You are using an outdated browser. Please upgrade your browser to improve your experience.

Personal Accounts

Business Accounts

Online Services

Help & Support

Personal Cards

Businesses Cards

Featured Personal and Business Cards

Discover More

Online Travel

Business Travel

Other Travel Services

Credit Card

Membership Rewards® Program

Other Reward Programs

Benefits and Offers

Refer a Friend

Corporations

Small Business

Global Network

It appears that JavaScript is either disabled or not supported by your web browser. JavaScript must be enabled to experience the American Express website and to log in to your account.

Welcome to the Help Centre

Learn more about travel benefits and using your Card abroad.

Browse all topics

Travel benefits

Using your card abroad

- Skip to main content

- Skip to site information

Language selection

Help us to improve our website. Take our survey !

Travelling and money

Take steps that will help you avoid financial problems that may ruin your trip. Make sure you purchase travel insurance , and most importantly make sure you always carry a backup source of funds in case of emergency or an unexpected delay.

On this page

Cards (credit, debit and pre-paid).

- Traveller’s cheques

Travelling with $10,000 or more

Check with the embassy or consulate in Canada of the country you are planning to visit to make sure you are allowed to import or export its currency. If you are permitted to import its currency, bring enough cash to get by for a couple of days and keep it in a money belt or in several different pockets in case your wallet is lost or stolen or your financial institution accidently freezes your cards. When you arrive at your destination, you can withdraw more cash from an ATM.

Exchanging your money

The currency exchange rate tells you how much your Canadian money is worth in the local currency. When you exchange your money, you are actually using it to buy or sell foreign currency at a specific price called the exchange rate. You can find the official exchange rate of the currency in the country you will be visiting by using the Bank of Canada’s online currency converter .

It pays to know your options when dealing with foreign exchange rates. There are a number of ways to manage your finances when you are abroad that will save you a lot of money in exchange fees.

If you want cash on hand before you leave Canada, you can buy foreign currency from your financial institution over the phone or online. It can be delivered to your local branch for pick up. Exchange rates at banks are slightly better than elsewhere. You can also order currency before you leave on your trip from a number of websites that will ship it to your home within a couple of days.

Exchange desks

If you need cash in an emergency, there are foreign exchange desks at airports and hotels that will exchange Canadian money for the local currency. Fees tend to be very high. Even those advertising no commissions may have hidden fees, making these desks the most expensive places to change money.

Black market

The currency black market forms part of the underground economy in a number of countries. In a currency black market, transactions are almost always in cash, since its participants don’t want to leave any evidence.

This illegal or parallel market in foreign exchange operates outside legal banking channels. If you are tempted to take advantage of the currency black market you should be aware that you will be breaking the country’s laws and could be arrested and imprisoned . You are subject to the country’s criminal justice system. Consular officials will not arrange your release from prison.

Be aware of anyone approaching you on the street offering to exchange your money for a much better rate than a bank. Typical money exchange scams include stealing your money in the process of counting and recounting a pile of bills or mixing your money with currency from another country with a much lower exchange rate. It is safer to go through an authorized agency or a bank.

Credit cards

Use a major international credit card for your big purchases, such as your airplane tickets, hotel bills and restaurant tabs. If you reserve your hotel and rental car on your credit card, the reservation should be guaranteed even if you arrive late.

Use the credit card instead of cash wherever possible. Credit card issuers typically charge fees for international transactions and you may get the best exchange rate and fees lower than those associated with exchanging cash. However, you should not use your credit card to withdraw money from an ATM, because the fees and interest charges are usually very high.

Before you leave:

- Know the expiry dates, account balance and amount of credit available to you on all of your credit cards. Make sure you have enough money in your accounts to cover your trip expenses, plus extra in case of emergency.

- Make sure your credit card company and financial institution have your up-to-date contact details, including a cellphone number, and information on where and when you will be travelling so that your account isn’t flagged for unusual activity.

- Check with your financial institution before you leave on your trip. Not all major credit cards are accepted everywhere. Merchants in some destinations prefer to be paid in cash because they must pay a fee to the credit card company. There may be a risk that your credit card will be cloned at some destinations, particularly in restaurants.

Debit cards

Always use bank-affiliated ATMs when you are outside Canada. Check if your financial institution has international branches or partners in your destination country where you can use your debit card fee-free. Using your debit card to withdraw money from ATMs will cost you extra in fees, but you can minimize them by withdrawing larger amounts less often.

You should carry some cash to cover daily expenses. Your debit card may not work in every ATM machine or be accepted at stores or restaurants in your destination country. If you are travelling to a rural area, you may not be able to find an ATM that is part of your financial institution’s network, so withdraw enough cash to manage until you are back in a city.

Due to the potential for fraud and other criminal activity, you should use your credit cards and debit cards with caution. Use ATMs during business hours inside a bank, supermarket, or large commercial building.

Pre-paid cards

Some financial institutions offer pre-paid travel cards in foreign currencies. They may have higher fees than credit and debit cards, so check the terms and conditions and costs before you decide to travel with one. You can usually replace a pre-paid travel card as you would a lost or stolen travellers’ cheque.

Be aware that pre-paid cards may not be accepted at some hotels and car rental companies, and may be difficult to use at the ATM machines of foreign banks.

Dynamic Currency Conversion

Some shops, restaurants and ATMs give the option of using the currency of the country you are in or having the transaction converted into Canadian currency. Always choose to be charged in the currency of the country you are in. You will pay high conversion rates and transaction fees if they convert to Canadian currency.

Save your receipts

As you travel, save all ATM and transaction receipts in an envelope. Bring them home in your carry-on bag. Save your airline boarding pass to prove your return date. If you need to dispute a transaction, sending a copy of your receipt will speed up the resolution process.

After you return home, carefully examine your credit and debit card statements and continue to do so for several months. Identity theft and credit card fraud are not confined to Canada. If you notice any unusual charges on your statement, inform your financial institution immediately and request a copy of the receipt.

Travellers’ cheques

Canadian travellers’ cheques are not widely accepted worldwide, but are an option if you don’t want to use credit or debit cards or carry large amounts of cash.

When possible, order the cheques in the local currency and carry multiple cheques in small denominations. If you can’t order cheques in the currency of your destination country, order them in U.S. funds, which are widely accepted. Sign them as soon as you get them and keep the receipt in a separate location. If they are stolen they can be replaced anywhere in the world, usually within 24 hours.

Keep a record of your travellers’ cheque numbers, credit card account numbers and expiry dates and the telephone numbers for reporting lost or stolen cards in a safe place. If possible, leave a copy of the list with a family member or friend at home who can help you make telephone calls quickly if your cards are lost or stolen.

Any time you enter or leave Canada, you must declare any money or monetary instruments, such as stocks, bond or cheques, you are carrying valued at $10,000 or more.

Canadians who live or work abroad or who travel a lot may still have to pay Canadian and provincial or territorial income taxes.

If you are planning to be outside Canada for an extended period of time, you should inform the Canada Revenue Agency (CRA) before you go to ask for a determination of your residency status. Your residency status depends on whether you are leaving Canada permanently or only temporarily and the residential ties you keep with Canada and establish in another country:

You are leaving Canada permanently

You are leaving Canada temporarily

Visit International and non-resident taxes for information about income tax requirements that may affect you.

Departure tax

In some countries you must pay a departure tax or service fee at the airport or point of departure. Make sure you set aside enough money in local funds to pay it.

- Travel Advice and Advisories

- Financial assistance

- Overseas fraud: An increasing threat to the safety of Canadians

- Proceeds of Crime (Money Laundering) and Terrorist Financing Act

American Express Travelers Cheques Review: Is it safe? How does it work? What are the rates?

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Traveling or spending money overseas? Discover American Express Travelers Cheques for a safe and secure way to get currency to spend abroad. You'll learn how to save money and how to get the best rate for your next holidays abroad.

American Express Travelers Cheques - All you need to know

American Express (AMEX) Travelers Cheques were first issued more than a hundred years ago, in 1891. Although the traditional travelers cheque has been overtaken by more modern currency exchange options, they’re still used by some as a safe and secure way to spend money overseas. We’ll explore how American Express Travelers Cheques work, what they offer, the fees you’ll need to pay and various other aspects of their services.

*We’re using the same spelling for travelers cheques as AMEX uses on their website, which means no apostrophe and “cheque” instead of “check” — just so you know.

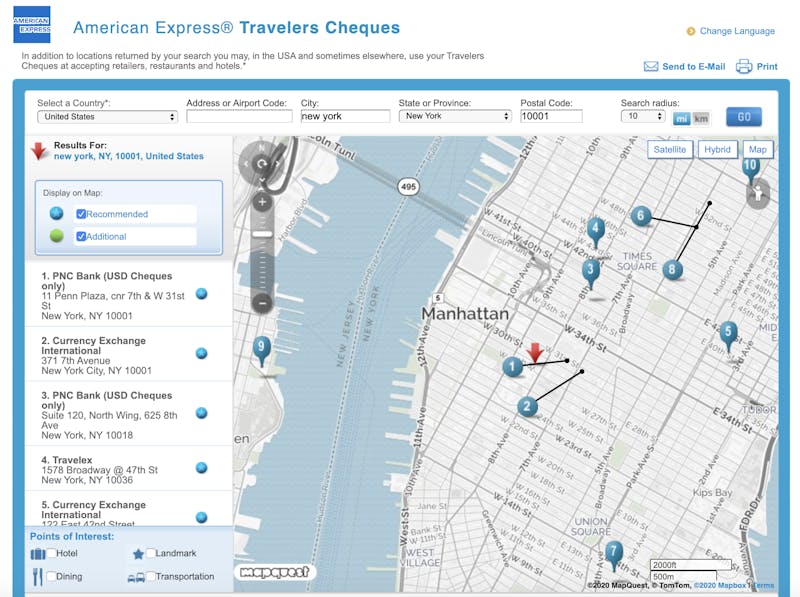

Where to buy AMEX Travelers Cheques

Travelers cheques are available from AMEX service centers, some AAA locations, certain banks and some currency exchange shops. Options to buy travelers cheques outside of major cities like New York, London, Toronto or other big metropolitan areas are limited. Places you may be able to purchase travelers cheques in the US include PNC bank branches and Travelex.

You should contact the location before you visit to check fees, limits, payment methods, restrictions, exchange rates and availability. AMEX recommends you keep your original purchase receipt as proof of purchase.

Where to redeem AMEX Travelers Checks

You can redeem, or “cash” your travelers cheques at thousands of locations around the world. Several currency exchange services, bureaux de change and banks will accept and redeem travelers cheques. Some merchants may even accept travelers cheques directly as payment for goods and services. If you want to make payment, redeem or cash in your travelers cheques, confirm this with the relevant business ahead of time.

When you redeem your travelers cheques, the person you are redeeming them with will need to watch you countersign the cheques, and you may need to present photographic ID and have your original purchase receipt.

In some circumstances, AMEX will allow you to redeem travelers cheques directly with them. They say, “Redemption of your Travelers Cheques directly with American Express may take longer than 30 days, depending on the circumstances of the request. There may be restrictions on the currency and method of redemption and the value of Travelers Cheques that can be directly redeemed.”

Travelers cheques do not expire, so you can either choose to redeem unused ones, or save them for future trips.

Safety and security of AMEX Travelers Cheques

If you’ve purchased travelers cheques, and they’re lost or stolen, AMEX will refund the cheques to you. Travelers cheques are not linked to your bank account either, which means you’re less likely to suffer from identity theft if the cheques are stolen from you.

What Monito Likes About AMEX Travelers Cheques

- A safe and secure way to get currency to spend abroad

- Backed by American Express, a trusted brand and financial services provider

- Refunds available if travelers cheques are lost or stolen

What Monito Dislikes About AMEX Travelers Cheques

- Can be difficult to find locations to buy travelers cheques

- Can be difficult to find locations to redeem or cash in travelers cheques

- Not as widely accepted as they once were

- High commission fees and poor exchange rates can make travelers cheques expensive to use

Alternatives to American Express Travelers Cheques

- Trust & Credibility 10

- Service & Quality 8.7

- Fees & Exchange Rates 9.6

- Customer Satisfaction 9.5

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

How American Express Travelers Cheques works

1. Buy your travelers cheques from certain banks, currency exchange services and various other locations

2. Travelers cheques are available in a variety of denominations, depending on the currency

3. When you buy the travelers cheques, you will normally need to present your ID and sign the travelers cheques in the top left-hand corner

4. Write down the serial numbers of your travelers cheques as you may need these if they are lost or stolen

5. Once you have purchased your travelers cheques, you can travel to a foreign country and redeem them when you need to

6. Take your travelers cheques to a location that will cash them, sign in the bottom left-hand corner and present your identification

7. The place where you are exchanging your travelers cheques will provide local currency at their prevailing exchange rate

8. You can then spend the local currency as normal

AMEX Travelers Cheques fees & exchange rate

The fees and exchange rates for using travelers cheques can vary widely.

American Express Travelers Cheques fees

AMEX, banks and other issuers may charge a fee when issuing travelers cheques in the first place. This fee is typically between one and three percent of the total value of travelers cheques that you’re buying. AMEX will waive this fee if you’re an American Express cardholder.

Some currency exchange services, banks and other merchants may also charge a commission when you buy or redeem your cheques. You should contact them ahead of time to check what those fees are likely to be.

American Express Travelers Cheques exchange rates

The amount of foreign currency that you receive when redeeming travelers cheques depends on the exchange rates offered by the currency exchange service you’re using. Local bureaux de change and currency exchange services typically have fairly poor exchange rates, so you’ll end up paying more in hidden exchange rate fees.

For example, as we explain in our guide to exchanging currency in London , “this bureau de change is around 2.8 percent more expensive than the base exchange rate for exchanging between dollars and pounds. The base exchange rate was £0.81 for every dollar, but this currency exchange offers £0.79 for each dollar.”

Customer support

If your amex travelers cheques are lost or stolen.

You should safeguard your cheques as you would cash, but if they are lost or stolen, here’s what you need to do:

- Identify the serial numbers of any cheques that have been lost or stolen

- Call American Express as soon as possible to report the missing or stolen cheques and make a claim

- You will need to provide identification and proof of purchase

- AMEX will review your claim, and issue a refund if the claim is valid

When to consider using AMEX Travelers Cheques

Although they’re no longer widely issued or accepted, it does make sense to use travelers cheques in some circumstances:

- If you don’t have a credit or debit card, travelers cheques can be a good alternative

- If you’re concerned about money being lost or stolen, travelers cheques can provide extra security and are not linked to your bank accounts

- If you want to avoid foreign transactions fees (typically up to three percent) when you spend on your credit or debit card overseas, although commission or exchange rate fees on cheques may make this irrelevant

When to think about options besides American Express Travelers Cheques

One of the reasons for the decline of travelers cheques is that you have many more options when it comes to spending money abroad:

- You can use a prepaid travel money card that you top up with currency before you travel and use like a regular debit card

- You can use a credit or debit card that doesn’t charge a foreign transaction fee, like the TransferWise Borderless Account card

- You can compare all your different options for travel money, including fees and exchange rates, with our easy-to-use tool

You might also like these AMEX alternatives

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My watchlist

- Stock market

- Biden economy

- Personal finance

- Stocks: most active

- Stocks: gainers

- Stocks: losers

- Trending tickers

- World indices

- US Treasury bonds

- Top mutual funds

- Highest open interest

- Highest implied volatility

- Currency converter

- Basic materials

- Communication services

- Consumer cyclical

- Consumer defensive

- Financial services

- Industrials

- Real estate

- Mutual funds

- Credit cards

- Credit card rates

- Balance transfer credit cards

- Business credit cards

- Cash back credit cards

- Rewards credit cards

- Travel credit cards

- Checking accounts

- Online checking accounts

- High-yield savings accounts

- Money market accounts

- Personal loans

- Student loans

- Car insurance

- Home buying

- Options pit

- Investment ideas

- Research reports

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

An earthquake with a preliminary 4.8 magnitude rattles the Northeastern U.S., USGS says

Are traveler's checks obsolete here's what to use instead.

Traveler's checks were once a really popular and useful tool when going abroad—but with the widespread use of credit cards and debit cards, they are no longer as common. A traveler's check is verified by a bank and is used when traveling internationally to exchange for local currency.

"You might pay American Express $100 for a travelers check, and that check is worth $100 based on the amount you've given Amex," says Alex Miller, founder and CEO of travel site UpgradedPoints . "You then go to another country to cash that check and are given $100 in equivalent local currency."

RgStudio/Getty Images

People used traveler's checks as a way to keep money safe from fraud and theft while traveling, as they could be replaced. "Each check has a unique number, so it can be traced easily," says Phil Dengler, co-owner of The Vacationer , a resource for travel and credit card guides. Also, you have to sign the traveler's check when you buy it and when you go to redeem it to prevent fraud—if the signatures match, you get your money.

While most major banks no longer offer them, you can buy traveler's checks through American Express, VISA, and AAA—however, you could have a tough time finding hotels, banks, and stores that still accept them while traveling. Here are some of the modern alternatives to traveler's checks that are available today that will make your life easier and keep your money safe.

What to Use Instead of Traveler's Checks

Traveler's checks can be useful to avoid foreign transaction fees or if you don't have a credit card—but you run the risk of going somewhere that traveler's checks are not widely accepted. There are ways around foreign transaction fees and safe alternatives to traveler's checks so you don't have to carry a bunch of cash with you.

Credit card

Credit cards are a great option for keeping your money safe while traveling. "While credit cards can be lost or stolen, they offer fraud protection absolving you of any unauthorized charges," says Dengler. He recommends getting a credit card that does not charge foreign transaction fees, and sticking to VISA or Mastercard (as opposed to Discover or Amex) as they are more widely accepted.

While it is less than ideal, if you lose your credit card or it gets stolen, "banks and credit card companies have global call centers which can quickly deactivate and replace your cards in short order," says Warren Jaferian , dean of the Office of International Education at Endicott College.

Get a debit card that doesn't charge an ATM fee. ATMs are widely available and you can directly withdraw money in local currency—Miller recommends the Charles Schwab Bank card.

However, the safety of using a debit card internationally can be questionable, with experts advising extra caution when traveling to prevent fraud. Jaferian suggests using an ATM inside a bank to avoid skimmers or other devices that can be used to get your card number.

However, your PIN does provide an added layer of protection against fraud—"The modern institution of the Debit Card + PIN is just as, if not more secure, than the traveler's check," says business attorney Ryan Reiffert .

Bottom line: You don't really need them.

For the most part, traveler's checks seem to be a thing of the past. "Personally, I stopped buying travelers checks in the 1990s as secure alternatives became ubiquitous," says Warren.

While they provide safety and can help you avoid high transaction fees, it might be difficult to find places that accept them. If you're able to get a credit card or debit card with no fees, that's your best bet. "Traveler's checks are not as useful as they once were," says Dengler. "They are safer than carrying cash, however." Research your destination to see if traveler's checks are accepted there—if your bank or card charges high international fees, or you don't have a credit card, traveler's checks might still be a worthwhile option to consider.

Recommended Stories

Bronny james declares for nba draft, enters transfer portal after 1 season at usc.

LeBron James' eldest son averaged 4.8 points per game after missing the start of his freshman season due to cardiac arrest.

Warriors take Rockets' Tari Eason to task for wearing taunting T-shirt on bench

The Warriors blew out the Rockets 133-110.

NFL mock draft: Patriots trade out of No. 3 but still get their QB, and what do Bills do after Stefon Diggs trade?

As we turn toward the draft, here's Charles McDonald and Nate Tice's latest lively mock.

What the total solar eclipse could mean for your zodiac sign: An astrologer breaks it down

An astrologist weighs in on the 2024 solar eclipse.

Vontae Davis, former NFL star, found dead in Miami home at age 35

Davis published a children's book about his life in 2019

Dodgers couldn't avoid drama even with Shohei Ohtani's 1st HR ball

The fan who caught Ohtani's first Dodgers home run reportedly isn't happy with how she was treated.

Beyoncé's 'Texas Hold 'Em' took over the country charts. Here's what happens when it comes on in country bars.

It was initially unclear if the song would be accepted as a true “country” tune.

USWNT captain Lindsey Horan and Alex Morgan issue statement after Korbin Albert apologizes for anti-LGBTQ content

Morgan alluded to some "hard conversations" with Albert over the past week.

Rashee Rice apologizes for 'my part' in crash while injured couple reportedly lawyer up

Rice reportedly owned the Corvette and leased the Lamborghini involved in the crash.

A's reach deal to play in Sacramento while waiting for Las Vegas stadium

The A's will head to Las Vegas by way of Sacramento.

Mock Draft Monday with Field Yates: You will be shocked how early Bo Nix goes

'Mock Draft Monday' rolls on ESPN's Field Yates joining Matt Harmon to break down his latest mock draft. Harmon has Yates break down his mock draft methodology and what goes into his decision making when placing certain prospects on certain teams.

Dallas mayor hints at bringing Chiefs to Cowboys territory after stadium vote fails

This obviously isn't happening.

5 hitters surprising early this MLB season, including the Astros' Yainer Diaz and Yankees' Anthony Volpe

If these five hitters can sustain their hot starts, their 2024 breakouts could be difference-makers for their teams.

Biden is getting antsy about rising gas prices

The president isn't saying so, but the administration's behind-the-scenes actions reveal a fear that rising gas prices could doom his reelection effort.

Duke's Cooper Flagg, Rutgers' Ace Bailey lead 8 players who impressed during McDonald's All American practices

Ahead of Tuesday night's McDonald's All American Game, Yahoo Sports breaks down eight players who have already made lasting impressions on NBA scouts.

2024 Chevy Silverado EV RST gets more range — 440 miles — and lower price

GM just revealed some range and pricing details on the production 2024 Chevrolet Silverado EV.

In new surroundings and a very different role, LSU's Hailey Van Lith has gone through a mental evolution

Van Lith is a different player in a different place than a year ago, and now she's in position to win a championship after watching LSU cut down the nets last season.

Police investigation finds audio of racial slur used against Utah women's basketball team

Following the incident, the team moved to a different hotel closer to the host city.

NBA Fact or Fiction: Does Nikola Jokić have any challengers in the MVP race?

How do the top MVP candidates stack up with the Nuggets star. Let's take a case-by-case look.

Brock Purdy nearly doubles his salary due to a bonus from NFL's performance-based pay

Brock Purdy and other young NFL players had a nice payday.

- United States

- United Kingdom

Canadian money travel guide

Learn how to exchange cash or use a credit card in canada while traveling..

In this guide

Travel card, debit card or credit card?

These are your options for spending money in canada, compare travel credit cards, exchange rate history, withdrawing from canadian atms, how much should i budget for my vacation to canada.

Travel money type

Compare more cards

Top picks of 2024

Travelers to Canada will be glad to hear that you can use your cards in the same types of places as you would at home. There’s a similar number of ATMs and banks, and prices for accommodation and food are more or less the same — though it gets more expensive in specific cities, or if you’re going skiing or snowboarding.

A credit card that doesn’t charge foreign transaction fees is ideal to keep those pesky additional expenses away. Here’s a look at all of your purchasing options in Canada.

Our picks for traveling to Canada

50+ currencies supported

- 4.33% APY on USD balances

- $0 signup or subscription fees

- Withdraw $100 per month for free from ATMs worldwide

- Send, spend and withdraw 50+ currencies at the live rate

- Freeze and unfreeze your card instantly

Join to save up to 10% on hotels

- 0.50% APY on checking balance

- Up to 4.60% APY on savings

- $0 account or overdraft fees

- Get a $300 bonus with direct deposits of $5,000 or more

Travel rewards with no annual fee

- 20,000 miles (equal to $200 in travel) after spending $500 in the first 3 months

- Earn unlimited 1.25x miles on all purchases

- Low intro rates on purchases and balance transfers

Don’t stress about using your card to make purchases and to withdraw cash — card acceptance and ATM availability are similar to the US. Canadian merchants accept Visa, Mastercard and American Express credit cards.

Canada uses Interac Direct Payment (IDP) and you can use this system to get cash out over-the-counter if you’re paying with your debit or travel card. Travel cards, debit cards and credit cards are all worth comparing before you head out on your trip.

Even though you can get away with making card payment a lot of the time, there are still instances when you’ll need cash. Take a combination of the travel money products and use the right card for the right situation so you can save on international transaction charges.

Do your research before you leave so you can enjoy your trip to Canada with peace of mind that you’re spending your money smart and not giving it to your bank.

Using a credit card

Credit cards are a good way to make purchases, but it’s recommended you use your debit card when making ATM withdrawals. Cash-advance fees and interest can add up and give you a nasty surprise when you arrive home. You can avoid some unnecessary fees by picking up a credit card that waives foreign transaction fees, like the Capital One VentureOne Rewards Credit Card (Terms apply, see rates & fees ).

Some travel cards also come with additional benefits like rewards, statement credits and travel insurance. These perks can offer great value, so compare travel credit cards to find one that fits your travel needs.

- Complimentary travel and purchase insurance

- Interest-free days on purchases

- Accepted worldwide

- Protected by PIN and chip

- Emergency card replacement

- Benefits include rewards points on spending, 0% purchases, frequent flyer perks, complimentary travel insurance

- Cash advance rates and fees

- ATM withdrawal fees

- Higher spending limit (depends on your approved credit limit)

Which credit card issuers are accepted in Canada?

Explore top debit cards with no foreign transaction fees and travel credit cards by using the tabs to narrow down your options. Select Compare for up to four products to see their benefits side by side.

- Credit cards

Using a debit card

Look for a card that doesn’t charge for foreign exchange, international ATM fee and has no monthly or account keeping fees, like one from Betterment Checking . If you want to take your everyday debit card with you, you’ll most likely pay $5 for international ATM withdrawals, plus the ATM operator fee and a 3% currency conversion fee.

- No currency conversion fee

- No international ATM fee

- Unlimited free withdrawals at selected banks

- International transaction fees may apply

Using a prepaid travel card

Travel cards let you spend Canadian dollars in Canada, helping you avoid the fee for currency conversion. While you can avoid currency conversion fees, look for international ATM that waive fees to save on withdrawal costs.

- Tip: You might be able to miss ATM fees by taking cash out over the counter when you make a purchase.

- Multiple currencies

- Avoid currency conversion fees

- Supplementary card

- Reloading time

Paying with cash in Canada

There are always going to be times when you need to pay with cash, especially if you’re buying something small — some merchants won’t accept a card for a small payment due to surcharge fees.

If you’re wondering the best way to exchange US dollars for Canadian dollars , you have these options:

- Before you leave. Exchange cash using a foreign exchange service.

- When you arrive. Visit a bank or a dedicated foreign exchange office. Avoid exchanging cash at the airport as you can easily find a better rate elsewhere.

- Withdraw from a Canadian ATM. The simplest way to get CAD is to make an ATM withdrawal when you arrive. There are multiple ATMs at Canadian airports which offer a true rate, but be conscious of ATM withdrawal fees.

- Payment flexibility

- Convenience

- Foreign exchange fee may apply on foreign currency orders

- Higher risk of theft

Using traveler’s checks

Traveler’s checks have become a thing of the past when compared to the other forms of travel money compared for the following reasons:

- Your bank will give you your money back if you’re the victim of card fraud.

- You can use your card in a wide number of places in Canada. Meanwhile, traveler’s checks can only be cashed at banks and a select number of merchants.

- You’ll pay a fee to buy traveler’s checks.

- Secure and can be easily replaced if lost or stolen

- Can only be cashed at banks and selected merchants

- Fee paid when buying traveler’s checks

The Canadian dollar has become stronger against the US dollar in the past five years. That being said, when you exchange your money, it might not stretch as far when traveling in Canada.

Refreshing in: 60s | Thu, Apr 04, 06:34PM GMT

Did you know?

The Canadian dollar is one of the most traded currencies in the world, it’s referred to as the “loonie.” This can be traced back to 1987 when Canada stopped minting paper currency for the $1 bill and turned to coins. The animal on the reverse side of the $1 coin is the loon.

Common Canadian dollar banknotes:

Look for the Visa, Visa PLUS or Mastercard logo on the front of the machine to see whether you can use your card to get cash. A local ATM operator fee applies each time you withdraw cash. This fee is comparable to the US where you’ll pay $2 to $3 each time your withdraw in addition to international ATM charges and currency conversion charges.

However, some debit cards are more travel friendly and will waive international ATM charges, such as the one from Betterment Checking.

Find ATMs in Canada

Keeping your travel money safe.

Pickpocketing can happen anywhere, although it isn’t a huge problem in Canada — certainly not as problematic as it is in Europe. Nevertheless, remain vigilant, especially in larger cities and always stay aware of your surroundings. Keep your belongings close, even if you’re in a supposedly safe place like a restaurant.

To decrease the chances your cards or cash getting stolen, consider keeping it in a money belt. This is a fabric pouch that you wear around your waist and hide under your shirt or in your pants. Also, consider neck pouches, hidden pockets or a belt with hidden pockets.

Canada and the US are similar countries when it comes to daily spending and vacation expenses. Like all places around the world, prices jump up significantly in ski resorts. So, you’re going to need more cash if you head up the slopes. All prices are in US dollars.

Prices are approximate and are subject to change.

Case study: Michael's experience

Michael’s season in Whistler

Michael spent a season skiing Canada’s famous peaks: Whistler and Blackcomb. The season lasts for approximately six months starting in November and ending around May.

Michael’s tips for managing travel money in Canada

Michael says he had savings in his US bank account, and he needed to transfer this money to his new Canadian account. He made a lump sum transfer every month or two. He recommends the services of OFX , a foreign exchange and international payments company.

- International payments. He says it was very easy to create an account and make a payment to OFX. It only took a couple of days for the funds to clear in his Canadian account. A transfer fee of $25 was charged by OFX for each transaction.

- Travel safety. He also says give fanny packs a chance. While they may not be coolest choice of apparel, it’s savvy nonetheless. Michael’s words: “A travel fanny pack is probably a good idea for people who are prone to losing things.”

If you’re planning on hitting the slopes while you’re in Canada, make sure that you have additional insurance. Compare travel insurance policies and protect your trip today.

Kyle Morgan

Kyle Morgan is SEO manager at Forbes Advisor and a former editor and content strategist at Finder. He has written for the USA Today network and Relix magazine, among other publications. He holds a BA in journalism and media from Rutgers University.

More guides on Finder

How to pay, how much to bring and travel money suggestions for your trip to USA.

How to pay, how much to bring and travel money suggestions for your trip to South Africa.

How to pay, how much to bring and travel money suggestions for your trip to Sri Lanka.

How to pay, how much to bring and travel money suggestions for your trip to Mexico.

How to pay, how much to bring and travel money suggestions for your trip to Portugal.

How to pay, how much to bring and travel money suggestions for your trip to Hungary.

How to pay, how much to bring and travel money suggestions for your trip to Ecuador.

How to pay, how much to bring and travel money suggestions for your trip to Fiji.

How to pay, how much to bring and travel money suggestions for your trip to Japan.

How to pay, how much to bring and travel money suggestions for your trip to South America.

Ask a Question

Click here to cancel reply.

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

- skip to content

- Login to Online Banking

- Personal banking

- Business banking

- Manage my Visa card

- VirtualWealth

- Online business plus

- Vancity - Be a financial force for change.

- Foreign exchange

- Chequing accounts

- Savings accounts

- Ways to Bank - Personal Banking

- Quick cash solutions

- We've upgraded our credit card services.

- Go paperless for the planet

American Express Travellers Cheques

AMEX Travellers Cheques will no longer be available for sale in Canada as of August 31st, 2018.

American Express has decided to stop supplying Travellers Cheques for sale in Canada as of August 31st, 2018. We do not accept GBP or EURO American Express travelers cheques to be deposited. Please consider other financial products or services such as Visa , Vancity Member cards , or foreign cash to meet your travel needs. To find out more, please visit the American Express Travellers Cheque Service Centre , or call American Express toll free in Canada at (1) 866 296 5198.

- Social media approach

- Mobile Site

© 2024 Vancouver City Savings Credit Union

- How it Works

- Why choose us

- Snowbirds Real Estate

- Personal Expenses

- Importing Businesses

- Exporting Businesses

- Property Buyers

- International Students

Get started

What Are Traveller’s Cheques and How Do They Work?

You’ve probably heard of traveller’s cheques but may not have used them. A traveller’s cheque is among the many cashless methods of paying for services or goods. However, traveller’s cheques have been losing their popularity since the onset of credit and debit cards.

The good news is that traveller’s cheques are still functional and can save you from the stress and risk of carrying a huge chunk of money while travelling.

Here, we will answer the following questions:

- What are traveller’s cheques?

- How do they work?

- What are the benefits of traveller’s cheques?

- Can traveller’s cheques be a hassle?

- What are alternatives to traveller’s cheques?

Let’s get started.

Don't Waste Money With Banks. Get Exchange Rates Up to 2% Better With KnightsbridgeFX

What are Traveller’s Cheques?

A traveller’s cheque is a printed cheque that allows payment from one person to another and across currencies. So, travellers get the cheque before they travel to exchange it with the local currency after getting to their destination.

You can easily get traveller’s cheques in Canada from financial institutions like American Express or Visa. Also, some local banks offer traveller’s cheques, but most of them scrapped it a long time ago.

How Do Traveller’s Cheques Work?

Traveller’s cheques do not bounce since you pay upfront for a specific amount that you wish to spend. The cheque will have a fixed value and a unique serial number.

Once you receive your traveller’s cheque, you should be conversant with how to use it. So, you should follow the issuer’s instructions and sign the traveller’s cheque upon receipt.

When making purchases, countersign the cheque in the presence of the receiver; the recipient should compare the signatures and confirm that they match. Any change is returned in the local currency since the traveller’s cheque is accepted at the same exchange rate as a cash payment.

However, you must enquire from the recipient if they accept traveller’s cheques as a means of payment before making any purchases. While the traveller’s cheques still work, some institutions and persons refer to them as outdated and do not accept them. You can still make the purchases in such cases, but you need to deposit the traveller’s cheque and receive cash in the local currency. Also, do your research ahead of your trip. Ensure that you can easily access services via your traveller’s cheque before purchasing them.

Most importantly, keep the details of your traveller’s cheque safe. If you lose your traveller’s cheque, you need to provide proof of purchase and the unique serial number to get a refund. Also, contact your cheque issuer immediately after losing your traveller’s cheque.

The traveller’s cheques do not expire. Therefore, you can keep them safe and use them in the future. Alternatively, you can deposit them in your bank account once you get home.

Benefits of Traveller’s Cheques

Here are the various advantages of traveller’s cheques.

- Safety: Traveller’s cheques are safe and can allow you to carry a large amount of money while travelling.

- Refunds are possible: With traveller’s cheques, you can get a refund after you lose and report the issue to your issuer. Also, you can deposit your traveller cheque at your bank once you get home.

- Does not expire: Your traveller’s cheque does not expire and can be kept and used again in the future.

- Branded Cheques: The American Express and Visa offer branded traveller’s cheques that come in various denominations and are readily acceptable globally.

- Good exchange rates: In some cases, traveller’s cheques can access a better conversion rate.

Can Traveller’s Cheques Be A Hassle?

Traveller’s cheques have several advantages, but today, you can experience many struggles while using them.

For starters, the cheques have become outdated. Therefore, most hotels, banks, and individuals will decline them.

As a result, you will likely be forced to hunt down banks and hotels that will accept the traveller’s cheques prior to travelling. If you travel without doing your research, you can be frustrated finding that the cheques are not accepted at your destination.

Also, most banks no longer offer traveller’s cheques. The few banks that offer the cheques might charge you traveller’s cheque fees for the service.

Other Payment Methods That You Might Consider

Purchasing a traveller’s cheque may save you from the stress of carrying a large amount of money that can get lost or stolen. However, it has several limitations.

So, while travelling, you may need to consider the following alternatives:

Debit Cards

The popularity of debit cards is increasing every day. The size of the card and its acceptability rate make it among the most convenient methods of payment. So, many foreign banks, hotels, and ATMs accept foreign debit cards.

Credit Cards

Like a debit card, a credit card is small and secure to travel to various places. Besides, credit cards like MasterCard, Visa, and American Express are accepted as a method of payment in most countries globally.

Although carrying a huge amount of money while travelling is risky, it’s ideal to have a certain amount of money in cash for emergency purposes. For that reason, ensure you bring with you a given amount in the form of cash.

Prepaid Card

Prepaid cards work like debit cards and credit cards since you load them with your bank account money. Therefore, you can use your prepaid card as a debit card on the ATMs and credit card when making purchases and in hotels.

Traveller’s cheques are a safer, cashless method to use when travelling.

However, with the growing popularity of debit cards and credit cards, traveller’s cheques are quickly losing their place in the payment method.

Also, they are unacceptable in most places, making them more unreliable when travelling to destinations that limit their use. So, alongside your traveller’s cheque, carry your debit card, credit card, and some little cash to enjoy your travels .

Stop overpaying with your bank on foreign exchange

We are built to beat bank exchange rates and save you money

KnightsbridgeFx is registered with FINTRAC, under the MSB registration number M09819788. Like most financial institutions, we are required to validate the identity of all clients. We have strict measures in place to protect your privacy.

You're 0% there.

KnightsbridgeFx is registered with FINTRAC, under the MSB registration number M09819788 .

130,000+ Satisfied customers

There is no obligation to transact and no hidden fees.

We guarantee to beat your bank's rate 100% of the time.

Day 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31

Month January February March April May June July August September October November December

Year 1934 1935 1936 1937 1938 1939 1940 1941 1942 1943 1944 1945 1946 1947 1948 1949 1950 1951 1952 1953 1954 1955 1956 1957 1958 1959 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

Are you or any close relative a Politically Exposed Foreign Person?

(Head of State, Member of Senate, House of Commons, or Legistrature, etc)*

I confirm I am not transacting on behalf of a third party and I have read and I agree to the Terms and Conditions*

- Daily Update (2,662)

- Editorials (40)

- Finance Tips (23)

- Guides (285)

- Holiday Hours (1)

- In the News (34)

- International Money Transfer (10)

- Monthly Canadian Dollar Outlook/Forecast (108)

- Real Estate (11)

- Trading Tips (15)

- Travel Tips (34)

- Uncategorized (6)

Recent Posts

- FX Monthly Update | April 2024

- Canadian Dollar Update – Canadian Dollar on back burner

- Canadian Dollar Update – Canadian Dollar bounces off of support

- Canadian Dollar Update – Canadian Dollar is Steady

- Canadian Dollar Update – Canadian Dollar trickles higher

- Canadian Dollar Update – Canadian Dollar consolidating losses

- Canadian Dollar Update – Canadian Dollar plunges

- Canadian Dollar Update – Canadian Dollar rebounds sharply

- Canadian Dollar Update – Canadian Dollar looking ahead to CPI

- Canadian Dollar Update – Canadian Dollar trading negatively

- Canadian Dollar Update – Canadian Dollar takes a dive

- Canadian Dollar Update – Canadian Dollar treading water

- Canadian Dollar Update – Canadian Dollar is unchanged at open

- Canadian Dollar Update – Canadian Dollar awaiting direction

- Canadian Dollar Update – Canadian Dollar Rally Halted

Foreign/Currency Exchange Resources

- Currency converter Canada

- Currency Conversion

- Foreign Exchange

- $100 USD in CAD

- RBC currency converter

- RBC foreign exchange rate

- BMO exchange rate

- CIBC exchange rate

- BMO currency exchange

- Tire Bank Exchange Rate

- Scotiabank exchange rate

- HSBC exchange rate

- PayPal conversion rate

- Knightsbridge FX Reviews

- Canadian Dollar History

Useful Links

- Why Choose Us

- Get Started

- Send Money to US

- Currency Exchange Canada

- Currency Converter

- USD to CAD Exchange

Our Offices

Main office (Appointment only)

First Canadian Place

100 King Street West Suite 5700 Toronto, ON, M5X 1C7

(416) 479-0834 Toll-Free: 1-877-355-5239 Fax: 1-877-355-5239

Local offices

Toronto : (416) 479-0834 Montreal : (514) 613-0393 Calgary : (403) 800-3025 Ottawa : (613) 704-1798 Vancouver : (604) 229-1065 Victoria : (877) 355-5239 Winnipeg : (204) 318-1150 Halifax : (902) 800-2063

Get up to 5% better than the bank

Choose your currency pair and get rate alerts

All rights reserved. Knightsbridge Foreign Exchange

Currency Exchange Canada.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Traveler’s Checks When Traveling Abroad — Useful or Outdated?

Christy Rodriguez

Travel & Finance Content Contributor

87 Published Articles

Countries Visited: 36 U.S. States Visited: 31

Keri Stooksbury

Editor-in-Chief

29 Published Articles 3074 Edited Articles

Countries Visited: 45 U.S. States Visited: 28

What Are Traveler’s Checks?

Where to buy traveler’s checks, how to use traveler’s checks, what to do if traveler’s checks are stolen, 1. no access to credit or debit card, 2. limited access to atms, 3. access good exchange rates , 4. avoid common credit or debit fees, 5. as an added safety measure, 1. limited availability for use, 2. not all banks offer them, 3. potential for additional fees, 4. bulky paperwork, credit card, prepaid card, do your research, tell your bank you are traveling, don’t keep all of your money in 1 place, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

When traveling abroad, you might wonder how to pay for things once you arrive. Should you bring currency on your trip? Which currency should you bring? Can you get money once you arrive? How much cash should you carry at once?

Many of these questions can be answered by using traveler’s checks. Traveler’s checks might seem like an outdated choice, but they can still be useful in certain situations.

In this article, we’ll explain what traveler’s checks are, how they work, and when they might be worth the hassle. We’ll also explore other more common alternatives and give tips for obtaining foreign currency.

Traveler’s checks are documents that can be used like standard paper checks and cash. Travelers purchase them before they leave home to exchange for cash in the local currency when they arrive at their destination.

These checks are printed in varying denominations, and each check is uniquely numbered so that it can be replaced quickly if lost or stolen.

Banks, hotels, and merchants were once very used to accepting traveler’s checks. These places liked traveler’s checks because of the safeguards that were put in place. Basically, as long as the original signature matched the signature made at the time of the purchase, payment is guaranteed — eliminating any “bounced checks.”

Now, with the increased use of credit and debit cards (especially those with no foreign transaction fees ), prepaid cards, and ATMs on every corner, traveler’s checks have become less popular.

You may find it difficult to find banks or hotels that accept them , and if you do, you might be at the mercy of their business hours to cash them in.

How To Buy and Use Traveler’s Checks

You can still buy and use traveler’s checks in the U.S. and other countries.

You can find traveler’s checks offered by companies like American Express and Visa . You can also go to your local AAA office to purchase them.

The best place to purchase traveler’s checks is from your own bank, but unfortunately, many banks no longer offer traveler’s checks, including Chase, Wells Fargo, and Bank of America.

If you’re not sure if your bank offers traveler’s checks, it’s worth contacting them to confirm. If you are a customer, banks typically waive any fees to obtain them and this can add up because other companies can add on a 1% to 3% fee on top of the base currency amount that you request.

In order to obtain a traveler’s check, you will need to:

- Either go in person to an eligible bank or visit the website of the traveler’s check issuer.

- Select the total amount of currency to purchase.

- Submit payment, including any fees.

Once you have the traveler’s checks, you need to know how to use them. Traveler’s checks work a bit differently than other forms of currency. Here are the steps you’ll need to take:

- Sign the checks immediately. Follow the issuer’s instructions to find out where to sign (and only sign once).

- Leave evidence of your traveler’s check purchase somewhere safe. If checks get lost or stolen, you’ll need to provide proof of purchase along with check numbers to get a refund. Leave those details with a friend or save them online for easy remote access.

- Complete the payee and date fields. Once you have confirmed that the payee or bank will accept traveler’s checks, fill out the payee and date fields.

- Sign the check again. You must complete this portion in-person to ensure that the signature matches the original. You may also need to show some sort of identification as well. This is key to keeping traveler’s checks secure.

- If checks get lost or stolen, contact the issuer immediately. You may be able to get replacement checks locally, and the issuer needs to know which checks to cancel.

Traveler’s checks don’t expire , so if you don’t use them you can either keep them for future use or deposit them into your bank account once you’re home.

If all of your cash is stolen while you’re traveling abroad, you’ll have next to no chance of getting it back.

However, if this happens with your traveler’s checks, you’ll likely get them replaced as long as you’ve complied with your check issuer’s purchase agreement . This is the primary benefit of traveling with traveler’s checks.

Bottom Line: Treat your traveler’s checks like cash. If you lose your checks, you may not get replacements if your check issuer has reason to believe you didn’t safeguard them appropriately.

Here’s what to do if your traveler’s checks are lost or stolen:

- Call the customer service phone number provided by your issuer or find it by accessing their website.

- Provide proof that the check is yours by submitting the check number, proof of purchase, and your identification. It’s important to have easy access to this information for this reason.

- If required by your issuer, provide evidence that you have reported your stolen check to the police.

- Be sure to return any other refund paperwork requested.

If you don’t comply, you could experience delays or even have your claim denied. After you’ve reported your missing check, your provider will void it and issue you a new check.

Some issuers even pledge to get replacement checks out to you within 24 hours !

Best Ways To Use Traveler’s Checks

The following are situations when you might consider using traveler’s checks:

If you don’t have a credit card or a debit card tied to your bank account, a traveler’s check could be a safe alternative to simply carrying lots of cash abroad.

This tip also applies if your particular credit or debit card isn’t accepted abroad. This is more likely to happen if your card is something other than a Visa or Mastercard , as those credit cards claim the widest global network.

In many places, you can easily get cash in the local currency at an ATM once you arrive. This wouldn’t be a problem in Europe, for example, but ATMs are rare in some parts of the world. In addition, ATMs can malfunction, networks can be down, and machines might even run out of cash.

Traveler’s checks allow you to get local currency at participating banks, hotels, and other foreign locations without regard for these potential problems.

Buying traveler’s checks can help you avoid bad exchange rates. If you decide to exchange currency once you arrive, you might not get the best conversion rates by doing this at the airport.

By purchasing traveler’s checks before you leave, you can lock in a set amount at the current exchange rate.

Read our guide for the best places to exchange currency .

If your credit or debit card charges a foreign transaction fee , you can be charged a fee every time you make a purchase with your card in a foreign country. If your card also charges ATM fees, these fees can add up quickly.

To avoid these fees, it might make sense to use traveler’s checks. Although there may be a fee involved when you purchase or cash a traveler’s check, it might still be less than other fees your credit or debit card may charge.

Hot Tip: If your card charges a foreign transaction fee, it will typically be 3% of each purchase you make.

If you’re traveling to a potentially unsafe region, traveler’s checks keep your money secure. Even if you’re in a relatively safe place, anyone who enters your room or has access to your bags could search for your money.

The main benefit of traveler’s checks is that they reduce your risk of theft or loss. Since they can’t be cashed without your signature and often require a photo ID, they are less appealing to thieves or pickpockets. They can also be easily replaced if you provide the issuer with the proper information.

Cons of Using Traveler’s Checks

Here are some reasons that might discourage you from using traveler’s checks:

In much of Europe and Asia, traveler’s checks are no longer widely accepted and cannot be easily cashed — even at the banks that issued them.

This means that cashing in traveler’s checks might require hunting down a bank branch or hotel that accepts them during business hours.

Bottom Line: Those relying solely on traveler’s checks may find that they are unable to cash them in many remote or rural locations.

Certain major banks, such as Bank of America, no longer offer traveler’s checks at all. This might mean ordering traveler’s checks online well in advance of your travel plans or having to find a new bank that offers them.

If a company does offer traveler’s checks, it typically charges fees for both buying and cashing in a traveler’s check. While some banks offer them for free if you are a customer, others charge between 1% to 3% of the total purchase amount.

Check the math for your own situation, but using traveler’s checks could actually cost more than using an ATM or credit card abroad.

Not only are traveler’s checks a hassle to carry, but most companies also require that you keep proof of purchase for the checks to verify the check numbers if they are lost or stolen.

Both of these just add up to keeping track of additional paperwork.

Other Alternatives

Obviously, traveler’s checks aren’t your only option when it comes to obtaining foreign currency. Here are some other options you should consider.

Cash is convenient and relatively easy to exchange. You can bring money from home into a foreign bank or currency exchange location almost anywhere in the world. It can be easily exchanged without the worry of multiple bank fees or ATM fees adding up.

Hot Tip: Be aware: if you exchange your money in tourist areas, you might be hit with a bad exchange rate.

On the downside, carrying paper money is a risk since it can’t be replaced if stolen.

A debit card can be used at an ATM to collect cash. While not all ATM machines (especially in more rural places) accept foreign debit cards, you will find that most do.

Depending on your bank, you might even have to pay both an out-of-network ATM and an international ATM fee for this convenience.

Hot Tip: An out-of-network ATM fee is typically between $2 to $3.50 per transaction in 2021 and a typical international ATM fee can range from $2 to $7 per transaction (plus a 3% conversion fee), depending on your bank and card.

Most restaurants and stores accept foreign debit cards, but carrying a form of backup currency is always wise . Additionally, foreign transaction fees can add up quickly if you are using your debit card frequently.

Like debit cards, credit cards are small and easy to carry. Mastercard, Visa, and more recently, American Express , are widely accepted in other countries, so you can rest easy knowing you will be able to complete your purchases. You can also limit fees by getting a credit card with no foreign transaction fees .

A credit card also comes with fraud protection. You can dispute fraudulent charges and get them removed from your account if reported timely.

Hot Tip: While you can use a credit card for ATM transactions, you will be hit with a cash advance fee . It’s best to avoid doing this, if possible.

If you have difficulty getting approved for a credit card , a prepaid card could be a good alternative. You simply load the card with money from your bank account and use it as a debit card at an ATM or as a credit card at merchants and hotels.

While prepaid cards are locked with a PIN number, they can sometimes be difficult to use at ATM machines. Additionally, fees for foreign currency transactions can be as high as 7% , depending on the card.

Hot Tip: Booking hotels, airfare, or activities online will require either a credit card, debit card, or prepaid card.

Money Tips for Traveling Abroad

Know which types of currency are accepted at your destination and how much of each type (if any) you should bring. Especially be aware of any cash you might need on arrival (to obtain a visa , exchange upon arrival, etc.) in case you can’t immediately locate an ATM or a currency exchange office.

Carry a mix of cash, cards, and maybe even traveler’s checks. Ideally, the cards you bring with you shouldn’t have foreign transaction fees or ATM fees . Having some variety also helps if one of your cards isn’t accepted or your cash is lost or stolen.

Always be sure to let your bank and credit card issuers know where you’re going and when so that your card isn’t declined when you try to make a purchase due to unusual activity.

If you exchange money at your bank, you will likely also get a better exchange rate.

Keep some of your currency or an extra card locked in your hotel room’s safe or in a money belt . In the terrible instance that you lose your purse or wallet, you would still have immediate access to additional money.

We’ve shown that traveler’s checks aren’t necessarily the most convenient way to take currency abroad, but depending on if you have limited access to debit or credit cards or they aren’t accepted where you are traveling, it might be worth it to bring some along.

Overall, if you’ve decided that traveler’s checks can be of use to you, taking some, along with some cash and a debit, credit, or prepaid card, may just be the smartest way to travel.

Frequently Asked Questions

Can you still buy traveler's checks.

While many larger banks are no longer offering traveler’s checks, they are still available at American Express and other smaller banks and credit unions. It is worth asking if your bank offers them and at what cost.

How much does it cost to buy traveler's checks?

While some banks offer them for free if you are a customer, others charge between 1% and 3% of the purchase amount.

What is the purpose of a traveler's check?

A traveler’s check offers a safer option than carrying around money. There are multiple safeguards in place to prevent fraud and if the checks are lost or stolen, they can be easily replaced.

Can you cash old traveler's checks?

Traveler’s checks do not expire. You can cash them in at any time — typically even at banks that don’t offer them for sale. This means you can go to your own bank and redeem your traveler’s checks.

To do this, date them, fill out the “Pay To” field (to your bank), and countersign in the presence of the cashier . Any unused value will be returned to you in cash.

Can I buy traveler's checks online?

American Express is the only large bank that offers traveler’s checks online. Its website offers a step-by-step process to order them.

You should check with your local bank or credit union to see if they might also offer this benefit.

Was this page helpful?

About Christy Rodriguez

After having “non-rev” privileges with Southwest Airlines, Christy dove into the world of points and miles so she could continue traveling for free. Her other passion is personal finance, and is a certified CPA.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![amex travellers cheques canada IHG One Rewards Traveler Credit Card — Review [2024]](https://upgradedpoints.com/wp-content/uploads/2023/06/IHGOneTravelerCard.png?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Toronto Tourism

- Toronto Hotels

- Toronto Bed and Breakfast

- Toronto Vacation Rentals

- Flights to Toronto

- Toronto Restaurants

- Things to Do in Toronto

- Toronto Travel Forum

- Toronto Photos

- Toronto Map

- All Toronto Hotels

- Toronto Hotel Deals

- Last Minute Hotels in Toronto

- Things to Do

- Restaurants

- Vacation Rentals

- Travel Stories

- Rental Cars

- Add a Place

- Travel Forum

- Travelers' Choice

- Help Center

AMEX travellers cheques - Toronto Forum

- Canada

- Ontario

- Toronto

AMEX travellers cheques

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Vacation Rentals

- Ontario forums

- Toronto forum

This topic has been closed to new posts due to inactivity.

- Areas with Charming brownstones where I can look for accommo yesterday

- Main location for hotels Apr 03, 2024

- Reliable taxi company Apr 03, 2024

- Toronto Pearson Inter'l Airport to Toronto Bus Terminal Apr 02, 2024

- Presto Card as Tourist Apr 02, 2024

- safest layover time for Toronto airportt Apr 02, 2024

- High Park Mar 31, 2024

- 4/5 day excursion from Toronto Mar 31, 2024

- We have 1.5 hours between flights at Toronto, Mar 30, 2024

- 1 night with teens who shop! Mar 30, 2024

- 1 day layover plan Mar 30, 2024

- Train Montreal-Toronto-Niagara Falls Mar 30, 2024

- 5 Hour Layover Mar 30, 2024

- Is the area around Toronto Western Hospital safe? Mar 30, 2024

- How long is the drive from Toronto to NYC? 12 replies

- Best Way to get from Toronto to Detroit 12 replies

- smoking rooms 4 replies

- Drive from Toronto to Montreal 9 replies

- Toronto to Buffalo airport 6 replies

- Family ROADTRIP to Florida 10 replies

- Getting to New York. 16 replies

- bus tour toronto to new york 13 replies

- Parking in downtown 20 replies

- Ways to get from Toronto to Boston? 4 replies

Toronto Hotels and Places to Stay

- *** TORONTO PEARSON INT'L AIRPORT (YYZ) ***

- Unlicensed Taxis a Problem at Pearson Int'l Airport

- Layover at Toronto Pearson Int'l Airport (YYZ) - What to do.

- Transiting Through Pearson Int'l Airport (YYZ)

- *** ENTER CANADA/CROSS THE BORDER ***

- What documentation do I require to enter Canada ? Do I need a passport ?

- New entry rules for Canadians with dual citizenship.

- Electronic Travel Authorization (eTA)

- ***** ACCOMMODATIONS *****

- Campgrounds in Toronto

- Stricter Short Term Rentals regulations in Toronto (Nov 2019)

- What's a good discount hotel in Toronto?

- ***** THINGS TO SEE AND DO *****

- What to do in Toronto?

- Toronto Railway Museum

- Casa Loma – Toronto’s Majestic "Castle"

- The 501 Streetcar

- When is the Toronto International Film Festival?

- How to get tickets to sports games?

- Air Canada Centre / Scotiabank Arena

- The Toronto Zoo from downtown ?

- Canada's Wonderland by public transit ?

- Provincial Parks in northern Ontario by public transit

- How to get from Toronto to Niagara Falls? (80 miles / 130 km away)

- ***** FOOD & DRINK *****

- What Are Toronto's "Best" Restaurants ?

- Where to eat in Toronto?

- Where is a good place to have dinner, that won't break the bank?

- Where Can I Find Gluten-free Restaurants in Toronto ?

- ***** MISCELLANEOUS *****

- Tourism Toronto

- Is there an online map of Toronto available somewhere ?

- Scams, Rip-offs, and Cautions

- Are there any unsafe neighbourhoods I should avoid?

- Canada's Cross Country Train - "The Canadian"

- Where Can I Store My Baggage ?

IMAGES

VIDEO

COMMENTS

American Express Travelers Cheques are no longer sold in Canada. If you have any outstanding Travelers Cheques, please visit our Travelers Cheque Website or contact +1-800-221-7282. Travelers Cheques Service Centre. Get help with your Travelers Cheques and find answers to common questions about them.

Travelers Cheques; Insurance. Overview. Insurance Overview; Coverage on your Credit Card; Travel. Travel Insurance; ... The American Express Aeroplan Reserve Card; The Business Platinum Card; Discover More. ... Amex Bank of Canada, P.O. Box 3204, Station F, Toronto, ON M1W 3W7 ...

1.25% commission (except when fees are waived for certain account packages and Visa customers) CAD Gift Cheques. 3% commission. To purchase American Express travellers cheques, please visit your RBC Royal Bank branch . You are on: Customer Service. Help is available 24 hours a day, wherever you travel. Call immediately for assistance with any ...

Keep a record of your travellers' cheque numbers, credit card account numbers and expiry dates and the telephone numbers for reporting lost or stolen cards in a safe place. ... Any time you enter or leave Canada, you must declare any money or monetary instruments, such as stocks, bond or cheques, you are carrying valued at $10,000 or more ...

American Express (AMEX) Travelers Cheques were first issued more than a hundred years ago, in 1891. Although the traditional travelers cheque has been overtaken by more modern currency exchange options, they're still used by some as a safe and secure way to spend money overseas.

People used traveler's checks as a way to keep money safe from fraud and theft while traveling, as they could be replaced. "Each check has a unique number, so it can be traced easily," says Phil Dengler, co-owner of The Vacationer, a resource for travel and credit card guides. Also, you have to sign the traveler's check when you buy it and when ...

Up to 4.60% APY on savings. $0 account or overdraft fees. Get a $300 bonus with direct deposits of $5,000 or more. Travel rewards with no annual fee. Go to site Terms apply, see rates & fees. 20,000 miles (equal to $200 in travel) after spending $500 in the first 3 months. Earn unlimited 1.25x miles on all purchases.

Please consider other financial products or services such as Visa, Vancity Member cards, or foreign cash to meet your travel needs. To find out more, please visit the American Express Travellers Cheque Service Centre, or call American Express toll free in Canada at (1) 866 296 5198. American Express has decided to discontinue the sale of ...

American Express® Travelers Cheques. Login to upload your documents. Claim Reference Number. The Claim Reference Number was provided to you by American Express when you submitted your claim. Continue. Still need help? You can find additional contact numbers based on your location. About.

What to know when using Visa Travellers Cheques. Be as careful with your cheques as you would be with cash. Do not countersign the cheques until you want to use them. Keep your purchase agreement separate from your cheques. Write down cheque serial numbers and emergency contact numbers for your destinations and keep them separate from your cheques.

A traveller's cheque is a printed cheque that allows payment from one person to another and across currencies. So, travellers get the cheque before they travel to exchange it with the local currency after getting to their destination. You can easily get traveller's cheques in Canada from financial institutions like American Express or Visa.

I have recently used Amex travelers cheques in both Canada and the U.S.A. with no problems at all. The main thing is to have your driver's license handy (they usually write the number on the back of the traveler's cheque). If you don't have a driver's license, bring photo id.

MilesBuzz - Canadians - TD Canada Trust No-Fee Travellers Cheques with Visa - So I was on the TD Canada Trust side, and came across this: American Express Travellers Cheques are welcomed at establishments around the world. As a TD Visa Cardholder, you're entitled to purchase any amount you need through participating TD