- Book a flight

- Hold the price

- Manage booking

- Flight status

- Seat selection

- Extra baggage

- Traveling with pets

- Business Upgrade

- Sports equipment

- Book a hotel

- Travel insurance

- Business Class

- Economy Class

- Dining on-board

- Inflight entertainment

- Turkish Airlines Lounge

- Stopover Istanbul

- Touristanbul

- Exclusive Drive

- PressReader

- Istanbul Airport

- Best flight deals

- Special offers

- Students discount

- Stay informed about offers

- Saudi Arabia

- Turkish Airlines Blog

- First stop: Istanbul

- Türkiye travel guide

- Travel tips

- Program content

- Status and privileges

- Terms and conditions

- Earn Miles from flights

- Bank partnerships

- Program partners

- Miles calculator

- Award Ticket

- Shop&Miles

- Redeeming Miles channels

- Check-in info

- Baggage services

- Transfer and transit passengers

- Infants and children info

- Patients and disabled passengers

- Codeshare partners

- Reservation and bookings

- Flight cancelations and change

- Dining onboard

- Infants and children

- Help center

- Get in touch

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- All Credit Card Guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- All Insurance Guides

- Travel Insurance Turkey

On This Page

- Key takeaways

Do I need travel insurance to visit Turkey?

How much does travel insurance for turkey cost, what does travel insurance for turkey cover, what isn’t covered by travel insurance for turkey, tips for getting the best turkey travel insurance, turkey travel information & requirements, faq: turkey travel insurance, related topics.

Travel Insurance for Turkey: U.S. Visitor Quotes & Requirements

- Travel insurance for Turkey isn’t required , but it’s recommended given the risk of earthquakes, political demonstrations and terrorism.

- Your U.S. health insurance won’t work in Turkey , so it’s especially important to purchase travel medical insurance before your trip.

- According to our research, our top picks for travel insurance for Turkey come from Seven Corners, Tin Leg and IMG ( skip ahead to view these plans ).

- We recommend comparing insurance plans online to find the right balance between price and coverage.

Our top picks for the best travel insurance turkey

- Seven Corners: Best for Robust Coverage

- Tin Leg: Best Rated Travel Plan

- IMG: Best Rated Travel Insurance

Our top picks for travel insurance for Turkey

Seven corners.

Travel insurance isn’t required for visiting Turkey , but it’s always a good idea.

Although most tourists have a safe and pleasant visit, Turkey presents a few common risks. If your trip is affected by something unexpected, insurance can help you recoup lost costs , pay for medical care and find medical transport in case of an emergency. If you fall and break a leg while climbing stairs in Istanbul, for example, your policy can help cover the hospital bills.

Risk of earthquakes and natural disasters

Turkey sits at the intersection of multiple tectonic plates, which means it sees a great deal of seismic activity. In fact, it’s one of the most active earthquake zones in the world; every part of the country is at risk.

Some areas of Turkey are also prone to other types of natural disasters, including wildfires and floods. These issues can be serious, rendering entire regions impassible and disrupting travel. A travel insurance policy can protect you if your trip is canceled or delayed due to earthquakes and other catastrophes.

Risk of terrorism and political demonstrations

Turkey is home to multiple terror groups, which means there’s always a risk of an attack. The tense political climate in Turkey can also pose a danger to travelers, especially when there are protests and demonstrations; the conflict between Israel and Hamas in Gaza has heightened this risk. Look for a travel insurance policy that can help minimize financial losses if your trip is canceled or interrupted due to a terrorist attack or political instability.

Water-related activities

Water activities are popular in the beautiful coastal regions of Turkey. If you’re planning to take a boat trip or go snorkeling and scuba diving, travel insurance is a must. It can pay your medical bills if you get into a boating accident or experience decompression sickness while diving. Since healthcare facilities in smaller Turkish towns aren’t always well-equipped, insurance can also cover costs for transportation to a larger city.

Adventure activities

Some parts of Turkey are known for adventurous activities. Before you hop in a hot air balloon in Cappadocia, you should have a travel insurance policy to cover unexpected accidents that might happen. This is especially important if you’re exploring remote areas in Turkey that could require a long plane or ambulance ride after an injury.

Best for Robust Coverage

Why we like it.

- Offers coverage for pre-existing conditions

- Money-back guarantee

- Cancellation & Interruption coverage standard

- Covers action sports & equipment

- Cancel for any reason not included standard

- Must meet waiver for pre-existing conditions to be covered

Best Rated Travel Plan

- Excellent primary coverage for medical expenses

- High limit for emergency evacuation coverage

- Optional cancel for any reason (CFAR) coverage available

- Comes with coverage for hurricanes and inclement weather

- Coverage for pre-existing conditions is available if purchased within 14 days of the trip deposit

- Baggage delay coverage requires a 24-hour waiting period

- Low coverage limits for baggage and personal effects

Best Rated Travel Insurance

- 10-day money back guarantee

- Generous limits for trip delays, emergency evacuation, and more

- 24/7 emergency travel assistance included

- Coronavirus-related medical expenses covered

- Rental car coverage included

- Recently developed pre-existing conditions may not be covered

- CFAR and IFAR coverage only available as an add-on with premium plans

According to official sales data from Squaremouth , travel insurance for Turkey costs, on average, $263.26.

Our official sales figures over the past year show that our customers paid an average of $144.83 for travel insurance to Turkey.

Travel insurance for Turkey can cost as low as around $1 per day for the most basic medical and medical evacuation coverage.

For a more comprehensive policy that includes trip cancellation and trip interruption coverage, we found that you can expect to pay around $7 to $11 per day.

We gathered multiple quotes from a variety of providers to give you an idea of possible prices for travel insurance .

Each of the plans below uses these details:

- Age: 35 years old

- Destination: Turkey

- Trip Length: 7 days

- Trip cost: $2,000

You can see four quotes for basic travel insurance in this first table. The cheapest travel insurance plan costs less than $1 per day.

Example Where Plan Doesn’t Reimburse the Full Trip Cost

This next table shows our price quotes for more comprehensive policies that include trip cancellation and trip interruption coverage. These plans range from around $7 to $11 per day.

Example Where Plan Does Reimburse the Full Trip Cost

Bear in mind that travel insurance premiums can vary widely from person to person based on several factors, such as:

- State of residence

- Date of purchase

- Trip cost and length

- Trip location

- Planned activities

As you’re considering different types of travel insurance for Turkey, it’s important to read the terms carefully. Every policy comes with specific coverage options — you should understand exactly what a plan includes before you buy.

Trip cancellation insurance

A policy with trip cancellation coverage will pay back your nonrefundable costs if you have to call off the trip before departure. If you come down with COVID-19 a week before your flight to Turkey and can’t travel, for example, the policy will reimburse what you’ve already paid . Pay attention to restrictions; many plans require you to cancel 2 days or more before the scheduled departure date to qualify.

Trip delay insurance

This type of coverage reimburses the extra expenses you incur as a result of a delay. If your flight to Istanbul is pushed back by 12 hours and you have to stay overnight, your insurance will likely cover the cost of a hotel and meals. Trip delay insurance is particularly important for travel to Turkey, as many flights from the United States require a connection .

Trip interruption insurance

If an unexpected situation forces you to return home early from Turkey, trip interruption insurance covers the costs for the unused portion of the trip . This could happen if you’re injured while hiking the Lycian Way and can’t continue traveling, or if a family member passes away at home mid-vacation. Some plans will even pay you back for an earlier flight home, which could save you thousands of dollars.

Travel medical insurance

Pay close attention to the medical coverage in your travel insurance policy ; it determines how much the provider will pay for emergency healthcare during your trip. Most plans cover injuries, accidents and sudden illnesses . If you try street food in Istanbul and get severe food poisoning, the policy will cover your hospital stay. Some providers even offer translation services, which is helpful if the hospital personnel only speak Turkish.

Medical evacuation insurance

Medical evacuation coverage pays for your transportation during a health emergency. If you’re in a hot air balloon accident in Cappadocia, this might include a helicopter transfer to a well-equipped hospital in Ankara or Istanbul. And if doctors recommend you receive ongoing treatment in the United States, the policy can schedule and pay for a medical flight back home — an extremely expensive trip, given the distance from Turkey.

Insurance for personal items

This coverage can reimburse you if your luggage and belongings are damaged, lost or stolen during your visit to Turkey. Make sure to check limits and restrictions, especially if you’re bringing an expensive camera to capture the pools at Pamukkale or designer clothing for a night out in Istanbul.

Rental car coverage

This type of insurance pays for damage to your rental car — it’s a must if you’re planning a self-driving tour around Turkey. Road conditions can be rough in smaller towns and remote areas, and safety standards on the road may increase your chance of an accident.

Every travel insurance provider has a list of situations that aren’t covered by the plan.

Some common Turkey travel insurance exclusions are:

- Extreme sports

- Last-minute cancellations

- Pre-existing conditions , although you may be able to get a waiver to cover pre-existing conditions

- Routine or nonemergency medical care

- Excessive drug or alcohol use

- Suicide attempts

With so many options, it can feel overwhelming to choose the right travel insurance for Turkey.

Use these tips to find the right coverage for your trip:

Act quickly.

Many providers offer the best coverage if you buy a policy soon after making the first deposit for a trip.

Consider your itinerary.

If you’re traveling to far-off communities or rural destinations, look for high medical evacuation limits.

Check transportation coverage.

Travel insurance may only apply to common carriers — major transportation providers that serve the public.

Assess your plans.

Most policies exclude extreme sports. Read the details; many providers cover activities like scuba diving, but only if you meet specific conditions.

Are there COVID-19 restrictions for U.S. tourists?

Turkey has no COVID-19 restrictions for travelers from the United States.

Do I need a visa or passport to travel to Turkey?

If you’re traveling to Turkey as a tourist, you don’t need a visa if you’re staying less than 90 days . For longer stays, you must apply for a visa. You’ll also need a passport that’s valid for at least 6 months from the day you enter the country. Make sure your passport has at least one free page to accommodate Turkey’s entry and exit stamps.

Is Turkey safe for Americans?

As long as you’re sticking to major tourist destinations, such as Istanbul, Antalya, Cappadocia and Ankara, Turkey is generally a safe place to visit . The same goes for popular coastal areas.

Currently, it’s not safe to travel to eastern and southeastern parts of Turkey . You should avoid the regions along the border with Syria and Iraq. Ongoing conflicts in these areas make them extremely dangerous for tourists.

Is insurance mandatory in Turkey?

No; travel insurance isn’t mandatory for tourists visiting Turkey.

Is Turkey classed as Europe or worldwide for travel insurance?

This classification varies between insurance providers. You should read the fine print for each plan to determine whether the provider includes Turkey in Europe or if it’s covered under “worldwide travel” plans.

How much does travel insurance to Turkey cost?

The premiums for travel insurance for Turkey vary based on factors including the provider, traveler age, trip length, trip cost and place of residence.

Imogen Sharma is an experienced writer, specializing in business, culture, and financial guidance for young adults. She has contributed to articles for Varo Bank , Lendzi , MoneyTips and Indeed , providing invaluable insights into budgeting, financial planning, and lines of credit.

As a dedicated self-employed writer, she cherishes the opportunity to share her knowledge and experience with others, offering advice so they can master their bank accounts and secure their financial futures. Her articles, published in CMSWire , Reworked , WalletGenius and The Customer , serve as actionable guides to help people make solid financial decisions.

Prior to her writing career, Imogen honed her financial acumen in management roles, excelling in P&L analysis, budgeting and HR. During her tenure at Smith & Wollensky in London, her strategic contributions contributed to a 2% increase in EBITDA over a year, demonstrating her ability to drive financial performance and organizational success.

Imogen’s writing style combines expertise with accessibility, making complex financial topics easily understandable and actionable. With a focus on the long game, she encourages readers to approach financial matters with enthusiasm and determination.

Explore related articles by topic

- All Travel Insurance Articles

- Learn the Basics

- Health & Medical

- Insurance Provider Reviews

- Insurance by Destination

- Trip Planning & Ideas

Best Travel Insurance Companies & Plans in 2024

Best Medical Evacuation Insurance Plans 2024

Best Travel Insurance for Seniors

Best Cruise Insurance Plans for 2024

Best COVID-19 Travel Insurance Plans for 2024

Best Cheap Travel Insurance Companies - Top Plans 2024

Best Cancel for Any Reason (CFAR) Travel Insurance

Best Annual Travel Insurance: Multi-Trip Coverage

Best Travel Medical Insurance - Top Plans & Providers 2024

- Is Travel Insurance Worth It?

Is Flight Insurance Worth It? | Airlines' Limited Coverage Explained

Guide to Traveling While Pregnant: Pregnancy Travel Insurance

10 Romantic Anniversary Getaway Ideas for 2023

Best Travel Insurance for Pre-Existing Medical Conditions May 2024

22 Places to Travel Without a Passport in 2024

Best Spain Travel Insurance: Top Plans & Cost

Best Italy Travel Insurance: Plans, Cost, & Tips

Best Travel Insurance for your Vacation to Disney World

Chase Sapphire Travel Insurance Coverage: What To Know & How It Works

2024 Complete Guide to American Express Travel Insurance

Schengen Travel Insurance: Coverage for your Schengen Visa Application

Mexico Travel Insurance: Top Plans in 2024

Best Places to Spend Christmas in Mexico this December

Travel Insurance to Canada: Plans for US Visitors

Best Travel Insurance for France Vacations in 2024

Travel Insurance for Germany: Top Plans 2024

Best UK Travel Insurance: Coverage Tips & Plans May 2024

Best Travel Insurance for Trips to the Bahamas

Europe Travel Insurance: Your Essential Coverage Guide

Best Trip Cancellation Insurance Plans for 2024

Philippines Travel Insurance: Coverage Requirements & Costs

Travel Insurance for the Dominican Republic: Requirements & Tips

Travel Insurance for Trips Cuba: Tips & Safety Info

AXA Travel Insurance Review May 2024

Best Travel Insurance for Thailand in 2024

Travel Insurance for a Trip to Ireland: Compare Plans & Prices

Travel Insurance for a Japan Vacation: Tips & Safety Info

Faye Travel Insurance Review May 2024

Travel Insurance for Brazil: Visitor Tips & Safety Info

Travel Insurance for Bali: US Visitor Requirements & Quotes

Travel Insurance for India: U.S. Visitor Requirements & Quotes

Australia Travel Insurance: Trip Info & Quotes for U.S. Visitors

Generali Travel Insurance Review May 2024

Travelex Travel Insurance Review for 2024

Tin Leg Insurance Review for May 2024

Travel Insured International Review for 2024

Seven Corners Travel Insurance Review May 2024

HTH WorldWide Travel Insurance Review 2024: Is It Worth It?

Medjet Travel Insurance Review 2024: What You Need To Know

Antarctica Travel Insurance: Tips & Requirements for US Visitors

Travel Insurance for Kenya: Recommendations & Requirements

Travel Insurance for Botswana: Compare Your Coverage Options

Travel Insurance for Tanzania: Compare Your Coverage Options

Travel Insurance for an African Safari: Coverage Options & Costs

Nationwide Cruise Insurance Review 2024: Is It Worth It?

Costa Rica Travel Insurance: Requirements, Tips & Safety Info

What Countries Require Travel Insurance for Entry?

- Travel Insurance

- Travel Insurance for Seniors

- Cheap Travel Insurance

- Cancel for Any Reason Travel Insurance

- Travel Health Insurance

- How Much is Travel Insurance?

- Is Flight Insurance Worth It?

- Anniversary Trip Ideas

- Travel Insurance for Pre-Existing Conditions

- Places to Travel Without a Passport

- Christmas In Mexico

- Europe Travel Insurance

- Philippines Travel Insurance

- Dominican Republic Travel Insurance

- Cuba Travel Insurance

- AXA Travel Insurance Review

- Travel Insurance for Thailand

- Ireland Travel Insurance

- Japan Travel Insurance

- Faye Travel Insurance Review

- Brazil Travel Insurance

- Travel Insurance Bali

- India Travel Insurance

- Australia Travel Insurance

- Generali Travel Insurance Review

- Travelex Travel Insurance Review

- Tin Leg Travel Insurance Review

- Travel Insured International Travel Insurance Review

- Seven Corners Travel Insurance Review

- HTH WorldWide Travel Insurance Review

- Medjet Travel Insurance Review

- Antarctica Travel Insurance

- Kenya Travel Insurance

- Botswana Travel Insurance

- Tanzania Travel Insurance

- Safari Travel Insurance

- Nationwide Cruise Insurance Review

- Compulsory Insurance Destinations

Policy Details

LA Times Compare is committed to helping you compare products and services in a safe and helpful manner. It’s our goal to help you make sound financial decisions and choose financial products with confidence. Although we don’t feature all of the products and services available on the market, we are confident in our ability to sound advice and guidance.

We work to ensure that the information and advice we offer on our website is objective, unbiased, verifiable, easy to understand for all audiences, and free of charge to our users.

We are able to offer this and our services thanks to partners that compensate us. This may affect which products we write about as well as where and how product offers appear on our website – such as the order in which they appear. This does not affect our ability to offer unbiased reviews and information about these products and all partner offers are clearly marked. Given our collaboration with top providers, it’s important to note that our partners are not involved in deciding the order in which brands and products appear. We leave this to our editorial team who reviews and rates each product independently.

At LA Times Compare, our mission is to help our readers reach their financial goals by making smarter choices. As such, we follow stringent editorial guidelines to ensure we offer accurate, fact-checked and unbiased information that aligns with the needs of the Los Angeles Times audience. Learn how we are compensated by our partners.

Travel Insurance for Turkey – Requirements and Cost

Home | Travel | Travel Insurance for Turkey – Requirements and Cost

When traveling abroad, get a policy from one of the best travel insurance companies . Y ou can get a 5% discount on Heymondo , the only insurance that pays medical bills upfront for you, HERE!

Purchasing travel insurance for Turkey is always a smart idea, no matter what type of trip you’ll be taking. Mishaps, delays, and accidents can occur at any time while you’re traveling abroad, and travel insurance is often the only means of getting health insurance coverage in a foreign country.

Turkey travel insurance is an absolute necessity for many travelers, however, since you must show proof of travel health insurance coverage to obtain a Turkish visa. Of course, not all travelers need a visa to enter to Turkey, but many do.

In any case, even if you don’t need a visa to enter Turkey, buying insurance for travel to Turkey will ensure that you’re covered for any injuries or illnesses you experience while traveling, as well as for any travel-related misadventures. You’ll often find that travel insurance is worth having in the end.

If you’re in a rush, I’ll tell you that we’ve been using Heymondo travel insurance for the past few years, and it’s been the best option for us. Whether it was dealing with an illness or getting an injury abroad, Heymondo’s coverage and customer assistance were there for us. You can even get a 5% discount for being our reader.

5% OFF your travel insurance

That said, there are other Turkey travel insurance options, so keep reading to find the best one for your needs.

Guide to Turkey travel insurance

As I’ve already mentioned, if you need a visa to enter Turkey, you must buy travel insurance for Turkey as part of your visa requirements. Passport-holders from the following countries must have a visa to enter Turkey:

Countries that need a visa to enter Turkey

Even if you don’t hold a passport from one of these countries, you should at minimum purchase health insurance for Turkey travel to cover any potential medical bills, especially since the EHIC (European Health Insurance Card) doesn’t work in Turkey. Of course, health insurance from other countries also doesn’t apply in Turkey, so purchasing Turkey travel medical insurance is the only way to guarantee medical coverage.

This guide to Turkey travel insurance will cover the following information:

Travel insurance for Turkey visa requirements

How much is travel insurance to Turkey?

Best travel insurance for turkey.

Is Turkey in Europe for travel insurance purposes?

What travel insurance do I need for Turkey?

Luckily, the travel insurance requirements for Turkey are simple. The main requirement for Turkey visa travel insurance is that the policy must cover travelers for the duration of their stay in Turkey.

Naturally, the most important type of coverage is for medical expenses, so your policy should at least be a Turkey travel medical insurance plan . You can always opt for a Turkish travel insurance plan with travel-related coverage as well if you’d prefer to be covered for issues like trip cancellation and baggage loss.

Just to be safe, you should ensure that your travel insurance for Turkey includes COVID-19 coverage . Nowadays, most travel insurance plans do have some kind of coronavirus coverage, but, as always, some plans offer more coverage than others.

For more information on Turkey’s travel insurance requirements , visit the Turkish government’s website .

Getting travel insurance for a Turkey visa doesn’t have to be expensive. Just keep in mind that your age and nationality, as well as the length and cost of your trip, will affect the cost of your travel insurance for Turkey .

To give you an idea of Turkish travel insurance prices, I’ve generated quotes by using the example of a 30-year-old American who is traveling to Turkey for two weeks and whose trip costs $2,500.

* price used for example

Heymondo , as you’ll see, easily stands out as the best travel insurance for Turkey , but all of the Turkey travel insurance companies in our comparison have their merits. To help you choose the best travel insurance for Turkey for your needs, you’ll find information below on all four companies’ advantages and disadvantages.

1. Heymondo , the best travel insurance to Turkey

Heymondo ’s Turkey travel insurance plans have it all: a high amount of coverage in all travel- and medical-related categories, incredible value for money, a $0 deductible for medical expenses, and coverage for COVID-19 testing and treatment.

Add in the fact that Heymondo pays your medical expenses directly and upfront for you, so you don’t even have to file a claim, and it becomes clear why Heymondo is considered the best travel insurance for Turkey .

As I said, we’ve been using Heymondo for over three years now, specifically the annual multi-trip insurance , and we have no complaints. One of my favorite things about Heymondo is their customer support app, which I’ve used to quickly file a claim when I lost my luggage. The service team takes care of the rest and I got reimbursed in no time.

If you’d like to learn more about the company, check out our Heymondo travel insurance review . You can even save 5% on Heymondo’s Turkish travel insurance plans with the discount code below.

2. World Nomads , a top-rated travel insurance for Turkey

If you’re planning on scuba diving, hot air ballooning, or kayaking while you’re in Turkey, World Nomads has got you covered. Their Standard and Explorer plans include coverage for hundreds of sports and activities, so you can adventure to your heart’s content without worrying about having to pay hundreds of dollars if you get injured.

Beyond sports coverage, World Nomads’ Turkey travel insurance plans include solid coverage in all medical- and travel-related categories, as well as coverage for COVID-19 treatment. There’s even a $0 deductible for medical expenses.

Still, although World Nomads offers excellent insurance for travel to Turkey , you can, in fact, get higher coverage in all categories for a lower price with Heymondo . As such, World Nomads is best suited for travelers who plan to do lots of exhilarating, potentially dangerous activities.

3. SafetyWing , the cheapest travel medical insurance for Turkey visa

Of course, you may just want to buy the cheapest plan that fulfills Turkey’s visa travel insurance requirements . Still, looking for an affordable price doesn’t mean you should skimp on quality coverage.

Luckily, SafetyWing is a Turkey travel medical insurance that offers the best of both worlds: excellent medical coverage and a reasonable price. Their Nomad Insurance plan also provides worldwide coverage, so you can head to other places besides Turkey, and coverage for COVID-19 testing and treatment. You can even choose to automatically renew your plan every 28 days until you pick an end date.

As with most travel medical insurance , SafetyWing doesn’t offer much travel-related coverage, which is not necessarily a problem, as you certainly don’t need this kind of coverage to meet Turkish visa requirements. SafetyWing’s major drawback, though, is its $250 deductible for medical expenses, which means you’ll have to put $250 towards any medical bills before SafetyWing pays any remaining balance.

4. IMG , a reliable travel health insurance for Turkey

IMG is consistently ranked as not only one of the best Turkey travel insurance companies but also one of the best travel insurance companies in general. As such, you can’t go wrong with their plans, which offer high, reliable coverage in all categories.

As with most top travel insurance for Turkey , IMG offers a $0 deductible for medical expenses and includes coverage for COVID-19 treatment. Moreover, their iTravelInsured Travel Lite plan is affordably priced, considering it offers both travel- and medical-related coverage.

If you feel that IMG’s already high coverage isn’t sufficient for you, though, depending on your age and nationality, you could get twice as much coverage for just $1 more with Heymondo .

You may be wondering, does Europe travel insurance cover Turkey ? After all, part of Turkey is located on the European continent, while the rest of it is located in Asia.

Ultimately, the answer to this question depends on the particular European travel insurance you’re looking at. Some insurance companies include Turkey in their European coverage, while others put the country under their worldwide coverage. Heymondo , for instance, includes Turkey as part of their European travel insurance coverage.

The best way to find an answer is to check with your individual insurance company when you’re purchasing insurance for travel to Turkey .

In summary, you must obtain Turkey travel insurance if you need a visa to enter Turkey. Even if you don’t need a visa, purchasing travel insurance for Turkey is an excellent idea because it will guarantee medical coverage if you fall ill or get injured.

As you’ll have seen from the comparison above, Heymondo stands out as the best travel insurance for Turkey for travelers who want both travel- and medical-related coverage. For travelers who are looking to save a little money, SafetyWing , the best Turkey travel medical insurance , is an equally viable option.

Whichever plan you choose, if you need a visa, just make sure that your policy covers you for the duration of your stay in Turkey. Hopefully, this guide has covered everything you need to know about insurance for travel to Turkey , but if you still have any questions, feel free to leave a comment down below.

Enjoy your trip to Turkey!

Don't miss a 5% discount on your HeyMondo travel insurance

and the only one that pays all your medical bills upfront for you!

Ascen Aynat

2 replies on “ Travel Insurance for Turkey – Requirements and Cost ”

What are the Turkey medical insurance requirements? I’m traveling 9/1/22 to Turkey and need medical insurance. My insurance agent is asking me what the requirements are for turkey. THank you.

The only requirement for the turkey travel insurance is that it must cover travelers for the duration of their stay in Turkey.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Traveling From the USA to Turkey? Here Are 3 Health Insurances to Know in 2023

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Whether you're travelling to Turkey to visit friends or family there, or just as a tourist eager to see the famous Hagia Sophia, Topkapi Palace, or ride balloons over Cappadocia, before arriving from the US, it's crucial to consider your travel insurance options And while traveling to Turkey can be an accessible, it's worth remembering that out-the-pocket healthcare costs tend to be pricey, so it's a good idea to arrive with travel health insurance under your belt.

Luckily, online global insurances (known as 'insurtechs') specialize in cost-savvy travel insurance to Turkey and other countries worldwide. Our list below explores the four services we believe provide the best deals for young adventurers, everyday holidaymakers looking for comprehensive but affordable coverage, and longer-term expats alike.

Turkey Insurance Profile

Here are a few of the many factors influencing the scope and cost of travel insurances for Turkey:

Best Travel Insurances for Turkey

- 01. Should I get travel insurance for Turkey? scroll down

- 02. Best medical coverage: VisitorsCoverage scroll down

- 03. Best trip insurance: Insured Nomads scroll down

- 04. Best mix for youth and digitial nomads: SafetyWing scroll down

- 05. FAQ about travel insurance from the USA to Turkey scroll down

Is Travel Insurance Mandatory From the USA to Turkey?

Yes, travel insurance is mandatory for travel to Turkey. This means that as a traveller to Turkey, you must provide valid travel insurance coverage for the entire duration of your stay. If you don't arrive with travel insurance, you risk being denied entry into Turkey, or even deported in certain cases from America.

However, regardless of whether or not it's legally required, it's always a good idea to take our health insurance before you travel — whether to Turkey or anywhere else. For what's usually an affordable cost , taking out travel insurance will mitigate most or all of the risk of financial damage if you run into any unexpected troubles during your trip abroad. Take a look at the top five reasons to get travel insurance to learn more.

With that said, here are the top three travel insurances for Turkey from America:

VisitorsCoverage: Best Medical Coverage

Among the internet's best-known insurance platforms, VisitorsCoverage is a pioneering Silicon Valley insurtech company that offers comprehensive medical coverage for visitors from the USA traveling to Turkey. It lets you choose between various plans tailored to meet the specific needs of your trip to Turkey, including coverage for emergencies, doctor's visits, and other medical-related expenses. With its easy online purchase process and 24/7 live chat support, VisitorsCoverage is a reliable and convenient option if you want good value and peace of mind while travelling abroad.

- Coverage 9.0

- Quality of Service 9.0

- Pricing 7.6

- Credibility 9.5

VisitorsCoverage offers a large variety of policies, and depending on your needs and preferences, you'll need to compare and explore their full catalogue of plans for yourself. However, we've chosen a few highlights for their travel insurance for Turkey:

- Policy names: Varies

- Medical coverage: Very good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, mental health-related conditions, and many others.

- Trip coverage: Excellent - but only available for US residents.

- Customer support: FAQ, live chat and phone support

- Pricing range: USD 25 to USD 150 /person /month

- Insurance underwriter: Lloyd's, Petersen, and others

- Best for: Value for money and overall medical coverage

Insured Nomads: Best Trip Coverage

Insured Nomads is another good travel insurance provider for Turkey, especially if you're adventurous or frequently on the go and are looking for solid trip insurance from the USA with some coverage for medical incidents too. With Insured Nomads, you can choose the level of protection that best suits your needs and enjoy a wide range of benefits, including 24/7 assistance, coverage for risky activities and adventure sports, and the ability to add or remove coverage as needed. In addition, Insured Nomads has a reputation for providing fast and efficient claims service, making it an excellent choice if you want peace of mind while exploring the world.

- Coverage 7.8

- Quality of Service 8.5

- Pricing 7.4

- Credibility 8.8

Insured Nomads offers three travel insurance policies depending on your needs and preferences. We go through them below:

- Policy names: World Explorer, World Explorer Multi, World Explorer Guardian

- Medical coverage: Good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, and many others.

- Trip coverage: Good. Includes coverage for trip cancellation and interruption, lost or stolen luggage (with limits), adventure and sports activities, and many others.

- Customer support: FAQ, live chat, phone support

- Pricing range: USD 80 to USD 420 /person /month

- Insurance underwriter: David Shield Insurance Company Ltd.

- Best for: Adventure seekers wanting comprehensive trip insurance

SafetyWing: Best Combination For Youth

SafetyWing is a good insurance option for young people or digital nomads from the USA because it offers flexible but comprehensive coverage at a famously affordable price. With SafetyWing, you can enjoy peace of mind in Turkey knowing you're covered for unexpected medical expenses, trip cancellations, lost or stolen luggage, and more. In addition, SafetyWing's user-friendly website lets you manage your policy, file a claim, and access 24/7 assistance from anywhere in the world, and, unlike VisitorsCoverage, you can even purchase a policy retroactively (e.g. during a holiday)!

- Coverage 7.0

- Quality of Service 8.0

- Pricing 6.3

- Credibility 7.3

SafetyWing offers two travel insurance policies depending on your needs and preferences, which we've highlighted below:

- Policy names: Nomad Insurance, Remote Health

- Medical coverage: Decent. Includes coverage for doctor and hospital visits, repatriation, and many others.

- Trip coverage: Decent. Includes attractive coverage for lost or stolen belongings, adventure and sports activities, transport cancellation, and many others.

- Pricing range: USD 45 to USD 160 /person /month

- Insurance underwriter: Tokyo Marine HCC

- Best for: Digital nomads, youth, long-term traveling

Compare For Yourself

In this post, we explored three travel insurance providers you should consider for your next trip to Turkey from the USA. That being said, there are many more providers out there, some of which might make even more sense for you depending on your travel needs and preferences. To compare the top providers on the market, run a search on Monto's travel insurance comparison engine below 👇

Find travel insurance for you:

How do they compare.

Interested to see how VisitorsCoverage, SafetyWing, and Insured Nomads compare as travel insurances to Turkey? Take a look at the side-by-side chart below:

Data correct as of 14/02/2023

FAQ About Travel Insurance from the USA to Turkey

Travel insurance typically covers trip cancellation, trip interruption, lost or stolen luggage, travel delay, and emergency evacuation. Some travel insurance packages also cover medical-related incidents too. However, remember that the exact coverage depends on the insurance policy.

Yes, travel insurance is mandatory for travel to Turkey. This means that as a traveller to Turkey, you must provide valid travel insurance coverage for the entire duration of your stay. If you don't arrive with travel insurance, you risk being denied entry into Turkey, or even deported in certain cases.

Yes, medical travel insurance is almost always worth it, and we recommend taking out travel insurance whenever visiting a foreign country. Taking out travel insurance will mitigate some or all of the risk of covering those costs yourself in case you need medical attention during your stay. In general, we recommend VisitorsCoverage to visitors worldwide because it offers excellent value for money and well-rounded travel and medical benefits in its large catalogue of plans.

Health insurance doesn't cover normal holiday expenses, such as coverage for missed flights and hotels, but in case you run into medical trouble while abroad, it may cover some or all of your doctor or hospital expenses while overseas. However, not all health insurance providers and plans offer coverage to customers while abroad, and that's why it's generally best to take out travel insurance whenever you travel.

Although there's overlap, health and travel insurance are not exactly the same. Health insurance covers some or all of the cost of medical expenses (e.g. emergency treatment, doctor's visits, etc.) while travel insurance covers non-medical costs that are commonly associated with traveling (e.g. coverage for missed flights, stolen or lost personal belongings, etc.).

The cost of travel insurance depends on several factors, such as the length of the trip, the destination, the age of the insured, and the level of coverage desired. On average, travel insurance can cost anywhere between 3% and 10% of the total cost of the trip.

A single-trip travel insurance policy covers a specific trip, while an annual one covers multiple trips taken within a one-year period. An annual policy may be more cost-effective for frequent tourists.

Yes, you can sometimes purchase travel insurance after starting your trip, but it is best to buy it before the trip begins to ensure maximum coverage. If you do need to buy insurance after you've started your trip, we recommend VisitorsCoverage , which offers a wide catalogue of online trip and medical insurance policies, most of which can be booked with immediate effect. Check out our guide to buying travel insurance late to learn more.

Yes, you can most certainly purchase travel insurance for a trip that has already been booked, although we recommend purchasing insurance as soon as possible aftwerwards to ensure all coverage is in place before your journey begins. Check out our guide to buying travel insurance late to learn more.

See Our Other Travel Insurance Guides

Looking for Travel Insurance to Another Country?

See our recommendations for travel insurance to other countries worldwide:

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

Turkey Travel Insurance

Travel insurance for turkey.

The beautiful country of Turkey found where Europe meets Asia, is an enchanting gateway to ancient monuments and imperial legacies. From old ruins like Ephesus to lively bazaars in Istanbul, it offers both ancient charm and modern excitement. The unique rock formations of Cappadocia and the beautiful Mediterranean shores call travelers to explore and discover Turkey's many treasures. Beyond that, its lively culture, captivating scenery, and delectable cuisine entice globetrotters from across the globe. If you're set for a brief visit, discovering Turkey's renowned destinations is a must for your itinerary. When journeying to such a captivating destination, you probably have a whole bucket list ready -- and that should include your travel insurance for Turkey as well. In this guide, we will explore the range of travel insurance options available to you, including, trip cancellation, interruption, or delay, emergency medical, baggage loss or theft, and more, to ensure a Turkey adventure.

- What should your Travel insurance cover for a trip to Turkey?

- How does Travel Insurance work for Turkey?

- Do I need Travel Insurance for Turkey?

- How much does Travel Insurance cost for Turkey?

- Our Suggested AXA Travel Protection Plan

- What types of medical coverage do AXA Travel Protection plans offer?

Are There Any COVID-19 Restrictions for Travelers to Turkey?

Traveling with pre-existing medical conditions , what should your travel insurance cover for a trip to turkey.

At a minimum, your travel insurance should cover trip cancellation, trip interruption and emergency medical expenses. When it comes to international travel, the US Department of State outlines key components that should be included in your travel insurance coverage. AXA Travel Protection plans are designed with these minimum recommended coverages in mind.

- Medical Coverage – The top priority is ensuring your health is in order. With AXA Travel Protection, you can have access to quality healthcare during your trip overseas in the event of unexpected medical emergencies.

- Trip Cancellation & Interruptions – Assistance against unexpected trip disruptions can dampen the mood, AXA Travel Protection offers coverage against unforeseen events.

- Emergency Evacuations and Repatriation – In situations where transportation is dire, AXA Travel Protection offers provisions for emergency evacuation and repatriation.

- Coverage for Personal Belongings – AXA offers coverage for your belongings with assistance against lost or delayed baggage.

- Optional Cancel for Any Reason – For added flexibility, AXA offers optional Cancel for Any Reason coverage, allowing you to cancel your trip for non-traditional reasons. Exclusive to Platinum Plan holders.

In just a few seconds, you can get a free quote and purchase the best travel insurance for Turkey.

How Does Travel Insurance Work in Turkey?

Ever had a plan that got totally derailed by unexpected curveballs? That's where travel insurance coverage steps in. Say you've booked your dream trip, but before takeoff, a sudden illness or a family emergency happens. Travel insurance can help assist and support you with non-refundable expenses like flights or hotels that you've already paid for but can no longer use due to these unforeseen events. You could get a refund for the things you can no longer enjoy. However, there is more to it than just that! Imagine you're exploring the ancient wonders of Turkey, and suddenly, someone in your group needs serious medical attention. That's where travel insurance goes beyond refunds. It offers services like medical evacuation, and swooping in to transport you or your family member to a better-equipped medical facility or a safer place if needed. Consider travel insurance as a steadfast companion throughout your Turkish escapade, not just for reimbursements for unexpected hiccups, but also for lending a hand when things take an unexpected turn. Here’s how travelers can benefit from an AXA Travel Protection Plan:

Medical Benefits:

- Emergency Medical Expenses: Should you fall ill or have an accident during your trip, your policy may offer coverage for medical expenses, including hospital stays and doctor's fees.

- Emergency Evacuation & Repatriation: In case of a serious medical emergency, your policy may include provisions for evacuation to the nearest appropriate medical facility or repatriation.

- Non-Emergency Evacuation & Repatriation : In non-medical crises (e.g., political unrest), your policy may cover evacuation or repatriation, subject to policy terms.

Pre-Departure Travel Benefits:

- Trip Cancellation: You may be eligible for reimbursement if you cancel your trip due to a sudden illness or injury.

- COVID-19 Travel Insurance: Coverage is available for trip cancellation and medical expenses related to COVID-19, subject to policy terms and conditions.

- Trip Delay: If your flight faces delays due to unforeseen circumstances, you may have coverage for additional expenses such as meals and accommodations.

Post-Departure Travel Benefits

- Trip Interruption: In case of an unexpected event, you could be eligible for reimbursement for the unused portion of your trip.

- Missed Connection: If you miss a connecting flight due to delays or cancellations, this coverage may help with expenses like rebooking fees and accommodations.

Baggage Benefits:

- Luggage Delay: If the airline delays your checked baggage, your policy might offer reimbursement for essential items like clothing and toiletries.

- Lost or Stolen Luggage: In the unfortunate event of permanent loss or theft of your luggage, your policy may offer reimbursement for its value, assisting you in replacing your belongings.

Additional Optional Travel Benefits

- Rental Car (Collision Damage Waiver): Exclusive to Gold & Platinum plan policy holders, this optional benefit gives travelers extra coverage on their rental car against damage and theft.

- Cancel for Any Reason: Exclusive to Platinum plan policy holders; this optional benefit gives travelers more flexibility to cancel their trip for any reason outside of their standard policy.

- Loss Skier Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate some costs associated with pre-paid ski tickets that you or your traveling companion cannot use due to specified slope closures.

- Loss Golf Days: Exclusive to Platinum plan policy holders, this optional benefit offers reimbursement to mitigate the expenses linked to prepaid golf arrangements that you or your travel companion are unable to utilize due to specified golf closures.

Do I Need Travel Insurance for Turkey?

If you're not seeking a visa for your Turkey visit, travel insurance isn't a compulsory requirement. You can indeed journey to Turkey without it. Nevertheless, it's highly recommended to get travel insurance whenever you venture abroad, even if it's not obligatory. The coverage it offers can be valuable, providing support and assistance against unforeseen circumstances during your travels. Why? There are several reasons:

Medical Emergencies: Your health is a top priority. If you face a sudden illness or injury in Turkey, travel insurance offers the means to receive prompt and quality medical care.

Lost Baggage: Airlines sometimes mishandle baggage, and the last thing you want is to be without your essentials in an unfamiliar place. Travel insurance offers to cover the cost of replacing necessary items, allowing you to continue on.

Missed Connection: Missed connection coverage comes in handy when you find yourself stranded due to flight delays or cancellations, helping cover additional expenses for accommodation or transportation if you miss a connecting flight. It's a lifesaver when unforeseen circumstances mess up your flight schedule, keeping you from getting to your destination on time.

How Much Does Travel Insurance Cost for Turkey?

In general, travel insurance costs about 3 – 10% of your total prepaid and non-refundable trip expenses. The cost of travel insurance depends on two factors for AXA Travel Protection plans:

- Total Trip cost: The total non-prepaid and non-refundable costs you have already paid for your upcoming trip. This includes prepaid excursions, plane tickets, cruise costs, etc.

- Age: Like any other insurance type, the correlation is rooted in increased health risks associated with older individuals. It's important to note that this doesn't make travel insurance unattainable for older individuals.

With AXA Travel Protection, travelers to Turkey will be offered three tiers of insurance: Silver, Gold and Platinum. Each provide varying levels of coverage to cater to individual's preferences and travel needs.

Our Suggested AXA Travel Protection Plan

AXA presents travelers with three travel plans – the Silver Plan , Gold Plan , and Platinum Plan , each offering different levels of coverage to suit individual needs. Given that Turkey hospitals often do not accept U.S. health insurance or Medicare, we genuinely recommend travelers to consider purchasing any of these plans, particularly for the crucial coverage they offer for emergency accident and sickness medical expenses. The Platinum Plan stands out as the ideal option for enhanced coverage, like the Lost Golf Rounds, during your Turkey adventure. This can be very beneficial since Turkey is known for its world-class golf resorts and can help you get back your prepaid green fees if a scheduled round of golf is missed due to covered reasons like illness or injury during your trip. This can help you not lose out on these planned golfing experiences and make a nice option for a golf lover exploring Turkey.

What types of medical coverage does AXA Travel Protection plans offer?

Axa covers three types of medical expenses:

Emergency Medical: covers medical expenses, hospital stays, and even emergency evacuations, covering the expenses of hefty bills and ensuring access to quality healthcare while away from home.

Emergency Evacuation and Repatriation: covers your immediate transportation home in the event of an accidental injury or illness.

Non-Medical Emergency Evacuation and Repatriation: offer assistance in unexpected situations such as political unrest or natural disasters, ensuring safe and timely relocation to a secure location or repatriation back home.

No, there are no longer any strict COVID-19 restrictions to enter Turkey—no vaccine proofs, quarantines, or mandatory masks are needed anymore.

Traveling with pre-existing medical conditions can complicate your plans, but with AXA Travel Protection, we're here to support you during your trip. Our Gold and Platinum plans offer coverage for pre-existing medical conditions. The Platinum plan, in particular, is our highest-offered choice for travelers who want our highest coverage limits and optional add-ons,

What does this mean for you? If you've got a medical condition that's been hanging around, you can qualify for coverage under our Gold and Platinum plans with a pre-existing medical condition , so long as it’s within 14 days of placing your initial trip deposit and in our 60-day look-back period. We're here to ensure you travel easily, no matter your health situation.

1.Can you buy travel insurance after booking a flight?

You can buy travel insurance even after your flight is booked.

2.When should I buy Travel Insurance to Turkey?

It's advisable to purchase travel insurance for your trip as soon as you have made your initial trip deposit (prepaid and non-refundable trip costs.) AXA Travel Protection offers coverage as soon as you purchase your protection plan. We can give coverage against unforeseen events before you leave for your trip. Additionally, our policies offer coverage for preexisting medical conditions and Cancel for Any Reason if you purchase your protection within 14-days of making your initial trip deposit.

3.Do Americans need travel insurance in Turkey?

You don't have to get travel insurance if you're a US citizen visiting Turkey, but it's highly recommended you do so. Even though it's not mandatory, having travel insurance for Turkey can really save the day if you face any unexpected travel hiccups or health issues.

4. What is needed to visit Turkey from the USA?

U.S. citizens traveling to Turkey for tourism or business purposes for up to 90 days within a 180-day period typically need an e-Visa. This e-visa can be easily obtained online before arrival in Turkey.

5. What happens if a tourist gets sick in Turkey?

If you become sick in Turkey, travelers with AXA Travel protection can contact the AXA Assistance hotline at 855-327-1442 . Contact information is typically provided within the insurance documentation. Please ensure to read through your policy details and information.

Disclaimer: It is important to note that Destination articles are for editorial purposes only and are not intended to replace the advice of a qualified professional. Specifics of travel coverage for your destination will depend on the plan selected, the date of purchase, and the state of residency. Customers are advised to carefully review the terms and conditions of their policy. Contact AXA Travel Insurance if you have any questions. AXA Assistance USA, Inc.© 2023 All Rights Reserved.

AXA already looks after millions of people around the world

With our travel insurance we can take great care of you too

Get AXA Travel Insurance and travel worry free!

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip.

Winter is here! Check out the winter wonderlands at these 5 amazing winter destinations in Montana

- Travel Destinations

What Travel Insurance Do I Need For Turkey?

Published: December 18, 2023

Modified: December 28, 2023

by Ertha Manis

- Safety & Insurance

Introduction

Welcome to the mesmerizing land where the East meets the West – Turkey! As you plan your journey to this enchanting country, it’s crucial to ensure that you have the right travel insurance to safeguard your trip from unforeseen events. Turkey, with its rich history, diverse landscapes, and vibrant culture, offers a myriad of experiences, from exploring ancient ruins to indulging in delectable cuisine. However, amidst the excitement of planning your Turkish adventure, it’s easy to overlook the importance of securing comprehensive travel insurance.

Whether you’re drawn to the bustling streets of Istanbul, the surreal landscapes of Cappadocia, or the stunning beaches along the Mediterranean coast, having the appropriate travel insurance can provide you with peace of mind and financial protection throughout your journey. This comprehensive guide is designed to demystify the world of travel insurance, helping you navigate the options and select the most suitable coverage for your Turkish escapade.

Join us as we delve into the intricacies of travel insurance, explore the specific types of coverage essential for a trip to Turkey, and gain valuable insights into the factors to consider when choosing the right policy. By the end of this journey, you’ll be equipped with the knowledge and confidence to make an informed decision, ensuring that your Turkish expedition is not only memorable but also worry-free.

Understanding Travel Insurance

Travel insurance serves as a safety net, offering financial protection and assistance in various unforeseen situations that may arise during your trip. It is designed to mitigate the risks associated with travel, providing coverage for incidents such as trip cancellations, medical emergencies, lost baggage, and more. Understanding the fundamental components of travel insurance is crucial for ensuring that you select the most suitable policy for your journey to Turkey.

One of the primary benefits of travel insurance is its ability to mitigate the financial impact of unexpected events. For instance, if your trip is disrupted due to a sudden illness or injury, travel insurance can cover the costs of medical treatment, evacuation, and even trip cancellations. Additionally, in the unfortunate event of lost or delayed baggage, travel insurance can provide reimbursement for essential items, offering a sense of security during your travels.

Moreover, travel insurance often includes 24/7 assistance services, providing access to a global support network in case of emergencies. This can be particularly valuable when traveling to a foreign country like Turkey, where language barriers and unfamiliar healthcare systems may present challenges in times of crisis. By understanding the protective umbrella that travel insurance offers, you can embark on your Turkish adventure with confidence, knowing that you are prepared for unforeseen circumstances.

Types of Travel Insurance for Turkey

When planning a trip to Turkey, it’s essential to explore the various types of travel insurance available to ensure comprehensive coverage throughout your journey. The diverse landscapes and cultural experiences that Turkey offers necessitate specific forms of insurance to address potential risks and provide peace of mind for travelers.

1. Medical Insurance : Prioritizing your health and well-being is paramount when traveling, making medical insurance a fundamental component of travel coverage. In the event of illness or injury during your Turkish adventure, medical insurance can cover expenses related to hospitalization, emergency medical treatment, and repatriation to your home country. Given the importance of accessing quality healthcare while abroad, medical insurance is indispensable for travelers exploring Turkey’s enchanting destinations.

2. Trip Cancellation and Interruption Insurance : Unforeseen circumstances such as flight cancellations, natural disasters, or personal emergencies can disrupt your travel plans. Trip cancellation and interruption insurance provide reimbursement for non-refundable expenses, ensuring that you are financially protected in the event of unexpected trip disruptions. This type of insurance is particularly valuable when embarking on a journey to Turkey, where diverse experiences await, from historical marvels to natural wonders.

3. Baggage and Personal Belongings Insurance : Protecting your belongings while traveling is vital, especially when exploring a culturally rich and geographically diverse country like Turkey. Baggage and personal belongings insurance offer coverage for lost, stolen, or damaged items, providing financial recourse in situations where your possessions are compromised during your travels.

4. Adventure and Outdoor Activities Insurance : For travelers seeking adrenaline-pumping experiences such as hot air balloon rides in Cappadocia or water sports along the Turkish Riviera, adventure and outdoor activities insurance is essential. This specialized coverage addresses the inherent risks associated with adventurous pursuits, ensuring that you can partake in exhilarating activities with confidence and security.

By understanding the distinct types of travel insurance available for a Turkish expedition, you can tailor your coverage to align with the specific experiences and potential risks associated with your travel itinerary. This proactive approach not only enhances your travel preparedness but also allows you to immerse yourself fully in the wonders that Turkey has to offer, knowing that you are safeguarded against unforeseen events.

Factors to Consider When Choosing Travel Insurance

As you embark on the journey to select the most suitable travel insurance for your Turkish escapade, several essential factors warrant careful consideration. By evaluating these key elements, you can ensure that your chosen policy aligns with the specific requirements of your trip, providing comprehensive coverage and peace of mind throughout your travels.

1. Coverage for Pre-Existing Medical Conditions : If you have pre-existing medical conditions, it’s crucial to ascertain whether your travel insurance provides adequate coverage for these conditions. Understanding the extent of medical coverage and any exclusions related to pre-existing conditions is essential for managing potential health-related risks during your travels in Turkey.

2. Destination-Specific Coverage : Given Turkey’s diverse landscapes and travel experiences, including historical sites, coastal regions, and adventurous activities, it’s important to ensure that your insurance policy offers destination-specific coverage. This may include provisions for medical care in remote areas, coverage for outdoor activities, and protection against travel disruptions in regions with distinct travel risks.

3. Trip Duration and Frequency : The duration of your trip and the frequency of your travels should influence the type of insurance you select. Whether you’re planning a short, one-time visit to Turkey or embarking on multiple trips throughout the year, choosing a policy that aligns with your travel patterns is essential for maximizing the value of your insurance investment.

4. Policy Exclusions and Limitations : Thoroughly reviewing the exclusions and limitations of a travel insurance policy is imperative for understanding the scope of coverage. This includes examining restrictions related to adventurous activities, high-value belongings, and specific travel scenarios, ensuring that you are aware of any potential gaps in coverage that may impact your Turkish journey.

5. Emergency Assistance Services : Access to reliable emergency assistance services is vital when traveling to a foreign country like Turkey. Evaluating the scope and responsiveness of the insurance provider’s assistance network, including medical evacuation and 24/7 support, can significantly impact your peace of mind and preparedness for unforeseen events.

By carefully evaluating these factors and aligning them with your unique travel needs, you can make an informed decision when choosing travel insurance for your Turkish adventure. This proactive approach not only enhances your travel preparedness but also ensures that you can fully immerse yourself in the captivating experiences that Turkey has to offer, knowing that you are equipped with comprehensive and tailored insurance coverage.

As you prepare to embark on an unforgettable journey to Turkey, the significance of securing appropriate travel insurance cannot be overstated. From the bustling bazaars of Istanbul to the surreal landscapes of Pamukkale, Turkey beckons with a tapestry of experiences, each deserving of exploration and appreciation. By understanding the nuances of travel insurance and tailoring your coverage to align with the specific demands of your Turkish adventure, you can ensure that your travels are safeguarded against unforeseen events, allowing you to immerse yourself fully in the wonders of this captivating destination.

Throughout this comprehensive guide, we’ve navigated the intricacies of travel insurance, shedding light on the diverse types of coverage essential for a trip to Turkey. From medical insurance to protection against trip disruptions and coverage for adventurous pursuits, the spectrum of travel insurance options is designed to address the unique facets of travel in a country as diverse as Turkey.

Moreover, we’ve explored the vital factors to consider when choosing travel insurance, emphasizing the importance of aligning your policy with your specific travel needs, destination-related risks, and personal circumstances. By evaluating these factors with diligence and foresight, you can select a policy that not only provides financial protection but also offers peace of mind, allowing you to savor every moment of your Turkish odyssey.

As you set forth on your Turkish expedition, may your travels be filled with enchanting discoveries, cultural revelations, and cherished memories. With the right travel insurance as your steadfast companion, you can navigate the labyrinthine alleys of Turkey’s ancient cities, traverse its breathtaking landscapes, and revel in its warm hospitality, knowing that you are prepared for the unexpected and empowered to embrace every facet of this remarkable destination.

So, as you pack your bags and set your sights on Turkey, remember that comprehensive travel insurance is not merely a safeguard; it is a gateway to worry-free exploration, allowing you to uncover the treasures of Turkey with unbridled enthusiasm and unwavering confidence.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

Turkish Airlines Travel Insurance - 2024 Review

Turkish airlines travel insurance.

- Insurance Available At Checkout

- Low Coverage

Sharing is caring!

Turkish Airlines is the national flag carrier airline of Turkey. It operates scheduled services to approximately 340 destinations in Europe, Asia, Africa, and the Americas, making it the largest mainline carrier in the world by number of passenger destinations.

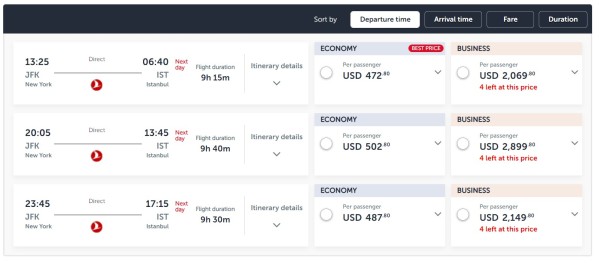

Turkish Airlines – Our Sample Trip

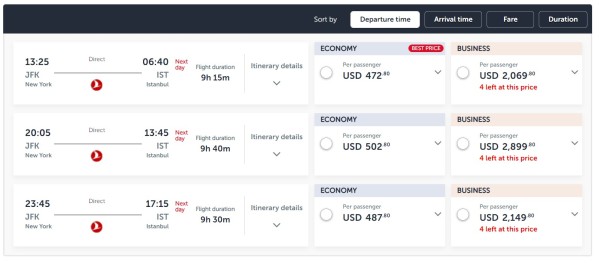

For our sample trip, our two travelers will be traveling from New York to Istanbul on January 17 and returning on January 29. The Turkish Airlines website makes trip selection easy with just a few options to enter before showing available flights for the trip details entered.

However, if a table view is preferred, then there is a link to it within the initial quote screen. The table shows a seven-day view and lowest fares are asterisked.

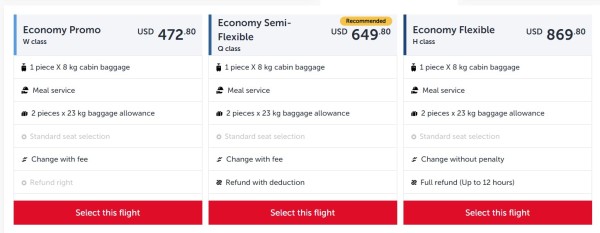

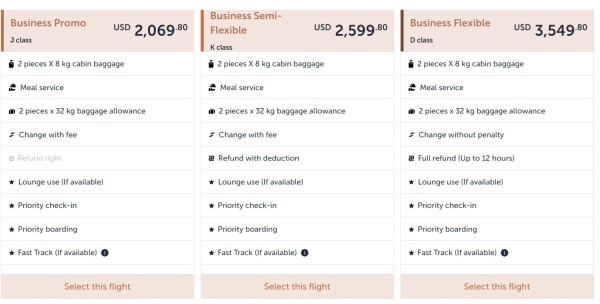

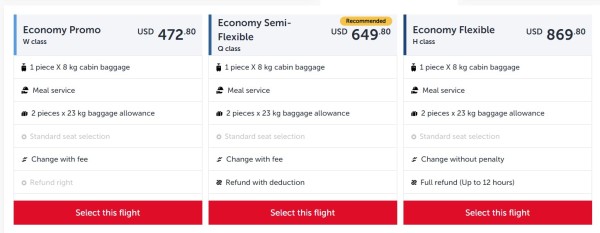

When you select a fare, the screen opens to show you various fare options. For example, selecting the Economy fare opens three choices – Economy Promo (the lowest fare), Economy Semi-Flexible and Economy Flexible. Besides the pricing differences, different penalty fees are incurred with each option.:

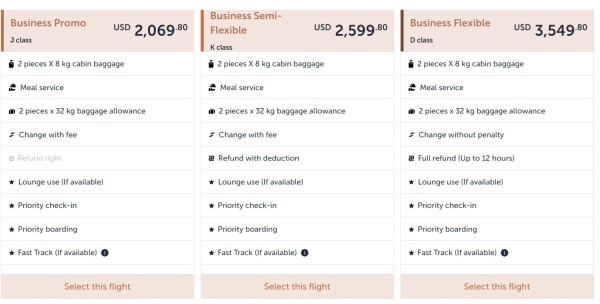

The same applies for Business Class:

We opted for a Business Promo fare for both legs of the trip. Total cost for both travelers after choosing seats was $9,561.56

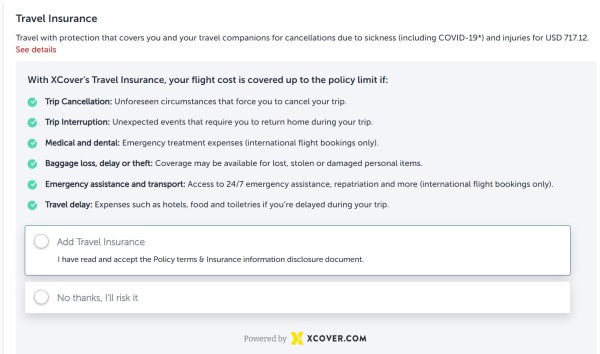

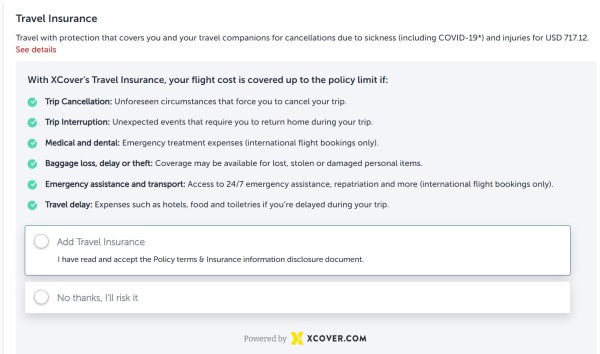

Prior to payment we have the option to purchase travel insurance from a company called XCover, a newer player in the travel insurance industry. The policy is underwritten by Generali, a well-known insurer. Total cost of insurance, called ‘XCover Protection’, is $717.12.

Let’s look at the benefits for this policy:

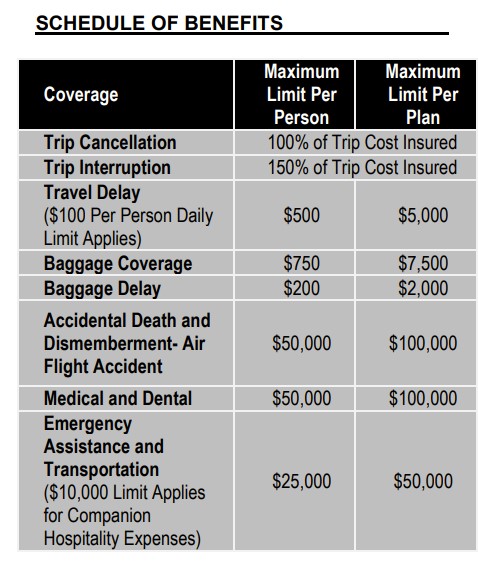

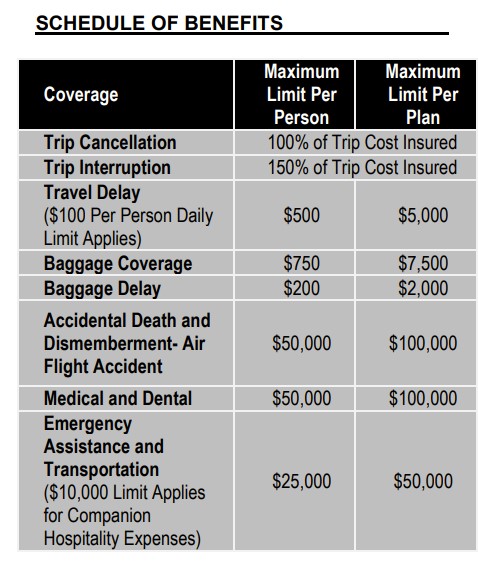

The policy provides a 100% refund for trip cancellation, and 150% for trip interruption.

Medical benefits are $50,000 per traveler but only up to $100,000 total per policy.

Medical Evacuation benefits are $25,000 per traveler with a maximum of $50,000 per policy.

Both the medical coverage and medical evacuation coverage are low even for international travel close to US shores and totally inadequate for travel far from the US.

Before deciding on taking Turkish Airlines’ travel insurance, let’s see what we can find in the open marketplace.

TravelDefenders – The Travel Insurance Marketplace

TravelDefenders is a travel insurance marketplace. We get quotes from leading travel insurers and show them to you in an easy-to-read format.

Inputting our trip details into the quoting system at TravelDefenders, we’re presented with 27 options to choose from.

With so many options, what would be the best policy to choose?

TravelDefenders recommends having a minimum of $100,000 of medical coverage and $500,000 of medical evacuation coverage for travel to Asia and points beyond.

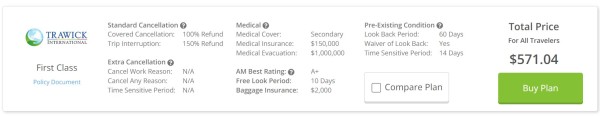

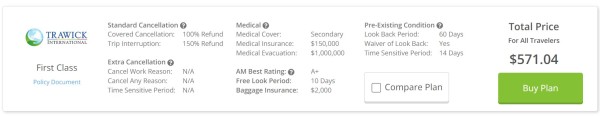

The least expensive plan with adequate medical coverage is the Trawick First Class for $571.04 which is the total cost for both travelers combined.