Buying a Sim Card for Jamaica in 2024

Are you planning a trip to Jamaica and looking for the best way to stay connected? This is a complete guide for buying a sim card for Jamaica in 2024 with where to buy a sim card in Jamaica, up to date prices as per January 2024, the best e-sim cards for Jamaica, the best 4G/5G network in Jamaica, my recommendation, a vlog about my experiences and even info about international sim cards for Jamaica.

Wherever I go one of the first things I do is making sure I get instantly connected to the internet. Having data on your phone makes life so much easier. Traveling to Jamaica is more fun if you can get directions from your phone, stay in touch with friends, look up nearby cool things to do, find fun bars and good restaurants, order a taxi through an app, etc.

As I am also traveling to every country in the world and I write a sim card guide everywhere I go you can already find more than 200 sim card guides on Traveltomtom from all over the world: USA , Miami , New York , Newark , Dominican Republic , Mexico , Mexico City , Guatemala , Panama , Colombia , Antigua & Barbuda , UK , London , Europe , Germany , Switzerland , Hong Kong , Dubai and many more.

So next time you are planning your adventure abroad come check out Traveltomtom for the latest prepaid sim card and e-sim card advice for your holiday destination. Bookmark me!

Why buying a sim card for Jamaica

First of all we don’t want our Jamaica holiday to be ruined by high roaming charges. Roaming charges on your sim card from home can easily be $3 USD per MB, which means just opening the Instagram app can costs you around $100 USD.

Also keep in mind that overseas data roaming plans from your home provider limit your data speed. Which means you probably will be surfing the internet on 3G.

A smartphone without data is useless these days and getting directions from Google Maps, or finding nearby friends suddenly becomes impossible.

Yes, the resorts and hotels in Jamaica have reliable WiFi and I must say I was surprised with the data speed of the WiFi. However, as soon as you walk out on the beach you will lose connection.

Also keep in mind that surfing the internet on public WiFi is through an unsecured network. The use of a VPN service is recommended. With a local prepaid sim card or an e-sim card you use a secured network.

My recommendation

Traveltomtom recommends a Digicel sim card for Jamaica. They have the best 3G/4G network and sim cards with data are cheap. The price depends where in Jamaica you buy your sim card.

If you are planning to buy a sim card in Jamaica then keep in mind that you can only get physical prepaid sim cards, there are no e-sim cards available for tourists in stores in Jamaica, only on the internet.

Traveltomtom definitely recommend e-sim cards, but for traveling to Jamaica there are unfortunately very limited options available in 2024. See below for more info.

That said, another great way to stay connected when traveling to Jamaica in 2024 is a world travel sim card. These international prepaid sim cards with data work in sometimes up to 140 countries. Click on the link to find my comparison of the best travel sim cards in 2024.

When using a Jamaica sim card, international or an e-sim card for Jamaica, always make sure your phone is unlocked. In general phones from the USA are locked, phones from other countries around the world are mostly unlocked. When not sure ask your sim card provider from home and unlock your phone before your trip to Jamaica.

Best e-sim cards for Jamaica

The easiest way to stay connected when traveling to Jamaica in 2024 is an e-sim card. No more visiting a sim card shop and swapping physical sim cards. You order an e-sim card for Jamaica online, you receive a QR code, scan it, follow the simple steps and within just a couple minutes you have installed your Jamaica e-sim card on your phone.

As soon as you arrive in Jamaica you are automatically connected and can enjoy data on your phone as if you were at home. Pretty much as soon as the plane lands.

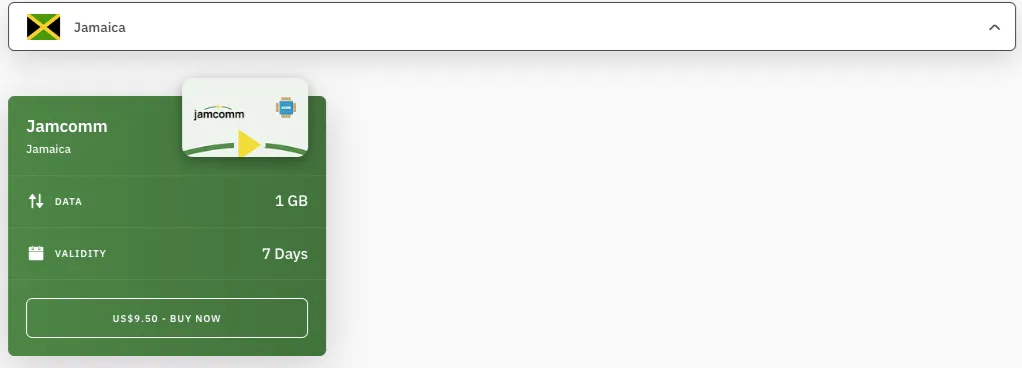

Airalo is a reputable e-sim card provider that offers e-sim cards for Jamaica from Jamcomm.

- 1 GB for 7 days = $9.5 USD

Click here for more info or to order an e-sim card for Jamaica directly online via Airalo .

The above Jamcomm e-sim card operates on the 4G/LTE network of Digicel and is a data-only e-sim card.

SimOptions sells an e-sim card from Ubigi which is valid all over the Caribbean in 28 countries/islands.

- 1 GB data for 30 days = $29.90 USD

The Ubigi e-sim card is basically the ultimate e-sim card for the Caribbean but it is also more expensive than the Airalo e-sim card for Jamaica.

Click here to order this e-sim card for the Caribbean via SimOptions .

Nomad is a trusted e-sim provider that often has amazing e-sim card deals. However, the Jamaica e-sim cards are rather expensive compared to Airalo. At least Nomad has bigger data packages.

- 1 GB for 7 days = $25 USD

- 3 GB for 30 days = $40 USD

- 5 GB for 30 days = $45 USD

Click here for more info or to order an e-sim card for traveling in Jamaica via Nomad .

Make sure your phone is e-sim compatible before ordering an e-sim card for Jamaica.

Mobile internet operators in Jamaica

Jamaica is a relatively small country with a population of 3 million. There are only 2 mobile internet operators: Flow and Digicel. Both mobile internet provider offer prepaid sim cards for tourists in Jamaica.

Both operators only sell physical prepaid sim cards for tourists, e-sim cards are not available. So in case you have one of the newest iPhones from the USA and no physical sim card slot anymore, you can NOT buy a tourist sim card in Jamaica.

In that case the only option is ordering an e-sim card for Jamaica via either Airalo , Nomad or SimOptions .

Prepaid sim card registration

When buying a prepaid sim card in Jamaica you will need to bring your passport for the registration. A copy of your passport will be taken in the store and you will receive a new prepaid sim card with a Jamaican phone number. Jamaican phone numbers start just like in the USA with +1.

You can buy up to 3 prepaid sim cards with 1 passport. If for some reason you prefer your sim card not to be registered on your passport there is a way out. International sim cards and e-sim cards do NOT require a registration with your passport, just your email address.

Want to stay anonymous then order an e-sim card for Jamaica via Airalo , Nomad or SimOptions and you will only need your email address to register.

Where to buy a sim card for Jamaica

The most convenient place to buy a sim card in Jamaica is at the airport on arrival. But prices will of course be much higher.

Sangster International Airport Montego Bay

At Sangster International Airport in Montego Bay there is a local phone shop called ‘Stay Connected’. Here you can buy a Digicel sim card for Jamaica, but expect tourist prices. They easily charge 3x as much as the original price. Not the cheapest place to buy a Jamaica sim card, but the fastest way to get connected when arriving in Jamaica.

Normal Manley International Airport Kingston

At Kingston Airport there is an actual Flow and Digicel store now. They recently opened and they replace the representatives in the company t-shirt roaming outside. Expect also here tourist prices. The same as at Montego Bay. Both phone stores are in the arrival hall.

Official retail stores of Digicel or Flow

The best place to buy a sim card in Jamaica is at an official retail store of Digicel or Flow. Here you will get the best service, the cheapest prices and the staff makes sure you are instantly connected and your Jamaica sim card is registered properly. This is my advice when you are looking for the best sim card for tourists in Jamaica.

On the streets

Traveltomtom does not recommend buying a sim card on the streets in Jamaica. In tourist hotspots like Negril and Montego Bay I have seen people offering prepaid sim cards for tourist prices. First of all they are overpriced and second, keep in mind that a Jamaica prepaid sim card only works if it is registered on your name.

These ready to use sim cards you buy on the streets in Jamaica are registered on someone else’s name. NOT recommended!

As mentioned before there is the possibility to order an e-sim card for Jamaica via Airalo , Nomad or SimOptions or buy an international prepaid sim card that will be delivered to your home address before your trip.

Prices prepaid sim cards Jamaica

Prepaid sim cards for Jamaica are much cheaper at official Digicel or Flow stores. At the international airports they sell sim cards in USD.

Stay Connected - Montego Bay Airport

At the phone store ‘Stay Connected’ at Sangster International Airport you can buy one of the following Digicel prepaid sim card plans:

- 6 GB data + 300 minutes + 10 GB for social media for 3 days = $15 USD

- 14 GB data + 700 minutes + 25 GB for social media for 7 days = $23 USD

- 20 GB data + 2,500 minutes + 50 GB for social media for 28 days = $45 USD

Opening hours: daily 10.00 am - 6.00 pm - CASH ONLY, credit cards are not accepted.

You can find the same tourist sim cards at Kingston International Airport.

As I mentioned before the best place to buy a sim card in Jamaica is at an official retail store. The prices below are in Jamaican Dollars and as per January 2024: $1 USD = $155 JMD and $100 JMD = $0.64 USD.

A Digicel prepaid sim card costs $750 JMD ($5 USD) and it comes with the following plan:

- 6 GB data + 300 minutes + 10 GB social media

On top of that you can top up with one of the following prepaid data plans:

- 3 GB data + 100 minutes + 5 GB social media for 1 day = $216

- 6 GB data + 300 minutes + 10 GB social media for 3 days = $479 - $3 USD

- 6 GB data + 500 minutes + 25 GB social media for 7 days = $895

- 15 GB data + 2,500 minutes + 50 GB social media for 28 days = $3,349 - $21 USD

All Digicel stores around Jamaica are only open from 09.00 AM till 6.00 PM. Located the nearest one by using Google Maps.

Flow has several prepaid sim card plans that all come with unlimited calls & text as well as international minutes:

- 1 GB data + unlimited social media apps + 1 GB TikTok for 2 days = $315 JMD - $2 USD

- 3 GB data + unlimited social media apps + 2 GB TikTok for 5 days = $585 JMD

- 8 GB data + unlimited social media apps + 4 GB TikTok for 7 days = $830 JMD - $5 USD

- 8 GB data + unlimited social media apps + 4 GB TikTok for 28 days = $2,300 JMD

- Unlimited data + unlimited social media apps + 8 GB TikTok for 28 days = $4,900 JMD - $31 USD

Best 4G/5G network in Jamaica in 2024

Pretty important for staying connected when traveling to Jamaica is the network coverage and therefore I will compare the Jamaica network coverage maps for both mobile internet providers and find the best 4G/5G network in Jamaica in 2024.

Is there 5G in Jamaica?

Unfortunately as per January 2024 there is still no 5G in Jamaica. The best you can get is 4G/LTE. The data speed I experience was pretty solid on my Digicel prepaid sim card with up to 45 Mbps download and 25 Mbps upload.

Flow 3G/4G network coverage map

Digicel 3G/4G network coverage map

Although the above mobile data network coverage maps are updated for 2024 they are not completely correct, that said it is a great indication to prove the point. Because from the above mobile data network coverage maps we can clearly see that Digicel has by far the best network coverage in Jamaica in 2024.

For example I went to Negril and I had a pretty good 4G/LTE signal throughout my stay at 7 Mile Beach.

Best sim card for Jamaica in 2024

Traveltomtom is a fan of e-sim cards for traveling the world. However, for Jamaica the e-sim card plans are very limited and I simply need more than just 5 GB data. Therefore if you are a heavy data user I recommend buying a physical prepaid sim card for tourists in Jamaica. But if you just need 1 or 2 GB data to stay connected than an e-sim card is my first recommendation for when traveling to Jamaica in 2024.

Buying a local prepaid sim card in Jamaica is the cheapest way to stay connected on your holiday. Prices for Jamaican sim cards are fairly cheap, but much more expensive when you buy them at the airport. At the international airports of Kingston and Montego Bay you pay tourist prices in USD for the sim cards.

There are two options, a Flow and a Digicel prepaid sim card, but it leaves no doubt that Digicel is the best prepaid sim card in Jamaica in 2024. Have a look at my comparison of the 4G/LTE network coverage maps in Jamaica and you instantly understand why Digicel is the best tourist sim card.

Here is also a vlog about my experiences buying a Jamaica sim card with all my tips and what it looks like arriving at Montego Bay Airport.

Order a sim card for Jamaica online

Normally Traveltomtom also recommends sim cards that you can order online. Unfortunately for Jamaica there are very limited options and Traveltomtom recommends buying a sim card in Jamaica as the best way to stay connected on your trip. As soon as there are international prepaid sim card deals for Jamaica online I will add them here.

Actually there is a physical international prepaid sim card available for Jamaica but you pay $49.90 USD for just 1 GB data. If that is what you want then you can order this Jamaica prepaid sim card via SimOptions .

For now I am sure all the information about staying connected when traveling to Jamaica was helpful for your upcoming trip. Let me know if you have questions and leave me a message below or reach out to me on social media.

Curious what it looks like trying to visit every country in the world ? Go check out my Instagram account @traveltomtom and follow along. As of January 2024 I have visited more than 155 countries, so still a long way to go.

View this post on Instagram A post shared by Adventure Traveler & Blogger (@traveltomtom)

Enjoy your trip to Jamaica!

- montego bay

Jamaica SIM Cards: Everything You Need To Know

by Melissa Giroux | Last updated Apr 23, 2024 | Caribbeans , North America , SIM Cards , Travel Tips

Visiting Jamaica soon? Make sure to know what to expect when it comes to purchasing a Jamaica SIM card .

In this guide, we’ll explain where to buy a SIM card in Jamaica in person and online. We’ll also discuss prepaid SIM cards and eSIMs if your mobile supports them.

Before you read this guide, you may wonder if you actually need a SIM card in Jamaica. If you don’t mind not having Internet, you’ll likely find free Wifi in restaurants, shopping malls, and hotels.

That said, if you need data to get around or call a cab – you may want to get a Jamaican SIM card for your travels.

Best SIM Cards For Jamaica

If you’re traveling in Jamaica, we recommend using a SIM card from Digicel, Flow, or Airalo. (I’ll get back to Airalo later on, so keep reading to learn more!)

That said, if you’re planning on visiting other countries during your trip to the Caribbean, you might want to make sure to pick an option that offers coverage in other Caribbean countries.

How To Buy A Jamaican SIM Card

You can either buy a Jamaica prepaid SIM card in person in some international airports, mobile provider stores, convenience stores, or online.

Usually, you can expect higher costs and low data offers at the airport, so we don’t recommend buying a SIM card at the airport.

That said, you won’t necessarily find SIM card shops in every airport, so it’s essential to keep this in mind. And, when you see a shop, you might also have limited options.

For this reason, I’d recommend buying a SIM card directly from the mobile provider store. Note that you may need your passport to buy one.

Although, this means you won’t get data right upon your arrival. So, if you prefer to be connected at all times, you could use an eSIM or purchase a Caribbean prepaid SIM card online.

Now, let’s take a look at the data plans offered by Digicel, and Flow.

Digicel SIM Card

Digicel offers several different types of tourist plans:

- 3 GB valid for 1 day for JMD 195 ($1.27)

- 8 GB valid for 2 days for JMD 325 ($2.12)

- 10 GB valid for 3 days for JMD 435 ($2.84)

- 18 GB valid for 5 days for JMD 595 ($3.88)

- 25 GB valid for 7 days for JMD 895 ($5.84)

Flow SIM Card

Flow has several different prepaid plans available:

- 500 MB valid for 2 days for JMD 285 ($1.86)

- 2 GB valid for 5 days for JMD 530 ($3.46)

- 6 GB valid for 7 days for JMD 775 ($5.05)

- 10 GB valid for 28 days for JMD 2600 ($16.96)

- Unlimited data valid for 30 days for JMD 4900 ($31.96)

Overall, we think Flow is the best option if you plan to buy your prepaid SIM card in person.

That said, any would do if you can’t find their store!

How To Buy A Jamaica Prepaid SIM Card Online

If you wish to have your SIM card ready for your arrival, you could purchase it online or on websites like Amazon.

You’ll find different plans on Amazon. For example, Orange Holiday World SIM works in more than 100+ countries and gives you up to 10 GB of data for 14 days. Jamaica is included.

But there are many other options worth considering, so have a look and make sure the countries you plan on visiting are listed.

Browse your options on Amazon

Finally, the last option is to buy an eSIM for Jamaica or, if you’re traveling to multiple countries, an eSIM plan for the Caribbean.

How To Buy A Jamaica eSIM Card

eSIM is a new concept allowing you to have a virtual SIM card inside your phone. If your mobile phone supports eSIM cards – it’s definitely one of the best options to get data in Jamaica.

Curious? Learn more about eSIMs for travelers on eSIM Roamers .

I started using eSIM as soon as my mobile phone supported it. And I first tried it when visiting my family in Canada. To buy eSIMs, I usually use Airalo .

Keep reading to learn more about the best eSIMs for Jamaica.

Airalo Jamaica

If you want an eSIM for Jamaica, you could purchase one on Airalo . This website offers many eSIM cards worldwide and special plans for North America and Jamaica.

I’ve been using Airalo for several months, and it works fine.

Here are the options available :

- 1 GB, valid for 7 days for $9.50

Here’s an overview of the plan available for the Caribbean :

- 1 GB, valid for 7 days for $15

The option mentioned above is part of the Island Hopper plan and offers coverage in 24 countries in the Caribbean, including Jamaica.

Now, one important thing to note about Airalo is that you’ll need to keep an eye out for the provider in each country.

Suppose you ever have trouble connecting to the Internet during your trip. In that case, it might be because you’re connecting automatically to networks and need to select a network manually instead.

When you purchase the eSIM, you’ll get access to the list of networks supported in each country.

Go to Airalo

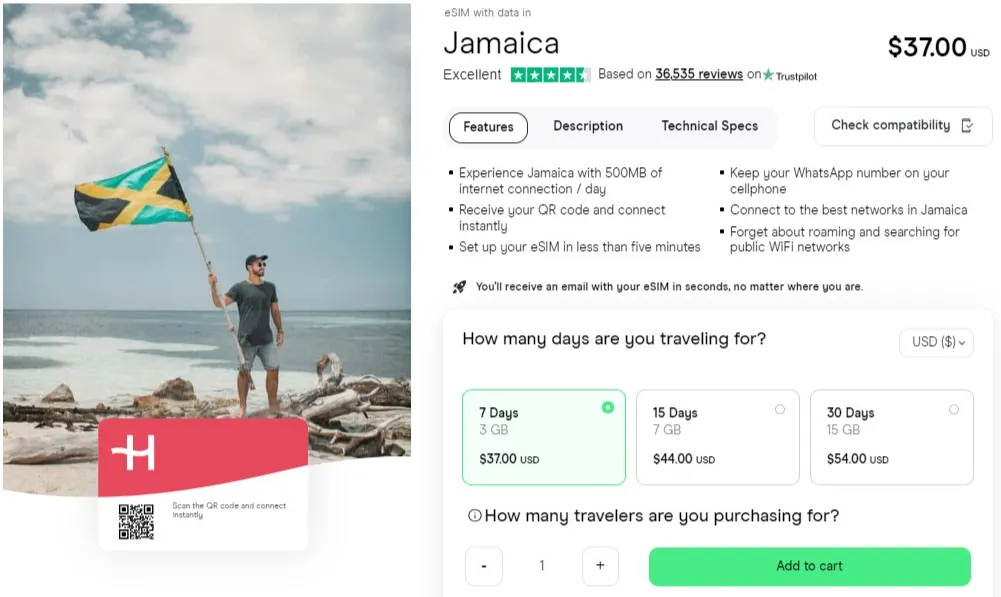

Holafly Jamaica

Alternatively, you could look at your options on Holafly . You can read our Holafly review to learn more about this eSIM store.

Here’s an overview of their plans for Jamaica:

- 3 GB, valid for 7 days for $37

- 7 GB, valid for 15 days for $44

- 15 GB, valid for 30 days for $54

Go to Holafly

Nomad Jamaica

Finally, Nomad is also a great eSIM provider.

Here’s an overview of the plans available for Jamaica:

- 1GB, valid for 7 days for $20

- 3GB, valid for 30 days for $48

- 5GB, valid for 30 days for $54

Go to Nomad

Final Thoughts On Jamaica SIM Cards

As you can see, getting a prepaid SIM card in Jamaica or even an eSIM for your travels in Jamaica is pretty straightforward.

You’ll even be able to stay connected wherever you go in the Caribbean without changing your SIM card, especially if you purchase a Caribbean plan.

I believe the eSIM card is the most convenient way to get data in Jamaica if you wish to have data upon your arrival. This way, you won’t need to go to a store to buy a SIM card.

Obviously, you need to make sure your mobile phone supports eSIM first.

Traveling soon? Read one of the following blog posts:

- Panama SIM card

- Dominican Republic SIM card

- Costa Rica SIM card

MY TOP RECOMMENDATIONS

BOOK HOTEL ON BOOKING.COM

BOOK HOSTEL ON HOSTELWORLD

GET YOUR TRAVEL INSURANCE

LEARN HOW TO START A TRAVEL BLOG

LEARN HOW TO VOLUNTEER ABROAD

123 Main Street, New York, NY 10001

- 123-456-7890

How to Buy a SIM Card in Jamaica in 2024

- May 2, 2024

Traveling to Jamaica, known for its vibrant culture, stunning beaches, and reggae music, is an experience that greatly benefits from reliable connectivity. Whether you’re soaking up the sun on the sands of Negril, exploring the Blue Mountains, or enjoying the nightlife in Kingston, having a local SIM card provides convenient and cost-effective access to mobile data and communication. Here’s everything you need to know about buying a SIM card in Jamaica in 2024. We’ll also cover how to buy and use an eSIM in Jamaica .

Table of contents

Mobile carrier stores, electronics stores, convenience stores and supermarkets, benefits of buying before you travel, who are the main operators in jamaica, how to buy a sim card with digicel jamaica, how to buy a sim card with flow jamaica, benefits of buying your sim card in jamaica, how much does a prepaid sim card in jamaica cost, using an esim in jamaica, using esim.net in jamaica, why should i buy a sim card for jamaica, what if i have a problem with my sim card in jamaica, can i use wi-fi in jamaica, what are the mobile operators in jamaica, how much is a sim card in jamaica, how much does roaming cost in jamaica, can a traveler get a sim card in jamaica, where can i get a sim card for jamaica.

Upon arriving in Jamaica, particularly at Norman Manley International Airport in Kingston or Sangster International Airport in Montego Bay, you’ll find kiosks and retail stores that sell SIM cards. These outlets are conveniently located in the arrivals area, making it easy to purchase a SIM card as soon as you land.

In Jamaican cities and major tourist areas, stores of the main mobile operators offer a variety of SIM card options. These stores are typically found in shopping centers, along main streets, and in popular tourist destinations.

Electronics retailers and mobile phone shops across Jamaica also sell SIM cards. They offer a variety of plans from different providers, allowing you to compare options.

Many convenience stores, supermarkets, and even some pharmacies throughout Jamaica offer prepaid SIM cards. This option is perfect for travelers who need immediate connectivity.

Purchase Before You Travel

Purchasing a SIM card before your arrival in Jamaica offers several benefits:

- Immediate Connectivity : Activate your phone as soon as you land, saving time and avoiding the hassle of finding a store.

- Avoid Language Barriers : While English is the official language, purchasing your SIM in advance can help ensure you understand all terms and conditions.

- Peace of Mind : Start your trip knowing that your communication needs are already taken care of.

Buy Your Tourist SIM Card in Jamaica

The telecom market in Jamaica is primarily served by two key providers, each offering comprehensive coverage and competitive packages:

- Digicel Jamaica : Known for its excellent nationwide coverage and high-quality service.

- Flow Jamaica : Offers robust service with competitive data packages and good customer support.

Visit any Digicel store, which are prevalent throughout urban areas and tourist centers. Digicel offers various plans, including those specifically designed for tourists, featuring generous data allowances and reasonable call rates.

Flow stores are widespread across the island and provide a range of SIM card plans that cater to different needs, including those of international visitors.

Purchasing your SIM card directly in Jamaica ensures:

- Local Rates : Enjoy competitive local rates for data and calls.

- Immediate Support : Access customer service easily if you encounter any issues.

- Flexible Plans : Choose a plan based on your specific travel needs, with options to adjust as necessary.

Prices for prepaid SIM cards in Jamaica are quite affordable, typically starting from around 500 JMD (about 3 USD) for basic packages with limited data and calls. More comprehensive packages, particularly those designed for tourists, can cost up to 3000 JMD (about 20 USD) and include significant data allowances and some international calling options.

For those with compatible devices, opting for an eSIM provides a convenient and flexible way to stay connected:

- Instant Activation : Download and activate your eSIM before you arrive or right after landing.

- No Physical SIM Required : Avoid the hassle of swapping physical SIM cards, while keeping your home number active.

- Flexible Plans : Easily switch between different eSIM profiles to find the best rates and coverage.

Using eSIM.net while traveling in Jamaica offers a seamless and efficient way to stay connected as you explore its vibrant culture, beautiful beaches, and lush landscapes. Here’s how to make the most of your eSIM.net service during your visit to Jamaica:

Step 1: Choose Your eSIM Plan

Selecting the Right Plan: eSIM.net provides a variety of Jamaica eSIM plans tailored to different needs. For your trip to Jamaica, consider whether a data-only plan is sufficient or if a more comprehensive package including voice and SMS would be better. Data-only plans are ideal for short visits or if you primarily need internet access, while full-service plans are better for longer stays or if you need to make frequent local and international calls.

Step 2: Purchase and Activate Your eSIM

Buying Your eSIM: You can select and purchase your desired eSIM plan directly from the eSIM.net website. The process is straightforward—pick a plan that matches your duration of stay and anticipated data usage, then complete the transaction. You’ll receive an email with a QR code.

Activating Your eSIM: Ensure your smartphone supports eSIM technology and is unlocked. Navigate to the cellular settings on your device, tap “Add Cellular Plan,” and scan the QR code. Follow the setup prompts, ideally while connected to Wi-Fi, as it requires internet access.

Step 3: Manage Your eSIM

Using the MyeSIM Portal: eSIM.net offers an online portal called MyeSIM, where you can manage your account. This portal allows you to check your data usage, top up your plan as needed, and adjust settings to suit your needs during your stay in Jamaica.

Customer Support: If you encounter any issues or have questions regarding your eSIM service, eSIM.net provides robust customer support. Assistance is available via email, or you can access an extensive FAQ section on their website for quick help.

Step 4: Understanding Mobile Usage in Jamaica

Data Roaming: If your itinerary includes visiting other Caribbean islands or countries, check if your eSIM plan includes international roaming. This feature can be beneficial for maintaining seamless connectivity across different regions.

Network Coverage: Jamaica has good mobile network coverage, especially in urban areas and major tourist destinations such as Kingston, Montego Bay, and Ocho Rios. However, coverage can be less consistent in remote or rural areas.

Step 5: Maximizing Your eSIM Benefits

Cost-Effectiveness: Using an eSIM from eSIM.net can significantly reduce your roaming costs compared to traditional mobile services. It offers a straightforward solution for managing data and calls throughout Jamaica without the need for multiple SIM cards.

Flexibility and Convenience: eSIM technology allows easy switching between different plans or carriers without needing to physically change SIM cards. This flexibility is particularly useful if your travel plans are dynamic or if you visit multiple countries during your trip.

Additional Tips for Using eSIM in Jamaica

- Device Compatibility: Before your trip, ensure that your device is compatible with eSIM technology and is unlocked. Most modern smartphones, including recent models from Apple, Samsung, and Google, support eSIMs.

- Emergency Services: In Jamaica, you can dial 119 for emergency police services, 110 for fire, and 112 or 911 for ambulance services, accessible free of charge from any phone, including those using an eSIM.

- Public Wi-Fi Access: Jamaica offers public Wi-Fi in many hotels, cafes, and some public areas. These networks can help save on data usage, but always ensure secure connections when accessing sensitive information.

- Cultural Insights: Familiarize yourself with local customs and mobile usage etiquette to enhance your interactions and avoid any potential misunderstandings. Jamaicans are known for their friendly and relaxed demeanor, so respecting local traditions and engaging with people in a courteous manner will enhance your experience.

SIM Card Jamaica FAQs

To ensure affordable and reliable mobile data and voice communication, enhancing both convenience and security during your trip.

Visit the nearest store of your mobile provider where customer service will help resolve issues promptly.

Yes, free Wi-Fi is widely available in public spaces, cafes, and hotels throughout Jamaica, but a local SIM card provides a more consistent and secure connection.

The main mobile operators are Digicel Jamaica and Flow Jamaica.

Prices for SIM cards start at around 500 JMD, with more comprehensive options available for up to 3000 JMD.

Roaming can be expensive, especially for non-Caribbean travelers. It’s usually more economical to use a local SIM card.

Yes, travelers can easily purchase a SIM card upon arrival in Jamaica by presenting a valid ID at the time of purchase.

Related Posts

How to Buy a SIM Card in the Czech Republic in 2024

Traveling to the Czech Republic, a country renowned for its beautiful architecture, historical towns, and vibrant cultural scene, is best

How to Buy a SIM Card in Slovakia in 2024

Visiting Slovakia, known for its breathtaking mountainous landscapes, historic castles, and vibrant urban life in cities like Bratislava and Košice,

Best sellers

Regional plans

- North America

- Latin America

- United Kingdom

All destinations

- Bosnia and Herzegovina

- Central African Republic

- Democratic Republic of Congo

- Dominican Republic

- Czech Republic

- El Salvador

- Faroe Islands

- Isle of Man

- Ivory Coast

- Liechtenstein

- New Zealand

- Papua New Guinea

- Philippines

- Puerto Rico

- Republic of Congo

- Saudi Arabia

- South Africa

- South Korea

- St. Pierre and Miquelon

- Switzerland

- The Netherlands

- Trinidad and Tobago

- Turks and Caicos

- United Arab Emirates

You haven't added products to the cart

Total: EUR € 0,00

Continue shopping

Choose a currency

Suggested languages

iPhone XS Max

iPhone 11 Pro

iPhone 11 Pro Max

iPhone SE (2020)

iPhone 12 Mini

iPhone 12 Pro

iPhone 12 Pro Max

iPhone 13 mini

iPhone 13 Pro

iPhone 13 Pro Max

iPhone SE (2022)

iPhone 14 Plus

iPhone 14 Pro

iPhone 14 Pro Max

iPad Pro (2018 and onwards)

Watch series 3

Watch series 4

Watch series 5

Watch series 6

Pixel 6 Pro

Pixel 7 Pro

P40 Pro (not including the P40 Pro +)

Mate 40 Pro

Galaxy Z Flip

Galaxy Z Flip 5G

Galaxy Z Flip3 5G

Galaxy Z Flip4

Galaxy Fold

Galaxy Z Fold2 5G

Galaxy Z Fold3 5G

Galaxy Z Fold4

Galaxy S21+ 5G

Galaxy S21 Ultra 5G

Galaxy S22+

Galaxy S22 Ultra

Galaxy Note 20 Ultra 5G

Galaxy Note 20

Galaxy S23+

Galaxy S23 Ultra

Galaxy S20 Ultra 5G

Rakuten Mini

Find X3 Pro

Find X5 Pro

Xperia 10 III Lite

Xperia 10 IV

Xperia 1 IV

Xperia 5 IV

Magic 4 Pro

Aquos Sense6s

Check out our guide on how to find out if my device is eSIM compatible or contact us on our online chat

If there have been changes in your plans and you no longer need your Holafly eSIM, we will provide you with a full refund .

If you purchased the eSIM and it turned out to be incompatible with your device, we will provide you with a full refund .

If your eSIM doesn't work due to an issue with Holafly or the network infrastructure of the destination country has problems and is unstable, we can offer you a full or partial refund .

eSIM with data in Jamaica

€ 44,00 € 34,00 EUR

Based on 36,973 reviews on

Description

Technical Specs

- Experience Jamaica with 500MB of internet connection / day

- Receive your QR code and connect instantly

- Set up your eSIM in less than five minutes

- Keep your WhatsApp number on your cellphone

- Connect to the best networks in Jamaica

- Forget about roaming and searching for public WiFi networks

Connect to the Internet in Jamaica with a prepaid eSIM with data. Keep in touch with your family and friends through your favorite apps like WhatsApp, iMessage, or Skype. Forget about roaming and start saving on your trip.

It’s easy to activate and use. After your purchase, we will send you a QR code to your email. Scan it to install the eSIM for Jamaica and start using the service. No paperwork or waiting.

- Speed: 4G / LTE

- Tethering / Hotspot : Yes

- Data Packages: 3GB

- Days of use: 7

- Phone number: No

- Plan type: Prepaid

- Analog calls: No, only through apps (VOIP).

- Activation: Automatic, activated when connected to a cellular network.

- Compatibility: all smartphones with eSIM technology enabled. Operation on smartwatches and tablets is not guaranteed.

- Shipping: via email.

- Delivery time: immediate, after purchase.

- Installation: scan a QR code.

- ID required: No

- Technology: eSIM

- Designed for: tourism, backpackers, vacations, digital nomads, and business.

- Networks: Digicel

Choose when your plan starts! Install the eSIM before your trip and activate the data upon arrival.

How many days are you traveling for?

- % discount applied to all plans

Secure payment guaranteed

Advantages of using Holafly eSIM in Jamaica

Change of plans? No problem at all!

Purchase your Holafly eSIM with added peace of mind. You have up to 6 months to request a refund.

Conoce por qué nuestra eSIM de viajes internacionales es tu mejor elección de datos móviles para tener internet en el extranjero y mantenerte conectado en tu próxima aventura.

Very easy to use

Set up your data plan by scanning a simple QR code or with the manual installation. Activate the eSIM when you land and you’ll be connected instantly. All products come with thorough instructions.

Share your data with family and friends

You can share data with family, friends or whoever you’re traveling with. Use your cell phone to generate a WiFi network and connect multiple devices.

Keep your WhatsApp number

You can call and message all your contacts on WhatsApp, like you’re in the same country. Don’t lose touch with family and friends.

24/7 customer support

The eSIM is easy to use, but if you have questions or experience technical issues you can reach us by email or our 24 hour chat support. We’re here to help.

Immediate delivery

If you’re in a rush or you’re already traveling, don’t worry about waiting for delivery. We send the Jamiaca eSIM immediately to your email, so you can connect in seconds.

Keep your original SIM for calls

The eSIM is digital, so your original SIM will work as usual if you need it.

How does the Holafly eSIM for Jamaica work?

Check your phone is compatible with esim.

Check if your smartphone is compatible now

Buy your prepaid eSIM

Chose the plan that suits you best and buy your eSIM card from our online store.

Scan the QR code

It’s easy. Just scan the QR code we send you and turn on data roaming from your settings. Now you can enjoy browsing the web.

Fast and reliable connection

- Clear video calls with no delays

- Share stories in just a few seconds

- Enjoy creating video content and super fast uploading

- Find your way wherever you go!

The best performace in all your apps

Discover the freedom of reliable connectivity with high speed 4G and 5G . Holafly keeps you connected, no matter the adventure!

What you should know about eSIMs

No local phone number.

This eSIM only includes data. It does not allow you to make cell phone calls or send SMS messages. You can still use WhatsApp or Skype to call your contacts.

Your phone must support eSIM

Make sure your phone is both unlocked and compatible with eSIM technology.

Install before you travel and take off

Scan the QR code from your smartphone settings and add the data plan. But don’t activate it until you land at your destination. Take the printed QR code on your travels just in case.

We will send you the eSIM to your e-mail

As soon as you complete your purchase, you’ll receive the instructions to install and activate your international travel eSIM and get unlimited internet on your adventure!

Installation instructions with QR code

Manual installation instructions

Holafly eSIM User Reviews

DON’T stress about your phone service when you travel abroad! I used Holafly to travel home to California this year. The instructions were super easy to follow and I had no problems with the service for the whole 20 days that I used it. It was nice not to worry about how much my phone company was going to charge me for service abroad.

I have used your Sim for my trip to the USA! I recommend it 100%. Thank you very much for your service.

I swear that Holafly has a customer service that is to cry with pleasure ;___; In no time will I buy another unlimited data SIM for Japan because the first time it worked wonderfully

A complicated request was solved urgently within 24 hours of traveling. They are wonderful and I recommend it to everyone. Thank you HolaFly team!

Frequently Asked Questions about the Jamaica eSIM

When does my data plan start?

Your data plan starts the moment you activate your eSIM, by turning on data roaming in the Holafly eSIM. You should do this once you arrive at your destination.

Can I make phone calls and send messages with my Holafly eSIM?

The Jamaica eSIM only allows you to use mobile data. It does not include a local phone number for mobile calls or messages. You can still make calls using apps like WhatsApp.

Which devices work with the eSIM card?

You can check if your smartphone is eSIM compatible here.

When will I receive my eSIM?

Once you purchase your eSIM, you will receive a confirmation email with instructions to install it immediately using a QR code or manual code. Remember that once the eSIM is purchased, it cannot be returned.

Can I keep my WhatsApp number?

You don’t need to do anything to keep your WhatsApp number. You’ll automatically keep your number, contacts and conversations.

How quick is the Holafly eSIM?

The Holafly eSIM offers maximum speed coverage (4GLTE). But bear in mind that in some areas of limited coverage there may be a lower speed connection.

Do I have to activate data roaming on my device?

Yes. To ensure that your eSIM gets the best coverage, you must turn on data roaming on your mobile settings. This will not incur any additional charges, as long as you have already set up the Holafly eSIM.

What do I do if I delete or lose my eSIM’s QR code?

If you cannot find the code, please contact our 24/7 customer support team at [email protected] or our online chat function. We will resend the code to your email.

What happens if I use up my data or my days of validity?

If you use all your data or run out of days, your eSIM card will no longer work and you will lose internet connection.

What eSIM data plan should I choose for Jamaica?

You can choose 3GB for 7 days, 7GB for 15 days and 15GB for 30 days. You can contact us at any time if you’re not sure which plan is best for you.

What is an eSIM?

An eSIM (embedded SIM) is a digital SIM card that can be installed directly into your smartphone or other mobile devices. It is an alternative to the physical, removable SIM card you’re used to.

Can I renew or extend the data on my eSIM?

Yes, you can do so by logging into your customer panel on the Holafly Center. You will find the data plans you can purchase there. Once you’ve made your purchase, it will be activated immediately on the eSIM you have linked.

Can I share data with other devices?

Yes, the Jamaica eSIM allow you to share data or use a hotspot with other devices.

How do I set up the eSIM on my device?

After your purchase, we will send a QR code and manual instructions to your email. Either print the QR code or open it on your computer. On your cell phone, go to Settings > Mobile Data > Add Data Plan and scan the QR code. Your phone will allow you to assign a specific name to this data plan. You will now be able to switch between your Holafly data plan and the original plan from your provider. The Holafly data plan will only be operational once you arrive at your destination. Once you land, turn on data roaming on your cell phone settings and activate the Holafly data plan. Consult your phone’s user manual for more details on adding a data plan. All eSIM products come with comprehensive set-up instructions.

When should I set up my eSIM?

Set up your eSIM before your departure. Once you reach your destination, just activate the data plan turning on data roaming. We recommend you print the QR code to take it and manual instructions with you on vacation, just in case. Remember that you need internet access to install the eSIM.

How can I check my data balance?

You can manage your eSIMs and access all purchased data plans by logging into your Holafly Center through the Holafly website.

How many times can I use my eSIM card?

If needed or when changing phones during your trip, you can transfer your eSIM. However, note that you can only transfer the eSIM to two devices—the original one and a new one. Once you’ve installed it on a different device than the original, you won’t be able to reinstall it on the original device and you must deliver the eSIM from the original device to install it in the second device.

Can I delete the Holafly eSIM once I’ve used my data?

Yes! But keep in mind that you don’t need to do so. As soon as your plan expires your eSIM will no longer work.

Can I use my SIM card and Holafly eSIM at the same time?

If you are using an Apple device, you can use your SIM card and your eSim at the same time. Choose the Sim card for phone calls and SMS, and Holafly eSIM for data from your device. Please remember that if you leave your Sim card activated, your network provider may apply data roaming charges to receive or make phone calls as well as SMS.

How do I get a refund?

At Holafly we are aware that our users may have unforeseen events after making the purchase. Therefore, you can request a refund in the following circumstances: – You bought the eSIM without checking the compatibility with your cellphone. – You canceled your trip or you no longer need the eSIM. – Our eSIMs generally work fine, but if you experience connection issues, we can provide you with a full or partial refund. Once the refund is approved, you will receive the money on to the same account with which you made the payment. This process can take between 5 to 10 business days. For more details, terms and conditions, we invite you to read our Refund Policy .

To which mobile network will I connect at my destination?

Your eSIM will connect to all the local phone networks that Holafly partners up with. You can review them in the Technical Specs tab.

15 days 7 GB

Check that your device is compatible with eSIM

Don't worry! We are here for you.

If you have any questions during this process, remember we're here to assist you 24/7 through our Online chat.

- Privacy Overview

- Strictly Necessary Cookies

- Statistic Cookies

- Marketing Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookies should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!

This website uses the following additional cookies:

(List the cookies that you are using on the website here.)

- Travel eSIM

- Install eSIM

- Delivery Options

Loading Cart

The best Prepaid SIM Card to travel in Jamaica. Choose the best SIM Card for your needs.

Best sim card operators, best market prices, pay as you go, 24/7 customer service, compare and buy the best simcard for jamaica, easy to get, get your sim cards with ease, choose destination.

Choose from over 200+ travel destinations worldwide

Select the best Jamaica SIM Card for you

Choose the best Jamaica SIM Card deal for your needs

Receive your SIM Card by mail

Select one of our reliable logistics partners at a low cost

SimOptions in the news

In the spotlight.

"SimOptions, The Revolutionary eSIM Marketplace"

"providing the best eSIM package for the best price"

"covers 160 countries across the world"

"SimOptions offers a prime eSIM bundle at the best price"

Frequently asked questions

Choose your destination, find your prepaid sim card, they trust simoptions, simoptions ratings, selected posts, the best sim cards for europe, the best sim cards for france, the best sim cards for the usa.

Operating from major hubs in Paris (France), Bangkok (Thailand), and Hong Kong, SimOptions is at the forefront of the international Prepaid SIM Card market. Our mission is to provide global travelers with a reliable solution to completely avoid roaming charges in Jamaica through the use of Jamaica Prepaid SIM Cards. We take pride in our diverse offerings that span continents, including Europe , Asia , Oceania , North America , and South America . When it comes to Prepaid SIM Cards for Jamaica, SimOptions is your go-to provider. Wondering about the shipment? We collaborate with global couriers such as DHL, UPS, FEDEX, ARAMEX, Australia Post, among others, ensuring prompt delivery to your doorstep in over 100 countries. Connect with SimOptions today and keep in touch with your family and friends back home!

Jamaica SIM Card

Compare Prepaid SIM Cards For Jamaica

SELECT DAYS

Frequently Asked Questions

How do i get a prepaid sim card for jamaica.

You can purchase a prepaid SIM card for Jamaica in person on arrival or online. However, if you wish to have more options, you may want to get an eSIM for Jamaica instead.

Which SIM Card Provider Is The Best For Jamaica?

The best SIM card provider for Jamaica depends on your needs. You'll have more options if you opt for an eSIM plan instead.

What Is Better In Jamaica: SIM Or eSIM?

If your device supports eSIM technology, we recommend using an eSIM. However, a prepaid Jamaica SIM card might suit you better if you need SMS or phone calls.

More Destinations

Simpackers OÜ (“we”) is a private limited company registered under registration No. 16749674, with an address at Harju maakond, Tallinn, Lasnamäe linnaosa, Lõõtsa tn 2a, 11415, Estonia. Simpackers is a website that helps you compare data plans around the world. By using Simpackers.com, you accept our cookie policy and terms and conditions. We may receive compensation from third-party advertisers for some of the offers listed on our website.

Simpackers OU © 2024 All rights reserved.

- Terms & Disclaimer

- Partner Hub

- Destinations

- eSIM Comparison

Stay connected, wherever you travel, at affordable rates | Jamaica

Our eSIMs are trusted by over 5,000,000 people worldwide

- Local eSIMs

- Regional eSIMs

- Global eSIMs

How Airalo Works

Download the app, choose your destination and package, install your esim, activate your esim, instant connectivity.

Purchase your eSIM from anywhere

by Dr.Jolin

Global Coverage

Get connected in 200+ countries and regions around the world

by BCGregory

Fantastic experience!

Affordable and Transparent

No hidden fees and entirely prepaid

by David Schouten

Extremely useful app for travelers!

24/7/365 Support

Our support team is available every day across all time zones

by Levy Borromeo

Customer service was really great.

Ready to try eSIMs and change the way you stay connected?

Download the Airalo app to purchase, manage, and top up your eSIMs anytime, anywhere!

Use Your Free Credit.

You can earn US$3 Airmoney credits by sharing your referral code with friends.

Find Rates for Calls, Text and Data per MB

- Physical SIM

- International eSIM

Your product has been added to the basket

ONE-TIME OFFER - Get 5 OFF

(This is our best offer)

- Works in over 200 countries, with a single card & phone number. (And get your card FAST with express delivery).

Find your SIM Card number on the back of the product package or if you no longer have the product package, you can also find the SIM Card phone number from the plastic card .

Change settings

Your Worry-Free Trip to Jamaica Starts With a TravelSim Prepaid SIM Card

Talk, text, data with jamaica prepaid sim card.

The Jamaica Prepaid SIM Card is the most convenient and economical solution for staying in touch.

Chat to your friends and family back home by easily connecting to a local Jamaican Digicel network. Your SIM can also be used in over 205 countries across 340 networks . Use your phone as if you were back home, saving you up to 85% on roaming charges.

The one-size-fits-all Prepaid Jamaica SIM Card is suitable for use in any unlocked cell phone or wifi device. Simply add prepaid credit anytime online. We’ve got you covered across Jamaica + more.

Configure Your TravelSim

Universal SIM size — Mini, Macro & Nano Size

Choose credit for calls & texts

Unlimited USA calls voice package includes unlimited calls from USA to USA and European Union numbers. It does not include calls to voicemail and other TravelSim numbers. You can make unlimited calls from USA to following countries: USA, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech.Rep., Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, St. Barthelemy / St. Martin Island, Sweden, United Kingdom.

- Burkina Faso

- Central African Republic

- Congo Democratic Republic

- Cote d’Ivoire

- Equatorial Guinea

- Guinea-Bissau

- Sierra Leone

- South Africa

- South Sudan

- Philippines

- Russian Federation

- South Korea

- Cook Islands

- New Caledonia

- New Zealand

- Papua New Guinea

- Antigua and Barbuda

- British Virgin Islands

- Cayman Islands

- Dominican Republic

- Netherlands Antilles

- Saint Lucia

- Saint Vincent and the Grenadines

- St Kitts and Nevis

- Trinidad and Tobago

- Bosnia And Herzegovina

- Czech Republic

- Faroe Islands

- Liechtenstein

- Netherlands

- North Macedonia

- Switzerland

- United Kingdom

- Vatican City

- Afghanistan

- Saudi Arabia

- Turkmenistan

- United Arab Emirates

- Puerto Rico

- Turks and Caicos Islands

- United States

- United States Virgin Islands

- El Salvador

- Falkland Islands

- French Guiana

Add the best data plan to SIM card

Find your zone, add extra number.

Your SIM card phone number starts with +372 by default. In addition to that, you can choose to purchase a UK phone number (+44) or a US phone number (+1).

If you purchase a US number, it will become your primary phone number for outgoing calls. Your default +372 number will still work for incoming calls. Data usage is not affected by phone numbers. Incoming call 0.20$ or 0.15€/min. Incoming SMS is free. US numbers can only receive calls, no SMS service available for US numbers. Incoming call 0.20$ or 0.15€/min

Here are all the countries you can travel to when you select this data plan:

AUSSIE OWNED & OPERATED | FAST & FREE SHIPPING | Money Back Guarantee

FREE SHIPPING OVER $60

- All Products

- Europe eSIMs

- Caribbean eSIMs

- Middle East eSIMs

- Egypt eSIMs

- France eSIMs

- Travel Accessories and Necessities

- Travel Journals

- Packing Cubes

- Laundry Bags

- Best eSIM by Airport

- Best eSIM by Country

- Travel Tips And Hacks

- Travel Guides

- Login / Register

Stay Connected In Jamaica. Buy Prepaid SIM Cards & eSIMs at Negril Airport.

Need eSIM & Sim Card At Negril Airport ? (In Jamaica)

Planning a trip for Jamaica ? Here's the Best 10 eSIM & Sim Card (Compared + Reviewed) to buy at Negril Airport.

Over 12,000+ Reviews across

Best eSIMs & Sim Cards To Buy At Negril Airport

6GB of Data

15 Days of service from activation

![best prepaid travel card for jamaica [eSIM] 15 Day International Travel eSIM(6GB) | SimCorner](https://us.simcorner.com/cdn/shop/products/esim-15-day-international-data-esim6gb-955986_{width}x.png?v=1699706886)

Not included

Best 10 eSIM's To Buy Near Negril Airport in Jamaica

Jamaica eSIM By Yoho Mobile - $ 19

Jamaica 1GB - 30 Days By Maya Mobile - $ 24

Jamaica By GlobaleSIM - $ 13

Global - 30 Days - 3 GB By Nomad - $ 40

Jamaica 5GB - 30 Days By Maya Mobile - $ 79

Surf 500MB/month in Jamaica By BNESIM - $ 51.728571428571435

Caribbean 3GB - 15 Days By Maya Mobile - $ 64

Surf 500MB in Jamaica By BNESIM - $ 79.59

Caribbean By GigSky - $ 12.99

Caribbean 5GB - 30 Days By Maya Mobile - $ 92

Need esim + sim card at negril airport .

Need eSIM + Sim Card At Chelinda Airport ? (In Malawi)

Need eSIM + Sim Card At Club Makokola Airport ? (In Malawi)

Need eSIM + Sim Card At Dwangwa Airport ? (In Malawi)

You may also like.

Need eSIM + Sim Card At Ouarzazate Airport ? (In Morocco)

Need eSIM + Sim Card At Beihan Airport ? (In Yemen)

Need eSIM + Sim Card At Dhamar Airport ? (In Yemen)

Need eSIM + Sim Card At Al Janad Airport ? (In Yemen)

Need eSIM + Sim Card At Nauru International Airport ? (In Nauru)

Need eSIM + Sim Card At Caucasia Airport ? (In Colombia)

Need eSIM + Sim Card At Carimagua Airport ? (In Colombia)

Need eSIM + Sim Card At Candilejas Airport ? (In Colombia)

Need eSIM + Sim Card At Mandinga Airport ? (In Colombia)

Need eSIM + Sim Card At Casuarito Airport ? (In Colombia)

How simcorner works.

Get eSIM from SimCorner

Receive eSIM via Email or Phone Settings

Scan QR Code from Email or Configure in Phone Settings

Activate and Enjoy Your eSIM

Why traveler loves us.

Who needs the stress of roaming fees? Travel smart with prepaid International SIM cards from SimCorner. Choose the right option for your needs and stay connected without hassle.

Convenience

No roaming fees, hidden fees, or extra costs! We’ve partnered with some of the largest telecommunications service providers across the globe to ensure that our travelers get the best deal possible.

Customer Service

Need help? Travel suggestions? Trouble finding the right plan? Our customer service team goes the extra mile to offer you the support you need no matter where you are.

Hear What They Say

Are you prepared to experience a new way of staying connected.

Explore Simcorner's offerings to buy, manage, and recharge your SIM cards and eSIMs conveniently, wherever you are!

Get Exclusive Offers

Sign up to stay informed about our latest news. Join our newsletter for exclusive offers and updates.

- Choosing a selection results in a full page refresh.

- Press the space key then arrow keys to make a selection.

MASTERCARD BENEFIT INQUIRIES

Within the U.S.: 1-800-Mastercard (1-800-627-8372) | Outside the U.S.: Mastercard Global Service Phone Numbers

Availability of insurance benefits on your card may vary by card issuer. Please refer to your issuing financial institution for complete insurance benefit coverage terms, conditions and exclusions.

*Card registration required. Certain exceptions apply. Click here for terms and conditions .

†Requirements may vary. See card packaging for details or contact card issuer.

Getting a Jamaica SIM Card in 2024: Prepaid SIM Card in Jamaica

By: Author Ruben Arribas

Posted on Published: February 10, 2024 - Last updated: February 12, 2024

Categories Jamaica , Sim Cards

Last updated on February 12th, 2024 at 09:19 am

Looking for the best Jamaica Sim Card for your next trip to Jamaica?

For the best sim card in Jamaica, Flow Jamaica sim card is our favorite for coverage and data packages. Looking at mobile eSIM alternatives? Go for Holafly and Airalo

Table of Contents

What Is The Cheapest Sim Card In Jamaica?

The cheapest Jamaican sim card data for tourists with Flow prepaid sim card in Jamaica for 2600 JMD=$17 USD with 10 GB data valid for 28 days. And for 4900 JMD=$33 USD valid for 30 days with unlimited data.

Alternatives to Getting Cheap Data in Jamaica

Read here the best sim card for Caribbean

You can find the cheapest Jamaica eSim with Airalo Jamaica eSim prepaid for $8 USD with 1 GB data valid for 7 days ( USING DISCOUNT CODE GAMINTRAVELER 10% ).

Holafly Jamaica eSim for $34 USD if you use our code GAMINTRAVELER coming with 3 GB data valid for 7 days . For $47 USD with 7 GB data valid for 15 days and for $59 USD with 15 GB data valid for 30 days.

WHERE TO STAY IN JAMAICA

There are dormitory rooms that you can rent the bed for as low as $20 USD a night if you want the cheapest option . AirBnb is also available, mostly for about $30-45 USD a night. Double-room hostels can cost up to $30-40 USD a night while mid-range hotels cost more or less $80 USD a night.

Click here if you want to find the best deals

BOOK YOUR TRAVEL INSURANCE

Two of our favorite travel insurance: Heymondo Vs Safetwing cheapest travel Insurance . You can get for $135 USD your Heymondo Travel Insurance with Heymondo discount code valid for 90 days. Read our full comparison of Genki vs Safetywing Travel Insurance Review and the comparison Heymondo vs Genki

JAMAICA SIM CARD COMPARED AND PREPAID SIM CARD JAMAICA

First thing we have to say about Jamaican sim card, internet and data connection in Jamaica is great especially in the cities. There are a few places off the beaten path like mountains, beaches and forest where the connection will be weak.

We recommend you to get outside the airport when getting to the city in an official phone shop. There are 2 main phone operators in Jamaica: Flow and Digicel Jamaica .

BUYING JAMAICA PREPAID SIM CARD AIRPORT (JAMAICA SIM CARD MONTEGO BAY AIRPORT)

Getting a Jamaica sim card Montego Bay airport is simple and easy. You can get your sim card in Norman Manley International Airport . Since it’s easier to check maps and it’s great to check internet while you are going to your hotel.

You can buy a Jamaica sim card in Montego Bay Airport and buy your Jamaica sim card at Kingston airport . This option it will be more expensive but it’s great especially if you are heading outside the city to the beach.

If you aren’t in a hurry you can wait until get to the city to get your Jamaica prepaid sim card. There are kiosks and phone shops where to buy your Jamaica tourist sim card.

WHERE TO BUY JAMAICA SIM CARD FOR TOURIST

You can buy a Jamaica sim card almost anywhere from the airport to cities. There are phone kiosks and local shops willing to sell a Jamaica prepaid sim card. Just make sure that you present your foreign passport.

BEST PREPAID SIM CARD JAMAICA COMPARISON

We will focus in this prepaid sim card Jamaica with Digicel Jamaica the most popular one in the country. We will tell you about Flow Jamaica too. Keep reading below rates and data packages:

Digicel Sim Card Jamaica

Digicel sim card Jamaica is the largest phone operator in the country. You will have the best coverage and we totally recommend this sim card if you are traveling in a few destinations in Jamaica. You can get a Digicel sim card for 600 JMD =$4 USD in the phone stores. Check here prices and packages in Digicel website !

You can get these packages for 850 JMD=$6 USD with 6 GB data and valid for 7 days. You can get a Digicel prepaid sim card in Jamaica for 3000 JMD=$20 USD with 12 GB data and valid for 28 days.

All these packages with Digicel Jamaica are coming with unlimited domestic calls and social media ( Facebook, WhatsApp, Snapchat, Instagram and Twitter ).

MORE PREPAID SIM CARD IN JAMAICA

Flow jamaica sim card.

Flow sim card Jamaica is the second largest phone operator. You can get a Flow prepaid Jamaica sim card for 500 JMD =$3 USD in the phone stores. Check here prices and packages in Flow website !

You can get these packages for 775 JMD=$5 USD with 6 GB data valid for 7 days. For 2600 JMD=$17 USD with 10 GB data valid for 28 days. If you want unlimited data for 4900 JMD=$33 USD valid for 30 days.

All these packages with Flow Jamaica are coming with unlimited domestic calls and social media ( Facebook, WhatsApp, Snapchat, Instagram and Twitter ).

Mobile eSIM Alternatives to Best Sim Card In Jamaica

Holafly jamaica esim discount code.

Holafly Jamaica eSim for $34 USD if you use our code GAMINTRAVELER coming with 3 GB data valid for 7 days. For $47 USD with 7 GB data valid for 15 days and for $59 USD with 15 GB data valid for 30 days.

AIRALO JAMAICA ESIM DISCOUNT CODE

Airalo Jamaica eSim prepaid for $8 USD with 1 GB data valid for 7 days ( USING DISCOUNT CODE GAMINTRAVELER 10% ).

Nomad eSim Jamaica

Nomad eSim Jamaica for $20 USD with 1 GB data valid for 7 days. Nomad eSim Jamaica prepaid start at $48 USD with 3 GB data and for $54 USD with 5 GB data valid for 30 days.

MTX Connect eSim Jamaica

MTX Connect eSim Jamaica for €24 with 4 GB data valid for 14 days.

UBIGI JAMAICA ESIM

Ubigi Jamaica eSim for $19 USD with 1 GB data valid for 30 days. ( USING DISCOUNT CODE GAMINTRAVELER 10% ).

GIGSKY JAMAICA ESIM

GigSky Jamaica eSim for $13 USD with 1 GB data valid for 7 days and for $60 USD with 5 GB data valid f

OUR FINAL THOUGHTS AND RECOMMENDATION ON BEST JAMAICA SIM CARD FOR TOURISTS

My Jamaican Sim Card Conclusion is getting a Flow prepaid sim card Jamaica if you are planning to travel around the country since the coverage is similar and it has better packages but there is no big difference.

You can buy Flow Jamaica for 2300 JMD=$15 USD with 4 GB data valid for 28 days and unlimited data for 4900 JMD=$33 USD valid for 30 days.

Feel free to use our links for discounts. By using our links, you will help us to continue with the maintenance of the website and it will not cost you anything. Thanks for the love guys.

Happy Travels!

About the Author : Ruben , co-founder of Gamintraveler.com since 2014, is a seasoned traveler from Spain who has explored over 100 countries since 2009. Known for his extensive travel adventures across South America, Europe, the US, Australia, New Zealand, Asia, and Africa, Ruben combines his passion for adventurous yet sustainable living with his love for cycling, highlighted by his remarkable 5-month bicycle journey from Spain to Norway. He currently resides in Spain, where he continues to share his travel experiences alongside his partner, Rachel, and their son, Han.

Negril Food: 30 Best Restaurants In Negril And Where To Eat In Negril - Gamintraveler

Thursday 28th of April 2022

[…] Rios vs. Montego Bay, what to wear in Jamaica, the most instagrammable places in Jamaica, Jamaica sim card for tourist, Jamaica travel tips, how to get from Kingston Airport to Ocho Rios, how to get […]

How To Get From Kingston Airport To Mandeville - All Possible Ways - Gamintraveler

Tuesday 26th of April 2022

[…] Read here how to get from Montego Bay airport to Negril, how to get from Montego Bay airport to Ocho Rios, Kingston airport to Montego Bay, Kingston airport to Ocho Rios, Kingston airport to Negril, Montego Bay to Kingston, Ocho Rios to Kingston, Kingston airport to Port Antonio, Kingston airport to Portmore, Kingston airport to Spanish Town, Kingston airport to May Pen and best Jamaica sim card for tourist […]

How To Get From Kingston Airport To Portmore - All Possible Ways - Gamintraveler

Friday 22nd of April 2022

[…] Read here how to get from Montego Bay airport to Negril, how to get from Montego Bay airport to Ocho Rios, Kingston airport to Montego Bay, Kingston airport to Ocho Rios, Kingston airport to Negril, Montego Bay to Kingston, Ocho Rios to Kingston and best Jamaica sim card for tourist […]

How To Get From Montego Bay Airport To Spanish Town - All Possible Ways - Gamintraveler

Friday 8th of April 2022

[…] restaurants in Negril, Jamaican vegetarian food, Jamaican drinks, best Jamaica sim card for tourist, the most instagrammable places in Jamaica, Ocho Rios Vs Montego Bay, what to wear […]

How To Get From Ocho Rios to Negril - All Possible Ways - Gamintraveler

Thursday 7th of April 2022

[…] Read here how to get from Montego Bay airport to Negril, how to get from Montego Bay airport to Ocho Rios, how to get from Kingston airport to Ocho Rios, Kingston airport to Montego Bay, best restaurants in Montego Bay and best Jamaica sim card for tourist […]

- Open an Account

- Get Started

JMMB Money Transfer VISA Prepaid Card

The JMMB Money Transfer VISA Prepaid Card is a game changer for those who receive funds from friends and family overseas. Why is this card a game changer? With the JMMB Money Transfer VISA Prepaid Card, you can now receive remittances from over 150 countries and able to have access to your funds within minutes, 24/7, without the hassle of visiting a branch or agent location. This card offers you the convenience of accessing your funds instantly and securely.

Not only can you receive money directly to your card, but you can also withdraw your funds at ATMs and make purchases at Point of Sale (POS) terminals island-wide. The card is accepted wherever VISA is accepted, giving you the freedom to shop and pay for goods and services wherever you are.

This prepaid card is easy to use, secure and gives you the peace of mind that comes with knowing your money is safe. Whether you're at home or abroad, the JMMB Money Transfer VISA Prepaid Card is your ideal financial companion.

Features/Benefits

- Access your remittance from any ATM that accepts VISA

- No Bank Account Needed

- Shop locally or online anywhere VISA payments are accepted

- No POS Fees

- No Annual Fees

- Up to 4 free transaction at the JMMB Bank ATM.

- The first transaction free at any other ATMs that accept VISA.

Click here to apply for your JMMB Money Transfer VISA Prepaid Card

Read the Terms & Conditions for the JMMB Money Transfer VISA Prepaid Card Incentive

How to get a JMMB Money Transfer VISA Prepaid Card

Get your jmmb money transfer visa prepaid card in just a few easy steps.

Step 1 - Visit The Online Application Portal

Online Sign-Up: Click here to begin the online application process.

Step 2 - Complete the Application

Fill out the required information, including your personal details, contact information, and identification. Ensure that you provide accurate and up-to-date information.

Step 3 - Submit Supporting Documents

Upload or provide the necessary supporting documents, such as proof of identity as per the application requirements.

Step 4 - Await Approval

After submitting your application and the required documents, wait for the approval notification from JMMB. This will take two business days.

Step 5 - Collect your JMMB Money Transfer VISA Prepaid Card

Once approved, collect your JMMB Money Transfer VISA Prepaid Card from your nearest branch, or await its arrival via courier if you selected that option.

Step 6 - Activate Your Card

Follow the activation instructions provided with your new prepaid VISA card to ensure it's ready for use.

Step 7 - Start Enjoying the Benefits

Use your JMMB Money Transfer VISA Prepaid Card to make secure transactions, receive money, and enjoy the convenience of cashless payments.

Sign up for your JMMB Money Transfer VISA Prepaid Card

JMMB Money Transfer VISA Prepaid Card FAQ

how can i apply for a jmmb money transfer visa prepaid card.

Clients will be able to apply for the JMMB Money Transfer Visa Prepaid Card online by clicking here to complete the application form.

What will I need to sign up for the Money Transfer VISA Prepaid Card?

Clients signing up online will need a valid Government issued ID (Driver's Licence, Passport or National ID), TRN, mobile number and the ability to upload a selfie for verification.

Can a minor sign up for the JMMB Money Transfer VISA Prepaid Card?

Yes, however, minors will have to visit the nearest JMMB branch with their guardian to apply for a JMMB Money Transfer Visa Prepaid Card.

Can I use my JMMB Money Transfer VISA Prepaid card outside Jamaica?

Yes, you can use your JMMB Money Transfer card at any VISA-certified ATM locally or internationally, at POS terminals and online.

Can I attach multiple accounts both local and international to the same card?

No, Only the JMMB Money Transfer Prepaid account can be attached to the JMMB Money Transfer Visa Prepaid Card.

Are there any transaction fees associated with using the JMMB Money Transfer VISA Prepaid Card?

Yes, please view the fee guide below. - Up to 4 free transaction at the JMMB Bank ATM. - The first transaction free at any other ATMs that accept VISA.

Is there an additional fee for receiving my remittances to the JMMB Money Transfer VISA Prepaid Card?

No, there will be no additional charges to receive remittances to the JMMB Money Transfer Visa Prepaid Card.

Will I be charged for using a JMMB ATM?

Yes. there will be a charge for using a JMMB ATM to conduct a withdrawal transaction, after your first four free transactions.

Will I be charged for using another bank's ATM machines?

Yes. However, clients will receive the first withdrawal transaction of the month for FREE using any ATM islandwide.

My first withdrawal transaction of the month was at a JMMB ATM; will that count as my free withdrawal transaction?

Yes. The transaction will be counted as your first free withdrawal transaction for that month and therefore any withdrawal thereafter from any non-JMMB Bank ATM will attract a cost.

Will I be able to use the funds right away?

Once the funds have been successfully loaded into the Money Transfer VISA Prepaid Card, the funds will be available right away to be used at any VISA-certified ATMs locally or internationally, at POS terminals and online.

How can I add funds to my JMMB Money Transfer VISA prepaid card?

JMMB Money Transfer Prepaid cardholders will be able to fund their cards via inbound remittances as long as they are able to provide the sender with their JMMB Money Transfer account number, at the JMMB Money Transfer Sub-Agent locations.

Can I add funds to my JMMB Money Transfer VISA prepaid card via the ATM?

No, JMMB Money Transfer Prepaid cardholders will not be able to fund cards via the ATM. Adding funding at JMMB Money Transfer Sub-Agent locations is the only available method.

How do I view my JMMB Money Transfer statements?

Statements will be emailed to clients monthly.

Will I receive an email or SMS notification when funds are added or deducted from my JMMB Money Transfer VISA prepaid card?

JMMB Money Transfer prepaid cardholders will receive notifications either via email or SMS when a transaction is done.

Can I access my JMMB Money Transfer VISA prepaid account balance online?

No, balances can only be viewed at any VISA-certified ATM worldwide or via the statements that will be sent monthly to the client’s email address provided.

Can I use my JMMB Money Transfer VISA prepaid card to shop online?

Yes, your JMMB Money Transfer VISA Prepaid Card can be used wherever VISA is accepted; online, at POS terminals in stores, and ATMs worldwide

What is my JMMB Money Transfer Visa prepaid card daily limit for withdrawals?

You will be able to withdraw up to currency J$100,000 per day using your JMMB Money Transfer VISA Prepaid card. This can be done at any JMMB ATM or any other bank ATMs that accept VISA cards (locally or internationally).

What currencies can I withdraw from the ATM machines using my JMMB Money Transfer Visa prepaid card?

The currency allowed for withdrawals is dependent on the bank that owns and operates the ATM. However, JMMB Bank only offers JMD currency withdrawals for JMMB Money Transfer Prepaid Card at JMMB ATMs.

What is my daily limit for POS/Online purchases using my JMMB Money Transfer VISA Prepaid Card?

You will be able to purchase goods valued up to J$250,000 per day using your JMMB Money Transfer VISA Prepaid card whether via a store’s point of sale machine or online. This limit includes both transactions being done online and at the point of sale for the day.

- Jamaica Tourism

- Jamaica Hotels

- Bed and Breakfast Jamaica

- Jamaica Holiday Rentals

- Flights to Jamaica

- Jamaica Restaurants

- Jamaica Attractions

- Jamaica Travel Forum

- Jamaica Photos

- Jamaica Map

- All Jamaica Hotels

- Jamaica Hotel Deals

- Last Minute Hotels in Jamaica

- Things to Do

- Restaurants

- Holiday Rentals

- Travel Stories

- Add a Place

- Travel Forum

- Travellers' Choice

- Help Centre

pre paid travel money cards in Jamaica - Jamaica Forum

- Caribbean

- Jamaica

pre paid travel money cards in Jamaica

- United Kingdom Forums

- United States Forums

- Europe Forums

- Canada Forums

- Asia Forums

- Central America Forums

- Africa Forums

- Caribbean Forums

- Mexico Forums

- South Pacific Forums

- South America Forums

- Middle East Forums

- Honeymoons and Romance

- Business Travel

- Train Travel

- Traveling With Disabilities

- Tripadvisor Support

- Solo Travel

- Bargain Travel

- Timeshares / Holiday Rentals

- Caribbean forums

- Jamaica forum

Also any other tips welcome!! (staying at Sunset beach.

On the pre-paid card, is there a Visa logo or a MasterCard logo? if so you will be able to use it. Credit and debit cards from Visa and MasterCard can be used at almost all hotels, better shops, better places to eat and drink, etc. that are aimed for tourists. Most other places want cash.

For the other questions see

http://www.tripadvisor.com/Travel-g147309-c140152/Jamaica:Caribbean:Which.Currency.Should.Be.Used.html

thank you, the page you suggested is very helpful.

The pre-paid card is master-card so I guess it will be OK to use and take a small mix of US dollars and Jamaican dollars in cash!

thanks again :-)

This topic has been closed to new posts due to inactivity.

- Breathless or secrets wild orchid. 21:36

- Solo July 21:19

- Couples Negril - Excursions and a few other general question 20:12

- Transfers between Port Antonio and Montego Bay 18:15

- Montego bay weather today

- Beaches Ochos Rios yesterday

- Trip report - hike to Blue Mountain peak yesterday

- Late April Weather yesterday

- Weather now? yesterday

- Safety in Treasure Beach? yesterday

- Too Many Places to Choose From yesterday

- Tipping in CDN? yesterday

- Montego Bay, Jamaica OR Cancun, Mexico? Adults Only AI Hotel yesterday

- Tipping in Montego BayJamaica vs Punta Cana DR yesterday

- Best Time of Year to Visit Jamaica 12 replies

- is sandals gay friendly? 42 replies

- Excellence Oyster Bay Jamaica 108 replies

- 1st time. Best area to stay? 2 replies

- The best beach in Jamaica 8 replies

- Grand Palladium Lady Hamilton 199 replies

- Road-trip - Montego Bay to Kingston 11 replies