Letters in English

Sample Letters, Letter Templates & Formats

Home » Letters » Request Letters » Sample Request Letter for Traveling Allowance – Letter to HR Requesting Travel Allowance

Sample Request Letter for Traveling Allowance – Letter to HR Requesting Travel Allowance

To, The HR Manager, __________ (Company’s Name) __________ (Company’s Address)

Date: __/__/____ (Date)

Subject: Request letter for travel allowance

Respected Sir/ Madam,

My name is ___________ (name) and I have been working in your company’s _________ (department) for last _________ (duration) and my employee ID is ________ (employee ID).

This is to inform you that I have been working in your company for last _______ (duration) and I have been availing the travel allowance for last __________ (duration) but due to ____________ (mention reason), I was not provided with the travel allowance. In this regard, it is to request you to kindly provide with the same as this will be good financial support.

I shall be highly obliged for your kind support.

Yours Truly, ________ (Signature), ________ (Name), ________ (Contact Number)

Incoming Search Terms:

- sample letter of request for travel allowance

- travel allowance sample request letter to the hr manager of your company

- Request Letter for Relocation Allowance – Letter to HR Manager for Relocation Allowance Request

- Request Letter for Uniform Allowance – Letter of Request for Allowance of Uniform

Leave a Reply Cancel reply

You must be logged in to post a comment.

Privacy Overview

Letters.org

The Number 1 Letter Writing Website in the world

Request Letter for Allowance

Last Updated On March 3, 2020 By Letter Writing Leave a Comment

Occasionally, an employee can request an allowance if assigned duties away from the work station or to perform the duties of a coworker. Other types of allowances are housing, transport, travel, and medical allowance. Employers have provisions to manage allowances.

When an employee assumes more responsibilities, the employer can make arrangements to offer the employee allowance. Under such arrangements, the employee can write a request letter for allowance. This letter is addressed to the employer or the relevant authority responsible for making payments.

A request letter for allowance is applicable when the company has a policy that manages allowance or the employer has made such arrangements. This is a formal document to notify your employer that you are eligible for an allowance based on the current circumstances. It is important for reference to the employer of the amount of money you are requesting and the reason for the request.

Tips for writing a request letter for allowance

- Acquaint yourself with the employer’s contract or company’s policy to determine provisions for allowance

- State precisely the reason for the request

- Ensure the format and content of the letter are formal

- Address the letter to the relevant authority

- Write the letter in a professional and polite language

- Be straight to the point

Request Letter for Allowance Template

If you have been taking more workload than usual, you can request for an allowance. See the request letter for allowance template and sample letters that you can customize to your needs.

_____________

Date (date on which letter is written)

________________

Sub:_________________________________________

Dear _________________,

My name is ____________, an employee with your company ____________ in the department of ____________. I have worked with your company for ____________ years and I take pride in being part of your team. I hereby write this letter to request for my ____________ allowance of ____________ which is due for ____________.

I have brought this matter to the attention of ____________ but as of today ____________ the payment has not been made to my bank account. I submit all my bills in good time hence this cannot the cause of the problem.

This problem is putting me in a difficult financial position because this has been the arrangement since I joined the company. Additionally, employees in my job group ____________ are eligible for this allowance as stipulated in the employees’ policy.

I have visited the bank and they say that the payment has not been made yet. Kindly take up this issue with the relevant party so that I can have my ____________ allowance by the latest ____________. I herewith attach documents on when the last payment was made and receipts of the pending bills.

Please help me solve this matter at the earliest.

Thank you.

Yours sincerely,

(__________________)

Request Letter for Allowance Samples

If you have no idea how to write an allowance request letter, check out our free request letter for allowance sample that you can use to tailor a professional and convincing letter to your employer.

Dane Leblanc,

50 Corona Ave.

Fair Lawn, NJ 07410

United States

Date:____________ (Date on which letter is written)

Troy Coffey,

Nampack Ltd

76 Prince Ave.

Millville, NJ 08332

Sub; Request for travel allowance

Dear Mr. Coffey,

My name is Dane Leblanc an employee with Nampack Ltd in the department of occupational health and safety. I hereby write this letter with respect to the travel allowance which is due for the last month and not yet received.

I traveled to Denmark on 21 st November 2019 to represent the company in a conference and workshop about the health and safety of employees’ in the workplace. The conference was a success and our company was recognized to have good policies to protect employees in the workplace.

Before I left for Denmark, the human resource manager assured me that I will get my travel allowance of $5,000 when I get back since the attendance invitation was received late. However, this allowance has not been paid as of today 30 th January 2020. Kindly receive the agreement attached herewith.

Please look into this matter in person to help me solve this problem.

Yours Truly,

Dane Leblanc

Sub: Requesting for allowance

Dear Mr. Winton,

I want to bring to your kind attention that I have not received my medical and transport benefit till now. I have been serving your organization for the past ten years, and it has happened to me for the first time. I have submitted all my bills to the Accounts department in time, but till now, my allowance has not been credited into my bank account. The total amount needs to be credited $4000 for the month of July-August.

I would request you to please look into the matter and get the needful done at the earliest. I am enclosing the copies of the bill for your reference.

Your promptness in this regard will be highly appreciated.

Thanking you,

___________

Marc Steven

Request Letter for Allowance Email Formats

Are you wondering how to approach your employer with an allowance request? Have a look at the email sample of request letter for allowance that you can use to write a professional request to your boss.

Dear HR Manager,

My name is Gus Mcintosh and I am a dedicated employee of Kevian Industries for five years. I hereby write this letter to request for my housing allowance for September to December 2019. Employees in my job group P3 are eligible monthly housing allowance as stated in the company’s employees policy. Unfortunately, I have not received my allowance for September to December.

I have submitted my monthly bills to the finance department for the above stated months but still the payments have not been made of $10,000. Over the past years, this problem has never occurred. I am in a tough position of being evicted from my house that I have lived for over ten years. Additionally, I have visited the bank several times but my account has not been accredited.

I wish to request that you look into this matter personally and do the needful. I would be very grateful to have my housing allowance by the end of the week. Please contact me on my cell 362-438-4720 if you have any updates on this issue.

Thank you in advance.

Kind regards,

Gus Mcintosh

I want to bring to your kind attention that I have not received my medical and transport allowance till now. I have been serving your organization for the past ten years, and it has happened to me for the first time. I have submitted all my bills to the Accounts department in time, but till now, my allowance has not been credited into my bank account. The total amount needs to be credited $4000 for the month of July-August.

Different employers offer various allowance provisions to their employees. Sometimes the allowance can be delayed or not given as agreed. When writing a request for allowance, it is essential to address the recipient in a polite language, acquaint yourself with allowance provisions, and use formal content.

Additionally, be clear on the amount due, the reason for the request, and address the request to the relevant party.

Megha Kothari

Comments are disabled for this post.

Related Letters:

- Salary Request Letter

- Credit Increase Request Letter

- Request Letter for a Bank Statement

- Sample Loan Request Letter

- Sample Request Letter for personal loan

- Change of Address Request Letter

- How to Write a Request Letter

- Request Letter for Experience Certificate

- Job Promotion Request Letter

- Request Letter – Request for an Endorsement or Testimonial

- Official Document/Contract Request Letter

- Request to Waive Bank Fee

- Request Letter for Salary Increment

- Request for Production of Document

- Request For Issue Of Voting Card

- Transfer Request Letter

- Request Letter – Change of Address Request Letter

- Request Letter – Cheque Book Request Letter

- Request Letter – Salary Request Letter

- Request Letter – Grant Request Letter

- Request Letter

- Request For The Postponement Of The Last Day

- Job Request letter

- Request for Volunteers

Leave a Reply Cancel reply

You must be logged in to post a comment.

Thank you for signing up!

AI Summary to Minimize your effort

Leave Travel Allowance (LTA) - Exemption Limit, Rules, How to Claim, Eligibility & Latest Updates

Updated on : Mar 22nd, 2024

The Income-tax Act, 1961 offers salaried individuals several tax exemptions, beyond deductions like LIC premiums and housing loan interest. While deductions reduce your total taxable income, exemptions exclude specific types of income from being taxed altogether. This allows employers to design an employee's Cost to Company (CTC) package in a tax-efficient manner.

One such exemption available to the salaried class under the law and widely used by employers is Leave Travel Allowance (LTA)/Leave Travel Concession (LTC). LTA exemption is also available for LTA received from former employer w.r.t travel after the retirement of service or termination of service. LTA can be claimed for any two years in a block of 4 years . The current block year for claiming LTA is 2022 to 2025.

Note: The tax exemption of leave travel allowance is not available in case you choose the new tax regime .

What is Leave Travel Allowance (LTA)?

Leave Travel Allowance/Leave Travel Concession is a type of allowance given by an employer to their employee for travelling to any place in India: either on leave, after retirement or after the termination of his service. Though it sounds simple, many factors need to be kept in mind before you plan to claim an LTA exemption. Income tax provision has laid down rules for claiming exemption of LTA which are provided below.

Note: The red arrow shows the lower of the two amounts will be exempted. For instance, if you travel by air, the exemption amount will be either your actual travel costs or the cost of an economy class ticket, whichever is lower. The journey should be taken through the shortest route to the destination.

Who Can Claim LTA?

Only individuals can claim LTA for travel costs incurred for themselves and their family (Spouse, children, wholly or mainly dependent siblings, parents)

Conditions for Claiming LTA

Let us understand the conditions/requirements for claiming the exemption:

- Individual must be an employee and should have an LTA component in CTC.

- Actual journey is a must to claim the exemption

- Only domestic travel is considered for exemption, i.e., travel within India. No international travel is covered under LTA/LTC

- The exemption for travel is available for the employee alone or with his family, where ‘family’ includes the employee’s spouse, children and wholly or mainly dependent parents, brothers, and sisters of the employee.

- Further, such an exemption is not available for more than two children of an employee born after 1 October 1998. Children born before 1 October 1998 do not have any restrictions. Further, in cases of multiple births on a second occasion after having one child is also not affected by this restriction.

Amount of LTA/LTC Exemption

The exemption is available only on the actual travel costs i.e., the air, rail or bus fare incurred by the employee. No expenses such as local conveyance, sightseeing, hotel accommodation, food, etc., are eligible for this exemption. The exemption is also limited to LTA provided by the employer.

For example, if LTA granted by the employer is Rs 30,000, and the actual travel cost incurred by the employee is Rs 20,000, then only Rs 20,000 will be available as an exemption and the balance of Rs 10,000 would be included in taxable salary income.

Exemption w.r.t Various Modes of Transport

Can lta exemption be claimed on every vacation.

No, an LTA exemption is available for only two journeys performed in a block of four calendar years .

A block year is different from a financial year and is decided by the Government for LTA exemption purposes. It comprises 4 years each. The very first 4-year block commenced in 1986. The list of block years is 1986-1989, 1990-93, 1994-97, 1998-2001, 2002-05, 2006-09, 2010-13 and so on. The block applicable for the current period is 2022-25. The previous block was the calendar year 2018-21.

Carryover of Unclaimed LTA/LTC

In case an employee has not availed exemption with respect to one or two journeys in any of the block of 4 years, he is allowed to carryover such exemption to the next block provided he avails this benefit, in the first calendar year of the immediately succeeding block.

Consider the below example for a better understanding:

• Where carry over exemption is claimed in the first calendar year of the immediately succeeding block

• Where carry over exemption is not claimed in the first calendar year of the immediately succeeding block

Procedure to Claim LTA

The procedure to claim LTA is generally employer specific. Every employer announces the due date within which LTA can be claimed by the employees and may require employees to submit proof of travel such as tickets, boarding pass, invoice provided by travel agent etc., along with the mandatory declaration. Though it is not mandatory for employers to collect proof of travel, it is always advisable for employees to keep copies for his/her records and also to submit them to the employer based on the LTA policy of the company to tax authorities on demand.

Multi-Destination Journey

Income tax provision provides exemption w.r.t travel cost incurred on leave to any place in India. Conditions pertaining to the mode of transport also refer to the place of ‘origin’ to the place of ‘destination’ and the route which must be the shortest available route.

Hence, if an employee travels to different places in a single vacation, the exemption can only be availed for the travel cost eligible from the place of origin to the farthest place in the vacation by the shortest possible route.

LTA Exemption for Vacation on Holidays

Many organisations that go strictly by the wordings of the income tax provision are allowing employees to claim LTA only if the employee applies for leaves and travel during that time. Such organisations may reject LTA claims for travel on official holidays or weekends.

You Might be Interested in

UAN Login Aadhar PAN Link Last Date to File ITR Section 115BAC of Income Tax Act Income Tax Deductions List How to e verify ITR Annual Information Statement (AIS) Section 80D Home Loan Tax Benefit Budget 2023 Highlights House Rent Allowance (HRA)

Frequently Asked Questions

The amount of LTA/LTC exemption depends on the LTA/LTC component in your compensation package or CTC. You can furnish proof of travel within the block period and claim up to the amount prescribed in your CTC.

The latest block period of four years is from 1 January 2022 until 31 December 2025.

You can claim LTA/LTC exemption only for one trip in one calendar year.

You can claim LTA/LTC benefit for the travel costs of yourself and your family consisting of your spouse, children, dependent parents, brothers, and sisters of the employee.

No, LTC is taxable in case of new tax regime and exempted if chosen to pay tax under old tax regime by fulfilling the required criteria.

Exemption will be available in respect of 2 journeys performed in a block of 4 calendar years.

Yes, you can avail LTC in current block (2022-2025), if you have not availed LTC in previous block. (2018-2021). Where such travel concession or assistance is not availed by the individual during any block of 4 calendar years, one such un-availed LTC will be carried forward to the immediately succeeding block of 4 calendar years and will be eligible for exemption.

Below example gives you clear understanding :

Example : An employee does not avail any LTC for the block 2018-21. He is allowed to carry forward maximum one un-availed LTC to be used in the succeeding block of 2022-25. Accordingly, if he avails LTC in April, 2023, the same will be treated as having availed in respect of the block 2018-2021. Therefore, he will be eligible for exemption in respect of that journey and two more journeys can be further availed in respect of the block of 2022-25.

Illustration : Mr. D went on a holiday on 25.12.2023 to Delhi with his wife and three children (one son – age 5 years; twin daughters – age 3 years). They went by flight (economy class) and the total cost of tickets reimbursed by his employer was 60,000 (45,000 for adults and 15,000 for the three minor children). Compute the amount of LTC exempt if Mr. D chose to pay taxes under old regime.

Solution : Since the son’s age is more than the twin daughters, Mr. D can avail exemption for all his three children. The restriction of two children is not applicable to multiple births after one child. The holiday being in India and the journey being performed by air (economy class), the entire reimbursement met by the employer is fully exempt in the hands of Mr. D, since he chose to pay taxes under the old regime.

In the above illustration, will there be any difference if among his three children the twins were 5 years old and the son 3 years old?

Since the twins’ age is more than the son, Mr. D cannot avail for exemption for all his three children. LTC exemption can be availed in respect of only two children.

Taxable LTC = 15,000 × 1/3 = 5,000.

LTC exempt would be only 55,000 (i.e. 60,000 – 5,000).

About the Author

Ektha Surana

Multitasking between pouring myself coffees and poring over the ever-changing tax laws. Here, I've authored 100+ blogs on income tax and simplified complex income tax topics like the intimidating crypto tax rules, old vs new tax regime debate, changes in debt funds taxation, budget analysis and more. Some combinations I like- tax and content, finance & startups, technology & psychology, fitness & neuroscience. Read more

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

- How to Claim Your Leave Travel Allowance?

- Post author: fincart

- Post published: October 20, 2023

- Post category: Income Tax

Table of Contents

We all like traveling these days, don’t we? Every year we all plan to make at least one trip. But little do we know that we could claim one of the allowances if provided by your employer. It could also help you to save taxes too! But how do you claim it? Can you claim it every year? How much amount does it cover? What is included in this? Is there an eligibility criterion to claim this allowance?

Tax deductions and exemptions provided by the Income Tax department have allowed us to save the most amount of tax possible. By using these exemptions, employers can structure employee Cost to Company (CTC) in a tax-efficient manner. Leave Travel Allowance (LTA) is an exemption available to salaried workers under the law that is also widely used by employers.

When planning travel to claim an LTA exemption, many factors need to be considered. LTA exemptions are governed by income tax provisions:

What is Leave Travel Allowance (LTA)?

Leave Travel Allowance (LTA) is an allowance provided by employers to employees who are on leave from work to cover their travel expenses. By the Income Tax Act, of 1; 961, LTAs are an important component of an employee’s salary, as they are eligible for income tax exemptions, making them a valuable tool for tax saving . LTA received by the employee during the year will not be included in his net income under Section 10(5) of the Income Tax Act.

Example of LTA

Assume that LTA granted by your employer is Rs 30,000, and the actual travel cost is Rs 20,000, then only Rs 20,000 will be available as an exemption and the balance of Rs 10,000 would be included in taxable salary.

Take another example, suppose the Leave Travel Allowance provided by the employer is Rs 25,000. The actual expenses spent on travel are Rs 30,000. Here, the LTA exemption allowed would be Rs 25,000 irrespective of a higher amount spent on travel.

Benefits of Leave Travel Allowance

Tax Exemption : LTA provides tax benefits as the amount spent on eligible travel expenses is exempt from income tax.

Family Inclusion : The allowance covers immediate family members, promoting family travel and bonding.

Domestic Exploration : Encourages employees to explore different parts of India, contributing to tourism and cultural exchange.

Reimbursement : Allows reimbursement of actual travel expenses or up to specified limits, easing financial burden on employees.

Employee Well-being : Promotes work-life balance by facilitating quality time with family during approved leave periods.

Conditions to claim Leave Travel Allowance exemption

The following conditions must be satisfied for claiming an LTA exemption:

- You can claim LTA for travel costs incurred for yourself and your family.

- LTA can be claimed for any two years in a block of 4 years. The current block year for claiming LTA is 2022 to 2025.

- Actual journey is a must to claim the exemption.

- The exemption is available only on the actual travel costs i.e., the air, rail or bus fare incurred by the employee. Local conveyance, sightseeing, hotel accommodation, food, etc., are not eligible.

- The exemption is also limited to LTA provided by the employer.

- It applies to travel only within the country.

What is the eligibility of LTA exemption?

The LTA (Leave Travel Allowance) exemption for tax purposes is based on the actual travel cost. It covers expenses for a journey from the employee’s origin to the destination and back, using the shortest route by air, rail, or bus. Only the cost of travel tickets is eligible for exemption. Other expenses like conveyance, sightseeing, accommodation, shopping, and food are not allowed. If the employer’s LTA allowance is less than the actual travel cost, the exemption is limited to the employer’s provided amount.

Documents required for claiming LTA

To claim LTA, fill out the LTA application form supplied by your employer, including essential details like travel date, destination, mode of transport, and incurred costs. Alongside the application, submit supporting documents such as tickets, boarding passes, and invoices as evidence for your LTA claim. These documents are crucial to validate your travel expenses and support your application.

LTA Exemption Rules for Various Modes of Transport

The LTA claim depends on the mode of transport.

- If travel is by air, the LTA limit is Actual Expenses or Economy class air fare of the national carrier by the shortest route to the place of destination, whichever is lower.

- If travel is by rail, the LTA limit is Actual Expenses or first-class AC rail fare by the shortest route to the place of destination, whichever is lower.

- If travel is by a recognized public transport system, the LTA limit is Actual Expenses or 1st class/ deluxe class fare by the shortest route to the place of destination, whichever is lower.

- If no recognized public transport system is available, the LTA limit is Actual Expenses or first-class rail fare by the shortest route to the place of destination, whichever is lower. (It is assumed as if the journey had been performed by rail.)

How Much Leave Travel Allowance Exemption Will You Get?

There is a limit on how much LTA an employer may provide as an exemption. For instance, if Rs. 30,000 of LTA is granted by your employer and the actual travel cost incurred is Rs. 20,000 by an employee then the exemption will only be available till Rs. 20,000. Therefore the balance of Rs. 10,000 will be included in the taxable salary income. Procedure to Claim LTA

LTA claims are generally handled by employers. Employers announce the deadline for employees to claim LTA and may require employees to submit proof of travel along with the mandatory declaration, such as tickets, boarding passes, invoices from travel agents, etc. Although employers don’t need to collect proof of travel, it is always advisable for employees to keep copies for their records as well as to submit them to their employer on demand based on the LTA policy of the company.

What Happens to LTA If There is No Traveling Involved?

Because the LTA is part of your salary structure, it is automatically credited to your account regularly. If you do not travel or do not have valid proof of travel, you cannot claim the LTA received for tax exemption purposes. Your net taxable income will be increased if you receive an LTA.

What expenses can be included under LTA?

Under the Income Tax Act, LTA (Leave Travel Allowance) can include the following expenses:

Travel Expenses : LTA encompasses the travel costs for the employee and their immediate family members (spouse, children, and dependent parents or siblings). The travel can be by air, rail, or public transportation, following the employer’s or Income Tax Department’s specified rules.

Destination : LTA is applicable for travel within India. Employees can claim expenses incurred on traveling to any location in India during their leave period.

Mode of Travel : LTA covers expenses for travel by air, train, or other public transportation. Reimbursement is based on the actual amount spent or as per limits set by the employer or tax authorities.

Leave Period : LTA can be claimed for travel during the employee’s leave period, including annual leave, casual leave, or any other approved form of leave.

Unclaimed LTA

Unclaimed LTA is allowed to be carried forward. If an employee has not availed LTA exemption once or twice in a block of 4 years, he is allowed to carryover one exemption to the next block provided he avails this benefit, in the first calendar year of immediately succeeding block.

For example, during the 4-year block of 2014-2017, if you did not claim LTA or claimed it only once, then you will be allowed to carry forward one LTA to 2018 (first year of next block, i.e. 2018-21). Thus, from 2018 to 2021, you will be able to claim LTA three times.

Can Unclaimed LTA be Carried Over to the Next Block Year?

Under the carry-over concession rules, under which the employee can claim LTA tax breaks on three journeys made in the current block of years if he hasn’t claimed LTA in the last running block or has just claimed it once, the employee can still claim one additional LTA in the next block of calendar years. To utilize the carryover concession facility, one LTA exemption for the journey must be claimed during the first calendar year of the next block.

For instance, in the last block of the year, between 2018-2021, you made only one tax exemption claim under LTA as an employee. Therefore, you become eligible for LTA claims for up to 3 journeys in the current block, between 2022 and 2025. However, your first claim must be filed in the first calendar year of the current block, i.e. in 2022.

Also Read: Smart Tax Planning Strategies for High Earners

Leave travel allowance is an amount provided by the employer to the employee for Travelling while on Leave. This is a part of your salary which is exempted from tax.

Employees in India are generally eligible for LTA. To claim LTA, employees must undertake travel during their leave period, and the exemption is subject to specified conditions and limits set by the income tax regulations.

Under LTA, expenses related to travel within India are covered. This includes the cost of transportation by air, rail, or bus for the employee and eligible family members.

LTA can be claimed for two journeys in a block of four years and not on every financial year.

The concept of “block years” in the context of LTA (Leave Travel Allowance) refers to a four-year block set by the income tax authorities. This block consists of four consecutive calendar years, during which an employee is allowed to claim LTA for up to two trips.

No, LTA (Leave Travel Allowance) is specifically applicable for domestic travel within India.

For LTA exemption, the costs incurred for family members traveling with the employee are allowed. Family members include spouses, children, dependent parents, and dependent siblings.

The exemption can be claimed for up to two children if born on or after 1st October 1998.

LTA exemption is calculated as the least of the actual travel expenses incurred on a trip within India or the fare of the equivalent journey by the shortest route in the chosen mode of transportation (air, rail, or bus). Again, it is limited to the LTA component in your compensation package or CTC.

If an employee doesn’t travel at all or lacks valid proof of travel, they cannot claim LTA for tax exemption purposes. In such a scenario, the received LTA amount is treated as a part of the employee’s taxable income.

If an employee does not fully utilize their LTA entitlement in a particular block of four years, it can be carried over to the next block. But the employee is usually required to utilize this carryover LTA in the first calendar year of the immediately succeeding block.

If the unutilized LTA is not claimed within the first year of the next block, it will expire and would not be allowed to be claimed later on.

Yes, there is a specific deadline for employees to claim LTA. Usually, LTA can be claimed for exemption twice under the block of 4 years.

No, LTA (Leave Travel Allowance) is specifically designed for personal travel during leave periods and cannot be claimed for business trips or official travel.

You Might Also Like

Best Tax Saving Investment Plans & Schemes for FY 2023-24

Plan And File Your Income Tax Return to Live Your Dreams.

Smart Tax Planning Strategies for High Earners

SemiOffice.Com

Your Office Partner

Request Letter of Request of Travelling allowance

These are sample application letter for traveling allowance from company, office, manager, or boss for visits, meetings. Here you can learn how to write Transportation Allowance Request Letter. You can modify this format according to your needs, and requirements.

Request Letter of Request of Travelling allowance that I travel on uber

Institution name…

Institute Address…

Dear Sir/Madam,

It is stated that I come to office everyday on uber, or careem. I live 25 kilometer away from the office so Uber charges me a lot. Moreover, half of my pay gets wasted in the cost of traveling. Every company provides a traveling allowance , or free petrol, or other things. Coming on uber provides an edge that you can see that I am charging for only the way from my house to office, and no other place. You can ask for end of week maps sent officially by uber along with dates, and times.

Therefore, it is requested to please give us traveling allowance, or some sort of discount on uber. I shall be very thankful to you. I am looking forward towards a positive reply. Thank you!

Best regards

name of employee

Letter of Request of Travelling allowance that I traveled to visit a site, and yet allowance has not been given.

It is requested with due respect that I am writing to claim my traveling allowance that has been pending for 2 weeks now. Being a Civil Engineer, and project Director of your company, I have to travel a lot. I almost travel to 3 different cities in a week to visit grid station, and other places for inspection.

I recently visited Diamer Bhasha Dam on (mention the date). I stayed at that place of a 3 days. I had to spend on food stuff, and hotel rent by myself. Moreover, the petrol finished as it is a 26 hours long driver, and I had pay for the petrol from my pocket. I am attaching down all the receipts, and bills.

I also visited Sukkhar Poll Plant on (mention the date). We had a night stay at a private hotel because the Company’s own rest house had no water, and electricity connection, and it was scorchingly hot, and humid weather. I am attaching down all the receipts, and bills.

Moreover, I recently visited Karachi as well. I had to pay for the air tickets, and paid the expenditures of entire journey. Including hotel rents, and other food stuff. I am attaching down all the receipts, and bills.

Therefore, it is requested to please give my travelling allowance. I shall be very thankful to you. I am looking forward towards you for your cooperation. Thank you!

Best regards,

Share this:

Please ask questions cancel reply.

- Email Letter to Request Travelling Allowance

Email 1: Request for Travelling Allowance for Business Trip

Subject: Request for Travelling Allowance for Business Trip

Dear [Manager's Name],

I am writing to request for reimbursement of travel expenses incurred during my recent business trip to [destination]. As per the company's policy, employees are eligible for reimbursement of travel expenses when travelling for business purposes.

I have attached the receipts for airfare, hotel accommodation, meals, and transportation for your reference. The total expenses incurred during my trip amount to [amount]. I would appreciate if you could approve my request for reimbursement of these expenses.

Thank you for your attention to this matter.

[Your Name]

Email 2: Request for Travelling Allowance for Job Interview

Subject: Request for Travelling Allowance for Job Interview

Dear [HR Manager's Name],

I am writing to request for reimbursement of travel expenses incurred during my recent job interview for the position of [position] at your company. I appreciate the opportunity to interview for the position, but I had to travel from [location] to [destination] for the interview.

Email 3: Request for Travelling Allowance for Conference

Subject: Request for Travelling Allowance for Conference

I am writing to request for reimbursement of travel expenses incurred during my recent attendance at [conference name] held at [destination]. As per the company's policy, employees are eligible for reimbursement of travel expenses when attending conferences.

Email 4: Request for Travelling Allowance for Training

Subject: Request for Travelling Allowance for Training

I am writing to request for reimbursement of travel expenses incurred during my recent training program at [location]. As per the company's policy, employees are eligible for reimbursement of travel expenses when attending training programs.

Email 5: Request for Travelling Allowance for Sales Visit

Subject: Request for Travelling Allowance for Sales Visit

I am writing to request for reimbursement of travel expenses incurred during my recent sales visit to [customer name] at [location]. As per the company's policy, employees are eligible for reimbursement of travel expenses when visiting customers for sales purposes.

We are delighted to extend our professional proofreading and writing services to cater to all your business and professional requirements, absolutely free of charge at Englishtemplates.com . Should you need any email, letter, or application templates, please do not hesitate to reach out to us at englishtemplates.com. Kindly leave a comment stating your request, and we will ensure to provide the necessary template at the earliest.

Posts in this Series

- Causes Of Corruption, And Their Solutions Letter To Editor

- Chair Request Letter For Office, Teacher, Employee

- Change Of Address Letter For Customers

- Change Of Engineer Of Record Letter, Change Engineer Of Record Florida

- Change Of Residential Address Letter Sample

- Character Reference Letter From Mother To Judge

- Character Reference Letter Sample For Jobs

- Cheque Date Correction Letter Request Format

- Clarification Letter From Shipper On Mistake To Customs

- Closure Letter To Someone You Love

- Clothing Store Manager Cover Letter

- Company Address Change Letter To Bank

- Compensation Letter For Damages

- Complaint Letter About A Rude Staff

- Complaint Letter Against Father In Law

- Disability Insurance Recovery Letter

- Disappointment Letter To Boss On Appraisal

- Disappointment Letter To Client

- Disappointment Letter To My Wife

- Dishonoured Cheque Letter Before Action

- Diwali Holiday Announcement Email To Employees, Customers

- Donation Letter For Football Team

- Donation Request Letter For Laptop

- Donation Request Letter For Orphanage

- Donor Meeting Request Letter

- Down Payment Request Letter Sample

- Draft A Letter Of Interest To Contract, Or Lent Cars To Government Departments, And Agencies

- Early Payment Discount Letter Sample

- Early Retirement Letter Due To Illness

- Early Retirement Letter Of Resignation

- Early Retirement Request Letter For Teachers

- Eid Greetings Letter From Company To Staff Members, Employees And Students

- Electrical Engineer Experience Letter Sample

- Employee Encouragement Letter Sample

- Employee Not Returning Uniforms

- Employee Recognition Letters Sample

- Employee Warning Letter Sample For Employers

- Best Thank You Letter After Interview 2023

- Beautiful Apology Letter To Girlfriend

- Babysitter Cover Letter No Experience

- Babysitter Letter Of Payment

- Babysitting Letter To Parents

- Back To School Letter From Principal In Florida

- Balance Confirmation Letter Format For Banks And Companies

- Bank Account Maintenance Certificate Request Letter

- Bank Balance Confirmation Letter Sample

- Bank Internship Letter Format, And Sample

- Bank Loan Repayment Letter Format

- Authorization Letter To Collect Money On My Behalf

- Authorized Signatory Letter Format For Bank

- Aviation Management Cover Letter Example

- Attestation Letter For Employee

- Attestation Letter Of A Good Character

- Audit Document Request Letter

- Authority Letter For Degree Attestation Sample

- Authority Letter For Issuing Degree

- Authority Letter For Receiving Degree

- Authority Letter To Collect Documents

- Authority Letter To Collect Passport

- Authorization Letter For Air Ticket Refund

- Authorization Letter For Car Insurance Claim

- Authorization Letter For Driver License Renewal

- Authorization Letter For Getting Driver License

- Authorization Letter For Student Driver License

- Authorization Letter For Tree Cutting Permit

- Ask Permission From My Boss For Straight Afternoon

- Asking For Compensation In A Complaint Letter Example

- Appointment Letter With Probation Period

- Appreciation Letter For Good Performance On Duty

- Appreciation Letter For Hosting An Event

- Appreciation Letter For Manager

- Appreciation Letter From Hotel To Guest

- Appreciation Letter To Employee For Good Performance

- Apprenticeship Result Letter By Principal

- Approval Letter For Job Transfer

- Approval Letter For Laptop

- Approval Request To Govt Authorities For Sports Shop Approval

- Ask For A Letter Of Recommendation Taxas

- Apply For Government Contracts Letter

- Appointment Letter Daily Wages

- Appointment Letter For A Medical Representative Job

- Appointment Letter For Job In Word Free Download

- Appointment Letter For Patient

- Credit Card Address Change Request Letter To Hdfc Bank

- Customer Request Letter For Insurance Policy Pending

- Data Collection Application Letter Request From University

- Dealership Cancellation Request Letter

- Death Intimation Letter Format To Bank

- Debit Card Cancellation Letter Format

- Demand For Assurance Letter

- Demand Letter For Attorney Fees

- Demand Letter For Mortgage Payment

- Demand Letter For Property Return

- Demand Letter For Return Of Items

- Demanding Letter For The Competition Exams Books For Your College Library

- Denial Letter For Insurance Claim

- Compliment Letter To Hotel Staff

- Compromise Agreement Sample Letter

- Compromise Letter For The Reason Of Disturbance

- Compromise Letter To Police Station

- Computer Repair, And Replacement Complaining Letter

- Condolence Letter For Death Of Friend

- Condolence Letter For Death Of Mother

- Condolence Letter For Loss Of Child

- Condolence Letter For The Death Of Father, Mother, Or Someone Else

- Condolence Letter On Death Of Father In English

- Condolence Letter To A Friend Who Lost His Brother

- Condolence To My Player Lost A Parent

- Condolences Letter On Loss Of Wife

- Confessional Letter To Church

- Confirm Meeting Appointment Letter Sample

- Confirmation Letter For Airport Pick Up

- Confirmation Letter For Appointment In Email

- Confirmation Letter For Bank Account

- Confirmation Letter For Completion Of Training

- Confirmation Letter For Teacher After Completion Of 1 Year Of Probation With Necessary Terms, And Conditions

- Conflict Resolution Letter For Employees

- Congratulation Letter After Job Interview

- Congratulation Letter Business Success

- Congratulation Letter For Passing Board Exam

- Congratulation Letter For Promotion

- Congratulations Letter Receiving Award

- Consent Letter For Children Travelling Abroad

- Consent Letter For Guarantor

- Construction Contract Approval Letter

- Construction Delay Claim Letter Sample

- Contract Approval Letter Example

- Contract Extension Approval Letter

- Contract Renewal Letter To Manager

- Contract Termination Letter Due To Poor Performance

- Contract Termination Letter To Vendor

- Contractor Recommendation Letter Format

- Convert Residential To Commercial Property

- Courtesy Call Letter Sample

- Work From Home After Accident Letter Format

- Uniform Exemption Letter For Workers, Students, Employees

- Thanks Letter For Visitors Free Download

- Thanks Letter To Chief Guest And Guest Of Honor

- Apology For Resignation Letter

- Apply For Funds For Ngo Dealing With Disabled People, We Have A Land, And Want To Build The Proper Shelter

- Allow Vehicles For Lifting Auction Material Letter Format

- Address Change Request Letter For Credit Card

- Address Proof Letter Format

- Admission Confirmation Letter Format

- Admission Rejection Letter Samples

- Accreditation Letter For School

- Accreditation Letter For Travel Agency

- Accountant Letter For Visa

- Accreditation Letter For Organization

- Absence Excuse Letter For Professor-Lecturer

- Acceptance Letter By Auditor

- A Letter Of Support For A Graduation

- School Timing Change Notice

- Thank You Letter For Sponsoring An Event

- Sample Letter Of Data Collection, And Research Work

- Sample Letter Of Request For Borrowing Materials

- Sample Letter Of Thank You For Participation

- Sample Letter To Bank Manager For Unblock Atm Card

- Sample Letter To Claim Car Insurance

- Sample Letter To Close Bank Account Of Company

- Sample Letter To Parents About Fee Increase

- Sample Letter To Parents For School Fees Submission

- Sample Letter To Return Products, Or Ordered Items Or Replacement

- Sample Nomination Letter To Attend Training

- Sample Notice For Parent Teacher Meeting (Ptm)

- Sample Authority Letter For Cheque Collection

- Sample Experience Letter For Hotel Chef Or Cook

- Sample Experience Letter For Nurses

- Sample Holiday Notification Letter Format For Office

- Sample Invitation Letter To Chief Guest

- Sample Letter Asking Permission To Conduct Seminar

- Sample Letter For Acknowledging Delivery Of Goods, Or Services

- Sample Letter For Leave Without Permission

- Sample Letter For Requesting Quotations

- Sample Letter For Urgent Visa Request

- Salary Deduction Letter To Employee

- Request Letter For Any Suitable Job - Covering Letter Format

- Request Letter For Change Of Name In School Records

- Reply To Employment Verification Letter

- Request Application Letter To The College Principal -Vice-Chancellor -Admission Office For Taking Admission

- Request Final Payment Settlement After The Resignation

- Request For Fuel Allowance To Company-Employer

- Request For Meeting Appointment With Seniors - Other Employees-Clients Sample Letter

- Request For Office Supplies Templates

- Request Letter For Accommodation In University

- Request Letter For An Online Interview

- New Email Address Change Notification Letter

- Notice On Cleanliness In Your Office Compound

- Office Closing Reason For Business Loss Letter Format

- One Hour Leave Application Request Letter

- Permission Letter For Blood Donation Camp

- Promotion Request Letter And Application Format

- Proposal Letter For School Events And Activities

- Quotation Approval Request Letter With Advance Payment

- Recommendation Letter For Visa Application From Employer

- Remaining Payment Request Letter Sample For Clients, Customers

- Letter To Principal For Change Of School Bus Route

- Letter To Principal From Teacher About Misbehavior of a Student

- Letter To Remove Name From Joint Bank Account

- Letter To Renew Employment Contract Sample

- Letter To Subcontractor For Work Delay By The Contractor

- Letter To Your Friend About An Exhibition You Have Seen Recently

- Loan Cancellation Letter Sample

- Marriage Leave Extension Letter To Office-Manager Or Company

- Letter Of Introduction From A Company To An Employee For Visa

- Letter Of Recommendation For Further Studies By Employer

- Letter Regarding Visa Delay To Embassy

- Letter Requesting School Principal To Issue A New Student Identity Card

- Letter Requesting Sponsorship For Education From Ngo-Spouse-Court

- Letter To Airline For Refund Due To Illness, Death, Or Medical Grounds

- Letter To Cancel The Approved Leave Of Employee Due To Work In Office

- Letter To Customs Officer To Release Goods-Cargo

- Letter To Friend Telling About Your New School

- Letter To Friend Thanking Him For The Books He Lent To You

- Letter To Increase PF(Provident Fund) Contribution

- Letter To Inform Change Of Bank Account

- Letter To Insurance Company For Change Of Address

- Letter To Municipal Commissioner For Street Lights

- Letter To Municipal Corporation For Road Repair

- Letter To Parents Asking For Money

- 10 Examples of Letters of Recommendations

Ultimate Letter

Letter For Everyone

Sample And Pattern To Request Letter For Allowance

As an employee, you may occasionally get assigned to perform the job duties of a co-worker. Temporary job assignments can last a few weeks or a few months. If you are expected to perform these duties for an extended period of time, a responsibility allowance may be in order. This allowance is essentially a pay increase for as long as you carry the extra workload. Whether you receive an allowance depends upon the employer. If you believe you are entitled to a responsibility allowance, submit a written request to your employer. There is a pattern to write a request letter for allowance. To know the format to write a request letter for allowance read here more…

Table of Contents

- 1.1 Sample 1:

- 1.2 Sample 2:

- 1.3 Sample 3:

- 1.4 Sample 4:

- 1.5 Sample 5:

Tips To Write Request Letter For Allowance:

- Peruse your business contract or the organization strategy to decide if there is an arrangement for obligation recompenses.

- Utilize proficient business designing for your letter. Position the date in the upper left hand corner of the letter, trailed by a line break. Incorporate the name and address of your boss.

- Address the duty stipend letter to your chief or HR executive (if material). By and large, just enormous companies have an HR chief.

- Start the letter by including your name, official employment position and the brief occupation position you’ve been allotted.

- Notice how your outstanding task at hand has expanded because of the brief position. Give instances of the expanded outstanding task at hand. Indicate the period of time you have had an expanded remaining burden and to what extent you anticipate that the outstanding task at hand should last.

- Request a transitory recompense to remunerate you for the expanded remaining task at hand. Request a gathering to additionally talk about your remittance alternatives and the measure of your stipend.

- Finish your remittance letter with an expert shutting, trailed by your transcribed mark. Test proficient closings incorporate “Genuinely” and “Thank You.”

Q. How To Write Request Letter For Allowance?

A. There are a pattern and format to write a Request Letter for Allowance. While writing a request letter you need to maintain a pattern. While requesting you should more polite. To know the sample and pattern read here more…

Q. Is There Any Pattern To Write Request Letter For Allowance?

A. Yes, there is a pattern to write a Request Letter for Allowance. Every letter has its own pattern that one should maintain while writing letters. If you want to know the pattern to write a letter for allowance read here more…

More Recommended Articles :-

- Sample And Pattern Of Request Letter For Leave

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Reddit (Opens in new window)

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Leave Travel Allowance: Through a magnifying glass

The LTA is an allowance paid to the employee by the employer when the former submits original travel tickets/invoices, which were used for travelling with their family or alone when the employee was on leave.

The amount paid as LTA is tax free. The LTA is one of the best tax-saving components that an employee can avail.

Multifold Benefits of LTA

Encouraging employees to avail earned/privilege leaves also helps organizations as they don’t have to encash leaves upon an employee’s exit or retirement, which can be significantly high in cases where employees avail very few leaves!

If you look at the bigger picture, LTAs indirectly boost the tourism and travel sector as more and more salaried individuals and their families travel during their annual leaves/vacations!

Maximum Claim Limits

Though, there is no upper limit defined for LTA by the income tax authorities, most organizations cap it for effective administration. The most popular upper limit capped for LTA is an employee’s monthly basic salary.

RELATED POST: Common allowances decoded

LTA Restrictions

As the name suggests, LTA exemption is restricted only to the travel cost incurred by the employee. It’s not valid for other costs incurred during the entire trip, which might include expenses such as food, shopping and stay, etc.

Concept of block years

An employee can claim for LTA for only two journeys in a block of four years . These block years are different from the financial years (they’re based on calendar year) and are created by the Income Tax department.

Current Block for LTA Claims

Next Block for LTA Claims

1 January 2014 - 31 December 2017

1 Jan 2018 - 31 December 2021

In the current block, an employee can claim LTA for two journeys that have occurred during the period 2014 to 2017. However, if the employee has not made any LTA claims in the current year, then the exemption gets moved to the next year within the current block.

Also, if an LTA exemption is not claimed in the current block, only one LTA claim can be carried over to the first year of the next block. The exemption of the carried forward LTA should be claimed in the first year itself of the next block.

Also, the employee can claim LTA for multiple travels in the same year.

Rules of Exemption

Given below is a list of expenses that is exempted under LTA:

Travel by air : Economy class airfare by the shortest route or amount spent will be exempted depending on whichever is lesser.

Travel by rail : A.C. first class fare by the shortest route or the amount spent on travel will be exempted depending on whichever is lesser.

Place of origin and destination connected by rail but journey performed by other mode of transport

Place of origin and destination not connected by rail (partly/fully) but connected by other recognised public transport system

Place of origin and destination not connected by rail (partly/fully) and not connected by other recognised public transport system also.

Travel Limitations

Given below are the travel limitations applicable under LTA:

- It covers only domestic travel and doesn’t cover international travel. This is because originally it was meant to boost domestic tourism and travel!

- The mode of travel should be either air travel, rail or any other public mode of transport.

When to claim LTA

Before considering claiming for LTA, an employee is advised to check his/her pay structure. The LTA amount can vary from one employee to the other, however, if they’re eligible for LTA, they’ll need to produce original tickets/bills as per the criteria and submit the same to their employer.

Every company will formally announce the dates for LTA claims. They will then need to fill in the applicable forms, attach the documents such as travel tickets, boarding passes, etc., and send them to their HR or accounts team. Documents such as ‘boarding passes’ are needed as proof of the travel, tickets are usually not enough.

Employees should make their LTA claims before their employers make the final calculation for tax liability.

What if claimed amount is lesser than entitled amount?

If an employee is entitled to an LTA amount of INR 30,000 but he/she has claimed only for INR 20,000, the applicable LTA deduction will be for INR 20,000 and the remaining INR 10,000 will be added to his/her taxable income, which will be accountable for tax liability.

Providing Proof of LTA

Employers usually don’t have to submit proof of LTA to tax authorities while assessing LTA claims. Even though it is not mandatory for employers to collect proof of travel from the employees, they still have the right to demand documentary proof, if needed.

The employee is advised to keep proof of their travel such as boarding passes, flight tickets, invoice of travel agent and other documentary proof in case the assessing officer or the employer demands for it.

Also, it is also important for HR to verify that the employee was on leave of absence for the duration for which LTA is being claimed.

Related Posts

Central & State Notifications - COVID 19 (Sep-Oct 2020)

Statutory Notifications of September 2020

Employees Deposit Linked Insurance Scheme (EDLI Scheme)

Subscribe to our newsletter

The Economic Times daily newspaper is available online now.

How to claim lta from your employer.

Before availing of the tax benefit on LTA, there are, however, certain other important conditions attached to it. Read on to know them. Do keep in mind that tax exemption on LTA can be claimed in the old tax regime only for FY 2021-22.

Read More News on

(Your legal guide on estate planning, inheritance, will and more.)

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Prime Decoder: New RBI regulations trigger changes to the corporate bond market and treasury ops of banks. Here’s how.

12th pass: Meet Vishesh Khurana, the ‘college dropout’ who will lead Tribe Capital’s India foray

Prime Decoder: Understanding India’s proposed move from minimum wage to living wage

Entire INR25 crore poll bonds bought by Dangi’s Authum ahead of its Reliance-ADAG deals went to BJP

Stock Radar: GSFC shows signs of trend reversal after falling 30% from highs

At Suzlon, CEO Chalasani is powering profitability. But is the turnaround sustainable?

Find this comment offensive?

Choose your reason below and click on the Report button. This will alert our moderators to take action

Reason for reporting:

Your Reason has been Reported to the admin.

To post this comment you must

Log In/Connect with:

Fill in your details:

Will be displayed

Will not be displayed

Share this Comment:

Uh-oh this is an exclusive story available for selected readers only..

Worry not. You’re just a step away.

Prime Account Detected!

It seems like you're already an ETPrime member with

Login using your ET Prime credentials to enjoy all member benefits

Log out of your current logged-in account and log in again using your ET Prime credentials to enjoy all member benefits.

To read full story, subscribe to ET Prime

₹34 per week

Billed annually at ₹2499 ₹1749

Super Saver Sale - Flat 30% Off

On ET Prime Membership

Unlock this story and enjoy all members-only benefits.

Offer Exclusively For You

Save up to Rs. 700/-

ON ET PRIME MEMBERSHIP

Get 1 Year Free

With 1 and 2-Year ET prime membership

Get Flat 40% Off

Then ₹ 1749 for 1 year

ET Prime at ₹ 49 for 1 month

Stay Ahead in the New Financial Year

Get flat 20% off on ETPrime

90 Days Prime access worth Rs999 unlocked for you

Exclusive Economic Times Stories, Editorials & Expert opinion across 20+ sectors

Stock analysis. Market Research. Industry Trends on 4000+ Stocks

Get 1 Year Complimentary Subscription of TOI+ worth Rs.799/-

Stories you might be interested in

- Eviction Notice Forms

- Power of Attorney Forms Forms

- Bill of Sale (Purchase Agreement) Forms

- Lease Agreement Forms

- Rental Application Forms

- Living Will Forms Forms

- Recommendation Letters Forms

- Resignation Letters Forms

- Release of Liability Agreement Forms

- Promissory Note Forms

- LLC Operating Agreement Forms

- Deed of Sale Forms

- Consent Form Forms

- Support Affidavit Forms

- Paternity Affidavit Forms

- Marital Affidavit Forms

- Financial Affidavit Forms

- Residential Affidavit Forms

- Affidavit of Identity Forms

- Affidavit of Title Forms

- Employment Affidavit Forms

- Affidavit of Loss Forms

- Gift Affidavit Forms

- Small Estate Affidavit Forms

- Service Affidavit Forms

- Heirship Affidavit Forms

- Survivorship Affidavit Forms

- Desistance Affidavit Forms

- Discrepancy Affidavit Forms

- Guardianship Affidavit Forms

- Undertaking Affidavit Forms

- General Affidavit Forms

- Affidavit of Death Forms

- Travel Form

FREE 9+ Sample Travel Allowance Forms in PDF | MS Word | Excel

10+ Sample Travel Claim Forms

Travel expense form - 8+ free documents in pdf, doc, sample travel expense claim form - 11+ free documents in word ....

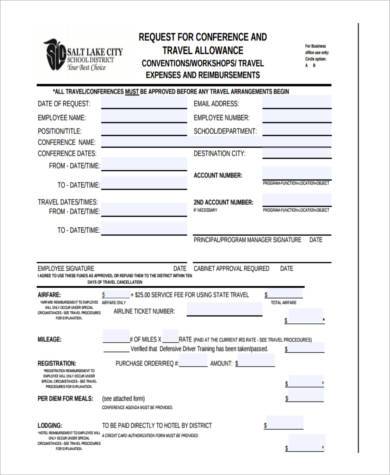

Companies have policies on expenses and allowances, which lays down arrangements for employers to cover costs for employees’ travel and other employment-related activities. However, pre-authorization is required and needs approval (typically by the executive director) before the money is spent. Employees assigned to go on business trips need to be prepared at all times. The first thing they need to secure is a travel form. Travel Forms are forms which need to be filed prior to the date of travel. Once you’ve filled out the form, you can either send it via e-mail or print it out and submit it.

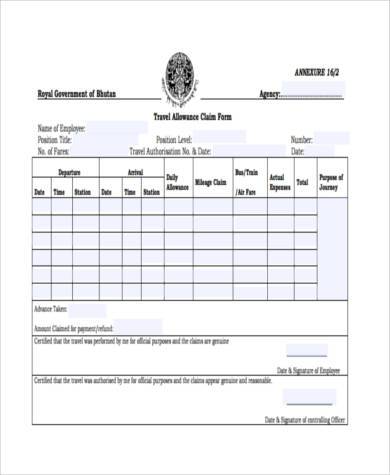

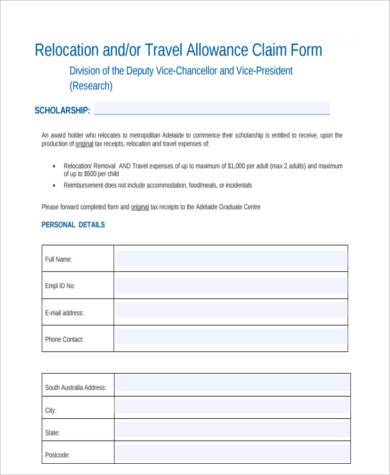

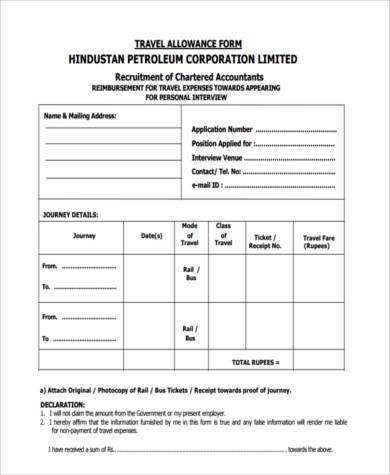

Travel Allowance Claim Form

Size: 74 KB

Travel Allowance Bill Form

Size: 14 KB

- Travel Allowance Request Form

Size: 133 KB

Travel Allowance Claim Form Sample

Size: 554 KB

Travel Allowance Form in PDF

Size: 142 KB

Travel Forms are categorized into two:

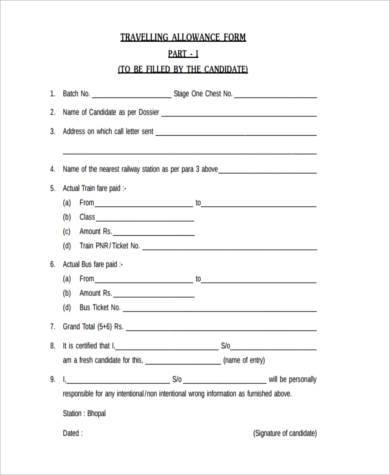

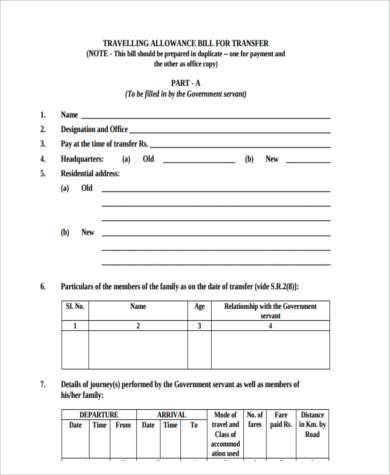

Allowance Forms

These type of forms are provided by the company for its employees to make use of. The company has allotted a certain percentage of its funds for necessary expenses for business trips.

Below are the different types of Allowance Forms:

- Travel Allowance Claim Forms

– are filed after the trip has taken place

– original receipts need to be attached

- Travel Allowance Bill Form to Tour

– are filed prior to the trip

– requires precise details

– filed before travel arrangements – needs approval (by the executive director)

Free Travel Allowance Form

– filed before travel arrangements by possible candidates who can avail of this

Leave Travel Allowance Form

– filed prior to the leave – provides an outline of the details of the trip

Transfer Travel Allowance Form

– is filed prior to the transfer

– family members are included in the transfer

Companies also have some policies which provide employees with travel allowances and reimbursements of accommodation, transportation, and other expenses. In some situations, companies provide a monetary budget for assigned business trips, and it’s the employees prerogative on how to make use of it as long as the work gets done. Another type of form needed are the Travel Claim Forms . Some forms need to be filled out prior to travel and require approval depending on the urgency.

Travel Allowance Form in Word Format

Size: 106 KB

Size: 13 KB

General Travel Allowance Form

Size: 29 KB

Expense Forms

Trips, whether to domestic or international destinations, incur expenses. However, companies have the prerogative to accept or decline such requests. Travel Expense Forms are readily available to all employees provided that the task on hand requires him or her to travel. How frequent do companies grant a reimbursement of travel expenses? This concern undergoes a long process, especially since the Executive Director together with the majority of stockholders have to agree to it. For as long as employees can provide legitimate receipts, then companies would increase their budget for travel and many workers would become more motivated to travel more.

Related Posts

Travel request form template, sample child care expense forms - 8+ free documents in word ..., 7+ sample mileage reimbursement forms sample forms, claim form template, 12+ sample reimbursement request forms, 17+ sample reimbursement forms, 12+ travel proposal form samples - free sample, example format ..., sample business expense form - 8+ free documents in pdf, doc, 39+ free claim forms, sample medical reimbursement form - 10+ free documents in pdf, sample employee expense reimbursement forms - 7+ free ..., sample expense authorization forms - 7+ free documents in word ..., sample expense report - 9+ free documents in pdf, xls, sample generic direct deposit forms - 8+ free documents in pdf, sample expense reimbursement form - 11+ free documents in ..., 8+ sample employee reimbursement forms, sample employee expense forms - 8+ free documents in word, pdf, 6+ travel document forms, sample medical expense forms - 8+ free documents in word, pdf.

Thank you for signing up!

Leave Travel Allowance Exemption: A Comprehensive Guide

What is leave travel allowance, conditions to claim lta exemption, eligibility for lta exemption, quantum of lta exemption, lta exemption rules for various modes of transport, unclaimed lta, lta exemption in case of job change, lta for multi-destination travel, lta for vacations on holidays, expenses included under lta, procedure to claim lta, frequently asked questions.

Leave Travel Allowance (LTA) is a popular tax benefit provided by employers to their employees in India. It allows employees to save taxes on travel expenses incurred during their vacations within the country. In this comprehensive guide, we will delve deeper into the concept of LTA, how it works, and the rules and regulations surrounding it. Whether you're an employee looking to understand the benefits of LTA or an employer seeking to implement it, this guide will provide you with all the information you need. So, let's begin!

Leave Travel Allowance (LTA) is a tax-free allowance provided by employers as part of their employees' salary component. It allows employees to claim tax exemption on the costs incurred for leisure travel within India. Under LTA, employees are permitted to take a leave from work and travel on vacation, with the costs incurred considered as a tax-free expense. The exemption is allowed twice in a block of four years, subject to certain conditions.

To avail of the LTA tax benefit, employees must submit the bills and travel documents to their employer as proof of travel expenses. The exemption is allowed only for the expenses incurred during the travel period and is subject to specific conditions.

To claim an exemption for LTA, employees must fulfill the following conditions:

- The employee must actually travel to be eligible for LTA. Claiming LTA without actually traveling is not permitted.

- The vacation should be taken only within India.

- Costs incurred for family members who travel with the employee would also be allowed as an exemption. The family members include spouses, children, dependent parents, and dependent siblings.

- LTA components must be included in the salary structure of the employee.

- The exemption can be claimed for up to two children born on or after 1st October 1998. There is no restriction for children born before this date or in cases of multiple births on a second occasion after having one child.

- LTA exemption is allowed for up to two journeys taken within a block of four calendar years. The current block year for claiming LTA started in 2022 and will end in 2025. Unused LTA entitlement for the current block year is forfeited if not claimed, and the employee will need to wait for the next block year to claim LTA again.

- LTA can be claimed for travel by any mode of transport, including air, train, or road.

- No LTA is allowed for hotel accommodation and food.

The eligibility for LTA exemption depends on the actual cost incurred on travel. Employees can claim LTA exemption for the expense incurred on booking a journey from their place of origin to the place of travel and back. The journey should be undertaken through the shortest possible route by air, rail, or bus. Only the cost of tickets booked for travel is allowed as an exemption. Costs incurred on conveyance, sightseeing, accommodation, shopping, and food are not allowed. If the employer offers a lower LTA allowance than the actual travel cost, the exemption is limited to the LTA allowed by the employer.

For example, if the employer allows an LTA of INR 25,000 and the employee incurs travel costs of INR 35,000, the LTA exemption can be claimed only for INR 25,000. Conversely, if the employee incurs a cost of INR 20,000, the exemption allowed would be INR 20,000.

The quantum of LTA exemption depends on the actual cost incurred on travel. The LTA exemption is allowed for the expense incurred on booking a journey from the employee's place of origin to the place of travel and back, through the shortest possible route via air, rail, or bus. Only the cost of tickets booked for travel is allowed as an exemption. Costs incurred on conveyance, sightseeing, accommodation, shopping, and food are not allowed.

The actual travel costs incurred for LTA exemption depend on the mode of transport. The rules for determining the exempted travel costs for various modes of transport are as follows:

- When the destination is not connected directly by a recognized public transport, the exempted travel costs are considered to be the fare of AC first-class rail tickets from the origin city to the destination city, assuming the journey is made by rail and the shortest route is taken.

- If the destination is connected by all recognized public transport other than trains, the exempted cost would be the fare of first class or deluxe class on such transport for the journey taken using the shortest route.

- If the destination is connected by trains, the exempted cost would be the fare of an AC first-class train ticket for the shortest route, whether the journey has been taken by train or not.

- If the employee travels by air, the exempted cost would be the fare for economy class of a national carrier using the shortest route.

LTA exemption is available for two journeys undertaken in a block of four years. However, if an employee does not take two journeys within the four-year block, only one unutilized LTA can be carried forward to the next block of years and claimed therein. To claim the unutilized LTA, the employee must take a trip in the first calendar year of the next block. If the unutilized LTA is not claimed within the first year of the next block, it will expire and cannot be claimed later on.

Even if an employee changes their job within a block of four years, LTA exemption is still available. If the change happens within the block and there is any unutilized LTA, it can be claimed with the new employer. However, if the LTA has been availed from the old employer, the new employer will not allow any new LTC.

If an employee goes on vacation and visits multiple cities, the exempted LTA amount will cover the cost of round-trip travel from their home city to the farthest city they visit and back. In other words, the LTA will reimburse the employee for the most expensive leg of their travel.

For example, if an employee resides in Delhi and decides to go on vacation to Mumbai, Kolkata, and Chennai, the cost of round-trip travel from Delhi to Mumbai is ₹5000, from Delhi to Kolkata is ₹4000, and from Delhi to Chennai is ₹6000. In this scenario, the exempted LTA amount would be ₹6000, which is the cost of the round-trip travel from Delhi to Chennai and back. Even though the employee visited multiple cities, the LTA will cover the expense of the farthest city visited and the return journey.

Under the Income Tax Act, LTA is allowed only when the employee takes a leave from work and then travels on vacation. If the traveling is done on holidays, the same is not allowed for LTA exemption. However, organizational practices might differ, and some companies may allow LTA exemption even if the trip is taken on a holiday, while others may not.

Under the Indian Income Tax Act, the following expenses can be included under LTA:

- Travel expenses: LTA covers the cost of travel for the employee and their immediate family members, including spouse, children, and dependent parents or siblings. The travel can be undertaken by air, rail, or public transportation as per the specific rules defined by the employer or the Income Tax Department.

- Destination: LTA is meant for travel within India. Employees can claim expenses incurred on traveling to any place in India for their leave period.

- Mode of travel: LTA covers expenses incurred on travel by air, train, or other public transportation. The expenses are eligible for reimbursement based on the actual amount spent or as per the limits set by the employer or tax authorities.

- Leave period: LTA can be claimed for travel during the employee's leave period, which may include annual leave, casual leave, or any other form of approved leave.

The procedure to claim LTA may vary depending on the employer's policies and procedures, but here are the general steps that most employees need to follow:

- Check your eligibility: Ensure that you are eligible for LTA and have completed the required years of service with your employer. Check the LTA rules and regulations specific to your employer.

- Plan your travel: Plan your travel in advance and select the mode of transport you wish to use. Keep all the relevant documents related to your travel, such as tickets, boarding passes, and invoices.

- Apply for LTA: Fill out the LTA application form provided by your employer and provide all the relevant details of your travel, such as the date of travel, destination, mode of transport, and cost incurred.

- Submit proof of travel: Along with your application form, submit all the relevant documents such as tickets, boarding passes, and invoices that prove your travel. These documents serve as proof of your LTA claim.

- Await approval and reimbursement: Your employer will verify your LTA claim and, once approved, reimburse the amount claimed as per their policy. The reimbursement may be processed as part of your regular salary or as a separate payment.

Q: If the employee takes one journey in the block of 2022-23, by when should the unclaimed LTC be claimed in the next block?

A: The unclaimed LTC exemption should be claimed within the year 2025 if it is carried forward to the next block.

Q: Is LTA exemption available in the new tax regime applicable from the financial year 2022-23?

A: No, LTA exemption would not be allowed under the new tax regime, which is applicable from the financial year 2022-23.

Q: If the employee's parents-in-law travel with him, would the travel costs for the parents-in-law be claimed as an exemption?

A: No, LTA exemption cannot be claimed for travel costs of parents-in-law.

Q: Which section of the Income Tax Act allows an exemption for LTA?

A: Section 10(5) of the Income Tax Act, 1961 allows LTA exemption.

Q: If the boarding pass is lost, can LTA be claimed?

A: LTA can be claimed if the boarding pass is lost. However, allowing LTA exemption would depend on the employer and the availability of other proofs.

Q: If the employee's wife travels with him, would her travel costs be allowed as an exemption?

A: Yes, the travel costs of spouses can be claimed under LTC exemption.

Q: Can only the travel costs of the family members be claimed as LTA if the employee does not travel?

A: No, if the employee does not travel, no LTA exemption would be allowed even if the family members travel.

Q: What would happen if the employee did not travel in a block of four years?

A: If the employee does not travel in a block of four years, LTA exemption would not be allowed. However, one unutilized LTA can be carried forward to the next block.

Q: Can return airfares on international trips be claimed under LTA?