- Report Store

- AMR in News

- Press Releases

- Request for Consulting

- Our Clients

Luxury Travel Market Size, Share, Competitive Landscape and Trend Analysis Report by Types of Tour, by Age Group, by Types of Traveler : Global Opportunity Analysis and Industry Forecast, 2021-2031

CG : Sports, Fitness and Leisure

Report Code: A01337

Tables: 122

Get Sample to Email

Thank You For Your Response !

Our Executive will get back to you soon

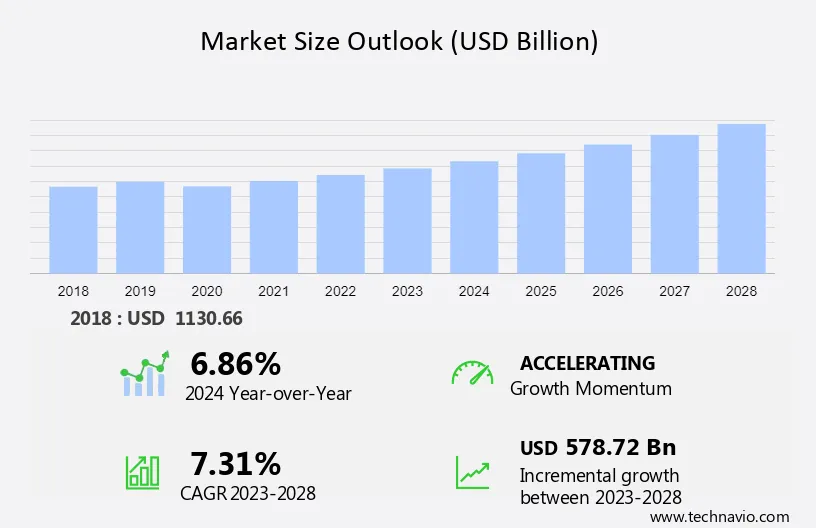

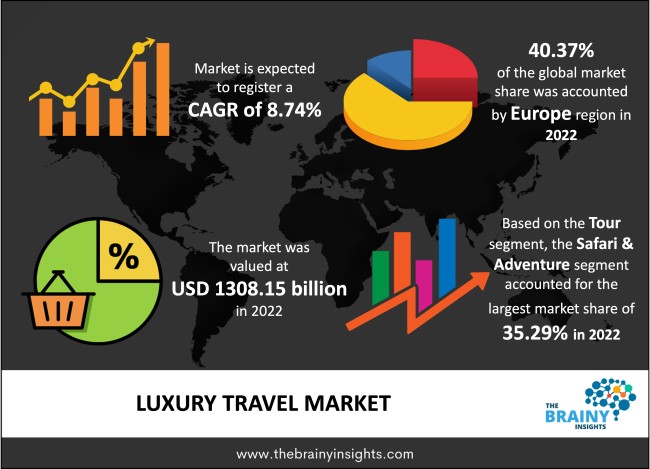

The global luxury travel market size was valued at $638.2 billion in 2021, and is projected to reach $1650.5 billion by 2031, growing at a CAGR of 8.9% from 2022 to 2031.Luxury travel services cover most desirable and premium experience in terms of luxurious accommodations, convenient transport facilities, and authentic travel experience. The service providers aim to provide outstanding services to its travelers. Private jet planes, spas, special menus, private island rentals, and private yacht are some of the unique services offered by the stakeholders to the travelers. Travelers, nowadays, focus on experimenting with destinations to gain experience in terms of cultures, foods, and other experiences. To gain a valuable and unforgettable experience, people increasingly opt for unique trips, which include cultural visit, cruising, and adventure activities. The luxury travel industry has emerged as one of the fastest growing sectors to contribute significantly to the global economic growth and development. Growth in disposable income and increase in upper middle class expenditure has raised the demand for higher service standards. To capitalize the same, market players formulate unique strategies to target the growth in middle class segment; for instance, hiring qualified individuals who can speak international language and communicate easily with travelers. This rise in demand for unique travel experiences offers tremendous opportunities for the market players to remain competitive.

The luxury travel market size is projected to be the fastest growing segment of the travel industry worldwide during the forecast period. The key drivers of rising luxury travel trend include inclination of people toward unique and exotic holiday experiences, increase in the middle- & upper-class disposable income & related expenditure, and growth in need and interest of people to spend more time with family. The growth luxury travel market is attributed to the increase in disposable income and growth in middle class population in countries such as China, Hong Kong, India, and Malaysia. As per recent statistics, Asia-Pacific millionaires now control more wealth than their peers in North America. In terms of future spending options, travel has been recognized as the top priority with greater focus on unique luxury experiences and adventure activities. Although the key developed countries such as the U.S. hold a highest revenue share of the luxury travel market, there has been a rise in demand for international luxury travel in developing countries such as China and India. This drift is due to the increase in the per capita income of middle-class travelers in the developing countries.

COVID-19 pandemic has impacted all industries globally. The tourism industry has been hit hard all over the world, impacting its associated sectors such as travel agencies, hospitality, tour operators, all kinds of transportation services. Around 90% of the global population was adjusted to their lifestyle under several travel restrictions and remaining population stayed home in fear of the virus itself. Thus, the tourism sector came to a near standstill. According to the article published by the World Travel and Tourism Council (WTCC) in August 2020, the COVID-19 pandemic is likely to cost the tourism industry revenue loss of almost $25 billion and a loss of almost 100 million jobs worldwide. Furthermore, owing to the implementation of lockdown and social distancing norms in almost every country of the world, flights were grounded, trains stopped running, and almost all public transport services were halted. With social distancing becoming the new lifestyle in public places and masks & gloves turning to be daily wear accessories, people prefer to remain safe at homes, thereby declining the number of travelers.

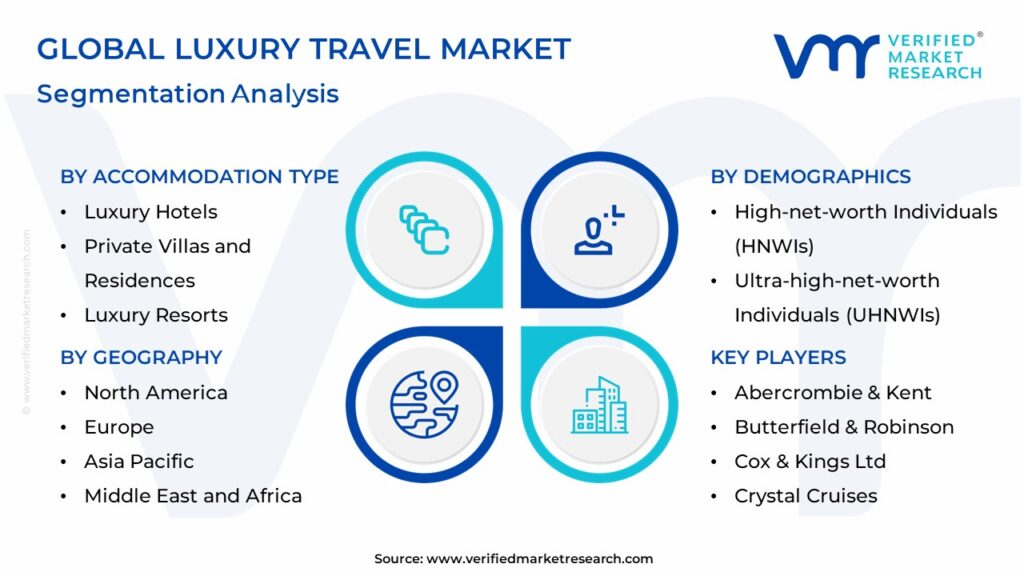

According to the market analysis, the luxury travel market is segmented into types of tour, age group, types of travelers, and region. As per types of tour, the market is categorized into customized and private vacations, adventure and safari, cruise/ship expedition, small group journey, celebration and special events and culinary travel and shopping. By age group, it is segregated into millennial, generation x, baby boomer and silver hair. Depending on types of travelers, it is segmented into absolute luxury, aspiring luxury and accessible luxury. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Spain, Italy and Rest of Europe), Asia-Pacific (China, India, Singapore and Rest of Asia-Pacific), and LAMEA (Middle East, Latin America and Africa).

On the basis of type of tour, the cruise/ship expedition segment accounted for around 4.6% of global luxury travel market share in 2021, and is expected to sustain its share throughout luxury travel market forecast period. Luxury cruising is gaining attraction and is expected to get tripled by the next decade. From the growth perspective, Asia-Pacific and LAMEA are the two potential markets, expected to witness considerably higher growth rates during the forecast period. Introduction of innovative cruise design concepts, new ship lengths, new and more exotic destinations around the globe, and new on-board and on-shore activities and themes drive the growth of the market for cruise/ship expedition. Luxury cruising is mostly opted by silver hair group since it is much more convenient, relaxing, and more glorious mode of traveling. With the advent of Crystal Cruises’ luxury travel portfolio has expanded into the luxury river cruise market and yachting & air market. Thus, aforementioned factors are likely to supplement for the growth of the luxury travel market through cruise/ship expedition segment during forecast period.

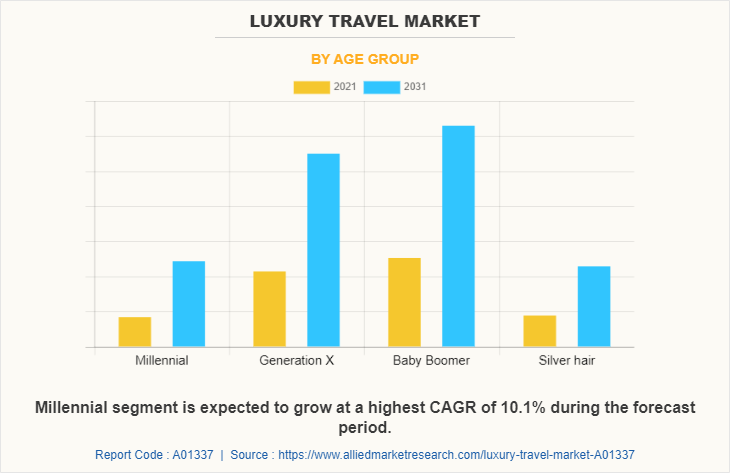

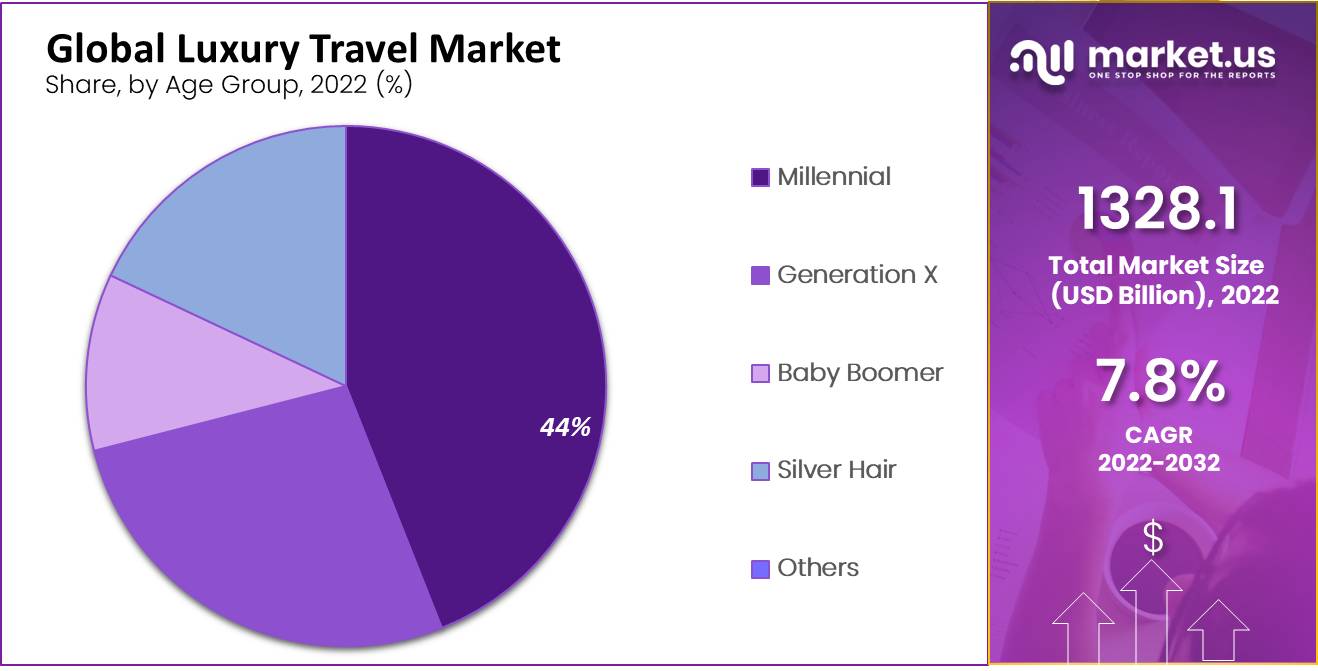

On the basis of age group, the millennial segment was valued at $83,842.5 million in 2021, and is expected to reach $242,050.1 million by 2031, with a CAGR of 10.1%. North America and Europe together accounted for about 67.4% of the millennial luxury travel market revenue in 2021, with the former constituting around 28%. From a growth perspective, Asia-Pacific and LAMEA are the two potential markets, expected to witness considerably higher growth rates over the forecast period. Millennial’s are avid travelers comprising of maximum number of population of traveling, on an average, millennial’s spend $527 a day on a trip which is 62% less than their older counterparts. They generally look for cultural and leisure breaks. Millennial’s are driven by wanderlust and breaking life’s monotony, these group of youngsters prefer short trips to culturally rich and different countries, also local shopping is a major factor of their traveling. Honeymoons and romantic gateways are also some important factors driving this category. Thus, above factors collectively increase luxury travel market demand through the millennial segment.

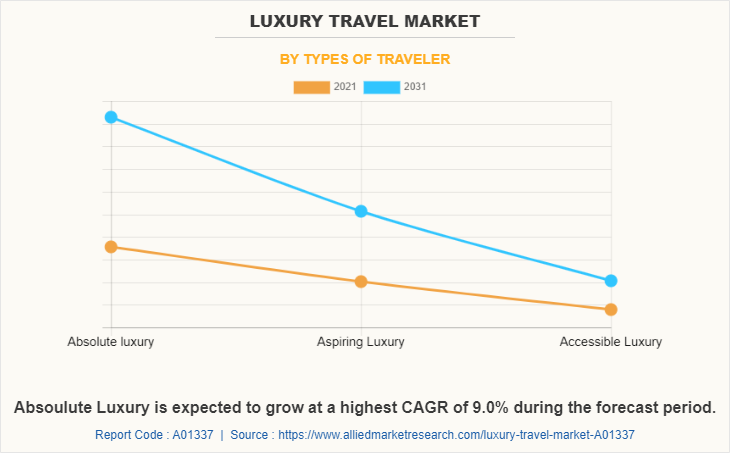

According to the luxury travel market trends, depending on types of travelers, the aspiring luxury segment was valued at $202,139.7 million in 2021, and is expected to reach $513,454.9 million by 2031, with a CAGR of 8.7%. Aspiring luxury class majorly comprises the millennial generation who prefer short, luxury trips, as they are moderately wealthy. This segment also comprise of ‘newly rich’, which are willing to pour money into the luxury travel industry and are the front-runner of this segment. Aspiring luxury travelers take an average of five business and leisure trips per year, owing to their high spending power and the potential to afford luxury traveling. Mid-income and aspirational shoppers are fostering the growth of upper premium brands and the second-hand market. Destinations such as Dubai have initiated programs to encourage investments in midmarket hotels such as releasing government land plots for three and four star hotel projects. Aspiring luxury prefer exclusive and unique destinations for their shopping which are specifically abroad destinations, while they have ample resources to spend, they are comparative don’t go all out for luxury services. This segment includes young, aspirational individuals who earn significantly and have limited family responsibilities. Increasing aspiring luxury travelers are likely to supplement the luxury travel market growth during forecast period.

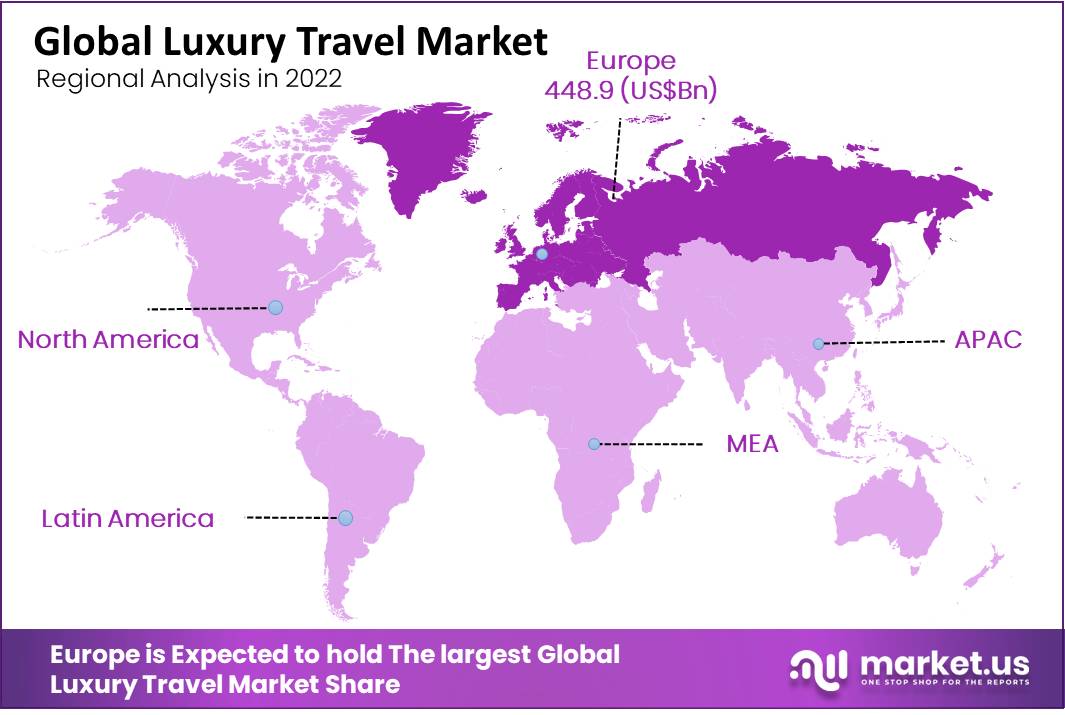

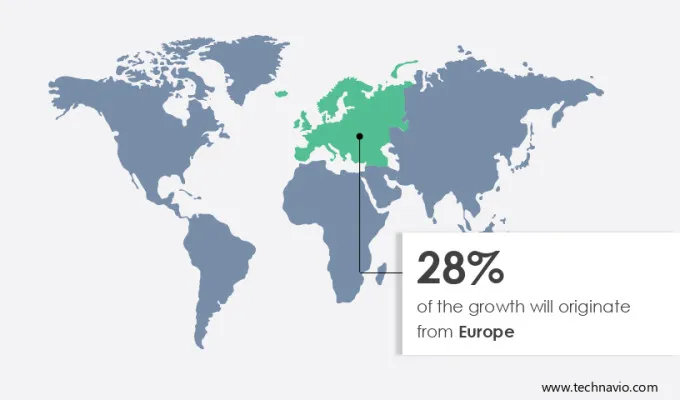

Region wise, the North America was valued at $152,531.4 million in 2021, and is expected to reach $354,846.3 million by 2031, with a CAGR of 7.8%. The U.S. is driving the luxury travel market in North American region, with wealthiest of population and most outbound trips. Canada and Mexico’s luxury travel market also show a hike in the number of people opting for luxury travel owing to serene winter destinations in Canada and glittering white Caribbean beaches and private luxury resorts in Mexico. The luxury travelers are attracted to Mexico due to its established and highly exclusive resorts like Four Seasons and St. Regis in Punta Mita and high-end resorts in Los Cabos. Luxury travel is also expected to see vigorous growth across North America due to increasing income trends, strong dollar, and growing middle class segment. Thus, above mentioned factors are likely to support the North America luxury travel market during forecast period.

The players operating in the global luxury travel market have adopted various developmental strategies to expand their market share, increase profitability, and remain competitive in the market. The key players profiled in this report include Abercrombie & Kent USA, LLC, Cox & Kings Ltd, Travcoa, Micato Safaris, Ker & Downey, Tauck, Thomas Cook Group PLC, Scott Dunn Ltd., Kensington Tours, Butterfield & Robinson Inc., TUI Group, Zicasso, Inc., Black Tomato, Backroads, Lindblad Expeditions and Exodus travels.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the luxury travel market analysis from 2021 to 2031 to identify the prevailing luxury travel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the luxury travel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global luxury travel market trends, key players, market segments, application areas, and market growth strategies.

Luxury Travel Market Report Highlights

Analyst Review

The global luxury travel market is anticipated to witness robust growth in regions such as Asia-Pacific and LAMEA. The growth in the number of HNI’s global population and easy availability of on-arrival visa propel the growth of the overall luxury travel market.

According to industry experts, French, Germans, Spaniards, and Australians opt for adventure and safari trips. In addition, Russian travelers opt for places like Goa in India, where they can relax and enjoy the tropical weather as they spend most of their time in a cold region. Culinary tours are also witnessing significant growth in the travel market. There is an increase in the number of private and culinary trips in Europe, owing to growth in interest of people in local culture and their aspiration to have a better understanding of local cuisines and people.

Countries such as China and India have huge growth potential and are the major investment pockets in the luxury travel market. Affluent Arabs prefer to spend their holidays in the most luxurious way like visiting London and splurging on high-end shopping. In addition, they opt for destinations, where they can spend huge amount on shopping. Affluent Chinese millennial travelers prefer to have quality travel experience, thus they opt for high-end accommodation and luxurious ways of traveling, thus propelling the growth of the overall luxury travel market. Key market players are adopting various growth strategies such as product launch (tour packages) and acquisition to sustain in the competitive market.

- Outdoor Adventures

- Leisure Activities

- Outdoor Activities

The global luxury travel market size was valued at $638,206.8 million in 2021, and is estimated to reach $1,650,447.7 million by 2031.

8.9% is the CAGR of luxury travel market.

You can request sample from the website (www.alliedmarketresearch.com) or you can call our sales representative on U.S. - Canada toll free - +1-800-792-5285, Int'l : +1-503-894-6022 and for Europe region + 44-845-528-1300.

2021 is the base year calculated in the luxury travel market report.

Abercrombie & Kent USA, LLC, Cox & Kings Ltd, Travcoa, Micato Safaris, Ker & Downey, Tauck and Thomas Cook Group PLC are some of the top companies in the luxury travel market report.

The luxury travel market is segmented into types of tour, age group, types of travellers and region.

The inclination of people toward unique and exotic holiday experiences, increase in the middle- & upper-class disposable income & related expenditure, and growth in need and interest of people to spend more time with family are the latest trends in the luxury travel market.

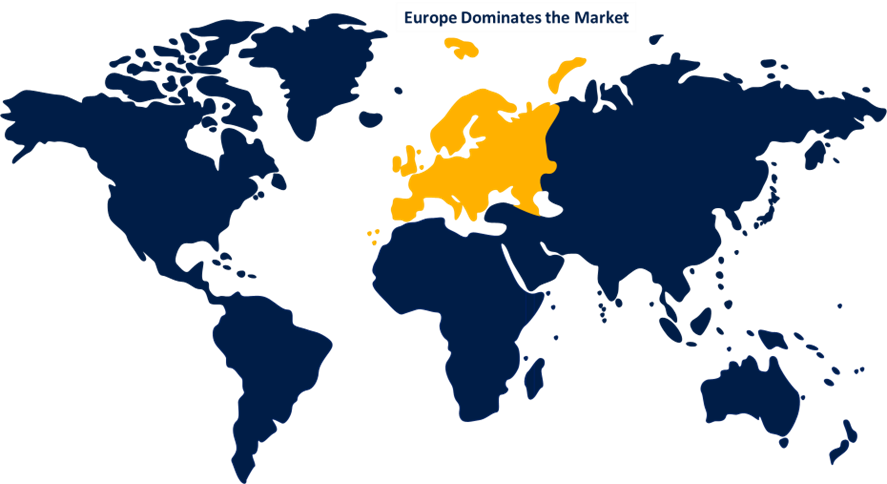

Europe region holds the maximum market share of the luxury travel market.

Outbreak of COVID-19 was negatively impacted the growth of the luxury travel market in 2020.

Loading Table Of Content...

- Related Report

- Global Report

- Regional Report

- Country Report

Enter Valid Email ID

Verification code has been sent to your email ID

By continuing, you agree to Allied Market Research Terms of Use and Privacy Policy

Advantages Of Our Secure Login

Easily Track Orders, Hassel free Access, Downloads

Get Relevent Alerts and Recommendation

Wishlist, Coupons & Manage your Subscription

Have a Referral Code?

Enter Valid Referral Code

An Email Verification Code has been sent to your email address!

Please check your inbox and, if you don't find it there, also look in your junk folder.

Luxury Travel Market

Global Opportunity Analysis and Industry Forecast, 2021-2031

- Transportation and Logistics

Luxury Travel Market

Luxury travel market report by type of tour (customized and private vacation, adventure and safari, cruise and ship expedition, small group journey, celebration and special event, culinary travel and shopping), age group (millennial (21-30), generation x (31-40), baby boomers (41-60), silver hair (60 and above)), type of traveller (absolute luxury, aspiring luxury, accessible luxury), and region 2024-2032.

- Report Description

- Table of Contents

- Methodology

- Request Sample

Market Overview:

The global luxury travel market size reached US$ 2,143.5 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 3,088.0 Billion by 2032, exhibiting a growth rate (CAGR) of 4% during 2024-2032. The rising demand for exclusive and personalized travel experiences, expanding high-net-worth individual (HNWI) population seeking luxury travel options, and increasing focus on wellness and sustainability in luxury travel offerings are some of the major factors propelling the market.

Luxury travel represents a premium and exclusive segment of the tourism industry that caters to discerning travelers seeking exceptional and opulent experiences. It goes beyond basic amenities and comfort, offering personalized services, exquisite accommodations, gourmet dining, and unique, immersive activities. Luxury travel often includes stays in luxurious hotels, private villas, or upscale resorts in picturesque destinations. Travelers can indulge in spa treatments, fine dining at Michelin-starred restaurants, private yacht charters, and cultural excursions tailored to their interests. Luxury travel is characterized by a focus on exclusivity, attention to detail, and a commitment to delivering the utmost in comfort and satisfaction, making it a sought-after choice for those seeking the pinnacle of travel experiences.

-(1).webp)

The increasing affluence of high-net-worth individuals (HNWIs) and affluent consumers around the world that expands the clientele seeking exclusive and opulent travel experiences, will stimulate the growth of the luxury travel market during the forecast period. These travelers seek to indulge in lavish accommodations, personalized services, and unique adventures. Moreover, the rising desire for experiential and transformative travel is propelling the luxury market, as travelers prioritize immersive cultural experiences, wellness retreats, and eco-conscious journeys. Apart from this, the enhanced convenience and accessibility of private jet and yacht charters has augmented the appeal of luxury travel, offering exclusivity and flexibility, thereby driving the market growth. Furthermore, the rise of remote working and digital nomadism that enables travelers to explore luxury destinations while maintaining their professional lives, contributing to the growth of extended-stay luxury experiences.

Luxury Travel Market Trends/Drivers:

Growing affluence of high-net-worth individuals (HNAWIs)

The increasing affluence of high-net-worth individuals (HNWIs) and affluent consumers is a primary driving force behind the luxury travel market's expansion. As economies grow and prosperity spreads globally, more individuals are gaining access to higher disposable incomes, enabling them to indulge in luxury travel experiences. This demographic seeks exclusivity, comfort, and premium services when exploring the world. They are willing to invest in opulent accommodations, private transportation, and curated itineraries that cater to their preferences. The luxury travel industry capitalizes on this trend by continuously innovating and offering top-notch services to meet the discerning tastes of affluent travelers. This growing affluence fuels demand for luxury travel and encourages the development of new destinations and experiences that cater to the evolving desires of this segment.

Rising desire for unique experiences

Luxury travelers today are not satisfied with mere comfort; they seek meaningful and distinctive experiences that set their journeys apart. This driver has led to the rise of experiential luxury travel, where travelers immerse themselves in local cultures, traditions, and landscapes. They opt for bespoke itineraries that cater to their interests, from culinary adventures and private art tours to wildlife safaris and wellness retreats. The desire for unique experiences has given rise to a trend where luxury travel becomes a form of self-expression, allowing travelers to collect memories and stories that differentiate them from conventional tourists. The luxury travel industry responds by providing exclusive access to hidden gems, private guides, and off-the-beaten-path adventures, ensuring that each journey is a one-of-a-kind experience tailored to individual preferences.

Increasing sustainability and wellness consciousness

Sustainability and wellness have emerged as crucial drivers in the luxury travel market. As travelers become more socially and environmentally conscious, they seek accommodations and experiences that align with their values. Luxury travelers now expect eco-friendly practices, responsible tourism, and sustainable accommodations, which include everything from eco-lodges in remote natural settings to sustainable cruises that minimize environmental impact. Additionally, the wellness aspect of luxury travel emphasizes physical and mental well-being, with travelers seeking spas, fitness centers, meditation retreats, and nutrition-focused experiences during their trips. The luxury travel industry recognizes these trends and is incorporating sustainable and wellness-focused offerings into its portfolio, ensuring that travelers can enjoy guilt-free luxury experiences that promote both personal well-being and environmental responsibility. This shift is an ethical choice and a competitive advantage for luxury travel providers, as it meets the evolving preferences of a socially conscious and health-focused clientele.

Note: Information in the above chart consists of dummy data and is only shown here for representation purpose. Kindly contact us for the actual market size and trends.

To get more information about this market, Request Sample

Luxury Travel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global luxury travel market report, along with forecasts at the global, regional and country levels from 2024-2032. Our report has categorized the market based on type of tour, age group, and type of traveller.

Breakup by Type of Tour:

- Customized and Private Vacation

- Adventure and Safari

- Cruise and Ship Expedition

- Small Group Journey

- Celebration and Special Event

- Culinary Travel and Shopping

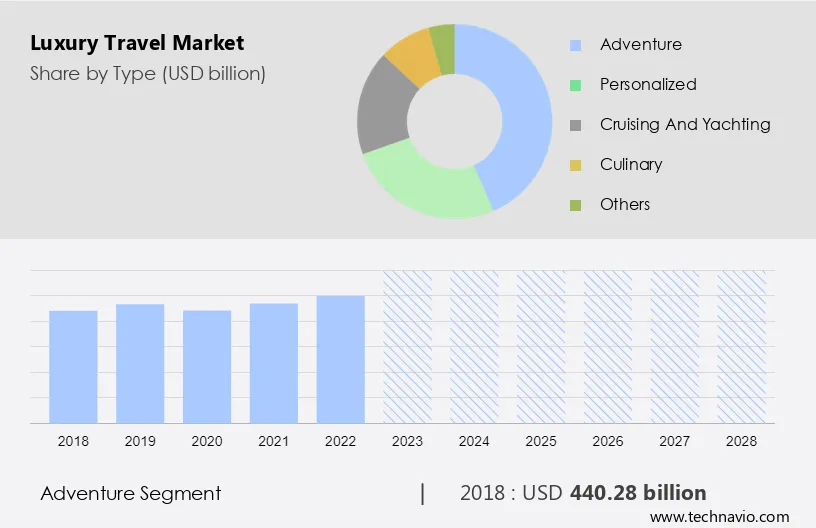

Adventure and safari hold the largest market share

The report has provided a detailed breakup and analysis of the market based on the type of tour. This includes customized and private vacation, adventure and safari, cruise and ship expedition, small group journey, celebration and special event, and culinary travel and shopping. According to the report, adventure and safari represented the largest segment.

Adventure and safari experiences are key drivers in the luxury travel market, attracting travelers seeking unique and exhilarating journeys. Adventure travel offers activities such as trekking, mountain climbing, scuba diving, and wildlife encounters in remote and often challenging environments. Safari adventures, on the other hand, focus on wildlife observation in natural habitats, with opportunities to see iconic species like lions, elephants, and rhinos. These experiences drive the luxury travel market by offering exclusivity and personalized adventures that cater to the desires of affluent travelers.

Furthermore, luxury adventure and safari providers offer private guided tours, high-end accommodations in pristine locations, and customized itineraries that combine adventure with comfort. They ensure travelers can enjoy thrilling experiences while maintaining the highest standards of safety and comfort. Moreover, the demand for sustainability in adventure and safari experiences is rising, with eco-friendly practices and conservation efforts playing a significant role, attracting travelers who value responsible and immersive encounters with nature.

Breakup by Age Group:

- Millennial (21-30)

- Generation X (31-40)

- Baby Boomers (41-60)

- Silver Hair (60 and above)

Baby boomers (41-60) represents the leading age group segment

A detailed breakup and analysis of the market based on the age group has also been provided in the report. This includes millennial (21-30), generation X (31-40), baby boomers (41-60), and silver hair (60 and above). According to the report, baby boomers (41-60) accounted for the largest market share.

Baby boomers, typically aged between 41 and 60, represent a generation known for its significant impact on various industries, including luxury travel. This demographic is characterized by its strong work ethic, higher disposable income, and a desire for fulfilling experiences during their retirement years. Baby boomers are fueling the luxury travel market by seeking personalized and experiential journeys that cater to their interests and preferences. They value comfort, quality, and authenticity, often opting for upscale accommodations, premium cruise experiences, and immersive cultural encounters. Many baby boomers are avid travelers, using their retirement years to explore the world and fulfill their travel bucket lists. Their influence extends to the rise of wellness-focused luxury travel, as they prioritize health and well-being in their journeys.

Moreover, baby boomers are early adopters of travel technology, embracing digital tools for booking, research, and staying connected while on the road. Their significant presence in the luxury travel market continues to shape the industry, catalyzing the demand for tailored, high-end experiences that align with their desires for exploration and relaxation in their golden years.

Breakup by Type of Traveller:

- Absolute Luxury

- Aspiring Luxury

- Accessible Luxury

Absolute luxury is the most popular type of traveler

A detailed breakup and analysis of the market based on the type of traveler has also been provided in the report. This includes absolute, aspiring and accessible luxury. According to the report, absolute luxury accounted for the largest market share.

The absolute luxury traveler is characterized by an unwavering pursuit of the finest experiences and the highest level of exclusivity. These travelers seek unparalleled opulence, from stays in ultra-luxurious accommodations like private villas on secluded islands or boutique hotels in historic city centers to bespoke itineraries that include private yacht charters, exclusive access to cultural events, and Michelin-starred dining experiences.

Moreover, absolute luxury travelers are the trendsetters and taste-makers in the luxury travel industry, fueling demand for innovation and pushing the boundaries of what constitutes a lavish travel experience. Their influence extends to the development of new, extraordinary destinations and the creation of entirely customized journeys that cater to their unique preferences. Their commitment to luxury and their willingness to invest in once-in-a-lifetime adventures shape the luxury travel market by inspiring providers to continuously elevate their offerings, ensuring that the absolute luxury traveler's appetite for the extraordinary is consistently met.

Breakup by Region:

To get more information on the regional analysis of this market, Request Sample

United States

- South Korea

United Kingdom

- Middle East and Africa

Europe exhibits a clear dominance in the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounted for the largest market share.

Europe held the biggest share in the market since the region is home to an array of iconic and culturally rich destinations, from the historical cities of Rome, Paris, and Prague to the scenic beauty of the Swiss Alps and the Mediterranean coast, offering a diverse range of luxury experiences. Apart from this, Europe boasts a long history of luxury hospitality, with its heritage luxury hotels and boutique properties, providing travelers with opulent accommodations and impeccable service.

Moreover, rising emphasis of the region on gastronomy and fine dining attracts luxury travelers seeking culinary excellence, with numerous Michelin-starred restaurants and local gourmet experiences. Furthermore, Europe's efficient transportation infrastructure and access to exclusive cultural events, from fashion shows to art exhibitions, enhance its appeal to luxury travelers. Additionally, Europe's commitment to sustainability and responsible tourism aligns with the values of eco-conscious luxury travelers, ensuring that the region continues to lead the way in delivering high-end, sustainable travel experiences that resonate with the evolving preferences of affluent global travelers.

Competitive Landscape:

The market is experiencing steady growth as key players are continually innovating to meet the evolving preferences of discerning travelers. Recent innovations include the integration of advanced technology to enhance the booking and travel experience, with virtual reality (VR) and augmented reality (AR) being used to provide immersive previews of accommodations and destinations. Additionally, there is a growing focus on sustainability, with luxury hotels and resorts adopting eco-friendly practices and designing carbon-neutral properties to cater to environmentally conscious travelers. Personalization remains a key trend, with luxury travel providers leveraging data analytics and artificial intelligence (AI) to curate bespoke itineraries and offer highly tailored services. Furthermore, luxury cruise lines are introducing cutting-edge amenities such as underwater lounges and sustainable ship designs. These innovations collectively aim to elevate the luxury travel experience, providing travelers with unique, sustainable, and personalized journeys that align with their values and preferences.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Abercrombie & Kent USA LLC.

- Butterfield & Robinson Inc.

- Cox & Kings Ltd.

- Exodus Travels Limited (Travelopia)

- Kensington Tours Ltd.

- Micato Safaris

- Scott Dunn Ltd.

- Thomascook.in (Fairbridge Capital (Mauritius) Limited)

Recent Developments:

- In August 2023, Abercrombie & Kent introduced a new private jet journey to meet increased demand for wildlife experiences. This exclusive adventure is designed to captivate the hearts of discerning travelers who seek to explore the world's most breathtaking natural wonders while indulging in unparalleled luxury and comfort. This unique expedition takes travelers on a globe-spanning odyssey, whisking them away on a meticulously planned itinerary that delves deep into some of the planet's most pristine and wildlife-rich regions.

- In February 2020, Kensington Tours, a leading luxury travel company, introduced new itineraries that showcase the natural wonders and cultural richness of Iceland and Wales. These meticulously crafted journeys promise travelers unforgettable experiences in two distinct yet equally captivating destinations. The Iceland itinerary invites adventurers to explore the land of fire and ice, where dramatic landscapes meet geothermal wonders. It offers a perfect blend of outdoor exploration and relaxation in Iceland's geothermal baths.

- In February 2023, Tauck, a renowned leader in guided travel experiences, announced the expansio of its small group land departures by an impressive 35%, catering to the growing demand for intimate and immersive travel adventures. This increase in small group departures signifies Tauck's dedication to providing travelers with the chance to delve deeper into the destinations they visit.

Luxury Travel Market Report Scope:

Key benefits for stakeholders:.

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the luxury travel market from 2018-2032.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global luxury travel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the luxury travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global luxury travel market was valued at US$ 2,143.5 Billion in 2023.

We expect the global luxury travel market to exhibit a CAGR of 4% during 2024-2032.

The growing consumer inclination towards leisure activities and exotic holiday destinations is primarily driving the global luxury travel market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary restrictions on intra- and inter-national travel activities, thereby negatively impacting the global market for luxury travel.

Based on the type of tour, the global luxury travel market can be categorized into customized and private vacation, adventure and safari, cruise and ship expedition, small group journey, celebration and special event, and culinary travel and shopping. Currently, adventure and safari accounts for the majority of the global market share.

Based on the age group, the global luxury travel market has been segregated into millennial (21-30), generation X (31-40), baby boomers (41-60), and silver hair (60 and above). Among these, baby boomers (41-60) currently exhibit a clear dominance in the market.

Based on the type of traveler, the global luxury travel market can be bifurcated into absolute luxury, aspiring luxury, and accessible luxury. Currently, absolute luxury holds the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Europe currently dominates the global market.

Some of the major players in the global luxury travel market include Abercrombie & Kent USA LLC., Butterfield & Robinson Inc., Cox & Kings Ltd., Exodus Travels Limited (Travelopia), Kensington Tours Ltd., Micato Safaris, Scott Dunn Ltd., Tauck, Thomascook.in (Fairbridge Capital (Mauritius) Limited), and TUI Group.

India Dairy Market Report Snapshots Source:

Statistics for the 2022 India Dairy market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports.

- India Dairy Market Size Source

- --> India Dairy Market Share Source

- India Dairy Market Trends Source

- India Dairy Companies Source

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Purchase options

Benefits of Customization

Personalize this research

Triangulate with your data

Get data as per your format and definition

Gain a deeper dive into a specific application, geography, customer, or competitor

Any level of personalization

Get in Touch With Us

UNITED STATES

Phone: +1-631-791-1145

Phone: +91-120-433-0800

UNITED KINGDOM

Phone: +44-753-713-2163

Email: [email protected]

Client Testimonials

IMARC made the whole process easy. Everyone I spoke with via email was polite, easy to deal with, kept their promises regarding delivery timelines and were solutions focused. From my first contact, I was grateful for the professionalism shown by the whole IMARC team. I recommend IMARC to all that need timely, affordable information and advice. My experience with IMARC was excellent and I can not fault it.

The IMARC team was very reactive and flexible with regard to our requests. A very good overall experience. We are happy with the work that IMARC has provided, very complete and detailed. It has contributed to our business needs and provided the market visibility that we required

We were very happy with the collaboration between IMARC and Colruyt. Not only were your prices competitive, IMARC was also pretty fast in understanding the scope and our needs for this project. Even though it was not an easy task, performing a market research during the COVID-19 pandemic, you were able to get us the necessary information we needed. The IMARC team was very easy to work with and they showed us that it would go the extra mile if we needed anything extra

Last project executed by your team was as per our expectations. We also would like to associate for more assignments this year. Kudos to your team.

.webp)

We would be happy to reach out to IMARC again, if we need Market Research/Consulting/Consumer Research or any associated service. Overall experience was good, and the data points were quite helpful.

The figures of market study were very close to our assumed figures. The presentation of the study was neat and easy to analyse. The requested details of the study were fulfilled. My overall experience with the IMARC Team was satisfactory.

The overall cost of the services were within our expectations. I was happy to have good communications in a timely manner. It was a great and quick way to have the information I needed.

My questions and concerns were answered in a satisfied way. The costs of the services were within our expectations. My overall experience with the IMARC Team was very good.

I agree the report was timely delivered, meeting the key objectives of the engagement. We had some discussion on the contents, adjustments were made fast and accurate. The response time was minimum in each case. Very good. You have a satisfied customer.

.webp)

We would be happy to reach out to IMARC for more market reports in the future. The response from the account sales manager was very good. I appreciate the timely follow ups and post purchase support from the team. My overall experience with IMARC was good.

IMARC was a good solution for the data points that we really needed and couldn't find elsewhere. The team was easy to work, quick to respond, and flexible to our customization requests.

- Competitive Intelligence and Benchmarking

- Consumer Surveys and Feedback Reports

- Market Entry and Opportunity Assessment

- Pricing and Cost Research

- Procurement Research

- Report Store

- Aerospace and Defense

- Agriculture

- Chemicals and Materials

- Construction and Manufacturing

- Electronics and Semiconductors

- Energy and Mining

- Food and Beverages

- Technology and Media

Quick Links

- Press Releases

- Case Studies

- Our Customers

- Become a Publisher

134 N 4th St. Brooklyn, NY 11249, USA

+1-631-791-1145

Level II & III, B-70, Sector 2, Noida, Uttar Pradesh 201301, India

+91-120-433-0800

30 Churchill Place London E14 5EU, UK

+44-753-713-2163

Level II & III, B-70 , Sector 2, Noida, Uttar Pradesh 201301, India

We use cookies, including third-party, for better services. See our Privacy Policy for more. I ACCEPT X

- Consumer Goods and Services

- Consumer Services

Luxury Travel Market

Global Luxury Travel Market Size, Share, Trends, Forecast: By Tour Type: Customised and Private Vacation, Adventure and Safari, Cruise and Ship Expedition, Small Group Journey, Celebration and Special Event, Culinary Travel and Shopping; By Age Group: Millennial (21-30 Years), Others; Regional Analysis; Competitive Landscape; 2024-2032

- Report Summary

- Table of Contents

- Pricing Detail

- Request Sample

Global Luxury Travel Market Outlook

The global luxury travel market size reached approximately USD 2.07 trillion in 2023. The market is assessed to grow at a CAGR of 5.5% between 2024 and 2032 to attain a value of around USD 3.38 trillion by 2032.

Key Trends in the Market

Luxury travel refers to a type of tourism that is associated with exclusive, personalised, and unique experiences. Luxury travellers typically choose high-end accommodations such as international hotels and exclusive boutique travel.

- One of the major factors aiding the luxury travel market growth is the increasing disposable incomes of the middle-class population. Although luxury travel has been traditionally associated with high-net-worth individuals, celebrities, influencers, and business tycoons, a growing young population with rising income levels and a knack for adventure and unique experiences is fuelling the market.

- The luxury travel market demand is being propelled by the growing demand for rejuvenating and relaxing travel experiences by affluent individuals amid the rising trend of self-care and the growing focus on overall well-being. With the affluent population prioritising their mental, physical, and spiritual health, the interest in luxury wellness travel, especially in countries like India, Thailand, Switzerland, and Japan, is increasing.

- The rising demand for personalised services and offerings is one of the key luxury travel market trends. Luxury travellers value tailored and unique experiences that can cater to their specific interests. To capitalise on this trend, luxury travel operators and agents are leveraging innovative technologies such as data analytics to analyse the preferences, interests, social media activities, and travel history of affluent travellers to provide them with exclusive and personalised luxury travel experiences.

High-end travellers are also demanding authentic, meaningful, and unique experiences, hence choosing offbeat destinations not frequented by the masses with personalised tours and exclusive services.

- The increasing trend of sustainable travel is significantly driving the luxury travel market development. Luxury travellers are willing to spend more on travelling responsibly, preserving local culture and biodiversity, and contributing to the local economy. Moreover, they are choosing low-carbon emission modes of transportation and eco-friendly luxury accommodations that use sustainable practices, renewable energy, and eco-friendly and responsibly sourced materials.

Market Analysis

Based on tour type, the luxury travel market segmentation includes customised and private vacation, adventure and safari, cruise and ship expedition, small group journey, celebration and special event, and culinary travel and shopping.

On the basis of age group, the market can be divided into millennial (21-30 years), Generation X (31-40 Years), baby boomers (41-60 years), and silver hair (60 years and above). The major regional markets for luxury travel include North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis. The report gives a detailed analysis of the following key players in the global luxury travel market, covering their competitive landscape and latest developments like mergers, acquisitions, investments and expansion plans.

- Abercrombie & Kent Ltd.

- Scott Dunn Ltd.

- TUI Group

- Tauck, Inc.

- Lindblad Expeditions, LLC

- Taicoa Corporation (Micato Safaris, Inc.)

- Exodus Travels Limited

- Travelopia Holdings Limited

- Butterfield & Robinson Inc.

- Globus Travel Kft.

Market Share by Age Group

As per the luxury travel market analysis, millennials prefer luxury immersive and experimental travel that can provide them with spiritual awareness, physical enrichment, and intellectual nourishment. Moreover, luxury tours with a focus on culture, art, history, and music are gaining popularity among millennials seeking authentic and unique experiences.

Market Share by Region

The Asia Pacific accounts for a substantial portion of the luxury travel market share. Countries such as Thailand, India, Japan, Singapore, and Vietnam have emerged as leading destinations for travellers seeking a blend of comfort, luxury, natural beauty, and culture. The increasing number of luxury hotels, coupled with exceptional customer services and diverse locations in the region, is further aiding the market growth.

Besides, the surging number of high-net-worth-individuals (HNWI) and ultra-high-net-worth individuals (UHNWI), especially in countries like China, Japan, Singapore, and Hong Kong, are expected to positively impact the luxury travel market expansion in the coming years.

Competitive Landscape

Abercrombie & Kent Ltd. , established in 1962, has been a pioneer in the luxury adventure travel sector. It is recognised as one of the premier travel companies in the world and offers its services in over 100 countries. The company offers different types of travel services, ranging from private jet journeys to small group journeys, and luxury expedition cruises.

Scott Dunn Ltd. is a leading travel operator that is headquartered in London, the United Kingdom. The company offers high-end adventurous holidays across the globe, from Antarctica to the Alps. It aims to use its expansive knowledge to create customised, personalised, immersive, and memorable travel experiences.

TUI Group has established its position as a reputed tourism platform company that offers services in prominent holiday destinations across the globe. With its focus on social, economic, and environmental sustainability, the company has created memorable trips for more than 21 million travellers.

Other luxury travel market players include Tauck, Inc., Lindblad Expeditions, LLC, Taicoa Corporation (Micato Safaris, Inc.), Exodus Travels Limited, Travelopia Holdings Limited, Butterfield & Robinson Inc., and Globus Travel Kft., among others.

Key Highlights of the Report

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface 2 Report Coverage – Key Segmentation and Scope 3 Report Description 3.1 Market Definition and Outlook 3.2 Properties and Applications 3.3 Market Analysis 3.4 Key Players 4 Key Assumptions 5 Executive Summary 5.1 Overview 5.2 Key Drivers 5.3 Key Developments 5.4 Competitive Structure 5.5 Key Industrial Trends 6 Market Snapshot 6.1 Global 6.2 Regional 7 Opportunities and Challenges in the Market 8 Global Luxury Travel Market Analysis 8.1 Key Industry Highlights 8.2 Global Luxury Travel Historical Market (2018-2023) 8.3 Global Luxury Travel Market Forecast (2024-2032) 8.4 Global Luxury Travel Market by Tour Type 8.4.1 Customised and Private Vacation 8.4.1.1 Historical Trend (2018-2023) 8.4.1.2 Forecast Trend (2024-2032) 8.4.2 Adventure and Safari 8.4.2.1 Historical Trend (2018-2023) 8.4.2.2 Forecast Trend (2024-2032) 8.4.3 Cruise and Ship Expedition 8.4.3.1 Historical Trend (2018-2023) 8.4.3.2 Forecast Trend (2024-2032) 8.4.4 Small Group Journey 8.4.4.1 Historical Trend (2018-2023) 8.4.4.2 Forecast Trend (2024-2032) 8.4.5 Celebration and Special Event 8.4.5.1 Historical Trend (2018-2023) 8.4.5.2 Forecast Trend (2024-2032) 8.4.6 Culinary Travel and Shopping 8.4.6.1 Historical Trend (2018-2023) 8.4.6.2 Forecast Trend (2024-2032) 8.5 Global Luxury Travel Market by Age Group 8.5.1 Millennial (21-30 Years) 8.5.1.1 Historical Trend (2018-2023) 8.5.1.2 Forecast Trend (2024-2032) 8.5.2 Generation X (31-40 Years) 8.5.2.1 Historical Trend (2018-2023) 8.5.2.2 Forecast Trend (2024-2032) 8.5.3 Baby Boomers (41-60 Years) 8.5.3.1 Historical Trend (2018-2023) 8.5.3.2 Forecast Trend (2024-2032) 8.5.4 Silver Hair (60 Years and Above) 8.5.4.1 Historical Trend (2018-2023) 8.5.4.2 Forecast Trend (2024-2032) 8.6 Global Luxury Travel Market by Region 8.6.1 North America 8.6.1.1 Historical Trend (2018-2023) 8.6.1.2 Forecast Trend (2024-2032) 8.6.2 Europe 8.6.2.1 Historical Trend (2018-2023) 8.6.2.2 Forecast Trend (2024-2032) 8.6.3 Asia Pacific 8.6.3.1 Historical Trend (2018-2023) 8.6.3.2 Forecast Trend (2024-2032) 8.6.4 Latin America 8.6.4.1 Historical Trend (2018-2023) 8.6.4.2 Forecast Trend (2024-2032) 8.6.5 Middle East and Africa 8.6.5.1 Historical Trend (2018-2023) 8.6.5.2 Forecast Trend (2024-2032) 9 North America Luxury Travel Market Analysis 9.1 United States of America 9.1.1 Historical Trend (2018-2023) 9.1.2 Forecast Trend (2024-2032) 9.2 Canada 9.2.1 Historical Trend (2018-2023) 9.2.2 Forecast Trend (2024-2032) 10 Europe Luxury Travel Market Analysis 10.1 United Kingdom 10.1.1 Historical Trend (2018-2023) 10.1.2 Forecast Trend (2024-2032) 10.2 Germany 10.2.1 Historical Trend (2018-2023) 10.2.2 Forecast Trend (2024-2032) 10.3 France 10.3.1 Historical Trend (2018-2023) 10.3.2 Forecast Trend (2024-2032) 10.4 Italy 10.4.1 Historical Trend (2018-2023) 10.4.2 Forecast Trend (2024-2032) 10.5 Others 11 Asia Pacific Luxury Travel Market Analysis 11.1 China 11.1.1 Historical Trend (2018-2023) 11.1.2 Forecast Trend (2024-2032) 11.2 Japan 11.2.1 Historical Trend (2018-2023) 11.2.2 Forecast Trend (2024-2032) 11.3 India 11.3.1 Historical Trend (2018-2023) 11.3.2 Forecast Trend (2024-2032) 11.4 ASEAN 11.4.1 Historical Trend (2018-2023) 11.4.2 Forecast Trend (2024-2032) 11.5 Australia 11.5.1 Historical Trend (2018-2023) 11.5.2 Forecast Trend (2024-2032) 11.6 Others 12 Latin America Luxury Travel Market Analysis 12.1 Brazil 12.1.1 Historical Trend (2018-2023) 12.1.2 Forecast Trend (2024-2032) 12.2 Argentina 12.2.1 Historical Trend (2018-2023) 12.2.2 Forecast Trend (2024-2032) 12.3 Mexico 12.3.1 Historical Trend (2018-2023) 12.3.2 Forecast Trend (2024-2032) 12.4 Others 13 Middle East and Africa Luxury Travel Market Analysis 13.1 Saudi Arabia 13.1.1 Historical Trend (2018-2023) 13.1.2 Forecast Trend (2024-2032) 13.2 United Arab Emirates 13.2.1 Historical Trend (2018-2023) 13.2.2 Forecast Trend (2024-2032) 13.3 Nigeria 13.3.1 Historical Trend (2018-2023) 13.3.2 Forecast Trend (2024-2032) 13.4 South Africa 13.4.1 Historical Trend (2018-2023) 13.4.2 Forecast Trend (2024-2032) 13.5 Others 14 Market Dynamics 14.1 SWOT Analysis 14.1.1 Strengths 14.1.2 Weaknesses 14.1.3 Opportunities 14.1.4 Threats 14.2 Porter’s Five Forces Analysis 14.2.1 Supplier’s Power 14.2.2 Buyer’s Power 14.2.3 Threat of New Entrants 14.2.4 Degree of Rivalry 14.2.5 Threat of Substitutes 14.3 Key Indicators for Demand 14.4 Key Indicators for Price 15 Competitive Landscape 15.1 Market Structure 15.2 Company Profiles 15.2.1 Abercrombie & Kent Ltd. 15.2.1.1 Company Overview 15.2.1.2 Product Portfolio 15.2.1.3 Demographic Reach and Achievements 15.2.1.4 Certifications 15.2.2 Scott Dunn Ltd. 15.2.2.1 Company Overview 15.2.2.2 Product Portfolio 15.2.2.3 Demographic Reach and Achievements 15.2.2.4 Certifications 15.2.3 TUI Group 15.2.3.1 Company Overview 15.2.3.2 Product Portfolio 15.2.3.3 Demographic Reach and Achievements 15.2.3.4 Certifications 15.2.4 Tauck, Inc. 15.2.4.1 Company Overview 15.2.4.2 Product Portfolio 15.2.4.3 Demographic Reach and Achievements 15.2.4.4 Certifications 15.2.5 Lindblad Expeditions, LLC 15.2.5.1 Company Overview 15.2.5.2 Product Portfolio 15.2.5.3 Demographic Reach and Achievements 15.2.5.4 Certifications 15.2.6 Taicoa Corporation (Micato Safaris, Inc.) 15.2.6.1 Company Overview 15.2.6.2 Product Portfolio 15.2.6.3 Demographic Reach and Achievements 15.2.6.4 Certifications 15.2.7 Exodus Travels Limited 15.2.7.1 Company Overview 15.2.7.2 Product Portfolio 15.2.7.3 Demographic Reach and Achievements 15.2.7.4 Certifications 15.2.8 Travelopia Holdings Limited 15.2.8.1 Company Overview 15.2.8.2 Product Portfolio 15.2.8.3 Demographic Reach and Achievements 15.2.8.4 Certifications 15.2.9 Butterfield & Robinson Inc. 15.2.9.1 Company Overview 15.2.9.2 Product Portfolio 15.2.9.3 Demographic Reach and Achievements 15.2.9.4 Certifications 15.2.10 Globus Travel Kft. 15.2.10.1 Company Overview 15.2.10.2 Product Portfolio 15.2.10.3 Demographic Reach and Achievements 15.2.10.4 Certifications 15.2.11 Others 16 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Luxury Travel Market: Key Industry Highlights, 2018 and 2032 2. Global Luxury Travel Historical Market: Breakup by Tour Type (USD Trillion), 2018-2023 3. Global Luxury Travel Market Forecast: Breakup by Tour Type (USD Trillion), 2024-2032 4. Global Luxury Travel Historical Market: Breakup by Age Group (USD Trillion), 2018-2023 5. Global Luxury Travel Market Forecast: Breakup by Age Group (USD Trillion), 2024-2032 6. Global Luxury Travel Historical Market: Breakup by Region (USD Trillion), 2018-2023 7. Global Luxury Travel Market Forecast: Breakup by Region (USD Trillion), 2024-2032 8. North America Luxury Travel Historical Market: Breakup by Country (USD Trillion), 2018-2023 9. North America Luxury Travel Market Forecast: Breakup by Country (USD Trillion), 2024-2032 10. Europe Luxury Travel Historical Market: Breakup by Country (USD Trillion), 2018-2023 11. Europe Luxury Travel Market Forecast: Breakup by Country (USD Trillion), 2024-2032 12. Asia Pacific Luxury Travel Historical Market: Breakup by Country (USD Trillion), 2018-2023 13. Asia Pacific Luxury Travel Market Forecast: Breakup by Country (USD Trillion), 2024-2032 14. Latin America Luxury Travel Historical Market: Breakup by Country (USD Trillion), 2018-2023 15. Latin America Luxury Travel Market Forecast: Breakup by Country (USD Trillion), 2024-2032 16. Middle East and Africa Luxury Travel Historical Market: Breakup by Country (USD Trillion), 2018-2023 17. Middle East and Africa Luxury Travel Market Forecast: Breakup by Country (USD Trillion), 2024-2032 18. Global Luxury Travel Market Structure

What was the global luxury travel market value in 2023?

In 2023, the market attained a value of nearly USD 2.07 trillion.

What is the growth rate of the global luxury travel market?

The market is assessed to grow at a CAGR of 5.5% between 2024 and 2032.

What is the forecast outlook of the global luxury travel market for 2024-2032?

The market is estimated to witness a healthy growth in the forecast period of 2023-2028 to reach about USD 3.38 trillion by 2032.

What are the major market drivers?

The major market drivers are the rising disposable incomes of the young population, the increasing spending on travelling by millennials, and the surging demand for relaxing and rejuvenating luxury travel.

What are the key trends of the market?

The rising demand for personalised offerings, the growing preference for sustainable and socially responsible luxury travel, and the surging preference for offbeat high-end destinations among affluent individuals are the key trends aiding the market expansion.

What are the major regional markets of luxury travel, according to the EMR report?

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

What are the different age groups of luxury travel?

The different age groups of luxury travel are millennial (21-30 years), Generation X (31-40 Years), baby boomers (41-60 years), and silver hair (60 years and above).

Who are the key players, according to the luxury travel market report?

The major players in the market are Abercrombie & Kent Ltd., Scott Dunn Ltd., TUI Group, Tauck, Inc., Lindblad Expeditions, LLC, Taicoa Corporation (Micato Safaris, Inc.), Exodus Travels Limited, Travelopia Holdings Limited, Butterfield & Robinson Inc., and Globus Travel Kft., among others.

Purchase Options 10% off

Methodology

Request Customisation

Report Sample

Request Brochure

Ask an Analyst

( USA & Canada ) +1-415-325-5166 [email protected]

( United Kingdom ) +44-702-402-5790 [email protected]

Mini Report

- Selected Sections, One User

- Printing Not Allowed

- Email Delivery in PDF

- Free Limited Customisation

- Post Sales Analyst Support

- 50% Discount on Next Update

Single User License

- All Sections, One User

- One Print Allowed

Five User License

- All Sections, Five Users

- Five Prints Allowed

Corporate License

- All Sections, Unlimited Users

- Unlimited Prints Allowed

- Email Delivery in PDF + Excel

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.

Stay informed with our free industry updates.

We use cookies, just to track visits to our website, we store no personal details. Privacy Policy X

Press Release

Industry Statistics

- Open in new window

- GLOBAL - EN

Select your location

No results found

- Five Trends Shaping the Market (779 KB PDF)

- The Sustainability Imperative (832 KB PDF)

- Hyperpersonalization (712 KB PDF)

Future of luxury travel

The latest trends shaping the luxury travel industry.

Luxury travel providers are striving to offer the most extravagant experiences money can buy, using descriptors such as "ultra-premium," "rare," "authentic," and "exotic" to entice travelers with offerings such as private villas and private islands, as well as special chef-inspired menus and exclusive members-only options. The luxury travel industry has rebounded to pre-pandemic levels and is currently thriving, with a global market value of US$1.2 trillion in 2021 and a projected Compound Annual Growth Rate (CAGR) of 7.6% until 2030, according to market research surveys ¹ . Changing consumer preferences, influenced by social media, have heightened demand for destinations that are deemed "Instagram-worthy," increasing awareness and interest in more remote and unique locations. This three-part article series explores the most significant trends that are currently shaping the luxury travel industry. We’ll examine how sustainability and hyperpersonalization strategies may disrupt the industry, and present new opportunities for growth.

Five Trends Shaping the Market

Despite the rise of online research and travel bookings, high-end travelers are turning to luxury travel agents for unique and hassle-free travel experiences. They offer invaluable advice with knowledge of travel restrictions and health and safety guidelines, along with easy, secure payment and on-call troubleshooting before, during, and after a trip. Luxury travelers are also showing a strong preference for tech-enabled planning, booking, and post-travel experiences. To meet this rising demand, luxury travel brands need to focus on digital innovation, including virtual reality experiences, IoT-enabled in-room preferences, etc. Customer demand for one stop solutions is also leading to cross-brand alliances, enabling luxury travelers to provide unique and comprehensive experiences. By monitoring and capitalizing on emerging hospitality trends, luxury travel brands can enhance customer engagement and foster brand loyalty, while also improving their online reputation through positive reviews and word-of-mouth recommendations, leading to potential revenue growth.

Download the PDF

The Sustainability Imperative

As per a recent survey, 80% of luxury travelers said they want to travel more responsibly, with 75% willing to pay more to do so, especially if it's clear how the money will be used ² . This can be made possible by doing something as simple as booking an ecofriendly or green hotel, or as intentional as volunteering with an immersive conservation project. Efforts need to be directed to deliver true luxury while making a tangible positive difference for the local people, cultures, and environment. It’s important that luxury travel brands take conscious steps to build sustainability into their development and operations to capitalize on this opportunity.

Hyperpersonalization

In a recent survey 3 , 68% of luxury travel advisors reported that travelers are opting for experiences tailored to what they value most: longer vacations, increased privacy, and premium and high-end amenities. This has led to a surge in popularity for luxury yacht, train, and cruise options. Luxury travelers want their journey to be just as exclusive and luxurious as their destination. Many travelers are also showing a keen interest in adventure or extreme sports combined with in-depth cultural touring. In addition, experiential and high-end wellness focus tourism is gaining traction. This trend towards hyperpersonalization is transforming the luxury travel industry, as travelers seek unique and memorable experiences that are tailored to their individual preferences and desires.

Reference 1. Grand View Research, " Luxury Travel Market Size, Share & Trends Analysis Report And Segment Forecasts, 2022-2030 ," accessed March 12, 2023.

2. Virtuoso® Travel Week 2022, “ The Future of Luxury Travel ” October 20, 2022.

3. Luxury Travel Advisor, " Affluent Sentiment Study " survey of 288 luxury travel advisors, April 2022

Did you find this useful?

Thanks for your feedback

If you would like to help improve Deloitte.com further, please complete a 3-minute survey

Your feedback is important to us

To tell us what you think, please update your settings to accept analytics and performance cookies.

Related content

A world in motion.

Frontline Workers in the Transportation, Hospitality & Services Sector | Deloitte Global

Scott A. Rosenberger

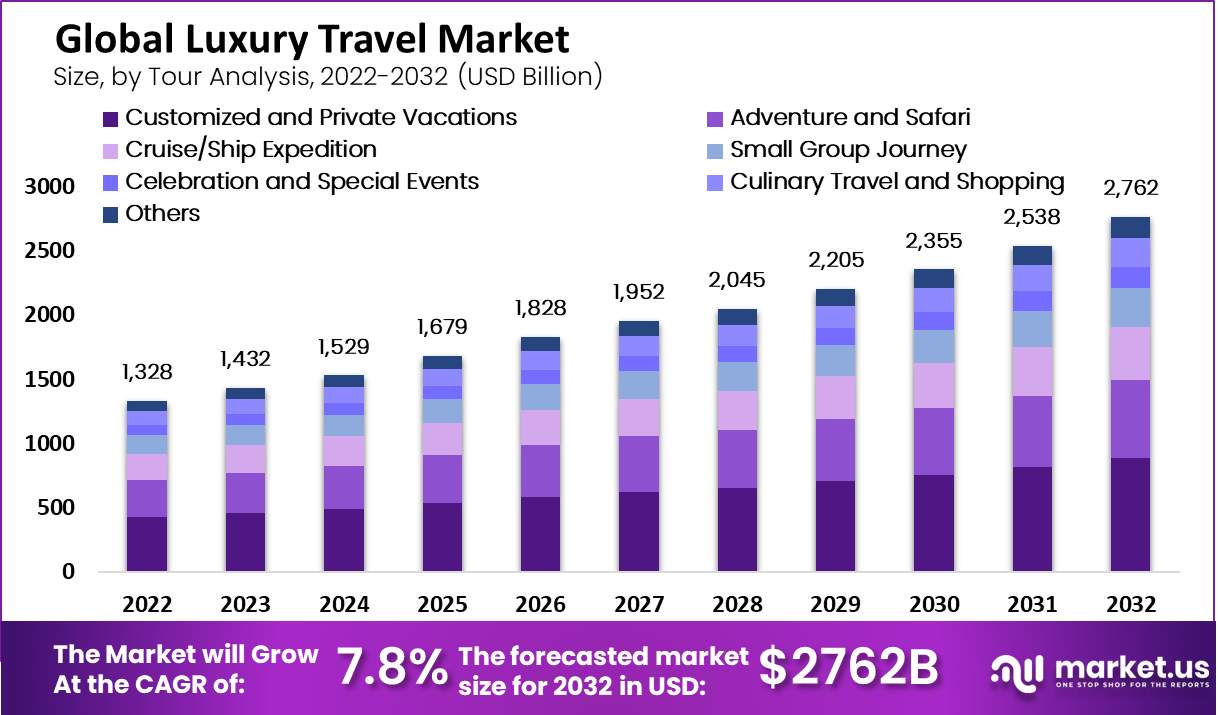

Global Luxury Travel Market Size, By Traveler (Absolute luxury, Aspiring Luxury, Accessible Luxury), By Tour (Customized & Private Vacations, Safari & Adventure, Cruises, Yachting & Small Ship Expeditions, Celebration Journeys, Culinary Travel & Shopping, Others), By Age Group (Millennials [21 – 30], Generation X [31 – 40], Baby Boomers [41 – 60], Silver Hair [60 +]), By Geographic Scope and Forecast 2022 – 2032

Global Luxury Travel Market Insights Forecasts to 2032

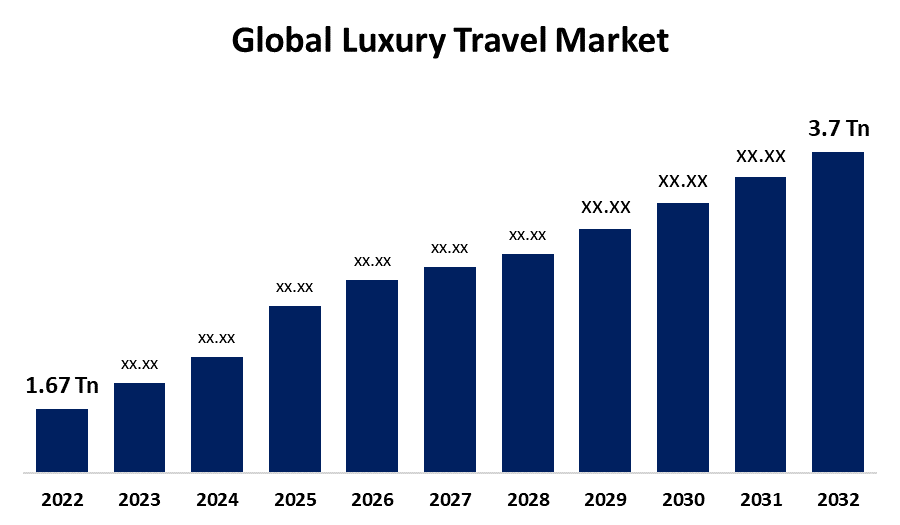

- The Global Luxury Travel Market Size was valued at USD 1.67 Trillion in 2022.

- The Market Size is Growing at a CAGR of 8.2% from 2022 to 2032

- The Worldwide Luxury Travel Market Size is expected to reach USD 3.7 Trillion by 2032

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Luxury Travel Market Size is expected to reach USD 3.7 Trillion by 2032, at a CAGR of 8.2% during the forecast period of 2022–2032.

Luxury travel is a luxurious and exclusive niche of the tourist business that offers discerning travelers who demand extraordinary and extravagant interactions. Private aircraft, luxury hotel stays, and exclusive excursions are all examples of luxury travel, as are private yacht charters, bespoke itineraries, and VIP access to cultural events. The vendors of services strive to give exceptional services to their customers. Nowadays, travelers focus on exploring destinations in order to get cultural, culinary, and other experiences. Numerous individuals are becoming more inclined toward one-of-a-kind excursions that involve cultural visits, sailing, and thrilling adventures to acquire a valuable and lasting experience. The luxury travel business has emerged as one of the fastest-expanding sectors, greatly contributing to global financial expansion and development. Increased disposable income and upper-middle-class spending have increased demand for improved service standards. Furthermore, the increasing popularity of remote employment and freelance work allows tourists to explore luxury destinations without disrupting their day-to-day jobs, which contributes to the expansion of extended-stay luxury experiences.

Market Outlook

Luxury Travel Market Price Analysis

The luxury travel market's price analysis revolves around the distinctive pricing dynamics of high-end travel experiences. Luxury travelers demand exceptional quality, personalized services, and exclusive access. Pricing factors in this segment encompass luxury accommodations, private transportation, gourmet dining, and tailored experiences. Seasonality, destination, and demand fluctuations play a crucial role in determining prices. Luxury travel providers must balance opulence with value to cater to discerning clientele while ensuring profitability. Ensuring transparent pricing and delivering an unparalleled experience is key to success in the luxury travel market, where clients expect nothing short of the extraordinary.

Luxury Travel Market Distribution Analysis

The worldwide luxury travel industry distribution analysis indicates a complex network that caters to discerning tourists seeking exclusive and high-end experiences. Typically, luxury travel is distributed through specialized channels such as luxury travel agencies, tour operators, and high-end concierge services. These middlemen create customized itineraries and offer tailored services to fulfill the specific needs of affluent guests. Luxury travel offerings are also distributed through online platforms, particularly upmarket travel websites and apps. Hotels, airlines, and cruise companies frequently work with travel agencies to ensure that their premium services are distributed seamlessly. Overall, luxury travel distribution focuses on producing unique, bespoke vacations for the world's elite passengers.

Global Luxury Travel Market Report Coverage

Market Dynamics

Luxury Travel Market Dynamics

Growing affluence and aspirational travel

The increasing global affluence, especially in emerging economies, has given rise to a burgeoning segment of travelers seeking luxury experiences. As disposable incomes rise, so does the aspiration for exclusive and high-end travel. This driver propels the luxury travel market as more travelers have the means and desire to indulge in premium experiences. It creates a larger customer base, leading to the development of new luxury destinations, accommodations, and services to cater to this demand.

Customization and experiential travel

Modern luxury travelers are increasingly seeking unique and personalized experiences. They prioritize authenticity, cultural immersion, and tailor-made itineraries over standardized packages. This shift drives the industry towards offering highly customized and experiential travel. Luxury providers must adapt by curating authentic and exclusive experiences, from boutique hotels to cultural tours, to meet the demands of this discerning clientele. This trend not only attracts more customers but also fosters brand loyalty and positive word-of-mouth recommendations, further stimulating market growth.

Restraints & Challenges

Economic and geopolitical uncertainties

The luxury travel market is sensitive to economic fluctuations and geopolitical uncertainties. Economic downturns or political instability in key source markets can affect travelers' disposable income and willingness to spend on luxury experiences. During such periods, luxury travel may witness reduced demand as consumers prioritize essentials over indulgent travel. Luxury providers need to adapt by offering value-added services or diversifying their target markets to mitigate the impact of economic and geopolitical uncertainties.

Regional Forecasts

Europe Market Statistics

Europe is anticipated to dominate the luxury travel market from 2023 to 2032. Europe is a prominent destination for luxury travel, renowned for its rich history, diverse cultures, and opulent experiences. Major European cities like Paris, Rome, London, and Barcelona offer luxury travelers a wealth of historical sites, fine dining, and high-end shopping. Luxury resorts in the Mediterranean, alpine ski destinations, and exclusive spas are also popular choices for affluent travelers. The region's well-preserved heritage, world-class services, and accessibility make it a top choice for luxury tourism.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. Asia Pacific is increasingly becoming a sought-after region for luxury travel. Countries like Japan offer a blend of ancient traditions and modern luxury, while destinations in Southeast Asia, such as Bali, Thailand, and the Maldives, provide tropical paradises with upscale resorts. The rising affluence in countries like China and India has led to a growing demand for premium travel experiences. Additionally, Asian destinations are known for their unique cultural experiences and exquisite cuisine, making the region appealing to luxury travelers.

Segmentation Analysis

Insights by Travel

The safari and adventure segment accounted for the largest market share over the forecast period 2023 to 2032. The aspiring luxury class primarily consists of the millennial age, who opt for short, luxury travel due to their moderate money. This sector also includes the 'newly rich,' who are eager to invest in the luxury travel business and are the market leaders in this segment. While they have a lot of money to spend, they don't go all out for luxury services. Aspiring luxury prefers rare and distinctive shopping destinations, especially those in foreign countries. This group consists of young, aspiring people who make a lot of money and have little obligations to their families. Increasing numbers of aspiring luxury travelers are expected to augment the expansion of the luxury travel industry throughout the predicted time frame.

Insights by Tour

The aspiring luxury segment accounted for the largest market share over the forecast period 2023 to 2032. This is because luxury travelers aspire to acquire more about the local culture and experience a sense of adventure, the environment, historical infrastructure, and a less congested atmosphere. Luxury tents, sometimes known as "Glamping" accommodations, are typically utilized for excursion groups such as safaris or outdoor-focused excursions. These tents are often outfitted with modern conveniences such as private toilets and showers, as well as gorgeous teak floors. Luxury safari tours typically include an on-site personal guide for the duration of the journey.

Insights by Age Group

The baby boomers (41 – 60) segment accounted for the largest market share over the forecast period 2023 to 2032, driven by growing preference of baby boomers to travel with family and friends. This demographic tends to spend more on luxury vacations in order to stay healthy, relax, and socialize. This generation is wealthier, has greater freedom than previous generations, and is more likely to spend money on leisure. They travel four to five times per year on average, which is an important factor for the luxury travel market growth.

Competitive Landscape

Major players in the market

- TCS World Travel

- Butterfield & Robinson Inc.

- Cox & Kings Ltd.

- Scott Dunn Ltd.

- Kensington Tours

- Zicasso, Inc.

- Abercrombie & Kent USA, LLC

- Lindblad Expeditions

- Geographic Expeditions, Inc.

- Micato Safaris

- Exodus Travels Limited

- Travelopia Holdings Limited

- Travel Edge (Canada) Inc.

Recent Market Developments

- On October 2023, TJH announced a strategic alliance with Inspirato Incorporated, the unique luxury travel subscription company. As part of the agreement, Inspirato will provide TJH clients with a complimentary 12-month Inspirato Travel Membership. This membership permits clients to book travel within Inspirato's handpicked collection of 750+ luxury vacation options in 100+ locations worldwide at members-only rates.

- On August 2023, VOMOS, a forerunner in the luxury travel industry, has announced its latest collaboration with Summit Black Car, a leading provider of elite transportation services. This collaboration intends to reimagine premium travel experiences for Colorado residents and visitors. This strategic placement assures that passengers, no matter where they are, may enjoy the unrivaled ease of quick and elegant transportation, even for last-minute reservations.

- On December 2022, Marriott International, Inc. has announced plans to open more than 35 luxury hotels by 2023, providing the unique and profound experiences that today's premium traveler seeks. Marriott International continues to push the boundaries, reimagining travel with a globally inspired perspective that defines the future of luxury, with a portfolio of luxury brands that includes The Ritz-Carlton, Ritz-Carlton Reserve, St. Regis, W Hotels, The Luxury Collection, EDITION, JW Marriott, and Bulgari Hotels & Resorts.

- Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Luxury Travel Market, Traveler Analysis

- Absolute luxury

- Aspiring Luxury

- Accessible Luxury

Luxury Travel Market, Tour Analysis

- Customized & Private Vacations

- Safari & Adventure

- Yachting & Small Ship Expeditions

- Celebration Journeys

- Culinary Travel & Shopping

Luxury Travel Market, Age Group Analysis

- Millennials [21 – 30]

- Generation X [31 – 40]

- Baby Boomers [41 – 60]

- Silver Hair [60 +]

Luxury Travel Market, Regional Analysis

- North America

- Rest of Europe

- Asia Pacific

- South Korea

- Rest of Asia Pacific

- South America

- Middle East & Africa

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

- 1. What is the market size of the luxury travel market? The global luxury travel market is expected to grow from USD 1.67 Trillion in 2023 to USD 3.7 Trillion by 2032, at a CAGR of 32.5% during the forecast period 2023-2032.

- 2. Who are the key market players of the luxury travel market? TUI Group, TCS World Travel, Butterfield & Robinson Inc., Cox & Kings Ltd., Scott Dunn Ltd., Kensington Tours, Zicasso, Inc., Abercrombie & Kent USA, LLC, Lindblad Expeditions, Geographic Expeditions, Inc., Micato Safaris, Exodus Travels Limited, Travelopia Holdings Limited, Travel Edge (Canada) Inc.

- 3. Which segment holds the largest market share? Aspiring Luxury segment holds the largest market share and is going to continue its dominance.

- 4. Which region is dominating the luxury travel market? Europe is dominating the luxury travel market with the highest market share.

- Single User: $3550 Access to only 1 person; cannot be shared; cannot be printed

- Multi User: $5550 Access for 2 to 5 users only within same department of one company

- Enterprise User: $7550 Access to a company wide audience; includes subsidiary companies or other companies within a group of companies

Premium Report Details

15% free customization.

Share your Requirements

We Covered in Market

- 24/7 Analyst Support

- Worldwide Clients

- Tailored Insights

- Technology Evolution

- Competitive Intelligence

- Custom Research

- Syndicated Market Research

- Market Snapshot

- Growth Dynamics

- Market Opportunities

- Regulatory Overview

- Innovation & Sustainability

Connect with us

- smartphone USA- +1 303 800 4326

- smartphone APAC- +91 9561448932

- email [email protected]

- email [email protected]

Need help to buy this report?

- +1-773-382-1049

- +91-81800-96367

- [email protected]

- Visit Our Office

- Introspective Market Research | Global Market Research Reports

- Luxury Travel Market- Global Industry Growth and Trend Analysis

Luxury Travel Market Size By Type Of Tour (Adventure & Safari, Customized & Private, Celebration & Special Events, Cruise/Ship Expedition, Others), Age Group (Millennial, Generation X, Baby Boomers) And Region Global Market Analysis And Forecast, 2023-2030

- Report ID : 16465

- Category : Public Transport

- No Of Pages : 218

- Published on : November 2022

- Status : Published

- Table Of Content

- Table of Figures

- Segmentation

- Request sample

Global Luxury Travel Market Overview

The Global Luxury Travel Market size is expected to grow from USD 1.57 billion in 2022 to USD 3.29 billion by 2030, at a CAGR of 9.7% during the forecast period (2023-2030).