Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Capital One Venture X

Full List of Travel Insurance Benefits for the Capital One Venture X Card [2023]

Senior Content Contributor

486 Published Articles

Countries Visited: 24 U.S. States Visited: 22

Director of Operations & Compliance

1 Published Article 1171 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![capital one venture x travel insurance covid Full List of Travel Insurance Benefits for the Capital One Venture X Card [2023]](https://upgradedpoints.com/wp-content/uploads/2022/09/Capital-One-Venture-X-Upgraded-Points-LLC-04-Large.jpg?auto=webp&disable=upscale&width=1200)

Basic Card Information

Primary car rental loss and damage insurance, trip cancellation and trip interruption insurance, trip delay reimbursement, lost luggage reimbursement, travel and emergency assistance services, travel accident insurance, filing a claim, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The Capital One Venture X Rewards Credit Card is one of the hottest in today’s ultra-premium market, and even though Capital One is a new entrant into the ultra-premium niche, it did an incredible job with this card. The card boasts thousands of dollars of value every year for the discerning traveler, streamlined bonus rewards, and access to an attractive points landscape in Capital One Miles.

This card doesn’t just stop at lounge access and travel credits — its benefits extend all the way to high-quality travel insurance perks. Unfortunately, learning about the travel insurance offered by the Capital One Venture X card is easier said than done. This is made even more complicated by the fact that insurance policies are some of the most difficult topics to read about.

So in this guide, our goal is to demystify the travel insurance benefits and coverage offered by the Capital One Venture X card. This guide will cover everything from primary rental car insurance to travel accident insurance.

Let’s get right into it!

For you to better understand the card’s coverage, it’s important to have a little background on the card. We’ve detailed the benefits, welcome bonus, and annual fee for the Capital One Venture X card below:

Capital One Venture X Rewards Credit Card

The Capital One Venture X card is an excellent option for travelers looking for an all-in-one premium credit card.

The Capital One Venture X Rewards Credit Card is the premium Capital One travel rewards card on the block.

Points and miles fans will be surprised to see that the Capital One Venture X card packs quite the punch when it comes to bookings made through Capital One, all while offering the lowest annual fee among premium credit cards.

Depending on your travel goals and preferences, the Capital One Venture X card could very well end up being your go-to card in your wallet.

- 10x miles per $1 on hotels and rental cars purchased through Capital One Travel

- 5x miles per $1 on flights purchased through Capital One Travel

- 2x miles per $1 on all other purchases

- $300 annual travel credit on bookings made through Capital One Travel

- Unlimited complimentary access for cardholder and 2 guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- 10,000 bonus miles awarded on your account anniversary each year

- Global Entry or TSA PreCheck credit

- Add authorized users for no additional annual fee ( rates & fees )

- No foreign transaction fees ( rates & fees )

- $395 annual fee ( rates & fees )

- Does not offer bonus categories for flights or hotel purchases made directly with the airline or hotel group, the preferred booking method for those looking to earn elite status

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck ®

Financial Snapshot

- APR: 19.99% - 29.99% (Variable)

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Capital One Miles

- Benefits of the Capital One Venture X Card

- Best Ways to Use Venture X Points

- Capital One Venture X Credit Score and Approval Odds

- Capital One Venture X Lounge Access

- Capital One Venture X Travel Insurance Benefits

- Capital One Venture vs Venture X

- Capital One Venture X vs Amex Platinum

- Capital One Venture X vs Chase Sapphire Reserve

- Best Credit Cards with Priority Access

- Best Credit Cards for Airport Lounge Access

- Best Capital One Credit Cards

- Best Luxury and Premium Credit Cards

- Best Metal Credit Cards

- Best High Limit Credit Cards

- Choice Privileges Loyalty Program Review

One of the pillars of travel insurance is coverage for your rental car. Indeed, this is one of the most important areas to pay close attention to. Why? Coverages vary wildly — and you might not actually be getting the coverage you’re expecting. If something unexpected happens while you’re renting, you could be liable for thousands of dollars worth of damages.

The Capital One Venture X card confers excellent primary rental car coverage (in contrast to secondary rental car coverage). When renting a car for a period of 15 consecutive days in your country of residence or 31 days outside your country of residence, you can get coverage. Countries excluded are Israel, Jamaica, the Republic of Ireland, and Northern Ireland.

Some exclusions apply, including expensive, exotic, and antique cars, cargo vans, certain vans, vehicles with an open cargo bed, trucks, motorcycles, mopeds, motorbikes, limousines, and recreational vehicles.

In order to utilize this coverage, you have to decline the rental car company’s collision damage waiver (CDW), also sometimes referred to as the loss damage waiver (LDW), and pay for the entire rental car using your Capital One Venture X card .

To file a claim, you need to immediately call the benefits administrator at 800-825-4062 (outside the U.S., call collect at 804-965-8071).

You’ll need to provide:

- A copy of the accident report form

- A copy of the initial and final auto rental agreements (front and back)

- A copy of the repair estimate and itemized repair bill

- 2 photographs of the damaged vehicle, if available

- A police report, if obtainable

- A copy of the demand letter that indicates the costs you are responsible for and any amounts that have been paid toward the claim

Be sure to complete and sign the claim form that the benefits administrator provides and postmark it within 90 days of the theft or damage date, even if all of the other required documentation isn’t yet available.

You’ll want to also submit a copy of your billing statement showing that the entire car rental was booked with the Capital One Venture X card.

One of the core pillars of travel insurance is trip cancellation and interruption insurance.

If your upcoming travel plans are disrupted or canceled, there could be potentially huge financial implications. For example, if your airline becomes insolvent, and you have to cancel your vacation because of that, you’ll want to leverage your trip cancellation and interruption insurance, which typically covers unexpected events.

You can even use this coverage while you’re in the middle of your trip — it specifically relates to travel on “common carriers.” Common carriers are generally any model of transportation by land, water, or air operating for hire under a license to carry passengers for which a ticket must be purchased prior to travel.

The most applicable common carrier travel would likely be airfare, and the Capital One Venture X card covers up each insured person, so long as you charge the entire cost to that credit card. Your spouse and dependent children are generally eligible for coverage, as long as their trips are paid for on the credit card, too.

You’re generally covered if the interruption or cancellation is from the death of a family member (as well as accidental bodily injury, disease, or physical illness) or financial insolvency of the common carrier.

Exclusions to this insurance include any preexisting conditions, injuries arising from participation in professional sports events, cosmetic surgery, suicide, declared or undeclared war, and more.

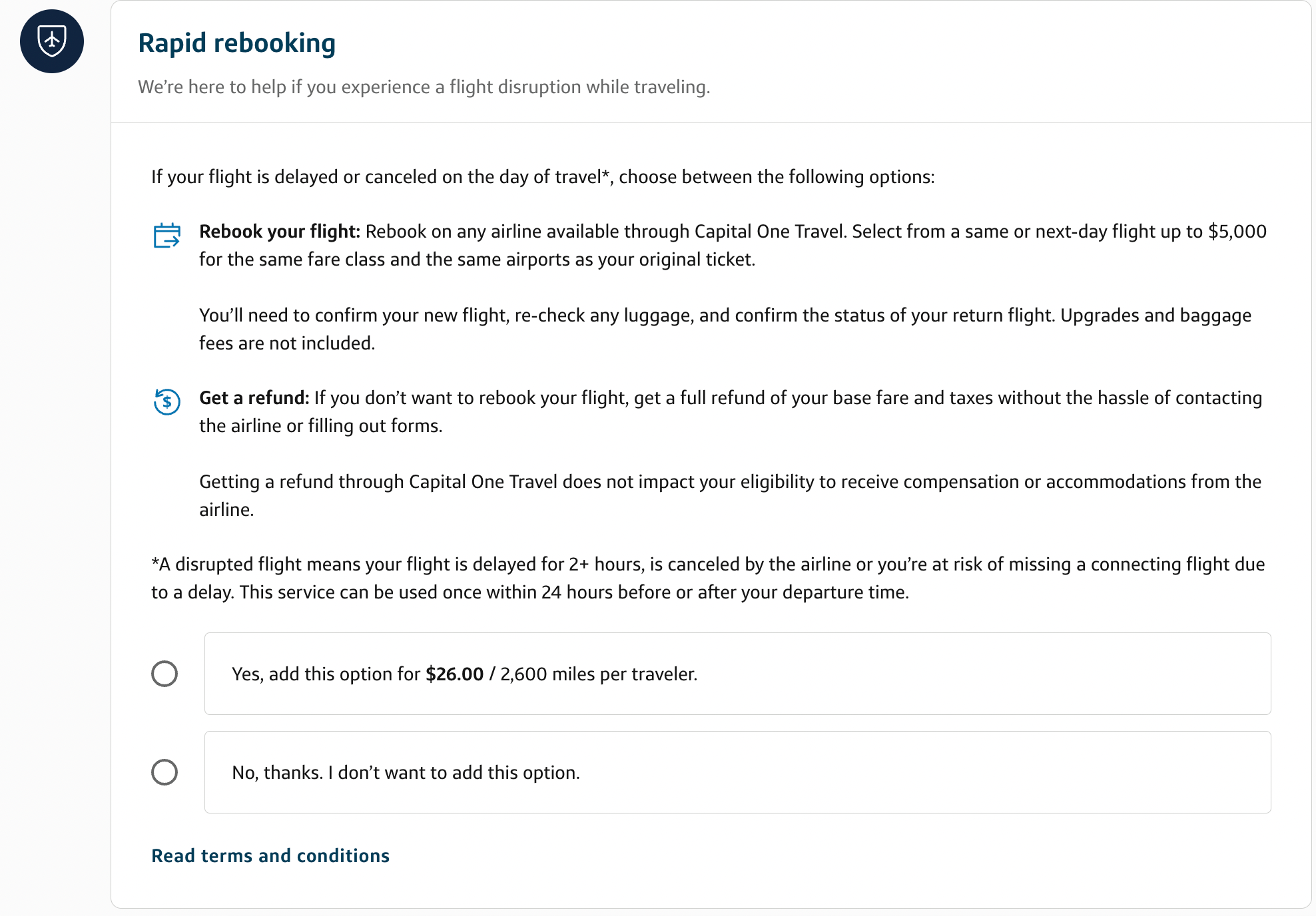

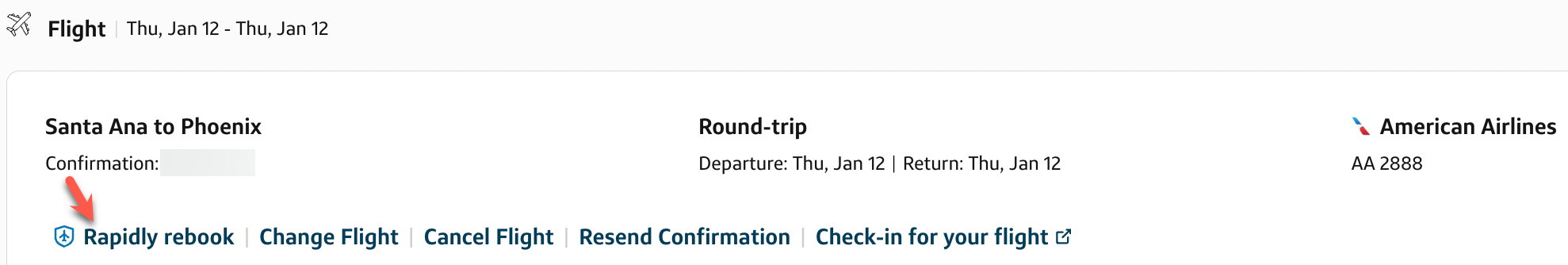

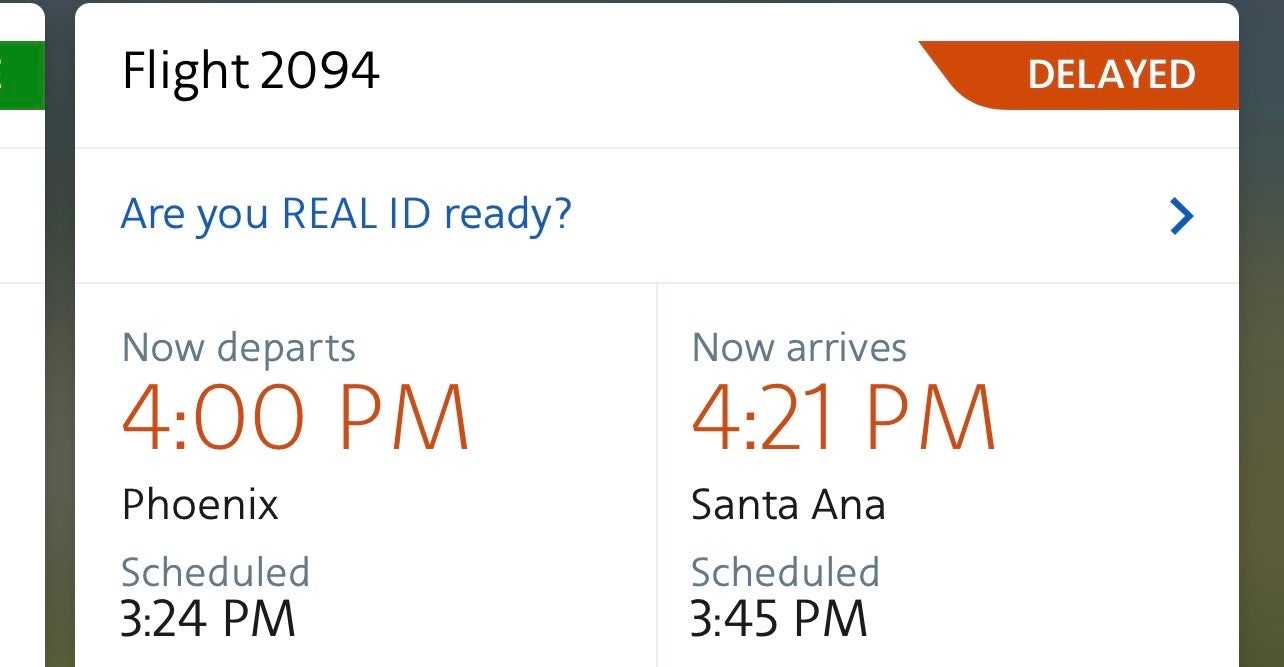

Trip delays are one of those unexpected annoyances that happen to travelers sooner or later.

Luckily, the Capital One Venture X card covers trip delay reimbursement for every purchased ticket on your card, so long as your trip is delayed for more than 6 hours or requires an overnight stay .

You can have up to 1 claim per trip only, and you need to purchase at least a portion of the common carrier fare using your credit card . You don’t need to purchase the entire fare using your credit card — award ticket taxes and fees count, too!

You, your spouse, and your dependent children under 22 years old are generally covered as long as all of their trip was purchased using the same Capital One Venture X card.

Ever wondered what happened to your luggage, only to find out that, just like a nightmare in a scary movie, the airline has lost your luggage?

Worry no further because you can use the Capital One Venture X card’s lost luggage reimbursement coverage to recover costs.

Technically, the coverage is for the difference between the claimed value and whatever the common carrier has reimbursed you already. If the common carrier hasn’t reimbursed you at all, you should be covered for the complete value of the baggage and its contents.

You and all of your immediate family members are covered, as long as you purchase a portion of the covered trip with your Capital One Venture X card; this includes award ticket taxes and fees.

The Capital One Venture X has a suite of travel and emergency assistance services that can connect you to local emergency and assistance resources 24/7, 365 days a year.

Remember, travel and emergency assistance services provide assistance and referral only; the cost of any services or goods provided is your responsibility and is not covered.

Some specific services include:

- Emergency Message Service — Record and relay emergency messages for travelers or their immediate family members

- Medical Referral Assistance — Provides medical referral, monitoring, and follow-up

- Legal Referral Assistance — Arranges contact with English-speaking attorneys and U.S. embassies and consulates if you’re detained by local authorities, have a car accident, or need legal assistance

- Emergency Transportation Assistance — Helps make all necessary arrangements for emergency transportation home or to the nearest medical facility

- Emergency Ticket Replacement — Helps you through your carrier’s lost ticket reimbursement process and assists in the delivery of a replacement ticket

- Lost Luggage Locator Service — Can help you through a common carrier’s claim procedures or can arrange shipment of replacement items if an airline or common carrier loses your checked luggage

- Emergency Translation Services — Provides telephone assistance in all major languages and helps find local interpreters

- Prescription Assistance and Valuable Document Delivery Arrangements — Helps you fill or replace prescriptions and transport critical documents that you may have left at home or elsewhere

- Pre-trip Assistance — Gives you information on your destination before you leave, like ATM locations, currency exchange rates, and more

In general, the primary cardholder, spouse, and all dependent children under 22 are eligible to use these services.

Terms, conditions, and exclusions apply. Refer to your guide to benefits for details. Some of these benefits are provided by Visa or Mastercard and may vary by product and depends on the level of benefits you get at application.

As a Capital One Venture X cardholder, you are automatically insured against accidental loss of life, limb, sight, speech, or hearing while riding as a passenger in, entering, or exiting any licensed common carrier, as long as the entire cost of your fare has been charged to your Capital One Venture X card.

Exclusions include taxes, as well as bus, train, airport limousine, and courtesy transportation. Note that terms, conditions, and exclusions apply. Refer to your Guide to Benefits for more details. Travel Accident Insurance is not guaranteed. It depends on the level of benefits you get at the time of application

The exact process for filing a claim may vary depending on which coverage you’re trying to use, but the general process is usually the same:

- Notify your benefits administrator as soon as you possibly can about your covered event.

- Provide any preliminary claim information to the benefits administrator.

- The benefits administrator will send a more complete claim form to fill out, as well as a list of documentation required.

- Submit the claims and wait to receive the reimbursement you’re eligible for.

- Follow up with the benefits administrator as needed.

The exact documentation you’ll need to collect will vary — for example, if you want to file for a car rental-related reimbursement, you’ll likely need to furnish items like your rental car agreement.

On the other hand, if you’re applying for trip cancellation or interruption coverage, you’ll need to provide the confirmation of the nonrefundable tickets on the common carrier.

In general, all claim forms must be submitted within 90 days of the covered event, even if all of the supporting documentation isn’t yet available.

Hot Tip: Keep as much documentation as possible, including receipts, police reports, email communications from third parties, and more.

The Capital One Venture X card has some of the best travel insurance a credit card can offer. This is on top of the other benefits you get, such as unlimited Capital One Lounge access , up to $300 Capital One Travel credit every cardmember anniversary year, cell phone insurance , and so much more.

In particular, the primary rental car insurance rivals the best that ultra-premium credit cards offer.

Although this card doesn’t have baggage delay coverage, emergency medical and dental coverage, or emergency medical transport and evacuation insurance, it has most of the features travelers are looking for.

For Capital One products listed on this page, some of the above benefits are provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Frequently Asked Questions

Does the capital one venture x rewards credit card include travel insurance.

Yes! The Capital One Venture X card offers a suite of travel insurance perks, like primary rental car coverage, trip cancellation and interruption coverage, lost luggage reimbursement, and travel accident insurance.

Is it worth it to get trip insurance?

In most cases, it’s worth it to get trip insurance, especially in an era of COVID-19 complications. However, the Capital One Venture X card may provide most of what you’re looking for, for free!

How does travel insurance work for trip cancellation?

If your trip is cancelled or interrupted due to covered reasons (including death, accidental bodily injury, or physical illness of yourself or an immediate family member) or default of the common carrier resulting from financial insolvency, you can submit a claim for trip cancellation and interruption reimbursement.

You’ll want to provide a claim notice to a plan administrator, follow any instructions to provide evidence, fill out the required forms, and submit all of the documentation.

What is not covered by travel insurance?

In general, travel insurance excludes epidemics and pandemics, as well as any voluntary changes/events that occur. Additionally, there is a list of exclusions for each travel insurance benefit in your benefits guide.

Was this page helpful?

About Stephen Au

Stephen is an established voice in the credit card space, with over 70 to his name. His work has been in publications like The Washington Post, and his Au Points and Awards Consulting Services is used by hundreds of clients.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![capital one venture x travel insurance covid Credit One Bank Wander® Visa® – Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2021/08/Credit-One-Wander-Card.jpeg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Capital One Venture X Card Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

About the Capital One Venture X Rewards Credit Card

Trip cancellation and interruption coverage, trip delay coverage, common carrier travel accident coverage, lost or damaged baggage coverage, rental car collision coverage, capital one venture x rewards credit card travel insurance recapped.

The Capital One Venture X Rewards Credit Card is a travel credit card offering a long list of benefits for travelers. For the card’s $395 annual fee, you get a lot of perks — an annual $300 Capital One Travel credit , a 10,000-point anniversary bonus and Priority Pass lounge access, among other travel perks.

The card also offers several travel insurance benefits, which makes it a good choice for booking travel. Even if another card offers you more points, paying for travel with your Capital One Venture X Rewards Credit Card might make sense if the other card doesn’t have insurance and you want coverage.

Here’s a rundown of how the Capital One Venture X Rewards Credit Card travel insurance benefits work.

The Capital One Venture X Rewards Credit Card is a premium travel credit card with an excellent rewards rate and access to a unique set of airport lounges (including Capital One-branded options in Dallas, Washington, D.C., and Denver, plus Priority Pass lounges).

It also has hundreds of dollars worth of travel credits that can make up for the $395 annual fee.

To maximize your card, book travel in the Capital One Travel Portal or transfer your points to one of the bank's travel partners .

The current sign-up bonus is: Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel.

» Learn more: The Capital One Venture X Rewards Credit Card versus Chase Sapphire Reserve

Trip cancellation and trip interruption coverage is included and can help cover a variety of prepaid expenses if you need to cancel or change your trip.

If you pay with the Capital One Venture X Rewards Credit Card you can be reimbursed up to $2,000 per person for any nonrefundable airline, bus, train or ferry tickets if your trip is canceled or cut short for an eligible reason. Only the cardholder, their spouse and any dependent children are covered.

The card's included trip interruption or cancellation insurance doesn’t provide coverage for prepaid tours or hotel reservations.

The card's plan only covers trip cancellation or interruption in two specific scenarios:

The death, injury or illness of you or an immediate family member.

Financial insolvency of the common carrier, resulting in default.

If you have to cancel a trip or return home early for any other reason, this policy will not reimburse you the cost of your tickets.

How to submit a trip cancellation or interruption claim

Trip cancellation and interruption protections are managed by an external claims administrator, so you’ll need to work with them to process your request. Claims can be initiated by mail to the following address: CBSI Card Benefit Services; 550 Mamaroneck Avenue, Suite 309; Harrison, NY 10528.

Once you’ve initiated your claim, you’ll use the portal at www.myclaimsagent.com to upload documents and check the status of your claim. Note that you can’t initiate claims online.

You should submit your claim within 20 days of when the incident that cancels or interrupts your travel occurred. Once you’ve received the required forms from the benefits administrator, you’ll need to sign and return them, along with all necessary documentation, within 15 days.

Here are some of the documents you may be required to submit:

Copies of proof of cancellation from the common carrier, as well as an itinerary with the traveler’s names and ticket cost.

Document showing the common carrier’s cancellation policies.

A copy of your credit card statement, showing that the travel was charged to your card.

Confirmation showing the reason for the trip cancellation or interruption.

Other claim documentation, as requested by the benefit administrator.

» Learn more: The guide to Cancel For Any Reason (CFAR) travel insurance

When you book your airline or other common carrier tickets with your Capital One Venture X Rewards Credit Card , you also receive trip delay coverage .

If your trip is delayed by more than six hours, or requires an unexpected overnight stay, you’ll receive up to $500 per eligible passenger toward any reasonable incurred expenses. This typically includes purchases like hotel accommodations, food, toiletries and other essentials.

Capital One offers trip delay coverage when you use credit card rewards for your travel or pay for all or part of the fare with your Capital One Venture X Rewards Credit Card . Plus, it covers you, your spouse and any children under 22 years of age.

How to file a trip delay reimbursement claim

Within 30 days of your trip, you’ll need to file a claim with the benefits administrator by filling out a form at www.eclaimsline.com or calling 800-825-4062. Be sure to save your receipts and get a statement from your carrier about the reason for the delay.

Here’s what you’ll be expected to provide with your claim:

A copy of your itinerary and common carrier tickets.

Your monthly billing statement, showing that your travel expenses were charged to your account.

A statement from your common carrier stating the reason for the delay.

Itemized receipts for expenses claimed.

» Learn more: Flight delay? Why you probably should still wait near your gate

Even with careful planning, accidents can happen when traveling. If you’re injured (or worse) while traveling on a common carrier, you’re protected by up to $1,000,000 of travel accident insurance — as long as you charge your trip to your Capital One Venture X Rewards Credit Card . The coverage protects you against loss of life or specific, significant bodily injuries.

Capital One’s coverage is door-to-door as long as you’ve charged your common carrier fare to your card. This means you’ll be protected from your home all the way to your destination, including any travel by taxi, bus, ferry or other form of public transportation.

How to file a travel accident claim

If you need to file a claim under Capital One’s common carrier travel accident insurance policy, contact Broadspire, the claim administrator for this benefit. Broadspire’s contact information is as follows: Broadspire, a Crawford company; P.O. Box 459084; Sunrise, FL 33345. It can also be reached by phone at 855-307-9248.

During the claims process, you’ll need to fill out a form and provide the requested documentation and proof of loss.

» Learn more: How free travelers insurance through credit cards works

When an airline loses or damages your luggage, you may receive some compensation , but it might not cover the total cost of your loss. If you’ve booked your trip with your Capital One Venture X Rewards Credit Card , its lost luggage coverage can make up the difference. This benefit will pay up to $3,000 per passenger to cover the difference between what the airline pays you and the value of your claim.

The lost luggage policy also covers carry-on baggage, but only in cases where it was damaged or mishandled by the common carrier.

How to file a lost or damaged baggage claim

Your first step when you have a lost or damaged bag is to submit a claim with the common carrier. Once you’ve done this, you should contact the benefits administrator at 800-825-4062 or file online at www.eclaimsline.com . You’ll need to do this within 20 days of the bag being lost or damaged.

You’ll also need to provide documentation, including:

A copy of your billing statement showing payment of the common carrier fare.

A copy of your common carrier ticket.

Evidence of any payment provided by the common carrier as a settlement of your baggage claim.

The declarations page of any other applicable insurance policies, plus copies of any settlements from them.

» Learn more: What to do if an airline loses your luggage

Rental car insurance , also known as an auto rental collision damage waiver, protects you against the cost of damage to or theft of a rental car.

As long as you charge the rental to your Capital One Venture X Rewards Credit Card and decline the rental company’s collision damage waiver agreement, you’ll receive reimbursement for the cost of theft or damage of the rental car. The coverage is primary and covers the actual cash value of the rental, up to $75,000 when the vehicle is new.

Capital One’s car rental insurance doesn’t cover liability — meaning if you damage property or injure someone with your rental car, they can still pursue a claim against you or your personal automobile insurance. Additionally, the coverage has some exclusions, including rentals in specific countries, antique and luxury cars, motorcycles, recreational vehicles (RVs) and cargo vans, among others.

The rental period cannot be longer than 15 days within your country of residence or 31 days outside your country of residence.

How to submit a rental car insurance claim

If you need to submit a rental car insurance claim, you’ll want to inform the benefits administrator as soon as possible — but no later than 45 days after the incident occured. As soon as you are aware of damage or theft, you should call the benefit administrator at 800-825-4062. You can also start your claim online at www.eclaimsline.com .

During the claim process, you’ll be required to provide documentation:

A copy of the rental company’s accident report form and the rental car agreement.

A copy of a repair estimate and itemized repair bill.

Photos of the damaged vehicle.

A police report, if available and/or applicable.

A copy of the letter from the rental agency showing what costs you are responsible for and what has already been paid.

» Learn more: Where to find rental car discounts

The Capital One Venture X Rewards Credit Card offers a suite of travel protection benefits that can protect you when you’re on the road and encounter unexpected circumstances.

Be sure to read your card’s guide to benefits to understand important benefit limitations and exclusions.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

1%-10% Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases. Earn 8% cash back on Capital One Entertainment purchases. Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024. Terms apply.

$200 Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening.

2x-10x Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel, Earn unlimited 2X miles on all other purchases.

75,000 Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel.

/static-assets/statics-12383/images/financebuzz.png)

Trending Stories

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

15 Legit Ways to Make Extra Cash

/images/2019/12/06/smart_strategies_to_save_money_on_car_insurance.jpg)

6 Smart Strategies to Save Money on Car Insurance

Capital one venture x rewards credit card travel insurance: your guide to benefits.

/authors/ben_walker_updated.png)

This article was subjected to a comprehensive fact-checking process. Our professional fact-checkers verify article information against primary sources, reputable publishers, and experts in the field.

/images/2023/05/26/woman_canoeing_on_beautiful_river.jpg)

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies .

The Capital One Venture X Rewards Credit Card provides excellent travel insurance benefits that could help protect your trips. Depending on how you travel, you might benefit from trip delay reimbursement, primary auto rental insurance, lost luggage reimbursement, and more. 1

Let’s explore the Capital One Venture X travel insurance benefits so you can see how they work and when they might apply.

Key Takeaways

Primary car rental coverage, trip cancellation and interruption insurance, trip delay reimbursement, lost luggage reimbursement, travel and emergency assistance, travel accident insurance, additional card benefits, bottom line.

- Credit card travel insurance benefits often have strict requirements for when they apply and how you can submit claims. It’s important to read over your card’s benefits guide to understand how each travel insurance benefit works, including whether you have to pay a deductible and how much time you have to submit a claim.

- Most travel rewards credit card insurance benefits have a limit on how much you can be reimbursed for if you have a successful claim.

- Credit card issuers tend to work with third-party providers who handle credit card insurance benefits. So don’t be surprised if you have to submit a claim to a company that isn’t Capital One, Chase, Citi, American Express, or another major card company.

- While not necessarily related to travel insurance, the Capital One Venture X also provides other protection perks and benefits, including purchase security, extended warranty protection, return protection, and cell phone protection.

The auto rental collision damage waiver could reimburse you for car rental damages caused by theft or collision. This counts as primary coverage, meaning you don’t have to apply your personal or other car insurance policy before this coverage applies.

The Venture X rental car insurance can reimburse you for up to $75,000 and covers rental periods of 15 consecutive days within your country of residence or up to 31 consecutive days outside your country of residence.

You must use your card to pay for your entire car rental transaction and decline the rental company’s collision damage waiver option or similar provision. This benefit isn’t available in Israel, Jamaica, the Republic of Ireland, or Northern Ireland.

In addition, this benefit doesn’t cover certain vehicles, including antique cars, cargo vans, trucks, motorcycles, limousines, recreational vehicles, and more.

This insurance could cover up to $2,000 per insured person (which could include you, your spouse, and your children) for nonrefundable common carrier tickets, such as nonrefundable flights.

You must charge the entire cost of your trip to your card for this benefit to apply. In addition, this benefit only applies if the trip is canceled or interrupted because of one of the following situations:

- A death, accidental bodily injury, disease, or physical illness of you or an immediate family member.

- Default of the applicable common carrier because of financial insolvency, such as the airline you booked through declaring bankruptcy.

If you’re delayed more than six hours or require an overnight stay, the trip delay benefit could cover up to $500 for each purchased ticket on a covered trip for reasonable expenses made with your card.

Reasonable expenses could include meals and lodging. Toiletries and/or clothing might also count. You and your family (spouse and children under age 22) are covered if you paid for your fares using your card.

You and your immediate family members could receive up to $3,000 in reimbursement each if your checked and/or carry-on luggage (or its contents) is lost due to theft or misdirection by an airline.

This coverage only applies if you paid for your fares using your applicable credit card. Lost luggage reimbursement doesn’t cover the loss or theft of certain items, including contact lenses, eyeglasses, sunglasses, money, documents, cameras, sporting equipment, perfume, keys, automobiles, and more.

If you need help while traveling, travel and emergency assistance services are available 24/7 and could help connect you with applicable emergency and assistance resources..

The card benefits team can help you find these services:

- Emergency message service

- Medical referral assistance

- Legal referral assistance

- Emergency transportation assistance

- Emergency ticket replacement

- Lost luggage service locator

- Emergency translation services

- Prescription assistance and valuable document delivery arrangements

- Pre-trip assistance

Note that this is a service and not coverage that’s going to cover the cost of any local resource you might end up using. For example, it’s free to have the card benefits team put you in contact with an English-speaking doctor in another country, but any costs associated with employing the services of said doctor are your responsibility.

As the cardholder, you and your spouse and children under age 22 can use the travel and emergency assistance services benefit.

You could receive up to $1,000,000 in travel accident coverage if you paid your fare with your credit card. This coverage insures you against accidental loss of life, limb, sight, speech, or hearing while riding as a passenger in or entering or exiting any licensed common carrier. A common carrier could include any applicable land, water, or air transportation.

This benefit is provided to you as the Capital One Venture X cardmember, not to your spouse or children, though authorized users typically receive their own benefits. If loss of life occurs, the benefit is paid to the first surviving beneficiary in this order:

- Your spouse

- Your children

- Your parents

- Your siblings

- Your estate

The Capital One Venture X Visa Infinite card also provides other types of protection benefits in addition to its travel insurance coverage and services.

Purchase security

Purchase security is a type of protection is eligible items recently purchased in the last 90 days with your applicable card. It can cover damage or theft of up to $10,000 per eligible item and up to $50,000 per card account.

This purchase protection benefit could apply if you shatter a newly-purchased tablet on the ground or if you’re traveling and your new phone is stolen.

But purchase security doesn’t cover antique or collectible items, animals, computer software, medical equipment, cash, credit or debit cards, or used items.

Extended warranty protection

Many items come with a manufacturer’s warranty that can help protect your purchase for a certain period. This extended warranty benefit can extend eligible warranties on items by an additional year

For example, if an item has an eligible manufacturer’s warranty of two years, the extended warranty benefit would grant an additional warranty year. So your item would have three total years of warranty protection.

This benefit only applies if you use your card to purchase all or a portion of an item with an eligible manufacturer’s warranty of three years or less.

Return protection

Return protection applies when you purchase an eligible item, and the retailer won’t accept it as a return. You could be reimbursed up to $300 per eligible item and up to an annual maximum of $1,000 per card account.

For this benefit to apply, you must use your card to purchase an eligible item, and the retailer where you purchased the item won’t accept it as a return within 90 days from the date of purchase.

Cellular telephone protection

Cell phone protection could help protect you if your phone is damaged, stolen, or lost in a manner where you know where it is but can’t retrieve it, like a phone that falls off a cliff or into the ocean. This benefit can provide coverage of up to $800 per claim with a maximum of two claims and $1,600 reimbursement every 12 months.

The cell phone coverage benefit only applies to cell phones attached to a monthly bill you pay with your card. This protection doesn’t cover most cell phone accessories, cosmetic cell phone damage, or prepaid phones.

What is the Capital One Venture X card?

The Venture X is a premium travel card from Capital One. It has a $395 annual fee, but provides amazing travel benefits, including:

- $300 annual travel credit for bookings through Capital One Travel

- 10,000 anniversary bonus miles

- Airport lounge access for you and up to two guests to Priority Pass, Plaza Premium, and Capital One Lounges.

- A statement credit of up to $100 toward the application fee for TSA PreCheck or Global Entry

Does the Capital One Venture X have purchase protection?

Yes, the Capital One Venture X provides purchase security for eligible items purchased with your card. Eligible items may be covered if stolen or damaged up to the total purchase price of the item — up to $10,000 per claim and up to $50,000 per cardholder. Some ineligible items include boats, computer software, antiques, animals, and medical equipment.

How does the Capital One Venture X compare to other travel insurance cards?

The Capital One Venture X has excellent travel insurance benefits compared to many other travel credit cards. But the Chase Sapphire Reserve ® generally has better travel insurance.

For example, the Sapphire Reserve provides primary car rental coverage of up to 31 consecutive days, whether you’re in the U.S. or in an applicable foreign country. The Venture X provides primary car rental coverage of up to 31 consecutive days outside your country of residence and only up to 15 consecutive days within your country of residence.

However, the Venture X provides a cell phone protection benefit, while the Sapphire Reserve doesn’t.

Capital One Venture X travel insurance benefits range from primary car rental coverage to travel accident insurance. And, in some cases, you can also take advantage of other card benefits while traveling, including purchase protection, cell phone protection, and extended warranty protection.

Keep in mind that these benefits only work if you follow the rules, such as correctly filing a claim within a given period. So it’s important to read over your guide to benefits to know the ins and outs of your card’s benefits, including the documentation you need to provide with a claim.

For other credit card offers that might also provide helpful travel benefits, check out our list of the best travel credit cards .

Easy-to-Earn Unlimited Rewards

Card Details

Earn 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases

- Earn 1.5 points per $1 spent on all purchases

- Longer intro APR on qualifying purchases and balance transfers

- No foreign transaction fees

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

/images/2023/08/22/boa-travel-rewards-credit-card.png)

FinanceBuzz writers and editors score cards based on a number of objective features as well as our expert editorial assessment. Our partners do not influence how we rate products.

on Bank of America’s secure website

Intro Offer

Why we like it

The Bank of America ® Travel Rewards credit card is great for individuals who enjoy earning rewards and traveling.

Cardholders will enjoy the flexibility to redeem points with no blackout dates and receive a statement credit to pay for travel and dining purchases.

Earn 1.5X points on all purchases everywhere, every time.

Author Details

/authors/ben_walker_updated.png)

- Credit Cards

- Best Credit Cards

- Side Hustles

- Savings Accounts

- Pay Off Debt

- Travel Credit Cards

Want to learn how to make an extra $200?

Get proven ways to earn extra cash from your phone, computer, & more with Extra.

You will receive emails from FinanceBuzz.com. Unsubscribe at any time. Privacy Policy

- Vetted side hustles

- Exclusive offers to save money daily

- Expert tips to help manage and escape debt

Hurry, check your email!

The Extra newsletter by FinanceBuzz helps you build your net worth.

Don't see the email? Let us know.

- Compare the Best Credit Cards With Travel Insurance

- Best for Trip Delay Insurance

- Best for Rental Car Insurance

- Best for Trip Cancellation and Interruption

- Best for Lost Luggage Reimbursement

- Best for Travel Accident Insurance

- Best for Emergency Evacuation Coverage

- Why You Should Trust Us

The Best Credit Cards With Travel Insurance in 2024

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: U.S. Bank Altitude® Reserve Visa Infinite® Card, Marriott Bonvoy Bold® Credit Card. The details for these products have not been reviewed or provided by the issuer.

A credit card's travel insurance feature may not sound as exciting as a 100,000-point sign-up bonus or a high earning rate on everyday spending — but when you find yourself in a bind, it can be significantly more valuable.

Here's everything you need to know about credit card travel insurance, along with the best credit cards offering the most comprehensive coverage.

Compare Credit Cards With Travel Insurance

Best credit cards for trip delay insurance.

Earn 5x points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1x point per $1 spent on all other purchases.

22.49% - 29.49% Variable

Earn 60,000 bonus points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual travel credit can effectively shave $300 off the annual fee if you use it

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong travel insurance

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong bonus rewards on travel and dining

- con icon Two crossed lines that form an 'X'. Very high annual fee

If you're new to rewards credit cards you may want to start elsewhere, but if you know you want to earn Chase points and you spend a lot on travel and dining, the Sapphire Reserve is one of the most rewarding options.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

- Member FDIC

Earn unlimited 10 miles per dollar on hotels and rental cars booked through Capital One Travel. Earn 5 miles per dollar on flights booked through Capital One Travel. Earn unlimited 2 miles on all other purchases.

19.99% - 29.99% variable

Earn 75,000 bonus miles

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Excellent welcome bonus and miles earning

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Premium perks including airport lounge access and credits for certain purchases

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Visa Infinite benefits including travel and shopping protections

- con icon Two crossed lines that form an 'X'. High annual fee

- con icon Two crossed lines that form an 'X'. Annual travel credits only apply to Capital One Travel purchases

The Capital One Venture X Rewards Credit Card is one of the best credit cards for frequent travelers, with top-notch benefits and a wide range of built-in protections. It comes with a generous welcome bonus and credits that can help offset the annual fee — which is much lower than similar premium cards.

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

Earn 1-5x points on purchases

21.24% - 28.24% Variable

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Substantial welcome bonus and great earning opportunities, especially with mobile wallets

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. $325 annual travel and dining credit can offset most of the $400 annual fee

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Top-notch travel insurance and protections

- con icon Two crossed lines that form an 'X'. You must have an existing relationship with US Bank to be approved

- con icon Two crossed lines that form an 'X'. Limited to a 12-month complimentary Priority Pass membership with only four free visits for cardholder (plus a guest) included

- con icon Two crossed lines that form an 'X'. No airline or hotel transfer partners

The U.S. Bank Altitude® Reserve Visa Infinite® Card is a premium credit card with benefits that have no trouble offsetting the annual fee. One of its most unique (and valuable) qualities is its ability to earn 3x points on all purchases made through a mobile wallet, so if you use payment methods like Apple Pay or Samsung Pay, you'll have no problem accruing points in a hurry.

- The information related to the U.S. Bank Altitude® Reserve Visa Infinite® Card has been collected by Business Insider and has not been reviewed by the issuer.

- Earn 50,000 points worth $750 on travel after spending $4,500 in the first 90 days of account opening

- Earn 5X points on prepaid hotels and car rentals booked directly in the Altitude Rewards

- Earn 3X points for every $1 on eligible travel purchases and mobile wallet

- Earn 1X point per $1 spent on all other eligible net purchases

- Use your mobile device to instantly redeem points for almost any purchase

Best Credit Cards for Rental Car Insurance

Limited time offer: Earn 10X Membership Rewards® Points at restaurants worldwide for three months, on up to $25,000 in purchases when eligible card member refers a friend and the friend applies by May 22, 2024 and gets the card (terms apply). Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel (on up to $500,000 per calendar year) and on prepaid hotels booked with American Express Travel. Earn 1X Points on other purchases.

See Pay Over Time APR

Earn 80,000 Membership Rewards® points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Long list of travel benefits, including airport lounge access and complimentary elite status with Hilton and Marriott (enrollment required)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual statement credits with Saks and Uber

- con icon Two crossed lines that form an 'X'. Bonus categories leave something to be desired

- con icon Two crossed lines that form an 'X'. One of the highest annual fees among premium travel cards

If you want as many premium travel perks as possible, The Platinum Card® from American Express could be the right card for you. The annual fee is high, but you get a long list of benefits such as airport lounge access, travel statement credits, complimentary hotel elite status, and more.

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card®. Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card®. Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card®. Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card®. An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Best Credit Cards for Trip Cancellation/Interruption Insurance

Earn 5x on travel purchased through Chase Travel℠. Earn 3x on dining, select streaming services and online groceries. Earn 2x on all other travel purchases. Earn 1x on all other purchases.

21.49% - 28.49% Variable

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High intro bonus offer starts you off with lots of points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong travel coverage

- con icon Two crossed lines that form an 'X'. Doesn't offer a Global Entry/TSA PreCheck application fee credit

If you're new to travel rewards credit cards or just don't want to pay hundreds in annual fees, the Chase Sapphire Preferred® Card is a smart choice. It earns bonus points on a wide variety of travel and dining purchases and offers strong travel and purchase coverage, including primary car rental insurance.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

Best Credit Cards for Lost Luggage Reimbursement

Best credit cards for travel accident insurance.

Earn up to 14X total points per $1 spent at over 7,000 hotels participating in Marriott Bonvoy®. Earn 2X points for every $1 spent on other travel purchases (from airfare to taxis and trains). Earn 1X point for every $1 spent on all other purchases.

Earn 30,000 bonus points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No annual fee

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cardholders get 15 elite night credits toward status

- con icon Two crossed lines that form an 'X'. Only offers strong rewards for Marriott purchases

The Marriott Bonvoy Bold® Credit Card comes with an increased limited-time welcome bonus and good perks for a no-annual-fee card, but unless paying an annual fee is a dealbreaker for you, other Marriott cards — like the Marriott Bonvoy Boundless® Credit Card , Marriott Bonvoy Brilliant® American Express® Card, or Marriott Bonvoy Business® American Express® Card — are a better deal.

Best Credit Cards for Emergency Evacuation Coverage

Earn 4 miles per $1 spent on United® purchases including tickets, Economy Plus, inflight food, beverages and Wi-Fi, and other United charges. Earn 2 miles per $1 spent on all other travel. Earn 2 miles per $1 spent on dining including eligible delivery services. Earn 1 mile per $1 spent on all other purchases.

21.99% - 28.99% Variable

Earn 80,000 bonus miles

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Great intro bonus offer

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. If you want United Club membership, this card gets you it for less than buying it outright

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Get two free checked bags on United

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Earns 4x miles on United® purchases

- con icon Two crossed lines that form an 'X'. Steep annual fee, especially for an airline credit card

- con icon Two crossed lines that form an 'X'. The non-United bonus categories (travel and dining) only earn 2x miles

While a few of the best travel credit cards are great for United flyers, the United Club℠ Infinite Card is the most high-end of the bunch. Not only does it offer a full United Club airport lounge membership, but it can also help you rack up the miles for free trips quickly through everyday spending.

- Earn 80,000 bonus miles after qualifying purchases

- Earn 4 miles per $1 spent on United® purchases

- Earn 2 miles per $1 spent on all other travel and dining

- Earn 1 mile per $1 spent on all other purchases

- Free first and second checked bags - a savings of up to $320 per roundtrip (terms apply) - and Premier Access® travel services

- 10% United Economy Saver Award discount within the continental U.S. and Canada

- Earn up to 10,000 Premier qualifying points (25 PQP for every $500 you spend on purchases)

Best Credit Cards With Trip Delay Insurance

Trip delay insurance covers you (and often family members traveling with you) for expenses like meals, transportation, lodging, medication, and toiletries. For example, if your flight is delayed by more than six hours, your card may reimburse you up to $500 in "reasonable expenses" such as:

- An Uber or taxi from the airport to a hotel

- A one-night hotel reservation

- Dinner at a nearby restaurant

I've used this benefit a handful of times, and it's saved me hundreds. Just note that you must use your qualifying card to pay for your fare — even if that means simply paying taxes and fees on an award flight.

Trip delay insurance applies to more than just flights. You're eligible for coverage whenever you book a "common carrier" — defined as "any land, water, or air conveyance that operates under a valid license to transport passengers for hire and requires purchasing a ticket before travel begins." As long as it's not a taxi, limo, commuter rail, bus, or rental car, you're likely covered.

Below are the top three credit cards for trip delay insurance. Even if you don't travel regularly, you should be using one of these cards to reserve your travel, because trip delay insurance will come in handy sooner or later.

Chase Sapphire Reserve®

The Chase Sapphire Reserve® is the gold standard of trip delay insurance. After just six hours of delay — or any delay that requires an overnight stay — you're eligible for up to $500 in covered expenses per ticket. You and those traveling with you (a spouse and dependent children under 22) are covered.

The Chase Sapphire Reserve charges a $550 annual fee, but it also comes with valuable travel benefits such as:

- Up to $300 in annual travel credits (offsets the first $300 in travel you purchase each year with the card)

- Airport lounge access (Priority Pass Select, Chase Sapphire lounges , and the Chase Sapphire Terrace at Austin airport )

- Up to $100 NEXUS, Global Entry, or TSA PreCheck application fee credit

- Complimentary two-year Lyft Pink All Access membership

You'll also earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. That's worth $1,080 in travel, based on Personal Finance Insider's valuation of Chase Ultimate Rewards® points at 1.8 cents each.

Chase Sapphire Reserve Credit Card Review

Capital One Venture X Rewards Credit Card

The Capital One Venture X Rewards Credit Card is Capital One's first premium travel credit card . It's a Visa Infinite card (similar to the Chase Sapphire Reserve®), and benefits from extremely generous trip delay insurance***. You'll get up to $500 per ticket in covered expenses after a delay of six hours or more. Those eligible for this insurance are your spouse and dependent children under age 22.

The card has a welcome bonus offer of 75,000 bonus miles when you spend $4,000 on purchases in the first three months from account opening. That's worth $1,275 in travel, based on our valuation of Capital One miles. In addition, it also comes with travel perks like:

- $300 per year in credits toward Capital One Travel bookings

- Priority Pass, Plaza Premium, and Capital One airport lounge access

- 10,000-mile bonus each account anniversary

- Access to the Capital One Premier Collection luxury hotel booking program

- Global Entry or TSA PreCheck application fee credit

Capital One Venture X Rewards Credit Card Review

U.S. Bank Altitude® Reserve Visa Infinite® Card

The U.S. Bank Altitude® Reserve Visa Infinite® Card is another one of the few Visa Infinite cards on the market. As you'd expect, it's got excellent trip delay insurance. You'll receive up to $500 per ticket in coverage for expenses like meals and lodging (that aren't reimbursed by the airline or other "common carrier") when your trip is delayed more than six hours or requires an overnight stay.

The U.S. Bank Altitude® Reserve Visa Infinite® Card comes with 50,000 points after you spend $4,500 on purchases in the first 90 days of account opening. These points are worth 1.5 cents each when you use them toward travel. That means this bonus is worth $750. You'll also get benefits like:

- Up to $325 in annual travel credits

- Up to $100 in statement credits toward Global Entry and TSA PreCheck

- Up to 30% discount on Audi on Demand (formerly Silvercar) rentals

U.S. Bank Altitude Reserve Review

You might already know that most travel credit cards offer some form of rental car insurance. It's a great benefit because it can save users significant money in the case of damage or theft to your rental. Even by renting a car for just a few days, you could save $50+ by waiving the rental agency's in-house insurance CDW and instead covering your rental by paying with this card.

Two kinds of rental car insurance come with many popular cards:

- Secondary insurance — Offers coverage benefits that are secondary to your personal auto insurance policy. In the event of damage due to theft or collision, car renters still have to file a claim through their personal auto insurance policy, and the secondary insurance is there to cover a portion of leftover costs. So, although this is a nice perk, it doesn't ease the sting of having to report to your personal insurance — often with resultant premium hikes.

- Primary insurance — Coverage for loss or damage will be taken care of by the credit card company without you having to make a claim with your personal policy. In the long run, this could save a car renter significantly on both CDW and LDW, and it could help avoid raising premiums on their personal auto policy.

Primary rental car insurance is what you want. You must pay for the entire transaction with the credit card you'd be filing the insurance under. Some cards even require that renters book the entire trip on the card, so read the fine print carefully.

Primary insurance also generally doesn't include liability, damage to other cars, damage to personal property, personal bodily injury, or injury to others. See Personal Finance Insider's guide to liability car insurance for more details on this type of coverage.

Below are the top three credit cards for car rental insurance.

The Chase Sapphire Reserve® comes with up to $75,000 for theft and collision for rental cars in the U.S. and abroad.

You'll be extra motivated to make this card your dedicated car rental payment method because it earns 10 points per dollar for this expense when reserving through the Chase Travel Portal℠ . Personal Finance Insider estimates Chase points value to be 1.8 cents each when used for travel — so earning 10x points equates to an 18% return.

When booking outside the portal, you'll earn 3 points per dollar for travel including rental cars.

The Capital One Venture X Rewards Credit Card is another rewards-earning monster when it comes to car rentals. Not only will you receive primary rental car insurance***, but you'll earn 10 miles per dollar on rental cars booked through the Capital One Travel Portal . You'll earn 2 miles per dollar for travel booked outside the portal.

The Platinum Card® from American Express

The Platinum Card® from American Express doesn't offer primary rental car insurance by default. However, you can receive primary premium car rental protection for a flat rate between $15.95 and $24.95 per rental period (not per day). It's not free like the other insurances on this list, but premium rental car benefits may fit your situation better:

- You'll be covered for up to 42 consecutive days, whereas most other cards won't allow your rental to exceed 31 consecutive days.

- You're insured for up to $100,000 of primary coverage against damage or theft — a higher number than several other cards.

You can enroll your Amex Platinum and automatically be covered whenever you rent a car. You'll be charged this flat rate whenever you pay for a rental with your card.

This card has a $695 annual fee — but it also offers 80,000 Membership Rewards® points after you spend $8,000 on purchases on your new card in your first six months of card membership. That's worth $1,440 in travel per our valuation of Amex points. You'll also find travel perks such as:

- Up to $200 in airline fee credits each calendar year**

- Up to $100 in Saks Fifth Avenue credits each calendar year**

- Global Entry or TSA PreCheck application fee credit ($100 statement credit every 4 years for a Global Entry application fee or up to $78 statement credit every 4.5 years for TSA PreCheck®)

- $189 per year in credits for CLEAR® Plus membership**

- Up to $200 in annual credits toward prepaid hotel bookings through Amex Fine Hotels and Resorts or The Hotel Collection (minimum two-night stay)

American Express Platinum Card Review

Trip cancellation/interruption insurance protects you if you're no longer able to go on a covered trip or your covered trip is interrupted mid-travel for reasons such as:

- Your airline declared bankruptcy and cancels your flight

- One of your immediate family members dies

- There's a terrorist incident

This coverage will reimburse you for prepaid nonrefundable travel such as airfare, hotel stays, activities, etc. which you can't use (or finish). Additionally, you may be reimbursed for an unexpected flight back home.

The Chase Sapphire Reserve® will reimburse you for up to $10,000 per person and $20,000 per trip for pre-paid, non-refundable travel expenses like plane tickets, hotel reservations, cruises, etc. Chase states that if your name is embossed on the card, you and your immediate family are all covered under this benefit. That means authorized users can utilize this benefit, as well as the primary cardholder.

The Capital One Venture X Rewards Credit Card can reimburse you, your spouse, and your children up to $2,000 each for prepaid, non-refundable travel expenses like plane tickets, hotel bookings, etc. This is a significantly smaller per-person payout than the Chase Sapphire Reserve® — but there doesn't appear to be a hard cap on how much you can earn.

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card offers a trip cancellation/interruption reimbursement of up to $10,000 per person and $20,000 per trip for pre-paid, non-refundable travel expenses like plane tickets, hotel reservations, and hotels. That's part of what makes both Chase Sapphire cards excellent options for travel insurance.

The Chase Sapphire Preferred® Card is the single best beginner points credit card. Its annual fee is reasonable at $95 per year, and it manages to offer many similar travel protections as much more expensive credit cards.

In terms of return rates, this card earns:

- 5 points per dollar on Lyft rides through March 2025

- 5 points per dollar on all travel purchased through Chase Ultimate Rewards

- 3 points per dollar on dining, including eligible delivery services, takeout, and dining out

- 3 points per dollar on select streaming services

- 3 points per dollar on online grocery purchases (excluding Target, Walmart, and wholesale clubs)

- 2 points per dollar on other travel

- 1 point per dollar on everything else

You'll also receive perks like up to $50 in annual statement credits toward hotel stays booked through Chase and a 10% anniversary point bonus (based on the dollar amount you spend).

The Chase Sapphire Preferred® Card is currently offering a welcome bonus of 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. That's worth an average of $1,080 in travel, based on Personal Finance Insider's points and miles valuations.

Chase Sapphire Preferred Card Review

If your carry-on or checked baggage goes missing — or if the airline, cruise ship, or other common carrier damages your belongings, this coverage could reimburse you up to a specified amount. Card issuers tend to price your belongings as the lesser of the following:

- The original purchase price of your items

- The actual cash value of your items when they were lost

- The cost to replace those items

You must pay for your trip with an eligible card to be covered. Below are the three best credit cards for lost luggage reimbursement.

This card will give you up to $3,000 per person if you or an immediate family member check or carry on luggage that is damaged or lost.

If you or an immediate family member's check or carry-on luggage is damaged or lost, the Capital One Venture X Rewards Credit Card will cover you for the difference between the "value of the amount claimed" and the common carrier's compensation, up to $3,000 per covered trip.