According to this info, if I’m a citizen of the U.S. but reside in Ecuador and am over 66, I can’t use any of the above?? I’ve always used World Nomads but didn’t know they had an age limit! (I’ll be turning 66 before my next trip back to the States) Thanks for all this info!

The main issue seems to be country of residence. When you go to any of these sites to get a quote, it will ask for country of residence. They generally are looking for where you are actually living – regardless of your legal status in that country. When I say “home country” I am referring to where you are from. Frequently expats cannot get insurance from their home country because of being a resident of another one.

One must be very careful. As a Canadian expat, Revenue Canada, the tax collectors, have me officially identified as a “non-resident” and I pay a lower tax rate on my Canadian income. Revenue Canada has very strict rules that they enforce because they want to get all the money from you that they can. You must be completely (almost) removed from Canada with no intention of returning. People have lost their non-resident tax status for not cancelling their Provincial driver’s license of having too many bank accounts in Canada. If one lives in Ecuador and, for insurance purposes, declares Canada , they may be at risk if the tax man finds out.

You’re right that you need to be careful. There is a form that you can submit and get an actual ruling. We did that and now we can confidently submit tax returns, etc. The laws are quite straight forward. If you are a resident of Ecuador you won’t consider you a resident of Canada. We talk more about it in this post . For insurance purposes, it seems that the companies are asking where you reside – not where you are a citizen.

Ohhh, I have to start shopping around, so THANK YOU for doing the legwork for me!

Absolutely!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Nationwide Travel Insurance

- AXA Assistance USA

- Seven Corners Travel Insurance

- HTH Worldwide Travel Insurance

- World Nomads Travel Insurance

Cruise Travel Insurance Tips

- Why You Should Trust Us

Best Cruise Insurance Companies of April 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

A cruise vacation can take much of the stress out of planning a vacation. With a pre-set itinerary on the high seas, you don't have to worry about how you're getting to your destination and what you're going to do there. However, an unexpected emergency can take the wind out of your sails and money out of your travel budget. So you'll want to ensure you have the best travel insurance coverage that won't leave you high and dry in an emergency.

Best Cruise Insurance Companies

- Nationwide Travel Insurance : Best Overall

- AXA Assistance USA : Best for Affordability

- Seven Corners Travel Insurance : Best for Seniors

- HTH Worldwide Travel Insurance : Best for Expensive Trips

- World Nomads Travel Insurance : Best for Exotic Locations

Compare the Top Cruise Insurance Offers

- Trip cancellation coverage of up to 100% of trip costs (for cruises) or up to $30,000 (for single-trip plans)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Three cruise-specific plans to choose from

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual travel insurance plans available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong trip cancellation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cancel for any reason coverage available

- con icon Two crossed lines that form an 'X'. CFAR insurance not available with every single plan

- con icon Two crossed lines that form an 'X'. Medical coverage is lower than what some competitors offer

Nationwide Travel Insurance offers many of the standard benefits you might see with a travel insurance policy. This can include things like trip cancellation coverage, so you can recover pre-paid costs or trip interruption in the event your vacation is interrupted by an unexpected event. There's also baggage delay coverage and medical coverage.

- Cancel for any reason coverage available

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Diverse coverage options such as CFAR, optional sports equipment coverage, etc.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Available in all 50 states

- con icon Two crossed lines that form an 'X'. Prices are higher than many competitors

- con icon Two crossed lines that form an 'X'. Reviews around claims processing are mixed

- Trip cancellation insurance of up to 100% of the trip cost

- Trip interruption insurance of up to 150% of the trip cost

- Cancel for any reason (CFAR) insurance available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Three plans to choose from

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Reasonable premiums

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. CFAR coverage available with some plans

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High medical emergency and evacuation coverage

- con icon Two crossed lines that form an 'X'. Special coverages for pets, sports equipment, etc not available

- con icon Two crossed lines that form an 'X'. Limited reviews with complaints about claims not being paid

- Trip cancellation of up to $5,000 with the Economy plan and up to $50,000 with the Preferred plan

- Cancel for any reason insurance and missed connection insurance available with the Preferred plan

- Baggage delay insurance starting after 24 or 12 hours depending on the plan

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Coverage for 200+ activities like skiing, surfing, and rock climbing

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Only two plans to choose from, making it simple to find the right option

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can purchase coverage even after your trip has started

- con icon Two crossed lines that form an 'X'. If your trip costs more than $10,000, you may want to choose other insurance because trip protection is capped at up to $10,000 (for the Explorer plan)

- con icon Two crossed lines that form an 'X'. Doesn't offer coverage for travelers older than 70

- con icon Two crossed lines that form an 'X'. No Cancel for Any Reason (CFAR) option

- Coverage for 150+ activities and sports

- 2 plans: Standard and Explorer

- Trip protection for up to $10,000

- Emergency medical insurance of up to $100,000

- Emergency evacuation coverage for up to $500,000

- Coverage to protect your items (up to $3,000)

Cruise Insurance Reviews

Best cruise insurance overall: nationwide travel insurance.

Nationwide Travel Insurance is a long-standing and reputable brand within the insurance marketplace that offers cruise insurance plans with solid coverage and reasonable rates.

It has three cruise insurance options: Universal, Choice, and Luxury. The Nationwide Choice plan, for example, offers $100,000 in emergency medical coverage and $500,000 in emergency medical evacuation coverage.

The right plan for you depends on your budget and coverage needs. But each plan offers cruise-specific coverages like ship-based mechanical breakdowns, coverage for missed prepaid excursions if your cruise itinerary changes, and covered service disruptions aboard the cruise ship.

Read our Nationwide Travel Insurance review here.

Best Cruise Insurance for Affordability: AXA Travel Insurance

AXA Assistance USA offers three comprehensive coverage plans: Gold, Silver, and Platinum. Each of these plans offers coverage for issues like missed flights, medical emergencies, lost luggage, and more.

The highest-tier Platinum plan provides $250,000 in medical emergency coverage and $1 million in medical evacuation coverage. The baggage loss coverage is $3,000 per person, and their missed connection coverage is $1,500 per person for cruises and tours.

In addition, travelers can take advantage of AXA's concierge service, which provides an extensive network of international service providers. They'll be able to assist you with things like restaurant reservations and referrals, golf course information, and more. This service could come in handy if you're stopping at a variety of unfamiliar destinations during your cruise.

The coverage limits on AXA's policies are on the higher end compared to other providers. And you can buy coverage for a little as 4% of your trip cost depending on your age, travel destination, and state of residence.

Read our AXA Travel Insurance review here.

Best Cruise Insurance for Seniors: Seven Corners Travel Insurance

Seven Corners Travel Insurance lets cruisers enjoy traveling in their golden years with the knowledge they're covered in the event of an accident or emergency. While other providers do offer coverage to those 80+ years old, Seven Corners is known for its affordable premiums while offering above-average medical expenses and medical evacuation coverage limits — two areas of travel insurance coverage that are even more important as we get older.

Seven Corners also offers the option of a preexisting conditions waiver and CFAR insurance at an additional cost, plus "Trip Interruption for Any Reason" coverage, which you won't find on many policies.

You can choose between the Trip Protection Basic or Trip Protection Choice plans, with the higher-tier Choice plan costing more but providing more coverage.

Read our Seven Corners Travel Insurance review here.

Best Cruise Insurance for Expensive Trips: HTH Worldwide Travel Insurance