- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Maximize the AmEx Platinum Hotel Credit

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

As the COVID-19 pandemic rocked the world in 2020, many credit card issuers rolled out new temporary benefits to help boost value to cardholders.

American Express was no exception, and offered a particularly generous perk: a $200 hotel credit for some holders of The Platinum Card® from American Express . They also extended the amount of time that new cardholders had to meet the minimum spending requirements by three months, then went on to add a bevvy of new incentives , like limited-time bonus rewards, streaming credits, wireless credits and a host of juicy AmEx offers .

Since I’m a travel enthusiast and credit card junkie (admittedly), I found myself flush with newfound perks and growing balances of bonus points from everyday shopping. The problem was, like many people, I wasn’t really traveling.

Here’s how I was able to make use of — and maximize — the $200 travel credit.

» Learn more: How credit card issuers are responding to COVID-19

About the $200 American Express travel credit

Some cardholders of The Platinum Card® from American Express who renewed their card became eligible for a credit up to $200 for travel booked through American Express Travel. Terms apply.

I didn’t give the credit much thought at first. Due to COVID-19 considerations, I had canceled all of my travel for the foreseeable future. Even when I do travel frequently in “normal” times, I rarely book through American Express. I generally prefer to transfer my Membership Rewards points to travel partners to get outsize value.

Still, $200 is a generous credit that I didn’t want to waste. And when my family was starting to go stir-crazy after months of quasi-lockdown, I set out to plan a safe “staycation” using the bonus AmEx travel credit.

How the booking portal, American Express Travel, works

American Express Travel is a booking portal available to cardholders to book flights, hotels, cruises, tours and flight + hotel package deals. When you log into your AmEx account, just click into your Rewards page and you can find the AmEx Travel portal.

When you make a booking through American Express Travel, you can choose to pay with either your Membership Rewards points or with cash.

If you hold The Platinum Card® from American Express or The Business Platinum Card® from American Express , you’ll earn 5x points when you use your card to charge travel in the AmEx travel. All other Membership Rewards-earning cards will earn 2x points on AmEx travel bookings. Terms apply.

If you choose to pay with points, they’ll be worth 1 cent each. This isn’t a great redemption value, since you can easily get more value for your points by transferring to AmEx’s travel partners . But when you consider that you will earn airline miles (and sometimes hotel points) when you book your trip through AmEx travel, the value jumps up a bit. That’s because the airline or hotel sees this as a “cash” booking rather than an “award” booking, even when you’re using your Membership Rewards.

» Learn more: Best American Express credit cards

How I got out-sized value from my travel credit

Since my family was staying grounded during the pandemic, we decided to take a “staycation” in a nearby hotel. And since we had missed most of our planned travel in 2020, we decided to use the $200 credit toward a splurge for luxury.

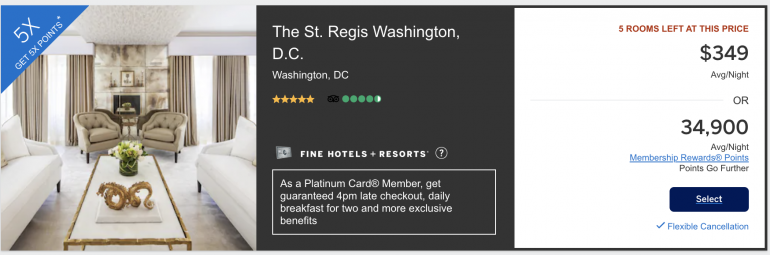

When I started hunting for hotel options in the American Express Travel portal, the first several hotels that appeared in my search were designated as being part of the Fine Hotels & Resorts program.

Available only to cardholders of The Platinum Card® from American Express , The Business Platinum Card® from American Express and the Centurion Card from American Express, the FHR program offers extra benefits, including:

Early check-in.

4 p.m. checkout.

Room upgrade (based on availability).

Daily breakfast for two.

$100 property credit (varies by hotel, but dining and spa credits are common).

Since my $200 AmEx credit would cover anything booked through AmEx Travel — including a hotel in the FHR program — I knew I could pack even more value when I combined the benefits.

We decided on a “staycation” night at the luxurious St. Regis close to where we live.

When booked through AmEx travel, the room was going for $349 a night. To be clear, booking a hotel through FHR doesn't always give you the lowest rate. If booked directly, a room at this same hotel could have cost $308 for that same night.

But the added benefits from booking through FHR can usually outweigh the added cost.

Here’s how my AmEx travel booking broke down. The room rate was $349, but by booking a FHR property through AmEx travel I got:

The Platinum Card® from American Express credit: $200.

Property credit: $100.

Breakfast credit: $60.

My family got the red-carpet treatment at the St. Regis. We were able to check in early at 11 a.m. to kick off our staycation, and we were upgraded to a larger room with a prime view.

The $100 property credit at this hotel was good for a food and beverage credit, so we used it to splurge on a fancy, socially-distanced tea party, to the sheer delight of our two young kids.

Photo courtesy of Erin Hurd

In the morning, we were informed that we would be given $60 in breakfast credits from our booking. Even at St. Regis prices, that credit was enough for all four of us to enjoy a light breakfast.

At checkout, we had a few incidental charges, including valet parking, that we needed to pay for out of pocket. Since St. Regis is a Marriott brand, I used my Marriott Bonvoy Brilliant® American Express® Card for those charges. The card comes with up to $300 in credits for eligible purchases at Marriott hotels. In September, the $300 Marriott credit will be replaced with a new benefit of up to $300 in statement credits per calendar year (up to $25 per month) for eligible purchases at restaurants worldwide. Terms apply.

The bottom line

This staycation was certainly not free, since I pay a hefty $695 annual fee to hold The Platinum Card® from American Express . But by booking a room through American Express’ Fine Hotels & Resorts program, I was able to get even more value from the extra $200 travel credit. Terms apply.

Though earning hotel points can sometimes be hit-or-miss with FHR bookings, I was pleasantly surprised a few days after checkout to see that I had earned Marriott Bonvoy points and an elite night credit on this booking.

If you have The Platinum Card® from American Express and are eligible, make sure you remember to use your extra $200 AmEx travel credit whenever you’re ready to travel again. The credit is good for travel through the end of 2021. Check your AmEx account to see if you have the offer, or contact customer service through online chat or over the phone to confirm your eligibility.

To view rates and fees of The Platinum Card® from American Express, see this page .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

- Book Travel

- Credit Cards

How Does the American Express Platinum Card $200 Annual Travel Credit Work?

The American Express Platinum Card and the Business Platinum Card from American Express are two of the best travel cards in Canada, as they come with a bevy of travel-related perks and a hefty welcome bonus to help justify the high annual fees.

In This Post

What is the american express platinum card annual travel credit, how to use the american express platinum card annual travel credit, how to maximize the american express platinum card annual travel credit.

The American Express Platinum Card and Business Platinum Card from American Express ‘s $200 annual travel credit is exactly what it sounds like. Each year, cardholders are given a $200 credit that can be used to book flights, hotels, car rentals, or other travel through the Amex Travel portal.

Aside from being approved for the card and paying the $799 annual fee, you don’t have to do anything extra to earn the $200 travel credit. It becomes available as soon as you activate your card, and then once per year on your cardholder anniversary date.

For example, if you’re approved for the American Express Platinum Card in March 2024, you’ll have one $200 travel credit that must be used before March 2025. Then, in March 2025, you’ll have a new $200 annual travel credit available in your account, which must be used by March 2026.

The $200 annual travel credit can only be used for bookings made through Amex Travel. This means that you won’t be able to book travel on your own elsewhere, and then apply the credit against your own travel expenses retroactively.

The $200 travel credit has to be used all at once towards a single travel booking of $200 or more. This means that you won’t be able to use it if your travel booking is less than $200, and you won’t be able to spread it out over multiple bookings.

Lastly, you need to opt in to using the travel credit at the time of booking. Simply booking $200 in travel through Amex Travel isn’t enough to trigger the credit — rather, you have to specify that you want to use your $200 annual travel credit, which we’ll cover in detail below.

Once you’ve made a booking, you’ll receive $200 as a statement credit on your Platinum Card within two business days or so. This means that you’re charged the full amount of the booking first, and then you receive a separate $200 statement credit posted to your account.

On September 26, 2023, the $200 annual travel credit became available on the Business Platinum Card from American Express . This new benefit came in tandem with other changes to the cards, including increasing the annual fee.

If you’re already a Business Platinum cardholder, you’ll have access to the $200 annual travel credit on the next anniversary date that falls on or after September 26, 2023, and every year thereafter on your anniversary date.

There are two ways to use the $200 annual travel credit from the American Express Platinum Card : over the phone, or online.

If you choose to phone in to book travel and redeem your credit, make sure the Amex Travel agent knows that you’d like to make use of your $200 travel credit. You’ll also need to use your personal or business version of the Platinum Card to pay for the rest of the charges on your booking, so be sure to have it handy.

If redeeming online, you’ll have to first login to your American Express account, and then head to Amex Travel.

You can do this by clicking on the “Menu” tab after you’ve logged in, selecting “Travel”, and then “Book Travel Online”.

If you have multiple American Express cards, you’ll be prompted to select the card you’d like to use.

In order to use the $200 annual travel credit, you’ll need to choose a Platinum Card from the list. If you haven’t used the travel credit yet, it’ll indicate that it’s available on this screen, as well as its expiry date.

After selecting the Platinum Card, you can choose which type of travel you’d like to book. The options include flights, hotels, or car rentals, as well as combinations of those three in the “Bundles” tab.

Once you’ve found your desired travel booking, head to the payment screen, and then keep an eye out for the option to apply your $200 annual travel credit.

If you don’t select it as an option at this point, the credit won’t automatically be applied against your travel.

After you’ve opted to use the travel credit, you’ll still need to enter the rest of your Platinum Card information. Your card will then be charged the full amount of the booking, and the $200 credit will appear on your Platinum Card account shortly thereafter.

Even though American Express restricts the $200 annual travel credit in that it can only be used through Amex Travel, there are still ways you can make the most out of your credit, and elevate your travel.

Amex Fine Hotels & Resorts

One of the best ways to use the $200 annual travel credit is for a hotel stay with Amex Fine Hotels & Resorts , which gives you additional perks to enjoy during your stay.

You can use the $200 annual travel credit to get a free or very inexpensive night if the stay costs around $200, or you could use it to offset the cost of a more luxurious stay.

For example, a one-night stay at The Tasman, a Luxury Collection Hotel , in Hobart, Tasmania might cost around $455 (CAD).

By booking through Amex Fine Hotels & Resorts, you’ll be able to use your $200 travel credit to reduce the cost down to $255 (CAD), and you’ll also have access to a number of additional perks.

You’ll receive a $100 (USD) property credit, free breakfast for two, guaranteed 4pm late check-out, and, when available, a room upgrade upon arrival and early check-in.

What’s more, if you have Marriott Bonvoy Elite status , you’ll still be able to enjoy your status benefits through hotels booked through Amex Travel, and you’ll also be credited with an elite qualifying night to work towards reaching a higher status, or retaining your status for next year.

If you have an upcoming trip planned and want to try out a luxury hotel, be sure to apply your $200 annual travel credit against the cost.

Amex Travel Amex Offers

American Express cardholders have exclusive access to Amex Offers , which are special opt-in promotions offered through your online account.

In the past, there have been specific Amex Offers available for spending on Amex Travel online.

One offer that’s popped up over the past couple of years has been a “Spend $800, Get $200” Amex Offer for bookings made through Amex Travel .

If you’ve been targeted with such an offer, you’d receive a $200 statement credit after making $800 worth of eligible prepaid hotel or car rental bookings through Amex Travel, which is separate from your $200 annual travel credit.

However, it’s also possible to stack the $200 annual travel credit with offers like this, which would effectively result in an out-of-pocket cost of $400 for $800 worth of travel.

Therefore, if you’re able to take advantage of both an Amex Travel Amex Offer and the $200 annual travel credit, you’ll end up with a significant discount on your booking.

A situation such as this can also be a great opportunity to try out a high-end property, such as the Four Seasons, Shangri-La, or Mandarin Oriental, without paying anywhere near the full price.

Offset the Annual Fee

Lastly, the $200 annual credit can be used as a way to offset the card’s annual fee.

If your plans fall through and you have to cancel a refundable travel booking, you’ll no longer have access to the travel credit.

As per the terms and conditions on the American Express Platinum Card :

If you cancel your travel booking after redeeming the Annual Travel Credit, you will not be able to use it again in the same year.

However, since you’re charged the full amount to begin with, you’ll still receive a full refund for the Amex Travel booking, even after the $200 annual travel credit has been applied to your account.

For example, if you make a refundable hotel booking for $400, you’ll have two items post to your account: a charge for $400 (your hotel booking), and a statement credit of $200 (from your travel credit). At this point, the net cost to you is $200.

If you need to cancel the hotel booking, you’ll receive a full refund of $400, and the $200 statement credit will remain posted to your account. Therefore, if you had a $0 balance before you made the booking, you’d now have a balance of –$200, since the annual travel credit can’t be reversed.

Having to cancel a booking due to unforeseen circumstances may not be ideal; however, if it comes to that, it’s nice to know that at least your $200 credit doesn’t go to waste.

The $200 annual travel credit is a great perk that comes with every Canadian-issued American Express Platinum Card and Business Platinum Card from American Express .

Fortunately, the credit is easy to use through Amex Travel. While you’re limited to what’s available on the platform, you can use it to score a deal on a luxury hotel stay through American Express Fine Hotels & Resorts , or to otherwise lower the cost of other expenses for a trip.

If you’re lucky, you’ll be able to stack the $200 annual travel credit with an Amex Travel Amex Offer to unlock even more value. And if your plans fall through, it’s nice to know that the statement credit will remain on your account even after your booking is refunded.

It doesn’t matter how you make use of the $200 annual travel credit — just be sure to use it up before it expires each year.

- Earn 70 ,000 MR points upon spending $10,000 in the first three months

- Plus, earn 30,000 MR points upon making a purchase in months 14–17 as a cardholder

- Also, earn 2x MR points on all dining and travel purchases

- Also, receive an annual $200 travel credit

- Also, receive an annual $200 dining credit

- Transfer MR points to Aeroplan and other frequent flyer programs for premium flights

- Unlimited airport lounge access for you and one guest at Priority Pass, Plaza Premium, Centurion, and other lounges

- Credits and rebates for daily expenses throughout the year with Amex Offers

- Bonus MR points for referring family and friends

- Annual fee: $799

I won’t ever deal with Amex again after their petty and frankly pathetic actions when they cancelled their Air Miles program. Cancelled cards with one day notice but mailed that notice. Very poor customer relations..

Amex always charged me back for the $200 travel credit after I cancelled my booking in the past couple of years.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Prince of Travel is Canada’s leading resource for using frequent flyer miles, credit card points, and loyalty programs to travel the world at a fraction of the price.

Join our Sunday newsletter below to get weekly updates delivered straight to your inbox.

Have a question? Just ask.

Business Platinum Card from American Express

120,000 MR points

American Express Aeroplan Reserve Card

85,000 Aeroplan points

American Express Platinum Card

100,000 MR points

TD® Aeroplan® Visa Infinite Privilege* Card

Up to 85,000 Aeroplan points†

Latest News

Positioning Flights: What You Need to Know

Guides May 8, 2024

Bilt Rewards Launches Partnership with Hilton Honors

May 8, 2024

30% Transfer Bonus from RBC Avion to British Airways Executive Club

Recent discussion, 6 reasons why we love air france klm flying blue, rbc changes earning rates on the rbc® british airways visa infinite†, christopher, status match to flying blue silver, gold, or platinum, amex upgrade offers: green to cobalt & cobalt to gold, prince of travel elites.

Points Consulting

- My Account My Account

- Cards Cards

- Banking Banking

- Travel Travel

- Rewards & Benefits Rewards & Benefits

- Business Business

Best Chase credit cards of May 2024

If you’re looking for great cash-back rates and valuable transferable reward points, consider our top picks for the best Chase credit cards. Chase offers a wide selection of credit cards for all customers, whether you’re looking for the easiest cash-back option or a premium travel card. Chase also makes it easy to combine rewards across multiple accounts, so holding more than one Chase card can allow you to maximize your earning strategy — especially if you’re interested in maximizing Chase Ultimate Rewards points.

With so many card options available, you’re sure to find a Chase card that fits your wallet — so check out the list below of offers from our partners compiled by our team of travel experts.

- Chase Sapphire Preferred® Card : Best for overall mid-tier cards

- Ink Business Preferred® Credit Card : Best for business travelers

- Chase Sapphire Reserve® : Best for dining and travel insurance

- Ink Business Cash® Credit Card : Best for office supplies and technology services

- Chase Freedom Flex℠ : Best for rotating bonus categories

- Southwest Rapid Rewards® Priority Credit Card : Best for frequent Southwest flyers

- Southwest Rapid Rewards® Plus Credit Card : Best for a lower annual fee

- Ink Business Unlimited® Credit Card : Best for no annual fee business card

Browse by card categories

Comparing the best credit cards, more details on the best credit cards, maximizing chase credit cards, how we rate, what is chase, how to choose the best chase credit card, ask our experts, pros + cons of chase credit cards, frequently asked questions, chase sapphire preferred® card.

The Chase Sapphire Preferred® Card is one of the most popular travel rewards credit card on the market. Offering an excellent return on travel and dining purchases, the card packs a ton of value that easily offsets its $95 annual fee. Cardholders can redeem points at 1.25 cents each for travel booked through Chase or transfer points to one of Chase’s 14 valuable airline and hotel partners. Read our full review of the Chase Sapphire Preferred Card .

- You’ll earn 5 points per dollar on travel purchased through Chase Travel, 3 points per dollar on dining, select streaming services and online grocery store purchases, 2 points per dollar on all other travel and 1 point per dollar on everything else.

- Annual $50 hotel statement credit when booked through Chase Travel

- Premium travel protection benefits including trip cancellation insurance, primary car rental insurance and lost luggage insurance

- The card comes with a $95 annual fee

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Ink Business Preferred® Credit Card

The Ink Business Preferred Credit Card’s sign-up bonus is among the highest we’ve seen from Chase. Plus, earn points across the four bonus categories (travel, shipping, advertising and telecommunication providers) that are most popular with businesses. The card comes with travel protections, shopping protections and will also have primary coverage when renting a car for business purposes for you and your employees. Read our full review of the Ink Business Preferred Credit Card .

- One of the highest sign-up bonuses we’ve seen — 100,000 bonus points after $8,000 worth of spend in the first three months after card opening

- Access to the Chase Ultimate Rewards portal for points redemption

- Reasonable $95 annual fee; bonus categories that are most relevant to business owners

- Primary car insurance; and perks including cellphone and purchase protection

- Extended warranty

- Trip cancellation/interruption insurance; trip delay reimbursement

- High spending needed to get 100,000-point sign-up bonus

- No travel perks

- Subject to Chase's 5/24 rule on card applications

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

Chase Sapphire Reserve®

The Chase Sapphire Reserve is one of our top premium travel cards. With a $300 travel credit, bonus points on dining and travel purchases and other benefits, you can get excellent value that far exceeds the annual fee on the card. Read our full review of the Chase Sapphire Reserve .

- Access to Chase Ultimate Rewards hotel and airline travel partners

- 10 points per dollar on hotels and car rentals through Chase Travel, 10 points per dollar on dining purchases through the Ultimate Rewards portal, 5 points per dollar on flights booked through the Chase Travel portal, 3 points per dollar on all other travel and dining, 1 point per dollar on everything else

- 50% more value when you redeem your points for travel directly through Chase Travel℠

- $300 Annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year

- Steep initial $550 annual fee

- May not make sense for people that don't travel frequently

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 75,000 points are worth $1125 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

Ink Business Cash® Credit Card

The Chase Ink Business Cash is an excellent no annual fee card for small business owners. Cardholders can earn 5% cash back on office supplies and select utilities, as well as 2% cash back at restaurants and gas stations. On top of that, the Ink Business Cash card also offers automatic credit limit increase assessments every six months — and sometimes even sooner — to suit the needs of growing businesses. Read our full review of the Chase Ink Business Cash card .

- The current sign-up bonus on this card is an impressive up to $750.

- There is no annual fee which is perfect for small business owners.

- You’ll earn 5% at office supply stores and on common monthly bills such as internet, cable and phone services. Plus, you’ll earn 2% cash back at gas stations and restaurants each account anniversary year.

- 5% cash back earned on certain categories is capped at the first $25,000 you make in combined purchases each account anniversary year.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- 0% introductory APR for 12 months on purchases

Chase Freedom Flex℠

The Chase Freedom Flex delivers a formidable 5% cash back on select bonus categories and travel purchased through Chase Ultimate Rewards. This card is an excellent addition to your wallet as it provides ongoing rewards, a welcoming sign-up bonus and no annual fee to worry about. Read our full review of the Chase Freedom Flex .

- The generous sign-up bonus is impressive for a no annual fee card.

- The card features several categories that earn 5% cash back on travel purchased through Ultimate Rewards and rotating quarterly bonus categories and 3% back on dining and drugstores.

- Your phone is protected against theft or damage for up to $800 per claim (up to $1,000 per year) when you pay that bill with the card.

- You must remember to activate your bonus categories quarterly or risk not earning 5x on select purchases.

- This card charges foreign transaction fees so it's best to use it within the U.S.

- Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening.

- 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter!

- 5% cash back on travel purchased through Chase Ultimate Rewards®, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more

- 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49%-29.24%.

- No annual fee - You won't have to pay an annual fee for all the great features that come with your Freedom Flex℠ card

- Keep tabs on your credit health - Chase Credit Journey helps you monitor your credit with free access to your latest score, real-time alerts, and more.

Southwest Rapid Rewards® Priority Credit Card

While other airlines’ top credit cards have annual fees toppling over $500 per year, the Southwest Rapid Rewards Priority Card comes with just a $149 annual per year. If Southwest is your airline of choice, you’ll receive a number of perks every year: a $75 Southwest travel credit and 7,500 points on your cardmember anniversary. These benefits alone make up the annual fee for frequent Southwest flyers. For every $10,000 spent on this card, you’ll earn 1,500 Tier Qualifying Points, fast-tracking your way to A-List Status. Read our full review of the Southwest Rapid Rewards Priority Card .

- Travel and purchase protections through Chase.

- $75 annual Southwest travel credit.

- 7,500 points on each cardmember anniversary.

- 20% inflight discount on food, drinks and WiFi.

- Ability to earn A-List status faster by spending on this card

- $149 annual fee.

- Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- 7,500 anniversary points each year.

- Earn 3X points on Southwest® purchases.

- Earn 2X points on local transit and commuting, including rideshare.

- Earn 2X points on internet, cable, and phone services; select streaming.

- $75 Southwest® travel credit each year.

- No foreign transaction fees.

Southwest Rapid Rewards® Plus Credit Card

The Southwest Plus credit card is a great starter card for those who are loyal to the carrier. Read our full review of the Southwest Rapid Rewards Plus Credit Card .

- Earn 3,000 points each year after your cardmember anniversary

- Extended warranty and purchase protection

- Secondary car rental insurance and collision damage waiver.

- Baggage delay insurance

- Up to $3,000 in reimbursement for lost luggage

- Roadside dispatch

- Travel accident insurance via Visa Signature

- $69 annual fee

- 3% foreign transaction fee

- Flight redemption limited to U.S., Caribbean and Central American destinations

- 3,000 anniversary points each year.

- Earn 2X points on Southwest® purchases.

- 2 EarlyBird Check-In® each year.

- Earn 1 point for every $1 spent on all other purchases.

Ink Business Unlimited® Credit Card

The Ink Business Unlimited’s sign-up gives you a generous $750 cash back spending $6,000 on purchases in the first three months from account opening plus unlimited 1.5% cash back on every business purchase. It fills in rewards gaps not covered by the Ink Business Cash® Credit Card and the Ink Business Preferred® Credit Card. You can maximize this card by pairing it with cards including the Chase Sapphire Reserve®, the Chase Sapphire Preferred® Card and the Ink Business Preferred. Read our full review of the Ink Business Unlimited Credit Card .

- No annual fee

- Flat 1.5% cash back on all purchases

- Primary insurance for car rentals

- 0% introductory APR for the first 12 months on purchases (then a variable APR of 18.49% - 24.49% applies)

- Higher spend to receive sign-up bonus

- No conversion to Chase points without holding the Chase Sapphire Reserve, Chase Sapphire Preferred or Ink Business Preferred

- No travel protections

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

The Chase Sapphire Preferred is one of the best travel rewards credit cards available. It offers comprehensive travel protection plus elevated rewards on travel and dining purchases while maintaining a reasonable $95 annual fee.

New travel credit card users who are looking to earn transferable rewards without committing to a high annual fee would be a great fit for the Chase Sapphire Preferred.

“The Chase Sapphire Preferred has been in my wallet for 5-plus years and is the go-to midlevel rewards credit card that I recommend to people. It usually has a pretty solid sign-up bonus, with points that can be transferred to some of my favorite loyalty programs, like British Airways Executive Club and World of Hyatt. The strong earning rates on dining and travel as well as streaming services makes it a good choice for a millennial like me. Finally, I like using this card when renting cars, as it provides primary rental car insurance and a little more peace of mind.” — Matt Moffitt , senior credit cards editor

Transferable points are often considered the golden currency in the travel reward world, but if you find that you prefer American Express travel partners, the American Express® Green Card offers a comparatively low annual fee while still allowing you to earn on travel, restaurants and more.

The information for the American Express Green Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

You get tons of perks for a $95 annual fee. Instead of having to spend $15,000 to qualify for the 100,000 bonus points offer, new cardholders can qualify for the bonus points by spending $8,000 within the first three months of account opening.

Although this is primarily a business card, it’s also a great travel card as well. Frequent flyers who book trips through Chase’s Ultimate Rewards can maximize the value of their earned points when booking travel through the Ultimate Rewards portal. The best part? The cash back you earn doesn’t expire as long as your account remains open.

“I originally signed up for the Ink Business Preferred primarily for its sign-up bonus. But, over the last year, I’ve found myself making it my go-to card when booking travel. After all, the Ink Business Preferred earns 3 points per dollar spent on travel and provides excellent travel protections, including trip delay protection and rental car insurance.” — Katie Genter , senior writer

The Chase Ink Business Cash® Credit Card is a good option if you want to avoid paying an annual fee and want to earn 5% cash back on the first $25,000 you spend at office supply stores, on internet, cable and your phone bill, 2% cash back on the first $25,000 you spend at gas stations and restaurants plus an unlimited 1% cash back on every other purchase you make.

The Chase Sapphire Reserve is a premium travel card with matching benefits. The card offers an elevated earning rate on many bonus categories, includes premium lounge access and features a $300 annual travel credit . For just about any traveler, the Chase Sapphire Reserve is a solid pick.

Frequent flyers will find the Chase Sapphire Reserve to be a great addition to their wallet, thanks to its travel perks and benefits.

“The Chase Sapphire Reserve is a no-brainer for me. My top two spending categories are travel and dining, and this card lets me earn 3 points per dollar in both of these categories. Then, I can transfer these points to one of Chase’s 14 travel partners or redeem them for a generous 1.5 cents apiece through the Chase travel portal or Pay Yourself Back program. The card has a high annual fee, but I don't mind paying it thanks to perks like a $300 travel credit, Priority Pass lounge access and impressive travel protections.” — Benji Stawski , former senior reporter

If you’re looking for a more luxury-focused travel card, consider The Platinum Card® from American Express instead. The Amex Platinum comes with more benefits, travel credits and lounge access — as well as a higher annual fee of $695 (see rates and fees ).

The Ink Business Cash offers a great introductory offer, no annual fee and multiple elevated reward rates. In addition, you can increase the value of your rewards by transferring rewards to an eligible Chase card that earns Ultimate Rewards points.

New business owners who are looking to separate their business and personal expenses while earning rewards on a card with no annual fee should consider the Ink Business Cash card.

The Ink Business Cash card offers elevated cash-back rates on regular business categories and a solid sign-up offer, all with no annual fee. When combined with a higher-end Ultimate Rewards card, the Ink Business Cash is a no-brainer for any small-business owner looking to maximize their rewards earning.

If you’re looking for a no-annual-fee business card but have varied spending habits, consider the Ink Business Unlimited® Credit Card . That card earns an unlimited 1.5% cash back on all spending and features a similar introductory bonus.

The Chase Freedom Flex makes cash-back earning easier than ever. You can earn elevated cash back on dining and travel, but every quarter, the Freedom Flex also earns 5% back on up to $1,500 in combined purchases at a rotating selection of merchants (after activation).

The Chase Freedom Flex is a great addition to any beginner’s wallet since it has no annual fee and offers a large spectrum of elevated cash-back categories.

“I love when a cash-back card is more than a cash-back card, and that's definitely the case with the Chase Freedom Flex. I can effectively convert the cash-back rewards on this card into fully transferable Ultimate Rewards points, since I also have the Chase Sapphire Reserve — opening up fantastic redemptions like luxury World of Hyatt properties and top-notch premium airplane cabins.” — Nick Ewen , director of content

If you know your spending habits do not align with the quarterly bonus categories offered by the Chase Freedom Flex, consider the Chase Freedom Unlimited® instead. You will still earn the same elevated rate on travel and dining but you get 1.5% cash back on all other purchases instead of 1%.

The Southwest Priority card is a great card for Southwest loyalists who can maximize the card’s perks and benefits. Some notable features include an annual bonus of 7,500 Rapid Rewards points (valued at $113, according to TPG’s valuations ), a $75 annual Southwest travel credit and four upgraded boardings per year.

Southwest loyalists can easily justify the Priority’s annual fee with the anniversary point bonus, travel credit and other perks.

Any Southwest loyalist should add the Priority card to their travel wallet, as the perks and benefits easily pay for the annual fee every year.

If you still want a Southwest card but find that you don’t need all of the perks on the Priority, consider the Southwest Rapid Rewards® Premier Credit Card , which offers similar perks with a lower fee.

The information for the Southwest Rapid Rewards Premier has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

The Southwest Rapid Rewards Plus credit card is a great starter card for Southwest travelers thanks to its low annual fee. In addition to earning bonus points on Southwest purchases, the card comes with two EarlyBird check-ins annually and bonus points for each account anniversary.

If you’re a casual Southwest flyer (at least once a year), you’ll likely benefit from the perks on the Southwest Rapid Rewards Plus card.

For beginner travelers who occasionally fly Southwest, adding the Southwest Plus card can be a great way to expand your travel card collection.

If you’re looking for more benefits from your Southwest credit card, consider the Southwest Rapid Rewards® Premier Credit Card which features a higher annual bonus upon card renewal and additional benefits when flying the carrier.

There is no easier cash-back business card than the Ink Business Unlimited, as you’ll earn 1.5% back on all purchases. In addition, it features a generous introductory annual percentage rate period and primary insurance on business-related car rentals — all for no annual fee.

Small-business owners who want a simple business card will benefit from the Ink Business Unlimited’s flat reward rate.

“I have the Chase Ink Business trilogy — the Ink Business Cash Credit Card, Ink Business Preferred Credit Card and Ink Business Unlimited cards. The first two cards maximize my points-earning on things like office supply, internet and phone purchases, whilst the Ink Unlimited covers everything else, with a flat 1.5% earning rate. The fact that I have the Ink Preferred means I can convert my cash back from the Ink Unlimited into more valuable Chase Ultimate Rewards points. This no-annual-fee card will stay in my wallet for years to come.” — Matt Moffitt , senior credit cards editor

If your business has more specialized purchases that align with the Ink Business Cash® Credit Card , it can be a better fit, as the bonus categories have higher earning rates than the Ink Business Unlimited’s flat 1.5%.

Decide the type of rewards you want to earn

Chase offers a wide range of credit cards — including ones that earn the issuer’s own Ultimate Rewards points as well as cobranded products with partners like United and Marriott . You could even opt for a top cash-back card if you don’t want to mess with travel rewards. Before you apply for a Chase credit card, consider what type of rewards are most useful for you. Many travelers will benefit from the flexibility of Chase Ultimate Rewards, though everyone’s situation is different.

Earn the welcome bonus

Once you’ve pulled the trigger on applying for a new card, it’s critical to ensure you hit the minimum spending requirements to earn the welcome bonus. Most Chase credit cards give you at least three months to do so, but it’s critical to plan your spending accordingly. In some cases, the bonus can get you over $1,000 worth of rewards, so missing out on it can be a major setback for your travel planning.

Add new cards to maximize your earning potential

Getting a top Chase credit card can unlock valuable rewards, but if you really want to take your card strategy to the next level, consider adding more than one to your wallet. While managing multiple credit cards takes added effort, it can also expand the number of points or miles you can take home. You can use one card to earn bonus points on travel and dining, for example, and then another card can give you extra rewards at drugstores. In fact, Chase cards feature prominently in our guide to the best credit card pairings .

Chase, also known as JPMorgan Chase Bank, is a large American national bank. It offers a large variety of banking and investment products for both consumers and small businesses — including a wide range of credit cards.

Types of Chase credit cards

Chase offers a large selection of credit card products. Some notable types are defined below.

Travel credit cards are typically tailored to travelers, offering more rewards on travel purchases and providing additional protection and value-added perks. For example, the Chase Sapphire Reserve® offers an annual $300 travel credit, which can help lower the out-of-pocket cost of your trips. In addition, it offers extensive travel protection when things go wrong, along with lounge access — both perks that can make your next trip a simpler process.

Cash-back credit cards earn a percentage of cash back on each purchase you make. Some — like the Ink Business Unlimited® Credit Card — offer a simple, flat cash-back rate on all purchases. This could be a great fit for someone who is looking for a straightforward earning structure without needing to worry about maximizing bonus categories.

Other cards — like the Chase Freedom Flex℠ — feature bonus categories which help those who have more tailored spending habits get the most return on their spending.

But the best part about Chase is that you can effectively convert your cash-back rewards into fully transferable (and more flexible) Ultimate Rewards points, simply by having a higher-end Chase card.

A “starter” credit card typically refers to a simple product that’s relatively easy to get. Generally these don’t impose an annual fee, and they offer basic cash back so as not to overwhelm a new entrant into the world of credit cards.

One such card would be the Chase Freedom Unlimited®, as it earns an unlimited 1.5% back on all purchases plus an elevated rate on travel and dining, two big expense categories for many people. With no annual fee, even the newest credit card user can find many benefits with the Freedom Unlimited.

Business credit cards typically offer business-focused perks and elevated earning rates on business spending. These cards are a great way to keep your business expenses separated from your personal expenses and earn on what you are already spending. Chase offers multiple business products under the Ink family of credit cards .

Business owners will have to look over their spending and see which card will help them earn the most on their current expenses.

Finally, cobranded credit cards are issued by a bank in partnership with another organization. The cards typically feature brand-specific rewards and benefits, most frequently with travel companies. For example, Chase issues cobranded cards with United Airlines, Southwest Airlines and the World of Hyatt loyalty program.

However, it can also partner with a lifestyle brand — as it’s done with the Instacart Mastercard® and DoorDash Rewards Mastercard® .

How to apply for a Chase credit card

You can apply for a Chase credit card online, by mail or in person at a Chase bank. You'll need some basic information like your social security number and gross annual income. Here's what else you should know before you submit an application.

The Chase 5/24 rule is infamous in the credit card world. While Chase has never publicly published this policy, data has proven that it almost always applies.

In short, Chase will not approve new applicants who have opened five or more personal credit cards within the last 24 months. This applies to all bank cards, not just Chase cards. You generally have to be under this number to be approved for a new Chase credit card. You can learn more with our full guide to the Chase 5/24 rule .

Chase's 48-month rule states that you're ineligible to earn a bonus on a Chase card if you're a current cardholder of that specific card or if you have already earned a sign-up bonus on a specific card you've had within the last 48 months.

Chase credit card benefits

Chase credit cards come with many benefits and perks. Some notable benefits are highlighted below.

Many Chase cards fit into the Ultimate Rewards ecosystem . However, only three that are available to new applicants earn Ultimate Rewards points: the Chase Sapphire Reserve®, the Chase Sapphire Preferred® Card and the Ink Business Preferred® Credit Card. These Ultimate Rewards points can be transferred to a number of airline and hotel partners but can also be used to book travel directly, making them incredibly valuable when it comes to redemption.

Luckily, if you have one of these products, you can combine your cash-back rewards with your Ultimate Rewards points in a single account — allowing you to maximize your earning.

Chase is known for some of the best welcome bonuses in the card industry. You can see the current welcome bonus on the card tiles above — and you can refer to our guide with historical offers to see how the current ones measure up.

Travel and shopping protections can be some of the most underrated perks offered by credit card companies. You hope you won’t need to use them, but they can save the day when things go wrong.

One of Chase’s most notable benefits is primary rental car coverage, available on many popular products like the Chase Sapphire Preferred® Card and Chase Sapphire Reserve®. When you charge a rental car to an eligible card, you’re covered for theft, loss or damage to the vehicle, without needing to invoke your personal insurance.

Related: Best credit cards with travel insurance

One of the most notable features of Chase cards is their pairability, thus maximizing the reward potential for your wallet. It is worth considering adding multiple Chase cards to your wallet to get the best return on your spending.

There are multiple strategies for pairing Chase cards, but one of the most popular is commonly known as the Chase Trifecta — the Chase Sapphire Reserve®, Ink Business Preferred® Credit Card and Chase Freedom Unlimited®. However, the best combination of cards should be tailored to your spending and specific reward needs.

That being said, you’ll almost certainly want to feature the Sapphire Reserve, Sapphire Preferred or Ink Business Preferred in your strategy to ensure you’re earning fully transferable Ultimate Rewards points. Then, select the cash-back Chase cards that best match your spending habits.

Related: How (and why) to combine your Chase Ultimate Rewards points into a single account

Redeeming your Chase Ultimate Rewards

Chase Ultimate Rewards points are among the most valuable transferable rewards currencies out there. TPG values Ultimate Rewards points at 2 cents each, but you have the potential to redeem them at a higher rate for the right travel redemption.

In many cases, the best way to use your Chase Ultimate Rewards points is by transferring them to Chase’s travel partners . Popular programs that can unlock luxury travel experiences include World of Hyatt, Air Canada Aeroplan and United MileagePlus. However, if you don’t want to mess with another loyalty program, using your Ultimate Rewards points directly with Chase Travel can still offer a solid value .

For an in-depth look at how to maximize your Chase Ultimate Rewards points, check out our complete guide .

- 1 Sign-up bonus Choose a card that aligns with your financial goals — if you’re saving for a big vacation, applying for a card with a generous sign-up bonus may help cover some of the travel costs for that trip.

- 2 Annual fee Whether your preference is a card with no annual fee or a premium card with a high annual fee, choose the one that best fits your lifestyle.

- 3 Bonus categories Choose the card that earns rewards in your most frequently used bonus categories like groceries, gas and streaming subscriptions.

What's your favorite Chase card — and why?

- Using Chase credit cards responsibly can help you build your credit score.

- Chase credit cards can earn points, miles or cash back on every dollar you spend.

- Some Chase credit cards provide purchase, theft and fraud protection.

- Select Chase credit cards provide perks like travel insurance, lounge access and more.

- Chase credit cards can encourage overspending.

- Carrying a balance and using your Chase card irresponsibly can damage your credit score.

- The cost of borrowing on Chase credit cards is higher than traditional loans.

- Having too many card applications can negatively affect your credit score.

- Chase has some of the most stringent application restrictions of any issuer.

There’s no single Chase credit card that’s best for everyone. Instead, it will depend on your spending habits and what rewards you are looking for. Luckily, Chase cards are easy to pair and maximize, so you can consider adding multiple cards to your wallet.

To apply for any Chase card on this list, you can click on the card’s name, photo or “Apply Now” link to the right of the card. Then, simply follow the on-screen instructions to complete (and submit) your application.

Chase doesn’t have an official limit on the number of Chase cards one person can have. In fact, many TPG staffers have had several Chase credit cards at the same time. However, Chase does limit the amount of total credit it will extend to you. It also has the 5/24 rule (more on that below). Finally, as a general rule of thumb, you can only be approved for one personal card and one business card within 90 days — but even that’s not a hard-and-fast rule.

There are also different application rules for specific Chase cards. You can only hold one Sapphire card at a time. You can only have a single personal Southwest credit card; however, you can hold both a Southwest business card and personal card, which is a great way to earn the Southwest Companion Pass.

For more details on Chase’s application rules, read our guide to credit card application restrictions .

That being said, having a score of at least 700 will give you the best chances of being approved for the top Chase credit cards. Of course, it’s possible to be approved with a slightly lower score; it’s just not as likely.

To cancel a Chase credit card, you’ll need to call the number on the back of your card. A phone agent can help you complete the cancellation process. However, be sure to use (or transfer) all of your rewards first, since you may forfeit them after canceling (or shortly thereafter). Pay off any outstanding balances, and be sure to update your account with any merchants that automatically bill the card you’re closing.

Just note that canceling a credit card should not be taken lightly, as it can affect your credit score. You can check out our guide to how to cancel a credit card to help you determine if you should go this route.

Chase does not publish an official score for approval, but our data suggests that a score of at least 670 will increase your chances of getting approved. In addition, rewards credit cards generally require a higher credit score for approval, typically 720-plus.

Having a score of at least 700 will give you the best chances of being approved for the top Chase credit cards. Of course, it’s possible to be approved with a slightly lower score; it’s just not as likely.

Related: How to check your credit score for absolutely free

IMAGES

VIDEO

COMMENTS

I tried to change my return flight to come back from an alternate airport and they said I can only use the credit for an identical departure/ destination. I had to buy my return flight and it's a year later and I still haven't had an opportunity to use my Amex travel credit since I haven't flown from X to Y yet. Terrible!!

Use the "Pay with Miles" feature to use 5k miles to reduce your ticket by $50. Pay for the rest with your Amex Platinum (or Gold) that you wish to use the credit on. The Pay with Miles portion makes the remainder of the ticket an "Additional Collection" which triggers the credit. It has worked on 3/3 cards for me for multiple years in a row.

Right below that, there is a box/section that says the following: Receive a $200 Travel Credit. Book through American Express Travel to receive up to $200 in statement credits for eligible travel purchases on your eligible Platinum Card. Through December 31, 2021. Then there is a bar that tracks the spending $0.00 received.

I just did it last week and it worked perfectly with a e-credit I had. Dec 5 Booked a random Economy Plus one way ticket for $232 using my $32 credit and charging $200 to my Amex plat card. Dec 7 Charge posted to Amex for $200 (additional info shows up as Additional Collection) Dec 11 received my $200 Credit on Amex.

Get the Reddit app Scan this QR code to download the app now ... We discuss Amex offers, Membership Rewards, benefits, offers, maximizing card usage and everything related to "ALL" American Express Cards. Please free to add content and join in the conversation. ... But Amex will give you the travel credit. Pretty much if you don't use the ...

The personal Platinum card is now offering SUBs as high as 125-150K plus a dining bonus. I don't count that in offsetting the AF as that's a one time benefit but that also is easily worth $1500 at a poor redemption and $4500 at a good redemption. We just booked $5700 flights for 87K MRs and $219 but that's a rarity.

amex travel is fairly useless, they aren't very good at finding good fares and will try to book you on some rather funky airlines, especially in Asia. Make sure you're making the most of Amex transfer partners. Marriott and Hilton for hotels and several airlines. Check how many points you would need to book directly with Hilton or the airline ...

5 suggestions on using the airline fee credit this year. Here are some ideas for using your Amex Platinum airline incidental credits throughout 2024: Pay for seat assignments and checked bag fees. Use it to splurge on food and beverages while inflight. Purchase airline lounge daypasses for future use.

Good for you, and you have the whole 2021 to use the credit. It depends on the airlines, instead of refunding it, you can ask for e-credits (atleast I know Delta does that). Since it's not a refund to credit card, the travel credit will remain on the card. Though I haven't tested it. Yeah my ecredit for a specific airline shows in Amex ...

Steps to use the American Express airline credit. 1. Choose your AmEx card. The first step in using the AmEx airline credit comes in having a card that offers this credit, as not all cards do ...

Use the airline fee credit to pay for checked bags, prepay for a seat or buy lounge passes. If you're able to use up all $200 each year you're a card member, it helps offset the card's high ...

The American Express Travel portal allows you to redeem Membership Rewards points directly for travel reservations and activities rather than transfer your rewards to airline or hotel partners like Delta Air Lines SkyMiles and Marriott Bonvoy.. You also can book discounted premium tickets, use benefits like a 35% points rebate on certain bookings and even book premium hotels with additional ...

Meanwhile, the Hilton Aspire card's annual credit is the largest at $250 a year. The *amex gold card* previously got $100 a year in airline credits, though that ended in 2022. All of these travel credits reset each calendar year, not based on the month you opened your account. So you can use up the credits from Jan. 1 through Dec. 31.

The Platinum Card® from American Express is one of the top premium travel rewards cards on the market, though it comes with a hefty $695 annual fee (see rates and fees) to match. One of the easiest ways to recoup that upfront investment is by taking advantage of the card's up to $200 annual airline incidental fee credit, though over the years ...

To use the airline fee credit, charge an eligible purchase to your enrolled card. AmEx should automatically reimburse the fee to your card. The terms and conditions say the credit will typically ...

Here's how my AmEx travel booking broke down. The room rate was $349, but by booking a FHR property through AmEx travel I got: The Platinum Card® from American Express credit: $200. Property ...

Step 2: Search. Begin your travel search through the American Express Travel Online website. Your available payment options will be displayed in the results. Step 3: Apply Credit. On the checkout page, redeem. your Annual Travel Credit by selecting the '$$$ Annual Travel Credit' button on. the checkout page. Your credit can only be used in ...

First-Year Value: $1,361. Earn 70,000 MR points upon spending $10,000 in the first three months. Plus, earn 30,000 MR points upon making a purchase in months 14-17 as a cardholder. Also, earn 2x MR points on all dining and travel purchases. Also, receive an annual $200 travel credit. Also, receive an annual $200 dining credit.

Bottom line. The up to $200 prepaid hotel credit is one of the most valuable benefits of the Amex Platinum. If you can fully utilize it and think it's worth it at or near face value, you're already coming out ahead of the Platinum Card's $695 annual fee (see rates and fees ). The properties bookable through the Amex FHR and The Hotel Collection ...

All Amex Platinum cardholders now get an annual credit of up to $200 to use for prepaid hotel stays, and it's easy to use. All you need to do to get started is search for hotels through the Amex Travel booking portal. This new credit only applies to Fine Hotels + Resorts® (FHR) or Hotel Collection properties.

1. Visit the American Express Travel Online website to book flights, hotels, and car hire. 2. Make a booking to the full value of your Travel Credit or more and select the Travel Credit at checkout. 3. Pay for your booking using your eligible American Express Card and we will credit the amount to your Account within 3 business days.

The American Express® Green Card is one of our top cards for travel purchases and is featured in our best Amex credit cards.. New cardholders can now get a welcome bonus of 40,000 bonus Membership Rewards points after they spend $3,000 on purchases on your new card in the first six months of cardmembership.. The Amex Green earns 3 points per dollar on travel, transit and dining at restaurants.

1. Search our curated collections of Fine Hotels + Resorts and The Hotel Collection properties. Choose the one that's right for you and book a prepaid stay through American Express Travel with your eligible Platinum Card. 2. Receive $200 in statement credits each year after you book an eligible stay with your Platinum Card. No enrollment ...

Travel credit cards are typically tailored to travelers, offering more rewards on travel purchases and providing additional protection and value-added perks. For example, the Chase Sapphire Reserve® offers an annual $300 travel credit, which can help lower the out-of-pocket cost of your trips. In addition, it offers extensive travel protection ...