Manage Booking

Access your bookings, easy cancellation, date change and much more

Joining fee - Rs 499 + GST

Introducing the Goibibo ICICI Bank Travel Card. Enjoy the convenience of using one card at multiple countries with zero cross-currency charges, and enjoy hefty discounts on flight & hotel bookings.

Sign up today & enjoy benefits worth up to INR 20,000!

Load your card with min. USD 1,000 and avail:

Terms & Conditions

Offer Redemption Process

INR 500 goCash+ Gift Voucher

- The voucher will be a part of the welcome kit

- click on "goCash+" icon on goIbibo App

- Click on "Load Wallet"

- Select "Use Voucher Code"

- Enter the Gift Voucher Number

- Click on "Confirm"

INR 15,000 worth goibibo vouchers

- The vouchers will be a part of the welcome kit

- The offers will be as below:

- Flat INR 500* Off on Domestic Flights (minimum booking amount should be INR 3,000)

- Flat 25% Off* on Domestic Hotels (minimum booking amount should be INR 2500. Maximum discount that can be availed is INR 10,000)

- Flat INR 2500* Off on International Flights (minimum booking amount should be INR 25,000)

- Flat INR 3000 Off* on International Hotels (minimum booking amount should be INR 10,000)

- To avail the offer, customer must enter the unique Coupon code provided in the welcome leaflet in the Coupon field

- Voucher code is valid as per the date mentioned on the leaflet

- The offer is valid for bookings made on Goibibo’s Website, Mobile site, Android & iOS App only This offer cannot be clubbed with any other offer of Goibibo

- The coupon code can be used only once.

- Offer is not applicable on payments made through Goibibo’s Wallet 3rd party wallets, COD, Google Pay

- Discount will be calculated on Booking amount exclusive of convenience fee, Insurance, Zero Cancellation Protection & Ancillaries fee

- In case of cancellation, Goibibo will refund the purchase price after deducting the Discount amount and any other applicable cancellation charges/penalty

- If the Cardholder doesn't receive the Discount, he/she can claim for the same within 3 months from the booking date. In the event the Cardholder fails to do so, he/she will not be eligible for any Discount

- This offer cannot be clubbed with any other offer of Goibibo

- For any card related claims, the customer shall approach ICICI Bank and Goibibo shall not entertain any such claims

- For any card related issue arising due to technology, the customer shall approach Goibibo and ICICI Bank shall not entertain any such claims

- Goibibo and ICICI Bank are the sole authority for interpretation of these terms

- Goibibo and ICICI Bank shall not be liable for any loss or damage arising due to force majeure event

INR 5,00 discount on shopping at Croma outlets

Offer can be availed on online shopping and at retail stores

- Visit https://www.croma.com/

- Select the product to purchase and enter the coupon code for the discount

- Visit the nearest Croma store

- Mentioned the coupon code for discounted price while purchasing

Complimentary cards protection from OneAssist wallet assistance worth INR 1600

What is the OneAssist Package?

How to avail of OneAssist plan features?

- One call is enough to block all cards. The customer must provide and promptly update all his/her card details with OneAssist.

- OneAssist will communication the membership details within 3 working days of your card activation

- In the event of theft or loss of wallet, the customer has to immediately call OneAssist to report the loss of the wallet and block any card registered with OneAssist. In the event that customer input is required in the form of confidential Personal Identification Number (PIN) or a Telephone Identification Number (TIN) (which cannot be disclosed to a third party), OneAssist will assist the customer by conferencing the customer on the telephone call with the issuer for the customer to provide such PIN/TIN for authentication purposes.

- In case customer has not shared the details of a particular card with OneAssist and requests the same to be blocked, OneAssist shall attempt to block the same card with the help of other details provided by the customer on best effort basis.

Flat 15% off on Dining in 6 countries at 100+ Indian restaurants

Offer is applicable in restaurants in Kuala Lumpur, Dubai, London, Singapore, Hong Kong, Bangkok.

The Card member has to present his valid Bank Card to the restaurant and state the intention to use the offer before asking for the bill.

- Offer is valid on A La Carte only.

- The discount is valid on only the net amount (excluding taxes or any other charges).

- Any applicable taxes have to be paid by the card holder.

- The benefits as mentioned here in above cannot be used or redeemed in combination with any other discounts or promotions or vouchers or 'Sunday Brunches' or 'Happy Hours' or any other such promotions.

- The Offer is not valid on the Blackout Dates & Public Holidays, unless otherwise stated by the individual restaurant we advise to contact the restaurant directly before visiting.

- The offers mentioned above are subject to change/withdrawal without prior notice.

- This offer has no monetary value, is not transferable, is not for sale or resale nor redeemable for cash.

- Offer is not valid on group bookings (8 pax and above).

- In case of any escalation, a copy of the bill is mandatory.

- The Offer doesn't guarantee the Reservations & Admissions at participating restaurants (Dining Partner), we advise to contact the restaurant directly before visiting.

- Individual Restaurant Terms & Conditions apply.

- Offer is not valid on Home Delivery.

- In case the restaurant refuse the offer inspite of adhering to all the terms & conditions listed please retain and share the copy of the bill within 72 hours for Reference & Resolution.

- Rights of admission are reserved by the restaurant.

Cab vouchers worth INR 1,000

- 4Cab voucher worth up to Rs.1000 (Load USD 1000 & get voucher worth Rs.500 & Load USD 2000 & get voucher worth Rs.1000)

- Get Rs.500 Ola/Uber voucher on load of USD 1000 & Rs.1000 voucher on load of USD 2000.

- Go to the payment section in the app

- Tap ‘Add Payment Method’ and select ‘Gift Card’

- Enter the gift code

- Use the discount on the next payment

40p discount on currency conversion rate

- Promo Code applicable is- FOREX40. Use FOREX40 while applying for Goibibo ICICI Bank Travel Card to avail 40 paise/unit discount on transaction rate.

Minimum amount of transaction for eligibility:-

- Travel Card Load- 1000 units of USD, AUD, CAD, CHF & SGD

- Travel Card Load – 750 units of GBP & EURO

For more information

- Visit www.icicibank.com/travelcard

*Zero cross currency will be levied if the transaction currency is same as billing currency loaded in the card

- OUR PRODUCTS

- Domestic Hotels

- International Hotels

- Domestic Flights

- International Flights

- Multi-City Flights

- Bus Booking

- Cab Booking

- Airport Cabs Booking

- Outstation Cabs Booking

- Train Booking

- Terms of Services

- User Agreement

- YouTube Channel

- Technology@Goibibo

- Customer Support

- Facebook Page

- Twitter Handle

- TRAVEL ESSENTIALS

- Airline Routes

- Train Running Status

- Cheap Flights

- Cancellation

Book Tickets faster. Download our mobile Apps

Popular With Goibibo

Popular hotels in india to stay, popular luxury hotels in india, best hotels in india for family, top hotels cities, top hourly hotels cities.

- Best Credit Cards

- Lifetime Free

- Forex Credit Cards

- RuPay Credit Cards

- International Travel

- Railway Lounge

- Credit Card Guides

- Credit Card News

- Offers & Rewards

- Credit Score Guide

- Credit Card Limit

- Lounge Access

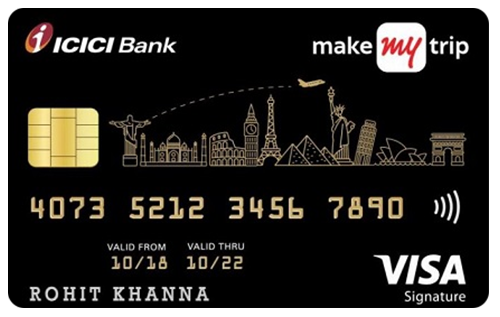

MakeMyTrip ICICI Bank Signature Credit Card

Issued by ICICI Bank, the MakeMyTrip ICICI Bank Signature credit card is a co-branded card that offers exclusive travel benefits in collaboration with MakeMyTrip. The card is issued at a joining fee of Rs. 2,500 and offers exciting welcome gifts such as 1,500 My Cash & a MakeMyTrip holiday voucher (worth Rs. 2,500). The card provides you with My Cash (rewards) on almost all your spending and extra My cash on purchases made on MakeMyTrip . These rewards (My Cash) are redeemable against booking flights/hotels/holidays on MakeMyTrip.

Moreover, you get bonus My Cash rewards based on your spending in an anniversary year. Talking about its travel benefits, you get 2 complimentary access to domestic airport lounges per quarter and 1 complimentary railway lounge access every quarter. Not only this, but the card also offers exclusive discounts on movies & dining through this card. The MakeMyTrip ICICI Bank Signature Credit Card provides you with several other benefits. Keep reading to know more about such benefits in detail:

Joining Fee

Renewal fee, best suited for, reward type.

Reward Points

Welcome Benefits

Movie & dining.

A discount of 25% on movie tickets through Bookmyshow & Inox, Exclusive discount offers on dining through the Culinary Treats Programme of ICICI Bank.

Rewards Rate

1.25 My Cash on every domestic spend of Rs. 200 and 1.5 My Cash per international spend of Rs. 200.

Reward Redemption

The rewards you earn are transferred to MakeMyTrip My Wallet as My Cash.

You get complimentary domestic & international lounge visits quarterly.

Domestic Lounge Access

2 complimentary access to domestic lounges per quarter on spending over Rs. 5,000 in a quarter.

International Lounge Access

1 Complimentary international lounge visit via Dreamfolks membership.

Insurance Benefits

Zero liability protection.

The cardholder will not be held liable for any fraudulent transactions done after the issue has been reported.

Spend Based Waiver

Rewards redemption fee.

Rs. 99 (plus applicable taxes) pre redemption request

Foreign Currency Markup

3.5% on all foreign currency transactions

Interest Rates

3.5% per month (42% annually)

Fuel Surcharge

1% fuel surcharge is waived off

Cash Advance Charges

2.5% of the withdrawal amount, subject to a minimum of Rs. 300

Add-on Card Fee

Rs. 250 (plus applicable taxes)

- Get 1.25 My Cash on every Rs. 200 you spend on domestic purchases outside MakeMyTrip.

- 1.5 My Cash on every Rs. 200 spent on international purchases outside MakeMyTrip.

- 2 My Cash on every Rs. 200 spent on flight bookings through MakeMyTrip.

- 4 My CashPoints per Rs. 200 you spend on hotel or holiday bookings through MakeMyTrip.

- Welcome benefit of 1,500 My Cash and a holiday voucher worth Rs. 2,500.

- Get 2 complimentary access to domestic lounges every quarter.

- Get 1 complimentary access to railway lounges every quarter.

MakeMyTrip ICICI Bank Signature Card Features and Benefits

Being a co-branded travel card, the MakeMyTrip ICICI Bank Signature Card comes with various exclusive benefits in the travel category.

- Get a bonus of 1,500 My Cash as a welcome benefit.

- You get a MakeMyTrip holiday voucher worth Rs. 2,500 and complimentary MMT BLACK enrolment.

- You will receive these benefits within 45 days settling the joining fee.

Milestone Benefits

- Get 4,000 My Cash if you spend Rs. 5 lakhs or above in an anniversary year.

- Get 1,100 My Cash if you spend Rs. 2.5 lakhs or above in an anniversary year.

Travel Benefits

- You get 1 complimentary international lounge access through Dreamfolks membership.

- The primary cardholders get 2 complimentary access to domestic lounges per quarter if Rs. 5,000 or more were spent in a quarter.

- You get 1 complimentary railway lounge access every quarter.

Dining Benefits

Get exclusive dining benefits through the ICICI bank culinary treats program.

Movie Benefits

- Get a 25% discount (up to Rs. 150) for a minimum purchase of 2 movie tickets through Bookmyshow or Inox.

- This offer can be availed two times a month on Inox and Bookmyshow each.

Other Benefits

- With Airtel International Roaming Pack the cardholders get a complimentary international roaming pack worth up to Rs. 3,999 for 10 days.

- You also get exclusive access to MakeMyTrip cabs benefits.

MakeMyTrip ICICI Bank Signature Credit Card Rewards:

The following table shows the number of My Cash you earn on every Rs. 200 you spend on different categories:

Rewards Redemption

- 1 My Cash = Re. 1, the My Cash you earn through your card is transferred to your MakeMyTrip My Wallet.

- My Cash can be redeemed against hotel/flight or holiday bookings through MakeMyTrip.

- My Cash Points accumulated are valid for a period of 1 year.

MakeMyTrip ICICI Bank Signature Credit Card Eligibility Criteria

Documents required.

Following are the documents that are required when applying for the MakeMyTrip ICICI Bank Signature Card:

- Identity Proof – Voter’s Id, Passport, Pan Card, Aadhar Card, driving license, etc (anyone).

- Address proof – Utility bills, Aadhar Card, Passport, etc (anyone).

- Income Proof – Latest ITR (for self-employed people) or salary slip or bank statement (for salaried individuals).

Cards Similar To the MakeMyTrip ICICI Bank Credit Card

In the table given below, you can some a few other cards similar to the MakeMyTrip Signature Card offered by the ICICI Bank:

The MakeMyTrip ICICI Bank Signature credit card is a genuinely significant credit card as it provides you with compelling benefits in several categories, including travel, dining, movies, flight/hotel bookings, etc. The card comes at a joining fee of Rs. 2,500, the card welcomes you with 1,500 My Cash (which is equal to Rs. 1,500), and a holiday voucher worth Rs. 2,500. So, you are not really losing any money as you are getting back more than you paid for the card. Also, with this card, you get lounge access no matter if you are traveling by train or on a flight. Moreover, its movie and dining benefits can also not be overlooked. After keeping all these benefits in mind, it is hereby clarified that the MakeMyTrip ICICI Bank Signature credit card is a great choice for all.

Write A Comment Cancel Reply

Save my name, email, and website in this browser for the next time I comment.

Find the perfect credit card in India by comparing the most rewarding options in one place!

- Privacy Policy

- Terms & Conditions

Contact Info

© Copyright 2024 Card Insider

Made With ❤ in India.

Type above and press Enter to search. Press Esc to cancel.

Add cards to start comparing

Safe, convenient and flexible.

The ICICI Bank Platinum Chip Credit Card offers you great value as a no-frills, easy to manage card with exciting benefits

Keep fuel costs under check with powerful cashback and zero fuel surcharge. What’s more, you earn accelerated rewards which can be redeemed for fuel at HPCL petrol pumps.

Get rewarded with ICICI Bank Coral Credit Cards.

The ICICI Bank Coral Credit Card offers you exciting rewards and benefits to your delight.

Amazing rewards and features with ICICI Bank Rubyx Credit Card.

The ICICI Bank Rubyx Credit Card brings to you a host of power packed features and rewards to your benefit.

Experience the joy of rewards with ICICI Bank Sapphiro Credit Card

The ICICI Bank Sapphiro Credit card offers you premium rewards and features like no other.

Your ticket to Old Trafford, Manchester.

Win a fully paid trip to Old Trafford, Manchester, UK with Manchester United Signature Credit Card by ICICI Bank . What’s more! You stand a chance to win Manchester United Jersey and Match Tickets.

Manchester awaits you!

Stand a chance to win a fully paid trip to Old Trafford, Manchester, UK with Manchester United Platinum credit card by ICICI Bank.

Escape the ordinary.

Avail amazing cashbacks and discounts on domestic and international flight and hotel bookings with MakeMyTrip ICICI Bank Platinum Credit Card.

Travel with excellence

Experience the finest in travel with MakeMyTrip ICICI Bank Signature Credit cards.

A cut above the rest

Enter a world of pure indulgence and convenience with ICICI Bank Emeralde Credit Cards.

Domestic spends(except fuel): 2 PAYBACK Points per 100 spent on Mastercard

Double PAYBACK Points on international spends.

1 PAYBACK Point per Rs. 100 on utilities & insurance. No points on fuel transactions.

2 complimentary international airport lounge visits per calendar year.

2 complimentary access per quarter to airport lounges on each card, courtesy Mastercard.

2 domestic airport spa sessions per calendar year under complimentary Dreamfolks DragonPass membership.

One complimentary Golf Round/Lesson for every ₹50,000 worth of spend on card, maximum of 4 rounds per month.

Welcome vouchers on travel and shopping worth ₹10,000.

4000 bonus PAYBACK Points on crossing spends of ₹400000 & 2000 bonus PAYBACK Points each time spends cross ₹100000 thereafter in an anniversary year, maximum of 20000 bonus PAYBACK Points.

Buy One Get One offer on movie/sports/theatre/music event tickets on BookMyShow, twice per month, for tickets valued at up to ₹500 per ticket.

Salary Mode

Is Income Tax Return duly acknowledged by Income Tax department?

Amazon Super Value Days: 15% cashback as Amazon Pay Balance on ` 1500 and above upto a maximum of ` 600.

Lenskart - existing offer of ` 500 off on purchase of ` 3000 or more

GrabOn - existing offer

ICICI Platinum Chip Credit Card

ICICI Bank HPCL Coral Credit Card

ICICI Bank coral Credit Card

ICICI Bank Rubyx Credit Card

ICICI Bank Sapphiro Credit Card

ICICI Bank Manchester United Signature Credit Card

ICICI Bank Manchester United Platinum Credit Card

ICICI Bank MakeMyTrip Platinum Credit Card

ICICI Bank MakeMyTrip Signature Card

ICICI Bank Emeralde Credit Card

*Terms and Conditions of ICICI Bank apply. For details visit www.icicibank.com.

Corporate Office Address:- ICICI Bank Towers,Bandra-Kurla Complex, Mumbai 400 051.

- e-ATM Order

- Share Market News

- FindYourMojo

- Live Webinar

- Relax For Tax

- Budget 2024

- One Click Mutual Fund

- Retirement Solutions

- Execution Algos

- One Click F&O

- Apply IPO through UPI

- Sovereign Gold Bonds

- New Bonds on Offer

- Government Securities

- Exchange Traded Bonds

- ICICI Bank FD

- Top Performing NPS Schemes

- NPS Calculator

- NPS Important FAQ and Disclosures

- Equity Trending News

- Self learning

- Customer Service

- Corporate Services

- Open Account

- Masters of the Street

- Features and Products

- Will Drafting

- Goal Planner

- Retirement Planning

- Brokerage Fees and Charges

- Business Partner

- Business Partner Opportunity

- Business Partner Earning Calculator

- Business Partner App

- Partner Universe

- Insurance – POSP

- Global Invest

- Travel Card Loan

- Credit Card

- Two Wheeler

- More Business Loan SME LOAN FOREX & REMITTANCE TRAVEL CARDS

- Introduction

- REGISTERING YOUR TRAVEL CARD

- Features and Benefits

- MANAGING TRAVEL CARD FUNCTIONS

Get smart, convenient and reloadable foreign-currency with the smartest travel card.

ICICI Travel Cards offer you:

Join the growing number of smart global travellers with ICICI Travel Cards. With the convenience of the card and the security of a check, your ICICI Travel Card will allow you to travel abroad without the worries of carrying foreign currency in cash.

Say goodbye to forex procuring hassles with your Smart ICICI Travel Card.

Browse through our wide range of travel card variants to choose the one that fits you best. All ICICI Travel Cards are accepted globally across international stores and online shopping sites.

About International Travel Card

Travelling abroad for business or leisure? Can’t decide how much money to carry? Now you can say goodbye to all the forex-procuring hassles with ICICI Travel Card. Carry forex smartly, safely and conveniently on your travel card and access a world of rewards and benefits. The prepaid Travel Card is your perfect alternative to carrying foreign currency; it is the ideal travel companion for all your international trips.

Choose from a wide range of Travel Card Variants by browsing through our website. Our travel cards are globally accepted across international retail stores and online shopping websites.

Travel Card Functions and Facilities Accessible on the Self Care Portal

- Change/ Regenerate your ATM/POS PIN: My Profile My Setup Repin

- Change/Regenerate your online Login/Transaction passwords: My Profile My Setup Change Password

- Temporarily block/ unblock Travel Card: My Accounts Support Functions Change Card Status

- E-Com Activation: My Profile My Setup e-com Activation

- View/download your transaction history: My Accounts Statement View

- Instant Wallet to Wallet transfer: My Profile Fund transfer Wallet to Wallet

How to Register a Travel Card?

Register your Travel Card on the Self Care Portal in 3 easy steps

Enter your Travel Card number and your 4-digit ATM PIN

Define your user id, login password and transaction password, set your security questions, input their respective answers and submit to create user id, manage travel card through imobile/ internet banking.

You can now link yours and your close relatives’ Travel Cards to your Savings Account to view, manage and update basic Travel Card details on the go through Internet Banking and iMobile app*.

Features of Travel Card

EXCLUSIVE FEATURES

- Safe and convenient mode of carrying forex

- Globally accepted mode of payment

- Available in 15 foreign currencies

- Facility to check balance on travel card at ATMs worldwide

- Facility to recharge the travel card on-the-go via mobile or net banking

- Doubles as ATM-cum-debit card

Benefits of Forex Card

- Load up to 15 currencies on the same card

- No additional charges levied on PoS swipes

- Better exchange rates than buying forex currency in cash

- Reward points on every swipe

- Exclusive discounts at select retail stores and restaurants worldwide

- High daily withdrawal limit of USD 2000 or its equivalent amount

Managing Travel Card Functions via Internet Banking and Imobile

View the balance amount in your travel card, view last 10 transactions, reload your travel card instantly, update e-mail id & domestic & international mobile number, block or unblock your travel card, online refund of your travel card, pin generation of your travel card.

Travel Card FAQs

What is the use of forex prepaid card.

Forex Prepaid Card is a smart, convenient and secure alternative to carry foreign currency while travelling overseas.

How do forex cards work?

Forex Card/Money Card/Travel Card/Currency Card are Prepaid Cards. Once an amount is loaded in a currency wallet, it can be used for transactions by swiping at merchant outlets or at e-commerce sites, as well as for cash withdrawal at ATMs

What is ICICI Bank Forex Prepaid Card?

ICICI Bank Forex Prepaid Card is a Prepaid Card offering 15 currency wallets. It is a smart, convenient and secure alternative to carry foreign currency while travelling overseas

What is the benefit of Forex Prepaid/Travel Card?

Forex Prepaid/Travel Cards provide a convenient and secure alternative to carry foreign currency while travelling overseas. Moreover, it allows the customer to store multiple currencies in a single card, in case they are travelling to different countries. Unlike Credit and Debit Cards, there is no extra charge associated with POS and e-commerce transactions. They are universally accepted. Exchange rate is fixed during loading of the card and there are no Dynamic Currency Conversion charges

What is a multi-currency card?

A multi-currency card features multiple wallets of different currencies in a single card. ICICI Bank currently offers loading of up to 15 currencies in a single multicurrency card.

Can you transfer money from a Forex Prepaid/Travel Card to a bank account?

Yes. Once requirement of forex is over, the remaining amount in the Forex Prepaid Card can be refunded to the linked bank account

How can I apply for a Forex Prepaid/Travel Card?

Request for Forex Prepaid Card can be submitted at the nearest ICICI Bank Forex Branch. ICICI Bank Savings Account holders can apply through iMobile too.

How do you put money in a Forex Prepaid/Travel Card?

You can put/load money in an ICICI Bank Forex Prepaid/Travel Card online, through Internet Banking or iMobile app. If the account is not linked, the request can be submitted at the nearest ICICI Bank Forex Branch by the cardholder or any third party

How can I activate my Forex/Travel Card?

With a fresh load, the Forex/Travel Card will be automatically activated. However, if your ICICI Bank Forex Prepaid Card is inactive/temporary blocked, please call ICICI Bank Customer Care to get it re-activated.

I am unable to withdraw funds from ATM using my Forex Prepaid/Travel Card, what should I do?

If you are unable to withdraw funds from the ATM using your Forex Prepaid/Travel Card, kindly check the balance in the card, for confirmation on whether you can withdraw the amount. If there is balance, check that you are not exceeding the daily withdrawal limit (includes ATM withdrawal charges). If it is within the limit and still you are unable to withdraw using an Active Forex Prepaid/Travel Card, please call ICICI Bank Customer Care.

What is the limit for cash withdrawal from ATM in my Forex Prepaid/Travel Card?

The daily limit of withdrawal is USD 2,000 or equivalent (including withdrawal charges and tax), unless otherwise specified.

Best no annual fee travel credit cards of April 2024

Fortune Recommends™ has partnered with CardRatings for our coverage of credit card products. Fortune Recommends™ and CardRatings may receive a commission from card issuers.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Travel rewards cards are a lot like gyms. The best ones may come with tons of added benefits (saunas, yoga class, etc.) but they also cost a lot, usually with a big financial commitment upfront.

As a result, whether you’re considering a Chase Sapphire Preferred ® Card (with its $95 annual fee) or a CrossFit membership, you probably have the same question on your mind: will I really use it enough to justify paying for it?

While there aren’t any free gyms we know of, there thankfully are plenty of no-annual-fee travel rewards cards that require essentially zero commitment. And just like an ab roller or a Richard Simmons DVD, you can simply use them a few times, forget about them, and put them in a drawer until beach season. Or, you can stick with it and make them part of your daily routine—whatever works for you.

You’re also far more likely to see “instant results” with these cards, too. From 100,000-point welcome bonuses to rewards for paying rent, free travel insurance to 3X on gas, these cards offer way more than you’d expect for a fee of $0 per year.

The best no-annual-fee travel cards for April 2024

Best overall: bilt mastercard, best for hotel rewards: ihg one rewards traveler credit card, best for airline rewards: united gateway℠ card, best for travel earnings: wells fargo autograph℠ card, best for flat-rate earnings: capital one ventureone rewards credit card.

The Bilt Mastercard allows you to earn points from paying rent and transfer them 1:1 to well over a dozen different travel partners including United MileagePlus and Marriott Bonvoy. Toss in some surprisingly robust travel insurance and you have our unconventional—yet logical—choice for the best overall no-annual-fee travel card of 2024.

Bilt Mastercard®

See Rates and Fees

Special feature

Rewards rates.

- 1x Earn 1X points on rent up to 100K/year

- 1x Earn 3X points on dining

- 2x Earn 2X points on travel

- 1x Earn 1X points on other purchases

- Use the card 5 times each statement period to earn points

- Uniquely earns points on rent

- Rent Day bonus every first of the month offers double points (excluding rent)

- Robust travel transfer partners

- Cash redemption rate is poor

- No traditional welcome bonus

- Travel perks: Trip Cancellation and Interruption Protection, Trip Delay Reimbursement, Auto Rental Collision Damage Waiver

- See this page for details

- Foreign Transaction Fee: None

Why we like this card: As mentioned, the Bilt Mastercard’s most compelling feature is that it allows you to pay rent with a credit card—even if your landlord doesn’t take plastic—and avoid the transaction fee paying rent by credit card would typically incur. Then, as long as you complete five transactions each month, you’ll trigger 1X rewards on your rent payments.

Note that rewards on rent are capped at 100,000 points per year.

In terms of earning potential, if you pay the median ~$2,000 rent in the U.S., you could earn approximately 24,000 points per year which can be used to book travel in Bilt’s portal at a value of 1.25 cents per point or transferred to any of Bilt’s airline or hotel partners at a 1:1 ratio. In other words, you could likely earn a domestic flight with United or a weekend stay at Hyatt, all for simply paying rent on time.

The Bilt card also provides trip cancellation and interruption protection, trip delay reimbursement, and primary rental car insurance (terms apply)—perks you wouldn’t typically find on a no-annual-fee credit card.

If you’re looking for a hotel rewards card that offers the most free nights for no annual fee, wait until you read about the IHG One Rewards Traveler Credit Card. With a six-figure welcome bonus, up to 17X on stays and other compelling rewards, it’s currently the gold standard for no-fee hotel rewards.

IHG One Rewards Traveler Credit Card

Intro bonus.

- 17x Earn up to 17X points when you stay at IHG Hotels & Resorts

- 3x Earn 3X points on dining, utilities, internet, cable, and phone services, select streaming services, and at gas stations

- 2x Earn 2X points on all other purchases

- Generous welcome bonus not typically seen in a $0 annual fee card

- Travel protections that are unusual for a no-annual-fee card

- Fourth night free on award bookings

- Limited redemption options outside of IHG

- IHG points are worth less than some other rewards currencies

- Silver status granted with the card has limited benefit

- Additional perks: Trip cancelation/interruption insurance, auto rental collision damage waiver, purchase protection, ability to spend to Gold status

- Foreign transaction fee:None

Why we like this card: We like calling the IHG One Rewards Traveler card the “Liam Hemsworth” of travel rewards cards because it lives in the shadow of its big brother—the IHG One Rewards Premier Credit Card —but still delivers plenty of quality and substance in its own right (with no annual fee, to boot).

For starters, you can get a welcome bonus of 80,000 bonus points after spending $2,000 on purchases within the first 3 months of account opening, potentially worth around $500 to $700 in IHG redemption.

Plus, enjoy up to 17X points when you stay at IHG Hotels & Resorts, instant Silver Elite status and a handy bonus where you redeem points for three consecutive nights and get the fourth night in your stay free. So, if you book a three-night stay using your welcome bonus, you’ll essentially be getting a complimentary four-night stay at a nice IHG property for no annual fee. The IHG One Rewards program could be very rewarding for the right traveler.

Check out our full review of the IHG One Rewards Traveler .

As a no-annual-fee airline card, the United Gateway℠ Card currently edges out its rival the Delta SkyMiles® Blue American Express Card by offering a more generous welcome bonus and travel insurance that the Delta card does not provide. If you fly occasionally and would like to earn miles, but aren’t willing to make the commitment of $95 or more for a mid-tier airline card with more perks, the Gateway is a strong choice.

United Gateway℠ Card

- 2x 2 miles per $1 spent on United® purchases, including tickets, Economy Plus, in-flight food, beverages and Wi-Fi, baggage service charges and other United purchases.

- 2x 2 miles per $1 spent on local transit and commuting, including rideshare services, taxicabs, train tickets, tolls, and mass transit.

- 1x 1 mile per $1 spent on all other purchases

- No annual fee or foreign transaction fee

- Reward bonus categories outside of United Airlines

- Robust travel protections for a no-annual-fee card

- No baggage or expanded award availability benefits like with other United cards

- Subject to Chase 5/24 rule.

- United perks: 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Gateway Card

- Other perks: Auto Rental Collision Damage Waiver, Trip Cancellation/Interruption insurance, Purchase Protection, Extended Warranty

- Foreign transaction fee: None

Why we like this card: The United Gateway card offers 2 miles per $1 spent on United® purchases, at gas stations and on local transit and commuting plus 1 mile per $1 spent on all other purchases. Considering a United Mile is worth roughly around 1.2 cents these days, effectively earning 2.4 cents back on everyday purchases is a solid value proposition.

You’ll also get a welcome bonus of 20,000 bonus miles after you spend $1,000 on purchases in the first 3 months your account is open. And, you can save with a discount of 25% back on United in-flight and Club Premium drink purchases.

New cardholders will enjoy a 0% Intro APR on Purchases for 12 months, after 21.99%–28.99% variable applies.

If the United Gateway card has a small lead on the Delta Skymiles Blue Amex at this point, it soars ahead (pun intended) when you look at the included travel and shopping protections. Both cards offer secondary rental car insurance, but only the Gateway includes trip cancellation and interruption insurance, purchase protection and extended warranty protection.

So, if you’re seeking a no-annual-fee card you can use to rack up miles—and you either tend to fly United most of the time or you’re at minimum not devoted to a competing airline—the United Gateway is the card to beat.

Check out our full review of the United Gateway Card for more info.

To view rates and fees of the Delta SkyMiles® Blue American Express Card, see this page

With a generous welcome bonus in exchange for an attainable spend amount, 3X on travel, and a fancy name, you’d think the Wells Fargo Autograph℠ Card would command an annual fee of at least $95. But it doesn’t, making it a superb candidate for general travel use.

Wells Fargo Autograph℠ Card

Intro bonus.

- 3X 3X points on restaurants, travel, gas stations, transit, popular streaming services and phone plans

- 1X 1X points on other purchases

- No annual fee

- 20,000 bonus points when you spend $1,000 in purchases in the first 3 months (that's a $200 cash redemption value)

- Points transfer to partners

- Car rental insurance is secondary

- No travel insurance

- Transfer partners are limited

- Additional perks: Cell Phone Protection: Provides up to $600 in cell phone protection when you pay your monthly cell bill with your Wells Fargo Autograph card. Coverage is subject to a $25 deductible and limited to two claims every 12-month period.

- Foreign transaction fee: N/A

Why we like this card: The Wells Fargo Autograph offers unlimited 3X points on restaurants, travel, gas stations, transit, popular streaming services and phone plans and even your landline bill too if you have one, plus 1X points on other purchases—all without charging an annual fee. And, to make traveling a little cheaper/less stressful, you’ll also get $600 worth of cell phone protection (minus a $25 deductible) as long as you pay your phone bill with this card and secondary rental car insurance.

Cardholders can transfer points at a 1:1 ratio to Wells Fargo’s first wave of transfer partners including Air France‑KLM Flying Blue, Avianca Lifemiles, British Airways Executive Club, AerClub, and Iberia Plus and 1:2 to Choice Privileges.

But even if you aren’t a member of those loyalty programs, earning 3X on dining, travel, gas, and more is hard to pass up. You can redeem points at a value of 1 cent each to offset past purchases on your account, meaning you can wield the Autograph either as a no-annual-fee travel card or as a cash-back card effectively earning unlimited 3% back in a wide swath of useful categories.

Check out our full review of the Wells Fargo Autograph .

Sometimes, you just want a card that offers a little more than 1X on every purchase—without having to worry about what this quarter’s rotating rewards are, or whether a specific merchant qualifies as “groceries” for the purposes of your card’s rewards. If you value simplicity and the lack of an annual fee in your travel card, you’ll probably be a fan of the Capital One VentureOne Rewards Credit Card and its straightforward rewards program.

Capital One VentureOne Rewards Credit Card

Reward Rates

- 5x Earn 5x miles on hotels and rental cars booked through Capital One Travel

- 1.25x Earn 1.25x miles on every other purchase

- Flexible travel rewards

- No foreign transaction fee

- Maximizing Capital One Miles requires a learning curve

- Cash redemption value is limited

- The VentureOne offers travel accident insurance, rental car coverage, extended warranty protection, exclusive access to events through Capital One Dining and Capital One Entertainment

Why we like this card: The Capital One VentureOne Rewards offers 1.25X miles per dollar spent on everyday purchases and 5x miles on hotels and rental cars booked through Capital One Travel. That’s pretty much all that you have to remember. You can also get a nice welcome bonus of 20,000 miles after spending $500 on purchases within 3 months from account opening, which is a solid payout for a very attainable spending target.

Capital One Miles can be transferred to well over a dozen airline and hotel partners, most at a 1:1 rate. Partners include Air Canada’s Aeroplan, British Airways Executive Club, Choice Privileges, Virgin Red, and Wyndham Rewards, among others. Other ways to book travel include redeeming miles through Capital One’s portal or making the purchase directly, paying with your card like normal, then using miles for a statement credit to cover the transaction.

The Venture One also offers a 0% intro APR on purchases for 15 months (after that, the variable APR will be 19.99%–29.99%). There’s an intro balance transfer fee of 3% of the amount of each transferred balance that posts to your account during the first 15 months that your account is open , then 4% per transfer for any promotional APR offered after.

Come to think of it, provided you have the excellent credit needed to apply, the VentureOne could make a great travel companion for a grad student given its simplicity, lengthy intro APR period and low spending threshold required to trigger the welcome bonus.

Check out our full review of the Capital One VentureOne Rewards .

Frequently asked questions

Which card is best for international transactions without extra charges.

Zero foreign transaction fees is actually a common benefit among travel rewards cards, including many with no annual fee. For example, neither the Bilt Mastercard nor the United Gateway card charges a foreign currency conversion fee.

What is the best travel credit card for a young person?

If you’re still paying rent, the Bilt Mastercard is an excellent choice since it can generate points from rent payments which can then be transferred 1:1 to well over a dozen airline and hotel partners. If you’d prefer a card with a welcome bonus, which the Bilt card lacks, the IHG One Rewards Traveler card currently offers a massive welcome bonus for a no-annual-fee card—potentially worth hundreds of dollars toward a future IHG hotel stay.

Is a travel card with an annual fee worth it?

Using a travel rewards card with an annual fee can be worth it as long as you’re extracting enough points and benefits to justify paying the fee each year. If you travel infrequently or just want one less fee to worry about, consider one of the no-annual-fee cards on our list above. But, the best perks and protections are typically available on cards with annual fees.

For example, the Capital One Venture X card offers a $300 annual travel credit for bookings made through Capital One Travel. If you use that every year, you’ve gone a long way toward offsetting the $395 annual fee. You also get 10,000 bonus miles, worth at least $100 toward travel, every year starting on your account anniversary.

Methodology

To bring you our top picks for the best travel rewards cards with no annual fee, the Fortune Recommends surveyed more than a dozen cards currently available from today’s top issuers. From there, we ranked each one based on the following core categories and weights:

- Welcome bonus (10%): Some cards—even those with no annual fee—offer welcome bonuses that you can earn once you make enough purchases within a certain time frame, such as spending $1,000 within three months of account opening.

- Travel earnings (25%): These are the point rewards you’d earn by making travel-related purchases (e.g. 3X on hotels, 2X on airfare).

- Car rental insurance (15%): Many, but not all travel-centric rewards cards include an auto rental collision damage waiver, which allows you to decline a portion of the rental company’s insurance and save potentially up to $30 per day. We gave extra consideration to if a card offers primary rental car insurance versus secondary, because primary kicks in immediately in a covered scenario—whereas secondary only applies after your own, personal insurance.

- Travel insurance benefits (15%): Some travel rewards cards automatically apply trip cancellation/interruption insurance, lost/delayed luggage reimbursement and even travel accident insurance on travel bookings made using the card.

- Gas earning (5%): Since road trips remain a common form of travel, whether or not a card offers points rewards at the pump factored into our rankings.

- Dining earning (10%): If a no-annual-fee travel rewards card offered 2X or more on restaurant purchases it favored well in this category.

The remaining 20% was based on the card’s main focus: hotel, airline or general travel rewards.

- For general travel—points transferrable to partners (20%): Points are literally worth more if you can transfer them to certain partners, so a card’s ability to transfer rewards to airline and hotel partners factored into our rankings.

- For hotel rewards—free award night with booking (20%): Some hotel rewards cards offer a BOGO-like perk where if you redeem a certain number of nights with points you get an extra tacked on for free.

- For airline rewards—ability to spend towards status (20%): Most airline rewards cards allow you to earn miles, but not all of them count those miles towards your next loyalty status. If a card treated them as “qualifying miles,” it fared better in this category.

Lastly, just keep in mind that virtually every aspect of a travel rewards card—from the rewards to the welcome bonus and fee structure—is subject to change, which could impact how many miles or points you earn.

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefits guide for more details. Underwritten by Amex Assurance Company.

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

EDITORIAL DISCLOSURE : The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends ™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

Guide to travel rewards credit cards

Best travel credit cards of april 2024, luxury travel for less: your guide to free airport lounge passes, 10 credit card tips to help you avoid disaster when traveling abroad, how credit card travel insurance works—and what it doesn’t cover, insure your adventures: the ultimate guide to credit cards offering travel insurance, how credit card rental car insurance saves money on every rental, chase lga lounge review: luxury at laguardia, chase beefs up new york profile with a new jfk sapphire lounge—here's what you need to know, biggest-ever amex centurion lounge opens in atlanta — with outdoor terraces and bars for both whiskey and smoothies, amex centurion lounge atlanta: what to expect now that it’s open, how to use your credit card to save on travel as airline costs soar, do you have travel rewards saved up these are the best ways to use them, 5 ways your credit card can help you save on spring break travel costs, capital one lounge: what you need to know, how i travel with my wife for less than a date night, best credit cards for cheap airport lounge access in april 2024.

- Talk To Us NEW

- Check Your Refund NEW

- Complete Booking

- Make a Payment

- Flight Cancellation Charges

- Complete Holidays Booking

- Company Information

- Investor Relations

- Partner With Yatra

- Yatra for Business

- Customer Care

Yatra Online, Inc is the parent company of Yatra Online Limited (formerly known as Yatra Online Private Limited). which is based in Gurugram, India, and is India's leading Corporate Travel services provider with over 700+ Corporate customers, and one of India's leading online travel companies and operates the website Yatra.com. The company provides information, pricing, availability, and booking facility for domestic and international air travel, domestic and international hotel bookings, holiday packages, buses, trains, in city activities, inter-city, and point-to-point cabs, homestays, and cruises. As a leading platform of accommodation options, Yatra provides real-time bookings for more than 103,000 hotels in India and over 1,500,000 hotels around the world. Launched in August 2006 , Yatra was ranked the Most Trusted E-Commerce Travel Brand in India in the Economic Times Brand Equity Survey 2016 for the second successive year, and has won the National Tourism Award for 'Best Domestic Tour Operator (Rest of India)' conferred by the Government of India for the fourth time.

- More About Us

- Leadership Team

- Our Products

- Customer Testimonials

- Press Releases

- Travel Agent Sign Up

- Register Your Hotel

- Register Your Homestay

- Sell Holiday Packages

- Sell Your Activities

- List Your Bus Inventory

- Advertise With Us

- Become a Yatra Franchisee

- Support & FAQs

- Terms & Conditions

- Privacy Policy

- User Agreement

- Product Offerings

- Cautionary Notice

- Hotels in India

- Spiritual Journey in India

- About Yatra

- International Flights

- Cheap Air tickets

- Charter Flights

- Hotels Near Me

- Homestays and Villas

- India Tour Packages

- International Tour Packages

- Delhi to Chennai Flight

- Delhi to Mumbai Flight

- Delhi to Goa Flight

- Chennai to Mumbai Flight

- Mumbai to Hyderabad Flight

- Delhi to Bangalore Flight

- Pune to Delhi Flight

- Mumbai to Delhi Flight

- Bangalore to Ayodhya Flight

- Pune to Ayodhya Flight

- Chennai to Ayodhya Flight

- Delhi to Ayodhya Flight

- Mumbai to Ayodhya Flight

- Kolkata to Ayodhya Flight

- Bhubaneswar to Ayodhya Flight

- Ahmedabad to Ayodhya Flight

- Surat to Ayodhya Flight

- Guwahati to Ayodhya Flight

- Kochi to Ayodhya Flight

- Ranchi to Ayodhya Flight

- Delhi to Kolkata Flight

- Delhi to Patna Flight

- Delhi to Srinagar Flight

- Hotels in Delhi

- Hotels in Mumbai

- Hotels in Haridwar

- Hotels In Goa

- Hotels In Jaipur

- Hotels In Ooty

- Hotels In Udaipur

- Hotels in Puri

- Hotels In Shimla

- Hotels In Rishikesh

- Resorts In Udaipur

- Resorts In Munnar

- Villas In Lonavala

- Villas In Goa

- Honeymoon Packages

- Bali Packages

- Maldives Packages

- Gangtok Packages

- Darjeeling Packages

- Manali Packages

- Ladakh Packages

- Munnar Packages

- Andaman Packages

- Goa Packages

- Europe Packages

- Kerala Packages

- Kashmir Packages

- Thailand Packages

- Flight status

- Web Checkin

- International Airlines

- Flight Schedule

- Air India Express

- Emirates Airlines

- Singapore Airlines

- Indian Railways

- Check PNR Status

- Thailand Visa

- Sri Lanka Visa

- Vietnam Visa

- Hong Kong Visa

- Indonesia Visa

- Cambodia Visa

- Morocco Visa

- Azerbaijan Visa

- Turkey Visa

- India Tourism

- International Tourism

- Monuments of India

- Distance Between

- Outstation Cabs

- Yatra on Mobile

- Yatra for SMEs

- Yatra for Corporates

- Product Offering Temp Child

Our official websites and social media handles are :

- Retails Stores

- Visa Information

- Experience Our Apps:

- Connect with us :

Copyright © 2024 Yatra Online Limited, India. All rights reserved

- Customer Care Number

Internet banking

- NRI Banking

- Money2World

- Money2India

Offers especially for you!

Open an Insta Save Account.

No Paperwork, No Branch Visits, No Hassle!

ICICI Bank Credit Cards

Save more on your everyday expenses.

ICICI Bank Personal Loans

For your safe, comfortable, and convenient travel needs

ICICI Bank Home Loans

The key to your Dream Home, within easy reach

Campus Power - from a dream to a degree, with you at every step.

Solutions for student, parents and institutes.

Just getting returns on your investment?

Save Tax too, while you build your corpus!

Manage all your utility bills, smartly.

Pay bills easily, using Internet Banking.

ICICI Bank Two-Wheeler Loan

Get your dream bike now!

ICICI Bank FD

Choose certainity during uncertain times.

ICICI Bank PPF Account

A blessing for wealth creation is here for you!

Your guide to Personal Finance

A refreshing way to learn all about Personal Finance.

All it takes is 5 minutes!

Instant payout on selling shares, with the ICICIdirect Prime Account.

ICICI Bank Car Loan

Experience a seamless Car Loan process!

- Vacations Newsletter

Colombia Newsletter – March-2024

Want us to help you with anything? Request a Call back

Thank you for your request..

Your reference number is CRM

Our executive will contact you shortly

THE ORANGE HUB

Vacations – Travel magazine by ICICI Bank – March 2024

This month’s theme introduction

Ready to break free from the mundane and dive headfirst into a world of adventure?

This month, we invite you to embark on a journey that surpasses borders and defies expectations. Our feature country invites you to break free from the ordinary and embrace the extraordinary. And what better place to start this adventure than in the captivating country of Colombia?

Colombia, a land of unparalleled beauty and rich cultural heritage, offers endless opportunities to go beyond the beaten path. From the mist-covered Andean peaks to the lush Amazon rainforest, this South American gem allows travellers to delve deeper into its fascinating landscapes and vibrant communities.

But going beyond isn't just about navigating geographical boundaries; it's about delving into the heart and soul of a destination. In Colombia, this means immersing yourself in the rhythms of salsa in Cali, sampling the bold flavours of Colombian cuisine in Medellín or discovering the ancient secrets of the Lost City in the Sierra Nevada.

Moreover, going beyond in Colombia means connecting with its warm and welcoming people, who are eager to share their stories and traditions with visitors. It's about embracing new experiences with an open mind and a sense of wonder.

So, whether you're trekking through lush coffee plantations or wandering through the colourful streets of Cartagena, embrace the spirit of adventure and go beyond in Colombia. Let this vibrant country ignite your curiosity and inspire you to discover the beauty that lies beyond the horizon. Join us as we embark on an unforgettable journey to explore, discover and go beyond in Colombia.

Push Your Boundaries

In a world bustling with endless possibilities, there's a call echoing from distant corners, inviting you to explore beyond the familiar. Beyond the practicalities lies the wealth of experiences waiting to be discovered. From savouring exotic flavours to dancing to the beats of unfamiliar rhythms, every moment is a treasure trove of sensations. It's in these moments we find ourselves truly alive, embracing the essence of wanderlust.

Picture yourself amidst the lush emerald landscapes of Colombia, where every step unveils vibrant culture and natural beauty. Why stay within the confines of routine when the allure of the unknown awaits? This beautiful country in South America is our feature country of the month.

Travelling to far-off places like Colombia isn't just about crossing borders; it's about surpassing boundaries within ourselves. The advantages of such journeys are as vast as the landscapes. As you immerse yourself in the rhythm of a new culture, your perspective widens and your understanding of the world deepens. Each encounter becomes a chapter in your own adventure tale, weaving memories that last for a lifetime.

Moreover, undertaking a long journey opens the door to personal growth. Stepping out of your comfort zone promotes resilience, adaptability and a newfound appreciation for diversity. As you navigate through the unfamiliar, you discover hidden strengths and forge connections that go beyond language barriers.

So, why wait? Embrace the call of adventure and let the winds of wanderlust carry you to far-off lands. Whether it's Colombia or beyond, the journey promises not just destinations, but a kaleidoscope of experiences waiting to be discovered. Dare to wander and let the world be your guide.

Discover Your World

Colombia – Coffee, Emeralds and Adventure

After a long journey from India, you land in the lap of Colombia’s endless adventure and vibrant culture! From the lush greenery of its jungles to the rhythm of its salsa-filled streets, Colombia offers a unique experience for travellers seeking excitement and discovery.

While you may associate Colombia with coffee, salsa dancing, Shakira and Sofia Vergara, this South American country has one of the most unique landscapes in the world. From the stunning Caribbean Beaches in the North to the exotic Amazon Rainforest in the East and the Andes Mountains in the South, there are many things for which Colombia is known.

Due to its proximity to the Equator, the weather stays the same throughout the year. The factor that makes the biggest difference to Colombia’s weather is the altitude of the places you are visiting rather than the time of year meaning Colombia is a pleasant country to visit in any month.

In March and April, Colombia offers plethora of activities and attractions waiting to be explored. Whether you're a nature enthusiast, a history buff or a foodie craving new flavours, Colombia has something special in store for you.

Don’t restrict yourself to just Bogota – the capital city. First stop on your Colombian adventure: Cartagena. This coastal city has a rich history dating back to the colonial era. Wander through the cobblestone streets of the Old Town, where colourful buildings and bougainvillea-filled balconies transport you back in time. Don't miss a visit to Castillo San Felipe de Barajas, a fortress overlooking the Caribbean Sea that offers breathtaking views of the city.

Next up, Medellín. Known as the ‘City of Eternal Spring,’ Medellín welcomes visitors with its pleasant climate and lively atmosphere. Take a ride on the city's iconic metro cable to get a bird's-eye view of Medellín's sprawling landscape. Explore the vibrant neighbourhoods of Comuna 13, once considered one of the city's most dangerous areas but now a hub of street art and community resilience.

For nature lovers, a trip to the Coffee Region is a must. This attractive area, nestled in the heart of Colombia's coffee-producing region, offers stunning sceneries and plenty of outdoor activities. Hike through lush coffee plantations, swim in crystal-clear rivers and sample some of the world's finest coffee straight from the source.

As you venture further into Colombia's interior, be sure to visit the stunning Cocora Valley. Home to the towering wax palm, Colombia's national tree, this verdant valley is a hiker's paradise. Trek through cloud forests and past rushing waterfalls, watch colourful hummingbirds and other native wildlife along the way.

No trip to Colombia would be complete without a visit to the Amazon Rainforest. In the southern region of the country, this vast expanse of jungle teems with life, from exotic birds and monkeys to elusive jaguars and anacondas. Embark on a guided tour with a local guide to learn about the rich biodiversity of the Amazon Rainforest and immerse yourself in the rhythms of local culture.

Those seeking a taste of adventure, head to the Pacific Coast. Here, you can swim with humpback whales, surf waves and explore pristine beaches bordered by lush tropical rainforests. March and April are prime whale-watching seasons, so be sure to book a tour for a chance to witness these majestic creatures up close.

In Colombia, the possibilities are endless. Whether you're exploring ancient ruins, dancing the night away at a salsa club or simply soaking up the sun on a secluded beach, you're sure to be captivated by the beauty and diversity of this remarkable country. So pack your bags, grab your camera and get ready for the adventure of a lifetime in Colombia!

Travel Smart

Tips for storing pictures

The camera has become an important part of every travel journey today. And four people travelling together means four cameras taking several similar pictures. While there are many resources available to learn how to take better pictures, let’s delve into the topic of best ways to store and retrieve the pictures.

Back up regularly : Make it a habit to back up your travel photos regularly to prevent the loss of precious memories.

Organise by location or date : Enable your camera to record the location of each picture. Sort your photos by location or date to easily find specific moments from your travels.

Use cloud storage : Take advantage of cloud storage services like Google Drive or Dropbox to store your photos securely and access them from anywhere.

Label and tag : Add descriptive labels and tags to your photos to quickly identify and search for specific scenes or subjects.

Create albums : Organise your photos by creating photo albums based on themes or events to create curated collections of your travel memories.

Delete duplicates and unwanted shots : Delete duplicates and unwanted photos to streamline your photo collection and save storage space.

Invest in external hard drives : Consider investing in external hard drives for additional storage and backup options, especially for large photo libraries.

Use photo management software : Explore photo management software like Adobe Lightroom or Apple Photos to enhance your editing and organising capabilities. There are many apps now to help you do the same.

Print and frame favourites : Take some time to select your favourite travel photos and print them to create memories or frame the photos & decorate your home with cherished memories.

Sustainable Travel Tip of the Month

“To get a sample itinerary for Colombia , " Click here ”

Take Time to Know the Local Customs

Responsible travel isn't just about reducing the carbon footprint; it's also about fostering cultural understanding and respect. One key rule of travelling responsibly is immersing ourselves in the local cultures we encounter along the way.

When we take the time to learn about the customs, traditions and beliefs of the communities we visit, we not only enrich our own travel experiences but also show respect for the people who call those places home. Whether it's tasting traditional cuisines, participating in local festivals or striking up conversations with residents, every interaction helps bridge the gap between cultures and promotes mutual appreciation.

Respecting local cultures goes beyond surface-level gestures; it involves understanding and adhering to cultural norms and practices. This might mean dressing modestly in certain countries, observing local customs regarding greetings and gestures or being mindful of sacred sites and rituals.

By demonstrating sensitivity and openness to different ways of life, we not only avoid causing offence unintentionally but also foster positive connections with the communities we encounter. These interactions not only enhance our travel experiences but also contribute to the preservation of cultural heritage and traditions for future generations.

Ultimately, responsible travel is about recognising our role as guests in the places we visit and embracing the opportunity to learn from and engage with diverse cultures. By approaching our travels with curiosity, empathy and respect, we can make a positive impact on the communities we visit while creating meaningful and memorable experiences for ourselves.

Which city in Colombia is known as the Land of the Eternal Spring?

‘Vacations’ is powered by OneShoe Trust for Responsible & Mindful Travels – a social enterprise that promotes travelling as a means to raise awareness about climate change and environmental issues. Incubated at IIM Bangalore, OneShoe is the source of most authentic travel experiences around the world. Link: oneshoetravels.com

Your reference number is CRM 786578956

Sorry! Please check back in a few minutes as an error has occurred.

Share this blog, get social with us..

Scroll to top

IMAGES

COMMENTS

Refresh your finances with a fulfilling credit card from ICICI Bank. Explore Now. Loans. Personal Loan ... Your family and you can enjoy Offers across Loans, Cards, Demat & more with our Privilege Banking Programme. Visit your nearest branch to enrol today. ... Travel Offers View Popular offers. Offers By Travel. View Popular offers. Scroll To Top.

Steps to Avail the offer: Visit www.yatra.com or Click on the Yatra banner/creative on ICICI Bank offers page. Select the destinations you wish to fly on and proceed to checkout. On the checkout page, type in the following code for 12% OFF up to Rs 1500 on Domestic Flights: ICICINB. Make the payment with only ICICI Bank Internet banking.

Sale with ICICI Bank Credit Cards on flights, domestic hotels and bus. Upto 13% OFF (up to Rs. 1,800) on domestic flights, Flat 10% OFF (upto Rs. 5,000) on international flights, Flat 15% OFF (upto Rs. 5,000) on domestic hotels and Flat 15% OFF (upto Rs. 500) on bus.Hurry ! This offer is valid on every Tuesday, between Apr 2 - Jun 25, 2023.Use YRICICICC for ICICI Bank Credit Cards.

Joining Fee: Rs. 6,500 Renewal Fee: Rs. 3,500 (waived off on spending Rs. 6 lakh in a year) ICICI Bank Sapphiro Credit Card is a premium credit card that is suited for both domestic and international travellers. This credit card offers premium privileges to its users, including complimentary membership, travel vouchers, complimentary lounge access and more.

Earn a MakeMyTrip holiday voucher of up to Rs. 3000 as the joining benefit. Enjoy the Rs. 500 My Cash to kickstart your journey. Add benefits up to Rs. 20,000 with the ICICI travel credit cards. Get up to 2.5 Skywards Miles per Rs. 100 spent. Earn 40,000 reward points while using the card for travel bookings.

Here are some of the top offers for ICICI cardholders available under Festive Bonanza: Category. Offer Details. Online Shopping. Amazon: 10% instant discount on all categories. Myntra: 10% discount, up to Rs. 200 on a minimum purchase of Rs. 3,500. Tata CliQ: 15% discount, up to Rs. 500 every Saturday and Sunday.

The ICICI Multi-Currency Travel Card is one of a handful of travel card options available at ICICI, but it offers the most flexibility as far as currencies. With 15 currencies available to hold in a single account, the card is useful for those that travel often to those respective countries. How it works is that you open an account at ICICI and ...

Get the Best deals on Flights and Hotel with ICICI Bank Credit Cards on EMI Transactions. Flat 10% OFF (up to Rs. 1,500) on domestic flights, Flat 8% OFF (up to Rs. 6,000) on international flights, Flat 15% OFF (upto Rs. 5,000) on domestic hotels and Flat 8% OFF (up to Rs. 6,000) on Holidays.Use promo code YTICICIEMI to avail this offer. This offer is valid between April 1 - June 30, 2024.

About The Offer. Book your domestic flight using code: IXICICID and get flat 12% off upto ₹1200 on payments via ICICI Bank Credit Cards. The minimum booking amount for the same is ₹10000. This offer is valid till 26th June 2024.

Travel Period : between March 20 - April 04, 2024. Hotel Check-in Checkout Period : between March 20 - April 04, 2024. Offer validity : between March 14 - 18, 2024. Offer valid on ICICI Bank Credit Cards only. Use promo code ICICIFESTCC to avail this offer. Offer is valid once per user, per product, per card during the offer period.

The offers will be as below: Flat INR 500* Off on Domestic Flights (minimum booking amount should be INR 3,000) ... Use FOREX40 while applying for Goibibo ICICI Bank Travel Card to avail 40 paise/unit discount on transaction rate. Minimum amount of transaction for eligibility:-Travel Card Load- 1000 units of USD, AUD, CAD, CHF & SGD;

Issued by ICICI Bank, the MakeMyTrip ICICI Bank Signature credit card is a co-branded card that offers exclusive travel benefits in collaboration with MakeMyTrip. The card is issued at a joining fee of Rs. 2,500 and offers exciting welcome gifts such as 1,500 My Cash & a MakeMyTrip holiday voucher (worth Rs. 2,500).

Offline -Shop for Rs.8,000 & above using ICICI credit & debit cards and get 10% cashback. Maximum cashback Rs.1500 per card account. / Online -shop for Rs.3,000 & above using ICICI credit & debit cards and get 10% cashback. Maximum cashback Rs.1000 per card account. Offer valid till 30-Aug-21. Kalyan Jewellers.

Avail 10% discount on subscription of Solutions for Businesses and Educational Institutions. Make the payment through ICICI Bank Internet Banking, Credit or Debit Card. Know more View Debit Card Offers. 628d 21.36.10.

ICICI Travel Cards offer you: Easy to Use One Card ... Now you can say goodbye to all the forex-procuring hassles with ICICI Travel Card. Carry forex smartly, safely and conveniently on your travel card and access a world of rewards and benefits. The prepaid Travel Card is your perfect alternative to carrying foreign currency; it is the ideal ...

MakeMyTrip ICICI are co-branded credit cards that come with offers on travel and hotel bookings along with access to airport and railway lounges in India. The card has two variants - the Signature and the other being Platinum. Both credit cards come with attractive lifestyle privileges like 'MMTBLACK Exclusive' membership by MakeMyTrip ...

In a bid to make domestic travel more accessible and affordable, ICICI Bank has partnered with Ixigo to offer an exclusive 12% discount on domestic flight bookings made using ICICI Credit Cards.This limited-time promotion serves as a boon for travel enthusiasts, providing an opportunity to explore the beauty of India while enjoying substantial savings.

Forex Prepaid Card in India - Buy or reload forex prepaid card for your foreign trips to save money at ICICI Bank. Buy smart, cost effective, convenient and secure Forex Prepaid card with ICICI Bank and enjoy your travelling aborad.

The best no-annual-fee travel cards for April 2024. Best overall: ... For example, the Capital One Venture X card offers a $300 annual travel credit for bookings made through Capital One Travel ...

Get the Best deals on Flights, Domestic Hotels and Bus during the Amazon Pay ICICI Bank Credit Card Winter Sale. Flat 12% OFF (up to Rs. 1,500) on domestic flights, Flat 10% OFF (up to Rs. 5,000) on international flights, Flat 15% OFF (upto Rs. 5,000) on domestic hotels, and Flat 10% OFF (up to Rs. 500) on bus. Hurry ! This offer is valid every Friday and Saturday between Jan 5 - Mar 30, 2024.

Forex Prepaid Card in India - Reload or apply for Travel and Forex Cards for your trips overseas, with ICICI Bank and save money. For a smart, cost effective, convenient & secure multi-currency Forex Card, Apply Now! ... A Forex Prepaid Card from ICICI Bank offers you 360° protection on your international journeys. Secured transactions

Refresh your finances with a fulfilling credit card from ICICI Bank. Explore Now. Loans. Personal Loan ... Travel magazine by ICICI Bank - March 2024. Colombia. This month's theme introduction. ... Colombia offers plethora of activities and attractions waiting to be explored. Whether you're a nature enthusiast, a history buff or a foodie ...