A guide to NDIS participant transport and provider travel funding

Reliable and accessible transportation is important for people with disabilities to help them build independence and participate in the community.

The National Disability Insurance Scheme (NDIS) recognises the significance of mobility for NDIS participants and provides dedicated funding for transportation.

This guide explains NDIS transport funding and how it works.

Understanding NDIS transport funding

Who is eligible for ndis transport funding.

To qualify for NDIS transport funding, individuals must meet specific criteria related to their disability and support needs.

The eligibility process considers how the disability affects daily life, especially in terms of mobility and participation in community.

Factors such as whether a person faces challenges in using public transport and if they require specialised or modified transportation are considered.

How to get NDIS transport funding included in your plan?

If your participant would like to have transport funding covered in their NDIS plan , be sure to ask for it in the initial planning meeting.

Make sure you are clear about why the participant needs it and emphasise how the disability affects their ability to get around.

How does the NDIS fund transport in an NDIS plan?

There are four main ways the NDIS can fund transport:

- Annual transport funding – paying for transport services such as taxi’s or rideshares if you are unable to catch public transport

- Core support budget – paying a support worker to drive you or travel with you,

- Capacity building support budget – building your capacity to get around by yourself

- Capital support budget – funding modifications to a vehicle

Funding for participant transport

NDIS transport funding is designed to enable individuals to move from one location to another efficiently, helping to increase community participation, independence, and the achievement of their NDIS plan goals.

If a participant’s disability makes it difficult for them to catch public transport, the NDIS may find it reasonable and necessary to fund access to transport support services.

The NDIS provides an annual travel allowance based on predetermined levels of activity.

Participants receive recurring fortnightly payments directly into their bank account for transport costs.

The NDIS does not fund specific services however participants can choose how they use these funds to access transport services such as a private car services, taxis, Uber, or buses to enable them to get to an activity or appointment.

Funds cannot cover costs associated with travel for informal supports such as a family member or friend and they aren’t intended to cover tips, petrol or any other expense during a trip.

There are three levels of transport funding based on a participants’ needs:

- Level 1 – Up to $1,606 annually for participants who are not working, studying or enrolled in day programs but want to improve their community access

- Level 2 – Up to $2,472 annually for participants who are working or studying up to 15 hours a week

- Level 3 – Up to $3,456 annually for participants who are working, job-seeking or studying for 15 or more hours a week

Funding for travelling with a support worker

Funding under the ‘Assistance with social and community participation’ category in the Core Support budget, allows funding for a support worker to drive a participant around or accompany them out into the community including shopping trips, social events or medical appointments.

These trips are charged at an agreed hourly rate with the support worker and will include the total time the support worker attends the outing and can also cover the time it takes to travel to and from the participants residence.

It may also include travel costs such as road tolls, parking costs or public transport tickets.

Funding for training to enable independent travel

The NDIS can provide funding to support participants in developing essential life skills including learning to travel more independently.

Included under ‘Improved Daily Living’ category in the Capacity Building Supports budget participants may be eligible for funding for training to use public transport, driving lessons or assistive technology.

Funding for vehicle modifications

Under the ‘Assistive Technology’ category in the Capital Support Budget specialist transport funding is available for those requiring modified vehicles or assistive technology ensuring customised solutions for unique needs.

Funding for provider travel to deliver support

Providers travelling to deliver Core or Capacity Building Supports to participants can claim both labour and non-labour costs associated with that travel.

Labour costs cover the time spent travelling, while non-labour costs can include public transport fees, petrol, tolls, parking, and vehicle maintenance.

Providers can only claim travel costs when delivering support if the NDIS Support Catalogue (price list) includes a line for the cost of travel when delivering the service and the service agreement they have in place with the participant specifies that travel costs can be claimed.

Need help with NDIS transport funding?

NDIS transport funding plays an important role in improving independence and community engagement for participants.

Understanding what NDIS transport funding options are available empowers participants to make the most of the support available, achieve their goals and enhance their overall quality of life.

As an experienced provider of NDIS Plan Management services MyIntegra can assist participants in managing their NDIS funds and help you understand NDIS transport funding and what is and isn’t covered.

If you have any questions, contact us on 1800 696 347 for Plan Management or 1300 937 187 for Support Coordination or email [email protected] .

Navigating the NDIS made easy

Your details

Chat is only available during business hours 9am - 6pm AEDT.

NDIS Provider Travel: Everything You Need to Know and Examples

Table of content

NDIS Provider Travel refers to the journey you and your team travel to participants' homes. Unlike Activity Based transport, Provider Travel covers the time and costs incurred by support workers while travelling to provide face-to-face support to participants. In this article, we'll provide insights on how to handle Provider Travel within the framework of NDIS guidelines effectively.

For more information on Activity Based Transport, which focuses on the journey support workers transport their participants, please read here.

What is NDIS Provider Travel?

Provider Travel framework is designed to reimburse travel costs and the time a worker spends travelling to a participant’s location to provide direct support. In some cases, it may also cover the time spent travelling back to the provider’s place of business.

Service providers can only claim from a participant’s plan for Provider Travel if all of the following conditions are met:

- The NDIS Pricing Arrangements and Price Limits indicate that you can claim for Provider Travel related to that support item.

- The travel charges must comply with the NDIS Pricing Arrangements and Price Limits .

- The travel must be a part of delivering a specific disability support item to that participant.

- The support must be delivered directly, through face-to-face interaction.

- Service providers must explain to the participant why paying for provider travel is a good use of their NDIS funds.

- Service providers must have the participant's advance agreement, which should specify the travel costs that can be claimed.

- Service providers must pay the worker delivering the support for the time they spent travelling unless they are sole traders travelling from the usual place of work to or from the participant, or between participants.

The NDIS allows for travel claims in two types:

- Labour Costs: the time and effort of support workers

- Non-Labour Costs: kilometre cost, parking fees and road tolls

NDIS Provider Travel - Labour Costs (Travel Time)

Provider Travel - Labour Cost is the time spent travelling to (and sometimes from) a participant, and it must be claimed separately from the claim for the primary support.

Modified Monash Model (MMM)

The Modified Monash Model is a system the NDIA uses to categorise different areas as regional, remote, or very remote. Instead of relying on geographical distance, population density data provided by the Bureau of Statistics is used to determine these classifications. To see where you are located according to the MMM, please click here to access the MMM complete list.

How much can you claim for Provider Travel - Labour Cost?

When it comes to claiming for Provider Travel - Labour Cost, understanding how much you can claim is crucial. The amount you can claim largely depends on the region, as defined by the Modified Monash Model (MMM), and the nature of the support provided.

Here's a breakdown of the key points to consider when calculating your claim:

- You can claim up to 30 minutes (MMM1,2,3 areas) or 60 minutes (MMM4,5 areas) for travelling to each participant.

- If you’re delivering core and capacity-building supports and you must pay your worker for this return travel time (as part of the employment agreement), you can claim up to 30 minutes (MMM1,2,3 areas) or 60 minutes (MMM4,5 areas) for the return journey from the last participant to your usual workplace.

- If a worker serves multiple participants in a 'region’, you can distribute the travel time (including the return journey, where applicable) among these participants, with prior agreement from the participants.

- Submit travel claims separately from the primary support claim using the same line item and the "Provider Travel" option in the Myplace portal.

- Calculate the claimable travel costs using the agreed hourly rate for the primary support (or a lower hourly rate) with prior agreement from the participant.

NDIS Provider Travel - Non-labour Costs

In addition to the cost of a worker’s time, you can negotiate with participants to make reasonable contributions to cover additional costs incurred when travelling to deliver face-to-face support, such as road tolls, parking fees, and vehicle running expenses.

The NDIA defines reasonable contributions as follows:

- Up to the full amount for other transportation-related costs like road tolls, parking, and public transport fares.

- Up to $0.97 per kilometre for provider or worker-owned vehicles

You can only claim for non-labour costs as part of Provider Travel related to a support item if it is allowed by NDIS.

Similar to the worker’s time, if you travel to multiple participants on one trip, you should divide non-labour costs amongst participants, with the agreement of each participant in advance.

Moreover, claims for non-labour costs related to Provider Travel must be made separately from the claims for the primary support and the travel time. These non-labour costs should be claimed under the "Provider Travel - non-labour costs" support item specified in the NDIS Pricing Arrangements and Price Limits .

NDIS Provider Travel Example

Your support worker travels 35 minutes (20 kilometres) to help a participant in Zone 3 of the Modified Monash Mode to provide two hours of Core support ( Assistance With Self-Care Activities ).

You and the participant have agreed to an hourly rate of $72.13. They have also agreed that the you can claim for travel time and for the non-labour costs associated with that travel (at $0.85 per kilometre). Zone 3 has a travel claim limit of 30 minutes; this means you can claim a maximum of 30 minutes for the travel to the participant.

Moreover, the worker has to pay a toll fee ($10). The participant has agreed that you can claim this toll cost too.

So technically, your claim for this support comes in four separate parts:

- $144.26 for the two hours of direct support. (01_015_0107_1_1, no longer 01_301_0104_1_1)

- $36.07 for the 30-minute travel to the participant (30/60 * $72.13) as Provider Travel (Labour cost) (01_015_0107_1_1)

- $17 for the 20-kilometre travel to and from the participant ($0.85 * 20) as Provider Travel (Kilometres) (01_799_0107_1_1)

- $10.00 for the toll fee as Provider Travel (Toll charges) (01_799_0107_1_1)

To see how you can claim for Provider Travel in Comm.care, check out this tutorial .

NDIS Provider Travel FAQs

If the travel time is 20 minutes, can I claim the 30-minute maximum time cap? No. The claim must reflect the actual travel time.

I operate my business from home, can I charge from home to the first participant? Yes. If your home is the registered business address.

Can travel costs be claimed for non-face-to-face support activities? No, Provider Travel is specifically for travel related to face-to-face support services. Travel costs for non-face-to-face activities are not claimable under this category.

Can I claim the return travel time to my usual place of work? Yes, if you’re a provider of core and capacity-building services, you can claim return travel time when you must pay your workers for the return journey. The maximum claimable time for return travel varies based on MMM classifications.

Get paid faster with Comm.care

Manual invoicing can be a real problem as mistakes are time-consuming. Over time, they can lead to real problems: delayed payments and wasted time your business could have spent caring for customers.

Book a demo and explore how Comm.care can help your business invoice quicker and easier.

Comm.care Team

Comm.care is a comprehensive platform designed to seamlessly streamline care management, invoicing, rostering, and compliance process. Comm.care offers a unified platform for organisations to collaborate with other care institutions and manage care for the elderly, people with disabilities, along with their families and friends.

Save this information for later.

You may also like these blogs

Why NDIS providers need a bulletproof claims process

%20for%20a%20Short%20Term%20Accommodation.png)

How to create a claim (within seconds) for a Short Term Accommodation

Top 5 NDIS payments mistakes and ways to avoid them

Subscribe to our newsletter.

Acknowledgement of Country

In the spirit of reconciliation Pnyx acknowledges the Traditional Custodians of country throughout Australia and their connections to land, sea and community. We pay our respects to their Elders past and present and extend that respect to all Aboriginal and Torres Strait Islander peoples today.

Quick Links

NDIS provider travel costs and activity based transport.

Payments for provider travel costs are often a source of confusion among NDIS participants and providers alike.

A provider can charge your NDIS plan for transport costs associated with delivering approved NDIS services.

Extra costs may include the driving time for a provider to deliver face-to-face supports such as at your home, travel time for taking you to and from an activity and other items such as car parking or toll fees.

Provider costs under the NDIS highlights

- Provider transport costs are charged separately to the support

- Costs may include a combination of support worker travel time and other related transport costs

- Participants must agree to these costs in advance

- Costs must be split if the travel costs cover providing supports to two or more participants at the same time.

Looking for information about how the NDIS funds transport costs for participants? Check out Travel and transport funding under the NDIS . Or check out our PACE page for more details about recurring transport funding.

A guide to provider travel costs for face-to-face support.

Sometimes NDIS providers need to travel to a location such as a person’s home or a place of respite to deliver supports. In this case, providers may be able to bill you for travel costs.

All of the following conditions must be met for providers to claim travel costs from a participant’s NDIS Plan:

- The NDIS participant has agreed in advance

- NDIS Pricing Arrangements and Price Limits must indicate that providers are eligible to claim travel costs for the support item and the proposed claim must comply with the price limits guide

- The activity must be related to delivering specific disability support to the participant

- The support must be delivered face-to-face (in person not online)

- The provider must explain to the participant why paying for provider travel is a good use of their NDIS funds

- Travel time can be claimed if: a) the provider has to pay the worker for their travel time or b) the provider has their own business (sole trader).

Provider travel: Labour costs.

The NDIS uses 7 zones determined by population and location to set prices for supports and services, including travel allowance for providers. Zone 1 includes major cities, while zone 7 covers very remote areas. All of the other zones sit in between.

Reflecting the cost of providing services, price limits vary based on the zone where the service is provided. The maximum time providers can claim for travelling to each participant per session is:

- Zones 1-3: 30 minutes

- Zones 4-5: 60 minutes

- Zones 6-7 (remote and very remote areas): as agreed up to the hourly rate for the support item.

In addition, providers delivering Core and Capacity Building supports can also claim for the time spent travelling from the last participant to their usual place of work (if the provider is paying the worker for that time). The maximum amount of return travel time depends on the zone as above.

Provider travel: non-labour costs.

In addition to the worker’s time, they may incur other travel-related costs when delivering face–to–face support. This can include car parking costs, toll fees and car running costs like petrol and maintenance. Such additional items can only be claimed if the support allows travel time to be claimed.

Under the NDIS, the participant can be asked to make a reasonable contribution to these costs, as follows:

- For a vehicle owned by the provider or the worker, up to $0.97 a kilometre

- For other forms of transport or associated costs such as road tolls, parking, and public transport fares, up to the full amount.

Provider claims for activity-based transport costs.

A participant can engage a provider to help them get to and from certain activities such as driving to a community activity covered under their NDIS plan. This assistance is called “activity based transport”.

Providers of Core > Assistance with social, economic and community participation supports and some Capital supports can claim costs for transporting a participant to an activity.

The participant must have agreed in advance. How this works and the agreed costs are usually included in the service agreement between the participant and the provider.

Not all Capacity Building supports are eligible to claim activity-based transport costs. The following are permitted:

- Finding and keeping a job > Employment support

- Improved learning > Transition through school and to further education

- Improved living arrangements > Assistance with accommodation and tenant obligations

- Increased social and community participation > Life transition planning

- Support coordination > Psychosocial recovery coaching

- Increased social and community participation > Skills development and training

- Improved relationships > Individual social skills development.

Activity-based provider transport costs the NDIS may cover.

Where a worker incurs costs to drive you to an activity and home again, they can claim for transport time and relevant travel-related costs.

- Activity-based transport: Labour/time costs.

The provider can bill the participant’s plan for the time that support workers spend delivering transport directly connected to the support. This includes picking you up and driving you to the location as well as the return trip.

The worker’s travel time can be charged at the hourly rate for the relevant support item if the participant agrees. In some cases, you may be able to negotiate a lower hourly rate.

- Activity-based transport: Non-labour costs.

As is the case for some face-to-face supports, the delivery of activity-based supports means some providers have to pay other costs such as road tolls, parking feed and vehicle running costs.

Providers can negotiate with participants to make a reasonable contribution towards these costs, usually considered to be the following:

- For a vehicle that is not modified for accessibility, up to $0.97 a kilometre

- For a vehicle that is modified for accessibility or a bus, up to $2.76 a kilometre

- For other forms of transport or associated costs, such as road tolls, parking and public transport fares, up to the full amount.

Keep in mind that providers can only charge these fees if they’re directly connected to the support and you have agreed to pay these in advance.

Top tip: Provider activity-based transport costs are not subject to price limits. However, you may be able to negotiate a lower rate for the worker’s time during transport in your service agreement.

Billing for activity-based provider transport costs.

- Costs should be claimed against the relevant activity-based transport support item.

- These support items can be delivered to individual participants and groups of participants subject to the rules set out in the NDIS Pricing Arrangements and Price Limits.

- Claims should be made using the relevant support item and against the participant’s core budget.

- Providers must separate support costs and travel costs on invoices. In some cases, this means three separate costs will appear.

- If a worker incurs costs transporting more than one participant, travel costs can be split between the participants (called ‘apportioning’) if each participant agrees in advance.

An example of how activity-based transport costs work under the NDIS.

A provider is delivering Assistance with social and community participation services. They are required to transport a participant from their home to a local swimming pool and back including:

- 25 minutes driving the participant to the pool and setting them up in the activity

- 40 minutes of support in the pool during the activity

- 20 minutes returning the participant to their home in the same vehicle

- The agreed hourly rate of both the support and support worker’s transport time is $50

- They have also agreed to cover the support worker’s car park fee ($4.50) and school running costs at $0.85 a kilometre.

The provider’s claim looks like this:

- $33.33 for the 40 minutes of direct support at the agreed rate of $50 per hour

- $37.50 for the 45 minutes of transport time at the agreed rate of $50 per hour

- $21.50 for the non-labour costs ($0.85 x 20 km = $17 plus the $4.50 car park fee).

Source: NDIS Pricing Arrangements and Price Limits 2023-2024 V1.2.

Leap in! is here to help.

If you need some help to understand how travel and transport charges work under the NDIS, the Leap in! Crew is here to help.

Give us a call on 1300 05 78 78 or chat with us here on our website (Monday to Friday 9am to 5pm).

Originally published 5 January 2022, revised and updated 11 March 2024.

Further reading.

Travel and transport funding under the NDIS.

Taxi vouchers and transport support .

PACE and changes to the NDIS.

Never miss an update – subscribe to Leap in! eNews.

Refine your search.

- Acquired Brain Injury

- ADHD and associated conditions

- angelman syndrome

- Augmentative and alternative communication

- Autism and related conditions

- Cerebral palsy

- Deafness and hearing loss

- Developmental delay

- Down syndrome

- Global development delay

- Intellectual disability

- Invisible disability

- Mental health

- Motor Neurone Disease

- Multiple sclerosis

- Neurological

- Other – physical

- Other intellectual/learning conditions

- Other psychosocial/psychiatric

- Other sensory/speech

- Physical Disability

- rare conditions

- Schizophrenia

- Supported Independent Living

- Vision Impairment / Blindness

- Younger Onset Dementia

- Accommodation/Tenancy

- Adventure Therapy

- Allied health – general

- Allied health professional

- Art Therapy

- Assessment of home modification requirements

- Assist Travel/Transport

- Assistance Animals

- Assistance in the community with daily activities

- Assistance with household tasks

- Assistive Technology

- Behavioural assessment and support

- Capital supports

- Community Connection

- Community participation/inclusion

- Completion of home modifications (major)

- Completion of home modifications (minor)

- Consumable products

- Developmental Education

- Domestic services

- Early Childhood Early Intervention

- Emergency housing/accommodation

- Equipment and assistive technology

- Exercise physiology

- Family counselling

- Finding employment

- Free Tools/Support

- Group/Centre Activities

- Hearing Support

- Home Maintenance

- Horse/Equine Therapy

- Hydrotherapy

- Individual counselling

- Individualised Living Options

- Information Service

- Meal delivery

- Meal preparation

- Medium Term Accommodation

- Mobility & Orientation

- mobility-&-orientation

- Music Therapy

- Occupational therapy

- Other counselling

- Personal care

- Personal Training

- Pet Care Services

- Physiotherapy

- Play Therapy

- Recovery Coach

- Residential accommodation/housing

- Respite (Day)

- Respite (overnight)

- School Holiday programs

- School Leaver Employment Supports

- Shared living support (24 hour)

- Short Term Accommodation

- Skill development

- Social and recreation supports

- Social work

- Specialised Driving Lessons

- Specialist Disability Accommodation

- Specialist Support Coordination

- Speech pathology

- Speech Therapy/Pathology

- Sport and recreation activities

- Support coordination

- Support Independent Living

- Supported employment

- supported emplpyment

- Tenancy support

- Therapeutic Supports

- Therapy assessment

- Travel and Holiday Support

- Vehicle Modification

- Work experience and placements

- Yard maintenance

- Assistance with Daily Life

- Assistance with Social & Community Participation

- assistance-with-social-&-community-participation

- capacity building

- Consumables

- Core supports

- Finding and Keeping a Job

- Home Modifications

- Improved Daily Living Skills

- Improved Health and Wellbeing

- Improved Learning

- Improved Life Choices

- Improved Living Arrangements

- Improved Relationships

- Increased Social and Community Participation

- Social and Community Participation

- Support Coordination

NDIS and autism: The support coordinator advantage.

Preparing for your ndis plan meeting or plan reassessment., ndis support categories explained..

Home / December 2023 | Newsletter / NDIS Travel Allowances Guide for NDIS Providers

NDIS Travel Allowances Guide for NDIS Providers

- December 14, 2023

What is an NDIS Travel Allowance?

This guide clarifies the distinctions between Provider travel and Participant transport under the NDIS, outlining specific rules for managing each type of transportation.

What is NDIS Provider Travel?

Provider travel, refers to situations where a Provider can claim worker time spent traveling to deliver supports to a Participant, as outlined in the NDIS Provider travel information. This guide will consistently refer to provider travel as worker travel time.

What are Participant NDIS Travel Allowances?

Participant transport encompasses the transport supports utilised by Participants and may receive funding in a Participant’s NDIS plan to address associated expenses. Providers delivering community access supports can claim, alongside workers’ time, an additional contribution for transport costs (like public transport expenses or a per-kilometer car usage cost) if pre-approved by the Participant in advance.

What Travel Allowances Can an NDIS Provider Claim?

Several factors dictate a Provider’s eligibility to claim worker travel time, such as:

- The type of support provided

- The appointment’s location

- The starting and ending points of a worker’s journey

Providers can claim worker travel time under specific circumstances when delivering the following supports:

- Personal care

- Community access

- Therapeutic supports

- Early Childhood Early Intervention (ECEI) supports

How to Enhance Travel Allowance Management for NDIS Providers

- Prior to initiating services, Providers should engage in discussions regarding worker travel time with Participants and obtain their advance agreement before claiming associated costs.

- Service Agreements ought to outline the specifics of how and when Providers will claim worker travel time, personalised for each Participant.

- Accurate record-keeping of worker travel time is crucial when making claims, ensuring payment reliability, as the NDIA reserves the right to audit Providers at any given time.

When Can’t a Workers Travel Time be Claimed?

Instances where worker travel time cannot be claimed encompass several scenarios, including but not limited to cases where a worker:

- Travels beyond 20 minutes between appointments for personal care, community access, therapeutic, or ECEI supports in metropolitan areas and other regions categorised as MMM1−3 in the Modified Monash Model. Click here

- Travels beyond 45 minutes between appointments for personal care, community access, therapeutic, or ECEI supports in regional areas (MM−4 or 5).

- Travels from the last appointment back to the office while delivering personal care or community access supports.

- Provides supports that fall outside the scope of NDIA’s provider travel policy, such as support coordination.

How Can NDIS Providers Claim Worker Travel Time?

Providers should consider the service location when claiming worker travel time, as it directly impacts the maximum claimable duration. In metro areas designated by the Modified Monash Model (MMM1−3, encompassing sizable regional centers), Providers can claim up to 20 minutes of worker travel time for appointments. In regional areas categorised as MMM4 or 5, Providers can claim up to 45 minutes of worker travel time. However, if a Provider travels between two metro areas, they can only claim up to 20 minutes of travel time, even if the actual travel duration exceeds an hour.

Providers must distinctly claim worker travel time using the specific line item relevant to the support provided. This necessitates Providers to designate the claim type as ‘travel charges’ within either the bulk upload or individual payment request. For instance, if a Provider delivers 2 hours of personal care support and the worker has traveled 15 minutes to the appointment, the Provider submits a standard claim for 2 hours of personal care support and separately claims the 15 minutes as a travel charge.

How Can NDIS Providers Enhance Their Efficiency in Claiming Worker Travel Time?

To minimise worker travel time, Providers should explore adaptable work approaches. Considerations for improving efficiency include:

- Arranging Participant meetings at Provider premises, when suitable.

- Organising staff appointments based on Participant locations to reduce travel time and distance between engagements.

- Assisting Participants in scheduling periodic appointments for therapeutic supports, especially in remote or regional areas, to optimise timing and reduce travel needs.

Can Providers Recover Transport Costs?

Providers have the option to reclaim transport expenses, like those related to using Provider-owned vehicles, when accompanying or transporting participants within the community. This applies when delivering community access supports or transport supports.

Can a Provider Use a Participant’s Plan to Fund Transport Costs?

Transport funding might be included in a Participant’s plan if it’s deemed reasonable and necessary . Participants receive transport funding when they face substantial difficulty using public transport due to their disability. However, this funding isn’t intended to cover transport assistance for informal carers or parents transporting the Participant for everyday commitments.

To understand the specifics of when transport funding is incorporated into a Participant’s plan, please consult the NDIA’s Operational Guideline: Transport.

How Is the Determination Made for NDIS Participant Travel Allowances?

The NDIS Travel Allowance plays a crucial role in facilitating NDIS Participants’ access to disability resources beyond their residences, enhancing their ability to achieve plan objectives more easily. This provision is especially vital in situations where the use of public transportation presents significant challenges due to a Participant’s disability.

The provision of financial assistance for obtaining transportation support ensures that individuals facing difficulties in using public transit can seamlessly access necessary mobility assistance.

Moreover, the NDIS extends its support by allocating funds to engage service Providers in assisting with transportation to activities that may or may not be directly supported under the plan. Examples of such instances include travel to and from medical appointments, physiotherapy sessions, and commuting to work.

In essence, the NDIS Travel Allowance stands as a targeted support mechanism that addresses the transportation needs of participants and contributes to the achievement of their outlined plan objectives.

Do NDIS Participant Adults Have Varied Funding Arrangements for Transport?

There are three benchmark levels of funding available for adults receiving transport funding.

Transport assistance encompasses three distinct levels of support delineated as follows. These tiers serve to allocate a transport budget for Participants, with NDIA funded supports subject to annual indexing for adjustments.

Level 1 : The NDIS offers up to $1,606 annually for Participants not engaged in work, studies, or day programs but seeking improved community access.

Level 2 : Participants engaged in part-time work or studies (up to 15 hours a week), attending day programs, or involved in social, recreational, or leisure activities can receive up to $2,472 per year.

Level 3 : For those working, seeking employment, or studying at least 15 hours a week, and unable to use public transport due to their disability, the NDIS provides up to $3,456 annually.

Exceptional Circumstances : Participants may receive higher funding if they have general or funded supports in their plan specifically aimed at facilitating their employment participation.

NDIS Travel Allowance Funding Examples

Can i be eligible for travel allowance funding for public transport.

Yes, you can access NDIS funding for transportation if you’re unable to use public transport. For instance, if you’re unable to utilise services like city buses or trains.

Can I be eligible for Travel Allowance funding if I’m unable to use public transport?

If you’re unable to use public transport, the NDIS offers funding for alternative transportation options, such as:

- Community buses – designed for individuals with disabilities

- Taxi services

- Other suitable modes of transportation.

Can I Use NDIS Travel Allowance Funding for Expenses in Other Areas?

Travel Allowance Funding cannot be used:

- To pay your carer

- For a family member to provide transportation, such as driving you to activities like shopping.

For additional details, please visit the Participant Transport Fact Page.

What Constitutes NDIS-Funded Transport Supports?

NDIS-funded transport support offers Participants four management options. They can opt for NDIA management, enlist a plan manager, self-manage, or receive regular payments (typically fortnightly or monthly) into their chosen bank account.

In cases where a Participant receives transport support or utilises their funding for additional Provider transport expenses, Providers must recover costs in alignment with the Participant’s chosen funding management method. For instance, if a Participant receives transport funding as periodic payments into their bank account, Providers need to directly invoice the Participant for any extra Provider travel expenses.

Providers should ensure proper procedures when claiming transport costs via the NDIA Provider Portal by using the designated NDIS support line item (i.e., transport: 02_051_0108_1_1), refraining from claiming transport costs using different line items. Additionally, Participants have the option to cover travel expenses using personal funds from their non-NDIS income.

How Can Participants Exercise Choice and Control Over Their Core Supports to Access Additional Transport Supports?

Participants have the flexibility to utilise Core supports across various categories, including transport, except in cases where their total transport funding is arranged as periodic payments or when no funding has been allocated for transport supports.

Flexibility in using transport funding within Core supports is only available if the Participant’s transport funds are managed by the NDIA, plan-managed, or self-managed. Participants have the option to have the NDIA manage a portion of their transport funds while receiving the rest as periodic payments. This arrangement enables access to flexible use of their Core budget, particularly for additional transport funding, if desired.

How Can Providers Collaborate with Participants to Minimise Their Transport Expenses?

- Developing Participant skills to utilise alternative transport options (e.g., public transport, taxis, Uber, informal assistance, etc.)

- Promoting carpooling among Participants when suitable or utilising group supports where transport is collectively supporting multiple individuals.

- Leveraging existing transport resources to offset overall transport expenses (e.g., using vehicles across various locations or service types during idle periods)

Practical Examples for Managing NDIS Travel for Providers

Demonstrating the management of NDIS Travel and Allowances in differing scenarios for NDIS Providers.

Example One: Extra Expenses

Accompanying and/or transporting Participants in the community involves the Provider being present with the Participant in the vehicle during the journey.

Providers Can Recover Travel Costs Under Specific Conditions:

When a Provider faces extra expenses beyond the worker’s time while delivering transport supports.

Payment Process for NDIS Providers in This Scenario

Agreed upon through negotiation between the Participant and Provider, typically detailed in the service agreement outlining the method for claiming transport costs.

What Is the NDIS Support Category for This Type of Travel Allowance?

Core Supports, such as transport funding (including periodic payments), or contributions from Participants utilising funds external to the NDIS.

Quick Guide to Managing This Type of Travel Allowance:

- Providers have the option to determine additional transport costs based on the distance traveled, often calculated by kilometers. They should refer to relevant employee awards for guidance during negotiations regarding these additional expenses.

- Worker time can be claimed at the hourly rate for the relevant support line item during the entire duration when the worker is accompanying or transporting the Participant in the community. This includes the incurred transport cost, such as kilometers traveled. However, worker time cannot be claimed if the Provider is solely transporting the Participant without delivering other disability supports.

- When a Provider transports multiple Participants on the same trip, the individual charge should be calculated based on the group ratio. For instance, if there are 2 staff members accompanying 10 Participants, charges should be calculated accordingly.

- Certain Participants might require assistance from Support Workers while accessing transport supports. In such cases, Providers can offer support to Participants during the receipt of transport supports if deemed reasonable and necessary.

Example Two: Travel Without a Participant

A worker travels to deliver personal care and community access services (without the Participant being present in the vehicle).

- The worker must be traveling from a workplace to offer support to a Participant.

- The claim must be against the Participant’s plan being travelled to (e.g., the 2nd, 3rd, 4th plan, etc.).

Travel Costs Cannot Be Reclaimed If:

- The worker is commuting between their home and workplace including vice versa.

- The worker is traveling back to the workplace from the last appointment.

- 4 hours + Support time is surpassed.

Before claiming, a Provider must secure prior agreement from the Participant, detailed within the service agreement specifying the allowable worker travel time.

The maximum allowable travel time for claiming purposes is:

- Up to 20 minutes travel time at the hourly rate for the relevant support line item in metro areas (MMM1-3).

- Up to 45 minutes travel time at the hourly rate for the relevant support line item in regional areas (MMM4-5).

Personal care or Community access supports (as appropriate).

- The term ‘workplace’ denotes an office or a Participant’s home where the service is delivered.

- Providers must separate the travel time claim from the standard claim and categorise it as worker travel time.

- Claims should accurately reflect the actual travel duration. For instance, if the travel time is 10 minutes, only 10 minutes can be claimed. The maximum claimable time is either 20 or 45 minutes, contingent on the support’s delivery location.

- Providers should consider scheduling shifts with Participants to avoid disproportionate travel cost burdens on certain Participants.

- In regional, remote, and very remote areas, Providers can distribute travel costs among scheduled Participants if agreed upon in advance. For instance, if a worker spends two hours traveling between four Participants in a regional area, each participant will be billed 30 minutes of worker travel time, irrespective of the actual travel duration between them.

Example Three: Child Supports

Travel undertaken to deliver therapeutic or Early Childhood Early Intervention (ECEI) supports.

- Travel is necessary for the worker to attend an appointment and provide support to a Participant.

- Providers have the allowance to claim travel time for the initial and final appointments to and from their workplace.

- Worker travel time needs to align with the Participant’s specific plan being visited, such as the 2nd, 3rd, 4th, etc. plan.

In metropolitan areas (MMM1-3), a maximum of 20 minutes of travel time can be claimed at the hourly rate for the relevant support line item. In regional areas (MMM4-5), up to 45 minutes of travel time at the hourly rate for the relevant support line item is permissible.

Improved Daily Living

- The term ‘workplace’ refers to either an office, where the Participant might be present, or the Participant’s home.

- Providers must invoice travel time separately from the standard claim, labeling it specifically as worker travel time.

- Invoiced amounts should accurately mirror the actual travel duration. For instance, if the travel time amounts to 10 minutes, only 10 minutes can be invoiced. The maximum invoiceable travel time is limited to 20 minutes.

- Providers should strategise shift schedules with Participants to prevent potential imbalances where certain Participants bear more Provider travel costs than others.

- In regional, remote, and very remote areas, Providers can apportion travel costs among scheduled Participants, with prior agreement. For instance, if a therapist travels for two hours, servicing four Participants in a regional area, each Participant would be invoiced for 30 minutes of worker travel time, regardless of the actual travel duration between Participants.

Example Four: Remote Travel

Journeys conducted in remote or extremely remote areas.

Supports are provided in remote or extremely remote areas. For further details on geographic locations, consult the Modified Monash Model.

Dependent on applicable loading or an arrangement agreed upon between the NDIA and the Provider. This item is eligible for quotation.

Core or Capacity Building Supports (based on the nature of supports provided).

In remote and extremely remote areas, prices are 20% and 25% higher, respectively, compared to supports delivered in other regions. If local Providers aren’t accessible in these areas, the NDIA might engage in agreements with alternative Providers, such as those in limited markets, to offer necessary supports.

The Modified Monash Model Inclusions of the Australian Standard Geographical Classifications

The NDIA employs the Modified Monash Model (MMM) to categorise different population sizes in regional areas across Australia. MMM efficiently classifies metropolitan, regional, rural, and remote areas based on their population and level of isolation, particularly with regard to their distance from major cities.

- December 2023 | Newsletter

- March 2024 | Newsletter

- November 2023 | Newsletter

- October 2023 | Newsletter

- September 2023 | Newsletter

Administrator Software

- Administrator App Overview

- NDIS Software Package

- About CareMaster NDIS Software Licences

- NDIS Scheduling Calendars

- NDIS Rostering Software

- NDIS Accounting Software Integrations

Support Worker App

- Support Worker App Overview

- Support Worker App Features

- NDIS Incidental Cost Management

Participant App

- Participant App Overview

- Participant App Features

Quick Links

- Book a Demo

- NDIS Software Training

- Provider Types Supported

- Software Integrations

- NDIS Software Accreditation

- Privacy Policy

- News & Media

- Website Designed and Developed by

- Anchor Digital

How to understand the NDIS MMM Pricing

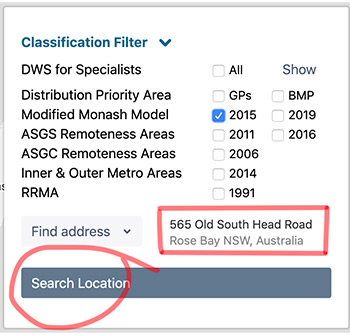

What is the MMM Model?

The NDIS uses the Modified Monash Model / MMM 2019 (from 1 Oct 2020) to determine whether a location is a city, rural, remote or very remote.

The model measures remoteness and population size on a scale of Modified Monash (MM) category MM 1 - MM 7.

MM 1 is a major city and MM 7 is very remote.

This influences the prices charged by a provider and paid by a participant in a specified location .

See below for an excerpt from the NDIS Support Catalogue that shows 3 prices for 1 single support.

How does the NDIS use the MMM Model?

Under the NDIS, the location of a service affects its cost : the more remote the service delivery area, the more expensive it is.

The NDIS currently has 3 levels of pricing for each support:

- MMM 1 - 5 is classified as National Non Remote and uses the standard (lowest) NDIS price rate.

- MMM 6 is classed as National Remote and are generally 40% higher.

- MMM 7 is classed as National Very Remote and are generally 50% higher.

Delivery of Online Services

The cost of a service delivered online is based on the location of the Service Provider who is delivering the service.

So, even if the participant is located in a remote area (MMM6 or 7), if the provider is located in a metro area (MMM1-5), regular rates apply .

How can I work out what price level to use?

The MMM rating of a location affects its cost .

NDIS providers and participants can determine the MMM rating of a location using the Health Workforce Locator tool which allows you to input the address of the service and then it advises the MMM rating of that location.

The NDIA uses the 2019 MMM for classifying remote and very remote classifications.

How do I use the Health Workforce Locator Tool?

Open the Health Workforce Locator:

Health Workforce Locator Tool

Next to ' Modified Monash Model ' select the 2019 Checkbox

Click Find Address button and enter the address .

Click Search Location button

View the MMM Classification

Use the appropriate column in the NDIS Support Catalogue.

Exceptions to MMM = Isolated Towns

Isolated towns modification.

The NDIA modifies the Modified Monash Model classification of some locations. Where a location is surrounded by Remote or Very Remote areas then the NDIA classifies that enclave as a Remote area for planning and pricing purposes. The following Table sets out the enclaves that the NDIA has reclassified.

=========================================================

- Monash Modified (MMM)

- Healthforce Locator App

- NDIS Price Guide

NDIS THERAPY FINDER - FREE SERVICE

Let us find you a skilled support worker, share this resource, how helpful was this resource, more like this, free service, connecting you with skilled ndis support workers.

We will find you verified providers with immediate availability.

Tap here to start

We help you find therapies in your area.

Therapy, Social Options, Capacity Building

Call us today

1300 2888 93, don’t feel like speaking, meet the members of the access care group, become a mycarespace member.

Receive special offers, free webinars, news of providers and services & NDIS updates

1300 MYPLAN

Will the NDIS fund provider travel and transport costs?

Will the NDIS cover my travel costs as a provider?

The rules for providers being able to claim their travel costs from a participant’s plan are well defined. Each of the following criteria must be met by the provider to be eligible:

- The NDIS participant must agree beforehand the provider can claim for these costs from their plan. The provider must explain to the participant why paying for provider travel is good use of their NDIS funds.

- The NDIS Price Guide must state providers are eligible to claim transport costs for the particular support item and the proposed claim must meets the requirements in the price guide.

- The travel must be connected to delivering a specific disability support to the participant.

- The support must be delivered in person.

- Travel time can be claimed if a) the provider has to pay the worker for their travel time, or b) the provider has their own business (sole trader).

What is the NDIS transport allowance for providers?

There are seven zones defined by population and location the NDIS uses to set prices for supports and services including travel allowance for providers. Zone 1 includes major cities, zone 7 covers very remote areas and each of the remaining zones fall in between.

Generally speaking, the further one has to travel to provide the service, the higher the allowance will be. The maximum time providers can claim for travelling to each participant per session is:

- Zones 1-3: 30 minutes

- Zones 4-5: 60 minutes

- Zones 6-7 (remote and very remote areas): as agreed up to the hourly rate for the support item.

Capacity Building providers may be able to claim for time spent travelling from their last participant to their usual place of work. Core support providers cannot claim for time spent travelling back to their usual place of business.

Can I ‘apportion’ my travel costs between NDIS participants?

A provider who provides services to more than one participant in the same region is able to split their travel costs between participants, however each participant must agree to this arrangement in advance. This cost may include the journey to and from the location the support is delivered.

What travel costs will the NDIS fund?

The NDIS will fund a per kilometre amount for provider travel if the participant’s support budget includes funding for transport and the participant approves the costs in advance. The NDIS deems $0.85 per kilometre for a vehicle not modified for accessibility a reasonable amount to claim for provider transport.

Other costs incurred while travelling including public transport, tolls or parking fees may be claimed. Once again, the participant must agree to this in advance.

If a participant’s plan doesn’t include transport, these costs may be charged as an out-of-pocket expense to the participant.

How do I prepare my invoice to reflect travel costs?

Providers must separate support costs from travel costs on their invoice. In some instances, there will be three separate line items on the invoice:

- The support item provided

- Provider travel – labour costs (time)

- Provider travel – non-labour costs (e.g., cost per km, parking fees and tolls).

Will the NDIS cover costs for transport to community activities?

Where a provider accompanies a participant to a social activity or transports them from home to an activity, the worker’s travel time can be charged at the hourly rate for the relevant support item if the participant agrees in advance.

To learn more about NDIS transport funding, you can read the NDIS Pricing Arrangement and Price Limits document here .

- March 8, 2022

- Blog , Providers

- NDIS , NDIS plan management

You might also like...

New rules to endorse a plan manager when you have an NDIS plan

Reading Time: 2 mins

Update to NDIS Code of Conduct and Price Differentiation Rules

Easing the back to school transition

Reading Time: 4 mins

Contact our Plan Managers directly and we will get you ready to kick start your journey!

Professional. Friendly. Purposeful. Plan Management

655 Sherwood Road Sherwood QLD PO Box 100 Sherwood QLD 4075

Quick Links

Keep up to date with Acacia Plan Management news, access exclusive client resources and NDIS updates.

- Follow us on Facebook

Acacia Plan Management Pty Ltd ABN 62 620 837 952

© acacia plan management 2023. all rights reserved. view our privacy statement ..

- AFL Partnership

- Maple Emerging Talent Scholarship

- Maple Equality and Inclusion Scholarship

- Maple Youth Empowerment Scholarship

- Scholarship Application

- Albinism Care & Support

- Amputation Care & Support

- Anxiety Care & Support

- Arthritis Care

- Autism Care

- Bipolar Care & Support

- Brain Injury Rehabilitation & Care Support

- Cerebral Palsy Care & Support

- Depression Care & Support

- Down Syndrome Care & Support

- Genetic Condition Care & Support

- Huntingtons Disease Care

- Inhome Care Services Sydney

- Mental Illness NDIS

- Motor Neurone Disease Care

- Multiple Sclerosis Care

- Muscular Dystrophy Care

- Palliative Care Services Sydney

- Parkinson’s Disease Care

- PTSD Care & Support

- Rheumatoid Arthritis Care & Support

- Stroke Rehabilitation & Care Support

- Life Skill Development

- NDIS Cleaning

- NDIS Community Participation

- NDIS Garden Maintenance

- NDIS Meal Preparation

- NDIS Transport and Travel

- Personal Activities

- Personal Care

- Accessible Transports

- SIL Newcastle

- SIL Penrith

- SIL Liverpool

- SIL Campbelltown

- SIL Brisbane

- Assisted Living

- NDIS Accommodation

- NDIS Disability Group Homes

- NDIS Disability Housing

- NDIS Disability Independent Living

- NDIS Short Term Accommodation

- NDIS Specialist Disability Accommodation

- Respite Accommodation

- NDIS Plan Management

- Support Coordination

- Scholarship Application Form

- SIL Wollongong

- SIL Melbourne

NDIS Provider Travel: What You Need to Know

As NDIS transport providers and plan management providers , we want to ensure our participants receive the best support possible from us. Thankfully, the NDIS recognises that we spend a lot of time travelling between our place of work to visit different participants’ locations and places of interest. Sometimes this involves paying out of pocket for expenses as well as causing wear and tear on our vehicles.

The National Disability Insurance Scheme (NDIS) provider travel is a tool to claim back travel expenses and time travelling to and from delivering supports to our participants and other costs that might be incurred during travel time. It can also include travel time such as accompanying participants to community and educational activities.

For this reason, we believe it is important for you to have all the information you need to handle provider travel under NDIS effectively. Let’s delve into the specifics of the NDIS guidelines surrounding provider travel, including the circumstances under which providers can claim travel expenses and the parameters for calculating these costs.

What is NDIS provider travel?

As a service provider or one of your dedicated workers, it is important to acknowledge the efforts made when travelling to meet participants in order to provide essential support. The NDIS understands that these travel expenses can accumulate, and we want to assure you that you have the opportunity to claim these expenses through the participants’ NDIS funding.

However, it is crucial to adhere to certain conditions and maintain accurate records of these travel expenses. In addition, you can only claim these expenses as long as it is agreed upon with the participant before the service begins and it is outlined in the service agreement.

What are the guidelines and regulations for NDIS provider travel?

There are specific factors that come into play to determine whether a provider can claim for worker travel time:

- The type of support provided

- The location of the appointment

- Where a provider or workers journey begins and ends

- Worker travel time was agreed by the participant in advance

Supports covered

A provider can claim worker travel time when delivering the following supports:

- Personal care

- Community access

- Therapeutic supports

- Early childhood early intervention (ECEI) supports

Capacity Building providers have the ability to claim the time spent travelling from their last participant to their regular workplace. However, Core support providers are not eligible to claim for the time spent travelling back to their usual place of business.

Record Accurately

If you are claiming worker travel time with NDIS funding you will be required to keep accurate records of your work/travel times, receipts for tolls and parking, for payment assurance purposes. The NDIS is subject to audit providers at any time to ensure they continue to comply.

Agree in Advance

As a service provider, you should prioritise open communication and transparency when claiming workers’ travel time. You need to discuss and agree upon worker travel time claims in advance with the participants. By doing this, you encourage mutual understanding and avoid any potential confusion. It is also recommended to include this information in the service agreement, providing participants with clarity and peace of mind.

Multiple Participants

In situations where a worker provides services to multiple participants in a region, the costs can be apportioned among them. However, this can only be done with the explicit agreement of each participant in advance. This approach allows us to create a supportive environment where decisions are made collectively, including agreements on travel to and from the location where the support is delivered.

Community Participation

Accompanying a participant on outings or assisting with their transportation is a valuable and supportive service. In recognition of this, workers and providers have the opportunity to claim participant travel time. By reaching a mutual agreement with the participant, the worker can charge the same hourly rate for the relevant support item, ensuring fair compensation for their time.

How much can a provider claim for travel time?

The National Disability Insurance Scheme (NDIS) provides pricing arrangements and price limits to indicate what a reasonable cost for general transport would entail. As of the latest NDIS pricing Arrangements and Price Limits 2022/23 a worker or provider can claim $0.85 per kilometre for a privately owned vehicle or up to the full amount for other forms of transport or associated costs such as road tolls, parking and public transport.

In order to determine the appropriate cost for the time spent, it is crucial for the provider to engage in open dialogue with the participant before the services begin. This allows for a collaborative discussion regarding the rate that will be charged by the provider for their travel.

The provider can either use the same hourly rate as the support item or propose a lower rate that aligns with the participant’s preferences. By facilitating this conversation and considering the participant’s input, we can establish a fair and transparent pricing structure that reflects their needs and encourages a fruitful partnership.

What is the difference between provider travel vs participant travel?

Provider travel is the process through which a provider claims reimbursement for the time spent travelling to participants’ locations in order to deliver services. In some cases, it may also involve the time spent travelling back to the provider’s place of business.

Participant travel refers to the utilisation of a participant’s support funding from their NDIS plan to pay transport costs when providers are travelling with the participants. Providers can claim these travel expenses when accompanying participants to and from community or educational activities that are funded by the NDIS plan. These travel costs are typically itemised on the invoice as part of the overall support cost.

Providers must make sure that the support costs and travel costs are separated on the invoice and in some instances, three separate costs may appear. You will need the support item, the provider travel time spent and the other provider travel costs incurred such as parking fees and tolls.

Plan your NDIS with Maple Community Services by contacting us today!

- Share This Post:

IMAGES

VIDEO

COMMENTS

NDIS Pricing Arrangements and Price Limits (previously the NDIS Price Guide) assist participants and disability support providers in understanding how price controls for supports and services work in the NDIS. ... (travel, non-face-to-face, etc.) apply for each price-limited support item. Price limits are the maximum prices that registered ...

As of the 2023-2024 NDIS Pricing Arrangements and Price Limits, the NDIA considers the following to be a "reasonable" support worker's allowance: Petrol costs: up to $0.97 per kilometre. Other costs: Up to 100% of the cost. Travel costs must be billed separately to the travel time and support. Claim them as a "Provider Travel — non ...

NDIS Travel & Transport Funding - a Participant's guide. The NDIS defines transport costs in 2 ways: General Transport Supports and Activity-Based Transport. Activity-Based transport costs can as a result of delivering both CORE (personal care) and CAPACITY BUILDING supports (social, therapeutic supports etc).

The NDIS provides an annual travel allowance based on predetermined levels of activity. ... These trips are charged at an agreed hourly rate with the support worker and will include the total time the support worker attends the outing and can also cover the time it takes to travel to and from the participants residence.

NDIS Provider Travel Example. Your support worker travels 35 minutes (20 kilometres) to help a participant in Zone 3 of the Modified Monash Mode to provide two hours of Core support ( Assistance With Self-Care Activities ). You and the participant have agreed to an hourly rate of $72.13. They have also agreed that the you can claim for travel ...

These NDIS providers can charge you for: 1. Labour Costs (their time) This is the time they spend: travelling to your appointment and. returning to their usual place of business afterwards - ONLY IF you are their last appointment. 2. Non-Labour Costs. With your agreement (via a service agreement) a therapist may also charge you for a portion of ...

NDIS providers of support can charge for the cost of travel when: They spend time accompanying participants for community access (CORE) OR. They spend time travelling to a participant to deliver face to face supports OR. They incur non face-to-face/labour travel costs - parking, tolls, running costs of vehicle etc.; NOTE: The participant must agree to this before the service is delivered and ...

The provider's claim looks like this: $33.33 for the 40 minutes of direct support at the agreed rate of $50 per hour. $37.50 for the 45 minutes of transport time at the agreed rate of $50 per hour. $21.50 for the non-labour costs ($0.85 x 20 km = $17 plus the $4.50 car park fee).

Travel labour costs. Travel labour costs are the costs for the time in minutes taken for the worker to travel to or from an appointment. The maximum number of minutes that can be claimed varies depending on the travel regions, as defined by the NDIS price guide: up to 30 mins of travel can be claimed per worker for MMM-1-3 areas, and

The reimbursement rate is a maximum of $1 per kilometre as of June 2023. Providers are also able to claim other transport-associated costs like tolls, parking and public transport fares. Provider Travel Funding Example. Another key element of Terri's Plan is to help her maintain and, ideally, improve her mobility.

Providers have the allowance to claim travel time for the initial and final appointments to and from their workplace. Payment Process for NDIS Providers in This Scenario. In metropolitan areas (MMM1-3), a maximum of 20 minutes of travel time can be claimed at the hourly rate for the relevant support line item.

Under the NDIS, the location of a service affects its cost: the more remote the service delivery area, the more expensive it is. The NDIS currently has 3 levels of pricing for each support: MMM 1 - 5 is classified as National Non Remote and uses the standard (lowest) NDIS price rate. MMM 6 is classed as National Remote and are generally 40% higher.

Understand the cost of supports according to the NDIS Price Guide. Quickly calculate costs for multiple support items, so you can easily manage your budgets and organise supports over time. Check it out now Last price updated 1 July 2023 All details in the Navigator are current with the NDIS 2023-24 Pricing Arrangements/Price Guide

The NDIS will fund a per kilometre amount for provider travel if the participant's support budget includes funding for transport and the participant approves the costs in advance. The NDIS deems $0.85 per kilometre for a vehicle not modified for accessibility a reasonable amount to claim for provider transport.

MMM Zones 1 - 3 = 30 minutes max travel time. MMM Zones 4 - 5 = 60 minutes max travel time. MMM 6 & 7 = Remote & Very Remote: Capacity-building providers can make agreements with participants to cover travel costs. No travel time limit applies. The max charge rate per hour for the relevant support item applies.

If you are claiming worker travel time with NDIS funding you will be required to keep accurate records of your work/travel times, receipts for tolls and parking, for payment assurance purposes. ... The provider can either use the same hourly rate as the support item or propose a lower rate that aligns with the participant's preferences. By ...

Print this page. Short Term Accommodation, including respite, is funding for support and accommodation for a short time away from your usual home. It covers the cost of your care in another place for up to 14 days at a time. You might have a short stay with other people, or by yourself. It's often funded when your usual carers aren't ...