- FULLY COMPREHENSIVE INSURANCE

- TEMPORARY INSURANCE

- NEW DRIVER INSURANCE

- CAR INSURANCE FOR 17 YEAR OLDS

- MULTI CAR INSURANCE

- CLASSIC CAR INSURANCE

- YOUNG DRIVER INSURANCE

- CAR INSURANCE GROUP CHECKER

- CAR INSURANCE CALCULATOR

- CAR INSURANCE CLAIM CHECK

- CREDIT CHECK IMPACT ON INSURANCE

- ADMIRAL CAR INSURANCE REVIEW

- HASTINGS DIRECT CAR INSURANCE REVIEW

- TESCO BANK CAR INSURANCE REVIEW

- 1ST CENTRAL CAR INSURANCE REVIEW

- CHURCHILL CAR INSURANCE REVIEW

- ESURE CAR INSURANCE REVIEW

- AVIVA CAR INSURANCE REVIEW

- WHY IS CAR INSURANCE EXPENSIVE?

- WHAT TO DO IF I HIT A PARKED CAR?

- PRICE OF INSURANCE AFTER AN ACCIDENT

- WHY INSURERS CANCEL POLICIES

- NON-FAULT ACCIDENT IMPACT ON INSURANCE

- INSURANCE FOR LEASED CARS

- IS MY CAR INSURED?

- FIBRE BROADBAND

- BROADBAND ONLY PACKAGES

- BROADBAND AND PHONE

- BROADBAND AND TV

- BROADBAND FOR GAMING

- WIRELESS BROADBAND

- NO CONTRACT BROADBAND

- EE BROADBAND

- VIRGIN MEDIA BROADBAND

- BT BROADBAND

- SKY BROADBAND

- TALKTALK BROADBAND

- VODAFONE BROADBAND

- SHELL ENERGY BROADBAND

- BROADBAND LONDON

- BROADBAND MANCHESTER

- BROADBAND BIRMINGHAM

- BROADBAND GLASGOW

- BROADBAND LIVERPOOL

- BROADBAND HULL

- BROADBAND SPEED CHECKER

- SOLAR PANELS COST GUIDE

- BEST SOLAR PANELS

- BEST SOLAR PANEL INSTALLERS

- BEST SOLAR INVERTER GUIDE

- SOLAR BATTERY STORAGE GUIDE

- SOLAR PANEL GRANTS EXPLAINED

- WINDOWS PRICES

- DOUBLE GLAZED WINDOWS PRICES

- BEST DOUBLE GLAZING COMPANIES

- COST OF DOUBLE GLAZING A 3 BED HOUSE

- TRIPLE GLAZED WINDOWS

- WINDOWS GRANTS EXPLAINED

- SIMPLISAFE REVIEW

- VERISURE REVIEW

- RING REVIEW

- YALE REVIEW

- EUFY REVIEW

- BEST HOME INSURANCE COMPANIES

- ADMIRAL REVIEW

- POLICY EXPERT REVIEW

- BUILDINGS INSURANCE EXPLAINED

- CONTENTS INSURANCE EXPLAINED

- BEST VPN FOR IPHONE

- BEST VPN FOR MAC

- BEST VPN FOR ANDROID

- BEST VPN FOR FIRE STICK

- BEST VPN FOR CHROME

- BEST CHEAP VPN

- BEST VPN DEALS

- EXPRESSVPN REVIEW

- NORDVPN REVIEW

- SURFSHARK VPN REVIEW

- CYBERGHOST VPN REVIEW

- PROTON VPN REVIEW

- PRIVATE INTERNET ACCESS VPN REVIEW

- PROTON VPN FREE REVIEW

- ATLAS VPN FREE REVIEW

- WINDSCRIBE VPN FREE REVIEW

- PRIVADOVPN FREE VPN REVIEW

- HIDE.ME VPN FREE REVIEW

- VPN FREE TRIALS

- LIVE DATA BREACHES

- VPN DEFINITIONS

- BEST HEARING AIDS

- HEARING AIDS

- HOW TO GET A HEARING TEST

- HOW WE COVER HEARING AIDS

The Independent’s journalism is supported by our readers. When you purchase through links on our site, we may earn commission. Why trust us?

Best travel insurance UK 2024 guide

We all deserve a break now and then. And the last thing you want to think of when booking your holiday is something going wrong. But it’s better to be prepared than caught off guard. That’s why you should always consider travel insurance when going on a trip.

But how can you find the best travel insurance policy for your needs? Read our guide below to find out more.

Why do I need travel insurance?

Travel insurance protects you financially if your trip away doesn’t go as planned and you incur unexpected expenses for delays, losses or medical treatment.

All travellers can benefit from travel insurance. But travel insurance is particularly important if you are going on an independent trip without a tour operator, because if something goes wrong, you will have no other help.

There are three main types of travel insurance:

- Single-trip cover: this is the most typical form of travel insurance, covering you for a one-off trip or holiday. There will be a time limit on the cover that can range anywhere between one month and 365 days

- Annual multi-trip cover: this allows you to make multiple trips, or have multiple holidays, in a 12-month period, all under the same travel insurance policy. There may be a cap on how long each individual trip can be

- Long stay, or backpacker, cover: this is normally used for around the world trips, gap years, and longer cruises, and can last for up to 18 months

To find the best UK travel insurance, compare policies before you go to ensure you get the right coverage for you and the specific trip you’re planning.

How to find the best travel insurance policy

When comparing policies to find the best travel insurance for your trip, you should consider:

- Type of cover you need

- Excess (how much you’ll be expected to pay out yourself before the policy will cover you)

- Amount of medical coverage, and why pre-existing conditions aren’t included

- Limit on baggage claims

- Coverage for specific sports and activities

- Any potential rewards and discounts

- Add-ons, such as gadget insurance

Best travel insurance deals and discounts

Looking for the best travel insurance deals from the best travel insurance companies? In most cases, the easiest way to find the best travel insurance deals is to use a comparison website. Travel insurance comparison websites let you compare costs and coverage side by side to find the best UK travel insurance.

The four main comparison websites – Moneysupermarket, Comparethemarket, Confused.com and GoCompare – also often have certain deals and discounts when you buy travel insurance from them, offering some of the best travel insurance deals on the market.

Moneysupermarket : Find the same deal for less, and it will price match and give you a choice of a £20 gift card. Only on annual travel insurance.

Comparethemarket : Two for one cinema tickets with Meerkat Movies and savings at restaurants when you dine out or order pizza in with Meerkat Meals, as well as 25 per cent off coffee and pastries at Caffè Nero every day of the week through the Meerkat app.

(In November 2023, Confused.com and GoCompare had no deals or discounts for travel insurance).

Price is obviously a big consideration when you are looking for the best travel insurance – you’ve probably already spent a lot on your holiday. But you may be able to get much better coverage for just a few pounds extra, so it’s worth scrolling down the comparison site’s list of providers before buying.

Medical costs abroad will undoubtedly be the biggest expense you face if you fall ill abroad, so don’t scrimp on those.

Then think about your next biggest expense (probably cancellation/interruption of your trip) and make sure that you have high-value coverage for that.

If you find you can get much higher coverage (the maximum amount you can claim per type of claim, such as medical or baggage) for not very much more money, go for the slightly more expensive option.

Going direct

Comparison sites won’t always find you the cheapest deals, however. For example, Direct Line offers some of the best travel insurance with Covid cover and is not on comparison websites.

Some of the best travel insurance companies also offer discounts for buying directly from them, as follows:

Bundled coverage options

When looking for the best travel insurance for your holiday, it can make sense to buy a bundle of coverage under one policy.

Comparison websites will often offer add-on gadget cover, winter sports cover or cruise cover all under the one policy. If you need that extra cover, it is typically cheaper to buy your travel insurance this way rather than as separate policies.

What is covered by travel insurance?

The best travel insurance companies will offer you comprehensive coverage across all types of claims. It’s easy to compare the best travel insurance deals using a comparison website.

Medical coverage

This covers you for medical expenses you incur if you become ill or have an accident while away. The best UK travel insurance will have a high level of medical coverage.

For example, medical coverage will pay for any necessary treatment if you come down with severe food poisoning or you fall through a window and have to be taken to hospital in an ambulance.

- Avoid hefty bills or debt for medical assistance outside the UK

- Access better treatment – for example, at private vs public hospitals

- Often, as long as you declare existing conditions or pending treatment or tests, you are covered if you fall ill during your trip (check policy exclusions)

- Even the best travel insurance companies will likely charge you more if you have a pre-existing medical condition

- You might have to pay part or all your medical expenses first, then claim on the policy afterwards

- Even the best travel insurance companies do not cover events that happen after you have consumed alcohol excessively or taken recreational drugs or other substances

Trip cancellation/interruption

This insurance pays out the cost of your missed trip if you have to cancel or cut your holiday short due to unforeseen circumstances.

For example, cancellation insurance would normally pay out if you broke your leg just before you were due to travel and had to cancel your trip.

Interruption insurance would cover you if you had to come home early for certain reasons beyond your control – for example, if the area you were staying in was engulfed in wildfires.

- Money you would have lost on pre-paid, non-refundable travel expenses is paid to you under the policy

- It can be especially valuable if the trip you are planning is very expensive, as this is money you would lose if you couldn’t go

- You’ll usually only be covered if your trip is cancelled or cut short for specific reasons listed in your policy

- You usually won’t be covered if you miss your flight because you are held by customs or cancel because of a work issue or a pre-existing medical condition that is not covered

Baggage cover

This insurance covers the cost of replacing your luggage if it is lost or stolen.

For example, if an airline loses your luggage in transit or your suitcase is stolen from your hostel while you’re away, you can make a claim for the cost of replacing its contents.

You may also be able to claim for costs related to baggage delay if the airline temporarily misplaced your baggage.

- You can claim for the actual cash value of your belongings or the cost of replacing them (whichever is less)

- High-value items, such as jewellery or sports equipment, can be very expensive to replace without travel insurance

- Standard policies usually place per item and total limits on claims.

- If you are taking very expensive items away, check your policy carefully to ensure that you’re covered (and potentially get a separate policy)

- Some items could be covered by your home insurance policy, so check your policy carefully to see what is any isn’t. It’s also important to note that, should a lost item be covered by both policies, you can only claim once; an attempt to claim twice would be considered fraud

Personal liability

This insurance covers you if you are held responsible for harming another person or damaging their property.

For example, it covers you in situations where you cause serious damage to your holiday accommodation or accidentally stumble into someone else, causing them to need medical treatment.

- The cost of defending yourself in a legal case or repairing/replacing damage could be extremely costly without travel insurance

- Your travel insurance company will take over dealing with a foreign legal system

- You’re covered for the cost of any compensation (up to certain limits)

Limits:

- Not all travel insurance provides personal liability as standard

- Policies may exclude personal liability while you partake in adventure activities

- Claims related to you committing a crime or damage by wilful negligence won’t be covered

- You likely will not be covered if you admit liability or make an offer to pay before talking to your insurer

Finding the best travel insurance with Covid cover

Looking for the best travel insurance with Covid cover? Many travel insurance policies now include cancellation cover for reasons related to Covid. This often applies within two weeks of being due to travel, according to the Association of British Insurers, but individual policies can vary.

To make a claim, insurers often require proof in the form of a medically approved positive Covid test. A lateral flow test or self-diagnosis is usually not accepted.

What Covid-related cover to look for

The best travel insurance with Covid cover should include the following:

- Cover if you can’t start your trip because you tested positive for Covid before travelling

- Cover if you or family members cannot return home because you/they test positive for Covid during the holiday

- Cover for additional costs, such as alternative flights, accommodation and Covid tests

- Cover if you cannot reach your final destination during transit due to Covid-19

Travel insurance providers with comprehensive Covid cover

Looking for the best travel insurance providers with Covid cover? Most travel insurance policies now offer some kind of Covid cover, but Churchill, Direct Line, M&S and Aviva have some of the most comprehensive offerings, with cover for cancellations and expenses related to Covid.

- Covid covered as standard on travel insurance policies

- Cover for trip cancellations if you, a close relative or a travelling companion is diagnosed with Covid-19 or another pandemic disease

- Cover if you or a person you’re planning to stay with must quarantine (abroad or in the UK)

- Cover if you can’t use pre-booked and pre-paid accommodation affected by Covid-19

- Cover for quarantine or where the Foreign, Commonwealth & Development Office (FCDO) advises against travel within 28 days of departure

- Cover for emergency medical expenses abroad due to Covid-19

Direct Line

- Cover for travel to a destination where the FCDO is advising against all but essential travel

- Cover for medical expenses if you catch Covid-19 while you’re away

- Cover for additional accommodation and transport if you have to quarantine due to Covid

- Cover for cancellation costs if you or a close relative get Covid-19 before you go

- Cover for quarantine or if the FCDO changes its advice after you book your trip

- Cover if you have to cut your trip short if the FCDO changes its country advice unexpectedly

- Cover for emergency medical expenses if you catch Covid-19 during your trip

- Cover for unrecoverable costs up to £6,000 if you must cancel your trip or return early, including if you have to self-isolate or quarantine before you travel due to Covid-19

- Cover for if you need to cancel your trip due to a positive Covid-19 test or if the FCDO advise against travel to your destination in the 31 days leading up to your trip

- Providing you haven’t travelled against FCDO advice, you’ll also be covered if you catch Covid-19 while abroad

- Coverage of up to £5,000 per person if you must cancel your trip due to getting Covid (you’ll need to provide confirmation and evidence of a positive test result)

- Cover for Covid-related emergency medical treatment and expenses while away

- Cover if you unexpectedly need to quarantine, including extra travel and accommodation costs to get home (provided a return trip was booked)

- Cover for costs for any accommodation and excursions unused due to getting Covid where the costs can’t be recovered elsewhere

- No cover you if you travel against FCDO advice*

- No cover if you can’t travel because you don’t meet the entry requirements of a country (such as having had Covid vaccinations)*

* It’s worth noting that these clauses are not unusual and the majority of providers will have something similar

Tips for selecting the best UK travel insurance packages

Need some help picking the best UK travel insurance packages to make sure that you get the best travel insurance deals? Here are some tips for picking the best policy features for you.

Coverage limits

When looking for the best travel insurance companies to go with, check coverage limits. These are the maximum amounts your travel insurer will pay if you need to claim. You’ll see when you compare travel insurance policies that coverage limits vary for each type of claim and between policies.

The government-backed MoneyHelper website recommends that the best UK travel insurance should have the following minimum coverage for each type of claim:

- Medical: £1m or more for travel to Europe and £2m or more for the US

- Cancellation/interruption: £2,000 or more

- Missed departure: £500 or more

- Delay: £200 or more

- Baggage cover: £1,500 or more

- Personal liability cover: £2 million or more

Deductibles/excess

Deductibles, also known as the excess, is the amount you have to pay out of your own pocket before your travel insurance will start paying for your claim.

You have to make a trade-off when it comes to choosing the excess and the best travel insurance policy for you.

The lower the excess on a travel insurance policy, the better for you if you have to claim because you will have less to pay from your own pocket (or, more often, deducted from your claim).

But lower excess travel insurance policies are more expensive because the insurer knows it has more to pay out if you claim. Higher excess policies are cheaper, but you’ll have more deducted from your claim.

An exclusion on a travel insurance policy is an event the policy will not cover you for.

Common exclusions on a standard travel insurance policy may not be obvious. According to the ABTA – The Travel Association, these include:

- Incidents that occur after drinking too much alcohol or taking drugs

- Theft of unattended possessions

- Sports, extreme sports and activities such as skiing, white water rafting and bungee jumping

- Medical treatment resulting from existing medical conditions you have not declared or conditions preventable by vaccine or advisable medication, such as antimalarials

- Medical costs if you stay abroad after your doctor says you are fit to return to the UK

- Strikes and industrial action if it was known when you booked your trip

- Rescheduled flights where the airline has cancelled and then rescheduled your flight

- Travel to destinations where the FCDO advises against all but essential travel

To get the best travel insurance deals, one way around some of these exclusions is to buy add-ons for adventure activities. In addition, make sure to declare all pre-existing conditions and keep an eye out for any travel disruptions before you book.

Pre-existing conditions

Pre-existing conditions are illnesses or medical conditions you have and are aware of before you travel.

Travel insurance companies will ask you to disclose any pre-existing conditions. If you use a comparison website, it will be among the first questions you’re asked before it shows you quotes. It’s important to be honest.

Some travel insurance companies, but not all, will offer cover for pre-existing medical conditions, while others will offer cover but exclude any claims arising from that medical condition. This will depend on the person being covered and the medical condition.

Most price comparison websites include an option to show insurers who do offer coverage for pre-existing conditions, so that would be a good place to start.

The following are likely to be considered pre-existing conditions you should disclose, according to the government-backed MoneyHelper website:

- A condition where you are on a list for an operation

- A condition where you are waiting for test results

- Anything you have been to the doctor about in the last year, including minor things

- Any serious conditions you’ve ever had – for example, cancer, heart trouble, respiratory problems or a mental health breakdown

A good tip for everyone, but especially if you have a pre-existing condition, is to buy your travel insurance as soon as you book your holiday. If your condition gets worse and forces you to cancel your plans, you’ll be covered from the day the policy starts.

On family group policies, the cost will be determined based on the riskiest traveller (according to insurers), which could be someone with a pre-existing condition or an older individual. In this case, it is often cheaper for the group for that person to get a separate policy.

Add-on options

Add-ons are extras you can purchase in addition to a standard travel insurance policy. They cost a bit more, but you may find you’re not covered without them.

Gadget insurance

This covers things that a standard policy may not, such as your mobile phone or laptop. If these items are covered, you may find the claim limits are far less than the cost of replacing them.

Before you add this option to your travel insurance, check your home insurance policy, because you may already be covered.

Winter sports/adventure activities

Riskier activities, such as skiing or white water rafting, often require extra holiday insurance because insurers think that you are more likely to need to make a claim doing these things.

Winter sports/adventure activities cover is worth getting, or you may find you are not covered for medical expenses if something goes wrong.

Standard travel insurance is generally meant for land-based holidays so you’ll need to opt for a specialist cruise policy if your holiday is a cruise.

European FCDO travel advice extension

Most standard travel insurance policies are invalid if you travel when the FCDO advises against “all but essential travel”.

This add-on allows you to travel to Europe with a valid travel insurance policy, even if the FCDO has advised against it.

This can be an expensive add-on, but if you really must travel to a risky area, you will need this extension in order to make sure you have cover.

Best holiday insurance summary

Choosing the right travel insurance is an essential part of enjoying peace of mind while you are on holiday.

When looking for the best travel insurance deals, don’t just pick the cheapest policy. Instead, look for the cover limits that match your requirements. For example, baggage cover of £5,000 isn’t worth having if your baggage is worth £1,000; cancellation cover up to £10,000 isn’t worth having if your holiday cost you £2,000.

The easiest way to compare the best travel insurance is usually by using a travel insurance comparison website.

Think about the sort of activities you’ll be doing while you’re away. You may need extra holiday insurance for things such as winter sports or scuba diving or if you are going on a cruise.

Be honest about any pre-existing conditions when buying your travel insurance, or you won’t be covered if you have to claim.

The best travel insurance is a safety net for you and your family to enjoy your trip away stress-free, knowing that you’re covered for everything from medical expenses to cancellations if things go wrong.

Frequently asked questions about the best travel insurance UK packages

Is travel insurance necessary for domestic travel within the uk.

Even where medical costs in the UK are covered by the NHS, a sudden illness could lead to other expenses, forcing you to cancel your trip, the costs of which travel insurance would cover.

Lost or stolen luggage and broken gadgets or other claims for damage can just as easily occur in the UK as abroad.

What is annual travel insurance, and is it a good option for frequent travellers?

Annual travel insurance is a policy that covers you for multiple trips away within any 12-month period. It is often cheaper than buying a separate policy for each trip if you are planning to go away multiple times in one year.

Annual travel insurance is also useful if you are planning a long trip visiting several countries, as often insurers require you to buy travel insurance before you leave the UK rather than abroad mid-trip.

Are there any travel insurance companies that specialise in certain types of trips or travellers?

Specialist travel insurers cater to specific groups of people. It can make sense to seek out travel insurers that cover your needs.

Adventures Insurance, Sports Cover Direct and Snowcard tailor their travel insurance to those who enjoy activity holidays and extreme sports, for example.

Senior travellers are the focus of policies from All Clear, Avanti, Co-op Insurance Services, Free Spirit Flex, Good 2 Go Extra, Goodtogo Insurance, Saga, Staysure and Total Travel Protection.

Insurers offering business trip cover include Allianz, Direct Line, Coverwise and Insure & Go.

How do I make a claim with my travel insurance company?

To claim on your travel insurance while you are away, make sure that you take your policy number with you and the emergency number for your insurer. If you are travelling abroad, take any international numbers too.

Call your insurer as soon as you realise you need to make a claim. Keep all receipts and medical expense forms. If you are travelling with other people, make them aware of your policy details and the insurer’s phone number in case they need to call on your behalf.

To make a claim when you return home, check the following:

- You haven’t left it too late to make a claim

- What you’re claiming for is covered

- The excess is not more than the value of your claim (if so, it’s not worth claiming)

Notify your insurer as soon as possible for a claim form, send it back fast and keep a copy of it. You should also include copies of paperwork to support your claim, such as receipts or medical certificates (keep copies of the originals in case your claim is queried or refused).

Laura Miller

Laura Miller is a freelance journalist, editor, and producer. She has a wealth of consumer finance experience, having written about money matters and business for over 15 years.

During her tenure as a freelance writer, she has worked for ITN, Wired, and The Sunday Times, as well as financial institutions such as Aegon, the Chartered Insurance Institute, and Pension Bee, where she’s presenter of the Pension Confident Podcast.

Laura has previously held roles at The Times, where she was the Acting Editor of Times Money Mentor, The Telegraph as a senior finance reporter and was the co-host of the It’s Your Money Podcast, which was renowned for making complex finance issues accessible, and The Financial Times, where she worked as a News Editor. Laura has also worked at CNN, Politics.co.uk, and as a producer at Radio 5 Live.

Connor Campbell

Connor Campbell is an experienced personal and business finance writer who has been producing online content for almost a decade.

Connor is the personal finance expert for Independent Advisor, guiding readers through everything they need to know about car insurance and home insurance. From how much it costs to the best insurance providers in the UK, he’s here to help you find the right policy for your needs.

In his capacity as writer and spokesperson at NerdWallet , Connor explored a number of topics close to his heart, such as the impact of our increasingly cashless society, and the hardships and heroics of British entrepreneurs. His commentary was featured in sites such as The Mirror , the Daily Express and Business Insider .

At financial trading firm Spreadex, meanwhile, his market commentary was featured in outlets such as The Guardian , BBC , Reuters and the Evening Standard .

Connor is a voracious reader with an MA in English, and is dedicated to making life’s financial decisions a little bit easier by doing away with jargon and needless complexity.

- Best home insurance

- Best life insurance

- Best pet insurance

- Car insurance

- Home insurance guide

- Buildings insurance

- Contents insurance

- Home insurance glossary

- Admiral home insurance review

- Aviva home insurance review

- AXA home insurance review

- Churchill home insurance review

- Compare the market review

- Direct Line home insurance review

- Esure home insurance review

- LV home insurance review

- More Than home insurance review

- Policy Expert home insurance review

- Rias home insurance review

- How we cover home insurance companies

The Independent Advisor brand is operated by 3S Media International Limited. 3S Media International Ltd is an introducer appointed representative of Moneysupermarket.com Financial Group Limited, which is authorised and regulated by the Financial Conduct Authority (FCA FRN 303190).

Helping you make the most out of your money

Searching Money Mentor . . .

The best travel insurance providers.

Updated March 26, 2024

In this guide

If you’re looking to escape the UK winter, or if you’re saving your holiday for the height of summer, you may wish to consider travel insurance. We explain what travel insurance is and some of the best policies on the market for your holiday.

In 2022, UK residents made 71 million visits abroad. This was over three times the amount made in 2021, when COVID restrictions kept many people at home.

So if you’re part of a growing number of people spending time abroad, have you considered travel insurance? By taking out one of these policies you could be protected for lost baggage, delayed flights, and medical emergencies abroad among other unforeseen events.

In this article we explain:

- What is travel insurance

What does travel insurance cover?

The best travel insurance.

- Travel insurance and medical conditions

Read more: Passport renewal costs and waiting times

What is travel insurance?

Travel insurance covers the cost of unforeseen events and mishaps that either stop you from going on holiday or affect you while you’re away.

Depending on the policy, travel insurance might cover you for:

- Medical bills if you suffer illness or have an accident while you’re away

- Cancellation of your trip for reasons outside of your control

- Lost or stolen baggage

Policies are usually relatively inexpensive and can give you the peace of mind that your costs will be covered if something bad happens while you are on holiday.

According to the Association of British Insurers (ABI), a trade body, the average claim on travel insurance in 2022 was a little over £970. So while travel insurance won’t stop bad things from happening, but it can prevent you from having to find the money to pay for unexpected costs even after you return from your holiday.

Read more: Ten budget travel tips

Many people opt to take out travel insurance to cover potential medical care while away.

Every week, 3,000 Brits need emergency medical treatment while abroad, according to the ABI. But travel insurance isn’t just about covering medical costs. It can protect you against a range of unplanned events:

- Cancellation or trip interruption for reasons outside your control

- Missed transport or delayed departure for reasons outside your control

- Personal injury and death, including medical evacuation

- Lost, stolen or damaged items, including baggage, passports and money – check if your home contents insurance covers you

- Accidental damage or injury caused by you

Does travel insurance cover cancelled flights?

Most travel insurers provide a basic level of cover for cancelled flights. Aviva’s travel insurance, for example, will pay out if your flight is cancelled due to an airport shutdown.

If your airline cancels your flight then you should claim a refund directly with them, so your travel insurance could cover other costs such as hotel bookings, vehicle rentals, and other possible excursions.

What are my rights during strike action?

If your flights are cancelled because air staff are striking, which they have over last summer, you might be entitled to compensation from the airline. But for this to apply, customers must have been given less than 14 days’ notice.

It also depends on whether the airline was at fault or not: so if it’s the airline’s staff who are striking, you should be entitled to compensation.

If you’re worried that your flights might be delayed or cancelled, you should also check your travel insurance policy.

Some policies cover you for a cancelled or delayed flight, provided you took out the policy before the strikes were announced.

But if you haven’t yet bought your insurance, you may be out of luck. This is because most insurers won’t cover you for strikes which were already known about.

Read how travel insurance could catch you out.

Below we’ve listed some of the best travel insurance providers on the market, all of which were nominated in Times Money Mentor awards 2023.

Times Money Mentor award winning cover

Best for over-50s

Post Office

Best for those with pre-existing medical conditions

Best for those wanting substantial medical cover

Best for a range of unique add-ons

Looking for a new holiday destination?

Make sure to visit Times Travel for your holiday inspiration this year. From palm beaches in Fiji to the beautiful Italian coastline, Times Travel caters to all different tastes. Unlike other parts of the site, you also don’t need a subscription to enjoy their high-quality content.

Another notable provider

Despite not winning a nomination at the Times Money Mentor awards, this provider also offers a decent level of cover:

Switched On

The best travel insurance for cruises.

If you’re thinking about taking a cruise, it’s important to take out special additional cover such as a cruise insurance to protect you.

Cruise insurance is normally offered as an add-on to travel policies, and protects you if you:

- Miss connections to reach the departure

- Fail to get back on board after planned stops

- End up being confined to your cabin

Though if you want a dedicated travel insurance policy for a cruise, here’s an option to consider:

Just Travel Cover*

Best for cruise holidays

The best winter sports cover

If you’re planning a skiing and snowboarding trip then it’s important you have insurance that will cover you if you’re involved in an accident on the slopes.

Most travel insurers will offer winter sports cover as an optional add-on to their regular cover and will protect you if you:

- Need to be airlifted off the slopes or rescued and need medical treatment

- Turn up and there’s no snow

- Can’t start skiing and snowboarding because of avalanche risk

- Find out your equipment – such as skis, snowboard and boots – has been stolen

It’s difficult to predict what the next ski season will look like. But if you’re booking now and want cover for the essentials, here’s a policy to factor into your calculations.

InsureandGo*

Best for winter sports

What should a basic travel policy cover?

When shopping for travel insurance, you should ensure your policy comes with the following seven things as standard:

1. Medical expenses

This covers the costs of any emergency medical and surgical treatment while you’re away.

It usually costs more for cover in the US as medical bills can run into the tens or hundreds of thousands of dollars. Any treatment that can wait until you get home is not usually included.

Most policies offer cover of £1 million for medical costs in Europe. This is usually £2 million in the US.

2. Repatriation

This is where you might need to be evacuated from the country you’re visiting.

Repatriation usually happens when you need to get back home to the UK in the event of a medical emergency and is usually covered as standard in most travel insurance policies.

3. Cancellation/curtailment

This covers any travel and accommodation costs you have paid for and can’t use or claim back.

You need a good reason to cancel your trip, so make sure you double check the terms and conditions of your policy.

4. Missed departure

This covers your extra accommodation costs and travel expenses should you miss your departure due to situations outside your control.

It usually includes your car breaking down or being involved in an accident. Leaving home at the last minute won’t count.

This covers you for delays to your travel plans, such as severe weather conditions.

Delays known about before (such as strikes) won’t be covered.

6. Baggage cover

This should cover you if your baggage is lost, stolen, damaged or destroyed.

You might need extra cover for gadgets or valuable possessions as there are usually limits on separate items.

Losses need to be reported within a certain time frame and you must have a written report from your airline if it loses your baggage.

7. Personal liability cover

This should cover you if you are liable to pay damages due to:

- Accidental bodily injury to someone

- Or for loss or damage to someone else’s property

- Claims made by family members or employees won’t be covered

Choose a smooth private healthcare journey with Saga Insurance

• Easy access to a specialist

• Fast tests, scans and treatment

• Comfortable hospital stay

Get a Saga Health Insurance quote

For people over 50. Saga Health Insurance is a unique product designed by us specifically for our customers, and it’s only available through us. Together with our underwriter, Bupa Insurance Limited, we are committed to providing high standards of quality and service.

What extra cover can you buy?

To provide a peace of mind you might be able to add the following onto your policy too:

- Wedding cover – If you’re travelling abroad for a wedding, some providers might include an add-on which covers damage to your possessions. If you think you need something more comprehensive, then consider a separate wedding insurance policy

- Gadget insurance – While you’re abroad you may wish to cover your laptop, phone, or tablet from theft or damage

- Golf equipment cover – Planning to tee off abroad? Then consider cover for moving your clubs overseas. This type of add on includes cover for your equipment if it is lost, stolen, or accidentally damaged

Read more: Is credit card travel insurance any good?

What is not covered by travel insurance?

Travel insurance won’t cover you for a risk that is known about.

For example, if you have a long-standing medical condition that means you can’t go on holiday, your insurer might not cover you for the cancellation costs.

Insurers also won’t cover you if you have to cancel your trip for reasons within your control. For example, if you miss your flight because you woke up late, your claim is likely to be rejected.

Travel insurance is also unlikely to cover you if you have been irresponsible. For example, if you leave your valuables in your hold luggage then your policy won’t cover you if these items are damaged.

Each travel insurance policy will have specific things it won’t cover and this will vary depending on the provider. So it’s important to read the terms and conditions carefully.

What types of travel insurance can you buy?

There are two main options to choose from when taking out a travel insurance policy:

- Single trip — covers you for one trip of a specified length only

- Annual multi-trip — covers you for all your trips for one year (if you travel a lot this can work out cheaper than lots of single policies)

You need to make sure that either option of travel insurance covers you for where you are going, such as:

- Europe only

- Or the more expensive, worldwide policies (these either include or exclude the US)

But check first which exact countries providers include in their policies. For example, some policies include Turkey, Morocco, Tunisia and Egypt in their Europe insurance.

There is also specific travel insurance for backpackers, which offers extra cover for those who are likely to be away for an extended period of time or travelling to multiple destinations.

Also bear in mind that if you are doing any extreme sports like skiing or going on a cruise then you might need to buy an add-on.

When should I take out travel insurance?

It’s usually best to take out travel insurance as soon as you have booked your trip.

While many people think of travel insurance as something that covers problems while they are away, some policies cover you for issues, accidents and illnesses that stop you from being able to travel.

Cancellation is one of the main reasons that people claim on a travel insurance policy. If the cancellation happens before you have bought insurance then you wouldn’t be able to claim.

How much should I pay for travel insurance?

Your travel insurance premium will depend on a range of factors such as your age, health, type of policy, and destination. This is why an average travel insurance premium will likely be meaningless, so make sure to do your research and get a quote from several different providers before deciding on a policy.

Do I need travel insurance?

Unlike car insurance, travel insurance isn’t a legal requirement. However, it does come with a host of benefits such as cover for medical expenses.

We’ve already listed the benefits of having protection for unexpected medical costs above, and it remains pertinent if you’re travelling abroad and won’t have access to the NHS. According to the ABI, there is one recorded case in 2022 when a traveller in Thailand contracted a serious blood infection which needed intensive medical treatment. The bill eventually came up to £250,000 which was paid in full by their travel insurance provider.

Also consider that some visa applications require you to have a suitable travel insurance policy in place before you apply. If you’re applying for a Schengen visa to travel Europe you’ll need a policy in place which covers medical expenses up to €30,000 during your trip.

FAQs: Travel insurance and medical conditions

Many people solely take out travel insurance to protect themselves from medical expenses. According to the ABI, the average medical claim on travel cover is more than £1,300. Notoriously in the US, these figures run into the tens or hundreds of thousands of pounds.

So below we’ve answered some of the most common medical related questions on travel insurance:

Q. Does travel insurance cover pre-existing medical conditions?

Some insurers do provide cover for pre-existing conditions. However, it is vital that youflag these conditions during the application stage. If you don’t it could invalidate your policy.

Q. Do you need to tell your travel insurance provider if you have a new medical condition?

If there is a significant change to your personal health then you’ll need to inform your travel insurance provider. This includes being diagnosed with a new long-term illness.

Failure to do so could invalidate your policy.

Q. Can you get travel insurance if you’re over 75 with medical conditions?

Yes. In fact, there are some providers on the market which tailor their policies towards an older demographic. For example, Saga has dedicated policies for over 50s and 70s.

* All products, brands or properties mentioned in this article are selected by our writers and editors based on first-hand experience or customer feedback, and are of a standard that we believe our readers expect. This article contains links from which we can earn revenue. This revenue helps us to support the content of this website and to continue to invest in our award-winning journalism. For more, see How we make our money and Editorial promise

Important information

Some of the products promoted are from our affiliate partners from whom we receive compensation. While we aim to feature some of the best products available, we cannot review every product on the market.

What is travel insurance and is it worth it?

A technical issue with UK air traffic control systems left thousands of travellers facing long delays on one of the busiest days of the year in August. You have travel rights, so is it worth having travel insurance? Hundreds of flights were delayed and cancelled on bank holiday Monday due to the fault. The incident […]

Am I entitled to flight delay compensation?

In September, hundreds of flights were cancelled or delayed due to a “technical issue” with UK air traffic control systems. It left hundreds of passengers stranded. Here we explain your rights when it comes to flight compensation. Air traffic control faults are classified as “extraordinary circumstances” and therefore airlines do not have to give you […]

Is credit card travel insurance any good?

We explain how travel insurance on credit card works and look at the pros and cons of using it. Some rewards credit cards offer travel insurance. However, your credit card is unlikely to give you all the cover you need as full medical insurance is not included. This article will cover: Related content: What are […]

Sign up to our newsletter

For the latest money tips, tricks and deals, sign up to our weekly newsletter today

Your information will be used in accordance with our Privacy Policy.

Thanks for signing up

You’re now subscribed to our newsletter, you’ll receive the first one within the next week.

Best Travel Insurance

Here's our pick of the UK's best travel insurance policies, based on independent research 🏆

Top 10 Travel Insurance 2024

- Cedartree, Platinum 🥇

- Avanti, Deluxe – up to 16.8% cashback 🥈

- Tesco Bank, Premier 🥉

- Columbus Direct,Gold – up to 20.8% cashback

- LV=, Premier – up to £12.80 cashback

- Covered2Go, Platinum

- AA Travel Insurance, Gold

- Direct Line, Single Trip & Annual

- FreeSpirit, Gold

- Puffin Insurance, Platinum

We also have specific Top 10s for Backpacker / Long Stay Travel Insurance and Pre-existing Medical Conditions Travel Insurance .

How did we come up with this list?

We used an algorithm to combine independent ratings from Which? and Fairer Finance with Mr. Travel's summaries of customer feedback from reviews websites 🤓

Top 10 Travel Insurance Reviews

Read on for insights into the policy features of 2023's best travel insurance policies, as well as a summary of what the experts make of them.

Cedartree Travel Insurance: Platinum Policy

Tailored for Specific Needs

Cedartree's Platinum policy offers a range of specialized coverages to address specific requirements. With a 75% Which? policy score and a ranking of 16, Cedartree stands as a reputable provider. The policy includes medical expenses cover (£15,000,000), baggage cover (£3,000), and cancellation cover (£7,500). Cedartree specializes in cover for cruises, but not for medical conditions, travellers over 65, or winter sports activities.

Read the full Cedartree review or get a quote .

Avanti: Deluxe Policy

Unlimited Medical Expenses Cover

Avanti's Deluxe policy boasts unlimited medical expenses cover, setting it apart from other providers. With a Which? policy score of 70% and a ranking of 41, Avanti provides superior Covid Cover and caters to those with medical conditions. The policy also includes baggage cover (£3,000), cancellation cover (£10,000), and no excess payable on medical claims.

Get up to 16.8% cashback on Avanti travel insurance at Quidco, or read the full review .

Tesco: Premier Policy

Cover for Every Occasion

Known for their vast range of products, Tesco offers a comprehensive Premier policy that ranks impressively at number 3 with an 80% Which? policy score. With superior Covid Cover, Tesco's policy delivers an extensive range of coverage. Notably, the policy provides a high medical expenses cover of £20,000,000, baggage cover (£3,000), and cancellation cover (£10,000). Tesco also offers cover for cruises, winter sports activities, and backpackers .

Get notified about cashback on Tesco travel insurance by Quidco, or read the full review .

Columbus Direct: Gold Policy

Competitive Benefits for Explorers

Columbus Direct's Gold policy secures a 67% Which? policy score and ranks 47th, highlighting its competitive benefits. The policy provides medical expenses cover up to £15,000,000 and includes baggage cover (£2,500) and cancellation cover (£50,000). You can also avail specialized coverage for medical conditions, cruises, and winter sports activities.

Read the full review of Columbus Direct Travel Insurance , or head over to Quidco for up to 20.8% cash back .

LV: Premier Policy

Trusted Protection for All

With a Which? policy score of 77% and ranking at number 11, LV's Premier policy offers comprehensive coverage. The policy includes medical expenses cover (£10,000,000), baggage cover (£3,000), and cancellation cover (£10,000). LV specializes in providing coverage for medical conditions, cruises, and travellers over 65.

You can get up to £8.50 cashback on LV= travel insurance at Quidco – or you can read our full review of LV= Premier here .

Covered2Go: Platinum Policy

A Comprehensive Cover for Everyone

Covered2Go's Platinum policy stands out as a top choice due to its multitude of features. With a policy score of 79% from Which?, it secures a prestigious fifth position among 71 providers, ensuring high-quality coverage. Notably, Covered2Go excels in Covid Cover with its superior rating. Moreover, the policy offers extensive medical expenses cover (£10,000,000), baggage cover (£5,000), and cancellation cover (£7,500). They also specialize in providing coverage for medical conditions, cruises, travellers over 65 , and winter sports enthusiasts.

Check out our complete review of Covered2Go here .

AA: Gold Policy

Trusted and Reliable Assistance

The AA, a renowned name in the UK, brings forth their Gold policy with a solid Which? policy score of 74% and ranks at number 21. Similar to Covered2Go, the AA offers superior Covid Cover . The policy features medical expenses cover up to an impressive £15,000,000, along with comprehensive cover for airline failure and cancellation (£5,000). While they don't specialize in certain areas such as medical conditions and cruises, the AA does provide winter sports coverage.

Looking for an in-depth review of AA Travel Insurance ? We've got you covered!

Free Spirit: Gold Policy

The Saviours for Pre-Existing Medical Conditions?

Free Spirit's Gold policy resonates with those who have pre-existing medical conditions, earning a Which? policy score of 72% and ranking 32nd. With specialized coverage for medical conditions and cruises, Free Spirit has tailored its policy to meet the unique needs of these travellers. The policy offers up to £10,000,000 in medical expenses cover, baggage cover (£2,500), and cancellation cover (£5,000).

Read our full review of Free Spirit here .

Direct Line: Direct Line Single Trip & Annual

Simplicity and Convenience in One

Direct Line makes travel insurance simple and convenient with their Single Trip and Annual policies. With a solid Which? policy score of 76% and ranking at number 17, Direct Line ensures complete coverage. The policies provide a medical expenses cover of £10,000,000, and include baggage cover (£1,500) and cancellation cover (£5,000). Direct Line also caters to winter sports enthusiasts.

Read our longer review of Direct Line travel insurance , including customer reviews.

Puffin Insurance: Platinum Policy

An Adventure Awaits

Puffin Insurance's Platinum policy completes our list, with a Which? policy score of 75% and ranking at number 19. The policy offers medical expenses cover of £10,000,000, baggage cover (£2,500), and cancellation cover (£5,000). Puffin Insurance stands out by providing specialized cover for winter sports activities but does not specialize in medical conditions, cruises, or travellers over 65 .

Read the complete review of Puffin Travel Insurance here.

Looking for reviews on the best of the rest?

Did you know, Mr. Travel has reviewed more than 100 travel insurance companies? 🤯

See all the travel insurance reviews here .

Or, read our guides to the hottest topics in travel insurance.

Reviewed: 100+ UK travel insurance providers

- Privacy Policy

- Car Insurance Reviews

- Pet Insurance Reviews

- Home Insurance Reviews

Copyright © 2023 TravelInsuranceReview.co.uk

- Sitemap >

- Travel insurance >

- Travel Insurance - Compare Our Best Cover April 2024

Compare our best travel insurance

Travel insurance covers you for costs that could occur when you are travelling, find the best travel product for your needs, what is travel insurance.

A travel insurance policy protects you against costs you’d otherwise incur if problems arise when travelling. A good policy will cover you for essentials such as cancellation, lost luggage, delayed flights, stolen property, illness, injury and repatriation.

Sometimes, travel insurance is called “holiday insurance”. You don’t legally need it to travel, but it could prove invaluable if something happens while you were away.

A good policy will cover you for essentials such as cancellation, lost luggage and delayed flights."

Do I need travel insurance?

If you experience problems when travelling, you might have to fork out a lot of money.

For example, if you fall ill overseas, your medical bill can run into tens of thousands of pounds or even more, especially if you must remain in hospital for some time or need to be repatriated.

Don’t fall into the trap of only getting round to travel insurance when you’re pretty much on your way to the airport. Always search for and buy cover when you book your trip, so you’re protected against cancellations or delays, which could wreck your holiday even before it begins.

The right policy will contain all the elements you need. For example, the personal belongings cover limit should be higher than the cost of replacing any expensive items you’re taking with you.

Worldwide travel insurance

It’s also worth considering worldwide travel insurance if you are travelling outside of Europe. Worldwide travel insurance can either include or exclude the USA, Canada and the Caribbean, so read the small print.

Types of travel insurance

Single trip insurance.

This covers you for one trip to just one location (or locations - for example, if you’re travelling to a few destinations) for a specific period of time. The cover ends when you return home.

Multi-trip travel insurance

This covers you for every trip you make during a 12-month period. The best policy will depend on what cover you want and how often you travel. If you’re only going on one or two holidays in the next year, it’s usually a good idea to get single-trip travel insurance.

If you travel more often, annual travel insurance could work out much cheaper in the long run. Here’s how to choose between single-trip travel insurance or annual travel insurance.

How to choose the best travel insurance

Shop around, get the right kind of policy, don’t always get the optional extras, what does travel insurance cover, not covered with some policies, how does pre-existing medical conditions impact travel insurance.

Any pre-existing conditions must be declared when you apply for travel insurance. You’ll need to share information about these when you get your holiday insurance quotes and apply for a policy.

If you don’t declare your medical conditions, you cannot claim on your holiday insurance should you fall ill as a result of your condition. For example, if you don’t tell your insurer about your angina and then suffer a heart attack or stroke while on holiday, your policy probably won’t pay out.

That’s why it’s important to be as open and honest as you can when you sort out travel medical insurance. You might like to find specialist cover for people with pre-existing medical conditions.

If you don’t declare your medical conditions, you cannot claim on your holiday insurance."

How can I get cheap travel insurance?

It’s important to find the best travel insurance for your needs rather than just searching for cheap travel insurance. That’s because cheap holiday insurance might not cover what you need.

If you just need standard travel insurance, searching on a comparison site will provide you with an ample selection of policies to consider.

If you have more specific needs, such as a pre-existing medical condition, you may need to speak to a specialist. The Money and Pensions Service and the British Insurance Brokers’ Association should be able to help you find affordable cover.

Do I need extra protection or a specialist policy?

Not all activities are covered on every holiday insurance policy. Depending on what you’ll be doing while you’re away, you might need extra cover for activities that aren’t included as standard.

You can tailor your policy with extras such as:

Extreme and winter sports cover: This is for accidents that happen while you take part in sports such as skiing or snowboarding. You might see this being called ski travel insurance

Business cover: This provides cover if you’re travelling for work purposes

Golf cover: This covers your golfing equipment and other associated costs

You can also get specialist policies, including:

Travel insurance for seniors: This is for older people, who are statistically more likely to make a medical claim

Pre-existing medical conditions: This travel insurance element is for people with diagnosed health conditions

Cruise travel insurance: Cruise insurance covers incidents such as cabin confinement or a missed port

Backpacker travel insurance: If you’re going away for longer than usual periods, such as a gap-year trip, you may wish to consider backpacker insurance policies

Family travel insurance: If you’re travelling as a family, this can be a good way to save on the costs as it covers you all

Do I legally need to have travel insurance?

No, but you should never travel without it because medical treatment abroad can cost tens of thousands of pounds or more.

When should I buy travel insurance?

It’s best to buy travel insurance as soon as you book your holiday. That way, you’ll be covered if something happens that means you can’t go or you’re delayed. This could include illness or weather disruptions – but check your policy carefully to see what you’re covered for. If you’re not insured, you won’t be able to claim.

Remember that with travel insurance, you’ll usually have to pay for any costs yourself, and your insurer will pay you back later when you claim. So don’t forget to keep receipts and bills to prove what you paid for.

When might I not need to buy travel insurance?

While you should always travel with insurance, you might not need to buy a policy if you already have it through another source, such as through work or as part of a packaged bank account .

Can I get travel insurance with pre-existing medical conditions?

Yes, but it can be more expensive, and not all insurers will cover you. This guide explains how to find travel insurance with pre-existing conditions .

Will my destination be covered?

Most popular destinations will be, but check your policy and the Foreign & Commonwealth Office (FCO) because some countries may not be insured if they are deemed dangerous.

How long can I go away for?

It depends on your policy, but most insurers offer maximum single-trip lengths of between 30 and 90 days.

Some insurers will offer longer lengths of cover, such as up to 120 days, although there may be upper age limit restrictions.

Can I claim for cancellation before my holiday starts?

Yes, you’re covered from the moment you take out your policy. For this reason, it’s best to buy travel insurance when you book your trip.

Do I need travel insurance in Europe if I have a EHIC?

Yes, the European Health Insurance Card (EHIC) only gives you access to basic state-provided healthcare when in European Union countries and Switzerland. It doesn’t cover ongoing care, medicines or repatriation costs.

Despite Brexit, the cards remain valid until their expiration dates. When your EHIC expires, you can replace it with a EHIC UK or Global Health Insurance Card (GHIC).

Will travel insurance cover me if I travel for business?

Yes, and some policies will offer business cover as an extra to cover gadgets and other devices, including laptops and mobile phones as well as business equipment.

Explore our travel insurance guides

About the author

Customer Reviews

Very helpful

I love using money.co.uk for financial…

super helpful for newcomers!

We’ve been featured in

- Back to Travel Insurance Guides

Compare Best Travel Insurance Companies 2024

- Rated 4.92 / 5 by 3758 client reviews

What is the Best Travel Insurance?

Travel Insurance companies offer so many different types of cover under their various policies and each has their own unique limits, which can make it difficult to figure out which is the best Travel Insurance policy for you.

How long do you need to be covered?

Most providers also offer different variations of cover. At the very beginning of looking for your policy, you will need to decide how many trips you want to take while covered by your policy.

- Single-Trip – covers you for a single holiday

- Multi-trip policy – often taken out where there are likely to be multiple holidays or trips abroad over a set time period.

Where do you need to be covered?

After this, you will likely need to choose where you want to be covered. Standard coverage areas include:

- Worldwide (excluding North America)

- Worldwide (including North America)

The differentiation between including and excluding North America reflects higher medical expenses in this region.

You’ll also need to decide how comprehensive you want your policy to be and if you want to add any optional add-ons you would like to your policy, such as Winter Sports Cover.

All these different options mean it’s so important to seriously consider which types of cover you need how much you need before you shop around. The best Travel Insurance policy isn’t necessarily one that covers more or costs the least; it’s the one that ticks all your boxes for the best price.

Compare Top UK Travel Insurance Companies

For ease of comparison, the below policies are all the best Travel Insurance policies offered by each of the insurers. Some providers have tiers of cover available ranging from basic to fully comprehensive – check the insurer review pages for more on this.

Drewberry’s Best Travel Insurance Tips

- Don’t ignore pre-existing health conditions If you are suffering from any health problems, it is vital that you declare them to your insurer when you take out your policy. If you do not inform your insurer of a health problem you can jeopardise your coverage. This also includes health problems that you are still waiting for a diagnosis for if you have yet to get your results from investigations.

- Double check that your holiday activities are covered Insurers have a set list of activities and sports that they are willing to cover you for while you are abroad, with winter sports and activities typically offered as an optional add-on. Before you make great plans on your holiday, it pays to double check that all of the fun activities that you have planned are covered by your policy.

- Take the appropriate measures to ensure the safety of your belongings A common exclusion for most policies is the loss or damage of possessions that are improperly cared for. If you don’t take the necessary steps to protect your valuables – such as leaving them unattended while you take a dip in the sea – then your insurer is likely to reject your claim if something unfortunate were to happen.

- Consider your choice between a Single-Trip or Multi-Trip Policy Multi-trip policies can be great value if you travel abroad frequently, but it may be cheaper to buy Single-Trip policies for each trip if you don’t travel as frequently.

- Buy your policy early and leave enough time before your trip One of the most useful types of cover offered by Travel Insurance is Cancellation Cover. Buying your policy far ahead of going on your trip means that your insurance protection will be in place if anything happens that causes you to cancel or delay your trip. In fact, the best time to buy your policy is when you book your trip.

- Don’t ignore the excess If you are looking for cheap Holiday Cover then there are plenty of basic policies to choose from that still offer valid cover for things that matter. However, it is important that you look out for your policy’s excess before shopping around. Some of the cheaper policies available may be so because the excess is a lot higher than normal.

How Much Does the Best Travel Insurance Cost?

When comparing Travel Insurance policies, it is important that you look at more than just the cost. While it can be tempting to opt for a cheaper policy, some of the low-cost Travel Insurance options may have a high excess or may not offer enough cover to fulfil your needs while you’re abroad.

- Level of Cover The extent of cover that you get from your policy will be depend on the insurer you choose and the available options they offer you. Many of the best Travel Insurance companies offer a range of policies that give different levels of cover. More expensive policies may offer more types of cover while you’re abroad or more compensation for your claims.

- Excess Most policies – apart from some of the most comprehensive – will have a mandatory excess that will apply to certain types of claims.

- Health and Medical History If you aren’t in a good state of health or if you have a pre-existing medical condition, you may face the difficult choice of having to pay more for your cover to ensure you are covered or having your health problems excluded from your cover. Fortunately, there are certain providers on the market who will consider cover for those with pre-existing conditions.

- Destination European trips will typically cost less compared to trips elsewhere around the world. The level of risk that comes with travelling to your country of choice will contribute to the cost of your policy. Worldwide policies that cover you anywhere in the world will cost the most.

- Multi-trip or Single Trip Multi-trip Travel Insurance can sometimes cost as much as double a Single-trip policy. If you travel frequently throughout the year, however, a Multi-trip can save you money in the long run provided you travel frequently enough to get the most out of your policy.

By choosing a policy and the appropriate options that apply specifically to your needs, you can avoid overpaying for cover you don’t need or settling for insufficient, cheaper cover.

Common Travel Insurance Definitions...

What is medical cover and what does it include.

This will cover the cost of some or all of your medical bills while you are abroad if you suffer from a serious accident or illness during your trip. This does not cover the cost of medical tourism or any procedures arranged prior to your trip.

What to look for: If you have any pre-existing health conditions that you require cover for, it is important that you find a policy with the right type of underwriting that will not exclude the health problem(s) from your cover.

You’ll typically pay more for Travel Insurance that covers pre-existing conditions, but when thinking about premiums consider just how much your medical costs could be while you’re abroad if a pre-existing condition flared up while you were on your trip.

What does delay cover include?

This cover will pay out a daily benefit if your flight is delayed for more than 12 hours, although usually up to a limit.

What to look for: When you choose this type of cover, it’s worth it to consider policies that cover the delay of your luggage as well. It’s one thing to be forced to hang around for your flight, but the situation can be just as dire if you are stuck in a different country without any of your luggage. Compensation for your luggage will ensure that you can at least afford a change of clothes and toiletries if your luggage is delayed for more than 12 hours.

What does Accidental Death and Disability cover?

Accidental Death & Disability Cover will pay out a lump sum if a person covered by your policy dies or is made severely or permanently disabled while you’re travelling.

What to look for: Most insurance providers will offer this or a variation of this benefit to provide you with general compensation and support. Cover can reach up to £50,000, which can provide valuable financial support, but should not be relied upon if you return home from your holiday with a severe disability and unable to work.

What is cancellation and curtailment cover?

If you find that you need to cancel your holiday plans at the last minute or if you need to cut your holiday short due to an emergency, this cover could allow you to reclaim some or all of the cost of your trip.

What to look for: This type of cover is usually included as standard with the best Travel Insurance policies, although some providers can offer extended cover for any derailments of your trip. Some even offer cover if you need to cancel your trip because a pet is taken ill, so it’s important you look at just what’s covered by this element of your insurance policy.

Other Travel Insurance Cover Definitions

Baggage and personal belongings cover.

Definition: This cover will pay out to cover the loss or damage of any of your baggage or personal belongings up to a certain amount.

What to look for: If you plan to take any particularly valuable items with you while you are abroad, you will need to look carefully for your policy’s ‘per item’ cover limit. Some policies offer quite a low cover limit per item for your valuables but instead offer optional Gadget Cover or Tech Cover that will cover your expensive electronics for an extra fee. You will need to work out for yourself the value of your luggage and decide how much cover is the appropriate amount.

Money and Travel Documents Cover

Definition: This cover will provide you with compensation if your travel money, travel documents or passport are stolen or lost while you are abroad.

What to look for: This type of cover often has strict terms that ensure that you are not responsible for losing your money. Cover for these types of items can also be split up in some policies, with different cover limits applying to travel money, tickets, passports etc. Check the cover limits carefully and avoid carrying around an excess of travel money that may exceed your policy’s cover limit, otherwise you will not be fully compensated.

Personal Liability and Legal Expenses Cover

Definition: Personal Liability and cover for Legal Expenses are usually offered at the same time, but not always. Personal Liability Cover will cover you if you are guilty of accidentally injuring someone or damaging property while you’re abroad. Legal Expenses Cover will pay out if the opposite occurs and if someone is responsible for harming you or your personal property and you wish to take legal action.

What to look for: Some of the best Travel Insurance companies will appoint a lawyer on your behalf if you need one, which is a great benefit to have in addition to cover for the other legal expenses. Other providers will typically give you access to a legal helpline or remote service where you can make your claim and get basic advice about your case. These can be valuable benefits to look out for while you shop for your policy.

Sports / Winter Sports and Hazardous Activities Cover

Definition: You will usually find most insurance companies exclude ‘risky’ activities such as winter sports cover when you take out your policy. However, most insurers have an optional extra Ski Travel Insurance that will allow cover for winter sports if you add it to the policy. This usually even covers mountain rescue if you’re injured on the slopes.

Some providers are willing to cover – either as an option or automatically – dangerous activities such as skydiving and even base jumping, depending on the provider and the policy.

What to look for: Cover for dangerous activities can be expensive when you are given the choice to add it to your policy. If you tend to take part in a lot of sporting activities while you are abroad, then this cover can be very valuable as you don’t want to risk being injured in the pursuit of such activities and not being able to claim.

Major Incident / Catastrophe / Force Majeure Cover

Definition: If a major incident ruins your holiday plans, like an earthquake, flood or fire, this cover will pay for the cost of alternative accommodation and your travel expenses.

What to look for: This cover is vital if you prefer to organise your own holidays rather than booking package holidays. While resorts and agencies may offer some compensation if these incidents happen, booking your holiday alone means that you may need to pay out of your own pocket to resolve the problem if, say, a hurricane destroys your hotel. However, look carefully at exactly the types of incidents that your provider will cover because some will not cover all serious natural disasters.

Popular Related Guides

![best travel insurance uk for claims Post Office Travel Insurance [Review] Image](https://media.drewberry.co.uk/yoga-brushstroke.png)

Drewberry™ uses cookies to offer you the best experience online. By continuing to use our website you agree to the use of cookies including for ad personalization.

If you would like to know more about cookies and how to manage them please view our privacy & cookie policy .

The UK’s leading travel insurance providers reviewed

If you're looking for a travel insurance policy, the experiences of others can be an excellent indicator of what to expect. So what are people like you saying about some of the UK's leading travel insurance providers?

- Online reviews can provide helpful information on the strengths and weaknesses of travel insurance providers.

- Customers praise the leading UK travel insurers for customer service, ease of buying insurance and affordability of the policies for those with pre-existing medical conditions.

- Some customers have been let down by claims processes, especially in the wake of the coronavirus pandemic.

- You can look at online reviews to get an idea of the UK’s best travel insurance providers before comparing different policies.

Travel insurance for UK holidaymakers: FAQs

What is the highest-rated travel insurance in the uk.

The UK’s leading travel insurance providers include Staysure , Avanti , Travel Insurance 4 Medical, Cover Cloud Travel Insurance, Globelink , Saga and Direct Line. These providers all have at least a four-star rating on TrustPilot.

Can you trust online travel insurance reviews?

You can find a lot of great information from online reviews. Websites like TrustPilot provide trustworthy reviews of the UK's leading travel insurance providers . You can get a great overall view of an insurer when looking at reviews. However, you always want to take the reviews with a pinch of salt. You can't know the individual circumstances behind the complaints.

What is the cheapest travel insurance for older people?

The most affordable travel insurance always depends on your personal circumstances. Many great insurers provide affordable travel insurance for over-50s , from Saga to Avanti . You should compare different options to find the best travel insurance for your needs.

Does travel insurance cover Covid-19 related illness and cancellations?

Many travel insurance providers didn't cover cancellations due to the coronavirus at the start of the pandemic. You can read a lot of online reviews complaining about this. However, insurance companies have since updated their policies. With most insurers, you can also buy extra cover against Covid-19 related travel disruption .

Having the right travel insurance can give you the peace of mind to enjoy your next trip.

Thankfully, finding travel insurance doesn't have to be tricky, even as you get older. Sure, premiums may be more expensive than what you would have once paid. However, many UK travel insurance companies cover pre-existing conditions and offer other elements tailored to older holidaymakers.

While all insurers will talk about the positives of their policies, what matters most are the opinions of those who buy them and potentially have to make a claim.

Let’s look at what people say about some of the UK’s leading travel insurance providers.

Whether you're looking for single-trip, multi-trip, or specialist cover, or need assurance about pre-existing medical conditions, our panel of travel insurance providers has you covered. Click on your chosen provider below to get started.

- Some restrictions based on age

All TrustPilot figures correct as of 1st November 2023.

Allianz Travel Insurance

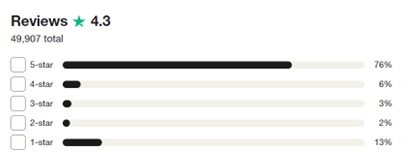

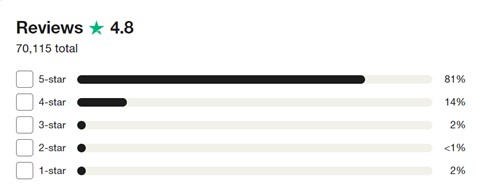

TrustPilot Rating: 4.3 from 49,907 reviews

Allianz Assistance , which takes in Allianz Travel Insurance , was incorporated back in 2014.

- Upper age limit of 80.

- Up to 180 days cover available with single trip insurance.

- Request a personalised quote for your specific requirements.