Growth of the Ocean Cruise Line Industry

Worldwide, the ocean cruise industry experienced an annual passenger compound annual growth rate of 5.9% from 1990 to 2024.

While the COVID-19 pandemic brought the ocean passenger cruise industry to a standstill for nearly two years, it also prompted the accelerated retirement of numerous older ships. Simultaneously, new additions to fleets adopted a more modern and environmentally friendly approach. In 2024, passenger numbers are expected to surpass the pre-COVID levels of 2019.

Between 2023 and 2024, a total of 10 new ships, with a combined passenger capacity of 25,450, are set to be added (refer to the tables below). This influx will bring the worldwide ocean cruise passenger capacity to 673,000, spread across 360 ships. These vessels are projected to carry a total of 30.0 million passengers by the end of 2024, representing a 4.2% increase over 2023 and a 9.2% increase over 2019.

Shipbuilding Summary

Sources: Royal Caribbean Cruises, Ltd., Carnival Corporation and plc, NCL Corporation Ltd., Thomson/First Call, Cruise Lines International Association (CLIA) , The Florida-Caribbean Cruise Association (FCCA) , DVB Bank and proprietary Cruise Market Watch Cruise Pulse data.

- Port Overview

- Transportation to the Port

- Uber & Lyft to the Port

- Dropping Off at the Port

- Cruise Parking

- Cruise Hotels

- Hotels with Parking Deals

- Uber & Lyft to the Ports

- Things to Do

- Cozumel Taxi Rates

- Free Things to Do

- Restaurants Near the Cruise Port

- Hotels & Resorts With Day Passes

- Closest Beaches to the Cruise Port

- Tips For Visiting

- Shore Excursions

- Cruise Parking Discounts

- Hotels with Shuttles

- Which Airport Should I Use?

- Transportation to the Ports

- Dropping Off at the Ports

- Fort Lauderdale Airport to Miami

- Inexpensive Hotels

- Hotels near the Port

- Hotels With Shuttles

- Budget Hotels

- Carnival Tips

- Drink Packages

- Specialty Restaurants

- Faster to the Fun

- More Articles

- CocoCay Tips

- Norwegian Tips

- Great Stirrup Cay

- Harvest Caye

- How to Get the Best Cruise Deal

- Best Time to Book a Cruise

- Best Websites to Book a Cruise

- Cruises Under $300

- Cruises Under $500

- Spring Break Cruise Deals

- Summer Cruise Deals

- Alaskan Cruise Deals

- 107 Cruise Secrets & Tips

- Tips for First-Time Cruisers

- What to Pack for a Cruise

- What to Pack (Alaska)

- Packing Checklist

- Cruising with Kids

- Passports & Birth Certificates

- Bringing Alcohol

- Cruising with a Disability

- Duty-Free Shopping

- Cruise Travel Insurance

- Things to Do on a Cruise Ship

- What Not to Do on a Ship

- News & Articles

Revealed: How Much Cruise Companies Earn Per Passenger

How much money do cruise companies make per passenger? Well, after more than a yearlong pause due to the pandemic, cruise lines are back to sailing completely full on many routes and are seeing revenues per passenger set new marks as the public gets back to traveling.

And because many cruise lines fall under the umbrella of large public companies with shares that trade on the stock exchanges, we can get some insight. Every quarter the major cruise companies like Carnival Corporation, Royal Caribbean Group, and Norwegian Cruise Line Holdings Ltd. offer a glimpse into their business via public reports. These reports let us know just how much money cruising makes.

Let’s just say the figures are substantial. In the course of a year, a cruise company brings in billions of dollars in revenue and carries millions of passengers. So how exactly do the figures break down? Take a look…

Carnival Corporation Revenue Per Passenger

Carnival Corporation is the company behind some of the largest and most well-known cruise lines on the planet. Names like Costa, Princess, Holland America — and of course, Carnival Cruise Line — are all brands operated by the company.

As of its most recent annual filing, Carnival Corporation had a passenger capacity across its 91 ships of roughly 254,000 cabins. Carnival Cruise Line boasts the largest portion of those cabins, with more than 75,000 rooms across 24 ships as of November 2022 — or about 30% of total capacity for the company.

While 2022 was a rebound year for Carnival, it wasn’t quite all the way back. For instance, before the pandemic, the occupancy percentage across the fleet was routinely at 100% or more. (Occupancy of 100% means that there are an average of two passengers per cabin on a cruise.) In 2022, the occupancy rate came in at 75%. That’s lower, but still a sharp increase from the 56% for 2021 and rising steadily.

In total, the company saw revenue of $12.17 billion in 2022, or about $33.3 million per day. Carnival Corporation also carried 7.7 million passengers during the year. That comes out to revenue of $1,580.26 per passenger carried.

Carnival Corporation:

- 2022 Revenue: $12.17 billion

- 2022 Passengers Carried: 7.7 million

- 2022 Revenue Per Passenger: $1,580.26

- Source data

Royal Caribbean Group Revenue Per Passenger

When it comes to cruising, Royal Caribbean is one of the biggest in the industry. Parent company Royal Caribbean Group is the force behind Royal Caribbean International, Celebrity Cruises, Silversea, TUI, and Hapag Lloyd.

When it comes to those brands, Royal Caribbean International is by far the largest, with roughly two dozen ships and about 90,000 berths.

Similar to Carnival Corporation, Royal Caribbean has seen a sharp rebound in traffic as the pandemic has waned. In the full year 2022, occupancy was 85% overall. The company reports now that Caribbean sailings are reaching 100% with holiday sailings “close to 110%.”

In other words, the company is well on its way back to normalcy.

Overall, Royal Caribbean Group saw total revenue in 2022 of $8.84 billion, or about $24.2 million per day. The company carried 5.5 million passengers during the year. That comes out to revenue of $1,596.82 per passenger carried. This figure is in line with what’s seen for Carnival Corporation.

Royal Caribbean Group:

- 2022 Revenue: $8.84 billion

- 2022 Passengers Carried: 5.5 million

- 2022 Revenue Per Passenger: $1,596.82

Norwegian Cruise Line Holdings Ltd. Revenue Per Passenger

The final of the “big three” public cruise companies is Norwegian Cruise Line Holdings. While it is the smallest of the three major players, it’s no slouch. Brands include Norwegian Cruise Line, Regent Seven Seas, and Oceania Cruises.

All told, the company operates 29 ships, with roughly 62,000 berths. That makes it roughly one-fourth the size of Carnival Corporation when it comes to capacity. However, the cruise company also focuses on higher pricing and more luxury, such as its newest ship — Norwegian Prima.

As of the time of this writing, Norwegian Cruise Line Holdings had yet to release its full-year 2022 figures . However, we can still see how much it earns in revenue per passenger by studying statements through the first nine months of the year (ending September 30, 2022).

During that time, Norwegian saw total revenue of $3.3 billion, or about $9.1 million per day. The company carried 1.1 million passengers during the first nine months of the year. That comes out to $2,989.96 per passenger carried. And while there is some seasonality to cruise fares, this figure is roughly double what’s seen by Royal Caribbean Group and more than double Carnival Corporation.

Norwegian Cruise Line Holdings Ltd.:

- 2022 Revenue (through 9/30): $3.32 billion

- 2022 Passengers Carried (through 9/30): 1.1 million

- 2022 Revenue Per Passenger (through 9/30): $2,989.96

Visualizing the Data

It can be easier to compare the different cruise companies with a chart instead of just figures. Below, we’ve compared the different metrics for each company. One thing to keep in mind, however, is that the data shown in this article represents the entire year for Carnival Corporation and Royal Caribbean Group. However, at this time Norwegian Cruise Line Holdings has only published data for the first nine months of 2022.

Popular: 39 Useful Things to Pack (17 You Wouldn't Think Of)

Read next: park & cruise hotels for every port in america, popular: 107 best cruise tips, secrets, tricks, and freebies.

How much do the cruise line make per person after expenses?

Currently profits have been negative due to Covid.

LEAVE A REPLY Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Crew Member Arrested for Stabbing Three Aboard Alaskan Cruise

15+ hotels with cruise shuttles between orlando and port canaveral, 57 must-have tips, advice, and info for first-time cruisers, hotels with cruise shuttles for every major port in america, 107 best cruise tips, tricks, secrets, and freebies, 39 useful things to pack for your cruise (including 17 you’d never think of).

- Privacy Policy

- Terms & Conditions

Carnival Corp. Reports Record 2023 Revenue and Fourth Quarter Earnings

- December 21, 2023

Carnival Corporation has reported fourth quarter and full year 2023 earnings and provided an outlook for the full year and first quarter 2024.

Full Year 2023

- Full year revenues hit an all-time high of $21.6 billion.

- Full year cash from operations was $4.3 billion and adjusted free cash flow was $2.1 billion (see “Non-GAAP Financial Measures” below).

- U.S. GAAP net loss of $74 million and positive adjusted net income of $1 million outperformed the September guidance range (see “Non-GAAP Financial Measures” below).

- The company made debt payments of $6 billion, reducing its debt balance by $4.6 billion from its peak in the first quarter of 2023 and ended the year with $5.4 billion of liquidity.

- The company entered 2024 with its best booked position on record, for both price and occupancy

Fourth Quarter 2023

- Record fourth quarter revenues of $5.4 billion with record net per diems (in constant currency) significantly exceeding 2019 levels and above the September guidance range and record net yields (in constant currency) (see “Non-GAAP Financial Measures” below).

- Booking volumes for the two weeks around Black Friday and Cyber Monday reached an all-time high for that period.

- Total customer deposits reached a fourth quarter record of $6.4 billion, surpassing the previous fourth quarter record of $5.1 billion (as of November 30, 2022), by 25 percent.

“We ended the year on a high note with another record-breaking quarter that exceeded expectations and achieved positive full year adjusted net income. In fact, we consistently outperformed in all four quarters of the year, buoyed by a strengthening demand environment across all our brands,” commented Carnival Corporation & plc’s Chief Executive Officer Josh Weinstein.

“Net yields for the fourth quarter continued on a positive trajectory, were significantly higher than a very strong 2019 and even higher than we had anticipated, enabling us to overcome four years of high cost inflation to deliver five percent higher per unit EBITDA than 2019 (holding fuel and currency constant),” Weinstein added.

“Thanks to a strong second half of 2023, we are already tracking ahead of our plan to achieve SEA Change, our three-year financial targets calling for the highest adjusted ROIC and adjusted EBITDA per ALBD in nearly two decades. Based on our 2024 guidance, we expect to deliver another big step forward, positioning us more than halfway toward realizing all our 2026 SEA Change targets. With nearly two-thirds of 2024 on the books already, we are well positioned to obtain another year of record revenues and adjusted EBITDA,” Weinstein noted.

Fourth Quarter 2023 Results

- U.S. GAAP net loss of $48 million, or $(0.04) diluted EPS, and adjusted net loss of $90 million, or $(0.07) adjusted EPS, was above the better end of the September guidance range (see “Non-GAAP Financial Measures” below).

- Adjusted EBITDA of $946 million exceeded the September guidance range, driven by continued strength in demand, which is driving ticket prices higher (see “Non-GAAP Financial Measures” below).

- Record fourth quarter revenues of $5.4 billion, with record net per diems (in constant currency) significantly exceeding 2019 levels, and above the September guidance range and record net yields (in constant currency).

- Occupancy in the fourth quarter of 2023 was over 101 percent, in line with the company’s expectations and historical levels.

- Gross margin per diems were down 2.3 percent compared to 2019, while net per diems (in constant currency) exceeded 2019 levels by over 10 percent and were three percentage points better than the midpoint of the September guidance range.

- Cruise costs per ALBD increased 12 percent as compared to the fourth quarter of 2019. Adjusted cruise costs excluding fuel per ALBD (in constant currency) increased 11 percent compared to the fourth quarter of 2019 and were in line with September guidance (see “Non-GAAP Financial Measures” below).

“We entered the year with the best booked position we have ever seen, and now have nearly two-thirds of our occupancy already on the books for 2024, at considerably higher prices (in constant currency). We continue to experience strong bookings momentum across the board, with our European brands showing remarkable strength during the quarter with booking volumes running up well into the double digits at considerably higher prices (in constant currency),” Weinstein noted.

Weinstein continued, “Our yield management strategy to base load bookings is clearly working as we pull forward booking volumes on strong pricing. We continue to build on that momentum with our ongoing advertising investments and lead generation efforts, increasing support from our trade partners, and the exceptional guest experiences our team members provide onboard every day, helping to deliver millions of cruising advocates.”

Booking volumes during the fourth quarter continued at significantly elevated levels, above both prior year and 2019 comparable periods, while recent booking volumes for the two weeks around Black Friday and Cyber Monday reached an all-time high for that period. Pricing on bookings during the fourth quarter was considerably higher than prior year pricing (in constant currency).

The cumulative advanced booked position is at considerably higher prices (in constant currency) than 2023 levels, with each quarter of 2024 booked above the high end of the historical range.

2024 Outlook

For the full year 2024, the company expects:

- Adjusted EBITDA of approximately $5.6 billion, over 30 percent growth compared to 2023

- Net yields (in constant currency) up approximately 8.5 percent compared to 2023, with full year occupancy returning to historical levels and nicely higher net per diems (in constant currency) reflecting continued strength in pricing and onboard spending

- Adjusted cruise costs excluding fuel per ALBD (in constant currency) up approximately 4.5 percent compared to 2023

For the first quarter of 2024, the company expects:

- Adjusted EBITDA of approximately $0.8 billion, more than double the first quarter of 2023

- Net yields (in constant currency) up approximately 16.5 percent compared to the first quarter of 2023 with occupancy returning to historical levels as the company closes the remaining occupancy gap in the first half of the year

- Adjusted cruise costs excluding fuel per ALBD (in constant currency) up approximately 9.5 percent compared to the first quarter of 2023 primarily due to higher occupancy levels, the timing of advertising investments and dry-dock related expenses compared to the prior year

Financing and Capital Activity

“During 2023, we made debt payments of $6 billion and ended the year with just over $30 billion of debt, which is $3 billion better than we forecasted just nine months ago during our March conference call and almost $5 billion off the first quarter peak,” noted Carnival Corporation & plc Chief Financial Officer David Bernstein.

“And looking forward, we will continue to evaluate refinancing opportunities and opportunistically prepay additional debt. Furthermore, we expect durable revenue growth to drive increases in adjusted free cash flow in 2024 and beyond, which will be the primary driver for paying down our debt balances on our path back to investment grade,” Bernstein added.

During 2023, the company generated cash from operations of $4.3 billion and adjusted free cash flow of $2.1 billion, making a significant contribution toward rebuilding the company’s financial strength.

During the fourth quarter of 2023, the company reduced its debt by another $725 million and for the full year made debt payments of $6 billion while ending the fourth quarter with $5.4 billion of liquidity, including cash and borrowings available under the revolving credit facility. In addition, the company amended an agreement with one of its credit card processors and now expects an additional $800 million to be returned during the first quarter of 2024, representing substantially all of the credit card reserves balance as of November 30, 2023.

Cruise Industry News Email Alerts

- Breaking News

Get the latest breaking cruise news . Sign up.

54 Ships | 122,002 Berths | $36 Billion | View

Highlights:

- Mkt. Overview

- Record Year

- Refit Schedule

- PDF Download

- Order Today

- 2033 Industry Outlook

- All Operators

- Easy to Use

- Pre-Order Offer

- Advertising

- Cruise News

- Magazine Articles

- Quarterly Magazine

- Annual Report

- Email Newsletter

- Executive Guide

- Digital Reports

Privacy Overview

The Disney Cruise Line Blog

An unofficial disney cruise line news, information, weather, and photo blog..

Disney Cruise Line Fiscal Year 2022 Annual Report & Financials – Directors’ Strategic Report

This week, Disney Cruise Line’s annual report for fiscal year 2022 was made public. Within the 51-page filing, the document contains a strategic report compiled by the directors which discusses the significant impact of the coronavirus pandemic on the cruise line during the industry shutdown. Additionally, there is some insight on new projects including the purchase of the partially completed, and yet to be renamed GLOBAL DREAM. The company shared the shipbuilding delays at Meyer Werft have been attributed in the report to both the COVID-19 pandemic and the war in Ukraine. The cruise line anticipates its financial performance will continue to improve and return to profitability in financial year 2023 as the industry recovers from a prolonged impact of COVID-19 and the business benefits from expanded capacity with the introduction of the Disney Wish which occurred in the second half of the fiscal year.

Before we get into the details, it is worth mentioning The Walt Disney Company released their FY22 earnings report back in November 2022 . Disney Cruise Line is part of the Disney Parks, Experiences and Products division, More often than not, there is very little mention of the cruise line during the quarterly earnings webcast and report. Due to the company’s size, Disney Cruise Line’s financials are bundled in the Disney Parks, Experiences and Products line item leaving little insight into the cruise line’s business. Since, Disney Cruise Line is actually Magical Cruise Company, Limited registered in London, it is required to submit an annual report to the United Kingdom.

Remember, the financial information in the annual report is for FY22 (year ending October 1, 2022), we will get to this eventually. The interesting information, prepared on behalf of the Board dated June 29, 2023 from the strategic report is transcribed below.

Magical Cruise Company, Limited Strategic report For the period from 3 October 2021 to 1 October 2022

The Directors present their strategic report of Magical Cruise Company, Limited (the ‘Company’) (trade name “Disney Cruise Line”) for the period from 3 October 2021 to 1 October 2022 (prior financial period from 4 October 2020 to 2 October 2021).

The financial statements on pages 24 to 27 were approved by the Board ofDirectors on 29 June 2023 and signed on its behalf by the Director stated below.

Principal activities and business review The principal activity of the Company is the operation of Disney themed luxury cruise vessels. It is considered that the Company’s activities will remain unchanged for the foreseeable future.

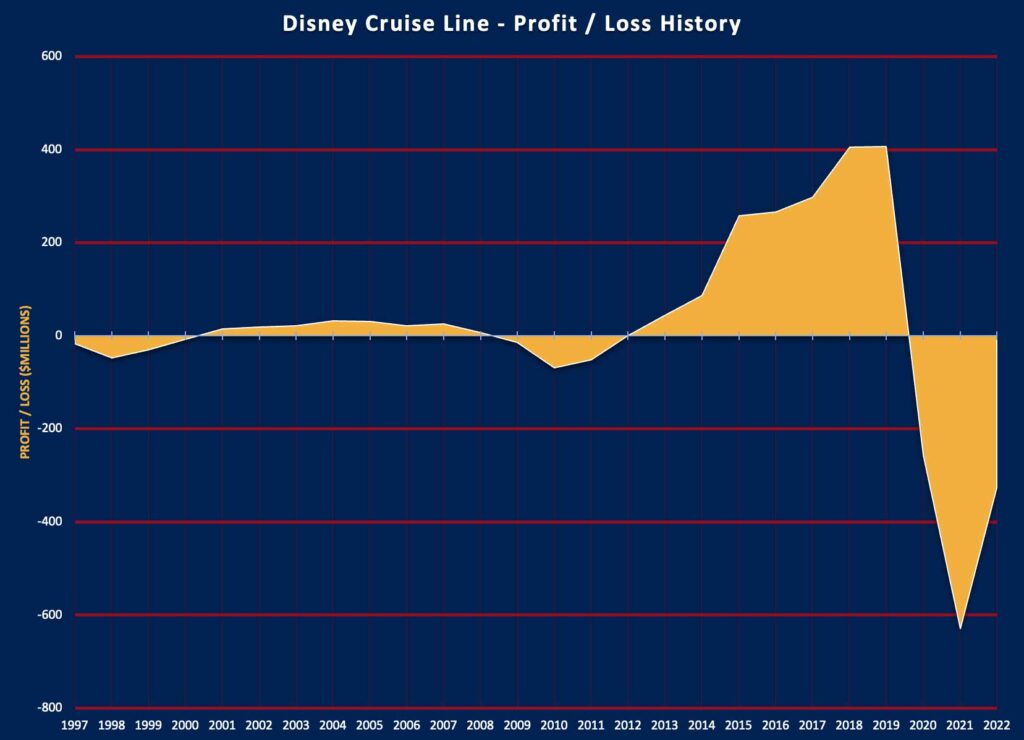

The Company’s loss for the financial year is $325,799,000 (2021: $629,475,000).

Revenue and operating losses have improved year over year due to resumed sailings, following a reduction in COVID-19 related restrictions and the addition of a new ship to the fleet, the Disney Wish, which was delivered in June 2022.

The Company experienced cancellations and booking postponements in the prior year due to COVID-19 which led to refunds, cruise credits of 125% of the reservation amount, as well as future booking payment deferrals. These future cruise credits expired 30 September 2022 (except for Disney Wish delays and Hurricane Ian related cancellations, which expire 31 December 2023 and 30 September 2024, respectively). The Company has also continued a short-term cruise date flexibility booking policy for reservations booked before 9 December 2022, allowing guests to change their sail date up to 15 days before departure where thereare qualifying COVID-19 related health concerns.

On March 17, 2016, The Walt Disney Company (TWDC), through-subsidiary, DCL Maritime LLC, entered a contract with the German Shipyard Meyer Werft GmbH &CO. KG (Meyer Werft) to build and deliver the Disney Wish (~144,000-ton ship). At the time of entering into the agreement, DCL Maritime LLC contemporaneously entered into an internal contract to sell the ship to the Company to coincide with the timing of completion of the ship by Meyer Werft. As a result of COVID-19 the Disney Wish was delayed and ultimately delivered 9 June 2022 .

As part of Disney Wish purchase, the Company issued 874,403,815 ordinary shares to Wedco Global Ventures LLP in exchange for cash in the amount of $1,100,000,000. Concurrently, the Company received an additional $500,000,000 promissory note from Disney Enterprises, Inc at an annual interest rate equal to the lesser of: (i) the maximum rate permitted by applicable law; and (ji) Libor Rate plus 50 basis points. Interest is payable semi-annually; and the maturity date is 15 June 2023 (1-year from the date of the agreement).

The Company also has committed to purchasing its sixth and seventh ships originally contracted to be delivered in calendar year 2022 and 2023. The impact of COVID-19 and the war in Ukraine has resulted in a delay to the delivery of these cruise ships. The Company now expects to the sixth and seventh ship to be delivered in 2024 and 2025, respectively. During September 2022, Disney announced the name of the 6th ship in their fleet as ‘Disney Treasure’ .

In November 2022, the Company purchased a partially completed ship , to expand its fleet and travel to new destinations from 2025 – the ship will be approximately 200,000 tons. Disney Cruise Line will incur the cost to complete construction. This ship is expected to be delivered in 2025.

The Directors are managing day to day working capital requirements closely with its related parent entity in order to meet the Company’s liabilities as they fall due. As the impacts of COVID-19 on the cruise industry have continued to subside in fiscal 2023, it is anticipated that the unfavorable impacts on future financial performance will be less significant.

Future developments The Company anticipates its financial performance will continue to improve and return to profitability in financial year 2023 as the industry recovers from a prolonged impact of COVID-19 and the business benefits from expanded capacity with the introduction of the Disney Wish, the Company’s fifth cruise ship. In fiscal 2023, the Company has seen a continued increase in occupancy and booking levels, with occupancy exceeding the comparable actual financial year 2022 quarterly levels on a year over year basis.

We continue to remain optimistic about the future as the Company continues to advance the development of its next two new cruise ships and the recently acquired partially completed ship. All are in active construction and expected to be delivered in 2024 and 2025 time frames. In addition, DCL Island Development Limited (the Company’s 100% owned subsidiary company) is advancing the development of its second private island, Lighthouse Point in Eleuthera, The Bahamas, which is planned to open in Summer 2024 . The Directors have reviewed a cash flow forecast extending to a period no less than 12 months from the date of the financial statements, including consideration of severe yet plausible financial downsides. Based onthis, whilst the Directors expect to be able to meet the day to day cashflow needs of the Company, they have received assurances of continued financial support from a fellow Group undertaking, in the form of a letter of support, to allow the Company to meet its liabilities as they fall due, as set out in Note 2, Going Concern.

Principal risks and uncertainties From the perspective of the Company, its principal risks and uncertainties and future outlook are integrated with those of The Walt Disney Company (‘Group’) and are not managed separately. Accordingly, the risks and uncertainties of the Group, which include those of the Company, are discussed in the Group’s annual report which does not form part of this report. However, the Directors view the following as being the principal risks facing the Company:

- Our sales may be adversely affected by changes in economic factors, political uncertainty and changes in consumer spending patterns Many economic and other factors outside our control, including consumer confidence, consumer spending levels, political uncertainty, employment levels, consumer debt levels, inflation and deflation, as well as the availability of consumer credit, affect consumer spending habits. A significant deterioration in the global financial markets and economic environment, recessions or an uncertain economic outlook adversely affects consumer spending habits and results ni lower levels of economic activity. In addition, an increase ni price levels generally, or in price levels in a particular sector such as the energy sector, could result in a shift in consumerdemand away from the entertainment and consumer products we offer, which could also adversely affect our revenues and, at the same time, increase our costs. Any of these events and factors could cause consumers to curtail spending and could have a negative impact on our financial performance and position in future financial years. The impact of pandemics on consumer confidence and ultimately occupancy levels could also affect our financial performance. However, regarding the recent Covid-19 related pandemic, sailings have fully resumed and we are seeing occupancy recover in 2022 and 2023 toward pre-pandemic levels.

- Our industry is highly competitive and competitive conditions may adversely affect our revenues and overall profitability The cruise industry is highly competitive and our results of operations are sensitive to, and may be adversely affected by, competitive pricing and other factors.

- A variety of uncontrollable events may reduce demand for our products and services, impair our ability to provide our products and services or increase the cost ofproviding our products and services Demand for and consumption of our products and services, is highly dependent on the general environment for travel and tourism. The environment for travel and tourism, as well as demand for and consumption of other entertainment products, can be significantly adversely affected in the U.S., globally or in specific regions as a result of a variety of factors beyond ourcontrol, including: adverse weather conditions arising from short-term weather patterns or long-term change, catastrophic events or natural disasters (such as excessive heat or rain, hurricanes, typhoons, floods, tsunamis and earthquakes); health concerns (including as it has been by COVID-19); international, political ormilitary developments; and terrorist attacks.These events and others, such as fluctuations in travel and energy costs and computer virus attacks, intrusions or other widespread computing or telecommunications failures, may also damage our ability to provide our products and services or to obtain insurance coverage with respect to some of these events. An incident that affected our property directly would have adirect impact on ourability to provide goods and services and could have an extended effect ofdiscouraging consumers from attending our facilities. Moreover, the costs of protecting against such incidents, including the costs of protecting against the spread of COVID- 19, reduces the profitability of our operations.

- Federal,State and foreign privacy and data protection laws and regulations.

- Regulation of the safety and supply chain of consumer products and Cruise Line operations.

- Domestic and international wage laws, tax laws or currency controls.

- Environmental protection regulations.

- Fuel prices Our objectives in managing exposure to commodity fluctuations are to use commodity derivatives to reduce volatility of earnings and cash flows arising from commodity price changes. The amounts hedged using commodity swap contracts are based on forecasted levels of consumption of certain commodities, such as fuel oil and gasoline. With respect to the risks the Directors regularly review such matters to mitigate their respective impact on the Company.

- Protection of electronically stored data and other cybersecurity is costly, and if our data or systems are materially compromised in spite of this protection, we may incur additional costs, lost opportunities, damage to our reputation, disruption of service or theft of our assets We maintain information necessary to conduct our business, including confidential and proprietary information as well as personal information regarding our customers and employees, ni digital form. We also use computer systems to deliver our products and services and operate our business. Data maintained in digital form is subject to the risk of unauthorized access, modification, exfiltration, destruction or denial of access and our computer systems are subiect to cyberattacks that may result in disruptions in service. If our information or cyber security systems or data are compromised in a material way, our ability to conduct our business may be impaired, we may lose profitable opportunities or the value of those opportunities may be diminished. If personal information of our customers or employees is misappropriated, our reputation with our customers and employees may be damaged resulting in loss of business or morale, and we may incur costs to remediate possible harm to our customers and employees or damages arising from litigation and/or to pay fines or take other action with respect to judicial or regulatory actions arising out of the incident.

- Damage to our reputation or brands may negatively impact ourCompany Our reputation and globally recognizable brands are integral to the success ofour business. Because our brands engage consumers across our businesses, damage to our reputation or brands in one business may have an impact on our other brands.

Key performance indicators (“KPIs”) The Company’s KPI’s are as follows:

As the cruise industry continues to recover from the COVID-19 pandemic, we have seen an increase in occupancy levels in FY22 to 55% as of June 2022 that continued to improve for the full fiscal year to 63%. We have seen a further increase in occupancy levels in FY23 to 96% as of March 2023.

Section 172(1)statement As asubsidiary within the group of companies of which TheWalt Disney Company is the ultimate parent company (the “Group”), the Company is subject to organisational and management systemswhich enable the Board of Directors (“the Board”) to oversee governanceofthe activities ofthe Company. As is normal for large companies, the Board delegates authority for day-to-day management of the Company to the managers responsible for management of the Company. The Board ensures that when applying group policies and delegating responsibility for operational matters to the managers, it does so with due regard to its fiduciary duties and responsibilities.

The Directors of the Company are aware of their duty under section 172 of the Companies Act 2006 to act in a way that they consider, in good faith, would be most likely to promote the success of the Company for the benefit of its members as a whole. In doing so they have considered (amongst other matters) factors (a) to (f) listed below:

(a) the likely consequences ofany decision in the long term; (b) the interests of the Company’s employees (also known as”Cast Members”); (c) the need to foster the Company’s business relationships with suppliers, customers known as”Guests”) and others; (d) the impact ofthe Company’s operations on the community and the environment; (e) the desirability of the Company maintaining a reputation for high standards of business conduct; and (f) the need to act fairly between members of the Company.

In performing their duties under section 172, the Directors ofthe Company have had regard to the matters set out in section 172(1) as follows:

a). The likely consequences of any decision in the long term We are aware that our decisions and strategies can have long-term effects on our business and its stakeholders. Therefore we aim to make well informed, fair and balanced decisions. Our key stakeholders. include Crew Members, Cast Members, Guests, home ports and ports of call, regulators and suppliers who are at the forefront of our minds when making decisions. We set out below some of the decisions the Board has taken during the course ofthe year with a view to creating long term success for the Company and its stakeholders as a whole.

After voluntarily suspending all voyages in 2020 in response to the global pandemic, Disney Cruise Line worked with governmental authorities and industry partners to resume passenger operations in a phased manner starting in July 2021. Disney Cruise Line’s fleet continued to operate with health and safety protocols throughout fiscal 2022 including requiring Guests and Crew Members to be fully vaccinated and tested for COVID-19 before boarding. Health and safety is a top priority for Disney Cruise Line and we continue to operate in a responsible manner and effectively manage any cases of COVID-19 aboard our ships. On the publishing date of this document, numerous healthand safety requirements including Guest vaccination and testingare no longer required by health authorities or Disney Cruise Line. Vaccination continues to be required for all Crew Members.

In December 2021, the Broward County Commission approved an amendment to the October 2021 agreement with Disney Cruise Line naming Port Everglades in Fort Lauderdale, Florida, USA, as our second year-round homeport . The 15-year partnership commits to a minimum of 10.6 million passenger movements, and three 5-year extension options that could add another 11.25 million passenger movements. The agreement provides for one ship to be homeported in Port Everglades year-round beginning fall 2023, joined by a second, seasonal ship in March 2025.

In the summer of 2022, Disney Cruise Line took delivery of its fifth ship, the Disney Wish – the first of three new Wish-class vessels announced previously.The Wish made her transatlantic voyage from the Meyer Weft shipyard in Germany to her homeport in Port Canaveral, Florida, USA , followed by its maiden voyage on July 14, 2022 . The Wish offers three- and four-night cruises to Nassau, Bahamas, and Disney’s Castaway Cay, a Disney destination located in the Abaco chain of The Bahamas. With the theme of enchantment, it showcases the immersive family entertainment, distinctly Disney storytelling, and unparalleled service that only Disney can deliver.

Disney Cruise Line also announced first details on the fleet’s sixth ship, the Disney Treasure . Inspired by Walt Disney’s love of exploration, it will be designed with the theme of adventure and is scheduled for delivery in 2024; with the third Wish-class ship expected to be delivered in 2025. All three Wish-class ships in the current fleet are powered by liquified natural gas (LNG), one of the cleanest-burning fuels available. At approximately 144,000 gross tons and 1,250 Guest staterooms, they are slightly larger than other ships in the fleet, namely the Disney Dream and Disney Fantasy.

Plans continued in fiscal 2022 for Disney Cruise Line’s second island destination, Lighthouse Point, in Eleuthera, The Bahamas . Disney is working closely with Bahamian artists and advisors to create a destination that represents the natural beauty and rich culture of the Bahamas, brought to life through Disney storytelling and the unparalleled service of local Cast and Crew. Disney has committed to develop less than 20 percent of the property, supply 90 percent of the site’s power from solar energy, employ sustainable building practices, and donate more than 190 acres of privately owned land to the government.

The Bahamas Department of Environmental Planning and Protection issued a Certificate of Environmental Clearance for the project in November 2021, and construction commenced in Spring of 2022. In May, the Bahamas National Economic Council, made up of Members of the Bahamian Cabinet, approved the seabed lease for the project. It was the last significant approval for the project and allowed construction to begin on the marine facilities. Disney’s Lighthouse Point is expected to open in Summer 2024 .

The destination will create sustainable economic opportunities for Bahamians, protect and sustain the natural beautyof the site, celebrate culture, and help strengthen the community in Eleuthera. It will complement Castaway Cay, giving families the opportunity to enjoy the site’s beautiful beaches and explore nature, as well as enjoy the broader tourism offerings in Eleuthera.

In September 2022, Disney Cruise Line announced it’s bringing the magic of a Disney vacation to Guests in Australia and New Zealand during brand-new “Disney Magic at Sea” cruises beginning late October 2023. The limited-time voyages are specially created to immerse local Guests in their favorite Disney, Pixar, Marvel and Star Wars stories through enchanting entertainment and enhanced experiences throughout each cruise. During the repositioning voyages between Honolulu and Sydney, the Disney Wonder will offer the fleet’s first-ever South Pacific itineraries, offering Guests the chance to experience exotic destinations like Fiji and Samoa .

b). The interests of the Company’s employees Since its launch in 1998, Disney Cruise Line is a well-established name in the cruise industry, providing a setting where families can reconnect, adults can recharge and children can experience all Disney has to offer. We strive to provide exceptional service that reflects our iconic brand, enabled by the passion and hard work of our Cast and Crew. We understand the importance ofour employees to our long-term success and are committed toproviding asafe working environment, adiverse and inclusiveculture andappropriate training and development.

Disney Cruise Line also complies with, and in some cases exceeds, the requirements set forth in the International Labour Organization’s (ILO’s) Maritime Labour Convention (MIC) which governs almost all aspects of working aboard a ship. Crew Members are organized through a collective bargaining unit (union) through the Federazione Italiana Transporti (FIT). The current union agreement went into effect on 1 January, 2020 and is binding for four years. It stipulates compensation, benefits, working hours, and contract lengths for the range of work positions on-board.

Disney Cruise Line Cast and Crew Members receive a wide range of employment benefits. While on contract in service of the ship, Crew Members receive medical care by the on-board medical team. Officers are offered full health benefits year-round when signed to a contract. Crew Members have access to mental health resources through an Employer Assistance Program offered ni multiple languages, as wel as access to online resources and wellness content offered on-demand via Crew stateroom TVs.

Disney has an ongoing commitment to diversity, equity and inclusion (DE&I) through a company-wide initiative composed of six pillars focused on People, Culture, Content, Community, Transparency, and Accountability.

c). The need to foster the Company’s business relationships with suppliers, customers and others We pride ourselves on delivering exceptional service and world-class family holidays. We have strong relationships with our suppliers and work closely with them to provide our Guests with high quality experiences and products.

Guests Creating unforgettable holiday experiences for our Guests is the primary motivation of our dedicated Disney Cruise Line Cast and Crew Members. Disney Cruise Line is considered a leader in the cruise industry by travel professionals, hospitality industry groups, and most importantly – by our Guests. Families sailing with Disney Cruise Line expect a unique holiday experience that only Disney can deliver. At the heart of all we do is the Guest experience and satisfaction with the Disney Cruise Line product. Multiple touch points provide us with the opportunity to hear directly from our Guests about what we’re doing right and areas for improvement. Our Call Center and Guest Communications team resolves issues brought to our attention in a timely manner, corresponding directly with any Guest who reaches out to us for assistance before, during and after their cruise. Our team is specifically trained to assist our Guests with their holiday needs and consistently receives some of the highest Guest Service satisfaction ratings within our Company.

Suppliers Disney Cruise Line has high standards for suppliers and has a thorough process for sourcing products and services of the best quality and value. Suppliers are held toTWDC’s International Labour Standards and Code of Conduct for Suppliers. Our supply chains follow Disney policies andcomply with UK government regulations. Food and beverage suppliers must follow a uniform set of TWDC guidelines that meet both Company and local standards, including conducting periodic sanitation and safety audits and maintaining liability insurance.

Disney Cruise Line also partners with travel agents for a significant source ofcruise bookings. Travel agents must be a registered Member supplier in good standing with the Cruise Line Industry Association or the International Air Transport Association (IATA), and supply proof of all qualifying tax and other documentation required to d o business as a travel agent/agency in its domestic and international markets. Travel agents and agencies must operate ethically, representing the Disney Cruise Line brand in good faith and providing accurate marketing and information about Disney Cruise Line’s products.

Disney Cruise Line is committed to conducting business and providing products and services in an ethical manner. We also believe that including diverse suppliers in our sourcing process provides us the greatest opportunity to develop the most innovative, highestquality, andmost cost-effective business solutions. We know this strengthens our Company as well as supporting our communities.

Port Communities Disney Cruise Line is very mindful of our impact on local communities. We engage in an ongoing basis with all our relevant stakeholders whether port authorities, ministers of tourism, shore excursion operators, and other in-destination partners to best understand how we can best collaborate with them to maximize the positive impacts of our business on their communities. Today, more than 70 percent of the cruises offered by Disney Cruise Line have at least one stop in The Bahamas. Disney Cruise Line has made significant economic contributions to The Bahamas while demonstrating a strong commitment to the environment and the community. It is estimated that Disney Cruise Line operations contribute more than $70 million toward the Bahamas gross domestic product annually.

Disney Cruise Line takes careful steps to ensure it respects the communities, environment and culture of each of its destinations through collaboration with stakeholders and relevant partners in ports of call. This includes understanding how to introduce our brand most appropriately to those communities, as well as introduce the unique character and culture of each destination to Disney Cruise Line Guests. We source products in our ports of call when it meets our quality standards, and we work with a variety oftour providers in each destination to diversify our products.

d). The impact of the Company’s operations on the community and the environment

Community Since The Walt Disney Company’s founding nearly 100 years ago, operating responsibly has been an integral part o f our DNA. Our corporate social responsibility (CS) efforts address the expectations of our people, consumers, communities, and investors, and help us to attract, retain, and develop talented and diverse creators and Cast Members, all of whom contribute to our business success. We take a strategic approach to setting our CSR priorities, addressing issues that are important to our businesses and to the communities where we operate. We regularly monitor issues and evolve our efforts to ensure we remain focused on the economic, environmental, and societal matters that impact those we serve.

Disney strives to inspire a world of belonging by embracing broad representation and respect for every individual in our workplace, storytelling, and communities; a world in balance by taking action to create ac leaner, safer, and healthier world; and a world of hope by supporting our communities, especially children. We are also investing in our people and operating responsibly.

Disney Cruise Line strives to make a positive impact in the many places around the world it calls home. The Disney Cruise Line Cast and Crew Members support many charitable organizations that nurture the lives of children and enrich the environment. Crew Members lead reading education programs in schools, give to local youth organizations and bring Disney characters to entertain children in port communities around the globe. Disney VoluntEARS also donate their time to plant micro-gardens at underserved schools, lead career exploration conversations for students interested in maritime careers, raise funds for worldwide disaster relief efforts, and host quarterly shore clean-ups to remove litter and debris from fragile coastlines. Each year, Cast and Crew Members donate thousands of hours of their personal time to benefit worthwhile causes in port communities around the world.

For more than 25 years, Disney Cruise Line has made significant contributions to support communities in The Bahamas. Recent key initiatives focus on supporting entrepreneurs and small businesses, workforce development starting at a young age, conservation and timely community needs. Disney Cruise Line is a founding sponsor of the Eleuthera Business Hub , in partnership with the Eleuthera Chamber of Commerce and the Small Business Development Center and is providing financial support to small and medium-sized businesses.

During the Disney Wish unveiling event in April 2021 , The Walt Disney Company announced a $1 million donation to Make-A-Wish®. The funding will help deliver magic to even more Make-A-Wish® kids from all backgrounds,supporting Disney’s ongoing commitment to diversity and inclusion. As part of this, Disney Cruise Line announced that all Make-A-Wish® children, including past, present and future wish recipients, are honored as godchildren of the Disney Wish . Redefining the longstanding maritime tradition of appointing a ship “godmother,” this was the first time in Disney Cruise Line history that children are being recognized in this prestigious role which symbolically bestows good fortune on the vessel and its travelers. Disney Cruise Line continues to support the transformative work that wish-granting organizations do every day through newly announced initiatives which include an exclusive merchandise collection and the donation of a stateroom aboard a sailing of the Disney Wish.

In celebration of the Disney Wish’s inaugural sailings, in July 2022 Disney Cruise Line launched its “Wishes Set Sail” program , an all-new initiative developed to support various youth activities in key port communities. In total, Disney Cruise Line distributed $400,000 to local youth organizations throughout the Disney Wish’s inaugural season as part ofthis campaign. This includes partnerships with Junior Achievement Bahamas, Ranfurly Home for Children Bahamas, LJM Maritime Academy in Nassau, and the Boys& Girls Clubs of Central Florida Brevard County Branches. The “Wishes Set Sail” campaign also supported back-to-school efforts in the Bahamas. More than 1,300 students in Abaco and Eleuthera received backpacks containing school supplies, courtesy of Disney Cruise Line. Crew Members based both in Florida and The Bahamas volunteered their time over several days filling the bags with pencils, notebooks, and other supplies.

Disney is committed to supporting education in The Bahamas and continues to work with the Ministry of Education to inspire and educate the next generation of professionals. In 2019, Disney Cruise Line introduced a scholarship program in partnership with the LJM Maritime Academy for female cadets aspiring to become ship captains and shipboard leaders.

Environmental The Walt Disney Company is committed to taking meaningful and measurable action to support a healthier planet for future generations as we operate and grow our business. Our commitment to environmental stewardship goes back to our founding nearly 100 years ago. Walt Disney himself said that “conservation isn’t just the business of a few people. It’s a matter that concerns all of us.”

The environmental commitments detailed below represent some of the ways we are focused on helping to build on that legacy, for every community and across the globe, generation after generation. Our environmental policies are based on a set of guiding principles intended to drive both our long-term environmental strategy and the everyday decision-makingo four leadership and Cast Members around the world.

The Walt Disney Company has made a 2030 net zero pledge and aims to establish and sustain a positive environmental legacy for Disney and for future generations. The Company has ambitious environmental goals for 2030 focused on key areas of ourbusiness where we believe we can have a significant, lasting impact and make a positive difference in protecting our planet.Goals include:

- Have a positive impact on the communities where w eoperate our businesses

- Create unique content and experiences that inspire connection with our planet and all who call it home;

- Reduce the environmental impacts of our operations, products, services, suppliers, licensees and value chains;

- Promote a culture of consideration, appreciation and respect for the environment among our leaders, CastMembers and Guests;

- Work with industry partners, non-governmental organizations, academia and others to create a cleaner, safer, healthier world for future generations.

At Disney Cruise Line, we are dedicated to minimizing our impact on the environment through efforts focused on utilizing new technologies, increasing fuel efficiency, minimizing waste and promoting conservation worldwide. We strive to instill positive environmental stewardship in our Cast and Crew Members and seek to inspire others through programs that engage our Guests and the communities in our ports of call. Disney Cruise Line is consistently recognized as an industry leader and regularly wins awards such as the Blue Circle Award from Port of Vancouver for voluntary efforts to conserve energy and reduce emissions.

As of 1 January 2020, the International Maritime Organization instituted a regulation that requires all ships to use 0.5% sulfur fuel compared to 3.5% previously. Disney Cruise Line has taken this a step further by using 0.1% low sulfur fuel fleet wide at all times. As previously mentioned, our Wish class of cruise ships will be powered by liquefied natural gas, or LNG, one of the cleanest-burning fuels available. Currently, four Disney Cruise Line ships have the equipment necessary to plug into shore power if the option is available at the port. Disney Cruise Line coordinates itineraries to be sure shore power-capable ships sail to ports of call that offer this technology.

As part of The Walt Disney Company’s overall efforts to reduce the amount of single-use plastics, Disney Cruise Line has taken great measures to eliminate single-use plastics on-board and on Disney Castaway Cay, Disney’s private island destination in The Bahamas. This effort has resulted in removing an annual volume of more than 14.7 million plastic straws and 2.2 million plastic amenity containers. Disney Cruise Line has also gone from annually distributing nearly 1million plastic merchandise bags fleetwide annually to nearly zero. Other measures include the removal of plastic cutlery, stirrers and condiment packets. Disney Cruise Line is committed to diverting waste from traditional waste streams. Shipboard recycling processes have helped to eliminate on average more than 2,500 tons of metals, glass, plastic and paper from traditional waste streams each year. Disney Cruise Line has invested in technology to ensure water purity and taken steps to select earth-friendly cleaners. All Disney Cruise Line ships feature Advanced Wastewater Purification Systems (AWPS that utilize natural processes to treat and purify on-board wastewater to levels far exceeding international shipping standards, and in some cases shore side potable water standards.

The Disney Conservation Fund (“DCF”) was created more than 25 years ago to build on Walt Disney’s legacy of saving wildlife, inspiring action, and helping to protect the planet. Disney Conservation is focused on saving wildlife forfuture generations through grants to leading conservation organizations working together tostabilize and increase the populations of at-risk animals including coral reefs, sea turtles, butterflies, cranes, elephants, gorillas and monkeys. In fiscal 2022, the DCF continued to provide financial support through grants helping more than 60 nonprofit organizations working across 32 countries. A Disney conservationist works with each organization to identify where Disney expertise can also play a role in reversing the decline of these animals and their habitats.

In collaboration with Disney Cruise Line and The Disney Conservation Fund, a team of Disney researchers has worked since 2007 to rehabilitate coral reefs in The Bahamas. They’ve planted more than 1,800 corals to rehabilitate five coral reefs, providing important habitat for the marine species, including endangered Nassau grouper and lobster, who call coral reefs home. To protect these reefs from excess algae growth, the team also relocates native long-spined sea urchins to the reefs to graze on algae, restoring balance to the ecosystem and allowing new corals to grow. This knowledge helped establish the Florida Coral Rescue Center in Orlando, the largest facility of its kind in the U.S. to care for and safeguard some of the most vulnerable species of Florida coral. The Disney Conservation Fund is also supporting the Perry Institute for Marine Science to address coral conservation and restoration acrossThe Bahamas alongside more than 30 partner organizations. Disney Cruise Line also supports summer eco camps and community engagement efforts in Abaco, and helps provide conservation curriculum support for Bahamian school children.

More details on Disney Cruise Line’s dedication to minimizing its impact on the environment is available at: https://dclnews.com/fact-sheets/2022/07/01/disney-wish-environmental-fact-sheet/

More details on TWDC’s environmental goals can be found at: https://thewaltdisneycompany.com/environmental-sustainability

e). The desirability of the Company maintaining a reputation for high standards of business conduct

We are committed to operating our businesses with integrity and adopting governance policies that promote the thoughtful and independent representation of our stakeholders’ interests. The Board of Directors has adopted Corporate Governance Guidelines which address, among other things, the composition and functions of the Board of Directors. Our Board of Directors is also expected to uphold our Code of Business Conduct. Similarly, the Group Company’s Standards of Business Conduct are applicable to all Cast Members of the Company including Board Members.

We regularly engage our leaders and Cast Members on these Standards through training and other forms of communication. It is compulsory that all office based Cast Members complete the mandatory online courses, examples include: Standards of Business Conduct, Bribery and Avoiding Corrupt Business Practices.

Acting responsibly and conducting our business ethically is an integral part of our brand.

f. The need to act fairly as between members of the Company

We are a wholly owned subsidiary of Wedco Global Ventures LLP, whose ultimate parent Company is The Walt Disney Company (TWDC). Magical Cruise Company is consolidated within TWDC results as part of the Disney Parks, Experiences, and Products Segment. Our parent company as well as TWDC are aware of key decisions and financial performance of the Company and take a keen interest in the strategies and future outlook of the Company.

The Strategic report is authorised by the Board of Directors and signed on its behalf on 29 June 2023 by:

TL Wilson Director

For FY22, Disney Cruise Line reported a loss of $325,799,000 primarliy attributed to the impact of the COVID-19 pandemic which shutdown cruise operations. As the cruise industry continues to recover from the COVID-19 pandemic, Disney Cruise Line reports an increase in occupancy levels in FY22 to 55% as of June 2022 that continued to improve for the full fiscal year to 63%. Disney Cruise Line has seen a further increase in occupancy levels in FY23 to 96% as of March 2023.

Furthermore, the Company’s principal activity is the operation of luxury cruise vessels. It is considered that the Company’s activities will remain unchanged for the foreseeable future.

Historical Magic Cruise Company, Limited Annual Report and Financial Statements

- FY-2019 – Overview

- FY-2020 – Overview

- FY-2021 – Overview

- FY-2022 – Overview

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Tumblr (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

2 Replies to “Disney Cruise Line Fiscal Year 2022 Annual Report & Financials – Directors’ Strategic Report”

Would love to know how much DCL pays to Disney Productions for use of all the copywrited material used on board. Its has to be a big #. Has a lot to do with the high cost of the cruises.

Find this line interesting “We continue to remain optimistic about the future as the Company continues to advance the development of its next two new cruise ships and the recently acquired partially completed ship. All are in active construction and expected to be delivered in 2024 and 2025 time frames” sounds like some of the 7th Triton class is also under construction.

Leave a Reply Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed .

- Norwegian Cruise Line-stock

- News for Norwegian Cruise Line

Norwegian Cruise Line Holdings Reports Strong First Quarter 2024 Financial Results

Revenue up 20% year-over-year on strong demand

Company beat Q1 guidance across key metrics and raises full year guidance based on strong revenue

MIAMI, May 01, 2024 (GLOBE NEWSWIRE) -- Norwegian Cruise Line Holdings Ltd. (NYSE: NCLH) (together with NCL Corporation Ltd., (“NCLC”), “Norwegian Cruise Line Holdings”, “Norwegian”, “NCLH” or the “Company”) today reported financial results for the first quarter ended March 31, 2024 and provided guidance for the second quarter and full year 2024.

First Quarter 2024 Highlights:

- Generated total revenue of $2.2 billion, a 20% increase compared to the same period in 2023 on 8% capacity growth, with GAAP net income of $17.4 million, or EPS of $0.04.

- Adjusted EBITDA nearly doubled over the prior year to $464.0 million, above guidance of $450 million. Achieved Adjusted EPS of $0.16, exceeding guidance of $0.12, compared to a loss of $(0.30) in the first quarter of 2023. Quarter performance was driven by strong revenue growth and continued focus on cost reductions and efficiencies. 1

- The Company’s ongoing margin enhancement initiative drove continued improvement in operating costs. Gross Cruise Costs per Capacity Day was approximately $300 for the quarter. Adjusted Net Cruise Costs excluding Fuel per Capacity Day was approximately $165, or $164 in Constant Currency, in line with guidance, and flat year-over-year when the $5 Dry-dock impact is excluded.

- Occupancy was 104.6% for the quarter, in line with guidance, and total revenue per Passenger Cruise Day increased approximately 8%, compared to Q1 2023.

- Gross margin per Capacity Day was up 53% versus 2023 on an as reported and Constant Currency basis. Net Yield growth beat guidance increasing approximately 16.4%, or 16.2% versus 2023 on a Constant Currency basis.

- Total debt was $13.7 billion. Net Leverage declined a full turn from December 31, 2023, ending the quarter at 6.3x.

Recent Highlights

- Announced the most transformative newbuild program in the Company’s history—a total of eight state-of-the-art vessels, representing nearly 25,000 additional berths, with new classes of ships for each of its three award-winning brands—and the construction of a multi-ship pier at Great Stirrup Cay, the Company’s private island destination in the Bahamas.

- S&P Global Ratings (S&P) upgraded both NCLC’s issuer credit rating and issue-level ratings. NCLC’s issuer credit rating has been upgraded to B+, marking a notable improvement in the Company’s creditworthiness. In addition, S&P raised the issue-level ratings on NCLC’s existing secured and unsecured debt. The Company’s senior secured debt ratings were raised to BB/BB- and its unsecured debt rating was upgraded two notches to B.

___________________________

2024 Outlook

- Record bookings during the first quarter, drove a record booked position for the next twelve months.

- 2024 full year Net Yield guidance on a Constant Currency basis increased 100 basis points from the prior guidance to approximately 6.4% from 5.4%.

- 2024 full year Adjusted EBITDA guidance increased $50 million from the prior guidance to approximately $2.25 billion from $2.20 billion.

- Full year Adjusted Net Income guidance increased $45 million from prior guidance to $680 million from $635 million, and Adjusted EPS guidance increased $0.09 from prior guidance to $1.32 from $1.23.

“We kicked off 2024 with impressive momentum, with record bookings in the first quarter propelling us to continue our all-time high booked position and an unprecedented level of advance ticket sales. These achievements demonstrate the continued growing demand we are experiencing for our product and offerings,” remarked Harry Sommer, president and chief executive officer of Norwegian Cruise Line Holdings Ltd.

“Recently, we announced the most comprehensive newbuild program in our Company’s history- eight state-of-the-art vessels, each a new class for our three award-winning brands as well as the construction of a new pier at Great Stirrup Cay. Later this month at our Investor Day, we will be unveiling our comprehensive multi-year strategic, operational and financial updates, which will underscore our focus on delivering experiences that our guests truly value. By enhancing our capacity and elevating our product to create the best, largest, and most efficient vessels in our fleet, we are honoring our 57-year history of innovation that has always driven our growth and continues to be at the forefront of what we do,” continued Sommer.

Business, Operations and Booking Environment Update

The Company continues to experience healthy consumer demand and thanks to a strong WAVE season, had record bookings during the first quarter leading to a continued record booked position for the next twelve months. Additionally, onboard revenue per Capacity Day remains robust, up 11% in the quarter compared to 2023, with broad-based strength across all revenue streams. The Company’s advance ticket sales balance, including the long-term portion, ended the first quarter of 2024 at an all-time record high of $3.8 billion, approximately 13% higher than the same period of 2023.

Occupancy was 104.6% for the first quarter of 2024, in line with guidance. Full year 2024 Occupancy is expected to average 105.1%, consistent with prior guidance. In addition, pricing growth in the first quarter was also strong with total revenue per Passenger Cruise Day up approximately 8%, with capacity growth of 8% compared to 2023. Gross margin per Capacity Day was approximately $102 in the quarter, up 53% versus 2023 on an as reported and Constant Currency basis. Net Yield growth was up approximately 16.4%, or 16.2% versus 2023 on a Constant Currency basis, above guidance.

The Company demonstrated continued progress on its ongoing margin enhancement initiative and efforts to maximize revenue opportunities and rightsize its cost base. Gross Cruise Costs per Capacity Day was approximately $300 in the first quarter, compared to $298 last year. Adjusted Net Cruise Costs excluding Fuel per Capacity Day in the first quarter of 2024 was approximately $165, or $164 in Constant Currency, which included a $5 impact from increased Dry-dock days and related costs, in line with guidance and essentially flat year-over-year without the impact of these Dry-docks.

For the full year 2024, the Company increased its Net Yield guidance by 100 basis points from prior guidance to growth of approximately 6.4% from approximately 5.4% on a Constant Currency basis compared to 2023. The increase in guidance is driven by exceptional demand across all three brands which almost fully offsets the impact from the redeployed voyages related to the Middle East and Red Sea. Full year Adjusted Net Cruise Cost Excluding Fuel per Capacity Day guidance remained unchanged and is expected to be approximately $159, increasing approximately 3.4% in Constant Currency, which includes an approximate 300 basis point impact from Dry-dock days and related costs in the year. Excluding this impact, Adjusted Net Cruise Cost Excluding Fuel per Capacity Day would be essentially flat year-over-year. As a result, full year 2024 Adjusted EBITDA guidance increased by $50 million to $2.25 billion from $2.20 billion and Adjusted EPS guidance was increased by $0.09 to approximately $1.32 from approximately $1.23.

Liquidity and Financial Position

The Company is committed to prioritizing efforts to optimize its balance sheet and reduce leverage. As of March 31, 2024, the Company had total debt of $13.7 billion and Net Debt of $13.2 billion and improved its Net Leverage by a full turn compared to December 31, 2023, ending the first quarter of 2024 with Net Leverage of 6.3x.

At quarter-end, liquidity was $2.4 billion. This consists of approximately $559.8 million of cash and cash equivalents, $1.2 billion of availability under our undrawn Revolving Loan Facility and a $650 million undrawn backstop commitment. In March 2024 we successfully refinanced our $650 million backstop commitment, replacing the secured commitment with an unsecured commitment. Additionally, as part of this refinancing, we repaid our $250 million 9.75% senior secured notes due 2028, our highest interest rate debt.

“We are pleased to report that we exceeded our guidance metrics for the first quarter of 2024. Thanks to robust consumer demand and continued success on our operational efficiency efforts, we are raising our 2024 full-year guidance for key metrics including Net Yield, Adjusted EBITDA and Adjusted EPS,” said Mark A. Kempa, executive vice president and chief financial officer of Norwegian Cruise Line Holdings Ltd.

Kempa continued, “the momentum we are experiencing allows us to make significant progress on our deleveraging efforts. During the first quarter of 2024 we reduced Net Leverage by a full turn from the end of 2023, ending the quarter at 6.3x. We plan to continue this trend and expect to reduce Net Leverage 1.5 turns during the year compared to 2023 year-end, marking an important milestone in improving our balance sheet.”

First Quarter 2024 Results

GAAP net income was $17.4 million or EPS of $0.04 compared to net loss of $(159.3) million or EPS of $(0.38) in the prior year. The Company reported Adjusted Net Income of $69.5 million or Adjusted EPS of $0.16 in the first quarter of 2024. This compares to Adjusted Net Loss and Adjusted EPS of $(127.7) million and $(0.30), respectively, in the first quarter of 2023. Adjusted EBITDA in the first quarter was approximately $464.0 million, better than guidance of $450 million, and almost doubled compared to 2023, driven primarily by solid revenue performance and Adjusted Net Cruise Cost Excluding Fuel that was essentially flat year-on-year excluding the impact of Dry-docks.

Gross Cruise Costs per Capacity Day was approximately $300 in the quarter. Adjusted Net Cruise Costs excluding Fuel per Capacity Day was approximately $165, or $164 in Constant Currency, which includes $5 related to Dry-dock days, and would have been essentially flat year-over-year without these Dry-dock impacts, reflecting the benefits from the Company’s ongoing margin enhancement initiative.

The Company reported fuel expense of $198 million in the quarter. Fuel price per metric ton, net of hedges, decreased to $735 from $779 in 2023. Fuel consumption of 269,000 metric tons was slightly better than projections.

Interest expense, net was $218.2 million in 2024 compared to $171.3 million in 2023. The increase in interest expense reflects higher losses in 2024 from extinguishment of debt and debt modification costs, which were $29.0 million in 2024 compared to $2.4 million in 2023. Excluding these losses, the increase in interest expense was primarily a result of higher debt outstanding and higher rates.

Other income (expense), net was an income of $18.1 million in 2024 compared to an expense of $(9.0) million in 2023.

Outlook and Guidance

In addition to announcing the results for the first quarter 2024, the Company also provided guidance for the second quarter and full year 2024, along with accompanying sensitivities. The Company does not provide certain estimated future results on a GAAP basis because the Company is unable to predict, with reasonable certainty, the future movement of foreign exchange rates or the future impact of certain gains and charges. These items are uncertain and will depend on several factors, including industry conditions, and could be material to the Company’s results computed in accordance with GAAP. The Company has not provided reconciliations between the Company’s 2024 guidance and the most directly comparable GAAP measures because it would be too difficult to prepare a reliable U.S. GAAP quantitative reconciliation without unreasonable effort.

The following reflects the foreign currency exchange rates the Company used in its second quarter and full year 2024 guidance.

The following reflects the Company’s expectations regarding fuel consumption and pricing, along with accompanying sensitivities.

As of March 31, 2024, the Company had hedged approximately 55% and 22% of its total projected metric tons of fuel consumption for the remainder of 2024 and 2025, respectively. The following table provides amounts hedged and price per metric ton of heavy fuel oil (“HFO”) and marine gas oil (“MGO”).

Capital Expenditures

Non-newbuild capital expenditures for the first quarter of 2024 were $127 million. Anticipated non-newbuild capital expenditures for full year 2024 are expected to be approximately $575 million including approximately $140 million in the second quarter.

Newbuild-related capital expenditures, net of export credit financing, are expected to be approximately $0.3 billion, $0.6 billion and $0.9 billion for the full years ending December 31, 2024, 2025 and 2026, respectively. Net newbuild-related capital expenditures for the first quarter of 2024 were approximately $60 million and are expected to be approximately $65 million for the second quarter of 2024.

Company Updates and Other Business Highlights:

Fleet and Brand Updates

- Oceania Cruises announced its 2026 Around the World voyage aboard Vista. Learn more here .

- Regent Seven Seas Cruises® announced its 2027 World Cruise will be hosted on board Seven Seas Splendor® for the first time. Learn more here .

- Oceania Cruises announced that celebrated Italian-American chef, author, restaurateur and Emmy award-winning food personality Giada De Laurentiis will be its new Brand and Culinary Ambassador. Learn more here .

- Norwegian Cruise Line unveiled all-new culinary experiences to debut aboard Norwegian Aqua, bringing three brand-new offerings: Sukhothai, NCL’s first-ever Thai restaurant, the new upscale Swirl Wine Bar, and Planterie, the brand’s first dedicated eatery offering a full plant-based menu. Learn more here .

Conference Call

The Company has scheduled a conference call for Wednesday, May 1, 2024 at 10:00 a.m. Eastern Time to discuss first quarter results and provide a business update. A link to the live webcast along with a slide presentation can be found on the Company’s Investor Relations website at https://www.nclhltd.com/investors. A replay of the conference call will also be available on the website for 30 days after the call.

About Norwegian Cruise Line Holdings Ltd.

Norwegian Cruise Line Holdings Ltd. (NYSE: NCLH) is a leading global cruise company which operates Norwegian Cruise Line, Oceania Cruises and Regent Seven Seas Cruises. With a combined fleet of 32 ships and approximately 66,500 berths, NCLH offers itineraries to approximately 700 destinations worldwide. NCLH expects to add 13 additional ships across its three brands through 2036, which will add approximately 41,000 berths to its fleet. To learn more, visit www.nclhltd.com.

Terminology

Adjusted EBITDA . EBITDA adjusted for other income (expense), net and other supplemental adjustments.

Adjusted EPS. Adjusted Net Income (Loss) divided by the number of diluted weighted-average shares outstanding.

Adjusted Gross Margin. Gross margin adjusted for payroll and related, fuel, food, other and ship depreciation. Gross margin is calculated pursuant to GAAP as total revenue less total cruise operating expense and ship depreciation.

Adjusted Net Cruise Cost Excluding Fuel . Net Cruise Cost less fuel expense adjusted for supplemental adjustments.

Adjusted Net Income (Loss). Net income (loss), adjusted for the effect of dilutive securities and other supplemental adjustments.

Berths . Double occupancy capacity per cabin (single occupancy per studio cabin) even though many cabins can accommodate three or more passengers.

Capacity Days. Berths available for sale multiplied by the number of cruise days for the period for ships in service.

Constant Currency. A calculation whereby foreign currency-denominated revenues and expenses in a period are converted at the U.S. dollar exchange rate of a comparable period in order to eliminate the effects of foreign exchange fluctuations.

Dry-dock. A process whereby a ship is positioned in a large basin where all of the fresh/sea water is pumped out in order to carry out cleaning and repairs of those parts of a ship which are below the water line.

EBITDA. Earnings before interest, taxes, and depreciation and amortization.

EPS. Diluted earnings (loss) per share.

GAAP. Generally accepted accounting principles in the U.S.

Gross Cruise Cost. The sum of total cruise operating expense and marketing, general and administrative expense.

Net Cruise Cost . Gross Cruise Cost less commissions, transportation and other expense and onboard and other expense.

Net Cruise Cost Excluding Fuel . Net Cruise Cost less fuel expense.

Net Debt . Long-term debt, including current portion, less cash and cash equivalents.

Net Leverage . Net Debt divided by Adjusted EBITDA.

Net Per Diem. Adjusted Gross Margin divided by Passenger Cruise Days.

Net Yield. Adjusted Gross Margin per Capacity Day.

Occupancy, Occupancy Percentage or Load Factor. The ratio of Passenger Cruise Days to Capacity Days. A percentage in excess of 100% indicates that three or more passengers occupied some cabins.

Passenger Cruise Days . The number of passengers carried for the period, multiplied by the number of days in their respective cruises.

Revolving Loan Facility . $1.2 billion senior secured revolving credit facility.

Non-GAAP Financial Measures