Stakeholders in tourism: Who are they and why do they matter?

Disclaimer: Some posts on Tourism Teacher may contain affiliate links. If you appreciate this content, you can show your support by making a purchase through these links or by buying me a coffee . Thank you for your support!

Stakeholders in tourism. This is a phrase often used in both academia and the tourism industry, but what does it actually mean?

The word stakeholder is a term that often throws people. In fact, it is commonly confused with the term shareholder . Whilst the two terms are not entirely dissimilar, the two mean two different things. So, lets clarify this- what exactly do we mean by stakeholders in tourism?

Stakeholders in tourism: What does it mean?

Stakeholder theory in tourism, stakeholder analysis in tourism, tourism organisations and operators, small and medium enterprises, utilities and infrastructure, communities, stakeholders in tourism: conclusion, further reading on stakeholders in tourism.

In this article I am going to explain to you want is meant by the term stakeholder and who the stakeholders in tourism are…. but before you read on, take a look at this short video that I created on the topic (and don’t forget to hit the like button too- thanks a million!)

A stakeholder is quite literally anyone who is involved with a particular project, organisation or industry. To put it simply, they hold a metaphorical ‘stake’.

A stakeholder in tourism can be an individual person, such as a tourist or a taxi driver. They could be a group of people such as a student group or a family. They could be a company or organisation.

A stakeholder is different from a shareholder . A stakeholder is a person, group or organisation who is in some way involved with a project. Whereas a shareholder is a person, group or organisation who owns part of the project (i.e. a share).

Therefore a stakeholder and a shareholder are two different things.

As such, when we refer to a stakeholder in tourism, we are NOT talking about somebody who is necessarily financially involved. Instead they could have a wide range of involvements, that are not necessarily related to ownership or money.

Stakeholder Theory is all about the way in which stakeholders should be taken into account when making business decisions.

Most of the world nowadays is built upon a capitalist society, within which there is a complex web of interconnected stakeholders. From customers through to suppliers, employees, investors and local communities, it is important that their needs and desires are taken into account in order to yield optimal results.

As such, Stakeholder Theory presupposes that an organisation should take into account and create value for all stakeholders when undertaking their planning and operational activities.

Stakeholder Theory was first introduced by R. Edward Freeman in 1984. Since this time businesses and organisations in a range of industries throughout the world have utilised Edward’s theoretical contributions in their operational plans.

Stakeholder Theory has become a key consideration in the research of business ethics and has served as a platform for further research and development in the area.

In order to ensure that a business, whether in tourism or in another industry, is effectively considering stakeholders needs and requirements, the organisation must carry out some form of stakeholder analysis.

Stakeholder analysis is a process whereby key stakeholders are identified and grouped according to levels of participation, interest and influence. The organisation must then determine how best to work with and satisfy said stakeholders.

In the context of tourism this could involve considering how best to work with the host community or working with the Government on tax policies, for example. Or it could involve investigating what products would be most popular with the tourists and what working conditions must be provided to yield the best outcomes from company employees.

To put it simply, stakeholder analysis is a complex task where each person, group or individual must be assessed in terms of their value to the organisation and what their needs and requirements are.

Theoretically then, if the organisation operates with all of its stakeholders’ needs and requirements in mind, they are more likely to satisfy stakeholders and therefore to conduct successful business operations.

Here is a bit more on exactly what stakeholder analysis is-

Who are the stakeholders in tourism?

The tourism industry is one of the biggest industries in the world. This means that there are many individuals, groups and organisations who are involved at some level or another.

As demonstrated in the diagram above, there are a number of key stakeholders who are commonly involved with the tourism industry. Through his work on the stakeholders in tourism, Peter Burns has classified stakeholders according to the type of engagement that they have: External, secondary or primary. This is demonstrated below.

I will provide a brief outline of the typical involvement that the above stakeholders are likely to have.

The Government plays in a key role in the tourism industry. Throughout the different levels of tourism policy and planning , the Government will dictate a variety of rules, requirements and practices.

From visa policies to the maintenance of public infrastructure, most tourism business will operate closely with Government.

There are a wide range of tourism organisations and operators.

From travel agents and airlines through to DMOs (Destination Management Organisations) and travel bloggers , to restaurants, hotels and tourist attractions, all of these organisations are key players in the tourism industry.

There are a wide range of businesses that are seen as stakeholders in tourism.

These may be directly associated with travel and tourism , such as an airline.

They may also be indirectly associated with tourism, such as a waste removal company (who deals with the waste created by tourism).

There are also many NGOs (non-governmental organisations) that are associated with the tourism industry.

These might include charities or non-profit organisations. Examples include the Tourism Society and The Travel Foundation .

Tourists are at the very heart of the tourism industry. Without tourists there would be no tourism!

The tourism industry relies on a wide range of suppliers.

From factories producing bedding used in hotels, to farmers growing the vegetables served in restaurants, there are many suppliers who work either directly or indirectly with the tourism industry.

One of the key stakeholders in tourism is the workforce.

Some have argued that the travel and tourism industry employs more people, directly and indirectly, than any other industry in the world (see my post on the economic impacts of tourism for more details).

Employees in the tourism industry are commonly undertaking low-paid jobs in areas such as hospitality, catering and customer service.

The education sector is also a stakeholder in tourism.

Many educational courses will involve visits to tourism areas to enhance the educational provision offered. For example a school history trip to the D-Day beaches in France .

Education is also offered to many employees who work in the tourism industry in the form of training.

In order for the tourism industry to function, certain utilities and infrastructure is required.

This means that the local power plant is a stakeholder in tourism, because it provides energy.

It also means that the builders, road workers and engineers are stakeholders in tourism, because they provide and maintain the necessary infrastructure.

Read more: You might also be interested in the following posts – What is the sharing economy and how does this influence tourism? – Authenticity in tourism: Explained -What is McDonaldisation and how does it work? – Economic leakage in tourism explained – How to write an awesome literature review

There is a strong relationship between transport and tourism .

In fact, the very definition of tourism , prescribes that a person must travel away from the place that they live in order to be a tourist (although with the growth of virtual tourism I would argue that there is a need to revise this widely used definition).

As such, the method of transport between point A and point B is an integral part of the tourism system, thus making the transport providers (airlines, trains, taxi etc) important stakeholders in tourism.

The final stakeholder in tourism that is worth mentioning is the community. In fact, many would argue that this is one of the most important stakeholders in tourism.

In my post on the social impacts of tourism , I outline how important it is for tourism organisations to work with the local community and what the consequences can be if tourism operators do not listen to the needs and requirements of the host community.

Good tourism management often involves community-level briefings, consultations and ongoing communication in order to ensure that this important stakeholder is empowered throughout the process of tourism development planning and operation.

Hopefully this post has helped you to understand what is meant by the term stakeholders in tourism. You should also now be familiar with the concepts of stakeholder theory and stakeholder analysis. There are many, many stakeholders in tourism and in this post I have provided you with lots of examples. Want to learn more? I have suggested some key texts for additional reading below.

- The 10 Major Types of Events

- The 8 Major Types of Cruise

- 150 types of tourism! The ultimate tourism glossary

- 20 Popular Types of Hotels Around The World

- 21 Types of Tourists Around The World

Liked this article? Click to share!

Understanding the Travel and Tourism Sector: A Business Perspective

The world of business is inextricably linked with the realm of travel and tourism. From corporate travel arrangements to the operation of hospitality giants, this sector plays a pivotal role in the global economy.

The travel and tourism industry is not merely about vacations and leisure; it encompasses a diverse array of activities, services, and businesses that fuel economies, create jobs, and shape the way we explore the world.

In this article, we will embark on a journey to understand the intricacies of the travel and tourism sector from a business standpoint. We will explore its significance in the global economy, delve into the core components of the industry, examine the economic impact, and discuss emerging trends and challenges.

Moreover, we will shed light on the business aspects of travel, highlighting the key players, revenue streams, and marketing strategies that drive success.

But why should business professionals, beyond those directly involved in tourism, care about this sector? The answer lies in the fact that travel and tourism intersect with nearly every industry. Whether you're in finance, technology, healthcare, or any other field, understanding how this sector operates can unlock opportunities for growth, collaboration, and innovation.

So, fasten your seatbelts and prepare for a journey through the multifaceted world of travel and tourism, where business meets exploration and economic growth meets wanderlust.

Travel and Tourism

Travel and tourism refer to the activities, services, and industries associated with people traveling to and staying in places outside their usual place of residence for leisure, business, or other purposes.

The Core Components of Travel and Tourism

At its heart, the travel and tourism sector comprises several key components, each playing a unique role in the industry's ecosystem. Understanding these components is crucial for any business professional aiming to navigate this dynamic sector effectively.

Here are the primary elements:

1. Accommodation: Accommodation providers are the backbone of the tourism industry. They include hotels, resorts, vacation rentals, and even unconventional options like Airbnb. These establishments cater to travelers by offering a place to stay, ranging from budget to luxury.

2. Transportation: Travel relies heavily on transportation. This segment encompasses airlines, cruise lines, railways, car rental services, and public transportation systems. Efficient transportation networks are vital for connecting travelers to their destinations.

3. Food and Beverage: Dining experiences are an integral part of any trip. This category includes restaurants, cafes, food trucks, and bars. Culinary tourism, where travelers explore local cuisine, has become a significant trend within this segment.

4. Travel Agencies: Travel agencies and tour operators serve as intermediaries between travelers and service providers. They help plan itineraries, book accommodations, and arrange transportation, making the travel process more convenient.

5. Attractions and Entertainment: Tourist destinations offer various attractions, from historical sites and museums to theme parks and natural wonders. Entertainment options such as theaters and music venues also contribute to the overall travel experience.

6. Travel Technology: In the digital age, technology has transformed the way people plan and experience travel. Online booking platforms, travel apps, and services like TripAdvisor have reshaped the industry's landscape.

7. Tourism Services: This category includes a range of services such as travel insurance, currency exchange, and visa assistance. These services ensure that travelers are prepared for their journeys and can navigate any unforeseen challenges.

8. Destination Management: Local governments and organizations play a pivotal role in managing and promoting tourist destinations. They invest in infrastructure, marketing, and sustainability efforts to attract visitors.

The Economic Impact of Travel and Tourism

From a business perspective, it's essential to grasp the significant economic impact of the travel and tourism sector. This industry is a global economic powerhouse that generates jobs, fosters investment and drives economic growth.

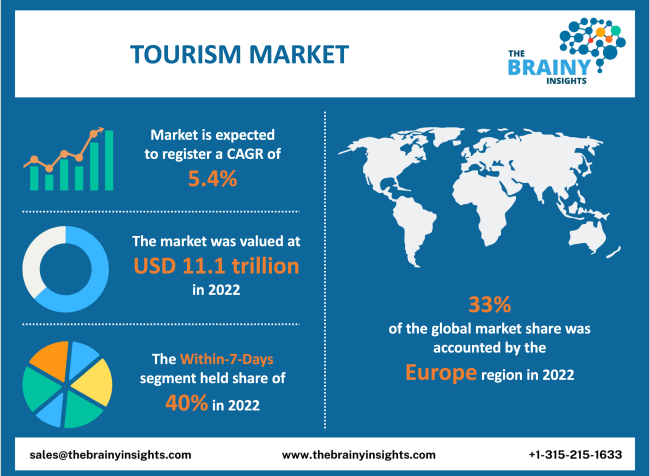

Here are some key statistics to illustrate the significance of travel and tourism :

- Job Creation: Travel and tourism directly support over 330 million jobs worldwide, accounting for 1 in 10 jobs globally.

- Contribution to GDP: In 2022, the travel and tourism sector contributed 7.6% to global GDP, highlighting its substantial economic footprint.

- Investment Magnet: This sector attracts investments in infrastructure, hotels, transportation, and more, further stimulating economic activity.

- Foreign Exchange Earnings: Tourism often serves as a vital source of foreign exchange earnings for many countries, boosting their balance of payments.

- SME Growth: Small and medium-sized enterprises (SMEs) play a significant role in the sector, benefiting from the opportunities created by tourism-related businesses.

The economic interplay between tourism and other industries is intricate.

For instance, the hospitality sector relies on agriculture for food supplies, airlines depend on the aerospace industry for aircraft and tourist destinations often collaborate with local artisans and businesses to promote cultural experiences.

In the business world, recognizing the economic clout of travel and tourism can open doors for collaboration, investment, and innovation. Many companies, even those seemingly unrelated to tourism, can find ways to tap into this lucrative market.

Emerging Trends and Challenges

The travel and tourism sector is continuously evolving, driven by changing consumer preferences, technological advancements, and global events. Business professionals must stay attuned to these trends and challenges to adapt and thrive in this dynamic industry.

Here are some notable developments:

1. Sustainable Tourism: Travelers increasingly prioritize eco-friendly and sustainable practices. Businesses that adopt green initiatives not only reduce their environmental footprint but also attract environmentally conscious travelers.

2. Digital Transformation: The digitalization of travel services has reshaped how consumers plan and book trips. Online platforms, artificial intelligence, and data analytics are instrumental in personalizing travel experiences.

3. Health and Safety: Recent global health crises have heightened travelers' concerns about safety and hygiene. Businesses must implement robust health and safety measures to regain consumer trust.

4. Shifts in Travel Behavior: The pandemic has brought about changes in travel behavior, with a focus on remote and nature-based destinations. Companies need to adapt their offerings to cater to these evolving preferences.

5. Regulatory Challenges: Navigating complex regulations, including visa requirements and health protocols, can be a challenge for travel businesses. Staying informed and compliant is crucial.

6. Geopolitical Factors: Political instability and international relations can significantly impact the tourism industry. Businesses must be prepared to adapt to changing geopolitical landscapes.

The Business of Travel and Tourism

Understanding how businesses operate within this sector is essential for both industry insiders and entrepreneurs looking to tap into this thriving market.

Role of Businesses in the Travel Sector

Businesses play a pivotal role in shaping the travel and tourism landscape. Whether you're a hotel chain, an airline, a tour operator, or a travel agency, your role is multifaceted, encompassing everything from customer service to marketing and sustainability initiatives.

- Customer-Centric Approach : At the heart of every successful travel and tourism business is a deep commitment to customer satisfaction. Travelers today expect exceptional service and unique experiences. From the moment a traveler starts planning their trip to the time they return home, businesses must focus on providing top-notch services, personalized recommendations, and seamless experiences.

- Innovation and Adaptation : The travel industry is highly competitive and constantly evolving. Successful businesses in this sector are those that innovate and adapt to changing trends. This could mean embracing digital technology, offering eco-friendly options, or creating new and exciting travel packages.

Business Models and Revenue Streams

To thrive in the travel and tourism sector, businesses employ various revenue models tailored to their specific niches. Here are a few common business models:

- Hospitality and Accommodation : Hotels, resorts, and vacation rentals rely on room bookings and additional services such as dining, spa treatments, and event hosting to generate revenue.

- Airlines and Transportation : Airlines make money through ticket sales, baggage fees, in-flight services, and partnerships with other travel-related businesses. Transportation services like taxis, trains, and cruise lines have similar revenue structures.

- Tour Operators and Travel Agencies : These businesses profit from organizing and selling travel packages, tours, and experiences. Commissions, booking fees, and tour sales are primary income sources.

- Online Travel Agencies (OTAs) : OTAs like Expedia and Booking.com aggregate information from various travel service providers and earn commissions on bookings made through their platforms.

Customer Experience and Service Excellence

In the digital age, the travel and tourism sector is driven by customer reviews and recommendations. Travelers share their experiences online, influencing the choices of others. Therefore, providing exceptional customer service is paramount. Here are some strategies to achieve service excellence:

- Personalization : Tailor recommendations and services to individual preferences.

- Seamless Booking and Travel : Make the booking process simple and provide support throughout the journey.

- Feedback and Improvement : Collect customer feedback and use it to enhance services continually.

- Crisis Management : Be prepared to handle unexpected situations, such as flight cancellations or health emergencies, with professionalism and empathy.

Marketing and Promotion Strategies

Effective marketing is essential for attracting travelers to your business. Here are some strategies commonly used in the travel and tourism industry:

- Digital Marketing : Utilize online channels such as social media, search engine optimization (SEO), email marketing, and paid advertising to reach a global audience.

- Content Marketing : Create engaging content, including blog posts, videos, and travel guides, to inspire and inform potential travelers.

- Partnerships : Collaborate with influencers, other businesses, and tourism boards to expand your reach and access new markets.

- Sustainability Promotion : Highlight your commitment to sustainable and responsible travel practices, as eco-conscious travelers seek eco-friendly options.

The business of travel and tourism is a multifaceted realm that demands a relentless focus on customer satisfaction, innovation, and responsible practices.

Success in this sector requires a deep understanding of your niche, a commitment to service excellence, and strategic marketing efforts. As the travel industry continues to evolve, businesses that can adapt and offer unique, memorable experiences will undoubtedly thrive in this exciting and ever-changing market.

Key Players in the Travel and Tourism Industry

As we dive deeper into the business of travel and tourism, it's crucial to recognize the key players that shape this industry. These players, ranging from airlines to accommodation providers and travel agencies, contribute to the diverse ecosystem of travel and tourism.

Understanding their roles and significance is essential for anyone interested in this dynamic sector.

Airlines and Aviation

Airlines are the lifelines of global travel. They provide the means for travelers to reach their destinations quickly and efficiently. Here's an overview of their role in the industry:

- Passenger Transportation : Airlines transport millions of passengers daily, connecting cities and countries across the globe. They generate revenue through ticket sales, baggage fees, and in-flight services.

- Cargo Services : Airlines also play a pivotal role in transporting goods and cargo, contributing significantly to international trade and logistics.

- Global Networks : Major airlines operate extensive global networks, allowing travelers to reach virtually any corner of the world.

Hotel Chains and Accommodation Providers

The hospitality sector, including hotels, resorts, and vacation rentals, is another cornerstone of the travel and tourism industry. Here's how they contribute:

- Lodging : These businesses offer lodging options, from budget-friendly to luxury, catering to diverse traveler preferences.

- Dining and Services : Many hotels provide dining options, spa services, event hosting, and recreational facilities, enhancing the guest experience and generating additional revenue.

- Destination Attraction : Iconic hotels and resorts often become attractions in themselves, drawing travelers to specific destinations.

Tour Operators and Travel Agencies

Tour operators and travel agencies specialize in creating and selling travel packages and experiences. Their roles include:

- Curating Experiences : They design itineraries and packages that offer unique and immersive travel experiences, from adventure tours to cultural excursions.

- Booking and Logistics : These businesses handle the logistics of travel, including accommodations, transportation, and activities, streamlining the process for travelers.

- Expertise : Tour operators and travel agencies provide expert guidance, helping travelers navigate complex travel decisions.

Destination Management Companies

Destination management companies (DMCs) focus on specific regions or destinations. Their roles encompass:

- Local Expertise : DMCs have in-depth knowledge of their respective destinations, enabling them to offer specialized services and experiences.

- Customized Services : They work closely with travel planners and agencies to tailor experiences for groups and individuals.

- Sustainability : DMCs often play a vital role in promoting responsible tourism practices within their destinations.

Online Travel Agencies (OTAs)

Online travel agencies have become a dominant force in the industry, leveraging digital platforms to connect travelers with various travel services. Here's what they do:

- Aggregation : OTAs aggregate information from airlines, hotels, and other travel service providers, offering a wide array of choices to travelers.

- Booking Platforms : They provide convenient booking platforms, allowing travelers to book flights, accommodations, and more in one place.

- Reviews and Recommendations : OTAs often feature user reviews and recommendations, influencing traveler decisions.

Understanding the roles of these key players in the travel and tourism industry is essential for anyone considering entering this sector.

Each player contributes uniquely to the travel experience, from transportation to accommodation and beyond. Successful businesses often collaborate with multiple stakeholders to offer comprehensive and memorable travel experiences to their customers.

Travel and Tourism Post-COVID-19

The travel and tourism industry, like many others, faced unprecedented challenges during the COVID-19 pandemic. Lockdowns, travel restrictions, and health concerns brought international travel to a standstill. However, the industry has displayed remarkable resilience and adaptability.

Let's explore how the sector is recovering and adapting in a post-pandemic world.

Impact of the Pandemic on the Industry

- Travel Restrictions : Stringent travel restrictions, including border closures and quarantine requirements, severely impacted international travel. Airlines faced a sharp decline in passenger numbers.

- Hospitality Struggles : Hotels and accommodation providers experienced a dramatic drop in occupancy rates. Many temporarily closed or adapted to offer quarantine and isolation services.

- Cruise Industry Challenges : Cruise lines faced significant setbacks due to onboard outbreaks. The industry had to reimagine health and safety protocols.

- Shift to Domestic Travel : With international travel restrictions, many travelers turned to domestic and regional destinations, boosting local tourism.

- Digital Transformation : The pandemic accelerated the adoption of digital technologies for contactless bookings, health monitoring, and communication.

Recovery and Adaptation Strategies

The travel and tourism industry is rebounding, thanks to a combination of factors:

- Vaccination Campaigns : Widespread vaccination campaigns have increased traveler confidence, making international travel safer.

- Health and Safety Protocols : Airlines, hotels, and other businesses have implemented robust health and safety measures to reassure travelers.

- Flexible Booking Policies : Many travel companies introduced flexible booking and cancellation policies to accommodate changing travel plans.

- Sustainability Focus : There's a growing emphasis on sustainable and responsible tourism, with businesses integrating eco-friendly practices.

- Digitalization : The industry continues to embrace digital technologies, offering contactless experiences and personalized services.

- Collaboration : Stakeholders across the industry are collaborating to rebuild and promote destinations.

Future Outlook and Resilience

The travel and tourism industry is poised for recovery and growth in the coming years. Here's what the future may hold:

- Pent-Up Demand : Many travelers postponed their plans during the pandemic, leading to pent-up demand for leisure and business travel.

- Sustainable Travel : Sustainable and eco-conscious travel is gaining momentum. Travelers are increasingly choosing destinations and businesses committed to environmental responsibility.

- Tech Integration : Technology will continue to play a significant role, with advancements in AI, mobile apps, and data analytics enhancing the travel experience.

- Health and Safety : Health and safety measures will remain a priority, with businesses maintaining rigorous protocols.

- Remote Work and Travel : Remote work trends may encourage a blend of work and leisure travel, with more extended stays in diverse locations.

- Resilience Planning : The industry is developing resilience plans to better handle future crises and disruptions.

The travel and tourism industry's ability to adapt and innovate in the face of adversity demonstrates its resilience. As it recovers and evolves, it offers promising opportunities for businesses and travelers alike.

The key to success lies in embracing change, prioritizing safety, and delivering exceptional experiences that meet the evolving needs of travelers in a changing world.

Sustainable Tourism and Responsible Business Practices

In a world increasingly concerned about the environment and social responsibility, the travel and tourism industry is under scrutiny to adopt more sustainable and responsible practices.

Let's delve into the importance of sustainable tourism and how businesses can contribute to a greener and more ethical travel sector.

Environmental and Social Responsibility

- Reducing Carbon Footprint : The travel industry is a significant contributor to greenhouse gas emissions. Airlines, for example, are exploring biofuels and more fuel-efficient aircraft to reduce their carbon footprint.

- Preserving Natural Resources : Eco-conscious travelers seek destinations that protect and preserve natural resources. Businesses can contribute by implementing eco-friendly initiatives like energy-efficient facilities and waste reduction programs.

- Conservation Efforts : Supporting local conservation projects and wildlife protection initiatives can be a part of responsible tourism. This can involve financial contributions or active participation.

- Respecting Local Cultures : Responsible tourism respects and celebrates local cultures and traditions. It involves engaging with local communities in a respectful and sustainable manner.

- Community Involvement : Businesses can support the communities they operate in through job creation, fair wages, and community development projects.

Sustainable Tourism Certifications and Initiatives

- Eco-Certifications : Numerous certifications, such as EarthCheck and Green Key , help businesses showcase their commitment to sustainability. These certifications often involve rigorous audits of a company's environmental practices.

- Zero-Waste Initiatives : Some hotels and resorts aim to become zero-waste establishments, recycling and repurposing nearly all their waste.

- Wildlife Conservation : Tour operators and businesses can partner with wildlife conservation organizations to promote ethical wildlife experiences.

- Local Sourcing : Restaurants and hotels can prioritize local sourcing of food and materials, reducing transportation-related carbon emissions.

- Plastic Reduction : Many businesses are eliminating single-use plastics and opting for sustainable alternatives.

Benefits of Responsible Tourism for Businesses

- Competitive Advantage : Travelers increasingly seek sustainable and responsible options. Businesses that embrace these practices gain a competitive edge.

- Cost Savings : Sustainable practices often lead to cost savings through reduced energy and resource consumption.

- Enhanced Reputation : Businesses committed to responsible tourism build a positive reputation and attract like-minded customers.

- Legal Compliance : Adhering to eco-friendly and ethical standards ensures compliance with evolving environmental and social regulations.

- Long-Term Viability : By protecting the environment and supporting local communities, businesses contribute to the long-term viability of their destinations.

- Guest Satisfaction : Eco-conscious travelers appreciate businesses that share their values, leading to higher guest satisfaction and loyalty.

The travel and tourism sector's future hinges on sustainable and responsible practices. Businesses that prioritize environmental and social responsibility not only contribute to a healthier planet but also position themselves for long-term success in an industry undergoing profound changes.

As a business professional, understanding and adopting these practices can be a strategic advantage in a world where ethical considerations increasingly influence consumer choices.

Hostile Takeovers

In a hostile takeover, the acquiring company pursues the target company despite the target's resistance. Hostile takeovers often involve aggressive tactics, such as tender offers directly to shareholders or attempts to replace the target's board of directors.

Case Studies: Successful Businesses in Travel and Tourism

To gain deeper insights into the strategies and approaches that have propelled certain businesses to success in the travel and tourism sector, let's examine a few notable case studies.

These examples showcase how innovation, adaptability, and a customer-centric approach can make a significant impact in this dynamic industry.

Airbnb: Revolutionizing Accommodation

Airbnb, founded in 2008, has transformed the hospitality sector. This online marketplace connects travelers with unique accommodations offered by hosts worldwide. What sets Airbnb apart?

Key Success Factors:

- Platform Model : Airbnb operates as a platform, allowing hosts to list their properties and travelers to book them. This asset-light model means Airbnb doesn't own properties, reducing capital requirements.

- User Reviews : User-generated reviews and ratings build trust among users. Travelers can make informed choices based on the experiences of previous guests.

- Personalization : Airbnb's recommendation engine suggests accommodations based on user preferences, enhancing the customer experience.

- Diverse Offerings : From treehouses to castles, Airbnb offers a wide range of unique accommodations, appealing to travelers seeking authentic experiences.

- Host Community : Airbnb invests in building a strong host community, providing support and resources to hosts.

Cross-Border Mergers and Acquisitions: Global Expansion

Cross-border M&A transactions involve companies from different countries coming together. These deals offer opportunities for global expansion but also present unique challenges.

Booking.com: Data-Driven Booking

Booking.com, founded in 1996, is a global online travel agency. It leverages technology and data to simplify travel booking.

- Vast Inventory : Booking.com offers a wide range of accommodation options, from hotels to vacation rentals. This extensive inventory caters to diverse traveler preferences.

- User Experience : The platform's user-friendly interface and transparent booking process contribute to its popularity.

- Data Analytics : Booking.com uses data analytics to understand traveler behavior, enabling personalized recommendations and pricing strategies.

- Global Reach : With a presence in over 220 countries and territories, Booking.com serves a global audience.

- Instant Confirmation : Providing real-time booking confirmation enhances the customer experience.

Delta Air Lines: Customer-Centric Air Travel

Delta Air Lines, a major U.S. carrier founded in 1924, is known for its customer-centric approach.

- Reliability : Delta prioritizes operational reliability, minimizing flight cancellations and delays.

- Fleet Upgrades : Investing in a modern and efficient fleet enhances the passenger experience and reduces operating costs.

- Customer Service : Delta emphasizes excellent customer service, and its efforts are reflected in high customer satisfaction ratings.

- Global Alliances : Participation in global airline alliances expands route networks and offers travelers more choices.

- Innovation : Delta embraces innovation, introducing features like biometric boarding and in-flight entertainment options.

These case studies highlight the diverse strategies and approaches that have driven success in the travel and tourism sector. From disruptive online marketplaces to data-driven booking platforms and customer-centric airlines, businesses that prioritize innovation, customer experience, and adaptability are well-positioned for growth.

By studying these examples, business professionals can gain valuable insights into the industry's evolving landscape and identify opportunities to innovate and excel in their own travel and tourism endeavors.

Lessons Learned from Industry Leaders

The travel and tourism sector offers a treasure trove of lessons for business professionals across various industries. Let's distill some key takeaways from the successes and innovations of industry leaders:

1. Customer-Centricity Is Paramount

Whether you're running an airline, hotel, or travel agency, prioritizing the customer experience is non-negotiable. Happy and satisfied customers become loyal patrons and brand advocates. Invest in personalized services, efficient booking processes, and responsive customer support.

2. Embrace Technology and Data

Technology is a game-changer in the travel industry. From data analytics that inform pricing strategies to mobile apps that enhance on-the-go experiences, leveraging technology can set your business apart. Be open to adopting new tools and systems that improve efficiency and customer satisfaction.

3. Diversity and Choice Matter

Offering a diverse range of products or services can attract a broader audience. In the travel sector, this means providing various accommodation types, transportation options, and tour packages. Embrace diversity to meet the unique preferences of your customers.

4. Transparency Builds Trust

Transparency in pricing, policies, and terms and conditions builds trust with customers. Hidden fees and ambiguous policies can lead to dissatisfaction. Clear communication and honesty go a long way in establishing credibility.

5. Sustainability Is the Future

Sustainability and responsible tourism are becoming central to the industry's ethos. Travelers are increasingly conscious of their environmental impact. Consider eco-friendly practices and promote responsible tourism. It's not only good for the planet but also a selling point for your business.

6. Innovate or Stagnate

Innovation is the lifeblood of the travel and tourism sector. Whether it's introducing new services, improving efficiency, or enhancing the customer journey, staying ahead requires a commitment to innovation. Monitor industry trends and be open to creative solutions.

7. Globalization Expands Reach

Participating in global networks and alliances can expand your business's reach. Collaborate with international partners to offer customers a wider range of options. Globalization also provides resilience in the face of economic fluctuations.

8. Resilience Is Crucial

The industry has weathered numerous storms, from economic crises to health emergencies. Building resilience into your business plans, such as having contingency measures for crises, is essential. Flexibility and adaptability are key.

9. Community and Culture Matter

Embrace the culture and communities where your business operates. Engage with local communities, respect their traditions, and contribute positively. This fosters goodwill and can lead to meaningful partnerships.

10. Continuous Learning Is a Competitive Advantage

The travel and tourism sector is ever-evolving. Continuous learning and staying informed about industry trends and regulations are essential. Attend conferences, workshops, and industry events to network and gain insights.

Incorporating these lessons into your business strategy can set you on a path to success in the dynamic and rewarding world of travel and tourism. By combining innovation, customer focus, and a commitment to sustainability, you can thrive in an industry that promises new horizons and unforgettable experiences for travelers worldwide.

The travel and tourism sector represents a dynamic and resilient industry with a significant impact on the global economy. As a business professional, understanding the nuances and opportunities within this sector is paramount. In this comprehensive guide, we've explored the multifaceted world of travel and tourism, delving into its significance, components, trends, and challenges.

We've seen how the industry intersects with business, offering a wide array of opportunities for entrepreneurs and established enterprises alike. Whether you're considering venturing into travel-related ventures or seeking to enhance an existing business through tourism, the sector holds immense potential.

Key takeaways from this exploration include:

- The Economic Powerhouse : Travel and tourism contribute significantly to GDP, job creation, and foreign exchange earnings in many countries. This sector's resilience is evident through its ability to rebound from crises.

- Diverse Components : The industry encompasses hospitality, transportation, attractions, travel services, and more, creating a rich tapestry of business opportunities.

- Trends and Challenges : Emerging trends like sustainable tourism and digital transformation offer avenues for innovation. Yet, challenges such as health concerns and environmental responsibility must be addressed.

- The Business of Tourism : Customer-centricity, technology adoption, transparency, and sustainability are vital principles for success in this sector.

- Key Players : Airlines, hotel chains, tour operators, and online travel agencies are among the key players shaping the industry's landscape.

- Post-COVID-19 Era : The pandemic prompted significant shifts in travel behavior. Recovery strategies and adaptability are critical for businesses in the post-COVID-19 world.

- Sustainable Tourism : Responsible practices not only benefit the environment but also appeal to conscious travelers and can drive business success.

- Lessons from Industry Leaders : Customer-centricity, innovation, transparency, and resilience are valuable takeaways from successful travel and tourism businesses.

As the world evolves, so do the travel and tourism opportunities. By staying informed, embracing innovation, and aligning with sustainability, you can position your business for success in an industry that promises both profitability and the chance to create unforgettable experiences for travelers around the globe.

Now, armed with insights from this guide, you're better equipped to navigate the exciting and ever-changing world of travel and tourism, contributing to its growth and shaping its future. Bon voyage!

- United Nations World Tourism Organization (UNWTO). (2022). Tourism Highlights 2022 Edition. Link

- World Travel & Tourism Council (WTTC). (2022). Economic Impact Reports. Link

- International Air Transport Association (IATA). (2022). IATA Economics. Link

- Deloitte. (2022). Travel, Hospitality, and Leisure Reports. Link

- Statista. (2022). Statistics and Market Data on Travel and Tourism. Link

- McKinsey & Company. (2022). Travel, Logistics & Transport Infrastructure. Link

- Booking.com. (2023). Link

- TripAdvisor. (2023). GreenLeaders. Link

- The New York Times. (2023). Travel and Tourism. Link

- National Geographic. (2023). Sustainable Travel. Link

- The World Bank. (2023). Tourism. Link

- World Tourism Organization (2022). Global Code of Ethics for Tourism. Link

Tumisang Bogwasi

2X Award-Winning Entrepreneur | Empowering Brands to Generate Leads, Grow Revenue with Business Strategy and Digital Marketing | Founder, CEO of Fine Group

Complete Overview of the 5 Sectors in the Tourism Industry

Overview of the sectors in tourism

The interplay of sectors in tourism, impact of each sector on the tourism industry, challenges and opportunities in each sector.

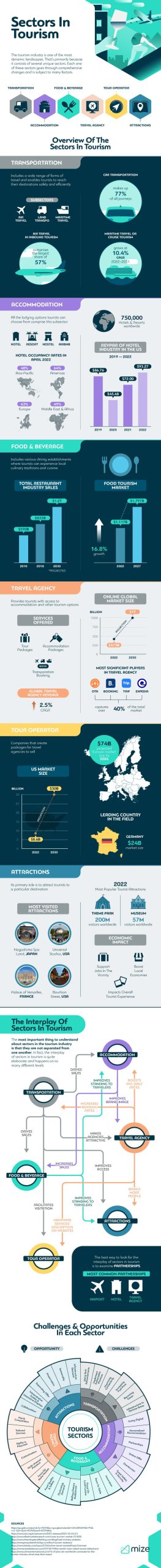

The tourism industry is one of the most dynamic landscapes . That’s primarily because it consists of several unique sectors. Each one of these sectors goes through comprehensive changes and is subject to many factors.

Nevertheless, understanding these sectors is quite essential! Why? Because it can help you make informed business decisions, identify valuable growth opportunities, future-proof your travel brand, and, ultimately, set it up for success.

Below you can find an in-depth analysis of the different sectors in tourism, how they affect each other, and the industry as a whole. Finally, you will discover unique challenges and opportunities for each sector.

The tourism vertical is quite extensive. It consists of six sectors, making it one of the most diverse industries. These sectors are transportation, accommodation, food and beverage, travel agencies, and attractions. Let’s take a closer look at the sectors, their sizes, and their economic impact.

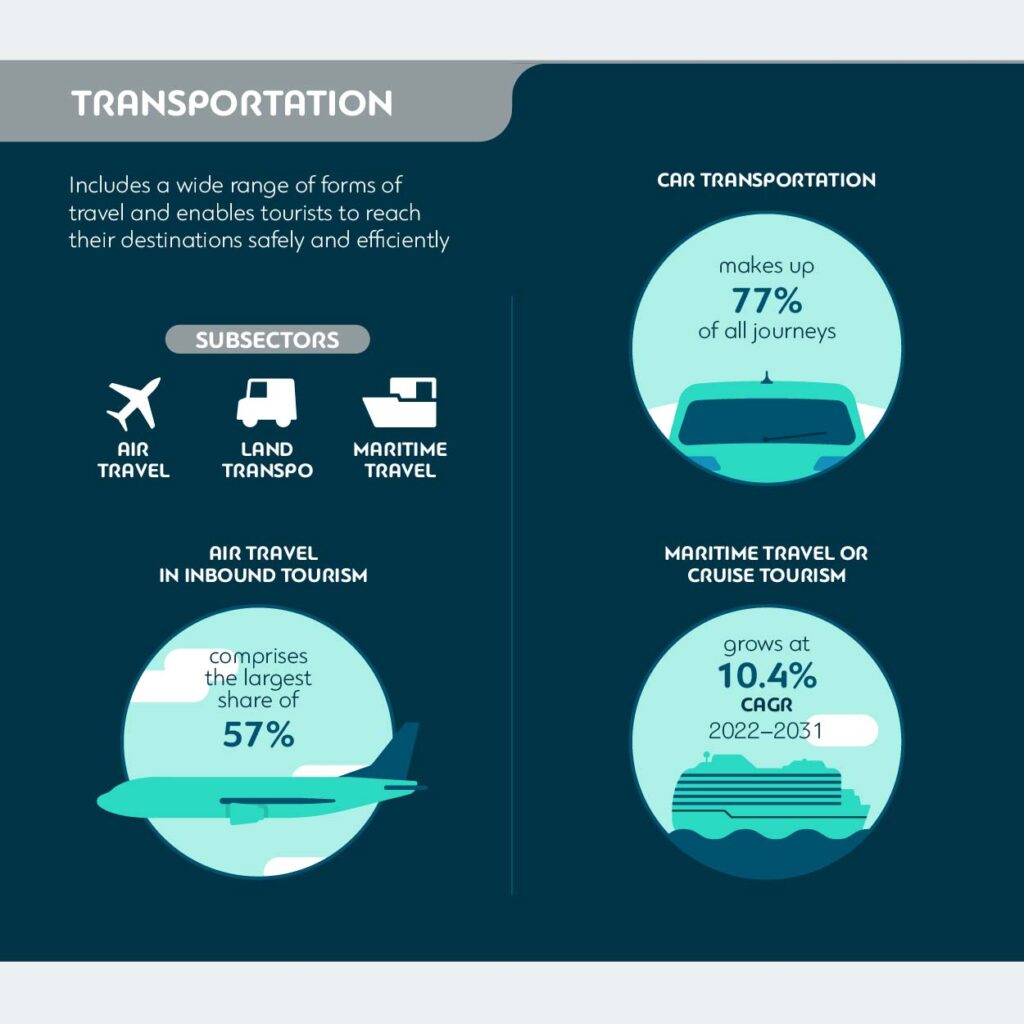

Transportation in Tourism

Transportation in tourism is a big sector. It encompasses a wide range of forms of travel and enables tourists to reach their destinations safely and efficiently. The sub-sectors include air travel, land transportation, and maritime travel.

When it comes to inbound tourism, air travel comprises the largest share, 57% . Travelers trying to reach faraway destinations often choose from various travel options. One can actually gauge the momentum of the tourism sector recuperation after the COVID-19 pandemic by looking at air transportation trends. The latest report states that total air traffic is up by 52% compared to 2022 .

Land transportation for tourists has been increasing in recent years. A recent study reveals that car transportation makes up 77% of all journeys . The reasons that explain this trend are flexibility, price, and independence.

Maritime travel or cruise tourism is also experiencing steady growth. This subsector is estimated to continue to grow at a CAGR of 10.4% from 2022 to 2031 .

Transportation is one of the pillars of the tourism industry, and as such, it has a tremendous economic impact on the vertical – its efficient functioning is critical for not only attracting tourists to destinations but also enabling them to reach their desired locations . It allows companies to generate revenue through ticket sales. However, by enabling tourists to reach their destinations, it also drives economic activity in hospitality.

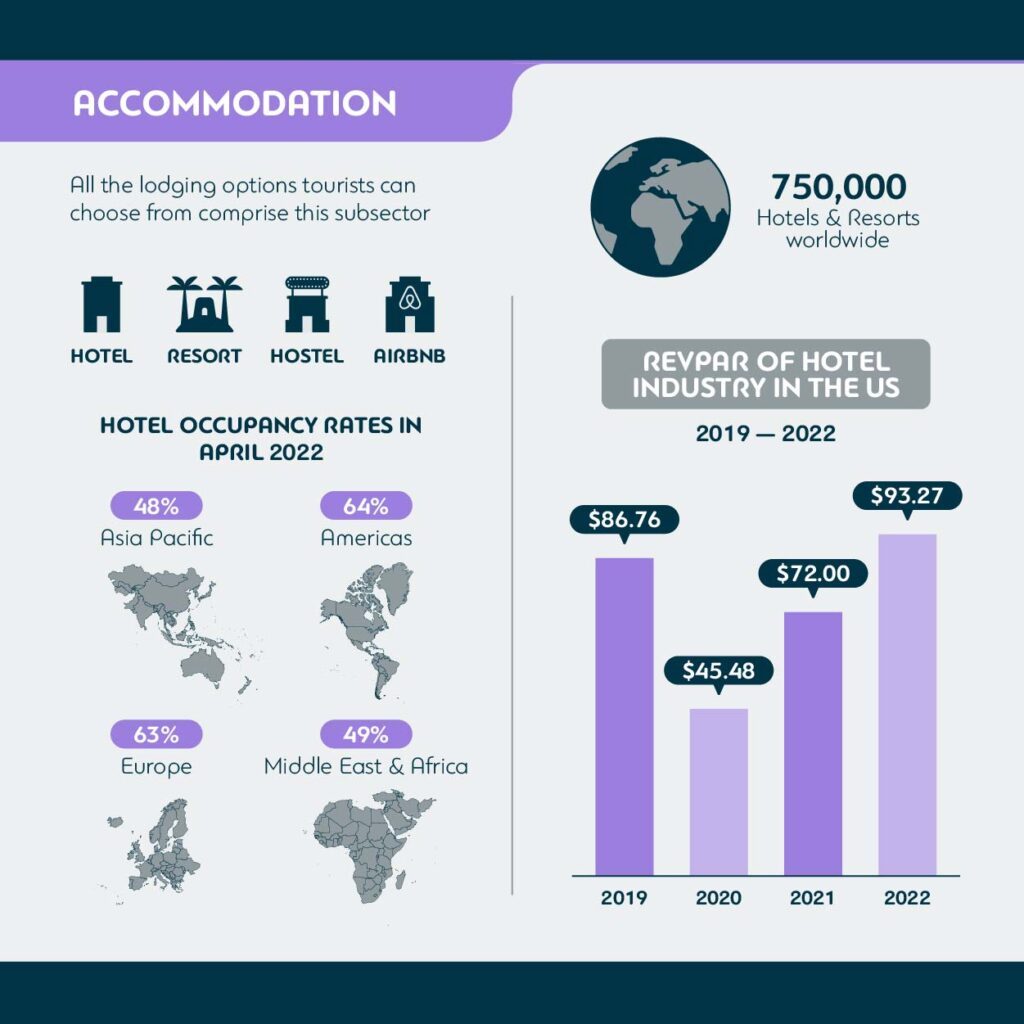

Accommodation in Tourism

All the lodging options tourists can choose from comprise the accommodation subsector of the tourism industry. It includes hotels, resorts, hostels, vacation rentals, Airbnb, and more.

The hotel occupancy rates metric is the best one to keep track of the developments in this subsector simply because there are almost 750,000 hotels and resorts worldwide . In April 2022, hotel occupancy rates were highest in the Americas, reaching 64% . Europe was in second place with the hotel occupancy rates at 63%, followed by the Middle East and Africa at 49% and the Asia Pacific at 48%.

When it comes to the economic impact, the best metric to track is revenue per available room or RevPAR. The RevPar reached $93.27 in 2022, an 8.1% increase compared to 2019 . The average daily rate is up by 13.6%, which makes $148.83 for the same period. Occupancy rates are still not at the pre-pandemic level, but with only a 4.9% difference, they are getting there.

The revenue this sector generates has a tremendous impact. The money is used toward creating new jobs, developing infrastructure, and boosting local economies. Local communities and governments also benefit from the taxes and fees collected from accommodation providers.

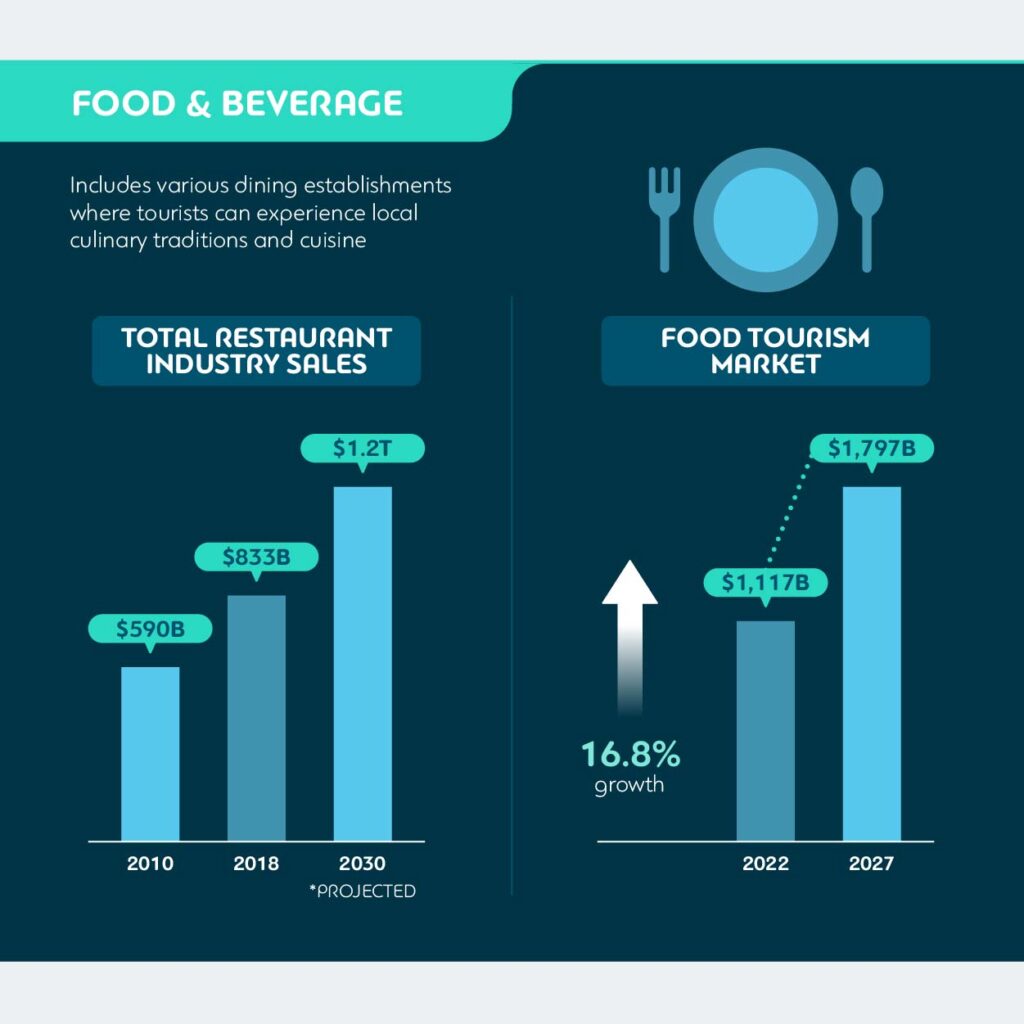

Food and Beverage in Tourism

The food and beverage tourism sector is quite diverse and doesn’t just include restaurants and cafes. It also encompasses various dining establishments where tourists can experience local culinary traditions and cuisine.

According to the National Restaurant Association research, the sales in the fine dining segment to travelers and visitors went down by 41% . However, total restaurant industry sales are projected to reach $.1.2 trillion by 2030 , and traveler purchases will significantly contribute to this positive development. The food tourism market is projected to reach $1,796.5 billion by 2027 in size, which is a 16.8% growth given that its size in 2022 is $1,116.7 billion.

One of the most extensive studies done recently encompassed the data from over 50,000 travelers to conclude that 64% of travelers base their traveling decisions on the food and drink options available at their destination.

There are two sides to the economic impact of food and beverage in tourism. First, it helps generate more direct revenue, and second, it fosters culinary entrepreneurship and can significantly boost agricultural and food production sectors. It can also help create more job opportunities.

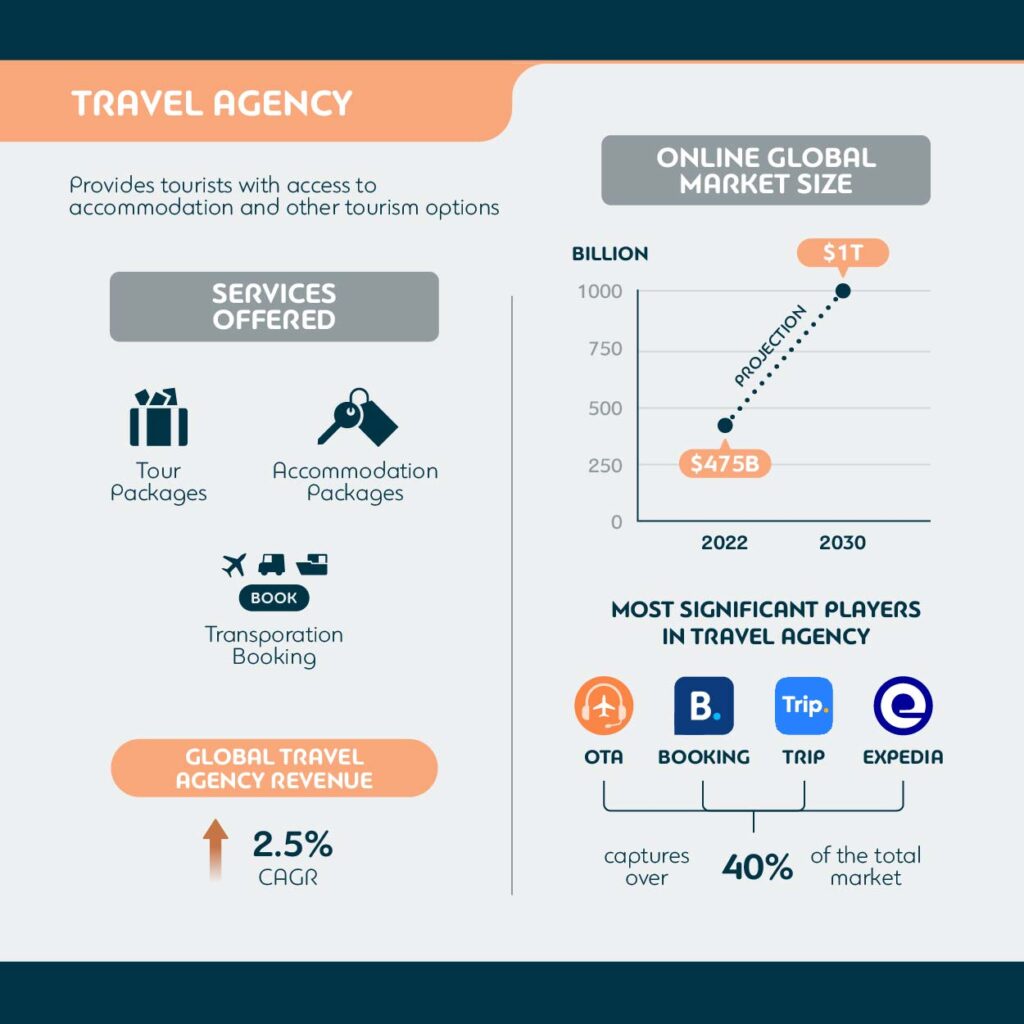

Travel Agencies and Tour Operators

Travel agencies are travel brands that specialize as intermediaries. They provide tourists with access to accommodation and other tourism options. Travel agencies can also offer various services, such as tour packages, accommodation reservations, and transportation booking .

Online travel agencies or OTAs are currently dominating this space. In 2022, the online global travel market size reached $475 billion and is projected to reach over one trillion US dollars by 2030. OTAs, including the most significant players such as Booking.com, Trip.com, and Expedia, captured over 40% of the total market .

While travel agencies continue to generate revenue, it’s important to note that global travel agency revenue is growing at a CAGR of 2.5% .

Travel agencies, both offline and online, are vital parts of the entire travel ecosystem. They both contribute to the whole sector and facilitate tourism overall. Travel agencies stimulate economic activity through other sectors as they are responsible for actually funneling tourists to destinations. They also help create new jobs, improve travel satisfaction, and ensure repeat business.

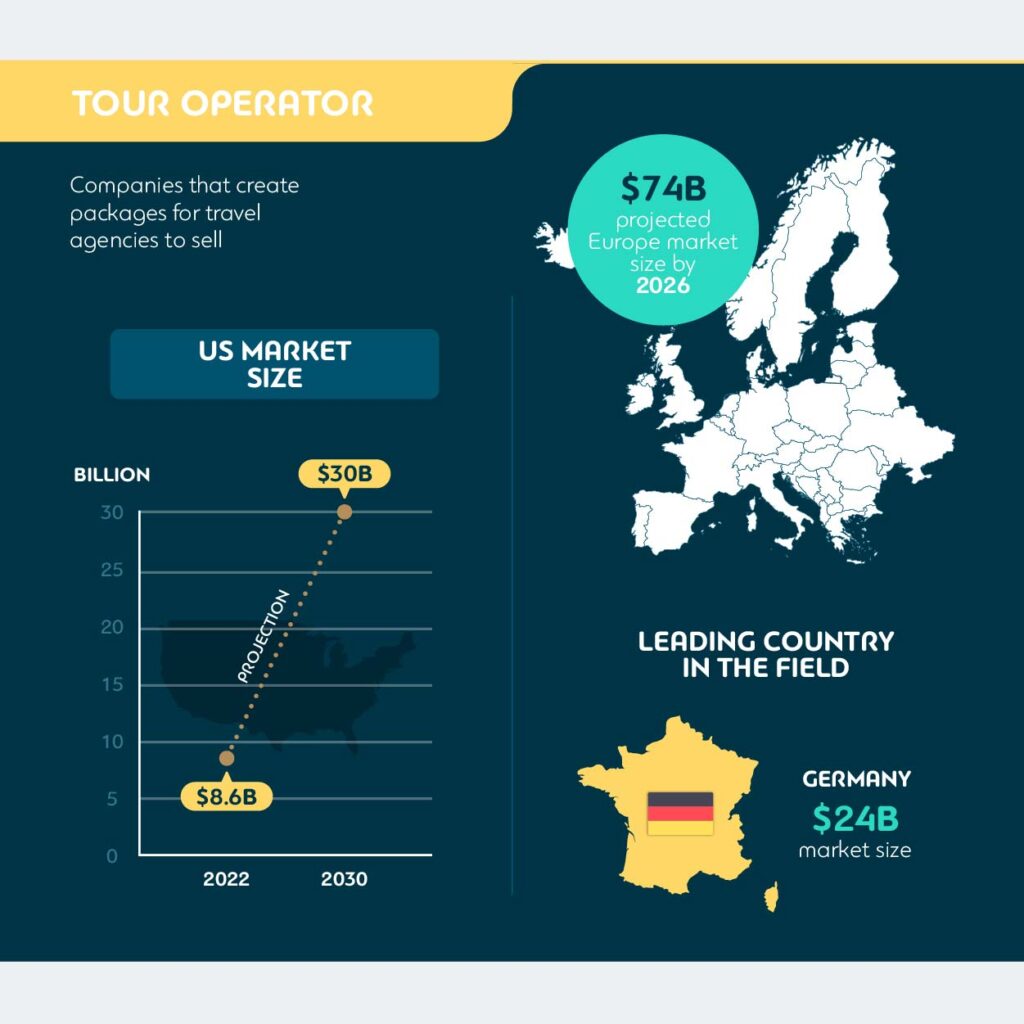

Tour operators, the companies that create packages for travel agencies to sell, also make up a sizable sub-sector. The market size of the tour operators industry in the US in 2022 was $8.6 billion . The US market will continue to grow at a CAGR of 17% to reach $30 billion in size by 2023 . Across the ocean, we have Europe, with its tour operator market size projected to reach $74 billion by 2026 , with Germany as the leader in the field with a market size of $24 billion.

Tourism Attractions

Tourism attraction is a place of interest. Generally speaking, tourism attractions’ primary role is to attract tourists to a particular destination. It can be anything from natural wonders and historical sites to museums and cultural landmarks.

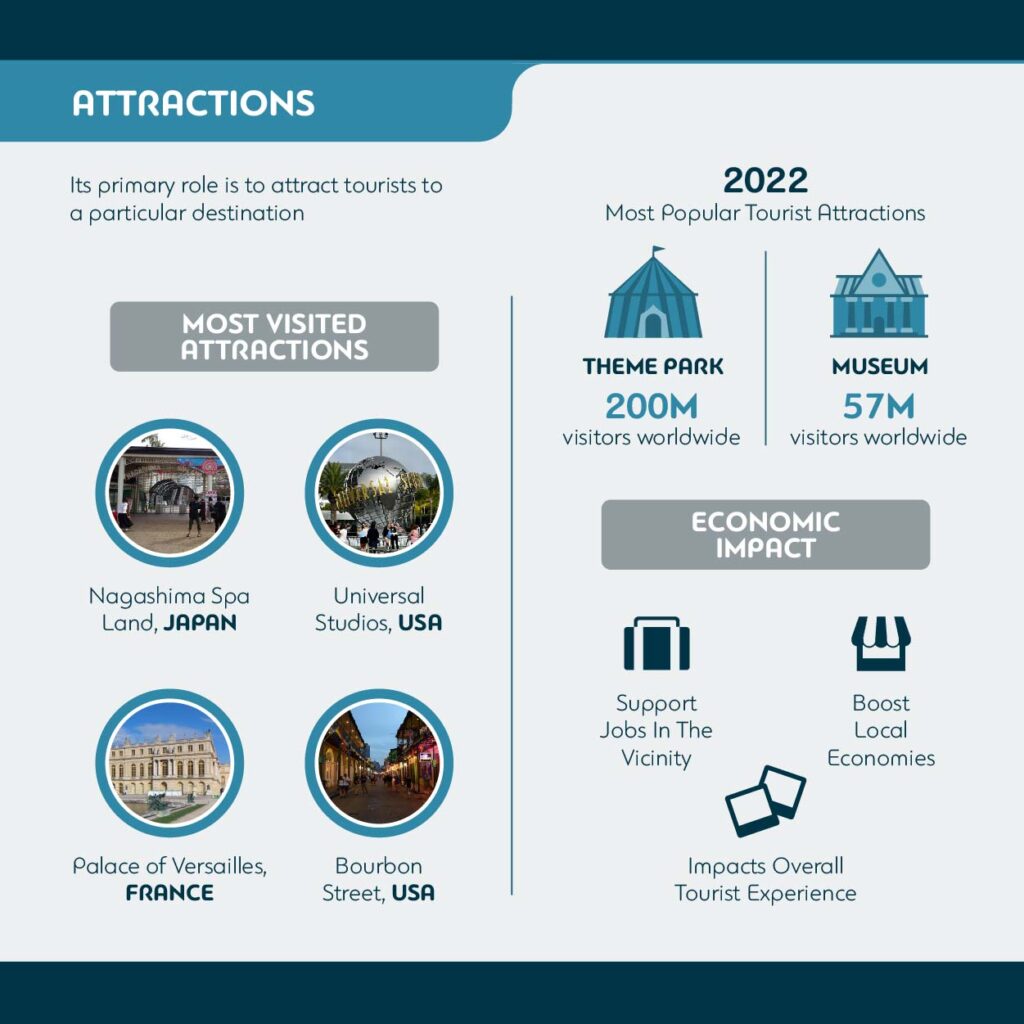

According to the latest data , the most visited attractions are spread across the globe. These include Nagashima Spa Land, Japan; Universal Studio, USA; Palace of Versailles, France; and Bourbon Street, USA.

Theme parks are also among the most popular tourist attractions. In 2022, these parks attracted almost 200 million visitors . The museums are right behind theme parks, with an attendance of 57 million.

Tourism attractions also have a significant economic impact. They support jobs in the vicinity, boost local economies, and positively impact the overall tourist experience. They are also the number one factor that often drives visitation.

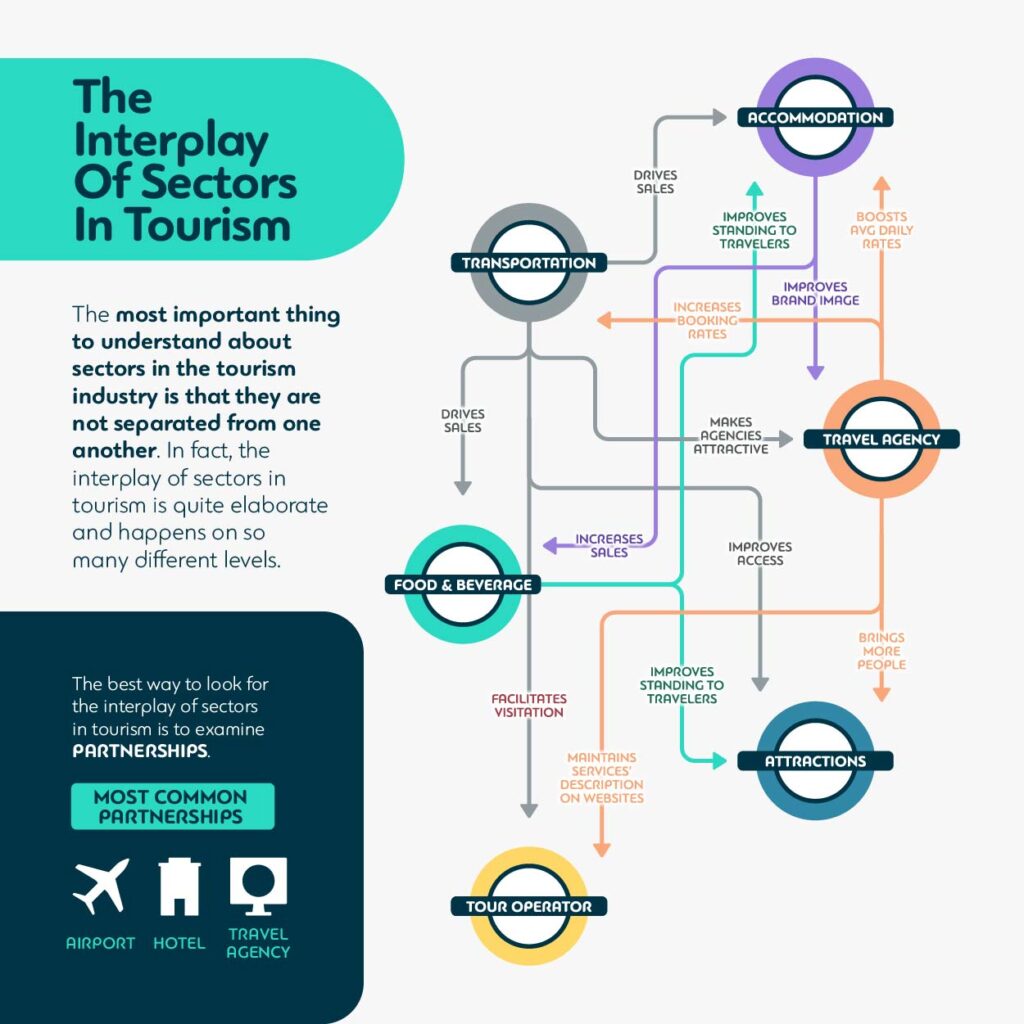

The most important thing to understand about sectors in the tourism industry is that they are not separated from one another. In fact, the interplay of sectors in tourism is quite elaborate and happens on so many different levels.

Let’s start with transportation. The affordable, dependable, and reliable means of transportation can facilitate visitation. Transportation is also responsible for the tourist experience. It can improve access to tourism attractions, make tourism agencies more attractive, and drive sales in the accommodation and food and beverage sectors.

Accommodation in tourism often interplays with travel agencies. It can help improve the brand image of a travel agency by enhancing the stay experience. It can also lead to increased food and beverage sales if the hotel or a resort has its own facilities, such as a restaurant or bar. In return, the food and beverage sector can improve the standing of accommodations and destinations in the eyes of travelers.

Travel agencies interplay with all of the sectors. The services they offer have to live up to the descriptions found on the websites. They can help boost the average daily rates for accommodation providers, increase booking rates at transportation companies, and bring more people to attractions.

The best way to look for the interplay of sectors in tourism is to closely examine partnerships. The transportation, accommodation, and other various travel brands have recognized the value of the interplay and decided to partner up to reap even more benefits.

The most common are partnerships between airlines, hotels, and travel agencies. It enables airlines to remain competitive while helping hotels and travel agencies maintain high customer satisfaction and enhanced travel experience.

The real-world example that comes to mind is Wilderness Safaris’ partnership with Qatar Airways . The big hospitality brand wanted its guests to arrive well-fed & rested, ready to engage in adventures in the great outdoors. Given that Qatar Airways received high marks in the catering and business class areas, it was the perfect pick for Wilderness Safaris.

Another real-world example is AEGAN’s partnership with Booking.com. Here, we have a transportation company and OTA joining forces together to reap unique benefits. AEGAN, an airline brand, wanted its customers to be able to conveniently check hotel availability in real-time, book accommodation at competitive prices, and benefit from friendly cancellation policies.

To encourage travelers to choose AEGAN services through Booking.com, the company also launched the Frequent Flyer Program and awarded consumers extra miles with every hotel booking using AEGAN transportation services.

As one of the largest industries, the tourism vertical contributes 10% of all jobs or 333 million . All sectors contribute to job creation and the global tourism market size of $2.4 trillion .

Accommodation and food and beverage sectors have a significant impact on the tourism industry as well. In terms of GDP, these sectors contributed 3.3% , a significant growth, given that the US average is 2.87% .

In raw numbers, it looks like the following. Global accommodation in tourism generates $903 billion . Almost half of it, 49%, comes from the USA sector. Europe, APAC, Middle East, and Africa contribute with their shares of 25%, 22%, 3%, and 2%, respectively. The global hotel and resort industry currently employs approximately 10.5 million people .

The global travel agency services industry’s revenue has reached $475 in 2023 . Travel agencies in the US employ 402,835 people. Over the last 5 years, the number of people working in the travel agency sector went up by 12%. On a global scale, travel agencies employ approximately 2 million people .

While every industry and sub-sector is unique, they all share a few things in common. In each one of them, you can find a couple of opportunities and encounter a few challenges. Let’s see what challenges and opportunities there are in each sector.

Transportation in tourism

Challenges:

- Ever-increasing prices of fuel – to remain profitable, airlines need to manage operational costs, and one of the enormous costs is fuel;

- Becoming green – transportation companies need to reduce carbon emissions and adopt sustainable travel practices, which can be challenging and costly;

- Infrastructure in remote destinations – building roads and developing infrastructure can be pretty challenging in remote destinations with tremendous tourism potential.

Opportunities:

- Using technological advancements – transportation technologies can help improve customer experience and improve operational efficiencies;

- Implementing sustainable practices – becoming eco-friendly can help brands attract environmentally conscious travelers;

- Improving connectivity – with connectivity expansion, transportation brands can help local economies and create new tourism opportunities.

Accommodation in tourism

- Online offer – as more and more competitors join online marketplaces, accommodation providers need to embrace a new paradigm;

- Overtourism – limited accommodation capacity is a massive problem in destinations where over-tourism is a norm;

- Guest safety and security – in some situations and locations, accommodation providers can struggle with ensuring guest safety and security.

- Going digital – embracing cutting-edge technologies can help enhance guest experience and ensure longer and repeat stays;

- Personalized accommodation – offering boutique and experiential lodging can help accommodation providers cater to modern travelers;

- Partnerships – aligning with relevant companies and local brands can help providers attract more travelers.

Food and beverage in tourism

- Quality and safety of food – upholding the highest food quality and safety standards can be challenging;

- Fluctuating demand – seasonal destinations can struggle with handling fluctuating food and beverage demand;

- Shifting dietary preferences – guests may have diverse dietary preferences, which require planning and management.

- Innovation – innovative dishes and fusion cuisines can attract guests who feel more adventurous;

- Farm-to-table – cooperating with local farmers can help bring fresh ingredients to restaurants;

- Focus on local cuisine – bringing local dishes into the spotlight can help attract people interested in authentic cuisine.

Travel agencies

- Harsh competition – travel agencies have to compete against hundreds of online travel booking platforms;

- Tailored services – many travelers look for personalized experiences, which can prove hard to provide if you are a small agency;

- Agility is required – getting ready for a wide range of disruptions is costly and hard to sustain at scale.

- Customization – offering unique packages can help generate more bookings;

- Multi-channel presence – being present across online and offline channels is paramount;

- Focus on a niche market – staying focused on a specific travel niche can help you truly cater to the needs of your target customers.

Tourism attractions

- Preservation – sustainable management of tourism attractions can be challenging;

- Seasonality – if traction generates the majority of the revenue through seasonal visitors, it can be a problem;

- Infrastructure demand – a growing number of visitors can cause infrastructure strain.

- Collaboration – partnerships can help create a better ecosystem;

- Interpretive guides and interactive displays – interpretive experiences can delight a wide range of visitors;

- Expanding offer – You can offer new activities to make the offer more attractive.

As you can see, the tourism industry landscape is quite comprehensive, with a lot of moving pieces on the board, and the best way to understand the vertical is to take a look at its subsectors.

Hopefully, now you understand transportation, accommodation, food and beverage, travel agencies, and tourism attraction sectors better. They are all intertwined, with many interplay activities. While the tourism sector comes with its fair share of challenges, there are also many opportunities. The current stats and projections tell us that all subsectors are prosperous and expected to grow in the foreseeable future.

Subscribe to our newsletter

Yay you are now subscribed to our newsletter.

Marc Truyols has a degree in Tourism from the University of the Balearic Islands. Marc has extensive experience in the leisure, travel and tourism industry. His skills in negotiation, hotel management, customer service, sales and hotel management make him a strong business development professional in the travel industry.

Mize is the leading hotel booking optimization solution in the world. With over 170 partners using our fintech products, Mize creates new extra profit for the hotel booking industry using its fully automated proprietary technology and has generated hundreds of millions of dollars in revenue across its suite of products for its partners. Mize was founded in 2016 with its headquarters in Tel Aviv and offices worldwide.

Related Posts

Unveiling the 13 Hottest Travel Trends of 2024

13 min. No one knows better than you how dynamic the realm of travel is. Dynamic shifts brought by technological strides, ever-changing traveler priorities, and global events are the new normal in 2024. How do you navigate this landscape that keeps transforming? You should familiarize yourself with the very travel trends that shape the world […]

30 Most Important Travel Industry Events for 2024

30 min. Many travel industry experts believe that travel industry events play a pivotal role in shaping the future of the travel industry. Why is this so? It’s because these events foster collaboration, networking, and innovation among key stakeholders in this vertical. As a platform for sharing best practices, trends, and insights, travel industry events […]

Empowering Equality: Mize Leads the Way in Travel Technology

7 min. Are we all equal? Are we all equally represented in the business world? In some professional sectors, there might still be some under-representation of women, minorities, and the LGBTQIA+ community. The tech sphere is no different, but is the travel tech sector a spark of hope? As the business world becomes more diverse, […]

The future of tourism: Bridging the labor gap, enhancing customer experience

As travel resumes and builds momentum, it’s becoming clear that tourism is resilient—there is an enduring desire to travel. Against all odds, international tourism rebounded in 2022: visitor numbers to Europe and the Middle East climbed to around 80 percent of 2019 levels, and the Americas recovered about 65 percent of prepandemic visitors 1 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. —a number made more significant because it was reached without travelers from China, which had the world’s largest outbound travel market before the pandemic. 2 “ Outlook for China tourism 2023: Light at the end of the tunnel ,” McKinsey, May 9, 2023.

Recovery and growth are likely to continue. According to estimates from the World Tourism Organization (UNWTO) for 2023, international tourist arrivals could reach 80 to 95 percent of prepandemic levels depending on the extent of the economic slowdown, travel recovery in Asia–Pacific, and geopolitical tensions, among other factors. 3 “Tourism set to return to pre-pandemic levels in some regions in 2023,” United Nations World Tourism Organization (UNWTO), January 17, 2023. Similarly, the World Travel & Tourism Council (WTTC) forecasts that by the end of 2023, nearly half of the 185 countries in which the organization conducts research will have either recovered to prepandemic levels or be within 95 percent of full recovery. 4 “Global travel and tourism catapults into 2023 says WTTC,” World Travel & Tourism Council (WTTC), April 26, 2023.

Longer-term forecasts also point to optimism for the decade ahead. Travel and tourism GDP is predicted to grow, on average, at 5.8 percent a year between 2022 and 2032, outpacing the growth of the overall economy at an expected 2.7 percent a year. 5 Travel & Tourism economic impact 2022 , WTTC, August 2022.

So, is it all systems go for travel and tourism? Not really. The industry continues to face a prolonged and widespread labor shortage. After losing 62 million travel and tourism jobs in 2020, labor supply and demand remain out of balance. 6 “WTTC research reveals Travel & Tourism’s slow recovery is hitting jobs and growth worldwide,” World Travel & Tourism Council, October 6, 2021. Today, in the European Union, 11 percent of tourism jobs are likely to go unfilled; in the United States, that figure is 7 percent. 7 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022.

There has been an exodus of tourism staff, particularly from customer-facing roles, to other sectors, and there is no sign that the industry will be able to bring all these people back. 8 Travel & Tourism economic impact 2022 : Staff shortages, WTTC, August 2022. Hotels, restaurants, cruises, airports, and airlines face staff shortages that can translate into operational, reputational, and financial difficulties. If unaddressed, these shortages may constrain the industry’s growth trajectory.

The current labor shortage may have its roots in factors related to the nature of work in the industry. Chronic workplace challenges, coupled with the effects of COVID-19, have culminated in an industry struggling to rebuild its workforce. Generally, tourism-related jobs are largely informal, partly due to high seasonality and weak regulation. And conditions such as excessively long working hours, low wages, a high turnover rate, and a lack of social protection tend to be most pronounced in an informal economy. Additionally, shift work, night work, and temporary or part-time employment are common in tourism.

The industry may need to revisit some fundamentals to build a far more sustainable future: either make the industry more attractive to talent (and put conditions in place to retain staff for longer periods) or improve products, services, and processes so that they complement existing staffing needs or solve existing pain points.

One solution could be to build a workforce with the mix of digital and interpersonal skills needed to keep up with travelers’ fast-changing requirements. The industry could make the most of available technology to provide customers with a digitally enhanced experience, resolve staff shortages, and improve working conditions.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

Complementing concierges with chatbots.

The pace of technological change has redefined customer expectations. Technology-driven services are often at customers’ fingertips, with no queues or waiting times. By contrast, the airport and airline disruption widely reported in the press over the summer of 2022 points to customers not receiving this same level of digital innovation when traveling.

Imagine the following travel experience: it’s 2035 and you start your long-awaited honeymoon to a tropical island. A virtual tour operator and a destination travel specialist booked your trip for you; you connected via videoconference to make your plans. Your itinerary was chosen with the support of generative AI , which analyzed your preferences, recommended personalized travel packages, and made real-time adjustments based on your feedback.

Before leaving home, you check in online and QR code your luggage. You travel to the airport by self-driving cab. After dropping off your luggage at the self-service counter, you pass through security and the biometric check. You access the premier lounge with the QR code on the airline’s loyalty card and help yourself to a glass of wine and a sandwich. After your flight, a prebooked, self-driving cab takes you to the resort. No need to check in—that was completed online ahead of time (including picking your room and making sure that the hotel’s virtual concierge arranged for red roses and a bottle of champagne to be delivered).

While your luggage is brought to the room by a baggage robot, your personal digital concierge presents the honeymoon itinerary with all the requested bookings. For the romantic dinner on the first night, you order your food via the restaurant app on the table and settle the bill likewise. So far, you’ve had very little human interaction. But at dinner, the sommelier chats with you in person about the wine. The next day, your sightseeing is made easier by the hotel app and digital guide—and you don’t get lost! With the aid of holographic technology, the virtual tour guide brings historical figures to life and takes your sightseeing experience to a whole new level. Then, as arranged, a local citizen meets you and takes you to their home to enjoy a local family dinner. The trip is seamless, there are no holdups or snags.

This scenario features less human interaction than a traditional trip—but it flows smoothly due to the underlying technology. The human interactions that do take place are authentic, meaningful, and add a special touch to the experience. This may be a far-fetched example, but the essence of the scenario is clear: use technology to ease typical travel pain points such as queues, misunderstandings, or misinformation, and elevate the quality of human interaction.

Travel with less human interaction may be considered a disruptive idea, as many travelers rely on and enjoy the human connection, the “service with a smile.” This will always be the case, but perhaps the time is right to think about bringing a digital experience into the mix. The industry may not need to depend exclusively on human beings to serve its customers. Perhaps the future of travel is physical, but digitally enhanced (and with a smile!).

Digital solutions are on the rise and can help bridge the labor gap

Digital innovation is improving customer experience across multiple industries. Car-sharing apps have overcome service-counter waiting times and endless paperwork that travelers traditionally had to cope with when renting a car. The same applies to time-consuming hotel check-in, check-out, and payment processes that can annoy weary customers. These pain points can be removed. For instance, in China, the Huazhu Hotels Group installed self-check-in kiosks that enable guests to check in or out in under 30 seconds. 9 “Huazhu Group targets lifestyle market opportunities,” ChinaTravelNews, May 27, 2021.

Technology meets hospitality

In 2019, Alibaba opened its FlyZoo Hotel in Huangzhou, described as a “290-room ultra-modern boutique, where technology meets hospitality.” 1 “Chinese e-commerce giant Alibaba has a hotel run almost entirely by robots that can serve food and fetch toiletries—take a look inside,” Business Insider, October 21, 2019; “FlyZoo Hotel: The hotel of the future or just more technology hype?,” Hotel Technology News, March 2019. The hotel was the first of its kind that instead of relying on traditional check-in and key card processes, allowed guests to manage reservations and make payments entirely from a mobile app, to check-in using self-service kiosks, and enter their rooms using facial-recognition technology.

The hotel is run almost entirely by robots that serve food and fetch toiletries and other sundries as needed. Each guest room has a voice-activated smart assistant to help guests with a variety of tasks, from adjusting the temperature, lights, curtains, and the TV to playing music and answering simple questions about the hotel and surroundings.

The hotel was developed by the company’s online travel platform, Fliggy, in tandem with Alibaba’s AI Labs and Alibaba Cloud technology with the goal of “leveraging cutting-edge tech to help transform the hospitality industry, one that keeps the sector current with the digital era we’re living in,” according to the company.

Adoption of some digitally enhanced services was accelerated during the pandemic in the quest for safer, contactless solutions. During the Winter Olympics in Beijing, a restaurant designed to keep physical contact to a minimum used a track system on the ceiling to deliver meals directly from the kitchen to the table. 10 “This Beijing Winter Games restaurant uses ceiling-based tracks,” Trendhunter, January 26, 2022. Customers around the world have become familiar with restaurants using apps to display menus, take orders, and accept payment, as well as hotels using robots to deliver luggage and room service (see sidebar “Technology meets hospitality”). Similarly, theme parks, cinemas, stadiums, and concert halls are deploying digital solutions such as facial recognition to optimize entrance control. Shanghai Disneyland, for example, offers annual pass holders the option to choose facial recognition to facilitate park entry. 11 “Facial recognition park entry,” Shanghai Disney Resort website.

Automation and digitization can also free up staff from attending to repetitive functions that could be handled more efficiently via an app and instead reserve the human touch for roles where staff can add the most value. For instance, technology can help customer-facing staff to provide a more personalized service. By accessing data analytics, frontline staff can have guests’ details and preferences at their fingertips. A trainee can become an experienced concierge in a short time, with the help of technology.

Apps and in-room tech: Unused market potential

According to Skift Research calculations, total revenue generated by guest apps and in-room technology in 2019 was approximately $293 million, including proprietary apps by hotel brands as well as third-party vendors. 1 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. The relatively low market penetration rate of this kind of tech points to around $2.4 billion in untapped revenue potential (exhibit).

Even though guest-facing technology is available—the kind that can facilitate contactless interactions and offer travelers convenience and personalized service—the industry is only beginning to explore its potential. A report by Skift Research shows that the hotel industry, in particular, has not tapped into tech’s potential. Only 11 percent of hotels and 25 percent of hotel rooms worldwide are supported by a hotel app or use in-room technology, and only 3 percent of hotels offer keyless entry. 12 “Hotel tech benchmark: Guest-facing technology 2022,” Skift Research, November 2022. Of the five types of technology examined (guest apps and in-room tech; virtual concierge; guest messaging and chatbots; digital check-in and kiosks; and keyless entry), all have relatively low market-penetration rates (see sidebar “Apps and in-room tech: Unused market potential”).

While apps, digitization, and new technology may be the answer to offering better customer experience, there is also the possibility that tourism may face competition from technological advances, particularly virtual experiences. Museums, attractions, and historical sites can be made interactive and, in some cases, more lifelike, through AR/VR technology that can enhance the physical travel experience by reconstructing historical places or events.

Up until now, tourism, arguably, was one of a few sectors that could not easily be replaced by tech. It was not possible to replicate the physical experience of traveling to another place. With the emerging metaverse , this might change. Travelers could potentially enjoy an event or experience from their sofa without any logistical snags, and without the commitment to traveling to another country for any length of time. For example, Google offers virtual tours of the Pyramids of Meroë in Sudan via an immersive online experience available in a range of languages. 13 Mariam Khaled Dabboussi, “Step into the Meroë pyramids with Google,” Google, May 17, 2022. And a crypto banking group, The BCB Group, has created a metaverse city that includes representations of some of the most visited destinations in the world, such as the Great Wall of China and the Statue of Liberty. According to BCB, the total cost of flights, transfers, and entry for all these landmarks would come to $7,600—while a virtual trip would cost just over $2. 14 “What impact can the Metaverse have on the travel industry?,” Middle East Economy, July 29, 2022.

The metaverse holds potential for business travel, too—the meeting, incentives, conferences, and exhibitions (MICE) sector in particular. Participants could take part in activities in the same immersive space while connecting from anywhere, dramatically reducing travel, venue, catering, and other costs. 15 “ Tourism in the metaverse: Can travel go virtual? ,” McKinsey, May 4, 2023.

The allure and convenience of such digital experiences make offering seamless, customer-centric travel and tourism in the real world all the more pressing.

Three innovations to solve hotel staffing shortages

Is the future contactless.

Given the advances in technology, and the many digital innovations and applications that already exist, there is potential for businesses across the travel and tourism spectrum to cope with labor shortages while improving customer experience. Process automation and digitization can also add to process efficiency. Taken together, a combination of outsourcing, remote work, and digital solutions can help to retain existing staff and reduce dependency on roles that employers are struggling to fill (exhibit).

Depending on the customer service approach and direct contact need, we estimate that the travel and tourism industry would be able to cope with a structural labor shortage of around 10 to 15 percent in the long run by operating more flexibly and increasing digital and automated efficiency—while offering the remaining staff an improved total work package.

Outsourcing and remote work could also help resolve the labor shortage