- Hospitality Industry

Hospitality Industry statistics to have on your radar 2024

November 01, 2023 •

11 min reading

The hospitality industry is a vast sector with many different categories that include recreation, lodging, entertainment, food and beverage which are constantly evolving. Due to the overwhelming amount of data available today, it has become increasingly challenging for industry players to gather all the necessary hospitality statistics to keep up with the latest trends. As a result, staying informed and up-to-date has become an impossible task.

Despite being an exhilarating career path with many avenues which demand a diverse skill-set , the hospitality industry is currently struggling to fill open positions. This is partly due to the changing nature of jobs and employee expectations. Customer needs and expectations have also evolved in recent times, largely off the back of the global pandemic of 2020 and 2021 which spurred a seismic shift in industry trends .

In the absence of access to data which tells a story, industry players are finding it increasingly challenging to optimize their social and digital strategies. This is especially problematic for hoteliers and destination marketers who are already overwhelmed with their day-to-day responsibilities.

In this comprehensive article, we have gathered a wealth of hospitality statistics and data that will equip you with the insights you need. Our goal is to empower you to harness the power of analytics in the hospitality industry to drive innovation, exceed customer expectations, and achieve remarkable value.

Numbers to take your business to the next level

Trends in the hospitality industry have always been in a state of flux because client demands are always shifting.

Understanding hospitality industry statistics allows you to properly equip yourself to handle your changed client needs for your business to grow rapidly in this new environment. They will help you know what you need to do to succeed and come up with strategies to take your business to the next level.

Current state of the Hospitality Industry

By examining general statistics, you can gain insights into the present condition of the hospitality industry and gain a glimpse into its future.

- The travel industry is poised for a robust comeback

- in 2024, bringing a ray of hope for hoteliers who have been eagerly awaiting positive signs. Room demand is set to reach an all-time high in 2024. STR, via (CoStar).

- Hotel occupancy will increase 2.5% globally next year.

- Hotel average daily rate (ADR) is projected to grow by 4.9% in the next 12 months. ( Siteminder).

The industry anticipates a steady growth rate

Industries such as hospitality, which were affected by COVID-19 safety measures, are seeing some impressive growth rates now that the restrictions are being relaxed worldwide. The statistics below indicate just how impressive the current and future growth rates are.

- The hospitality industry experienced a remarkable growth from $4,390.59 billion in 2022 to $4,699.57 billion in 2023, achieving a compound annual growth rate (CAGR) of 7.0%. This significant expansion is a testament to the industry's resilience and ability to bounce back from the challenges posed over recent years. ( Hospitality Global Market Report 2023)

- The projected growth of the global hospitality market is set to soar to a staggering $5,816.66 billion by 2027, with a remarkable compound annual growth rate (CAGR) of 5.5%. ( Hospitality Global market report 2022 )

Growth trends in specific sub-sectors

Due to changes in consumer expectations, preferences and the rapid advancement of technology (among other factors), some areas in the hospitality industry are seeing a bigger growth rate than others. The statistics below shed light on these areas.

- The Online Food Delivery Market, which includes both Grocery Delivery and Meal Delivery services, experienced significant growth during the COVID-19 Pandemic. This market is projected to continue its upward trajectory with a compound annual growth rate (CAGR 2023-2028) of 11.47%. As a result, the market volume is expected to reach a staggering US$1.79tn by 2028. (Statista).

- The bleisure market continues to rise —business trips which are extended for leisure purposed. The bleisure tourism market was estimated to be valued at nearly US$ 594.51 billion in 2023, and is predicted to continue to grow to $731.4 billion by 2032, with a CAGR of 8.9% from 2023 to 2032. ( Future Market Insights).

- The global health and wellness market is estimated to reach almost seven trillion U.S. dollars by 2025. (Statista).

Key stakeholders' market share and consumer influence

Similar to the different growth rates in different areas in the same hospitality industry, not all players in the industry saw the same changes or are seeing the same growth rate. This is due to size, services, products and way of doing business. The statistics below highlight these differences.

- Airbnb's market value reached $92.11 billion in U.S. dollars in 2023, representing a significant increase from $54.13 billion the previous year. However, it has experienced a decline from its peak valuation in 2021, surpassing a staggering $100 billion. (Statista).

- Airbnb holds a commanding market share of over 20% in the vacation rental industry but it seems to be declining due to rising rental pricing and overwhelming choice of properties. ( HelpLama).

- Booking.com is the most valuable travel and tourism brand in the world, with a market capitlization of $9B. ( Companies Market Cap).

- As of 2023 Hilton is the most valuable hotel brand in the world, with a brand value of $11.7B in 2023, although the Wyndam group has the most properties. ( Brand Directory) .

- It is estimated that a further 2,707 hotels will open their doors globally in 2024. ( Statista )

Jobs & employment in Hospitality & Leisure

It goes without saying that as travel died down during the pandemic, so did jobs in the hospitality industry. Whilst travel restrictions are firmly a thing of the past, the hospitality jobs market has been slow to bounce back and is still recovering now. Many of those laid off workers in 2020 found more reliable jobs with better perks and more sociable hours elsewhere. When should we expect a full recovery? The statistics answer these questions best.

- The Travel and Tourism sector is expected to employ approximately 320 million individuals in 2023, showcasing a steady growth trend after experiencing a decline in numbers in 2020. This decline saw employment figures drop from 334 million in 2019 to 271 million. However, the industry is now on the path to recovery, with employment opportunities steadily increasing once again. ( Unilever ).

- Discover the types of jobs available in this exciting growth sector.

- Hotels will struggle with staffing shortages until 2025 when the industry is expected to make a true adjusted recovery. ( STR and Tourism Economics )

- Only 28% of hospitality workers are on full-time hours. ( Labour Market Insights) .

Travel & Tourism

If 2022 was the year travel returned following the pandemic, 2023 was all about making up for lost time and ticking off bucket list items. In short, there's a healthy outlook to the travel and tourism sector in 2024 and beyond. To better understand the current changes and future of travel and tourism, we have compiled the statistics below.

General Travel & Tourism industry statistics

The general travel and tourism statistics below show the current and future state of the travel and tourism sector as a whole.

- The projected market volume is set to reach an impressive US$1,063.00 billion by 2028, with revenue expected to display a steady annual growth rate (CAGR 2023-2028) of 4.42%. ( Statista ).

- By 2028, online sales are projected to account for a staggering 76% of total revenue in the Travel & Tourism market. (Statista).

Growth trends in specific areas

The growth of the travel and tourism sector has been influenced by several factors including ease of access to information, an increase in the amount of paid leave, and rapid urbanization among others. Despite the pandemic slump, the industry is now doing well and is projected to do even better over the next few years, as indicated by the following statistics.

- Global tourism expenditure is projected to reach USD2 trillion, surpassing previous records driven by the strong demand for leisure travel. ( Euromonitor International ).

- As employees strive for a better work/life balance, the resurgence of business travel becomes a more intricate affair. In line with this shift, bleisure travel is poised to make a significant impact, with predictions indicating that it will soar to an impressive USD300 billion by 2024. This trend highlights the growing desire among professionals to combine work and leisure, creating a unique and enriching travel experience. ( Euromonitor International ).

- These 5 countries will be the fastest growing tourism destinations in 2024: Tunisia, Mexico, Morocco, Dominican Republic, and Sri Lanka. (Travel Off Path) .

Domestic vs. international travel

The statistics below help to better understand the "new traveler" whos is most likely planning 2 domestic trips and 2 international trips in 2024.

- International travel has rebounded post pandemic however going forward into 2024 it's clear that whilst consumer sentiment is very much in favor of international travel, domestic travel is much more budget friendly. ( Travel + Leisure ).

- Global business travel will fully recover by 2024. It is forecast to increase by 14% in 2022, with the US and China seeing the largest growth (30% each). ( Leslie Josephs )

Air, cruise & ground transport

The widespread adoption of the internet as a source of information, the ease of mobility and increased awareness of new destinations have brought significant changes to how consumers travel. The statistics below show how much travel has changed and what to expect.

- Global flight numbers were still below pre-pandemic levels at the end of 2023. According to the International Air Transport Association, global airlines anticipate that approximately 4.35 billion individuals took flights in 2023, a slight decrease from the 4.54 billion flyers in 2019.

- In the global airline industry, it was anticipated that 2023 brought in net profits of $9.8 billion, although these profits will come with a razor-thin net profit margin of 1.2%. ( Mint )

- Rail transport is set to experience exponential growth in 2024, emerging as the fastest-growing travel category worldwide with an impressive growth rate of 35.6% over the course of 2023-2024. ( Euromonitor International ).

- According to some travel experts, fly-to-the-meeting and fly-back-from-the-meeting day trips will stop being popular as more people prefer multi-day bleisure trips. ( SAP Concur Study of Global Business Traveler )

Jobs & employment in Travel & Tourism

As it was with all other sectors and industries, the travel and tourism sector experienced a labor shortage in 2023, but will it continue?

- Jobs in travel and tourism were still below pre-pandemic levels at the end of 2023 at a projected 320 million jobs. But with the growing demand for travel, jobs in this sector are set to rise to 430 million by 2033. ( Statista ).

- Candidates for these open positions have different expectations and priorities compared to those before the pandemic. They expect flexible working arrangements, skills training, and diversity and inclusion. Hotels will have to adapt to fill open positions. ( AHLA )

- New positions are opening up that are centred around digitalization, technology and sustainability .

Demographic statistics: Who's travelling in 2024?

Different segments play different roles in the travel and tourism industry. To fine-tune your digital strategy, you have to know your target market well and understand what they expect when they travel. Here are a few stats that show some key domgraphics that may be relevant to your business.

- In the modern era, travel has become increasingly digitalized, with 67% of consumers projected to make their travel bookings online in the year 2024.

- An interesting trend among post-pandemic travelers is the shift towards a younger demographic, with millennials (aged 30-44) comprising the largest portion of Wellness Worshippers, Leisure Seekers, Luxury Seekers, and Digital Travelers, as revealed by Euromonitor's Voice of the Consumer: Travel Survey. This highlights the changing preferences and behaviors of travelers in the modern era.

- Luxury Seekers are most commonly found in countries across the Middle East and Asia Pacific, while Eco-Adventurers tend to be prevalent in both Asia Pacific and Europe. On the other hand, Cultural Explorers are predominantly found in various countries throughout Europe.

- There is expected to be a 15% growth in sales of sports tourism packages sold through travel intermediaries from 2023 to 2024. ( Euromonitor International ).

Hospitality & Travel is evolving at speed

In 2024, the hospitality and travel sectors will be evolving at a rate of knots. Vacant positions and shifting consumer preferences define the landscape. Seamless online booking is now a necessity, just the beginning of a guest-centric approach. Elevating the experience means personalized on-site services, setting leaders apart.

Yet, beyond technology lies a deeper need—embracing diversity and inclusion as fundamental values. To cater to the evolving traveler, a blend of high-tech solutions and high-touch experiences aligning with their beliefs is vital. Statistics serve as signposts in this transformative journey. Adaptability is the key to survival, while a comprehensive guest journey and commitment to diversity steer success.

Amidst change, strategies demand recalibration. Embrace adaptability, shape a holistic guest experience, and embed diversity and inclusion into your brand. These principles navigate the industry toward leadership in the evolving hospitality and travel landscape of 2024.

Keep reading

The future of luxury experiences: Where luxury meets hospitality

Apr 09, 2024

The potential of green financing for hotel real estate in Asia

Apr 04, 2024

The future of hotel distribution channels: Seizing opportunity in channel disruption

Apr 03, 2024

This is a title

This is a text

More articles on trends and strategy

- Bachelor Degree in Hospitality

- Pre-University Courses

- Master’s Degrees & MBA Programs

- Executive Education

- Online Courses

- Swiss Professional Diplomas

- Culinary Certificates & Courses

- Fees & Scholarships

- Bachelor in Hospitality Admissions

- EHL Campus Lausanne

- EHL Campus (Singapore)

- EHL Campus Passugg

- Host an Event at EHL

- Contact our program advisors

- Join our Open Days

- Meet EHL Representatives Worldwide

- Chat with our students

- Why Study Hospitality?

- Careers in Hospitality

- Awards & Rankings

- EHL Network of Excellence

- Career Development Resources

- EHL Hospitality Business School

- Route de Berne 301 1000 Lausanne 25 Switzerland

- Accreditations & Memberships

- Privacy Policy

- Legal Terms

© 2024 EHL Holding SA, Switzerland. All rights reserved.

See how Cvent can solve your biggest event challenges. Watch a 30-minute demo.

What Is the Hospitality Industry? Your Complete Guide

What does hospitality mean? What is the hospitality industry, exactly? Where and how did it begin? This post answers all those questions and more as we explore the past, present, and future of hospitality. As we dive deeper into what the industry entails, you’ll discover how hospitality impacts employers, employees, economies, consumers, the environment, and so much more. Whether you’re curious about which businesses are part of the industry, what they do, or how to start a career in hospitality, you’ve come to the right place.

What is the hospitality industry?

The hospitality industry is a massive business sector. Casting a broad umbrella, it encompasses all economic and business activities that rely upon or contribute to travel and tourism. Hospitality-focused businesses like hotels and travel agencies contribute directly by providing essential services that enable travel and tourism. Suppliers, transportation services, and catering companies may indirectly contribute by delivering the goods and services necessary to keep the industry running; however, they do not solely rely on hospitality for their revenue.

Because the hospitality industry is so expansive, it includes a diverse spectrum of companies, businesses, and experts. Even with so much variety, most hospitality businesses fall into one of four categories.

1. Travel & tourism (T&T)

Although many people think travel and tourism are synonymous with hospitality, that’s not quite the case. More accurately, T&T is a specific category within the hospitality industry. It includes airlines, shuttle services, travel agents, destination marketing organizations (DMOs) , and other businesses or services that help facilitate the physical travel necessary for tourism. Those working in T&T help drive tourists, workers, and businesses to new destinations.

2. Accommodation

One of the largest and most diverse parts of the hospitality industry is the accommodation sector, which includes everything from lodging to event grounds and special event venues. Numerous different types of hotels and venues fall into this sector, including:

- Chain hotels

- Extended stay properties

- Boutique hotels

- Conference and convention centers

- Wedding venues

- Casinos/casino suites

3. Food & beverage (F&B)

Most hotels and resorts offer their guests some form of food or dining option. Whether operating a café, buffet breakfast, or full-service restaurant, food and beverage services are integrated directly into many hospitality-based businesses. Stand-alone F&B providers, like restaurants or food trucks, operate independently, but they also have a part to play in the local hospitality scene.

Event catering, quick-service establishments, full-service restaurants, and limited-service F&B are powerful revenue drivers contributing to the hospitality industry. In addition to serving in-house hotel guests, F&B is a critical component of meetings and events, from private parties, like birthdays or weddings, to large-scale corporate events .

4. Recreation & entertainment

Because businesses in the hospitality industry often rely on consumers’ disposable income, they market to customers’ desire for entertainment that refreshes the mind, body, and spirit. In addition to lodging, travel services, and culinary delights, hospitality is full of indoor and outdoor recreation.

Bars, nightclubs, theaters, stadiums, museums, zoos, and other attractions often act as special event venues and tourist attractions, helping to drive a destination’s economy . Spectacular outdoor spaces, including our national and state parks , attract travelers from near and far to feed their local markets.

Whether providing a memorable meal or a relaxing day at the spa, the true purpose of hospitality is to ensure that the customer has an enjoyable experience —whatever they do.

But how did it all get started? How far back do the roots of the hospitality industry actually go?

When did the hospitality industry begin?

Although hospitality doesn’t have a designated start date, its traditions date back thousands of years. Ancient symbols of hospitality exist worldwide, with the oldest signs discovered in French caves dating back to 15,000 BCE . Historians and archeologists believe early humans designed the caves to welcome guests and greet visiting tribes.

Xenia, a phrase translating to “the sacred rule of hospitality,” is another early sign of the tradition. In ancient Greece, the custom expressed the law or expectation that hosts would offer protection and kindness to strangers . The Greeks understood that a satisfactory hospitality experience relied on hosts respecting their guests and vice versa. Furthermore, they believed displaying proper hospitality was “fundamental to human civilized life.” Modern hospitality may not look like it did thousands of years ago, but its purpose remains the same.

Is the hospitality industry growing?

Pre-pandemic, the hotel and motel industries (i.e., hospitality) employed approximately 173 million workers . In our primarily post-pandemic world, the hospitality industry and its partners remain massive global employers. 2022 brought 22 million new jobs to the sector, representing an almost 8% increase since 2021. In 2023, the hospitality positions accounted for one of every ten available jobs .

Although many hospitality-focused businesses (e.g., hotels and restaurants) still face staffing shortages , the industry remains one of the largest global employment sectors. From 2022-2023, the international hospitality industry’s value grew at a compound annual growth rate of 7% . The rebound illustrates consumers’ desire to travel again and return to in-person events after restrictions were lifted. Paralleling this demand increase, the World Travel and Tourism Council estimates that the hospitality industry will create 126 million more jobs by 2032 .

How does the hospitality industry impact the environment?

In 2022, the hospitality industry was responsible for approximately 1% of global carbon emissions . Single-use plastics, high water consumption, energy usage, and excess waste are just a few ways hotels negatively affect their local environment and the overall climate.

To demonstrate a commitment to sustainability , social responsibility, and shifting consumer preferences, the industry is becoming greener through robust global initiatives and innovative day-to-day practices, like these eco-friendly hotel ideas . As consumer attitudes towards environmental conservation and sustainability strengthen, being eco-friendly is no longer optional for most businesses; it’s necessary.

Why work in hospitality?

If you enjoy making other people happy, hospitality might be right for you. It’s an industry where employees work together to create a welcoming atmosphere, satisfy customers, impress hotel guests , and create an exceptional visitor experience. With hotel, events, dining, planning, travel, custom service, and a wide variety of other roles available, there’s an opportunity for every worker and every personality type.

Hospitality is also a dynamic, fast-paced, and ever-changing field. Just as every guest is different, so is every day working in the industry. Whether working in a hotel or nightclub, you get to encounter diverse types of people with varying backgrounds from all over the world. As you connect with various guests and strive to meet their needs, you’ll get exposed to new cultures and expand your life experience.

Additionally, hospitality offers more flexible scheduling than many other industries, as hospitality businesses often operate outside of traditional 9 a.m. to 5 p.m. office hours. Many young people flock to hotels, restaurants, and similar businesses because of the work-life balance they provide. Working in the industry also comes with a diverse range of perks, such as discounted travel, competitive pay rates, and numerous opportunities to advance your career.

Become an expert on all things hospitality

How do you get a job in the hospitality industry?

There are many different paths you can take to begin a hospitality career. While some employees start at an entry-level position and work up the ranks, others translate their past professional experience into a hospitality-focused career. Increase your chances of building a successful career in the hospitality industry by:

1. Identifying which hospitality sector best suits you

The hospitality industry includes diverse careers and professions, making it an excellent sector for workers with various skills and personality types. Whether you’re an introvert who prefers to work alone or a bubbly, conversational individual, hospitality has something for everyone. If you want to work in a hotel, consider which department or position best fits you.

- Front desk: Front-facing, customer-focused positions, great for outgoing personality types

- Housekeeping: Back-of-the-house positions, perfect for task-oriented or meticulous employees

- F&B: Front-facing and back-of-house positions available, often working in a busy, high-stress environment

- Maintenance: Skill-based and goal-focused positions that require big-picture thinkers with excellent task-management skills

- Meetings and events: A range of primarily forward-facing positions available for event planners, organizers, coordinators, and more

2. Knowing where to look

As customer service lies at the heart of hospitality, it’s common for professionals to turn to members of their local network for references, recommendations, and referrals. Many entry-level hospitality jobs are shared through local and employee referrals, the hiring manager’s professional network, or an individual’s social media accounts.

If you already know where you want to work, get to know the people there. Introduce yourself to the management team at hotels, restaurants, and other venues that interest you. If you’re not sure where to start, there are a variety of hospitality employment resources available, including:

- Online advertisements. Online job ads are especially beneficial if you’re new to the industry or a particular destination. If you lack first-person word-of-mouth recommendations, breaking into your local industry may feel intimidating. Keep an eye out for online ads on job boards, local news sites, and search engine results to streamline your search.

- Social media pages. Follow venue Facebook pages, join local hospitality groups, and keep a close eye on the Instagram pages of the hotels or destinations where you want to work. Regularly check social media, scanning for links to external job sites or brand listings.

- Hospitality Online

- iHireHospitality

- Hospitality Crossing

- Hospitality Confidential

- Wyndham Careers

- Hyatt Careers

- Marriott International Careers

- Jobs at Hilton

- IHG Careers

- Accor Careers

- OYO Careers

- Staffing agencies. Staffing and temporary work agencies are fantastic resources for helping individuals get their foot through the door. Although there are various hospitality-specific staffing agencies, like Hospitality Staffing Solutions , it’s also common for local staffing agencies to work directly with nearby hotels as they help fill entry-level positions in guest service, housekeeping, maintenance, and other departments.

3. Expanding your hospitality knowledge

Become a go-to person for all things hospitality, from industry trends to the latest marketing techniques. Stay current on the latest to remain relevant in an increasingly competitive field.

4. Keeping up with industry certifications

Having credentials can significantly impact how quickly you land your dream travel job. Show other hospitality professionals that you’re serious about a career in the industry by holding various certifications, like HubSpot Academy’s Inbound Marketing Certification , a certificate in hospitality revenue management (CRHM), or ServSafe certifications for those involved on the F&B side.

5. Determining your career path

After exploring the wide and wonderful world of hospitality, pick a career path you’re enthusiastic about. Instead of thinking about where to start, consider where you’d like to go in the industry. Visualizing where you want to end up can help determine which steps you should take to advance your career down a path that speaks to you.

Now you know what the hospitality industry is and why it matters!

With a better understanding of how far hospitality extends and its immense influence worldwide, it’s easy to see why the industry is growing. To learn more, join us as we examine the most significant trends impacting the hospitality industry in 2023 .

Kim Campbell

Kim is a full-time copy and content writer with many years of experience in the hospitality industry. She entered the hotel world in 2013 as a housekeeping team member and worked her way through various departments before being appointed to Director of Sales. Kim has championed numerous successful sales efforts, revenue strategies, and marketing campaigns — all of which landed her a spot on Hotel Management Magazine’s “Thirty Under 30” list.

Don’t be fooled though; she’s not all business! An avid forest forager, post-apocalyptic fiction fan, and free-sample-fiend, Kim prides herself on being well-rounded.

More Reading

24 ai marketing tools to elevate your business, developing a hotel room block strategy, hotel information security: a guide to threats and prevention.

Subscribe to our newsletter

When you walk into your hotel, the staff will greet you by name, know your travel preferences, and anticipate your needs. Almost every aspect of your stay will be personalized to your tastes, and you can reconfigure your room at any time to make it suitable for work, exercise, socializing, or sleep. For all leading hotel brands, the well-being of both guests and employees—and the health of the planet—will be top priorities. Welcome to the hospitality industry’s next normal.

The view to 2030 and beyond

Hospitality that benefits people and the planet, more on the future of travel and hospitality.

Three innovations to solve hotel staffing shortages

Travel startups: Disruption from within?

The path toward eco-friendly travel in China

Accelerating the transition to net-zero travel

How to ‘ACE’ hospitality recruitment

Rebooting customer experience to bring back the magic of travel

The next normal explores the future of grocery, college, video entertainment, and more., latest editions of the next normal, the future of biotech: ai-driven drug discovery, could this be a glimpse into life in the 2030s, the future of video entertainment: immersive, gamified, and diverse.

The magazine of Glion Institute of Higher Education

- What is tourism and hospitality?

Tourism and hospitality are thriving industries encompassing many sectors, including hotels, restaurants, travel, events, and entertainment.

It’s an exciting and dynamic area, constantly evolving and adapting to changing customer demands and trends.

The tourism and hospitality industry offers a diverse range of career opportunities that cater to various interests, skills, and qualifications, with positions available from entry-level to executive management.

The booming tourism and hospitality industry also offers job security and career growth potential in many hospitality-related occupations.

What is tourism?

Tourism is traveling for leisure, pleasure, or business purposes and visiting various destinations, such as cities, countries, natural attractions, historical sites, and cultural events, to experience new cultures, activities, and environments.

Tourism can take many forms, including domestic, or traveling within your country, and international tourism, or visiting foreign countries.

It can also involve sightseeing, adventure tourism , eco-tourism, cultural tourism, and business tourism, and it’s a huge contributor to the global economy, generating jobs and income in many countries.

It involves many businesses, including airlines, hotels, restaurants, travel agencies, tour operators, and transportation companies.

What is hospitality?

Hospitality includes a range of businesses, such as hotels, restaurants, bars, resorts, cruise ships, theme parks, and other service-oriented businesses that provide accommodations, food, and beverages.

Hospitality is all about creating a welcoming and comfortable environment for guests and meeting their needs.

Quality hospitality means providing excellent customer service, anticipating guests’ needs, and ensuring comfort and satisfaction. The hospitality industry is essential to tourism as both industries often work closely together.

What is the difference between tourism and hospitality?

Hospitality and tourism are both related and separate industries. For instance, airline travel is considered as part of both the tourism and hospitality industries.

Hospitality is a component of the tourism industry, as it provides services and amenities to tourists. However, tourism is a broader industry encompassing various sectors, including transportation, accommodation, and attractions.

Transform your outlook for a successful career as a leader in hospitality management

This inspiring Bachelor’s in hospitality management gives you the knowledge, skills, and practical experience to take charge and run a business

Is tourism and hospitality a good career choice?

So, why work in hospitality and tourism? The tourism and hospitality industry is one of the fastest-growing industries in the world, providing a colossal number of job opportunities.

Between 2021 and 2031, employment in the hospitality and tourism industry is projected to expand faster than any other job sector, creating about 1.3 million new positions .

A tourism and hospitality career can be a highly rewarding choice for anyone who enjoys working with people, has a strong service-oriented mindset, and is looking for a dynamic and exciting career with growth potential.

Growth and job opportunities in tourism and hospitality

Tourism and hospitality offers significant growth and job opportunities worldwide. The industry’s increasing demand for personnel contributes to economic and employment growth, particularly in developing countries.

The industry employs millions globally, from entry-level to high-level management positions, including hotel managers, chefs, tour operators, travel agents, and executives.

It provides diverse opportunities with great career progression and skill development potential.

Career paths in tourism and hospitality

There are many career opportunities in tourism management and hospitality. With a degree in hospitality management, as well as relevant experience, you can pursue satisfying and fulfilling hospitality and tourism careers in these fields.

Hotel manager

Hotel managers oversee hotel operations. They manage staff, supervise customer service, and ensure the facility runs smoothly.

Tour manager

Tour managers organize and lead group tours. They work for tour companies, travel agencies, or independently. Tour managers coordinate a group’s transportation, accommodations, and activities, ensuring the trip runs to schedule.

Restaurant manager

Restaurant managers supervise the daily operations of a restaurant. They manage staff, ensure the kitchen runs smoothly, and monitor customer service.

Resort manager

Resort managers supervise and manage the operations of a resort. From managing staff to overseeing customer service, they ensure the entire operation delivers excellence.

Entertainment manager

Entertainment managers organize and oversee entertainment at venues like hotels or resorts. They book performers, oversee sound and lighting, and ensure guests have a great experience.

Event planner

Event planners organize and coordinate events, such as weddings, conferences, and trade shows. They work for event planning companies, hotels, or independently.

vent planners coordinate all aspects of the event, from the venue to catering and decor.

Travel consultant

Travel consultants help customers plan and book travel arrangements, such as flights, hotels, and rental cars. They work for travel agencies or independently. Travel consultants must know travel destinations and provide superb customer service.

What skills and qualifications are needed for a career in tourism and hospitality?

Tourism and hospitality are rewarding industries with growing job opportunities. Necessary qualifications include excellent skills in communication, customer service, leadership, problem-solving, and organization along with relevant education and training.

Essential skills for success in tourism and hospitality

A career in the tourism and hospitality industry requires a combination of soft and technical skills and relevant qualifications. Here are some of the essential key skills needed for a successful career.

- Communication skills : Effective communication is necessary for the tourism and hospitality industry in dealing with all kinds of people.

- Customer service : Providing excellent customer service is critical to the success of any tourism or hospitality business . This requires patience, empathy, and the ability to meet customers’ needs.

- Flexibility and adaptability : The industry is constantly changing, and employees must be able to adapt to new situations, be flexible with their work schedules, and handle unexpected events.

- Time management : Time management is crucial to ensure guest satisfaction and smooth operations.

- Cultural awareness : Understanding and respecting cultural differences is essential in the tourism and hospitality industry, as you’ll interact with people from different cultures.

- Teamwork : Working collaboratively with colleagues is essential, as employees must work together to ensure guests have a positive experience.

- Problem-solving : Inevitably, problems will arise, and employees must be able to identify, analyze, and resolve them efficiently.

- Technical skills : With the increasing use of technology, employees must possess the necessary technical skills to operate systems, such as booking software, point-of-sale systems, and social media platforms.

Revenue management : Revenue management skills are crucial in effectively managing pricing, inventory, and data analysis to maximize revenue and profitability

Master fundamental hospitality and tourism secrets for a high-flying career at a world-leading hospitality brand

With this Master’s degree, you’ll discover the skills to manage a world-class hospitality and tourism business.

Education and training opportunities in tourism and hospitality

Education and training are vital for a hospitality and tourism career. You can ensure you are prepared for a career in the industry with a Bachelor’s in hospitality management and Master’s in hospitality programs from Glion.

These programs provide a comprehensive understanding of the guest experience, including service delivery and business operations, while developing essential skills such as leadership, communication, and problem-solving. You’ll gain the knowledge and qualifications you need for a successful, dynamic, and rewarding hospitality and tourism career.

Preparing for a career in tourism and hospitality

To prepare for a career in tourism and hospitality management, you should focus on researching the industry and gaining relevant education and training, such as a hospitality degree . For instance, Glion’s programs emphasize guest experience and hospitality management, providing students with an outstanding education that launches them into leading industry roles.

It would help if you also worked on building your communication, customer service, and problem-solving skills while gaining practical experience through internships or part-time jobs in the industry. Meanwhile, attending industry events, job fairs, and conferences, staying up-to-date on industry trends, and networking to establish professional connections will also be extremely valuable.

Finding jobs in tourism and hospitality

To find jobs in tourism and hospitality, candidates can search online job boards, and company career pages, attend career fairs, network with industry professionals, and utilize the services of recruitment agencies. Hospitality and tourism graduates can also leverage valuable alumni networks and industry connections made during internships or industry projects.

Networking and building connections in the industry

Networking and building connections in the hospitality and tourism industry provide opportunities to learn about job openings, meet potential employers, and gain industry insights. It can also help you expand your knowledge and skills, build your personal brand, and establish yourself as a valuable industry professional.

You can start networking by attending industry events, joining professional organizations, connecting with professionals on social media, and through career services at Glion.

Tips for success in tourism and hospitality

Here are tips for career success in the tourism and hospitality industry.

- Gain relevant education and training : Pursue a hospitality or tourism management degree from Glion to gain fundamental knowledge and practical skills.

- Build your network : Attend industry events, connect with colleagues and professionals on LinkedIn, and join relevant associations to build your network and increase your exposure to potential job opportunities.

- Gain practical experience : Look for internships, part-time jobs, or volunteering opportunities to gain practical experience and develop relevant skills.

- Develop your soft skills : Work on essential interpersonal skills like communication, empathy, and problem-solving.

- Stay up-to-date with industry trends : Follow industry news and trends and proactively learn new skills and technologies relevant to tourism and hospitality.

- Be flexible and adaptable : The tourism and hospitality industry constantly evolves, so be open to change and to adapting to new situations and challenges.

- Strive for excellent guest service : Focus on delivering exceptional guest experiences as guest satisfaction is critical for success.

Tourism and hospitality offer many fantastic opportunities to create memorable guest experiences , work in diverse and multicultural environments, and develop transferable skills.

If you’re ready to embark on your career in tourism and hospitality, Glion has world-leading bachelor’s and master’s programs to set you up for success.

Photo credits Main image: Maskot/Maskot via Getty Images

LISTENING TO LEADERS

BUSINESS OF LUXURY

HOSPITALITY UNCOVERED

GLION SPIRIT

WELCOME TO GLION.

This site uses cookies. Some are used for statistical purposes and others are set up by third party services. By clicking ‘Accept all’, you accept the use of cookies

Privacy Overview

The 5 Different Sectors of the Hospitality Industry

Overview of all hospitality sectors.

Thanks to a highly diverse range of services, the hospitality sector enjoys a huge variety of business enterprises. While many of these goods or jobs revolve around creating an inviting and comfortable atmosphere for clients, they can also include helping people plan their own events, setting up environments to promote recreation, or catering to the needs of various professionals. As someone who may want to get into hospitality, it is important to understand the main branches of the industry.

Our article here can take you through some of the top sections that go into hospitality, and we will explain some of the key factors governing each one. No matter what your future in this business holds, it is likely that you’ll work in areas such as accommodations, food service, the traveling part of hospitality, basic entertainment, or how to plan for professional meetings and events.

Different Key Sectors Explained

Before we begin, we can offer some short explanations of the key sectors you’ll encounter in this business. It is a good idea to remember that this is an industry with segments. Although each segment maintains its own operations, other segments connect together. This presents some significant overlap within hospitality. Unlike a more isolated job, a career in hospitality might mean that you’ll need a wide range of skills you can use across multiple sectors. For example, your primary training might be in managing guest accommodations .

However, some of your duties may include learning about how the food and beverage options at your establishment work, or guests may ask you about local tourism. In either case, you’ll need some knowledge from different sections of the business in order to help them to the fullest extent. Additionally, there could be various levels of skill within each segment. Your future employers might expect a particularly high level of advanced knowledge from you in your chosen sector, but you may have lighter duties when you need to operate in an adjacent area of hospitality.

In the following sections, we will outline the key aspects of each of the major segments that most companies in the industry would consider vital to the success of a business . While the main focus will be on the primary duties or operations in a given sector, we’ll also dive into just how one might overlap with some of the others. Understanding how different parts of the business form relationships with each other is a big step toward being able to provide the highest quality of services that you can, further increasing guest satisfaction and customer retention.

1. Lodging or Accommodation

Accommodations within the industry will involve any venue at which guests will stay. These might include hostels, budget motels, private rental properties, or the hotel chains with which many travelers are familiar. While food and drink might represent the largest share of hospitality in some regions of the world, the accommodations sector serves as the backbone supporting everything else. Most management strategies within hospitality will place much emphasis on just what amenities lodging is able to offer to clients.

Aside from many of the types of locations we've mentioned, the hospitality industry can also construct entire resorts that provide high-quality accommodations to their customers. Many companies will put the focus on their rooms or physical locations, but resorts include easy access to the other pillars of hospitality we talk about here.

2. Food and Beverage

Depending on the specific global region on which you might focus, food and beverage might be the largest of the sectors in the hospitality industry. After all, even restaurants alone serve in some capacity here, and there are many types from which to choose in almost every major tourist location. A business can amplify this effect even further if a dedicated restaurant is part of the lodging area for guests . Even if this place is not part of the hotel itself, clients may ask staff about nearby recommendations for dining. Either case involves food or beverage as part of the experience, but there are other levels that we should consider here.

Some tourist locations may have parameters that emphasize fast service. Usually, this practice will result in the business hiring fewer employees than one might see at a more typical dining establishment. In fact, some small shops may have no on-site staff at all. Aside from stocking shelves, technology has allowed some businesses to let customers serve themselves and pay for items without needing to interact with any employees at all.

Conversely, fine dining restaurants will need staff with years of experience in order to provide the level of service guests might expect. Chefs, servers, and other members of house staff will need to show a great degree of skill and dedication to propel the hospitality industry forward here. Restaurants without a reputation for fine dining may need staff without quite so many skills, but they are no less important to how the food and beverage side of things may work in this business. Further, some businesses come to the client and try to meet their exact needs for each situation. This is where catering services might come into play.

3. Travel and Tourism

When experienced travelers think of tourism, this might conjure opinions or feelings about the hospitality industry as a whole. Tourism is certainly a huge part of hospitality, but those analyzing or working within the industry usually consider it to be its own segment. Tourism’s primary goal is to encourage the free and open travel of clients who will be in need of more general hospitality services. You can think of tourism as one of the means by which hospitality gathers new clients in order to increase the latter’s revenue streams. When people travel, they need all of the other things hospitality can provide, particularly the major points we’re talking about here.

It would not be unfair to say that all other parts of hospitality rely on successful tourism in order to function at a high level. If you’ve traveled, you may have heard about either tourist cities or tourist spots within certain cities. Some of the more popular places around the world enjoy robust local economies thanks to successful tourism. In these situations, any business that is part of hospitality may have trouble sustaining itself if tourism is largely absent from the area. Some restaurants may be able to draw local crowds, but whether that would be enough business to sustain them entirely is another matter. Similarly, hotels rely on a steady stream of clients passing through in order to stay profitable. The cogs of tourism are what keep the rest of the hospitality machine moving smoothly.

However, travel or tourism will contain separate industries that might tie back to the rest of hospitality. This is where some of the segments may overlap, and you can also use tourism as a way to see how you may need skills across multiple disciplines. Creating packages for tourists, vehicle rentals, flights, or even some transportation by waterways are all parts of the tourism side of this business. Guests may expect you to be able to arrange or recommend different options within each of these modes of travel.

On a related note, having some of this knowledge about the rest of the major pillars of hospitality could be essential to a fine career in tourism or travel. A specialist in this field should be able to help clients navigate accommodations, food, entertainment, and more. It could help you to have some experience in adjacent industries, too. Travel agencies themselves are a big part of this, and financial services for travels can be just as important here. Financial protection, insurance products, or medical packages are all things many customers will want to take advantage of before they begin their journeys to parts unknown.

4. Entertainment and Recreation

Many people go to places around the world just to see some new sights and experience other cultures. However, other travelers look for different versions of their favorite entertainments or recreational activities, too. Local or regional entertainment options make up a huge part of the hospitality industry. If you work in one of these places within a particularly touristic city, you have a hand in keeping the hospitality sector afloat.

In some cases, a simple massage might be a recreational activity, and many hotels offer services like this one to their guests. Just as with other parts of the business, some entertainment options overlap with other parts of the industry. A nightclub in a bustling city provides a wealth of entertainment to its patrons, but it also acts as a provider of food and beverages as well.

Large cinemas, traditional theaters with live-action productions on a stage, comedy clubs, museums, zoos, aquariums, sporting events, and even shopping are all parts of the entertainment or recreation segments of hospitality. This part of the business caters to clients who tend to have disposable income beyond what they’ve spent on the accommodations and travel in order to get to the destination itself.

Even historical sites are part of the entertainment side of things. Anything you can do to give clients activities to enjoy during their stay will be part of this business, and any job you perform to this effect makes you a part of it. An establishment may have its own casino, for example. Otherwise, there may be one nearby. Some hotels go up in prime locations that cater to clientele looking for everything from museums to sporting arenas in one area that is easy to navigate.

If you desire a career in travel management specifically, you’ll become familiar with the various entertainment options available to clients within a given region. This sort of position usually means that you’ll try to optimize all aspects of a trip for your customer. In doing so, you’ll help them take care of modes of travel, means of getting around once they arrive at their destinations, accommodations, food options, and all of the entertainment that might be available to them. You could even become the manager of a travel company yourself, but you would need to learn the major aspects of all the segments we’re covering here.

5. Timeshare and Meetings

You may be familiar with the seminars that involve timeshares. Generally, these events help prospective owners see the benefits of using such a property for either recreation or business ventures. A timeshare is any dwelling that has its own usage rights or ownership details divided between multiple people at once. For example, condominium units on or near resort locations are popular options for many people. Each person with a stake in the unit will have their own period of time during the year when they have usage rights to the property. In essence, they would become the owner of the property for the duration they outline in the usage agreement.

You may hear some industry experts call timeshares vacation ownership packages. While using such a place as a vacation spot is certainly a popular option, keeping your allotment for business purposes can make you a part of the hospitality industry as well. Similarly, you may be the owner of the property outright. In this case, you may wish to turn it into a vacation rental in order to increase the number of revenue streams at your disposal.

Should you decide to go this route, you can offer your property to different businesses at various times during the year. There are multiple ways in which you can set all of this up, and the paths you might take can offer a little or a lot of flexibility to your clients. Many businesses need locations like these in order to host seminars, new hire training courses, team-building retreats, and more. If you are a vacation rental owner, you can think of yourself in an accommodations management position within the hospitality industry itself.

Different clients may buy slots in your timeshare that they would want to use at regular intervals. If so, you’d be responsible for the upkeep of the property. A big part of this may include making sure the location has all the proper amenities that your guests might expect. What this category includes can vary according to the length of the client’s stay and what they will be doing while they are using the site. In some ways, you may run the property similarly to any other part of the accommodations segment of the hospitality industry.

As an umbrella that provides different goods or services to patrons, hospitality is a versatile and ever-growing sector. While we’ve outlined some of the major points of each of the sectors within the business here, it is a good idea to narrow your focus on the kinds of interests and skills you have already. In doing so, you can figure out which section is the right fit for you. There are also training courses, certifications, and degrees you can get to further improve your skills and viability as a hospitality professional .

Recent blog articles

Best guide to the top 10 j1 visa interview questions, transition from j1 experiences to thriving in hospitality jobs, ds-160 complete handbook for u.s. visa triumph, mastering the culinary art in top usa cities for j1 internships, hospitality unleashed: the power skill for every industry's success.

Travel, Tourism & Hospitality

Global tourism industry - statistics & facts

What are the leading global tourism destinations, digitalization of the global tourism industry, how important is sustainable tourism, key insights.

Detailed statistics

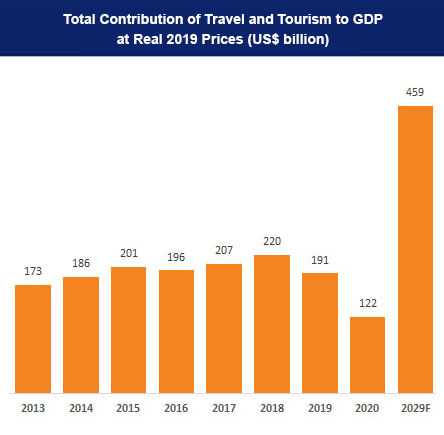

Total contribution of travel and tourism to GDP worldwide 2019-2033

Number of international tourist arrivals worldwide 1950-2023

Global leisure travel spend 2019-2022

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Leading global travel markets by travel and tourism contribution to GDP 2019-2022

Travel and tourism employment worldwide 2019-2033

Related topics

Recommended.

- Hotel industry worldwide

- Travel agency industry

- Sustainable tourism worldwide

- Travel and tourism in the U.S.

- Travel and tourism in Europe

Recommended statistics

- Basic Statistic Total contribution of travel and tourism to GDP worldwide 2019-2033

- Basic Statistic Travel and tourism: share of global GDP 2019-2033

- Basic Statistic Leading global travel markets by travel and tourism contribution to GDP 2019-2022

- Basic Statistic Global leisure travel spend 2019-2022

- Premium Statistic Global business travel spending 2001-2022

- Premium Statistic Number of international tourist arrivals worldwide 1950-2023

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Basic Statistic Travel and tourism employment worldwide 2019-2033

Total contribution of travel and tourism to gross domestic product (GDP) worldwide in 2019 and 2022, with a forecast for 2023 and 2033 (in trillion U.S. dollars)

Travel and tourism: share of global GDP 2019-2033

Share of travel and tourism's total contribution to GDP worldwide in 2019 and 2022, with a forecast for 2023 and 2033

Total contribution of travel and tourism to GDP in leading travel markets worldwide in 2019 and 2022 (in billion U.S. dollars)

Leisure tourism spending worldwide from 2019 to 2022 (in billion U.S. dollars)

Global business travel spending 2001-2022

Expenditure of business tourists worldwide from 2001 to 2022 (in billion U.S. dollars)

Number of international tourist arrivals worldwide from 1950 to 2023 (in millions)

Number of international tourist arrivals worldwide 2005-2023, by region

Number of international tourist arrivals worldwide from 2005 to 2023, by region (in millions)

Number of travel and tourism jobs worldwide from 2019 to 2022, with a forecast for 2023 and 2033 (in millions)

- Premium Statistic Global hotel and resort industry market size worldwide 2013-2023

- Premium Statistic Most valuable hotel brands worldwide 2023, by brand value

- Basic Statistic Leading hotel companies worldwide 2023, by number of properties

- Premium Statistic Hotel openings worldwide 2021-2024

- Premium Statistic Hotel room openings worldwide 2021-2024

- Premium Statistic Countries with the most hotel construction projects in the pipeline worldwide 2022

Global hotel and resort industry market size worldwide 2013-2023

Market size of the hotel and resort industry worldwide from 2013 to 2022, with a forecast for 2023 (in trillion U.S. dollars)

Most valuable hotel brands worldwide 2023, by brand value

Leading hotel brands based on brand value worldwide in 2023 (in billion U.S. dollars)

Leading hotel companies worldwide 2023, by number of properties

Leading hotel companies worldwide as of June 2023, by number of properties

Hotel openings worldwide 2021-2024

Number of hotels opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Hotel room openings worldwide 2021-2024

Number of hotel rooms opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Countries with the most hotel construction projects in the pipeline worldwide 2022

Countries with the highest number of hotel construction projects in the pipeline worldwide as of Q4 2022

- Premium Statistic Airports with the most international air passenger traffic worldwide 2022

- Premium Statistic Market value of selected airlines worldwide 2023

- Premium Statistic Global passenger rail users forecast 2017-2027

- Premium Statistic Daily ridership of bus rapid transit systems worldwide by region 2023

- Premium Statistic Number of users of car rentals worldwide 2019-2028

- Premium Statistic Number of users in selected countries in the Car Rentals market in 2023

- Premium Statistic Carbon footprint of international tourism transport worldwide 2005-2030, by type

Airports with the most international air passenger traffic worldwide 2022

Leading airports for international air passenger traffic in 2022 (in million international passengers)

Market value of selected airlines worldwide 2023

Market value of selected airlines worldwide as of May 2023 (in billion U.S. dollars)

Global passenger rail users forecast 2017-2027

Worldwide number of passenger rail users from 2017 to 2022, with a forecast through 2027 (in billion users)

Daily ridership of bus rapid transit systems worldwide by region 2023

Number of daily passengers using bus rapid transit (BRT) systems as of April 2023, by region

Number of users of car rentals worldwide 2019-2028

Number of users of car rentals worldwide from 2019 to 2028 (in millions)

Number of users in selected countries in the Car Rentals market in 2023

Number of users in selected countries in the Car Rentals market in 2023 (in million)

Carbon footprint of international tourism transport worldwide 2005-2030, by type

Transport-related emissions from international tourist arrivals worldwide in 2005 and 2016, with a forecast for 2030, by mode of transport (in million metric tons of carbon dioxide)

Attractions

- Premium Statistic Market size of museums, historical sites, zoos, and parks worldwide 2022-2027

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Basic Statistic Monuments on the UNESCO world heritage list 2023, by type

- Basic Statistic Selected countries with the most Michelin-starred restaurants worldwide 2023

Market size of museums, historical sites, zoos, and parks worldwide 2022-2027

Size of the museums, historical sites, zoos, and parks market worldwide in 2022, with a forecast for 2023 and 2027 (in billion U.S. dollars)

Leading museums by highest attendance worldwide 2019-2022

Most visited museums worldwide from 2019 to 2022 (in millions)

Most visited amusement and theme parks worldwide 2019-2022

Leading amusement and theme parks worldwide from 2019 to 2022, by attendance (in millions)

Monuments on the UNESCO world heritage list 2023, by type

Number of monuments on the UNESCO world heritage list as of September 2023, by type

Selected countries with the most Michelin-starred restaurants worldwide 2023

Number of Michelin-starred restaurants in selected countries and territories worldwide as of July 2023

Online travel market

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Leading online travel companies worldwide 2020-2022, by revenue CAGR

- Premium Statistic Leading online travel companies worldwide 2022-2023, by EV/EBITDA

Online travel market size worldwide 2017-2028

Online travel market size worldwide from 2017 to 2023, with a forecast until 2028 (in billion U.S. dollars)

Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

Estimated desktop vs. mobile revenue of leading online travel agencies (OTAs) worldwide in 2023 (in billion U.S. dollars)

Number of aggregated downloads of leading online travel agency apps worldwide 2023

Number of aggregated downloads of selected leading online travel agency apps worldwide in 2023 (in millions)

Market cap of leading online travel companies worldwide 2023

Market cap of leading online travel companies worldwide as of September 2023 (in million U.S. dollars)

Leading online travel companies worldwide 2020-2022, by revenue CAGR

Revenue compound annual growth rate (CAGR) of leading online travel companies worldwide from 2020 to 2022

Leading online travel companies worldwide 2022-2023, by EV/EBITDA

Enterprise-value-to-EBITDA (EV/EBITDA) of selected leading online travel companies worldwide in 2022, with a forecast for 2023

Selected trends

- Premium Statistic Global travelers who believe in the importance of green travel 2022

- Premium Statistic Sustainable initiatives travelers would adopt worldwide 2022, by region

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Airbnb nights and experiences booked worldwide 2017-2023

- Premium Statistic Technologies global hotels plan to implement in the next three years 2022

- Premium Statistic Hotel technologies global consumers think would improve their future stay 2022

Global travelers who believe in the importance of green travel 2022

Share of travelers that believe sustainable travel is important worldwide in 2022

Sustainable initiatives travelers would adopt worldwide 2022, by region

Main sustainable initiatives travelers are willing to adopt worldwide in 2022, by region

Airbnb revenue worldwide 2017-2023

Revenue of Airbnb worldwide from 2017 to 2023 (in billion U.S. dollars)

Airbnb nights and experiences booked worldwide 2017-2023

Nights and experiences booked with Airbnb from 2017 to 2023 (in millions)

Technologies global hotels plan to implement in the next three years 2022

Technologies hotels are most likely to implement in the next three years worldwide as of 2022

Hotel technologies global consumers think would improve their future stay 2022

Must-have hotel technologies to create a more amazing stay in the future among travelers worldwide as of 2022

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Premium Statistic Inbound tourism visitor growth worldwide 2020-2025, by region

- Premium Statistic Outbound tourism visitor growth worldwide 2020-2025, by region

Travel and tourism revenue worldwide 2019-2028, by segment

Revenue of the global travel and tourism market from 2019 to 2028, by segment (in billion U.S. dollars)

Distribution of sales channels in the travel and tourism market worldwide 2018-2028

Revenue share of sales channels of the travel and tourism market worldwide from 2018 to 2028

Inbound tourism visitor growth worldwide 2020-2025, by region

Inbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Outbound tourism visitor growth worldwide 2020-2025, by region

Outbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Screen Reader

- Skip to main content

- Text Size A

- Language: English

Case Studies

- EXIM Procedure

Media & Events

- Image Gallery

- Media Coverage

Other Links

- GI of India

- Experience India

- Indian Trend Fair 2022

India Organic Biofach 2022

Gulfood dubai 2023, tourism and hospitality, tourism & hospitality industry in india, the tourism sector is projected to contribute us$ 250 billion to the country’s gdp by 2030, generating employment for 137 million individuals., advantage india, robust demand.

* The Medical Tourism sector is predicted to increase at a CAGR of 21.1% from 2020-27.

* The travel market in India is projected to reach US$ 125 billion by FY27 from an estimated US$ 75 billion in FY20.

* International tourist arrivals are expected to reach 30.5 million by 2028.

* According to WTTC, over the next decade, India’s Travel & Tourism’s GDP is expected to grow at an average of 7.8% annually.

Attractive Opportunities

* India is geographically diverse and offers a variety of cultures that come with its own experiences, making it one of the leading countries in terms of international tourism expenditure.

* Travel and tourism are two of the largest industries in India, with a total contribution of about US$ 178 billion to the country’s GDP.

* The country’s big coastline is dotted with attractive beaches.

Policy support

* US$ 2.1 billion is allocated to Ministry of Tourism in budget 2023-24 as the sector holds huge opportunities for jobs and entrepreneurship for youth. Rs. 2,400 crore (US$ 289.89 million) allocated to the Ministry of Tourism as the sector holds huge opportunities for jobs and entrepreneurship for youth.

* Under the Union Budget 2023-24, an outlay of US$ 170.85 million has been allocated for the Swadesh Darshan Scheme.

* 68 destinations/sites have been identified in 30 States/UTs for development under the PRASHAD Scheme as on March 31, 2022.

Diverse Attractions

* According to WTTC, the contribution of India's travel and tourism sector to India's economy was worth Rs. 15.9 trillion (US$ 191.25 billion) in 2022.

Tourism and Hospitality Industry Report

Introduction.

With a total area of 3,287,263 sq. km extending from the snow-covered Himalayan heights to the tropical rain forests of the south, India has a rich cultural and historical heritage, variety in ecology, terrains and places of natural beauty spread across the country. This provides a significant opportunity to fully exploit the potential of the tourism sector.

India being one the most popular travel destinations across the globe has resulted in the Indian tourism and hospitality industry emerging as one of the key drivers of growth among the services sector in India. The tourism industry in India has significant potential considering that Tourism is an important source of foreign exchange in India similar to many other countries.

It is widely acknowledged that the tourist and hospitality sector, which encompasses travel and hospitality services like hotels and restaurants, is a development agent, a catalyst for socioeconomic growth, and a significant source of foreign exchange gains in many countries. India's rich and exquisite history, culture, and diversity are showcased through tourism while also providing significant economic benefits. The consistent efforts of the central and state governments have helped the tourism industry to recover from the COVID-19 pandemic shock and operate at the pre-pandemic level.

Market Size

According to WTTC, India is ranked 10th among 185 countries in terms of travel & tourism’s total contribution to GDP in 2019. According to WTTC, the contribution of India's travel and tourism sector to India's economy was worth Rs. 15.9 trillion (US$ 191.25 billion) in 2022.

According to WTTC, over the next decade, India’s Travel & Tourism GDP is expected to grow at an average of 7.8% annually. In 2020, the Indian tourism sector accounted for 39 million jobs, which was 8% of the total employment in the country.

In 2021, the travel & tourism industry’s contribution to the GDP was US$ 178 billion; this is expected to reach US$ 512 billion by 2028. By 2029, it is expected to account for about 53 million jobs. In India, the industry’s direct contribution to the GDP is expected to record an annual growth rate of 7-9% between 2019 and 2030.

The travel market in India is projected to reach US$ 125 billion by FY27 from an estimated US$ 75 billion in FY20. The Indian airline travel market was estimated at ~US$ 20 billion and is projected to double in size by FY27 due to improving airport infrastructure and growing access to passports. The Indian hotel market including domestic, inbound and outbound was estimated at ~US$ 32 billion in FY20 and is expected to reach ~US$ 52 billion by FY27, driven by the surging demand from travellers and sustained efforts of travel agents to boost the market.

By 2028, international tourist arrivals are expected to reach 30.5 billion and generate revenue of over US$ 59 billion. However, domestic tourists are expected to drive the growth, post-pandemic. International hotel chains are increasing their presence in the country, and they will account for around 47% share of the tourism and hospitality sector of India by 2020 and 50% by 2022.

As per the Ministry of Tourism, Foreign Tourist Arrivals (FTAs) in October 2023 were 8,11,411. FTAs during the period January-October 2023 were 72,43,680 as compared to 46,55,160 in January-October 2022.

The percentage share of Foreign Tourist Arrivals in India during October 2023 among the top 5 ports was highest at Delhi Airport (34.74%) followed by Mumbai Airport (14.75%), Haridaspur Land Check Post (9.03%), Chennai Airport (7.05%), Bengaluru Airport (5.71%). FTAs during the period January-September 2023 were 6.43 million.

The percentage share of Foreign Tourist Arrivals in India during October 2023 among the top 5 source countries was highest from Bangladesh (21.41%), followed by USA (15.65%), UK (11.27%), Australia (4.38%) and Canada (3.81%).

In 2023-24* (January-October), 24.97% of foreign tourists visited for Indian Diaspora which marks 72,43,680 foreigners.

FEE during the period January-October 2023 were US$ 22.32 billion.

Domestic visitor spending increased by 20.4% in 2022, only 14.1% below 2019. International visitor spending rose by 81.9% in 2022, but still 40.4% behind 2019 numbers.

Cumulative FDI equity inflow in the Hotel and Tourism industry is US$ 17.29 billion during the period April 2000-September 2023. This constitutes 2.60% of the total FDI inflow received across sectors.

Investments/Developments

- In December 2023, IHCL expanded its presence in Maharashtra as it signed a hotel in Bandra, Mumbai. The Brownfield project will be branded an IHCL- SeleQtions hotel.

- In December 2023, TAJ won the ‘World’s finest luxury grand palaces’ award at the ‘101 Best Executive Summit’ in Germany.

- In November 2023, Indian Hotels Company (IHCL) announced the opening of Ginger Mumbai, Airport. The 371 Keys flagship Ginger hotel, strategically located near the domestic airport will introduce the brand’s lean luxe design and service philosophy of offering a vibrant, contemporary, and seamless hospitality experience to its guests.

- In September 2023, Mahindra Holidays & Resorts (MHRIL) signed an MOU with the Government of Uttarakhand (UK) to invest Rs. 1,000 crore (US$ 120.16 million) and build 4-5 large marquee resorts over the next few years in Uttarakhand.

- An investment of Rs. 2,400 crore (US$ 289.89 million) was allocated to the Ministry of Tourism as the sector holds huge opportunities for jobs and entrepreneurship for youth.

- An investment-linked deduction under Section 35 AD of the Income Tax Act is in place for establishing new hotels under the 2-star category and above across India, thus permitting a 100% deduction in respect of the whole or any expenditure of capital nature.

- In 2019, the Government reduced GST on hotel rooms with tariffs of Rs. 1,001 (US$ 14.32) to Rs. 7,500 (US$ 107.31) per night to 12% and those above Rs. 7,501 (US$ 107.32) to 18% to increase India’s competitiveness as a tourism destination.

- In Union Budget 2023-24, US$ 290.64 million was allocated to the Ministry of Tourism as the sector holds huge opportunities for jobs and entrepreneurship for youth in particular and to take the promotion of tourism on mission mode, with the active participation of states, the convergence of government programmes and public-private partnerships.

- An app will be developed covering all relevant aspects of tourism. States will be encouraged to set up Unity Malls in State Capital as the most prominent tourism centres to promote One District One Product, GI products, handicrafts and products of other States.

- In 2021, Government of India announced 40,000 e-tourist visas out of 500,000 free regular visas to the tourist, to ensure a geographical spread of the incentive to important source markets globally.

- Government of India has set a target to create 220 new airports by 2025.

- The Emergency Credit Line Guarantee Scheme (ECLGS) covered through a liberal definition of MSME (micro small and medium enterprises) has been expanded to include tourism and hospitality stakeholders. Infrastructure status has been granted to exhibition-cum-convention centres.

- A separate liquidity window of Rs. 15,000 crore (US$ 1.8 billion) has been released for the sector.

- A total of 48,775 accommodation units (both classified and unclassified) have been registered on the National Integrated Database of Hospitality Industry (NIDHI) portal and 11,220 units have self-certified for SAATHI standards in September 2022.

- In October 2022, Indian Hotels Company (IHCL) announced the launch of its new Indian-concept restaurant brand, Loya. Debuting at Taj Palace, New Delhi, Loya captures the culinary essence traversing the landscape of North India.

- Hospitality unicorn OYO has acquired Europe-based vacation rental company Direct Booker for US$ 5.5 million in May 2022.

- Accor, a French hospitality major will expand its India's portfolio by adding nine additional hotels in the mid-scale and economy categories, bringing the total number of hotels 54 in India.