- Turkish Lira

- Australian Dollars

- Canadian Dollars

- Polish Zloty

- VIEW ALL CURRENCIES

- canadian dollars

- ALL BUY BACKS

- US Dollar Card

- Multi-currency Card

Travel Money Comparison

Get the best exchange rates when you buy or sell foreign currency online

- buy Currency

- sell Currency

What Currency do you want to buy?

How much do you want to spend, what currency do you want to sell, how much do you want to sell, buy currency, sell currency, why use a travel money comparison site.

Have you ever started researching the best rates between different travel money providers?

We know it can be overwhelming: the different suppliers, their different offers and of course, the ever-changing currency exchange rates. It's a lot of information to process and compile!

Our comparison site takes the stress out of researching and does it all for you. FInd the travel money supplier that will get you the best rate today.

- ✓ Compare Travel Cash is a non-biased travel money comparison site.

- ✓ To ensure our independence, we always use transparent, objective and verifiable criteria in our comparisons.

- ✓ Our mission is to show you the best rates so you can save when buying your travel money.

- ✓ We constantly update our exchange rates as they change for each money exchange supplier, and whilst we try to do this in almost real-time, there will be times when our data is slightly out of date (in normal circumstances, not more than 5 minute). Our travel money comparison site is designed to save you money by showing you the latest rates.

- ✓ We check out all the companies we list, ensuring they are reputable suppliers and pass our standards before we list them.

- ✓ We value your privacy. We do not sell your data - you don't even need to give us your information to use our site. Even if you choose to, it is safe with us, we will never pass it on to third parties.

- ✓ You won't get cheaper rates if you go directly to the supplier, at times, we may have discounts and incentives that you would not get by going direct!

- ✓ We do sometimes make money - but we don't make it from you. We will never add fees or commissions to the travel money rates on the site.

Frequently asked questions

It's a great idea to buy your currency online to ensure you get the best exchange rate. You can often get much better deals online compared to what you can find on the high street or the airport. In fact ccording to recent surveys, 9 out of 10 tourists find that exchanging money at airports is the most expensive option.

The best thing about buying your travel money online through a comparison site is seeing all currency prices in one place, so whether you are buying euros , buying dollars or other currencies you get the best rate for your travel money and more importantly save time!

The quickest way to get the best currency exchange rate is by using our comparison tool . We compare the latest information from all the best travel money providers in the market to show you the best currency exchange rates.

Keep an eye out for the following when searching for the best currency exchange deals so you can choose the best option for buying your holiday money:

- High exchange rate - The higher the exchange rate number, the more holiday money you will get to the pound

- Delivery Charges - different currency providers charge different amounts for delivering your holiday money to your door

- Special offer - We will let you know if the providers are offering travel money deals

Commission is the fee that travel money providers charge for the service to exchange your money into foreign currency . The charge is usually included in the exchange rate they advertise. You will see that many foreign exchange companies advertise 0% commission, they are still charging you by including the charge in the rates.

All the travel money prices we quote include any fees and commissions, including delivery!

The simple answer is yes! Usually, the minimum order amount for foreign currency is £100, and the maximum is usually £7,500, although some providers allow you to exchange more.

Travel money is normally sent via special delivery service with Royal Mail. Travel cash orders worth more than £2,500 will be sent via a courier or multiple Royal Mail packages. This is for insurance reasons, making sure your travel money is safe.

This depends on the currency provider. Some providers offer next-day delivery, sending your travel money using Royal Mail's Special Delivery Guaranteed by 1pm service. There will be an extra cost for this and you can see how much when you compare the holiday money prices.

Don't forget, many foreign currency providers also allow you to pre-order currency and you can collect it in store, this means you can avoid delivery charges.

Most do, any holiday money that you have leftover after your trip abroad can be sold using a buy-back service that will convert it back to pounds. Our comparison tool will show you the providers offering the best buy-back rates .

Every few of minutes we compare the exchange rates and latest currency deals from the best travel money providers in the UK. You can see instantly who is offering the best deals and choose a service that suits your needs best.

Also, if you've come home from a trip abroad and have leftover currency, we compare many foreign currency buy back companies, showing the best rates to convert your foreign currency back into pounds.

Hundreds of customers order travel money through our site daily and have a great experience. However, as with ordering anything online, the process is never completely risk-free and you should always take care when transfering money to any company.

We undertake comprehensive checks on all of our providers and monitor them to make sure they meet our high standards and continue to do so. Having said that, no company is guaranteed not to come into trouble and we cannot guarantee the solvency of any of the providers listed on our website. We always recommend that you conduct your own due diligence before placing an order with any company.

There are many destinations where taking some local currency is extremely useful to make sure you are covered in places where credit cards are not accepted. Many of the smaller retailers globally will not allow credit cards, so cash is the only option.

Read our blog post on taking cash on holiday .

The best time to buy any travel money is when the pound is performing strongly relative to the currency you are buying, this means it will have a higher exchange rate, so will give you more currency for your money. The amount you receive is calculated by multiplying the exchange rate by the amount of pounds you want to spend, so the higher the exchange rate, the more foreign currency you get.

Exchange rates are constantly changing but we show you the historical exchange rate performance for each of the currencies so you can have more of an idea of whether now is a good time to buy your travel money.

Exchange rates tend to be very similar wherever you are in the world to those offered in the UK, however waiting until you are away means you may be stuck with poor exchange rates, fewer options of places to offer competitive rates or even worse, you may have to pay big additional fees and commissions. By buying your travel money in the UK there are no hidden fees, charges or nasty surprises, you know exactly how much you are getting.

Once you have found the best rate, place an order on the currency suppliers’ site, and pay for your currency.Each currency supplier has different payment options, including bank transfer, debit card, with some suppliers offering payment by Apple pay and Android pay. Once your order has been confirmed your order will be prepared and your currency sent to you by registered delivery, some suppliers even offer next-day delivery.

LATEST CURRENCY NEWS

The 8 Best Travel Money Belts of 2024: Secure Your Valuables on the Go

The best travel money belts of 2024 excel in comfort, style and security. These belts are not just fashionable, they are also equipped with the latest technology like RFID-blocking to protect your personal information from theft. Particularly noteworthy is a model that offers sizes adaptable to multiple waist measurements. After all, securing your cash and

The Perfect Carry-on Case for Airline Travel: Top Recommendations and Tips

The perfect carry-on case for airline travel fits within the usual size limits of 22 x 14 x 9 inches. This ensures it complies with most airlines’ overhead bin space restrictions. Despite this uniformity, some international airlines may have varying rules, so cross-checking with your specific airline before purchasing a case is a smart move.

What currency is used in Dublin, Ireland? A clear answer for travellers

Dublin, the capital city of Ireland, is a popular tourist destination known for its rich history, vibrant culture, and stunning architecture. As a result, many people who plan to visit Dublin may wonder what currency is used in the city. The official currency of Ireland is the Euro, which is used throughout the country, including

Join newsletter

- Best Euro Rate

- Best US Dollars Rate

- Best Turkish Lira Rate

- Best Australian Dollars Rate

- Best Thai Baht Rate

- Best UAE Dirham Rate

- Best Canadian Dollars Rate

- Best Polish Zloty Rate

- Best Croatian Kuna Rate

- Buy Travel Money

- Sell US Dollars

- Sell Turkish Lira

- Sell Australian Dollars

- Sell Thai Baht

- Sell UAE dirham

- Sell Canadian Dollars

- Sell Polish Zloty

- Currency buy backs

- Currency Online Group

- Sterling FX

- Covent Garden FX

- The Currency Club

- Tesco Money

- Sainburys Bank

- Virgin Money

- Natwest Travel

- Post Office

- Thomas Cook

- Marks and Spencer

- No1 Currency

- Rapid Travel Money

- Best Supermarket Euros

- Privacy Policy

@2024 Comparison Technology Ltd, 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ | Company Registration Number 12065287

CompareTravelCash.co.uk is a travel money comparison service that's designed to help you save money – whilst we do our best to ensure the site is 100% up-to-date, we cannot guarantee this. We advise you to carry out your own due diligence before buying or selling travel money.

- Search Search Please fill out this field.

A Single World Currency

Disadvantages, supply and printing, the bottom line.

- Macroeconomics

One World, One Currency: Could It Work?

:max_bytes(150000):strip_icc():format(webp)/image0-MichaelBoyle-d90f2cc61d274246a2be03cdd144f699.jpeg)

A global currency would mean that every country in the world uses the same currency. While the idea isn't new and would bring some benefits, there are also logistical, political, and economic considerations that would make it difficult to implement. Learn more about the case for a global currency and whether it will come to pass.

Key Takeaways

- The idea of a global currency is not a new one—the International Monetary Fund (IMF) created the Special Drawing Rights (SDR) in 1969 as a global reserve asset to supplement member countries' reserves.

- Among the benefits of a global currency would be the elimination of currency risk and conversion costs in international trade and finance.

- Economically developing nations would benefit from a stable currency and the removal of currency barriers, which would lead to increased trade among nations.

- A global currency could have several disadvantages, such as precluding nations from using monetary policy to regulate their economies and stimulate economic growth .

- Because monetary policy could not be enacted on a country-by-country basis, it would have to be implemented at a global level, which could lead to monetary policy decisions that benefit some countries at the expense of others.

The idea of a world currency is certainly not a new one. In 1969, the International Monetary Fund (IMF) created the Special Drawing Rights (SDR) as a supplementary global reserve asset. The SDR's value is based on a basket of five currencies: the U.S. dollar, the Japanese yen, the euro, the British pound sterling, and the Chinese renminbi.

While the SDR is not a currency in the classic sense, it does serve the purpose of supplementing member countries' official currency reserves and providing liquidity during times of economic distress. According to the IMF's Articles of Agreement, the SDR was intended to be "the principal reserve asset in the international monetary system."

One of the most frequently cited backers of a single currency is the legendary economist John Maynard Keynes . Many of Keynes' ideas have moved in and out of favor over the past 70 years. But could one global currency really work?

There would be a little something for everyone with a global currency.

No Currency Risk

All nations would certainly benefit since there would no longer be currency risk in international trade. Traders would no longer have to hedge their positions in fear of currency fluctuations.

Eliminating Conversion Costs

A global currency would mean all transaction costs related to international finance would be eliminated as well. Exchanging currencies always requires a conversion, which banks charge as a fee, and there can be a loss in value in changing one currency to another. Having one global currency would eliminate all of this. Individuals traveling abroad would benefit as well as businesses conducting operations in other countries.

Economic data shows that when European countries switched to the euro, it saved an estimated €13 billion to €19 billion per year in transaction costs.

Trade Improvements

Furthermore, breaking down a currency barrier leads to increased trade among nations. Again, if we take the European Union as an example, switching to the euro increased trade among member nations by 5% to 20%.

In addition, there would be somewhat of a leveling of the global playing field with one currency, since nations like China could no longer use currency exchange as a means to make their goods cheaper on the global market. For a long time, China has manipulated its currency, undervaluing it, and thus making the price of its exports more competitive across the world. This has been a detriment to the economies of other nations. With one global currency, China would not be able to do this, nor would it have a reason to do so.

Currency Stability

Economically developing nations would also benefit considerably with the introduction of a stable currency, which would form a base for future economic development. For example, Zimbabwe suffered through one of the worst hyperinflation crises in history. The Zimbabwean dollar had to be replaced in April 2009 by foreign currencies, including the U.S. dollar.

While there are certainly advantages to a global currency, there would be disadvantages, too. Some disadvantages would affect some countries more than others.

No Independent Monetary Policy

The most obvious downfall to the introduction of a global currency would be the loss of independent monetary policy to regulate national economies. For example, in 2022 in the wake of the Covid-19 crisis in the United States, when inflation rose to the highest level in 40 years, the Federal Reserve was able to raise interest rates and tighten the money supply in order to put downward pressure on inflation.

Under a global currency, this type of aggressive management of a national economy would not be possible. Monetary policy could not be enacted on a country-by-country basis. Rather, any change in monetary policy would have to be made at a worldwide level. Despite the increasingly global nature of commerce, the economies of each nation throughout the world still differ significantly and require different management.

Uneven Impacts

Subjecting all countries to one monetary policy would likely lead to policy decisions that would benefit some countries at the expense of others.

Typically, this would result in developed nations being negatively impacted rather than developing nations. For example, Germany had to bail out Greece when its economy had all but collapsed, spending billions of euros to prevent Greece from entering bankruptcy.

The supply and printing of a global currency would have to be regulated by a central banking authority, as is the case for all major currencies. If we look again at the euro as a model, we see that the euro is regulated by a supranational entity called the European Central Bank (ECB). This central bank was established through a treaty among the members of the European Monetary Union.

To avoid political bias, the European Central Bank does not exclusively answer to any particular country. In order to ensure proper checks and balances , the ECB is required to make regular reports of its actions to the European Parliament and to several other supranational groups.

Will There Be a Single World Currency?

While the U.S. dollar is often seen as the de facto world currency, to have one truly global currency would require a level of comparability between countries which does not currently exist and isn't likely to for some time to come.

What Is a Central Bank Digital Currency?

A central bank digital currency (CBDC) is a digital version of a country's currency. According to the Atlantic Council, 11 countries have launched a virtual currency backed by their central banks, including China. In all, 130 countries are exploring the concept. CBDCs are another way for the world's nations to try to address monetary challenges such as transaction costs and efficiency.

Is the Dollar Going Away?

The dollar has been a key component of global exchange since World War II. While some countries are increasingly attempting non-dollar transactions, much of the world's transactions are completed in dollars, making it unlikely that another currency will overcome it and take its place. Plus, 59% of foreign exchange reserves are in U.S. dollars.

At present, it appears that implementing a single currency worldwide would be highly impractical. Indeed, the prevailing theory is that a mixed approach is more desirable. In certain areas, such as Europe, gradually adopting a single currency may lead to considerable advantages. But for other areas, trying to force a single currency would likely do more harm than good.

International Monetary Fund. " Special Drawing Rights (SDR) ."

International Monetary Fund. " The SDR's Time Has Come ."

Commission of the European Communities. " European Economy: One Market, One Money ," Page 68.

Centre for Economic Policy Research. " The Euro and Trade: New Evidence ."

U.S. Department of the Treasury. " Treasury Designates China as a Currency Manipulator ."

XE. " ZWD - Zimbabwean Dollar ."

S&P Global. " Fed Tightens Money Supply as Us Inflation Falls From 2022 Peak ."

Council on Foreign Relations. " Greece's Debt Crisis ."

European Central Bank. " About ."

European Central Bank. " Economic and Monetary Union ."

Atlantic Council. " Central Bank Digital Currency Tracker ."

Council on Foreign Relations. " The Dollar: The World’s Reserve Currency ."

:max_bytes(150000):strip_icc():format(webp)/shutterstock_67023106-5bfc2b9846e0fb005144dd87.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

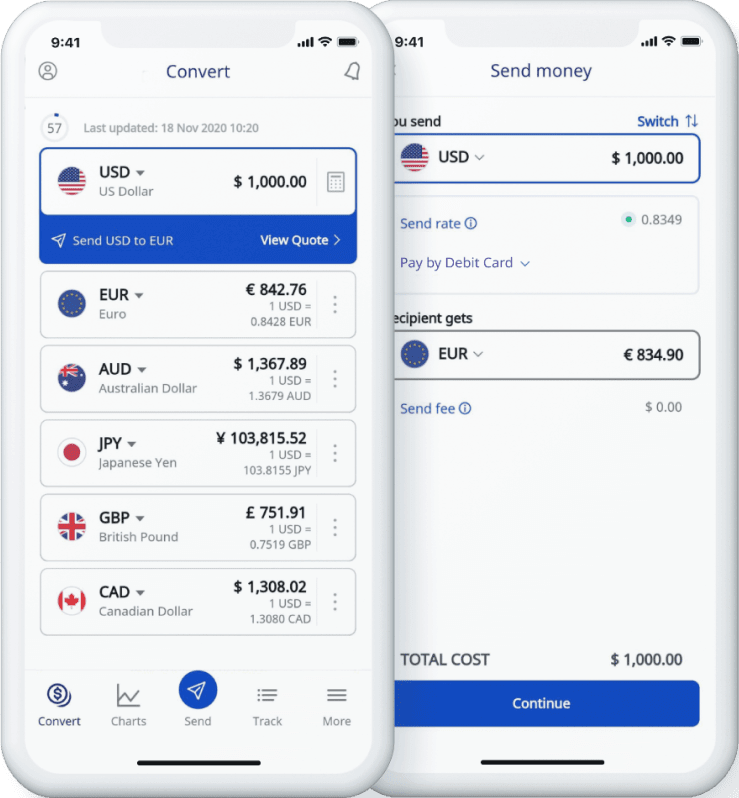

Currency Converter

{sendercurrencyname} to {receivercurrencyname}.

Convert popular currencies at effective exchange rates with our currency converter calculator.

Convert {senderCurrencyCode} to {receiverCurrencyCode} with Western Union to send money internationally.

- AUD – Australian Dollar

- BDT – Bangladeshi Taka

- CAD – Canadian Dollar

- GBP – British Pound

- IDR – Indonesian Rupiah

- MYR – Malaysian Ringgit

- NZD – New Zealand Dollar

- SGD – Singapore Dollar

- THB – Thai Baht

- TRY – New Turkish Lira

- USD – US Dollar

FX: 1.00 INR =

We encrypt your transfers.

We are committed to keeping your data secure.

Our customers made millions of transfers with Western Union last year. Here’s why:

Ease and convenience

Send money the way that’s convenient for you: online, via the app, or in person at an agent location.

Send money and check {senderCurrencyCode} to {receiverCurrencyCode} exchange rate through our website, app, or in person at an agent location.

Commitment to security

Our encryption and fraud prevention efforts help protect your Western Union transfers.

Speed and transparency

Send money in minutes* for fast cash pickup and easily track your money along the way.

Send money in minutes* for fast cash pickup and easily track your money. Just enter the {senderCurrencyCode} amount to be converted to {receiverCurrencyCode}.

Worldwide reach

We make an average of 25 transfers per second and move money from India to over 200 countries and territories.

Register to start sending money today.

Simply register online and verify your profile to send and receive money 24/7.

Pay online through your bank account, or cash in-store.

Easily track your money transfer online or via the Western Union ® app.

Send and receive money at a Western Union agent location in India. It’s easy to find one near you with a few clicks or taps.

Ready to get started with Western Union?

{sendercurrencyname} to {receivercurrencyname} conversion rate exchange rates shown are estimates, vary by a number of factors including payment and payout methods, and are subject to change..

* Funds may be delayed or services unavailable based on certain transaction conditions, including amount sent, destination country, currency availability, regulatory issues, identification requirements, Agent location hours, differences in time zones, or selection of delayed options. For mobile transactions funds will be paid to receiver’s mWallet account provider for credit to account tied to receiver’s mobile number. Additional third-party charges may apply, including SMS and account over-limit and cash-out fees. See the transfer form for restrictions.

- Money Transfer

- Rate Alerts

Xe Currency Charts

Review historical currency rates

With this convenient tool you can review market history and analyse rate trends for any currency pair. All charts are interactive, use mid-market rates, and are available for up to a 10-year time period. To see a currency chart, select your two currencies, choose a time frame, and click to view.

Live Currency Rates

Central bank rates, xe currency data api.

Powering commercial grade rates at 300+ companies worldwide

The world's most popular currency tools

Xe international money transfer.

Send money online fast, secure and easy. Live tracking and notifications + flexible delivery and payment options.

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

Xe Rate Alerts

Need to know when a currency hits a specific rate? The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

Download the Xe App

Check live rates, send money securely, set rate alerts, receive notifications and more.

Over 70 million downloads worldwide

money transfer to

Afghanistan

so easy as never before.

Monwy transfer to, to your friends & family., low fees best exchange rates., you should know where is your payment, professional money transfer.

Our branch network of 20 prime commercial across the Kingdom provides a full range of retail foreign exchange services

Secure Transactions

Buy or sell across any border in your currency. We can process 26 currencies from 203 countries and markets and convert them for your convenience. Your money is so well-travelled.

Global Access

Since your enhanced TD Access Card is accepted internationally wherever merchants take Visa, it's accepted in over 200 countries and at millions of places worldwide

Friendly & Fast Mobile app

No matter where you travel, taking local currency is a hassle-free way to pay for incidentals and unexpected expenses. Now you can pay easy with our our portable solutions

Online Customer Support

For any query please drop us a line or make a quick call

Daily Exchange Rates

- GBP-PKR 169.000

- BGP-AFN 92.000

- GBP-USD 1.215

- GBP-AED 4.600

- GBP-CNY 8.640

ABOUT THE COMPANY

Take a glimpse of our company to join us to know us

SPEEDY TRANSFER

One World promises to deliver your money the next day. Making it a unique One World service in the exchange market.

We aim to transfer your funds via your feedback and co-operation to avoid anti-money laundering activity

SECUARE TRANSACTION

Maintaining your trust on our safe & secure system for transfer of your money is our ultimate aim as your level of trust makes us perfect.

- Khalil Shah-

-Tajj Khan-

-Sami Ullah-

payout countries around the world

United Kingdom

Today’s best savings rates

Where are savings rates heading next, top reasons to open a high-yield savings account now , what to look for in a savings account , methodology, best savings rates today, april 22, 2024: now’s the time to earn more with one of these savings accounts .

Interest rates are expected to drop later this year, so now's the time to take advantage of high APYs before it's too late.

Liliana Hall

Associate Writer

Liliana Hall is a writer for CNET Money covering banking, credit cards and mortgages. Previously, she wrote about personal credit for Bankrate and CreditCards.com. She is passionate about providing accessible content to enhance financial literacy. She graduated from the University of Texas at Austin with a bachelor's degree in journalism, and has worked in the newsrooms of KUT and the Austin Chronicle. When not working, she is probably paddle boarding, hopping on a flight or reading for her book club.

Kelly Ernst

Kelly is an editor for CNET Money focusing on banking. She has over 10 years of experience in personal finance and previously wrote for CBS MoneyWatch covering banking, investing, insurance and home equity products. She is passionate about arming consumers with the tools they need to take control of their financial lives. In her free time, she enjoys binging podcasts, scouring thrift stores for unique home décor and spoiling the heck out of her dogs.

CNET staff -- not advertisers, partners or business interests -- determine how we review the products and services we cover. If you buy through our links, we may get paid.

Right now, high-yield savings accounts offer notably higher annual percentage yields, or APYs, than traditional savings accounts. However, the APY must outpace the current inflation rate of 3.5% to preserve your purchasing power.

The best high-yield savings accounts earn up to 5.55% APY, while some traditional savings accounts offer paltry APYs as low as 0.01%. Over time, you’re eroding your purchasing power with anything less than 3.5%. So, if you’re looking for the best place to stash your emergency fund or start a sinking fund , now’s the time to switch to a HYSA. Rates won’t stay this high forever.

Read on to learn where you can find today’s top savings rates.

Key takeaways

- Top savings account rates are still as high as 5.55% APY.

- Experts expect savings rates to fall later this year when the Fed begins cutting rates.

- Your savings must earn interest at a rate matching or exceeding the current inflation rate of 3.5% to preserve your purchasing power.

Experts recommend comparing rates before opening a savings account to get the best APY possible. You can enter your information below to see CNET’s partners’ rates in your area.

Here are some of the top savings account APYs available right now:

High-yield savings rates took off in 2022 when the Federal Reserve began raising interest rates to combat record inflation. But since July 2023, the federal funds rate has held at its target range of 5.25% to 5.5%, indicating to experts that savings rates are likely at their peak.

The Fed doesn’t directly affect savings rates, but its decisions have ripple effects. Experts expect rate cuts to begin later this year, and savings rates will likely follow suit once they do. But after the most recent Consumer Price Index report revealed an uptick in inflation, the timeline for future rate cuts is less clear.

“The elevated March inflation numbers have greatly reduced the odds of three Fed rate cuts in 2024,” said Ken Tumin, senior industry analyst at LendingTree. “One or two Fed rate cuts still look probable in the second half of 2024.”

Here’s where rates stand compared to last week:

The average APY for the top high-yield savings accounts we track at CNET is 4.88% -- with some accounts offering as high as 5.55%. That’s more than 10 times the national average of 0.46%. Since savings rates are variable, your APY is likely to go down once the Fed drops rates. Yet even after rates fall later this year, high-yield savings accounts will continue to offer significantly better APYs than traditional ones.

High-yield savings accounts are particularly attractive right now, making it a great spot to park a growing emergency fund or money for a short-term savings goal. But even though the rate environment may shift in the next several months, a high-yield savings account can always be a smart and low-risk savings strategy.

Here’s what makes HYSAs stand out:

- High rates: HYSAs often have APYs 10 times higher (or more) than the national average, as measured by the Federal Deposit Insurance Corporation.

- Low or no fees: Monthly maintenance fees can eat into your savings. Many online banks can charge low or no fees thanks to their lower operating costs.

- Liquidity: You can access money in your HYSA anytime without penalty (as long as you mind any withdrawal limits). CDs, another popular savings product, charge a penalty if you take out funds before the term is up.

- Accessibility: If you open an HYSA at an online bank, you’ll enjoy 24/7 account access through its mobile app. You may also have lots of customer service options, including by phone, online chat and secure messaging.

- Low risk: HYSAs are protected by federal deposit insurance if they’re held at an FDIC-insured bank or a credit union insured by the National Credit Union Administration. That means your money is safe up to $250,000 per account holder, per account type.

If you’re earning less than 1% with your current savings account -- some big banks offer as little as 0.01% APY -- you don’t have to close your existing account to enjoy higher rates. You can open a new account from an online bank in minutes and set up recurring transfers or direct deposits to start funding it.

A high-yield savings account can be a valuable tool for managing and growing your savings. But for an HYSA to work well with your money goals, you need to consider more than just the APY.

“Some accounts have mandatory minimums, transaction fees or other charges you might not expect,” said Ben McLaughlin , president of digital savings marketplace Raisin. “These hidden fees can chip away at your savings, so be sure you are satisfied with the terms and conditions before opening an account.”

Consider these factors to find an account that aligns with your financial goals:

- Minimum deposit requirements: Some HYSAs require a minimum amount to open an account -- typically, from $25 to $100. Others don’t require anything. How much you have to deposit initially can help you narrow down your options.

- Fees: Monthly maintenance and other fees can eat into your balance. Avoid unnecessary charges by looking for a bank with low or no fees.

- Accessibility: If in-person banking is important to you, look for a bank with physical branches. If you’re comfortable managing your money digitally, look for an online bank with a user-friendly app with all the features you need.

- Withdrawal limits: Some banks charge an excess withdrawal fee if you make more than six monthly withdrawals. If you think you may need to make more, consider a bank without this limit.

- Federal deposit insurance: Look for a bank that belongs to the FDIC or a credit union that belongs to the NCUA. Accounts at these institutions are protected up to $250,000 per account holder, per category in the event of bank failure

- Customer service: You want a bank that’s responsive and offers convenient support options if you ever need assistance with your account. Read online customer reviews to see what current customers say about their experiences. You can also contact customer service to get a feel for what it would be like to work with the bank.

CNET reviewed savings accounts at more than 50 traditional and online banks, credit unions and financial institutions with nationwide services. Each account received a score between one (lowest) and five (highest). The savings accounts listed here are all insured up to $250,000 per person, per account category, per institution, by the FDIC or NCUA.

CNET evaluates the best savings accounts with a set of established criteria that compares annual percentage yields, monthly fees, minimum deposits or balances and access to physical branches. None of the banks on our list charge monthly maintenance fees. An account will rank higher for offering any of the following perks:

- Account bonuses

- Automated savings features

- Wealth management consulting/coaching services

- Cash deposits

- Extensive ATM networks and/or ATM rebates for out-of-network ATM use

An account will rank lower if it doesn’t have a professional-looking website or doesn’t provide an ATM card, or if it imposes restrictive residency requirements or fees for exceeding monthly transaction limits.

Recommended Articles

Best high-yield savings accounts for april 2024, i struggled to save money until i opened this bank account, 6 reasons why you should own multiple savings accounts, 64% of americans are missing out on hundreds in savings account interest. are you one of them, 5 ways i’m thinking differently about saving money, car costs are absurdly high. i’m saving thousands driving a moped instead.

CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. For many of these products and services, we earn a commission. The compensation we receive may impact how products and links appear on our site.

Writers and editors and produce editorial content with the objective to provide accurate and unbiased information. A separate team is responsible for placing paid links and advertisements, creating a firewall between our affiliate partners and our editorial team. Our editorial team does not receive direct compensation from advertisers.

CNET Money is an advertising-supported publisher and comparison service. We’re compensated in exchange for placement of sponsored products and services, or when you click on certain links posted on our site. Therefore, this compensation may impact where and in what order affiliate links appear within advertising units. While we strive to provide a wide range of products and services, CNET Money does not include information about every financial or credit product or service.

Money latest: Morrisons shoppers are going to notice two changes in stores

Morrisons has launched two major changes for shoppers – with stores offering travel money and trolleys now featuring advertisements. Read this and all the latest consumer and personal finance news below - and leave your thoughts in the box.

Thursday 25 April 2024 19:51, UK

- Halifax hikes mortgage rates - as entire market moves upwards

- Renters' Reform Bill signed off - but with indefinite delay to no-fault evictions ban

- Morrisons rolls out bureau de change and trolley adverts

Essential reads

- The world of dark tourism - what is it, is it ethical, and where can you go?

- Money Problem : I have a mortgage offer - will it change now rates are rising?

- Savings Guide : Why locking into fixed-rate bond could be wise move

- 'More important than a will': What are lasting power of attorneys and how much do they cost?

- Cheap Eats : Michelin chef's secret lasagne tip - and expensive ingredient you shouldn't use

Ask a question or make a comment

Halifax has become the latest major lender to up mortgage rates.

They are putting up a range of deals by 0.2%.

BM Solutions also announced increases today.

It follows similar moves by TSB, NatWest, Virgin, Barclays, Accord, Leeds Building Society, HSBC and Coventry last week.

Lenders are responding to swap rates - which dictate how much it costs to lend money - rising on the back of higher than expected US inflation data, and concerns this could delay interest rate cuts there.

US trends often materialise elsewhere - though many economists are still expecting a base rate cut from 5.25% to 5% in the UK in June.

This is what average mortgage rates look like as of today...

Justin Moy, managing director of EHF Mortgages, told Newspage: "Yet more bad news for mortgage borrowers, as two of the biggest lenders announce increases to their fixed-rate products.

"As mortgage rates creep up and past 5% even for those with the largest deposits, we seem to be lacking a clear strategy of the government or the Bank of England on how rates will eventually fall.

"Even 2% inflation may not be enough to reverse the recent trends in rates."

Morrisons has launched two major changes for shoppers – with stores now offering travel money and trolleys featuring advertisements.

Announcing their bureau de change service, Morrisons said customers could exchange currencies in select stores or could place their money orders online at Morrisonstravelmoney.com.

Using the online service means customers can either click and collect their cash in certain Morrisons stores or at any of Eurochange's 240 branches. Alternatively, they can go for home delivery.

Services director at Morrisons, Jamie Winter, said the service "will provide our customers with easy access to a wide range of currencies at competitive exchange rates".

So far, stores in the following areas have travel money kiosks:

- Basingstoke

In other news, the supermarket chain rolled out a new trolley advertising across 300 stores in a partnership with Retail Media Group.

A sweetener used in drinks, sauces, savoury and sweet foods and chewing gum can cause serious damage to people's health, according to a new study.

Neotame, a "relatively new" sweetener, could damage the intestine by causing damage to healthy bacteria in the gut, according to the study, leading it to become diseased and attack the gut wall.

The study by Anglia Ruskin University (ARU), published in the journal Frontiers in Nutrition, found the negative effect of neotame "has the potential to influence a range of gut functions resulting in poor gut health", potentially impacting metabolic and inflammatory diseases, neuropathic pain, and neurological conditions.

The illnesses this could lead to include irritable bowel disease or insulin resistance.

Read the full story here ...

As we reported yesterday, a pilot programme is coming into force in Venice today that means visitors have to pay a €5 (£4.28) charge to enter the city.

Authorities say the pilot programme is designed to discourage tourists and thin the crowds that throng the canals during peak holiday season, making the city more liveable for residents.

Pictures have been emerging this morning of people queueing to register for a QR code that will allow them to enter after they have paid the charge - and officials carrying out checks on people inside the city.

People found to be contravening the rules can be fined up to €300 (£257).

As detailed in our story , the move has been met with anger among some in the city.

Venice is the first city in the world to introduce a payment system for tourists - but comments from its most senior tourist official suggested it may become a more common practice for major tourist hotspots in Europe.

Simone Venturini revealed the pilot programme was being closely watched by other places suffering from mass tourism - including other Italian art cities and hugely popular weekend-break destinations Barcelona and Amsterdam.

More than 160,000 people switched to Nationwide from other providers at the end of 2023, when the building society was offering a huge cash switching incentive.

According to figures from the Current Account Switch Service (CASS), Nationwide had a net gain of 163,363 account switchers between October and December, after leavers were taken into account.

It was the highest quarterly gain since the same period in 2022, when 111,941 switched to Nationwide.

The building society launched a £200 switching bonus for new joiners in September last year - the biggest giveaway on offer at the time. It withdrew the offer just before Christmas.

The latest CASS figures, which show Nationwide had 196,260 total gains before accounting for leavers, suggesting it could have spent up to £39m on nabbing customers from other providers in the last three months of the year.

Barclays and Lloyds Bank saw more modest net gains of 12,823 and 5,800 respectively, while the rest of the UK's big banks reported net losses.

NatWest and Halifax fared worst, losing over 40,000 more switchers each than they gained.

This week saw the last remaining switching offer on the market withdrawn.

Sainsbury's is having technical issues again - with shoppers taking to social media to say their deliveries have been delayed or cancelled.

The supermarket has been replying to customers saying: "I'm really sorry about the tech issues this morning.

"We're aware of the situation and are working to sort it as quickly as possible. In the meantime, we'd advise you place a new order for a future date."

Customer Andrew Savage wrote: "Order has not been delivered and no confirmation email this morning."

Another, John B Sheffield, said: "So angry! Just got through to your customer line after 40 min WAIT.

"Tells me NO DELIVERIES TODAY! tech problem? I've NO FOOD IN! ANGRY!"

In a statement to Sky News, a Sainsbury's spokesperson says: "A small technical issue affected some groceries online orders this morning.

"We have contacted these customers directly to apologise for the inconvenience."

In another update at 10am, the supermarket said that the issue has been resolved.

Responding to customers on X, Sainsbury's also offered those affected e-vouchers and details on how to rebook their orders.

It comes a month after the supermarket had to cancel almost all deliveries on a Saturday in mid-March due to another technical issue.

By Daniel Binns, business reporter

A potential $38.8bn (£31bn) takeover of UK-based mining company Anglo American has sent its shares soaring - and helped the FTSE 100 hit yet another record high this morning.

The attempted mega-merger, by larger Australian rival BHP, is currently being reviewed by Anglo American's board.

The deal, if it goes through, would create the world's biggest copper mining company - and comes as the price of the metal continues to climb amid soaring demand.

Anglo American's shares have surged as high as 13% this morning as news of the negotiations emerged.

The announcement also helped spur the FTSE 100 to a new intraday (during the day) high of 8,098 points.

The index, of the London Stock Exchange's 100 most valuable companies, has hit a string of records this week, including an all-time closing high of 8,044 points on Tuesday.

The score is based on a calculation of the total value of the shares on the index.

Also moving the markets are a string of company results which were published earlier on Thursday.

Among those issuing updates to investors was drugsmaker AstraZeneca. Its stock is up more than 5% after the firm reported quarterly profit and revenue above market estimates.

Unilever is also up 5% following similar better-than-expected quarterly figures.

Another good performer is Barclays - despite reporting a 12% fall in profits for the first three months of 2024. Its shares are up more than 4%.

That's because its quarterly figures are slightly better than expected, and the bank has said it expects its fortunes to improve later this year.

Meanwhile, as tensions in the Middle East continue, the price of a barrel of Brent crude oil continues to hover at a price of around $88 (£70).

This morning £1 buys $1.25 US or €1.16, similar to yesterday.

Every week we get experts to answer your Money Problems - usually on a Monday, but today we have a short, bonus addition in light of multiple lenders raising mortgage rates this week on fears an interest rate cut could be delayed to a little later this year (note: many economists still think it will come in summer).

A few readers have got in touch with questions similar to this one...

My remortgage is due to complete on 1 May. I already have an offer but with rates going up, is there any way at all my offer rate could increase? Saz681

We asked David Hollingworth, director at L&C Mortgages, to answer this one...

It's great news that you are already set up with a mortgage offer, Saz - ready to make a smooth switch to a new deal and/or lender, once the current one ends.

It does take time to set up a new mortgage so shopping around the market a good few months ahead will help you put everything in place and avoid slipping onto a high variable rate.

Fixed rates have been nudging up slightly but you have already got a formal offer in place so shouldn't worry.

Applying for a mortgage will generally secure that rate and the lender will then carry out any further checks to issue the mortgage offer.

The offer will be valid for a specified period, often for up to six months. Rates are always shifting for new customers but you can rest easy that your rate should be safe and sound for your switch in May.

This feature is not intended as financial advice - the aim is to give an overview of the things you should think about. Submit your dilemma or consumer dispute, leaving your name and where in the country you are, by emailing [email protected] with the subject line "Money blog". Alternatively, WhatsApp us here .

By Ollie Cooper , Money team

Interest in a phenomenon known as "dark tourism" has been steadily rising in recent years - but what is it?

To find out, we've spoken with tourism academic Dr Hayley Stainton and renowned dark tourist and author Dr Peter Hohenhaus, who runs a dark tourism website .

What is it?

In general, dark tourism involves travelling to sites connected to death or disaster.

"Dark tourism has been around for as long as we have been travelling to places associated with death," Dr Stainton says.

However, the term wasn't officially coined until 1996 by John Lennon, a professor of tourism at Glasgow Caledonian University, in Scotland.

"Not everyone is familiar with the term," says Dr Stainton, "[but] many people have been a dark tourist at some time or another, whether intentional or not."

Some examples of the most famous sites

- Auschwitz concentration camp, Poland

- 9/11 Memorial and Museum in New York, US

- Chernobyl, Ukraine

- Hiroshima and Nagasaki, Japan

- Choeung Ek "killing fields" and the Tuol Sleng genocide museum at the former S-21 prison in Phnom Penh, Cambodia

Areas with a degree of infamy, like Alcatraz, are extremely popular spots that also fall under the "dark tourism" umbrella.

How popular is it?

Dr Hohenhaus and Dr Stainton say they have noticed a rise in its popularity.

"Tourists are looking for more unique and unusual experiences," Dr Stainton says.

"This has seen a move away from the more traditional 'sun, sea and sand' type holidays to a variety of different tourism forms, which includes dark tourism."

Dr Hohenhaus adds: "Maybe people want to connect to more recent and hence more personally relevant history - that is definitely the case with myself."

He goes on: "I think I've learned more about the world through dark tourism than through all of my formal education or my previous academic career."

Is it ethical?

This is the big question associated with dark tourism.

Dr Stainton says that while problems do arise, the stigma around the practice is often misguided.

"People don't visit sites like the killing fields in Cambodia or the site of Chernobyl for 'fun' - they visit for the educational experience, as dark tourism is often also a form of educational tourism," she says.

Problems arise when tourists are not respectful to those who may have been impacted.

"For instance, taking inappropriate photos or laughing and joking when others may be in a state of mourning."

Notorious examples include people taking selfies outside Grenfell Tower and at Auschwitz.

"It is therefore imperative that dark tourists are considerate of those around them and respectful at all times," Dr Stainton says.

"As long as you are not just after a cheap sensationalist thrill - take dark tourism seriously and do it right, and it can be an immensely enriching thing to engage in." Dr Hohenhaus

Where could you go?

These are Dr Hohenhaus' recommendations:

- Ijen crater in Indonesia - where at night you can see the fabled blue flames of the sulphur mines next to the volcano crater lake;

- The Polygon, the former Semipalatinsk nuclear weapons test site of the USSR, now in Kazakhstan;

- The Goli Otok former prison island off the coast of Croatia;

- The Murambi memorial to the Rwandan genocide - which Dr Hohenhaus says is "certainly the very darkest place I have ever been";

- Majdanek concentration camp memorial near Lublin, eastern Poland.

What do you think of dark tourism? Is it misunderstood, educational or abhorrent? Let us know in the comments section...

John Lewis will be sharing its job interview questions online in an attempt to find the "best talent".

The retail chain hopes that allowing candidates to view questions before an interview will allow prospective employees to "really demonstrate what they can do" and prepare, the Financial Times reports.

John Lewis talent acquisition lead Lorna Bullett told Sky News that interviews can feel daunting and "nerves can seriously impact performance".

She added the company want "the right people" from a variety of backgrounds and with "the best talent" to join.

"It makes absolute business sense to find ways of helping candidates to really demonstrate what they can do," she said.

Ms Bullett added that the process will be "no less rigorous".

Be the first to get Breaking News

Install the Sky News app for free

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Capital One Venture X Review: A Worthy Option Among Premium Cards

What’s on This Page

The bottom line, pros and cons, detailed review, compare to other cards, benefits and perks, drawbacks and considerations, how to decide if it's right for you.

A big sign-up bonus, travel credits, high rewards and airport lounge access could make this card worth the hefty annual fee.

Rewards rate

Bonus offer

Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel.

Ongoing APR

APR: 19.99%-29.99% Variable APR

Cash Advance APR: 29.99%, Variable

Balance transfer fee

Balance Transfer Fee applies to balances transferred at a promotional rate

Foreign transaction fee

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

High rewards rate

New cardholder bonus offer

Lounge membership

Anniversary perk

Flexible rewards redemption

High annual fee

Requires excellent credit

The Capital One Venture X Rewards Credit Card has an excellent rewards rate, access to airport lounges and hundreds of dollars worth of travel credits that can make up for the $395 annual fee ( see rates and fees ).

To optimize the card, you’ll need to book on the issuer’s online travel portal. If that suits you, the card can stand up to the stiff competition in the market for premium travel credit cards. And despite its many features, the card is overall easier to understand than most premium cards, which can be baffling for newcomers.

You won’t get brand-specific perks, like free checked bags with a particular airline or a free hotel night at a hospitality chain, as you do with co-branded airline and hotel credit cards. But it offers the flexibility of the popular Capital One Venture Rewards Credit Card , while adding a raft of perks that just might give it the X-factor to make it your ideal travel companion.

Capital One Venture X Rewards Credit Card : Basics

Card type: Travel .

Annual fee: $395 ( see rates and fees ).

Sign-up bonus: Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel.

2 miles per dollar spent on purchases.

5 miles per dollar on flights booked via Capital One Travel.

10 miles per dollar on hotels and rental cars booked via Capital One Travel.

Redemption options:

Use miles to book travel through Capital One at a value of 1 cent per mile.

Redeem miles for statement credit against travel purchases at a value of 1 cent per mile.

Transfer miles to more than 15 partner airline and hotel programs. Per-mile value depends on the transfer partner and how you redeem the transferred miles.

Redeem miles for gift cards.

Interest rate: The ongoing APR is 19.99%-29.99% Variable APR .

Foreign transaction fees: None.

Credit required: Excellent .

Other benefits:

(Note: Benefits may change over time.)

Up to a $300 annual credit for bookings made on Capital One Travel.

10,000 bonus miles every account anniversary (equal to $100 toward travel).

Unlimited access to Capital One Lounges and more than 1,300 lounges through the Capital One Partner Network.

Access to entertainment, sports and dining events through the Capital One Experiences program.

Complimentary Hertz President’s Circle status. (Car upgrades, expedited pickup and more.)

Credit of up to $100 for the application fee for Global Entry or TSA PreCheck when you pay with the card.

Extra perks when you book a hotel stay through Capital One's Premier Collection like an $100 experience credit, daily breakfast for two people and complimentary WiFi.

Cell phone insurance.

Shopping protections. Includes price prediction, price watch, price drop protection, price match guarantee, extended warranty.

Travel protections.

Bonus miles on travel spending are expected for a higher-end travel credit card, and this one has those if you’re willing to use Capital One’s online travel-booking site:

Unlike some others in its category, this card is rewarding for everyday spending, too. It earns 2 miles per dollar spent on purchases outside those bonus areas. That’s an excellent rewards rate because so much spending falls outside the usual bonus categories.

If it’s your top-of-wallet card, you’ll rack up miles quickly even if you’re not booking a lot of travel.

Generous sign-up bonus

Sign-up bonuses can change over time, especially with travel credit cards. But the Capital One Venture X Rewards Credit Card has an excellent one: Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel.

That's enough to cover the annual fee for nearly two years. The downside is you’ll have to put a lot of spending on the card first. Spending $4,000 on purchases in the first three months is an average of about $1,333 per month.

» MORE: How to know if a credit card sign-up bonus is worth it

Airport lounge access

Besides access to more than 1,300 Priority Pass lounges , a somewhat common offering on travel cards in this class, the Capital One Venture X Rewards Credit Card offers access to Plaza Premium Lounges and full access to the new Capital One Lounges . As of November 2023, Capital One Lounges are open at Dulles International Airport outside of Washington, D.C., at Dallas-Fort Worth International Airport and at Denver International Airport.

Besides Capital One Venture X Rewards Credit Card holders, authorized users receive unlimited access to both types of lounges. Many travel credit cards restrict lounge access to the primary cardholder. Up to four authorized users can be added for free, which is not the case for other premium travel cards.

Anniversary perks

Central to the value of the Capital One Venture X Rewards Credit Card are the annual credits, which have substantial dollar value.

Up to a $300 annual credit for bookings made through Capital One Travel.

10,000 bonus miles every account anniversary (equal to $100 toward travel). The first batch of miles comes when you renew after one year of card membership.

Those credits alone, granted each year, make up for the annual fee. That assumes you’ll use the Capital One Travel online booking service. More on that later.

Flexible redemption options

Capital One's rewards program gives you several ways to use your miles for travel — both travel you already paid for and travel you want to book:

Redeem rewards as a statement credit. Book travel however you want, then redeem miles for statement credit for some or all of the cost. Miles are worth 1 cent each when redeemed, with no minimum redemption amount required. Any expense that Capital One considers "travel" is eligible, including not only flights and hotel stays, but "rail lines, car rental agencies, limousine services, bus lines, cruise lines, taxi cabs, travel agents and time shares," according to the Capital One website.

Book through the issuer's travel center. This online portal offers flights, hotels, rental cars and vacation packages. You can pay upfront with your miles, at a rate of 1 cent per mile.

Transfer miles to partners. Capital One lets you transfer your miles to the loyalty programs of a number of airline and hotel partners.

Aeromexico (1:1 ratio).

Air Canada (1:1 ratio).

Air France-KLM (1:1 ratio).

Avianca (1:1 ratio).

British Airways (1:1 ratio).

Cathay Pacific (1:1 ratio).

Emirates (1:1 ratio).

Etihad (1:1 ratio).

EVA (2:1.5 ratio).

Finnair (1:1 ratio).

Qantas (1:1 ratio).

Singapore Airlines (1:1 ratio).

TAP Air Portugal (1:1 ratio).

Turkish Airlines (1:1 ratio).

Accor (2:1 ratio).

Choice Privileges Hotels (1:1 ratio).

Wyndham Rewards (1:1 ratio).

Miles have no blackout dates and never expire.

“Simple” and “premium travel credit card” aren't concepts that usually go together, since the typical card in that category is wildly complicated. But relatively, the Capital One Venture X Rewards Credit Card is easier to understand than, say, The Platinum Card® from American Express . That card has a dizzying array of benefits, many of which aren’t super-useful to everybody or take an inordinate amount of effort to use.

By contrast, the Capital One Venture X Rewards Credit Card at its core retains the simplicity of the Capital One Venture Rewards Credit Card by offering a flat rewards rate on all spending and lets you use rewards to pay for travel.

It layers on airport lounge access and more rewards if you use the Capital One Travel portal.

The point is that someone willing to endure only modest hassle from their travel credit card can enjoy and benefit from the Capital One Venture X Rewards Credit Card . That same person might be frustrated by complex competing travel credit cards.

Travel-friendly perks

The Capital One Venture X Rewards Credit Card offers additional benefits frequent travelers will enjoy. Some come because it's a top-tier Visa Infinite card.

Complimentary Hertz President’s Circle status. This is the top status tier at Hertz. You can get confirmed one-car-class upgrades, 50% bonus on Gold Plus Rewards points on qualified rentals, free additional driver, expedited pickup and e-return, and more. The status is typically reserved for customers who have 20 or more rentals in a year or spend $4,000. The status level is good through 2024, at which point cardholders "will be reverted to the level commensurate with Hertz standard usage policies," says the card's terms and conditions.

Trusted traveler application credit. A statement credit of up to $100 for the application fee for Global Entry or TSA PreCheck. The credit is available once every four years.

Cell phone insurance . This is for the primary cardholders and authorized users.

Travel protections. These include auto rental collision damage waiver , trip cancellation and interruption, and trip delay reimbursement.

No foreign transaction fees. Standard on travel credit cards and useful for overseas purchases ( see rates and fees ).

» MORE: Capital One credit cards mobile app review

With annual fees, it’s all relative. A yearly fee of $395 is substantial, but other luxury travel credit cards have similar or even significantly higher fees.

A sampling:

U.S. Bank Altitude™ Reserve Visa Infinite® Card : $400 .

Chase Sapphire Reserve® : $550 .

The Platinum Card® from American Express : $695 .

Still, if the big annual fee bothers you, but you like aspects of the card, consider the original Venture card with fewer perks: Capital One Venture Rewards Credit Card . (See a comparison below.)

Outside the Capital One family, look at the Chase Sapphire Preferred® Card with an annual fee of $95 . It’s versatile and valuable as a travel credit card.

Value tied to booking portal

Capital One Travel, the issuer’s online travel-booking site, has nice features, including predictive pricing models and tools to help customers get the best deals — including proactively comparing hotel rates against Expedia, Orbitz and other travel booking sites. It offers access to thousands of flights, hotels and rental cars, and features free price-drop protection, 24/7 alerts and the option to freeze a price and come back 14 days later to book it.

But this card’s value is so tied to that booking portal that it diminishes one of the main traits of the Venture family of cards: flexibility.

If for some reason you won’t use Capital One Travel for booking, the bonus rewards for spending on this card as well as the huge $300 travel credit are worth nothing to you. The card’s value proposition quickly shrinks. Some savvy travelers prefer to book directly with hotels, for example, which adds to their elite status with a particular hotel chain or allows them to use status benefits they already have. Booking through a travel portal can negate those elite benefits.

By contrast, the competing Chase Sapphire Reserve® also links the value of its rewards to its travel portal. Chase Ultimate Rewards® points are worth 1.5 cents each if used to book travel there. But an important difference: Its $300 annual credit can be used for a broad range of travel purchases, including taxi rides, campground fees and train fares. That travel can be booked anywhere, and the credit is applied automatically.

The comparable anniversary credit on the Capital One Venture X Rewards Credit Card , one that can be used more flexibly for travel, is worth $100.

Granted, the Chase Sapphire Reserve® has a higher annual fee of $550 .

Lack of familiar transfer partners

For travelers who like to squeeze every last drop of value out of loyalty programs, the growing roster of transfer partners of the the Capital One Venture X Rewards Credit Card is appealing. You can now transfer your Venture miles to more than a dozen airline partners — but none are U.S. carriers. While transferring miles to foreign airline carriers can bring outsize value for your miles, it may be overwhelming for those just beginning with transfers. It does offer U.S. hotel partners for transfers to such programs as Wyndham Rewards.

If you want to work all the angles, one of the aforementioned Chase travel cards might be a better choice: The Chase Sapphire Preferred® Card or the Chase Sapphire Reserve® . You can move points to several useful airline and hotel loyalty programs at a 1:1 ratio. Partners include United Airlines, Southwest Airlines and Marriott.

Chase’s transfer partners:

Aer Lingus (1:1 ratio).

Iberia (1:1 ratio).

JetBlue (1:1 ratio).

Singapore (1:1 ratio).

Southwest (1:1 ratio).

United (1:1 ratio).

Virgin Atlantic (1:1 ratio).

Hyatt (1:1 ratio).

InterContinental Hotels Group (1:1 ratio).

Marriott (1:1 ratio).

How it compares to the Capital One Venture Rewards Credit Card

Both Venture cards are general travel credit cards and come with the same base rewards rate of 2 miles per dollar spent. You can redeem miles at 1 cent apiece for credit on your statement against a recent travel purchase, use them at Capital One Travel or transfer to more than 15 travel loyalty programs. And both offer the same credit for applying for TSA PreCheck or Global Entry. A third Venture card, the $0 -annual-fee Capital One VentureOne Rewards Credit Card , is a less useful comparison ( see rates and fees ).

Is the Capital One Venture X Rewards Credit Card worth the higher annual fee? Here’s a quick comparison.

If you already have the Capital One Venture Rewards Credit Card , you can also apply for the Capital One Venture X Rewards Credit Card .

» MORE: Full review of the Capital One Venture Rewards Credit Card

The value of the annual credit for bookings at Capital One and the anniversary miles, if you can fully use them, pays the annual fee on this card.

So the healthy rewards and the perks, including airport lounge access, are essentially free. That makes the Capital One Venture X Rewards Credit Card a contender for people on the hunt for a premium travel credit card.

Still unsure about whether this card, or any travel card, is what you need? See our best credit cards page for options across categories.

Hertz President's Club status : Upon enrollment, accessible through the Capital One website or mobile app, eligible cardholders will remain at upgraded status level through December 31, 2024. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g. at Hertz.com) will not automatically detect a cardholder as being eligible for the program and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

Fo r Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply .

This card earns bonus rewards in a variety of popular spending categories, including dining and travel. You can transfer points on a 1:1 basis to about a dozen airline and hotel programs, or you can use them to book travel through Chase at 1.25 cents per point. Annual fee: $95 .

Looking For Something Else?

Methodology.

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

About the author

Gregory Karp

IMAGES

VIDEO

COMMENTS

Whether it's a currency app on your mobile phone, or Travel Reviews to help you pick your destination, Xe Travel is the perfect resource for you. ... Keep track of live mid-market rates for every world currency on your Smartphone. That's 170+ currencies that you can convert on the go! Download the App. Travel Blog Posts.

Get the best currency exchange rates for international money transfers to 200 countries in 100 foreign currencies. Send and receive money with best forex rates.

Airport currency exchange rates are among the worst you'll find. It's not uncommon to see airport exchanges charging 14% more than the current International Monetary Fund (IMF) exchange rate ...

Use our currency converter to get live exchange rates for over 200 currencies, including cryptocurrencies. Convert major global currencies now.

Since 1995, the Xe Currency Converter has provided free mid-market exchange rates for millions of users. Our latest currency calculator is a direct descendent of the fast and reliable original "Universal Currency Calculator" and of course it's still free! Learn more about Xe, our latest money transfer services, and how we became known as the ...

On a day when currency markets suggest $100 should buy you €93, a currency exchange desk might hand you just €81, while a more modern method would net you a rate closer to €92, assuming you ...

What we do Compare Travel Cash is a non-biased travel money comparison site. To ensure our independence, we always use transparent, objective and verifiable criteria in our comparisons. Our mission is to show you the best rates so you can save when buying your travel money. We constantly update our exchange rates as they change for each money exchange supplier, and whilst we try to do this in ...

Many U.S. banks will exchange USD for foreign currencies without charging a fee, but there are often stipulations. For instance, Bank of America customers can exchange foreign currencies for free ...

Contact. 01924 339889 (option 1 for Foreign Exchange) Mei Li. Bureau Manager. 36 Teall Street. Wakefield. WF1 1QF. Name (required) First Name.

A Single World Currency. The idea of a world currency is certainly not a new one. In 1969, the International Monetary Fund (IMF) created the Special Drawing Rights (SDR) as a supplementary global ...

Convert the most popular world currencies at effective exchange rates with the Western Union currency converter calculator. Send money around the world. ... It's easy to find one near you with a few clicks or taps. Register now. Ready to get started with Western Union? ... The Western Union® Money Transfer℠ service is provided online by ...

ABTA Numbers P6972/6973/6974 and Y6336/6337/6338. Oneworld Travel is an independent Travel Agents based in Yorkshire. Our expert staff at each branch will be able to help you book your dream getaway.

Download the Xe App. Check live rates, send money securely, set rate alerts, receive notifications and more. Scan me! Over 70 million downloads worldwide. Create a free chart for any currency pair in the world to see their currency history for up to 10 years. These currency charts use live mid-market rates, are easy to use, and are very reliable.

No matter where you travel, taking local currency is a hassle-free way to pay for incidentals and unexpected expenses. ... SEND US MAIL +44 0203 3939 208 . Daily Exchange Rates. GBP-PKR169.000; BGP-AFN92.000; GBP-USD1.215; GBP-AED4.600; GBP-CNY8.640; ABOUT THE COMPANY. Take a glimpse of our company to join us to know us. SPEEDY TRANSFER. One ...

Best Savings Rates Today, April 22, 2024: Now's the Time to Earn More With One of These Savings Accounts Interest rates are expected to drop later this year, so now's the time to take advantage ...

Morrisons has launched two major changes for shoppers - with stores offering travel money and trolleys now featuring advertisements. Read this and all the latest consumer and personal finance ...

The Capital One Venture X has an excellent rewards rate, access to airport lounges and travel credits that can make up for the $395 annual fee.

Central Air Force Museum The Central Air Force Museum, housed at Monino Airfield, 40 km east of Moscow, Russia, is one of the world's largest aviation museums, and the largest for Russian aircraft. 173 aircraft and 127 aircraft engines are on display, and the museum also features collections of weapons, instruments, uniforms (including captured U2 pilot Gary Powers' uniform), other Cold War ...

Central Air Force Museum The Central Air Force Museum, housed at Monino Airfield, 40 km east of Moscow, Russia, is one of the world's largest aviation museums, and the largest for Russian aircraft. 173 aircraft and 127 aircraft engines are on display, and the museum also features collections of weapons, instruments, uniforms (including captured U2 pilot Gary Powers' uniform), other Cold War ...

Central Air Force Museum The Central Air Force Museum, housed at Monino Airfield, 40 km east of Moscow, Russia, is one of the world's largest aviation museums, and the largest for Russian aircraft. 173 aircraft and 127 aircraft engines are on display, and the museum also features collections of weapons, instruments, uniforms (including captured U2 pilot Gary Powers' uniform), other Cold War ...

Find the travel option that best suits you. The cheapest way to get from Kiyevsky Railway Terminal to Elektrostal costs only RUB 587, and the quickest way takes just 1 hour. ... Russia, is one of the world's largest aviation museums, and the largest for Russian aircraft. 173 aircraft and 127 aircraft engines are on display, and the museum also ...