- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AXA Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is AXA?

Axa travel insurance plans, which axa travel insurance plan is best for me, can you buy axa travel insurance online, is axa legit, what isn't covered by axa travel insurance, is axa travel insurance worth it.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss , trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

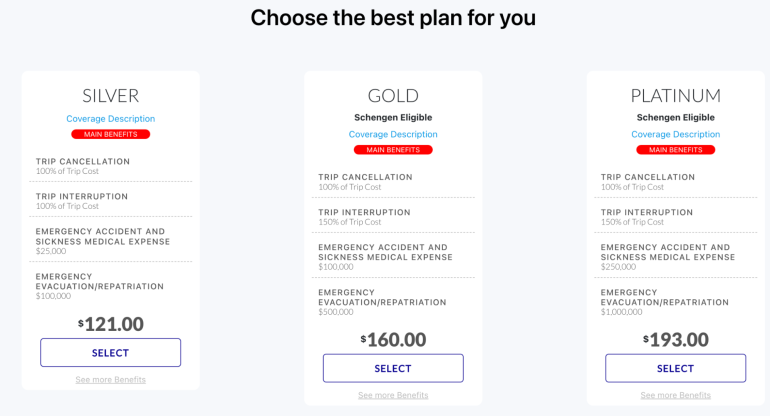

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions , a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

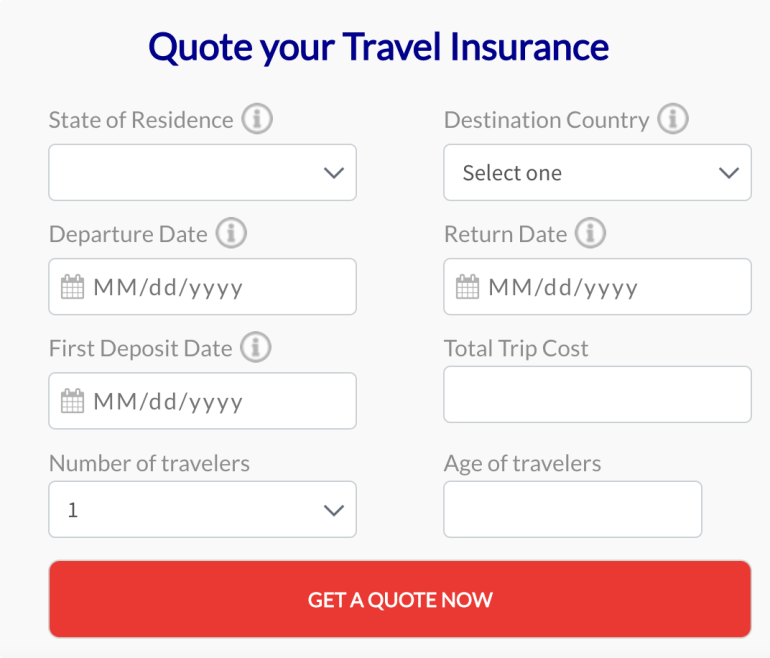

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

AXA handles more than 14 million cases each year, and every plan includes access to their 24/7 assistance hotline. The company is well established and has three plans for travelers to choose from.

AXA travel insurance covers several benefits including but not limited to 100% trip cancellation and trip interruption, medical emergencies, emergency evacuations, baggage delay or lost baggage, and accidental death and dismemberment. The Platinum plan also lets you add Cancel For Any Reason coverage.

AXA's least expensive plan, Silver, and its mid-range Gold policy do not have the option to add-on Cancel For Any Reason coverage. For travelers who opt to purchase the Platinum insurance plan, you can add Cancel For Any Reason coverage a la carte within 14 days of paying the initial trip deposit.

In the event that you need to make a claim, you can upload supporting documents online. If the claim is accepted, you will receive reimbursement within 30 days.

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

How does Travel Insurance Work?

How does travel insurance work.

Picture this: You and your siblings organize a cruise for the whole family to celebrate your parents’ 50 th anniversary. Everyone else has uneventful travel to the destination, but a delay in your outbound flight results in a missed connection. You finally arrive a day late and hours after the ship has departed without you.

Now what? In the worst-case scenario, you’re still stuck at the airport hours later. You feel powerless to do anything more than stare glumly at the vacation photos on your family’s social media feeds.

But if your trip is insured, your AXA-Assist representative already knows about that missed connection and started working on a solution even before you landed. Instead of having to figure it all out on your own, you have a team with the experience and contacts necessary to get you to the next port of call. Our priority is to get you aboard the ship as soon as possible so you can make everyone a little weepy with that toast you’ve been perfecting for weeks.

That’s how travel insurance works. It lets you offload the troubleshooting to the experts and frees you to just enjoy your trip.

What does travel insurance cover?

What exclusions should i be aware of, can i add options to a plan after i buy it but before my trip begins, can i extend my plan after my trip begins, do policies cover travelers individually, or are plans available for couples or families, how much time do i have to file a claim, what documentation do i need to present to support a claim, for trip interruption or trip delay, for medical or dental claims.

- For baggage delay, loss or theft claims

At the baseline, travel insurance covers:

Trip cancellation

Trip interruption

Lost, Misdirected or Damaged Luggage

Medical Emergencies (including Emergency Medical Evacuation).

You can also choose plans that cover medical or dental treatment, car rentals, or optional add-ons such as lost ski days or lost golf rounds.

But those “baseline” bullet points cover more than you might expect at first glance.

For example, if your medical emergency requires hospitalization, our network of doctors and nurses are on call to review your medical records, monitor the care you’re receiving and ensure you’re getting appropriate treatment.

If your condition doesn’t require hospitalization but you need to see a doctor, we can secure an appointment for you at a reputable facility. And we’ll follow up with you by phone after you’re treated to review the care you received and provide further assistance if needed.

Or let’s say you and a group of school friends book a one-week tour together. Prices are based on double occupancy, so everyone pairs up with a roommate, but your roommate gets sick at the last minute and has to cancel. Your travel insurance protects you from getting stuck paying the single supplement.

We’re a global brand, but we’re also people with the same interests and concerns as you. So we get it: even something that others might regard as a little thing can throw your trip off. That’s why we immerse ourselves in details that you might not even think about, like what happens to your pet if your flight home is delayed overnight. The answer? Your Travel Insurance covers reimbursement for that unexpected extra day of boarding your best friend.

We define a pre-existing medical condition as an illness, disease or other condition that you had during the 60-day period immediately prior to the effective date of your travel insurance coverage. That restriction extends to your traveling companions, business partners or family members who are booked to travel with you.

The condition is excluded from coverage unless it is treated or controlled solely by taking prescription drugs or medicine and remains controlled during the 60-day look-back period.

There are options for waiving the pre-existing conditions exclusion if you purchase an AXA-Assist Gold or Platinum plan within 14 days of paying your initial trip deposit.

For additional information, be sure to read your policy’s Terms and Conditions or call one of our representatives to discuss your specific concerns.

We allow you to make changes to your travel protection plan as long as your trip has not already started and you have not filed a claim. Refer to our contact page to get in touch with an AXA-Assist representative about any changes you wish to make to your plan.

Your AXA-Assist policy can cover up to 10 people per plan. They can be, but don’t have to be, family members. The only restriction is that each member of the group covered by your travel insurance plan must live in the same state. (That’s because travel insurance coverage is regulated by state.) If everyone in your travel group lives in the same state, but there are more than 10 people total, you’d have to buy multiple plans to extend coverage to everyone.

The time limit for filing a claim can vary depending on the specific policy you have purchased. It's crucial to carefully review the terms and conditions of your insurance policy document provided by AXA Partners US.

For any type of claim, you must provide your completed claim form, policy verification and booking confirmation. Additional documentation will depend on the reason for your claim and could include, but not be limited to:

claims, a cancellation statement from the travel supplier, documentation of the circumstances (such as injury or illness) that caused the interruption and documentation of expenses you need to have reimbursed.

receipts for costs you paid, a report detailing your diagnosis and the treatment you received and an explanation of the benefits statement from your primary insurance provider, if applicable. Note that if you have a Medicare supplement policy, you must submit charges to your Medicare supplement carrier before you submit your claim to AXA-Assist.

For baggage delay, loss or theft claims

your Property Irregularity Report from your airline, cruise line, or tour company and a copy of the carrier’s written response to the report you filed. In the event of theft, we will need to see a police report. You will also have to provide receipts for essential items you purchased or had repaired and for which you need reimbursement.

Refer to the File a Claim page on our website for additional details and phone contact information for team members who can answer any questions you have.

We wish you safe, happy travels, and we’re here 24/7 to help you resolve your concerns and get back to enjoying your best vacation experiences!

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

- Accessibility statement [Accesskey '0'] Go to Accessibility statement

- Skip to Content [Accesskey 'S'] Skip to main content

- Skip to site Navigation [Accesskey 'N'] Go to Navigation

- Go to Home page [Accesskey '1'] Go to Home page

- Go to Sitemap [Accesskey '2'] Go to Sitemap

- Private Banking

- International Banking

- Lloyds Bank Logo

Everyday banking

Online services & more

How to get online

- Set up the Mobile Banking app

- Register for Internet Banking

- Log on to Internet Banking

- Reset your logon details

Mobile Banking app

- Setting up our app

- App notifications

Profile & settings

- Change your telephone number

- Change your address

- Open Banking

Card & PIN services

- View your card details

- Report your card lost or stolen

- Order a replacement card

- View your PIN

- Payments & transfers

- Daily payment limits

- Pay someone new

- Cancel a Direct Debit

- Pay in a cheque

- Send money outside the UK

Statements & transactions

- See upcoming payments

- Search transactions

- Download statements

Help & security

We're here for you

Fraud & security

- Latest scams

- Lost or stolen card

- Unrecognised transactions

Money management

- Understanding credit

- Managing someone's affairs

- Financial planning

- Personal Tax Services

Banking near you

Life events

- Buying a home

- Getting married

- Family finances

- Separation & divorce

- Bereavement

Difficult times

- Money worries

- Mental health support

- Financial abuse

- Serious illness

Customer support

- Support & wellbeing

- Banking online

- Accessibility & disability

- Banking with us

- Feedback & complaints

- Current accounts

Accounts & services

- Club Lloyds Account

- Classic Account

Silver Account

- Club Lloyds Silver Account

- Platinum Account

- Club Lloyds Platinum Account

- Youth & student accounts

- Joint accounts

Travel services

- Using your card abroad

- Travel money

Features & support

- Switching to Lloyds Bank

- Everyday Offers

- Rates & charges

- Save the Change

- Current account help & guidance

- Mobile device trade in service

Already bank with us?

Existing customers

- Upgrade options

- Mobile banking

Club Lloyds

The current account with exclusive benefits. A £3 monthly fee may apply.

Cards, loans & car finance

Credit cards

- Credit card eligibility checker

- Balance transfer credit cards

- Large purchase credit cards

- Everyday spending credit cards

- World Elite Mastercard ®

- Cashback credit card

- Loan calculator

- Debt consolidation loans

- Home improvement loans

- Holiday loans

- Wedding loans

Car finance

- Car finance calculator

- Car finance options

- Car refinance

- Car leasing

- Credit cards help & guidance

- Loans help & guidance

- Car finance help & guidance

- Borrowing options

Already borrowing with us?

- Existing credit card customers

- Existing loan customers

- Existing car finance customers

Your Credit Score

Thinking about applying for credit? Check Your Credit Score for free, with no impact on your credit file.

Accounts & calculators

- First time buyer mortgages

- Moving home

- Remortgage to us

- Existing Lloyds Bank mortgage customers

- Buying to let

- Equity release

Mortgage calculators & tools

- Mortgage calculator

- Remortgage calculator

- Get an agreement in principle

- Base rate change calculator

- Overpayment calculator

- Mortgage help & guidance

- Club Lloyds offer

- Eco Home offers

- Mortgage protection

Already with us?

- Manage your mortgage

- Switch to a new deal

- Borrow more

- Switch deal & borrow more

- Help with your payments

- Learn about Home Wise

- Your interest only mortgage

Club Lloyds mortgage offer

Our Club Lloyds customers could be eligible for an exclusive discount on their initial mortgage rate.

Accounts & ISAs

Savings accounts

- Instant access savings accounts

- Fixed rate savings accounts

- Club Lloyds savings accounts

- Children's savings accounts

- Joint savings accounts

- Compare savings accounts

- Compare cash ISAs

- Help to Buy ISA

- Stocks & Shares ISA

- Investment ISA

- Savings calculator

- Save the Change®

- Savings help and guidance

- ISAs explained

- Savings interest rates

Already saving with us?

- Top up your ISA

- Transfer your ISA

- Tax on savings interest

- Your personal savings allowance

- Your ISA allowance

Club Lloyds Monthly Saver

Exclusive savings rate with our Club Lloyds current accounts.

Pensions & investments

- Compare investing options

- Share Dealing ISA

- Share Dealing Account

- Invest Wise Accounts (18 - 25 year olds)

- Ready-Made Investments

ETF Quicklist

- Introducing our ETF Quicklist

- View our ETF Quicklist

Guides and support

- Understanding investing

- Research the market

- Investing help and guidance

- Transfer your investments

- Trading Support

- ETF Academy

- Our Charges

Pensions and retirement

- Ready-Made Pension

- Combining your pensions

- Pension calculator

- Self-employed

- Pensions explained

- Top 10 pension tips

- Retirement options

- Existing Ready-Made Pension customers

Wealth management

- Is advice right for you?

- Benefits of financial advice

- Services we offer

- Cost of advice

Already investing with us?

- Log on to Share Dealing

Introducing the new Ready-Made Pension

A simple, smart and easy way to save for your retirement.

Show me how

Home, life & car

View all insurance products

Home insurance

- Get a home insurance quote

- Compare home insurance

- Buildings & contents insurance

- Contents insurance

- Buildings insurance

- Retrieve a home insurance quote

- Home insurance help & guidance

- Manage your home insurance policy

Car insurance

- Compare car insurance

- Car insurance help & guidance

- Log on to My Account to manage your car insurance

Life insurance

- Critical illness cover

- Mortgage protection insurance

- Life cover help & guidance

Other insurance

- Business insurance

- Van insurance

- Landlord insurance

- Make a home insurance claim

- Make a life insurance claim

- Make a car insurance claim

Already insured with us?

Support for existing customers

- Help with your existing home insurance

- Help with your existing life insurance

- Help with your existing car insurance

Get up to £100 cashback

Take care of what you value most, and we'll take care of you - a cashback reward with our range of insurance products: home, motor and life. T&Cs apply.

- Help & Support

- Branch Finder

- Accessibility and disability

- Search Close Close

Internet Banking

Keep me secure

- Packaged Bank Accounts

- Travel Insurance

Packaged Bank Account Travel Insurance

Have peace of mind when you're on holiday with travel insurance that covers you.

About Travel Insurance as part of Packaged Bank Accounts

Travel Insurance, administered by AWP Assistance UK Ltd (trading as Allianz Assistance) and underwritten by AWP P&C SA, is just one of the insurance benefits that come with our Packaged Bank Accounts . Our Silver & Platinum Accounts are packed with benefits including Family travel insurance, AA Breakdown Family Cover and mobile phone insurance for a monthly fee to maintain the account.

Travel Insurance is also a benefit on the Premier , and Gold accounts however these are no longer available to new customers.

If you’re a Platinum, Premier, Gold or Silver account customer, please read our FAQs (PDF, 145KB) for more information about the travel insurance which comes with your account and COVID-19. You can also visit our payment disputes page , for help if your travel has been disrupted.

Compare accounts

How do I make a claim?

You can log your claim online using the Allianz Assistance Hub that can be securely accessed through your mobile banking app or by using Internet Banking. You can also make a claim by calling Allianz Assistance on +44 (0)345 850 5300 .

Eligibility for each account

I have a silver account expandable section.

If you have a Silver Account the account comes with European Travel Insurance for you and your family (if eligible) including Winter Sports. This insurance policy is administered by AWP Assitance UK Ltd (trading as Allianz Assitance) and underwritten by AWP P&C SA.

Am I eligible for cover?

- All cover under the policy stops on the account holders 65th birthday - as long as the account holder is under 65, their spouse, civil partner or partner will be covered until they reach 65 years of age.

- Children must be 18 or under, or 24 or under if they're in full time education and must travel with the account holder, their spouse, partner, civil partner or a responsible adult. There's cover for a dependent child where they are staying with a responsible adult even if they were not accompanied during their travel to the destination.

- Subject to continued eligibility, you and your family are covered for travel within Europe as long as your Silver account is open.

- Keep in mind the cover is provided only if you will be living in the United Kingdom for at least six months during each 12 month period where all trips must start and end.

Medical conditions that you or your family have (or have had), which are not all on the ‘No Screen Conditions’ list in your policy document are not covered by this policy. To see if these can be covered you must call the insurer declaring all medical conditions, including those on the list and an extra cost may apply. Before you book a trip you also need to let the insurer know of any new conditions or changes to existing ones. Please refer to the Silver welcome pack (PDF, 1.7MB) for full details of any exclusions.

Once your account has been opened should you wish to notify the insurer of any medical conditions please call the number below.

- Silver Account: 0345 603 1839

Lines are open 24/7.

Not all Telephone Banking services are available 24 hours a day, seven days a week. Please speak to an advisor for more information.

I have a Gold, Platinum or Premier Account expandable section

If you have a Gold, Platinum or Premier Account, the account comes with Worldwide Travel Insurance for you and your family (if eligible) including Winter Sports. This insurance policy is administered by AWP Assistance UK Ltd (trading as Allianz Assistance) and underwritten by AWP P&C SA.

- All cover under the policy stops on the account holders 80th birthday - as long as the account holder is under 80, their spouse, civil partner or partner will be covered until they reach 80 years of age.

- Subject to continued eligibility, you and your family are covered for worldwide travel as long as your Lloyds Bank Gold, Platinum or Premier account is open.

- Keep in mind there is only cover for losses suffered whilst you are a UK, Channel Islands or Isle of Man resident and are registered with a Doctor in the UK where all trips must start and end.

Medical conditions that you or your family have (or have had), which are not all on the ‘No Screen Conditions’ list in your policy document are not covered by this policy. To see if these can be covered you must call the insurer declaring all medical conditions, including those on the list and an extra cost may apply. Before you book a trip you also need to let the insurer know of any new conditions or changes to existing ones. Please refer to the relevant policy document for full details of any exclusions.

Once your account has been opened should you wish to notify the insurer of any medical conditions please call the appropriate number below.

- Gold Account: 0345 850 5056

- Platinum Account: 0345 850 5300

- Premier Account: 0345 604 0440

What does my insurance come with?

- Multi-trip European travel cover for you and your family (includes, if eligible, your spouse, civil partner or partner and children)

- Includes golf cover and cover for certain sports and leisure activities

- Covers UK leisure travel when two or more nights' accommodation is pre-booked (five nights for business trips)

- There's cover for you or someone covered under the policy if a booked trip needs to be cancelled because either you or they, or a companion you are travelling with is asked to quarantine on an individual basis because of exposure to a contagious disease

- Emergency medical cover (up to £10,000,000)

- Cancellation or curtailment cover (up to £5,000)

- Personal accident cover (up to £30,000)

- Baggage cover (up to £2,500, £500 of which for valuables)

- Travel disruption cover (up to £5,000)

Important note :

- The standard maximum trip duration is 31 consecutive days

- For Winter Sports maximum 31 days cover in any calendar year

- £75 excess per adult per incident may apply

- Other exclusions apply, see policy documents

Gold, Platinum and Premier Accounts

- Multi-trip Worldwide travel cover for you and your family (includes, if eligible, your spouse, civil partner or partner and children)

- The standard maximum trip duration is 31 consecutive days - unless you are a Premier account holder, which is 62 consecutive days

- Gold and Premier accounts unavailable to new customers

Policy documents expandable section

- Silver Account Welcome Pack opens in a new window (pdf, 2.1 MB)

- Gold Account Welcome Pack opens in a new window (pdf, 1.3 MB)

- Platinum Account Welcome Pack opens in a new window (pdf, 2.6 MB)

- Premier Account Welcome Pack opens in a new window (pdf, 1.4 MB)

Important and emergency telephone numbers expandable section

You can find out more information about your travel insurance, or make a claim using the appropriate membership numbers below.

- Silver Account: 0345 603 1839

- Gold Account: 0345 850 5056

- Platinum Account: 0345 850 5300

- Premier Account: 0345 604 0440

Lines are open 24/7. Not all Telephone Banking services are available 24 hours a day, seven days a week. Please speak to an advisor for more information.

24-hour assistance helpline (outside the UK): +44 (0)208 239 4010 .

Packaged Bank Account benefits

Explore the other benefits of a Packaged Bank Account. Our Silver & Platinum Accounts include Family travel insurance, AA Breakdown Family Cover and mobile phone insurance for a monthly fee to maintain the account.

Mobile phone insurance

AA Breakdown Family Cover

Existing customer?

Manage your account Find out how to manage your account, from reporting a card lost or stolen to things you can do online

Upgrade now Want to upgrade your existing account? Why not take a look at the other accounts we offer

Change account Change an existing current account with us by logging in

Help and guidance Useful guides on how to use our secure Mobile Banking app and Internet Banking services

Financial Services Compensation Scheme

- Find out more

Important legal information

Lloyds Bank plc. Registered office: 25 Gresham Street, London EC2V 7HN. Registered in England and Wales No. 2065. Lloyds Bank plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 119278.

We may monitor or record telephone calls to check out your instructions correctly and to help us improve the quality of our service. Calls from abroad are charged according to the telephone service provider’s published tariff. Not all Telephone Banking services are available 24 hours a day, 7 days a week. Please speak to an adviser for more information.

IMAGES

VIDEO

COMMENTS

Travel Assistance Wherever, Whenever. Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage. 855- 327- 1441.

AXA Travel Insurance Policy Booklet. Helpful phone numbers +44 (0)1737 815626 0844 874 0361* 0844 874 0362* ... This is your travel insurance policy. It contains details of what is covered, what is not covered and the ... AXA Insurance This policy is underwritten by AXA Insurance UK plc

The AXA Silver plan is a budget-friendly and affordable travel protection plan offered by AXA, designed to provide coverage for unexpected events such as accidents, illnesses, and natural disasters, at a reasonable value for travelers. The Silver plan provides coverage for emergency accident and sickness medical expenses, as well as emergency ...

Platinum. Platinum is AXA's highest tier level. This plan includes: Trip delay: $300 per day, with a $1,250 maximum. Trip cancellation: 100% of the trip cost. Trip interruption: 150% of the trip ...

AXA Travel Benefits. For your holidays in the USA and abroad ... With our travel insurance we can take great care of you too. GET A QUOTE Hidden. PLANS ... by Nationwide Life Insurance Company and Nationwide Mutual Insurance Company, Columbus, Ohio. Applicable to policy forms NSIGTC 2000, NSHTC 2000, SRTC 2000, or state equivalent. ...

AXA Travel Insurance Policy booklet November 2013 F 34890_ACPD0203PE_POL_DL.indd 1 09/10/2013 15:38. 2 Policy summary - travel insurance 3 Introduction 7 Definitions 9 General conditions applicable to the whole policy 12 Claims conditions 13 Important conditions relating to health 14

Your AXA-Assist policy can cover up to 10 people per plan. They can be, but don't have to be, family members. The only restriction is that each member of the group covered by your travel insurance plan must live in the same state. (That's because travel insurance coverage is regulated by state.)

With AXA travel insurance you benefit from assistance throughout your trip: before, during and after and everywhere in the world. Take advantage of our comprehensive guarantees: coverage of your medical expenses abroad, 24-hour medical assistance, teleconsultation, travel cancellation insurance, repatriation insurance and loss of luggage.

Please read this policy booklet with your policy schedule to make sure that you are satisfied with your insurance. If you have any questions please contact your insurance adviser. Certain words and phrases have a defined meaning. You can find the meanings of these defined terms on pages 7 and 8. We have included some explanatory notes in your ...

Travel insurance About your policy wording The Insurance Contract If you have any queries about your cover, you can call us on the number listed in the important telephone numbers' section. Please make sure you have your policy number when you call. We want you to get the most from your policy and to do this you should:

AXA Travel Insurance - Exclusions or limitations Page 5 of 10 Significant or unusual exclusions or limitations The excess that you have agreed to pay will be shown on your policy schedule. Excesses apply per person, per incident. Under annual multi trip policies there is no cover for incidents that occur after your maximum trip

AXA is the number one provider of travel insurance for trips to Europe and offers assistance 24/7, as well as other options and tailor-made products. Other coverage available includes our Europe Travel insurance, costing €33 per week, or Schengen Multi Trip insurance, which is perfect for regular travelers and available for €328 for a year ...

Please read this policy booklet with your schedule to make sure that you are satisfied with your insurance. If you have any questions please contact your Insurance Agent. Certain words and phrases have a defined meaning. You can find the meanings of these defined terms on pages 9 - 12. We have included some explanatory notes in your policy ...

Welcome to your new Worldwide Travel Insurance policy. Inside this booklet you will find everything you need to know about your cover, from what to do in an emergency to important terms and conditions. ... Worldwide travel insurance provided by AXA Travel Insurance and underwritten by Inter Partner Assistance If you have answered YES to either ...

This is your travel insurance policy. It contains details of what is covered, what is not covered and the conditions for each insured person and is the basis on which all claims will be settled. It is validated by the issue of the policy schedule which should be read in conjunction with the policy. In return for having accepted your premium we will

Policy summary - AXA Travel Insurance continued Policy summary - AXA Travel Insurance continued Significant or unusual limitations or what is not covered 1 The standard excesses and any increased amount you have agreed to pay will be shown within your policy wording. 2 Under annual multi trip policies there is no cover for trips over 31 days.

For policies bought direct from MoneySuperMarket. Policy documents (PDF) Important notices (PDF) About our insurance services (PDF) Travel insurance is promoted by Co‑op Insurance Services and arranged by IES Limited and administered by Insure and Go Insurance Services. ^ Calls are charged at local rates from landline and mobiles.

Please refer to the relevant policy document for full details of any exclusions. Once your account has been opened should you wish to notify the insurer of any medical conditions please call the appropriate number below. Gold Account: 0345 850 5056. Platinum Account: 0345 850 5300. Premier Account: 0345 604 0440.

2. Worldwide Travel Insurance. Worldwide Travel Insurance. Inside this booklet you'll find all the information you need about your Worldwide Travel Insurance policy, which comes as standard with your Everyday Extra Current Account. It covers everything from what to do in an emergency, to important terms and conditions.

Policy summary - AXA Travel Insurance continued Significant or unusual limitations or what is not covered 1 The standard excesses and any increased amount you have agreed to pay will be shown within your policy wording. 2 Under annual multi trip policies there is no cover for trips over 31 days.

Policy summary - AXA Travel Insurance continued Policy summary - AXA Travel Insurance continued Significant or unusual limitations or what is not covered 1 The standard excesses and any increased amount you have agreed to pay will be shown within your policy wording. 2 Under annual multi trip policies there is no cover for trips over 31 days.