Wise (TransferWise) Review: All You Need to Know

Home | Travel | Wise (TransferWise) Review: All You Need to Know

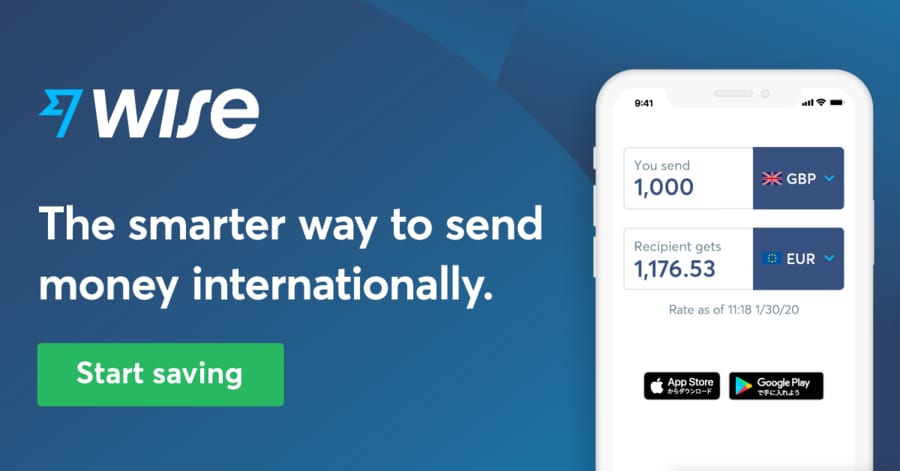

Wise (formerly TransferWise ) is the best way to send and spend money abroad. Traditional banks can do international wire transfers, but they often come at a high price, thanks to bad exchange rates and hidden fees.

Wise makes international transfers and transactions up to 8 times cheaper by using the mid-market exchange rate and charging low upfront fees. Plus, Wise is protected with bank-level security and financially regulated in each country it operates in.

*Wise fees depend on the amount you’re sending, the payment method and the currencies you’re converting. See Wise pricing page for more details.

If you’re a frequent traveler, an international student, a freelancer with customers paying in different currencies or you work abroad, then I recommend getting a Wise account to handle all your foreign transactions.

In this Wise review , I’ll share my experience after using TransferWise (now Wise) for four years and you’ll learn how to use Wise to transfer money across countries and currencies, always getting the best conversion with no hassle!

- What is Wise?

- How to use Wise

Wise debit card

Wise business account, wise fees vs. traditional banks, wise pros and cons.

- My Wise review – Running a small international business

What is Wise (formerly TransferWise)?

Wise , formerly TransferWise , is the fastest and cheapest way to send money internationally. With a Wise account in the U.S. , you can transfer money across borders knowing you’re always getting the best exchange rate.

Efficient, easy, and transparent, a Wise business account lets you send money via bank debit, wire transfer, or a debit or credit card. Whether you want to pay an employee abroad, send money back to your family at home, or put savings into a bank account you have in another country, Wise has got you covered.

I appreciate that Wise keeps track of my money every step of the way, keeping me informed through email notifications. Plus, with the Wise debit card and mobile app, you can keep all the currencies you work with in one place.

It’s no wonder why 10 million people worldwide use Wise to send $6 million every month. Plus, they save $1.5 billion every year thanks to Wise’s locked-in exchange rates.

If you are wondering if Wise is a bank, I will say thankfully it’s not! It’s much better than that. It has been a lifesaver for us (as Spaniards living in the US) and for our small but international business (with customers in more than 15 countries).

Who Wise is For

Anyone who works abroad, frequently travels, or deals with multiple currencies should open a Wise account. Wise takes the headache out of international payments, charging cheaper fees than traditional banks and allowing you to send money when it’s convenient for you. Start here!

Wise is ideal for:

- Freelancers

- International students

Travelers who need to pre-pay for a local tour or people with property in multiple countries can use Wise’s international money transfers to handle foreign payments with efficiency and ease. With the Wise debit card , you can withdraw money from an ATM while visiting another country without the hefty fees that traditional banks slam you with.

Moreover, if you’re a freelancer or run a multinational business, a Wise account makes it much easier for your international clients to send you payments. They will be paying in their currency and probably to a local bank account, but you’ll still receive the full amount with a minimal fee and no hassle!

At Capture the Atlas, we use Wise on a daily basis for our international transactions

This also applies to expats who want to send money back home or international students who need to pay tuition in another country, or parents who need to send money for their kids studying abroad.

If home for you is in several different countries, a Wise multi-currency account eliminates the need to open a bank account in each country. Wise even works for people who want to spread their savings across more than one bank account.

After learning about Wise , we set up an account and immediately started saving money on our international transfers. Wise is safe to use and makes multi-currency transactions as seamless and inexpensive as possible.

Main benefits of Wise

There are four main reasons why you should switch to Wise (formerly TransferWise) :

- It’s cheap

- It’s fast

- It’s safe

- It covers over 40 currencies

First, Wise uses competitive, mid-market currency exchange rates. When you set up a money transfer, you’ll see all the fees upfront, and the exchange rate is guaranteed for 2-72 hours, depending on the country. Unlike the hidden fees you’ll get with your bank, Wise’s fees are transparent and much lower.

Besides, over 30% of Wise transfers arrive instantly. Over half of them arrive within an hour, and 81% of all transfers arrive within 24 hours, so you get your money fast.

If you’re worried whether Wise is safe , rest assured that the company is protected by bank-level data security and is regulated by the U.S. Financial Crimes Enforcement Network and similar agencies around the globe.

Finally, customers can send and receive money in over 40 currencies, which makes Wise convenient and easy to use. Plus, Wise’s customer service is available in several languages, with 14 offices in Asia, Australia, Europe, and North and South America .

How to use TransferWise (now Wise)

Sending money with Wise is a no-brainer. Before you confirm any transaction, you will see how much of your money will go to the recipient, and when. For example, if you’re sending USD 1,000 from a Wise USD account to a Wise euro account , you’ll see the Wise fee and the fee for your preferred payment method (wire transfer, ACH, debit/credit card).

This calculator widget will show you the total amount Wise will convert, after fees, as well as the mid-market exchange rate, which will stay locked in after you set up the transfer.

How to open a Wise account

It takes just minutes to open a Wise account and set up an international transfer.

Start by going to Wise’s sign up page.

Select a personal or business account, and enter your country of residence, email address, and a strong password. You can also sign up with your Apple, Facebook, or Google account.

You’ll receive a confirmation email with simple verification instructions. After that, you’re all set to transfer money with Wise !

How to send money with Wise

Once your account is set up, you’re ready to start sending money with Wise .

To set up your first money transfer with Wise , enter the amount you want to send, the currency you have available, and the currency you want the recipient to receive. You’ll see all the fees upfront, as well as when the recipient will receive the money and how much they’ll get.

Provide the recipient’s banking information and, if required, verify your identity with a photo ID. Wise typically asks for verification for larger transfers.

Then, make the payment. Methods vary by country but may include wire transfer, ACH, Apple Pay, or debit or credit card. You can also pay from one of your balances in Wise if any, which is always the cheapest way. Then, you’ll receive a confirmation email every step of the way, including when your money is on the way and when the other person receives it.

How long does it take to transfer money?

While it can take up to two business days to receive money through Wise , most people get their money within 24 hours, and over half of them get it within an hour. The time it takes for your transfer to arrive depends on several factors:

- Which country you’re sending the money from/to

- Payment method

- What time you send/pay for the transfer

- Any required security checks or verifications

When you log into your Wise account and set up your money transfer, you’ll get a more accurate delivery estimate.

How to receive international payments with Wise

If you’re receiving a Wise money transfer , the process is similar to what you’d do with a traditional wire transfer. Log into your Wise account and open a balance in the currency you want to receive the payment. That takes just a couple of seconds and it’s equivalent to opening a bank account in another country since you will be given bank account details that, depending on the country (currency) you’re opening the account in, can include an account number, ACH routing number, wire routing number, BSB code, IBAN number, a BIC (or SWIFT) code, etc.

After sharing your banking details with the sender, it will be very easy for them to process the payment since they will be paying in their local currency and to a local bank with no commission for them. You will receive the full amount in that currency, and you can hold it in your Wise account.

Then, you can decide if you want to save the payment amount in that currency, if you want to convert it to another currency but keep it in a Wise balance, or if you want to transfer it to your main bank account outside Wise. In case you decide to convert that money to another currency, either for keeping that money in another Wise balance or to transfer it to your main account outside Wise, you will always pay a minimal exchange fee. Holding the money in your Wise account is always free.

How to deposit money into Wise

To deposit money into Wise (formerly TransferWise), it’s exactly the same. Check the bank account details of the balance where you want to deposit the money and make a transfer to that bank account as you usually would: ACH, wire, etc.

Your main bank account may charge a fee for transferring money, but you’ll need to check with them.

You can also add money to your Wise balances by using a debit or credit card, but a fee may apply depending on your country/currency .

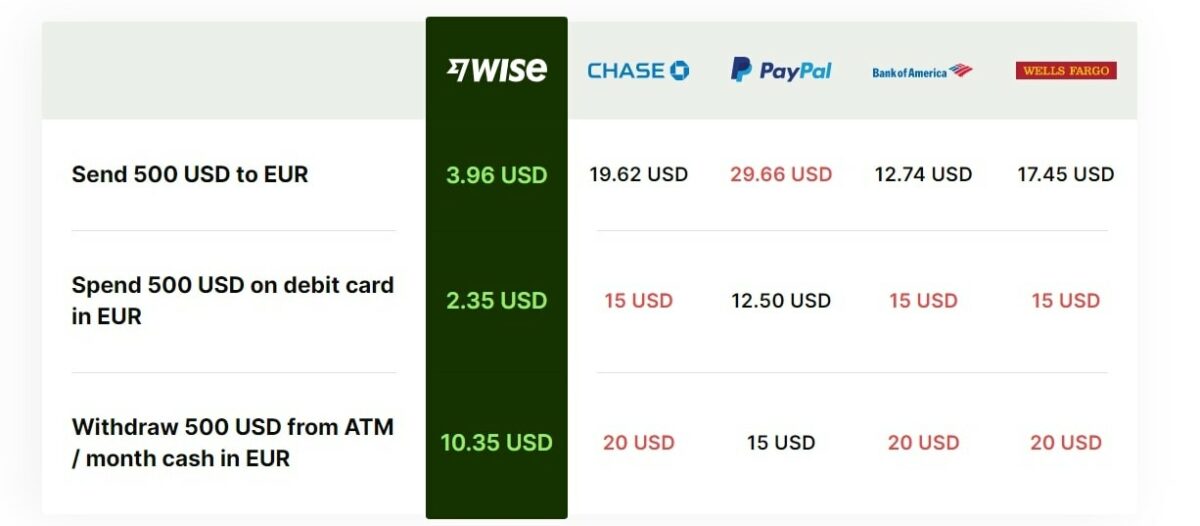

A Wise debit card allows you to send, spend, and withdraw money abroad without those pesky foreign transaction fees. The Wise Mastercard is up to four times cheaper than PayPal and the leading U.S. banks.

Finally, no more paying a fee to withdraw your money from a foreign ATM. With the Wise card, you can take out as much as $250 every 30 days for free (you’ll pay USD 1.50 for each additional withdrawal ). Plus, there aren’t any hidden annual fees, and you get the added benefit of low Wise rates and conversions.

With the mobile app, you can quickly and easily access your Wise business account to freeze/unfreeze your card, add to your balance, or convert currencies, always with the best mid-market exchange rate.

The Wise debit card works with over 40 currencies and when you make a purchase abroad, it automatically converts the amount using the best rate from all the balances you have in Wise. This is perfect for frequent travelers or those who are working or studying abroad.

We use it constantly when traveling outside the US or even for online purchases in other currencies.

How to get a Wise card

Signing up for a Wise debit card is easy and costs just USD 9. To get started, log into your Wise account via the Wise website or mobile app and order your card.

You’ll need to verify your Social Security Number and ID and add at least USD 20 to your account balance. Once you activate the card, that money is yours to use.

How does the Wise card work?

Your Wise debit card works anywhere that accepts Mastercard, and you can use it with Apple, Google, and Samsung Pay. Use it while abroad to pay in over 40 different currencies and convert your money whenever you want.

It’s free to hold and manage the money in your Wise account , although you’ll pay a small fee to convert currencies and transfer your money to another bank account. As always, you’ll get the best mid-market exchange rate, and all the money on your card is protected by bank-level security.

Wise card limits

The spending limits on your Wise debit card will vary depending on where you ordered your card. Keep in mind that you can select default and maximum limits in the Wise app, as well as turn off certain types of payments.

Below are the default and maximum limits for U.S. and UK/EU cardholders.

The daily limit resets each day beginning at midnight, while the monthly limit resets on the first day of the month .

A Wise business account allows you to run your operations on a global scale, all without the high fees and red tape of a traditional bank.

Now you can invoice payments in over 160 countries, all while getting the best exchange rates that you won’t find with PayPal or traditional banks. You can make payments from the Wise app, and 50% of transactions go through within the hour.

Set up recurring payments and batch invoices, and add team members to your account for more efficient payroll processing. This way, you can pay up to 1,000 people at once without high transaction fees. Also, don’t worry if your employees don’t have a Wise account; they don’t need one to get paid.

You can also review your Wise multi-currency account to see sort codes, IBAN, and routing numbers for different countries. Then, move money between accounts without the hassle of having to call your bank, so you can pay rent, payroll, and other work expenses no matter where you are.

Receive payments from third parties, set up direct debits, and integrate your Wise account with Stripe, Shopify, QuickBooks, and more. It’s free to sign up for a Wise business account, although if you want international banking details, you’ll need to pay a one-time fee of USD 31.

Since Wise isn’t a bank, it doesn’t keep your money in a financial protection scheme like your local bank would. Most banks use these schemes to lend your money or put it into high-risk investments.

With Wise, your money stays in your account and out of the company’s account. It stays stored in an established financial institution, protected by the Financial Crimes Enforcement Network or your country’s equivalent agency .

To know how much a transfer costs with Wise, you need to know that the fee depends on three things:

- The amount you’re sending

- How you pay (from your Wise balance, ACH, wire, debit or credit card, etc.)

- The exchange rate (which currencies are sent and received)

You can easily check Wise fees for a money transfer or conversion right here:

For example, if you want to send USD 1,000 from your USD Wise balance to Spain, either to your bank account in Spain or to pay someone else, the Wise fees for USD to euro would be USD 4.51. This includes a fixed fee of USD 0.33 and a variable fee of USD 4.18 (0.42%). So, the recipient in Spain would receive 849.25 euros as of today (exchange rates vary from day to day).

It’s worth noting that if you need to do a transfer and you don’t have the amount required in your Wise account, you will need to use another payment method that can include an ACH payment, a wire transfer or pay by debit or credit card, depending on the currency you’re sending. In any of these situations, you may have higher fees, but they’ll still be lower than traditional banks in the United States (typically 2-5%).

As an example, here you can see the different fees (in percentage) that Wise will charge for sending USD 1,000 to EUR depending on the payment method you use.

*Wise fees depend on the amount you’re sending, the payment method and the currencies you’re converting. For the tab above, we have converted USD 1,000 to EUR on March 30 th , 2021. Use the pricing page to see the current Wise fees.

We hold all the payments we receive in our Wise account balances so when we need to make a payment, we only pay the lower fixed and variable Wise fees. Remember, you can hold over 40 currencies in your multi-currency account at no extra cost. When using your Wise debit card , there is no fee to spend in currencies in your account. If you go over two ATM withdrawals in a month, you’ll pay USD 1.50 for each additional withdrawal .

By now, you’re probably thinking that all of this sounds great, but you’d like to know all the pros and cons of Wise . For example, is Wise safe ? How do I know I’m getting the best exchange rate? Do I really need just one account to handle all my international banking? Let’s break down the advantages and disadvantages of Wise.

First, your Wise account is an international account that lets you hold and convert money in over 40 currencies. Wise always uses the real exchange rate and locks in your rate for up to 72 hours for instant, cheap money transfers to over 160 countries.

With the Wise debit card , you can spend in any currency without hidden fees, and it works with contactless payments, too. Plus, with a Wise multi-currency business account, you can set up direct debits, invoices, and bank details in over 70 different countries.

There are few problems with Wise , but keep in mind that larger transfers often require pre-approval or verification, which can slow down the process. Also, it can be hard to get ahold of customer service over the phone since the U.S. support team is only available 9-5 on weekdays. That said, there’s a 24/7 help center on the Wise website.

Wise (formerly TransferWise) rebranding

Wise’s rebranding comes after a decade of making “money work without borders” so multi-currency individuals and businesses can send, spend, hold, and receive money internationally. By offering more than money transfers, TransferWise is now Wise .

The company that started 10 years ago is now a worldwide community of 10 million people and businesses. Wise is a global platform that over a dozen established financial institutions now use and that customers rely on to send money quickly and without hidden fees.

All its great features are still there, just under new names like the Wise business account and the Wise debit card . The name change simply reflects the wider scope of services and capabilities that you can expect from their company, but I have been using it for the last four years and plan to keep using it as the main financial platform to run our business.

Wise customer service

You can learn a lot about a brand by how much support they offer, and Wise’s customer service is a good indicator of its commitment to its clients.

Wise’s online help center is where you can find information on all kinds of topics, from Wise fees and account management to troubleshooting your Wise card and setting up direct debits. Once you log into your Wise account , you can get more personalized answers and contact your local Wise customer support office. The company has 14 offices across Europe, Asia, Australia, and the Americas.

There are over 111,000 Wise reviews on Trustpilot, with an average rating of 4.6 out of 5 stars, and Wise has been featured in The Economist , BBC , The Guardian , and more.

If I’m honest, I only remember contacting TransferWise (now Wise) once after four years using TransferWise on a daily basis and I think they were pretty quick helping me out. During that time, I used their online customer service chat and the team was super handful and friendly. However, the thing I like the most is that Wise works so well and the platform is so intuitive and easy to use that I haven’t needed to use Wise customer service much .

My Wise review

After learning how Wise works , I signed up and saw for myself how much easier my life and business operations can be with this service.

First, you should know that although I am from Spain, I’ve been living in the United States for 4 years, so since I moved, I’ve been looking for an easy and cheap way to send money back home.

At the same time, our blog, Capture the Atlas, began to grow, and soon the first payments from international companies arrived, paying us for advertising services. Some of them are located in Australia and the United Kingdom, and at the time, I had four open balances on my Wise account (EUR, USD, AUD, and GBP).

Later on, we started running photo tours around the world and with international clients, making TransferWise (now Wise) a necessity. First, it made it easier to collect payments from clients in different countries since, in addition to American and European clients, we have had clients from Thailand, Vietnam, Brazil, Argentina, Mexico, and Canada so far. Moreover, Wise simplified the process of paying local suppliers for things like hotels and rental cars in Iceland, Norway, and Russia.

Wise helps us to run our photo tour business

As you can see, if you have an international business, live, work or study abroad, Wise is a lifesaver. I can’t imagine how our little project would have been able to flourish if it weren’t for Wise.

Throughout the 4 years that we have been using TransferWise (now Wise), I estimate that we have saved more than USD 5,000 in fees compared to what we would have spent if we had processed all those transfers with our usual banks. Also, I believe that we would have lost more than one international customer for not being able to offer them a convenient and simple payment method for our tours.

Here are some frequently asked questions about Wise . If you still have a concern, leave me a comment below and I’ll be happy to help.

How much does Wise cost?

It costs nothing to set up a Wise account that can hold over 40 currencies. If you want the Wise debit card , you’ll have to pay just USD 9. You won’t pay anything to spend in a currency in your account, and you’ll get the best exchange rate if you need to convert currencies.

The cost to transfer money depends on the currency, but Wise exchange rates are always the most competitive mid-market rates.

How long does it take to transfer money with Wise?

Most Wise money transfers arrive within the same day, or even within an hour. The maximum wait time is two business days.

What are the Wise fees?

Wise’s fees range from 0.5% to 1% depending on the currency and payment type you use.

How many currencies does Wise work in?

Wise works in over 40 currencies.

How many countries does Wise work in?

Wise works in over 160 countries.

How does the Wise debit card work?

You can use a Wise debit card to fund transfers and complete payments, as well as withdraw money from an ATM.

Is Wise safe to use?

Yes. Wise protects your money with bank-level data security.

How do I withdraw money with Wise?

You can use your Wise debit card to withdraw money from ATMs around the globe. If you have a balance on your Wise account , you can send the amount to another bank account you have.

Can I send USD to USD?

Yes, you can send USD to USD or dozens of other currencies.

Is Wise a bank?

No, it’s an electronic money account.

Do I need a bank account to use Wise?

Yes. You need a bank account to send and receive money through Wise.

Final thoughts on Wise

If you’re an avid traveler, work or study abroad, or call more than one country home, then I highly recommend using Wise .

Wise transfers your money faster and for less than traditional banks and works in over 40 currencies. Plus, Wise fees are transparent, and their exchange rates are locked in for 2-72 hours after you set up a transfer. You can get a Wise account for business or pleasure, and the Wise debit card works anywhere that accepts Mastercard.

After using Wise to instantly send invoices abroad and make payments in different currencies, I can’t see myself switching to any other service. I hope this Wise review was helpful for you! Is there anything you would add about your experience with Wise? Let me know in the comments below!

Ascen Aynat

5 replies on “ Wise (TransferWise) Review: All You Need to Know ”

Hi…I´ve received my debit card ( VISA) , and I´ve watched the video, but it said that I need to activate it by entering the six digits in the bottom left corner of the front of the card, in the relevant box…But my card doesn´t have any digits at all, apart from the sixteen digits of the card number, and of course the three security digits. Is there another way to activate it ? TIA.

Hi Keith, It has been years since I activate my Wise Card. Can you please try to make a purchase with the card and see if it works? If not, I recommend contacting Wise.

Thank you Ascen, That´s exactly what I needed to know.

What is the maximum GBP´s that can be held in a wise account, and what are the fees

If you operate with GBP you wont have any problem since they don’t charge any fee for holding GBP. Not the same with EUR, where they charge 0.9% yearly for everything over €3000

Let me know if you have any questions, Ascen

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wise Reviews

In the Financial Institution category

Visit this website

Company activity See all

Write a review

Reviews 4.3.

215,669 total

Most relevant

This company is so good it makes me…

This company is so good it makes me sad. If every company was ran as well as Wise the world would be a much better place. Here are some examples of why I like them: • Mid-market rate for currency exchange • No exchange rate manipulation • A low transparent 0.39% fee • Downloadable account statements (Useful for verification)" • Actual bank details for each country • Wise card for international spending that uses the same fee structure as money transfers. p.s. I'm starting to feel like a sales rep, but honestly my experience is far so good : )

Date of experience : 16 April 2024

Absolutely fantastic - reliable and quick!

Absolutely fantastic!! I've used WISE a few times over the last couple of weeks to transfer money from an EU country, to the UK - and historically over the years to transfer money too. Their fees are amazingly low when compared to competitor companies, and they always seem to pay out super fast. I can really recommend anyone wholeheartedly to use wise for their money transfers. I've only ever had 100% reliability!

Just what you want

I have been using the app daily for the last 7months. The whole user experience with Wise is incredibly easy and efficient. Low fees, quick transfers. Never had an issue. The best app when you are abroad either traveling or for short internships. Highly recommended!

Get a fee free first transfer on up to £500 - Wise referral link

I've been using Wise for quite a while for now and recommending it to everyone I know as well. I was really surprised in the beginning that it is not just cheaper, but also faster to transfer money via Wise than via bank. I am not affiliated to this service in any way, but the link below is my referral link. Use it to get a fee free transfer on up to £500 (or its equivalent in another supported currency). Referral link - moneytransferwise.com

Date of experience : 10 April 2024

G.O.A.T ONLINE BANK

I just want to express my appreciation for the experience I've had with Wise. I've been with them since they were still TransferWise. Throughout my time with them, I've never encountered any issues. Their customer service is excellent and quick to respond with action; they've helped me recover my money from unscrupulous businesses on several occasions. The bank is very secure. I feel safe with them; they're like family and they understand your personal situation. Wise is the most compassionate and ethical bank in the world. Proud to have been with them for four years. The greatest of all time (GOAT) online bank.

Perfect way to spend abroad…

The wise card is so great for travel and moving money to alternative currencies. Front loading it for holiday spending allowing you to save money securely. The card is accepted everywhere and stops you from having to pay exchange rates on each purchase and using credit cards.

Date of experience : 09 April 2024

The Most Efficient Way to Send Money

Wise.com is the fastest and easiest way to pay friends and colleagues. The fees are so low it makes me feel as if I'm saving money as I'm spending it. It's so easy to send money, in just a few clicks, directly to the bank account of the recipient. I love the new features including the multi-currency debit card, and the Wisetag. Thank you, Wise.com!

Date of experience : 14 April 2024

Really satifyed of the service

Transfer of money from country to country effected in terms of seconds. Impressive the absence of costs in the transactions. Very good transfer rates adopted in the transactions. Alway precise, always fast (of course depending on the question) in the replies.

I've used this company for more than 10…

I've used this company for more than 10 years, it has become more sophisticated and user friendly over this time. The response time for deposits to a foreign bank is minutes. The exchange rate and fess are good too.

Though sometimes because of the new…

Though sometimes because of the new form of the app, I had to search for applications. Eventually I found them. Further more everything is going great, fast and I especially like the security. Sometimes I want access fast, but to know this is for safety reasons, it is all for the better. Transparant information.

Date of experience : 12 April 2024

Customer service went downhill fast

Customer service went downhill fast. Endless email exchange went nowhere (just got generic answers). Had to request a call to speak to a human, who was just as useless (sad to say) and hang up on me after 20 mins of basically constantly putting me on hold. After that, I requested another call, and the bloke was able to answer my Q - which is (simply!) an ATM withdrawal limit (in Thai baht) when withdrawn from ATMs in Thailand.... FFS!

Reply from Wise

Hi Kate, We always want to make sure that you’re getting what you need, and that we’re helping you fix any issues. So we’re sorry to hear that you had a bad experience with our support team. We can assure you that our team is in constant training, and we take your feedback seriously to continue improving. About the ATM situation — the daily withdrawal limits in Thailand vary depending on the bank. For example, Bangkok Bank’s limit is 25,000 THB, which is equivalent to 585 GBP. You might find this article helpful: https://wi.se/atminthailand There's also limits according to where your Wise card was issued, find more details here: https://wi.se/wisedebitcardlimits If you have any questions, reach out to us at: https://wi.se/contactus, or on X, Facebook and Instagram with your email and membership number. We’re here to help. Wise

Mixed feelings right now

Mixed feelings right now. My father was trying to set up payments between our accounts and the name of the party was an acronym. Wise support sent me a harsh email about suspecting money laundering. I did not appreciate the tone nor the message. I cannot control how the other party identifies themselves. Once I explained who the other party was, then Wise did kindly process the payments quickly, which I was happy about.

I use wise already a few years and i am always amazed how fast and easy the transaction is completed. I compare always the fees of my transactions to the fees from the banks and wise is always cheaper and way faster. Defintiley recommended!

Wise is a great resource

Wise is a great resource for exchanging money. It's services and very quick and efficient with very reasonable charges and it makes holding different currencies in my account very easy. I highly recommend it as a great place to keep your money.

Date of experience : 11 April 2024

Debit card and login

The multicurrency debit card works well. But I haven’t understood why, when you disconnect from the app, you have to enter your password even if the biometrical login is configured. Thanks for your help.

the best I have tried in digital banking operations.

The application is incredibly fascinating, precise, easy to use and above all very effective when carrying out your operations. 100% reliable. This has improved the gap in currency purchase operations that I have from my point of residence to other parts of the world. A solution that I applaud those who run it and that I would recommend to countless people.

Date of experience : 15 April 2024

A User Friendly Experience

Overall, WISE is doing great. It's VERY simple to receive and send money and to transfer to different currencies, etc. Had a recent experience where I was being paid and something went a bit haywire and they sent it back to the company that sent the $. I reached out and WISE did explain that there was an error on their side and they were working to resolve it. The next time the payment came in, there was a little survey or something and it all went fine. So, just a bit of a pain as the original funds got returned to the sender and they have to re-send them after verifying that they received the $ back into their bank account. Otherwise, the only other thing that I would request would be some way to deposit a hard copy check which is not possible with WISE. Other than that, I am very happy with their service and the app is very easy to use.

Very Difficult To Get a Transfer Out…

Very Difficult To Get a Transfer Out Everytime. I have been a customer for a long time and every time I try to send money somewhere it gets held by Wise and have to go through this aggravation and random check. Receive the standard responses about "protecting you from money laundry and fraud!" Please do me a favour and stop going after the hard working honest people that are doing genuine transactions!

Hi Mohamed, Our goal is to complete all payments as fast as we can. But as a regulated financial institution, we do need to carry extra checks on transfers from time to time. This keeps our platform safe for everyone using it (including you) while complying with local regulations. Depending on the case, it can take hours to several days. Keep an eye on your inbox for updates to your transfer along the way. However, it isn't common for this to happen to every transfer. We'd gladly double-check the case if you reach out to us at: https://wi.se/contactus, or on X, Facebook and Instagram with your email and membership number. We’re here to help. Wise

Poor transparence and no direct support person

After sending Money from Europe to Australia, they closed my account from one day to another because of not supporting payments to crypto platforms. It also worked 2 years before, so no reason for a cancellation. But, they're right! just a poor transparence and poor performance. No one is reachable for a chat or to discuss the problem. Thank you, Revolut and OFX, for being a perfect alternative for WISE. AND, with crypto support. :) "We made this decision because your activities exceed our risk tolerance. Please refer to section 1.2.2.c of our Acceptable Use Policy, which says that Wise doesn't support transfers related to crypto currencies."

Hi Thorsten, Deactivating accounts isn't something we take lightly. It's often a result of a conflict with our Terms of Service or Customer Agreement, or due to a discrepancy with a financial law. As stated by our team, we made this decision because we do not support transfers related to cryptocurrency. You can find more info in our Acceptable Use Policy: https://wi.se/usepolicy If you think we’ve made a mistake, you can follow these guidelines to appeal our decision: https://wi.se/accountdeactivation. We’ll review your request and get back to you ASAP via email. If you still have money in the account, we'll work on sending it back to you. But first, we need to carry out due diligence checks. While we do that, your money and information stays safe and secure. Our support team has limited access to closed accounts, which is why the best course of action is for you to do an appeal — this way the relevant team can look into the case. Since we currently don't facilitate cryptocurrency transfers, feel free to explore other providers that align with your needs. Wise

After a good experience with this…

After a good experience with this company I'm now experiencing their dark side. While making a transfer which I did 3 times before with the exact same details, I had to fill a questionnaire 3 times in a row (same one) then upload a video of myself. Then after 2 days I see that the transfer is paused because they want me to upload a photo as well. I did that but 4 days later it's still paused and the costumer service is completely useless. Meanwhile my money is in Their account just waiting there for a week now. I'm not using this app again.

Date of experience : 17 April 2024

Wise Review (Previously TransferWise): Send Money Internationally and Pay Bills Abroad for Just 1%

International money transfers are impossibly expensive. In this TransferWise review, I’m showing you why it’s the best option for sending and receiving money all over the world (note: it’s better than PayPal and wire transfers)!

Sending and receiving foreign currency used to be my biggest headache. In this Wise review (formerly TransferWise), I’m going to show you exactly why it’s now a complexity of the past.

When I was working and traveling in Australia , paying bills and sending money back home was nearly impossible. My wages were going into a foreign account, but I couldn’t use my foreign card to pay bills in the United States.

I couldn’t find a practical way to transfer the money between my accounts, or even to send money to my family and friends back home.

I tried transferring money from my foreign account to my US account via bank wire, but I was getting charged $35 every single time.

I tried using PayPal with multiple accounts hooked up to different cards in different countries—which was clunky at best—and I still had to deal with their criminal exchange rate.

And Western Union not only took days but they charged something like $50-$100.

Wise Review

Like many expats and long-term travelers, I was on the other side of the world with no way to send, receive or transfer money at a reasonable rate. The banks had me locked out. It should have been so easy, but it wasn’t.

Instead, I watched the banks take hundreds of dollars in fees while I worked my ass off to afford my travels.

I first heard about Wise last year and I now use it to send money to friends, to pay bills abroad, and even to accept payments from my international clients. I send and receive money all over the world, to and from any account, in any currency, at the official conversion rate, for a flat fee of about 1%.

It’s almost revolutionary. And in this Wise review, I’m going to tell you why this is the best way to send money abroad, bar none.

What is Wise, Anyway?

Wise was launched in 2011 as TransferWise, and has been backed by Peter Thiel (co-founder of PayPal, board of Facebook, an investor in Airbnb and Stripe) and Richard Branson (Virgin Airlines, Virgin Records, Virgin everything).

It’s made by two Estonian fellas: Kristo Käärmannone, financial consultant, and Taavet Hinrikus, the first ever employee at Skype . They’ve got some serious street cred, and with $117 million in funding , they’ve got the money behind them to make Wise a household name.

It’s my hope that, by using Wise , you’ll be able to spend less at the bank and more on your travels.

How Does Wise Work (and Why Is It So Cheap)?

Traditionally, sending money has involved a middleman—the bank. You give the money to them, they convert it, take their commission, then send it to the recipient.

But with Wise you exchange currency with other customers.

This is the cool part: Wise operates like a peer-to-peer service. Rather than exchanging money with the bank, you exchange money with a peer—someone else who also wants to use Wise to send money overseas. It cuts out all the fees (and it’s totally secure).

Pretty neat, huh? Technically, your money never even crosses a border, which is why they don’t have to charge you for the conversion.

Wise Review: Different Ways to Use the Service

The problem with a lot of money transfer services is that they only do one thing—they transfer money. Wise , however, is surprisingly versatile. Here are a few examples of how I’ve used them in the past:

- Transferring Money Between Accounts – Since I have bank accounts in multiple countries, I use Wise to transfer money between them. All I have to do is enter the bank details of each one and Wise initiates the transfer at the real conversion rate, only charging a minimal fee.

- Paying Bills Abroad – Wise makes it easy to pay bills from overseas, no matter which country you’re in. Just enter the business info and their bank information/IBAN number and they take care of the rest.

- Sending Money to Friends – Last year when I was in Bangkok, my friend Ben lost his bank card. Since he didn’t have any money on him, he logged online and sent me €400 with Wise. He paid €4 in fees, and I received the exact amount in my bank account in US dollars (within 24 hours and at the official exchange rate). I then withdrew Thai baht at the ATM and Ben could finally afford his dinner once again (though I obviously lent him enough to pay for dinner and a few beers in the meantime).

- Invoicing Freelance Clients – As a blogger, I do business with clients all over the world. I’ve found international wire transfers to be one of three things: costly, confusing, or unreliable. With Wise, I can send a simple money request to a client, who then initiates a standard bank transfer to Wise.

Because Wise has a bank account in each country, it’s technically a local transfer for the client and a local transfer for me, so they charge just 1%. The best part is that my clients don’t even have to sign up for an account, and neither one of us has to pay large fees! It’s all very simple.

Wise vs. PayPal vs. The Bank

For years, PayPal has been the big player when it comes to sending and receiving money online. Since a lot of people have a PayPal account these days, it’s the go-to option because it’s just plain easy. But is convenience worth paying 6.9%?

Not only do they charge about 3.9% to send money, but they charge you an extra 3% on top of their already criminal exchange rate. Once you have the money in your account, they force you to convert the currency with them. It’s locked in your PayPal account and you can’t withdraw it unless you use their conversion rates.

Sneaky buggers.

I’ll be honest, I used to be a big fan of PayPal, but I’ve come to despise them. For a long time they’ve been the only option, and even today I’m forced to use them a lot to run my business—they’re a necessary evil. I was really excited to find Wise because it means I can phase PayPal out of my life.

The other difficulty with PayPal is that, if you want to transfer money between your own banks, you have to sign up for multiple accounts. Since you’re only permitted to have one PayPal account per country, you have to log in and out multiple times, and you’re still stuck paying the excessive exchange rate.

With Wise, you pay about 1% per transfer. So if I send $1,000, the fee is about $10. With Paypal, it would cost $69. Using an international bank transfer, sending $1,000 could cost up to $100 in fees. It’s kind of a no-brainer.

So What's the Catch with Wise?

That was my first question, too. I’m so used to getting cheated by banks that I couldn’t understand why a company would charge reasonable fees. It’s the peer-to-peer functionality that makes Wise cheap (not to mention it’s really clever). Rather than having to constantly convert currency, Wise is matching up users from around the world, and it’s totally secure.

Realistically you don’t see anything that happens behind the scenes. I’m not searching for a guy named Markus to make an exchange with. Wise has a huge pot of money to draw from in each country, so you don’t have to worry about waiting for someone else to make a transfer, too. The platform is set up to operate like a traditional money transfer service—just enter the recipient and the amount, and press send.

And here’s something else: in most major currencies, Wise allows you to send money using your credit card as the funding source. And all they charge is 1%!

That definitely beats PayPal’s 6.9% and the bank’s hefty cut.

- Best Bank Accounts for Travel

- How to Save Up Money for Travel

- A Simple Guide to Banking While You Travel

How trustworthy is Wise?

Wise is a trustworthy solution for transferring money overseas quickly and without hefty bank transfer fees.

Is Wise better than PayPal?

Wise offers significantly lower fees than PayPal, which is a big deal if you are traveling overseas long-term.

Is Wise a good way to receive money?

Wise is a great way to receive money if you want to avoid PayPal’s high fees.

Is Wise legal in US?

Wise is totally legal to use in the US.

Does Wise report to the IRS?

Wise reports transfers to the IRS when they are legally obligated to do so.

Jeremy Scott Foster

What Theme do you use on the site

Awesome Write-up! Thanks for sharing! I share your frustration with Paypal. Especially, with Paypal… Having to open a separate account for each country is pretty lame as you have already highlighted. I will definitely check out Transferwise. Happy Travels!

Really well explained. I use Transferwise every month, they always give me the best rates.

However just to be fair and honest, you should mention that if 3 people use your link you will get £50 for referral. Not saying you don’t deserve it after taking time to write such a good article!

I got really excited until I realized they don’t support Chinese yuan…….. I’m not even sure if the Chinese government would allow this anyway.

I was using transferwise until my friend gave me Currency Fair. Over 500€ the fee is less than Transferwise.

Great article! Transferwise is amazing. It’s saved me so much money on my international transfers to my family in the US. I’ll be using never a bank again.

Thanks for the article.

Thanks for all the explanations! I’m living in Taiwan and PayPal is only allowed with only one local bank with expensive fees! I’m happy to fall on your article comparing PayPal and Transferwise. Great job! Many thanks Jeremy!

I hope it saves you some money!

Beware that if you use credit card with Transferwise, your credit card company may also charge you for a “cash-like transaction”. I used Barclaycard to make a Transferwise transfer and Barcaycard charged me 3%. This is in addition to the Transferwise charge, obviously. You still get the better mid-market rate from Transferwise, but check if your credit card will charge for this or use a debit card.

my question relates to using Transferwise to make purchases: Paypal provides a guaranteed service..ie if one doesn’t receive the item paid for, or it is not as described, then PayPal refunds your money & investigates. I have had this happen 3 or 4 times when buying products from overseasa..& each time PayPal came through & I wasn’t ripped off. Ive just purchased a $2000us item overseas & the company is giving me the run around. Does Transferwise help in these situations?

Hey Asa. PayPal does offer an escrow service & protection for when you purchase products, but this isn’t what TransferWise is intended for. It’s used for sending and receiving money, not for buying things online. Hope that helps, and good luck with that company!

The idea is excellent!

My only concern is the safety related to both sender and the recipient’s ID’s.

Is it at the level of any financial or public insitution in the sender’s home country?

TransferWise is a private company, so it doesn’t operate at the level of a financial institution.

but i don’t see TWD?

TransferWise is an inexpensive online wire service, but it comes with a bag of administrative regulations that make sending money from from point A to point B unnecessary complicated. Strongly suggested to use a different wiring service even if it’s a little bit more expensive. Sometimes the cheapest is not the best option. Not recommended.

What kind of regulations? I’ve never had a problem!

I’m using TransferWise now to make a simple transfer to Turkey. It’s been over 5 days now and I am still waiting for the money to be credited to the account. It may be cheap but it’s not fast.

Sorry to hear that! I believe there are different methods of transfer which all take different amounts of time.

Really well explained. Super easy, quick and reliable. Highly recommend.

Any update on your case? Hope you finally received the money.

I’ve been using TranserWise from almost 4 years now and I can proudly say there has been no problems with it . Though I think it takes time sending money to England but generally it’s good for me in terms of everything.

Your email address will not be published. Required fields are marked *

Search our latest articles, reviews and gear guides

- TravelFreak on Instagram

- TravelFreak on Facebook

- TravelFreak on Twitter

- TravelFreak on Pinterest

Sign up now and get the best gear, travel tips, deals and destinations, straight to your inbox.

Thank you for signing up!

Wise Vs Revolut: Which Is Better For Travelers?

by Melissa Giroux | Last updated Dec 5, 2023 | Travel Finances , Travel Tips

When searching online for money transfer services, two of the first companies you’ll find are Wise and Revolut .

Both providers offer similar services and make exchanging currency, receiving international payments, accessing cash abroad, and sending money overseas all a piece of cake.

Both Wise and Revolut have much better exchange rates compared to traditional banks and charge lower fees too.

However, both virtual banks have strengths and weaknesses and offer unique services that the other does not.

Therefore, when deciding between Wise or Revolut , you should do your homework to ensure you choose the best provider for your needs.

To help you make the right choice, we’ve created a comprehensive Wise vs Revolut comparison guide.

We’ll highlight the main differences between Revolut and Wise.

Note that you may opt to pick both Wise and Revolut to fulfill different needs.

❔ What Is Wise?

Wise is an electronic money transfer service that has been operating since 2011.

It was founded in the United Kingdom and was known as Transferwise until it changed its name in 2021.

Wise allows you to send money to 80 countries and hold over 40 currencies in your virtual wallet.

You can instantly exchange one currency for another using actual exchange rates and transfer to and from your bank account in less than a minute.

You can also receive payments in multiple currencies as you’ll have personal bank account details in the UK, USA, Canada, Australia, Europe, and more.

Learn more by reading information on the Wise multi-currency account .

Wise users also get a debit card that can be used worldwide to withdraw cash in local currency from ATMs.

You can also use the Wise MasterCard to pay for goods in local businesses and make payments online.

❔ What Is Revolut?

Revolut is a relatively new virtual bank founded in 2015. Just like Wise, Revolut is a private company based in the UK.

With Revolut, you can send money to other Revolut users and bank accounts. You can also receive money in over 30 currencies with no hidden fees.

Plus, you get a unique QR code and payment link to share with people to get paid quickly, even if they do not have a Revolut account.

Revolut customers receive a multi-currency debit card to withdraw money at an ATM or pay for goods abroad.

With your Revolut MasterCard, you can withdraw up to 120 currencies, and with the app, you can transfer money in 26 currencies.

Revolut has some additional features like budgeting tools and spending analytics.

You can also link your bank account to your Revolut account so you can see all your money in one place.

Moreover, as Revolut has a banking license, they can offer loans to UK residents.

Revolut is one of the best banks for digital nomads , so I highly recommend it if you’re a digital nomad or a long-term traveler.

Get Revolut

📣 Revolut Promotion

Upgrade to a global lifestyle with Revolut. Transform your finances when you level up to Premium with Revolut’s Premium trial .

You’ll get features to help you save, spend, and invest smarter than ever.

Get a 3-month Revolut Premium subscription trial, effective today.

Note that this promotion works everywhere except for Australia and Singapore, where the offer is a cash award of AUD 15 in Australia and SGD 15 in Singapore.

All new Revolut customers are eligible.

⚖️ Wise Vs Revolut: Full Comparison

As you can see, at first glance, both Wise and Revolut look pretty impressive.

But how do they stack up against each other?

Wise Vs Revolut: Exchange Rate

Both Wise and Revolut use FX rates based on real-time data from third parties such as Reuters.

Wise offers customers the best competitive rate on all currencies without adding a markup and allows customers to lock in a rate for 24 to 96 hours to avoid any fluctuations.

They also let you know if another provider currently offers a better rate.

Revolut operates slightly differently.

They match the mid-market rate during the week (when the market is open) with no markup, then apply a markup of 1% to all currencies for exchanges made during the weekend.

Verdict: When it comes to FX rates, Wise is the most transparent and matches the mid-market rate at all times with no markups. Therefore, they generally offer better exchange rates than Revolut.

Wise Vs Revolut: Fees

You can open a bank account on Wise and Revolut with no fee.

Let’s look at the fees you can expect to pay – because even if an account is free, it doesn’t mean it really is.

- Opening a bank account: free

- Sending money: fee varies by currency – you see the amount when sending money

- Withdrawing (up to 200 GBP per month within 2 or less withdrawals): free

- Withdrawing (after the free transaction above): 1.75%

- Getting the Wise debit card: 5 GBP

- Converting money into different currencies: from 0.41%

Revolut Fees:

- Opening a bank account: no fee for the standard plan (between GBP 2.99 and 12.99 per month for the Plus, Premium, or Metal plans)

- Sending money: no fee*

- Withdrawing (up to 200 GBP per month): no fee*

- Withdrawing (after the no fee transaction above): 2%

- Getting the Revolut debit card: GBP 4.99 / No fee for the Plus, Premium, and Metal plans

- Converting money into different currencies depends on the chosen plan

* Here’s more information about sending money overseas:

- Standard Accounts: 1 no fee International Transfer per month

- Premium Accounts: 3 no fee International Transfers per month

- Metal Accounts: 5 no fee International Transfers per month

* The Plus, Premium, and Metal plans have a higher no-fee withdrawal amount.

Verdict: Fees can depend on your usage, location, and currency. I love how cheap international Wise transfers are, so I use them a lot, but daily, I use Revolut to buy things or to withdraw money. I have the Revolut Metal plan.

Wise Vs Revolut: Transfer Fees

Both platforms have much lower fees for sending money abroad than any traditional bank.

The main difference between the two is that Revolut offers zero fees on transfers to Europe, whereas Wise charges a 0.35% variable fee.

So, for example, if you convert 1000 GBP to EUR, you will pay a fee of £3.69 with Wise and nothing with Revolut.

Both platforms charge fees to convert and send money outside of Europe, but Revolut is still the cheapest.

They have a fixed 0.3% transfer fee on most currencies, meaning you’ll pay a fee of £3 when you transfer 1000 GBP to anywhere outside the EEA.

Wise has fixed costs and variable fees that differ between each currency. Their variable fees range from 0.35% to 0.45%.

Verdict: Revolut has the cheapest fees, no matter where you send money. If you’re mainly transferring to Europe, you’ll save a lot of money with Revolut.

Wise Vs Revolut: Locations And Currencies

One area where Wise stands out is availability. For example, wise is available in 230 countries.

In contrast, Revolut is only available for residents of the European Economic Area (EEA) and Australia, Singapore, Switzerland, Japan, and the USA.

The countries Wise doesn’t operate in include Cuba, Hong Kong, India, Malaysia, and the United Arab Emirates.

Wise allows you to hold and exchange 56 currencies, whereas Revolut only allows 31.

However, the speed of sending money is similar between the two providers, both offering lightning-fast transfers in most cases.

Verdict: Wise’s availability is much greater than Revolut. For travelers, digital nomads, and expats who spend time in Asia, Central America, and South America, Wise is a far better choice.

Wise Vs Revolut: Additional features

Revolut may not operate in as many countries as Wise, but it offers many innovative features.

One key difference you should know when deciding between Wise or Revolut is that Revolut has a banking license, whereas Wise doesn’t.

This means Revolut can offer loans and insurance to UK customers, but Wise cannot.

Revolut also offers virtual cards. Plus, they allow you to link your bank account to the app to see all your money in one place, a feature that Wise does not have.

Moreover, Revolut has various budgeting and analytical features on its app.

Wise has recently launched Wise Interest . In short, it’s a new way for Wise customers to protect their money and put it to work at the same time.

The money is put in a fund that follows central bank interest rates, which means when their rates change, yours do too. That also means returns aren’t guaranteed.

However, this new feature could be interesting for many.

Verdict: It’s clear to see that Revolut is constantly looking for ways to grow and evolve into a one-stop shop for all your money needs. These features may be exciting and valuable for those looking to do more than just send and receive money internationally.

Wise Vs Revolut: Reputation

Wise has over 113,000 reviews on Trustpilot with an overall rating of 4.7 out of 5, qualifying them as an “excellent” provider.

Revolut has over 75,000 Trustpilot reviews with an overall rating of 4.3 out of 5.

Although lower than Wise, it still puts them in the Trustpilot “excellent” category.

Wise’s most positive things are their transparency, reliable exchange rates, customer service, and lower prices than competitors.

Negative reviews mention slow processing speeds for some currencies, price increases over the years, and, most worryingly, holding funds or blocking/deactivating accounts without any explanation.

Happy Revolut customers commented on the variety of features, easy-to-use app, and speed of transfers.

Negative comments included their higher rates on weekends, poor customer service, and having their account locked or under review for no reason given.

Verdict: From customer reviews, it seems both providers have pros and cons, but as Wise has more reviews and a higher overview rating, they have the best reputation.

Wise Vs Revolut For Travel

Regarding traveling, it’s helpful to have both a Wise travel card and a Revolut travel card .

While I use Revolut during my travels, I also have my Wise travel card with me in case of emergency.

I believe the fees and conversion on Revolut are brilliant, and I don’t need to use the Wise travel card.

In fact, I usually transfer money from my Wise account into my Revolut for withdrawals.

Verdict: If you’re traveling long-term, I recommend getting both Wise and Revolut during your travels. Having both options is great in case of an emergency abroad.

💳 Wise And Revolut Alternatives

Now, if you already have both Wise and Revolut and are looking for something a little different, there are plenty of other options.

Here are two of the most interesting alternatives:

✨ Our Verdict: Which Is Better, Wise Or Revolut?

Both Wise and Revolut are highly rated, popular money transfer companies.

However, after comparing Revolut vs Wise, you can see that both providers excel in certain areas and lack elsewhere.

Therefore, the best choice will depend on your specific needs.

Wise has more authority as a money transfer service and operates almost globally.

Therefore, it’s the best option for frequent travelers looking for cheaper access to money abroad.

It’s also ideal for remote workers receiving payments from clients worldwide.

You can learn how does Wise work .

However, Revolut is undoubtedly the best option for anyone who predominantly travels in Europe, thanks to their no fee transfers within the EEA.

PSSST! You can always use both! This is what I do.

Want to use Paypal instead? Read our blog post about Wise vs Paypal to learn more about both companies.

MY TOP RECOMMENDATIONS

BOOK HOTEL ON BOOKING.COM

BOOK HOSTEL ON HOSTELWORLD

GET YOUR TRAVEL INSURANCE

LEARN HOW TO START A TRAVEL BLOG

LEARN HOW TO VOLUNTEER ABROAD

Suggested companies

Wise Reviews

In the Financial Institution category

Visit this website

Company activity See all

Write a review

Reviews 4.3.

215,669 total

Most recent

Good expirience to onligne activities

Good expirience to onligne activities verry nice apply

Date of experience : August 05, 2022

Good exchange rates and fast transfer

Wise offers good exchange rates and keeps the rates within the time frame. When money arrives at their account, the transfer goes within minutes. If promised exchange rate expires, they give you good market rates.

Account has been closed becuase of the board's decision

Wise permanently closes this charity’s account because they don’t like buying drones for Ukraine. It had taken 3 weeks for their board to make a decision and the official answer was "Apologies on the extended delay, but we wanted to ensure a full and thorough review. We've received your appeal and regret to inform you that Wise stands by its decision to deactivate the account" 2-3 weeks more we should wait when money are going to be transferred back to the bank.

Easy to use

Easy to use Exchange rates are good Fast transactions

Very Good...

Great exchange rate

Great exchange rate. Site easy to use. Low charges. Also transfers are almost instant

Simply put, just excellent.

I find wise a very convenient.

I find Wise a very convenient, economical and efficient way to send money. I always use it.

Excellent exchange rates & easy to use

Wise is very very easy to use to transfer GB pounds to euros. One feature that is especially pleasing is that they always clearly show the exchange rate so you can choose your moment. Transfers are very very quickly done. I've used TransferWise and Wise for years and so no reason to continue to do so

freezing the money easily without any…

freezing the money easily without any reason.

I tried to cancel a £600 payment and they took the money out of my account twice! Impossible to speak to anyone and really confusing system. I want my money back!!

Very useful application

Very fast and efficient service,! Highly recommended!

The best money money transfer services…

The best money money transfer services ever. It’s so easy to use and fast especially in international transfers.

The best money app that i´ve used ever!

Great experience

I am really very satisfied with an impeccable service.

Very efficient

Very efficient, fast transactions, fair charges, perfect communications, very modern up-to-date services.

Quick, great but not best rate offered

Very quick and useful! However, not always the best rate offered but still fine.

The KYC process is horrible

The KYC process is horrible. I did send all the documents what was necessary to the Compliance 4 times. I needed to explain how they can analyse the docs so they can understand it. Specially I just sending money through wise, because the exchange rate is good. Still they needed so many things it didnt worth it at all.

Excellent Company!

Have used Wise (Transferwise) for years and no other company is as efficient at transferring money, along with giving a great rate!

Money Transfer Comparison

International Money Transfers Top 10 & Guide

- Not in the top 5 best rated money transfer services on MTC

- Not optimal for large transfers - no dedicated currency dealer, no flexibility in margins, no hedging and no guidance

- Wise Exchange Rate fees increased 2020 -> 2021 -> 2022 -> 2023 and we believe will continue rising (EUR and GBP most impacted by 2023 price increase)

- Wise CEO Kristo Kaarmann is currently being investigated by the FCA for tax default

- High proportion of negative customer reviews in late 2022 and 2023

- Customer support is slow to respond

- Froze a number of existing accounts without warning and refused to send money back to the account holder until required due diligence checks were passed (reportedly taking up to one year for some users)

- Wise subsidiary in UAE fined by regulatory body for breach of anti-money laundering regulations

- Turnover at board level in May 2023 - yet to see how this will impact Wise moving forward

- Really good online system with a strong UI

- Very usable money transfer app (rated 4.7 / 5 on Google Play, 4.6 / 5 on Apple Store)

- A strong multi-currency account and multi-currency card for travel

- Transparent exchange rates / fees, clear to know what you are paying

- Earn interest on your Wise account balances

What is Wise (ex-TransferWise)

Official website:, wise review: our opinion.

Here at Money Transfer Comparison, we have followed every step of the meteoric rise Wise had to the top of the international money transfer industry. The fintech, formerly known as TransferWise, is currently the largest money transfer company in the UK, boasting over £9bn in monthly turnover. Wise understood the changing demands of customers and was one of the first to roll out a tech-oriented solution that made international transfers easier, faster and cheaper.

Wise.com pride themselves on a transparent fee structure which hovers around 0.5% of the total value of the transfer. The online system is easy to use and based on a 4.2 / 5 TrustScore from over 195,000 customer reviews, it is fair to say that users are generally satisfied. The Wise app is highly rated for functionality with ratings of 4.7 / 5 on Google Play and 4.6 / 5 on Apple Store. On the downside, its platform is less geared towards high-sum transfers, as it does not offer a bespoke currency brokerage service like competitors Currencies Direct , TorFX , or moneycorp . The proportion of negative customer reviews has also drastically increased since 2022.

Wise, traded on the stock exchange as LSE WISE, is indeed a legitimate money transfer company. Millions of other Brits, Europeans, Australians and Americans use its services on a constant basis. Just be aware they have been freezing a number of accounts recently.

Click here to visit Wise (TransferWise) .

Current Rates?

Where is wise available, is a wise account the best choice for sending money abroad.

We believe that Wise is one of the best, and safest, options for:

- Transferring smaller amounts of money abroad online.

- Multi-currency bank accounts to receive and hold money.

- Prepaid multi-currency card for international travel.

At the same time, we believe Wise (Transferwise) may not be the optimal choice for transferring large amounts of money , as its purely “online” journey is lacking in comparison to a currency broker , who provides more informed guidance along the way. Through our industry knowledge, analysis of transaction data and speaking to prospective customers, clients feel SAFER when using a broker to transfer money overseas. Clients who make higher value transfers are much more likely to place that trade over the telephone. They prefer speaking to a dedicated currency dealer for peace of mind, something Wise does not offer.

We have listed the top Wise alternatives below.

Who Are the Top 3 Competitors of Wise?

Below you can find three Wise alternatives that clients and we at Money Transfer Comparison rated higher than Wise. These three providers are a subset of our selection of best international money transfer services . They all have a more close-up-and-personal approach for customers moving larger volumes of money, whether that be business clients, financial professionals or simply those wanting to hedge their FX risk (using a Forward Contract for example).

- Min Transfer: £/€/$ 250

- Currencies Supported: 120

- Offices : UK, EU, USA, HK, and UAE.

- Our Rating : 92.8% 🌟Best for Large Transfers🌟

- Business Oriented, Many High Profile Business Customers Industry Veteran since 1979 Safest and Most Geared Towards Large Amounts Up Close and Personal Service by Professionals Fix Today's Rates for Up to 2 Years with a Forward Contract

- Moneycorp Review

- Min Transfer: £/€/$/A$/NZ$/$CAD 100

- Currencies Supported: 140

- Offices : UK, EU, USA, Australia, NZ and Canada.

- Editorial App Rating : 98.4%

- Best Rated Money Transfer App & Online Money Transfer MoneyFact's Best Provider Award No Fees on Any Transfer, Ever Google Play Rating: 4.5 (3,300 ratings) App Store Rating: 4.8 (2,000 ratings)

- Min Transfer: £/€ 1,000

- Currencies Supported: 138

- Offices : UK, Europe.

- Our Rating : 90.6% TrustPilot Rating : 4.3 / 5

- Very Quick to Respond in a Friendly Manner Competitive Rates and No Wire Fees Very High Customer Satisfaction Operating from Cornwall, Less Operating Costs Rolled Over to Customers Directors Have Dozens of Years of Industry Experience

- Global Reach Review

… does the fact we have higher rated providers mean that Wise is unsafe or a scam? Of course not. Money Transfer Comparison has determined that Wise is safe to use, and the company is certainly legitimate.

Is Wise.com Safe? Is Wise Legit?

Wise, formerly TransferWise, is one of the hottest startups to emerge over the last ten years and is considered a market leader in the fintech sector. Since inception, it has grown at a staggering pace, seeing its value soar by billions between each funding round and ultimately resulting in an £8.8bn valuation at Wise’s direct listing on the London Stock Exchange in July 2021 (though this is now down to £6.8bn – more on this below).

In its latest quarterly trading report, Wise reported moving £28.2bn in transfer volumes between Apr – Jun 2023 (an average of circa £9.4bn per month and up on the £26.7bn transferred in the first three months of the year). There are currently more than 2200 employees working for Wise.com in numerous offices across 4 continents around the world.

Note: This Wise review for 2023 was updated to reflect the company’s new brand, Wise Money Transfers, and their continuous release of new fee schemes which make some transfer routes cheaper and some more expensive.

Wise, previously known as TransferWise, has definitely come a long way since its inception in 2010 (launched in 2011). It was established by two Estonian Fintech innovators, Taavet Hinrikus, (Skype’s first employee) and Kristo Käärmann, both of whom were working in the UK, and experiencing the high costs of bank-powered international money transfers. Quite early on in their journey to lower the costs of cross border remittances, they received a massive shot of encouragement in the form of two mega-investors who believed in the idea, and jumped on the Wise wagon. These two investors were PayPal ’s co-founder, Peter Thiel, as well as Virgin’s founder Richard Branson.

Here is a complete overview of then-TransferWise’s investment rounds, prior to going public in 2021:

Information from Angel.co

Secondary Share Sales

In May 2019 Wise announced it raised an additional $292 million through a secondary share sale – at the time valuing the company at $3.5 billion. This took the total funding in the company to a mammoth $689 million.

In July 2020 Wise money transfers confirmed a new $319 million secondary share sale, valuing the company at $5 billion dollars. Making it the second most valuable fintech in Europe.

Direct Listing on the LSE – July 2021

In what was perhaps an understated move for a listing of this size, Wise went public in July 2021 via a direct listing. The move means no new shares were created for the firm and only existing shares kicked off trading on the LSE. This made Wise the largest company to perform a direct listing on the LSE that isn’t already traded on another stock exchange.

The listing, which was said to be driven by Boris Johnson and Rishi Sunak in order to boost the UK economy, shows the increasing importance fintechs are gaining in the market against traditional banks.

Wise shares opened at £8 a share, giving the company a market value of £8.8 billion ($11 billion), twice the valuation it had received from private investors in 2020. By September 2021, Wise shares were valued at £11.50, representing a 30% increase in value over its first two months being public. However, this gain was short lived and in June 2022 the share price slumped to £3.60. As of May 2023, the share price recovered to £5.45 per share and by October 2023 this increased further to £6.80. Wise has a current market cap of £6.8 billion, representing a 23% drop on the original listing value.

From TransferWise to Wise

Transferwise rebranded itself to Wise (wise.com) just prior to the IPO in order to better reflect the full range of financial services it provides – much more than just Wise money transfers. For example, they also offer wise bank accounts which are used by over 10 million people to live, work, travel, and do business around the world (accompanied by the Wise debit card).

Co-founder and CEO of Wise Kristo Käärmann had this to say on the announcement, “Today our name catches up with who we’re already building for — a community of people and businesses with multi-currency lives… Wise is for all of us who live, work, travel, or support family around the world. It’s for those of us who want to cut out the middlemen that hold us back from being truly borderless.”

At MoneyTransferComparison our review will continue to focus primarily on Wise international money transfers. We also take a look at the Wise multi-currency account (formerly Wise borderless account) as this plays a central role in making and receiving money transfers.

Wise Unveils a New Look

In January 2023, at the same time that Wise hit 16 million registrations, the firm unveiled a brand new look. Ditching its trademark blue, the rebrand revealed a new font and new imagery based around a fresh green palette.

CEO Kristo Kaarmann Faces FCA Investigation After Tax Breach

In July 2022 it was announced CEO Kristo Kaarmann is being investigated by U.K. regulators after tax authorities found he failed to pay a tax bill worth over £720,000. Kristo Kaarmann has already been fined £365,651 by HMRC for defaulting on the tax bill in 2018. The FCA is now looking into whether Kaarmann failed to meet regulatory obligations and standards. The investigation could have significant ramifications for Wise and its chief executive Kaarmann who could be forced to step down and cease working in the industry if regulators deem he fails the “fit and proper” test. The investigation remains ongoing and advisory group Glass Lewis warned investors that any regulatory investigations into directors should be a cause for concern and legal proceedings could dent the valuation of Wise. As of October 2023, the matter remains unresolved.

In its earlier days, the then Transferwise marketed itself by saying it was the world’s first and only Peer to Peer money transfer provider. The logic was simple – Wise would be able to beat the banks by finding two clients who need to transfer money in opposite directions (say, one client is transferring Pound to Euro, and the other one is exchanging Euros for Pounds). This way, they claimed, the savings would be immense.

What they didn’t take into consideration is how volatile the market is and the fact people normally want to trade money instantly. Similarly, if there are large payments that Wise customers wish to make or there are significant flows into certain currencies (say EUR for example), it is difficult or even impossible to match those flows in the opposite direction. Long story short, Wise dumped this way of marketing themselves, and over recent years has made no reference on their website to the terms “peer to peer money transfer” or “peer to peer currency exchange”. The sheer volume Wise transacts these days (at least £9 billion a month) means it will access cheap liquidity from its banking partners.

Questions Raised Over Wise Compliance Protocols?

At the start of 2022, Wise said it made “significant improvements in our controls and security checks that keep your money safe. Unfortunately this meant more transfers being subject to checks, delays or other hurdles”.

The result seems to be an increase in the frequency that supporting documents are requested in order to process a transfer and a significant uptick in the number of Wise accounts to be deactivated. Ultimately, this suggests Wise is either going overboard on its compliance checks, or that they weren’t up-to-scratch in the first place. Whatever it is, it doesn’t paint Wise in a good picture.