RichVintage/Getty Images

Advertiser Disclosure

Citi Simplicity Card benefits guide

This Citi card's long 0% intro APR period is difficult to beat

Published: January 31, 2022

Author: Dan Miller

Editor: Kaitlyn Tang

Reviewer: Cathleen McCarthy

How we Choose

There aren’t many Citi Simplicity benefits, but one stands out – the 0% introductory APR period on purchases and balance transfers. You pay no interest on balance transfers for up to 21 months, one of the best 0% intro deals on any card.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

Citi is a CreditCards.com advertising partner.

As its name suggests the Citi Simplicity® Card is a fairly simple and straightforward credit card with limited benefits. The Citi Simplicity credit card does not have a rewards program, so you won’t earn cash back or Citi ThankYou points either as a sign-up bonus or for ongoing purchases. The Citi Simplicity card has no annual fee but does come with a few benefits that make it useful. We’ll look at some of the Citi Simplicity benefits and which ones might make the card worth it for you.

Citi Simplicity Card benefits

The Citi Simplicity card is a very basic Citi credit card that comes with no annual fee and no rewards program. While there aren’t as many Simplicity benefits as there are with other credit cards, there are a few you’ll want to keep in mind.

0% introductory period for balance transfers

One of the best Citi Simplicity benefits is an introductory period with a 0% APR interest rate. Citi will charge you a 0% intro rate for any balance transfers that you make for the first 21 months from the date of your first balance transfer, as long as you perform the balance transfer within four months of your account opening. After that intro period, you’ll have a variable APR rate of 16.24% to 26.24%.

If you’re not familiar with how balance transfers work , they can definitely save you money if you already have a significant balance on another credit card. Transferring that balance to the Citi Simplicity would help you stop accruing interest on it, so you can focus your efforts on paying off the balance. To find out if you can pay off your debt during the card’s 21-month intro period, check out our balance transfer calculator .

Remember, there is also a balance transfer fee of $5 or 5% of each transfer (whichever is greater). Still, if you have a large balance on another credit card, being able to get 0% for nearly two years will save you a lot of money.

0% introductory period for purchases

In addition, the Citi Simplicity card also has a 0% intro APR on purchases. This intro APR period on purchases lasts for the first 12 months from when you open your account (16.24% to 26.24% variable APR thereafter). Any purchases you make during this period will not accrue any interest charges as long as you fully pay for them before the intro period is over. Of course, it is solid financial practice to pay off your credit card statement in full, each and every month when possible.

No annual fee, late fees or penalty APR

Another great Citi Simplicity card benefit is that there are hardly any fees. There is no annual fee on the card. For those still resolving their credit debt and happen to miss a payment, the card will not charge you any late fees or penalty APR. This is especially helpful to ensure you don’t incur new debt while you’re still paying off old debts.

Two fees with the Citi Simplicity card that you do need to be aware of are the balance transfer fee which we discussed previously, as well as a 3% foreign transaction fee if you use the Citi Simplicity card in another country.

Other Citi Simplicity benefits

Like most credit cards, you are not held liable for any unauthorized purchases made on your credit card account. The card also allows you to set up account alerts to keep you informed about your account as well as access to Citi’s 24/7 customer service. Through your online account, you may also choose the specific day of the month you’d like your payment to fall on. The Citi Simplicity also allows you to set up a digital card number and contactless pay .

Maximizing the Citi Simplicity Card

Because the Citi Simplicity credit card doesn’t come with a ton of perks, there isn’t much you can do to maximize your Citi Simplicity benefits. The Simplicity Card is one of the best credit cards for carrying a balance , thanks to the long intro 0% APR periods for both purchases and balance transfers.

There aren’t any rewards or other fees to watch out for, so just make sure you have registered your account online and set up autopay , preferably for the full balance, to ensure you don’t miss any payments. And of course, make sure you make your balance transfers within the first four months or else they will not qualify for the 21-month intro APR period.

Bottom line

If you were hoping for some travel perks, you should check out the Citi Premier® Card . However, with its long intro APR offers, the Citi Simplicity card is worth looking at for anyone carrying a balance. If you end up choosing it, this card can save you a significant amount of money in interest.

Before you settle, be sure to compare the Citi Simplicity to its cousin , the Citi® Diamond Preferred® Card . It may help to examine their similarities and differences before making an informed decision on which one you’ll apply for.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Dan Miller is a freelance writer and founder of PointsWithACrew.com, a site that helps families to travel for free or cheap. His home base is in Cincinnati, but he tries to travel the world as much as possible with his wife and six kids.

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week.

By providing my email address, I agree to CreditCards.com’s Privacy Policy

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Learn more about Card advice

Basic ThankYou points: What does that actually mean?

Some Citi credit cards that earn ThankYou points have better redemption options. Combining points from multiple Citi cards can help you maximize the value of your ThankYou points.

Guide to Citi Custom Cash Card's rewards and benefits

The Citi Custom Cash Card offers cash back that adapts to your spending habits. It may be worth a look if you’re interested in flexible rewards.

Earn 60,000 bonus points with the Citi Premier Card

How to get preapproved for a Citi card

How to request a credit limit increase with Citi

How to earn and use Citi ThankYou points

Explore more categories

- Credit management

- To Her Credit

Questions or comments?

Editorial corrections policies

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe.

Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Our top goal is simple: We want to help you narrow down your search so you don’t have to stress about finding your next credit card. Every day, we strive to bring you peace-of-mind as you work toward your financial goals.

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience.

Editorial integrity is central to every article we publish. Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com , email Lance Davis, VP of Content, at [email protected] .

Ultimate guide to the Citi travel portal

Editor's Note

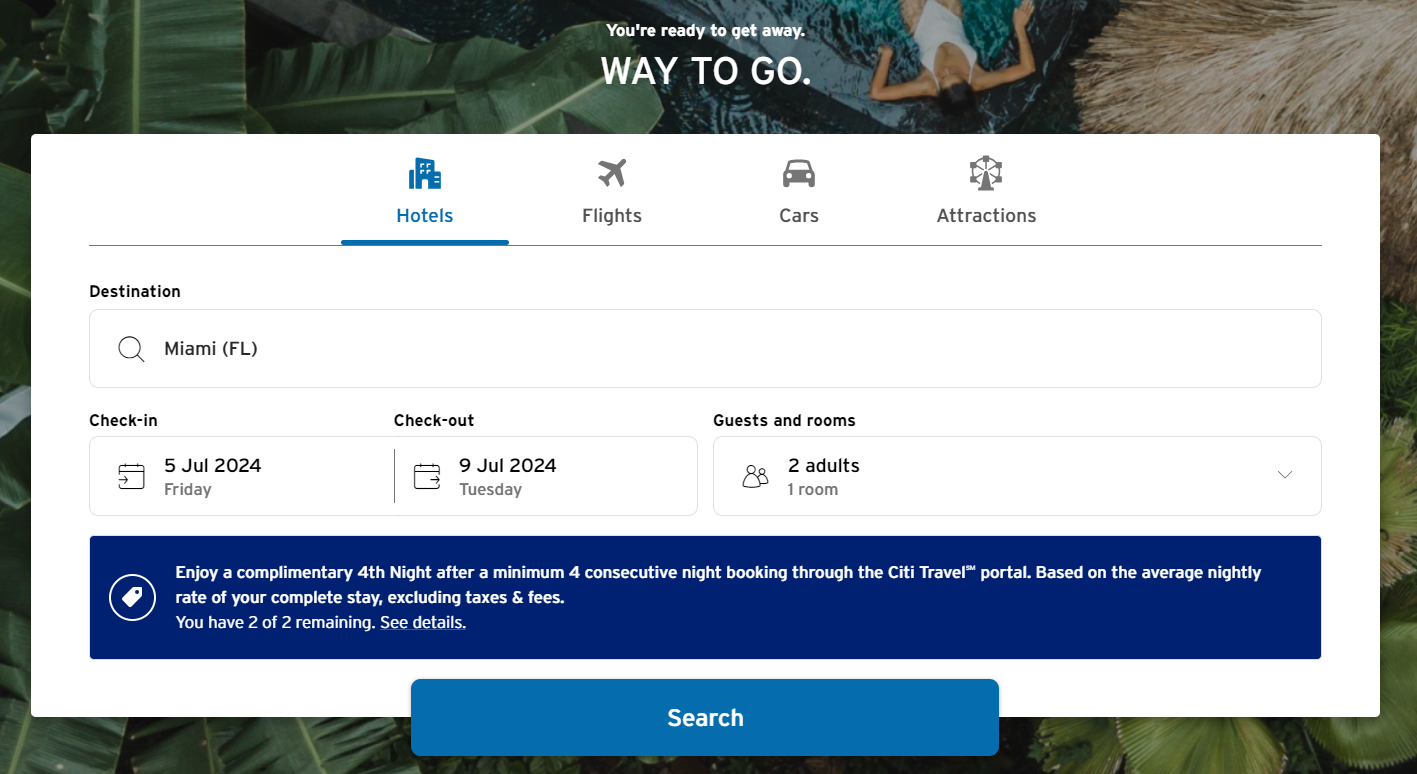

The new Citi travel portal launched earlier this year , offering an enhanced user experience, more hotel options and a new feature for booking activities and attractions. Citi Travel with Booking.com is powered by Rocket Travel by Agoda, utilizing the features and booking availability of Booking.com's brands.

In this article, we will explore the functionality of the new Citi travel portal, discuss any potential drawbacks and clarify who can access this booking engine. Additionally, we will provide a step-by-step guide on using the portal to book your desired travel experiences and explain how to pay using your ThankYou points.

What is the Citi travel portal?

There are four main selling points for using Citi Travel with Booking.com.

First, it provides a one-stop shop for travel that you can pay for with your Citi ThankYou points while booking multiple elements of a trip simultaneously. This can be simpler than transferring points to separate airline or hotel partners and booking your trip piece by piece — and you can even use as many or as few points as you want. The downside is that you might achieve less value from your points to gain simplicity.

Second, the portal allows you to use points to pay for travel beyond flights and hotels, such as guided tours and theme park tickets. You can't do this with Citi's list of transfer partners, and you may achieve better value paying for travel with points in Citi's portal than you would by cashing out your points .

Third, certain card benefits require using the Citi travel portal. This is true of hotel benefits built into the Citi Prestige® Card (no longer open to new applicants) and Citi Premier® Card (see rates and fees ). We'll explore those below.

The information for the Citi Prestige has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Lastly, if you're paying for travel (and not using points), you may be interested in the bonus points available when using Citi Travel with Booking.com. Competitors like the Chase Ultimate Rewards travel portal , American Express Travel and Capital One Travel offer higher earn rates (depending on which credit cards you have) when booking your travel in the bank's portal rather than directly.

Through June 30, 2024, Citi cardholders can earn bonus points as follows:

- 10 points per dollar on reservations for hotels, rental cars and eligible attractions with the Citi Prestige® Card (no longer open to new applicants) and the Citi Premier® Card

Through December 31, 2025, Citi cardholders can earn bonus points as follows:

- 5 points per dollar on these same bookings with the Citi ThankYou® Preferred Card (no longer open to new applicants) and the Citi Rewards+® Card (see rates and fees )

The information for the Citi ThankYou Preferred card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

The fact that Citi's portal provides a one-stop shop for your vacation is its main strength. The ability to book hotels, rental cars and even entrance tickets to tourist attractions in one place (and even pay for these with your points) provides great simplicity.

Related: The ultimate guide to Citi ThankYou Rewards

How to use the Citi travel portal

Citi's portal sets itself apart from competitors by being available to anyone with a credit card earning Citi ThankYou points . For comparison, some travel portals reserve their best features for cardholders with expensive premium credit cards . Thus, you can access the portal with the $495-a-year Citi Prestige Card and the no-annual-fee Citi Rewards+ Card .

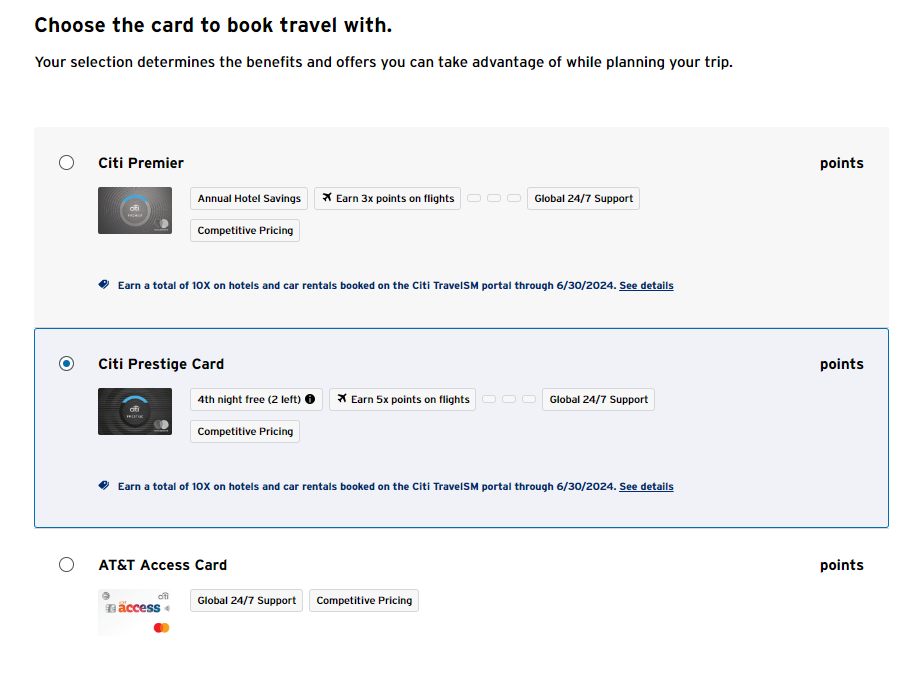

You can access Citi Travel with Booking.com by clicking this link and logging into your Citi account. If you have multiple Citi credit cards, you must select which card you want to use for booking travel.

Once you select a card, you're ready to start booking travel.

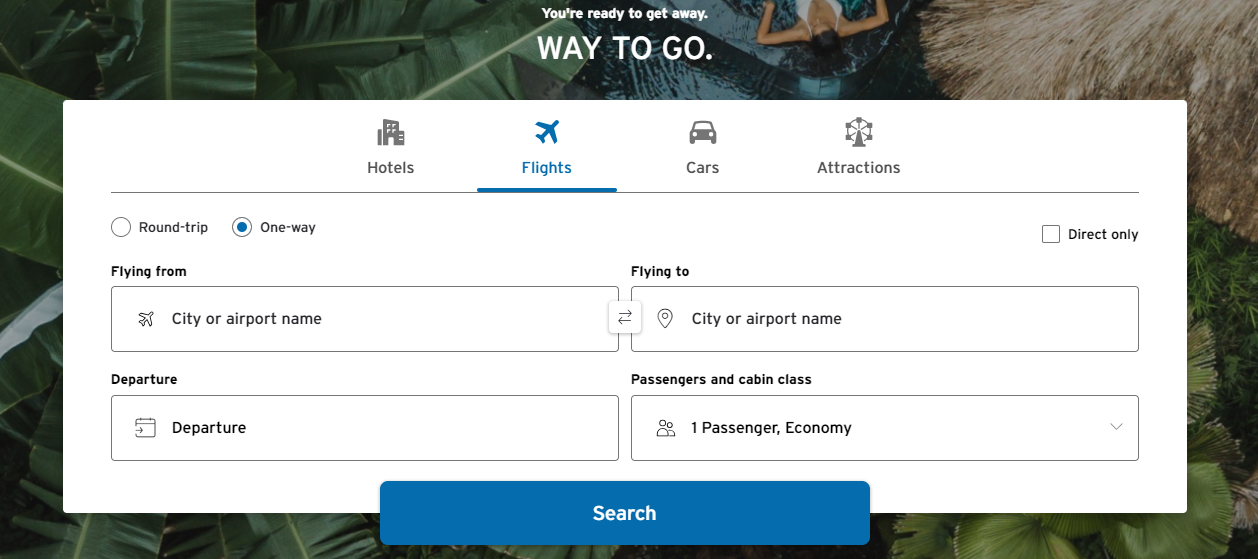

How to book flights using the Citi travel portal

Booking flights in Citi's portal functions similarly to other portals. You'll choose whether this is a one-way or round-trip flight and provide the route, number of passengers, dates and class of travel. Unfortunately, you can't book multi-city itineraries.

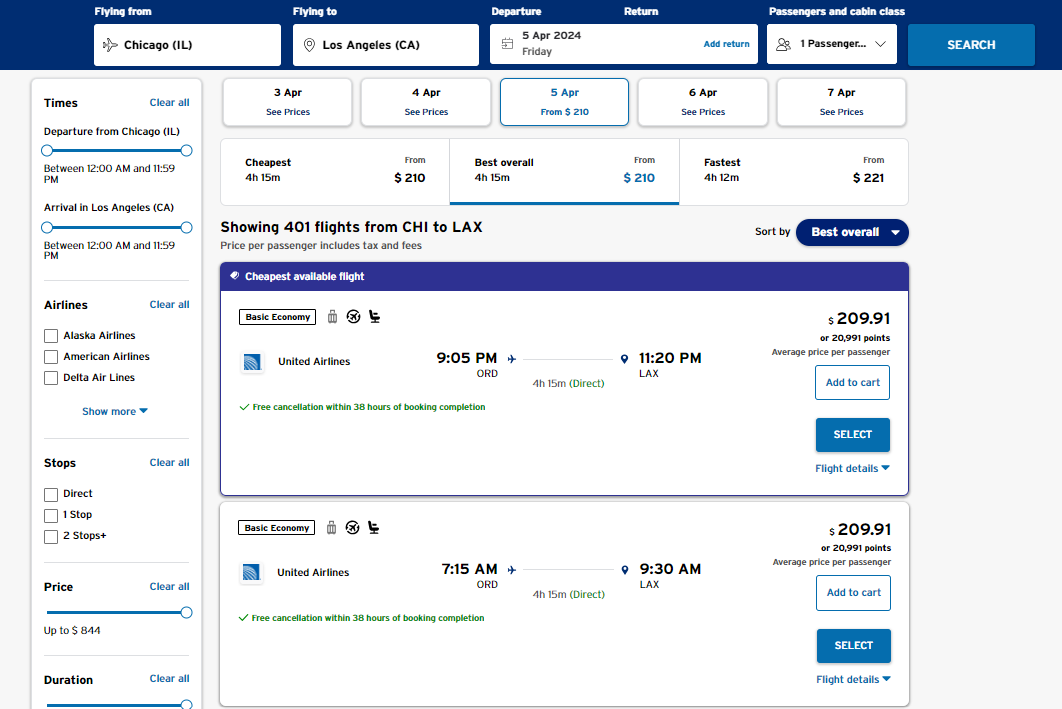

Here's an example search from Chicago to Los Angeles. Note that you can use cities for your search if you don't have a specific airport preference.

The Citi Travel portal offers many filters and sorting options to help you find the most suitable travel options. These filters allow you to refine your search based on price, duration, departure and arrival times, number of connections and even your preferred airline. Furthermore, you can sort the results using these options without losing any filtering choices.

To change the sorting order of the results, click on the "Best overall" drop-down menu on the right side above the price of the first result.

Once you have selected a flight, you will be prompted to provide passenger information, including names, dates of birth, frequent flyer numbers and known traveler numbers for TSA PreCheck and Global Entry (if applicable).

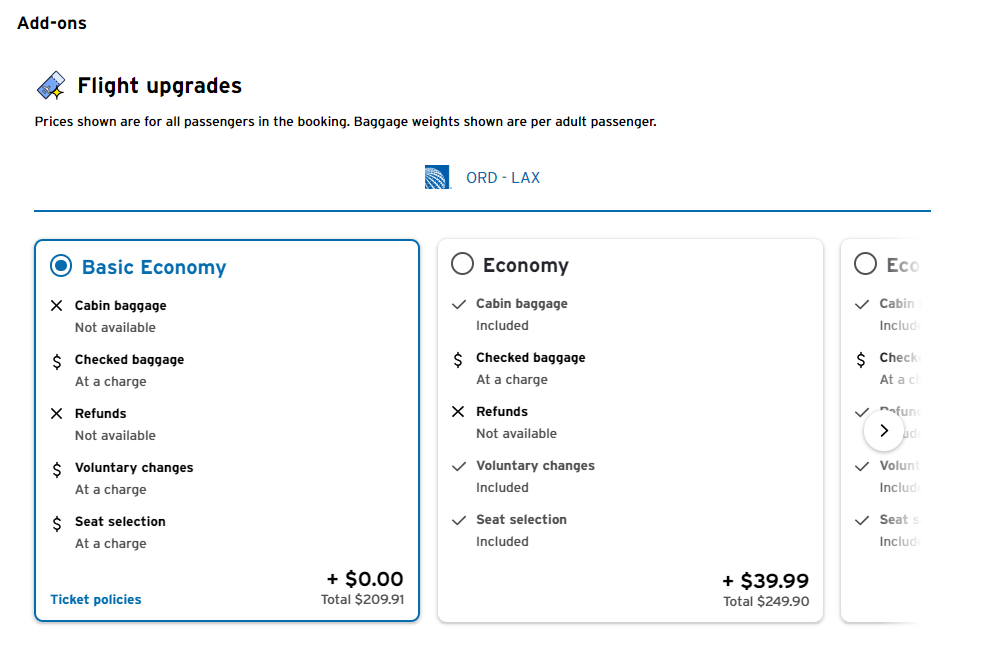

Additionally, before making your payment, you can upgrade to a higher class of travel if it is available. This is the first time you'll see the cost to book a main cabin fare instead of a basic economy fare.

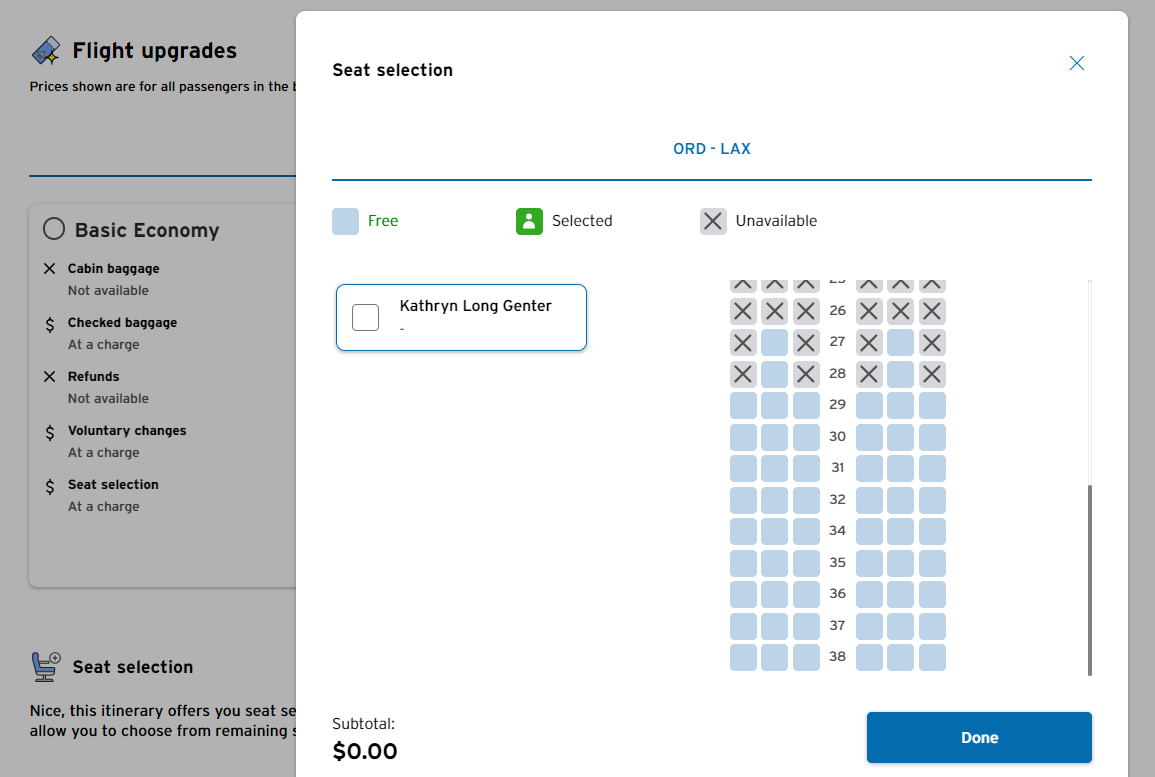

And if your fare class lets you select a seat, you can do so before heading to the payment page.

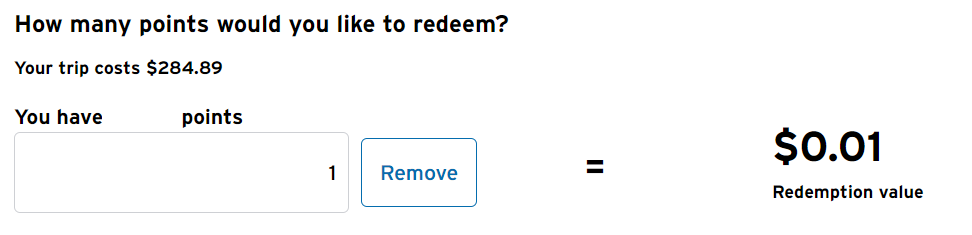

On the final page, you'll choose how you want to pay (with your points, credit card or a mix of the two) and complete your purchase. The redemption rate is an underwhelming 1 cent per point. For context, our valuations peg ThankYou points at 1.8 cents apiece, which you should be able to get by maximizing Citi's transfer partners .

How to book hotels using the Citi travel portal

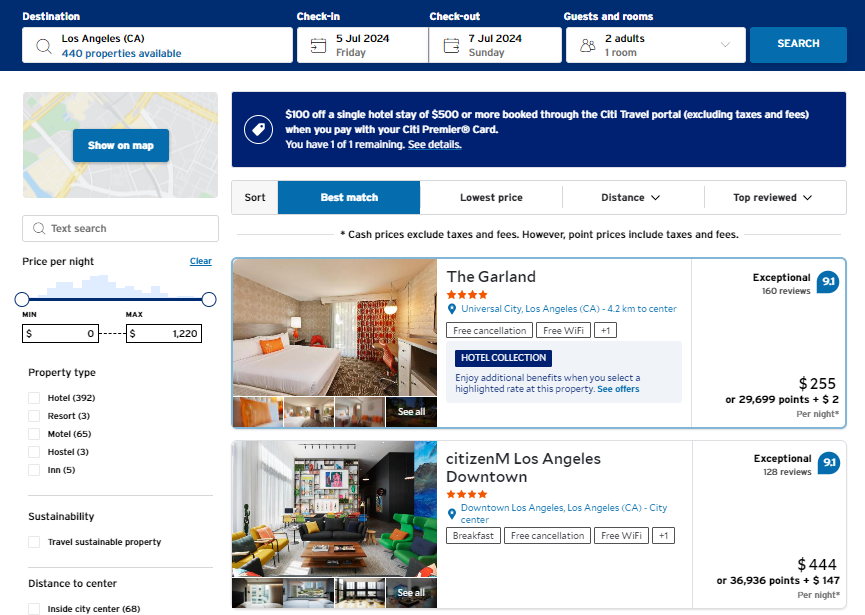

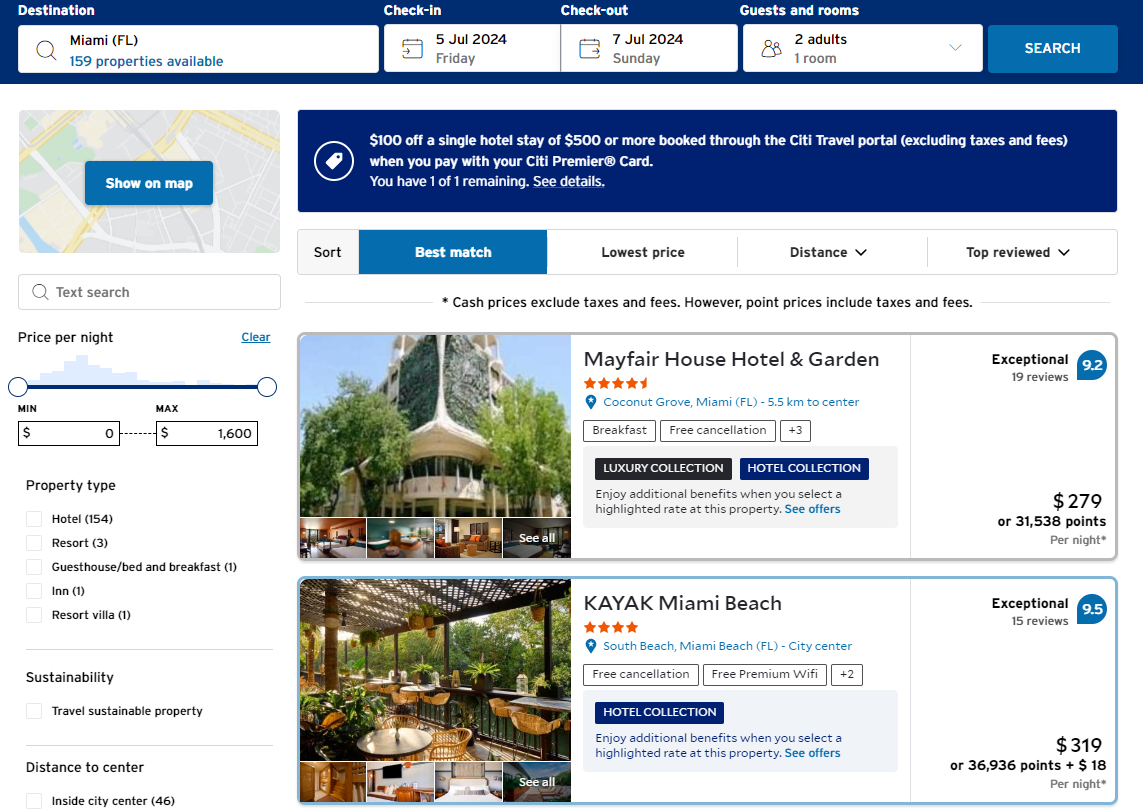

Booking hotels will feel familiar to those who have used other portals.

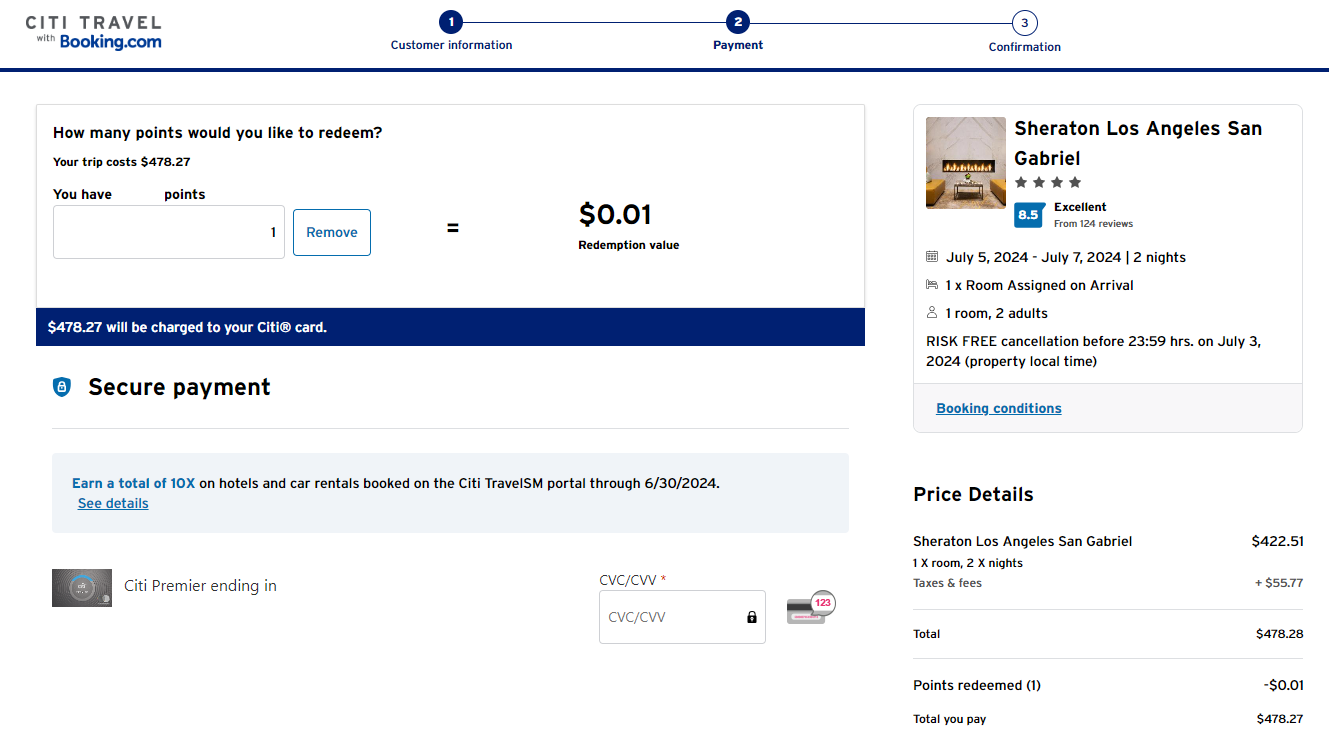

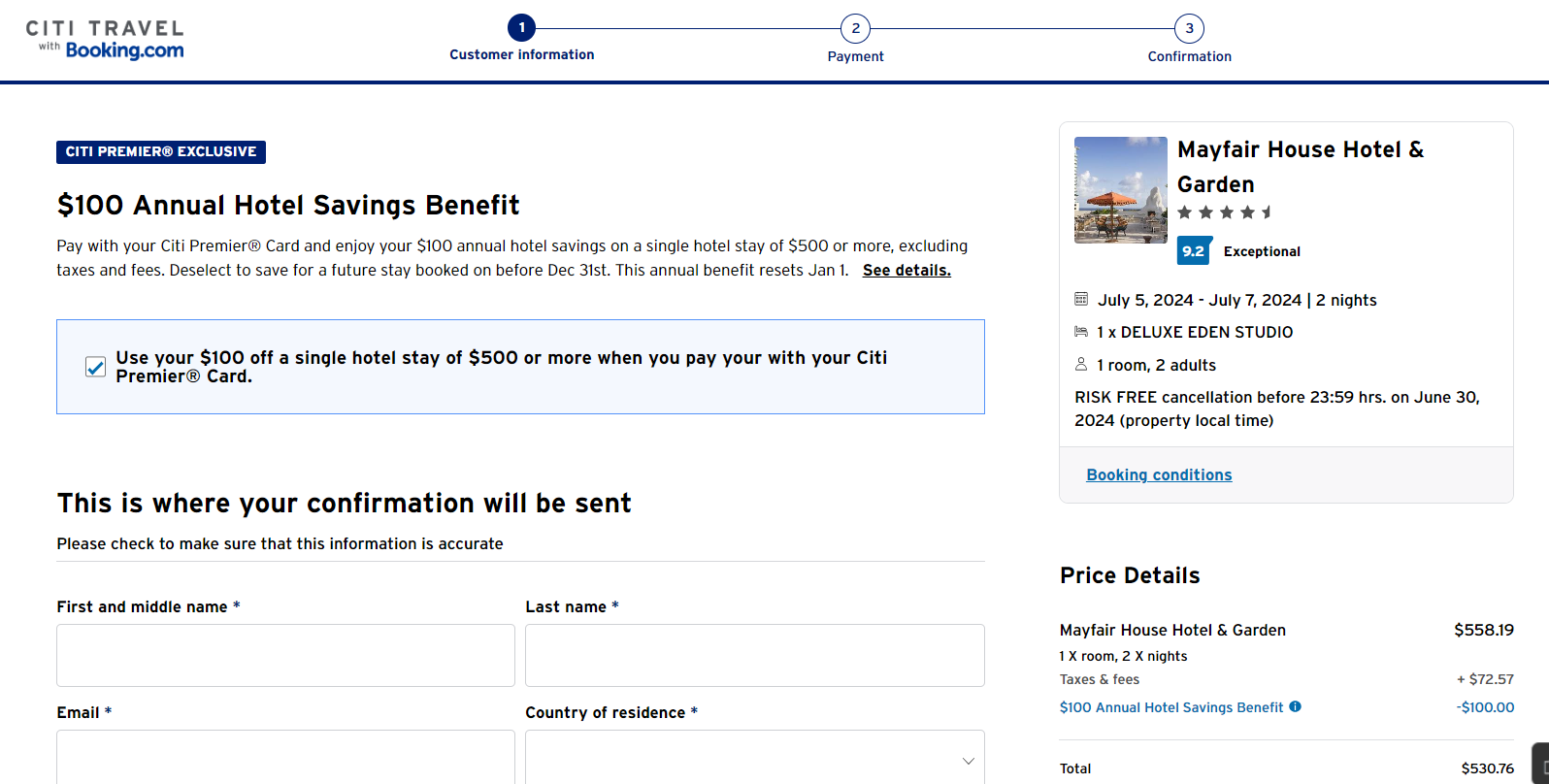

You should choose your Citi Premier or Citi Prestige card before beginning your hotel search if you intend to use those cards' benefits. Premier cardholders can use a $100 hotel credit each calendar year on a booking of $500 or more. In contrast, Prestige cardholders get a fourth night free on hotel bookings in the portal, available up to twice per calendar year.

From here, you can add filters to help you reduce your results, such as by price, neighborhood, star rating and nearby attractions.

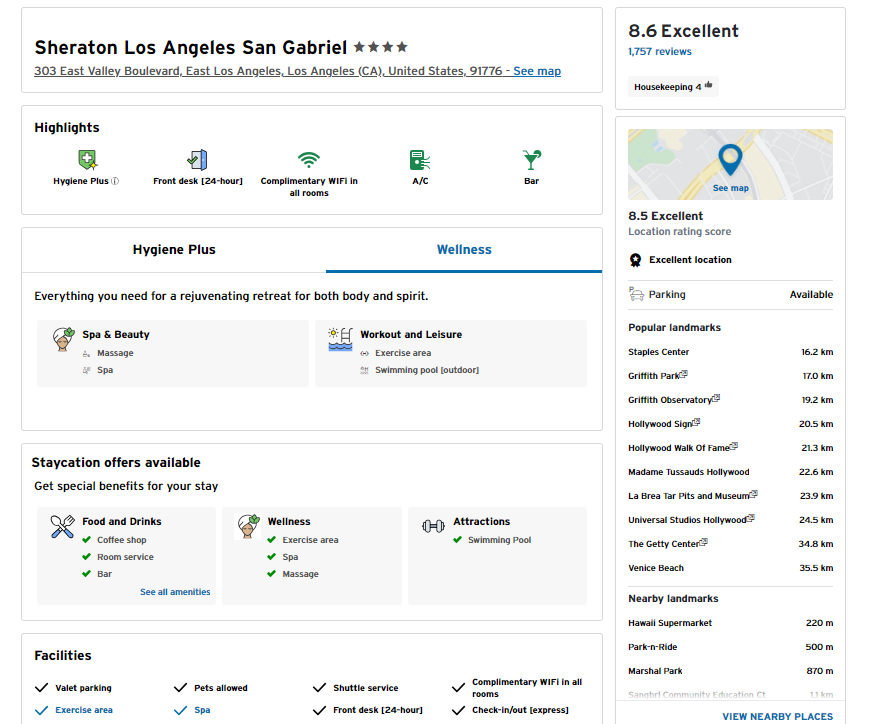

Once you pick a property, you'll see details on its amenities and features.

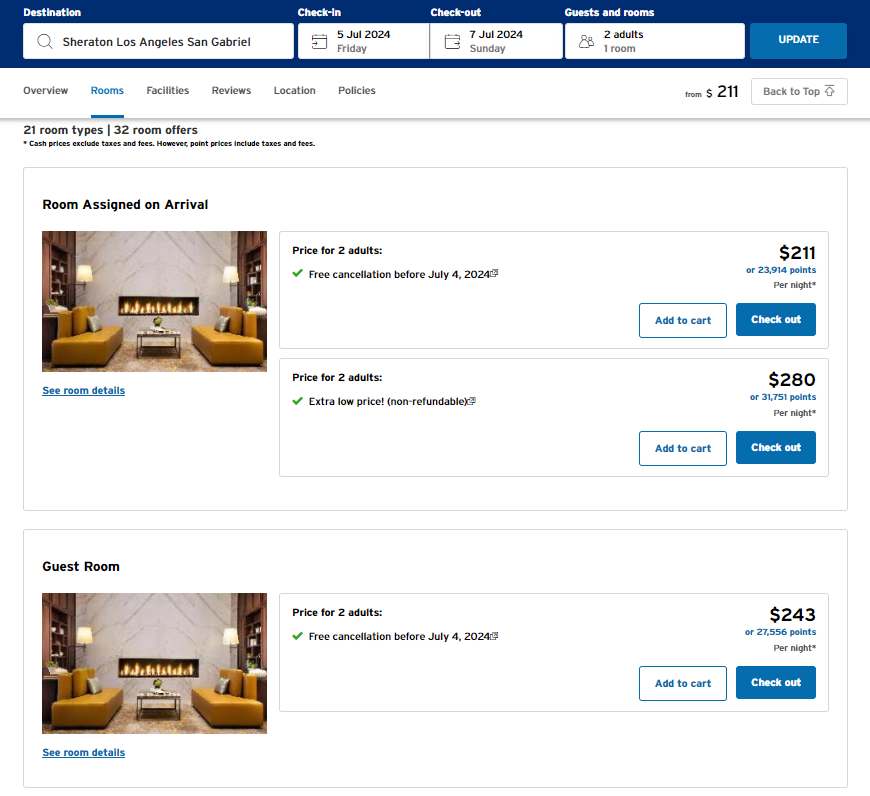

Then, you can select your desired room.

After choosing a room type, you can pay with points at checkout. Again, each point is worth a lackluster 1 cent.

You'll also have the option to view the cancellation policy before paying. Since policies can vary, ensure you know whether it's possible to change or cancel your booking before you make the final payment.

However, if you book a hotel that's part of a major loyalty program — like Hilton Honors or Marriott Bonvoy — through Citi, you likely won't earn points, nor will you enjoy any elite status perks on your reservation.

Hotel Collection and Luxury Collection properties

Alongside its revamped portal, Citi has introduced two new hotel programs, namely the Hotel Collection and the Luxury Collection. These programs offer similar advantages to other luxury hotel programs offered by credit cards .

Reservations through the Hotel and Luxury Collection have no minimum stay requirements. However, access to the Luxury Collection is exclusive to Citi Premier and Citi Prestige cardholders.

You will receive guaranteed benefits such as daily breakfast for two people and complimentary Wi-Fi for Hotel Collection bookings. In addition to these perks, the Luxury Collection offers a $100 on-property credit, which can be used based on the policies of each hotel. Both programs also provide other benefits, such as early check-in, late checkout and room upgrades (specifically for Luxury Collection bookings, subject to availability at check-in).

Unfortunately, you can't filter search results specifically for Hotel and Luxury collections properties. To identify these properties, you must look for a tag or description indicating their inclusion in your search results.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

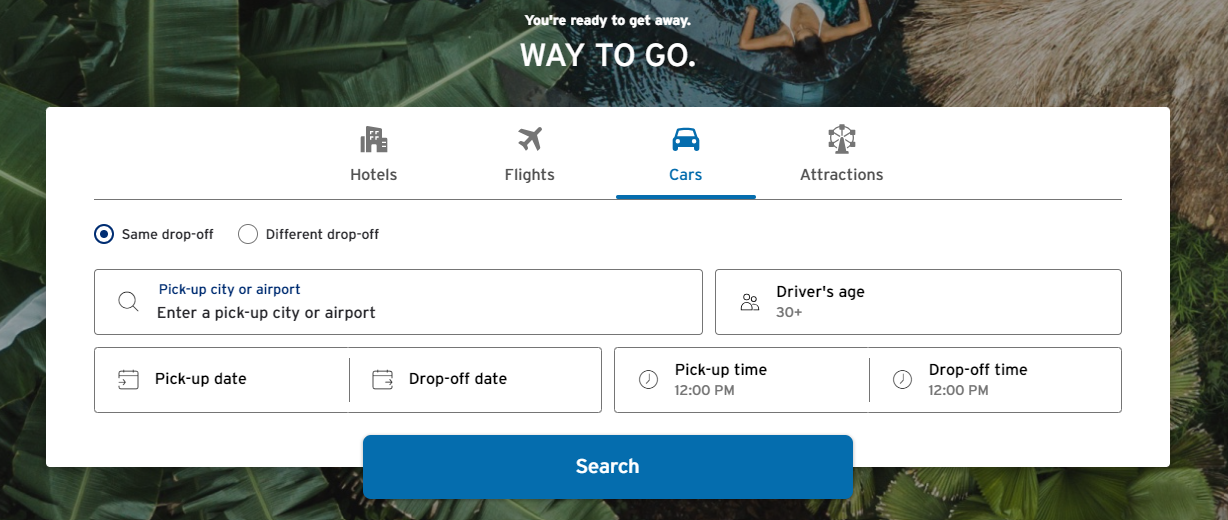

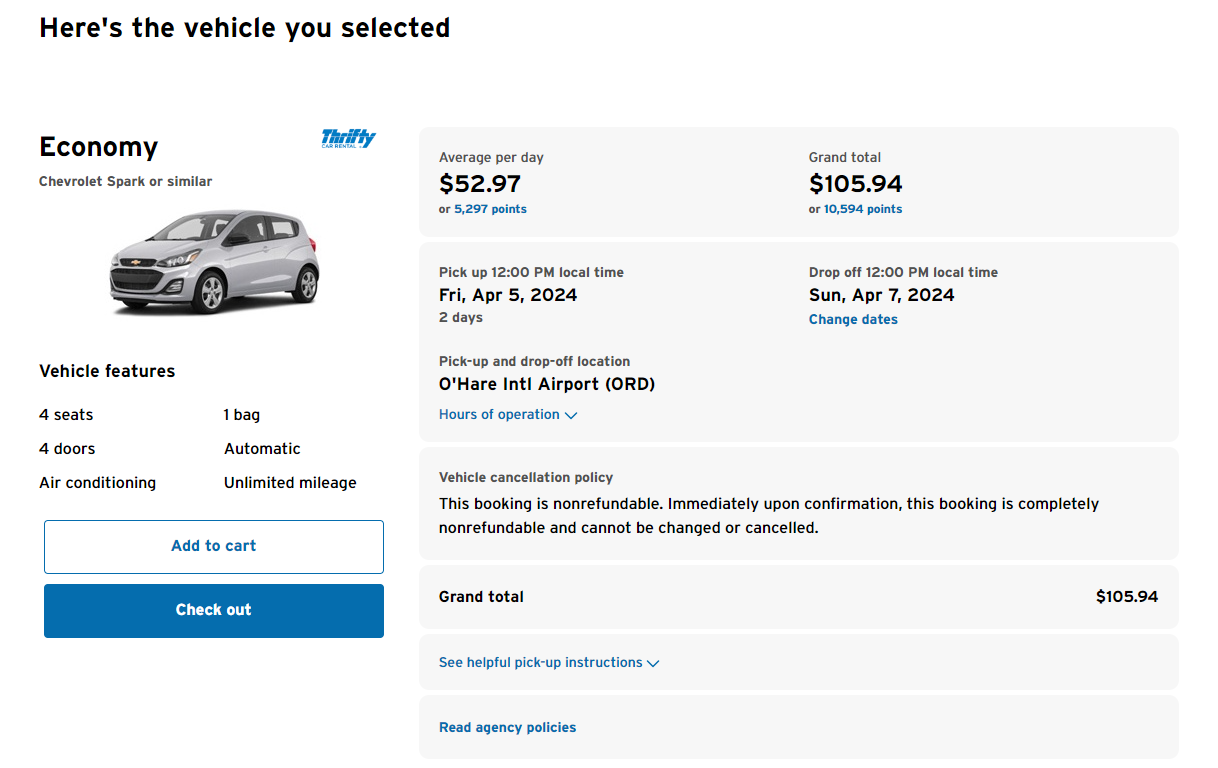

How to book rental cars using the Citi travel portal

Searching for rental cars feels familiar and works quickly.

After providing your location, dates, times and age, click "Search." From the available results, you can use the following filters:

- Vehicle type

- Rental company

- Free cancellation option availability

After choosing a car, you can see the full details and cancellation policy on the next page.

As with other items in Citi Travel with Booking.com , you can add your rental car to the shopping cart (if booking multiple travel elements) or go straight to check out to pay and reserve. Again, you can pay with points at a rate of 1 cent apiece.

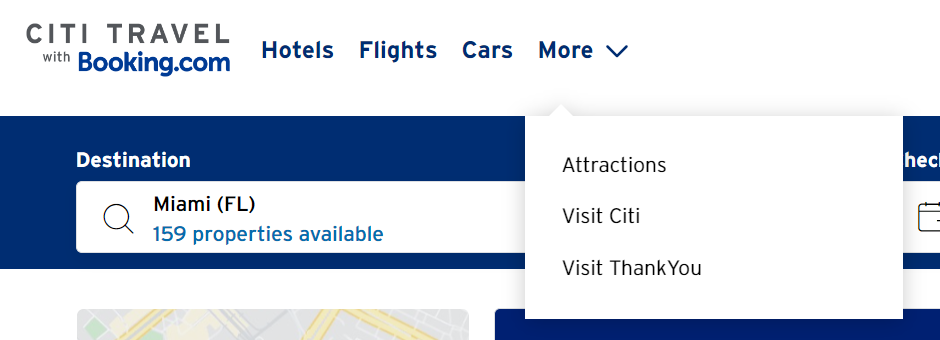

How to book attractions using the Citi travel portal

One standout feature of Citi's travel portal is the ability to book attractions along with your hotels, flights and rental cars. This convenient option allows you to make a single transaction for all your travel needs, and you can even use your points to pay for them.

To access this feature, look for the "Attractions" option in the main search bar. However, depending on your location within the portal, you may need to click "More" in the drop-down menu and select "Attractions" from there.

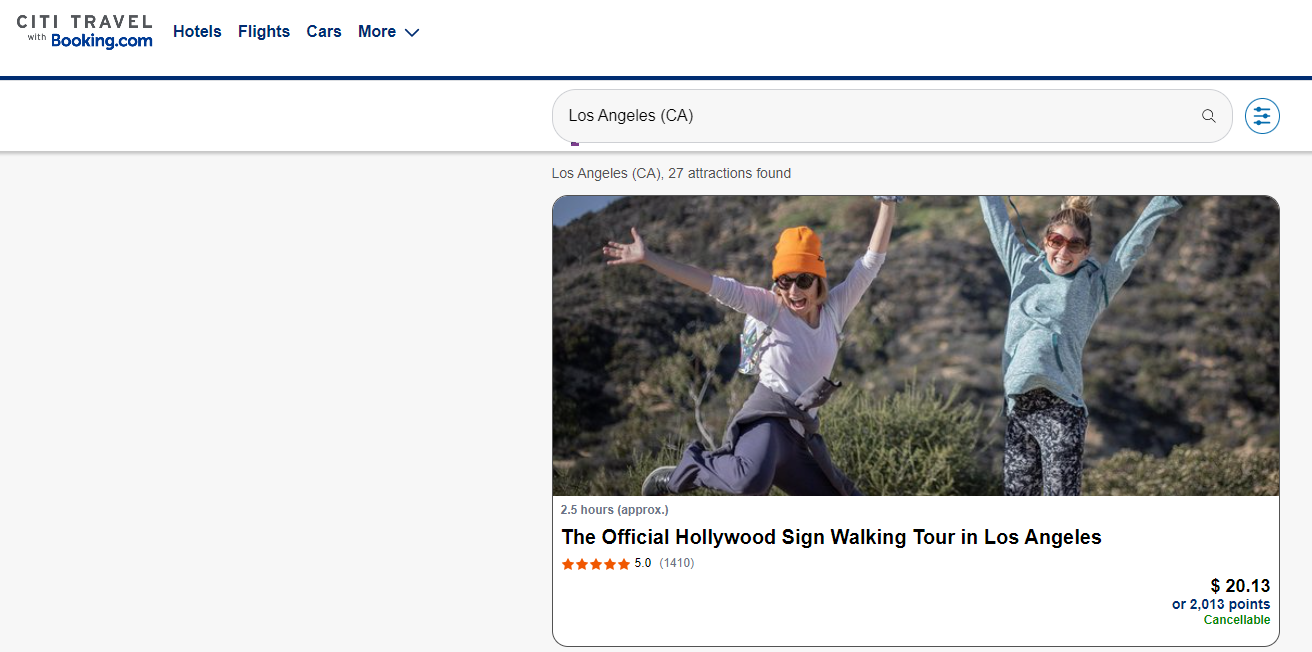

Once you search for a destination, you'll see all available options— from entrance tickets for tourist sights to guided tours. For example, you can book a guided walking tour of the Hollywood Sign.

When you see an activity or tickets you want to purchase, click on the tile. This will take you to a page with details about this offering and cancellation policies.

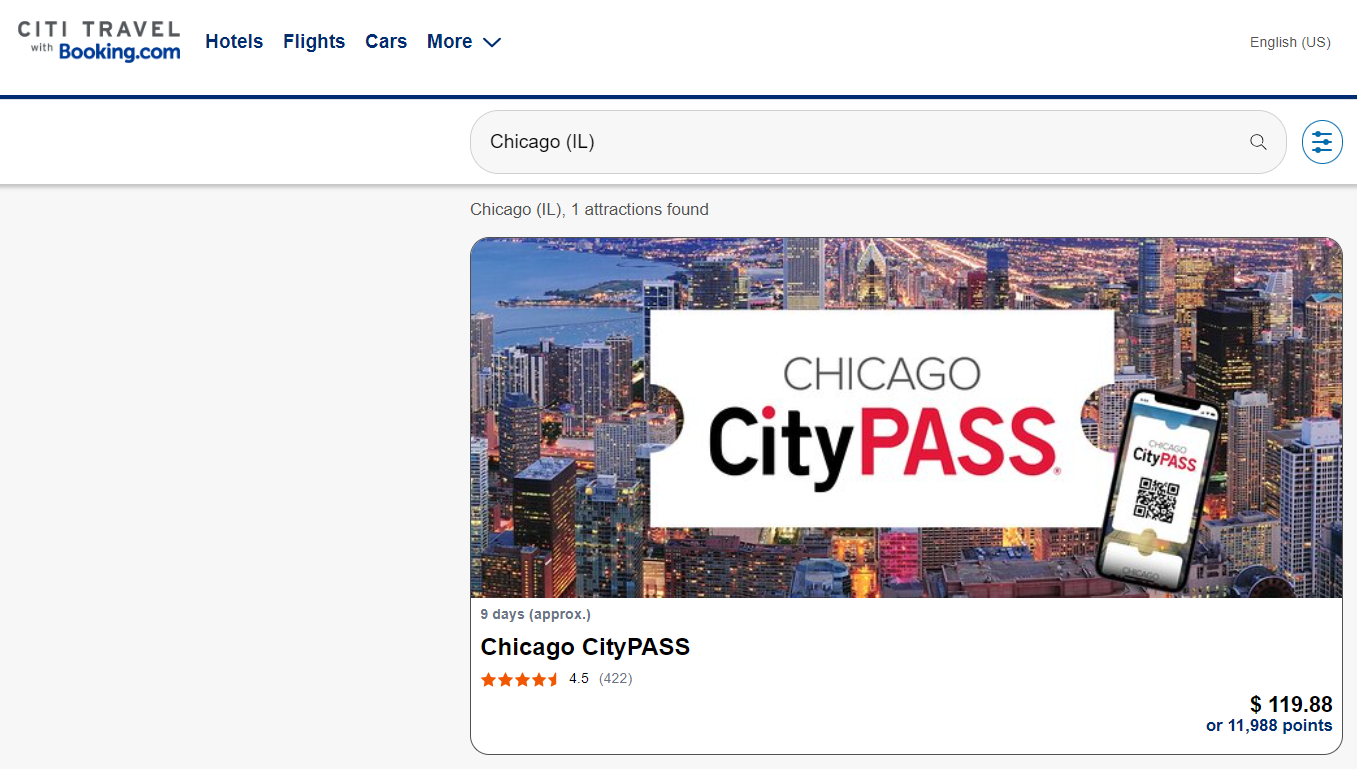

One noteworthy option is Chicago CityPASS tickets, including access to five popular attractions. Click on "Check availability" in the top right corner to choose your preferred date to find pricing and availability.

As with other elements of Citi's portal, you can pay for attraction bookings using ThankYou points with a value of 1 cent apiece.

More things to consider about the Citi travel portal

Now that you know how to use the Citi travel portal, here's some general guidance to maximize your experience.

As always, we recommend comparing prices. There is no guarantee that Citi Travel with Booking.com will offer the best price for your trip. It's recommended to compare the prices you see on the portal with prices available when booking directly with hotels, airlines, rental car companies or tour providers.

If you plan to pay with points, check if you can get better value by using fewer points with Citi's transfer partners . Transferring points to programs like Wyndham Rewards may let you get more value from your points. Check out our guide to redeeming Citi ThankYou points for high-value redemption ideas.

Also, if you book hotels or car rentals through Citi's travel portal, you may forfeit any elite status earnings and benefits. Many loyalty programs require direct bookings to recognize elite status and provide associated perks. Evaluate whether the benefits you would be giving up are worth it.

Finally, Citi Premier and Citi Prestige cardholders have exclusive benefits within the travel portal. Premier cardholders can enjoy $100 off a hotel stay of $500 or more once a calendar year, while Prestige cardholders can get a fourth night free on hotel stays of four nights or more twice a calendar year. If you're making an eligible hotel reservation, you'll see the option to use your available benefit on the payment screen.

You'll also see the benefit(s) highlighted on the hotel search page if you have one of these cards. This includes information on how many more times your benefit can be used.

If you don't see these benefits, check the top right corner of the portal and ensure your Premier or Prestige card is the active card for your searches.

Bottom line

Citi's revamped travel portal allows you to search and make travel reservations for flights, hotels, rental cars, and even tours and attractions. You can book travel up to a year in advance and pay using your Citi ThankYou points or any travel credit card .

Additionally, if you hold the Citi Premier or Citi Prestige, you can utilize your hotel benefits through the portal.

However, it's important to consider potential tradeoffs. Assess your elite status with hotel or rental car companies and determine if you might get better value by booking your travel through another platform. If convenience is your deciding factor, this user-friendly portal offers many results when planning your upcoming vacation.

Additional reporting by Kyle Olsen.

Advertiser Disclosure

Bankrate.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which Bankrate.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. Bankrate.com does not include the entire universe of available financial or credit offers.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

If you want a card that will give you time and flexibility to help you pay off your debt, the Citi Simplicity card may be an excellent fit.

- • Student credit cards

- • Building credit

As a Bankrate credit cards editor, Ashley Parks is fascinated by the ways people can make credit cards work for them when armed with the right knowledge.

- • Credit scores

Courtney Mihocik is an editor at Bankrate Credit Cards and CreditCards.com specializing in credit card news and personal finance advice. Previously, she led insurance content at Reviews.com and worked as the loans editor at The Simple Dollar.

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money and how we rate our cards . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Bottom line

If you need time and flexibility to pay off your debt, this card may be an excellent fit.

Citi Simplicity® Card

Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards.

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

Balance transfer intro APR

Regular APR

Rewards rate

Rewards rate is not available for this credit card.

On This Page

- Current offer details

Citi Simplicity pros and cons

- Reasons to get this card

- Reasons to skip this card

- Citi Simplicity card vs. other balance transfer cards

- Is this card worth getting?

- Rating methodology

Frequently asked questions

Citi is an advertising partner.

Citi Simplicity® Card Overview

If you need to pay off credit card debt , the Citi Simplicity Card could be a big help. It’s one of the most forgiving balance transfer credit cards out there as it not only possesses one of the longest intro APR periods currently available for balance transfers, but also carries no annual fee, late fees or penalty APR. New cardholders can take advantage of a 0 percent intro APR for 21 months on balance transfers made within the first four months of account opening (19.24 percent to 29.99 percent variable APR thereafter).

However, this card is something of a one-trick pony. Despite having a strong intro APR on balance transfers, its intro APR on new purchases is relatively short. The card also doesn’t include a rewards program or welcome offer, so it doesn’t carry the long-term value you’ll find rewards cards that feature balance transfer offers.

If getting as much time as possible to pay off debt is your key priority, this card is a great option, but if you want the best combination of short- and long-term value, another card may be a better fit.

- This card doesn’t offer rewards

Expert Appraisal: Typical See our expert analysis

- 0 percent intro APR on balance transfers for 21 months on transfers made within the first four months of account opening

- 0 percent intro APR on purchases for 12 months from the date of account opening

- 3 percent ($5 minimum) intro balance transfer fee for balances transfers completed within the first 4 months of account opening. After that, a 5% fee of each transfer (minimum $5) applies.

- 19.24 percent to 29.99 percent variable APR

Expert Appraisal: Good See our expert analysis

Rates and fees

- No annual fee

- No late payment fees

- No penalty APR

- 3 percent foreign transaction fee

Other cardholder perks

- $0 liability on unauthorized charges

- Automatic account alerts

- Identity theft protection

- Payment due date flexibility

- Digital wallets

- Contactless pay

Expert Appraisal: Unimpressive See our expert analysis

The Citi Simplicity can help you do one thing, and do it really well. But there are some drawbacks to the Citi Simplicity’s specialization.

It offers one of the longest intro APR periods available on balance transfers

You won’t pay any late fees or be subject to a penalty APR if you make a late payment.

Its balance transfer fee is on the low end of average, saving you money on the cost of moving debt to a new card.

The card lacks long-term value since it doesn’t include a rewards program or welcome offer

The intro APR for purchases doesn’t last as long as it does for balance transfers

There’s a 3 percent foreign transaction fee on purchases made outside of the U.S.

Why you might want the Citi Simplicity

The Citi Simplicity is one of the most competitive balance transfer cards available as it boasts one of the longest intro APR periods available for balance transfers. And with so few fees, it’s also one of the most affordable.

Intro APR offer: More than a year to pay down transferred balances

This card’s main strength and selling point is its intro APR offer: 0 percent for 21 months (19.24 percent to 29.99 percent variable APR after) on balance transfers made within the first four months of account opening.

Not only is this card’s intro APR period one of the longest on the market, but the card also gives you more time to transfer your balance and qualify for the intro APR than many other balance transfer cards (some cards only give you 60 days to transfer your balance). And while you can find other cards with comparable intro APR offers, they’ll likely have more fees than the Citi Simplicity card.

Rates and fees: Very forgiving on card penalties

The Citi Simplicity’s other strength is its affordability. In addition to charging no annual fee, the card charges no fee or penalty APR if you pay late or miss a payment (though missed and late payments can still damage your credit score).

This makes the Citi Simplicity stand out as an especially forgiving card for credit beginners and those managing debt. Saving money wherever you can is key to getting out of debt, and the Citi Simplicity helps in multiple ways.

Why you might want a different balance transfer card

Like other dedicated balance transfer cards, the Citi Simplicity carries few benefits beyond its intro APR offers. Once its intro offers end, the card won’t carry much ongoing value since it lacks a rewards program and noteworthy perks.

Rewards: Limited long-term value

Like most balance transfer cards, the Citi Simplicity does not have a rewards program. A rewards program shouldn’t necessarily be a priority when you’re focused on paying off debt, but it’s a nice bonus since it can help you save on everyday spending and gives your card better long-term value.

If you don’t need 21 months to pay off your balance, feel confident you’ll keep your spending and payments organized, and want a card for the long haul, consider a cash back card or a rewards card with a shorter — but still generous — intro APR on balance transfers and new purchases.

Cardholder perks: Shrug-worthy

Balance transfer cards often come with only a thin portfolio of cardholder perks, and the Simplicity card is no exception. The Citi Simplicity’s benefits aren’t particularly unique, making the card an unremarkable option if you’re looking for more than standard card perks like fraud protection and account alerts. If you’re after coveted no-annual-fee card perks like statement credits for food delivery or travel insurance, popular rewards cards will be a better option.

How the Citi Simplicity card compares to other balance transfer cards

The Simplicity card is one of your best options if you have high-interest credit card debt and need a long period of time to pay it off. But another card may be a better choice if you need to both pay off debt and finance new purchases.

Intro offer

Recommended Credit Score

BankAmericard® credit card

Wells Fargo Reflect® Card

Citi simplicity vs. bankamericard® credit card*.

The BankAmericard credit card offers a 0 percent intro APR period for 18 billing cycles on purchases and balance transfers made in the first 60 days, with a 16.24 percent to 26.24 percent variable APR thereafter (3% intro balance transfer fee for 60 days from account opening, then 4%). While this is a shorter intro APR period on balance transfers, the BankAmericard comes with a longer intro APR offer on new purchases and a lower ongoing interest rate than the Citi Simplicity card, making it the better choice for purchases both during and after your introductory period.

Citi Simplicity vs. Wells Fargo Reflect® Card

The Wells Fargo Reflect card should offer plenty of breathing room if you need to pay off debt or finance large purchases. While the Reflect card and the Citi Simplicity carry a similar intro APR offer on balance transfers, the Wells Fargo Reflect has the edge on new purchases thanks to its longer intro APR on new purchases.

The card has a 0 percent intro APR for 21 months from account opening on both new purchases and on qualifying balance transfers made within 120 days of account opening (then a variable APR of 18.24 percent, 24.74 percent or 29.99 percent). Unfortunately, though, a 5 percent balance transfer fee (or $5 minimum) also applies, which is on the high side for a balance transfer card. If you don’t plan on making any major purchases, the Simplicity card might be all you need to manage your debt and ongoing credit card use. Plus, it doesn’t charge late fees or a penalty APR for late payments, making it a better choice if you’re new to cards and need to ease your way into a regular payment schedule.

Who is the Citi Simplicity right for?

The Citi Simplicity is a great card for anyone with credit card debt that may take several months to pay off. Here are the types of spenders the Citi Simplicity is best for:

Credit beginners

The Citi Simplicity is a good choice for anyone learning to manage their credit cards and tackle their debt. If you are someone who may end up paying late , the Simplicity card’s lack of late fees and penalty APR make it one of the most forgiving balance transfer cards.

Debt consolidators

The intro APR offer on balance transfers with the Citi Simplicity is great and one of the longest on the market. Someone who mainly wants to transfer a balance with Citi and will get what they need from the Citi Simplicity card.

Best cards to pair with the Citi Simplicity

Since the Citi Simplicity doesn’t earn rewards, pairing it with a rewards credit card can give you one of the other major benefits of credit cards. But don’t let the pressure to earn rewards undermine the steps you’re taking to reduce your debt with the Citi Simplicity card.

The Wells Fargo Active Cash ® Card

If you want a rewards card that is simple, inexpensive and can earn rewards at a solid rate no matter the purchase, the Wells Fargo Active Cash® is the ideal pick. It earns an unlimited 2 percent cash rewards on purchases and even has a longer intro APR on purchases than you’ll find on the Citi Simplicity.

Chase Freedom Unlimited®

The Chase Freedom Unlimited is similar to the Wells Fargo Active Cash in that it earns a flat 1.5 percent back on purchases. However, it offers some additional rewards firepower thanks to a few bonus categories that earn 3 to 5 percent back. You can also pair the Freedom Unlimited with a premium Chase rewards card like the Chase Sapphire Preferred and potentially boost the value of your points when you redeem them through the Chase Travel portal.

Bankrate’s Take — Is the Citi Simplicity card worth it?

The Citi Simplicity card is great for people with debt who need a long introductory period for balance transfers. Though the lack of rewards may not make this card one to keep in your wallet forever, it can help build your credit history and decrease debt.

Plus, if you occasionally miss credit card payments, the Citi Simplicity card may be a fitting option since it lets you choose your payment due date and carries no late fees or penalty APR.

How we rated this card

Our proprietary card rating system takes into account a mix of factors when scoring balance transfer and low-interest cards, including each card’s introductory APR, intro APR period length, ongoing APR, balance transfer fee, perks and more.

While balance transfer and low-interest cards share a similar ratings rubric, we weigh features differently based on how a card is categorized. We categorize cards that carry an especially long intro APR offer on balance transfers as dedicated balance transfer cards, while cards that offer an especially low ongoing APR are considered general low-interest cards.

Based on its features, we assigned this card a primary category of balance transfer and tailored our ratings accordingly.

We analyzed over 100 of the most popular balance transfer and low-interest cards and scored each based on how its key features stacked up against those of other cards in the category.

Here’s a breakdown of what gave this card its score:

Intro and ongoing APR

The primary factor in a balance transfer or low-interest card’s rating is the quality of its introductory APR offer and ongoing APR. This includes both the introductory rate itself and the length of the intro APR on both balance transfers and new purchases.

For cards designed primarily for balance transfers, the intro APR offer on balance transfers has the largest impact on overall score. The quality of these cards’ intro APR on new purchases is also considered, but holds less weight than the intro APR on balance transfers.

For general low-interest cards, the intro APR offer on new purchases has the largest impact on overall score, followed by the ongoing APR and intro APR offer on balance transfers. This weighting assumes cardholders considering a card in this category will prioritize payment flexibility on new purchases or may need to carry a balance long term, whereas cardholders trying to pay off debt will opt for a dedicated balance transfer card.

The cards that score the highest in these categories tend to offer long 0-percent intro APRs on both balance transfers and new purchases as well as a lower-than-average low-end APR.

Along with evaluating each card’s intro APR offers, we score balance transfer and low-interest cards based on their fees.

Of primary importance is a card’s balance transfer fee, since this can play a large role in the total cost of a balance transfer. We rate each card’s balance transfer fee based on how it stacks up against the fee you’ll find on competing cards.

While this fee carries less weight when we assess general low-interest cards than dedicated balance transfer cards, it still factors into our evaluation since cardholders may decide to transfer debt to a low-interest card even if it offers no intro APR or an intro APR higher than 0 percent.

And while a lower balance transfer fee could save you more overall than a few extra months of 0-percent intro APR, this fee carries less weight in our scoring system than a card’s introductory APR and intro APR period. This is because many users prioritize getting as much time as possible to pay off debt while avoiding interest.

Our ratings also factor in the presence of annual, foreign transaction, cash advance and late payment fees, along with penalty APRs. Annual fees are weighted most heavily since these are the only “unavoidable” fees in the list and tend to be less common on dedicated balance transfer and low-interest credit cards.

Perks and long-term value

While getting a generous intro APR offer and low ongoing APR are likely to be the biggest priorities for someone looking for a low-interest or balance transfer card, we also consider how much value a card can offer after its intro APR comes to an end.

Balance transfer and low-interest cards receive a higher rating if they also include an ongoing rewards program or unique and valuable perks. Such features make a card more useful long term and make it less likely you’ll need to apply for a new card (and temporarily hurt your credit score) after you pay off debt.

*The information about the BankAmericard® credit card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Is it difficult to get the Citi Simplicity card?

The Citi Simplicity requires a good to excellent credit score for approval. If your credit score is lower than the recommended range, the card may be difficult to obtain. It could be better to look at credit cards that only require fair to good scores or a starter card to help you build a positive credit history.

How long does it take for a balance transfer to process with the Citi Simplicity card?

The process can take up to three weeks after account approval. We recommend checking your previous account as usual, as you will still need to make payments until the transfer is complete. If the transfer is still incomplete after four weeks, you can call Citibank’s customer service to check where you are in the process.

Is the Citi Simplicity a Visa or Mastercard?

What is the credit limit of the citi simplicity card.

* See the online application for details about terms and conditions for these offers. Every reasonable effort has been made to maintain accurate information. However all credit card information is presented without warranty. After you click on the offer you desire you will be directed to the credit card issuer's web site where you can review the terms and conditions for your selected offer.

Editorial Disclosure: Opinions expressed here are the author's alone, and have not been reviewed or approved by any advertiser. The information, including card rates and fees, is accurate as of the publish date. All products or services are presented without warranty. Check the bank’s website for the most current information.

Capital One Platinum Credit Card Review

SuperCash™ Card Review

Credit One Bank® Platinum Rewards Visa® with No Annual Fee Review

Credit One Bank® Platinum X5 Visa® Review

Credit One Bank Wander® Card Review

Credit One Bank American Express® Card Review

Credit One Bank® Platinum Visa® Review

Find your odds with no impact to your credit score

Apply for a credit card with confidence.

Apply for a credit card with confidence. When you find your odds, you get:

A personalized list of cards ranked by likelihood of approval

Special card offers from top issuers in our network

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score

Tell us your name to get started

This lets us verify your credit profile

Your personal information and data are protected with 256-bit encryption.

Your personal information is secure

We use your info to run a soft credit pull which won’t impact your credit score

Here’s how we protect your safety and privacy. That means:

We only use your info to run a soft credit pull, which won’t impact your credit score

We’ll never send mail to your home

All of your personal information is protected with 256-bit encryption

What’s your mailing address?

This helps us verify your credit profile.

Why we're asking

Your financial information, like annual income and employment status, helps us better understand your credit profile and provide more accurate approval odds.

Your financial information, like annual income and employment status, helps us better understand your credit profile.

Having a clearer picture of your credit profile will help us ensure that your approval odds are as accurate as possible.

What’s your employment status?

What's your estimated annual income?

Your answer should account for all personal income, including salary, part-time pay, retirement, investments and rental properties. You do not need to include alimony, child support, or separate maintenance income unless you want to have it considerd as a basis for repaying a loan. Increase non-taxbile income or benefits included by 25%.

Knowing your rent or mortgage payments helps us calculate your debt-to-income ratio (DTI) which is your monthly debt payments divided by your pre-tax monthly income.

Why does DTI matter? Your DTI gives us a clearer picture of your credit profile, which allows us to evaluate which cards you’re likely to get approved for more accurately.

Monthly rent or mortgage payment

Put $0 if you currently don’t have a rent or mortgage payment.

Almost done!

We need the last four digits of your social security number to run a soft credit pull.

We need the last four digits of your Social Security number to run a soft credit pull. This helps us locate your profile and identify cards that you may qualify for. Your information is protected by 256-bit encryption.

A soft credit pull will not affect your credit score.

Enter the last 4 digits of your Social Security number

Last step! Once you enter your email and agree to terms:

Your approval odds will be calculated

A personalized list of cards ranked by order of approval will appear

Your odds will display on each card tile

Enter your email address

Enter your email address to activate your approval odds and get updates about future card offers.

By clicking “Agree and See Results” you acknowledge receipt of our Privacy Notice , Privacy Policy and agree to our Terms of Use . By agreeing, you are giving your written instruction to Bankrate and our lending partners (together, “Us”) to obtain a soft pull of your credit report to determine whether you may be eligible ...show more for certain targeted offers, including pre-qualified and pre-approved offers (your "CardMatch offers"), as well as display what we estimate your approval odds to be for participating offers (“Approval Odds”). You instruct Us to do this each time you return to our sites to view product offerings and up to once per month so you can be provided up-to-date results.

You understand that this is not an application for credit and CardMatch offers and Approval Odds do not guarantee you will be approved for a partner offer. To apply for a product you will need to submit an application directly with that provider. Seeing your results won't hurt your credit score. Applying for a product may impact your score. See partner for complete product terms. Show less

We’re sending you to the issuer’s site to complete your application.

Just a second... We’re matching you with personalized offers

Hold tight, we’re loading your personalized results page, sorry, we couldn't access your approval odds..

This often happens when the information that's provided is incorrect. Please try entering your full information again to view your approval odds.

Check your approval odds before you apply

Answer a few questions and see if you’re likely to be approved in less than a minute—with no impact to your credit score.

Check your approval odds on similar cards before you apply

Before you apply...

See which cards you’re likely to be approved for

In less than 60 seconds, answer some questions and we’ll estimate your odds of approval on eligible cards. You get:

A personalized list of cards ranked by likelihood of approval.

Access to special card offers from top issuers in our network.

No credit hits. Enjoy a safe and seamless experience that won’t affect your credit score.

But don’t worry! You can check out other cards that are a better fit.

Personal Finance

Citi simplicity® card review 2024.

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created independently from TIME’s editorial staff. Learn more about it.

The card_name , from our partner, is more of an interest-fighting weapon than a credit card. It’s not for everyone. But if you are battling high-interest debt, you can get plenty of value from this card.

If you carry a large balance on high APR credit cards, the card_name could save you thousands of dollars in the long run. Our review will help you decide if it’s a good fit for your wallet.

Citi Simplicity Card

Time’s take.

The card_name has annual_fees annual fee, comes with a nearly unprecedented 0% intro APR offer for balance transfers , and waives things like late and returned payment penalties.

Unfortunately, that’s where the benefits end. The card doesn’t offer rewards and has no other ongoing perks worth mentioning. For that reason, you should only consider the card_name if you need to consolidate high-interest debt from another card.

Pros and cons

- Excellent intro APR offer for balance transfers

- No late payment penalties

- No standard welcome bonus

- No rewards program

- Minimal ongoing benefits

Who is the card for?

The card_name is for anyone who is struggling under the weight of high credit card interest charges each month. The card offers 0% intro APR for 21 months on balance transfers and 12 months on new purchases. When the intro APR period ends, the rate moves to reg_apr,reg_apr_type . Transferring debt from other high APR credit cards enables you to get a break from the interest charges you’ve incurred by carrying a balance month-to-month.

The credit limit you’re approved for will depend on your creditworthiness, so it’s important to have a “good” FICO credit score of at least 670. And you can’t transfer a balance higher than your credit limit. In other words, if your credit score only qualifies you for a $2,000 credit limit, it won’t help much if you are paying interest on a $10,000 balance.

Intro APR offer

The card_name ’s biggest upside is its intro APR offer. You’ll receive 0% APR (then reg_apr,reg_apr_type ) on:

- Balance transfers for 21 months.

- Purchases for 12 months.

It’s the best balance transfer offer in the business, hands down.

No late fees

The card_name does not charge a fee if you make a payment after your due date. Many cards charge penalties of up to $41 for this.

No penalty APR

Most cards will charge a higher interest rate if you make a late payment or your payment is returned due to insufficient funds. The card_name doesn’t do this. If your payment is late, your APR remains unchanged.

The fine print

The card_name is a no-annual fee credit card , so you won’t pay to keep this card in your wallet whether or not you’re using it. You can use the card as a tool to build your length of credit history and maintain a lower credit utilization even after you’ve moved on to better cards.

The card_name charges a regular purchase APR of reg_apr,reg_apr_type , based on your creditworthiness. If you never carry a balance on your credit card, this won’t affect you.

There is a cash advance APR of cash_advance_apr , which will begin accruing as soon as you take out the cash advance.

Balance transfer fees

When you transfer a balance to the card_name during the first four months from account opening, you’ll pay either $5 or 3% of the amount you transfer, whichever is greater. After that, you’ll pay between $5 or 5% of your transferred amount, whichever is greater.

Other standard credit card fees still apply to the card_name , including:

- A foreign transaction fee of foreign_transaction_fee .

- A cash advance fee of cash_advance_fee .

- A returned payment fee of up to $41.

What could be improved

The card_name is not a rewards credit card. You can’t earn cash back or points when you spend, and there is no welcome bonus. In other words, the card loses most of its value after you’ve used up the 0% intro APR offer. If Citi were to add even a modest rewards program, the card wouldn’t become obsolete after a couple of years.

The card_name could also increase its intro APR for purchases from a modest 12 months. Plenty of credit cards offer a similar or better interest-free period for purchases.

Card alternatives

Bottom line.

If you have a good credit score, a lot of high-APR debt, and want to avoid as many ancillary fees as possible, the card_name could save you hundreds (even thousands) of dollars in interest payments.

Frequently asked questions (FAQs)

Is the card_name hard to get.

The card_name isn’t hard to get. You should have at least a good credit score (670 or above) for the best chance at approval.

What kind of card is card_name ?

The card_name is a 0% intro APR credit card , with an appealing balance transfer offer.

How often does card_name increase its credit limit?

You can request a credit limit increase once every six months. Citi will base its decision on your creditworthiness—approval is not guaranteed.

The information presented here is created independently from the TIME editorial staff. To learn more, see our About page.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Benefits of the Citi Custom Cash Card

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The Citi Custom Cash® Card stands out for its simplicity in a competitive 5% cash-back field.

The $0 -annual-fee card offers automatically adjusted 5% back in popular everyday categories, which makes it ideal for those who want elevated rewards with no fuss.

Here are the benefits of the Citi Custom Cash® Card .

» MORE: NerdWallet's best Citi credit cards

High cash back in popular categories

The Citi Custom Cash® Card offers 5% cash back in your top eligible spending category, on up to $500 each billing cycle, and 1% back after that. What makes the card especially valuable is the fact that holders can earn high rewards in the following broad categories:

Grocery stores.

Restaurants.

Gas stations.

Streaming services.

Drugstores.

Home improvement stores.

Fitness clubs.

Select travel.

Select transit.

Live entertainment.

Until June 30, 2025, Citi Custom Cash® Card cardholders will earn an additional 4% cash back on hotels, car rentals and attractions booked through Citi. So if that's your top spending category, you'll earn a whopping 9% back. If not, you'll still earn 5% back on these purchases.

Simplicity of rewards

A key feature of this card is that rewards are automatically adjusted based on your monthly purchases. This means that if your spending leans more heavily toward one eligible bonus category than it did the previous cycle, your rewards will automatically adjust.

Many other cards in the 5%-back market feature categories that are chosen by the issuers and announced only at the start of each quarter. This can make it difficult to plan your spending. Also, some cards require you to activate your bonus categories each quarter, which is an extra hurdle.

» MORE: Credit cards with potentially confusing rewards programs

Benefits of the Alaska Airlines credit card

Benefits of the American Express Gold Card

Benefits of the American Express Green Card

Benefits of the American Express Platinum Card

Benefits of the Bank of America Travel Rewards card

Benefits of the Capital One Savor cards

Benefits of the Capital One Venture card

Benefits of the Capital One Quicksilver card

Benefits of the Capital One Platinum card

Benefits of the Chase Freedom Flex and Freedom Unlimited cards

Benefits of the Chase Sapphire Preferred Card

Benefits of the Chase Sapphire Reserve card

Benefits of the Citi Costco credit card

Benefits of Citi Double Cash Card

Benefits of Delta Air Lines credit cards

Benefits of the Discover it Cash Back

Benefits of Marriott Bonvoy credit cards

Benefits of Southwest Airlines credit cards

Benefits of United Airlines credit cards

Benefits of the Wells Fargo Active Cash Card

Benefits of the Wells Fargo Autograph

Benefits of the Wells Fargo Autograph Journey

0% intro APR offer

The Citi Custom Cash® Card features a 0% intro APR on Purchases and Balance Transfers for 15 months, and then the ongoing APR of 19.24%-29.24% Variable APR . This lengthy interest-free window is ideal for consumers who are looking to transfer over existing debt from another card, or pay off a large purchase without being charged the card’s APR.

» MORE: Best 0% APR credit cards

Transfer partners

Cardholders can redeem rewards for cash back as statement credit, check or direct deposit (at the rate of a penny per point), among other redemption options.

But points earned from the Citi Custom Cash® Card can also be combined and transferred to other cards that earn Citi ThankYou points. Plus, transferring points to one of Citi’s travel partners can sometimes get you a higher points value.

» LEARN: Citi ThankYou points: How to earn and use them

Sign-up bonus

New account openers will get the following welcome offer: Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back. This can get holders a good amount of cash for meeting the card’s spending requirement.

More about the card

Complete card details for the Citi Custom Cash® Card .

NerdWallet review of the Citi Custom Cash® Card .

On a similar note...

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Credit cards" data-destinationurl="https://www1.citibank.com.au/credit-cards?intcid=Meganav-CC" data-ctaposition="header:meganav" data-aria-label="Click here to view all Credit cards" href="https://www1.citibank.com.au/credit-cards?intcid=Meganav-CC" rel="" innerhtml="Credit cards">Credit cards

Features & Benefits

Citi rewards program, citi rewards program > citi rewards" data-destinationurl="https://www1.citibank.com.au/rewardsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to view the citi rewards program" href="https://www1.citibank.com.au/rewardsintcid=meganav-cc" rel="" innerhtml="citi rewards">citi rewards, citi rewards program >pay with points" data-destinationurl="https://www1.citibank.com.au/rewards/pay-with-pointsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to learn more about pay with points" target="_self" href="https://www1.citibank.com.au/rewards/pay-with-pointsintcid=meganav-cc" rel="" innerhtml="pay with points">pay with points, instalment plans" data-destinationurl="https://www1.citibank.com.au/credit-cards/instalment-plansintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to learn about citi instalment plans" target="_self" href="https://www1.citibank.com.au/credit-cards/instalment-plansintcid=meganav-cc" rel="" innerhtml="instalment plans">instalment plans, account information, account information > setting up repayments" data-destinationurl="https://www1.citibank.com.au/personal-loans/help-and-support/repaymentsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to setting up repayments" target="_self" href="https://www1.citibank.com.au/personal-loans/help-and-support/repaymentsintcid=meganav-cc" rel="" innerhtml="setting up repayments">setting up repayments, account information > useful forms and links" data-destinationurl="https://www1.citibank.com.au/help-and-support/useful-forms-and-links" data-ctaposition="header:meganav" data-aria-label="click here to view the useful forms and links page" target="_self" href="https://www1.citibank.com.au/help-and-support/useful-forms-and-links" rel="" innerhtml="useful forms and links">useful forms and links, calculators & tools" data-destinationurl="https://www1.citibank.com.au/credit-cards/calculatorsintcid=meganav-cc" data-ctaposition="header:meganav" data-aria-label="click here to use our credit card calculators" target="_self" href="https://www1.citibank.com.au/credit-cards/calculatorsintcid=meganav-cc" rel="" innerhtml="calculators & tools">calculators & tools, loans" data-destinationurl="https://www1.citibank.com.au/personal-loansintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view our personal loans page" target="_self" href="https://www1.citibank.com.au/personal-loansintcid=meganav-pl" rel="" innerhtml="loans">loans, loans > citi ready credit" data-destinationurl="https://www1.citibank.com.au/personal-loans/ready-creditintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view citi ready credit page" target="_self" href="https://www1.citibank.com.au/personal-loans/ready-creditintcid=meganav-pl" rel="" innerhtml=" citi ready credit"> citi ready credit, loans > personal loan plus" data-destinationurl="https://www1.citibank.com.au/personal-loans/personal-loan-plusintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view citi personal loan plus page" target="_self" href="https://www1.citibank.com.au/personal-loans/personal-loan-plusintcid=meganav-pl" rel="" innerhtml=" personal loan plus"> personal loan plus, loans > help me choose" data-destinationurl="https://www1.citibank.com.au/personal-loans/help-me-chooseintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view the help me choose page" target="_self" href="https://www1.citibank.com.au/personal-loans/help-me-chooseintcid=meganav-pl" rel="" innerhtml="help me choose">help me choose, loans > compare loans" data-destinationurl="https://www1.citibank.com.au/personal-loans/compare-loansintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view the compare loans page" target="_self" href="https://www1.citibank.com.au/personal-loans/compare-loansintcid=meganav-pl" rel="" innerhtml="compare loans">compare loans, view all loans" data-destinationurl="https://www1.citibank.com.au/personal-loansintcid=meganav-pl-view-all" data-ctaposition="header:meganav" data-aria-label="click here to view all loans page" target="_self" href="https://www1.citibank.com.au/personal-loansintcid=meganav-pl-view-all" rel="" innerhtml=" view all loans > "> view all loans >, account information > how to use your account" data-destinationurl="https://www1.citibank.com.au/personal-loans/how-to-use-your-accountintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to learn how to use your citi lending account" target="_self" href="https://www1.citibank.com.au/personal-loans/how-to-use-your-accountintcid=meganav-pl" rel="" innerhtml="how to use your account">how to use your account, account information > how to manage your account" data-destinationurl="https://www1.citibank.com.au/personal-loans/how-to-manage-your-accountintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to learn how to manage your citi lending account" target="_self" href="https://www1.citibank.com.au/personal-loans/how-to-manage-your-accountintcid=meganav-pl" rel="" innerhtml="how to manage your account">how to manage your account, account information > setting up repayments" data-destinationurl="https://www1.citibank.com.au/personal-loans/help-and-support/repaymentsintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to learn how to make repayments to your personal loan account" target="_self" href="https://www1.citibank.com.au/personal-loans/help-and-support/repaymentsintcid=meganav-pl" rel="" innerhtml="setting up repayments">setting up repayments, account information > fees & charges" data-destinationurl="https://www1.citibank.com.au/personal-loans/fees-chargesintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view personal loans fees & charges" target="_self" href="https://www1.citibank.com.au/personal-loans/fees-chargesintcid=meganav-pl" rel="" innerhtml="fees & charges">fees & charges, account information > useful forms and links" data-destinationurl="https://www1.citibank.com.au/help-and-support/useful-forms-and-linkstab=lending&intcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view useful forms and links" target="_self" href="https://www1.citibank.com.au/help-and-support/useful-forms-and-linkstab=lending&intcid=meganav-pl" rel="" innerhtml="useful forms and links">useful forms and links, calculators & tools" data-destinationurl="https://www1.citibank.com.au/personal-loans/calculatorsintcid=meganav-pl" data-ctaposition="header:meganav" data-aria-label="click here to view the calculators & tools" target="_self" href="https://www1.citibank.com.au/personal-loans/calculatorsintcid=meganav-pl" rel="" innerhtml="calculators & tools">calculators & tools, help with credit cards" data-destinationurl="" href="unsafe:javascript:void(0);" rel="" innerhtml=" help with credit cards"> help with credit cards, help with credit cards > check application status" data-destinationurl="https://www.citibank.com.au/global_docs/check_app_status.htm" data-ctaposition="header:meganav" data-aria-label="click here to check the status of your application" target="_self" href="https://www.citibank.com.au/global_docs/check_app_status.htm" rel="" innerhtml="check application status">check application status.

Account management

Account management > update contact details" data-destinationurl="https://www1.citibank.com.au/help-and-support/update-contact-detailsintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to update your contact details" target="_self" href="https://www1.citibank.com.au/help-and-support/update-contact-detailsintcid=meganav-hs" rel="" innerhtml="update contact details">update contact details, account management > travelling overseas" data-destinationurl="https://www1.citibank.com.au/help-and-support/travelling-overseasintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to view the travelling overseas page" target="_self" href="https://www1.citibank.com.au/help-and-support/travelling-overseasintcid=meganav-hs" rel="" innerhtml="travelling overseas">travelling overseas, account management > reset user id or password" data-destinationurl="https://www1.citibank.com.au/help-and-support/reset-passwordintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to reset your user id or password" target="_self" href="https://www1.citibank.com.au/help-and-support/reset-passwordintcid=meganav-hs" rel="" innerhtml="reset user id or password">reset user id or password, account management > document upload" data-destinationurl="https://www.citibank.com.au/aus/static/document_upload.htmintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to upload your forms and documents" target="_self" href="https://www.citibank.com.au/aus/static/document_upload.htmintcid=meganav-hs" rel="" innerhtml="document upload">document upload, account management > download citi mobile app" data-destinationurl="https://www1.citibank.com.au/citi-mobile-appintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about the citi mobile® app" target="_self" href="https://www1.citibank.com.au/citi-mobile-appintcid=meganav-hs" rel="" innerhtml="download citi mobile ®️ app">download citi mobile ®️ app, account management > deposit & home loan accounts" data-destinationurl="https://www1.citibank.com.au/nabintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about the move to nab" href="https://www1.citibank.com.au/nabintcid=meganav-hs" rel="" innerhtml="deposit & home loan accounts">deposit & home loan accounts, support > support services" data-destinationurl="https://www1.citibank.com.au/help-and-support/supporting-youintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about our support services" target="_self" href="https://www1.citibank.com.au/help-and-support/supporting-youintcid=meganav-hs" rel="" innerhtml="support services">support services, support > financial hardship" data-destinationurl="https://www1.citibank.com.au/help-and-support/financial-hardshipintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about financial hardship" target="_self" href="https://www1.citibank.com.au/help-and-support/financial-hardshipintcid=meganav-hs" rel="" innerhtml="financial hardship">financial hardship, support > disaster & crisis support" data-destinationurl="https://www1.citibank.com.au/help-and-support/disaster-and-crisis-supportintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about our disaster and crisis support" target="_self" href="https://www1.citibank.com.au/help-and-support/disaster-and-crisis-supportintcid=meganav-hs" rel="" innerhtml="disaster & crisis support">disaster & crisis support, support > scams" data-destinationurl="https://www1.citibank.com.au/help-and-support/scamsintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about scam prevention and reporting scams" target="_self" href="https://www1.citibank.com.au/help-and-support/scamsintcid=meganav-hs" rel="" innerhtml="scams">scams, support > dispute transactions" data-destinationurl="https://www1.citibank.com.au/help-and-support/dispute-transactionsintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn how to dispute a transaction" target="_self" href="https://www1.citibank.com.au/help-and-support/dispute-transactionsintcid=meganav-hs" rel="" innerhtml="dispute transactions">dispute transactions, support > banking code of practice" data-destinationurl="https://www1.citibank.com.au/help-and-support/banking-codeintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about the banking code of practice" target="_self" href="https://www1.citibank.com.au/help-and-support/banking-codeintcid=meganav-hs" rel="" innerhtml="banking code of practice">banking code of practice, support > data sharing consent (open banking)" data-destinationurl="https://www1.citibank.com.au/open-bankingintcid=meganav-hs" data-ctaposition="header:meganav" data-aria-label="click here to learn about our data sharing consents and open banking" target="_self" href="https://www1.citibank.com.au/open-bankingintcid=meganav-hs" rel="" innerhtml=" ul.navbar-sub-menus {color: #002a54 important;} #signon {color: #ffffff important; border: 2px solid #002a54 important; background: #002a54 important; line-height: 3rem; padding-left: 3rem; padding-right: 3rem; border-radius: 0.6rem; box-shadow: none important; transform: none important; transition: none important; min-width: 10rem; min-height: 3rem;}.navigation-bar.bg-base.main-menu-font-size .container.navigation {line-height: 4rem;}.meganav-sec{display:flex;flex-direction:row;border-radius:8px;width:350px;align-items: center; background-color:#fde8cc important;}.megabox1{width:30%;}.megabox2{width:70%;background-color:#fde8cc important;border-radius: 0 8px 8px 0;padding:5px 10px}.megabox2 p {margin: 0 important;}@media only screen and (max-device-width : 768px){.meganav-sec{width:260px;}} data sharing consent (open banking)"> ul.navbar-sub-menus {color: #002a54 important;} #signon {color: #ffffff important; border: 2px solid #002a54 important; background: #002a54 important; line-height: 3rem; padding-left: 3rem; padding-right: 3rem; border-radius: 0.6rem; box-shadow: none important; transform: none important; transition: none important; min-width: 10rem; min-height: 3rem;}.navigation-bar.bg-base.main-menu-font-size .container.navigation {line-height: 4rem;}.meganav-sec{display:flex;flex-direction:row;border-radius:8px;width:350px;align-items: center; background-color:#fde8cc important;}.megabox1{width:30%;}.megabox2{width:70%;background-color:#fde8cc important;border-radius: 0 8px 8px 0;padding:5px 10px}.megabox2 p {margin: 0 important;}@media only screen and (max-device-width : 768px){.meganav-sec{width:260px;}} data sharing consent (open banking), the move to nab" data-destinationurl="https://www1.citibank.com.au/nabintcid=meganav-au" data-ctaposition="header:meganav" data-aria-label="click here to learn about the move to nab" target="_self" href="https://www1.citibank.com.au/nabintcid=meganav-au" rel="" innerhtml="the move to nab">the move to nab, sign into nab >" data-destinationurl="https://ib.nab.com.au/login" data-ctaposition="header:meganav" data-aria-label="click here to sign in to nab" target="_blank" href="https://ib.nab.com.au/login" rel="" innerhtml=" sign into nab > "> sign into nab >, report lost or stolen card" data-destinationurl="https://www1.citibank.com.au/help-and-support/lost-or-stolen-cardintcid=meganav-cu" data-ctaposition="header:meganav" data-aria-label="click here to report a lost or stolen card" target="_self" href="https://www1.citibank.com.au/help-and-support/lost-or-stolen-cardintcid=meganav-cu" rel="" innerhtml="report lost or stolen card">report lost or stolen card, report a scam" data-destinationurl="https://www1.citibank.com.au/help-and-support/scamsintcid=meganav-cu" data-ctaposition="header:meganav" data-aria-label="click here to report a scam" target="_self" href="https://www1.citibank.com.au/help-and-support/scamsintcid=meganav-cu" rel="" innerhtml="report a scam">report a scam.

- Help and Support

Complimentary Insurance

Many of our Citi credit card cardholders are eligible for complimentary insurance cover. Check below to see if your credit card provides any complimentary insurance covers.

If you need to make a travel claim, we encourage you to do so online . If you are looking for information about the impact of COVID-19 on travel insurance, please refer to our FAQs .